Social•Feb 20, 2026

Fed Minutes Reveal Mixed Inflation, AI Boosts Productivity

In this week's #OnInvesting, @LizAnnSonders and I talk about Fed minutes, mixed signals on inflation & unemployment, and weakness in the survey data. Liz Ann & @KevRGordon discuss the latest GDP report and the impact of tariffs, AI-driven investment and productivity gains. https://t.co/0dvG26q8hH

By Kathy Jones

Social•Feb 20, 2026

IEEPA Threat Raises Tariff Ceiling, Shifts Negotiation Dynamics

While 15% is close to what many countries ended up negotiating with Trump, he invoked IEEPA to threaten much higher rates, providing powerful leverage. If 15% is an effective ceiling (outside 301/232 actions), that changes the bargaining dynamic.

By Greg Ip

Social•Feb 20, 2026

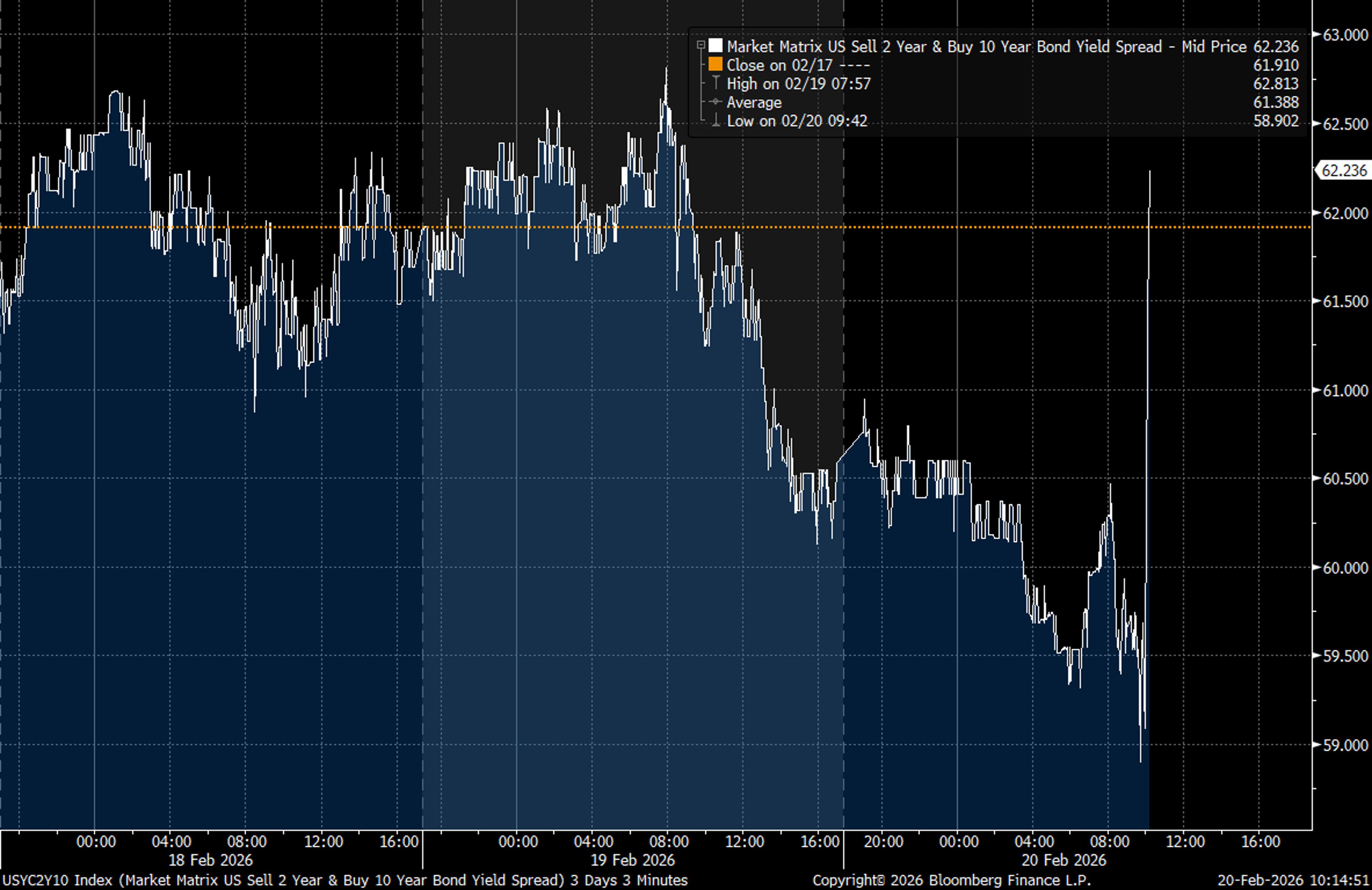

Yield Curve Ste

USTs for now reacting to the loss of tariff revenue, but it remains to be seen how this plays out. Curve steepening https://t.co/ZMjLP2vbxi

