Social•Feb 11, 2026

Forecasting Trends, NAV Squeeze Mechanics, Active ETF Surge

🆓 Wednesday links: focusing on forecasting, how NAV squeezing works, and the rise of the active ETF. https://t.co/bgzuhBy1Uq image: https://t.co/JRCEGjVQN2 https://t.co/PSs8BSV9vG

By Tadas Viskanta

Social•Feb 11, 2026

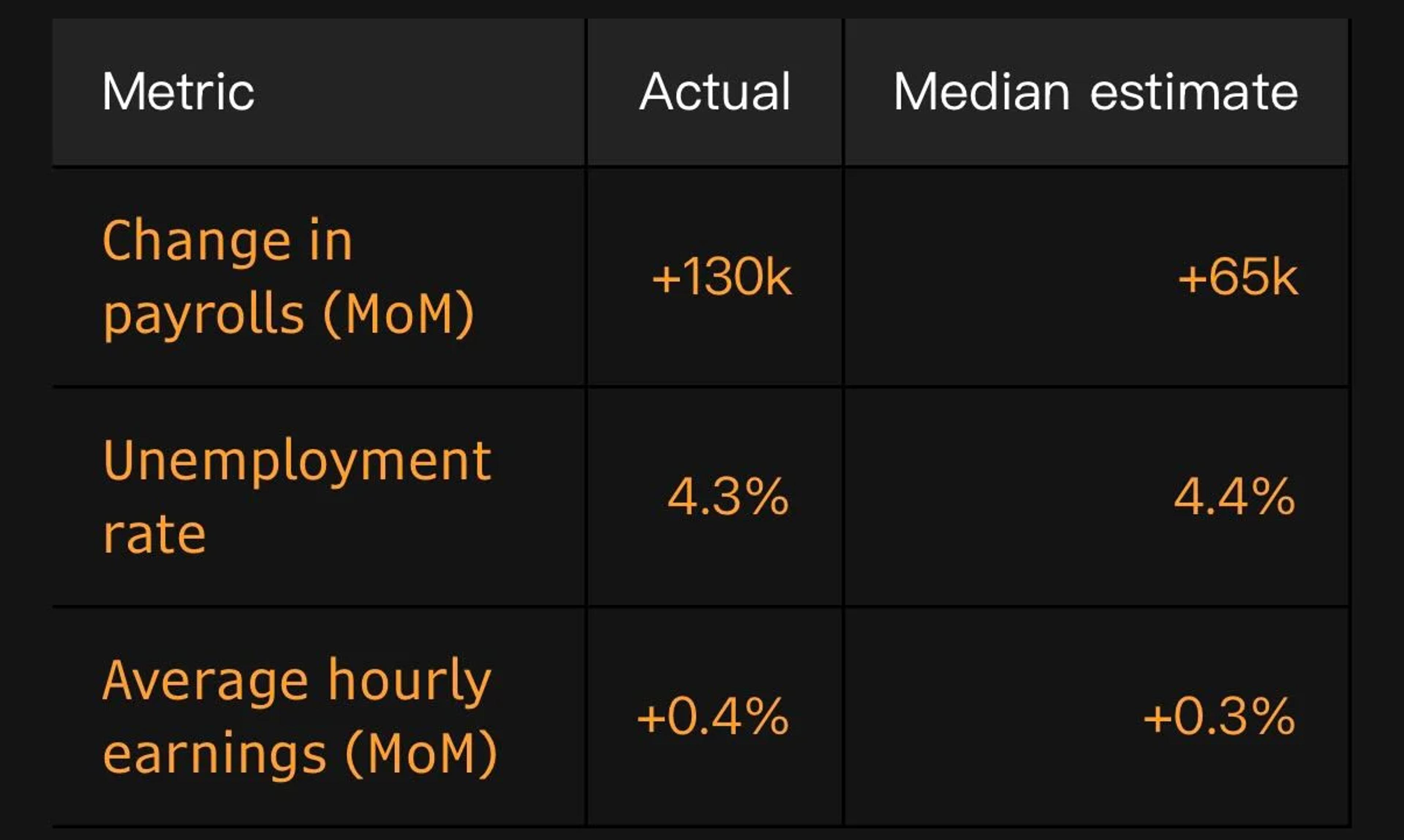

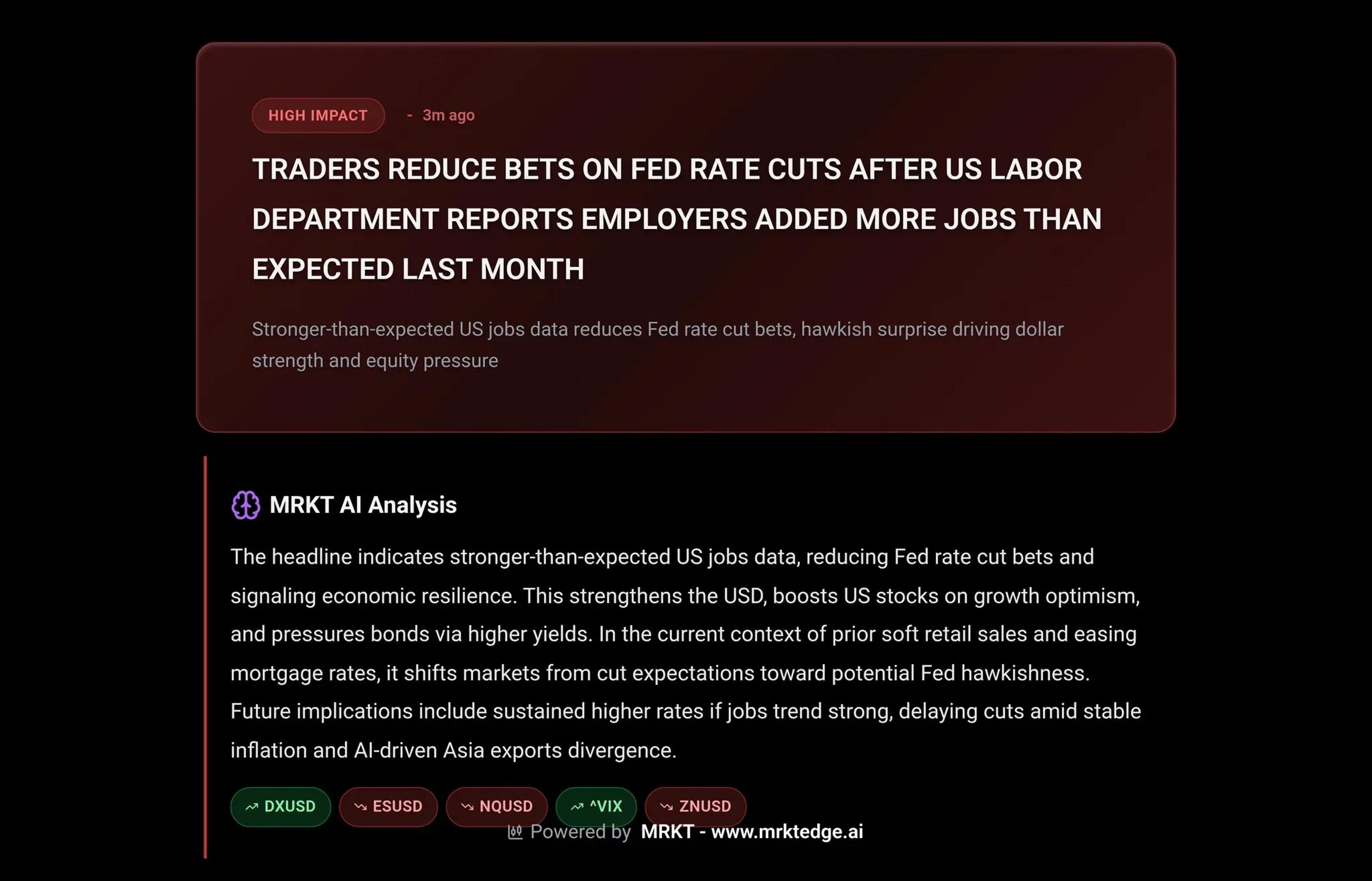

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

Shareholder Rejects Netflix Deal, Backs Paramount Bid

Small Warner Bros. Discovery Shareholder Blasts ‘Flawed, Inferior’ Netflix Offer and Backs Paramount’s Hostile Bid — but Will It Matter? https://t.co/NGSPvAdqOW via @variety

By Todd Spangler

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

Social•Feb 11, 2026

Jobs Report Day Shows Record Forecast Divergence

Good morning and welcome to Jobs Report Day in the US. The consensus forecasts are for a monthly employment gain of 65,000, an unemployment rate of 4.4%, and a 3.7% annual increase in average hourly earnings. As we head into this release,...

By Mohamed El‑Erian

Social•Feb 11, 2026

US Hiring Slumps to Recession-Level, Job Market Fragile

⚠️US HIRING IS AT RECESSION LEVELS: US hiring rate sits at just 3.3%, in line with the 2020 Crisis and one of the lowest readings in 13 years. Hiring is even weaker than during the 2001 recession and at levels seen during...

By Global Markets Investor (newsletter author)

