🎯Today's Currencies Pulse

Updated 3m agoWhat's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

Video•Feb 20, 2026

Sky News Gains Rare Access to Bank of England's Gold Vaults

Sky News has been granted rare and exclusive access to the Bank of England's gold vault in London. It's the second largest gold reserves in the world, with around 400,000 bars now worth close to £600 billion. The vast majority is held on behalf of the UK Government and central banks from across the globe. That includes Venezuela's reserves, which has been tied up in a long-running legal battle. Sky's economics and data editor Ed Conway reports. Read more: https://news.sky.com/story/sky-news-gains-rare-access-to-bank-of-englands-gold-vaults-13509266 #bankofengland #gold #skynews SUBSCRIBE to our YouTube channel for more videos: http://www.youtube.com/skynews Follow us on Twitter: https://twitter.com/skynews Like us on Facebook: https://www.facebook.com/skynews Follow us on Instagram: https://www.instagram.com/skynews Follow us on TikTok: https://www.tiktok.com/@skynews For more content go to http://news.sky.com and download our apps: Apple https://itunes.apple.com/gb/app/sky-news/id316391924?mt=8 Android https://play.google.com/store/apps/details?id=com.bskyb.skynews.android&hl=en_GB Sky News Daily podcast is available for free here: https://podfollow.com/skynewsdaily/ To enquire about licensing Sky News content, you can find more information here: https://news.sky.com/info/library-sales

By Sky News

Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it...

