Social•Feb 13, 2026

Ford Faces $900M Tariff Blow, Highlighting US Corporate Pain

Ford just disclosed an additional $900M tariff hit in its Q4 results. TARIFFS = BAD NEWS FOR AMERICAN CORPORATIONS. https://t.co/kau61WOizz

By Steve Hanke

Social•Feb 13, 2026

Services Inflation Sticks While Housing Disinflation Persists

Closing out the week with @GregDaco and @ElizRosner talking about inflation: "On the latest episode of The Inflation Brief from ECON-versations with NABE, hosts Greg Daco and Laura Rosner-Warburton are joined by special guest Claudia Sahm to break down the...

By Claudia Sahm

Social•Feb 13, 2026

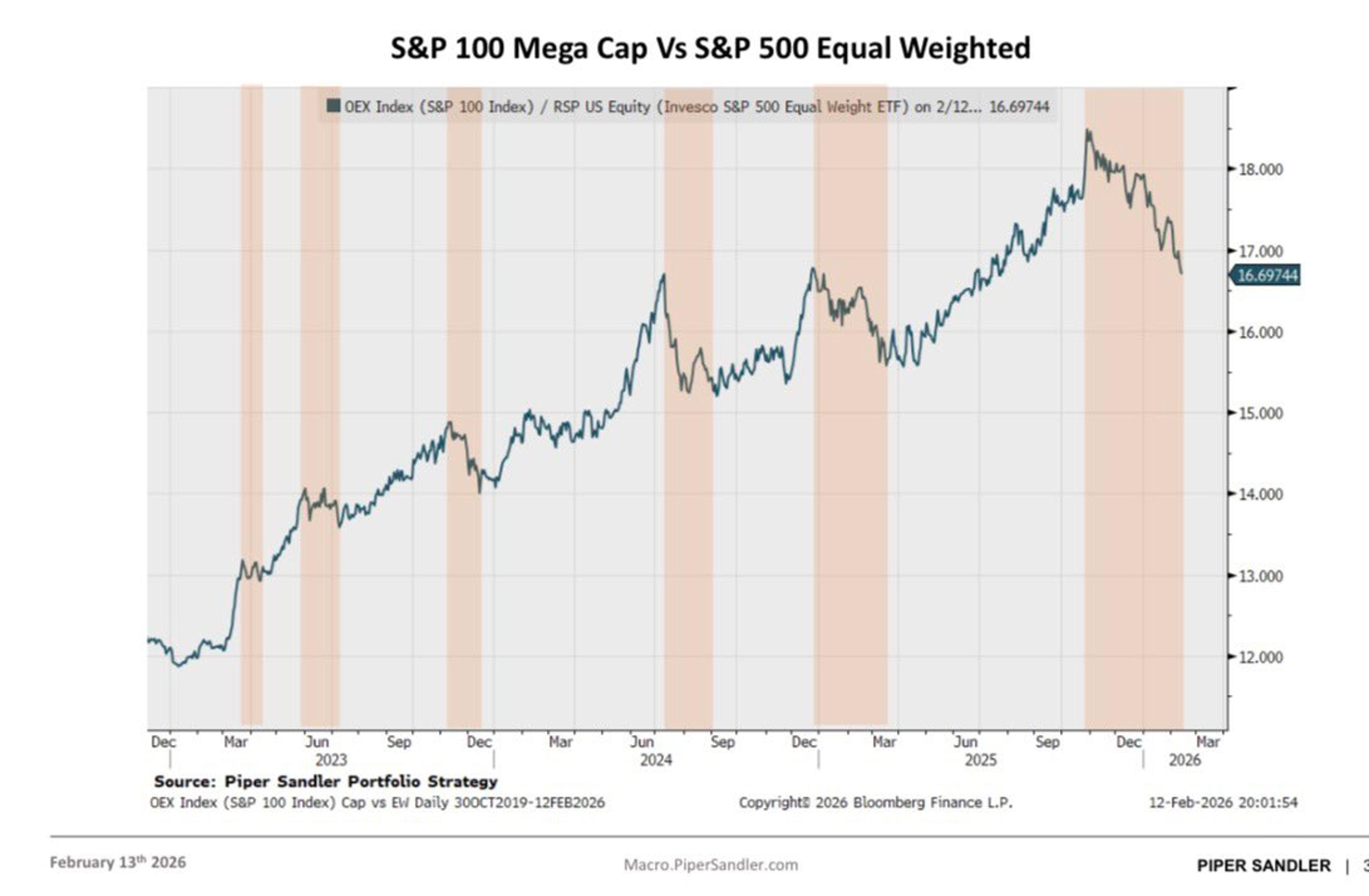

Broadening Value and Cyclical Rotation Driven by Fundamentals

We now have the longest and strongest breadth rotation in recent years. Notably, it’s the only rotation that has been propelled by broader macro and micro fundamentals rather than lower rates. We first recommended a broadening trade of value and...

By Michael Kantro

Social•Feb 13, 2026

Capital Shifts to Value: Cash Flow Beats Future Promises

Leadership didn’t vanish; it rotated. Capital moved from high-growth tech into value, dividends, and economically sensitive sectors. When rates stay higher and scrutiny rises, cash flow today beats promises tomorrow. Style matters again.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

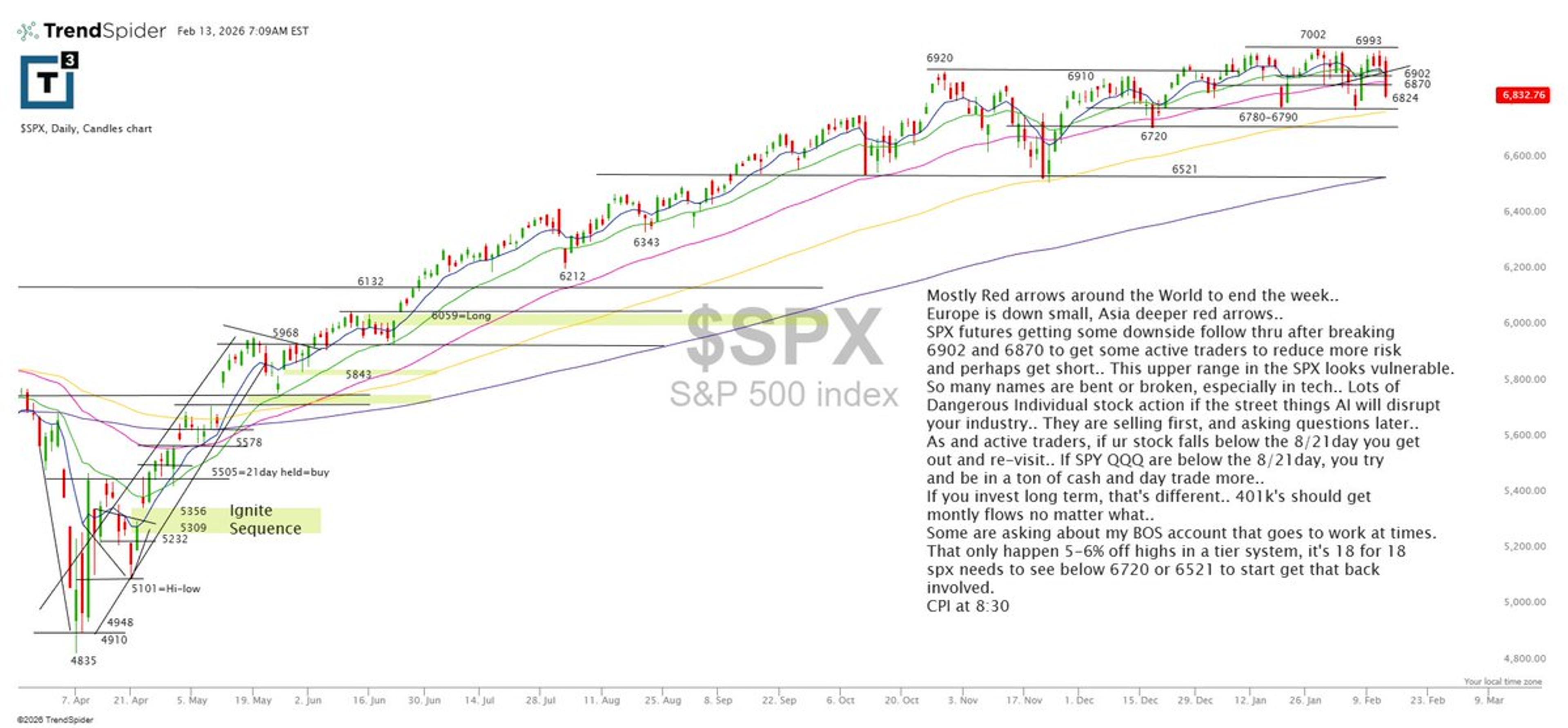

SPY Likely Drops Below $670 Before Hitting $690

Some ask. What do I think next week. The next ten $spy points. I’d say below $670 before above $690

By Scott Redler

Social•Feb 13, 2026

Old Leaders Fade; Adapt Fast to New Trading Landscape

The leaders of last year are no longer the favorites. The trading landscape is changing, and you have to adapt quickly to keep an edge.

By Hyperstocks

Social•Feb 13, 2026

Steel Stock SLX Surges: Rare Early Buying Opportunity

Helpful context. Your competitors completely missed this epic Cyclical ramp in the Steel Stocks $SLX and today's one of our 1st Buying Opportunities in a while

By Keith McCullough

Social•Feb 13, 2026

Signal Strength Recommends Holding Nucor Stock

Sam @SamofAmerica , Signal Strength says to stay with Nucor $NUE here. What say you?

By Keith McCullough

Social•Feb 13, 2026

DWSH Slides 1.3% as Borrowing Costs

Drosey Wrong $DWSH down another -1.3% and they're trying to jack up the borrow, sad

By Keith McCullough

Social•Feb 13, 2026

Professional Energy Bet After Yesterday’s Red Close

If you were buying more Energy Exposure via $XOP $OIH into a red close 24 hours ago, professionally done

By Keith McCullough

Social•Feb 13, 2026

Market Rally Likely False Amid Risk‑off Sentiment

I believe this is a false rally. Look at Utilities. That's defensive positioning. Same with long duration Treasuries. We remain in a risk-off condition for now.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

SaaS Still Thriving: Mispriced Narrative, Not Collapse

“Software is dead.” That’s the narrative. Revenue isn’t collapsing. Balance sheets aren’t broken. The Fed isn’t tightening. AI disruption… or mispricing? The setup in large-cap SaaS may be asymmetric. Read: https://t.co/dhUDCqMzbs

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Defensive Sectors Exhausted, Market Poised for Broad Correction

While sectors like staples (XLP), energy (XLE), materials (XLB) and industrials (XLI) have all provided a safe haven in recent weeks as large cap tech has sucked wind, most of these are all now reaching exhaustion. This means that from...

