🎯Today's Currencies Pulse

Updated 3h agoWhat's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

News•Feb 13, 2026

Asia Week Ahead: Key Growth Data From Japan

Japan is set to publish key macro data next week, including Q4 2025 GDP, export figures, and inflation. Analysts forecast a modest 0.3% quarter‑on‑quarter GDP rebound after a 0.6% contraction, driven by recovering construction and strong semiconductor exports. Inflation is expected to ease sharply to 1.5% year‑on‑year, aided by energy subsidies and stable food prices. The data will test the impact of the LDP’s landslide win and upcoming fiscal stimulus.

By ING — THINK Economics

Podcast•Feb 13, 2026•30 min

Weekend Edition: From Dairy to Data: Can NZ Outgrow Australia’s Shadow?

In this episode, Phil and NAB’s Ray Attrill dissect the widening gap between New Zealand and Australia as AI‑driven investment costs strain US markets and commodity prices slide, while the Aussie dollar weakens below 71 cents. They explore how rising AI spending,...

By NAB Morning Call

News•Feb 13, 2026

Appointment to the Monetary Policy Board

The Reserve Bank of Australia announced that Professor Bruce Preston has been appointed to the Monetary Policy Board, effective immediately. Preston brings a distinguished academic record and extensive experience in public‑policy economics. Governor Michele Bullock also thanked outgoing board member...

By Reserve Bank of Australia — Media Releases

Social•Feb 13, 2026

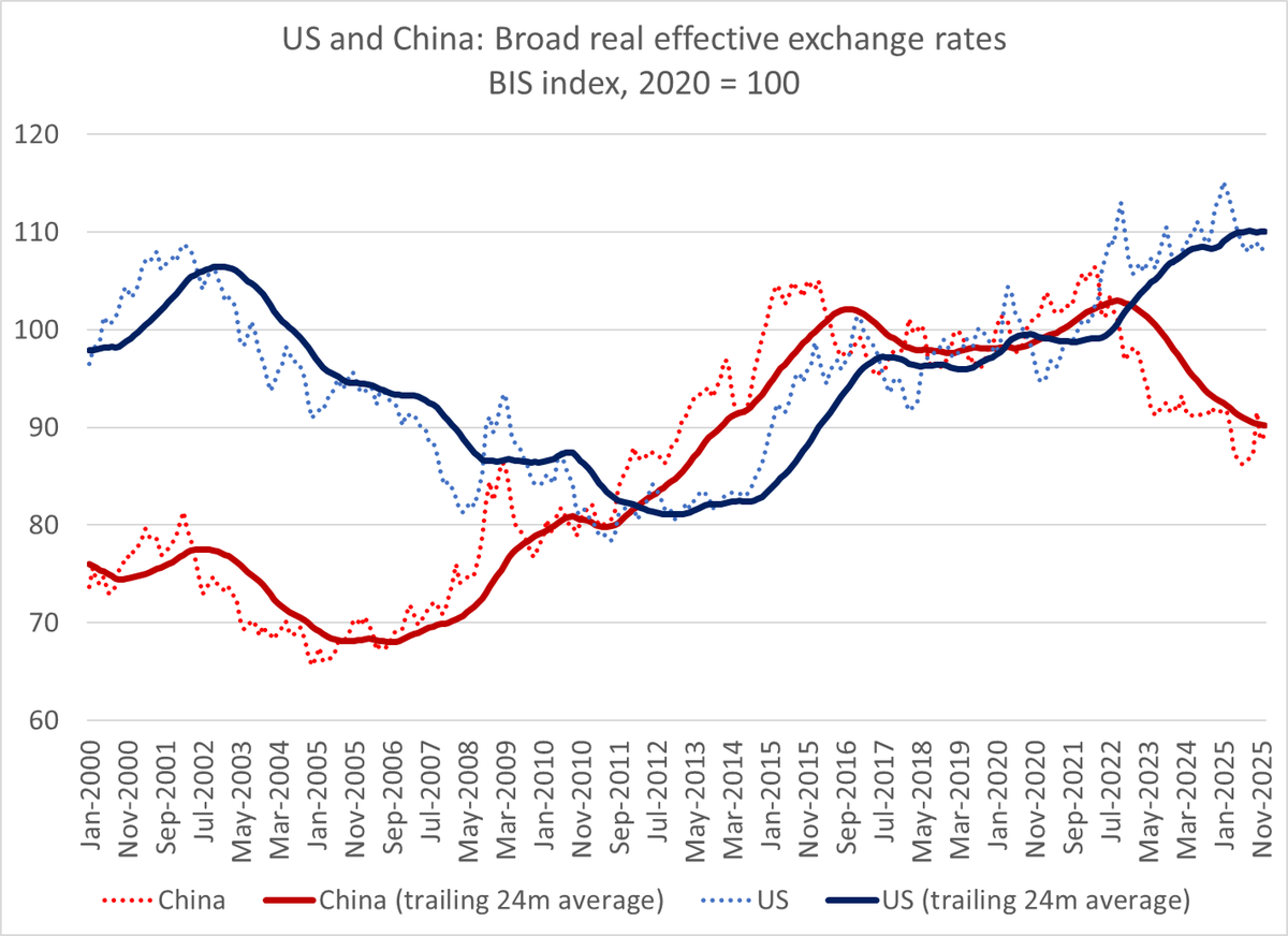

Inflation‑adjusted Dollar

A pet peeve. Talk about current dollar weakness. Numbers here are through December -- but in December the broad inflation adjusted dollar was stronger than in 01 or 02, the peak before 22-24 1/ https://t.co/c7KU9z1C6t

By Brad Setser

Social•Feb 12, 2026

China Eases Capital Controls as Asset Buildup Accelerates

China usually liberalizes its financial account when the PBOC (now the state banks) are accumulating assets at too rapid a pace, and it wans the dollar risk to be taken by others ... 1/2

By Brad Setser

News•Feb 12, 2026

Release: Market Participants Survey

On November 9 2026 the Bank of Canada published its quarterly Market Participants Survey, a systematic outreach to a broad cross‑section of financial‑market actors. The survey solicits expectations on key macro‑economic indicators such as inflation, growth, and exchange rates, as well as...

By Bank of Canada — RSS (site hub)

Social•Feb 12, 2026

East Asia Drives Surging Trade Surplus, Currencies Remain Cheap

Bingo And the global trade surplus (ex pharma) is now primarily in China, Taiwan and Korea ... Important qualification to the now standard argument the dollar has gotten weaker (which is true primarily if the clock starts at the end of 24,...

