News•Feb 17, 2026

Fitch Downgrades Missouri Hospital to ‘D’ Rating

Fitch downgraded John Fitzgibbon Memorial Hospital in Marshall, Missouri to a “D” rating from “C” and withdrew its issuer and bond ratings after the hospital defaulted on required debt payments. The default concerns principal and interest on 2010 bonds, and the bond trustee is preserving the debt‑service reserve to protect bondholders. The 60‑licensed‑bed acute hospital also runs a 99‑bed skilled‑nursing facility and several rural clinics, reporting $66.9 million in revenue for fiscal 2025. The downgrade signals heightened financial distress for the community health system.

By Becker’s Hospital Review

News•Feb 17, 2026

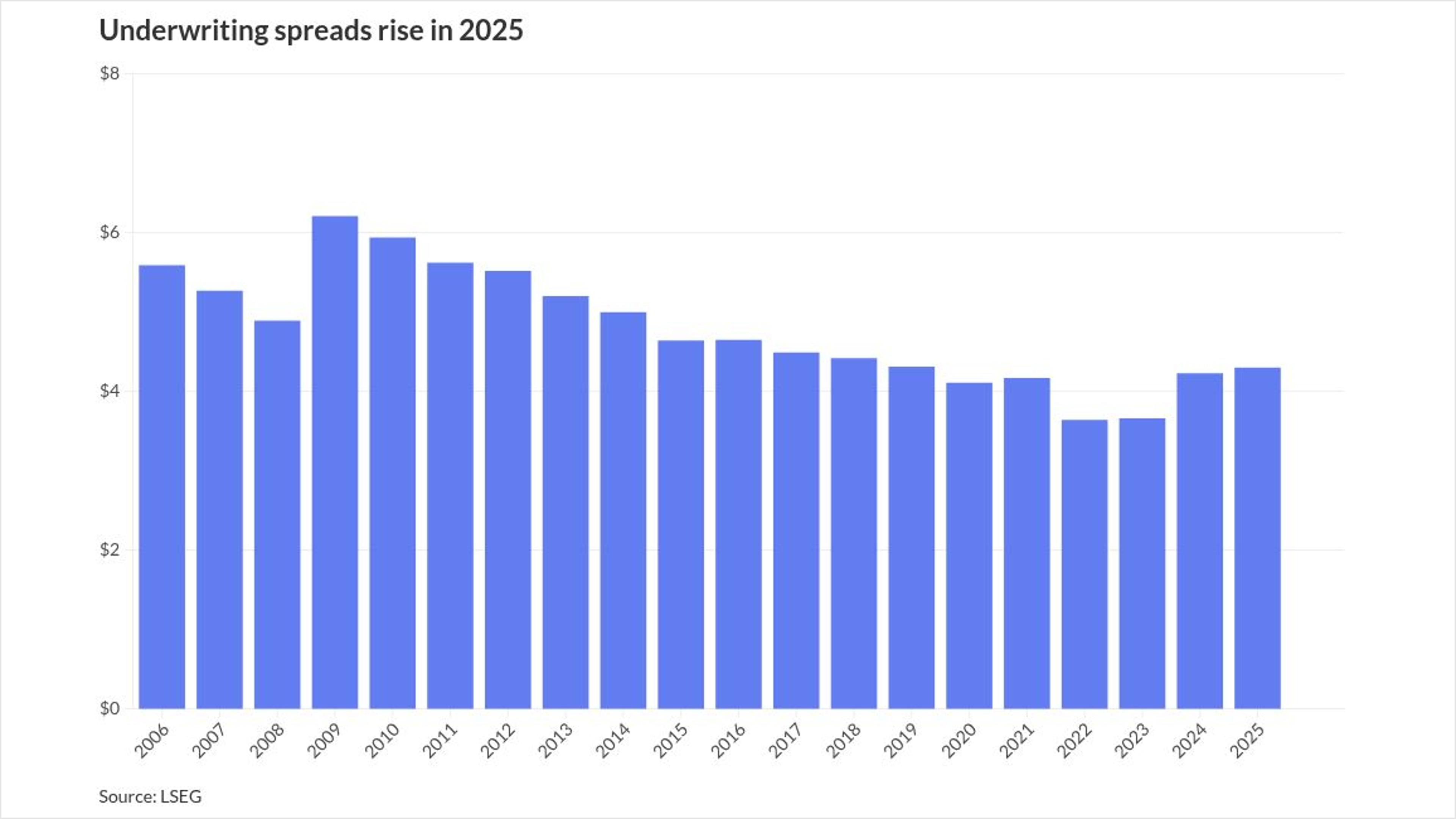

Underwriting Spreads Rise in 2025

Underwriting spreads for municipal bonds rose again in 2025, reaching an average of $4.30 per $1,000, up from $4.23 in 2024. Negotiated‑deal spreads increased to $4.64 while competitive‑deal spreads fell to $1.78. The uptick coincides with record issuance volumes—$586 billion in...

By The Bond Buyer (municipal finance)

News•Feb 16, 2026

Fitch Ratings Assigns ‘a’ Rating to Lee County, Florida Airport Revenue Bonds Series 2026

Fitch Ratings assigned an ‘A’ rating to Lee County, Florida’s airport revenue bonds, Series 2026, and affirmed the rating on existing bonds with a stable outlook. The rating reflects a balanced carrier mix serving a leisure‑focused market and enplanements that...

By Airport Improvement Magazine

News•Feb 16, 2026

Cohu: Maintaining Bearish Stance Post Q4 Earnings Release

Cohu, Inc. posted a Q4 earnings miss despite a 34% surge in recurring bookings and over 12% revenue growth, keeping operating losses and margins under pressure. The company added $290 million of convertible debt, raising dilution concerns, while one‑time inventory charges...

By Seeking Alpha — Site feed

News•Feb 16, 2026

S&P Global: An Undervalued Dividend King For Long-Term Investors

S&P Global (SPGI) is a $133 billion market‑cap provider of credit ratings, benchmarks, analytics and workflow solutions. The company has raised its dividend for 53 consecutive years and trades at a 21.9× P/E, roughly 20% below its five‑year average, implying undervaluation....