By Quinn Thompson

Social•Feb 13, 2026

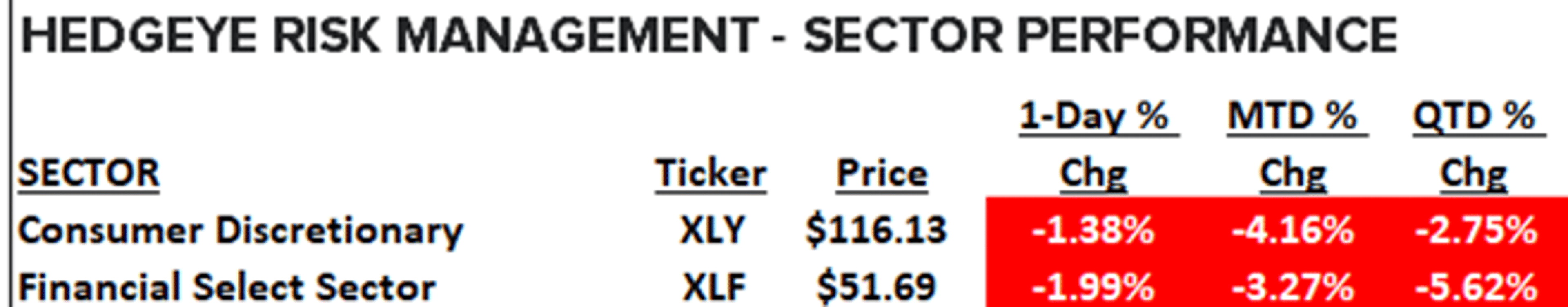

CPI Slowdown Fuels Falling Yields, Bullish Duration, Utilities, Gold

Post Hedgeye's Nowcast nailing another decel in CPI Growth decelerates → yields fall → correlations re-assert That’s the whole #Quad3 playbook ✔️ Duration bullish ✔️ Utilities work ✔️ Gold works ❌ Financials don’t

By Keith McCullough

Social•Feb 13, 2026

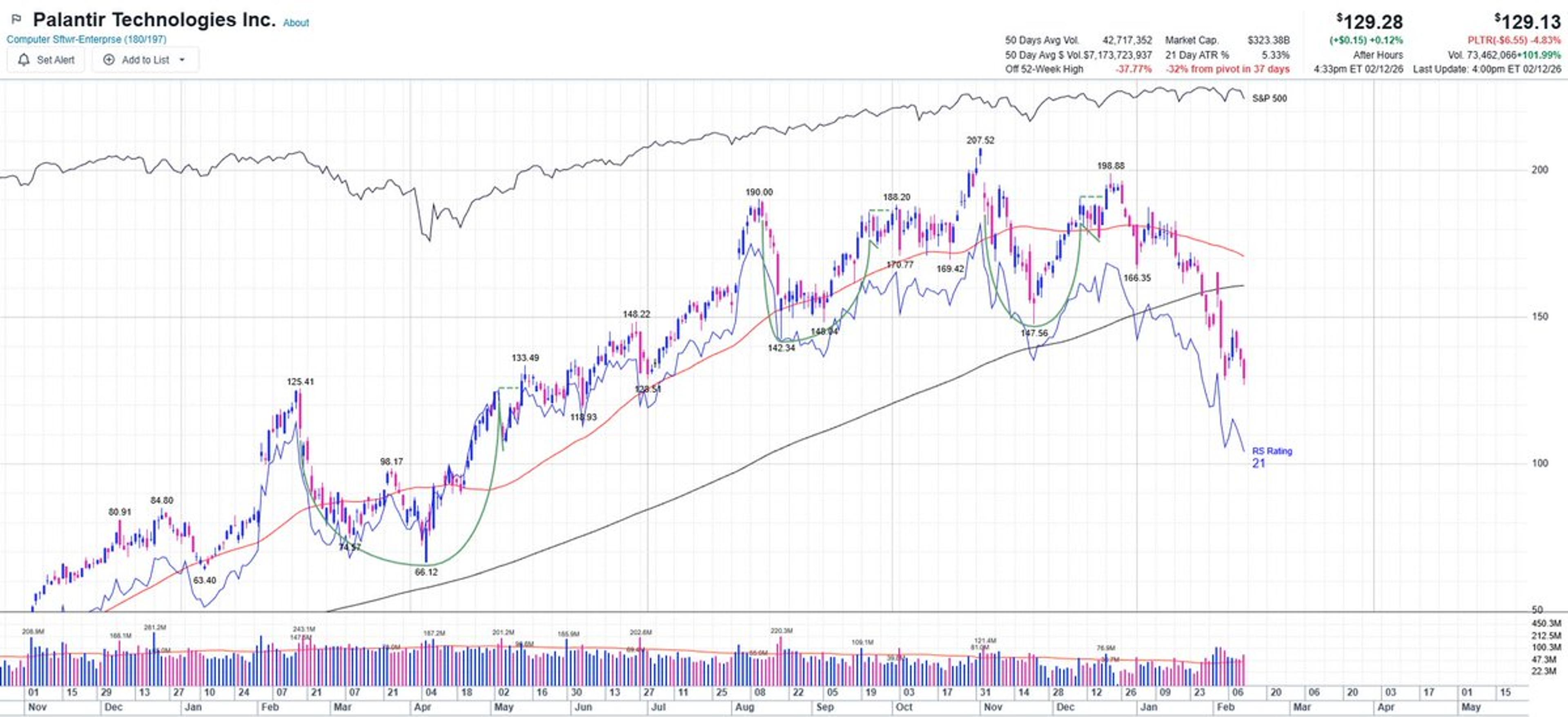

PLTR Near $120 May Offer Counter‑Trend Bounce

$PLTR not my style to buy dips after big breakdowns, but would have attractiveness from counter-trend perspective near 120 into Monday-Wed of next week. @IBDinvestors @marketsurge NEW charts link https://t.co/XW54gpkuMU Note that 4/7/25-11/3/25 rally of 210 cal. days...

By Mark Newton, CMT

Social•Feb 13, 2026

Danny Moses Show Returns: Economy, AI, Markets Forecast

The Danny Moses Show returns tonight @scrippsnews at 7PM sponsored by @Kalshi. Great to have @pboockvar join me & we talk about the global & U.S. economy, A.I. stocks/bonds, commodities, the consumer, #FED, Private Credit & make some @Kalshi predictions... https://t.co/vQGLUQMHUc...

By Danny Moses

Social•Feb 13, 2026

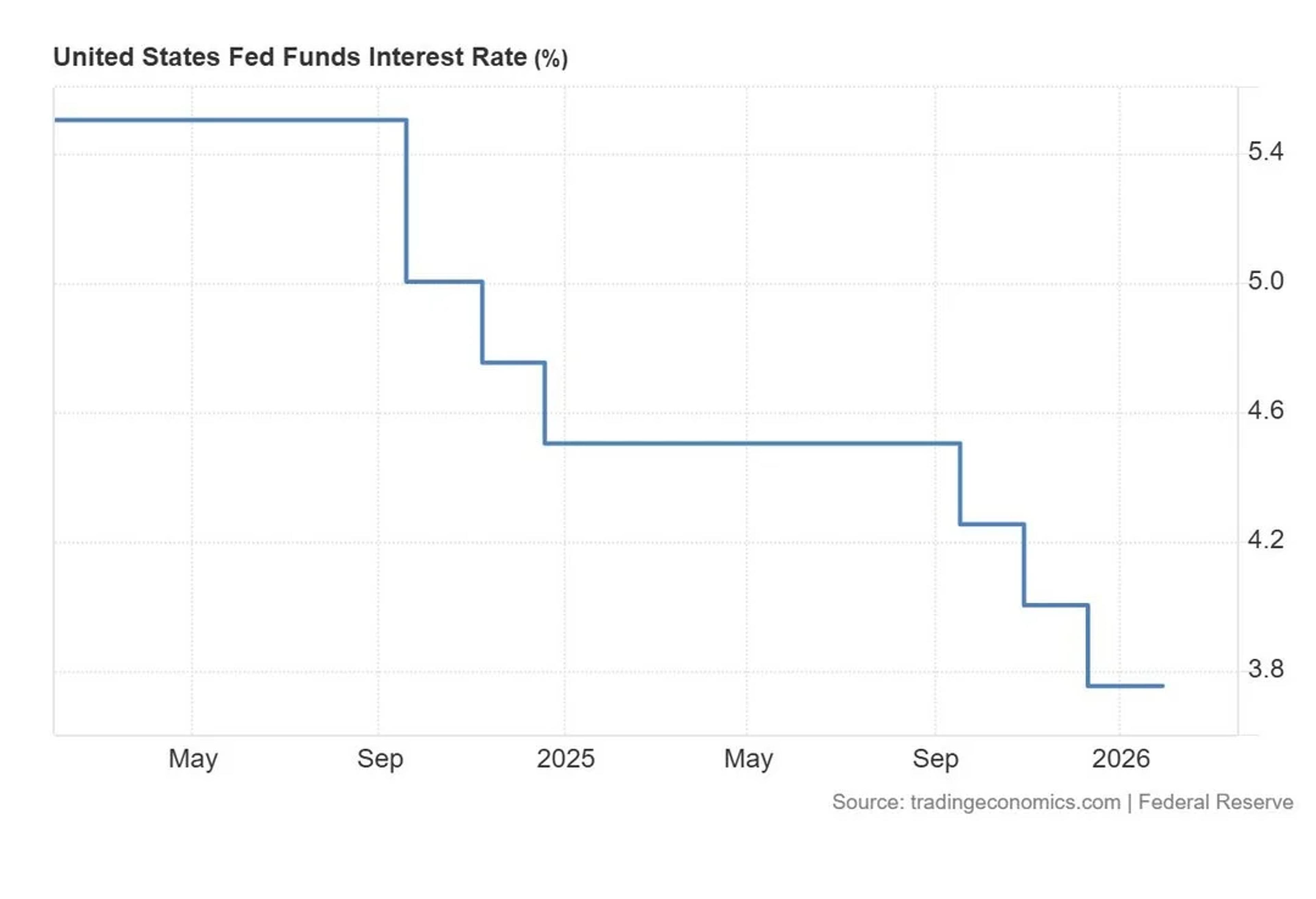

Markets Trade Transition as Central Banks Hold Steady

Pauses aren’t pivots. Central banks are holding steady, but easing remains conditional. Inflation is cooler, labor is softer, yet not weak enough to confirm a recession. Markets are trading the transition, not the destination.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

COIN Rebounds; Upside Hinges on Crypto Market Recovery

$COIN rebounding despite its earnings miss. Is the fallout over for crypto? Its recovery will be highly tied to the crypto markets. No crypto trading = less fees earned. Valuation is pretty attractive, but remains high risk. Solid upside above 170.00.