By Ed Bradford

Social•Feb 20, 2026

Most Weekly BDC Discounts Are Mispriced—Learn Why

Everyone has a BDC take this week. Most of them are wrong. If you don't understand how they trade, what drives the discount, or why NAV isn't what you think it is, start here. https://www.junkbondinvestor.com/p/the-bdc-primer-part-1

By JunkBondInvestor

Social•Feb 19, 2026

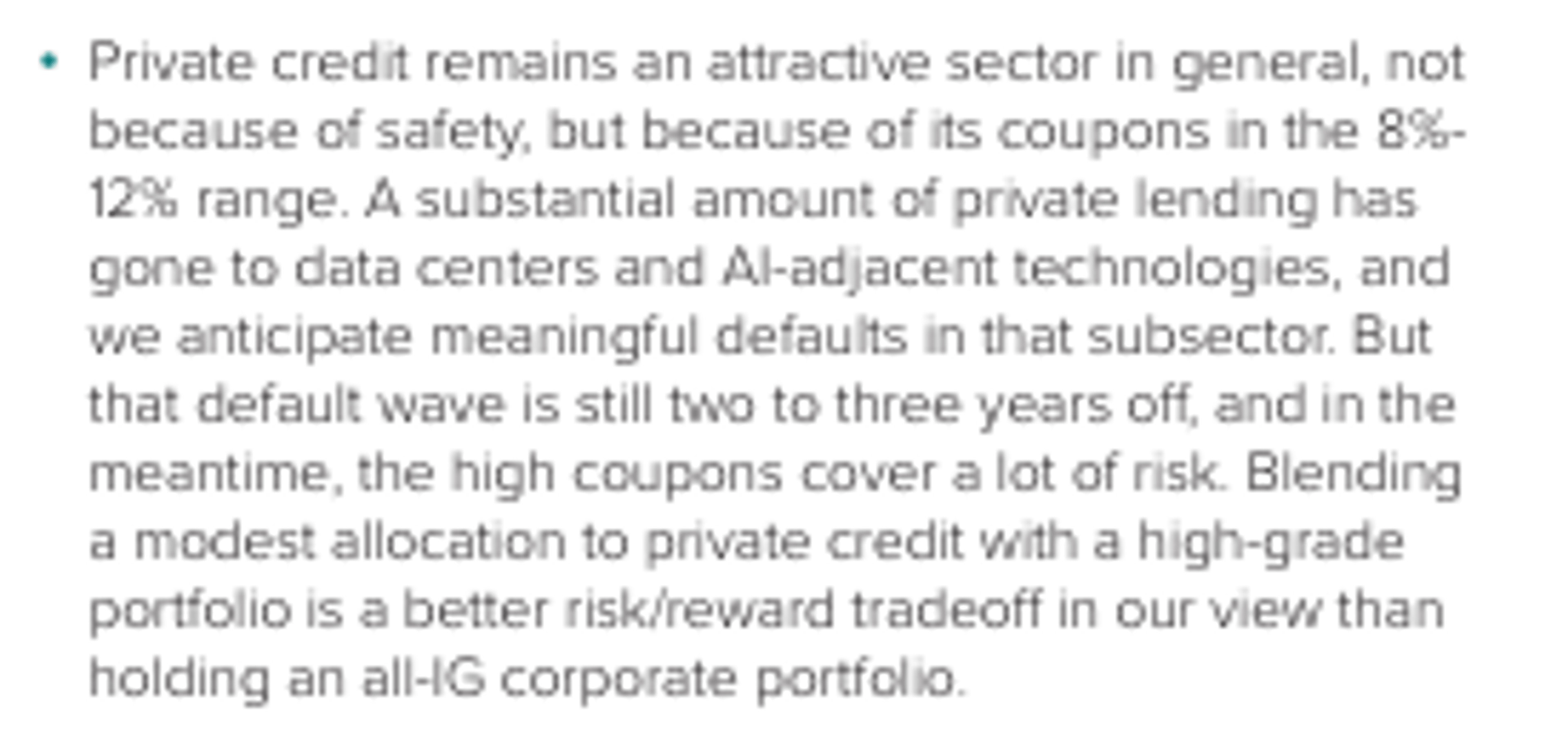

Discussing 2026 Credit Outlook, Including Private Credit

I will be joining @CNBC's @michaelsantoli this afternoon at 430p ET for a discussion of the credit markets--including, yes, private credit. Snip from our Outlook 2026. https://t.co/u8NP4oAYoL https://t.co/umYLiLDzTY

