🎯Today's Currencies Pulse

Updated 1h agoWhat's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with no fresh wave of private diversification beyond current trends. Goldman flags a notable upside if private‑sector diversification, especially via call‑option structures, accelerates. While the trajectory is upward, the firm warns that volatility could remain elevated around policy shifts and market shocks.

By ForexLive — Feed

Social•Feb 20, 2026

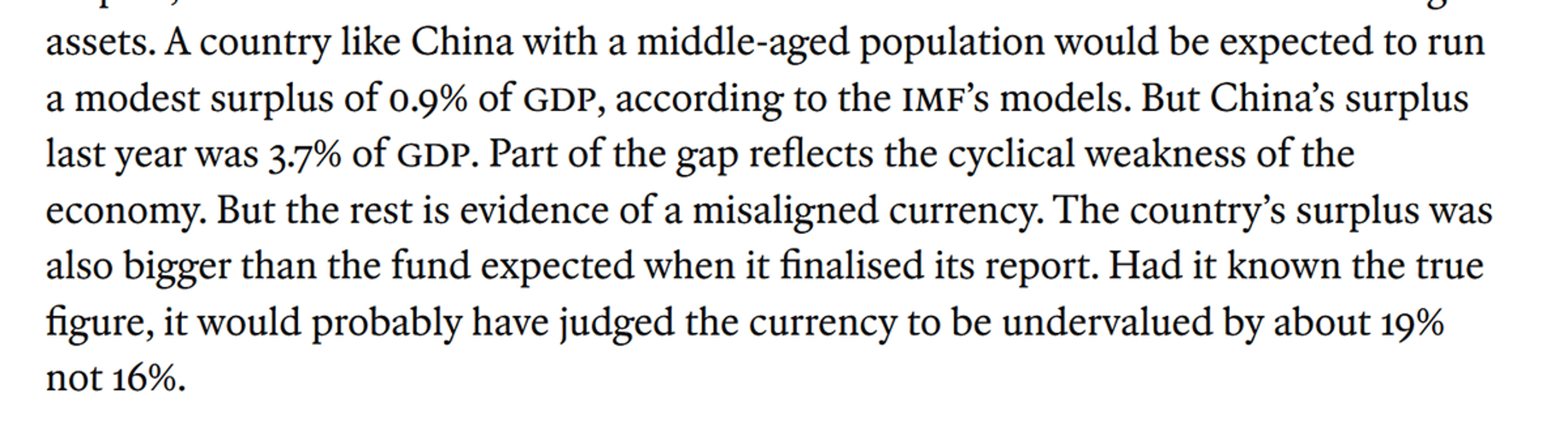

IMF Estimates Chinese Yuan Undervalued by Roughly 19%

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

By Brad Setser

News•Feb 20, 2026

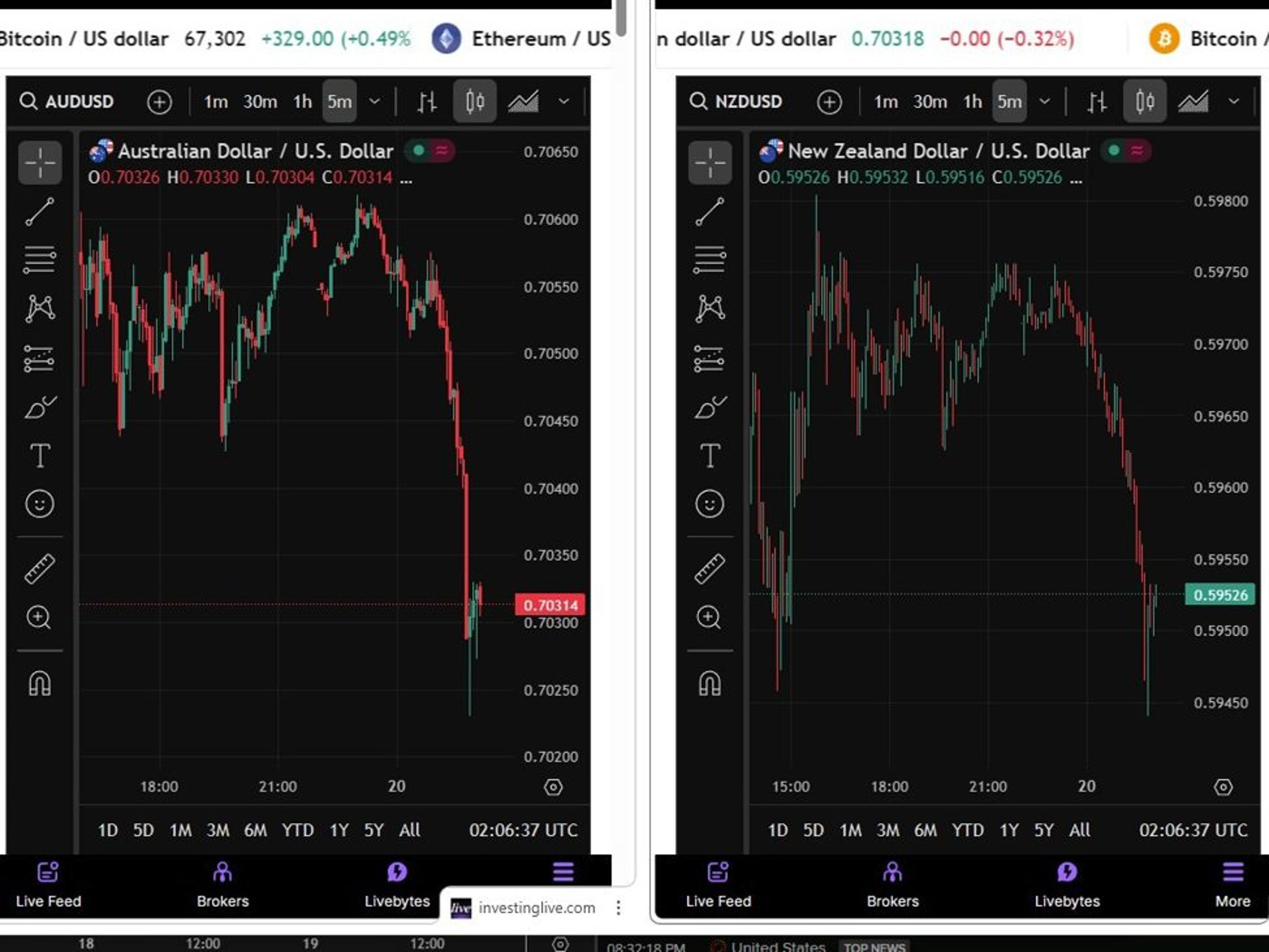

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

The New Zealand and Australian dollars slipped in Asian trade after the Reserve Bank of New Zealand signaled that inflation is already back within its 2% target band and is expected to stay there for the next year. Governor Adrian Breman emphasized that...

By ForexLive — Feed

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

News•Feb 20, 2026

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG’s Derek Halpenny says the U.S. dollar’s recent rally, sparked by stronger‑than‑expected durable‑goods, housing and industrial production data and hawkish Fed minutes, is unlikely to be sustained. While the minutes hinted at a cautious stance on further rate cuts, Halpenny...

By ForexLive — Feed

News•Feb 20, 2026

Shares of Local Oil Explorers Surge on Supply Disruption Fears

Shares of Indian upstream explorers jumped as Brent crude breached $71 per barrel amid renewed US‑Iran tensions and temporary Strait of Hormuz closures. Oil India rose 5.2% and ONGC gained 3.6%, while downstream marketers HPCL and BPCL slipped nearly 5%...

By Economic Times — Markets

News•Feb 20, 2026

IMF Warns Venezuela’s Economy and Humanitarian Situation Is ‘Quite Fragile’

The IMF warned that Venezuela’s economy and humanitarian situation remain “quite fragile,” citing triple‑digit inflation, a sharply depreciating currency and public debt at roughly 180 percent of GDP. The country has seen massive emigration, with about 8 million people leaving since 2014,...