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

Social•Feb 11, 2026

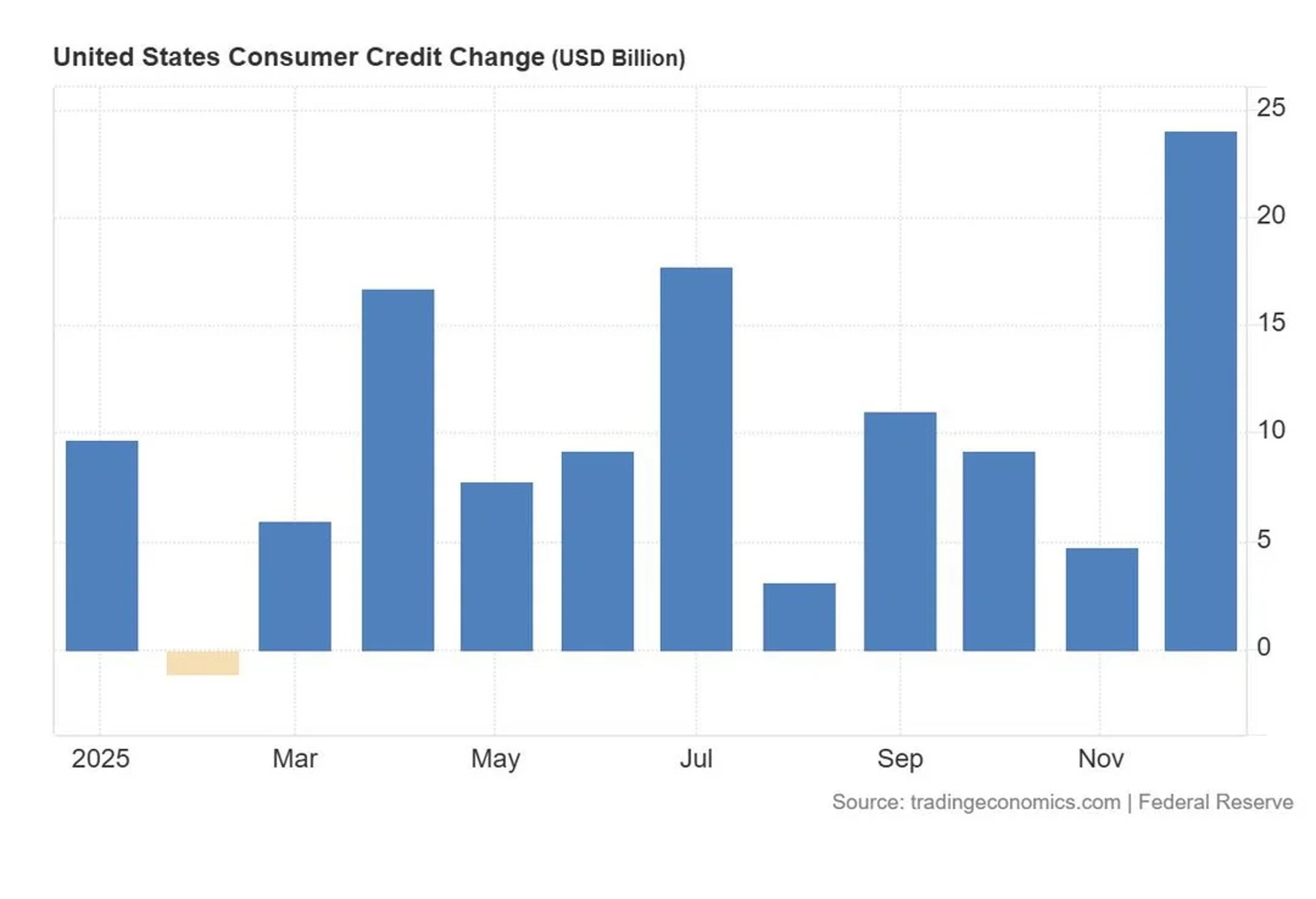

US Consumer Credit Surges $24B, Outpacing Forecasts

Total US consumer credit increased by $24.05 billion in December, far higher than forecasts of an $8.0 billion increase.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 11, 2026

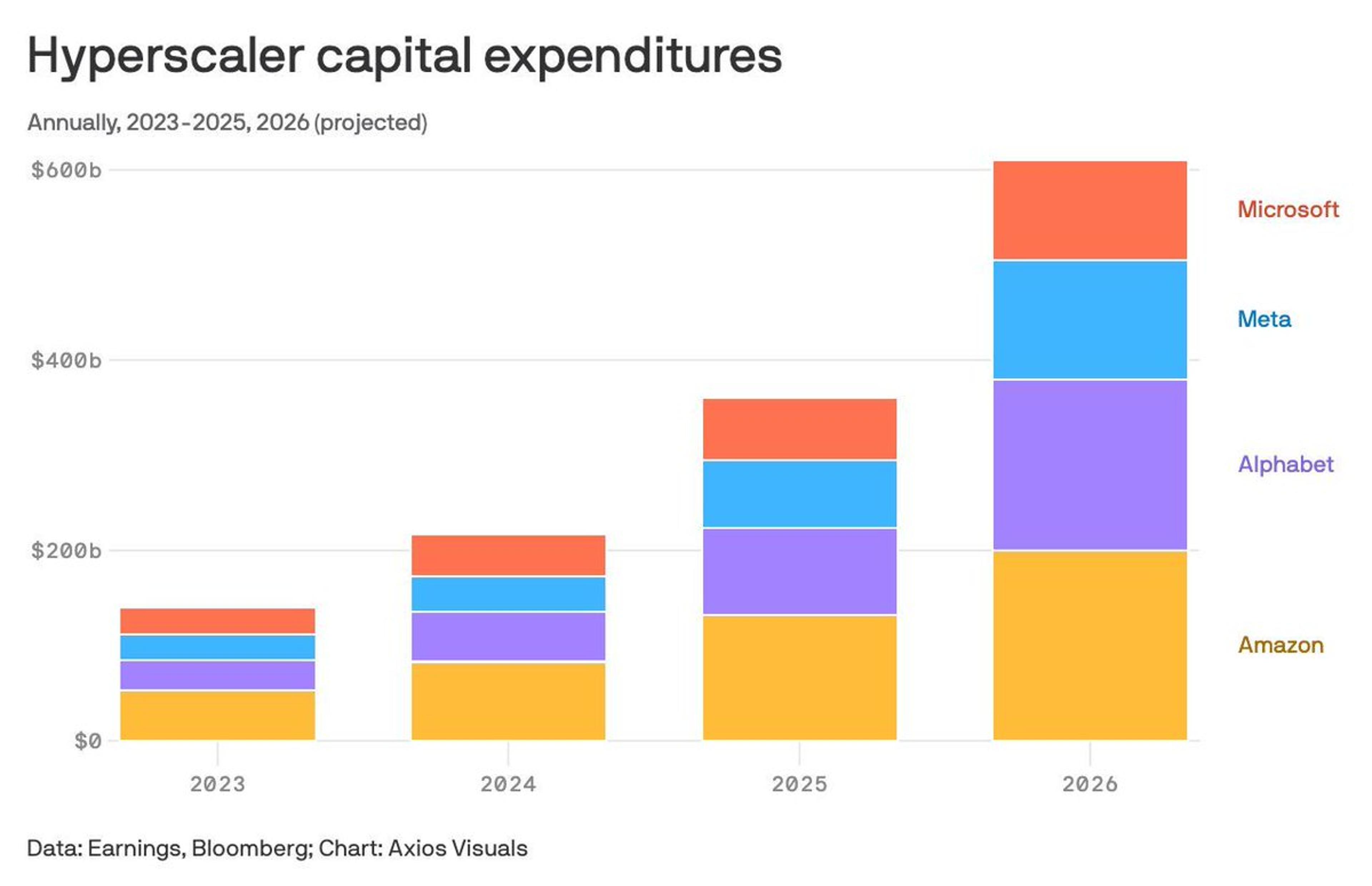

AI‑Driven Sell‑Off Sparks Tech Opportunities on Bloomberg TV

Look forward to discussing this AI driven sell-off and the opportunities in tech on @BloombergTV at 9:40 am with @mattmiller1973 and @daniburgz 🔥🍿📺🐂🏆🎯