By Hyperstocks

Social•Feb 13, 2026

S&P Erases Almost All 2026 Gains Amid AI Hype

Forget Trump's AI HYPE. The S&P Index has now given up nearly all its 2026 gains. https://t.co/GAL0TbU7KG

By Steve Hanke

Social•Feb 13, 2026

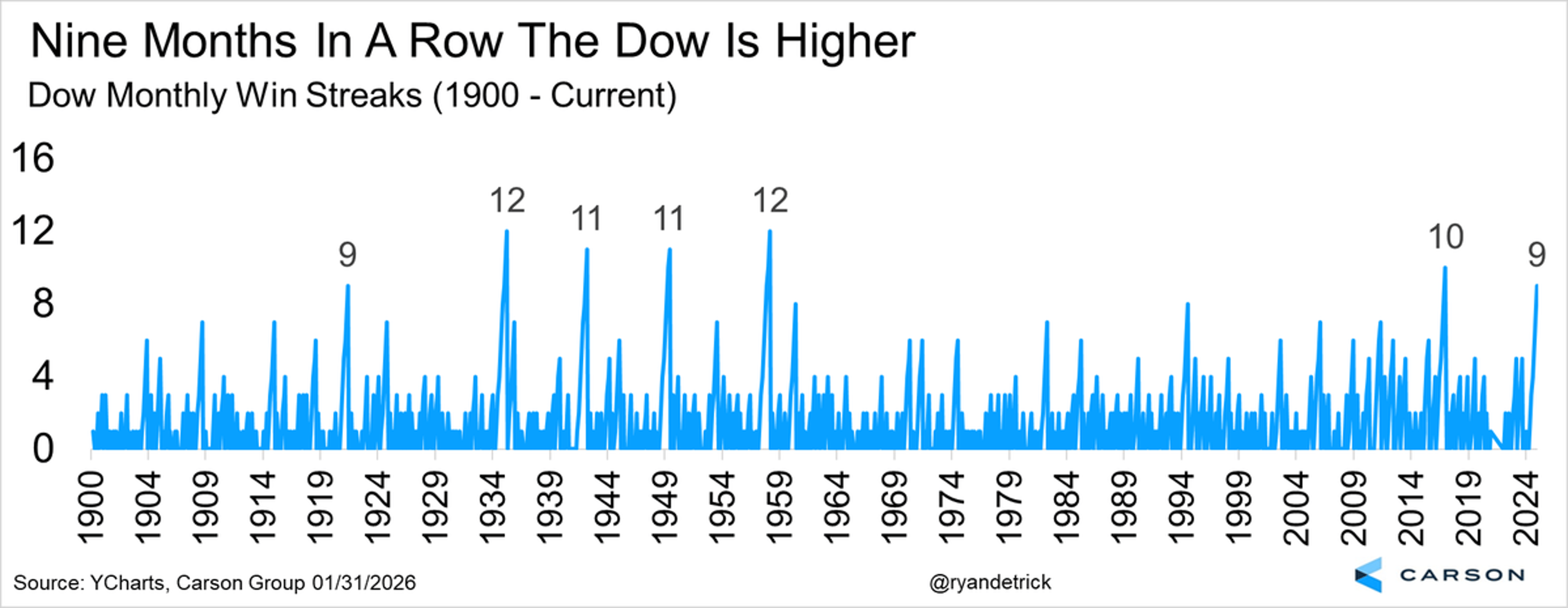

After 9-Month Rally, February Pause Is Healthy

The Dow is up 9 months in a row and we are in the banana peel month of February. Yes, they might blame it on AI or something else, just know a little pause here and now is perfectly normal and...

By Ryan Detrick

Social•Feb 13, 2026

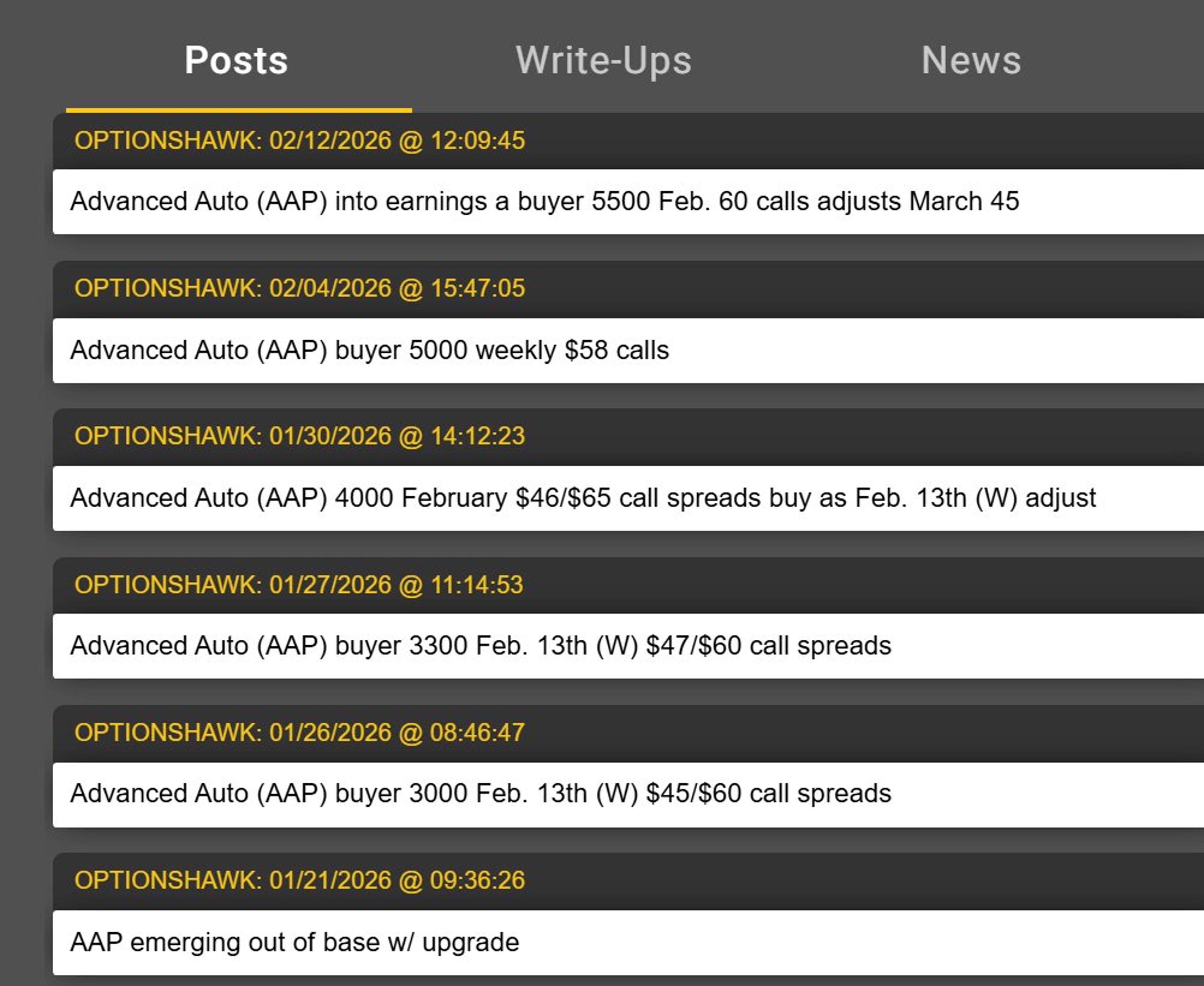

AAP Soars Post‑Earnings as Call Buyer Adjusts

$AAP ripping on earnings as call buyer been adjusting and right for weeks here https://t.co/NDM9mXOd3k

By Joe Kunkle

Social•Feb 13, 2026

No Evidence BLS Data Manipulation; Accusations Hinder Discourse

There is ZERO evidence that the Bureau of Labor Statistics is manipulating the data, not the CPI, not payrolls earlier this week. I am not being naive and people are watching carefully for signs of tampering. Such accusations now are harmful...

By Claudia Sahm

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen

Social•Feb 13, 2026

McGough Urges Immediate Buy of GameStop Stock

McGough LIVE on The Call right now saying BUY Gamestop $GME on the open @HedgeyeRetail

By Keith McCullough

Social•Feb 13, 2026

AI‑linked Firms See Growth, yet Stocks Tumble

The market is now punishing even those companies which are beneficiaries of AI. These businesses are accelerating their revenue growth and their management is explicitly stating that AI is a tailwind, yet their stocks are being crushed. Unreal.

By Puru Saxena

Social•Feb 13, 2026

SPX Futures Slip, Risk‑Off Bias Ahead

$SPX futures slipping after losing 6902/6870 as traders cut risk and lean short. Upper range looks vulnerable, especially in tech with lots of names bent or broken. If SPY/QQQ lose the 8/21-day, expect more cash + day trading. CPI at...

