🎯Today's Currencies Pulse

Updated 3h agoWhat's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

News•Feb 13, 2026

US Supreme Court Says Next Friday Will Be a Decision Day

The U.S. Supreme Court announced three decision days—Feb. 20, 24, and 25—when it will issue opinions, though it has not disclosed which cases will be decided. Lawmakers in the House have voted against new tariffs and the Senate is expected to follow, setting the stage for a potential Supreme Court ruling on the issue. The case could hinge on the Major Questions Doctrine, which limits agency authority on matters of vast economic significance. A ruling that curtails tariffs would likely clear the path for additional Federal Reserve rate cuts.

By ForexLive — Feed

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

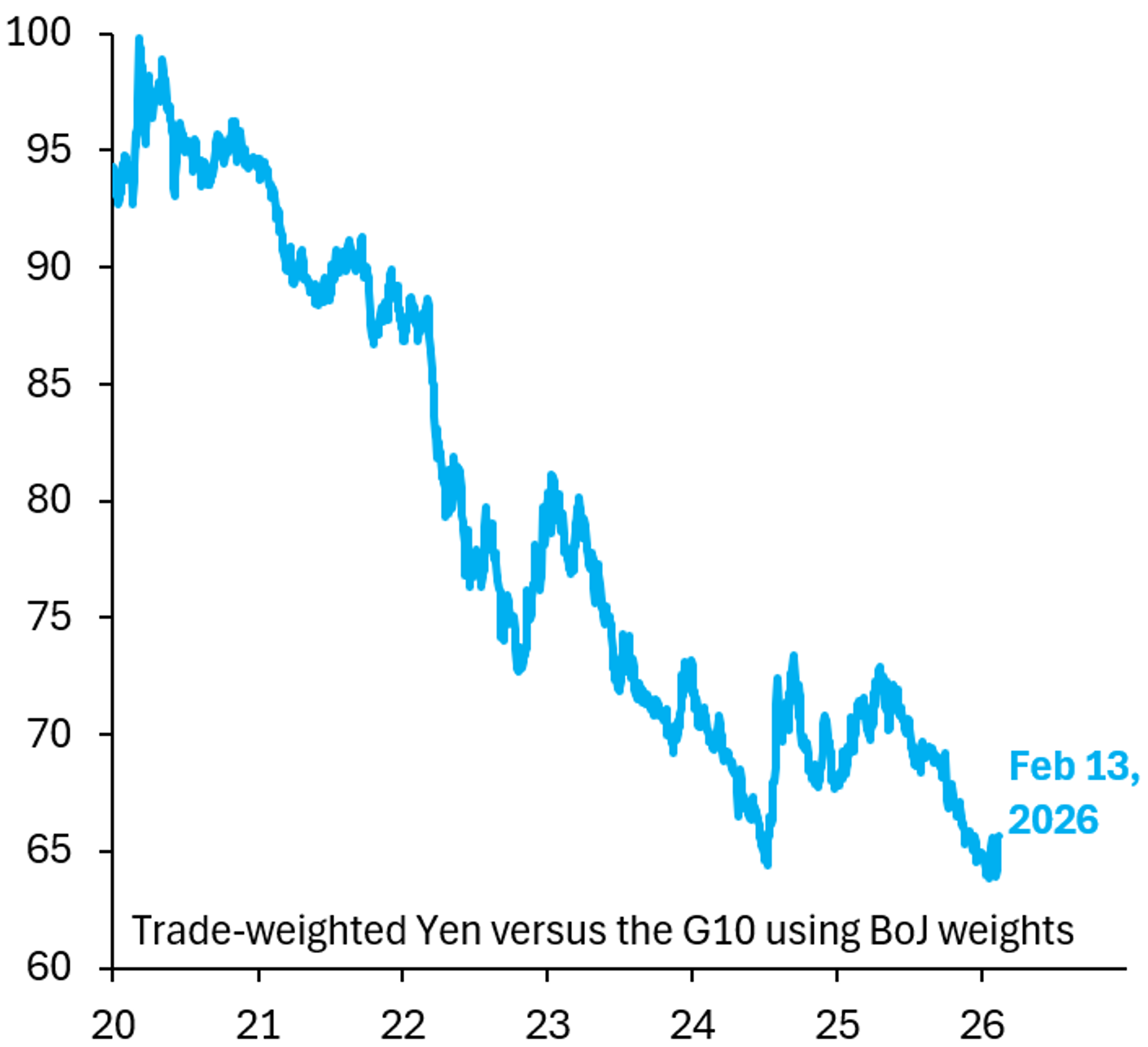

Yen Poised for New 2025 Lows Amid

The Yen will keep falling in trade weighted terms in 2025 and make new lows. Two reasons: (i) Japan remains in denial on the scale of its debt and what's needed to fix this; (ii) the Yen will be falling...

By Robin Brooks

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and...

By ForexLive — Feed

Social•Feb 14, 2026

Global Data Week: FOMC Minutes to RBA Jobs

Buckle up! Its going to be a VERY Busy Data Week ahead👇 🇺🇸 US -FOMC Minutes -Q4 GDP -Empire State & Philly Fed 🇪🇺 EZ -IP -ZEW -PMIs 🇬🇧 UK -Jobs -Retail Sales -CPI -PMIs 🇯🇵 JP CPI & GDP 🇨🇦 CA -CPI -Retail Sales -Trade 🇳🇿 NZ -RBNZ -PSI -PPI 🇦🇺 AU -RBA MINUTES -JOBS -PMIS