By Seeking Alpha — Site feed

News•Feb 16, 2026

Tract’s Fleet Data Centers Seeks $3.8bn to Fuel Nevada Build-Out

Fleet Data Centers, the development arm of Tract, announced a $3.8 billion senior secured note issuance to fund a 230 MW data center campus in Reno, Nevada. The facility, built on a 252‑acre site, is 100 percent leased to an unnamed investment‑grade tenant...

By Data Center Dynamics

News•Feb 14, 2026

A U.S. ‘Debt Spiral’ Could Start Soon as the Interest Rate on Government Borrowing Is Poised to Exceed Economic Growth,...

The CBO projects publicly held U.S. debt will surpass 106% of GDP by 2030 and reach 120% by 2036. Average Treasury interest rates are expected to climb to 3.9% by the end of the forecast, outpacing nominal GDP growth that...

By Fortune – All Content

News•Feb 14, 2026

VGMS: This New Low-Cost Active Bond ETF Is Growing

Vanguard launched the Multi‑Sector Income Bond ETF (VGMS) in June 2025, offering a 5.19% SEC yield and a low 0.30% expense ratio. Over the past eight months the actively managed fund outperformed the benchmark AGG by 93 basis points, delivering...

By Seeking Alpha – ETFs & Funds

News•Feb 13, 2026

Figures on Automotive Securitization Tapes: Definitions Report - February 2026

The Fixed‑Asset Securitization Tracker (FAST) released its February 2026 Definitions report, detailing the data fields used in automotive securitization tapes. The document supplies precise definitions, code tables, and cross‑references to related transaction disclosures. By standardizing terminology, the report aims to simplify...

By DBRS Morningstar – Research/News

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and...

By ForexLive — Feed

News•Feb 13, 2026

India Bond Traders Seek Buybacks as Yields Climb Despite Switch

Indian bond traders are pressing the government for buybacks as 10‑year yields climb despite a recent debt‑switch operation. The benchmark 10‑year yield rose to 6.6878%, up about five basis points after the Treasury swapped ₹755 billion of FY27 bonds for longer‑term...

By The Economic Times – Markets

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

News•Feb 12, 2026

Update on the Procurement for Digital Gilt Instrument (DIGIT) Pilot

The UK Treasury announced an update on the Digital Gilt Instrument (DIGIT) pilot, selecting HSBC’s Orion platform as the technology provider and Ashurst LLP for legal services. The competitive tender, launched in October 2025, aims to test distributed‑ledger technology for...

By HM Treasury – Atom feed

News•Feb 12, 2026

Fed Should ‘Aggressively’ Be Cutting Rates, Investor Says Amid Jobs Report Release

Anthony Pompliano, CEO of Professional Capital Management, argued on “Making Money” that the Federal Reserve should aggressively cut interest rates following the latest jobs report. He noted that the labor market remains solid but still offers room for monetary easing...

By Fox Business — Bonds (section)

News•Feb 11, 2026

Commonwealth Bank of Australia (CMWAY) Q2 2026 Earnings Call Transcript

Commonwealth Bank of Australia reported a solid second‑half 2025 performance, with cash net profit climbing 6% and earnings per share increasing $0.19. The bank highlighted disciplined growth across its core retail and business segments despite cost‑of‑living pressures and global uncertainty....

By Seeking Alpha — Site feed

News•Feb 11, 2026

MLPI: Supercharging MLPs For 15% Yields

NEOS MLP High Income ETF (MLPI) aims to deliver roughly 15% after‑tax yields by layering covered‑call premiums on a portfolio that mirrors the AMLP structure. The fund’s 100% return‑of‑capital distribution model defers taxes, boosting net income for investors. In addition...

By Seeking Alpha — Site feed

News•Feb 11, 2026

MPV: High-Quality Fund But Expensive At This Time

Barings Participation Investors (MPV) is a high‑quality, income‑focused closed‑end fund delivering a 7.8% yield and solid dividend coverage. The fund’s floating‑rate private‑credit portfolio positions it to profit from future interest‑rate cuts. However, shares currently trade at a 21% premium to...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Ladder Capital: No Harm In Positioning Itself Conservatively

Ladder Capital (LADR) continues to position itself as a low‑volatility, conservatively managed CRE REIT, with management holding over 10% of the equity. The Q4 2025 report showed a miss on dividend coverage, yet the portfolio remains anchored by more than...

By Seeking Alpha — Site feed

News•Feb 11, 2026

China Vanke Downsizes Serviced Apartment Business After Record Red Ink

China Vanke, a state‑backed developer, announced a record 82 billion yuan ($11.8 billion) loss for 2025. The loss prompted the company to shrink its serviced‑apartment business, scaling back operations in Shenzhen under the Port Apartment brand. The move is part of a...

By Nikkei Asia — Full feed

News•Feb 11, 2026

FTSE 100 Live: Heathrow Traffic Record; Homebuilders Call for Help

UK’s FTSE 100 slipped 0.3% after a string of negative corporate news. Energy giant BP announced a suspension of its share buyback programme and heightened cost‑cutting targets to fund oil production, while Standard Chartered saw its finance chief Diego De Giorgi...

By City A.M. — Markets

News•Feb 11, 2026

Voya Strategic Income Opportunities Fund Q4 2025 Commentary

Voya’s Strategic Income Opportunities Fund delivered outperformance in Q4 2025, surpassing its ICE BofA USD 3‑Month Deposit Index benchmark on a net asset value basis. The quarter was marked by heightened policy uncertainty due to a government shutdown, alongside market turbulence driven by a...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Thornburg Municipal Bond Funds Q4 2025 Commentary

U.S. fixed‑income markets ended 2025 on a positive note as Federal Reserve rate cuts and cooling inflation lifted bond prices. Thornburg's municipal bond funds posted mixed returns, with the AAA curve flattening and short‑term yields rising while longer maturities fell....

