🎯Today's Currencies Pulse

Updated 1h agoWhat's happening: Rupee slides to 90.95 per dollar as dollar strength and oil prices rise

The Indian rupee fell to 90.95 against the U.S. dollar in early Friday trade, down 27 paise from its previous close. The move was prompted by a firmer dollar, Brent crude climbing to $71.77 a barrel, and heightened U.S.-Iran tensions. Domestic equities also weakened, with the Sensex shedding 150 points.

News•Feb 17, 2026

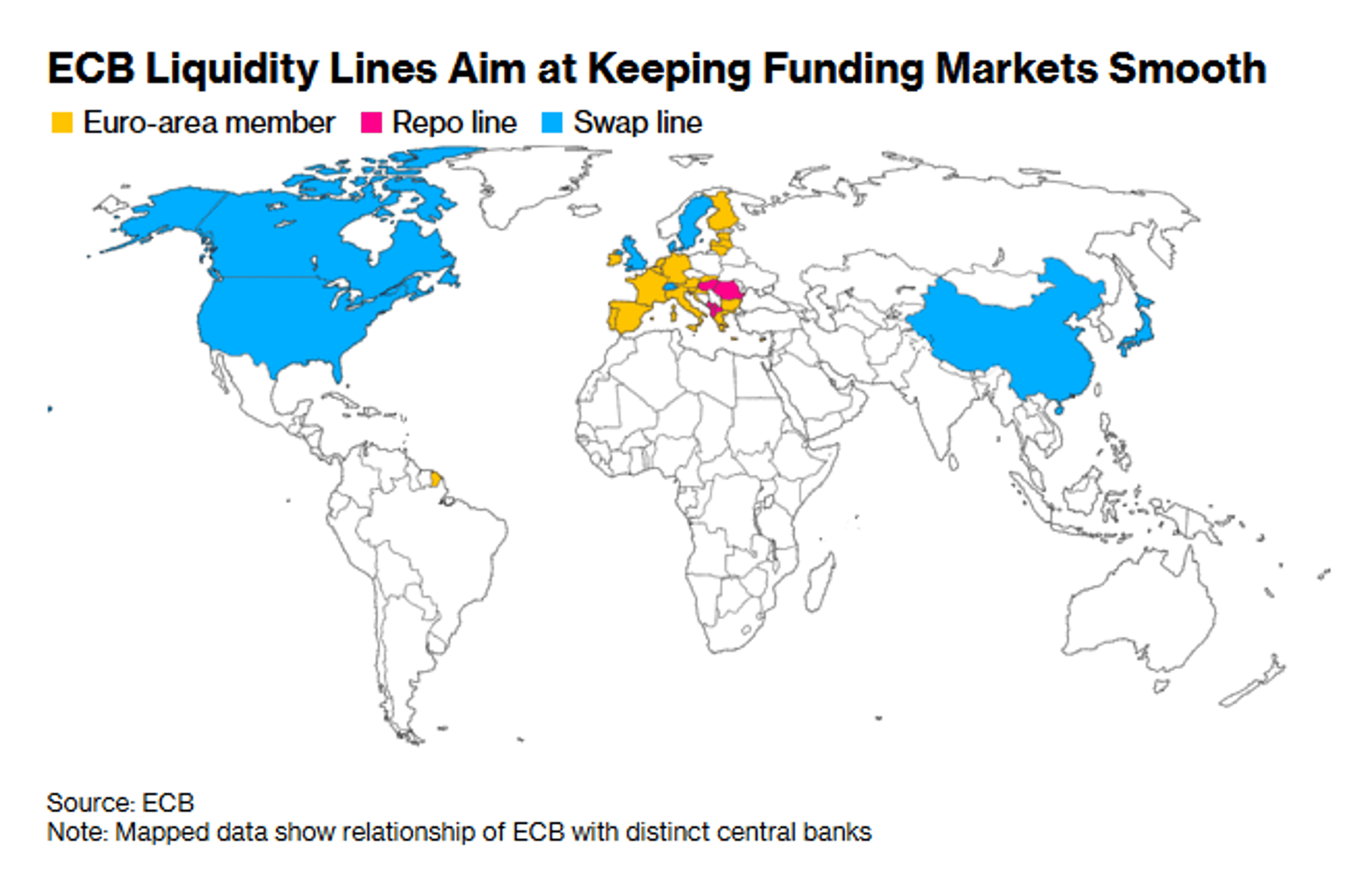

Philip R Lane: Bulgaria and the Euro

Philip R. Lane praised Bulgaria’s smooth euro cash changeover, noting that euros now represent 70 percent of cash in circulation as the dual‑lev/euro period ends on 31 January 2026. The speech highlighted Bulgaria’s new seat at the ECB Governing Council, giving the country a voice in euro‑area monetary policy. Lane outlined how a larger monetary union improves liquidity, market depth and the capacity for infrastructure projects such as the digital euro. He also warned that Bulgaria must pursue governance reforms, prudent fiscal policy and macro‑prudential safeguards to manage faster growth and inflation risks.

By BIS — Press Releases

Social•Feb 17, 2026

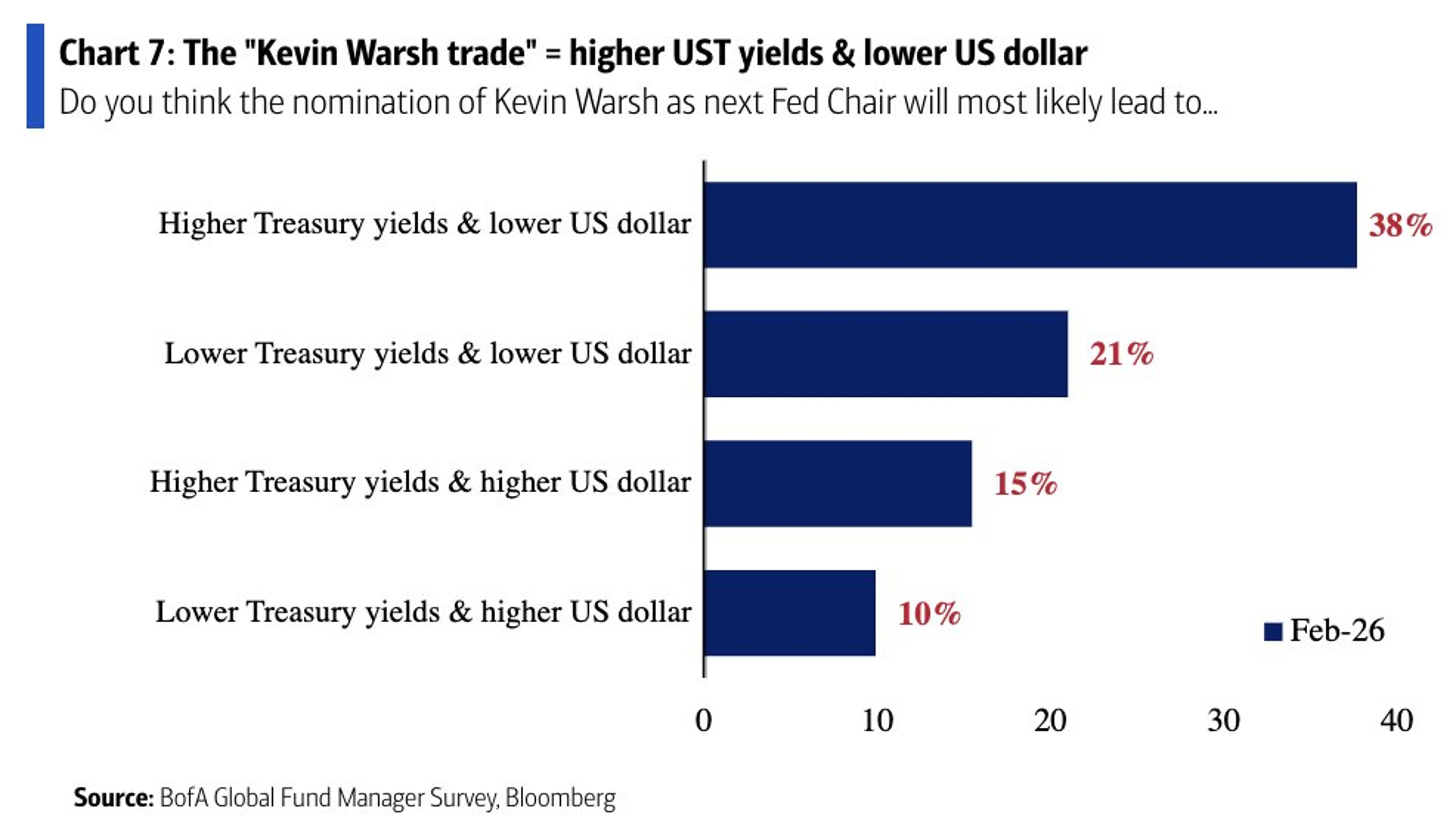

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

News•Feb 17, 2026

Christine Lagarde: Preparing for Geoeconomic Fragmentation

European Central Bank President Christine Lagarde warned that deepening supply‑chain interdependence now poses a security risk, prompting Europe to shift toward strategic autonomy. She outlined three policy levers—diversification, indispensability and independence—to reduce reliance on distant suppliers, especially in electronics, chemicals...

By BIS — Press Releases

News•Feb 17, 2026

Stablecoins Gain Ground for Paychecks and Daily Spending: BVNK Report

A BVNK‑commissioned YouGov survey of 4,658 crypto‑savvy adults across 15 countries shows that 39% receive income in stablecoins and 27% use them for everyday payments, attracted by lower fees and faster cross‑border transfers. Respondents hold an average of $200 in...

By Cointelegraph

News•Feb 17, 2026

BofA Survey Flags Dollar Bearish Bets at over a Decade High. Here's What It Means for Bitcoin

Bank of America’s February survey shows investor exposure to the U.S. dollar is at its most bearish since early 2012, marking a record underweight stance. Historically, a weaker dollar has acted as a bullish tailwind for bitcoin, but since early...

