Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it needs to cut anytime soon. https://t.co/T9YNiD61ly

By Nick Timiraos

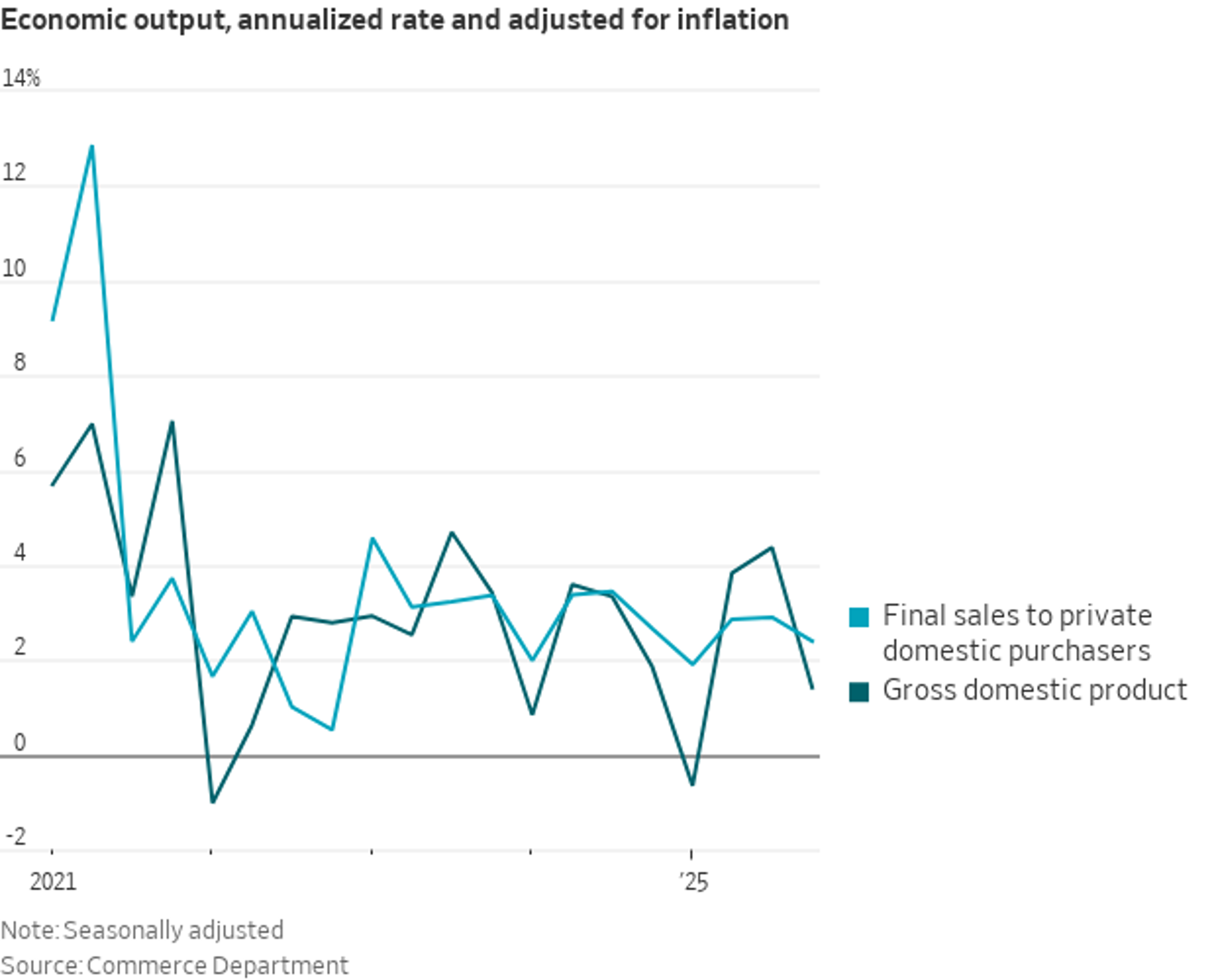

Social•Feb 20, 2026

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

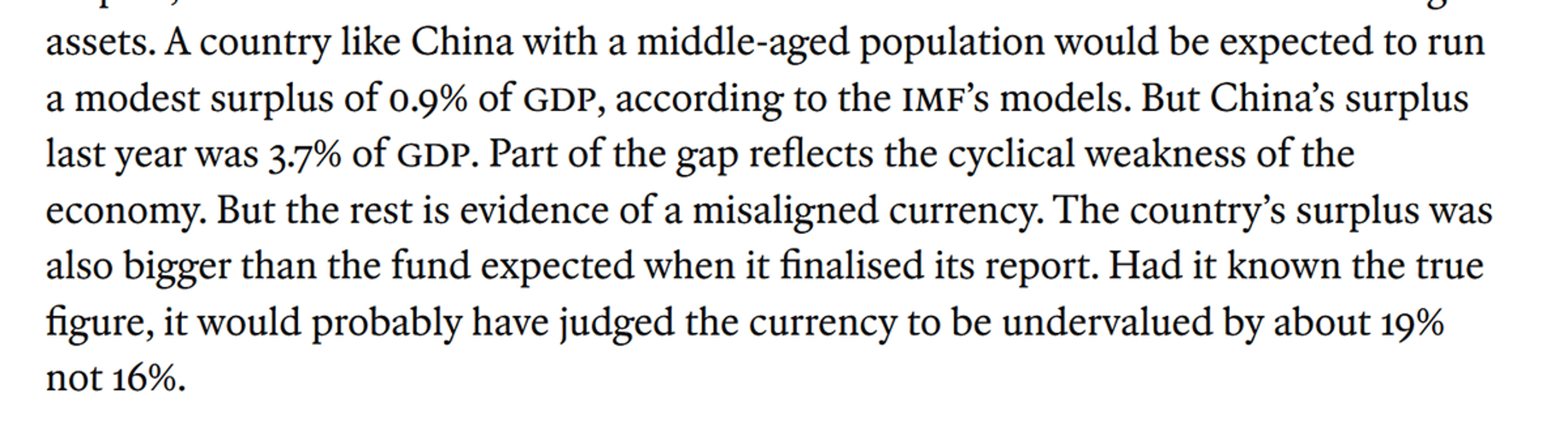

Social•Feb 20, 2026

IMF Estimates Chinese Yuan Undervalued by Roughly 19%

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

By Brad Setser

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

Social•Feb 19, 2026

91 Days, Two Rate Calls, Then Warsh Takes Over

Only 91 days and two more rate decisions (Mar 18 and Apr 29) before Jerome Powell's term as Fed Chair ends (May 15th). Then it is the Warsh era...

By John Kicklighter

Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency...