By Brad Setser

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada’s Governing Council released a detailed summary of its monetary‑policy deliberations for the decision announced two weeks ago. The Council kept the policy interest rate steady at 4.75%, citing modest progress toward its 2% inflation target. Officials...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada released a detailed Summary of Deliberations outlining the Governing Council’s discussion of the monetary‑policy decision announced two weeks earlier. The document highlights the Council’s assessment of inflation trends, labour‑market tightness, and the domestic growth outlook. It...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Interest Rate Announcement

On December 9, 2026 the Bank of Canada will release its next overnight rate target, one of eight scheduled policy announcements each year. The press release will outline the economic factors shaping the decision, including inflation trends, labour market conditions, and global...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Piero Cipollone: Europe and Monetary Sovereignty

In a February 2026 speech, ECB Executive Board member Piero Cipollone warned that Europe’s monetary sovereignty is threatened by growing dependencies on foreign payment systems and digital assets. He argued that control over the euro, both in cash and digital...

By European Central Bank — Press/Speeches

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2165717307-a843d8a1e1c94e9d98075343fa914292.jpg)

News•Feb 11, 2026

What To Expect From Friday's Report On Inflation

Economists expect the January Consumer Price Index to rise 2.5% year‑over‑year, a dip from December’s 2.7% and the lowest headline inflation since May 2021. Core CPI, which strips out food and energy, is also projected at 2.5%, matching the lowest...

By Investopedia — Economics

Blog•Feb 11, 2026

Infographics: Key Rates & Spreads In the Modern Repo Market

The episode breaks down the modern repo market by illustrating how overnight rates and dealer spreads vary across different repo segments—triparty, GCF, DVP, and NCCBR. It explains that dealers profit by maintaining a positive spread between the cost of borrowing...

