Social•Feb 18, 2026

March 2Y Futures Expected Heavy Amid Nasty Roll

Great reminder futures rolls (H25 to M26) are upon us. Bottomline March 2y futs should be heavy. Roll is nasty at -4.5 which should add to the flattening pressure along with front-end auctions next week.

By Ed Bradford

Social•Feb 18, 2026

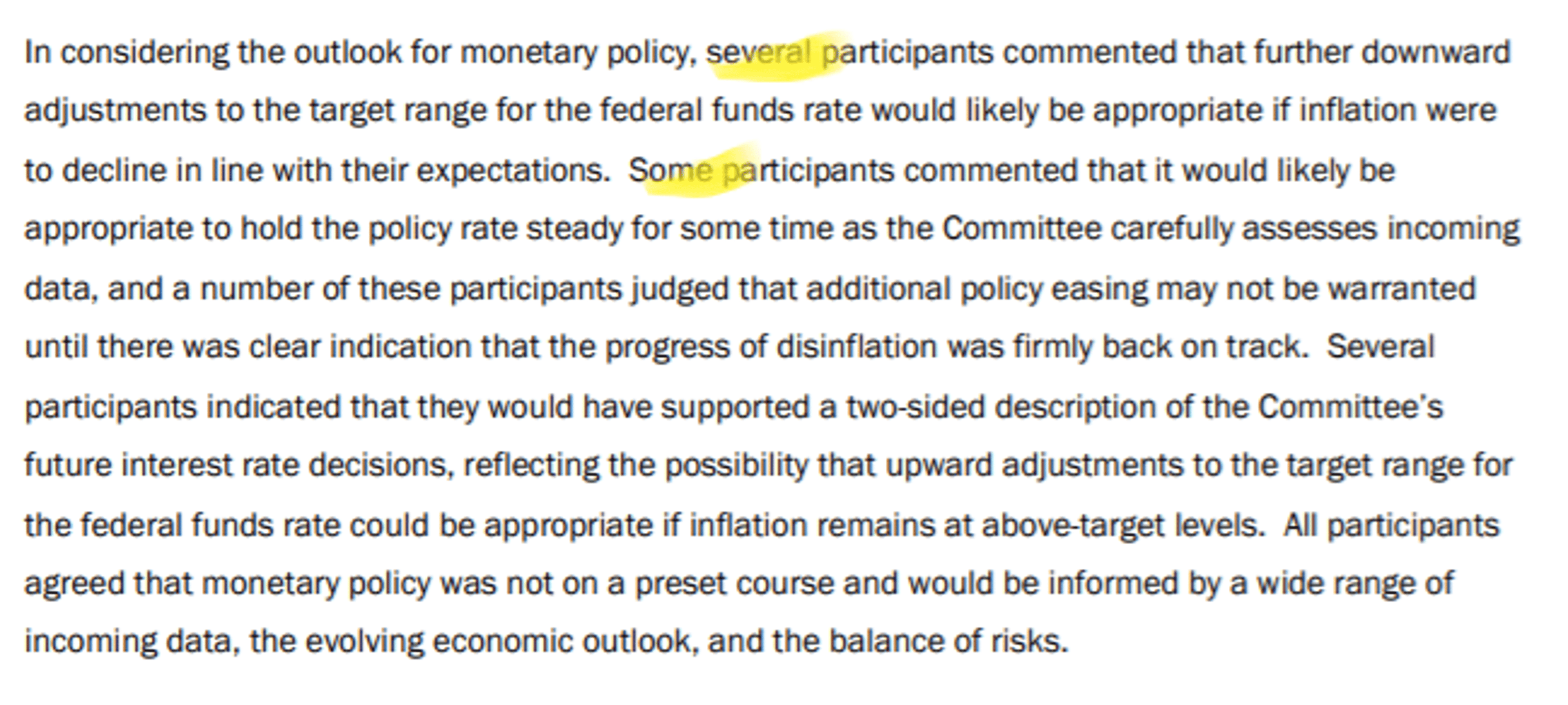

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

Social•Feb 17, 2026

TLT Seen as Lower High, Still Hating Treasuries

I think I might be the only person in the world who still hates US Treasuries here. $TLT is just another lower high imo until proven wrong.

By Quinn Thompson

Social•Feb 17, 2026

Fed Rarely Cuts Rates During >8% Nominal Growth

"The Federal Reserve has cut rates only a handful of times when nominal growth was greater than 8 per cent and most of those instances were in the 1970s." Richard Bernstein @RBAdvisors in the FT https://t.co/vzNnkKmGpY

By Greg Ip

Social•Feb 17, 2026

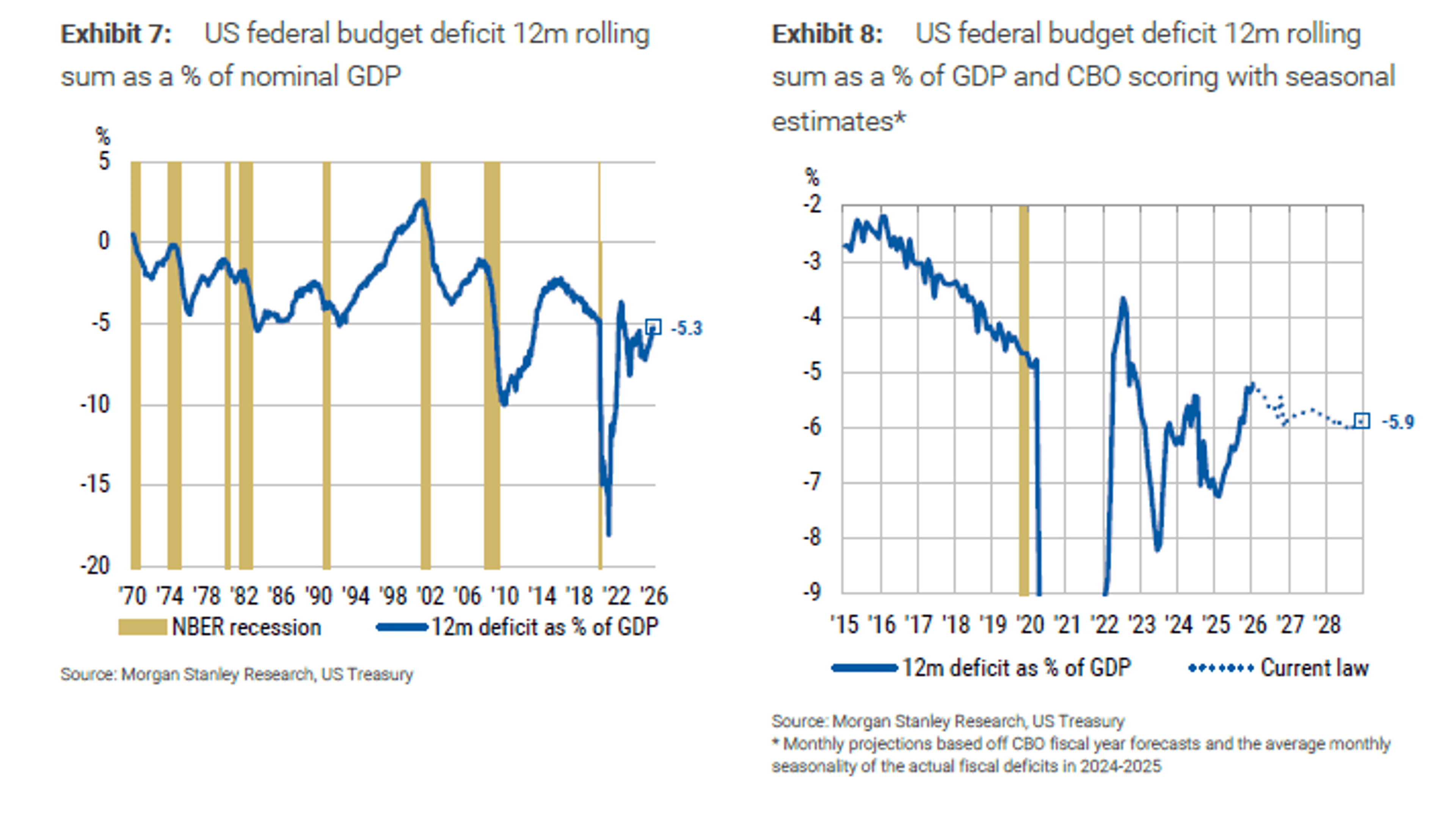

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Social•Feb 17, 2026

Rate Moves Aren’t Driven by Current Data, ADP Shows

Big mistake is assuming move in rates is about current economic data. Reaction to ADP a good example

By Ed Bradford

Social•Feb 17, 2026

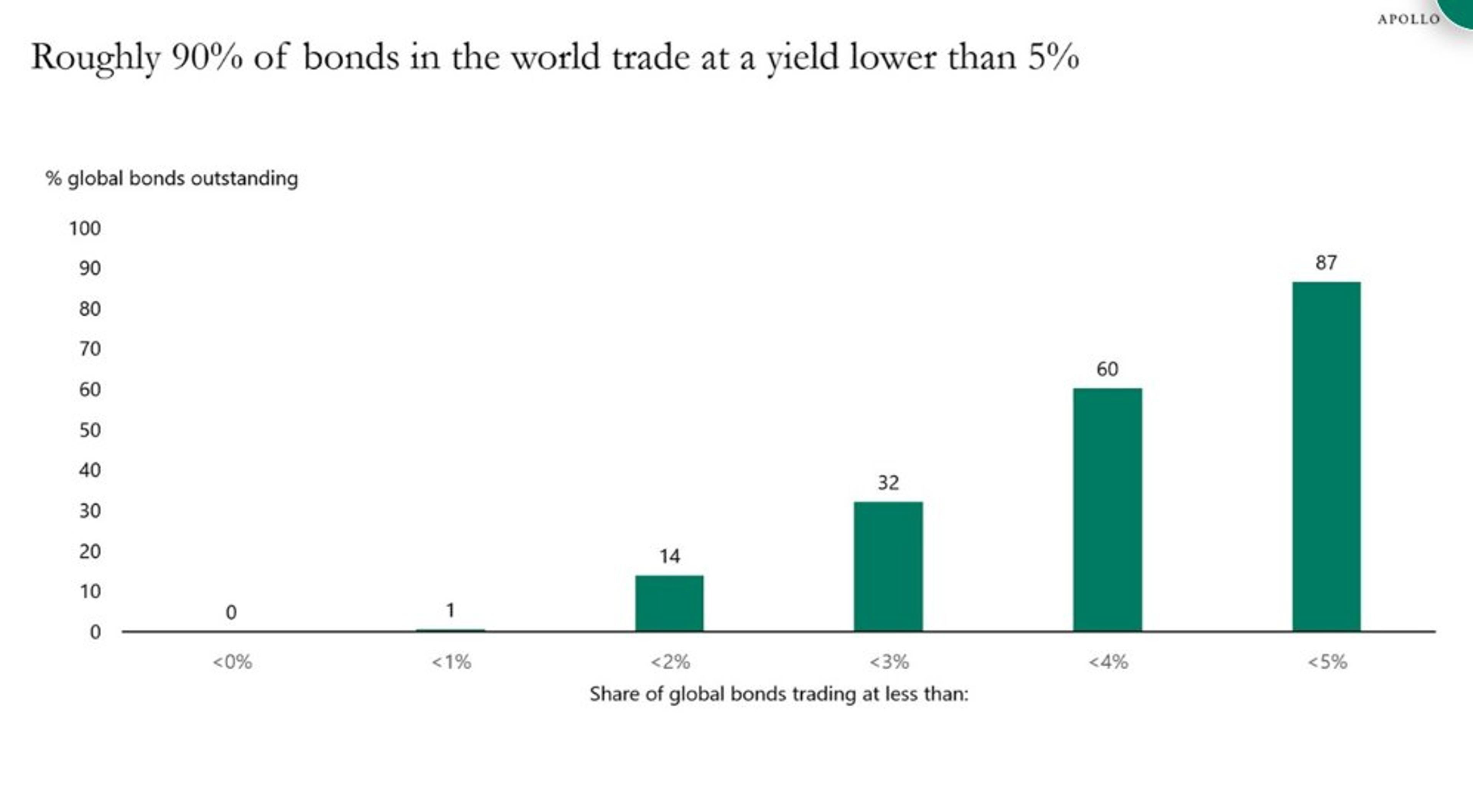

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

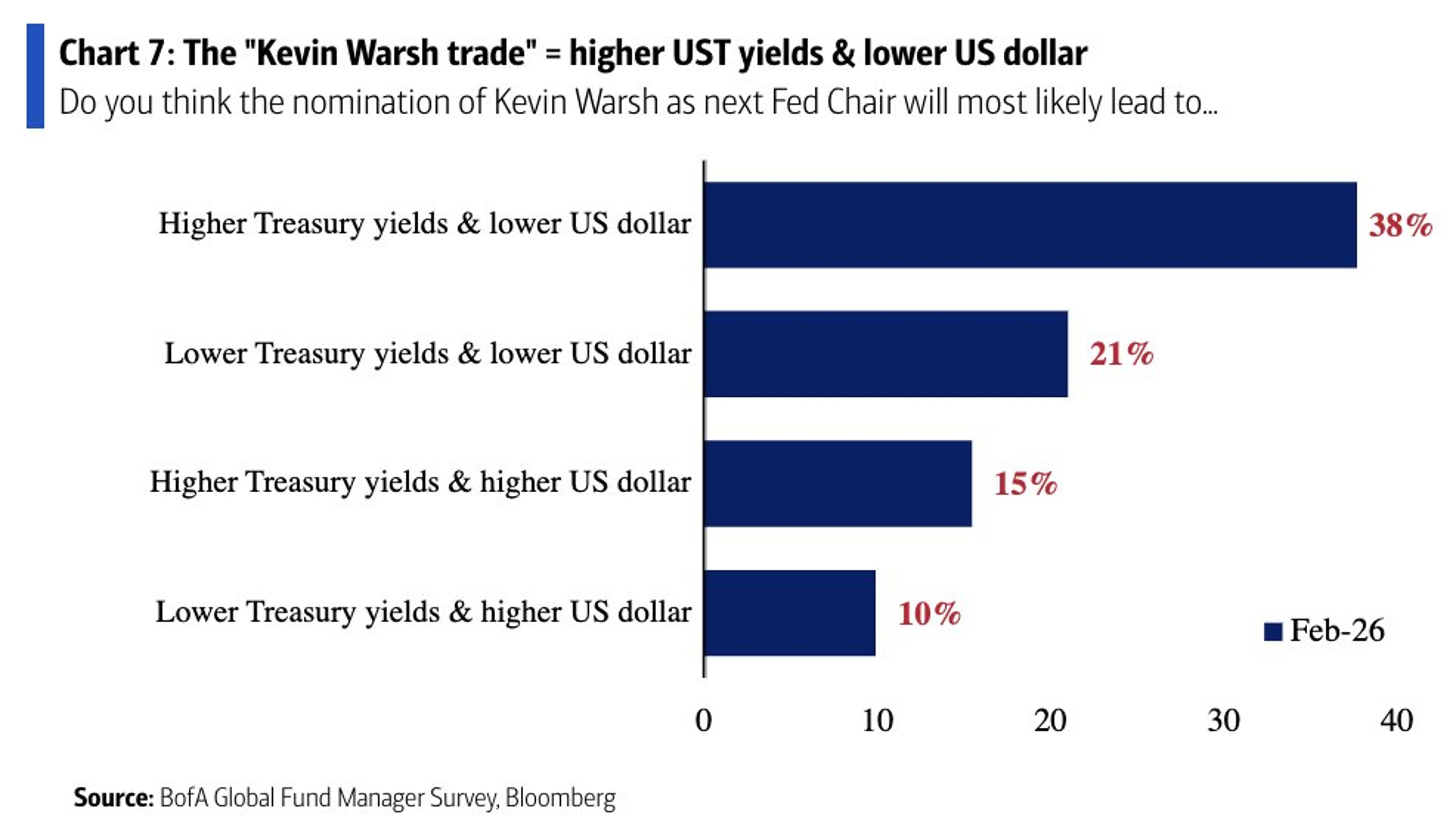

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

Social•Feb 16, 2026

Private Credit Bets on Software Amid AI Uncertainty

Five private credit firms just provided $1.4B for a software buyout of OneStream valued at $6.4B. Same week everyone’s asking whether AI will make these companies obsolete. The market is telling you software is at risk. The lenders are telling you...

By JunkBondInvestor

Social•Feb 16, 2026

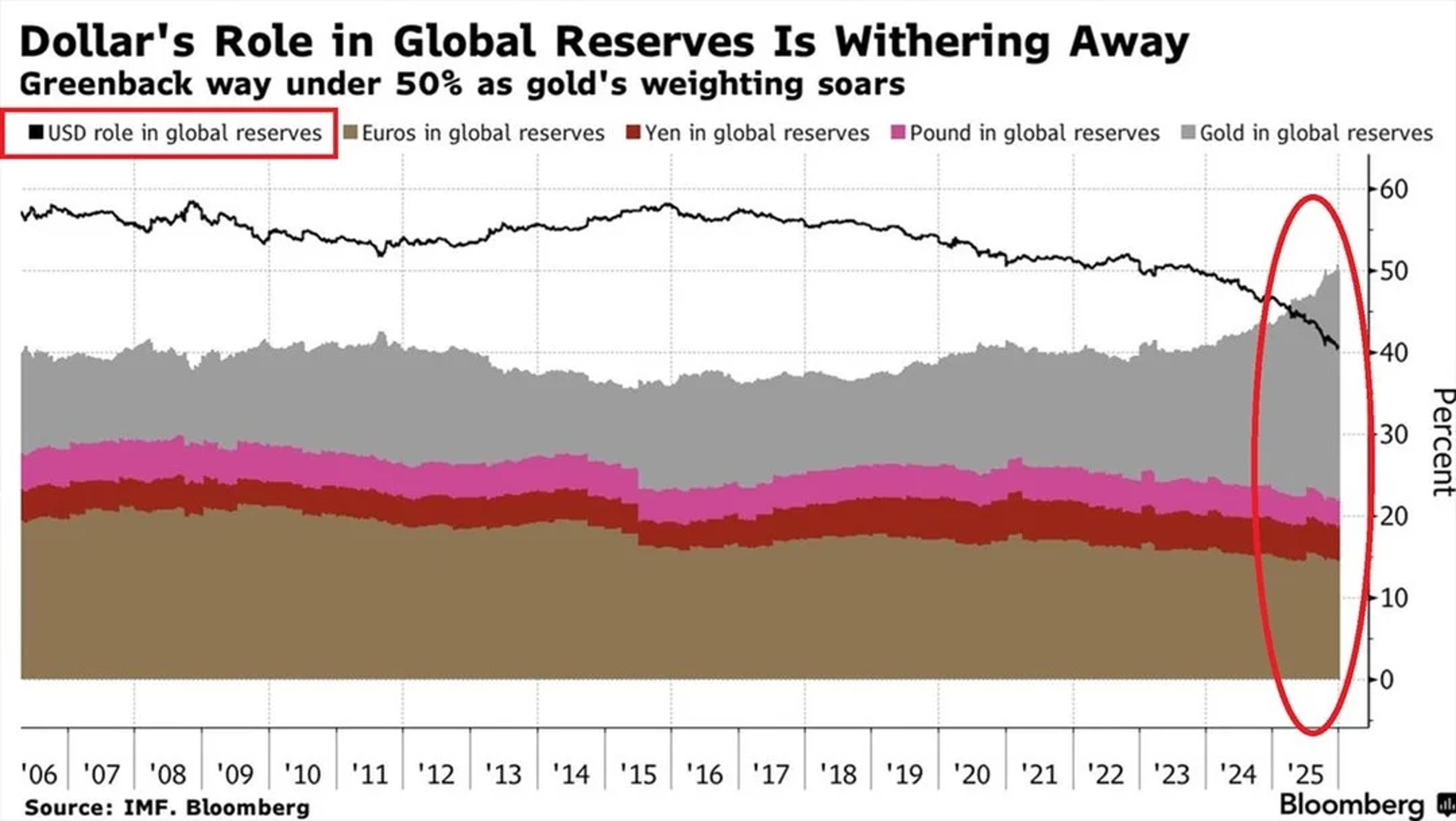

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

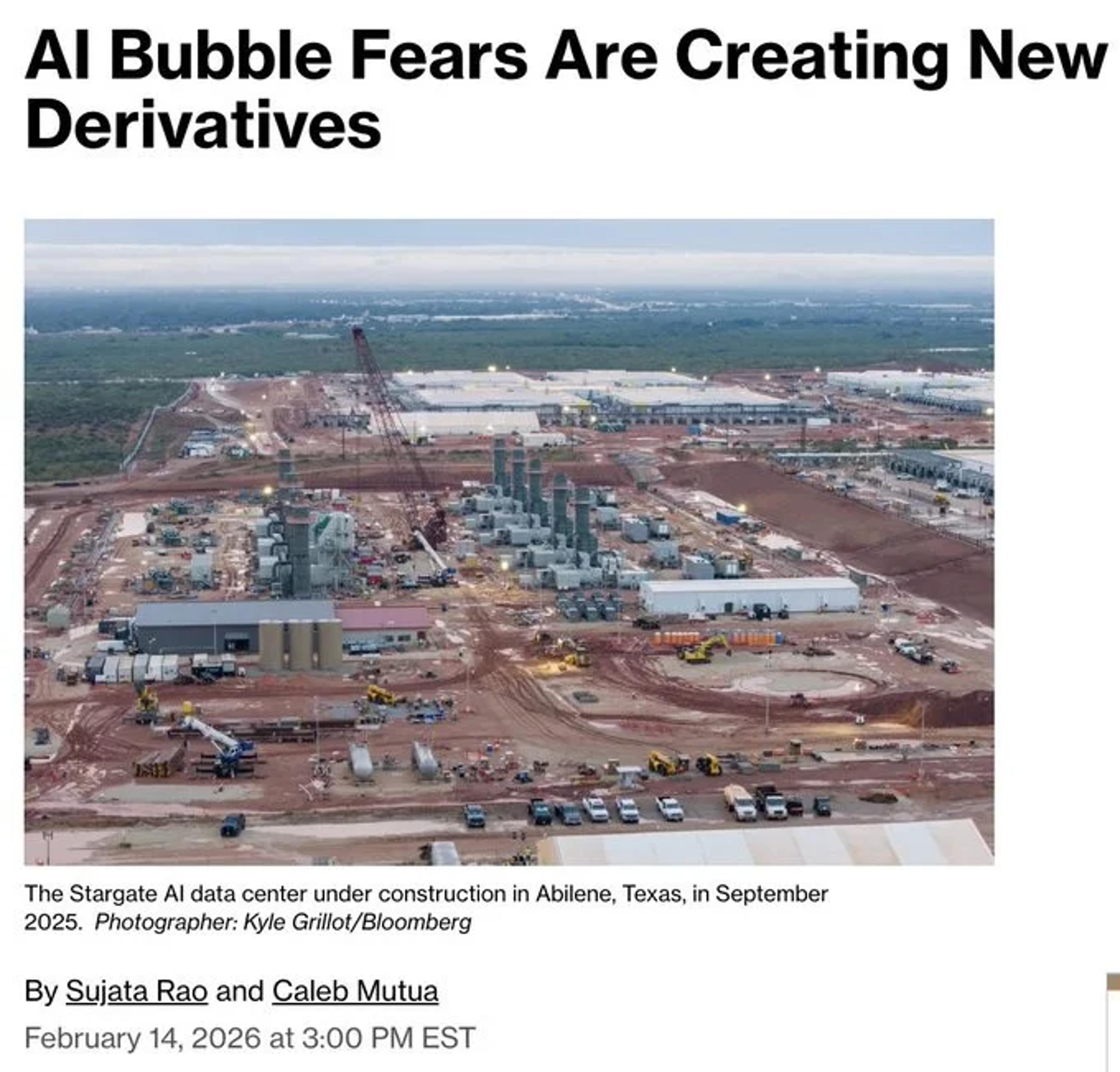

Alphabet and Meta CDS Explode From Zero to Top Traders

A year ago, CDS on Alphabet and Meta didn't exist. Now they're among the most actively traded single-name contracts in the US market Nobody creates a default insurance market for fun... $GOOG $META

By JunkBondInvestor

Social•Feb 16, 2026

AI Disruption Drives Widening Credit Spreads Ahead of Earnings

AI disruption is hitting IG credit spreads, not just stock prices. Concentrix: BBB-rated, 455,000 call center employees. Paid 130bps concession to refinance. Stock down 24% last week. Spreads doubled in February. Credit markets pricing obsolescence before it shows up in earnings.

By JunkBondInvestor

Social•Feb 15, 2026

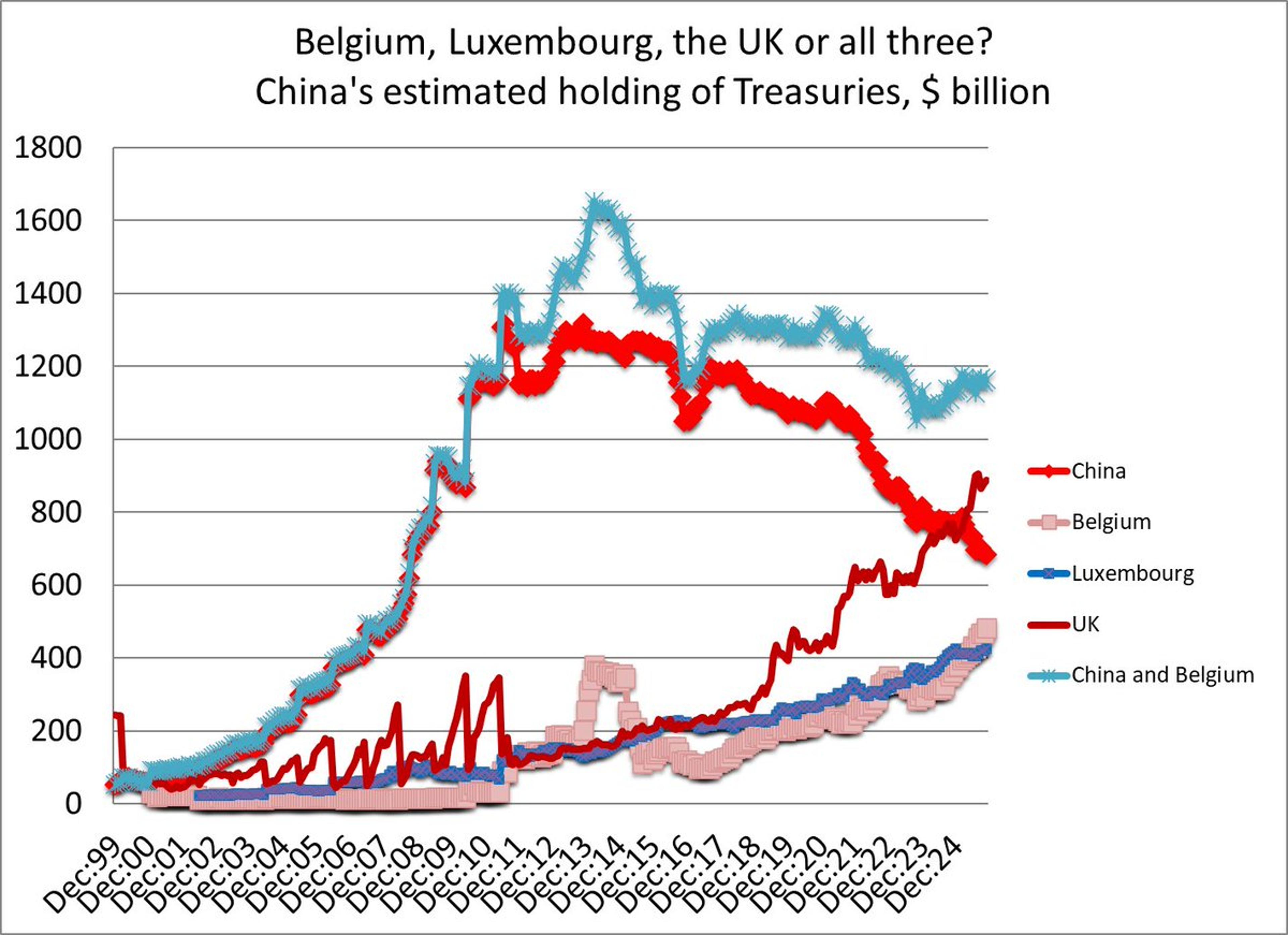

TIC Data Misses China’s Treasury Holdings Abroad

My periodic reminder that the US TIC data doesn't measure China's holdings of US Treasuries. It only measures China's holdings of Treasuries in US custodians. The real question is how many Treasuries Chinese entities hold in non US...

By Brad Setser

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See...

By Marc Chandler

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

Services Inflation Sticks While Housing Disinflation Persists

Closing out the week with @GregDaco and @ElizRosner talking about inflation: "On the latest episode of The Inflation Brief from ECON-versations with NABE, hosts Greg Daco and Laura Rosner-Warburton are joined by special guest Claudia Sahm to break down the...

By Claudia Sahm

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

Social•Feb 13, 2026

BDC Quarterly Letters: Refusing Write‑Downs, Defying Pressure

Every BDC quarterly letter should just say “we are choosing not to mark this down and you can’t make us.”

By JunkBondInvestor

Social•Feb 13, 2026

Market Rally Likely False Amid Risk‑off Sentiment

I believe this is a false rally. Look at Utilities. That's defensive positioning. Same with long duration Treasuries. We remain in a risk-off condition for now.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

CPI Slowdown Fuels Falling Yields, Bullish Duration, Utilities, Gold

Post Hedgeye's Nowcast nailing another decel in CPI Growth decelerates → yields fall → correlations re-assert That’s the whole #Quad3 playbook ✔️ Duration bullish ✔️ Utilities work ✔️ Gold works ❌ Financials don’t

By Keith McCullough

Social•Feb 13, 2026

Inflation Still Stubborn: CPI 2.8%, Core 3.2%

FWIW, since the first "clean" CPI in November (post shutdown), headline CPI inflation is 2.8% annualized and core is 3.2% annualized. Neither suggests much stepdown yet in underlying inflation.

By Greg Ip

Social•Feb 13, 2026

Soft US Inflation Sparks Dollar Slide, Yield Drop, Gold Rise

📉 Softer US Inflation - Markets React 🔻 Softer US inflation numbers 🔻 USD tumbling 🔻 10-year yield falling ⬆️ Gold rising ⬆️ Stocks rallying 📊 CPI Breakdown: • MoM: 0.2% actual vs 0.3% forecast • YoY: 2.5% actual vs 2.5% forecast (2.7% previous)

By Kathy Lien

Social•Feb 13, 2026

January Spike: Core CPI Gains Outpace Typical Inflation

JANUARY EFFECT, or “Why this inflation report matters more than others” Since the start of 2022, core CPI has risen 0.45% month-on-month in January, versus an average of 0.33% for all months.

By Luke Kawa

Social•Feb 13, 2026

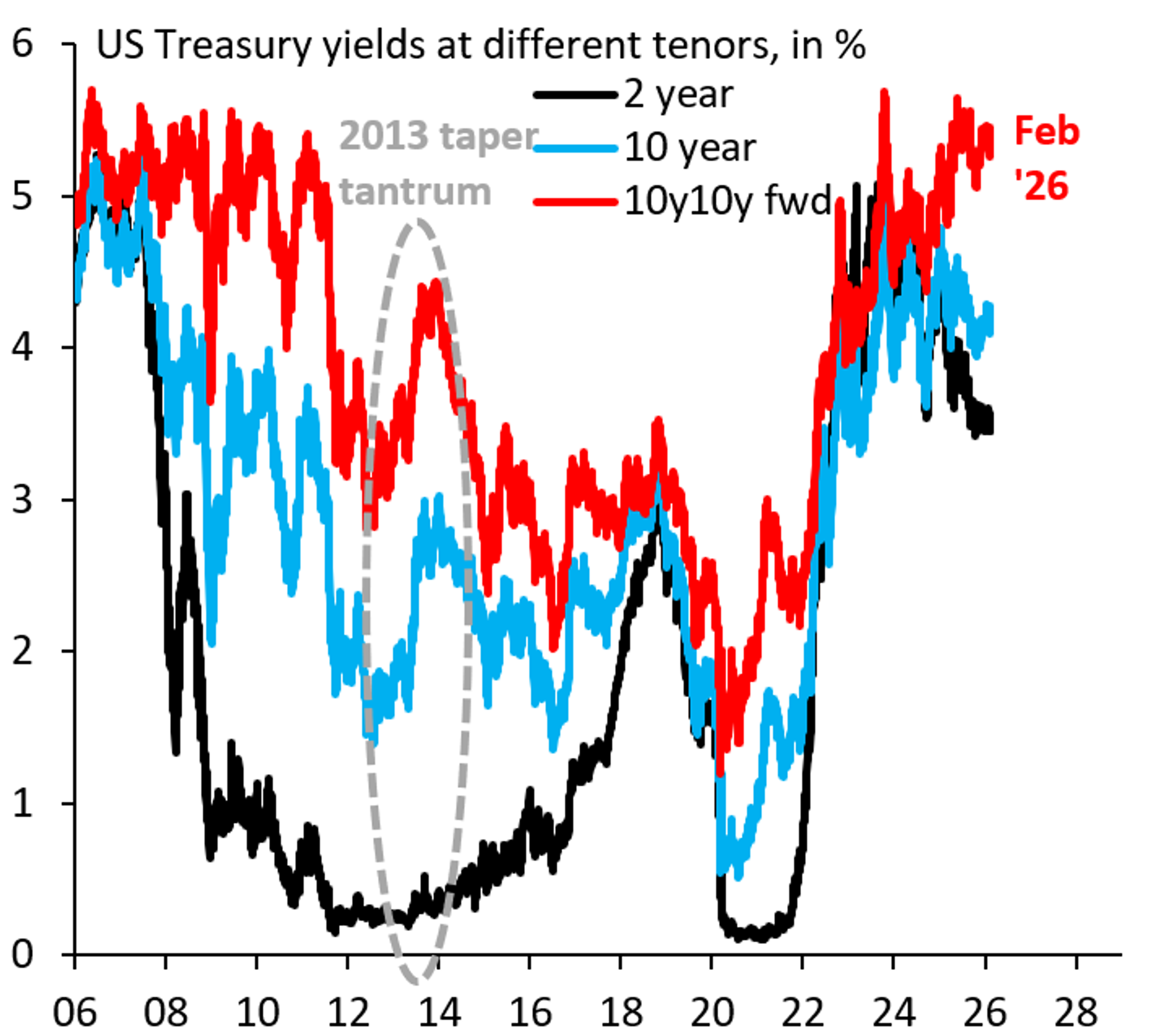

Trump Backs Off as Treasury Market Wobbles, Risk Premium Spikes

One constant in the Trump administration is that - when the Treasury market wobbles - it backs down. That happened on China in Apr. '25 and again on Greenland recently. 10y10y forward yield remains near its highs, even as 10y...

By Robin Brooks

Social•Feb 13, 2026

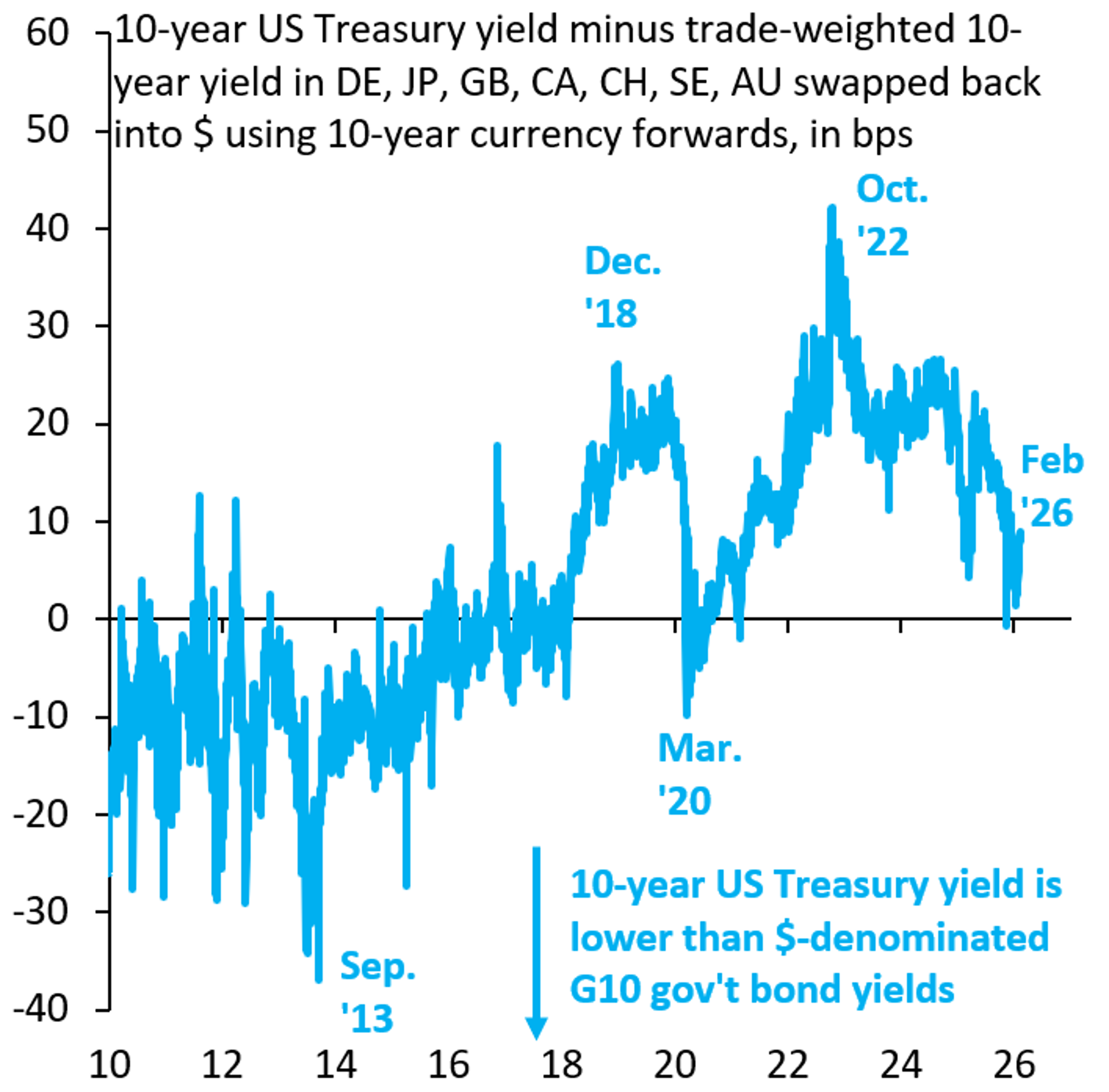

US Loses Cheap‑borrower Advantage, Now Pays Debt Premium

The US exorbitant privilege - the ability to issue debt more cheaply than others - ended about a decade ago. We're now issuing debt at a premium, the result of deficits and debt that are out of control. This change...

By Robin Brooks

Social•Feb 13, 2026

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 13, 2026

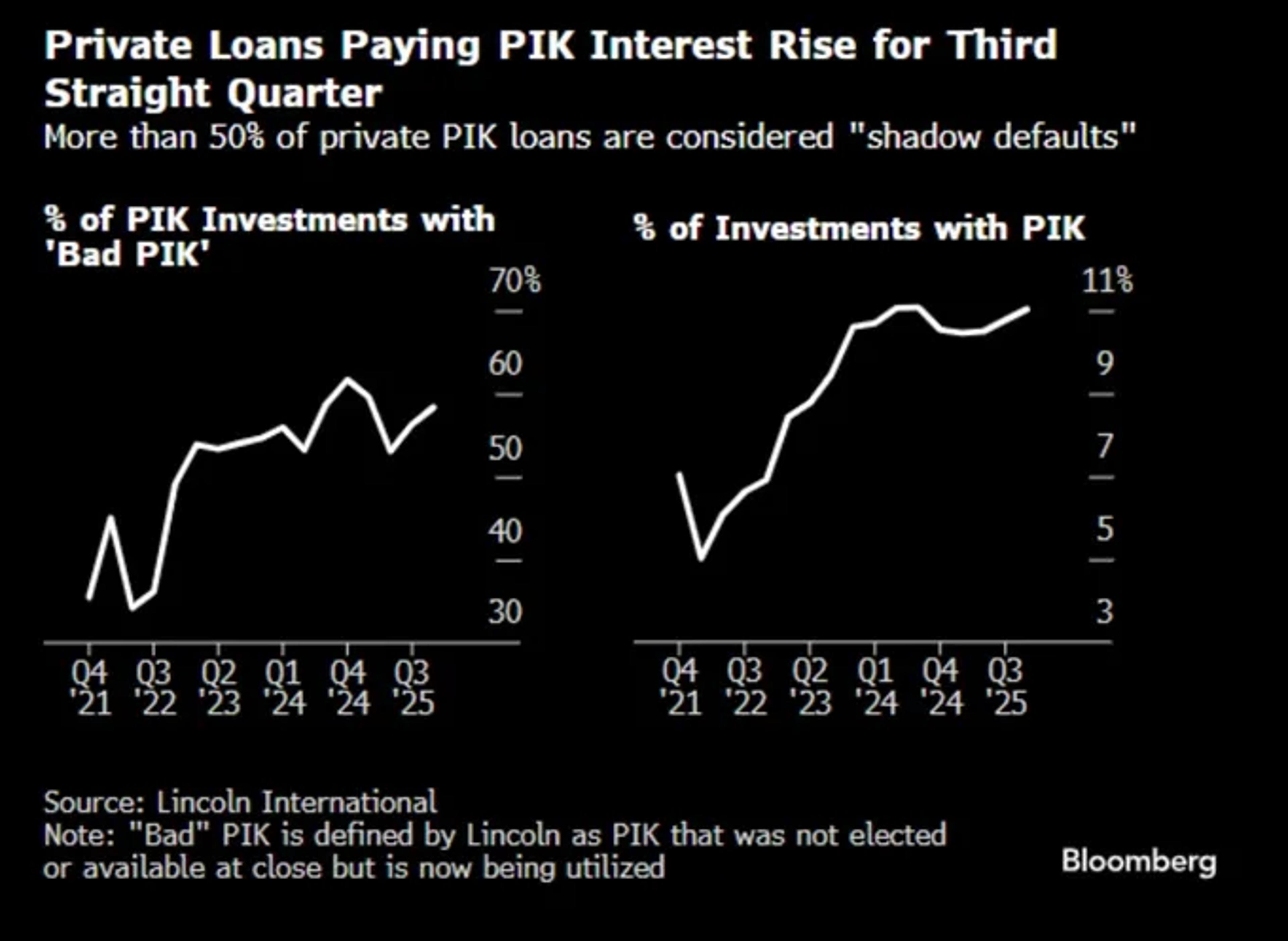

Most Private Credit PIK Is Bad Yet Labeled Performing

58% of PIK in private credit is "bad PIK" per Lincoln. Borrower stops paying cash. Lender accepts more debt instead. Everyone marks it at par. This is called "performing."

By JunkBondInvestor

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Social•Feb 12, 2026

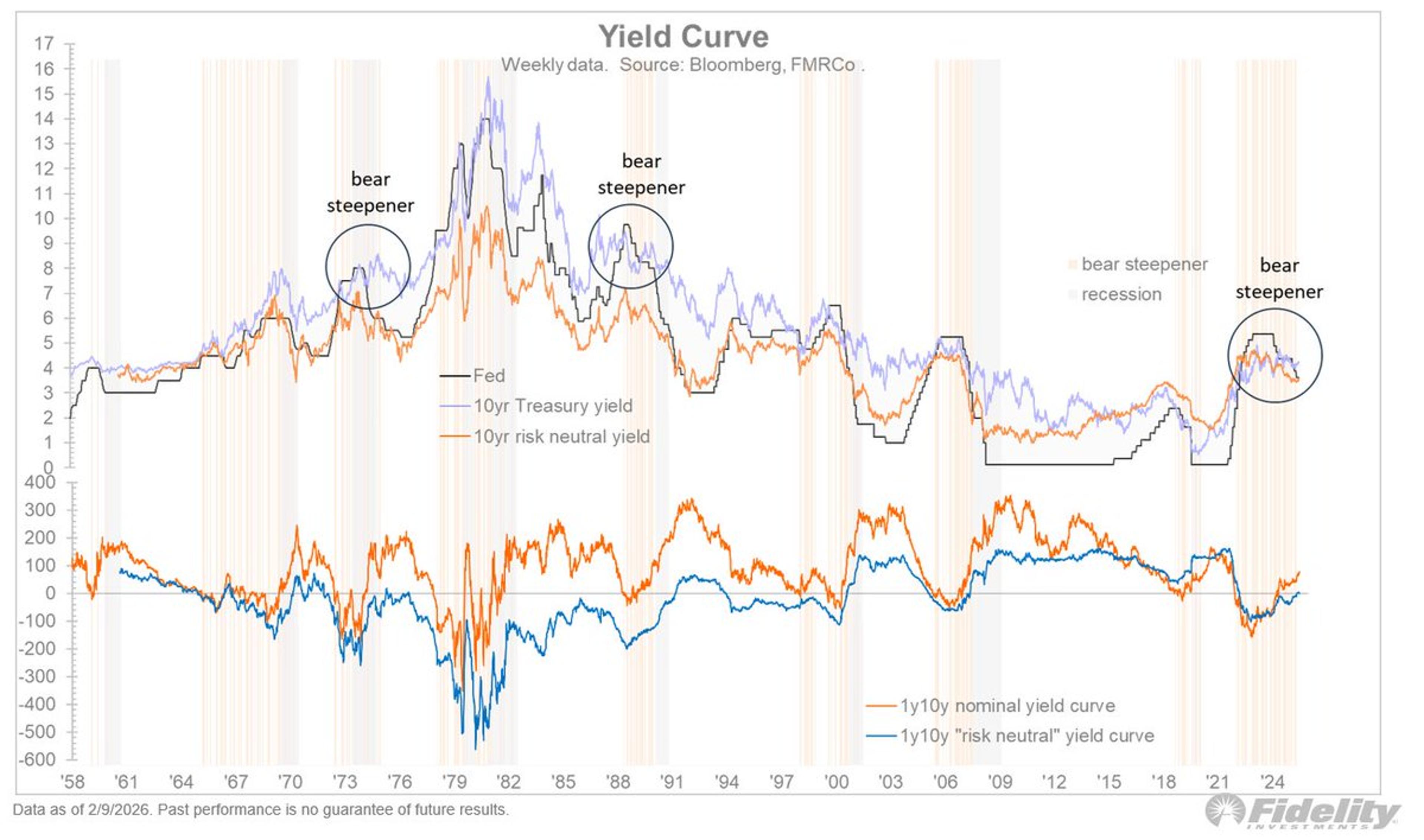

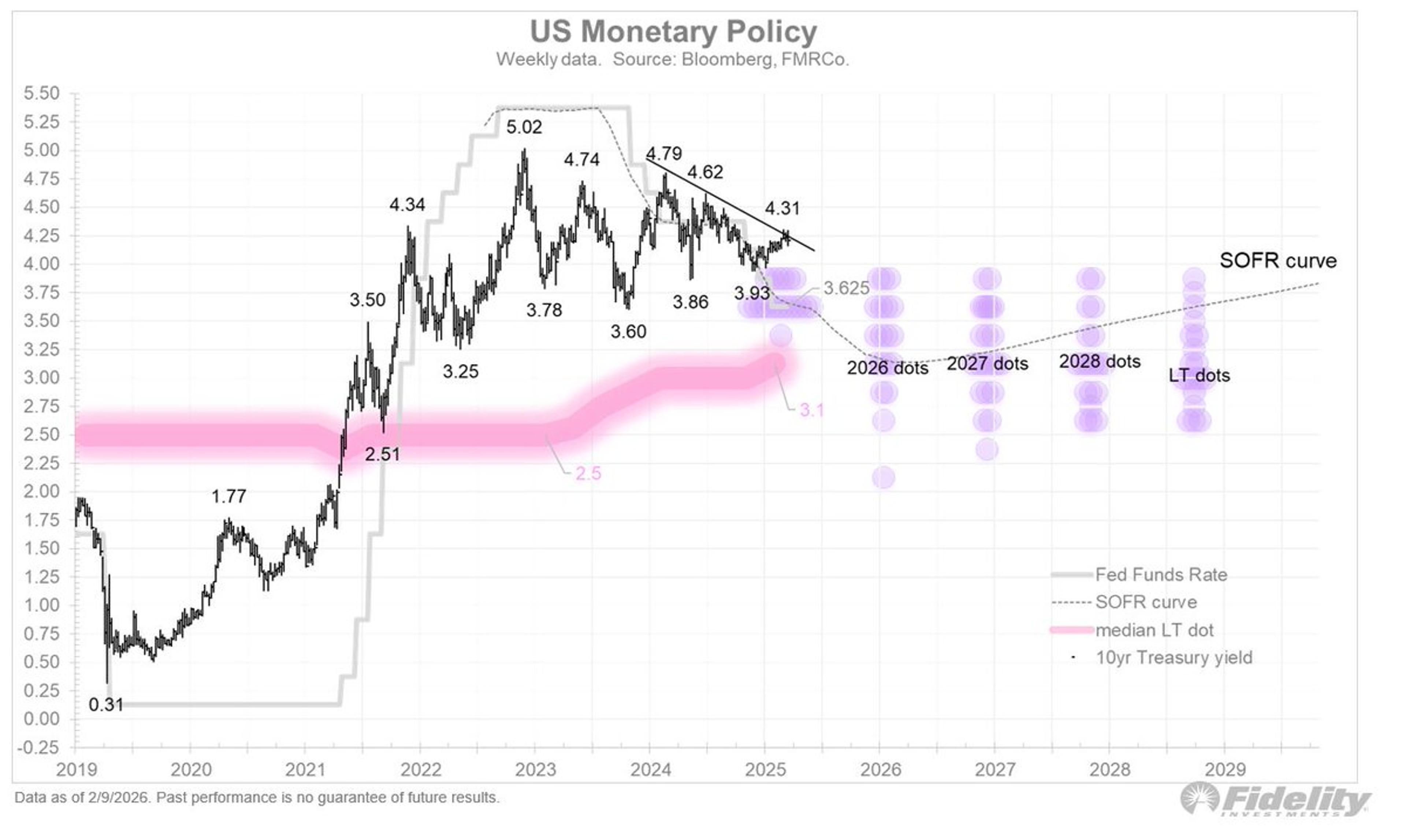

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 10, 2026

Software Selloff Hits BDCs, Creditors May Be at Risk

“Business Development Companies” have been hammered in the recent software selloff. Alphaville dug into the data of some of the biggest ones to find out if software creditors are in trouble. https://t.co/ybVLHwLoCi https://t.co/AMQPhflF5J

By Robin Wigglesworth

Social•Feb 10, 2026

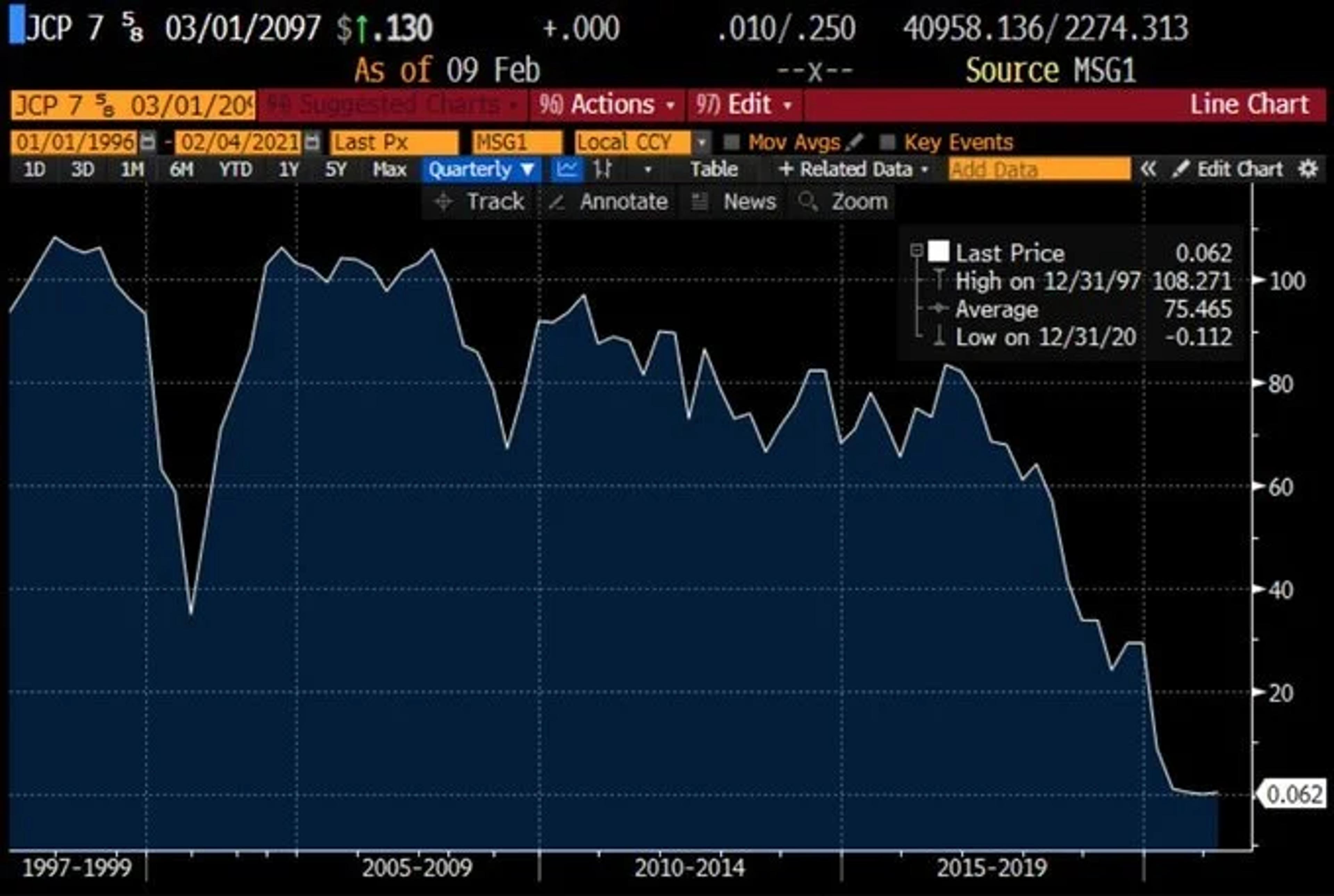

Google’s 100‑Year AI Bond: Ambitious or Foolhardy?

Google issuing a 100-year bond to fund AI capex. Remember JC Penney’s 100-year bond? Issued in 1997. Bankrupt in 2020. At least they got their basis back in coupons.

By JunkBondInvestor

Social•Feb 10, 2026

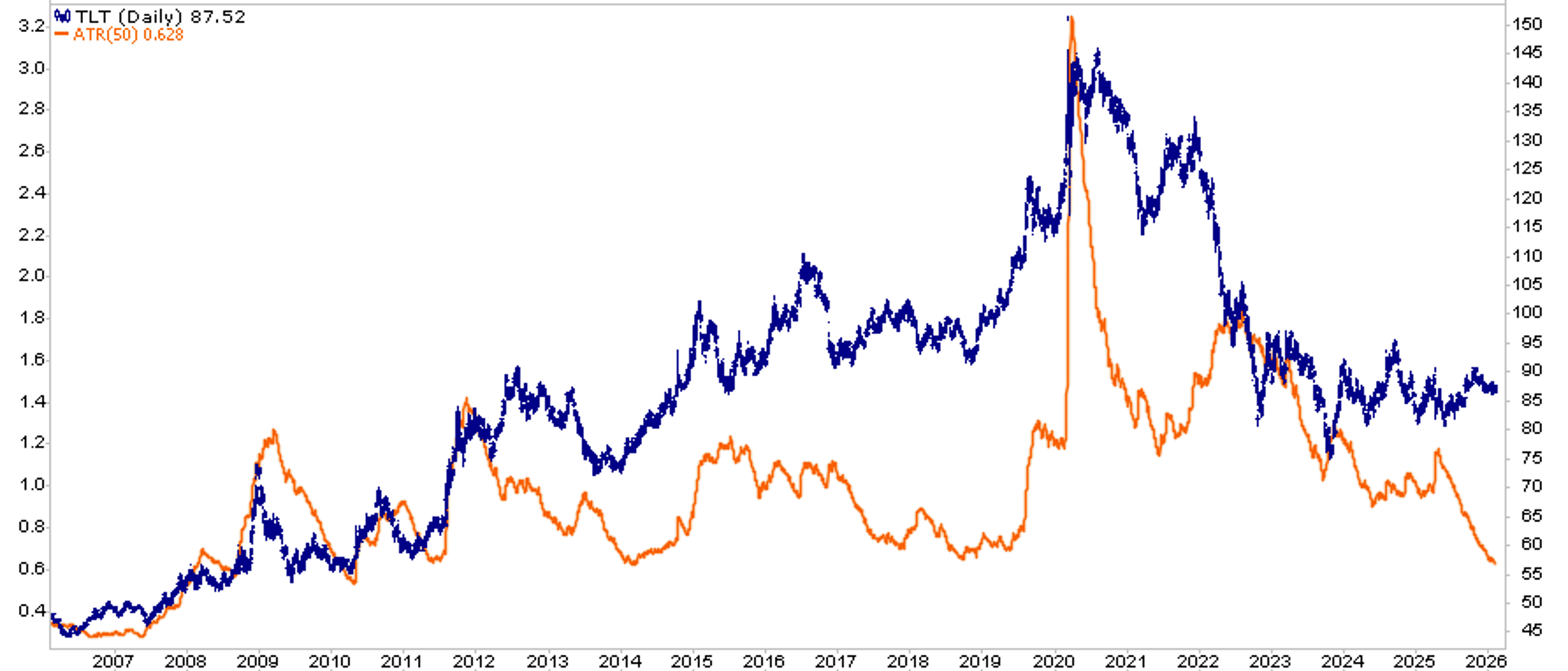

TLT's 15-Year Low ATR Signals Potential Breakout

$TLT : The Average True Range (orange) is now the lowest in over 15 years. Something has to give. Might the plummeting @truflation readings be a clue to which direction a breakout might occur? https://t.co/0pEENxYpXs

By Michael Lebowitz

Social•Feb 10, 2026

IG Spreads Widen Despite Equity Rally, Hinting Supply Worries

IG credit spreads wider +4bps from late-Jan yet HY wider by only +2bps. Last two days have seen +2.5% equity upside that statistically should mean IG spreads -2bps. May be nothing, may be worries about supply. A "balanced" IG...

By Guy LeBas

Social•Feb 10, 2026

Weak Data Fuels Bonds, 15% Growth Now Unrealistic

Soft retail sales, ECI flat for quarter and ADP jobs figures on the low end of expectations. Good data for the bond market, but that 15% GDP growth rate looks out of reach.

By Kathy Jones

Social•Feb 10, 2026

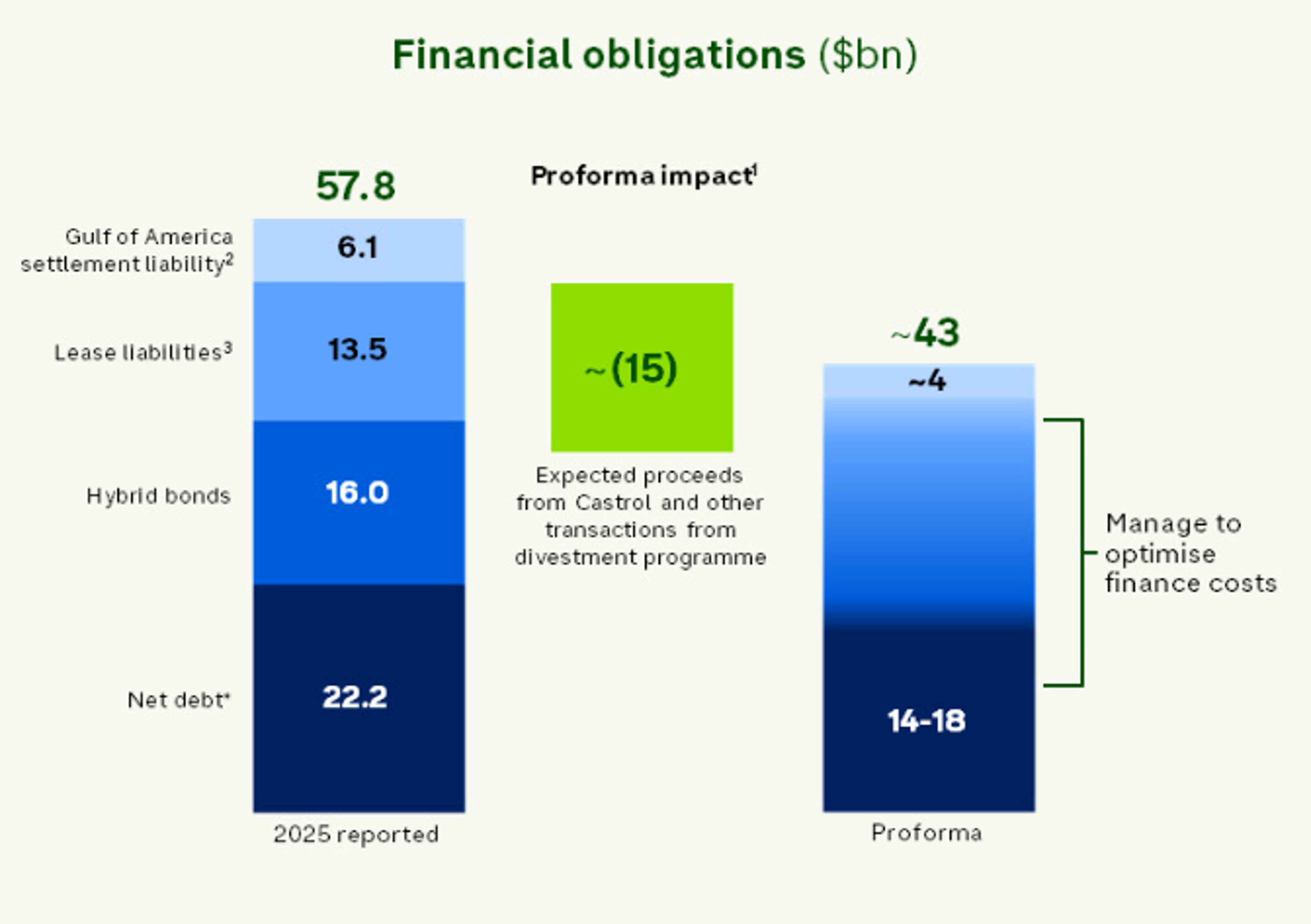

BP Finally Admits Debt Exceeds $50 Billion, Not $22 Billion

Regular readers know we at @Opinion had flagged BP had far more debt than the company's prefered metric (~$22 bn). Look at net debt + hybrids + leases + off-balance sheet items and it's >$50 bn. Now, BP acknowledges the issue...

By Javier Blas

Social•Feb 10, 2026

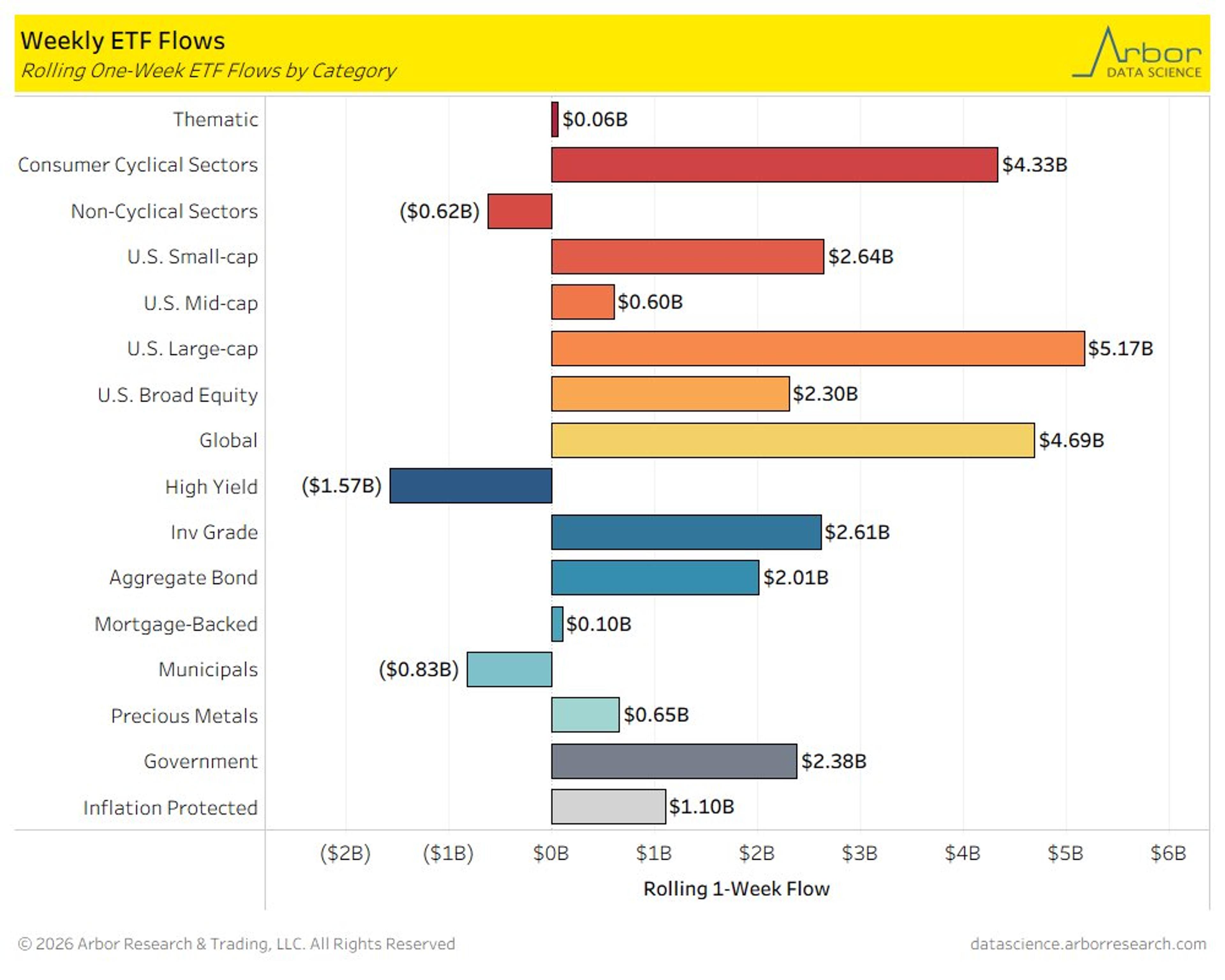

U.S. Large Caps Lead Inflows; High‑Yield Bonds Lose Ground

U.S. large caps dominated inflows last week, followed by global equities and consumer cyclicals ... high yield bonds saw most outflows, but broader fixed income universe was still positive @DataArbor https://t.co/l0soXmQF4S

By Liz Ann Sonders

Social•Feb 10, 2026

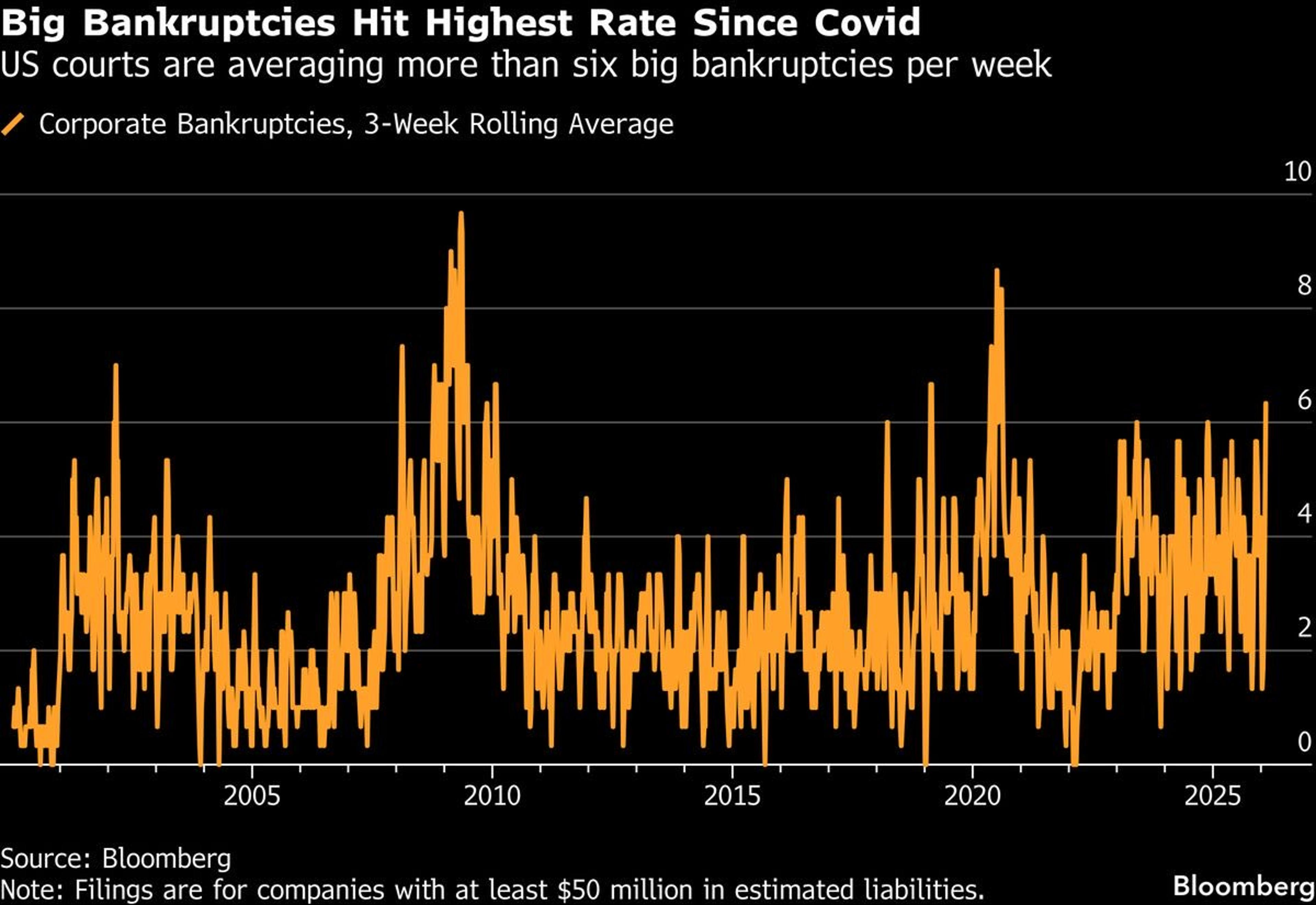

Record Wave of Large Bankruptcies Hits Weekly

How is this a healthy development? At least SIX big companies (liabilities >=$50M) have filed for bankruptcy EVERY WEEK during 3-wk period that began Jan 10, a level matched a handful of times since the turn of the century…last week alone...

By Daniëlle DiMartino Booth

Social•Feb 10, 2026

Alphabet's Sterling Bond Hits Record £4.5bn Demand

#Alphabet sterling bond raises a record £4.5 bn, with £24 bn in bids. They may start borrowing on behalf of Bessent if it continues like this $GOOG

By Ashraf Laidi

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler

Social•Feb 10, 2026

Equities Edge up as Dollar Slips, Data Awaits

Tuesday: Equity futures slightly higher, dollar weaker and treasury yields nearly unchanged. Retail sales, Employment Cost Index and Import prices out today.

By Kathy Jones

Social•Feb 10, 2026

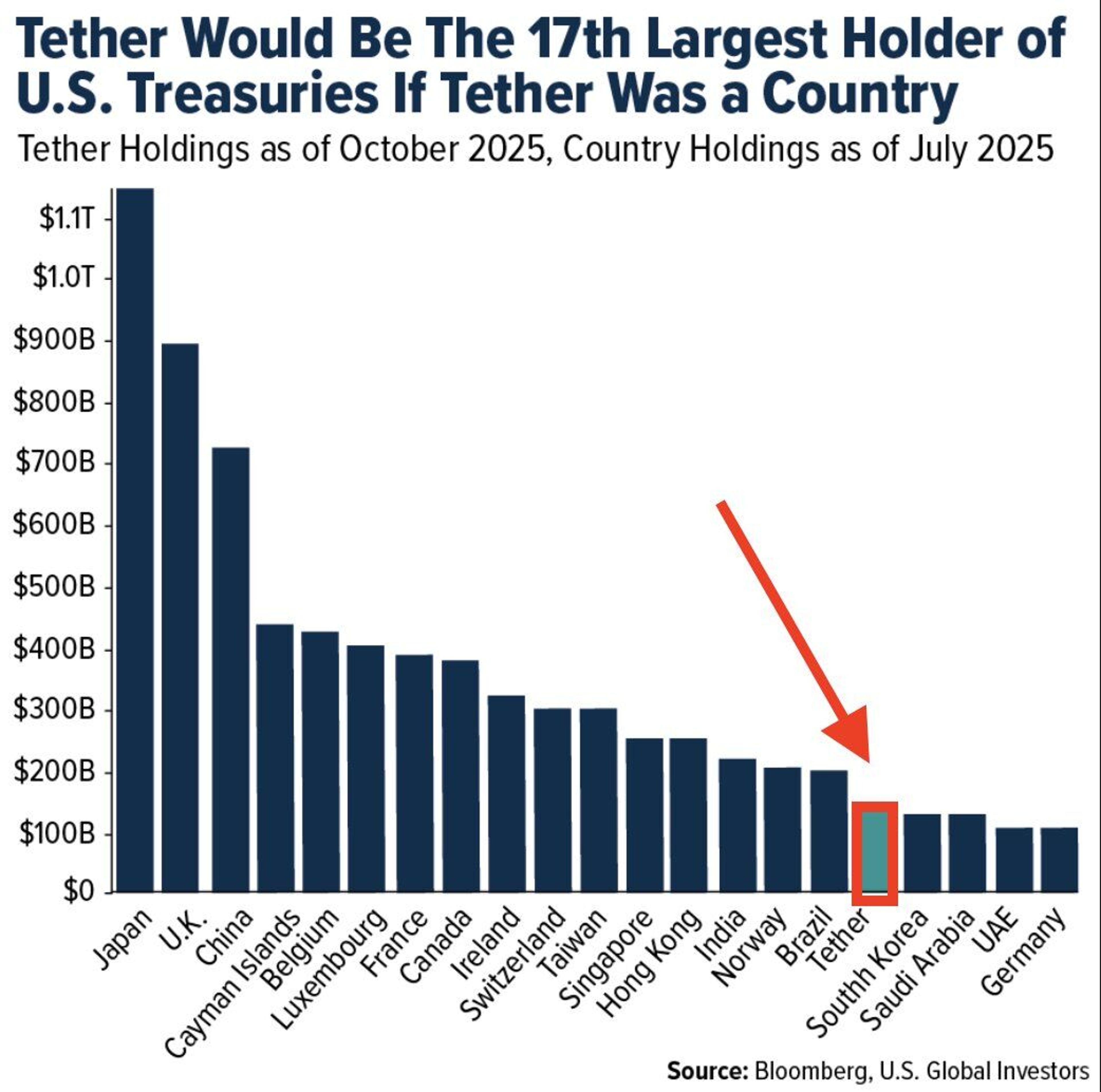

Tether Would Rank 17th in US Treasury Holdings

Who is the world's largest holder of US Treasuries? 🥇 Japan 🥈 United Kingdom 🥉 China But here's the wildest part - if Tether were a country, it would be the 17th largest holder of US Treasuries https://t.co/JoaE6JzFI9

By Kathy Lien

Social•Feb 10, 2026

Earn 12‑18% Risk‑Free with Nigerian Treasury Bonds

TREASURY BILLS & GOVERNMENT BONDS Low-risk, government-backed securities. In Nigeria, buy FGN Savings Bonds or Treasury Bills through the CBN portal or apps like Chaka, Bamboo, or Cowrywise (minimum ₦10,000). Returns typically 12-18% annually. Other African countries offer similar products through their...

By The Prophetic Investor

Social•Feb 10, 2026

Macron Urges EU to Adopt Eurobonds Now

Emmanuel Macron: « Now is the time for the EU to launch a joint borrowing capacity, through eurobonds. » https://t.co/NqqbjjecXk

By Frederik Ducrozet

Social•Feb 9, 2026

Alphabet Launches 100‑year GBP Bond, Eyes Currency Debasement

#Alphabet to issue 100-year GBPSterling bond after having issued 50-year $17.5 bn USD bond in November. Also plns to issue CHF bond. They're betting further currency debasement #forex

By Ashraf Laidi