Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency https://t.co/2Aijgy13Fd

By Jeff Park

Social•Feb 19, 2026

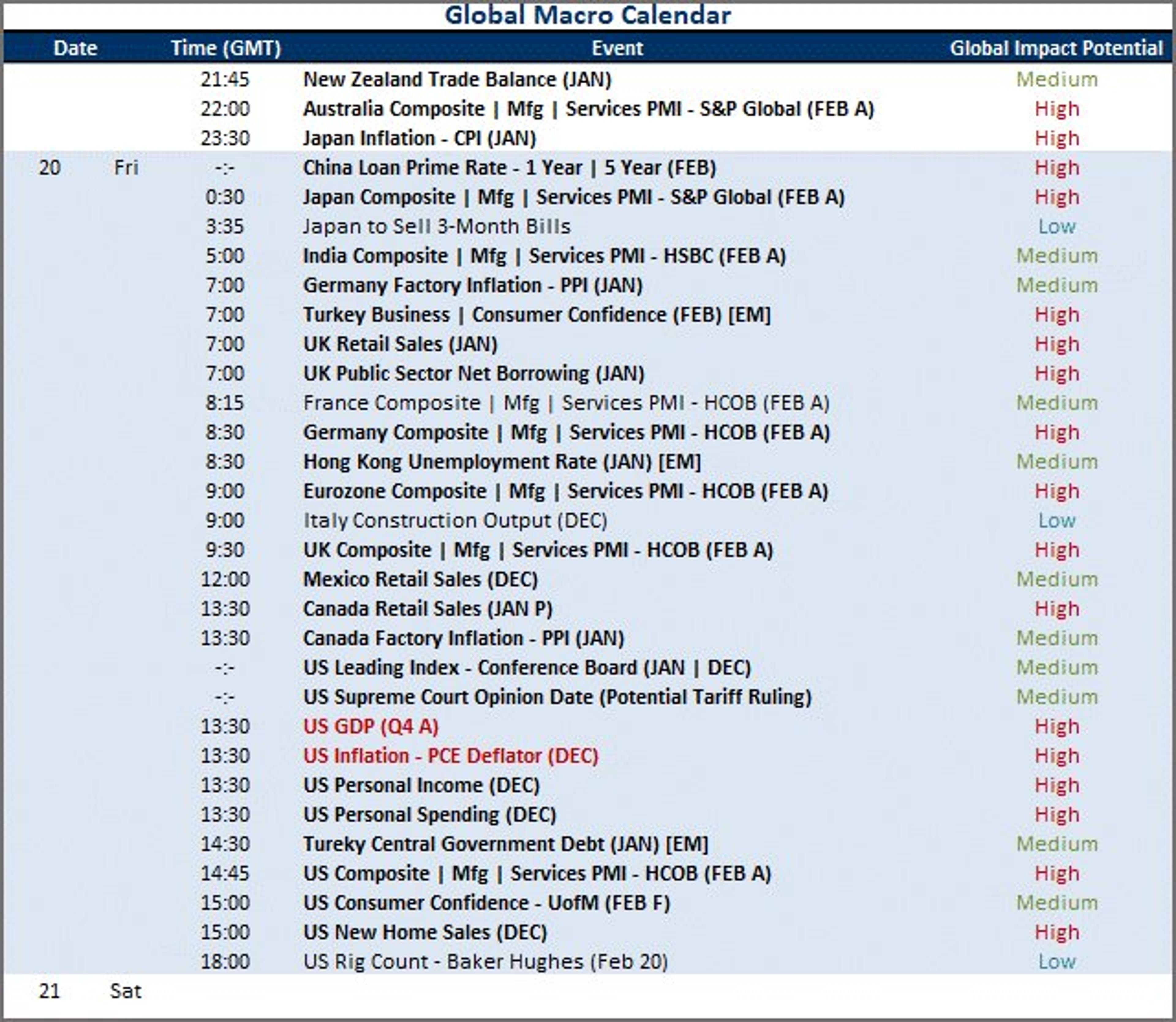

Grey Swan Risks Amid Busy Global Macro Calendar

While I will keep an eye out for grey swans catalyzing (Iran and Supreme Court's decision on tariffs principally), the global macro docket picks up through Friday. Top event risk includes: Japan CPI; February PMIs; Mexico and Canada retail sales; US...

By John Kicklighter

Social•Feb 19, 2026

AUD/USD Rally Pauses Near 2023 High, Streak Threatened

Australian Dollar Forecast: AUD/USD Rally Stalls Near 2023 High – Four-Week Streak at Risk https://t.co/srtBKcRq3k $AUDUSD Weekly Chart https://t.co/oGQK6Jc1uV

By Michael Boutros

Social•Feb 19, 2026

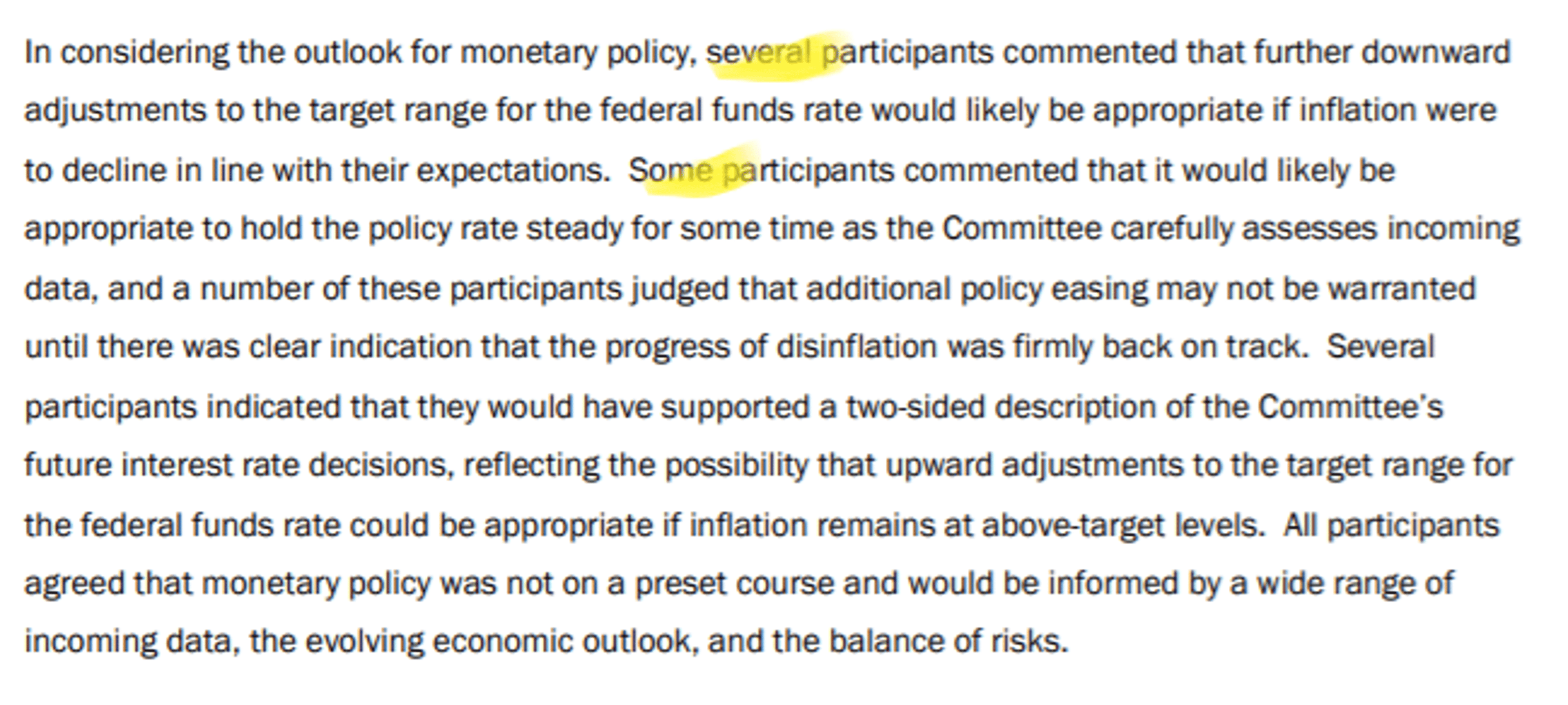

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

Social•Feb 18, 2026

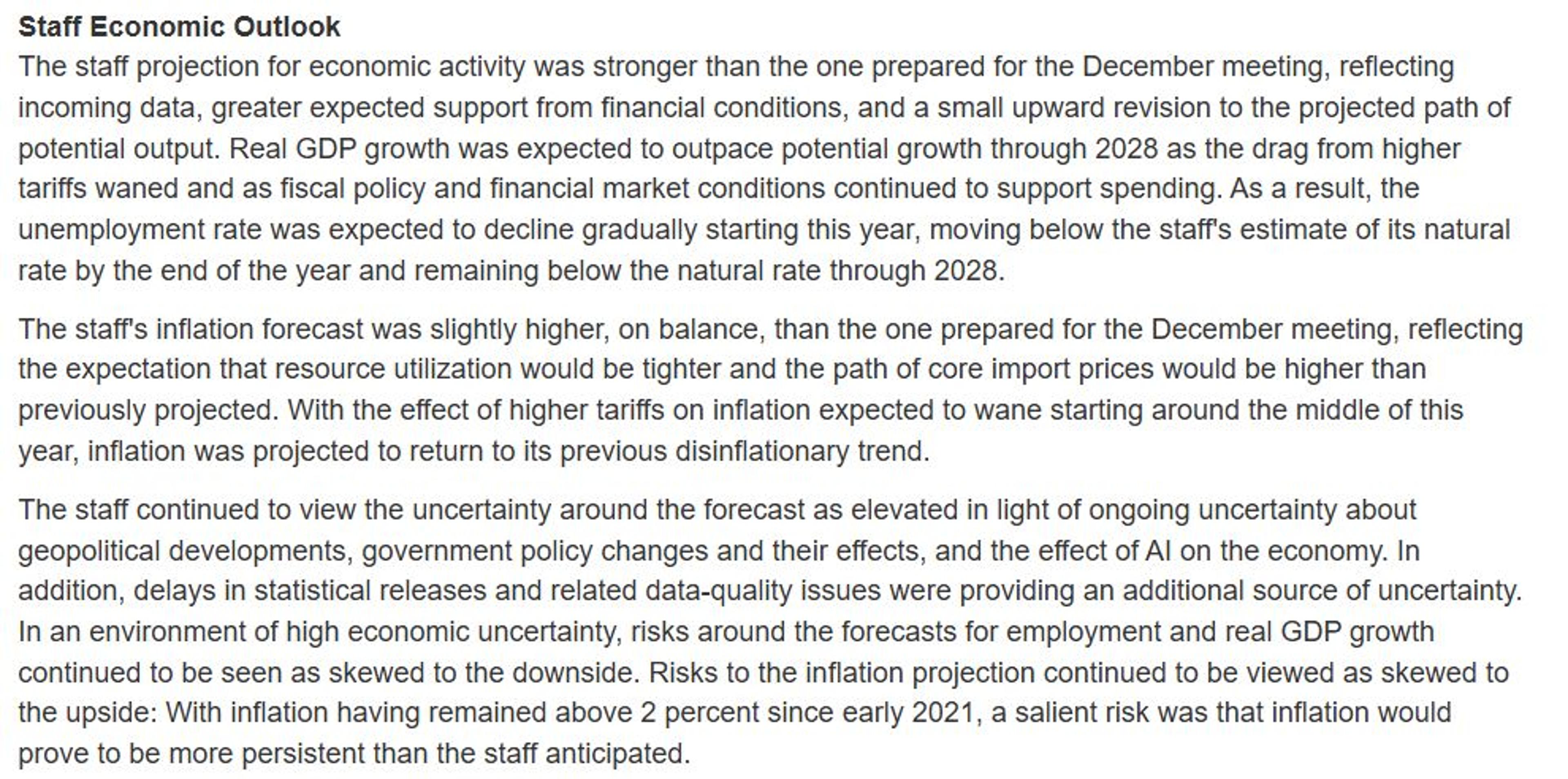

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

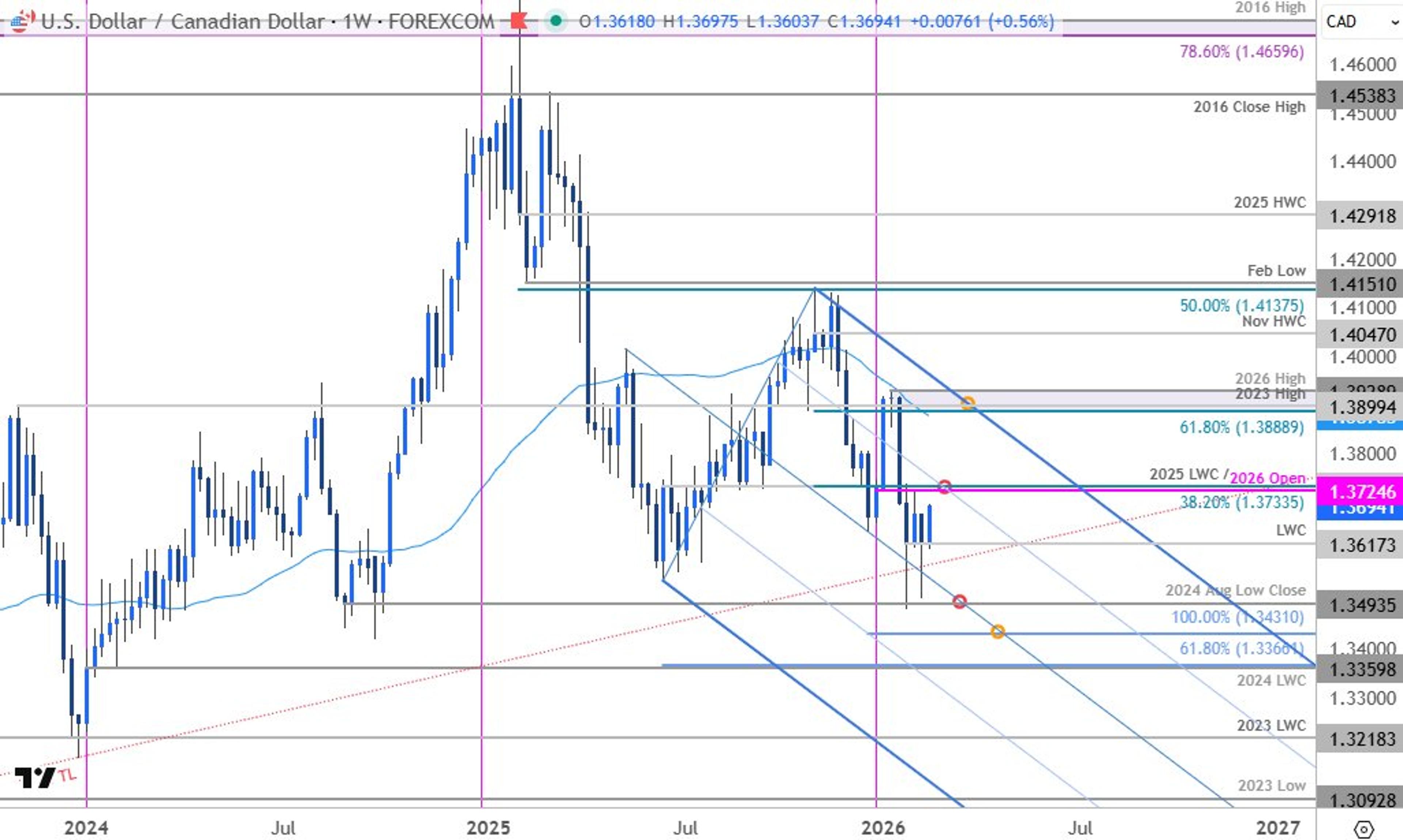

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss

Social•Feb 18, 2026

Markets May Slip as Fed Delays Rate Cuts

Will stock markets tip over amid worries about the Fed dragging its feet on rate cuts? FOMC meeting minutes are in focus. #stockmarkets #fed #fomc #dollar #macro #trading https://t.co/yYSQfOx27L

By Ilya Spivak

Social•Feb 17, 2026

Iranian Rial Crashes as US‑Iran Nuclear Talks Begin

Today, US-Iran nuclear talks began in Geneva. As the talks start, the Iranian rial is in the tank. It has depreciated by over 43% against the dollar in the past year, making it THE SECOND WORST CURRENCY IN THE WORLD. https://t.co/PORIO6lGtc

By Steve Hanke

Social•Feb 17, 2026

Weekly Technical Outlook: DXY, GBP/USD, Gold, Bitcoin

DXY, GBP/USD, AUD/USD, Gold, Bitcoin, Oil Weekly Technical Outlook (webinar archive) https://t.co/nitfuFDsGb Asset Chaptered on YouTube: https://t.co/yidtEBNR4M

By Michael Boutros

Social•Feb 17, 2026

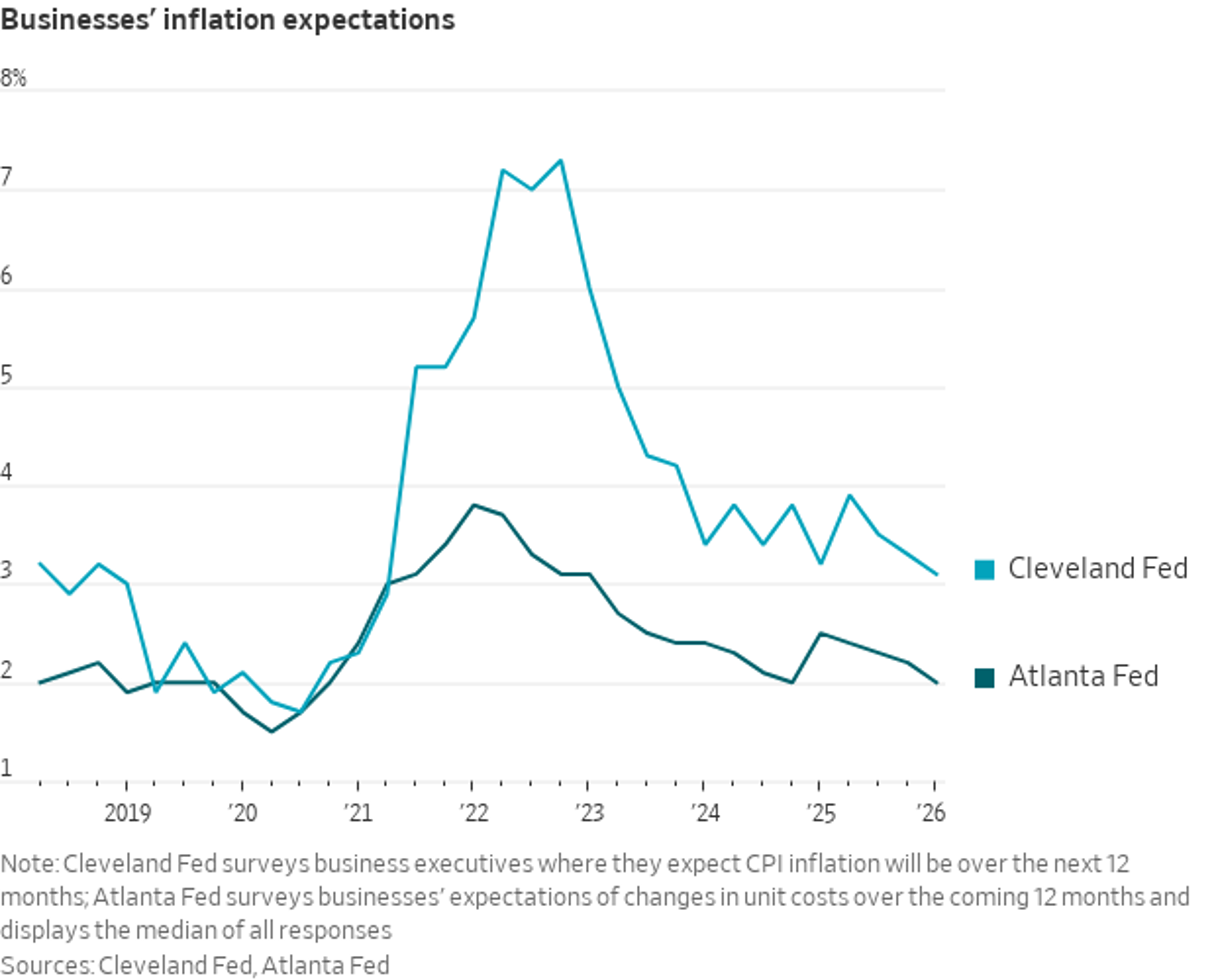

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

Dollar Up Shows Unchanged Signal Amid Correlation Risk

If there was something else to "dig into", I would have. Dollar Up has its implied Correlation Risk today. I'll do what the signal does. It didn't change.

By Keith McCullough

Social•Feb 17, 2026

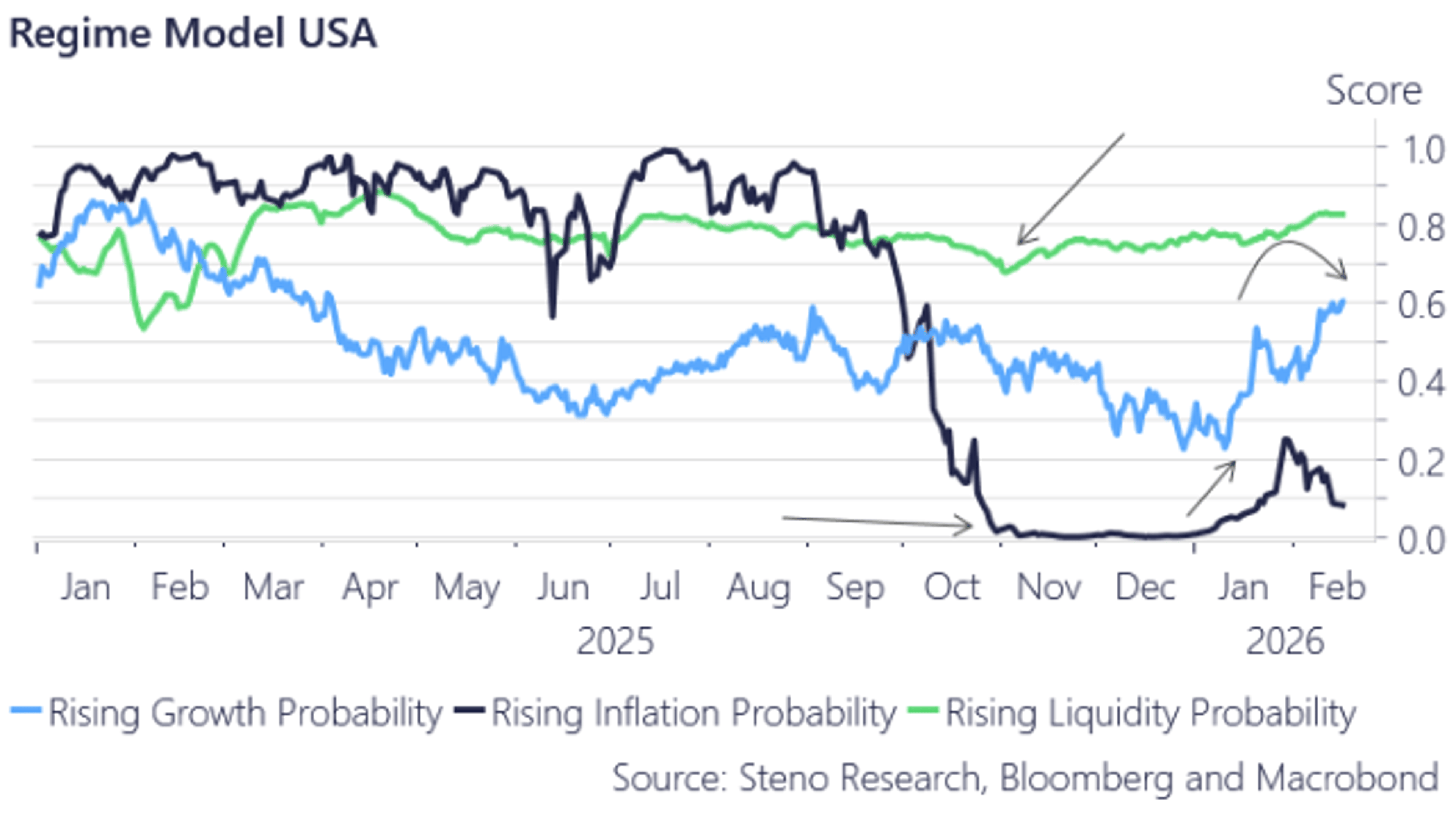

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

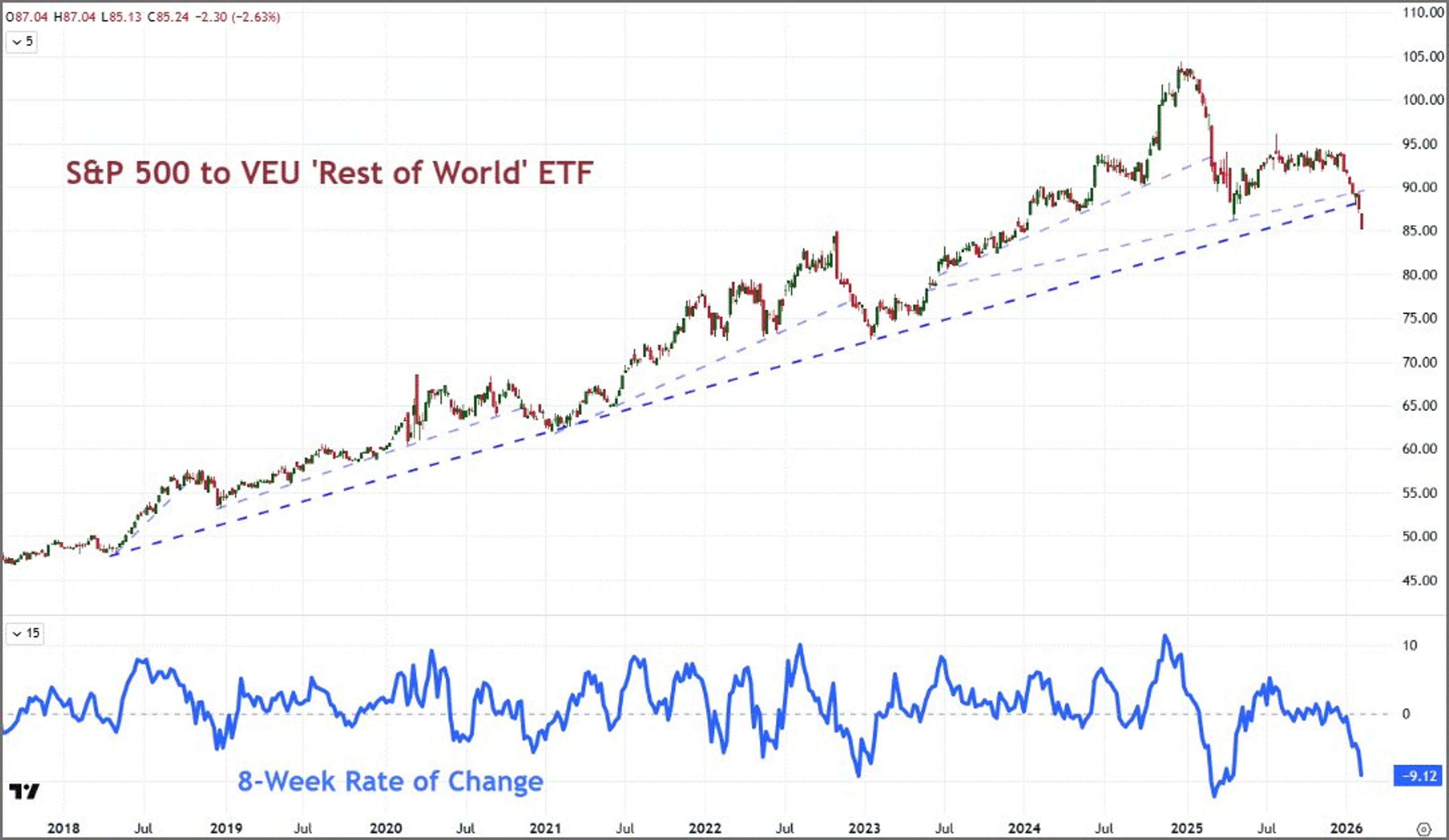

EURUSD Retreats to Fib Level as Longs Surge

$EURUSD has pulled back from its failed run on 1.20 a few weeks back - aligned to a 38.2% Fib of the 2008 to 2022 bear wave. Meanwhile, net speculative futures positioning has jumped this past week to its heaviest net-long...

By John Kicklighter

Social•Feb 17, 2026

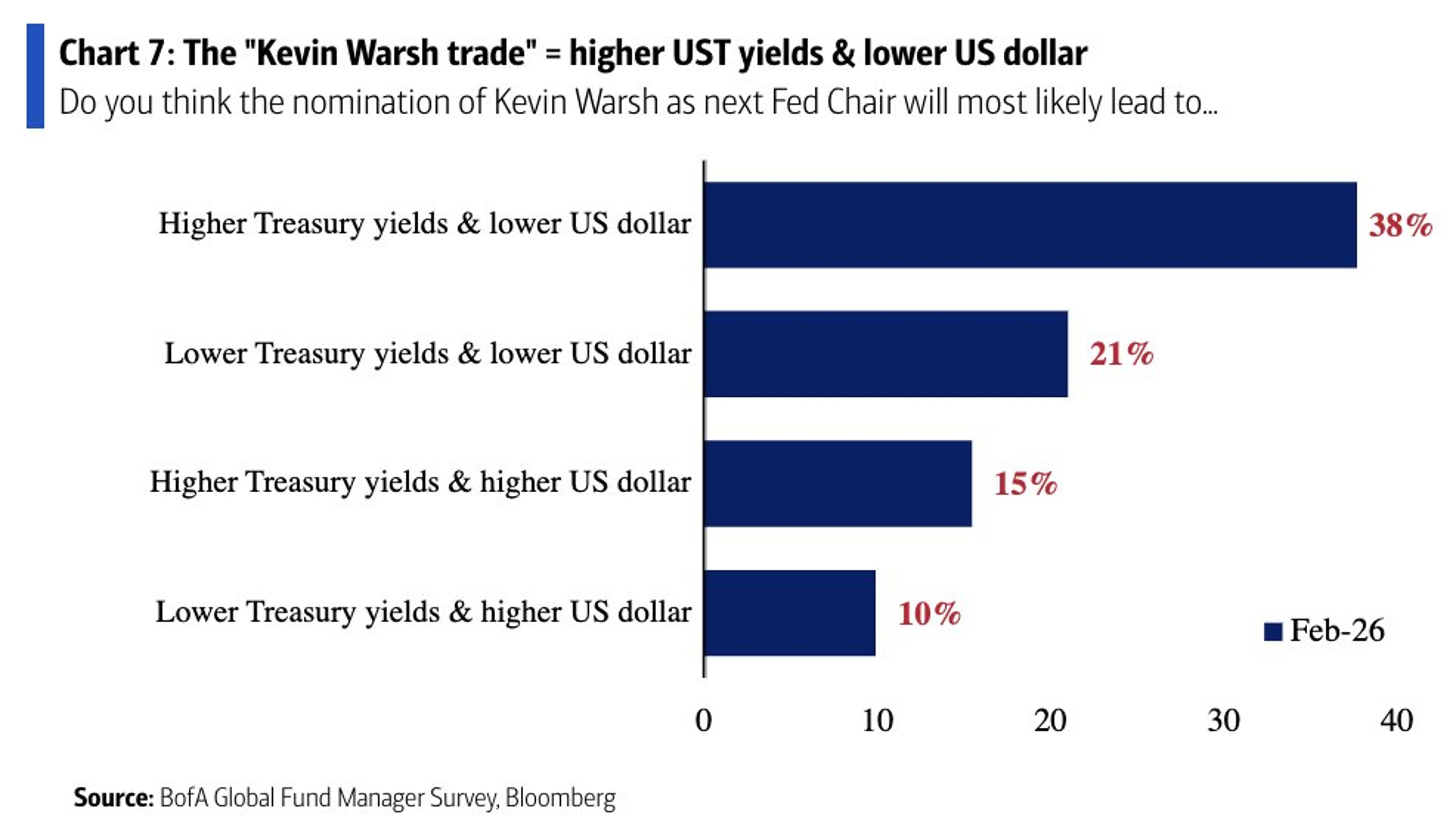

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

Social•Feb 17, 2026

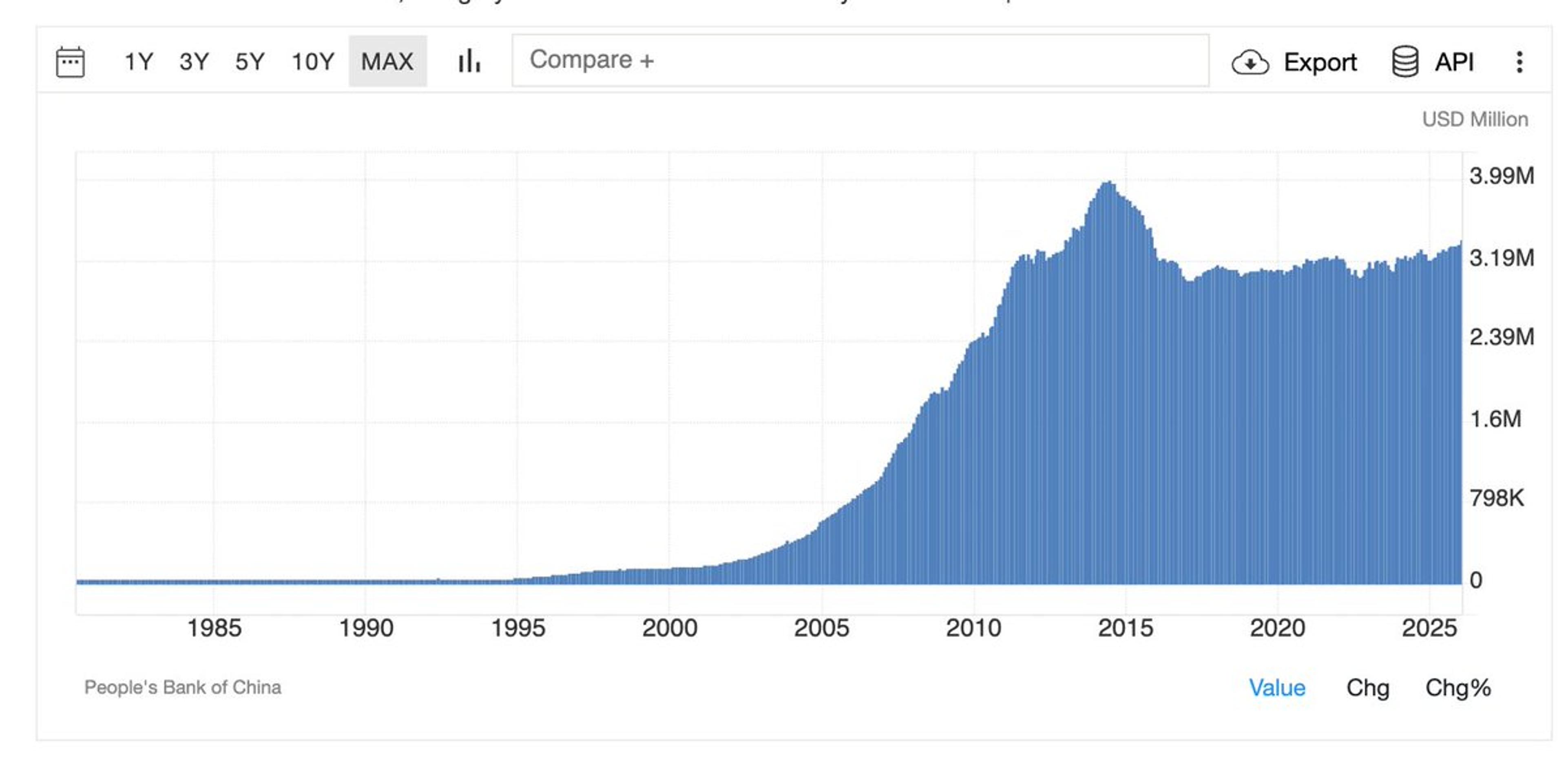

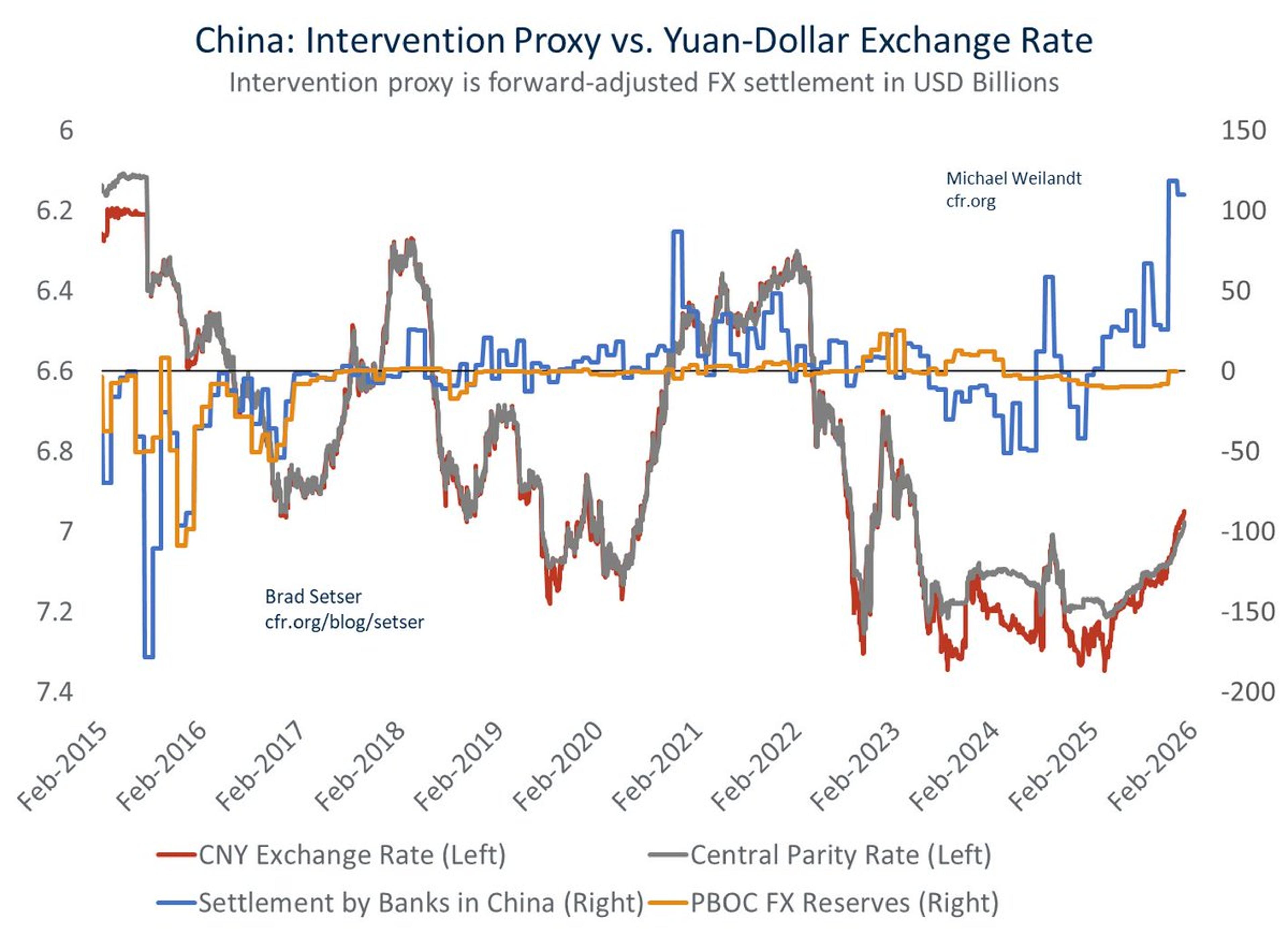

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

Social•Feb 17, 2026

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

Social•Feb 17, 2026

Iranian Rial Plummets, Becomes World's Second Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Iranian rial ranks as the WORLD'S 2ND WORST currency. The rial has depreciated by 44% against the USD over the past year. RIAL = THE GREAT DESTABILIZER. https://t.co/06OiclsaSq

By Steve Hanke

Social•Feb 16, 2026

Venezuelan Bolivar Plummets 87%, Becomes World’s Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Venezuelan bolivar ranks as the WORLD'S WORST currency. The bolivar has depreciated by over 87% against the USD in the past year. IT’S TIME TO DUMP THE BOLIVAR AND REPLACE IT WITH THE US DOLLAR. https://t.co/dHtPzNew81

By Steve Hanke

Social•Feb 16, 2026

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 15, 2026

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

Presidents Day Market Closure; Join Tuesday Technical Outlook Webinar

**Reminder: Markets Closed tomorrow in observance of Presidents Day Weekly Technical Outlook Webinar will be on Tuesday at 8:30am ET Interactive Session: https://t.co/EpyXNC6zVR Live Stream on YouTube: https://t.co/iiptWpNEz9

By Michael Boutros

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 15, 2026

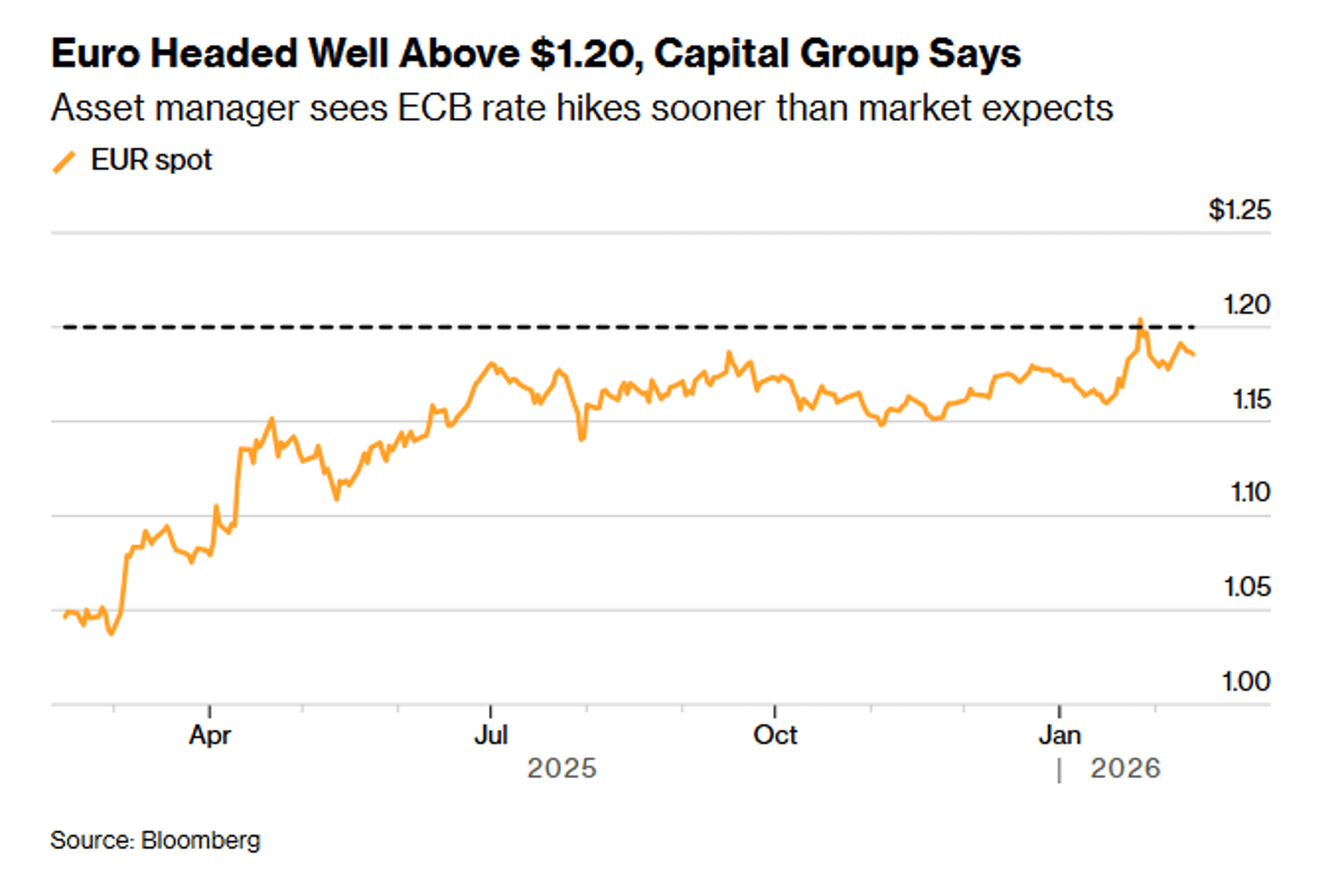

ECB Rate Hike Expected to Strengthen Euro, Says Capital Group

The ECB will raise interest rates at least once this year, significantly boosting the euro against the dollar, according to Capital Group, the $3.3 trillion asset manager https://t.co/CFxgbQlz0Q via @Sujata_markets https://t.co/6EBSHD6SYI

By Zöe Schneeweiss

Social•Feb 15, 2026

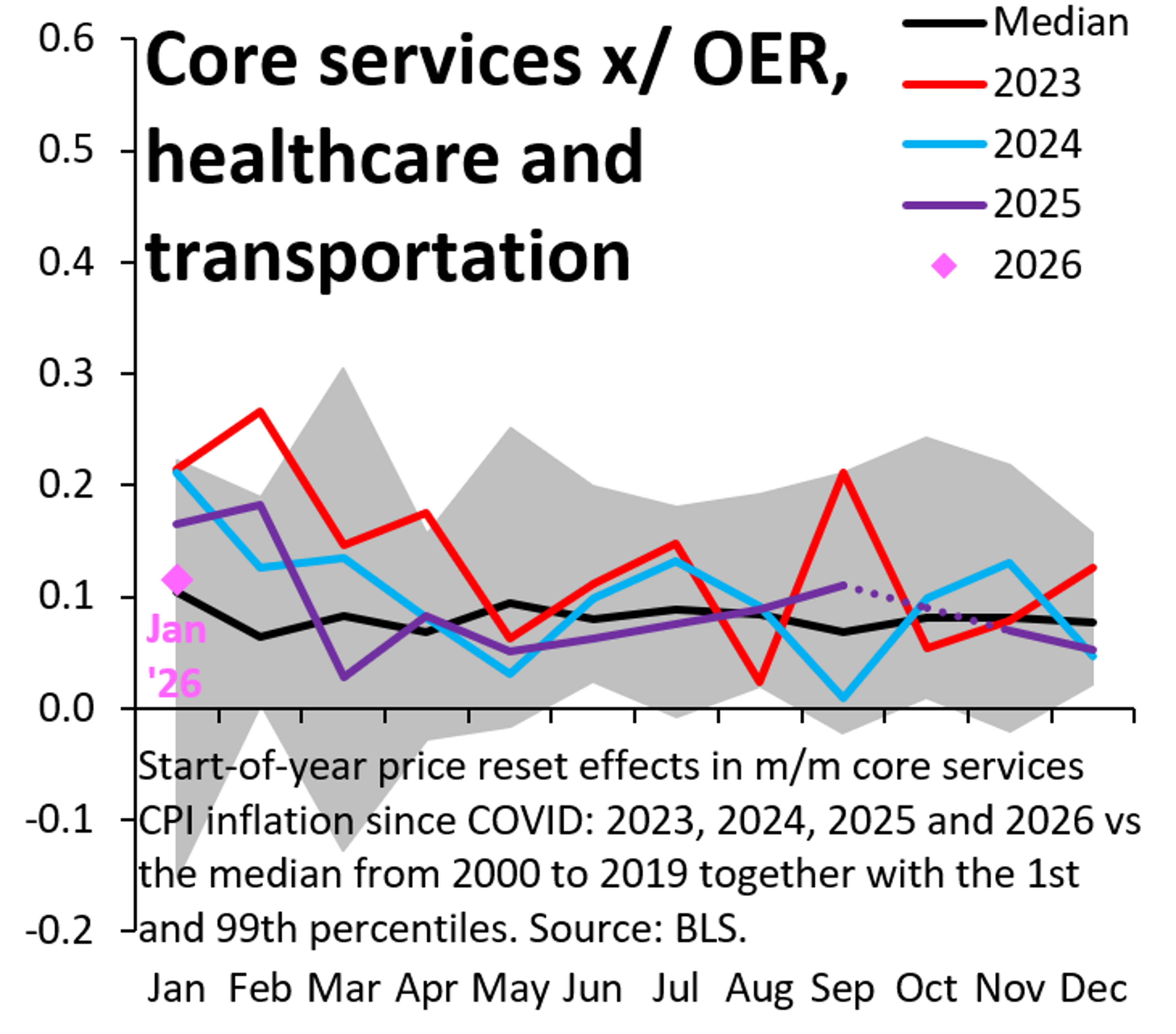

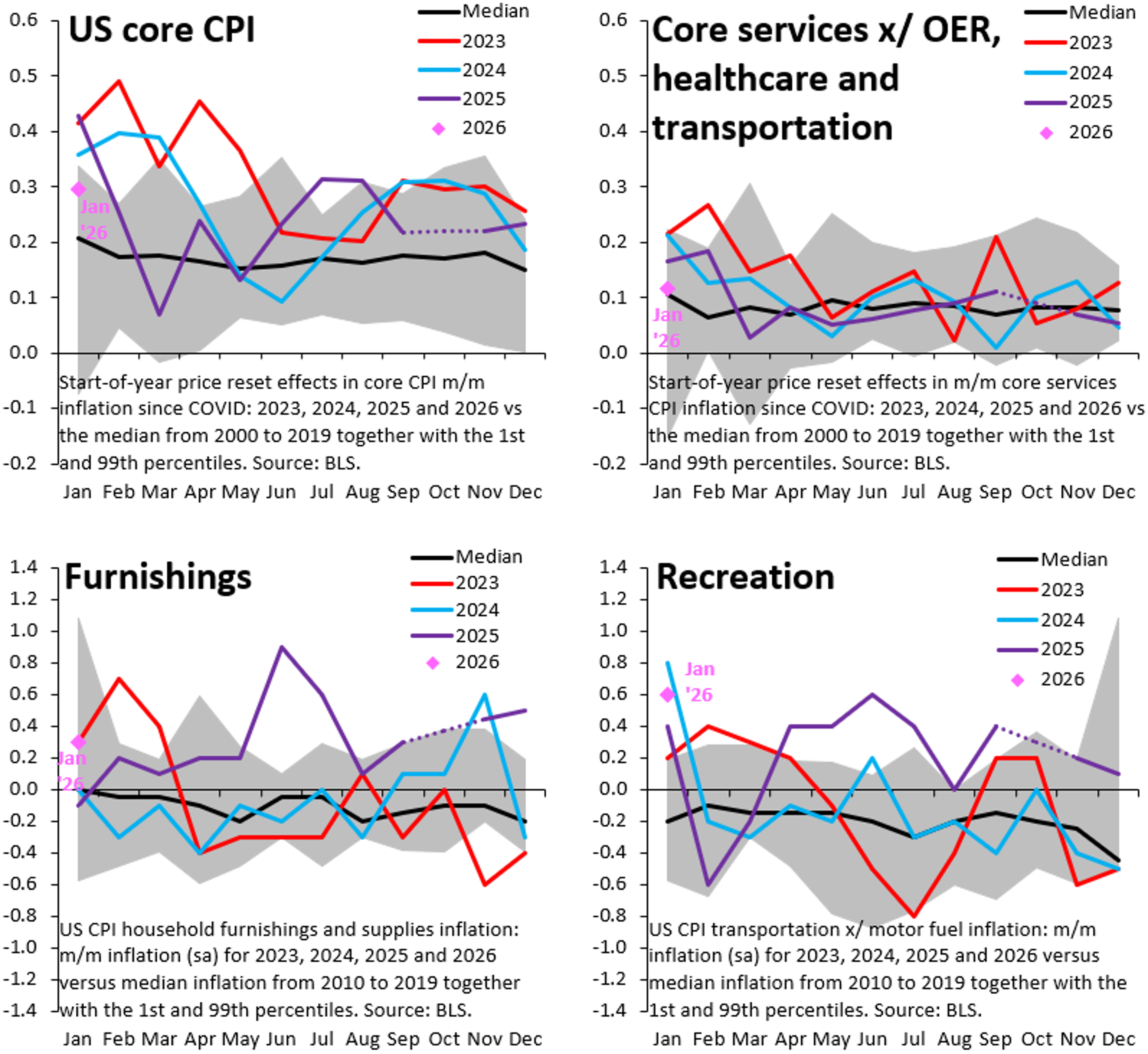

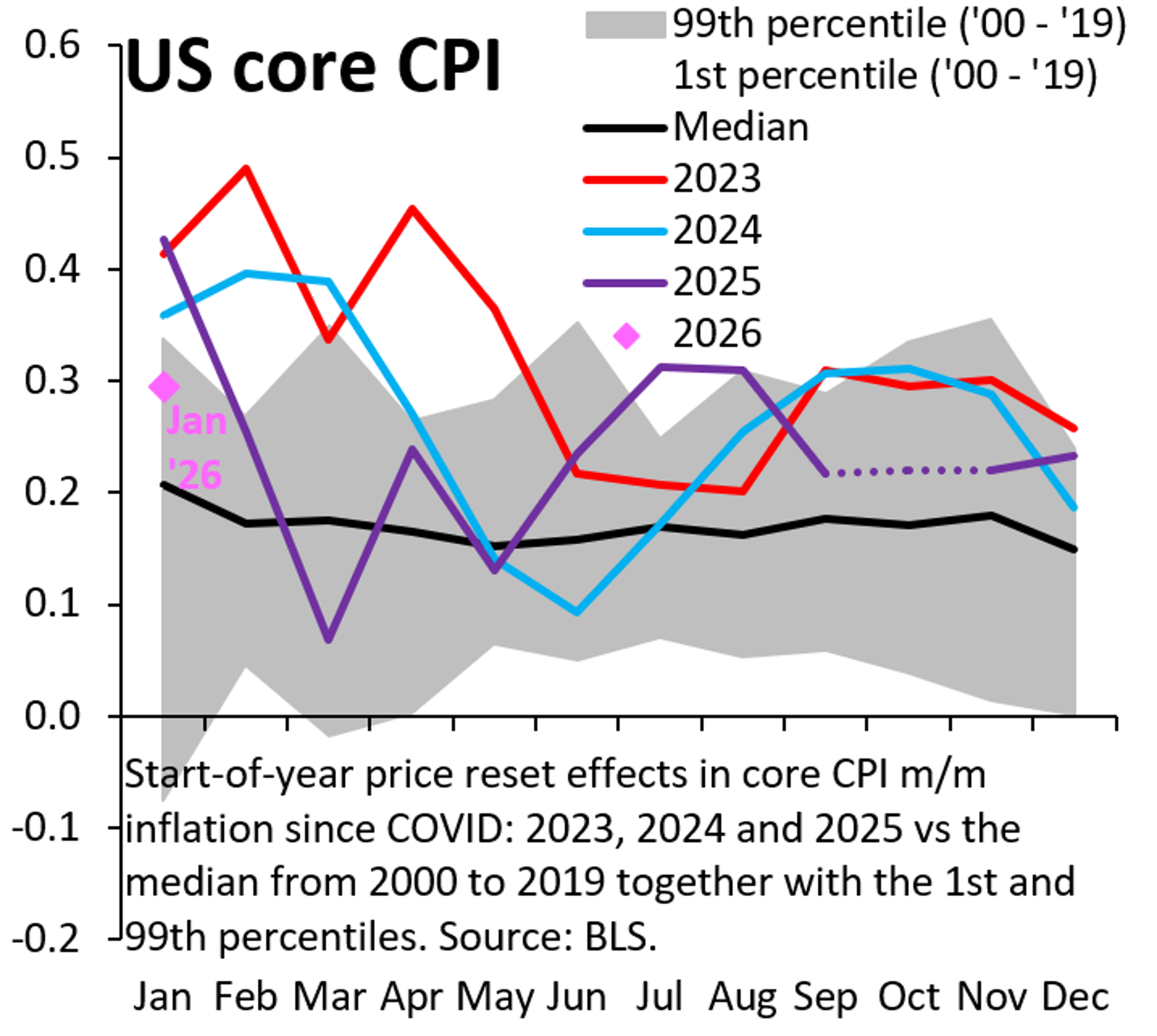

Core Services Inflation Stays Tame, No Overheating Signs

There's lots of commentary that US inflation will overheat, but there's no sign of that. My proxy for core services inflation was very well behaved in all of 2025 (purple) and the Jan. '26 data point (pink) was much more...

By Robin Brooks

Social•Feb 14, 2026

China's Foreign Exchange Reserves: Key Trends Unveiled

Deep dive into Chinese Foreign Exchange Reserves in today's version of the Chartbook Top Links. https://t.co/Yc09wNGpPK

By Adam Tooze

Social•Feb 14, 2026

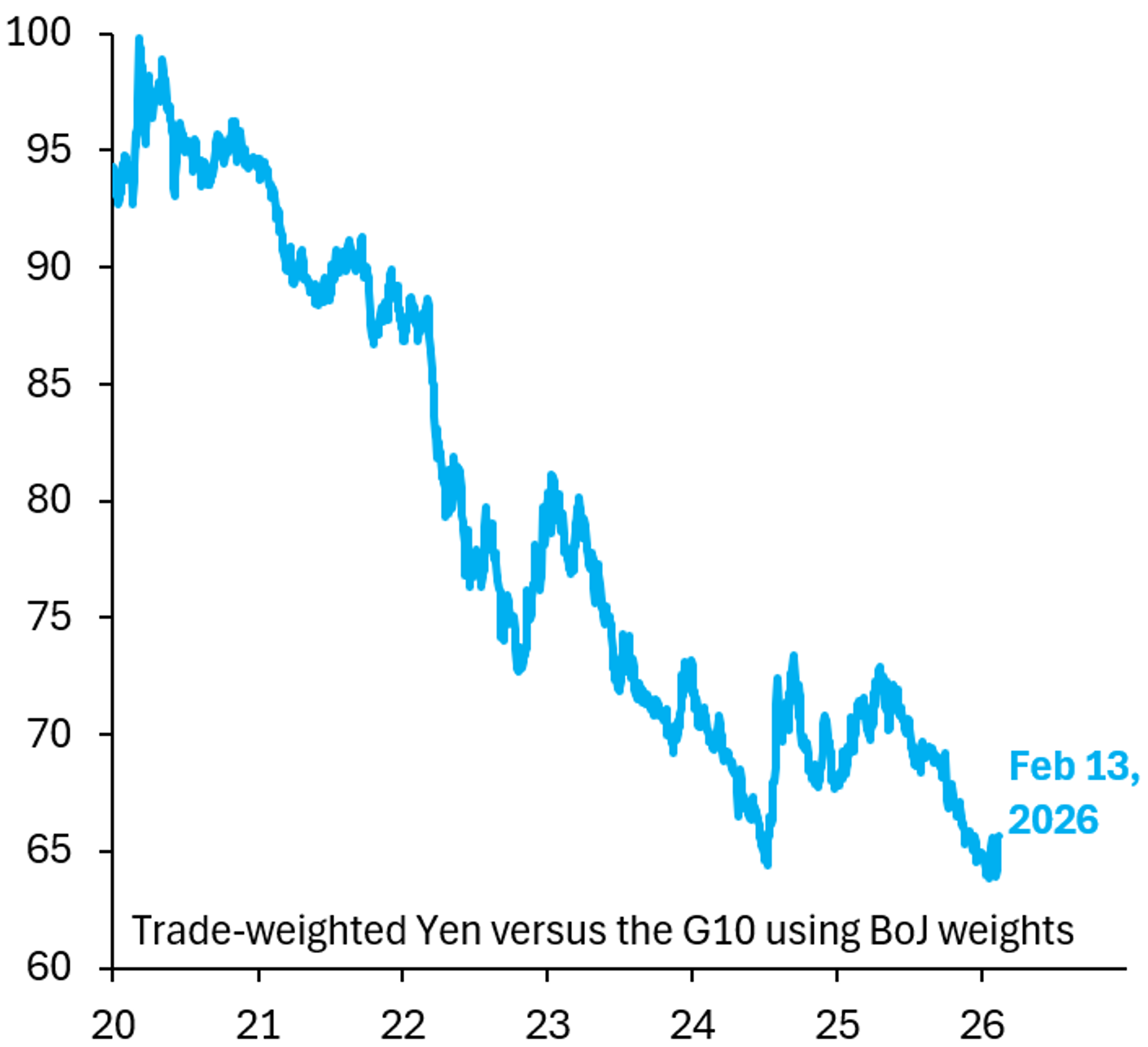

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

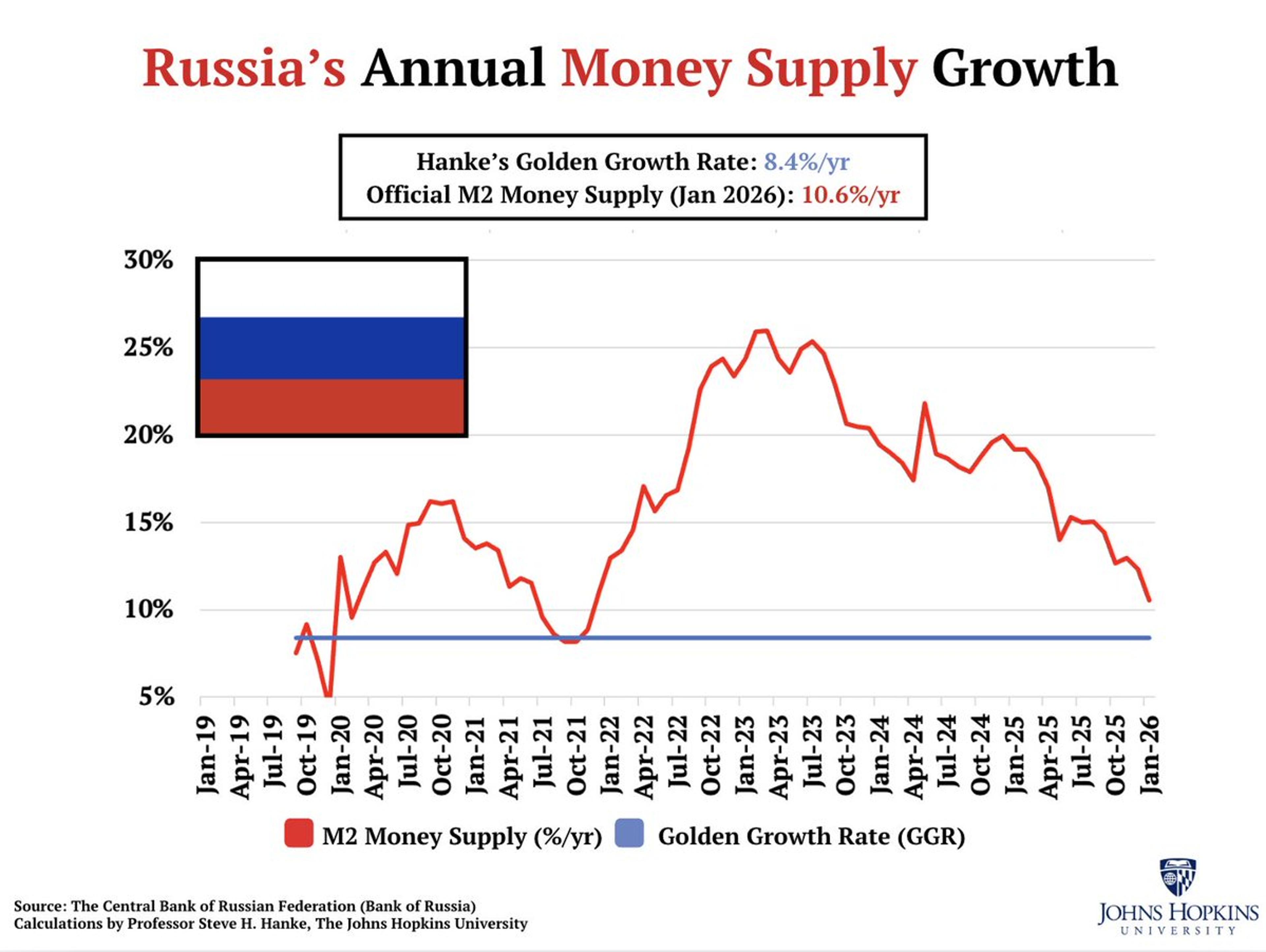

Russia's Inflation Spike Tied to Excess Money Supply

Russia’s inflation comes in at 6.0%/yr in January. That's ABOVE RU's 4%/yr target. RU's M2 money supply is growing at 10.6%/yr, ABOVE Hanke's Golden Growth Rate of 8.4%/yr, a rate consistent with hitting its inflation target of 4%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

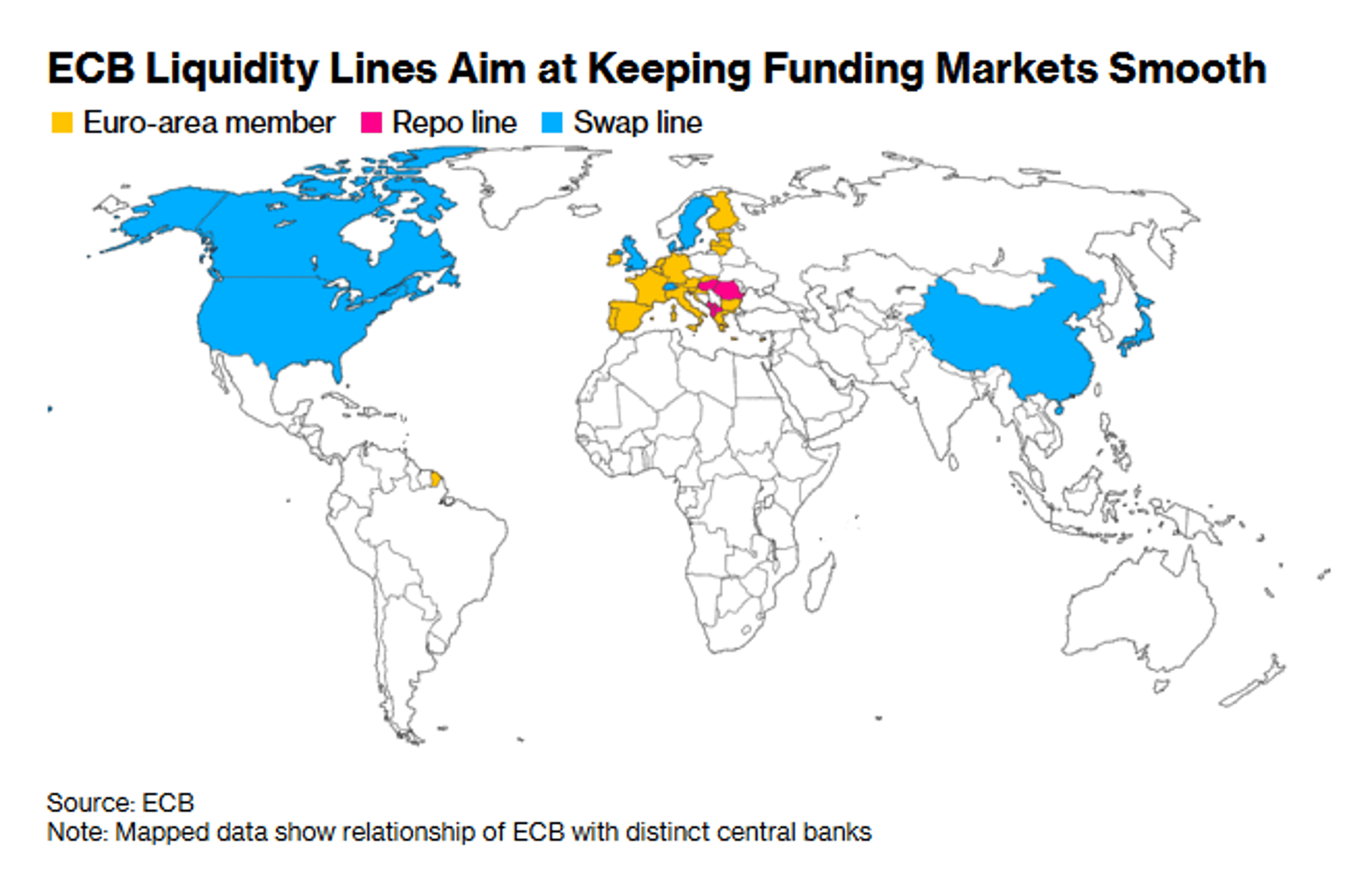

ECB Overhauls Euro Liquidity to Strengthen Currency Appeal

ECB revamps euro liquidity offer to boost the common currency’s appeal https://t.co/w17qKKKWLo via @jrandow https://t.co/FlhSjhqFkD

By Zöe Schneeweiss

Social•Feb 14, 2026

Yen Poised for New 2025 Lows Amid

The Yen will keep falling in trade weighted terms in 2025 and make new lows. Two reasons: (i) Japan remains in denial on the scale of its debt and what's needed to fix this; (ii) the Yen will be falling...

By Robin Brooks

Social•Feb 14, 2026

Global Data Week: FOMC Minutes to RBA Jobs

Buckle up! Its going to be a VERY Busy Data Week ahead👇 🇺🇸 US -FOMC Minutes -Q4 GDP -Empire State & Philly Fed 🇪🇺 EZ -IP -ZEW -PMIs 🇬🇧 UK -Jobs -Retail Sales -CPI -PMIs 🇯🇵 JP CPI & GDP 🇨🇦 CA -CPI -Retail Sales -Trade 🇳🇿 NZ -RBNZ -PSI -PPI 🇦🇺 AU -RBA MINUTES -JOBS -PMIS

By Kathy Lien

Social•Feb 14, 2026

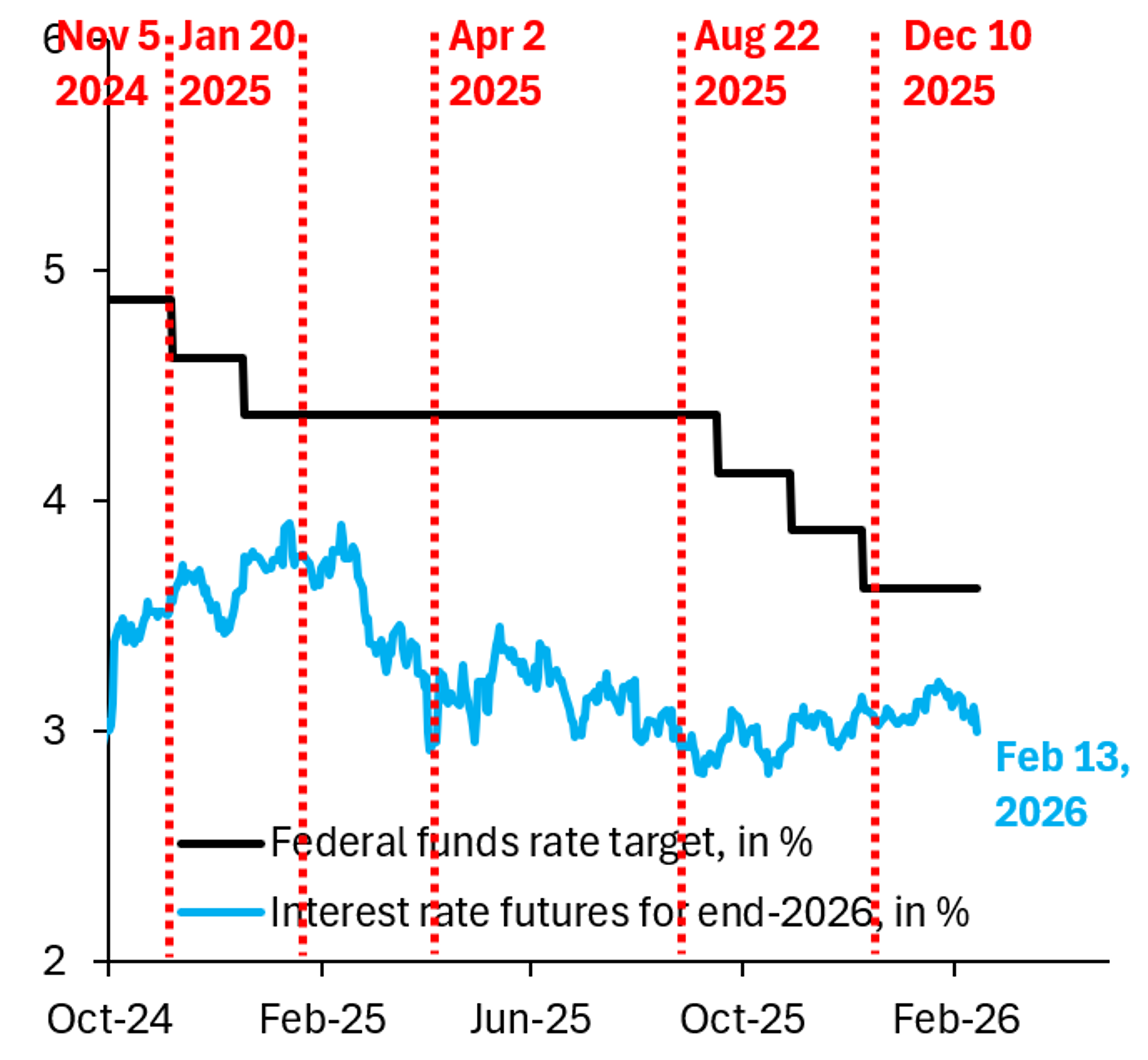

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See...

By Marc Chandler

Social•Feb 14, 2026

Warsh Fed Expected to Slash Rates 100bps, Dollar Falls

My forecast is for the Warsh Fed to cut policy rates by 100 bps in the 4 meetings after he takes over (June, July, September, October) ahead of midterms. Markets are moving in this direction, but still price only 63...

By Robin Brooks

Social•Feb 14, 2026

Markets Discount Fed Cuts Amid Japan Election, Tariff Uncertainty

Week Ahead: SCOTUS Decision on Tariffs? 8 Fed Officials Speak as the Market Discounts almost 65 bp of Cuts this Year: Last week began with the LDP's stunning victory in Japan. However, rather than sell-off as the market expected, the...

By Marc Chandler

Social•Feb 14, 2026

Dollar Decouples: US Growth Rises as USD Falls

Great piece by @katie_martin_fx in the @FT on the correlation break happening for the Dollar. As Trump leans more and more on the Fed, positive data surprises like payrolls no longer lift USD. The US will boom this year. But...

By Robin Brooks

Social•Feb 14, 2026

Anti‑Trump Bias Skews Dollar and Inflation Forecasts

A lot of economic commentary is inflected by anti-Trump sentiment. That's why so many forecast the Dollar would go into a death spiral last year (it didn't) & why there's so much focus on inflation overheating now (it isn't). Yesterday's...

By Robin Brooks

Social•Feb 14, 2026

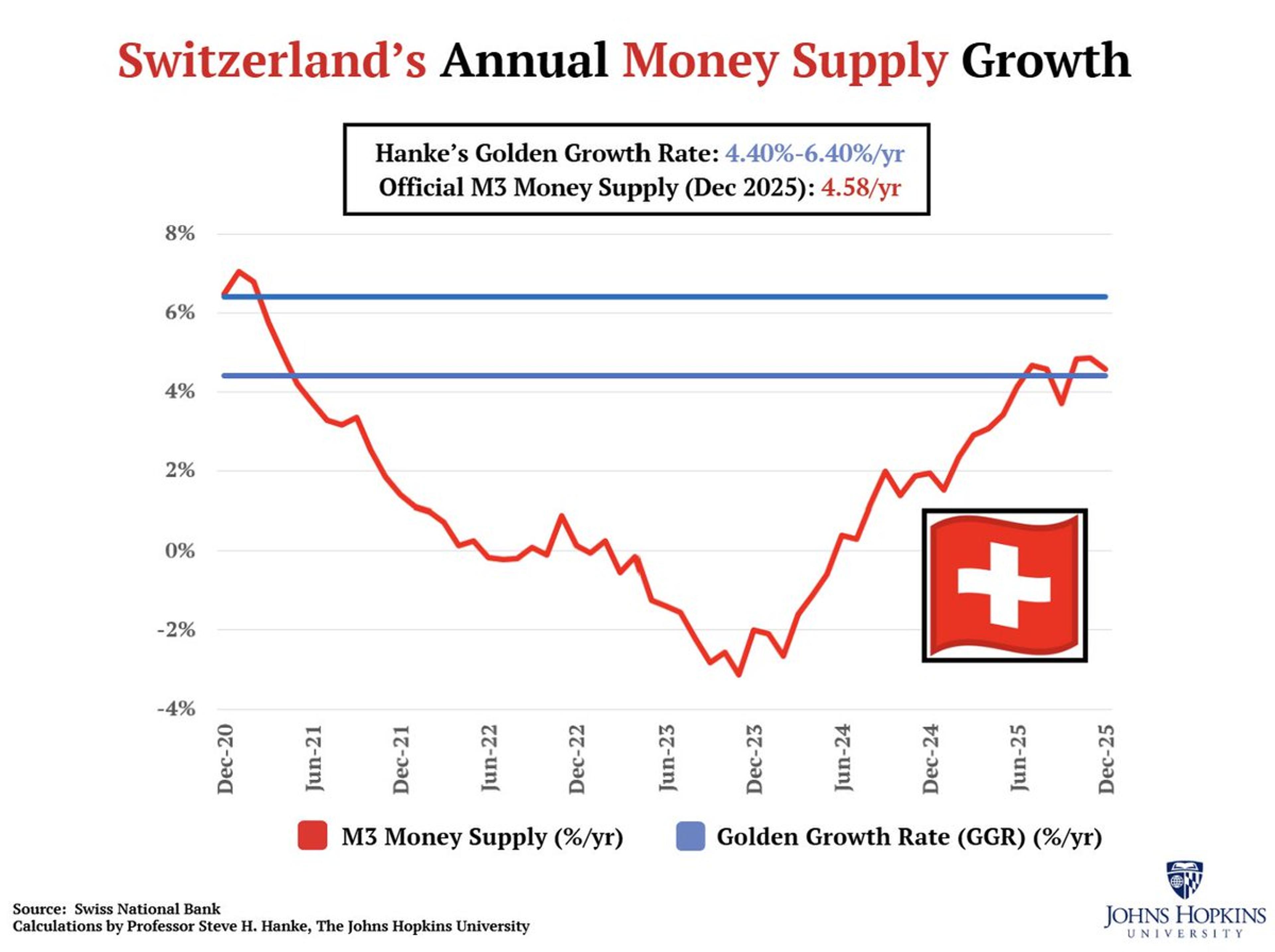

Swiss Inflation Near Zero as Money Growth Slows

Switzerland’s inflation rate is on the low end of its TARGET RANGE at 0.03%/yr. Switzerland’s money supply (M3) has been growing below Hanke's Golden Growth Rate of 4.40%-6.40%/yr since 2020 & is now only at 4.58%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

China’s $1.2 T Surplus Fuels Massive Market Interventions

One by product of China's exploding external surplus (goods surplus of $1.2 trillion, q4 current account surplus annualized is close to $1 trillion) is that it creates the raw material for some massive intervention numbers h/t @Mike_Weilandt for the chart https://t.co/PMvhatfgWh

By Brad Setser

Social•Feb 13, 2026

Assume BRICS' USD‑bypass Plans Are Real; Doubt USD Stability

Remember, every utterance from BRICS & Global South regarding potential new system to bypass USD is to be treated as if already operational & making material difference. And every piece of evidence that USD system isnt going anywhere is to be...

By Brent Johnson

Social•Feb 13, 2026

Market Prices Accelerating Fed Rate Cuts Through 2026

Notably, market-implied FOMC cuts through 2026 have been increasing. Through February, Fed Fund futures have priced in another -14bps of cuts for the year - and now the most dovish outlook after CPI since Dec 3rd: https://t.co/NZF2YksrWV

By John Kicklighter

Social•Feb 13, 2026

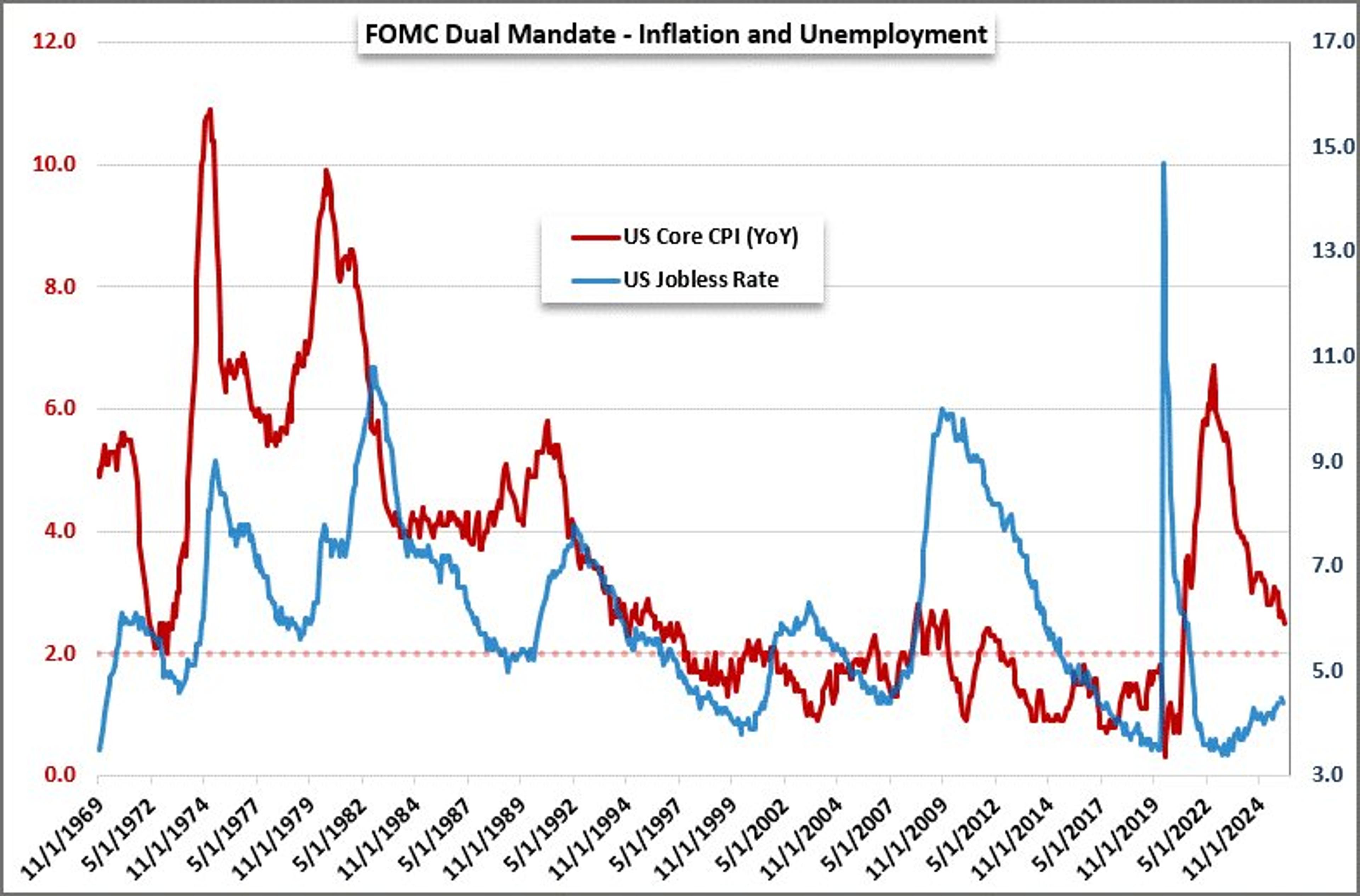

CPI Cools to 2.4%, Fed Eyes Jobs as Unemployment Falls

US #CPI inflation figures came in line with expectations of a pace cooling. Headline dropped from 2.7% to 2.4% while core eased 2.6% to 2.5%. This does shift priority towards employment in the Fed's dual mandate but the jobless rate...

By John Kicklighter

Social•Feb 13, 2026

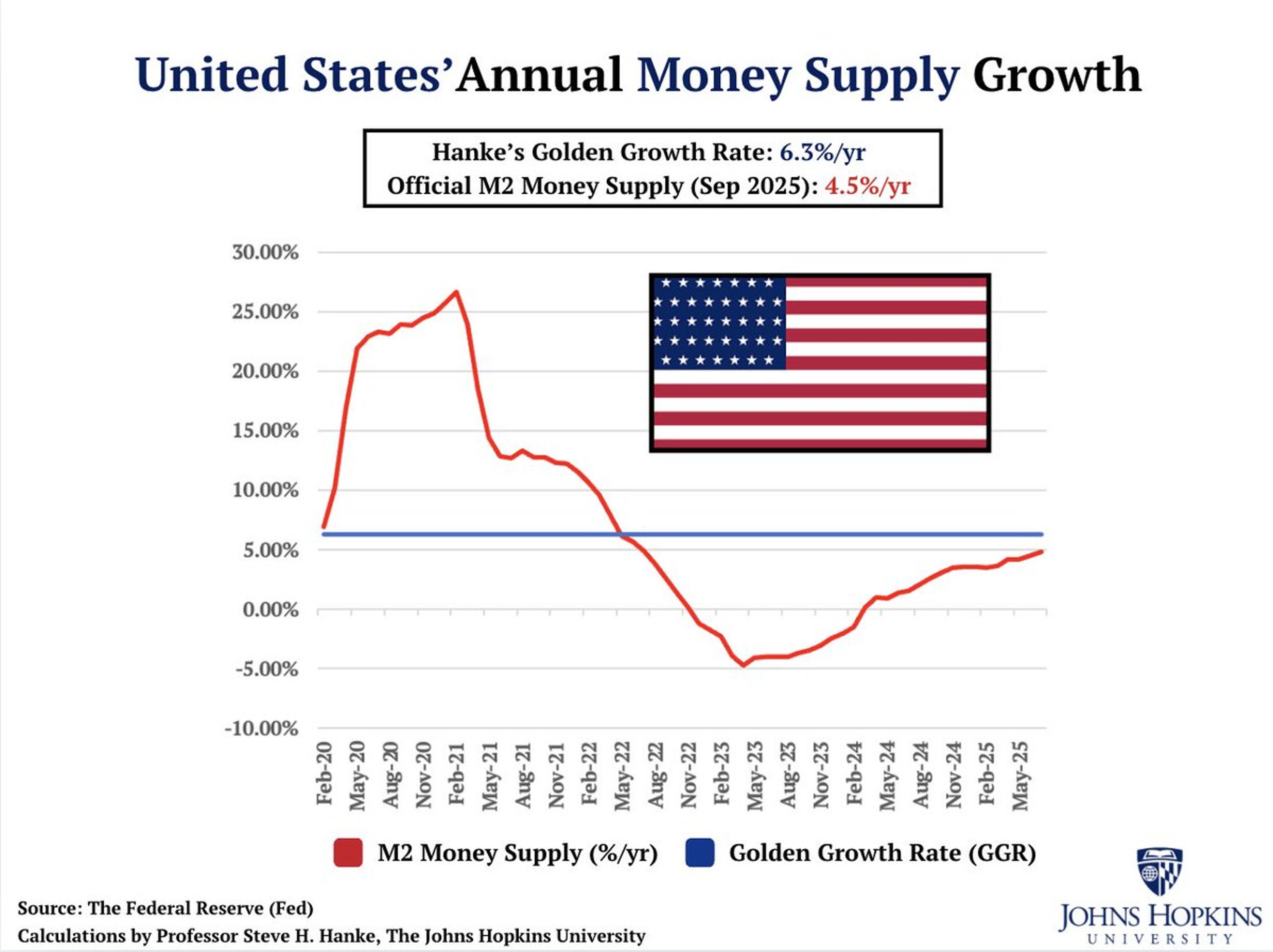

Inflation Stays Low as Money Supply Grows Below Golden Rate

US's CPI inflation rate comes in at 2.4%/yr in January. The US money supply (M2) has been growing BELOW Hanke's Golden Growth Rate of ~6.3%/yr, a rate consistent with hitting the Fed's 2%/yr inflation target, since April 2022. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 13, 2026

Bloomberg's Russia Dollar Rumor Likely Misleading, Says Hanke

Yesterday, Bloomberg reported that Russia is considering a re-entry into the US dollar system. Bloomberg's report created quite a stir. RELAX, HANKE'S 95% RULE = 95% OF WHAT YOU READ IN THE PRESS IS EITHER WRONG OR IRRELEVANT. https://t.co/8E7OK7Zm1t

By Steve Hanke

Social•Feb 13, 2026

January 2026 Defies Post‑COVID Seasonal Inflation Surge

Ever since COVID, the start of the year has seen hot inflation prints, because residual seasonality pushed up inflation in the first quarter. That isn't the case in Jan. '26 and I think that holds a warning for those forecasting...

By Robin Brooks