By Dan Ives

Social•Feb 11, 2026

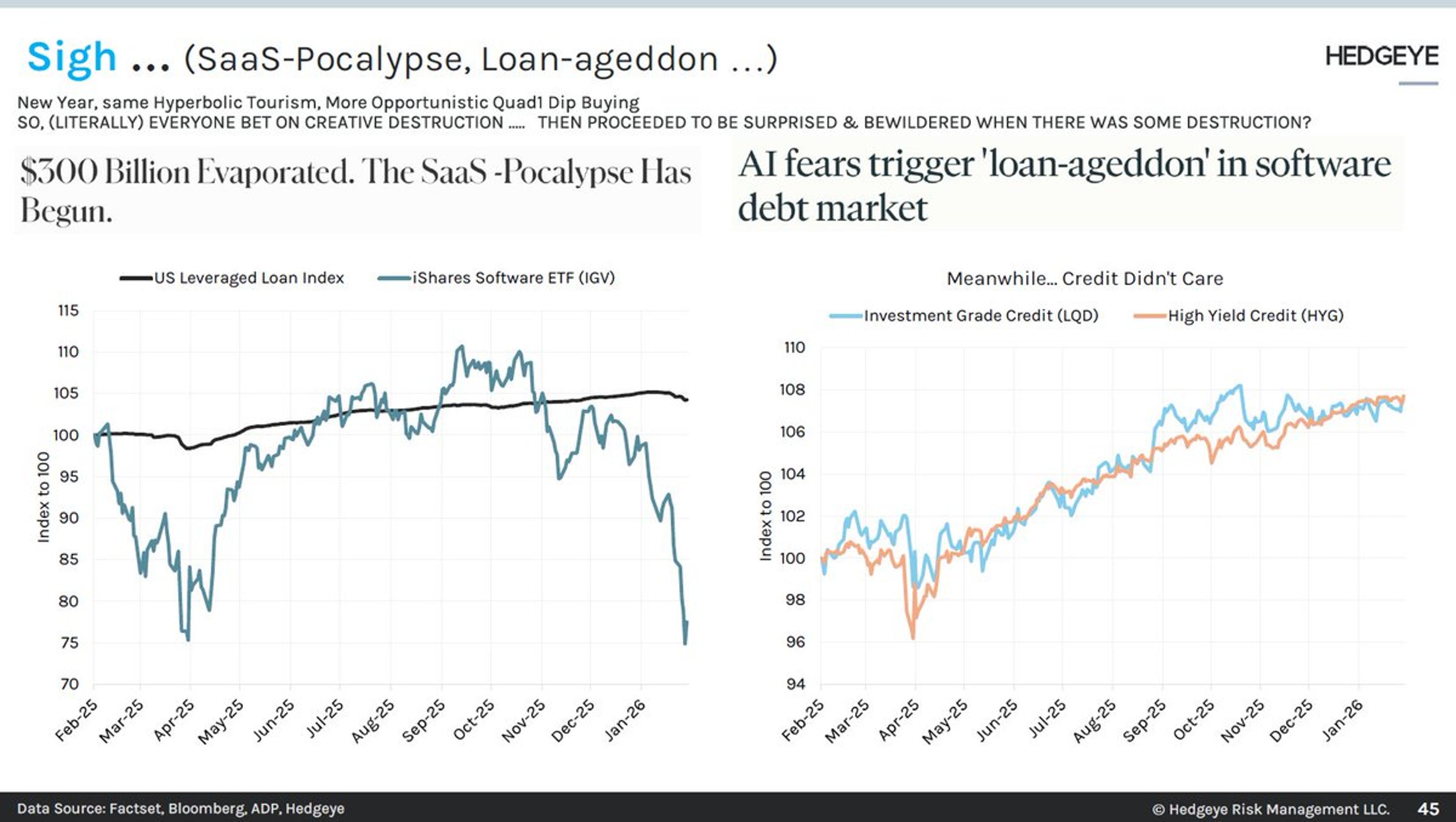

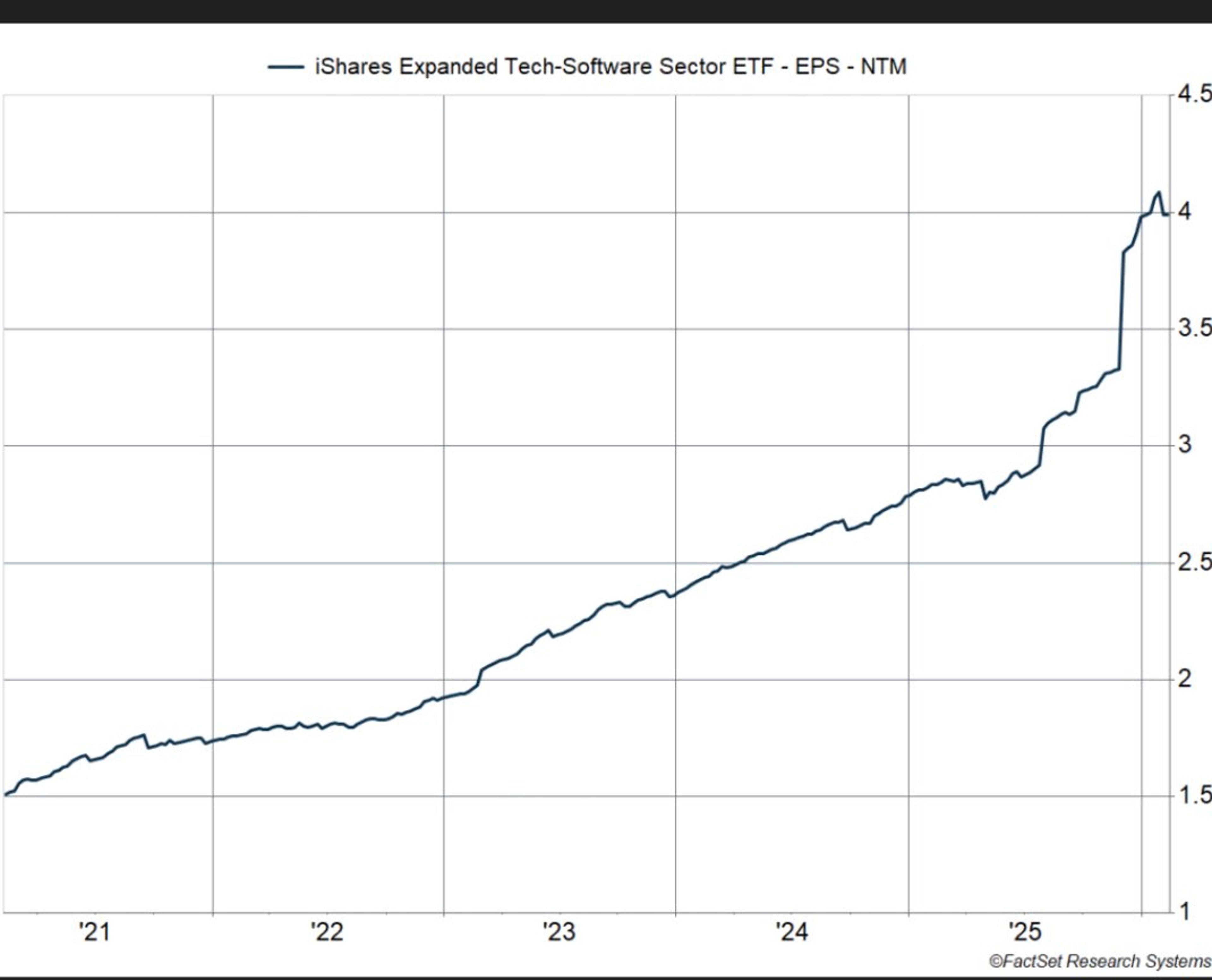

Long Credit, Short Software: Overlooked Hedgeye Macro Theme

Macro Themes Deck (148 slides) @HedgeyeTV 11AM tomorrow Sneak Peak: this slide shows our Long Credit, Short Software Theme that MANY missed https://t.co/sBbXGGtVAr

By Keith McCullough

Social•Feb 11, 2026

AI Accounts for Just 7% of January Layoffs

🔴AI is NOT the reason for job market LAYOFFS: Artificial Intelligence (AI) was cited in 7,624 of 108,435 layoffs announced in January, representing 7% of all cuts that month. Since 2023, AI has been referenced in just 3% of all job cuts...

By Global Markets Investor (newsletter author)

Social•Feb 10, 2026

Growth Slows, Yields Rise—Short Treasury Duration

Macro: growth softens, yields rise. Key: sticky CPI, Fed tightening, tight labor. Risks: stagflation, policy error. Trade: short US Treasury duration as real yields climb. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 10, 2026

Markets Defensive as SPX Stalls Below 7000

Markets turned more defensive Tuesday as early strength faded... In today’s CHART THIS: • $SPX stuck below 7000 • Bonds rally on weaker retail sales • $GOOGL below the 50-day • $AVGO trapped between key MAs • Earnings: $KO $MAR $GILD $HOOD CHART THIS -> https://t.co/pHGfUwqPar

By David Keller, CMT

Social•Feb 10, 2026

Dow Hits Record High, Markets Eye January CPI

MARKET RECAP 📈 The Dow Jones closed at another record high, now up 4.3% so far in 2026. All eyes on January CPI coming this Friday 👀 What the heck is going on?!? Let’s talk about it 🗣️

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 10, 2026

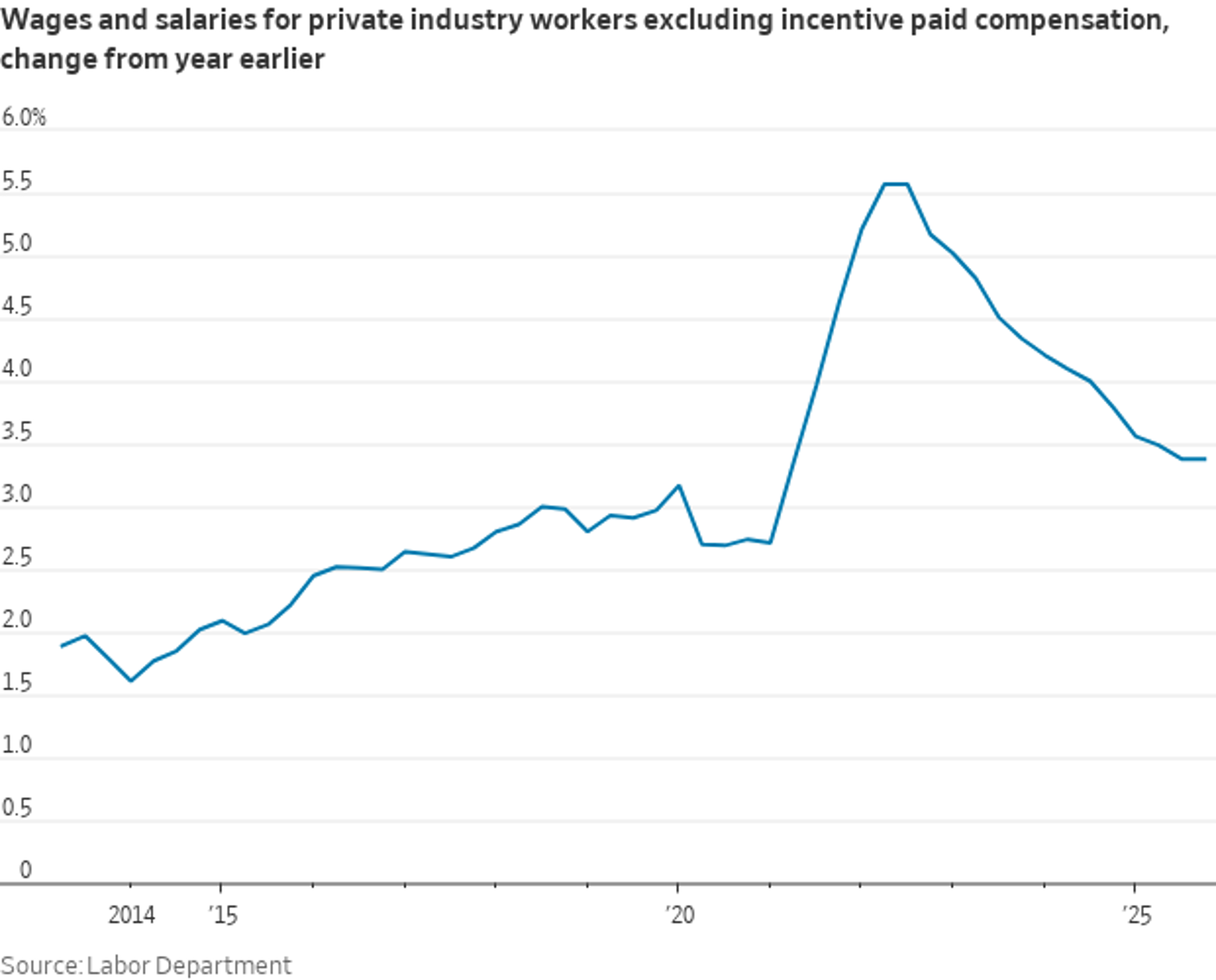

Underlying Inflation Near 2.5%, Likely to Ease Further

The ECI data out this morning is consistent with the thesis that underlying inflation is around 2.5%. And labor market looseness suggests that is more likely to go down than up. Wages ex volatile incentive pay have been steadily growing at...

By Jason Furman

Social•Feb 10, 2026

Uber Slides to Multi‑month Low, 30% Off Recent High

$UBER one of the show's favorite longs hits a multi month low and is now close to -30% below its recent high. Crickets. @dougkass @KeithMcCullough

By Doug Kass

Social•Feb 10, 2026

Financial Stocks Overvalued, Commoditization Signals Short Opportunity

Financial stocks are "overearning" and subject to disruption. Altruist's tool is the tip of the iceberg. Today's share price declines are justified, imho - as pricing of industry product offerings will become more commoditized. This was inevitable. Trading at historic premiums...