By Kathy Lien

Social•Feb 14, 2026

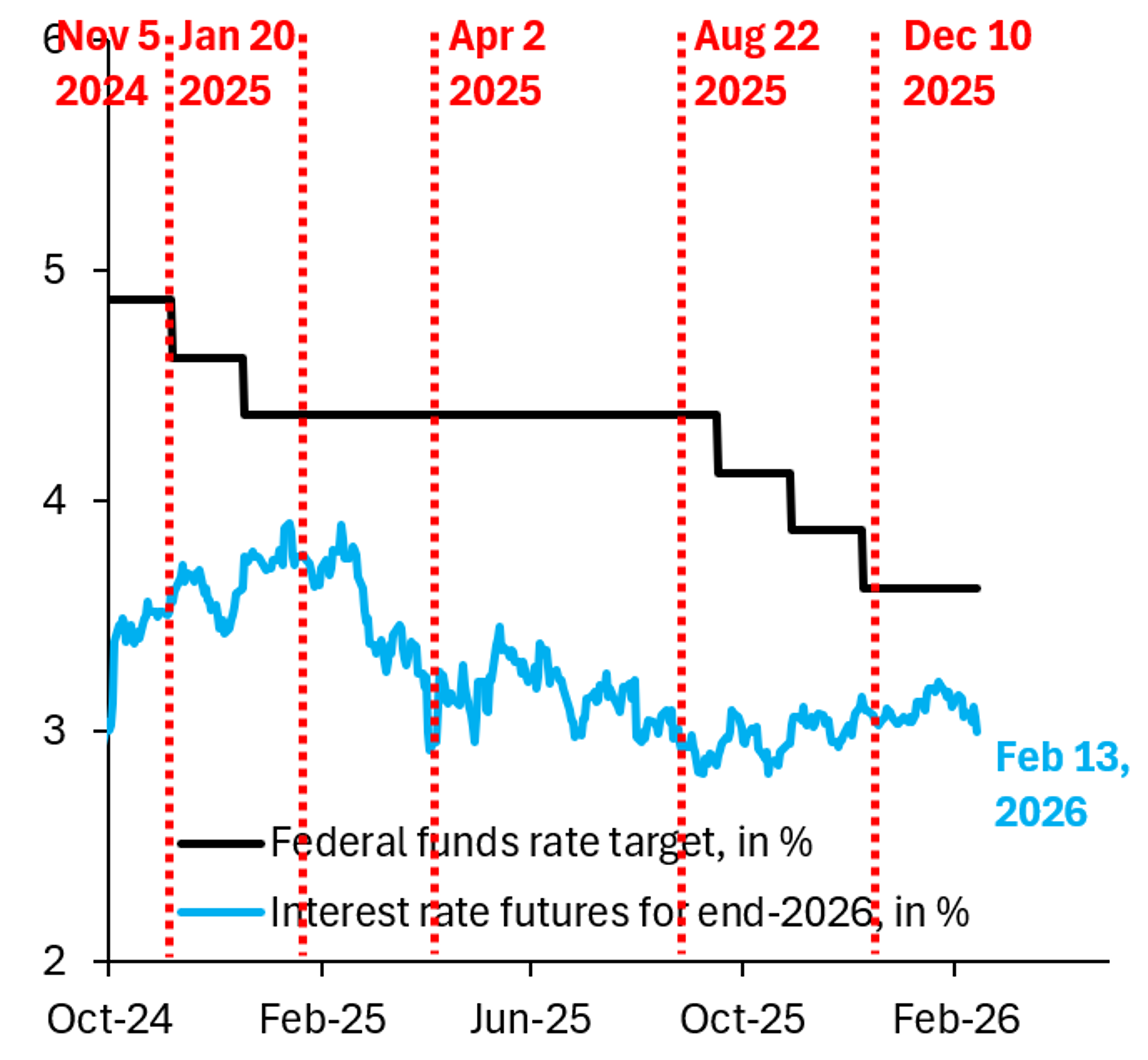

Warsh Fed Expected to Slash Rates 100bps, Dollar Falls

My forecast is for the Warsh Fed to cut policy rates by 100 bps in the 4 meetings after he takes over (June, July, September, October) ahead of midterms. Markets are moving in this direction, but still price only 63...

By Robin Brooks

Podcast•Feb 13, 2026•24 min

Global FX: How Much Is Too Much?

In this episode, J.P. Morgan Global Research analysts Arindam Sandilya, James Nelligan, and Patrick Locke examine the current foreign‑exchange (FX) outlook, focusing on how recent US equity stress and the relative underperformance of US stocks are influencing currency markets. They...