By Jeff Park

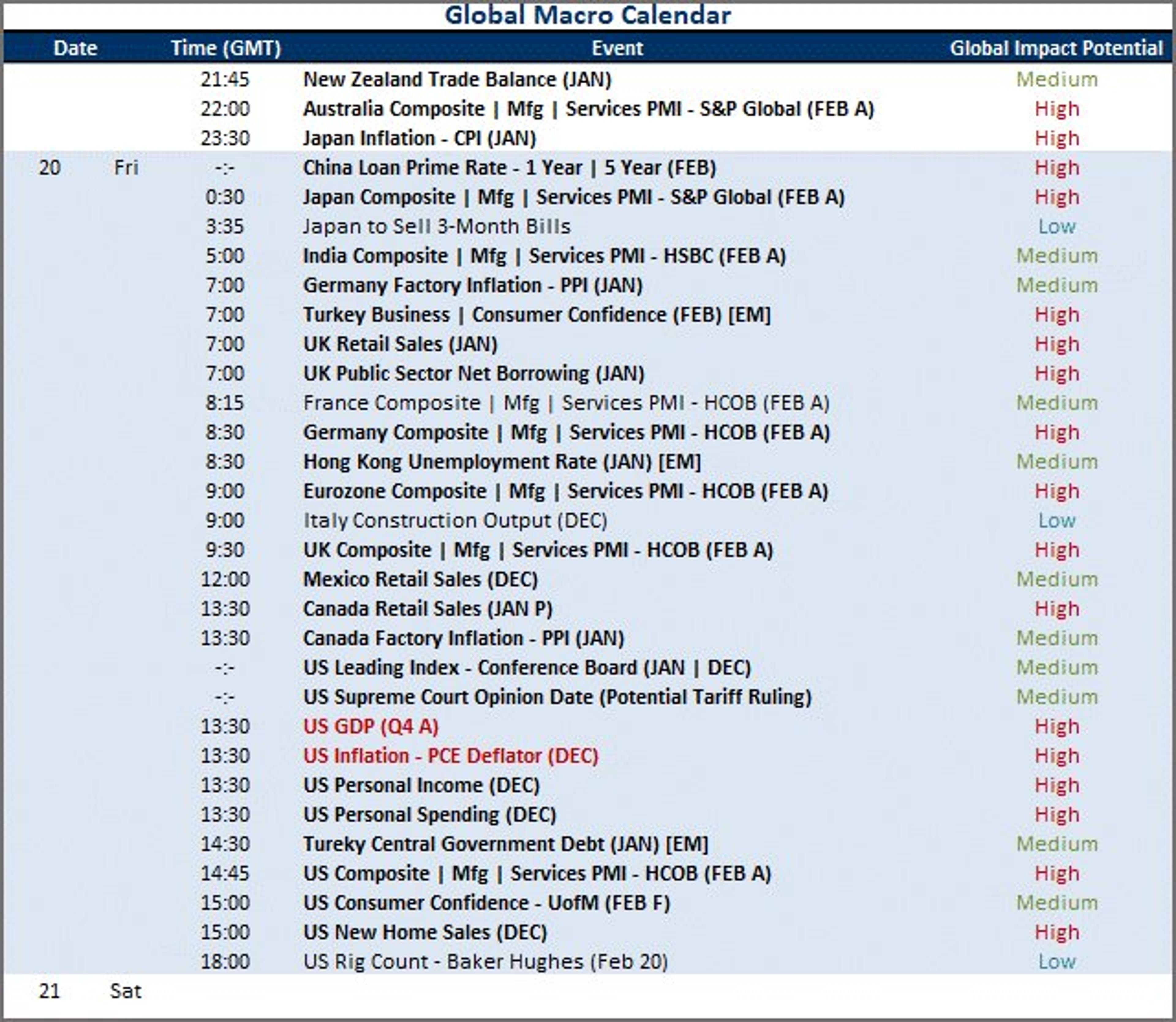

Social•Feb 19, 2026

Grey Swan Risks Amid Busy Global Macro Calendar

While I will keep an eye out for grey swans catalyzing (Iran and Supreme Court's decision on tariffs principally), the global macro docket picks up through Friday. Top event risk includes: Japan CPI; February PMIs; Mexico and Canada retail sales; US...

By John Kicklighter

Social•Feb 19, 2026

AUD/USD Rally Pauses Near 2023 High, Streak Threatened

Australian Dollar Forecast: AUD/USD Rally Stalls Near 2023 High – Four-Week Streak at Risk https://t.co/srtBKcRq3k $AUDUSD Weekly Chart https://t.co/oGQK6Jc1uV