By Doug Kass

Social•Feb 10, 2026

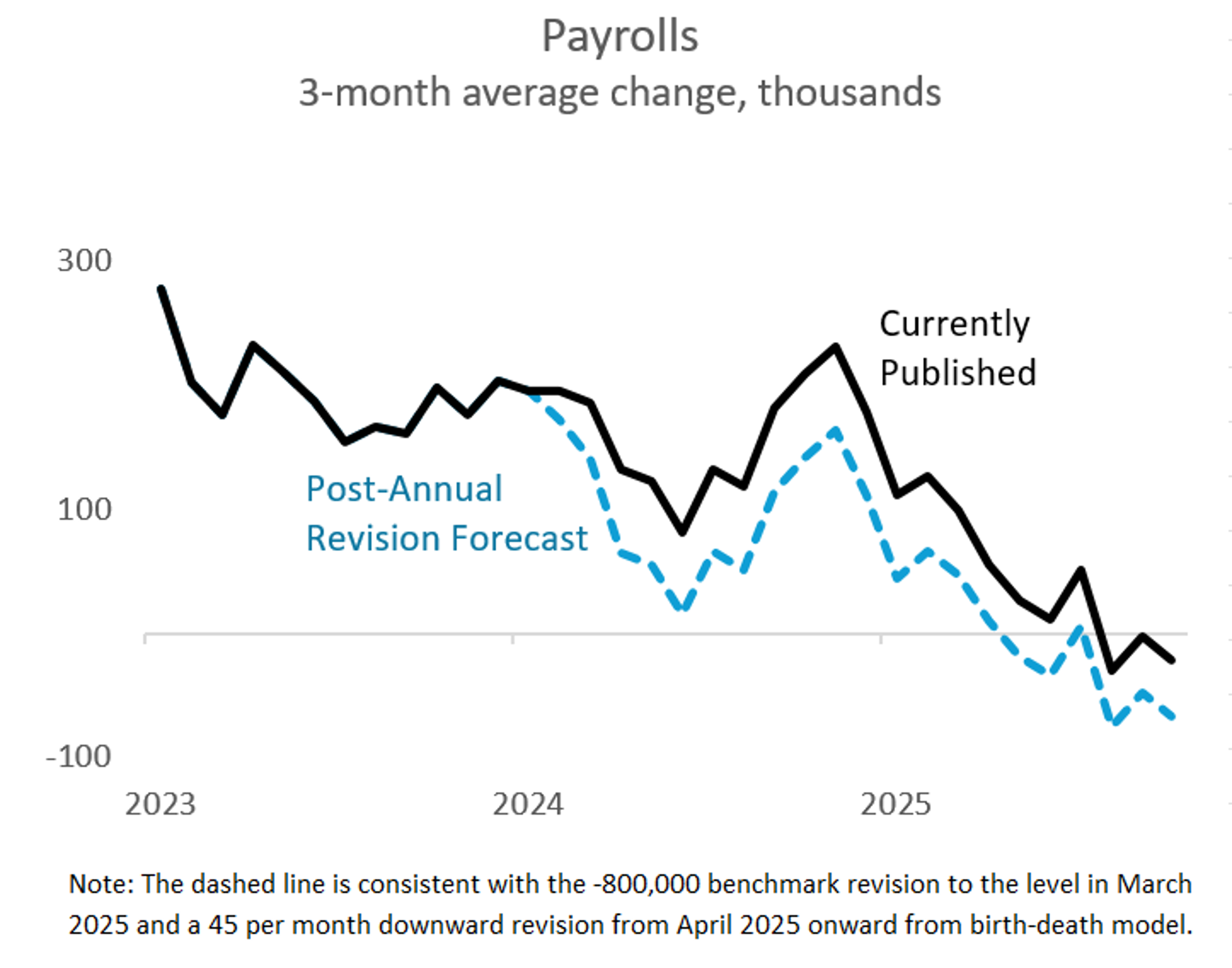

Upcoming Jobs Report May Reveal Weaker Labor Market

The jobs report is due out tomorrow. Along with it, are the annual benchmark revisions. In other words, we may soon learn that the labor market is in worse shape than we thought. https://t.co/b44jhyLPVL

By Eddy Elfenbein

Social•Feb 10, 2026

Dallas Fed Sees Rates Near Neutral, Warns Stubborn Inflation

Dallas Fed President Lorie Logan sounded more confident about the labor market outlook compared to Sept and Nov. She is also slightly more optimistic about inflation, pointing to recent downtrends in the "trimmed mean" PCE reading. But her bottom line is...

By Nick Timiraos

Social•Feb 10, 2026

Seeking Bull Case for Discounted HAL Stock

RPK, last time I asked you about $RIG signaling buy more - what's the bull case on $HAL on sale? @RPKent

By Keith McCullough

Social•Feb 10, 2026

Snap‑back Rallies Off Strong Support Aren’t Reversals

Little Bounces Off Big Support From my live trading room Friday... Snap-back rallies off big support does not a trend-reversal make 🙃 $MSFT $AMZN $QQQ $BTCUSD $SLV https://t.co/OLa6XrVvqJ

By Samantha LaDuc

Social•Feb 10, 2026

Railroads Hit All-Time Highs, AI Disruption Unlikely

No AI disruption worries in railroads, with Union Pacific, CSX, and Norfolk Southern all touching ATHs

By Lawrence Hamtil

Social•Feb 10, 2026

U.S. Stocks Under Pressure as SPX/VEU Hits Near Two‑Year Low

The 'sell America' trade pressure seems to be picking up again. The SPX-VEU (rest of world equity ETF) ratio is the lowest since April 22nd. A little further and it is a two year low. Adding the DXY Dollar Index in for...

By John Kicklighter

Social•Feb 10, 2026

Amazon Steadies; Rally to 200‑day MA Signals Trade

$AMZN is holding steady after the gap frenzy last week. A rally back to the 200-day moving average would make sense for the bulls and the bears, but that feels more like a "trade" to me. The real question...

By David Keller, CMT

Social•Feb 10, 2026

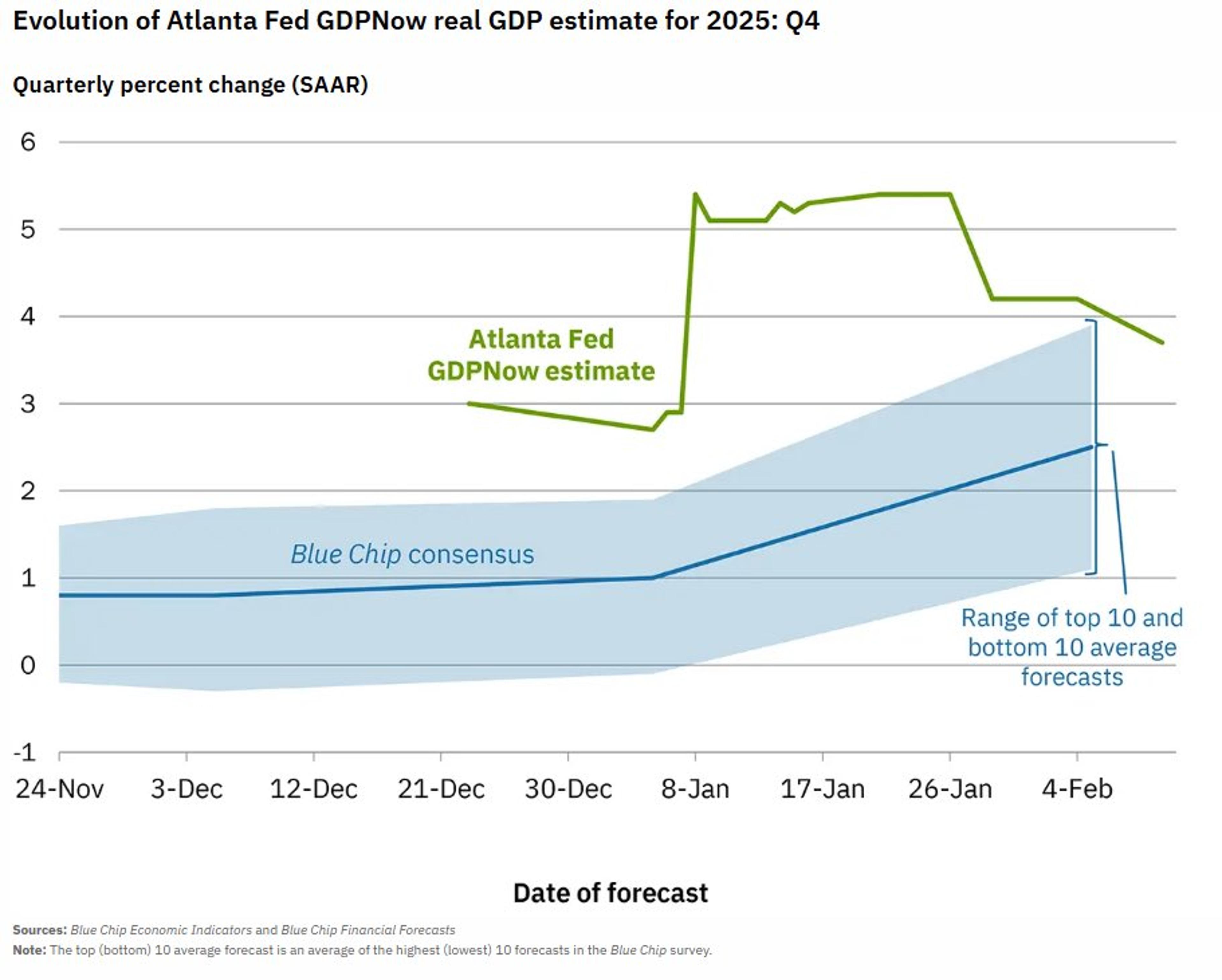

Atlanta Fed GDPNow Now at 3.7% Q4 2025

GDPNow model (a “nowcast,” not a forecast) from @AtlantaFed down to +3.7% q/q annualized for 4Q2025 https://t.co/NKqC4jdaL0

By Liz Ann Sonders

Social•Feb 10, 2026

Fed Likely Holds Off Policy Changes for Year

Bessent on balance sheet policy in a Warsh Fed: "I wouldn't expect them to do anything quickly. They've moved to an ample [reserves] regime ... that does require a larger balance sheet. So I would think they'll probably sit back,...

By Nick Timiraos

Social•Feb 10, 2026

Committee Claims New Focus, Still Clings to Big Caps

Imagine being on a pretent "investment committee" that has finally figured out being Long Industrials $XLI and isn't Long of the Big $CAT ? lol Reality: they're all still long of the #Bag7 Stocks and widely held Large Cap Financials...

By Keith McCullough

Social•Feb 10, 2026

White House Inflates Payrolls; Revisions Could

WH keeps 'pumping up' payrolls for tomorrow. Here's why. Revisions could wipe out all job growth last year. Zero. zip. nada. https://t.co/RILDizthdl

By Claudia Sahm

Social•Feb 10, 2026

Private-Sector Wages Barely Slowed, up 3.38% YoY

ECI: Private-sector pay growth decelerated ever so slightly last year. Wages and salaries for private sector workers ex-incentive paid occupations was +3.38% in Q4 from a year earlier, unchanged from Q3. https://t.co/769ycb4jwP

By Nick Timiraos

Social•Feb 10, 2026

COIN Bounces Off $145 Support, Aligns With Low Targets

Can't help but notice $COIN is bouncing off major league support around $145, lining up well with the Sep '24 and Mar '25 lows. Previous lows have been confirmed with a bullish crossover from weekly PPO. But dang...

By David Keller, CMT

Social•Feb 10, 2026

Software Multiples Hit 2014 Lows Amid AI Fears

Software earnings have been quite resilient, yet prices have collapsed over AI worries. As a result, multiples are the cheapest they've been since 2014. Sometimes things are cheap for a reason, but what if this is another DeepSeek moment? Nice charts...