By Al Jazeera – All News (includes Economy)

News•Feb 20, 2026

Japan Inflation Slows to 1.5% in January, Core Measures Ease. What Will the BoJ Think?

Japan’s consumer price index slowed sharply in January, with headline inflation dropping to 1.5% year‑over‑year, the lowest level since March 2022 and below expectations. Core inflation excluding fresh food eased to 2.0% YoY, while the core‑core measure fell to 2.6%,...

By ForexLive — Feed

News•Feb 19, 2026

Philippine Central Bank Cuts Rates in Latest Bid to Support Growth

The Bangko Sentral ng Pilipinas (BSP) lowered its overnight repurchase rate by 25 basis points to 4.25%, marking the ninth cut since August 2024. Inflation remains modest at 2%, comfortably within the 2‑4% target band, while the peso rallied to...

By Nikkei Asia — Economy/Markets

News•Feb 19, 2026

World Briefs | Rwanda Hikes Lending Rate on Higher Inflation

Rwanda’s central bank raised its key lending rate by 50 basis points to 7.25% on Thursday, reacting to a jump in consumer price inflation to 8.9% year‑on‑year in January. The move aims to bring inflation back within the bank’s 2‑8%...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Bank Indonesia Keeps Rates Steady, as Rupiah Weakness Threatens to Delay Easing

Bank Indonesia left its policy rate unchanged at 4.75% as the rupiah continued to weaken amid fiscal‑sustainability concerns and volatile investor sentiment. Moody’s downgraded Indonesia’s credit outlook to negative, reflecting uncertainty over policy direction and transparency. Real‑rate differentials with the...

By ING — THINK Economics

News•Feb 19, 2026

Philippines’ Central Bank Delivers Expected Rate Cut Paired with Uncertain Guidance

The Bangko Sentral ng Pilipinas trimmed its policy rate by 25 basis points to 4.25%, matching market expectations. However, the central bank softened its forward guidance, dropping language that it was nearing the end of easing and emphasizing lingering confidence...

By ING — THINK Economics

Social•Feb 19, 2026

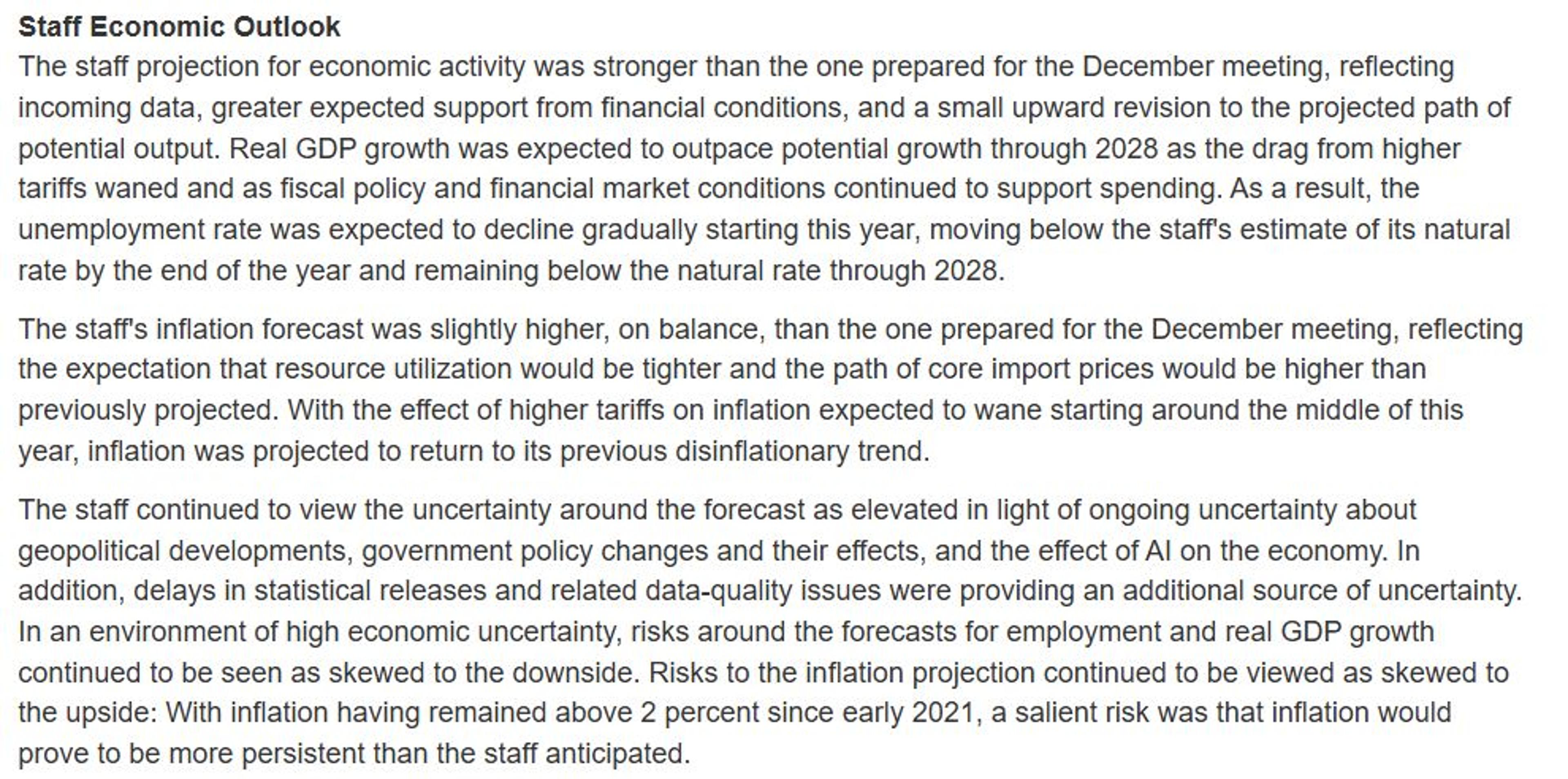

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 19, 2026

91 Days, Two Rate Calls, Then Warsh Takes Over

Only 91 days and two more rate decisions (Mar 18 and Apr 29) before Jerome Powell's term as Fed Chair ends (May 15th). Then it is the Warsh era...

By John Kicklighter

Blog•Feb 19, 2026

Job Creation Soft

The Australian Bureau of Statistics reported that January 2026 saw a modest net increase of 18,000 jobs, with full‑time employment rising by 50,500 and part‑time employment falling by 32,700. Total employment reached 14,703,800 and monthly hours worked climbed to 2,013 million, while...

By MacroBusiness (Australia)

Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency...