By At Any Rate

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

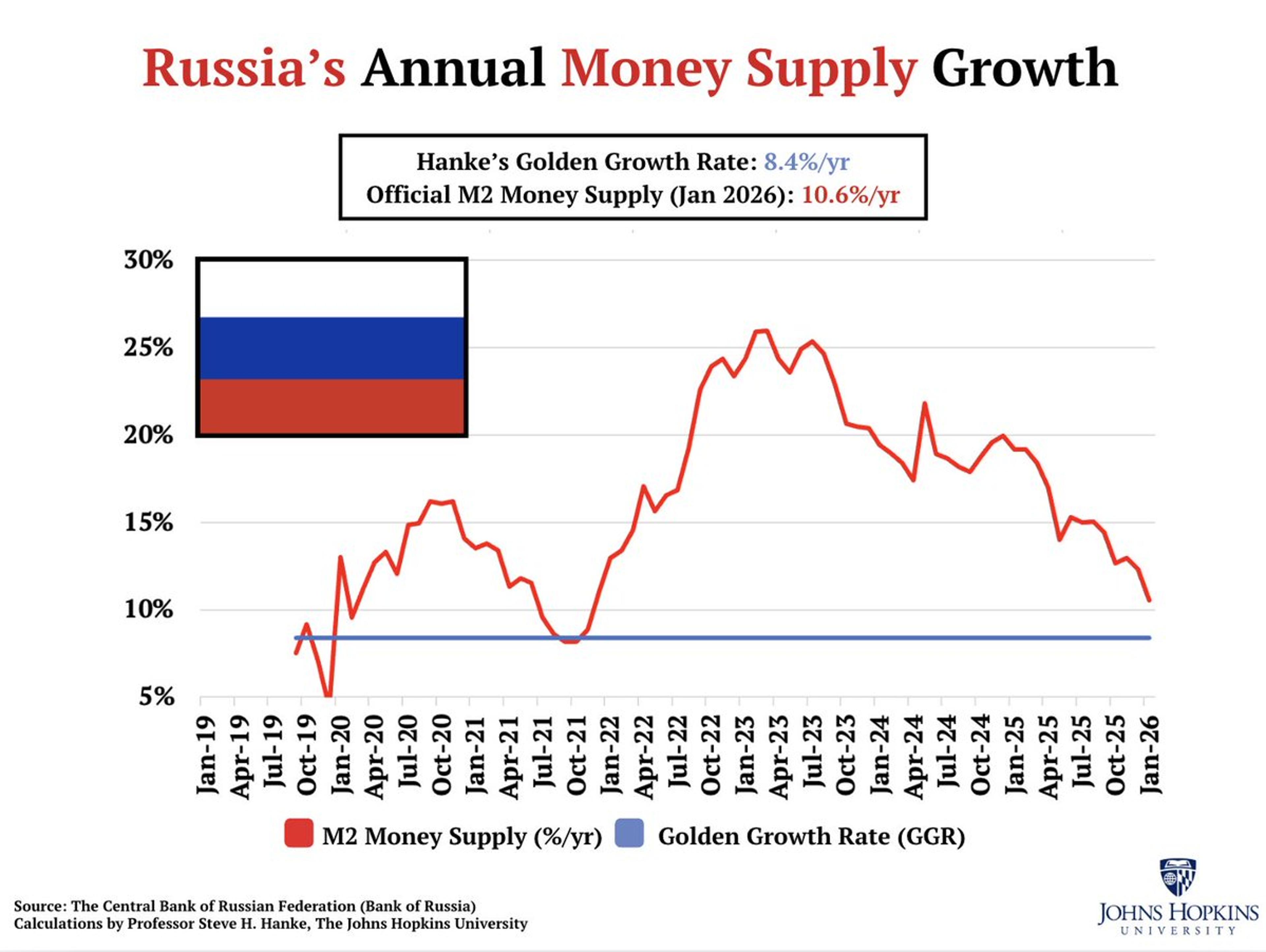

Russia's Inflation Spike Tied to Excess Money Supply

Russia’s inflation comes in at 6.0%/yr in January. That's ABOVE RU's 4%/yr target. RU's M2 money supply is growing at 10.6%/yr, ABOVE Hanke's Golden Growth Rate of 8.4%/yr, a rate consistent with hitting its inflation target of 4%/yr. THE INFLATION STORY =...

By Steve Hanke

News•Feb 13, 2026

Stable Money Leads Gold & Silver ETF Surge on ONDC as Investors Turn to Safe, Regulated Products

Stable Money reported record transaction volumes in gold and silver ETFs as Indian investors gravitate toward SEBI‑regulated products amid near‑record precious‑metal prices. The platform now handles over 95% of mutual‑fund trades on the Open Network for Digital Commerce (ONDC), reflecting...

By Business Standard — Economy/Markets

Social•Feb 14, 2026

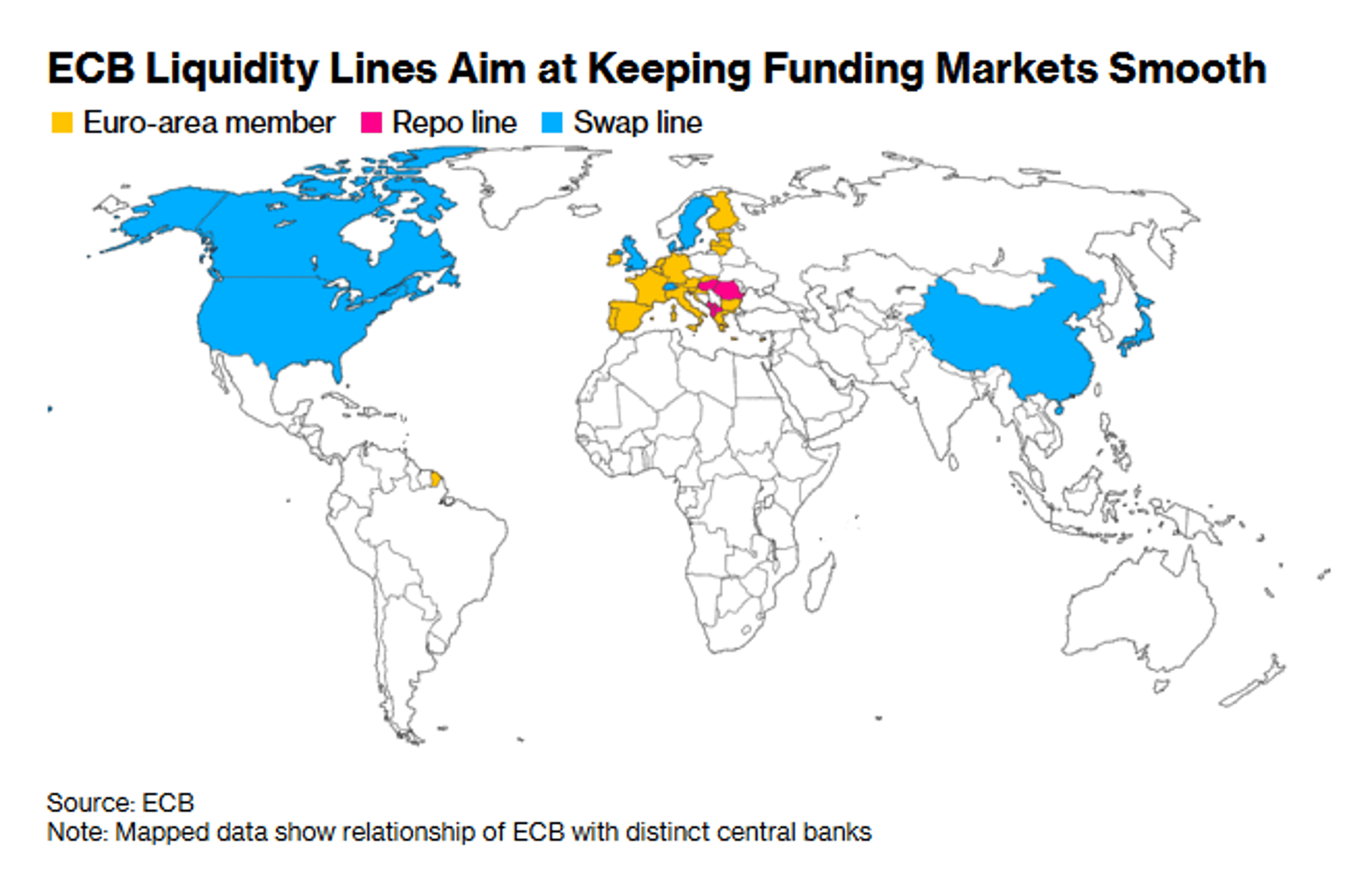

ECB Overhauls Euro Liquidity to Strengthen Currency Appeal

ECB revamps euro liquidity offer to boost the common currency’s appeal https://t.co/w17qKKKWLo via @jrandow https://t.co/FlhSjhqFkD

By Zöe Schneeweiss

Social•Feb 14, 2026

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See...