By Ryan Detrick

Social•Feb 10, 2026

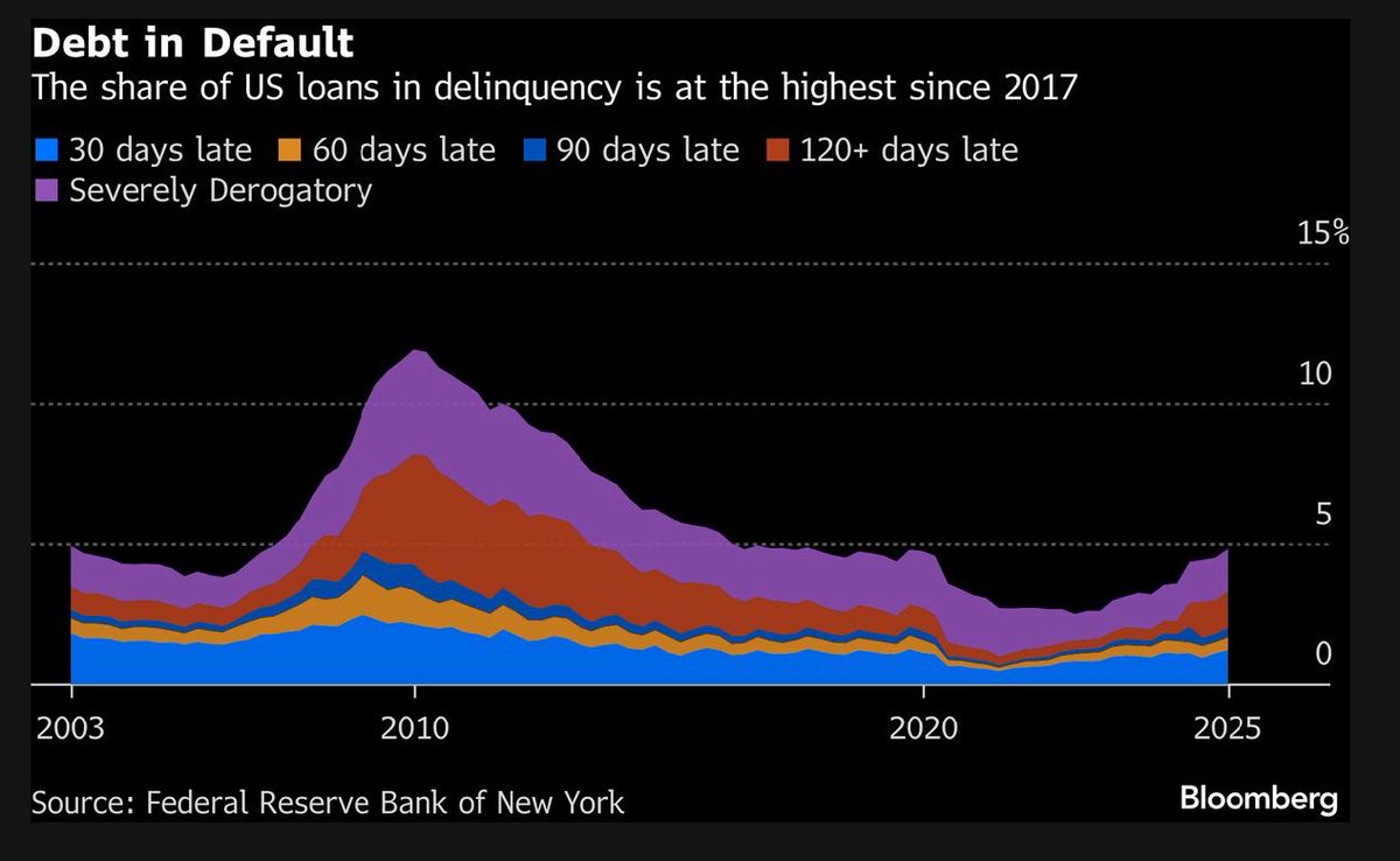

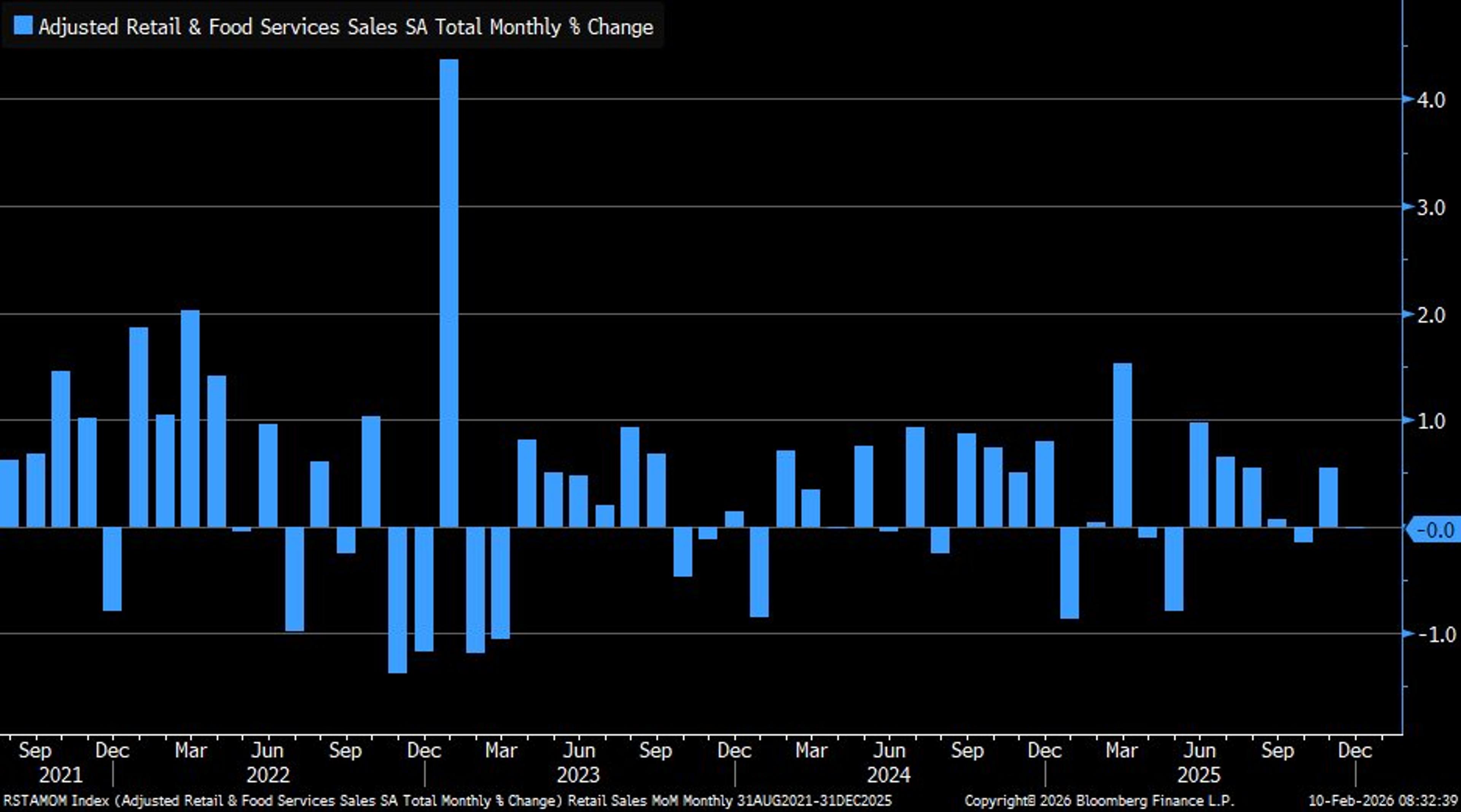

Holiday Sales Slump and Rising Delinquencies Hit Young, Low‑Income Americans

The one-two punch today of highly disappointing holiday retail sales and the highest consumer delinquencies since 2017 paints a bleak picture for lower-income and younger Americans. https://t.co/Bd2eX18BAU https://t.co/H1biY6UCIL

By Lisa Abramowicz

Social•Feb 10, 2026

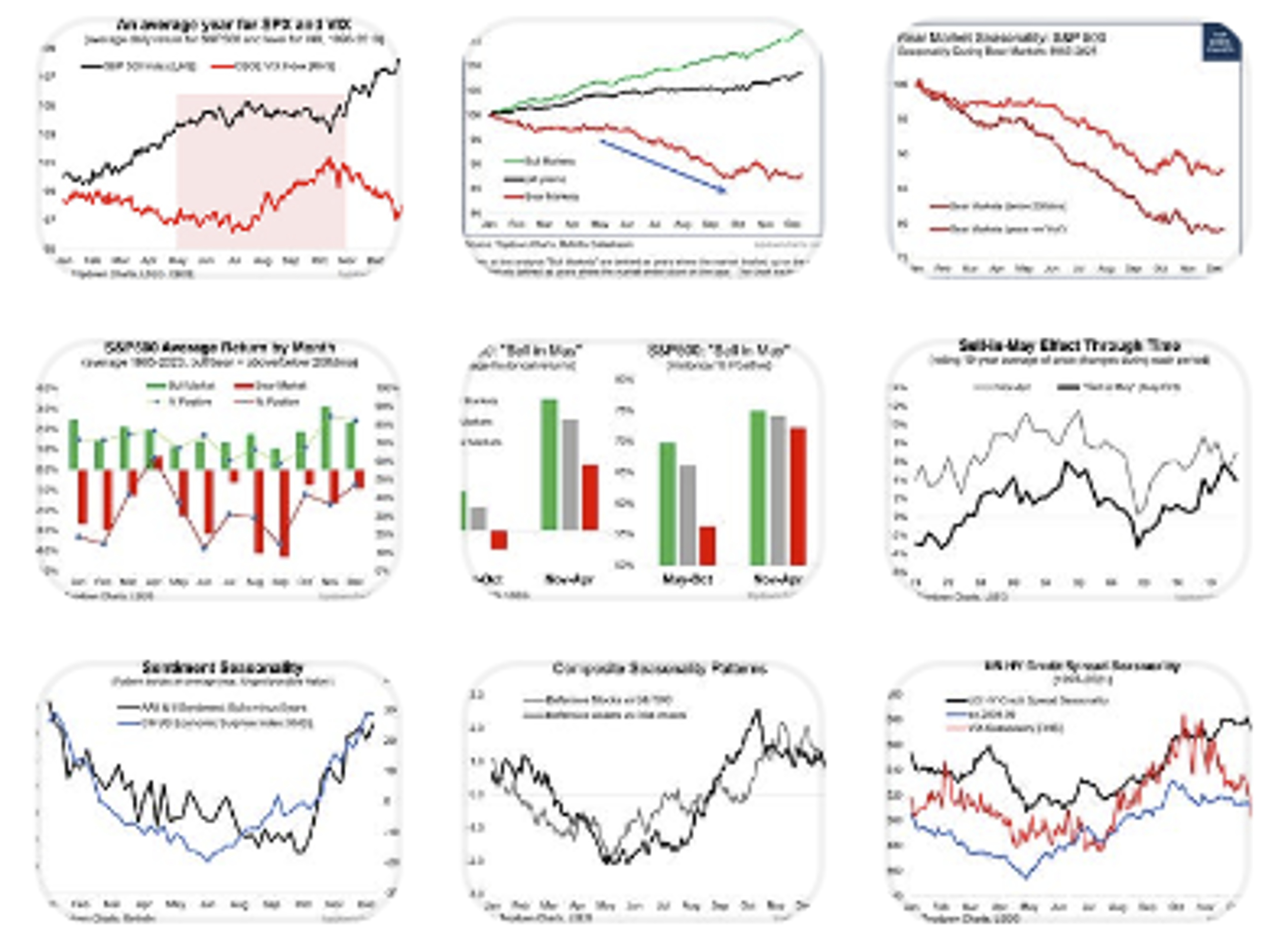

Weekly ChartStorm Reveals Hidden Stock Market Seasonality Angles

You may think you know all about stockmarket seasonality... but this special focus piece from the Weekly ChartStorm lays out a few more angles and details that you might not have considered before: https://t.co/5sf2QCC8pE https://t.co/XBuZIufwiB

By Callum Thomas

Social•Feb 10, 2026

Top Picks: Hundreds of Weekly Charts Highlighted

Our team probably creates a couple hundred charts each week. Here are some of our favorites from last week in the @CarsonResearch Charts of the Week. https://t.co/UIFr74RPu4

By Ryan Detrick

Social•Feb 10, 2026

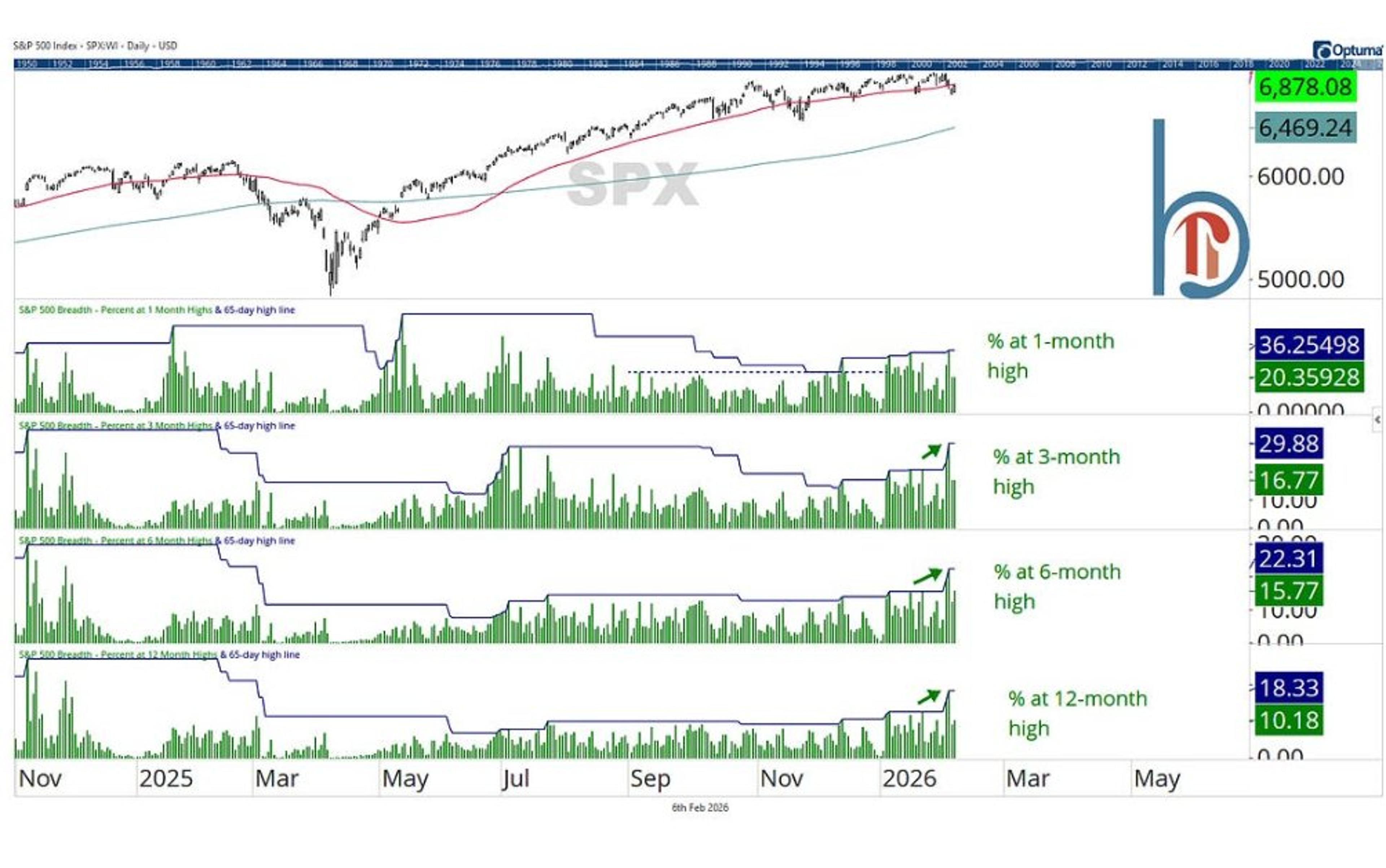

Market

Great analysis in his note this week on some positives and negatives from @scottcharts. But breadth continues to be the one big reason to expect this bull to continue imo. https://t.co/WO4e9HXrem

By Ryan Detrick

Social•Feb 10, 2026

Doubling Down: Shorting QQQ to Complement SPY Bet

Adding Some QQQ to My SPY Short @TheStreetPro I just shorted (QQQ) (to add to my (SPY) short earlier this morning): * QQQ $615.74 By Doug Kass Feb 10, 2026 9:26 AM EST

By Doug Kass

Social•Feb 10, 2026

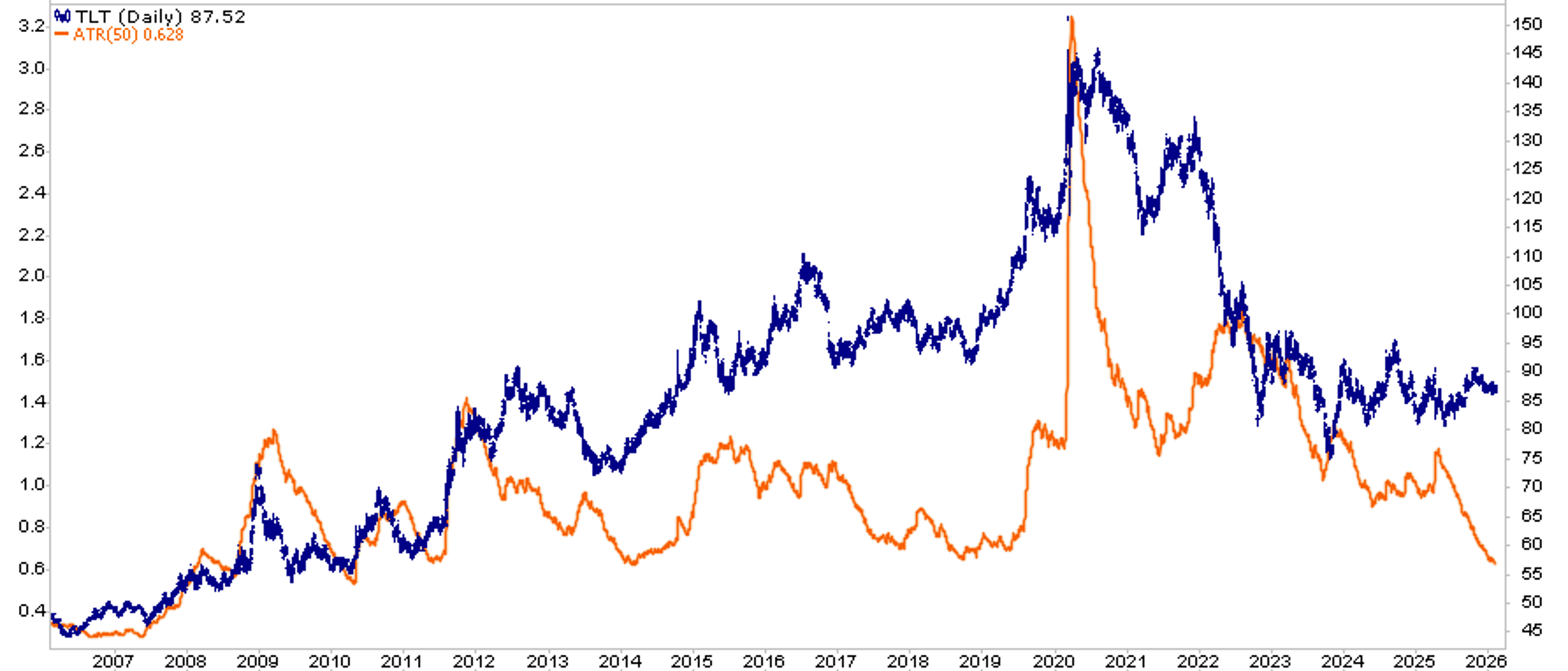

TLT's 15-Year Low ATR Signals Potential Breakout

$TLT : The Average True Range (orange) is now the lowest in over 15 years. Something has to give. Might the plummeting @truflation readings be a clue to which direction a breakout might occur? https://t.co/0pEENxYpXs

By Michael Lebowitz

Social•Feb 10, 2026

US Stocks Look Strong, Yet Lag Global Peers

"The US stock market, while it looks strong, is actually much weaker than almost any other industrialized country.... So while we're doing well… everyone else is doing even better." https://t.co/7KavXe5LXh

By Justin Wolfers

Social•Feb 10, 2026

Software Sector Oversold Bounce, Not Sustainable Trend Reversal

📺 SOFTWARE SECTOR: TACTICAL OVERSOLD BOUNCE, NOT A TREND REVERSAL Software $IGV is seeing a short-term oversold bounce, not a trend reversal. The sector remains broken after losing key moving averages, so upside is likely limited near short-term resistance like the 8-day....

By Scott Redler

Social•Feb 10, 2026

Bulls Hold SPY Above 680, Eye 7,000 Target

📺 BULLS TOOK CONTROL: HERE’S THE LEVEL THAT MATTERS Active bulls regained control after $SPY held the $687 level and followed through on Friday’s strength. Small caps $IWM and mid caps $MDY continue to lead, while $QQQ works back into key...

By Scott Redler

Social•Feb 10, 2026

December Retail Sales Stall at 0%, Missing Forecast

December retail sales 0% vs. +0.4% est. & +0.6% prior; control group -0.1% vs. +0.2% prior (rev down from +0.4%); ex-autos 0% vs. +0.4% prior (rev down from +0.5%) https://t.co/BbJwHL35ne

By Liz Ann Sonders

Social•Feb 10, 2026

Small Business Optimism Falls, Uncertainty Rises

January @NFIB Small Business Optimism Index down to 99.3 vs. 99.8 est. & 99.5 prior … net % of respondents expecting a better economy ticked down to 21%; percentage saying it’s a good time to expand rose to 15%; uncertainty...

By Liz Ann Sonders

Social•Feb 10, 2026

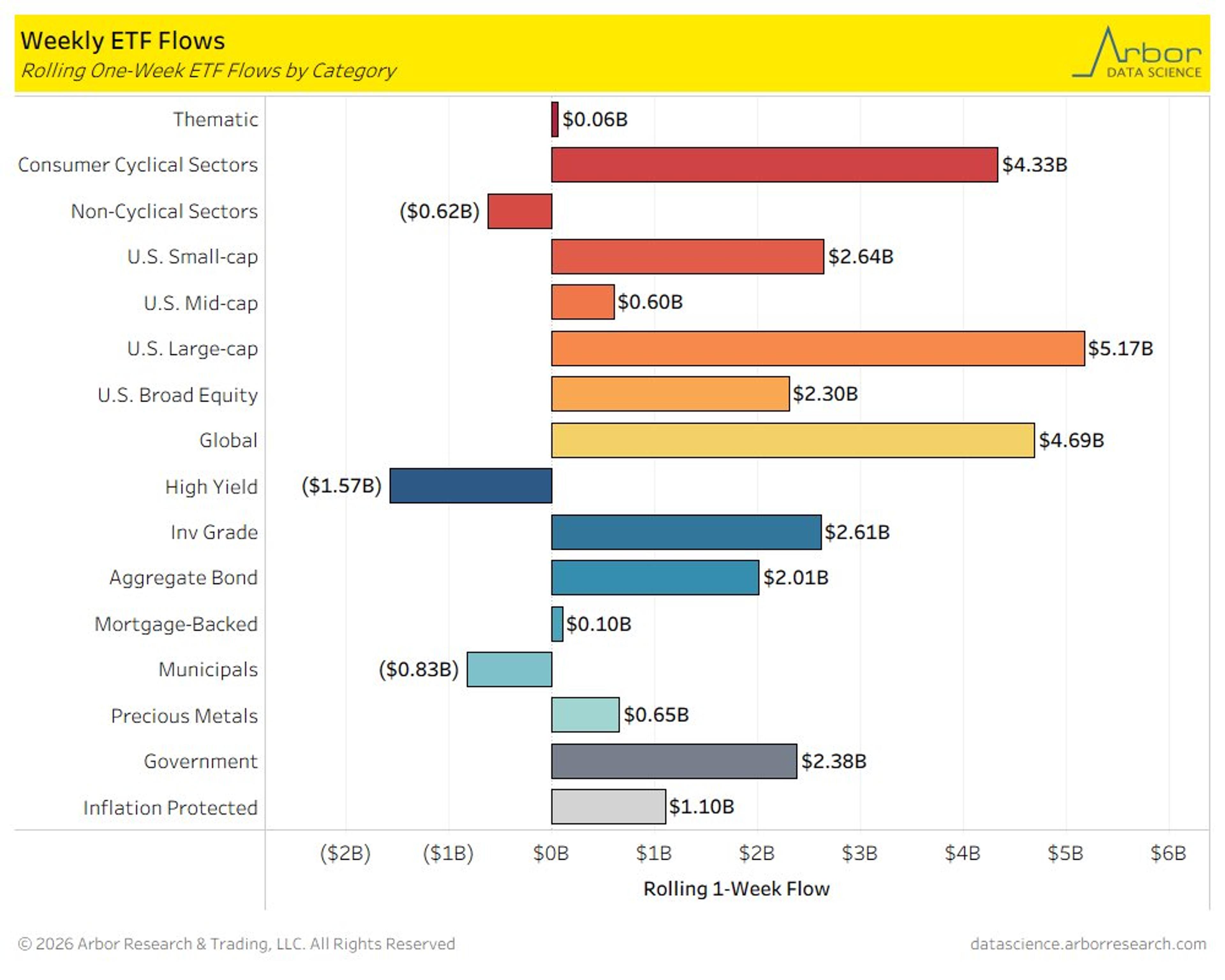

U.S. Large Caps Lead Inflows; High‑Yield Bonds Lose Ground

U.S. large caps dominated inflows last week, followed by global equities and consumer cyclicals ... high yield bonds saw most outflows, but broader fixed income universe was still positive @DataArbor https://t.co/l0soXmQF4S

By Liz Ann Sonders

Social•Feb 10, 2026

Household Pessimism on Finances Rises, Stays Elevated

Share of households expecting to be in a worse financial situation a year from now ticked up in January and has been elevated over past year per @NewYorkFed https://t.co/fGqXylhwzD

By Liz Ann Sonders

Social•Feb 10, 2026

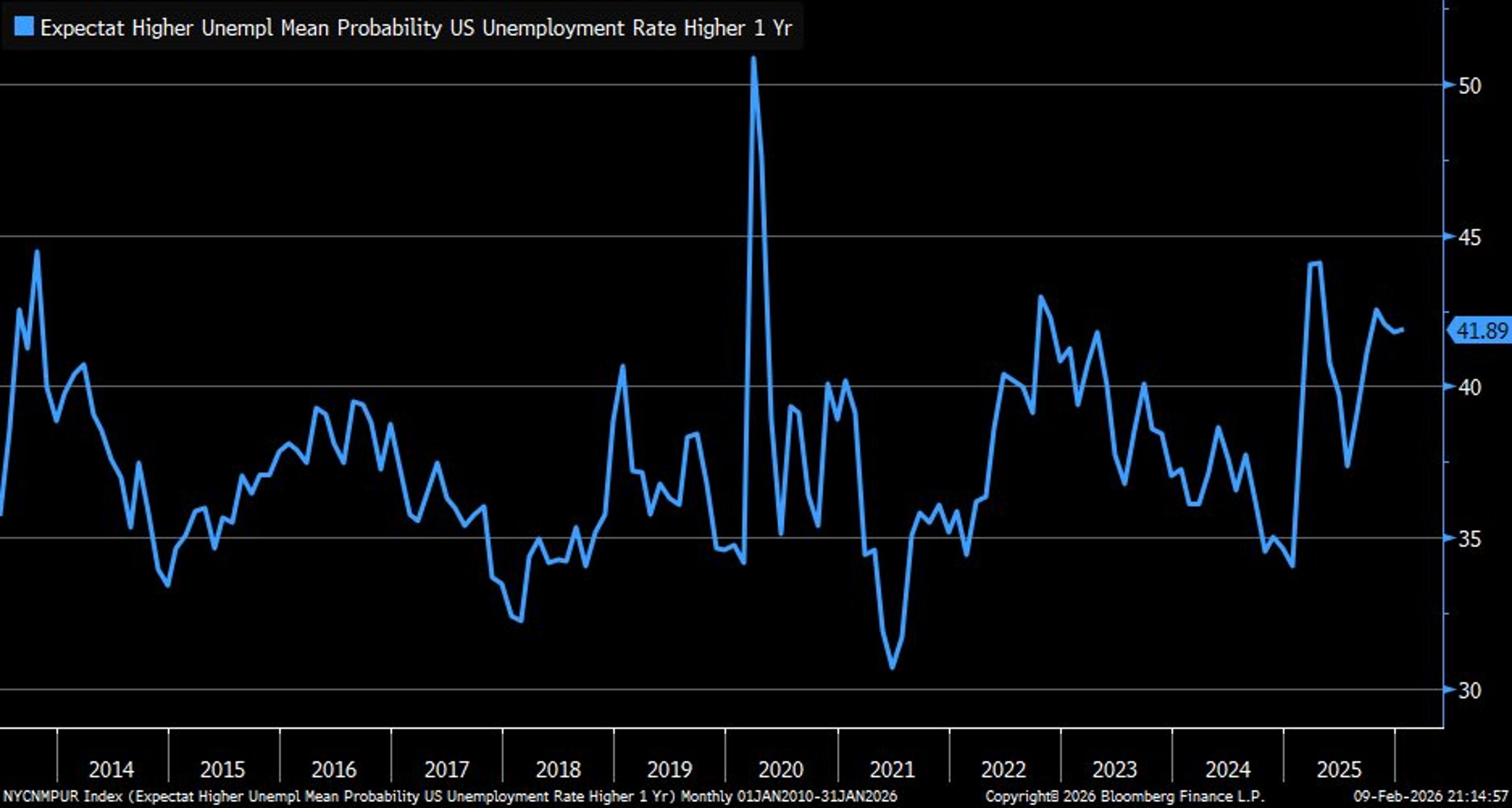

Nearly 42% Expect Rising Unemployment, Survey Shows

Consumers still showing concerns over labor market, with average of nearly 42% expecting higher unemployment in next year per January @NewYorkFed survey https://t.co/ykN7Bdc2C0