By Seeking Alpha — Site feed

News•Feb 11, 2026

Tradeweb Markets: Growth Outlook Remains Robust

Tradeweb Markets posted 12.5% year‑over‑year revenue growth in Q4 2025 and expanded its adjusted EBITDA margin to 53.2%, driven by strong volume gains in rates and derivatives. Early 2026 data shows double‑digit daily volume growth, supporting the firm’s high‑teens growth...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Country Garden Shares Edge up After Regulators Hold Back on Fines over Debt Disclosures

Country Garden shares rose about 1.8% after the Shanghai Stock Exchange issued a circulated criticism for delayed debt disclosures but stopped short of imposing fines. The regulator flagged failures across three reporting periods and recorded disciplinary action against the firm...

By South China Morning Post — Markets

News•Feb 11, 2026

Robinhood Markets, Inc. (HOOD) Q4 2025 Earnings Call Transcript

Robinhood held its Q4 2025 earnings call on February 10 2026, where CEO Vladimir Tenev and CFO Shiv Verma presented a solid financial rebound. Revenue rose 18% year‑over‑year to $1.2 billion and the net loss narrowed to $150 million, reflecting higher margin contributions from crypto...

By Seeking Alpha — Site feed

News•Feb 11, 2026

BNY Mellon Global Fixed Income Fund Q4 2025 Commentary

The BNY Mellon Global Fixed Income Fund posted a 0.67% return in Q4 2025, lagging its Bloomberg Global Aggregate USD‑Hedged benchmark by 11 basis points. Japanese government bonds surged, pushing the 10‑year yield 42 bp above the 2% threshold for the first...

By Seeking Alpha — Site feed

News•Feb 11, 2026

XOMA Royalty: Preferreds Still Offer Compelling Income Despite Call Risk

XOMA Royalty Corporation’s 8.375% cumulative preferred (XOMAO) trades at an attractive 8.3% yield, positioning it as a high‑income vehicle. The company added 24 royalty‑related assets in 2025, expanding its cash‑flow base from biotech milestones and licensing fees. Management highlights the...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Bristow Group: Strong Long-Term Setup, Near-Term Execution Still Key

Bristow Group (VTOL) is positioned for medium‑term growth, capitalising on robust offshore energy demand in Brazil, Africa and the Caribbean. Recent debt refinancing and stronger free‑cash flow have shored up its balance sheet, enabling planned share buybacks and a 2026...