By Scott Redler

Social•Feb 13, 2026

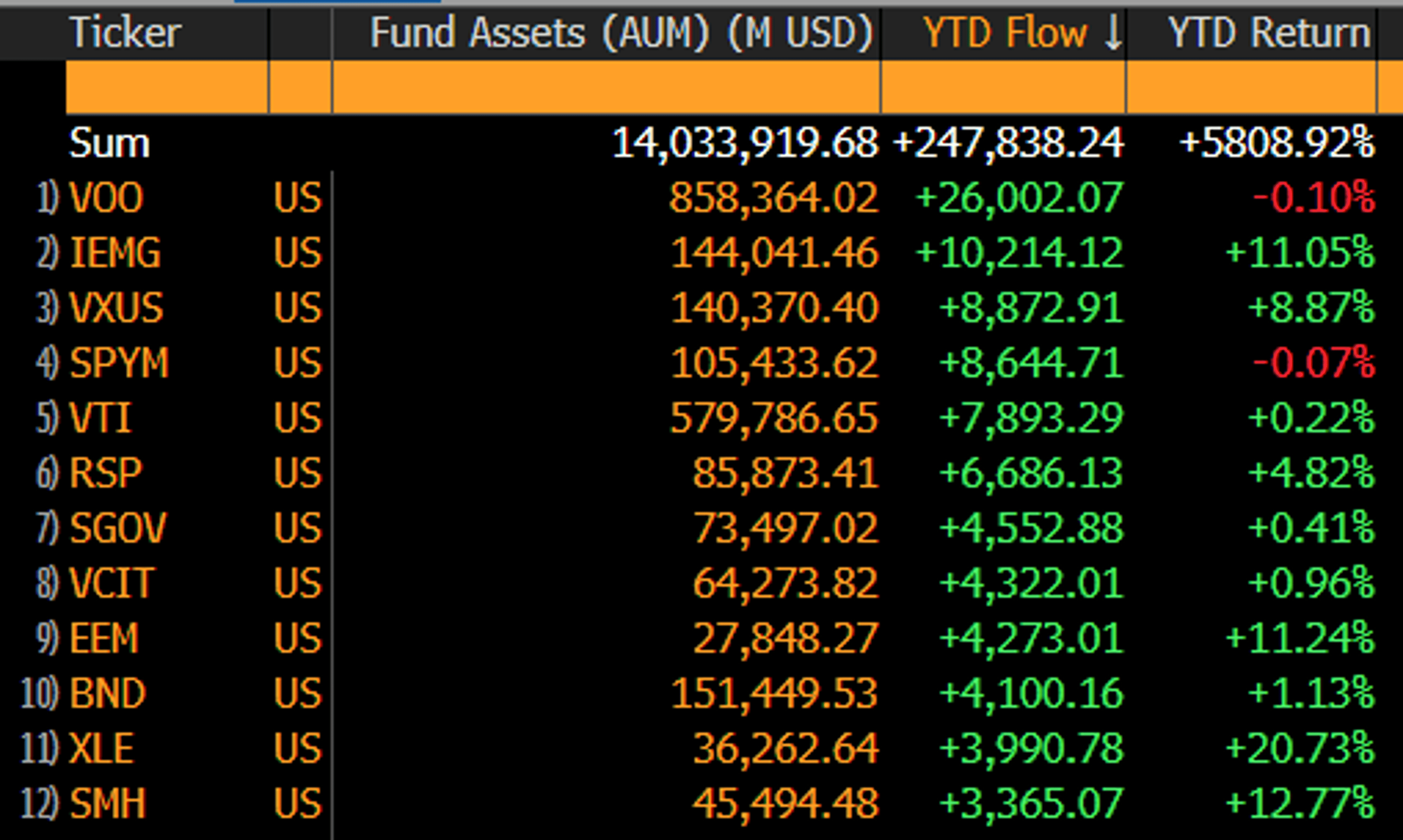

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

Social•Feb 13, 2026

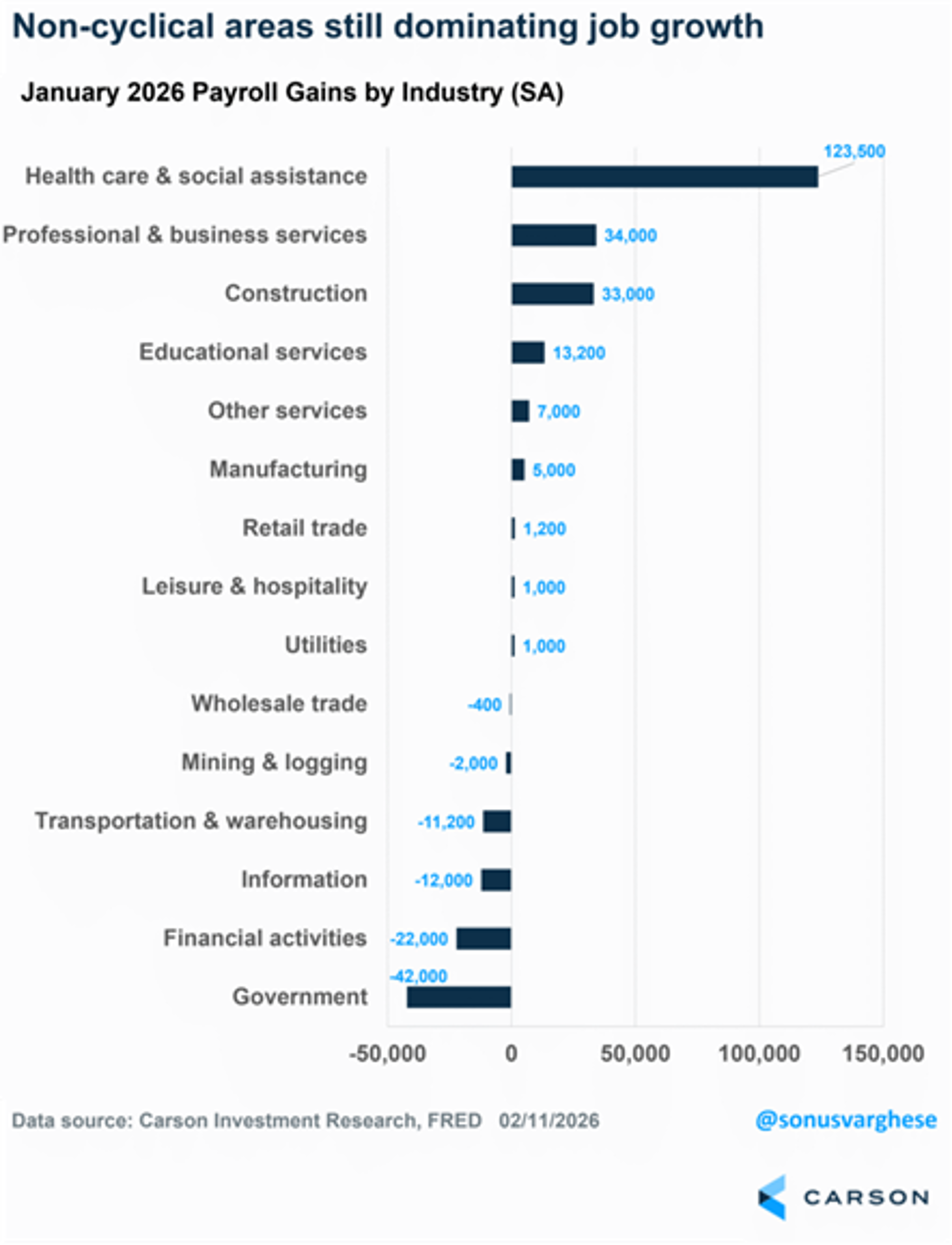

Labor Market Stabilizing: Health Care Leads, Construction Rebounds

Yes, most of the jobs last month (and the previous 18 months) have come from health care/social assistance. But if things were so bad would there be 32k in construction? Or 5k added in manufacturing? The labor market isn't great by...

By Ryan Detrick

Social•Feb 13, 2026

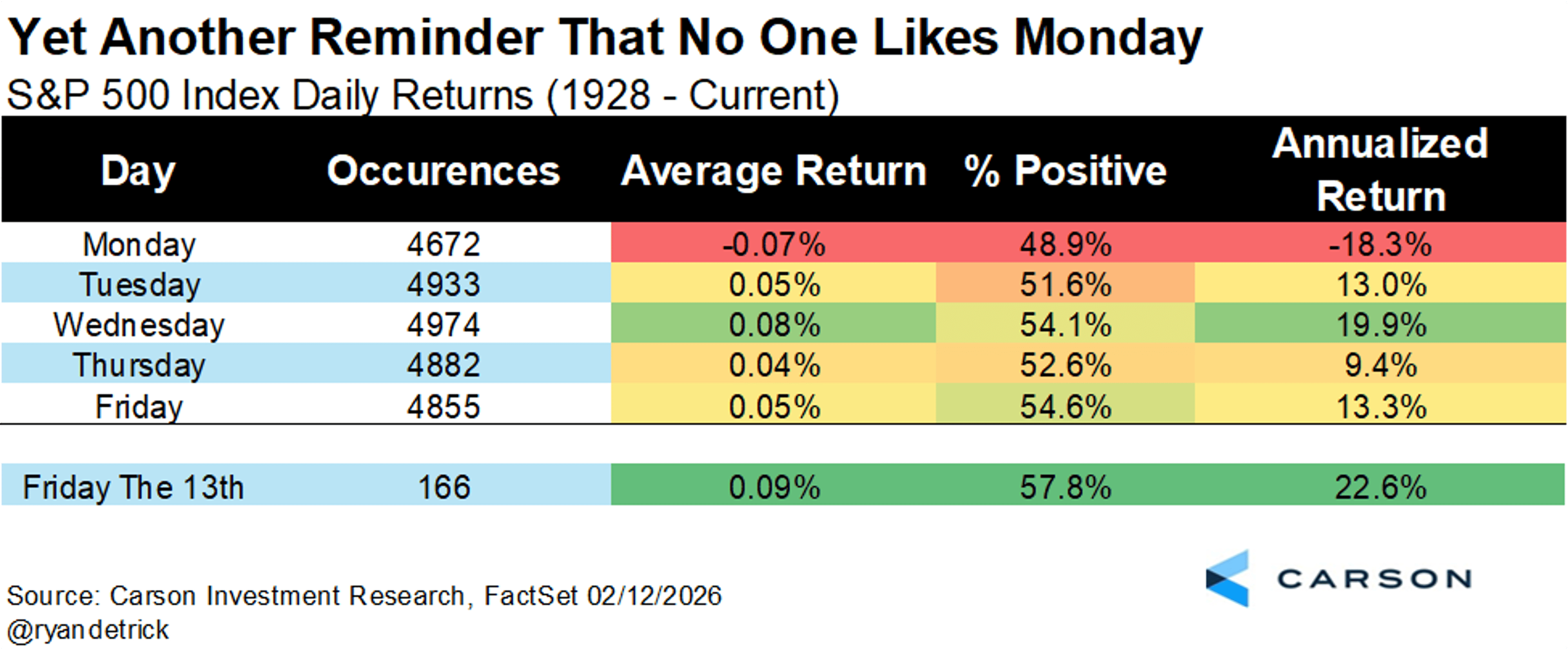

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 13, 2026

Friday the 13th Rally Masks Monday’s 18% Drop

Stocks are up an annualized 22.6% on Friday the 13th. What really should scare you is a simple case of The Mondays, as stocks are down 18.3% on Monday. #FridayThe13th https://t.co/M74coxbyXF

By Ryan Detrick

Social•Feb 13, 2026

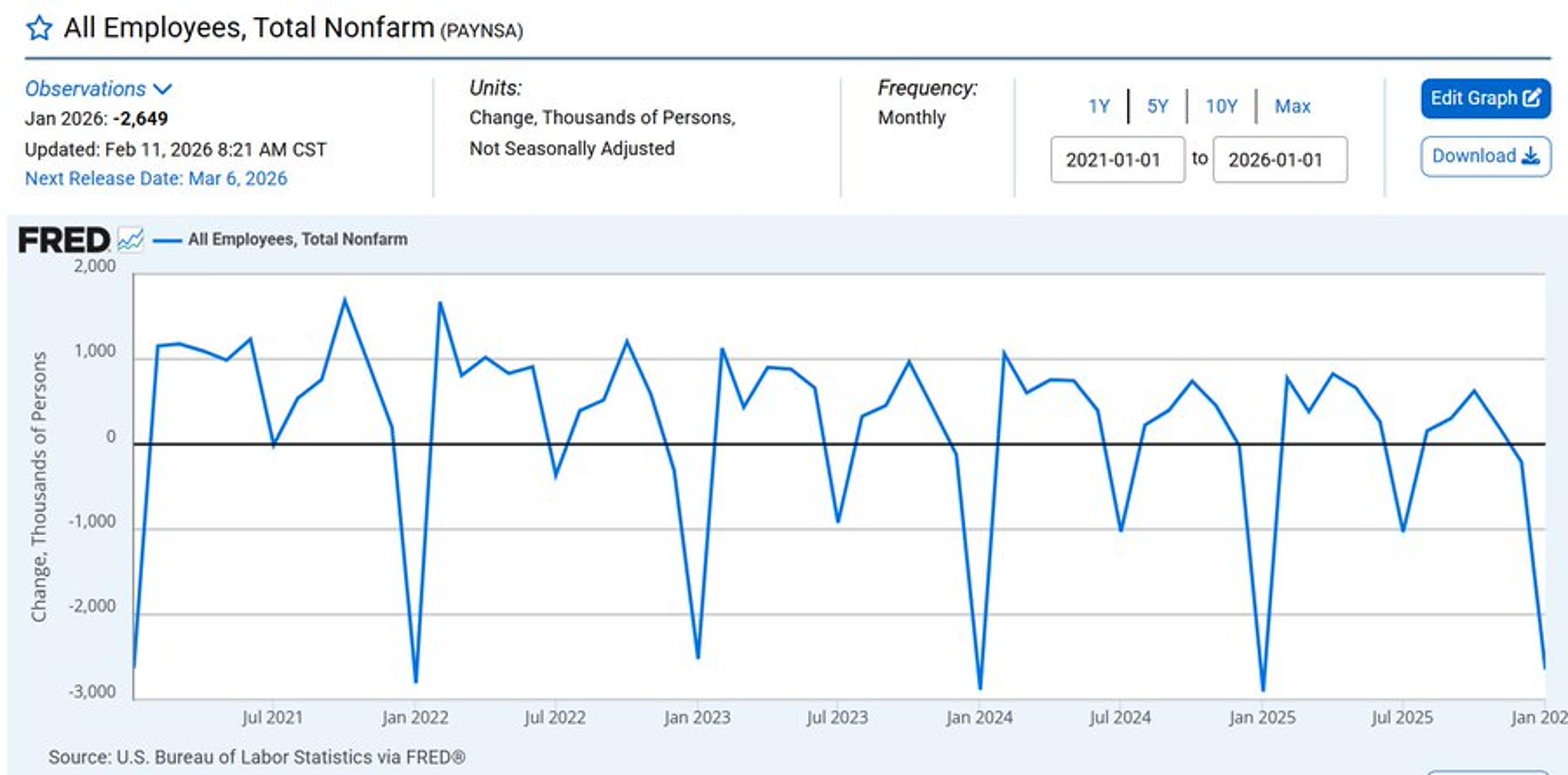

January Job Loss Smaller, Yields 130k Seasonal Gain

Great question. Drop in hiring happens every January. On a non-seasonally adjusted basis (left), we lost 2.6 million jobs in January 2026, but that was a smaller loss than a typical January ... so we got a good print seasonally adjusted...

By Claudia Sahm

Social•Feb 13, 2026

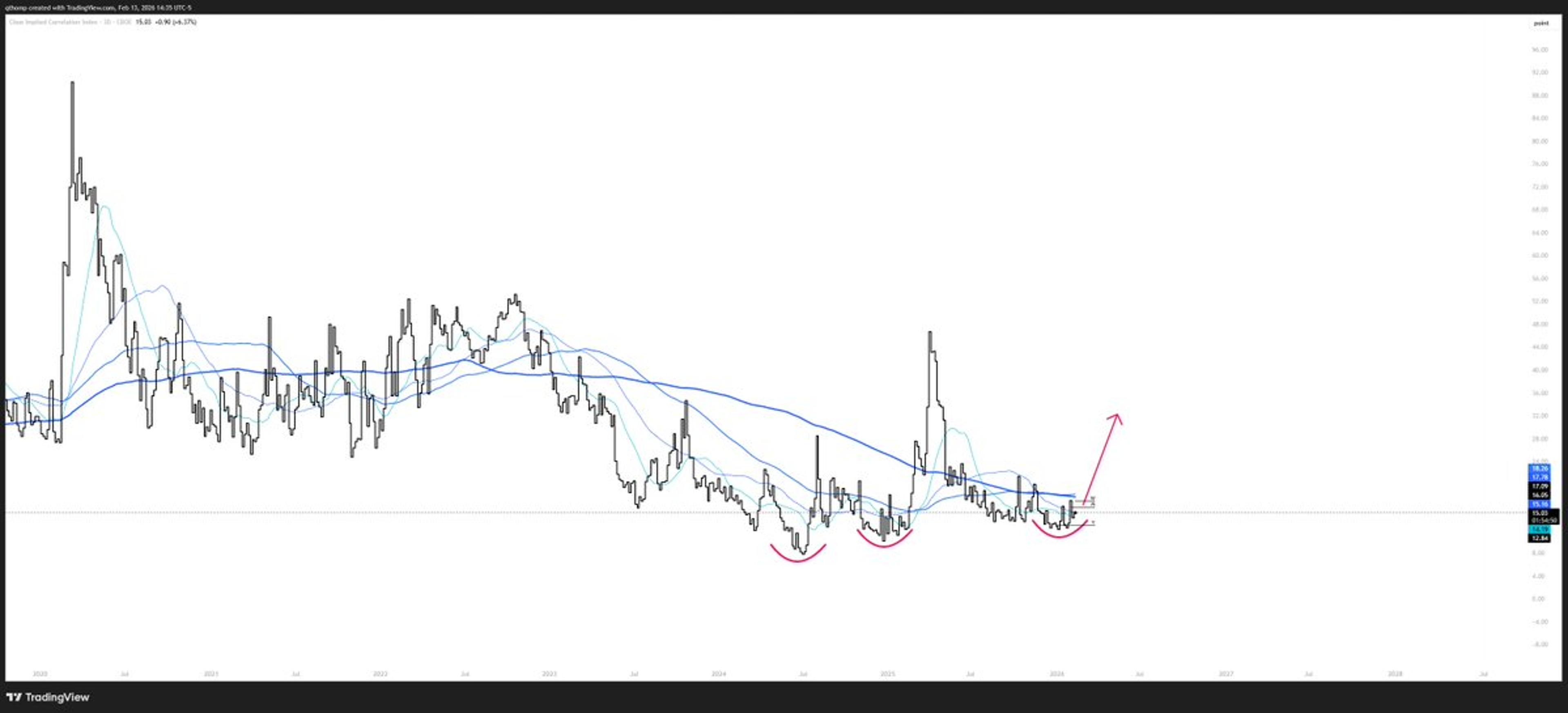

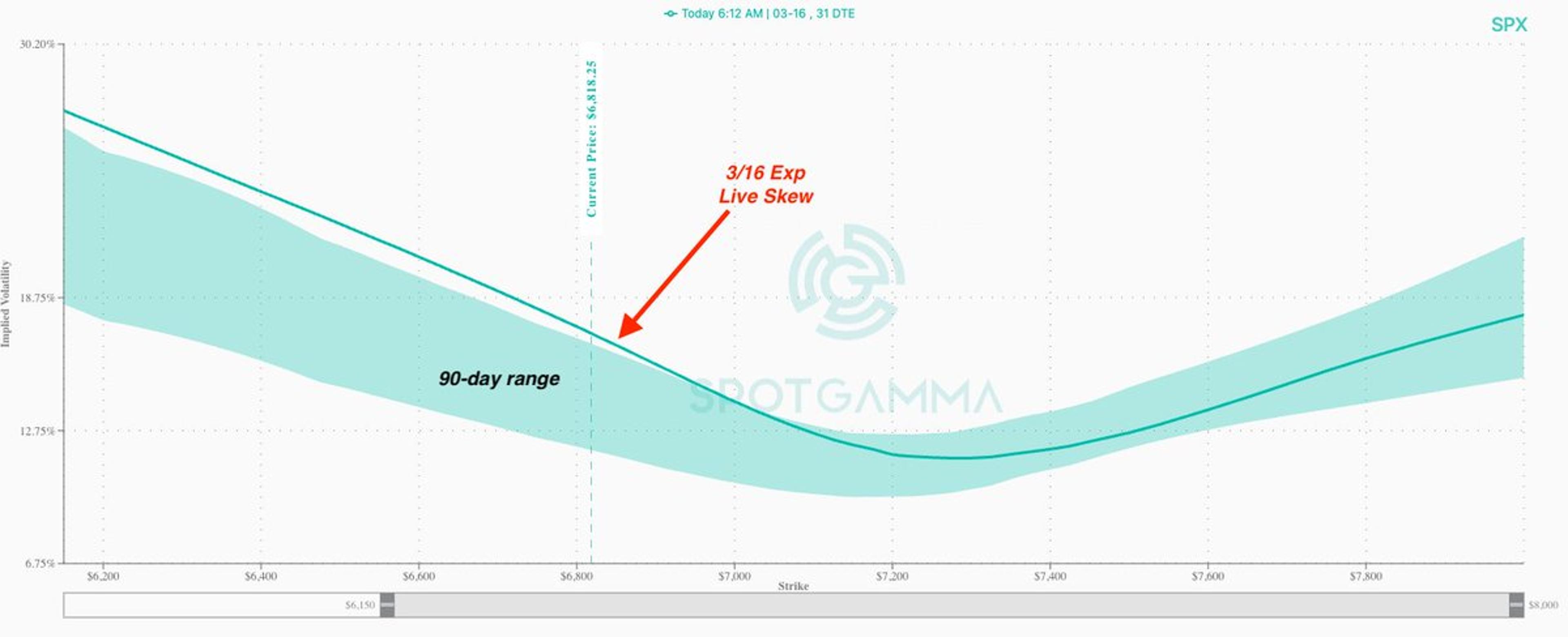

Rising SPX Put Skew May Push VIX to 30

SPX put skew is really starting to warm up here, while ATM IV remains relatively subdued. If SPX 30) https://t.co/p9qsHp8nHk

By Brent Kochuba

Social•Feb 13, 2026

Gemini Miscalculates Google’s Massive Depreciation Drag

Coming up on @thestreetpro More Tales From Nvidia: The Depreciation "Tail and Spike" Will Be Painful to Mag7 Profits (Issue #178!) * As free cash flow is plummeting... I decided to ask the AI about itself. In this case, I asked Google Gemini about...