By Liz Ann Sonders

Social•Feb 10, 2026

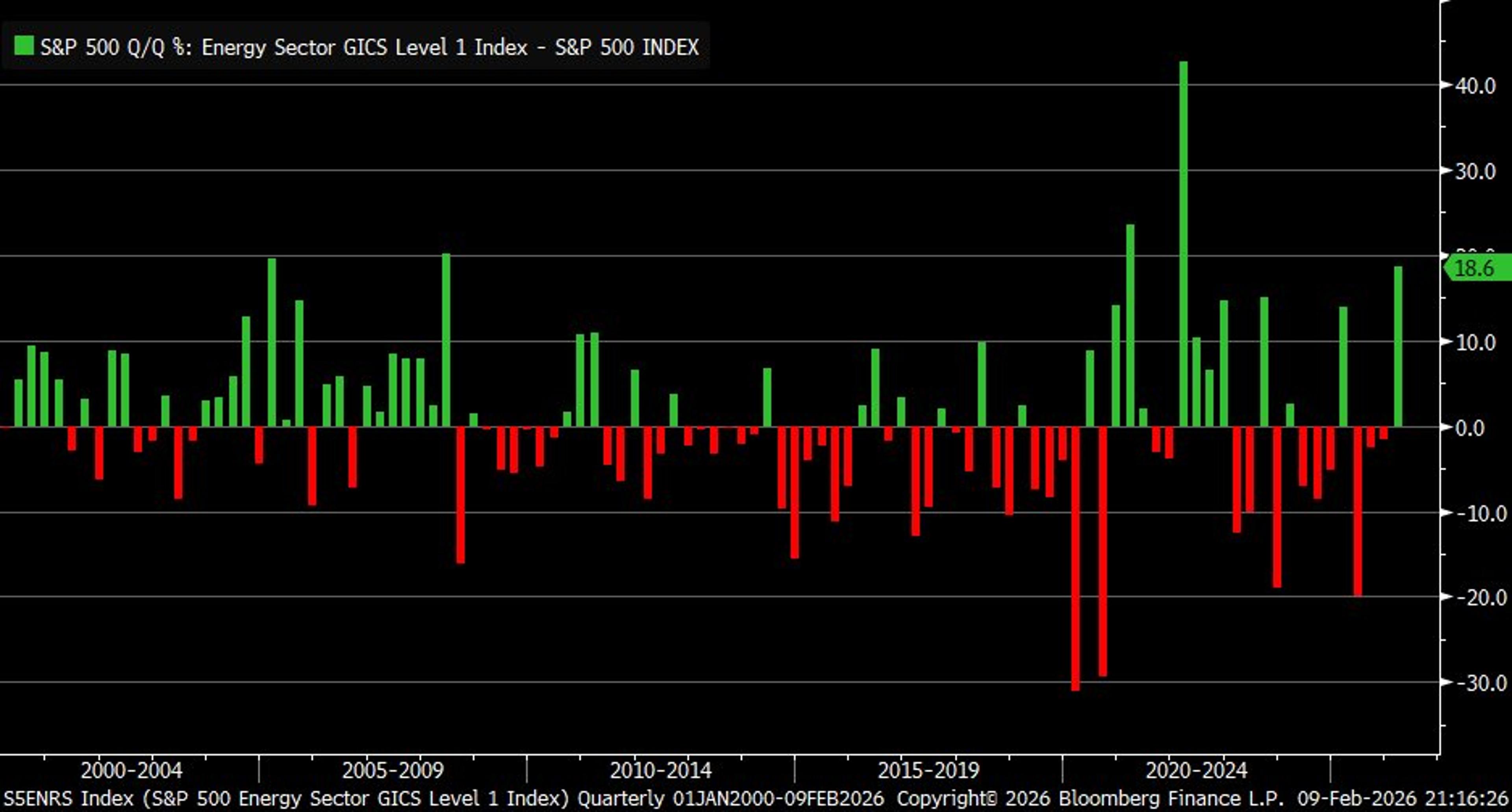

Energy Sector Outpaces S&P 500 by 19 Points.

Quarter-to-date, Energy sector is outpacing S&P 500 by nearly 19 percentage points … best since first quarter of 2022 and one of best performance spreads (as of now) since 2000 [Past performance is no guarantee of future results] https://t.co/1vvb9Qf0Mh

By Liz Ann Sonders

Social•Feb 10, 2026

Vanguard's $70B ETF Inflows Rank Top Three

Vanguard has already taken in $70b in ETF flows to start year, that's nearly $3b a day and more than all but 3 issuers took in last year. If VOO alone were an issuer it would be in 3rd place...

By Eric Balchunas

Social•Feb 10, 2026

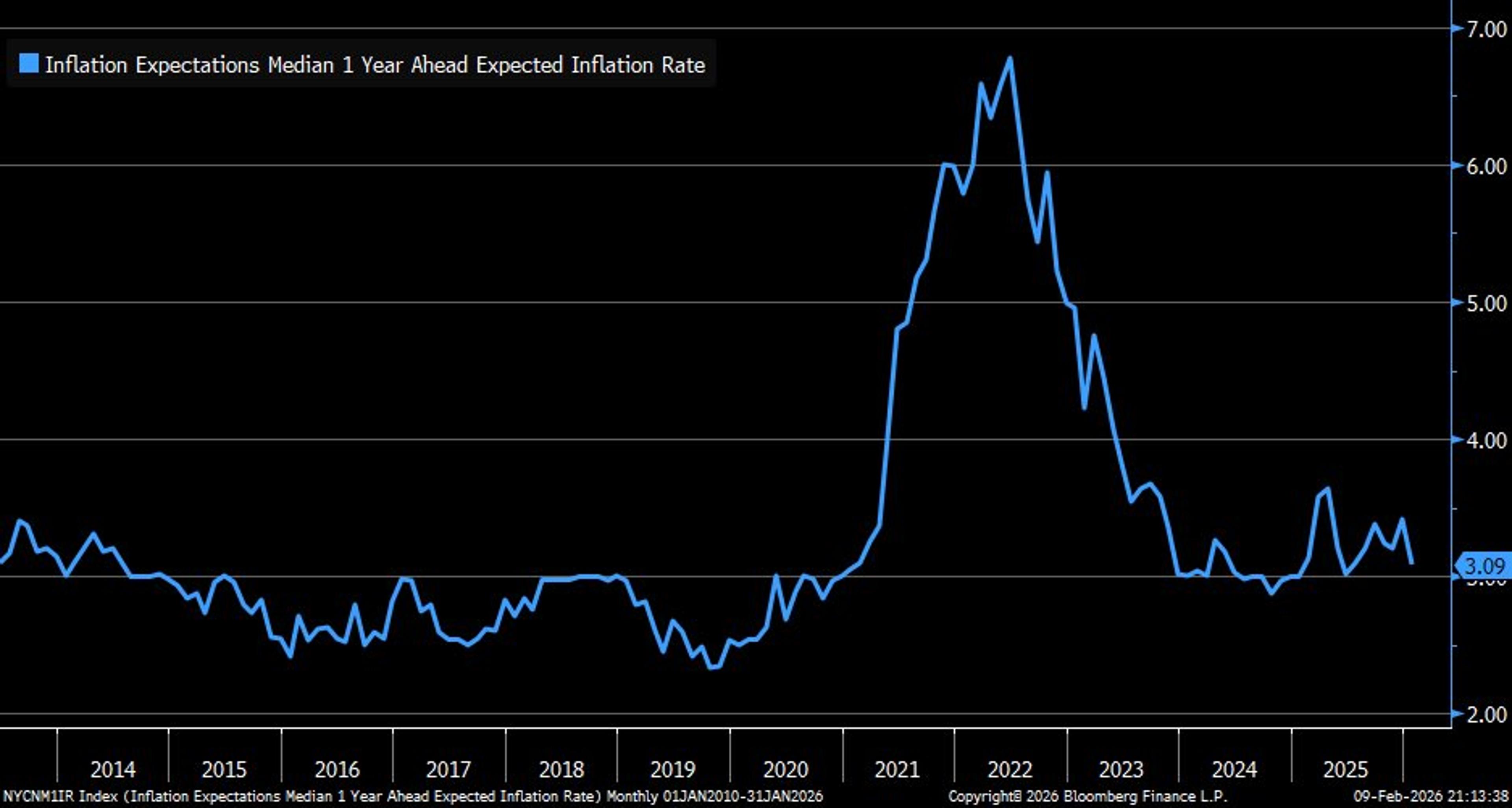

Consumers' 1‑Year Inflation Expectation Drops to 3.09%

Per @NewYorkFed survey, as of January, consumers’ median 1y inflation expectations moved down to 3.09% https://t.co/y6Jab93CyT

By Liz Ann Sonders

Social•Feb 10, 2026

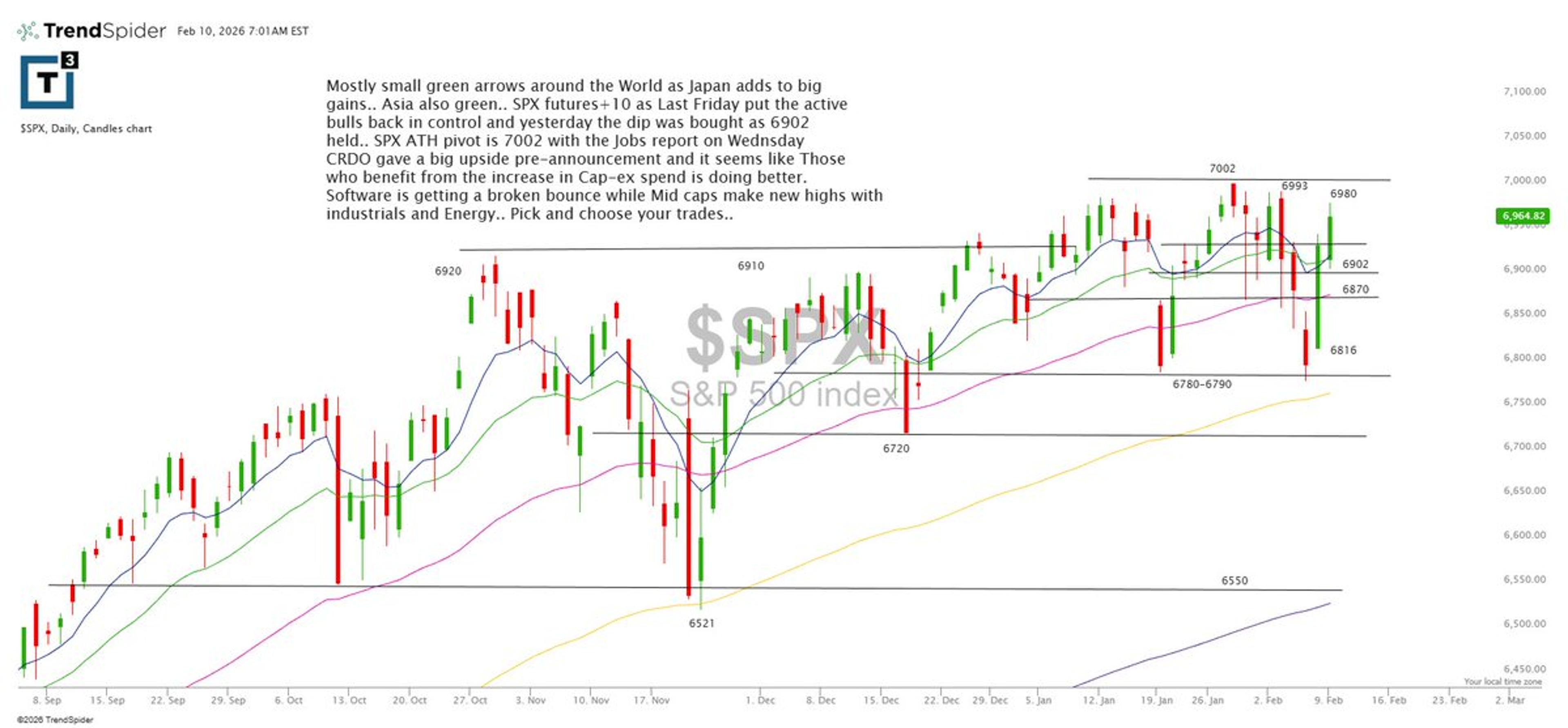

SPX Futures Rise, Bulls Hold Above 6900, Target 7002

$SPX futures +10 after Friday’s action put active bulls back in control and yesterday’s dip was bought off 6902—7002 remains the ATH pivot into Wednesday’s jobs report. https://t.co/bUhLX4Ywid

By Scott Redler

Social•Feb 10, 2026

Infrastructure Software Set for Multi-Month Rally as App Vendors Falter

Application software vendors are struggling and providing weak guidance, quality infrastructure software firms' revenue is accelerating. Infrastructure software vendors are attractively valued now and their stocks appear poised for a multi-month rally.

By Puru Saxena