By Marc Chandler

Blog•Feb 13, 2026

The Signal Is Finally Here

Forex analyst Ashraf Laidi unveiled a long‑awaited EUR/GBP chart, showing the pair’s daily price breaking out of a three‑month descending channel while the weekly chart preserved an 11‑month trendline support and is now bouncing higher. He suggests the breakout could...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

Markets Discount Fed Cuts Amid Japan Election, Tariff Uncertainty

Week Ahead: SCOTUS Decision on Tariffs? 8 Fed Officials Speak as the Market Discounts almost 65 bp of Cuts this Year: Last week began with the LDP's stunning victory in Japan. However, rather than sell-off as the market expected, the...

By Marc Chandler

Social•Feb 14, 2026

Dollar Decouples: US Growth Rises as USD Falls

Great piece by @katie_martin_fx in the @FT on the correlation break happening for the Dollar. As Trump leans more and more on the Fed, positive data surprises like payrolls no longer lift USD. The US will boom this year. But...

By Robin Brooks

Blog•Feb 13, 2026

Typical Trading Errors

Retail traders often sacrifice profits by exiting positions too early, driven by a desire for constant action rather than market fundamentals. Ashraf Laidi illustrates this with the USDJPY reaction to the February NFP surprise, where the pair swung more than...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

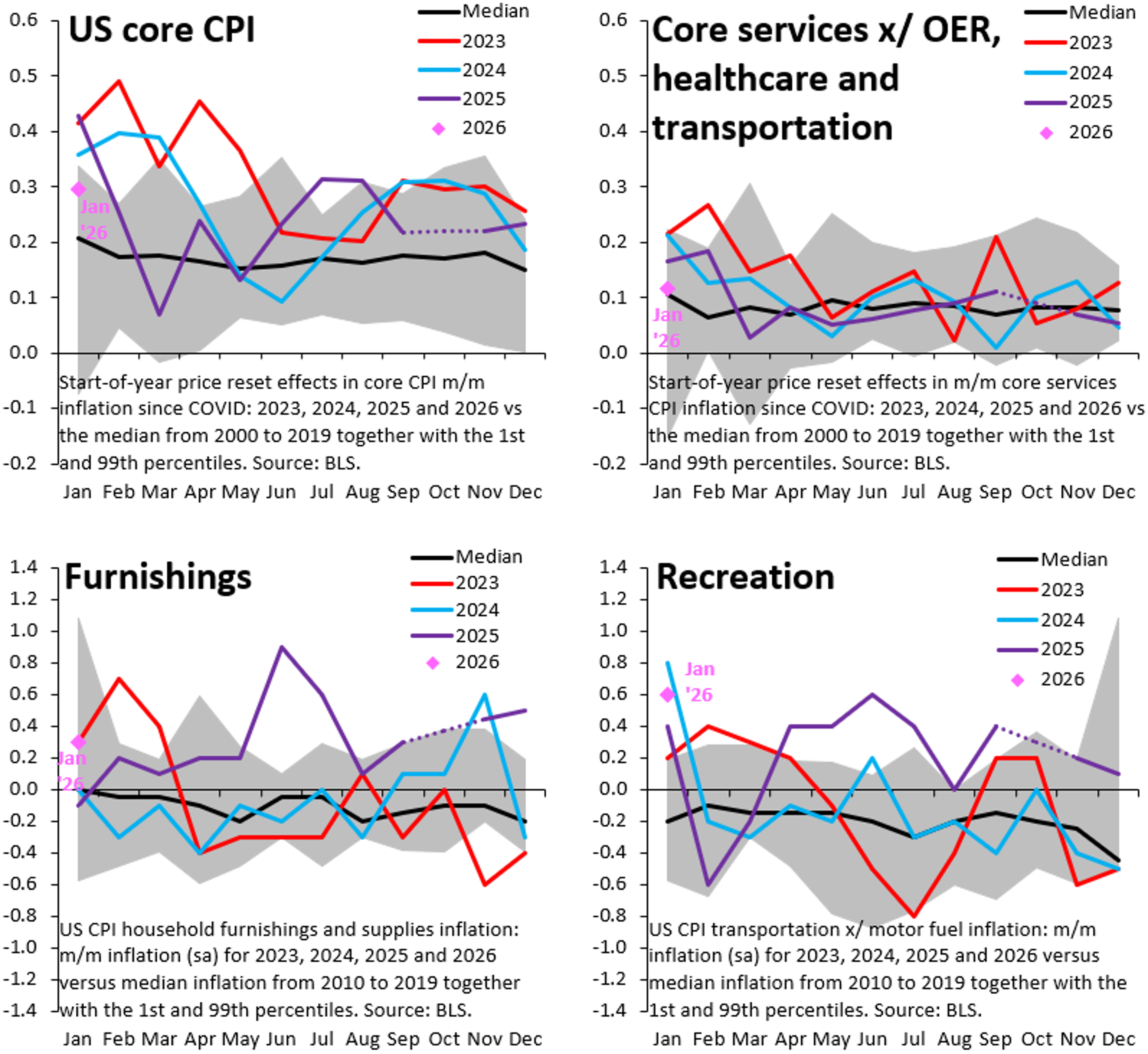

Anti‑Trump Bias Skews Dollar and Inflation Forecasts

A lot of economic commentary is inflected by anti-Trump sentiment. That's why so many forecast the Dollar would go into a death spiral last year (it didn't) & why there's so much focus on inflation overheating now (it isn't). Yesterday's...

By Robin Brooks

Social•Feb 14, 2026

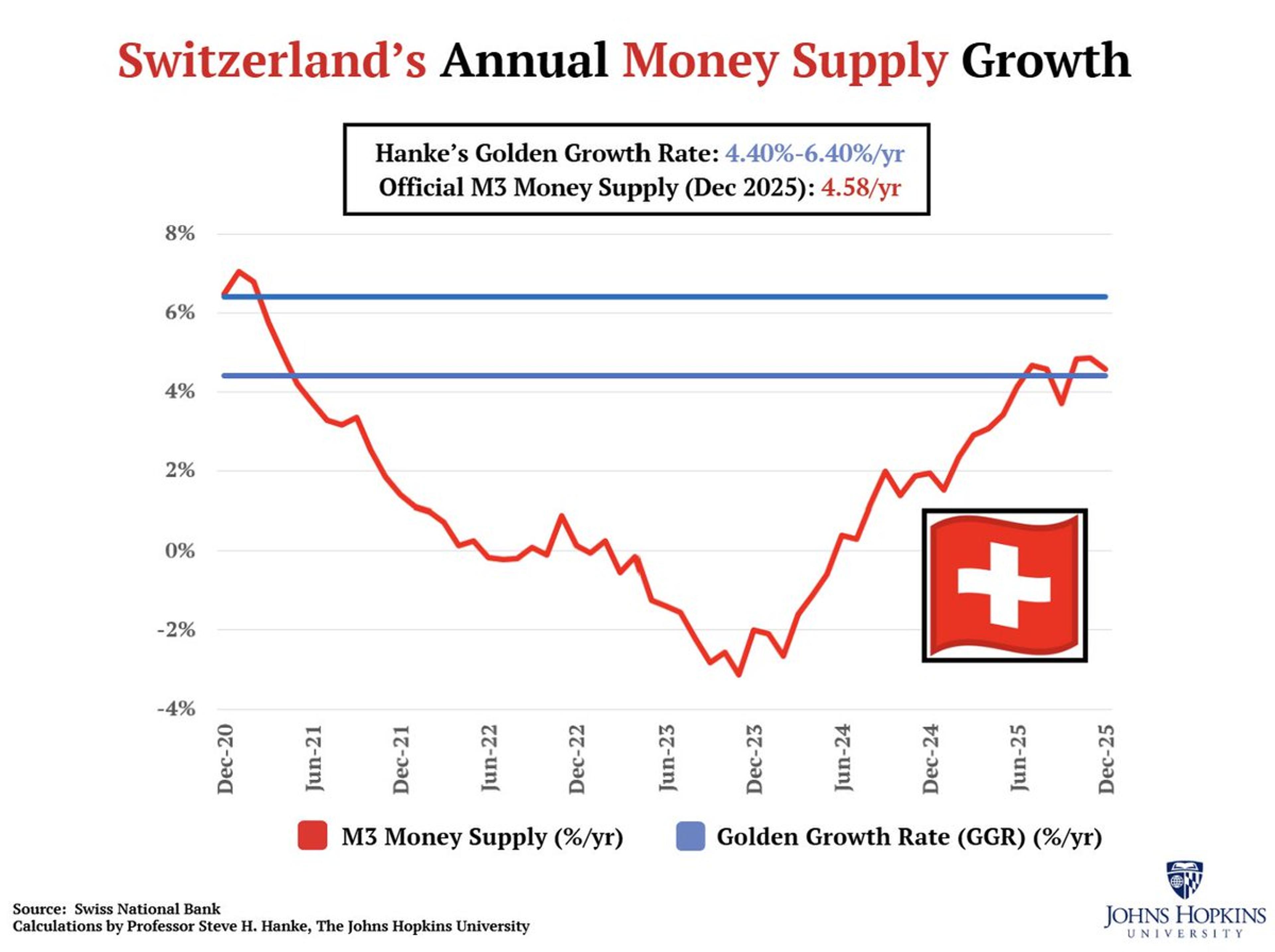

Swiss Inflation Near Zero as Money Growth Slows

Switzerland’s inflation rate is on the low end of its TARGET RANGE at 0.03%/yr. Switzerland’s money supply (M3) has been growing below Hanke's Golden Growth Rate of 4.40%-6.40%/yr since 2020 & is now only at 4.58%/yr. THE INFLATION STORY =...

By Steve Hanke

Blog•Feb 13, 2026

Trade Tips From Washington DC

Ashraf Laidi notes recent Trump administration comments that imply a deliberately weaker US dollar ahead of today’s non‑farm payroll (NFP) release. He suggests the labor data could fall far short of the 68,000 consensus, echoing a pattern of "benign neglect"...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

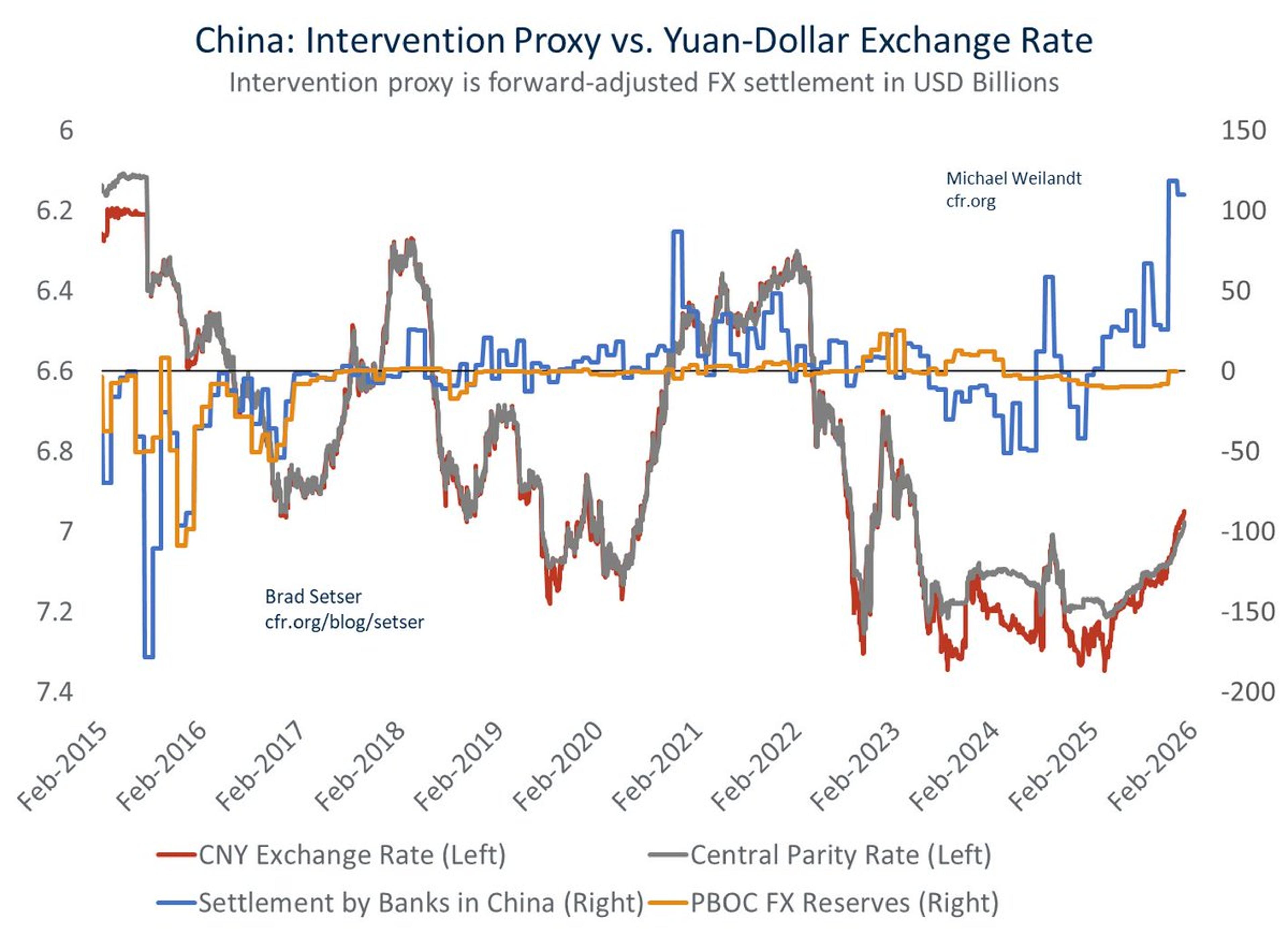

China’s $1.2 T Surplus Fuels Massive Market Interventions

One by product of China's exploding external surplus (goods surplus of $1.2 trillion, q4 current account surplus annualized is close to $1 trillion) is that it creates the raw material for some massive intervention numbers h/t @Mike_Weilandt for the chart https://t.co/PMvhatfgWh

By Brad Setser

Podcast•Feb 13, 2026•7 min

European Rates: Scandinavian Rate Outlook – a Long Winter Hibernation

In this brief episode, J.P. Morgan analysts Francis Diamond and Frida Infante examine the current state and near‑term outlook for Swedish and Norwegian sovereign and corporate rate markets. They highlight that both countries are entering a prolonged period of low‑rate...

By At Any Rate

Social•Feb 13, 2026

Assume BRICS' USD‑bypass Plans Are Real; Doubt USD Stability

Remember, every utterance from BRICS & Global South regarding potential new system to bypass USD is to be treated as if already operational & making material difference. And every piece of evidence that USD system isnt going anywhere is to be...

By Brent Johnson

Social•Feb 13, 2026

Market Prices Accelerating Fed Rate Cuts Through 2026

Notably, market-implied FOMC cuts through 2026 have been increasing. Through February, Fed Fund futures have priced in another -14bps of cuts for the year - and now the most dovish outlook after CPI since Dec 3rd: https://t.co/NZF2YksrWV

By John Kicklighter

Blog•Feb 13, 2026

Bulgarian Central Bank Deputy Governor Appointed Prime Minister

President Iliana Iotova appointed suspended Bulgarian National Bank deputy governor Andrey Gurov as interim prime minister, invoking a constitutional rule that limits caretaker‑PM candidates to ten senior officials. Gurov’s selection follows an anti‑corruption finding that barred him from his central‑bank...

By Mostly Economics

Social•Feb 13, 2026

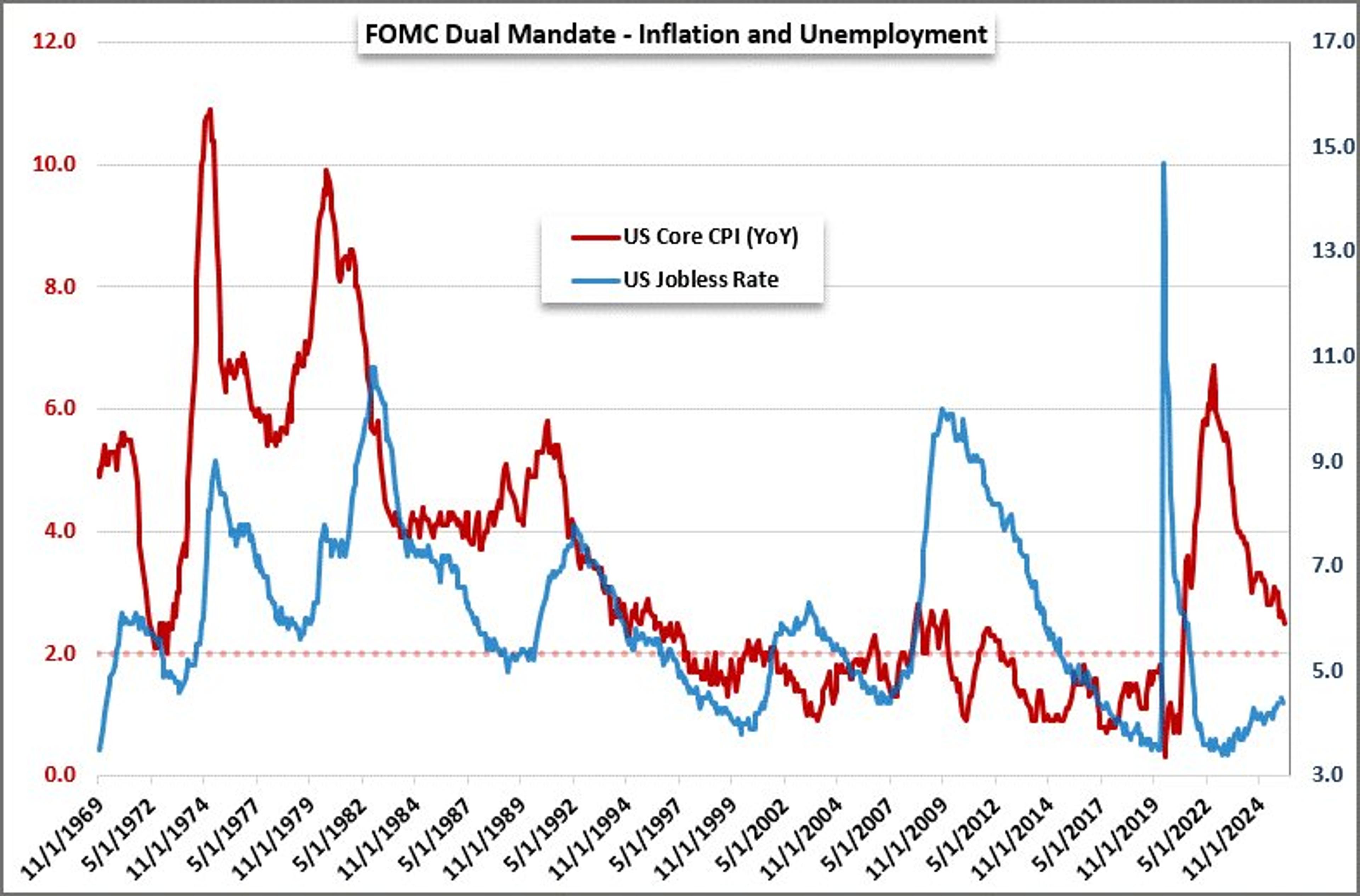

CPI Cools to 2.4%, Fed Eyes Jobs as Unemployment Falls

US #CPI inflation figures came in line with expectations of a pace cooling. Headline dropped from 2.7% to 2.4% while core eased 2.6% to 2.5%. This does shift priority towards employment in the Fed's dual mandate but the jobless rate...

