Synergy: Enterprise Cloud Infrastructure Spend Jumps $12bn in Q4 2025

•February 10, 2026

0

Companies Mentioned

Why It Matters

The spike underscores AI‑driven demand reshaping the public cloud market, pressuring incumbents and opening space for emerging providers. Investors and enterprise CIOs must reassess spend strategies amid rapidly evolving service offerings.

Key Takeaways

- •Q4 2025 cloud spend up $12 bn QoQ.

- •Year‑on‑year growth 30%, ninth consecutive accelerating quarter.

- •Generative AI drives 34% of Q4 growth.

- •Amazon leads with 28% share; Google, Microsoft close.

- •CoreWeave joins top‑10, $1.5 bn quarterly revenue.

Pulse Analysis

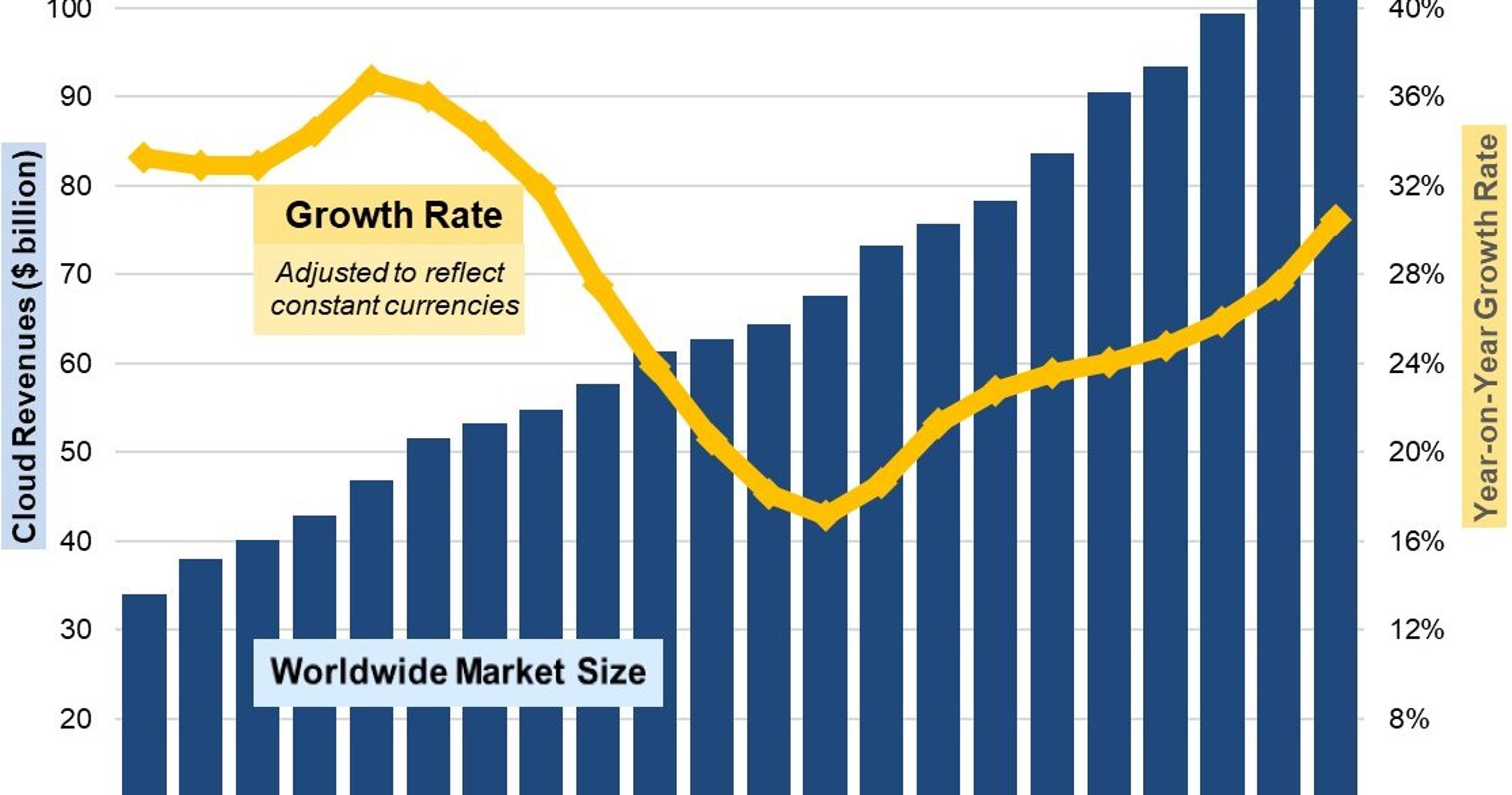

The latest Synergy Research Group data reveals that enterprise cloud infrastructure spend is entering a new growth phase, propelled largely by generative AI workloads. While the overall market expanded by 30 percent YoY, the $12 billion quarterly jump reflects both the scaling of AI‑intensive applications and the broader migration of legacy workloads to the cloud. This momentum mirrors the post‑2022 resurgence, but the market size has more than doubled, indicating that cloud providers are now central to digital transformation strategies across industries.

Competitive dynamics are shifting as the three hyperscale giants—Amazon, Google, and Microsoft—collectively command 68 percent of the public cloud market. Amazon’s 28 percent lead remains solid, yet Google’s 21 percent and Microsoft’s 14 percent shares are growing at faster rates, suggesting a narrowing gap. The emergence of CoreWeave into the top‑10 tier, with $1.5 billion in quarterly revenue, highlights the increasing relevance of niche, AI‑focused providers that can offer specialized GPU capacity and pricing models. Regional growth patterns also reveal robust demand in Asia‑Pacific economies such as India and Indonesia, alongside unexpected upticks in Ireland, Mexico, and South Africa, signaling a truly global expansion.

For enterprises, the surge translates into both opportunity and complexity. AI‑enhanced services promise higher productivity, but they also demand careful budgeting and governance to avoid cost overruns. Investors are likely to reward providers that can efficiently scale AI infrastructure while maintaining margin discipline. Looking ahead, sustained AI adoption, coupled with emerging use cases in edge computing and generative content creation, suggests that cloud spend will continue its upward trajectory, potentially outpacing traditional IT capital expenditures for the foreseeable future.

Synergy: Enterprise cloud infrastructure spend jumps $12bn in Q4 2025

Spending grows 30 percent year‑on‑year · February 10 2026 · Barney Dixon

Enterprise spending on cloud infrastructure in Q4 2025 skyrocketed by $12 billion quarter‑on‑quarter, according to new figures from Synergy Research Group.

This is double the reported increase between Q2 and Q3, and a $29 billion (30 percent) increase over the same quarter in 2024. It marks the ninth consecutive quarter of accelerating year‑on‑year growth.

Image: Hyperscale_Q425 (Synergy Research Group)

Synergy also reported that revenue for cloud infrastructure services in 2025 reached a total of $419 billion, with the research firm estimating $119.1 billion worth of revenue in Q4 alone.

Generative AI was listed as the primary driver of this growth, with public infrastructure‑as‑a‑service and platform‑as‑a‑service accounting for 34 percent of growth in Q4.

Amazon maintains a lead in this market, with 28 percent market share. However, Google and Microsoft are seeing higher growth rates, with market shares at 21 percent and 14 percent, respectively. Together, these three make up 68 percent of the public cloud market.

The research also claimed that CoreWeave has emerged as a top‑10 cloud provider, generating more than $1.5 billion in quarterly cloud revenue.

Synergy said that cloud was growing strongly in all regions of the world, with above‑average growth rates coming from countries in the Asia‑Pacific region, such as Australia, India, Indonesia, and Taiwan. Ireland, Mexico, and South Africa also saw above‑average growth in 2025.

Despite significant growth in these markets, the US remains the largest with 30 percent growth in Q4.

“We said that Q3 market numbers were very impressive, but they pale by comparison with Q4. Growth rates like these have not been seen since early 2022, when the market was less than half the size it is today,” said John Dinsdale, chief analyst at Synergy Research Group.

“GenAI has simply put the cloud market into overdrive. AI‑specific services account for much of the growth since 2022, but AI technology has also enhanced the broader portfolio of cloud services, driving revenue growth across the board. The leading cloud providers have all seen their revenue growth rates jump. Meanwhile, neoclouds remain relatively small compared with the leaders, but they too are now contributing meaningful incremental growth.”

0

Comments

Want to join the conversation?

Loading comments...