By Doug Kass

Social•Feb 13, 2026

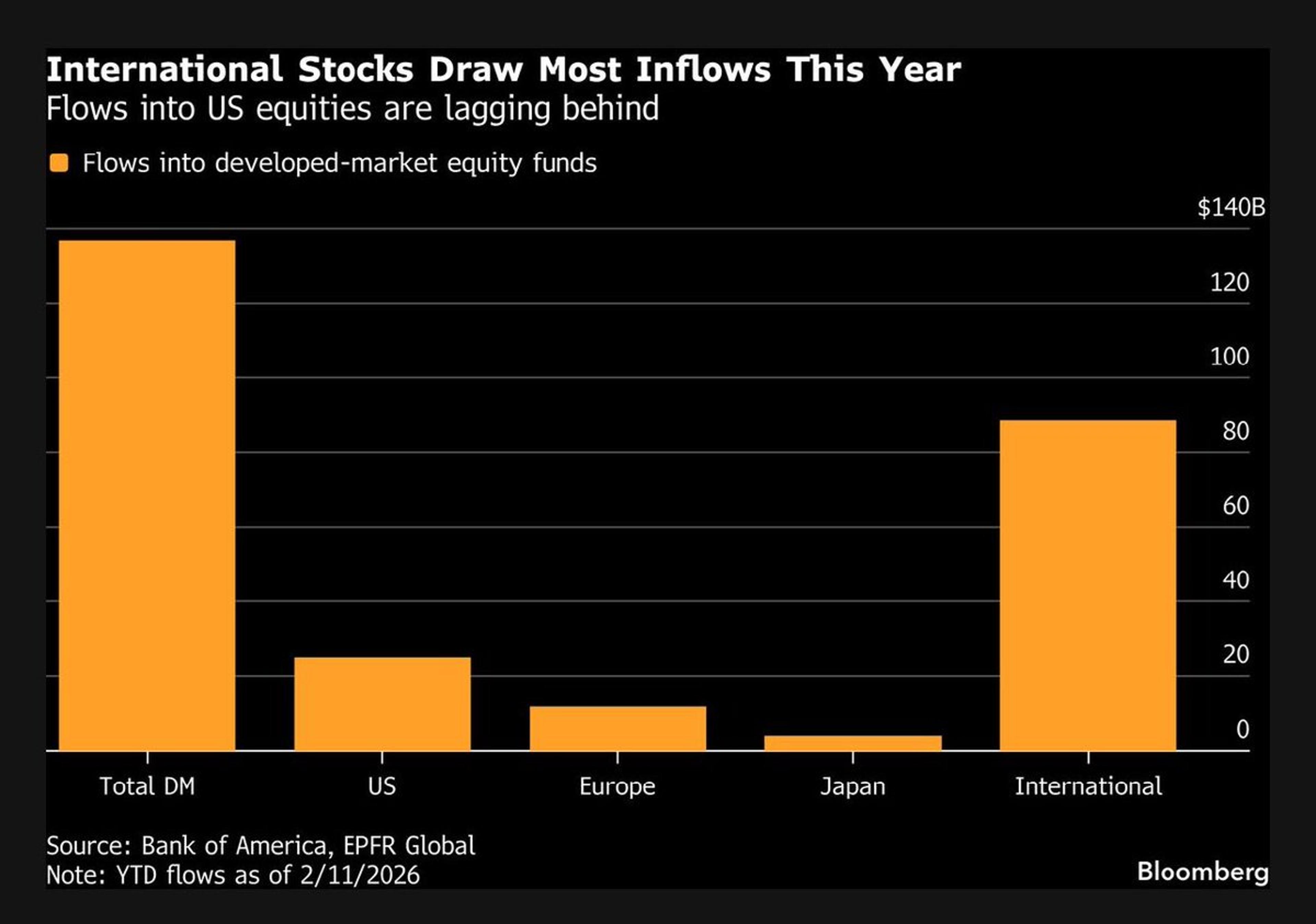

Global Fund Flows Outpace US, Shifting Investment Balance

US exceptionalism is turning into global rebalancing: BofA’s Michael Hartnett. Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that’s flowed into US funds: BofA citing EPFR Global. https://t.co/ah9arXM6u9...

By Lisa Abramowicz

Social•Feb 13, 2026

Oil Returns Green, Signaling Bullish Energy Buying Opportunity

OIL: ticks back into the green and remains Bullish TREND @Hedgeye Yesterday was the 1st day where we could start buying some Energy Exposure on red https://t.co/eURgEMfFpO

By Keith McCullough

Social•Feb 13, 2026

Two of Quad3’s Three Worst US Equity Sectors

SECTORS: as we reminded you, these are 2 of the 3 WORST US Equity Sector Styles in #Quad3 https://t.co/yr2fNhpUZH

By Keith McCullough

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Social•Feb 12, 2026

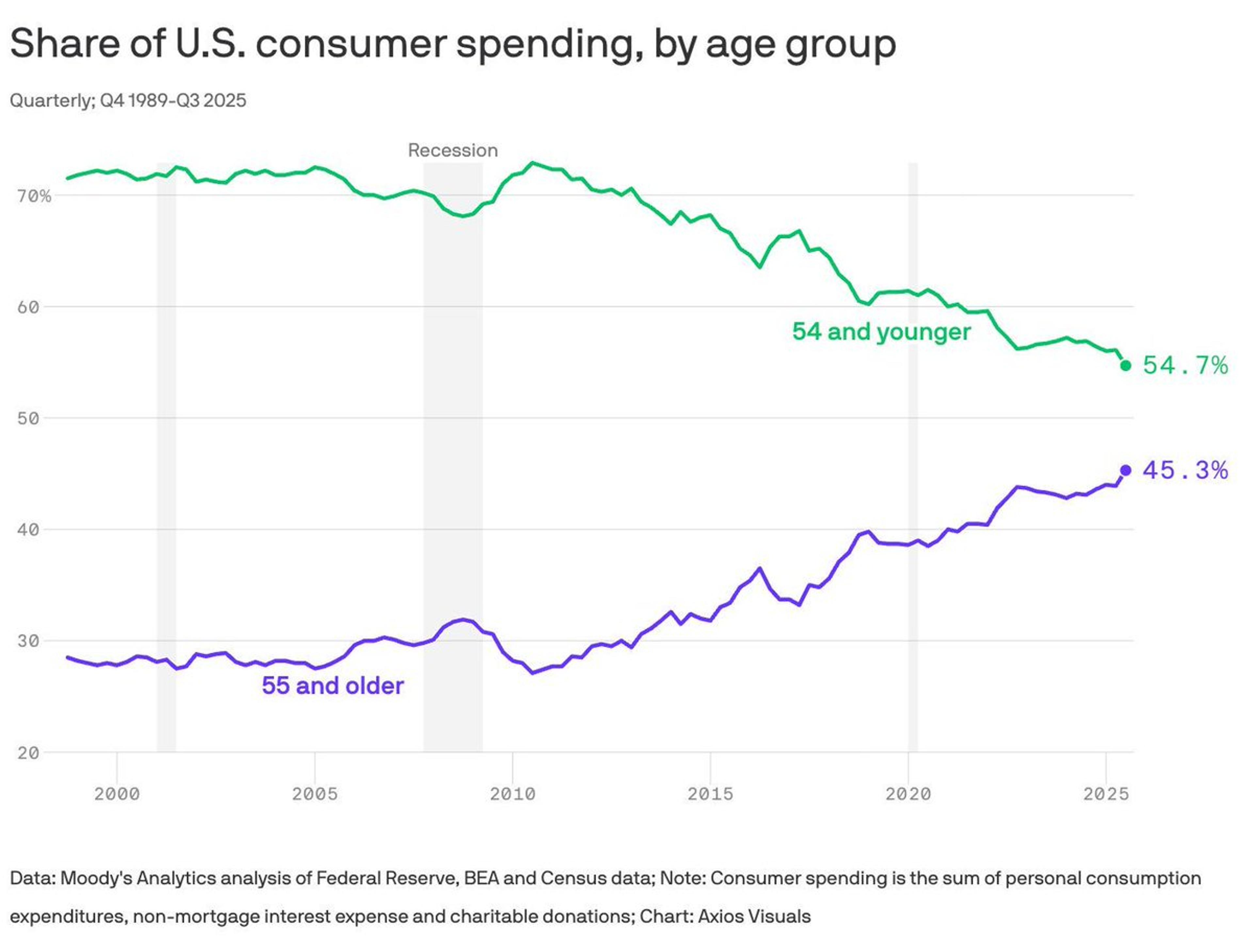

Defensive REITs and Utilities Lead Market Breakouts

Ventas $VTR the Fin Prop REIT, eclipsing highs going back to 2013 as REITS start to kick into gear again with Utilities to join the recent strength seen in Staples, Telco @IBDinvestors @marketsurge Strength in these defensives is more than...

By Mark Newton, CMT

Social•Feb 12, 2026

All Markets Tumble, $3.6T Erased in 90 Minutes

-$3.6T in 90 minutes Gold fell 3.76%, wiping out nearly $1.34T in market cap. Silver dropped 8.5%, losing around $400B in market value. The S&P 500 declined 1%, erasing $620B. Nasdaq slid more than 1.6%, shedding $600B. The crypto...

By Crypto Jack

Social•Feb 12, 2026

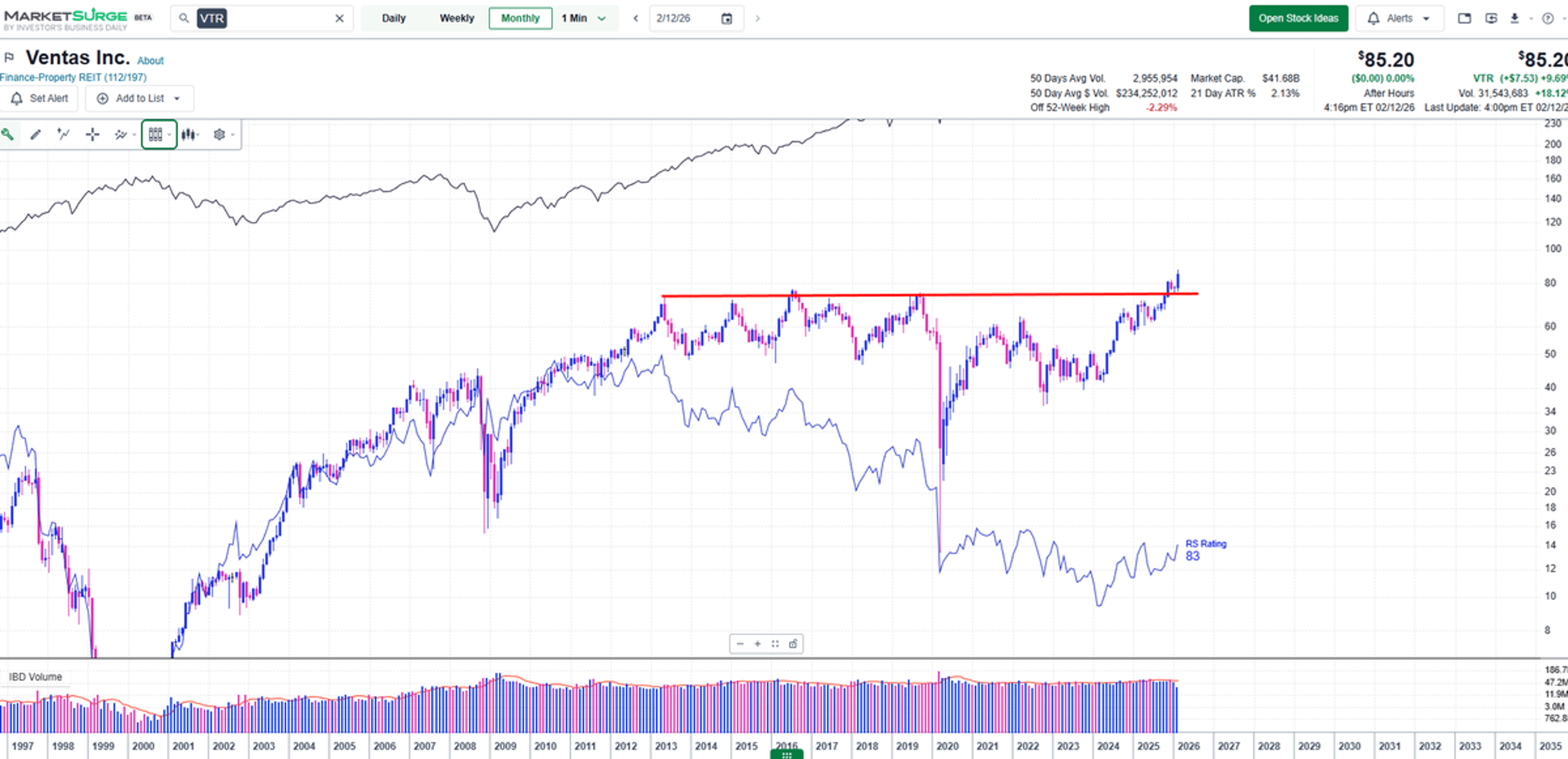

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

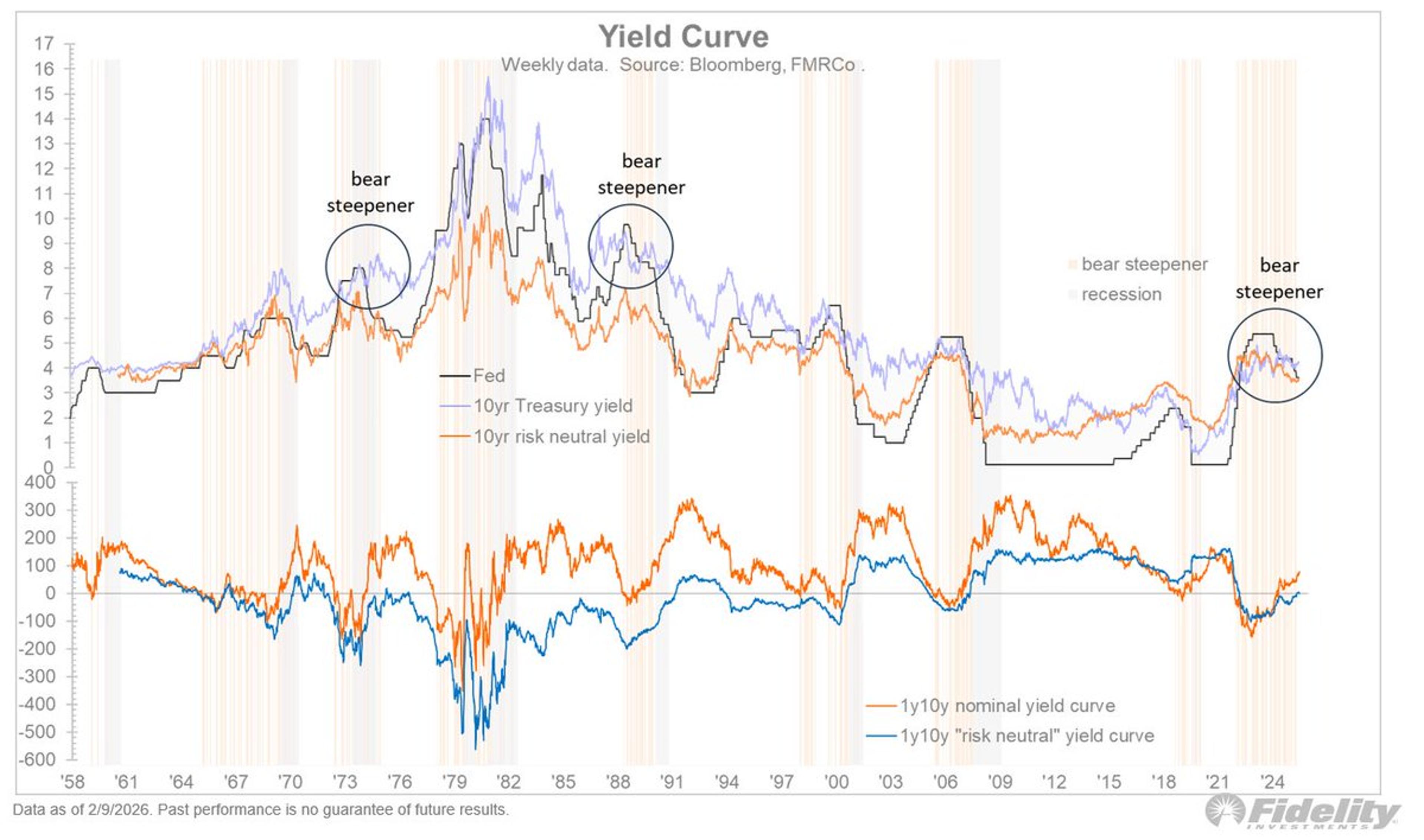

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 11, 2026

Forecasting Trends, NAV Squeeze Mechanics, Active ETF Surge

🆓 Wednesday links: focusing on forecasting, how NAV squeezing works, and the rise of the active ETF. https://t.co/bgzuhBy1Uq image: https://t.co/JRCEGjVQN2 https://t.co/PSs8BSV9vG