By Jeff Park

Social•Feb 19, 2026

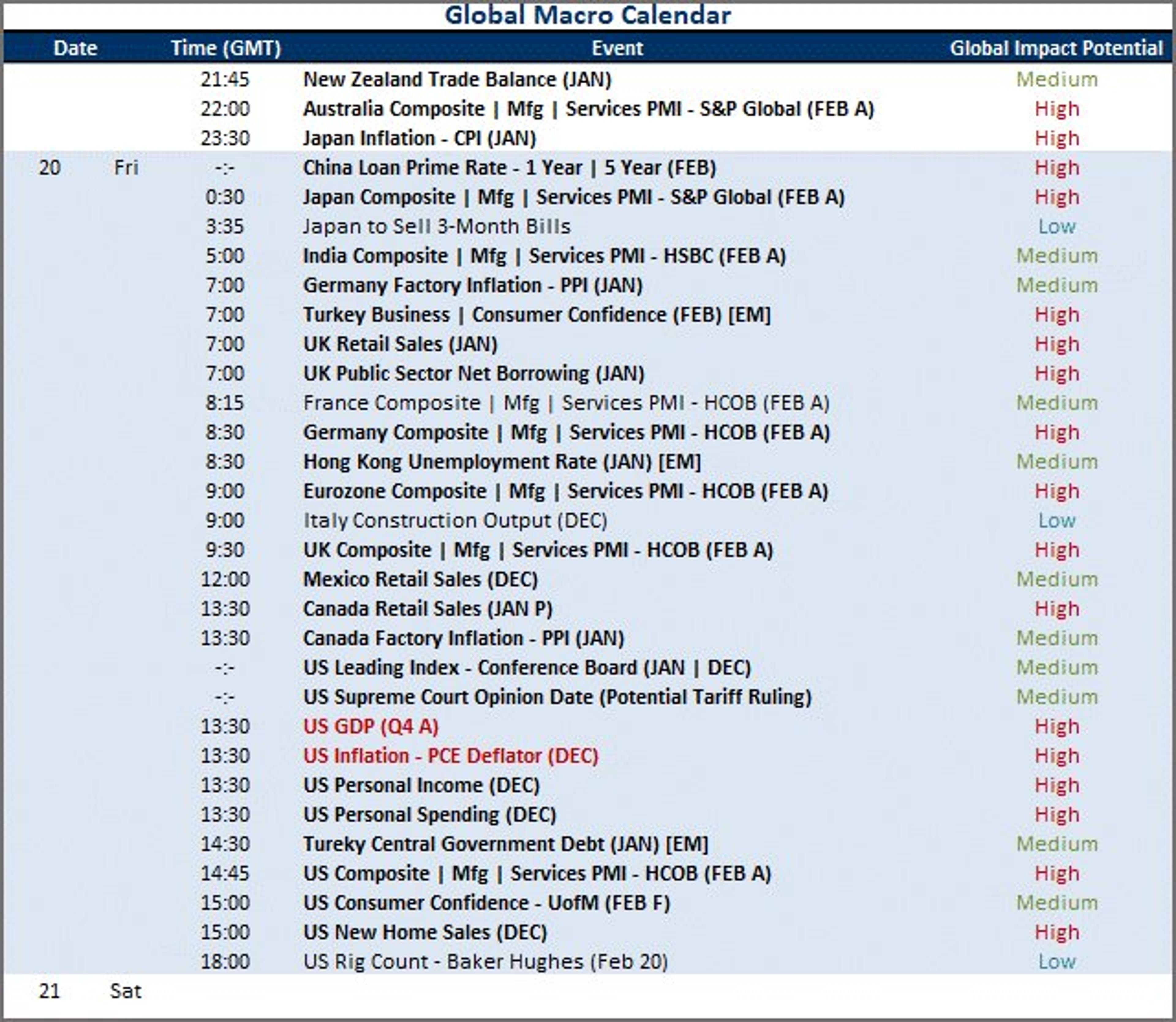

Grey Swan Risks Amid Busy Global Macro Calendar

While I will keep an eye out for grey swans catalyzing (Iran and Supreme Court's decision on tariffs principally), the global macro docket picks up through Friday. Top event risk includes: Japan CPI; February PMIs; Mexico and Canada retail sales; US...

By John Kicklighter

Blog•Feb 19, 2026

Banker Calls for Peak Banker

National Australia Bank CEO Andrew Irvine warned that Australia has hit "peak Australia," signalling that without a productivity boost the economy will stagnate. Real wages fell for the first time in two years, underscoring the pressure on living standards. Irvine...

By MacroBusiness (Australia)

Social•Feb 19, 2026

AUD/USD Rally Pauses Near 2023 High, Streak Threatened

Australian Dollar Forecast: AUD/USD Rally Stalls Near 2023 High – Four-Week Streak at Risk https://t.co/srtBKcRq3k $AUDUSD Weekly Chart https://t.co/oGQK6Jc1uV

By Michael Boutros

Social•Feb 18, 2026

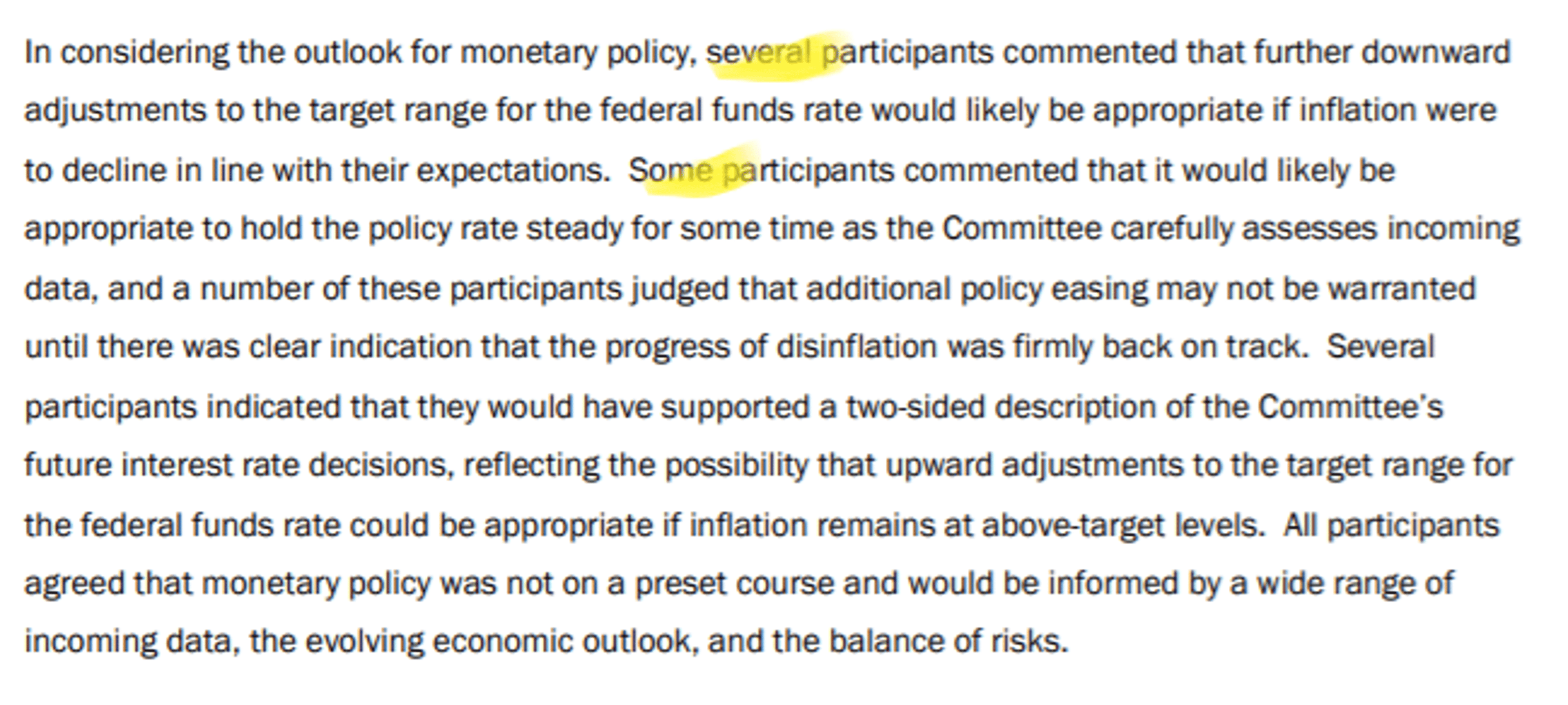

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

News•Feb 18, 2026

Isabel Schnabel: Fiscal Challenges Amid Geopolitical Uncertainty and Ageing Societies

Isabel Schnabel highlighted the euro area’s mounting fiscal pressures, noting that low debt levels often coincide with weak public investment. She examined Germany’s new defence and infrastructure package, showing it can lift GDP but also raise debt ratios under different...