By Michael Boutros

Social•Feb 19, 2026

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

Social•Feb 18, 2026

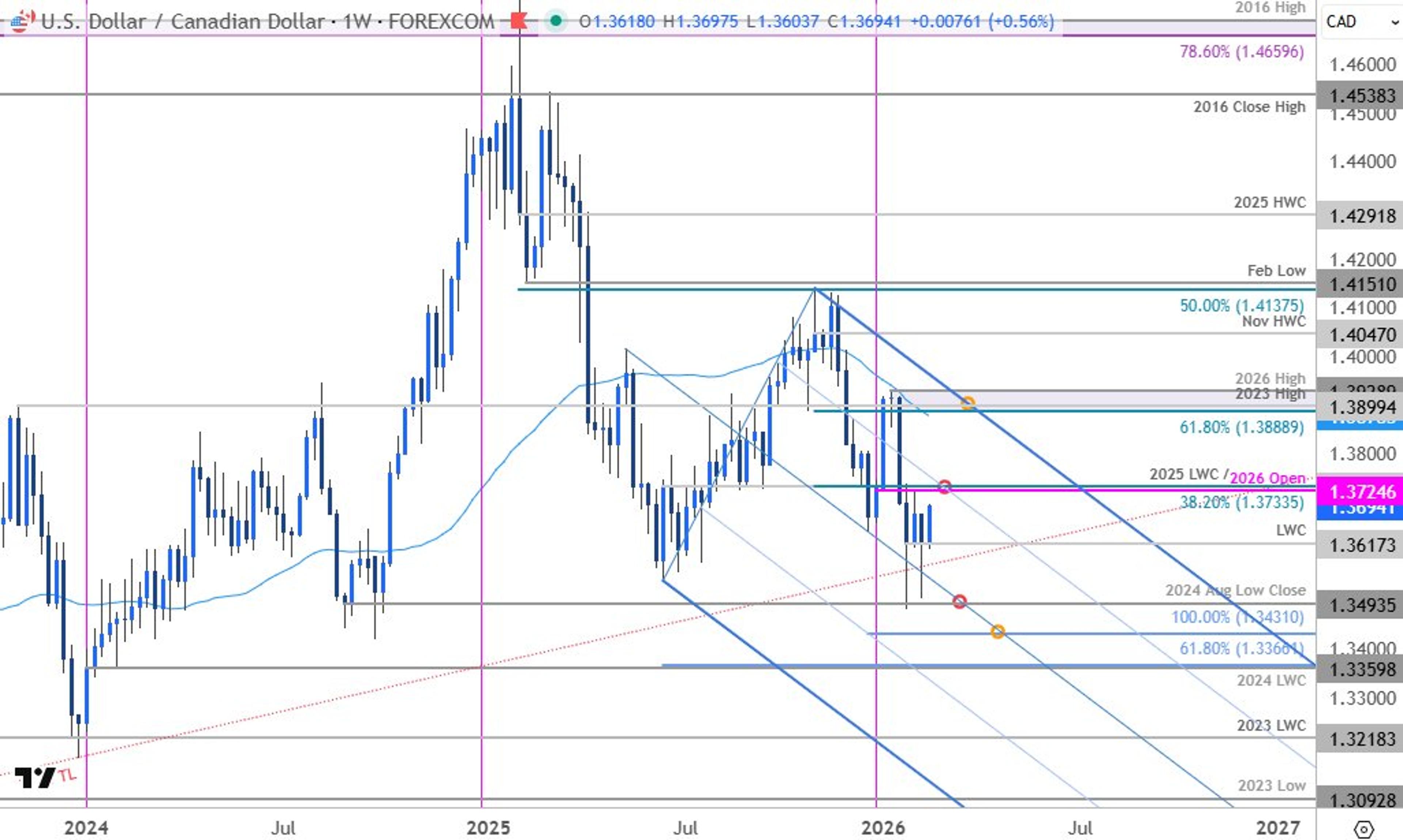