By Conks – global monetary mechanics

Social•Feb 11, 2026

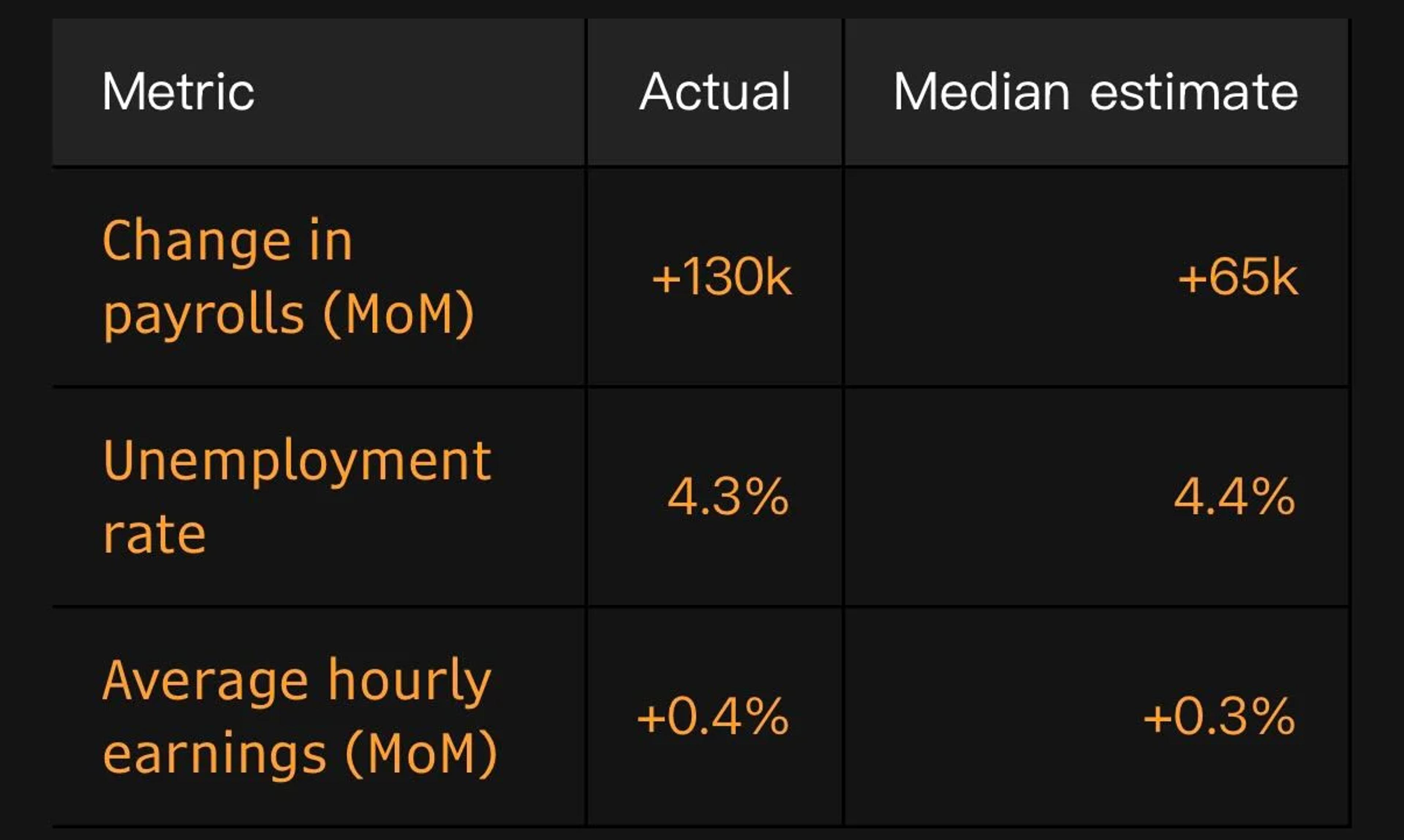

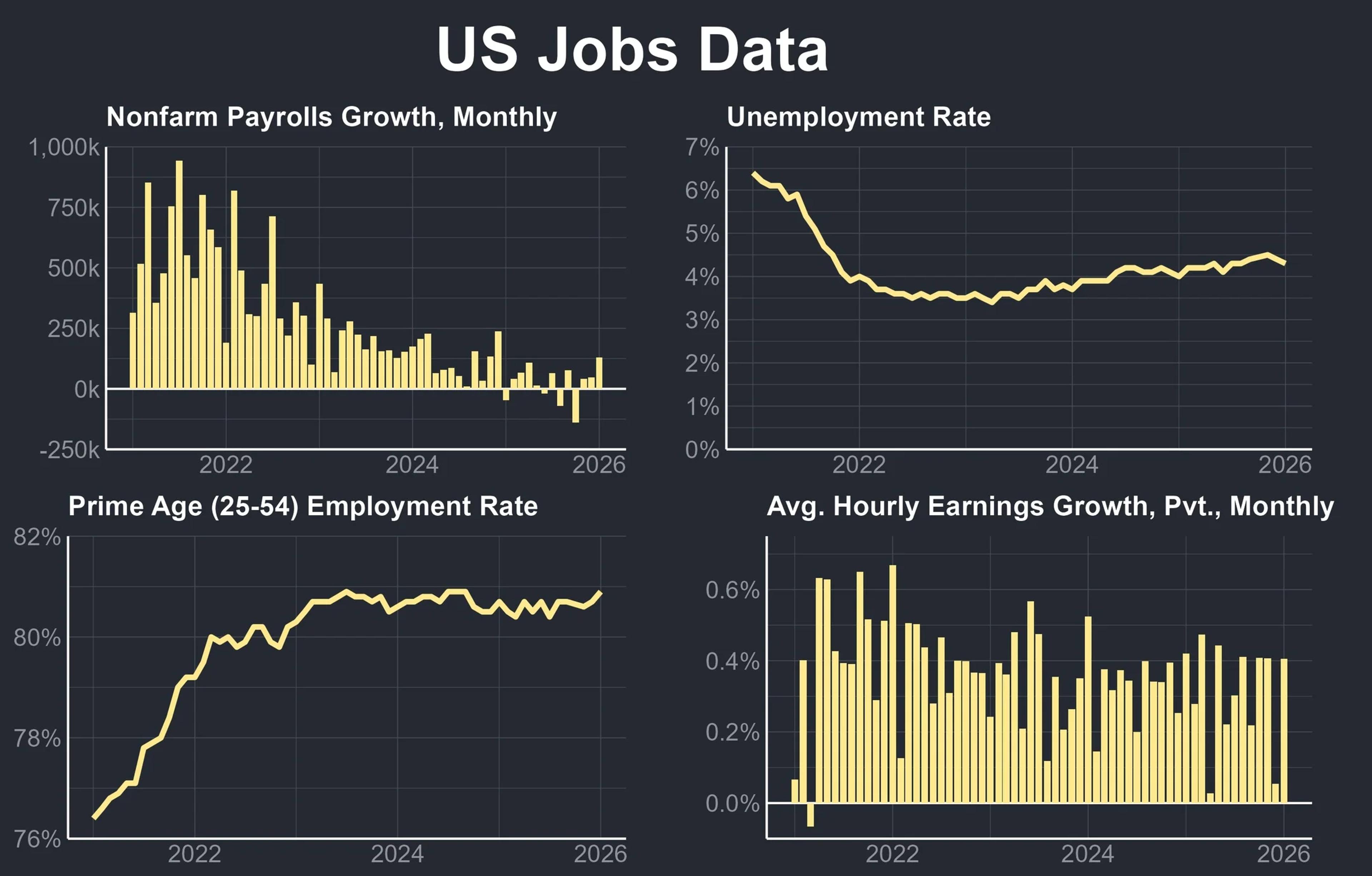

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

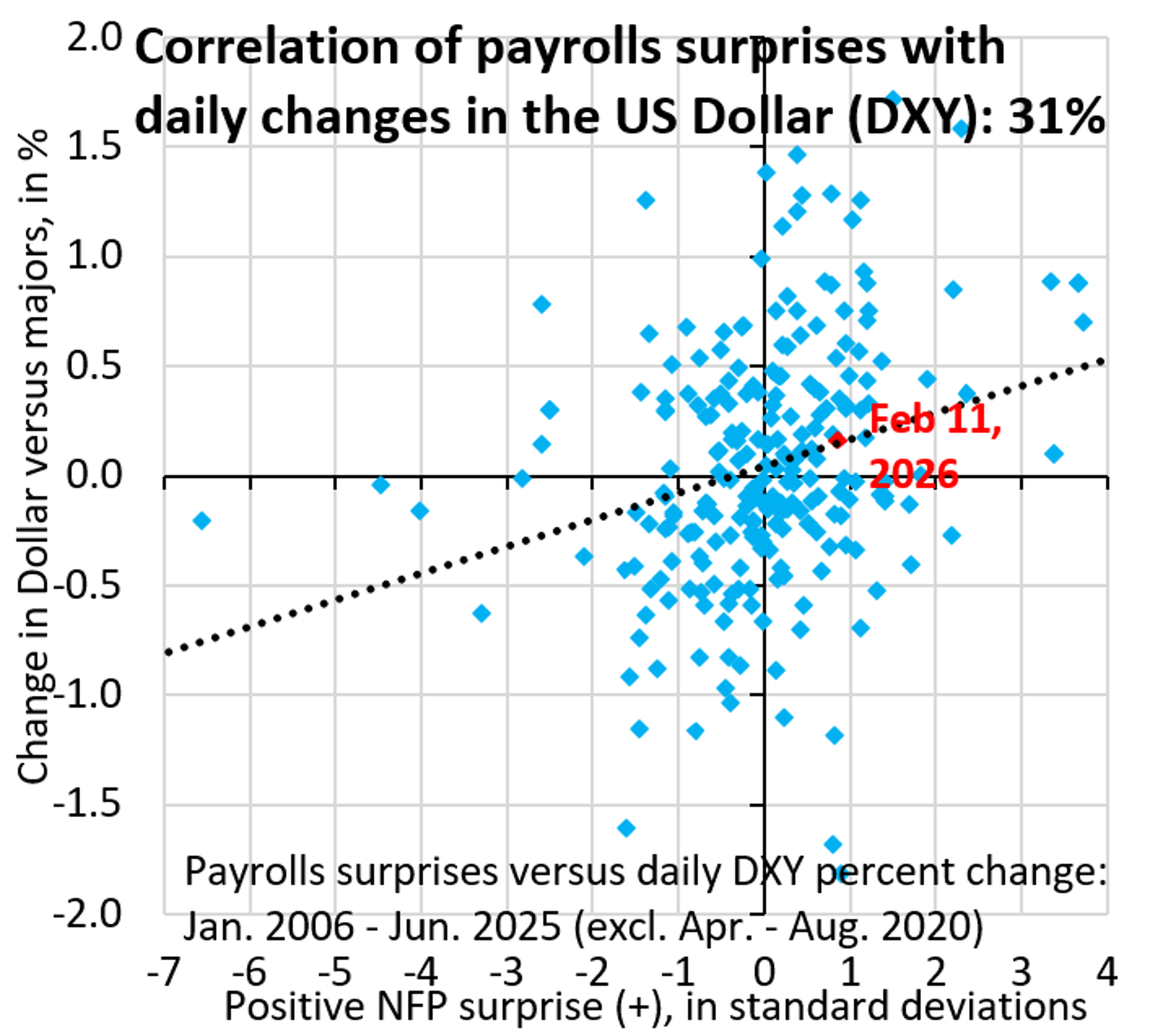

Strong Payrolls Fail to Boost Dollar, Correlation Shifts

Tepid response of the Dollar to a big upside surprise in payrolls. The whisper number for consensus was weak, so this was a solid beat, yet USD is barely able to rise. We're on our way to the correlation switch...

By Robin Brooks

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2260000264-d4302aace73f4036b1f16298e25f8b45.jpg)

News•Feb 10, 2026

What Is World Liberty Financial? What to Know About The Trump Family's Crypto Firm

World Liberty Financial, the Trump family’s crypto venture, has applied for a national banking charter and launched WLFI Markets, a DeFi platform that lets users borrow and earn points using its USD 1 stablecoin and WLFI token. The WLFI token, which...

By Investopedia — Economics

Social•Feb 11, 2026

US Adds 130k Jobs, Unemployment Slips to 4.3%

NEW US JOBS DATA: Non-farm Payrolls: +130k Unemployment Rate: 4.3% (-0.1%) Prime Age (25-54) Employment-Population Ratio: 80.9% (+0.2%) Average Hourly Earnings: +0.4% Annual Benchmark Revisions: -898k

By Joseph Politano

Social•Feb 11, 2026

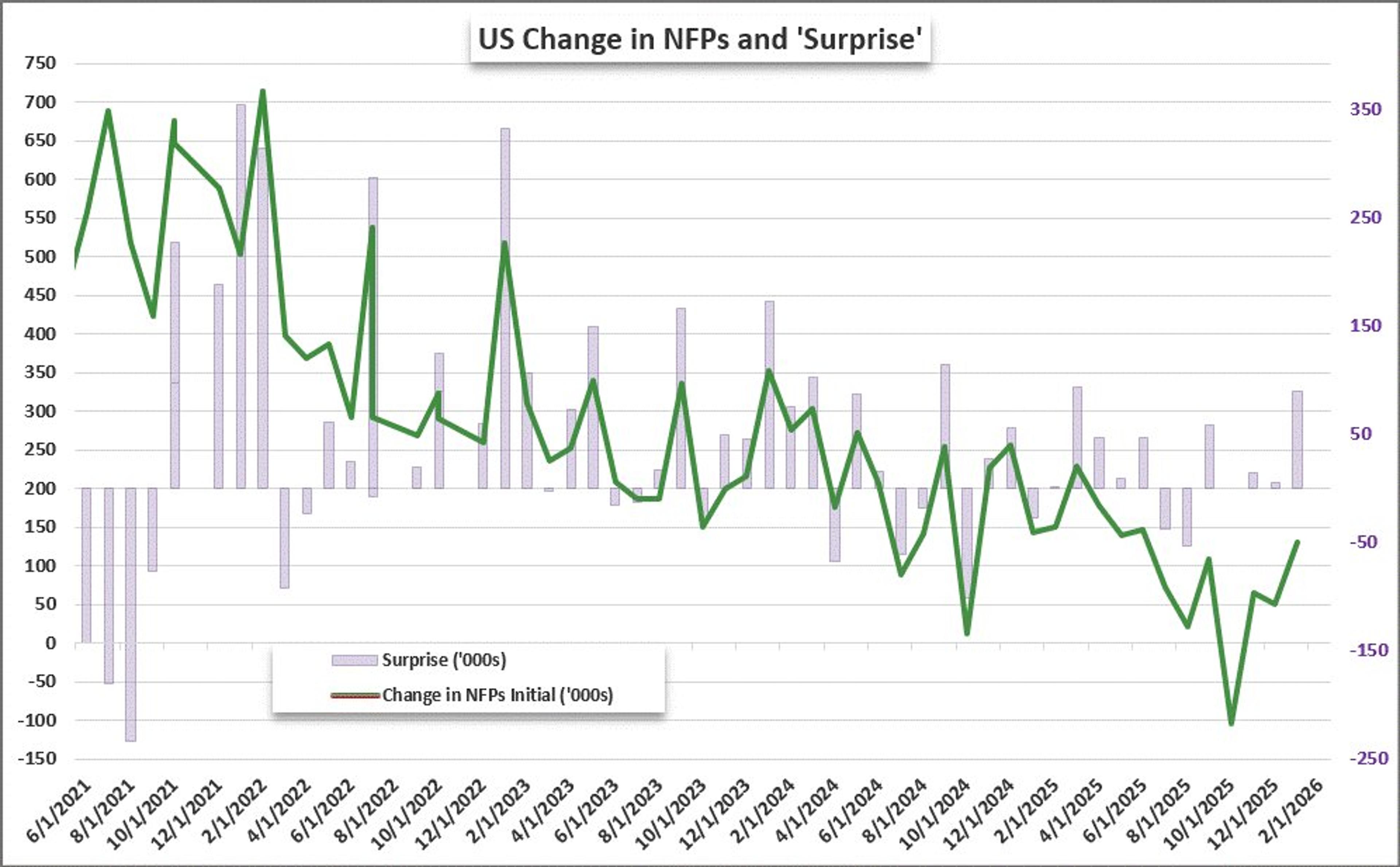

NEC Director Predicts Slightly Lower Jobs, NFP May Miss Forecast

https://t.co/k2T7oPbMh8 In an interview with CNBC on Monday (February 9, 2026), Kevin Hassett, the Director of the National Economic Council, advised markets to expect "slightly smaller job numbers" in the coming months. These remarks, have led many to speculate that the January...

By Boris Schlossberg

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-22113258881-f6461155210747d09aa8a6f5ea26c0cd.jpg)

News•Feb 10, 2026

Trump Expects An Economic Miracle From The New Fed Chair

President Donald Trump urged his Fed chair pick, Kevin Warsh, to deliver 15% annual GDP growth, a target rarely achieved outside wartime. The president’s demand follows criticism of current chair Jerome Powell and calls for aggressive rate cuts. Economists note...

By Investopedia — Economics

Social•Feb 11, 2026

Unveiling 2026 Prop Trading Roadmap and Upcoming Announcements

Great conversations at @iFXEXPO diving into the 2026 Prop Trading roadmap - with a few hints about big announcements coming from @the5erstrading @FundedNext @IC_Funded Apparently I was “grilling” them (according to the audience)😄… or just asking questions everyone’s thinking? https://t.co/GEGDCIAXIG

By Kathy Lien

Social•Feb 11, 2026

What a Schwab Brain Scan Reveals About Traders

Charles Schwab scanned my brain… and this is what they found 👀 Inside the Mind of a Trader | Kathy Lien https://t.co/7k3G7EUtU5 via @YouTube

By Kathy Lien

News•Feb 10, 2026

Is a Dollar Vibe Shift Under Way?

The Atlantic Council’s GeoEconomics Center podcast explores whether a sustained dollar depreciation is emerging. Host Dan McDowell explains how a weaker greenback could reshape U.S. trade balances, investment flows, and national‑security calculations. The discussion highlights potential benefits for exporters alongside higher...

By Atlantic Council

Social•Feb 11, 2026

Argentina's 32% Inflation Signals Milei Must Dollarize

Argentina’s January inflation came in at a RED HOT 32.4%/yr. Pres. Milei’s monetary model is not working. MILEI MUST DOLLARIZE NOW. https://t.co/MLSKqYfys7

By Steve Hanke

Social•Feb 11, 2026

Dollar Stabilizes Post‑NFP; CPI Sets Next Direction

US Dollar Technical Forecast: USD Stabilizes After NFP – CPI to Decide the Next Move https://t.co/xwnZkIUN3I $DXY Weekly Chart https://t.co/Cp7VSktXM6

By Michael Boutros

:max_bytes(150000):strip_icc():format(jpeg)/INV-Express-2026-02-09-21c6c996e3f24101be9e37a0d02d48d9.jpg)

News•Feb 10, 2026

What Is, and Isn’t Working in This Market

Investors pushed the Dow Jones Industrial Average past the 50,000 mark for the first time, even as volatility surged. Despite the icy winds of market turbulence, many are still buying the dip, signaling stubborn optimism. Paul Hickey of Bespoke Investment...

By Investopedia — Economics

Social•Feb 11, 2026

USDJPY Plunges 2.5% in Three Days, Reversal Uncertain

$USDJPY is down over -2.5% over the past three days. One of the biggest drops in the past year and a half. Doesn't mean it has to stall and reverse though... https://t.co/LRjhnctyzL

By John Kicklighter

Social•Feb 11, 2026

USD Strength Shifts EUR/AUD, EUR/JPY, GBP/JPY Post‑NFP

Today's Opening Bell A look at the USD crosses post-NFP with on-the-fly analysis on EUR/AUD, EUR/JPY and GBP/JPY https://t.co/Tu1RqyYsZf

By Michael Boutros

Social•Feb 11, 2026

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter

Social•Feb 11, 2026

Investors Dismiss Threat, Doubt USMCA Termination

"The market isn't taking this latest threat seriously at all," said Adam Button, chief currency analyst at investingLive, adding that investors doubt that the United States-Mexico-Canada Agreement, a continental trade pact, will be discontinued ... I'll say it...

By Adam Button

Social•Feb 11, 2026

Strong January Jobs, Lower Unemployment Boost USD Despite Cut Expectations

Jan jobs data better than expected and benchmark revision more or less in line. Unemployment rate ticks lower. $USD jump sold into quickly. Mkt still pricing in around two cuts this year.

By Marc Chandler

Social•Feb 11, 2026

January Jobs Surge 130K, Beating Forecasts, Unemployment Dips

January Non-Farm Payrolls print at 130K vs expected 66K - previously 48K Unemployment holds ticks lower to 4.3% #NFP

By Michael Boutros

Social•Feb 11, 2026

NFP Moved Ahead to Dodge Friday the 13th CPI Clash

Overheard "We preferred to release NFP today instead of Friday beause Friday is #Friday13th". CPI is on Friday.

By Ashraf Laidi

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler

Social•Feb 11, 2026

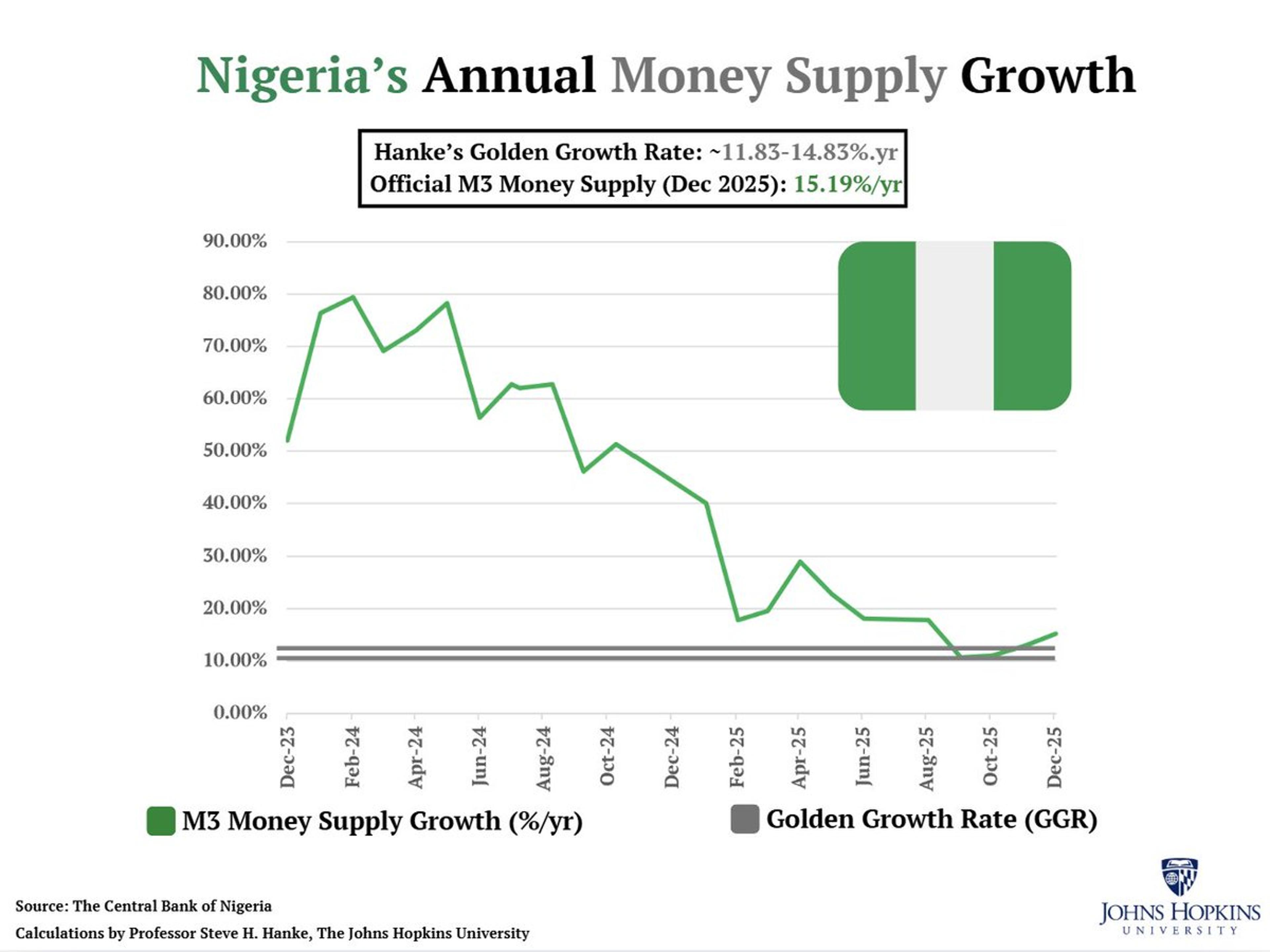

Nigeria's Inflation Surge Linked to Excess Money Supply

Nigeria’s inflation rate is DOUBLE NGA’s inflation target at 15.29%/yr. Nigeria’s money supply is growing at 15.19%/yr, ABOVE Hanke's Golden Growth Rate of ~11.83%-14.83%/yr, a rate consistent with Nigeria’s 6%-9%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/367h7H4ytf

By Steve Hanke

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

Social•Feb 10, 2026

MicroStrategy’s Bitcoin Bet Costs More Than Gold

Did MicroStrategy Make a Bad Bet on Bitcoin? Bitcoin made the headlines, but MicroStrategy’s numbers? Not so pretty. I’d have preferred gold, silver, or even interest-bearing cash. Opportunity cost matters — don’t get caught chasing hype. Bitcoin #PeterSchiff #CryptoNews #Investing #GoldVsBitcoin #FinanceTalk...

By Peter Schiff

Social•Feb 10, 2026

Dollar Weakening as Diverging Policies Boost Global Assets

I keep playing through the potential outcomes over the coming months and I have a very difficult time painting a bull case for the dollar. I expect: 1. Monetary policy divergence widens (more dovish US vs RoW/Japan) 2. Capital flight risk as...

By Quinn Thompson

Social•Feb 10, 2026

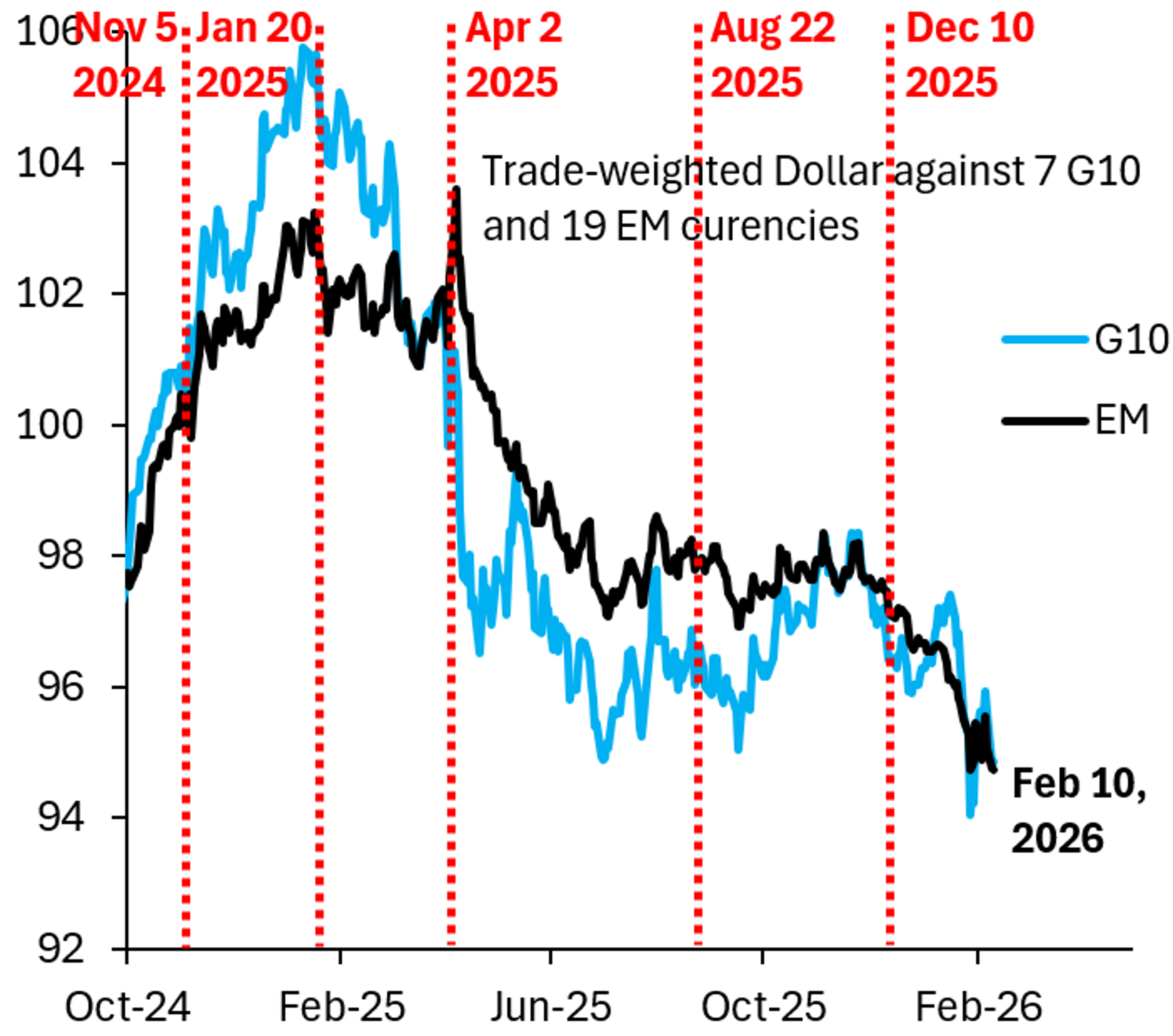

Dollar vs EM Hits New Low, Signaling Further Weakness

The Dollar versus EM today is down to a new low, which is below its level 2 weeks ago at the height of Greenland headlines. It's the Dollar versus EM you want to watch for future direction. The signal it's...

By Robin Brooks

Social•Feb 10, 2026

NFP Outlook: Expectation Management Raises 23K vs 15K

#NFP tomorrow. After yesterday's verbal managing of expectations from Hassett and Miran. Will NFP hit 23K ? 15K ?

By Ashraf Laidi

Social•Feb 10, 2026

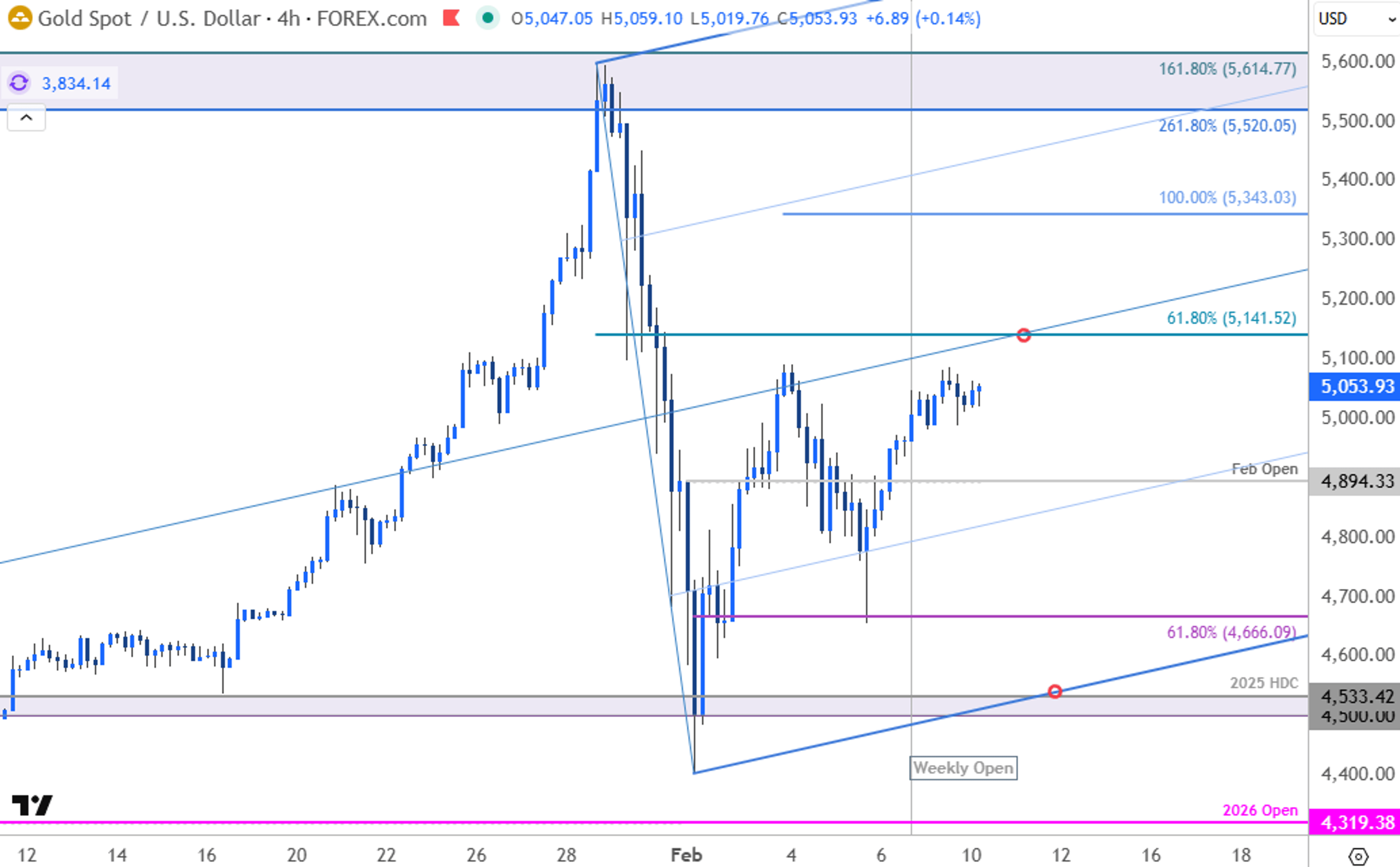

Gold Nears Breakout: From Panic to Directional Pause

Gold Price Short-term Outlook: XAU/USD From Panic to Pause- Breakout to Decide Direction https://t.co/e2vca3B4h2 $XAUUSD Daily & 240min Charts https://t.co/BsGu6wpKlh

By Michael Boutros

Social•Feb 10, 2026

U.S. Stocks Under Pressure as SPX/VEU Hits Near Two‑Year Low

The 'sell America' trade pressure seems to be picking up again. The SPX-VEU (rest of world equity ETF) ratio is the lowest since April 22nd. A little further and it is a two year low. Adding the DXY Dollar Index in for...

By John Kicklighter

Social•Feb 10, 2026

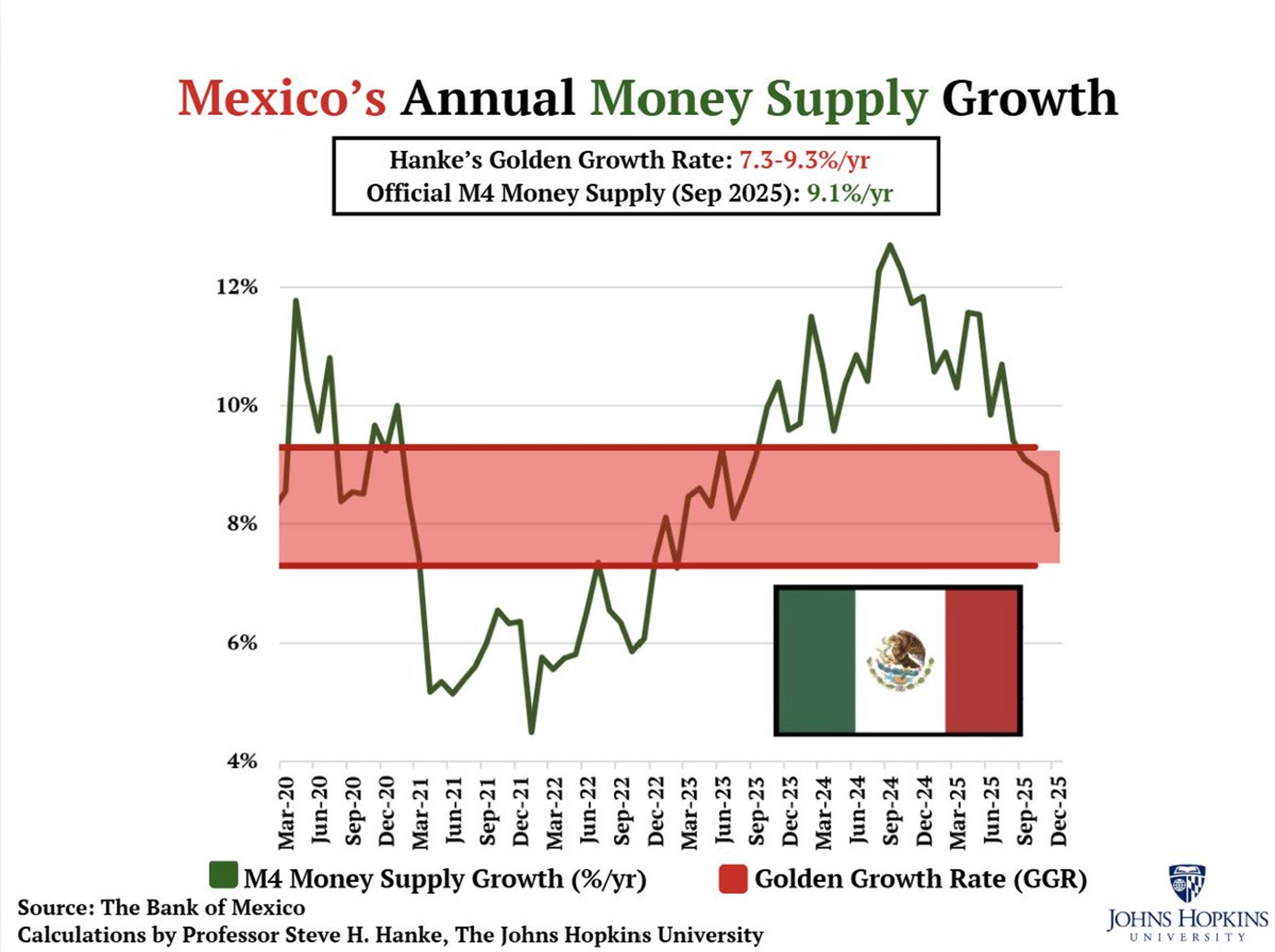

Mexico's Inflation On Target, Money Supply Within Golden Growth

Mexico’s inflation rate is ON TARGET at 3.65%/yr Mexico’s money supply (M4) is growing at 7.91%/yr, WITHIN Hanke's Golden Growth Rate of ~7.3%-9.3%/yr, a rate consistent with Mexico’s 2%-4%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/4w05Yr94Mz

By Steve Hanke

Social•Feb 10, 2026

Banking Chief Calls for Urgent European Payment Alternatives

European alternatives to Visa and Mastercard ‘urgently’ needed, says banking chief - https://t.co/TJ18SQs5Bg via @FT

By Ashraf Laidi

Social•Feb 10, 2026

December US Retail Sales Stall, Missing Growth Forecasts

US December Retail Sales comes in flat vs expected 0.4% - previously 0.6% m/m Core retail sales also flat vs expected 0.3% - previously 0.4% m/m

By Michael Boutros

Social•Feb 10, 2026

Dollar Stabilizes, Still Strong vs G10; Yen Diverges

Greenback Consolidates after Yesterday's Shellacking: After yesterday’s sharp losses, the US dollar is mostly consolidating with a firmer bias against the G10 currencies. The yen is the exception. The unexpected post-election gains have been extended… https://t.co/s4awtQJ5o7 https://t.co/Xlf89Ydd1E

By Marc Chandler

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

Alphabet's Sterling Bond Hits Record £4.5bn Demand

#Alphabet sterling bond raises a record £4.5 bn, with £24 bn in bids. They may start borrowing on behalf of Bessent if it continues like this $GOOG

By Ashraf Laidi

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler

Social•Feb 10, 2026

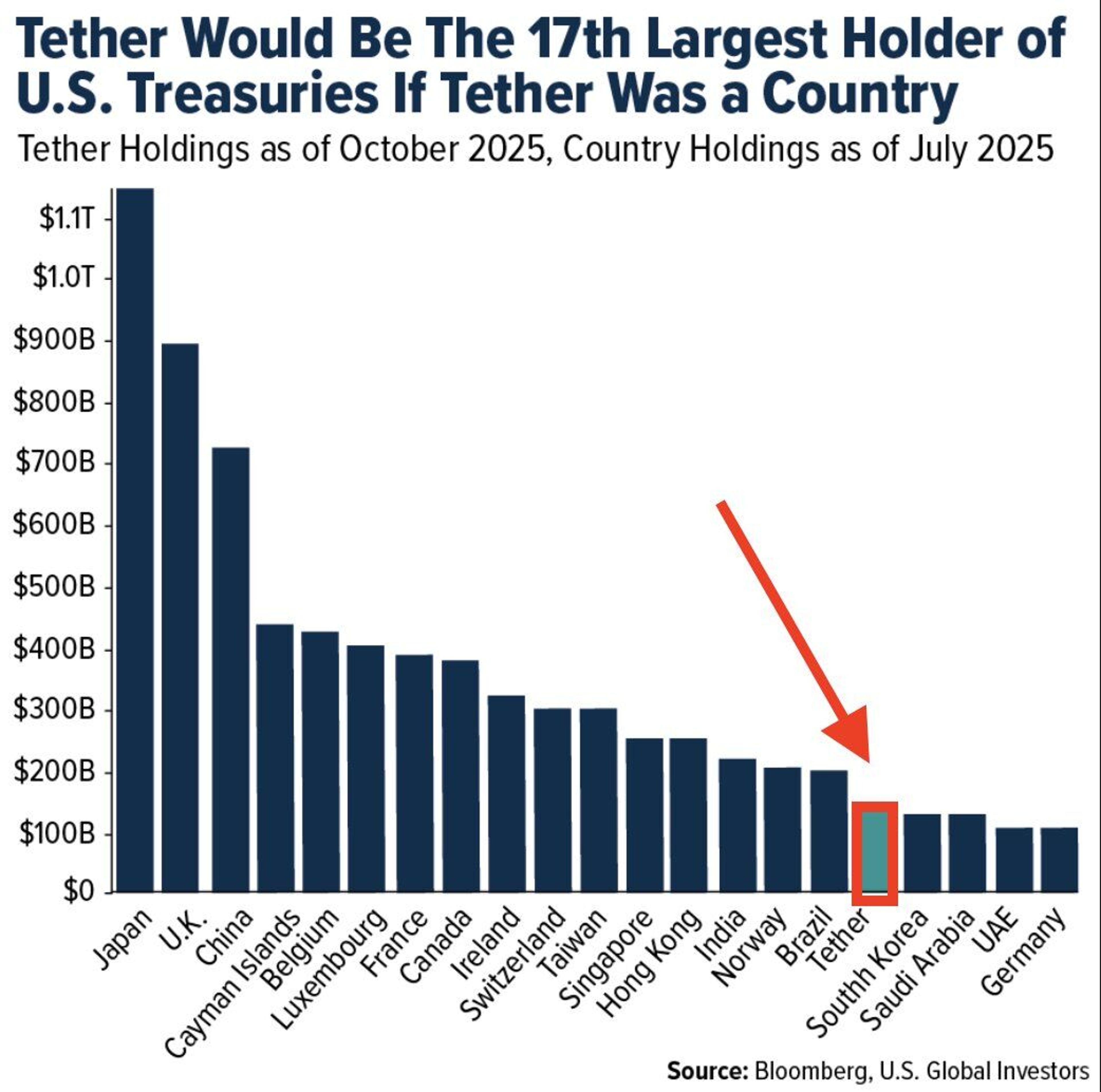

Tether Would Rank 17th in US Treasury Holdings

Who is the world's largest holder of US Treasuries? 🥇 Japan 🥈 United Kingdom 🥉 China But here's the wildest part - if Tether were a country, it would be the 17th largest holder of US Treasuries https://t.co/JoaE6JzFI9

By Kathy Lien

Social•Feb 10, 2026

Macron Urges EU to Adopt Eurobonds Now

Emmanuel Macron: « Now is the time for the EU to launch a joint borrowing capacity, through eurobonds. » https://t.co/NqqbjjecXk

By Frederik Ducrozet