By CoinDesk

Social•Feb 17, 2026

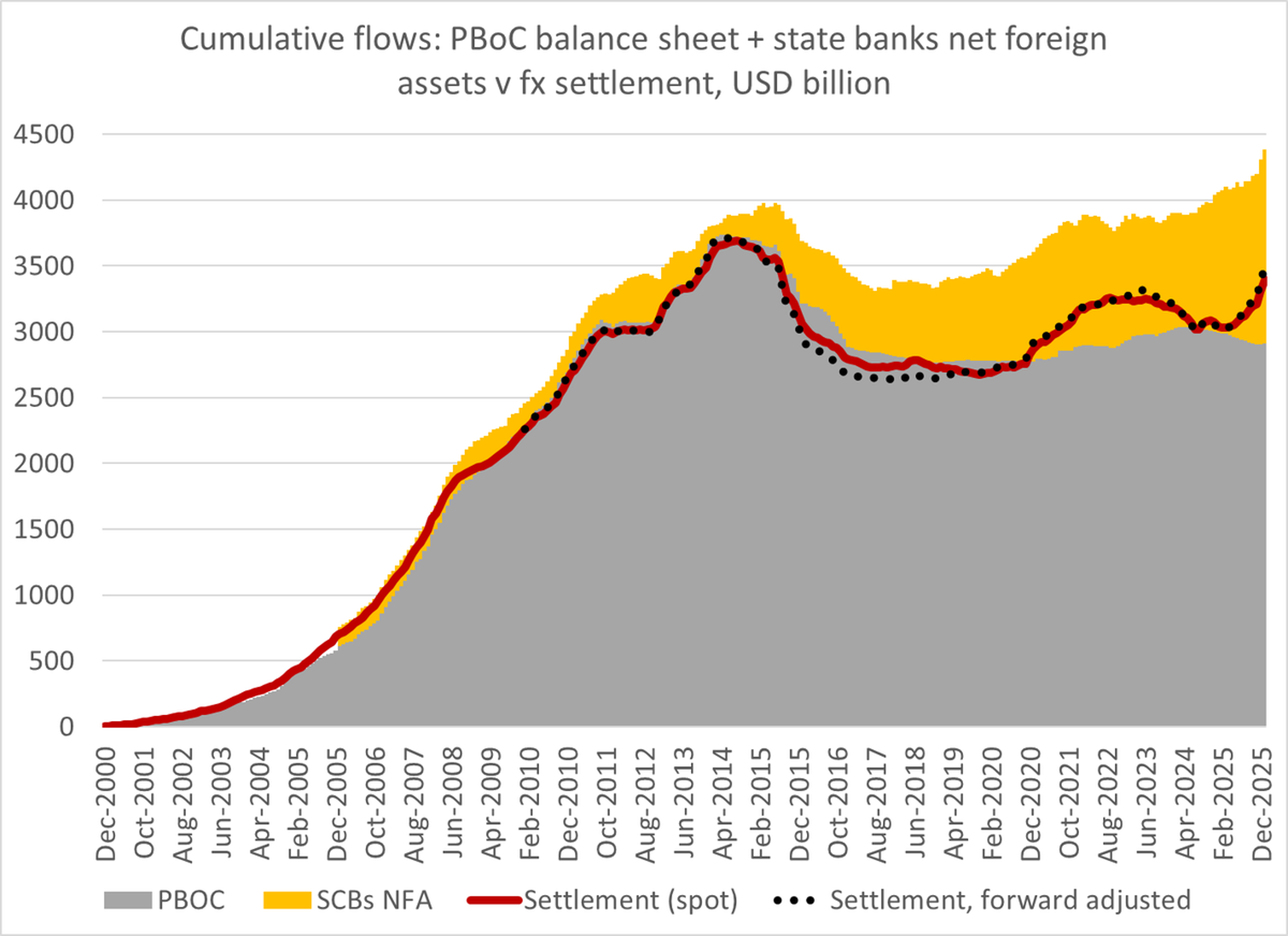

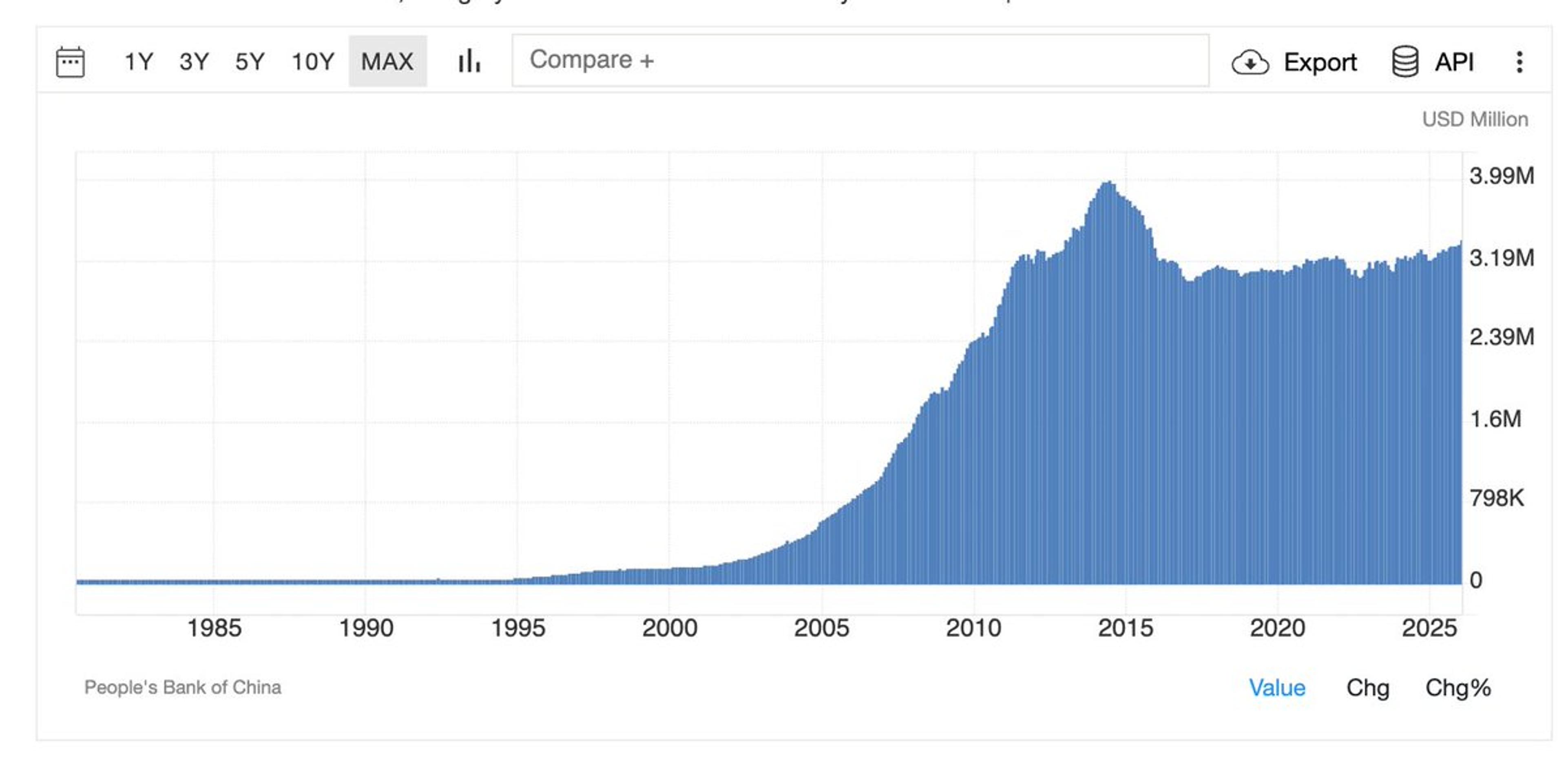

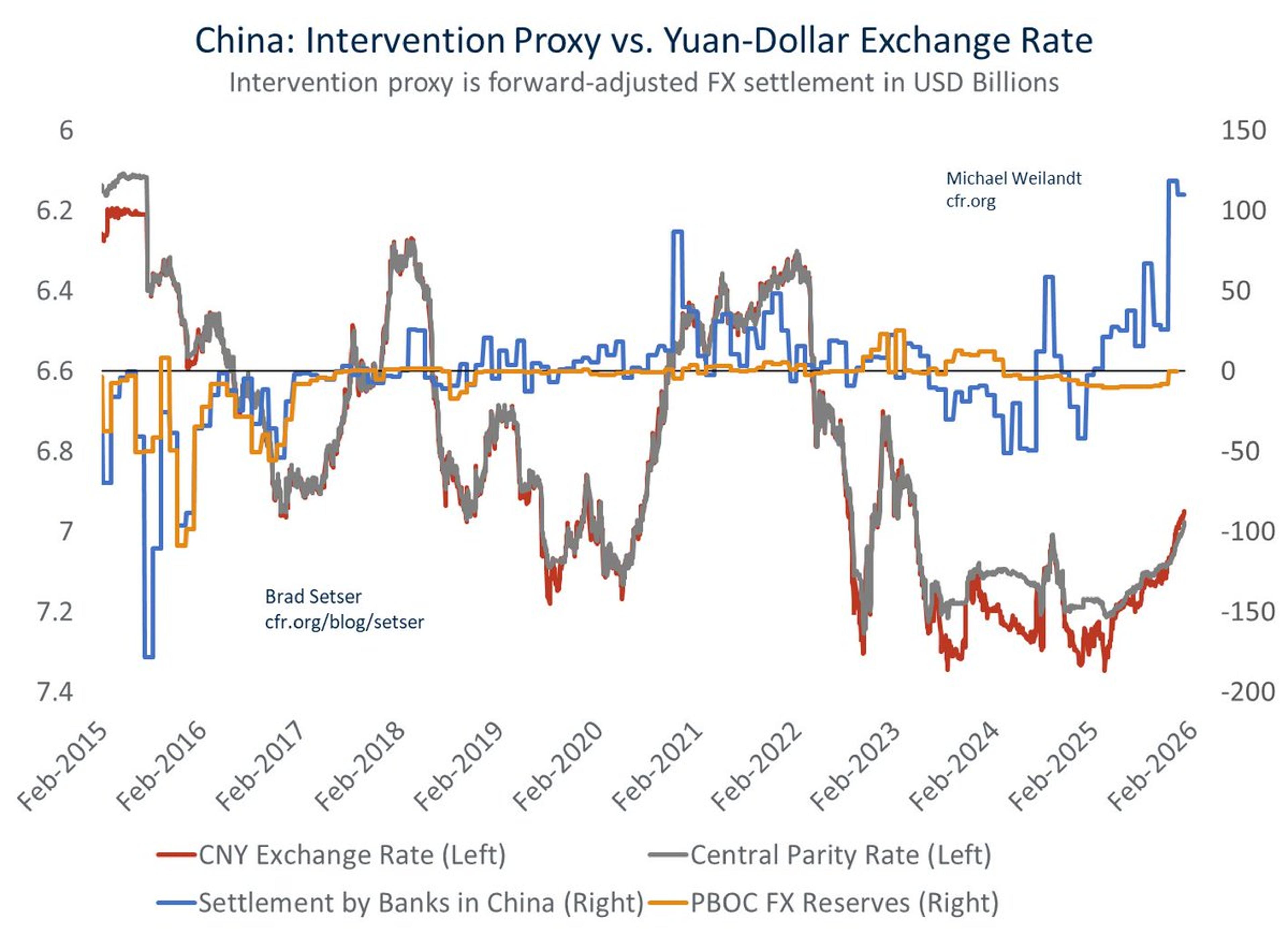

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

Social•Feb 17, 2026

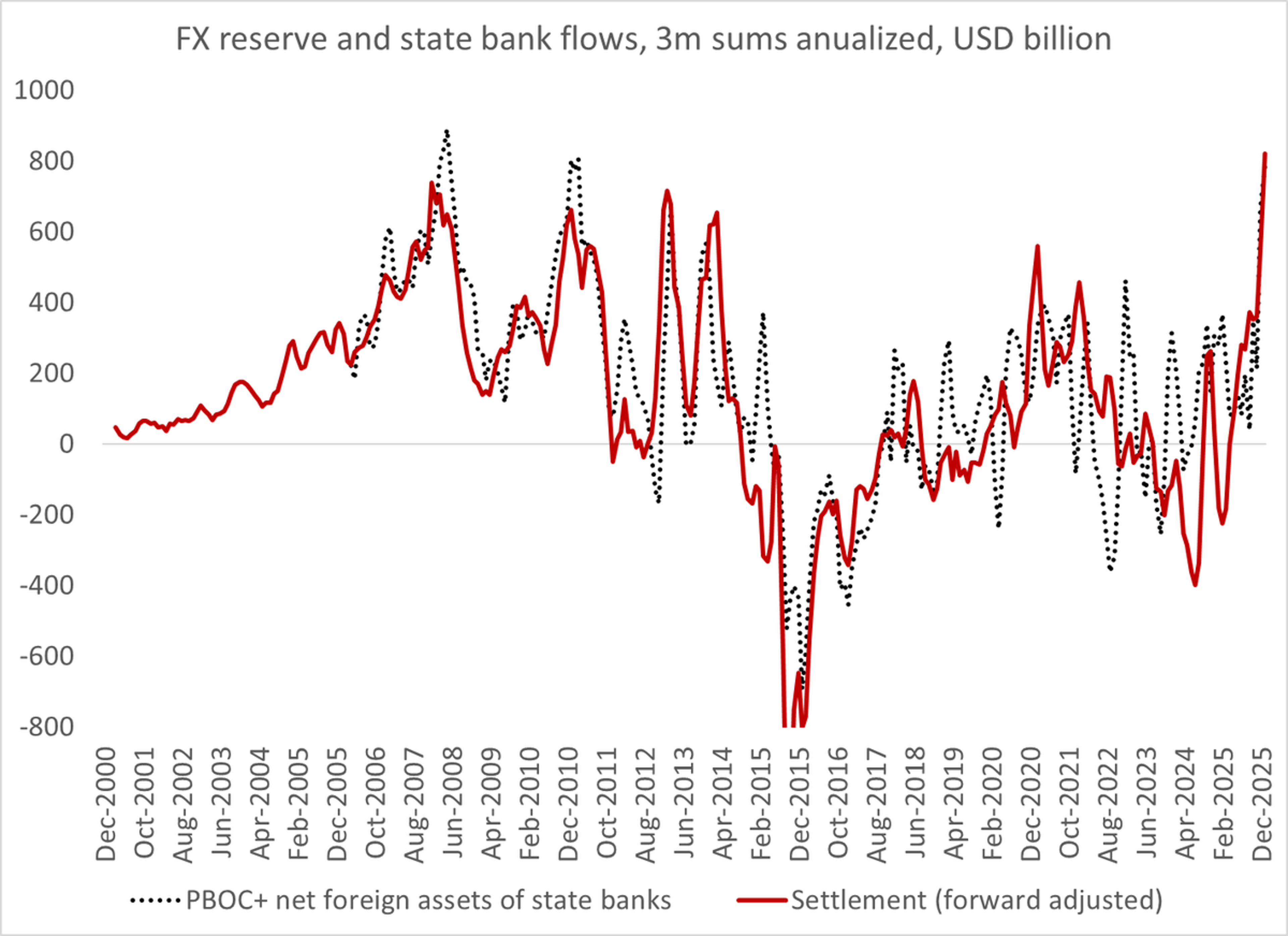

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

News•Feb 17, 2026

US Dollar Positioning Hits Record Underweight in Bank of America Survey

Bank of America’s FX sentiment survey shows net US dollar exposure at a record underweight, the most negative level since the survey began in January 2012. Short positions have surged to extreme levels, surpassing the lows recorded in April 2023....

By ForexLive — Feed

Social•Feb 17, 2026

Iranian Rial Plummets, Becomes World's Second Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Iranian rial ranks as the WORLD'S 2ND WORST currency. The rial has depreciated by 44% against the USD over the past year. RIAL = THE GREAT DESTABILIZER. https://t.co/06OiclsaSq

By Steve Hanke

News•Feb 17, 2026

BOJ Likely to Raise Rates 25bp April, Former Board Member Says. Gradual Move Toward 1.25%