By Nick Timiraos

Social•Feb 20, 2026

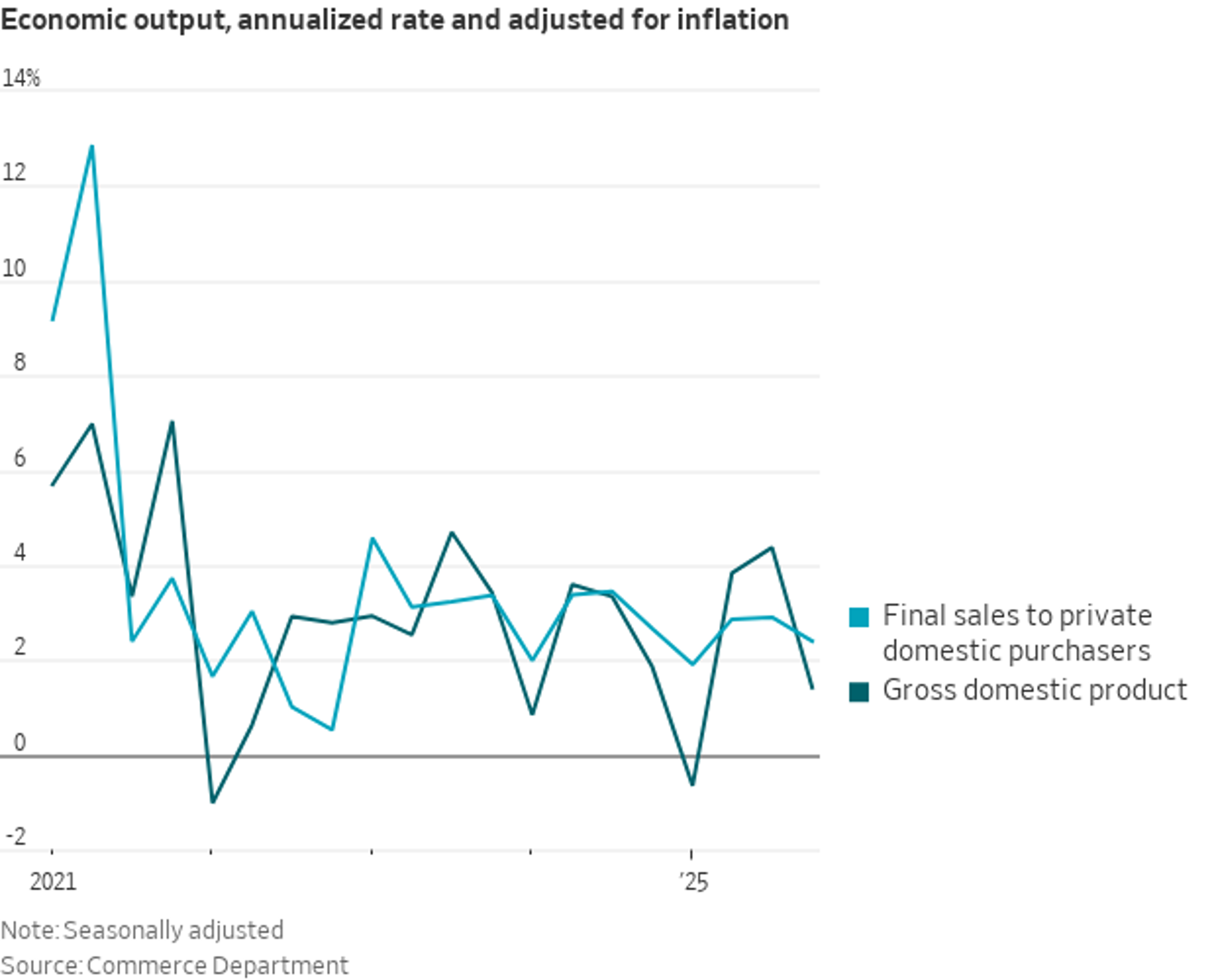

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

News•Feb 20, 2026

Could Medical Care Help Cure China’s Services Trade Deficit?

China’s medical tourism is gaining traction as foreign patients praise rapid, affordable care in megacities like Shanghai and Beijing. While the absolute number of inbound patients remains modest, industry insiders see a growing pipeline driven by visa‑free entry, expanding international...

By South China Morning Post — Economy

News•Feb 20, 2026

Rupee Declines 27 Paise to 90.95 Against US Dollar in Early Trade

The Indian rupee slipped to 90.95 per U.S. dollar in early Friday trade, down 27 paise from its previous close. The decline was driven by a firmer dollar, higher Brent crude at $71.77 a barrel, and escalating U.S.-Iran tensions. Domestic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Global Market | Japan’s Tightening Cycle Could Redraw the Map of Global Market Liquidity

The Bank of Japan has ended its ultra‑easy stance, pushing policy rates to the highest level in decades and pricing in another hike. Higher domestic yields are likely to trigger repatriation of Japanese savings, cutting the flow of low‑cost funding...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with...