By European Central Bank — Press/Speeches

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s...

By FXStreet — News

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

News•Feb 18, 2026

Five US Policy Shifts Could Reshape Financial Markets

The Trump administration is advancing five domestic policy initiatives that touch credit, housing, monetary policy, corporate governance, and digital‑asset regulation. Proposed credit reforms would tighten loan underwriting, while housing changes could modify the mortgage interest deduction. Monetary officials hint at...

By Project Syndicate — Economics

Social•Feb 18, 2026

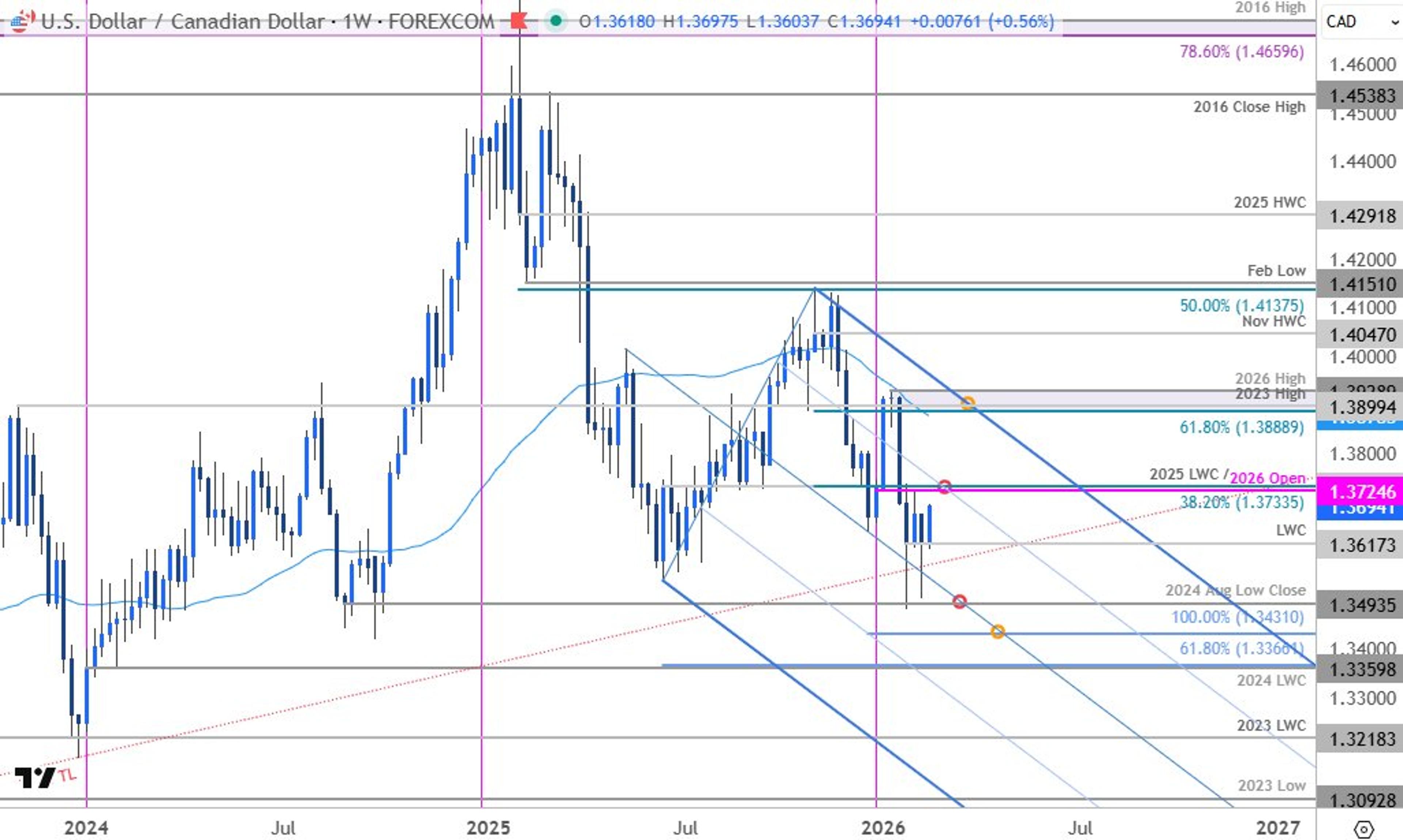

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss

News•Feb 18, 2026

The 'Ex-America' Trade Is Off to a Roaring Start in 2026

Global equities have surged ahead of the U.S. market in 2026, with the MSCI EAFE up roughly 8% and the MSCI ACWI ex‑U.S. gaining about 8.5% year‑to‑date, while the S&P 500 is down 0.5%. Goldman Sachs notes this is the widest...

By Quartz — Economy/Markets (site-wide feed)

News•Feb 18, 2026

Europe Is Squandering Its Leverage Over China

Europe is losing bargaining power with China as the continent’s growth stalls while Beijing posts a record trade surplus. German Chancellor Friedrich Merz’s upcoming China visit underscores the urgency, with Germany’s 2025 GDP expanding only 0.2% versus a $1.19 trillion Chinese surplus....

By Project Syndicate — Economics

News•Feb 18, 2026

Rupee Rises 5 Paise to Close at 90.67 Against US Dollar

The Indian rupee edged higher, closing at a provisional 90.67 per U.S. dollar, up five paise on the day. The modest gain was driven by fresh foreign fund inflows and a buoyant domestic equity market, which saw the Sensex climb...

By The Hindu BusinessLine – Markets

Social•Feb 18, 2026

Markets May Slip as Fed Delays Rate Cuts

Will stock markets tip over amid worries about the Fed dragging its feet on rate cuts? FOMC meeting minutes are in focus. #stockmarkets #fed #fomc #dollar #macro #trading https://t.co/yYSQfOx27L

By Ilya Spivak

News•Feb 18, 2026

Westpac: China Must Shift to Proactive Policy in 2026 to Sustain Growth

China met its official 5.0% GDP target in 2025, largely on the back of robust export growth to Asia, Europe and Latin America. Manufacturing investment, particularly in electric vehicles and electronics, remained resilient, while overall fixed‑asset investment fell 3.8% and...

By ForexLive — Feed

News•Feb 18, 2026

Chinese and Indian Tourists to Boost Europe’s Travel Market Amid US Slowdown

The European Travel Commission forecasts a 6.2% rise in international arrivals to Europe this year, driven largely by a surge in Chinese and Indian tourists. Chinese visitor numbers are expected to jump 28% and Indian arrivals 9% compared with 2025,...

By South China Morning Post — Economy

News•Feb 18, 2026

RBNZ Leave Cash Rate on Hold, as Expected

The Reserve Bank of New Zealand kept its official cash rate unchanged at 2.25%, matching market expectations. While inflation stays above the 2% target, slower wage growth and softened demand reduce immediate pressure for further hikes. The RBNZ modestly raised...

By ForexLive — Feed

News•Feb 18, 2026

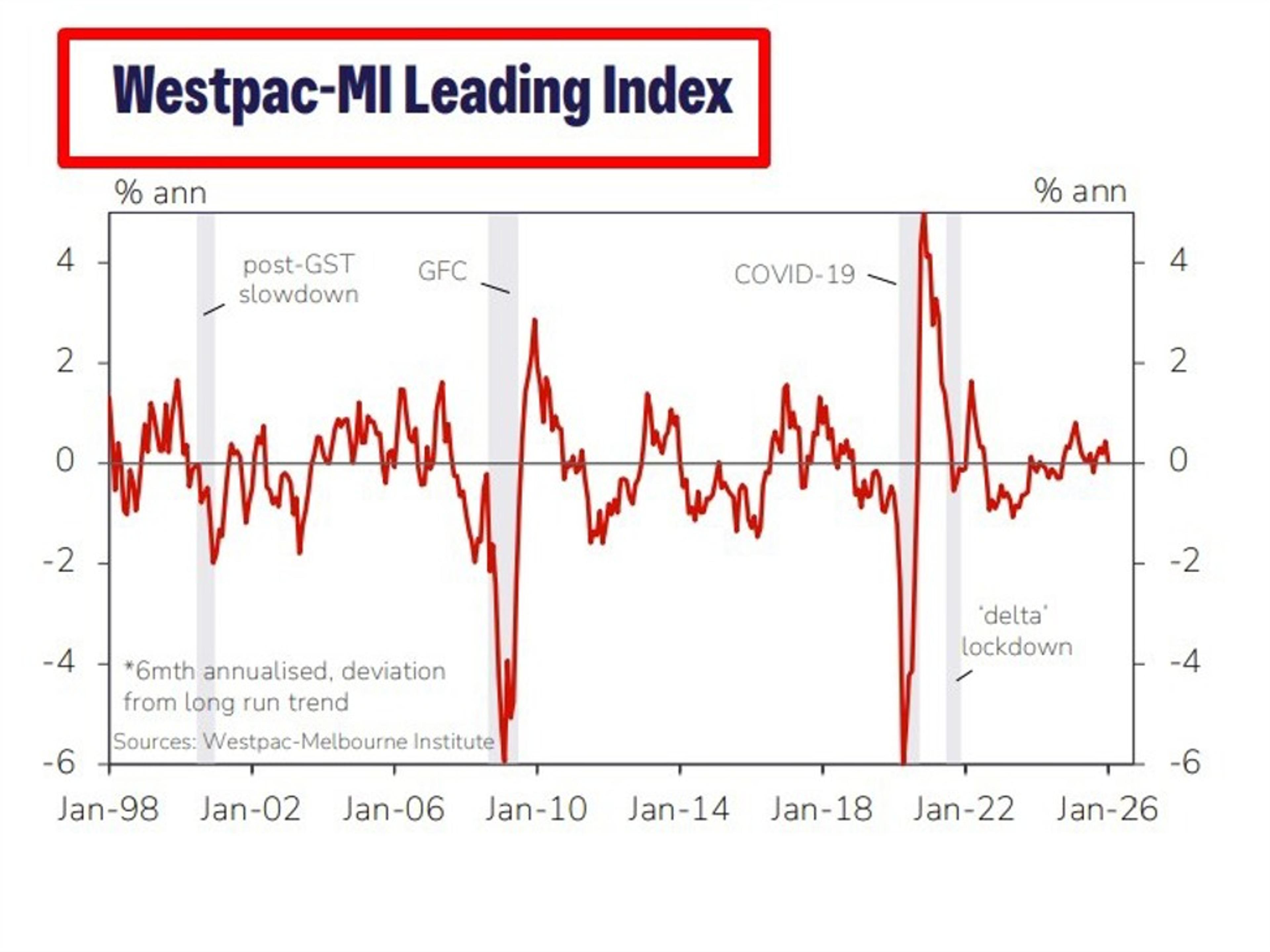

Westpac Leading Index Slows to Near-Flat, Signals Cooling Growth Momentum

Westpac’s Melbourne‑Institute Leading Index barely moved in January, posting a six‑month annualised gain of just +0.02% versus +0.44% in December. The slowdown reflects weakening consumer sentiment and a dip in dwelling approvals, while modest commodity price gains provided limited support....

By ForexLive — Feed

News•Feb 18, 2026

EU Capital Markets Reform Should Focus on Innovation Investment

The Bocconi Institute proposes six pragmatic reforms to close Europe’s “scale‑up gap” and boost venture‑capital financing for innovative firms. Using Dealroom data on 64,500 EU start‑ups, the report shows that VC investment in scale‑ups is under 10% of U.S. levels...

By CEPR — VoxEU

News•Feb 17, 2026

Exclusive: Tiago Da Costa Cardoso Returns to INFINOX as Commercial Director

Tiago da Costa Cardoso has rejoined INFINOX as Commercial Director, returning to the Dubai‑based broker after a stint at Exinity, HFM and XTB. His appointment follows INFINOX’s recent receipt of a UAE Capital Market Authority license, positioning the firm for...

By FX News Group — Feed

Social•Feb 17, 2026

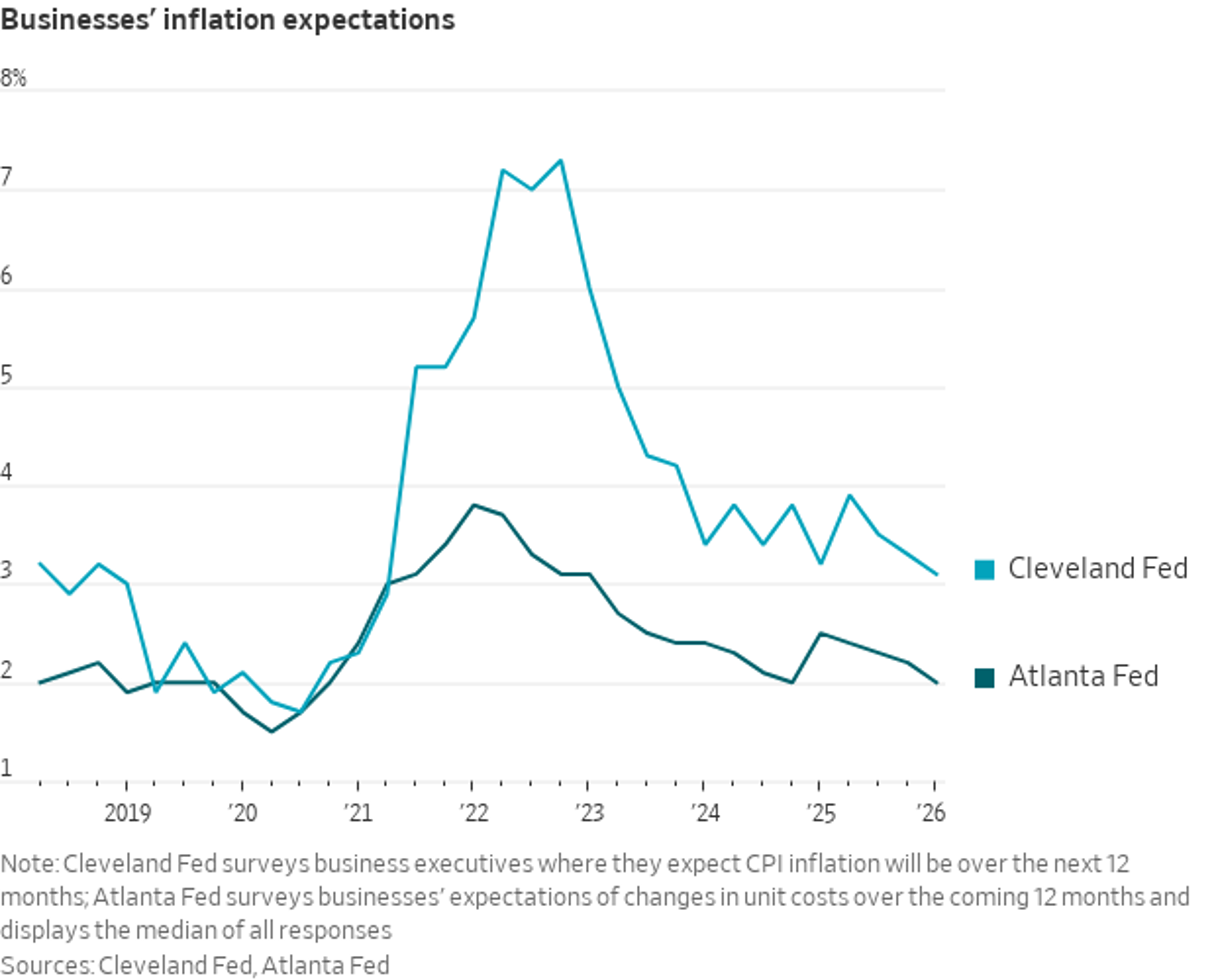

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

Iranian Rial Crashes as US‑Iran Nuclear Talks Begin

Today, US-Iran nuclear talks began in Geneva. As the talks start, the Iranian rial is in the tank. It has depreciated by over 43% against the dollar in the past year, making it THE SECOND WORST CURRENCY IN THE WORLD. https://t.co/PORIO6lGtc

By Steve Hanke

News•Feb 17, 2026

Breaking News: Canadian CPI Eases From 3-Month High, USD/CAD Extends Gain...

Canada’s annual CPI slipped to 2.3% in January 2026, easing from a three‑month peak of 2.4% and landing just below market forecasts. The trimmed‑mean core rate fell to 2.4%, the lowest level since April 2021, indicating waning underlying price pressure....

By Myfxbook — Latest Forex News

Social•Feb 17, 2026

Weekly Technical Outlook: DXY, GBP/USD, Gold, Bitcoin

DXY, GBP/USD, AUD/USD, Gold, Bitcoin, Oil Weekly Technical Outlook (webinar archive) https://t.co/nitfuFDsGb Asset Chaptered on YouTube: https://t.co/yidtEBNR4M

By Michael Boutros

Social•Feb 17, 2026

Dollar Up Shows Unchanged Signal Amid Correlation Risk

If there was something else to "dig into", I would have. Dollar Up has its implied Correlation Risk today. I'll do what the signal does. It didn't change.

By Keith McCullough

News•Feb 17, 2026

GBP/JPY Price Forecast: Short-Term Trend Turns Negative Below 210.00 Handle

GBP/JPY slipped below the 210.00 psychological level, trading around 207.28 and marking a near two‑month low. The decline follows weaker UK labour‑market data that has pushed market consensus toward two Bank of England rate cuts this year, with the first...

By FXStreet — News

Social•Feb 17, 2026

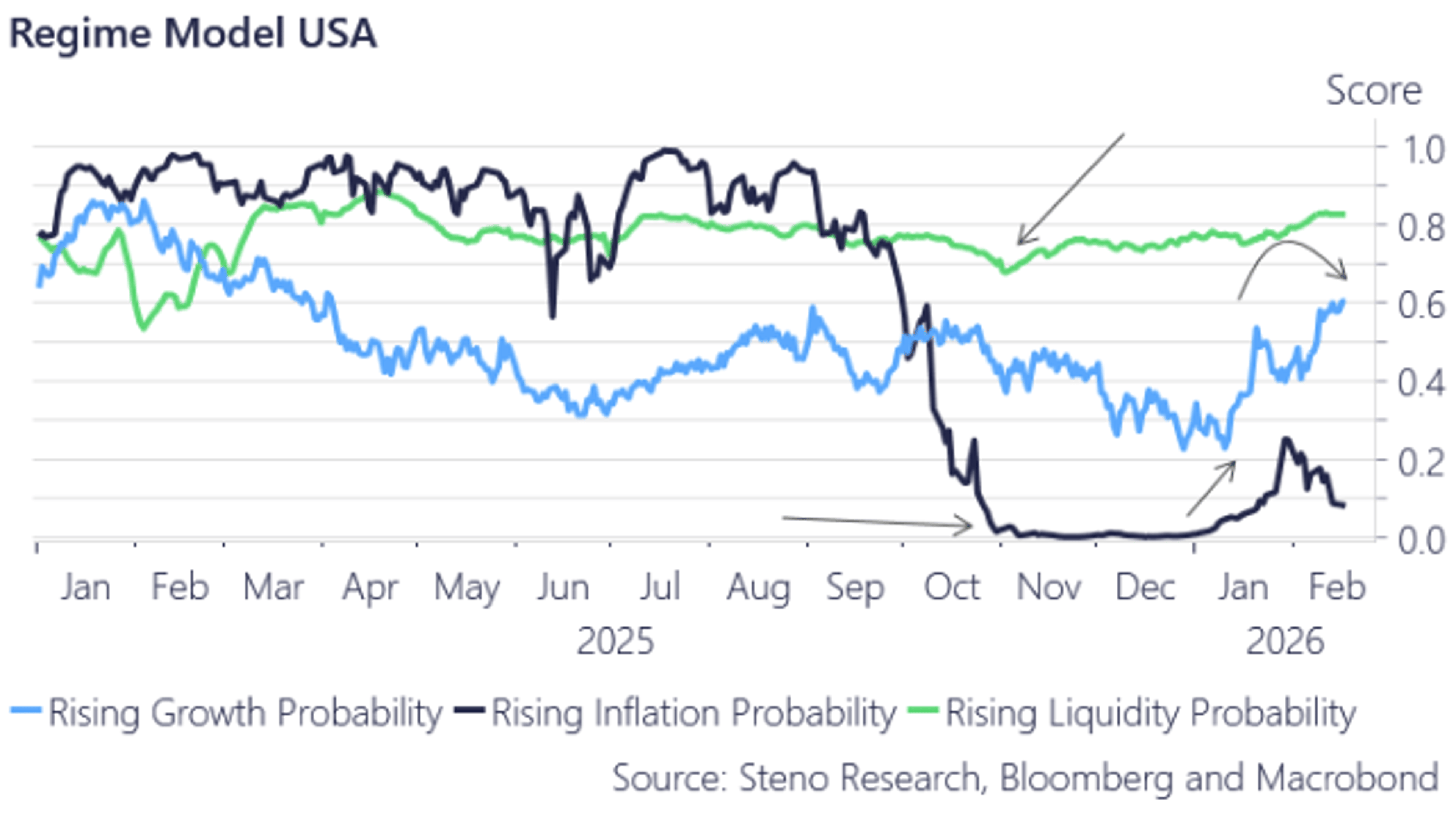

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

EURUSD Retreats to Fib Level as Longs Surge

$EURUSD has pulled back from its failed run on 1.20 a few weeks back - aligned to a 38.2% Fib of the 2008 to 2022 bear wave. Meanwhile, net speculative futures positioning has jumped this past week to its heaviest net-long...

By John Kicklighter

News•Feb 17, 2026

Conflicting Policies, Confused Investors, and the Weak Dollar

The United States continues to dominate global growth, driven by an AI-fueled expansion, yet its flagship currency is unusually weak. Markets are now pricing U.S. policy uncertainty on par with economies that lack a reserve currency. Conflicting fiscal and monetary...

By Project Syndicate — Economics

Blog•Feb 17, 2026

Baby Boomer Spending Helps Drive up Inflation

Australia’s Reserve Bank highlighted an unexpected surge in private demand, driven largely by heightened household spending from the baby‑boomer cohort. The increase in consumer‑durable price growth reinforced this trend, prompting the RBA to raise the official cash rate by 0.25%....

By MacroBusiness (Australia)

News•Feb 17, 2026

USD/JPY Is Looking for Direction Around 153.00 with Key US Data in Focus

USD/JPY is hovering around the 153.00 level as traders await key US data. The pair was rejected at the 153.70 resistance, found support near 152.70, and settled back near 153.00. Weak Japanese Q4 GDP, which fell short of forecasts, kept...

By FXStreet — News