By Seeking Alpha — Site feed

News•Feb 10, 2026

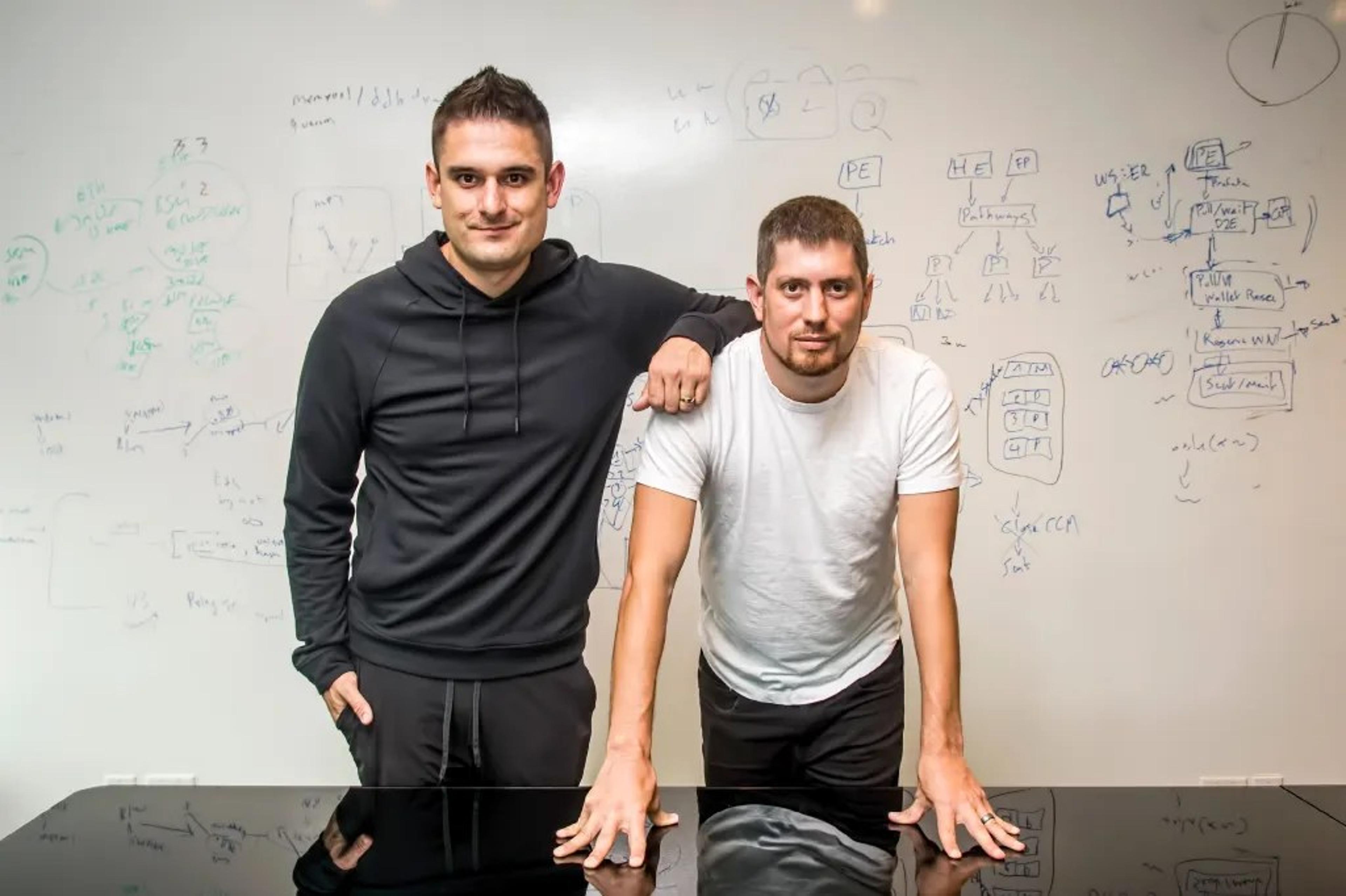

Citadel and Cathie Wood Back Zero, a New Blockchain Designed for Traditional Finance

LayerZero, backed by Andreessen Horowitz and Sequoia, unveiled Zero—a new blockchain built for traditional finance. The network leverages zero‑knowledge proofs to claim 2 million transactions per second at sub‑cent costs, far outpacing Solana’s 100k TPS limit. Wall Street heavyweights including Citadel Securities,...