By ForexLive — Feed

Social•Feb 20, 2026

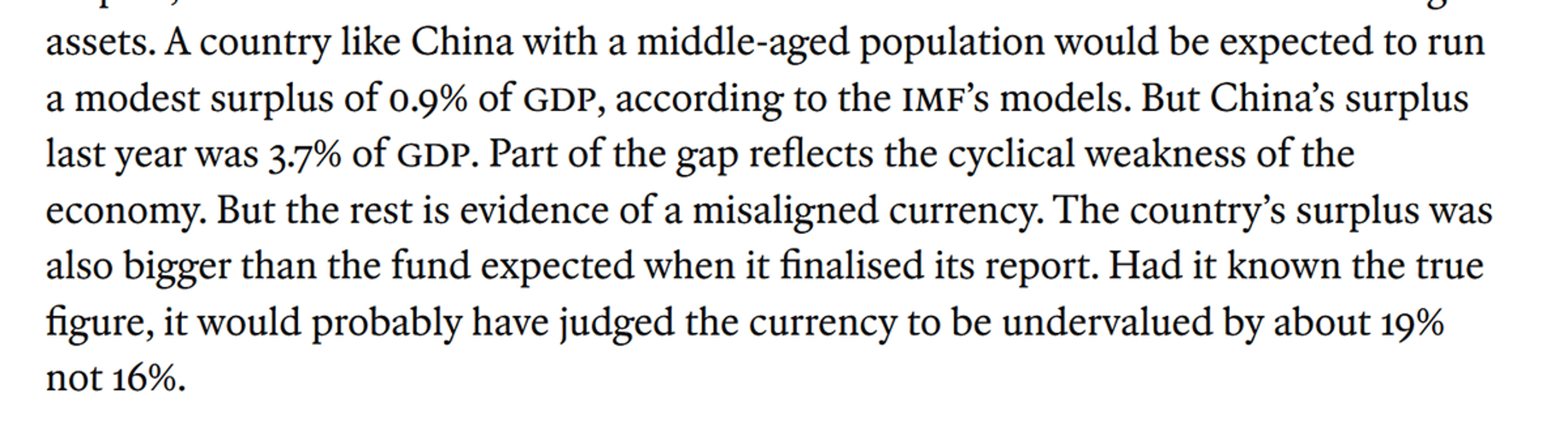

IMF Estimates Chinese Yuan Undervalued by Roughly 19%

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

By Brad Setser

News•Feb 20, 2026

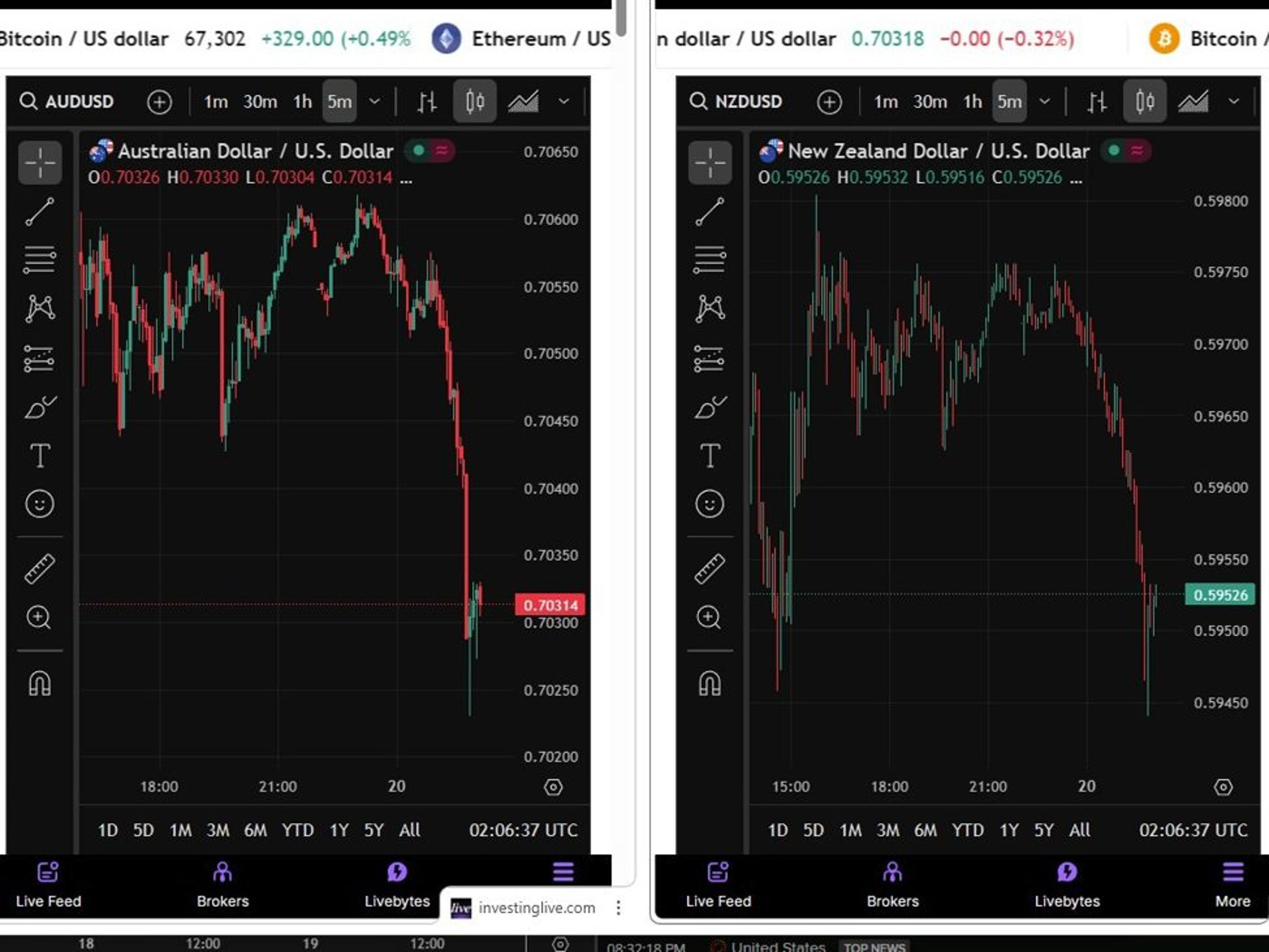

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

The New Zealand and Australian dollars slipped in Asian trade after the Reserve Bank of New Zealand signaled that inflation is already back within its 2% target band and is expected to stay there for the next year. Governor Adrian Breman emphasized that...

By ForexLive — Feed

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

News•Feb 20, 2026

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG’s Derek Halpenny says the U.S. dollar’s recent rally, sparked by stronger‑than‑expected durable‑goods, housing and industrial production data and hawkish Fed minutes, is unlikely to be sustained. While the minutes hinted at a cautious stance on further rate cuts, Halpenny...

By ForexLive — Feed

News•Feb 20, 2026

Shares of Local Oil Explorers Surge on Supply Disruption Fears

Shares of Indian upstream explorers jumped as Brent crude breached $71 per barrel amid renewed US‑Iran tensions and temporary Strait of Hormuz closures. Oil India rose 5.2% and ONGC gained 3.6%, while downstream marketers HPCL and BPCL slipped nearly 5%...

By Economic Times — Markets

News•Feb 20, 2026

IMF Warns Venezuela’s Economy and Humanitarian Situation Is ‘Quite Fragile’