Former Bank of Japan board member Seiji Adachi says the central bank is most likely to raise rates in April rather than March, waiting for clearer wage and inflation data. The BOJ’s December hike to 0.75% marked the first move...

By ForexLive — Feed

News•Feb 16, 2026

ICYMI: China to Remove Tariffs on Imports From 53 African Nations From May 1

China will eliminate tariffs on imports from 53 African nations starting May 1, 2026, expanding the preferential regime beyond the continent’s least‑developed economies. The zero‑tariff policy applies to every African country that maintains diplomatic ties with Beijing and is paired with a...

By ForexLive — Feed

News•Feb 16, 2026

FX Option Expiries for 17 February 10am New York Cut

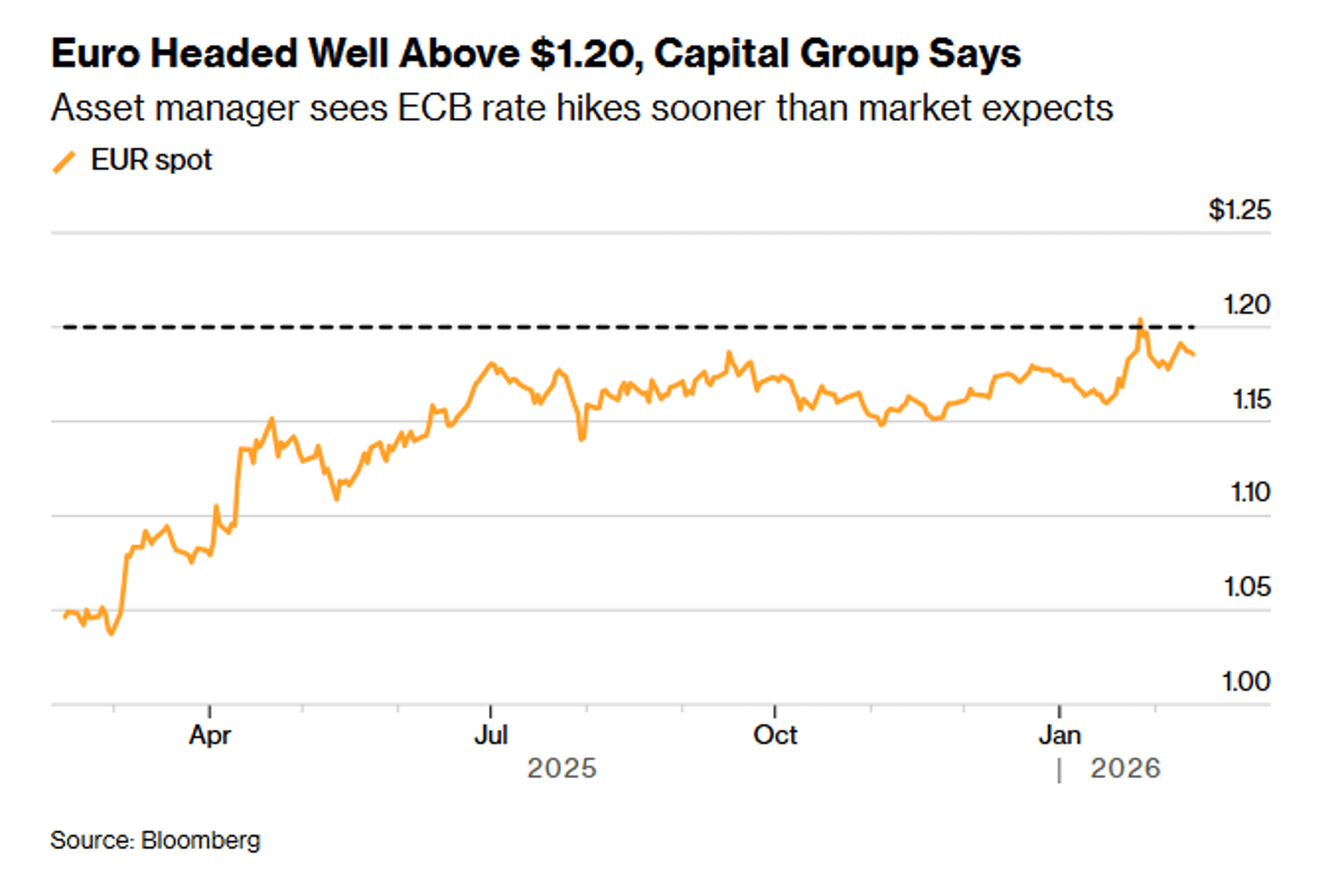

Investors received the FX option expiry list for 17 February 10 am New York cut, detailing strike levels and notional amounts across major pairs. EUR/USD options total roughly €2.6 billion at strikes 1.1900, 1.2000 and 1.2025. USD/JPY carries about $2.86 billion at 156.00 and 151.00,...

By ForexLive — Feed

News•Feb 16, 2026

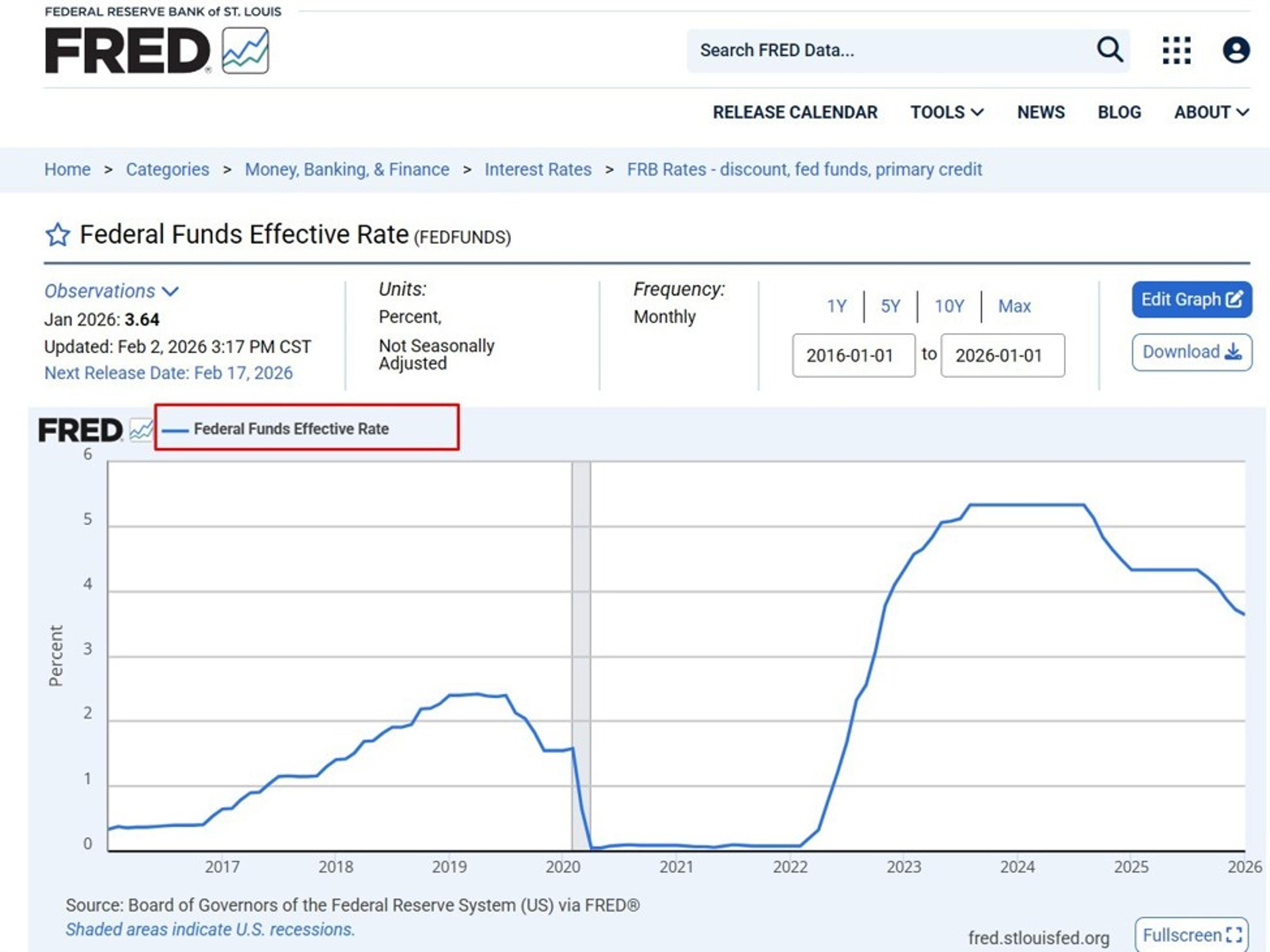

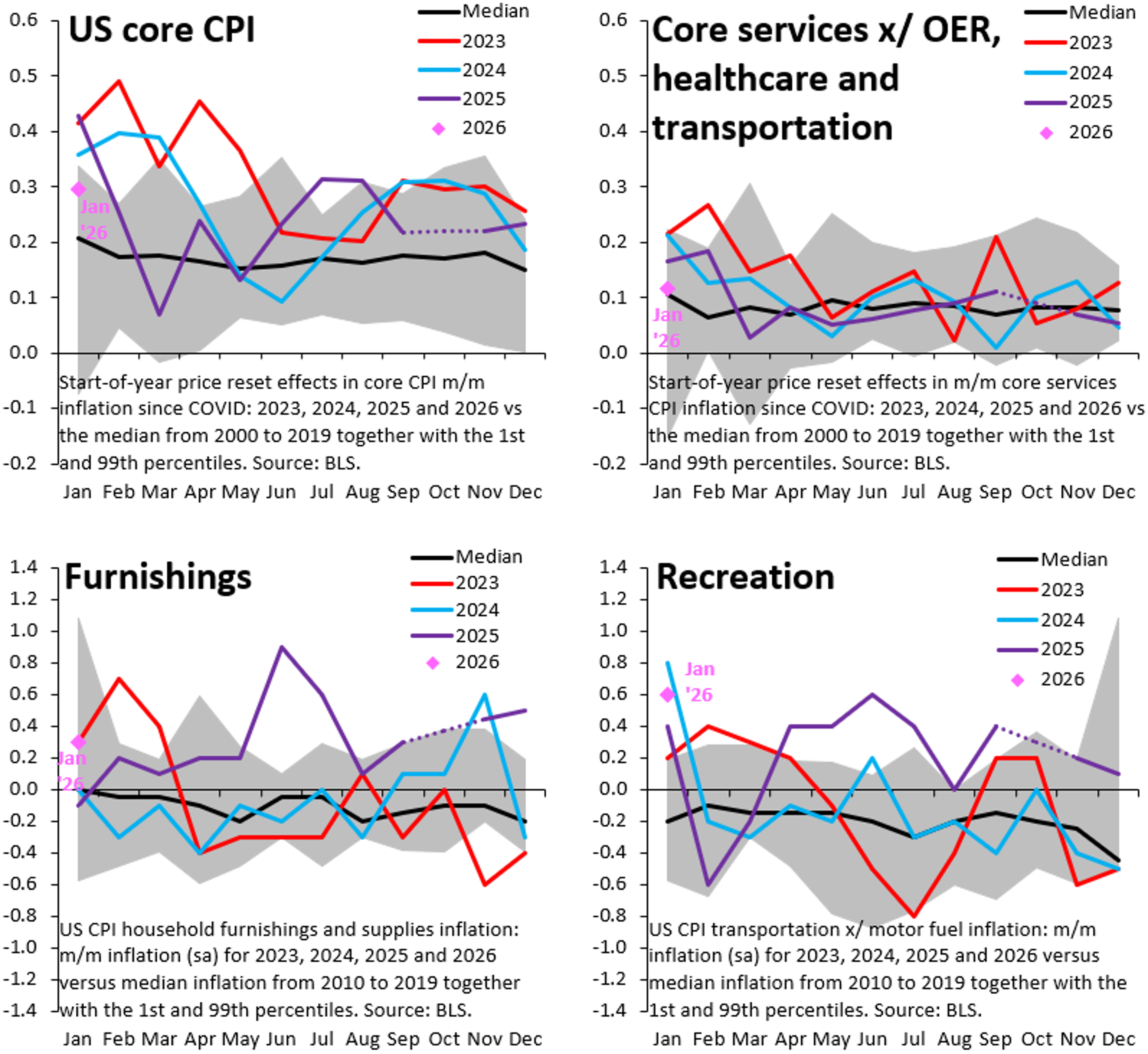

Soft Landing Looks More Plausible, but the Fed Isn’t Ready to Call It Done.

U.S. macro data are aligning for a potential soft landing, with core CPI easing to 2.5% year‑over‑year and unemployment slipping to 4.3% in January. While inflation is moving toward the Federal Reserve’s 2% goal, the Fed’s preferred gauge remains near...

By ForexLive — Feed

News•Feb 16, 2026

Germany‘s Central Bank President Touts Stablecoin and CBDC Benefits for EU

Bundesbank president Joachim Nagel endorsed the creation of a euro‑pegged retail CBDC and euro‑denominated stablecoins, arguing they would strengthen Europe’s payment independence. He highlighted that a wholesale CBDC would allow programmable payments in central‑bank money. Nagel warned that a surge...

By Cointelegraph

Social•Feb 16, 2026

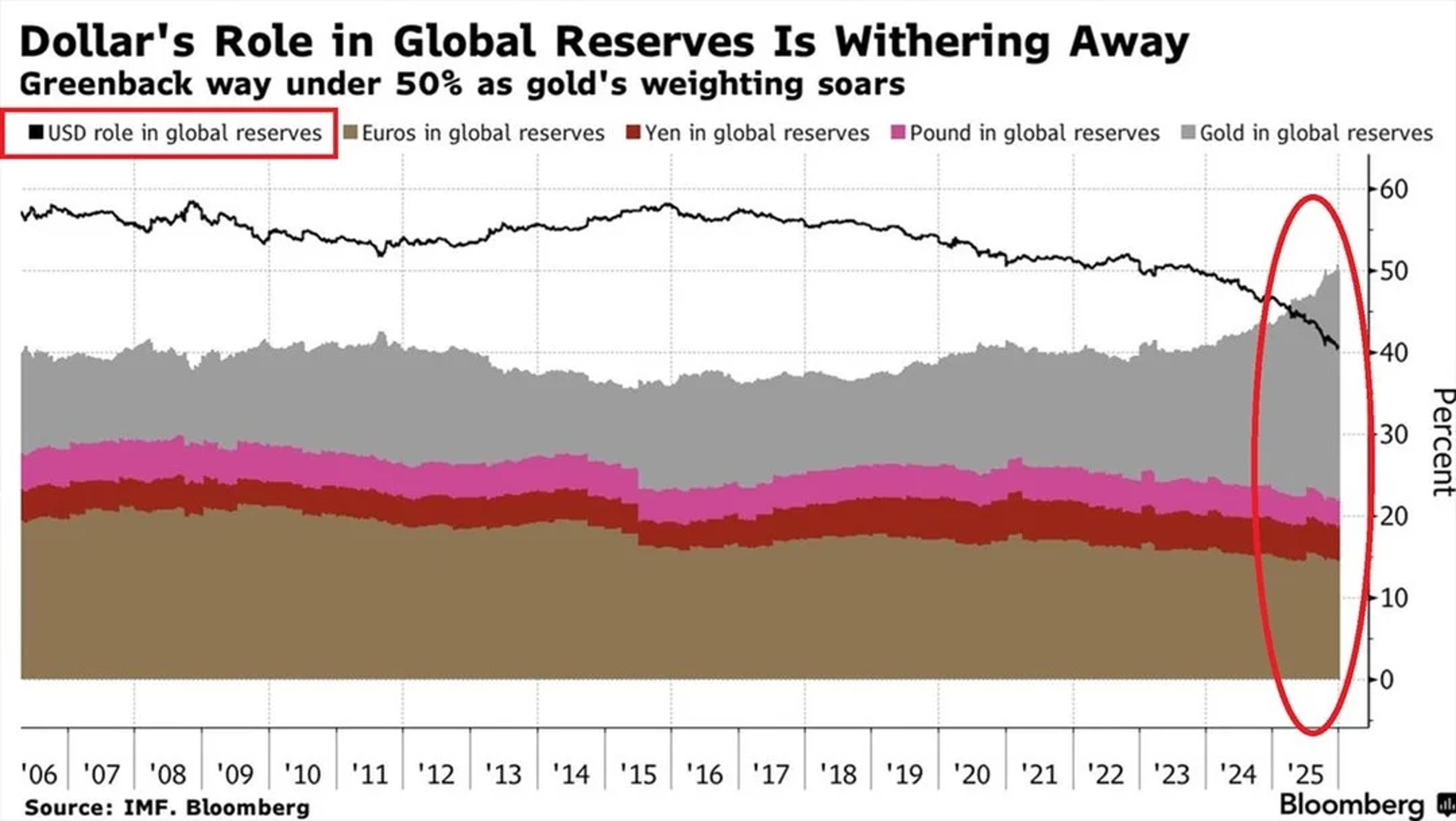

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

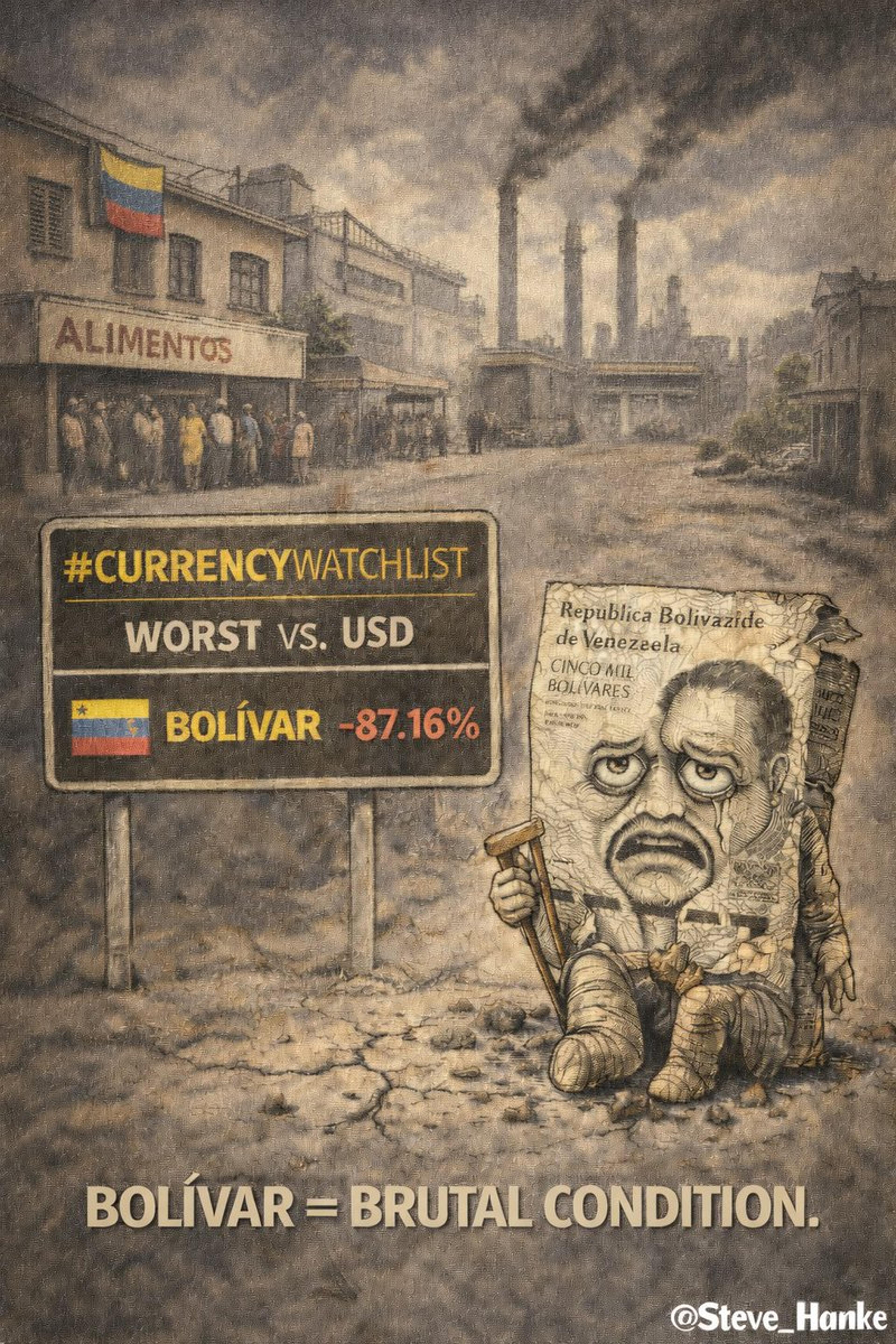

Venezuelan Bolivar Plummets 87%, Becomes World’s Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Venezuelan bolivar ranks as the WORLD'S WORST currency. The bolivar has depreciated by over 87% against the USD in the past year. IT’S TIME TO DUMP THE BOLIVAR AND REPLACE IT WITH THE US DOLLAR. https://t.co/dHtPzNew81

By Steve Hanke

News•Feb 16, 2026

AUD/USD Flat Amid US Dollar Strength, RBA Minutes Eyed

The Australian dollar held near 0.7072 against the U.S. dollar on Monday as a firmer greenback limited upside. The pair slipped from three‑year highs of 0.7147 after U.S. CPI showed inflation easing to 2.4% and unemployment edging down to 4.3%,...

By FXStreet — News

News•Feb 16, 2026

Plus500 CEO, CFO, CMO to Sell 1.5M Shares

Plus500’s chief executive, chief financial officer and chief marketing officer announced the sale of 1,500,000 ordinary shares, representing roughly 2.14% of the company’s issued capital. The transaction will be executed on the secondary market through Goldman Sachs International, with Panmure...

By FX News Group — Feed

News•Feb 16, 2026

RBI Issues Draft Norms for Reporting on Forex Derivative Transactions Involving Rupee

The Reserve Bank of India released draft norms requiring Authorised Dealer Category‑I banks to report all rupee‑denominated foreign‑exchange derivative transactions undertaken by their related parties worldwide. This follows earlier steps that mandated primary dealers and banks to disclose rupee interest‑rate...

By The Economic Times – Markets

News•Feb 16, 2026

India’s Game-Changing Digital Money Model

India’s Unified Payments Interface (UPI) has become the world’s largest real‑time payments network, handling billions of free transactions daily. Built on a public, open‑source infrastructure managed by the National Payments Corporation of India, UPI lets banks, fintechs and merchants interoperate...

By Project Syndicate — Economics

Social•Feb 15, 2026

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

Presidents Day Market Closure; Join Tuesday Technical Outlook Webinar

**Reminder: Markets Closed tomorrow in observance of Presidents Day Weekly Technical Outlook Webinar will be on Tuesday at 8:30am ET Interactive Session: https://t.co/EpyXNC6zVR Live Stream on YouTube: https://t.co/iiptWpNEz9

By Michael Boutros

Blog•Feb 15, 2026

Unpacking the Latest Finance News From China: Key Trends and Market Insights

China’s latest five‑year plan emphasizes a shift from property‑driven growth to technology, targeting near‑5 % GDP expansion in 2026 and projecting tech to account for 18.3 % of output by 2026. The renminbi has appreciated past the 7.0 per dollar mark, indicating reduced central‑bank...