By Guy LeBas

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

Social•Feb 19, 2026

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

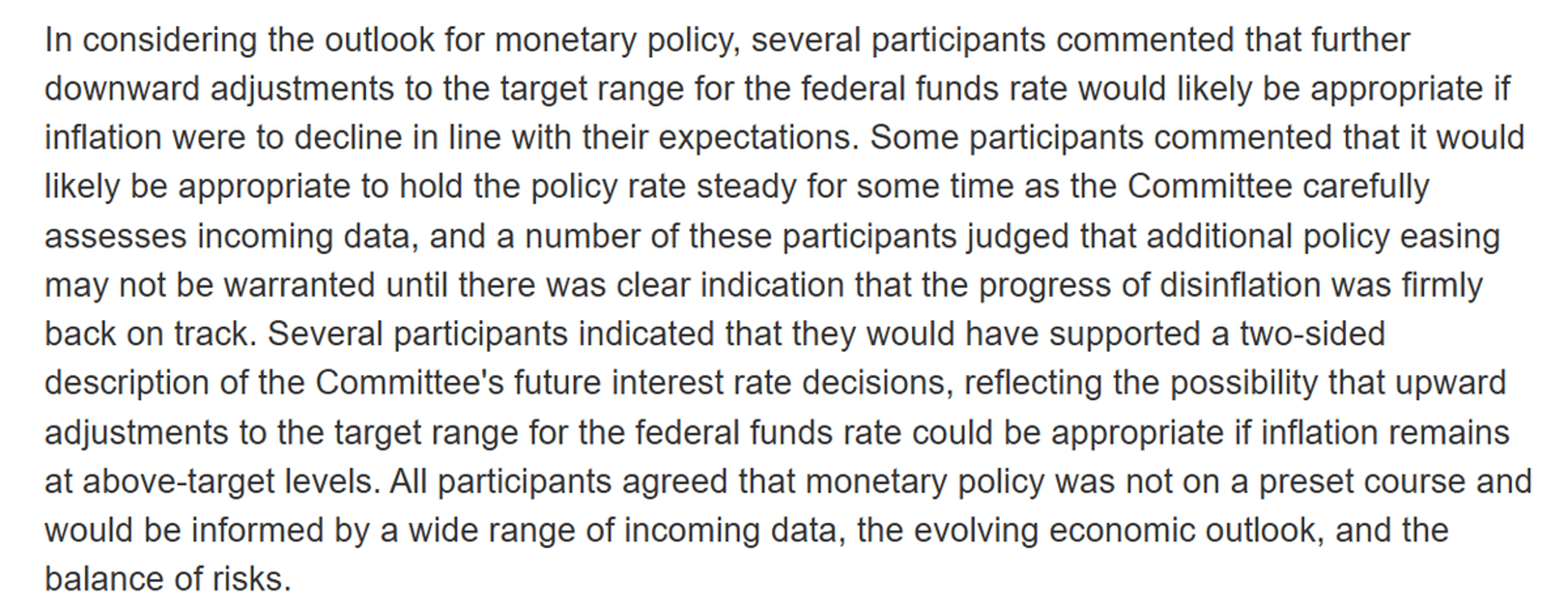

Hawks Push Back, Hint at Two‑Sided Policy Language

FOMC minutes suggest that the hawks pushed back. "Several would support two-sided language" about policy direction and "several" noted that if inflation remains high, rate hikes might be necessary.

By Kathy Jones

Social•Feb 18, 2026

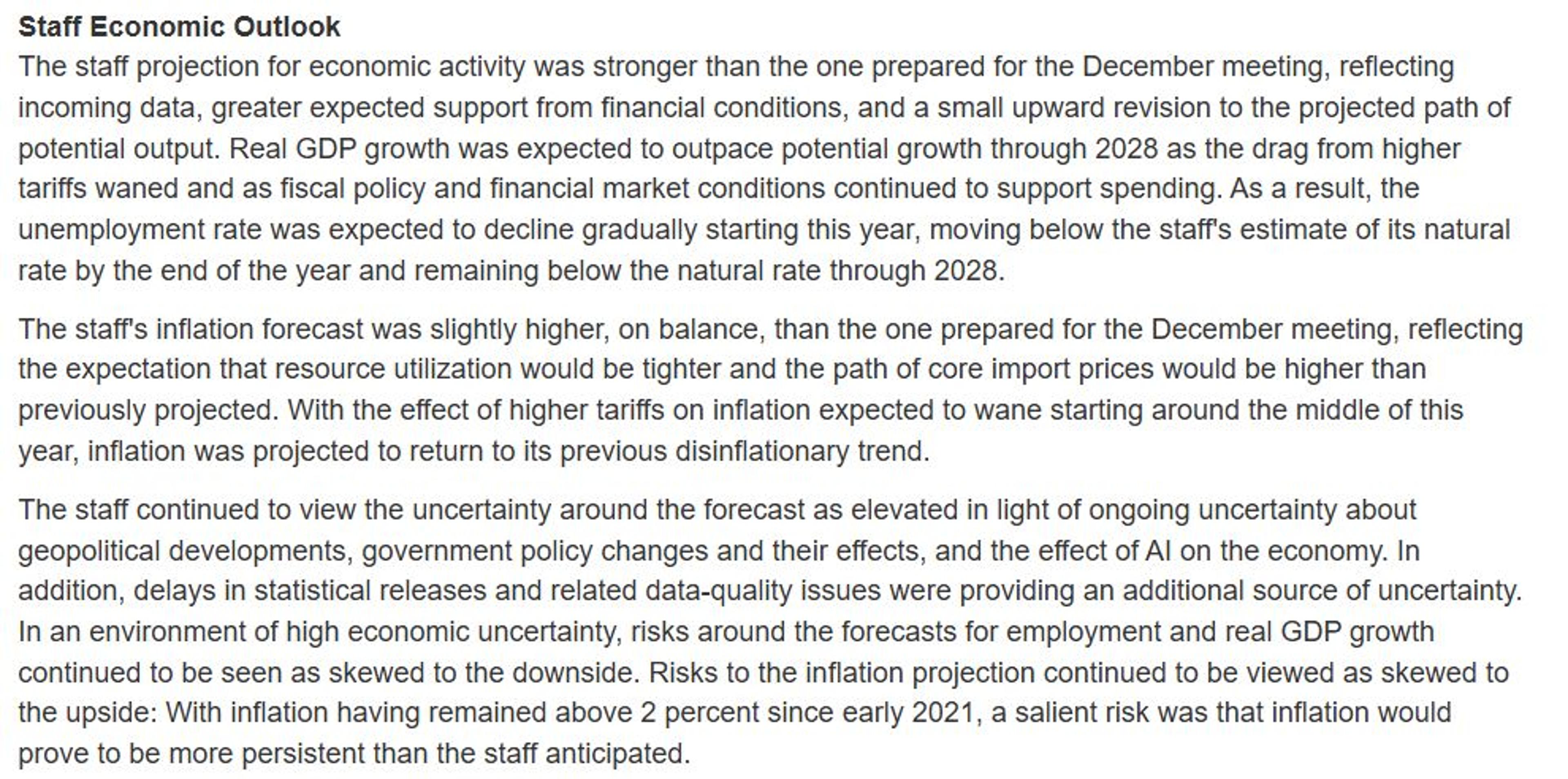

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm

Social•Feb 18, 2026

Lennar’s 13F Reveals 18.5M Opendoor

A note re: $OPEN and $Lennar --- if you back it out, Lennar held 18.5M shares of Opendoor at end of its Q3. The 13F likely indicates either they had some anti-dilution protections or participated in debt-for-equity swap, and that’s why...

By Luke Kawa

Social•Feb 18, 2026

FOMC Minutes Show Market‑Aligned Outlook, Fragile Jobs, Slowing Inflation

Few FOMC minutes takeaways: 1) Cmte basically in line with markets on major economic variables 2) Labor markets no longer outright weakening but remain fragile 3) Inflation decelerating as tariff passthru done, housing has downside (a misread on bad CPI method in Oct?) 1/...

By Guy LeBas

Social•Feb 18, 2026

March 2Y Futures Expected Heavy Amid Nasty Roll

Great reminder futures rolls (H25 to M26) are upon us. Bottomline March 2y futs should be heavy. Roll is nasty at -4.5 which should add to the flattening pressure along with front-end auctions next week.

By Ed Bradford

Social•Feb 18, 2026

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos