The 2025 State of Digital Agencies: It’s Still Rough Out There, but Slowly Improving; and Is AI Really a Threat?

•December 2, 2025

0

Why It Matters

Revenue growth and margin trends signal resilience, but rising AI anxiety and weak pipelines highlight strategic risks for agency leaders. Understanding these dynamics helps firms allocate resources and talent to sustain growth in a tightening market.

Key Takeaways

- •50% agencies reported revenue growth last year

- •AI threat perception rose to 53% of respondents

- •Only 14% rate sales pipeline as healthy

- •Larger agencies show stronger pipeline health

- •Junior staff career concerns affect two‑thirds of agencies

Pulse Analysis

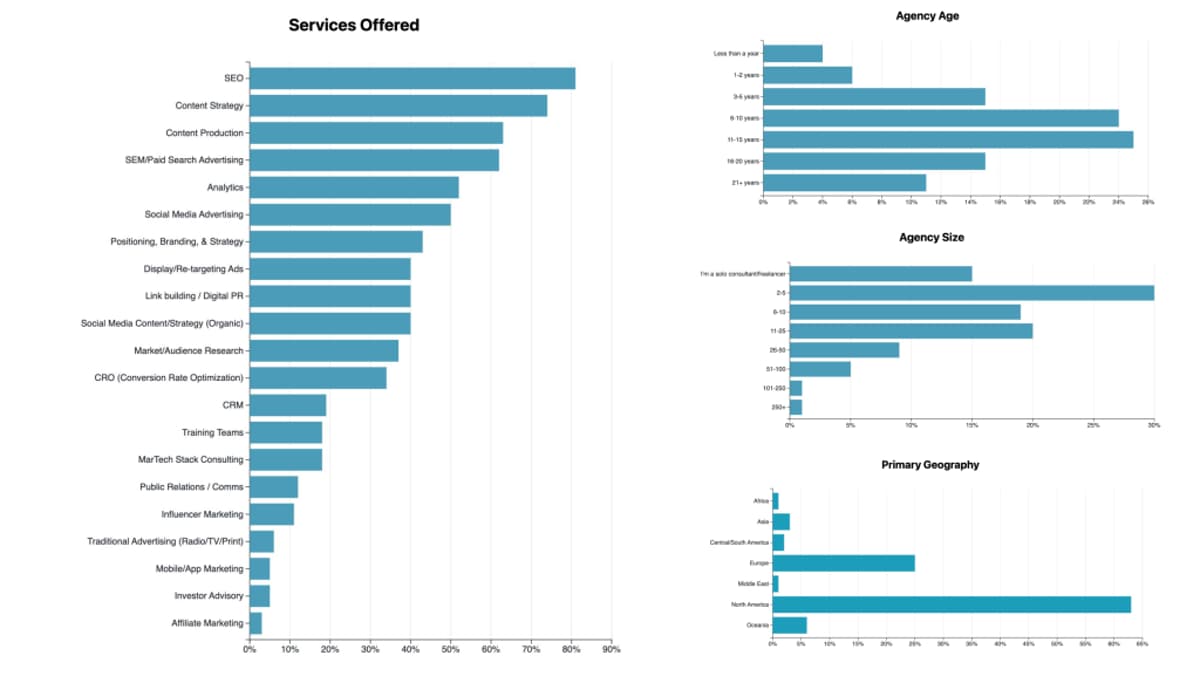

The digital agency sector continues to navigate a post‑pandemic recovery, with the 2025 survey confirming that revenue growth is no longer an outlier. About half of respondents posted higher top‑line figures, and a notable 12% achieved over 30% growth, suggesting that agencies that have embraced diversified service offerings and data‑driven strategies are gaining traction. At the same time, net margin improvements for roughly a third of firms indicate better cost control and pricing power, even as many still operate within tight profitability bands.

Sales pipeline health remains a critical pressure point. Only 14% of agencies describe their pipeline as healthy, and lead‑to‑close cycles are stretching, with 55% reporting 1‑6 week timelines and a growing share experiencing 7‑12 week or longer durations. Larger agencies (51+ staff) are faring better, likely due to broader client portfolios and more robust account management processes. This divergence underscores the importance of scaling operations and investing in sales enablement tools to shorten cycles and improve win rates.

Looking ahead, the heightened perception of AI as a threat—now affecting 53% of respondents—combined with concerns that junior talent may face fewer career opportunities, could reshape agency talent strategies. Firms that proactively integrate generative AI to augment, rather than replace, junior work will preserve developmental pathways while boosting efficiency. Simultaneously, cultivating a culture of continuous learning and upskilling can mitigate churn and position agencies to capture emerging market demand for AI‑enhanced marketing services. The modest optimism reflected in the survey suggests that agencies willing to adapt technology, refine sales processes, and invest in their workforce are best positioned for sustainable growth.

The 2025 State of Digital Agencies: it’s still rough out there, but slowly improving; and is AI really a threat?

0

Comments

Want to join the conversation?

Loading comments...