By HedgeThink

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 15, 2026

ECB Rate Hike Expected to Strengthen Euro, Says Capital Group

The ECB will raise interest rates at least once this year, significantly boosting the euro against the dollar, according to Capital Group, the $3.3 trillion asset manager https://t.co/CFxgbQlz0Q via @Sujata_markets https://t.co/6EBSHD6SYI

By Zöe Schneeweiss

News•Feb 13, 2026

US Supreme Court Says Next Friday Will Be a Decision Day

The U.S. Supreme Court announced three decision days—Feb. 20, 24, and 25—when it will issue opinions, though it has not disclosed which cases will be decided. Lawmakers in the House have voted against new tariffs and the Senate is expected...

By ForexLive — Feed

Social•Feb 15, 2026

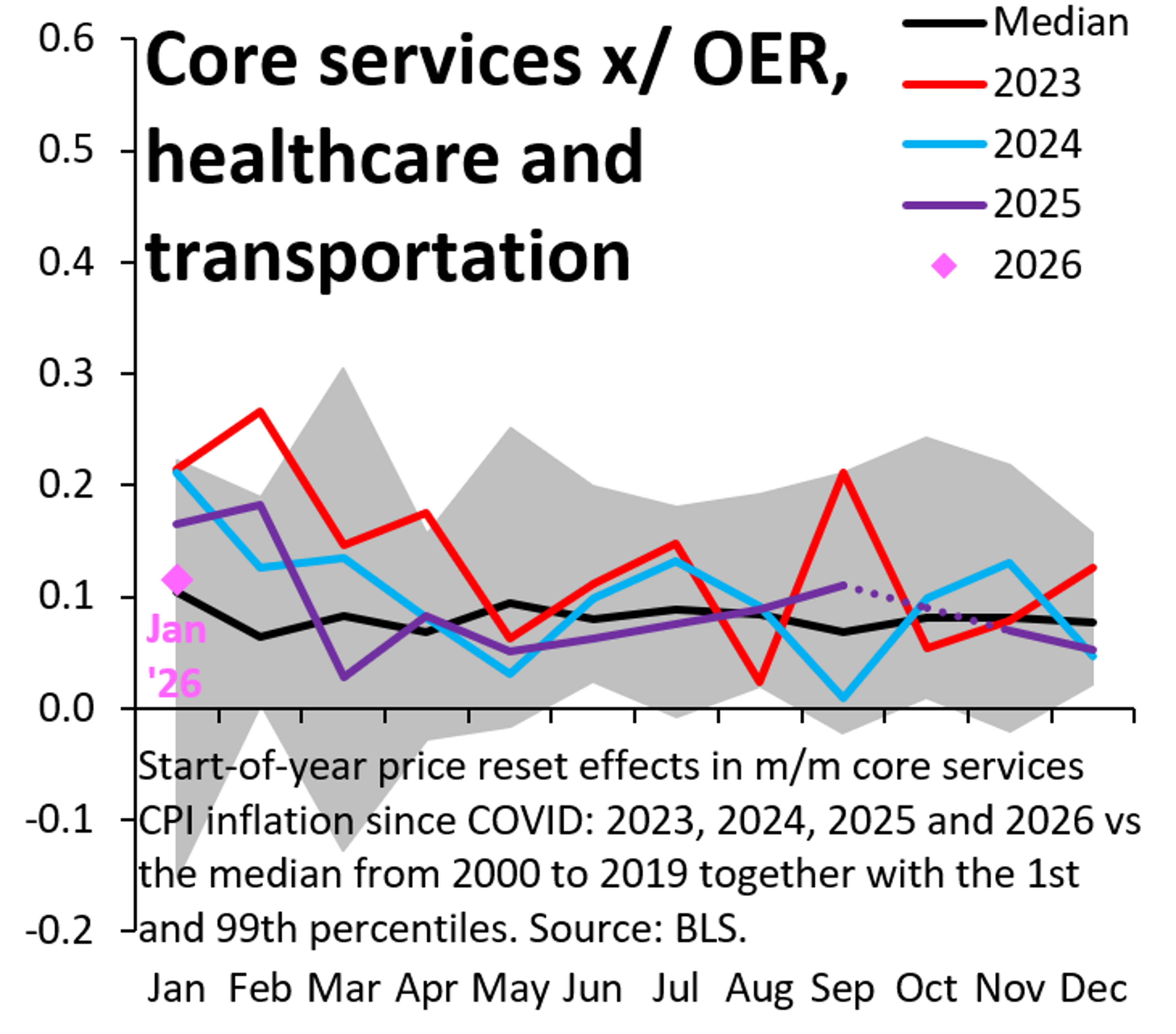

Core Services Inflation Stays Tame, No Overheating Signs

There's lots of commentary that US inflation will overheat, but there's no sign of that. My proxy for core services inflation was very well behaved in all of 2025 (purple) and the Jan. '26 data point (pink) was much more...

By Robin Brooks

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and...

By ForexLive — Feed

Social•Feb 14, 2026

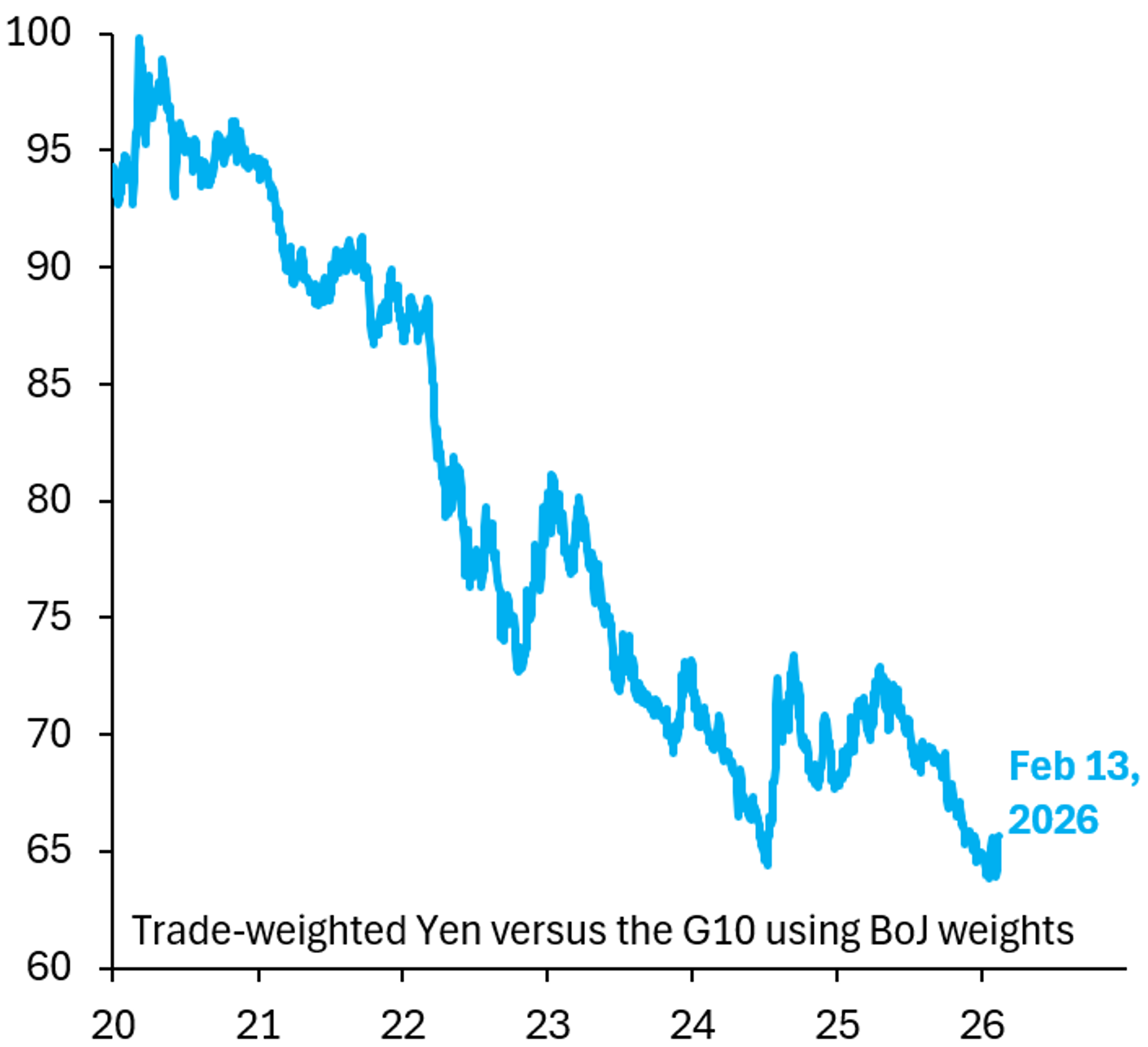

Yen Poised for New 2025 Lows Amid

The Yen will keep falling in trade weighted terms in 2025 and make new lows. Two reasons: (i) Japan remains in denial on the scale of its debt and what's needed to fix this; (ii) the Yen will be falling...

By Robin Brooks

Social•Feb 14, 2026

Global Data Week: FOMC Minutes to RBA Jobs

Buckle up! Its going to be a VERY Busy Data Week ahead👇 🇺🇸 US -FOMC Minutes -Q4 GDP -Empire State & Philly Fed 🇪🇺 EZ -IP -ZEW -PMIs 🇬🇧 UK -Jobs -Retail Sales -CPI -PMIs 🇯🇵 JP CPI & GDP 🇨🇦 CA -CPI -Retail Sales -Trade 🇳🇿 NZ -RBNZ -PSI -PPI 🇦🇺 AU -RBA MINUTES -JOBS -PMIS

By Kathy Lien

Podcast•Feb 13, 2026•24 min

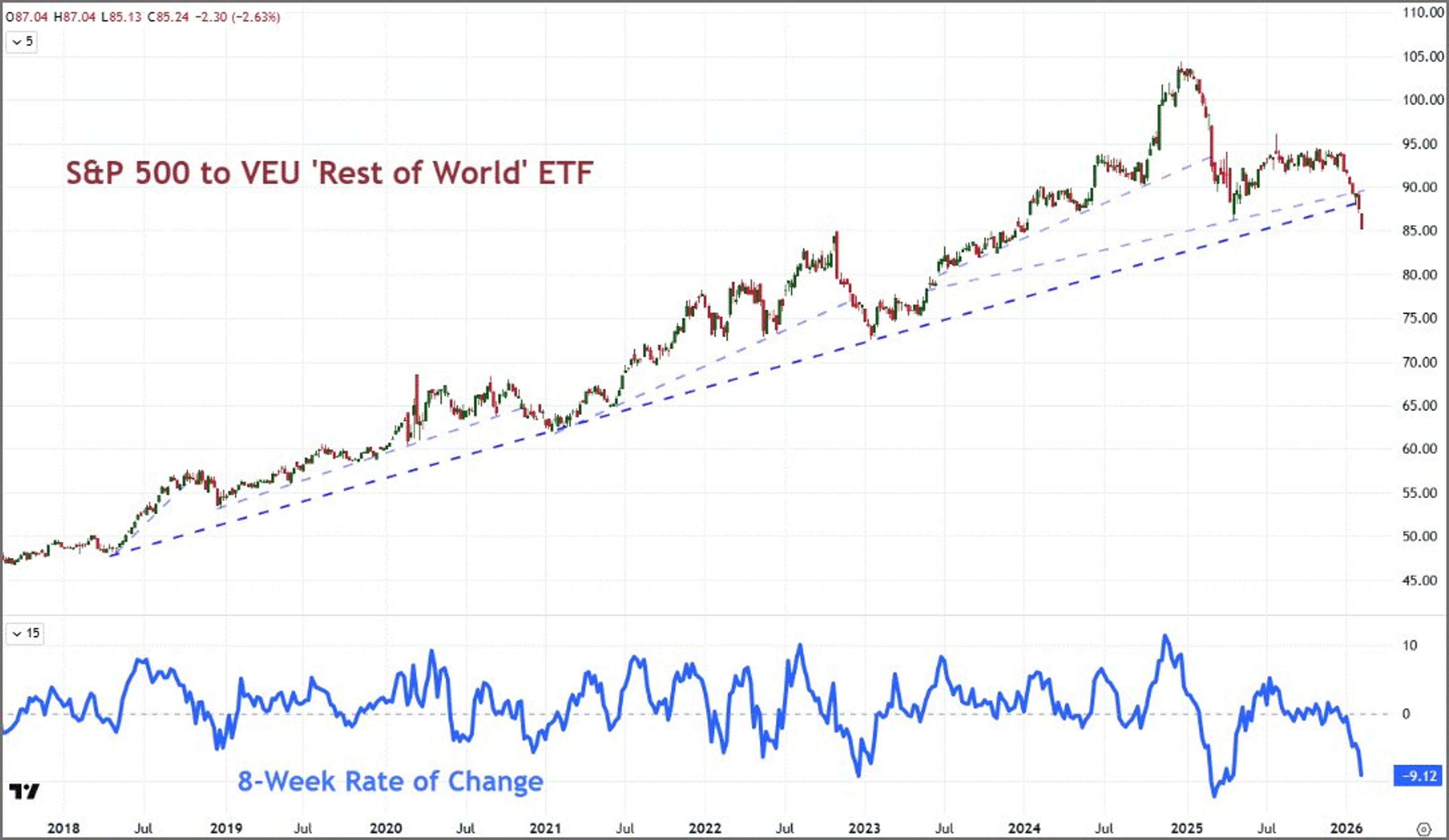

Global FX: How Much Is Too Much?

In this episode, J.P. Morgan Global Research analysts Arindam Sandilya, James Nelligan, and Patrick Locke examine the current foreign‑exchange (FX) outlook, focusing on how recent US equity stress and the relative underperformance of US stocks are influencing currency markets. They...

By At Any Rate

Social•Feb 14, 2026

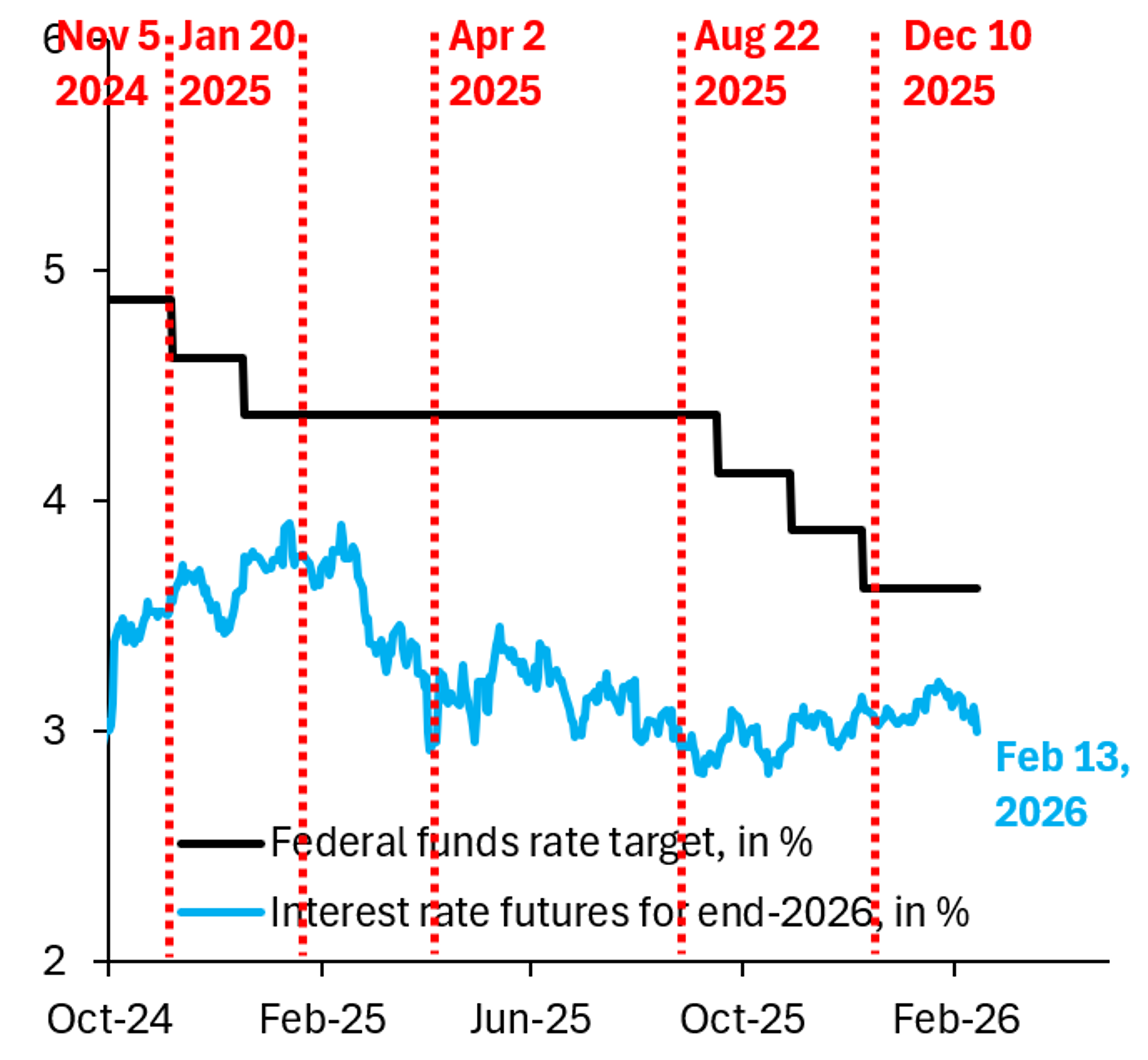

Warsh Fed Expected to Slash Rates 100bps, Dollar Falls

My forecast is for the Warsh Fed to cut policy rates by 100 bps in the 4 meetings after he takes over (June, July, September, October) ahead of midterms. Markets are moving in this direction, but still price only 63...

By Robin Brooks

Social•Feb 14, 2026

China's Foreign Exchange Reserves: Key Trends Unveiled

Deep dive into Chinese Foreign Exchange Reserves in today's version of the Chartbook Top Links. https://t.co/Yc09wNGpPK

By Adam Tooze

News•Feb 13, 2026

Stable Money Leads Gold & Silver ETF Surge on ONDC as Investors Turn to Safe, Regulated Products

Stable Money reported record transaction volumes in gold and silver ETFs as Indian investors gravitate toward SEBI‑regulated products amid near‑record precious‑metal prices. The platform now handles over 95% of mutual‑fund trades on the Open Network for Digital Commerce (ONDC), reflecting...

By Business Standard — Economy/Markets

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

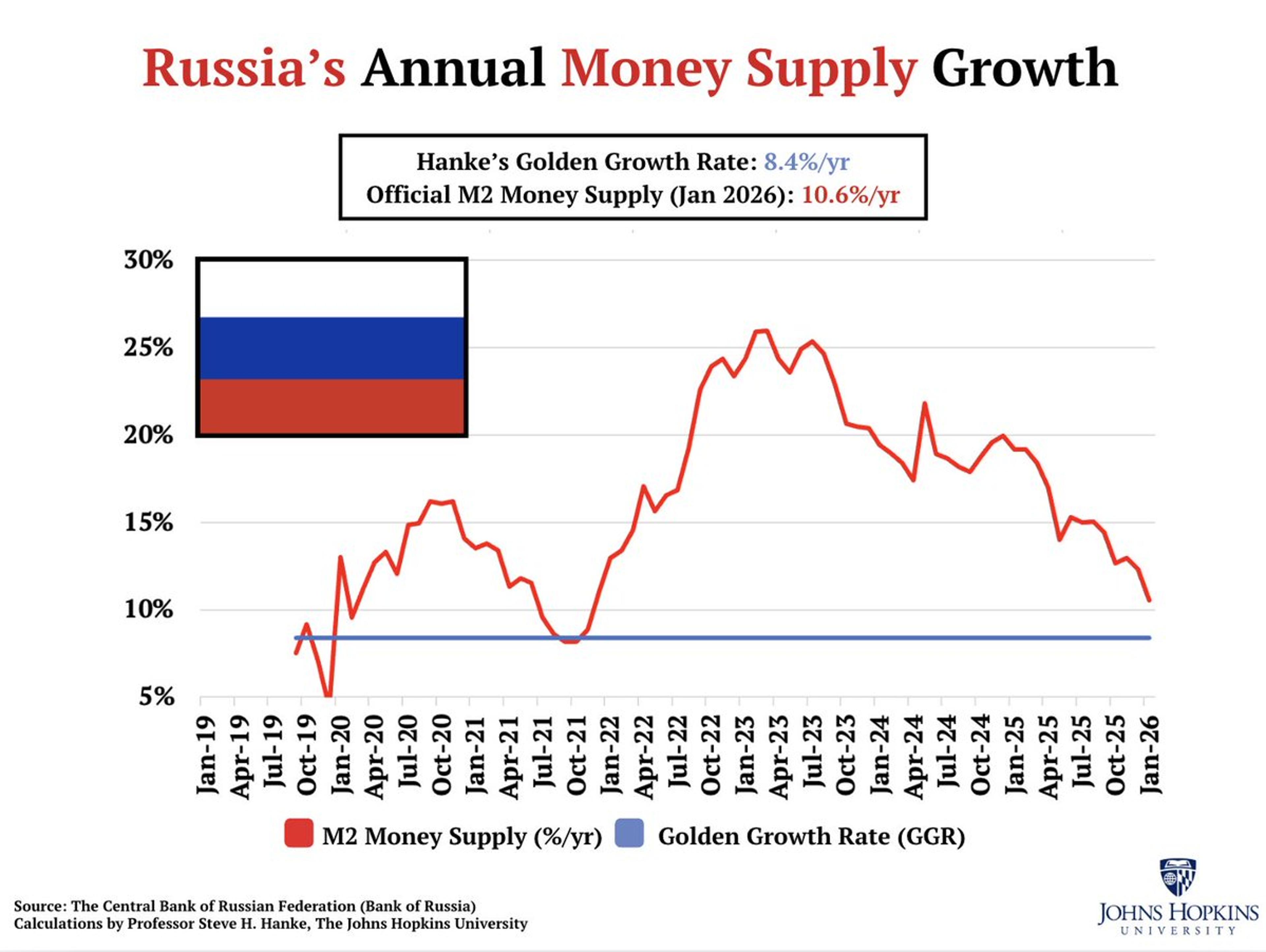

Russia's Inflation Spike Tied to Excess Money Supply

Russia’s inflation comes in at 6.0%/yr in January. That's ABOVE RU's 4%/yr target. RU's M2 money supply is growing at 10.6%/yr, ABOVE Hanke's Golden Growth Rate of 8.4%/yr, a rate consistent with hitting its inflation target of 4%/yr. THE INFLATION STORY =...

By Steve Hanke

Blog•Feb 13, 2026

Trade Tips From Washington DC

Ashraf Laidi notes recent Trump administration comments that imply a deliberately weaker US dollar ahead of today’s non‑farm payroll (NFP) release. He suggests the labor data could fall far short of the 68,000 consensus, echoing a pattern of "benign neglect"...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

ECB Overhauls Euro Liquidity to Strengthen Currency Appeal

ECB revamps euro liquidity offer to boost the common currency’s appeal https://t.co/w17qKKKWLo via @jrandow https://t.co/FlhSjhqFkD

By Zöe Schneeweiss

Social•Feb 14, 2026

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See...

By Marc Chandler

Blog•Feb 13, 2026

The Signal Is Finally Here

Forex analyst Ashraf Laidi unveiled a long‑awaited EUR/GBP chart, showing the pair’s daily price breaking out of a three‑month descending channel while the weekly chart preserved an 11‑month trendline support and is now bouncing higher. He suggests the breakout could...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

Markets Discount Fed Cuts Amid Japan Election, Tariff Uncertainty

Week Ahead: SCOTUS Decision on Tariffs? 8 Fed Officials Speak as the Market Discounts almost 65 bp of Cuts this Year: Last week began with the LDP's stunning victory in Japan. However, rather than sell-off as the market expected, the...

By Marc Chandler

Social•Feb 14, 2026

Dollar Decouples: US Growth Rises as USD Falls

Great piece by @katie_martin_fx in the @FT on the correlation break happening for the Dollar. As Trump leans more and more on the Fed, positive data surprises like payrolls no longer lift USD. The US will boom this year. But...

By Robin Brooks

Blog•Feb 13, 2026

Typical Trading Errors

Retail traders often sacrifice profits by exiting positions too early, driven by a desire for constant action rather than market fundamentals. Ashraf Laidi illustrates this with the USDJPY reaction to the February NFP surprise, where the pair swung more than...

By Ashraf Laidi – Intraday Market Thoughts

Social•Feb 14, 2026

Anti‑Trump Bias Skews Dollar and Inflation Forecasts

A lot of economic commentary is inflected by anti-Trump sentiment. That's why so many forecast the Dollar would go into a death spiral last year (it didn't) & why there's so much focus on inflation overheating now (it isn't). Yesterday's...

By Robin Brooks

Social•Feb 14, 2026

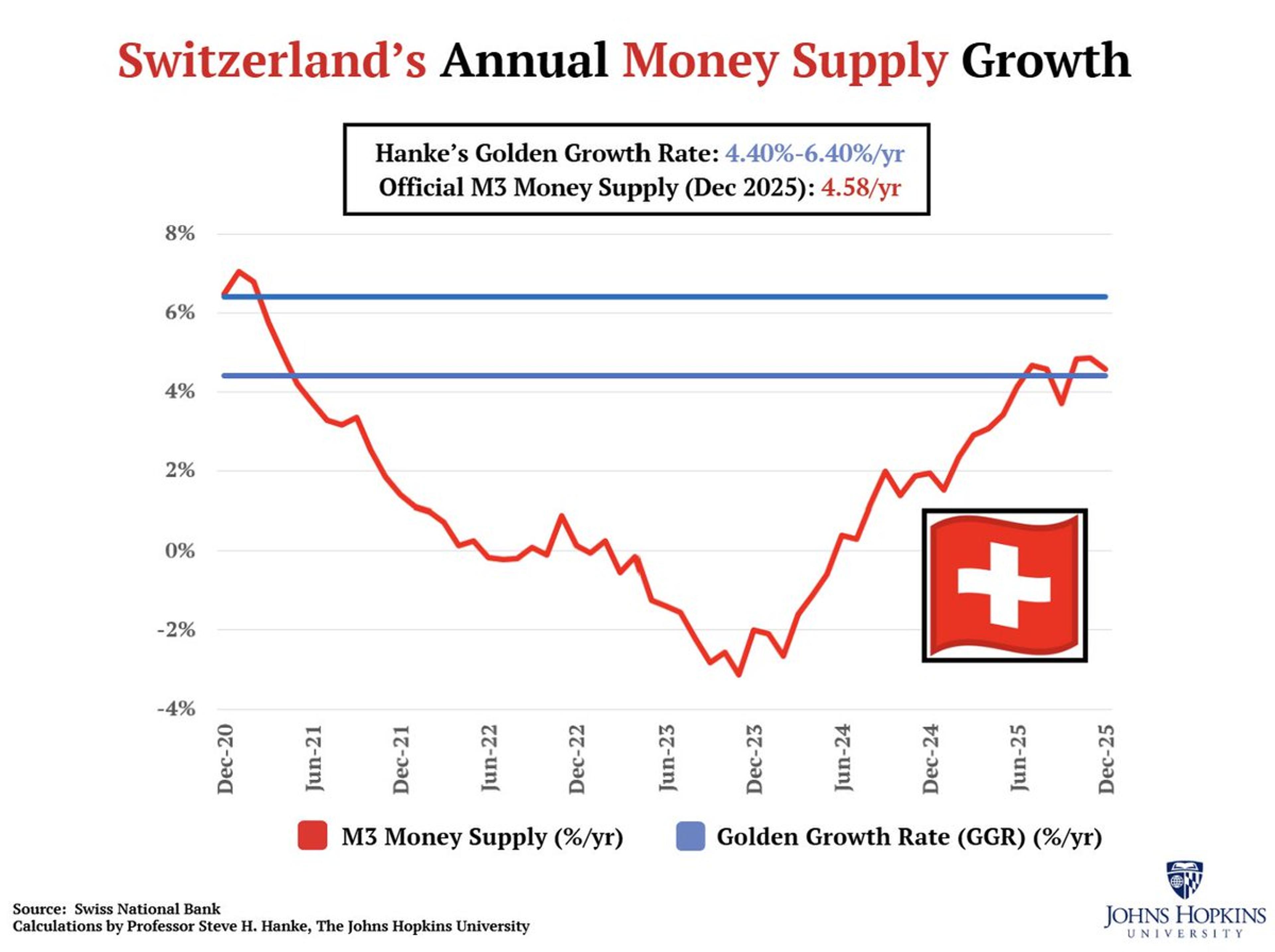

Swiss Inflation Near Zero as Money Growth Slows

Switzerland’s inflation rate is on the low end of its TARGET RANGE at 0.03%/yr. Switzerland’s money supply (M3) has been growing below Hanke's Golden Growth Rate of 4.40%-6.40%/yr since 2020 & is now only at 4.58%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

China’s $1.2 T Surplus Fuels Massive Market Interventions

One by product of China's exploding external surplus (goods surplus of $1.2 trillion, q4 current account surplus annualized is close to $1 trillion) is that it creates the raw material for some massive intervention numbers h/t @Mike_Weilandt for the chart https://t.co/PMvhatfgWh

By Brad Setser

Social•Feb 13, 2026

Assume BRICS' USD‑bypass Plans Are Real; Doubt USD Stability

Remember, every utterance from BRICS & Global South regarding potential new system to bypass USD is to be treated as if already operational & making material difference. And every piece of evidence that USD system isnt going anywhere is to be...

By Brent Johnson

Social•Feb 13, 2026

Market Prices Accelerating Fed Rate Cuts Through 2026

Notably, market-implied FOMC cuts through 2026 have been increasing. Through February, Fed Fund futures have priced in another -14bps of cuts for the year - and now the most dovish outlook after CPI since Dec 3rd: https://t.co/NZF2YksrWV

By John Kicklighter