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

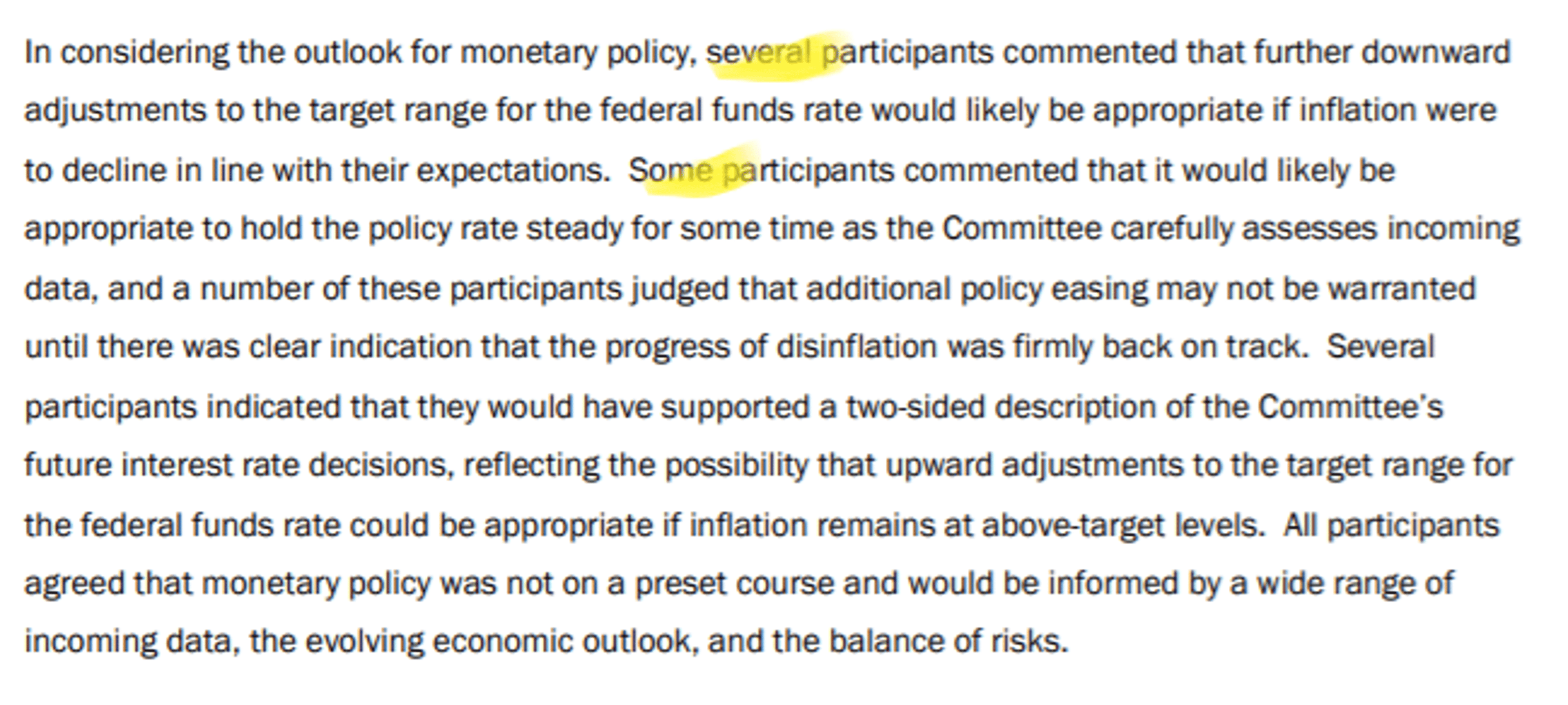

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos