Social•Feb 20, 2026

Fed Minutes Reveal Mixed Inflation, AI Boosts Productivity

In this week's #OnInvesting, @LizAnnSonders and I talk about Fed minutes, mixed signals on inflation & unemployment, and weakness in the survey data. Liz Ann & @KevRGordon discuss the latest GDP report and the impact of tariffs, AI-driven investment and productivity gains. https://t.co/0dvG26q8hH

By Kathy Jones

Social•Feb 20, 2026

Equity Risk Discount Signals Overvalued Market Amid Turmoil

An equity risk premium which has recently turned into an equity risk discount. (Historically, an awful launnching pad for future returns) Policy turmoil, slowing domestic economic growth, sticky inflation, circular financing deals in AI (holding up the econ data) and traditional...

By Doug Kass

Social•Feb 20, 2026

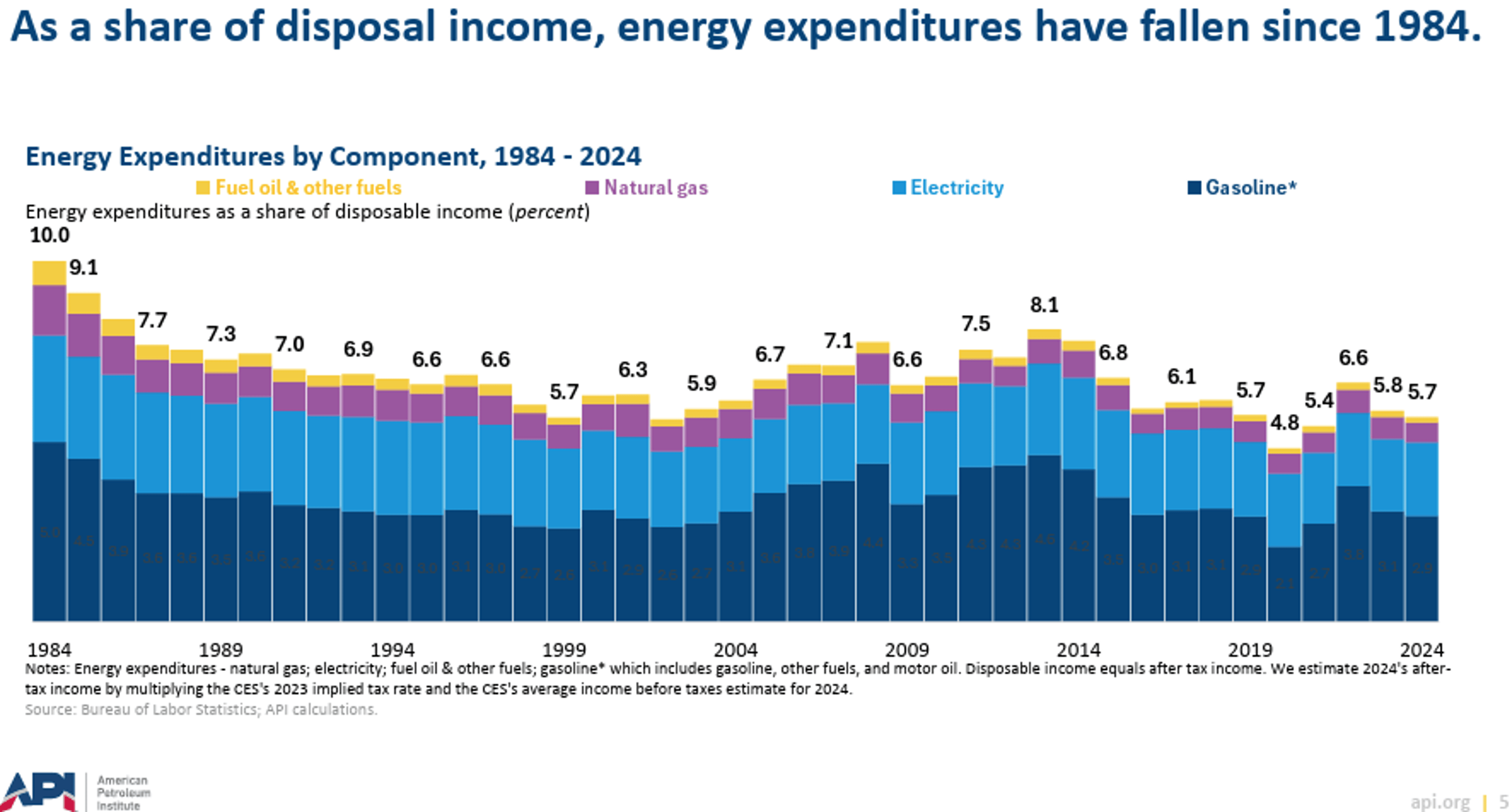

Real Energy Costs Have Declined Since 1960s

🚨New report from API 🚨: Energy & Inflation 2025 Highlights: - As a share of disposal income, energy expenditures have fallen since 1984 - In inflation adjusted terms, gasoline prices were lower in q4 2025 than in 1976 - Fuel costs have been declining...

By T. Mason Hamilton

Social•Feb 20, 2026

High Valuations Test Market Resilience in 2026

Markets flat near the highs + valuations near the upper end of history. Tom Martin of Globalt breaks down what that actually means—and what could sustain (or break) it in 2026! Our latest episode of the Market Misbehavior podcast: https://t.co/nA9bmU87rf...

By David Keller, CMT

Social•Feb 20, 2026

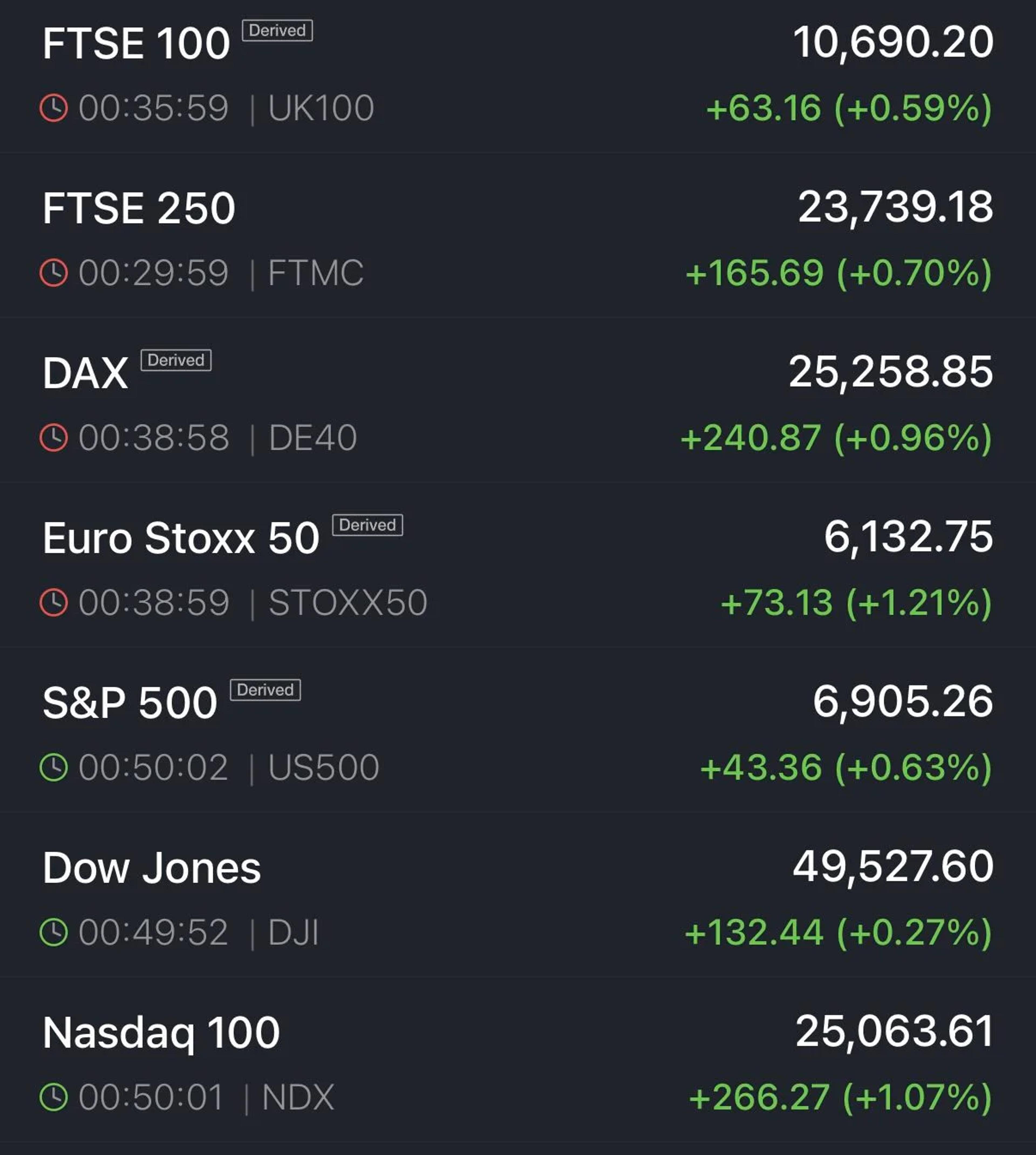

SCOTUS Overturns Trump Tariffs, Global Markets Surge

Trump Tariffs (most of them, not all) struck down by SCOTUS. Immediate reaction on stocks: •US higher (Mag7 up led by GOOGL +4%). •Europe higher: London, Paris, Amsterdam at ATH. •Asia likely positive, but on the contrary the front loadings...

By Azharuddin | Azha Investing

Social•Feb 20, 2026

IEEPA Threat Raises Tariff Ceiling, Shifts Negotiation Dynamics

While 15% is close to what many countries ended up negotiating with Trump, he invoked IEEPA to threaten much higher rates, providing powerful leverage. If 15% is an effective ceiling (outside 301/232 actions), that changes the bargaining dynamic.

By Greg Ip

Social•Feb 20, 2026

Accounting Rules Reveal Shutdown’s Massive Real GDP Loss

A fun(?) 🧵 on how nerdy government accounting rules had a big impact on Q4 GDP. And how they reflect how wasteful the 43-day government shutdown was. TL;DR: Small reduction in nominal federal spending in Q4. But a big decline in...

By Jason Furman

Social•Feb 20, 2026

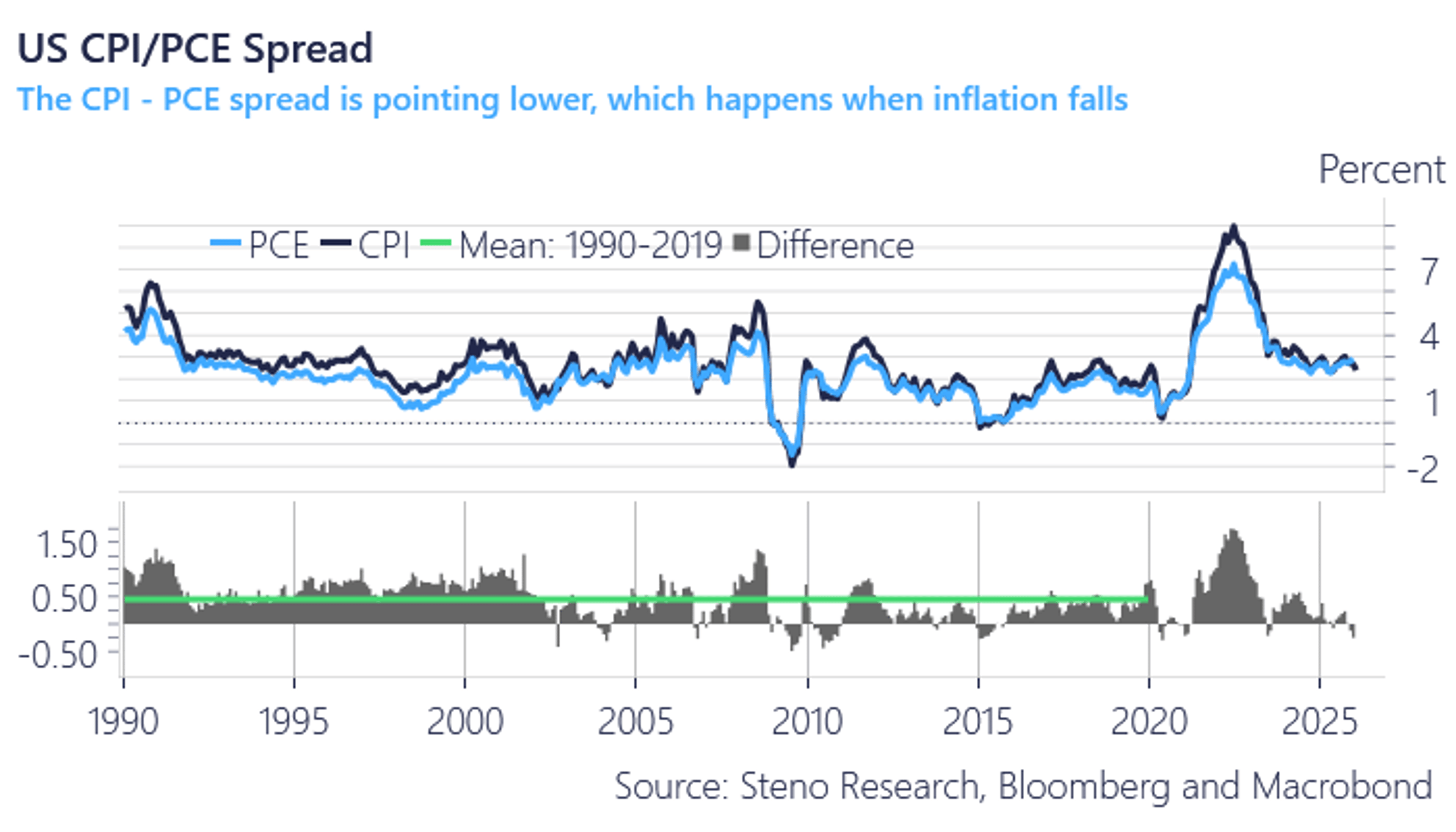

Falling CPI‑PCE Spread Signals Declining Inflation, Defying Q4 GDP

When the CPI-PCE spread heads lower (the spread is cyclical), it is because inflation is going lower. CPI is what matters.. End of discussion The economy is currently doing the opposite of that Q4 GDP report https://t.co/xBUcAxE1EP

By Andreas Steno Larsen

Social•Feb 20, 2026

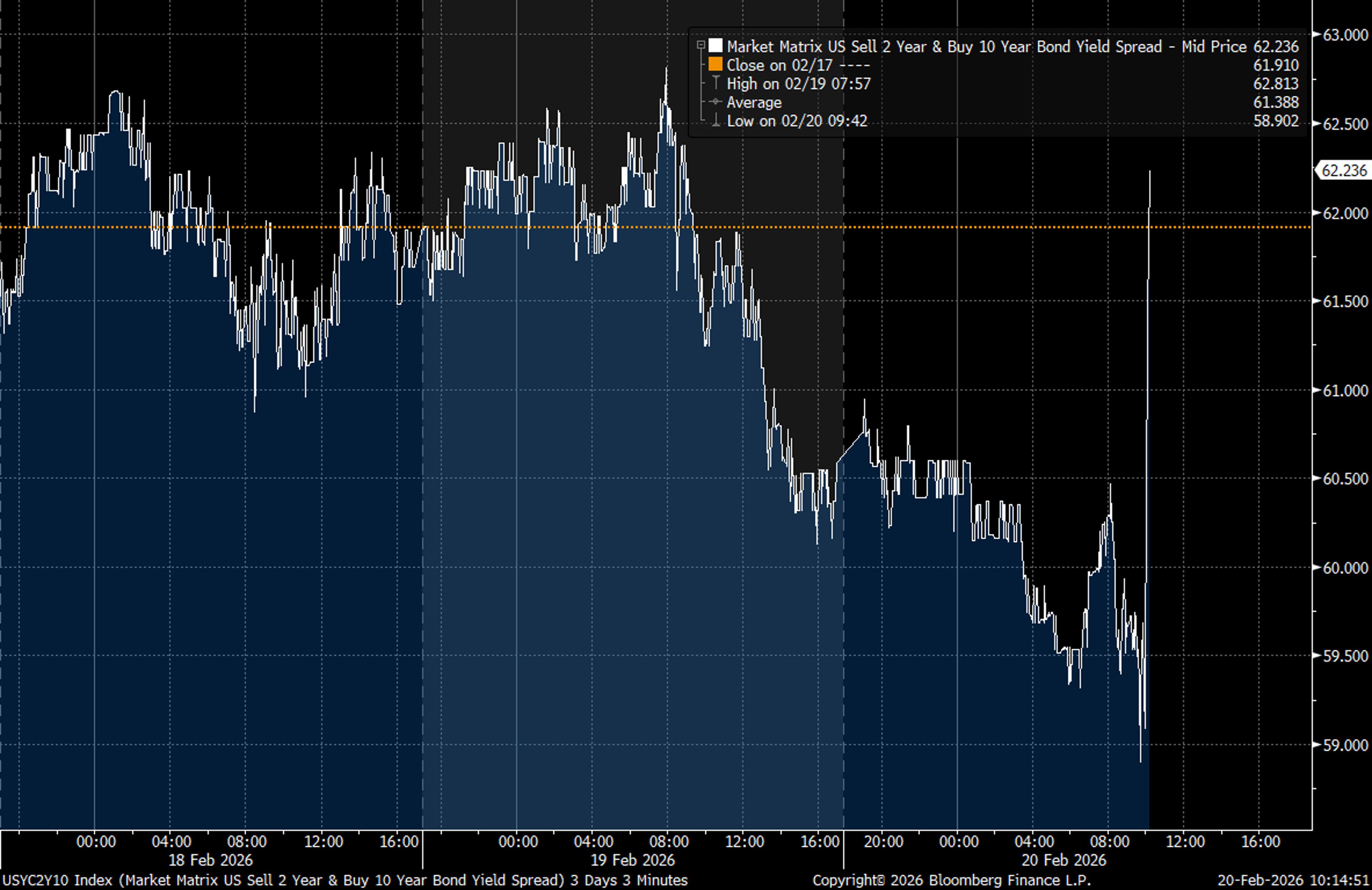

Yield Curve Ste

USTs for now reacting to the loss of tariff revenue, but it remains to be seen how this plays out. Curve steepening https://t.co/ZMjLP2vbxi

By Ed Bradford

Social•Feb 20, 2026

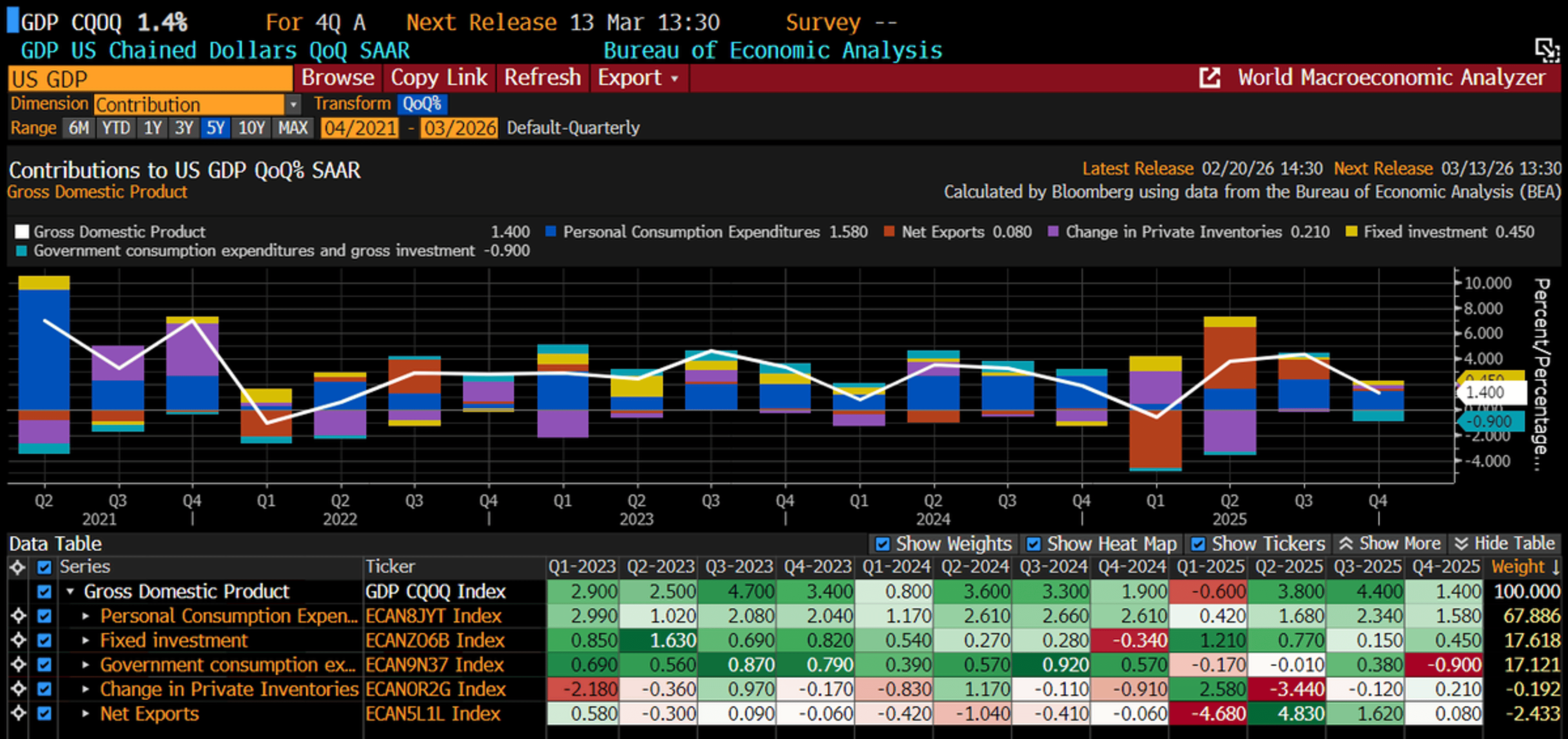

US Q4 Growth Stalls at 1.4% Amid Shutdown

The US econ grew less than expected in the fourth quarter, weighed down by a record-long govt shutdown, weaker consumer spending, and softer trade. GDP expanded at an annualized rate of 1.4% in Q4, down sharply from 4.4% in Q3....

By Holger Zschaepitz

Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it...

By Nick Timiraos

Social•Feb 20, 2026

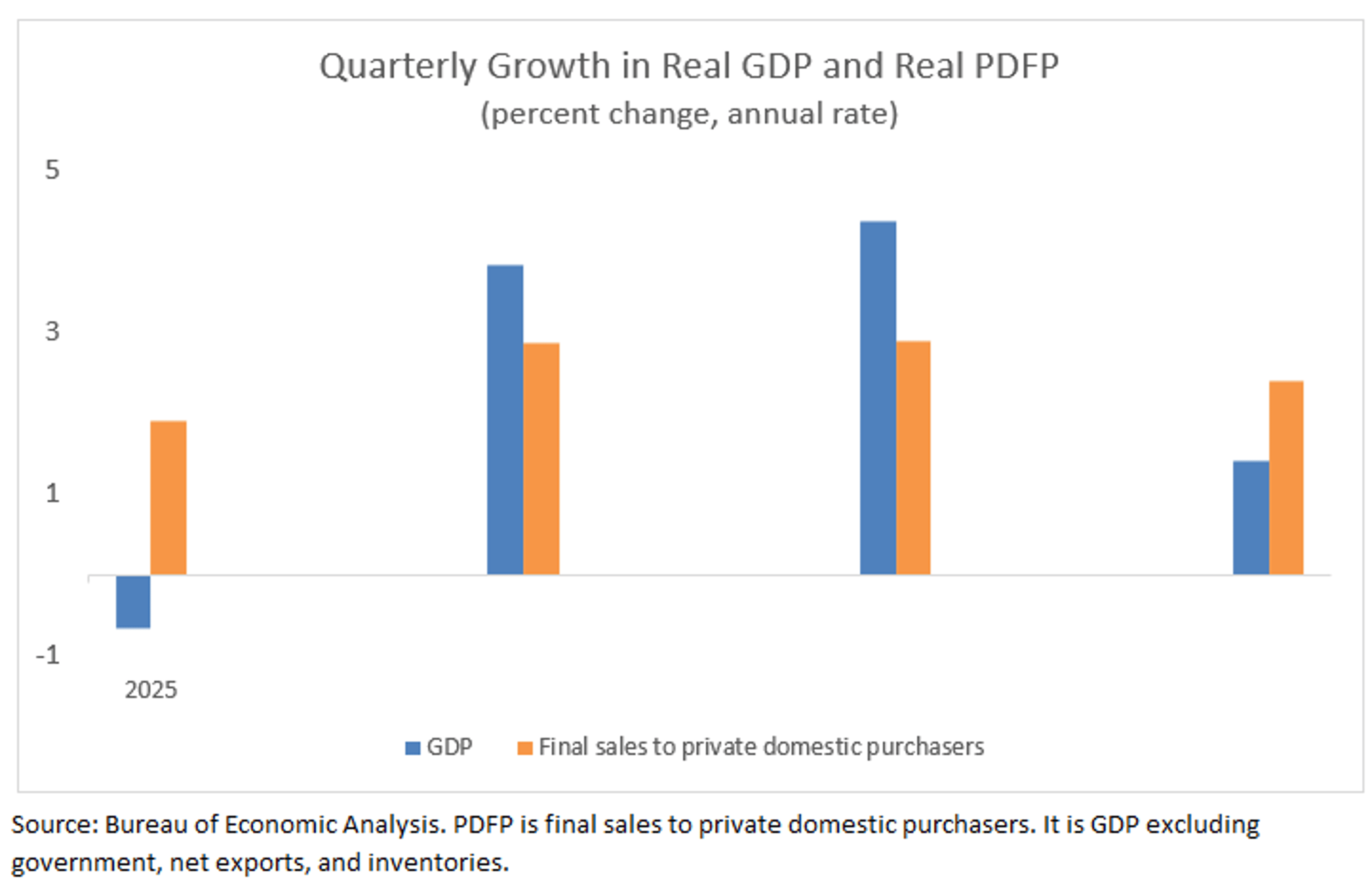

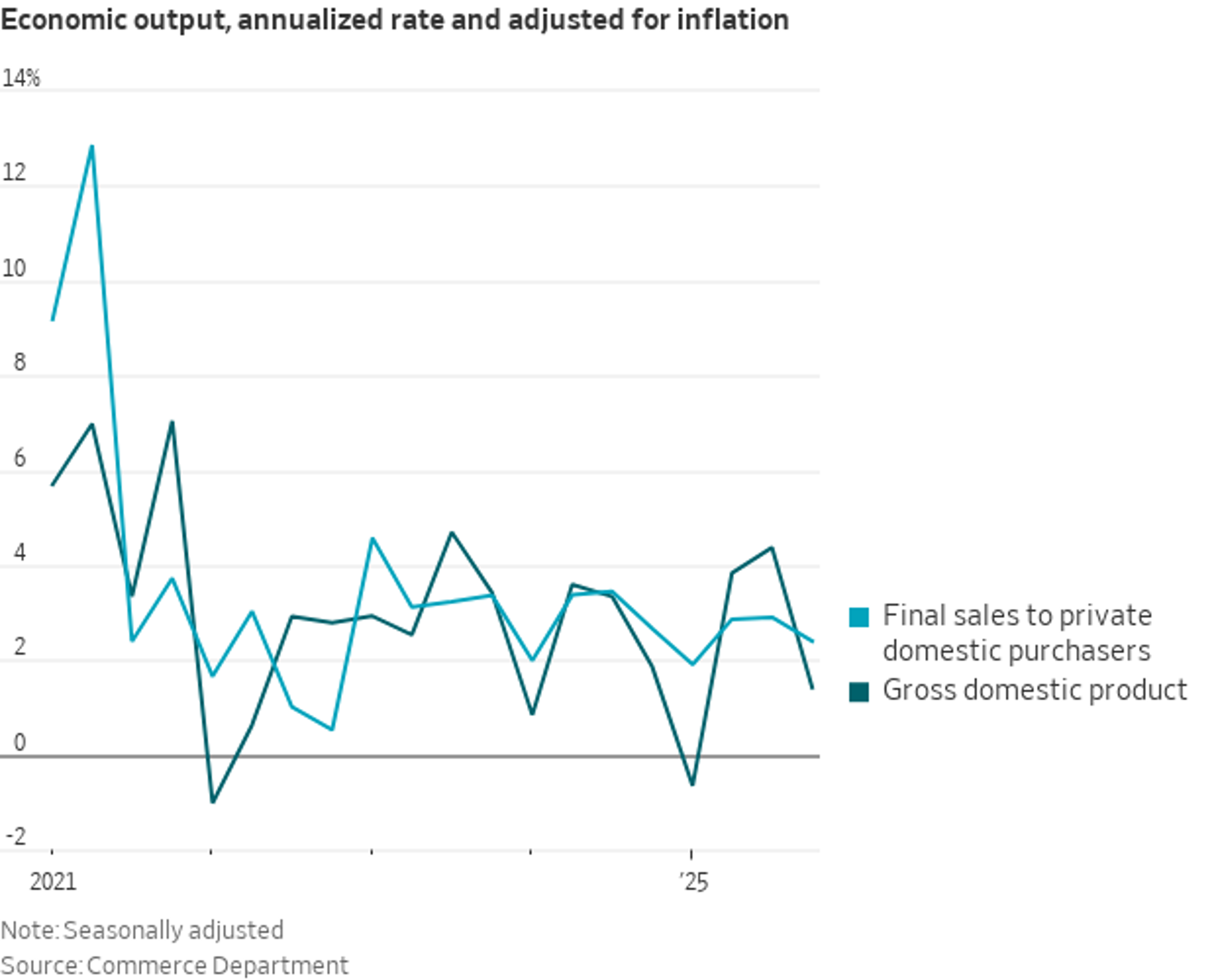

2025 GDP Volatile, PDFP Shows Steady Growth

Did 2025 feel like a wild ride? GDP feels your pain. The quarterly swings were big and short-lived. PDFP, which focuses on consumption and private fixed investment, showed more even, solid gains. https://t.co/LlVwQ7yna5

By Claudia Sahm

Social•Feb 20, 2026

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

Trump’s 5.4% GDP Claim Was Just a Model

Remember when Trump was bragging about Q4 GDP growth, quoting a 5.4% rate? That was the Atlanta Fed's GDPNow model, not the actual. Now we have the actual: 1.4%. Moral: Don't take GDP "trackers" or anyone citing them, remotely seriously....

By Ian Shepherdson

Social•Feb 20, 2026

Protecting Domestic EVs Requires Tariffs or Local Content Rules

Very good Rhodium piece on the cost advantage of Chinese EVs: “In practice, countries seeking to protect domestic industries have two broad options. One is to impose very high tariffs that account not only for subsidies but also for structural...

By Michael Pettis