By Tadas Viskanta

Social•Feb 11, 2026

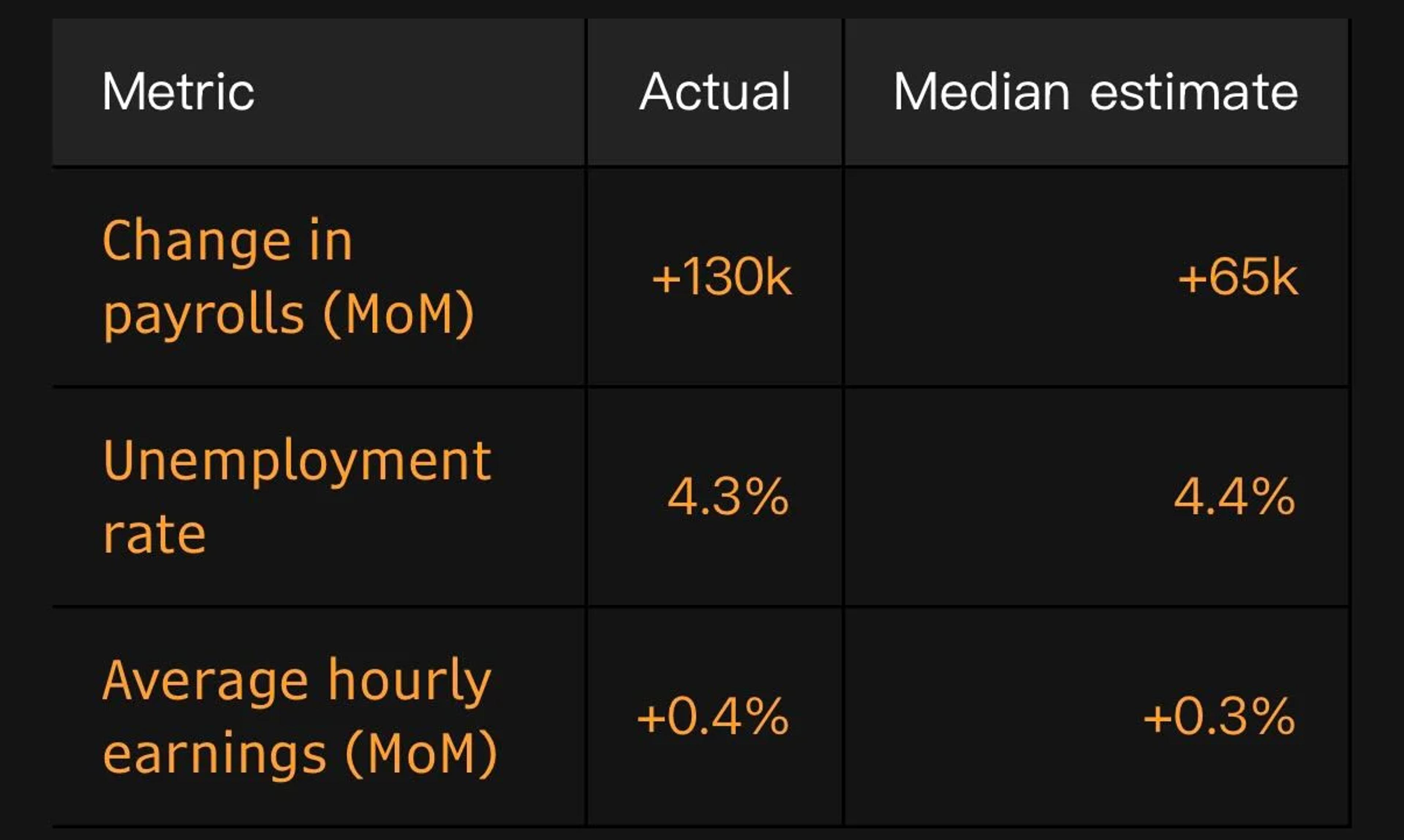

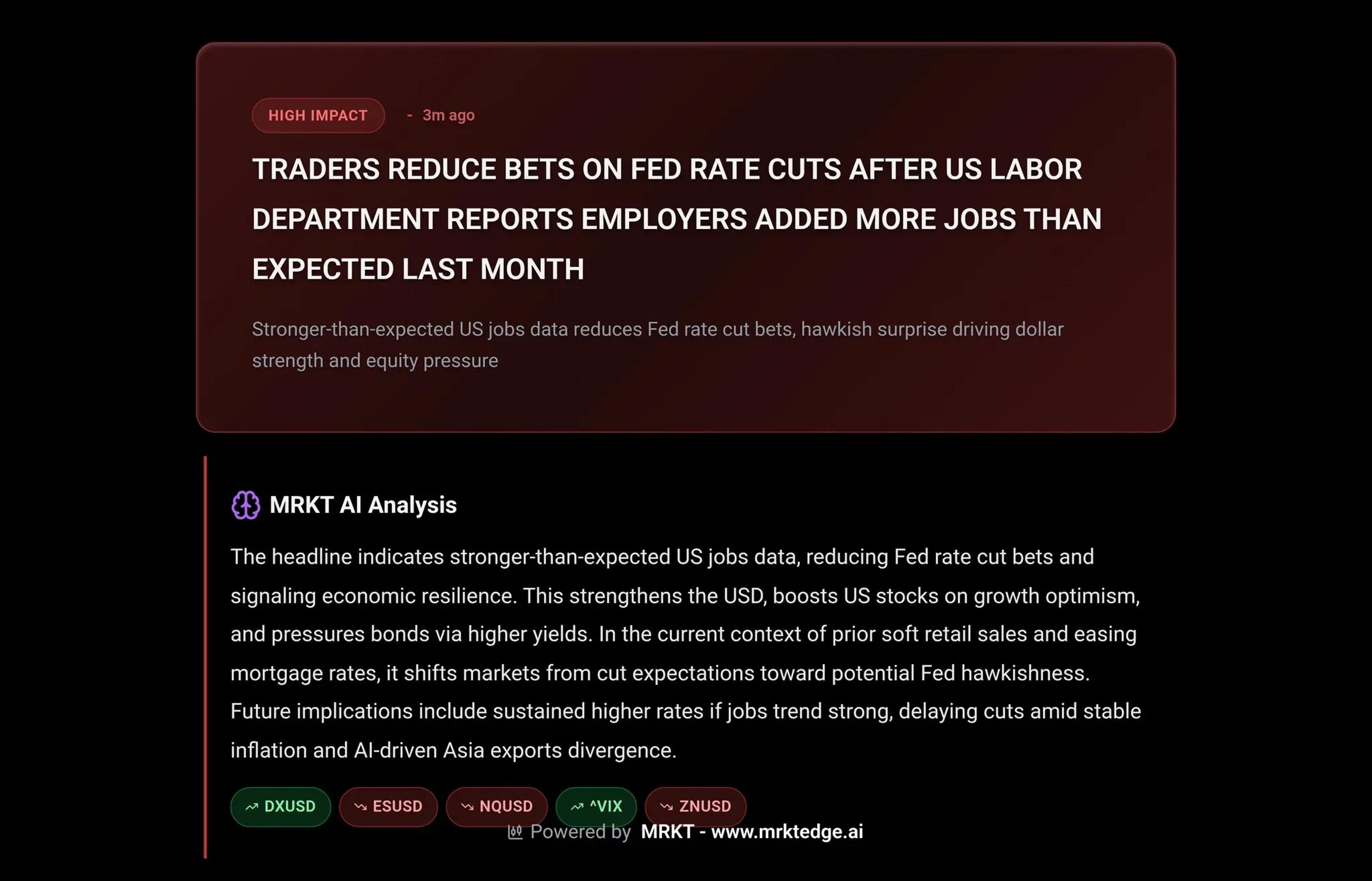

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

Shareholder Rejects Netflix Deal, Backs Paramount Bid

Small Warner Bros. Discovery Shareholder Blasts ‘Flawed, Inferior’ Netflix Offer and Backs Paramount’s Hostile Bid — but Will It Matter? https://t.co/NGSPvAdqOW via @variety

By Todd Spangler

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

Social•Feb 11, 2026

Jobs Report Day Shows Record Forecast Divergence

Good morning and welcome to Jobs Report Day in the US. The consensus forecasts are for a monthly employment gain of 65,000, an unemployment rate of 4.4%, and a 3.7% annual increase in average hourly earnings. As we head into this release,...

By Mohamed El‑Erian

Social•Feb 11, 2026

US Hiring Slumps to Recession-Level, Job Market Fragile

⚠️US HIRING IS AT RECESSION LEVELS: US hiring rate sits at just 3.3%, in line with the 2020 Crisis and one of the lowest readings in 13 years. Hiring is even weaker than during the 2001 recession and at levels seen during...

By Global Markets Investor (newsletter author)

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

Social•Feb 11, 2026

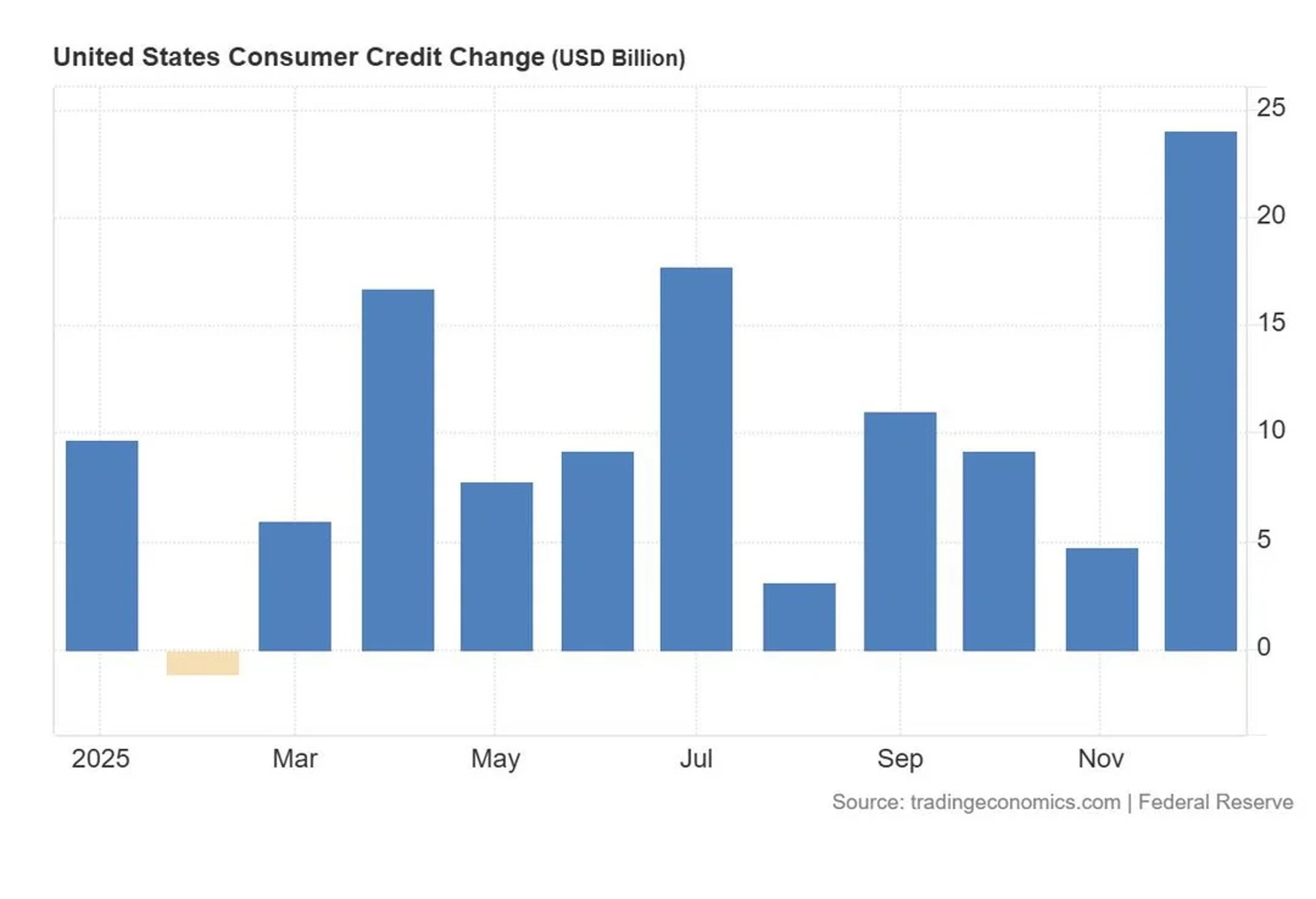

US Consumer Credit Surges $24B, Outpacing Forecasts

Total US consumer credit increased by $24.05 billion in December, far higher than forecasts of an $8.0 billion increase.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 11, 2026

AI‑Driven Sell‑Off Sparks Tech Opportunities on Bloomberg TV

Look forward to discussing this AI driven sell-off and the opportunities in tech on @BloombergTV at 9:40 am with @mattmiller1973 and @daniburgz 🔥🍿📺🐂🏆🎯

By Dan Ives