The IMF warned that Venezuela’s economy and humanitarian situation remain “quite fragile,” citing triple‑digit inflation, a sharply depreciating currency and public debt at roughly 180 percent of GDP. The country has seen massive emigration, with about 8 million people leaving since 2014,...

By Al Jazeera – All News (includes Economy)

News•Feb 20, 2026

Japan Inflation Slows to 1.5% in January, Core Measures Ease. What Will the BoJ Think?

Japan’s consumer price index slowed sharply in January, with headline inflation dropping to 1.5% year‑over‑year, the lowest level since March 2022 and below expectations. Core inflation excluding fresh food eased to 2.0% YoY, while the core‑core measure fell to 2.6%,...

By ForexLive — Feed

Social•Feb 19, 2026

91 Days, Two Rate Calls, Then Warsh Takes Over

Only 91 days and two more rate decisions (Mar 18 and Apr 29) before Jerome Powell's term as Fed Chair ends (May 15th). Then it is the Warsh era...

By John Kicklighter

Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency...

By Jeff Park

Video•Feb 19, 2026

Stocks Slide as Oil Spikes on US–Iran Tension | Closing Bell

The closing bell showed U.S. equities slipping as oil prices spiked on renewed U.S.–Iran tensions. The S&P 500 and Nasdaq each fell roughly 0.3%, while the Russell 2000 managed a modest gain, underscoring the market’s mixed reaction to geopolitical risk. Energy‑related concerns lifted...

By Bloomberg Television

Video•Feb 19, 2026

How Hedgeye’s Global Process Is Beating Consensus

Most U.S. investors are still heavily concentrated in the same exposures: the classic 60/40 portfolio, U.S. large-cap growth, and The Hoodie's latest crypto disaster. But while those portfolios have been getting hit, our country-level allocations have been smoking the consensus exposures...

By Hedgeye

Video•Feb 19, 2026

Stop Reading Candles… Start Reading STRENGTH vs WEAKNESS 🔥

Traders are urged to move beyond the simplistic red‑vs‑green candle view and focus on candle strength. The presenter explains three classifications—strong, weak, neutral—determined by the relationship between the body and the wicks. Strong bullish candles exhibit a large body that closes...

By Akil Stokes (Tier One Trading)

Video•Feb 18, 2026

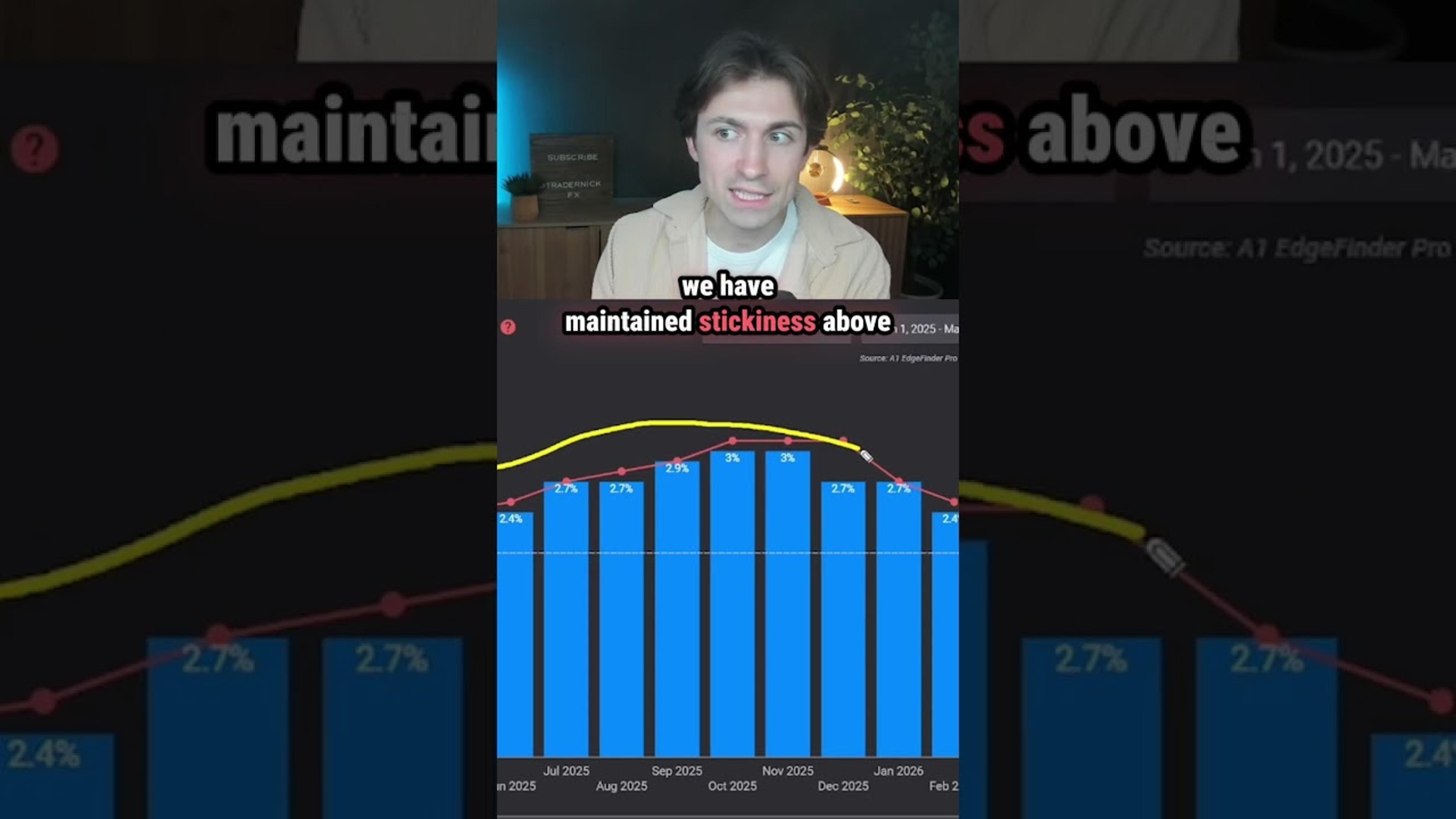

Is the Fed About to HIKE Rates...?

The video explores a less‑likely but plausible scenario in which the Federal Reserve shifts from cutting rates to hiking them, based on recent Fed meeting minutes that suggested some participants would back a two‑sided outlook if inflation stays above target....

By TraderNick

Video•Feb 18, 2026

How Traders Actually Use Barchart's Technical Opinion (Strength vs Direction)

The webinar introduces Barchart’s Technical Opinion tool, a consolidated dashboard that blends thirteen distinct technical indicators into a single buy‑or‑sell rating for stocks, ETFs, futures, and forex. John Roland likens the interface to a race‑car instrument panel, providing traders an...

By Barchart

Video•Feb 18, 2026

Governor Anna Breman Explains the February 2026 Monetary Policy Statement

Governor Anna Breman announced that the Reserve Bank of New Zealand’s Monetary Policy Committee kept the Official Cash Rate unchanged at 2.25% in its February 2026 meeting, emphasizing a cautious stance aimed at sustaining the nascent economic recovery. The committee highlighted...

By Reserve Bank of New Zealand

Video•Feb 16, 2026

How Chasers Get Trapped

The video titled “How Chasers Get Trapped” dissects a common market dynamic where price discounts create a narrow range that aggressive sellers exploit to ensnare inexperienced buyers, often called “chasers.” It frames the scenario as a battle between sellers who...

By Urban Forex (Navin Prithyani)

Video•Feb 16, 2026

Momentum Shift? Spot It BEFORE the Market Turns ⚡

The video explains the rising wedge—a chart pattern that indicates a loss of momentum in an uptrend. Using a ball‑throwing analogy, the presenter shows how price initially climbs steeply before the upward thrust slows and the trajectory flattens, mirroring a...

By Akil Stokes (Tier One Trading)

Video•Feb 15, 2026

“A Huge Problem for Everybody” | Paul Krugman on China, the Dollar, A.I., & More

In a recent Monetary Matters episode, Nobel laureate Paul Krugman examined the durability of the U.S. dollar, the consequences of China’s export‑driven model, and the looming threat of a disjointed global monetary order. Krugman noted micro‑data showing tariffs have lifted consumer...

By Monetary Matters Network

Deals•Feb 13, 2026

SMFG Issues World's First Digital Inclusion Bonds, Raising $500M

Japan's Sumitomo Mitsui Financial Group (SMFG) has issued $500 million of bonds billed as the world's first 'digital inclusion' bonds. The proceeds will fund infrastructure projects to improve internet connectivity in emerging markets, aiming to bridge the global digital divide....

Nikkei Asia — Economy/Markets

Deals•Feb 13, 2026

Sumitomo Forestry to Acquire Tri Pointe Homes for $4.2bn, Becoming 5th‑Largest US Homebuilder

Japanese homebuilder Sumitomo Forestry announced on Feb. 13, 2026 that it will acquire U.S. homebuilder Tri Pointe Homes for $4.2 billion, positioning Sumitomo as the fifth‑largest homebuilder in the United States. The deal is part of Sumitomo’s overseas M&A push as...

Nikkei Asia — Economy/Markets