By Fortune — Finance

News•Feb 10, 2026

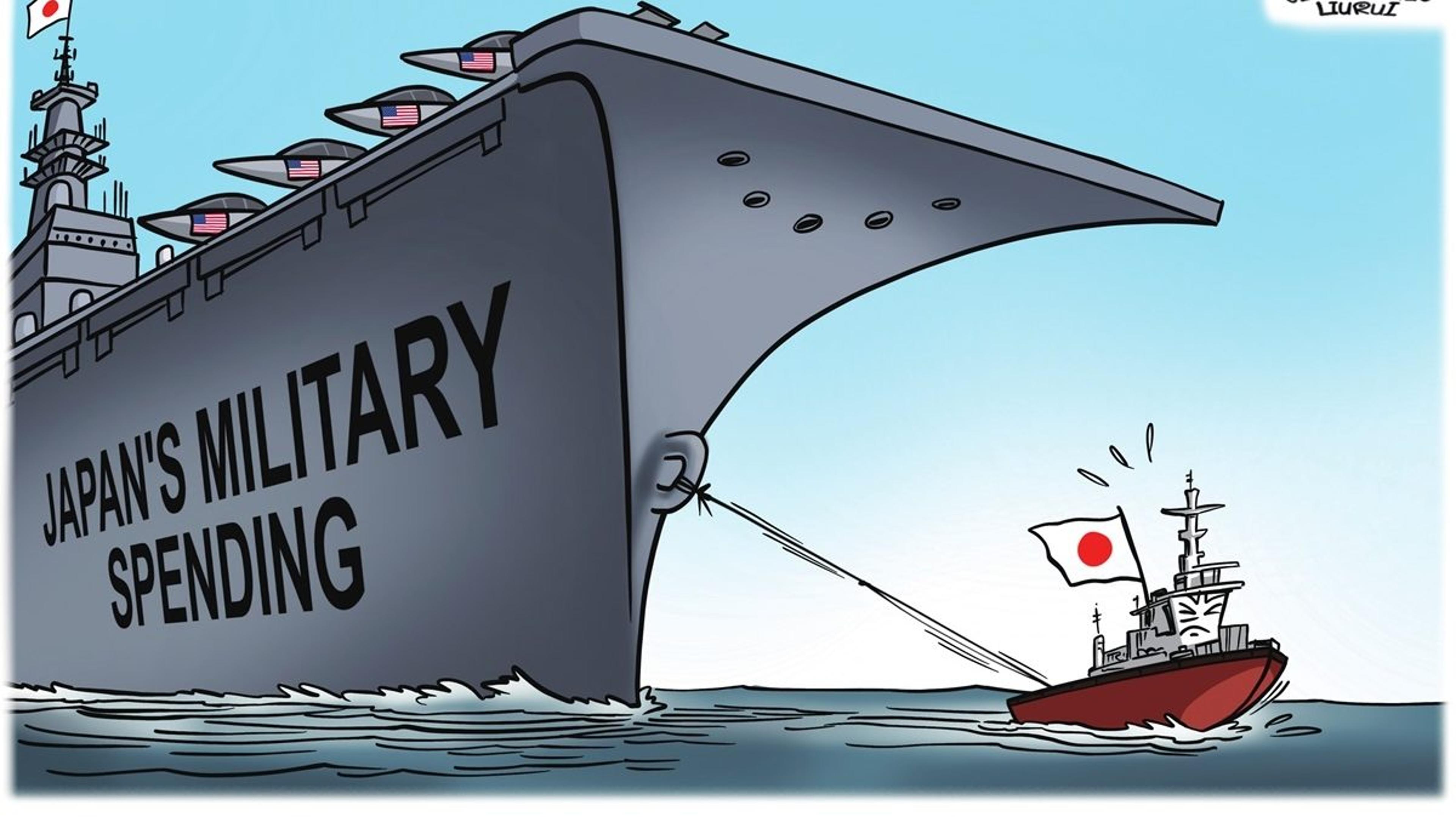

China’s US Treasurys Exit Could Limit Japan’s Military Spending

China is directing state‑owned banks to cut U.S. Treasury holdings to roughly $750 billion by 2025, halving its 2010 peak. The reduction removes a major buyer from the market, shifting the financing burden toward Japan, the world’s largest foreign‑reserve holder. Japan’s...

By Asia Times – Defense

News•Feb 10, 2026

Oxbridge Re Unveils New Tokenized Reinsurance Sidecar Securities with 20% & 42% Return Targets

Oxbridge Re Holdings has launched two new tokenized reinsurance sidecar tranches, T20-2027 and T42-2027, targeting 20% and 42% annual returns. The securities are issued on the Solana blockchain, replacing the earlier Avalanche platform. Prior token offerings delivered strong performance, including...

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Arbol and Pollen Systems Partner on Parametric Product for Agricultural & Climate Challenges

Arbol and Pollen Systems, backed by Esri and Omniris, have launched a parametric insurance product that fuses AI‑driven risk models with real‑time satellite, drone and field data. The solution leverages Esri’s GIS platform to deliver location‑aware insights throughout the policy...

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Plymouth Rock Sponsoring Debut Catastrophe Bond, $100m Tremont Re 2026-1

Plymouth Rock, a northeastern U.S. insurer, has launched its first catastrophe bond, seeking $100 million of named‑storm reinsurance through the Tremont Re Ltd. Series 2026‑1 issuance. The Bermuda‑based issuer will sell a single Class A tranche with a three‑year term, an attachment point...

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Global Warming Expected to Drive Structural Growth in ILS Spreads: Solidum Partners

Solidum Partners says global warming will structurally expand ILS spreads. As natural disaster frequency and severity increase, traditional reinsurers face capital constraints under Solvency II, limiting their capacity. ILS instruments, being event‑specific and fully collateralized, can absorb tail risk, leading investors...

By Artemis (ILS/cat bonds)

News•Feb 9, 2026

IRRBB Management in Emerging Market and Developing Economies: The Role of Derivatives in Supporting Financial Stability and Economic Development

Interest rate risk in the banking book (IRRBB) is emerging as a top priority for banks and regulators across emerging market and developing economies (EMDEs). Monetary tightening and persistent macro‑volatility are making balance‑sheet exposures more fragile, exposing the limits of...

By ISDA — News & analysis feed

News•Feb 9, 2026

DClimate Launches Tyche to Bring On-Chain Transparency to Catastrophe Reinsurance

Decentralised climate platform dClimate has launched Tyche, a blockchain‑based marketplace that tokenises catastrophe reinsurance using ERC‑20 assets. The platform recorded $20 million of notional risk during last year’s hurricane season and relies on dClimate’s AI‑driven Aegis engine for real‑time pricing and...

By Artemis (ILS/cat bonds)

News•Feb 9, 2026

Downing Street Resignations Trigger Bond Market Jitters

UK bond markets reacted sharply on Monday after a series of high‑profile Downing Street resignations, with the 10‑year gilt yield climbing to 4.62% – a ten‑basis‑point surge that set a three‑month high. The departures, including communications chief Tim Allan and...

By City A.M. — Markets

News•Feb 5, 2026

Bonds as Bargaining Chips: The $8 Trillion Selloff that Could Shake U.S. Markets

European investors hold roughly $8 trillion of U.S. Treasury debt, a quarter of the Treasury market, and recent geopolitical friction with the Trump administration has sparked talk of using those holdings as leverage. A Danish pension fund’s $100 million Treasury sell‑off highlighted...

By Quartz — Economy/Markets (site-wide feed)

News•Feb 4, 2026

Watchdog Warns on ‘Fire Sale Dynamics’ Risk in Repo Market

The Financial Stability Board warned that leveraged trades in the short‑term repo market could spark fire‑sale dynamics, pressuring sovereign bond prices. It highlighted a $16 trillion global repo market, with hedge‑fund borrowing near $3 trillion—about 25% of their assets—often conducted with zero...

By City A.M. — Markets

News•Feb 3, 2026

Bank of England Should Hold Interest Rates, City AM Shadow MPC Says

City AM’s Shadow Monetary Policy Committee, comprising nine independent economists, voted 7‑2 to keep the Bank of England’s base rate at 3.75%, citing persistent inflation and mixed business‑survey signals. Inflation for the year to December remains at 3.4%, above the...

By City A.M. — Markets

News•Jan 27, 2026

The Changing Shape of Variation Margin Collateral

Variation margin (VM) collateral, long dominated by cash, is facing pressure from higher funding costs, stricter regulations, and market stress, prompting firms to explore non‑cash alternatives. A Risk.net survey of 114 collateral specialists shows 57% of sell‑side and 33% of...

By Risk.net — Fixed Income topic

News•Jan 27, 2026

Profit Warnings Citing Global Upheaval Hit ‘Record High’

EY’s latest analysis shows 240 UK‑listed firms issued profit warnings last year, the lowest total since 2021 but the highest proportion citing policy and geopolitical uncertainty. About 42 percent of those warnings named regulatory flip‑flops, tariffs and wage hikes as profit‑dragging...

By City A.M. — Markets

News•Jan 26, 2026

Repo Clearing: Expanding Access, Boosting Resilience

Repo clearing is gaining traction as market liquidity tightens and regulators push for more transparency. LSEG’s RepoClear head Michel Semaan discussed how mandatory clearing and new haircut rules could enhance resilience while potentially shifting liquidity. Buy‑side firms, including hedge funds...

By Risk.net — Fixed Income topic

News•Jan 22, 2026

How Much Money Does the UK Government Borrow, and Does It Matter?

The UK’s public sector net borrowing fell 38% in December 2025, a £7.1 billion reduction from the previous month. Over the full financial year to March 2025 the government borrowed £152.6 billion, with an additional £140.4 billion borrowed between April and November 2025....

By BBC News — Business: Economy