By John Kicklighter

Social•Feb 13, 2026

Inflation Stays Low as Money Supply Grows Below Golden Rate

US's CPI inflation rate comes in at 2.4%/yr in January. The US money supply (M2) has been growing BELOW Hanke's Golden Growth Rate of ~6.3%/yr, a rate consistent with hitting the Fed's 2%/yr inflation target, since April 2022. THE INFLATION STORY =...

By Steve Hanke

News•Feb 13, 2026

THINK Ahead: Green Shoots or Just Weeds? What This Week’s Data Signals

Economists spot early signs of recovery in the US labor market, with private payrolls accelerating, yet underlying job quality remains thin. The Federal Reserve is expected to deliver two 25‑basis‑point cuts, likely in June and September, as inflation stays modest....

By ING — THINK Economics

Social•Feb 13, 2026

Bloomberg's Russia Dollar Rumor Likely Misleading, Says Hanke

Yesterday, Bloomberg reported that Russia is considering a re-entry into the US dollar system. Bloomberg's report created quite a stir. RELAX, HANKE'S 95% RULE = 95% OF WHAT YOU READ IN THE PRESS IS EITHER WRONG OR IRRELEVANT. https://t.co/8E7OK7Zm1t

By Steve Hanke

Social•Feb 13, 2026

January 2026 Defies Post‑COVID Seasonal Inflation Surge

Ever since COVID, the start of the year has seen hot inflation prints, because residual seasonality pushed up inflation in the first quarter. That isn't the case in Jan. '26 and I think that holds a warning for those forecasting...

By Robin Brooks

News•Feb 13, 2026

US Inflation Details Offer Room for Deeper Fed Rate Cuts

U.S. consumer price inflation in January eased to 0.2% month‑on‑month, with core CPI matching expectations at 0.3% and both headline and core year‑on‑year rates falling to four‑year lows of 2.4% and 2.5%. Goods prices excluding food and energy were flat,...

By ING — THINK Economics

Social•Feb 13, 2026

Inflation Misses Again; Labor Market Holds Real Power

🚨 Inflation just missed expectations. Again - Dollar dumping - Gold buying the dip - Stocks pumping on rate cut hopes ⚠️ But don't get comfortable - the labor market is the real story https://t.co/hpBwuiWtK4

By Kathy Lien

Social•Feb 13, 2026

Soft US Inflation Sparks Dollar Slide, Yield Drop, Gold Rise

📉 Softer US Inflation - Markets React 🔻 Softer US inflation numbers 🔻 USD tumbling 🔻 10-year yield falling ⬆️ Gold rising ⬆️ Stocks rallying 📊 CPI Breakdown: • MoM: 0.2% actual vs 0.3% forecast • YoY: 2.5% actual vs 2.5% forecast (2.7% previous)

By Kathy Lien

News•Feb 13, 2026

EUR/GBP Bounces From Daily Lows as Eurozone GDP Supports the Euro

Eurozone preliminary GDP showed a 0.3 % QoQ rise in Q4 2025, matching expectations and nudging annual growth to 1.4 %. The United Kingdom posted a weaker 0.1 % QoQ increase, missing forecasts and pulling annual growth to 1 %. The data lifted the...

By FXStreet — News

Social•Feb 13, 2026

The 5ers Introduces Overnight Futures Prop Trading

🚨 @the5erstrading releases details for @The5ersFutures On my panel at @iFXEXPO they said big things were coming… Only futures prop to allow overnight holds Looks like the evolution is here. What do you think - strong proposition or not competitive enough?👇

By Kathy Lien

Social•Feb 13, 2026

Trump Backs Off as Treasury Market Wobbles, Risk Premium Spikes

One constant in the Trump administration is that - when the Treasury market wobbles - it backs down. That happened on China in Apr. '25 and again on Greenland recently. 10y10y forward yield remains near its highs, even as 10y...

By Robin Brooks

News•Feb 13, 2026

US CPI Data Expected to Show a Mild Decline in Inflation in January

U.S. consumer price index data for January showed annual inflation easing to 2.4% from 2.7% in December, missing the 2.5% market forecast. Monthly CPI rose 0.2% and core CPI remained at 2.5% year‑over‑year, matching expectations. The softer headline number nudged...

By FXStreet — News

Social•Feb 13, 2026

US Loses Cheap‑borrower Advantage, Now Pays Debt Premium

The US exorbitant privilege - the ability to issue debt more cheaply than others - ended about a decade ago. We're now issuing debt at a premium, the result of deficits and debt that are out of control. This change...

By Robin Brooks

News•Feb 13, 2026

Silver Price Forecasts: XAG/USD Fails to Find Acceptance Above $79.00

Silver (XAG/USD) slipped to $77.35 on Friday, unable to sustain a breakout above the $79 resistance level. The metal is trapped below the 50‑period SMA at $81, reinforcing a bearish technical bias. A firm US Dollar Index and cautious market...

By FXStreet — News

News•Feb 13, 2026

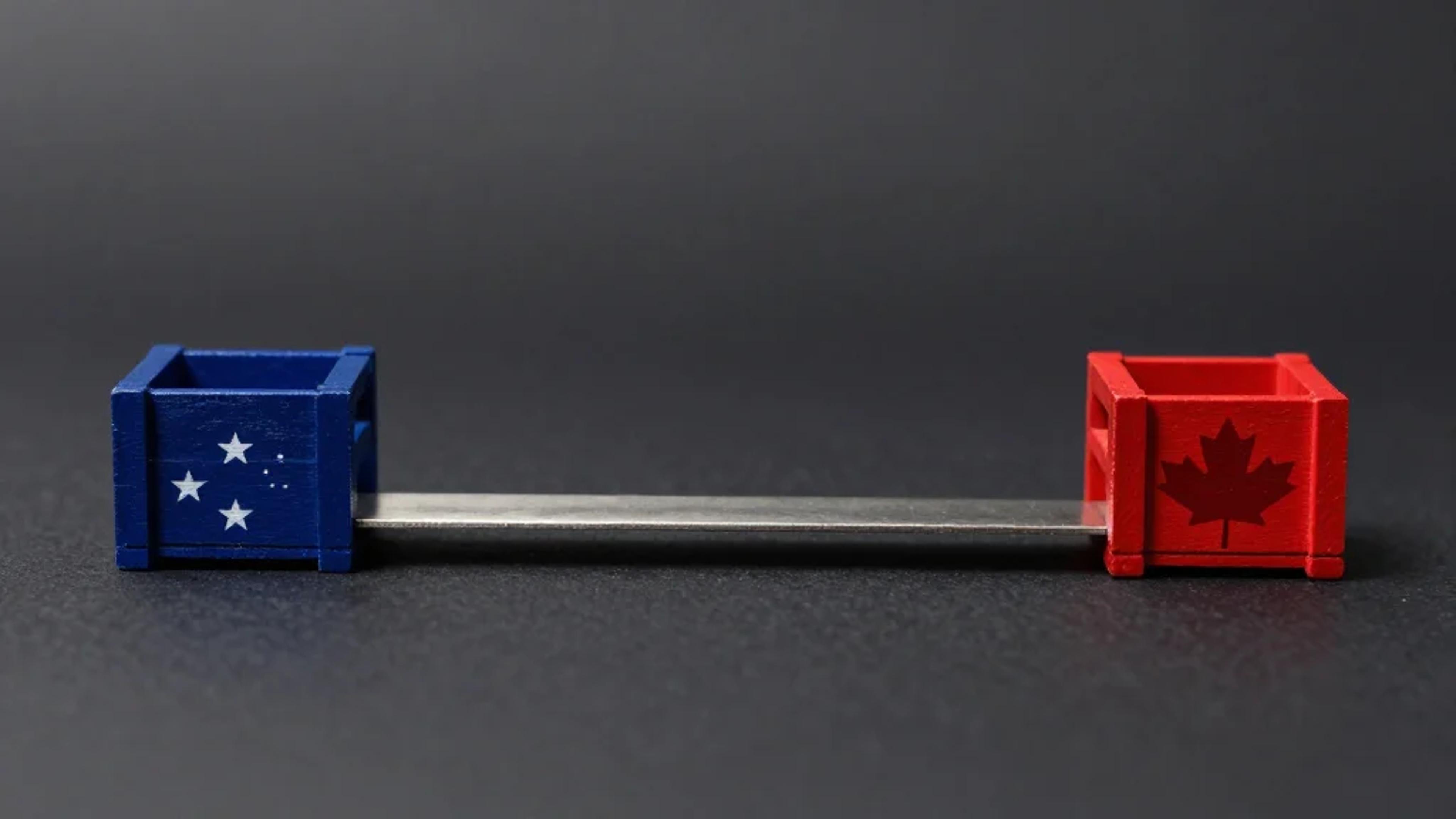

USD/CAD: Sideways Range with Tariff Risks – Rabobank

Rabobank analysts Molly Schwartz and Christian Lawrence project the USD/CAD pair to remain largely sideways throughout 2026, confined to a 1.36‑1.41 band. The outlook is driven by persistent US‑Canada trade tensions, a looming USMCA review, and a weakening U.S. dollar...

By FXStreet — News

News•Feb 13, 2026

Polish Disinflation Continues Despite Upside Surprise in January CPI

Poland’s January flash CPI showed headline inflation at 2.2% YoY, modestly above the 1.9% consensus but still under the NBP’s 2.5% ± 1‑point target. The decline was driven by a 7.1% drop in gasoline prices, while food prices held steady at 2.4%...

By ING — THINK Economics

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

News•Feb 13, 2026

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

India’s rupee ended Friday essentially unchanged, closing at 90.6350 per dollar, a slight dip from the prior session. The currency faced pressure from weak domestic equities, elevated interbank dollar demand, and maturing non‑deliverable forward contracts, while the Reserve Bank of...

By The Economic Times – Markets

News•Feb 13, 2026

We’re Trimming Our 2026 Romania Growth Forecast After a Bumpy End to 2025

Romania’s economy entered recession in early 2024 and posted a 1.9% quarterly contraction in Q4 2025, the steepest drop since 2012. Revised data also turned Q1 2025 growth negative, prompting analysts to slash the 2026 GDP outlook from 1.4% to 0.6%. The...

By ING — THINK Economics

News•Feb 13, 2026

Poland’s Economy Expanded by 4%YoY in the Final Quarter of 2025

Poland’s economy posted a 4.0% year‑on‑year increase in the fourth quarter of 2025, outpacing the 3.8% growth recorded in Q3. Quarterly expansion accelerated to 1.0% from 0.9% in the prior period, driven primarily by a surge in private consumption that...

By ING — THINK Economics

News•Feb 13, 2026

Turkey’s Current Account Deficit Remains on a Widening Track

Turkey posted a December current‑account deficit of $7.3 bn, well above the $5.3 bn forecast, pushing the 12‑month rolling deficit to $25.2 bn (about 1.8 % of GDP). The gap widened mainly because the trade balance slipped to a $‑7.4 bn deficit and primary‑income balances...

By ING — THINK Economics

News•Feb 13, 2026

Dollar Rises Against Dong on Black Market

The Vietnamese dollar rose 0.5% on the black market to VND 26,547 per U.S. dollar, while the official Vietcombank rate stayed at VND 26,160. The State Bank of Vietnam trimmed its reference rate marginally to VND 25,049. Globally, the greenback is set for...

By VNExpress – Companies (subset)

Social•Feb 13, 2026

ECB Still Assessing Full Effects of Euro Appreciation

ECB has yet to see full impact of euro appreciation, Kazaks says https://t.co/qqisWsfsJD via @aaroneglitis @Skolimowski https://t.co/TTDxRGmgMY

By Zöe Schneeweiss

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

Social•Feb 13, 2026

User‑centric Design Key to CBDC Resilience, Says IMF

"CBDCs... most significant resilience potential lies in user-centric design features, including offline functionality, flexible front-end solutions, and programmability for crisis response" Not my words. The IMF. https://t.co/aauwvtxTG8 https://t.co/O4sEWC2AN2

By Dave Birch