Social•Feb 20, 2026

Core PCE Near Target; Fed Cuts Still Unlikely

Q4/Q4 core PCE inflation was 2.9% last year (vs. 3.0% in 2024). Trump's statement on the GDP report includes a parenthetical jab at the Fed chair, but there's not much of anything in this report that tells the Fed it needs to cut anytime soon. https://t.co/T9YNiD61ly

By Nick Timiraos

Social•Feb 20, 2026

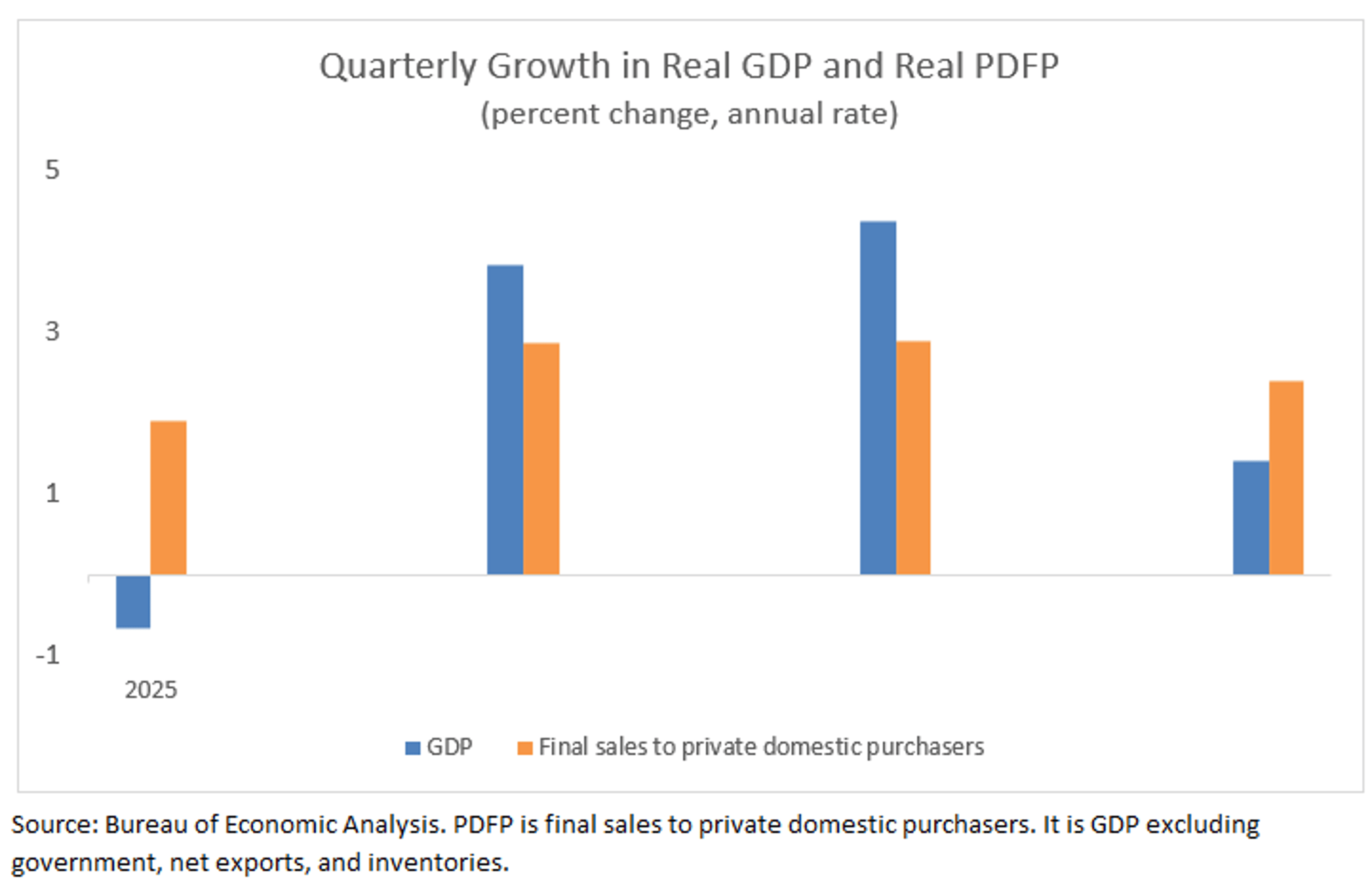

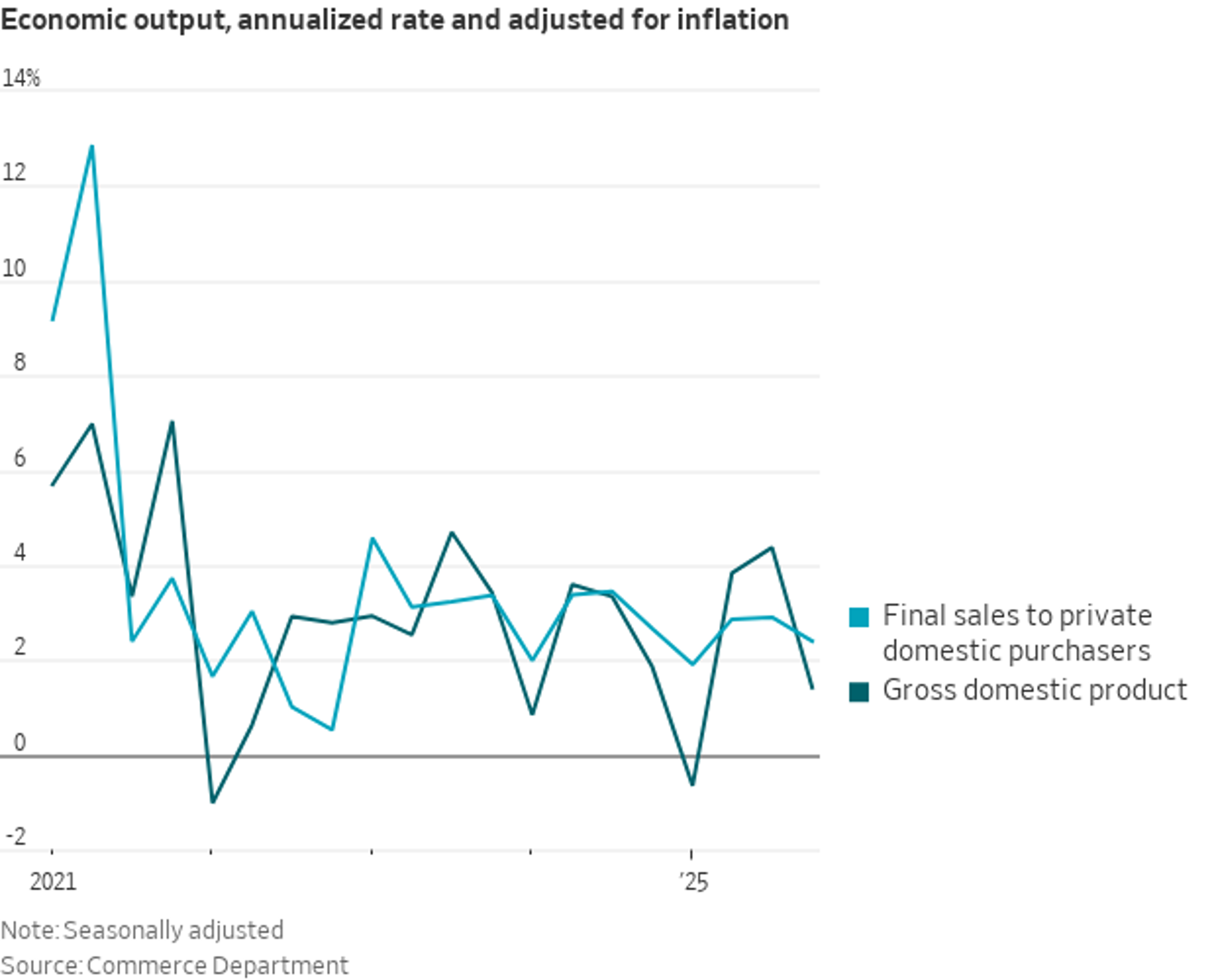

2025 GDP Volatile, PDFP Shows Steady Growth

Did 2025 feel like a wild ride? GDP feels your pain. The quarterly swings were big and short-lived. PDFP, which focuses on consumption and private fixed investment, showed more even, solid gains. https://t.co/LlVwQ7yna5

By Claudia Sahm

Social•Feb 20, 2026

US Underlying Domestic Demand Grew 2.4% in Q4

US GDP: A gauge of underlying domestic demand—real final sales to private domestic purchasers (GDP less inventory change, net exports, and government spending)—grew at a 2.4% annualized rate in Q4 https://t.co/XefZvVp18v

By Nick Timiraos

Social•Feb 20, 2026

Trump’s 5.4% GDP Claim Was Just a Model

Remember when Trump was bragging about Q4 GDP growth, quoting a 5.4% rate? That was the Atlanta Fed's GDPNow model, not the actual. Now we have the actual: 1.4%. Moral: Don't take GDP "trackers" or anyone citing them, remotely seriously....

By Ian Shepherdson

Social•Feb 20, 2026

Protecting Domestic EVs Requires Tariffs or Local Content Rules

Very good Rhodium piece on the cost advantage of Chinese EVs: “In practice, countries seeking to protect domestic industries have two broad options. One is to impose very high tariffs that account not only for subsidies but also for structural...

By Michael Pettis

Social•Feb 20, 2026

UK Retail Sales Record Fastest Growth in 20 Months

UK retail sales begin the year with the fastest growth in 20 months https://t.co/GPGNaZk4Oa via @irinaanghel12 https://t.co/kAm5UcAWvQ

By Zöe Schneeweiss

Social•Feb 20, 2026

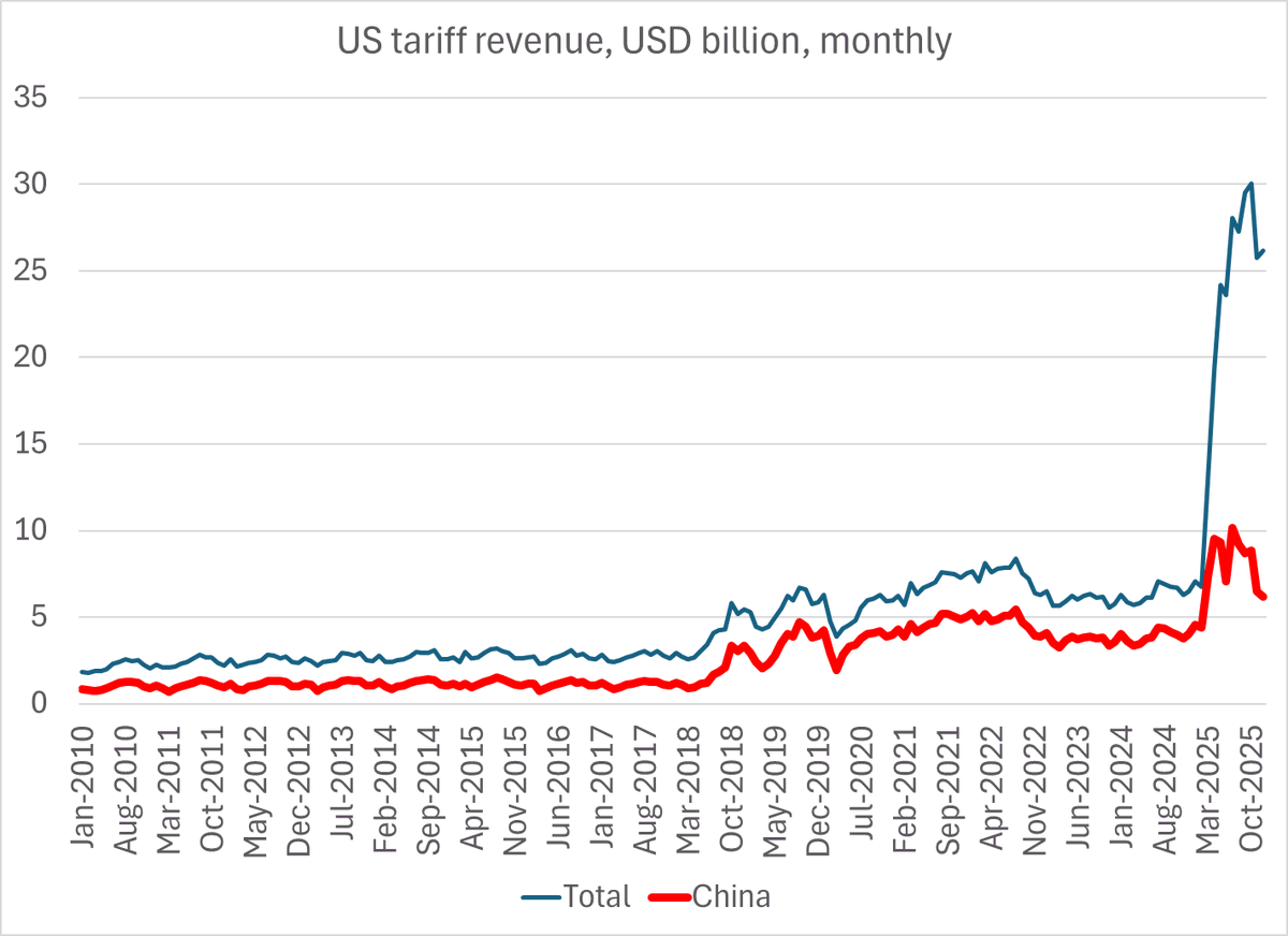

Busan Deal: US Sacrific

The impact of the "Busan" deal is now in the trade data -- the US clearly gave up a bit of tariff revenue (lowering the tariff on China) for a bit of supply chain peace, and the prospect of...

By Brad Setser

Social•Feb 20, 2026

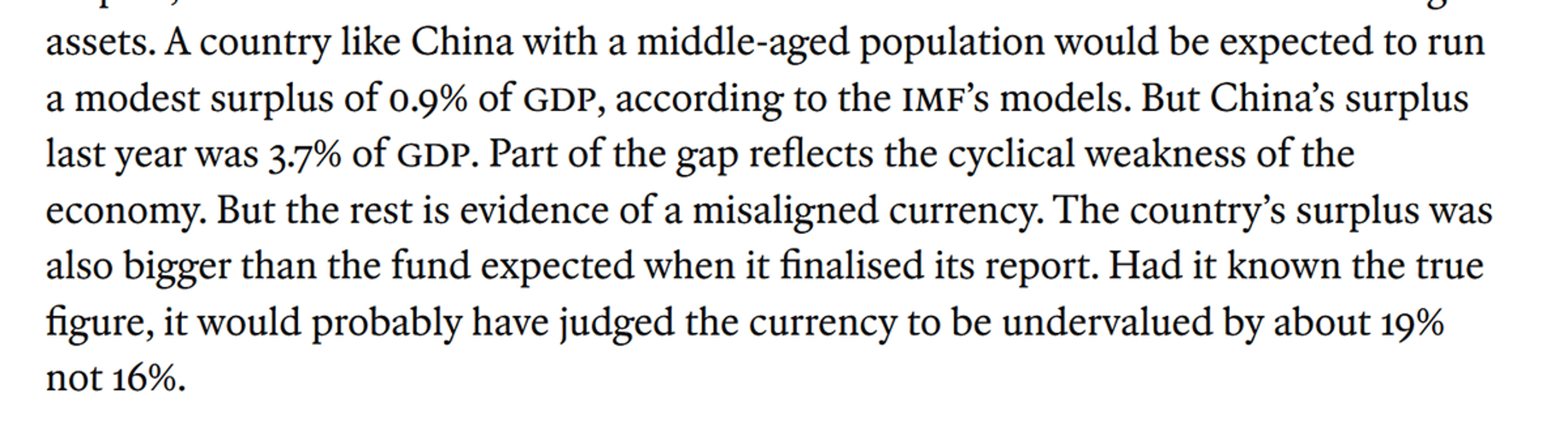

IMF Estimates Chinese Yuan Undervalued by Roughly 19%

Just how undervalued is the Chinese yuan -- the IMF (via the Economist) just revised its estimate up to 19% (plus or minus 4%) 1/many https://t.co/IJ4Z1SmGIq

By Brad Setser

Social•Feb 20, 2026

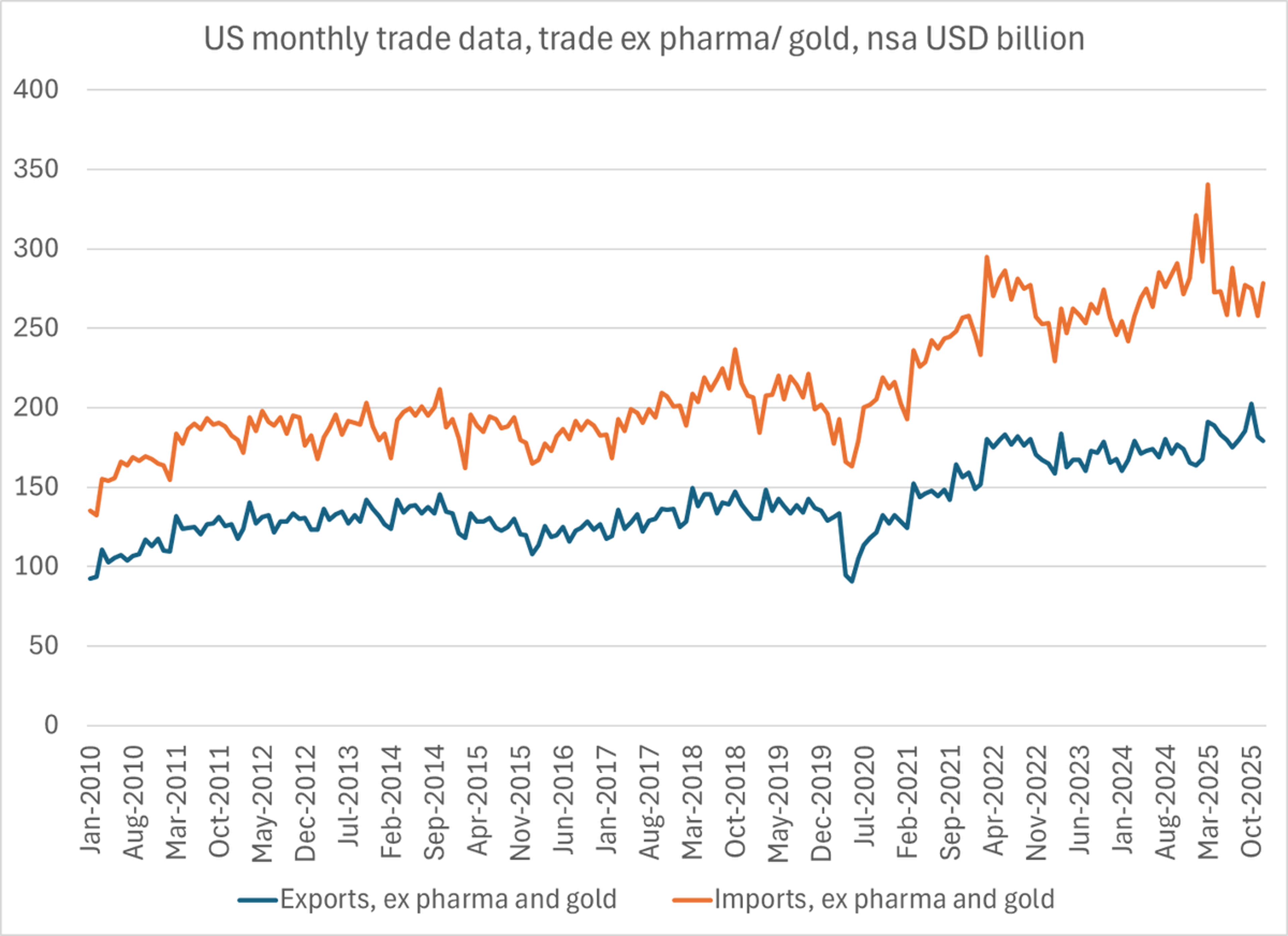

Exclude Pharma and Gold to Reveal True US Trade Trend

I think the best way to look at the underlying trend in the US trade data is strip out pharmaceuticals and gold (both were heavily influenced by the threat of tariffs, even though none were imposed on either category) 1/ https://t.co/7l20zR7CTr

By Brad Setser

Social•Feb 20, 2026

Rising PMI Could Spark Market Melt‑Down, Delay Fed Cuts

Will the stock market melt down if the US economy heats up, banishing traders' hopes for Fed rate cuts? All eyes turn to PMI data to find out. #stockmarkets #USD #fed #pmi #economy #interestrates #macro #trading https://t.co/fgEbuQrjnq

By Ilya Spivak

Social•Feb 20, 2026

Strategic Partnership Shouldn't Just Be German Production in China

Hope the "strategic partnership" is more than allowing German companies to produce in China for the German (and European) market ...

By Brad Setser

Social•Feb 20, 2026

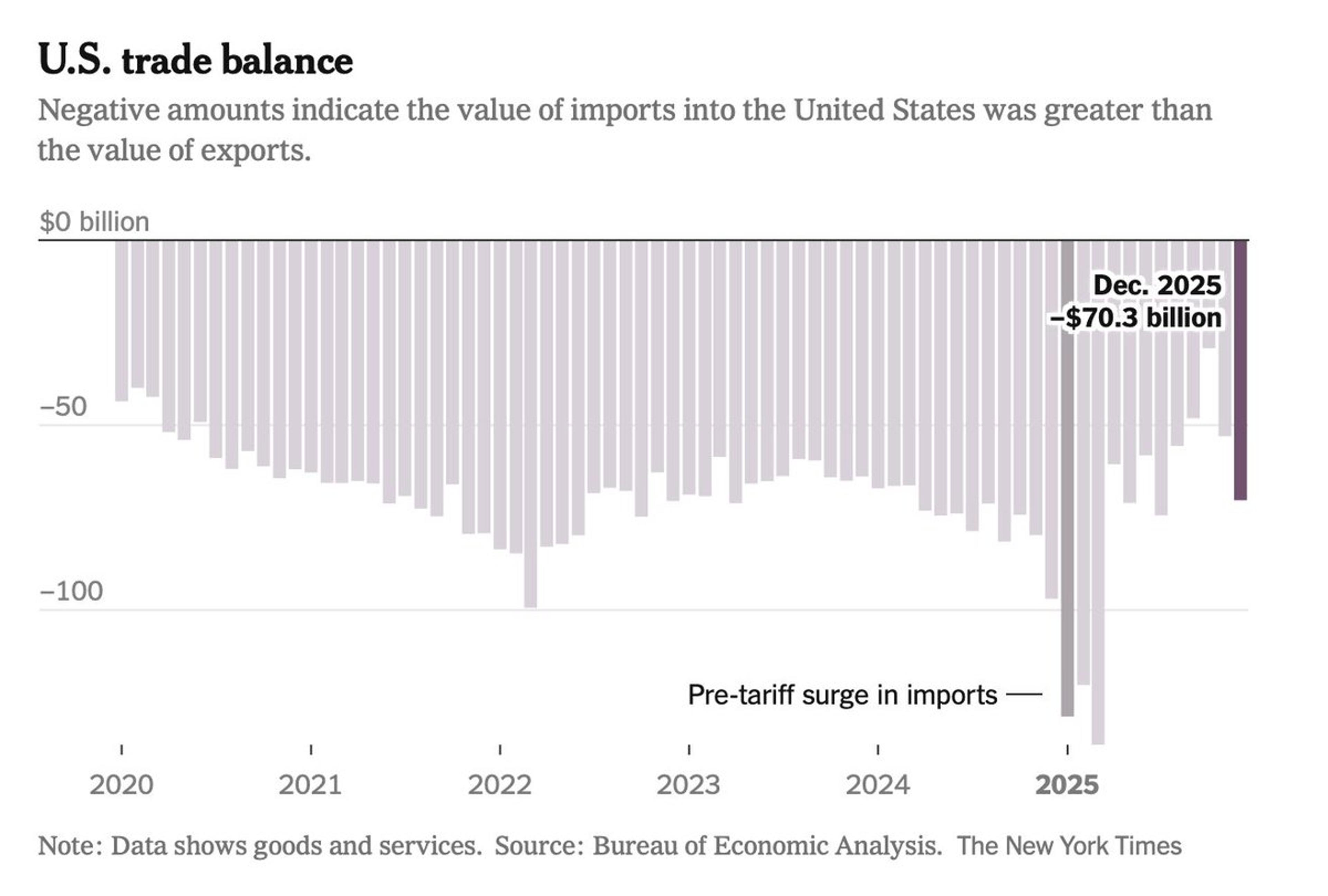

Trump's Tariffs Fail, Trade Deficit Widens to $70 B

Pres. Trump promised his steep tariffs would narrow the trade deficit and spark a manufacturing revival. New federal data show the U.S. trade deficit widened to –$70.3B in December 2025. So much for Trump's trade spin. https://t.co/NIGIRs4sQt

By Steve Hanke

Social•Feb 20, 2026

US Stock Market Hits Record Concentration: Top 10 Own 40%

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile...

By Global Markets Investor (newsletter author)

Social•Feb 20, 2026

HSBC Cuts US DCM, Shifts Focus to Asian Banks

Macro: HSBC trims ~10% of US DCM in broader $1.8bn cost overhaul and pivot to Asia/Middle East. Key factors: management cuts, M&A/ECM pullback. Risk: execution/credit cycles. Trade: favor Asian bank equities. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

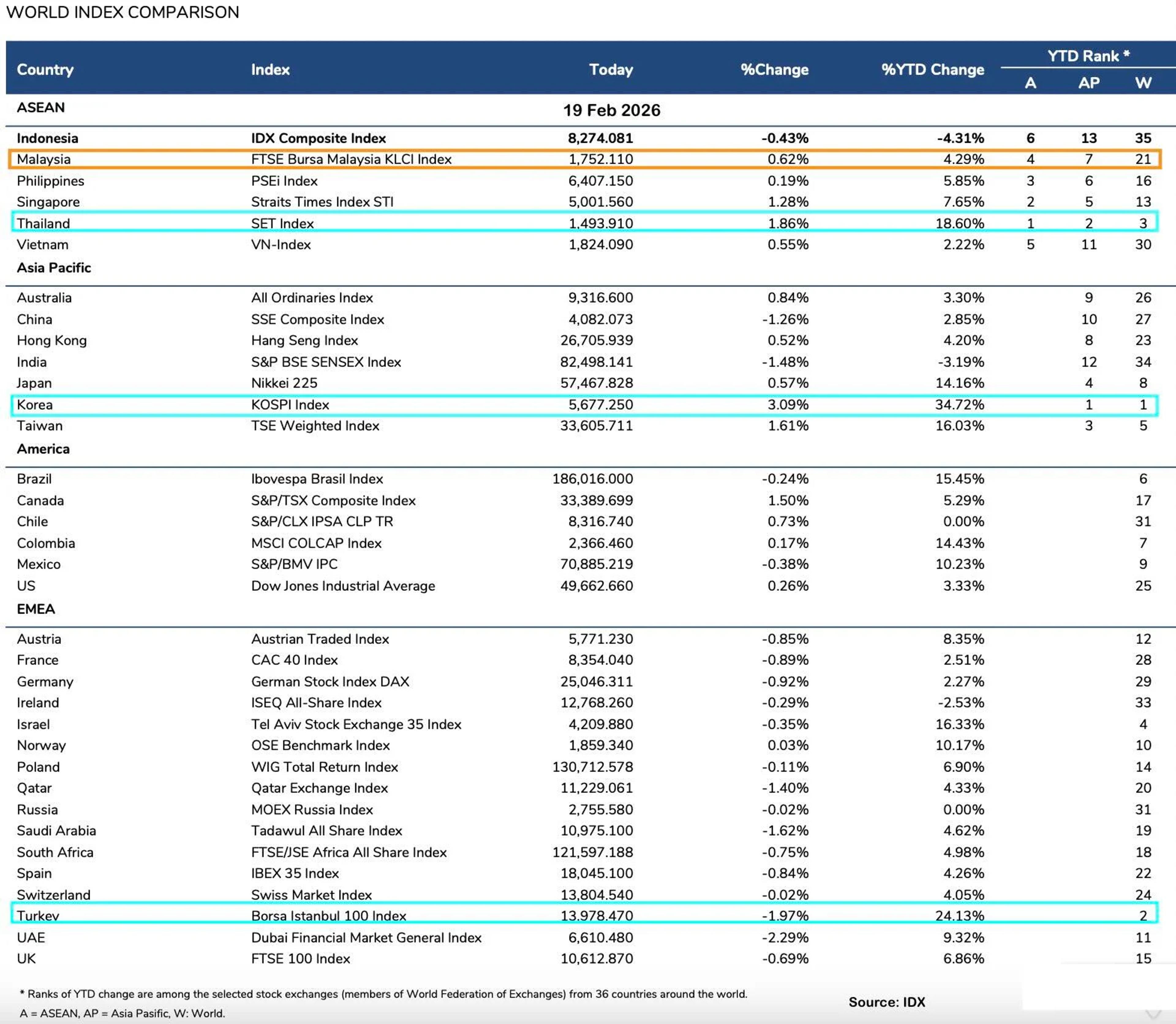

South Korea, Turkey, Thailand Lead YTD Market Gains

Best performing stock markets in the world (local currency) year-to-date. 1. S Korea +34.7% 2. Turkey +24.1% 3. Thailand +18.6% In Asia only Indonesia, India negative. Malaysia is up only 4.3%.

By Azharuddin | Azha Investing

Social•Feb 19, 2026

Buy Newmont on Pullbacks as Gold Rises

Macro: gold up on rate‑cut hopes & geopolitics. Key: Newmont beat as realized $4,216/oz offset 24% output drop. Risk: output erosion, volatility. Trade: buy Newmont on pullbacks. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

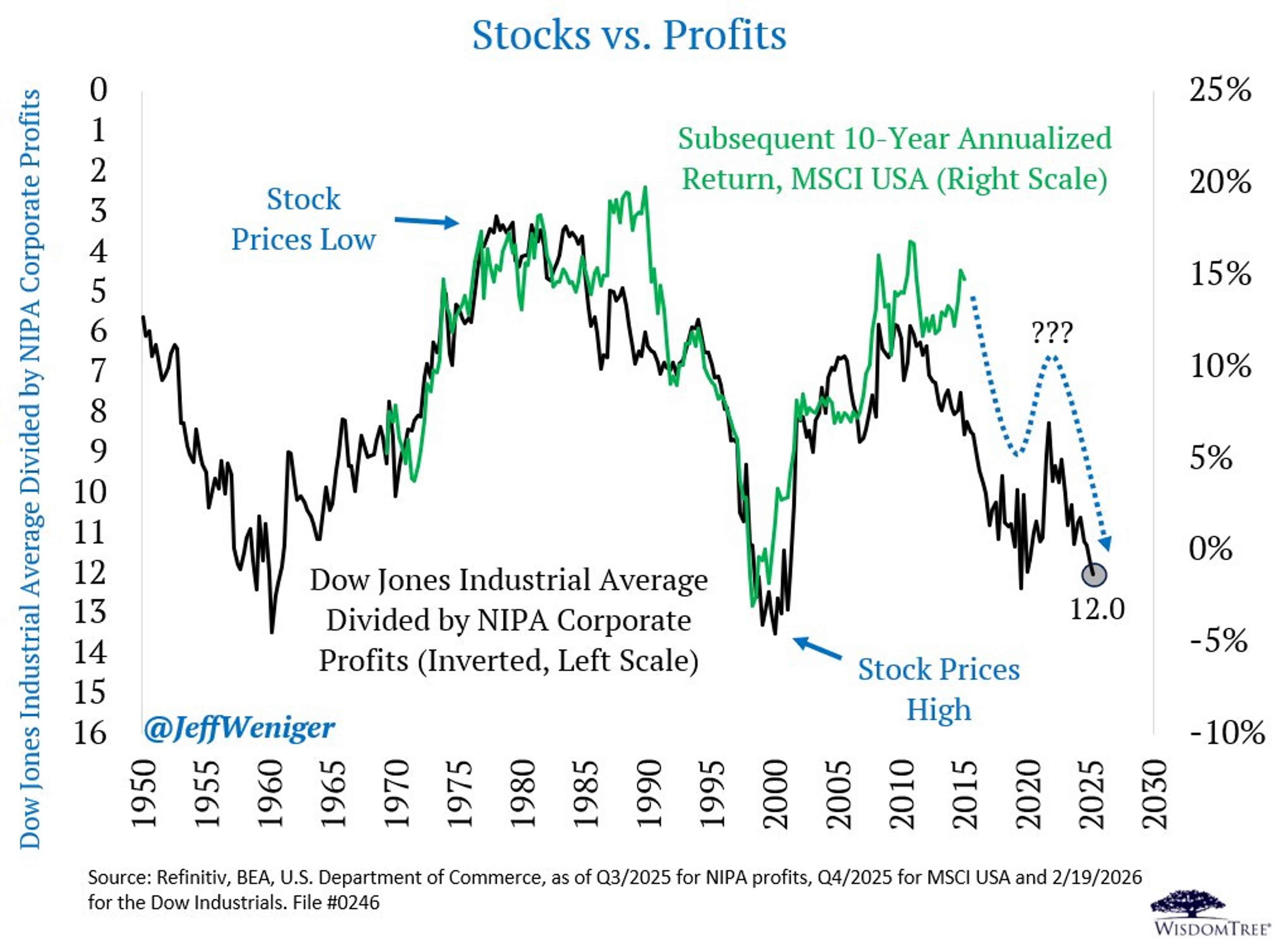

Energy and Materials Surge as Tech Falters in 2026

This is a pretty cool chart to show your investment committee. A classic stock price-to-corporate profits image that reveals extended conditions reminiscent of the turn of the century. If this chart has any prescience, we should remember that the leaders...

By Jeff Weniger

Social•Feb 19, 2026

91 Days, Two Rate Calls, Then Warsh Takes Over

Only 91 days and two more rate decisions (Mar 18 and Apr 29) before Jerome Powell's term as Fed Chair ends (May 15th). Then it is the Warsh era...

By John Kicklighter

Social•Feb 19, 2026

Fed‑Treasury Coordination Must Be Transparent, Not Secret

Fed independence was a 20th century virtue. Fed inter-dependence is a 21st century necessity. The question was never whether the Fed and Treasury coordinate-it's whether that coordination happens in the dark or in the light The American people deserve monetary transparency...

By Jeff Park

Social•Feb 19, 2026

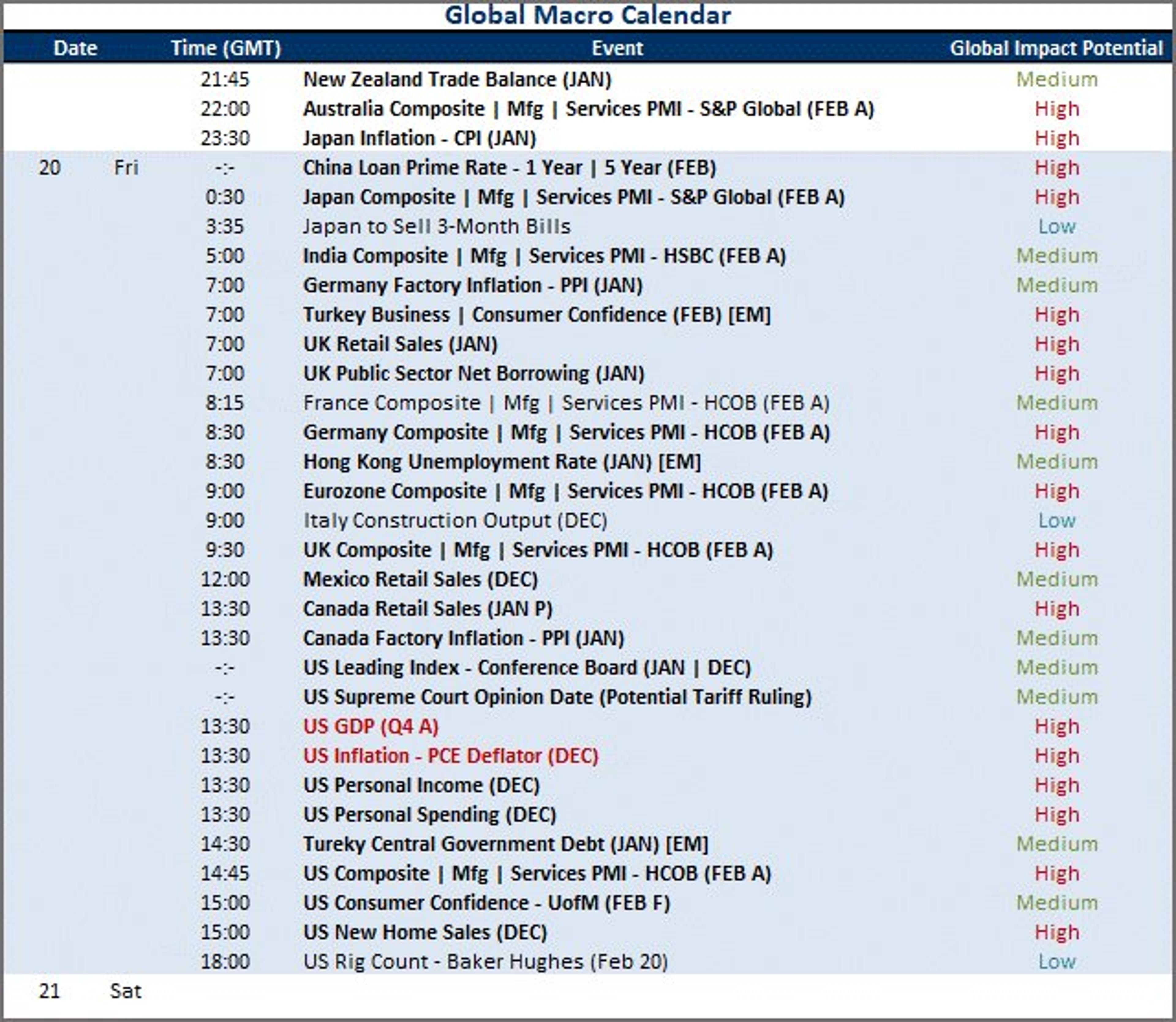

Grey Swan Risks Amid Busy Global Macro Calendar

While I will keep an eye out for grey swans catalyzing (Iran and Supreme Court's decision on tariffs principally), the global macro docket picks up through Friday. Top event risk includes: Japan CPI; February PMIs; Mexico and Canada retail sales; US...

By John Kicklighter

Social•Feb 19, 2026

AUD/USD Rally Pauses Near 2023 High, Streak Threatened

Australian Dollar Forecast: AUD/USD Rally Stalls Near 2023 High – Four-Week Streak at Risk https://t.co/srtBKcRq3k $AUDUSD Weekly Chart https://t.co/oGQK6Jc1uV

By Michael Boutros

Social•Feb 19, 2026

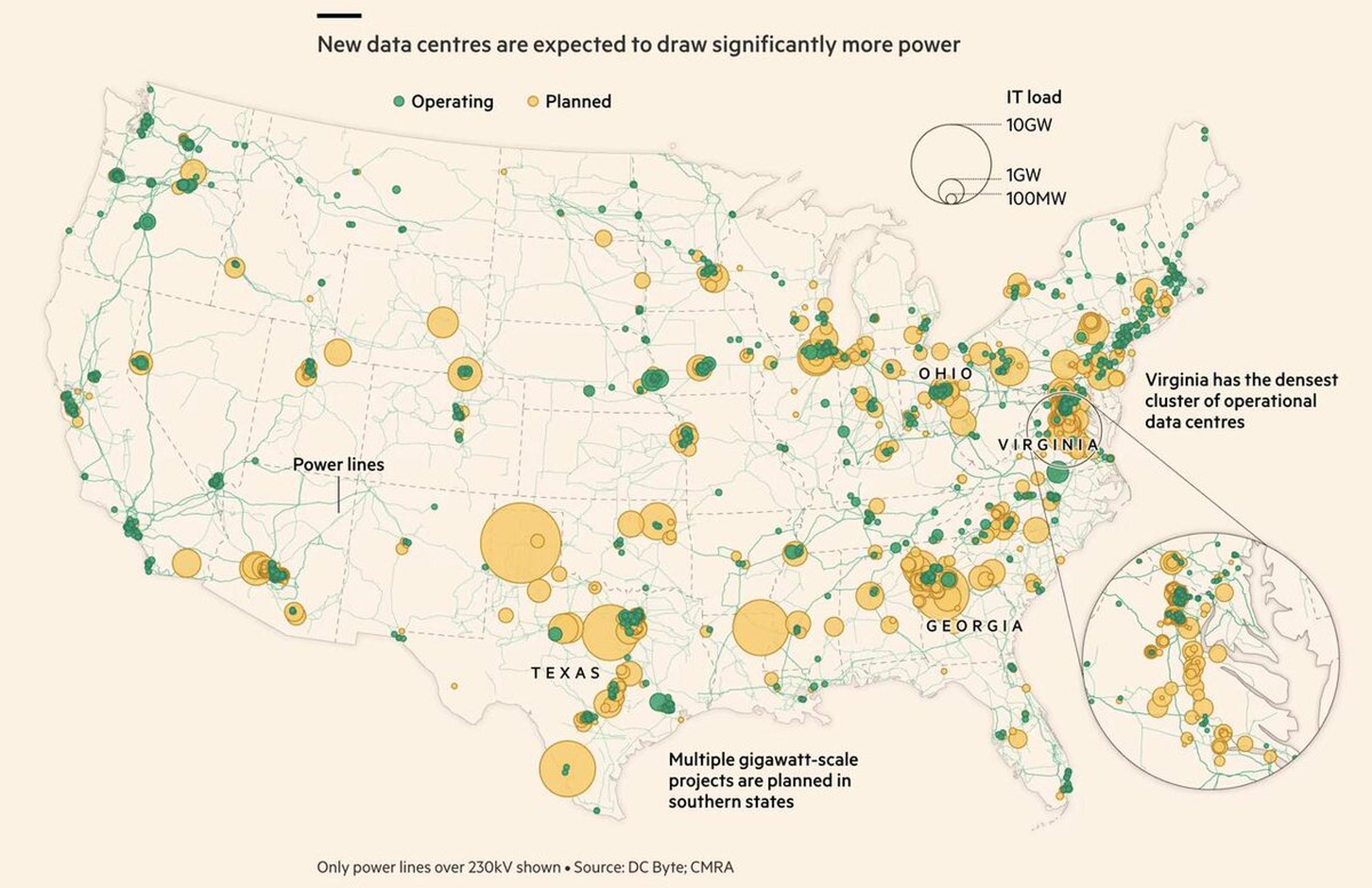

AI Data Centers Drain Power of 100k Homes

According to a report from the International Energy Agency, an average AI datacenter consumes as much electricity as 100,000 households. AI = HIGHER ELECTRICITY PRICES = AN AFFORDABILITY PROBLEM. https://t.co/65QNfr2y4U

By Steve Hanke

Social•Feb 19, 2026

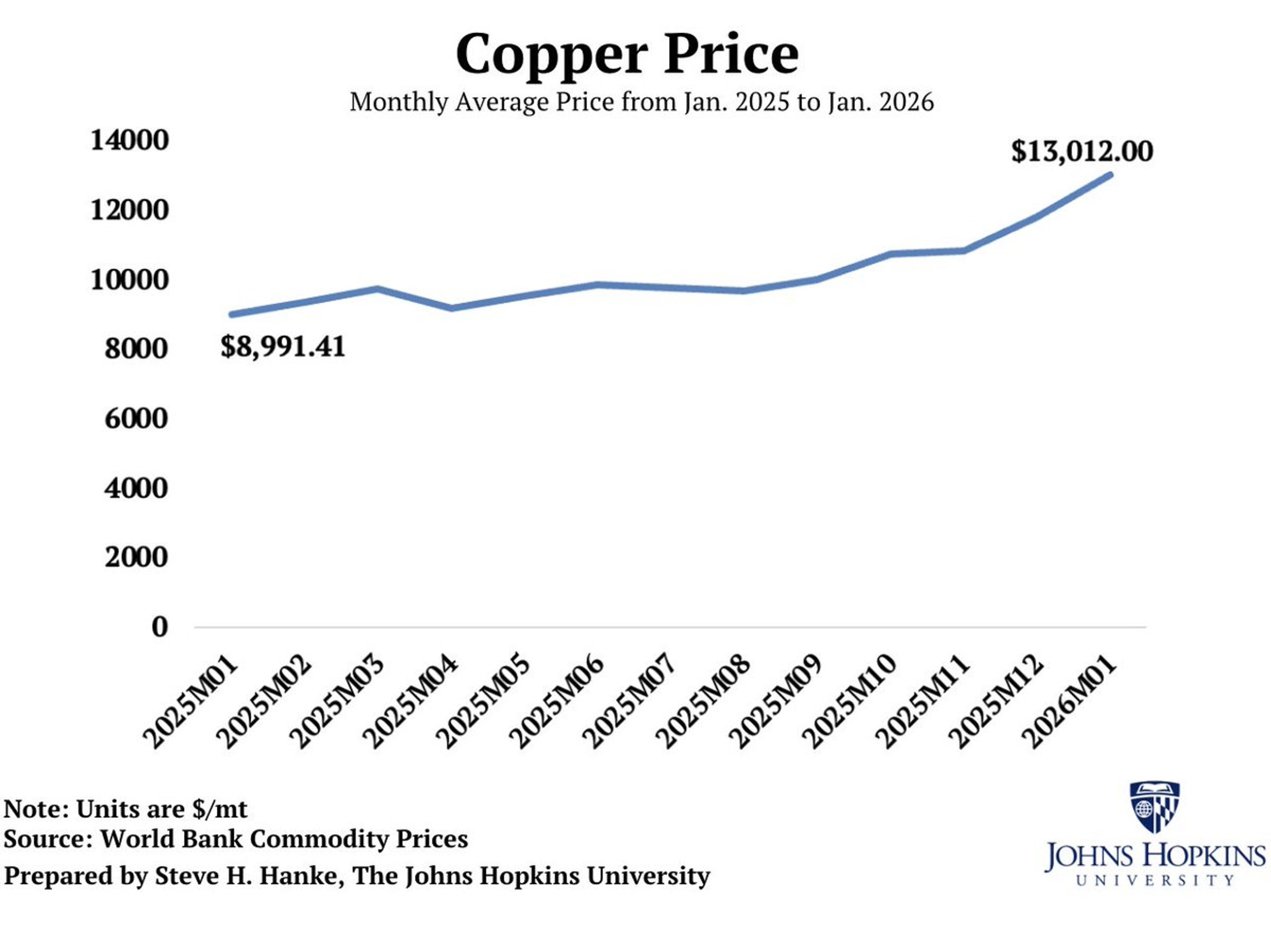

Copper Prices Jump 44% Year‑Over‑Year

Copper prices have surged to an average of $13,012/mt in January 2026 from $8,991/mt a year ago. That's a WHOPPING 44% INCREASE. BUY COPPER, WEAR DIAMONDS. https://t.co/FIhvIikhjQ

By Steve Hanke

Social•Feb 19, 2026

Small‑cap Outlook Dim Amid Credit Crunch, AI Slowdown

Asking for a friend how small caps are going to perform after everyone piled in long behind the economic reacceleration trade while private credit implodes, the AI capex buffer declines and the Fed remains on hold...

By Quinn Thompson

Social•Feb 19, 2026

US Strike Risk Adds Premium to Oil Market

Expectations of a possible US strike on Iran—currently oscillating between wait-and-see and watchful anticipation—have introduced a risk premium into an otherwise well-supplied oil market. My talk w/ @KellyCNBC @CNBCTheExchange https://t.co/XwyD5XmiRg

By Daniel Yergin

Social•Feb 19, 2026

Bipartisan Push for 3% GDP Deficit Cap Gains Momentum

I Love and Endorse the Bipartisan 3 % of GDP Budget Deficit Solution In the House of Representatives there is now a bipartisan bill in the works to enact, and a growing agreement that we need, a 3% cap on the budget...

By Ray Dalio

Social•Feb 19, 2026

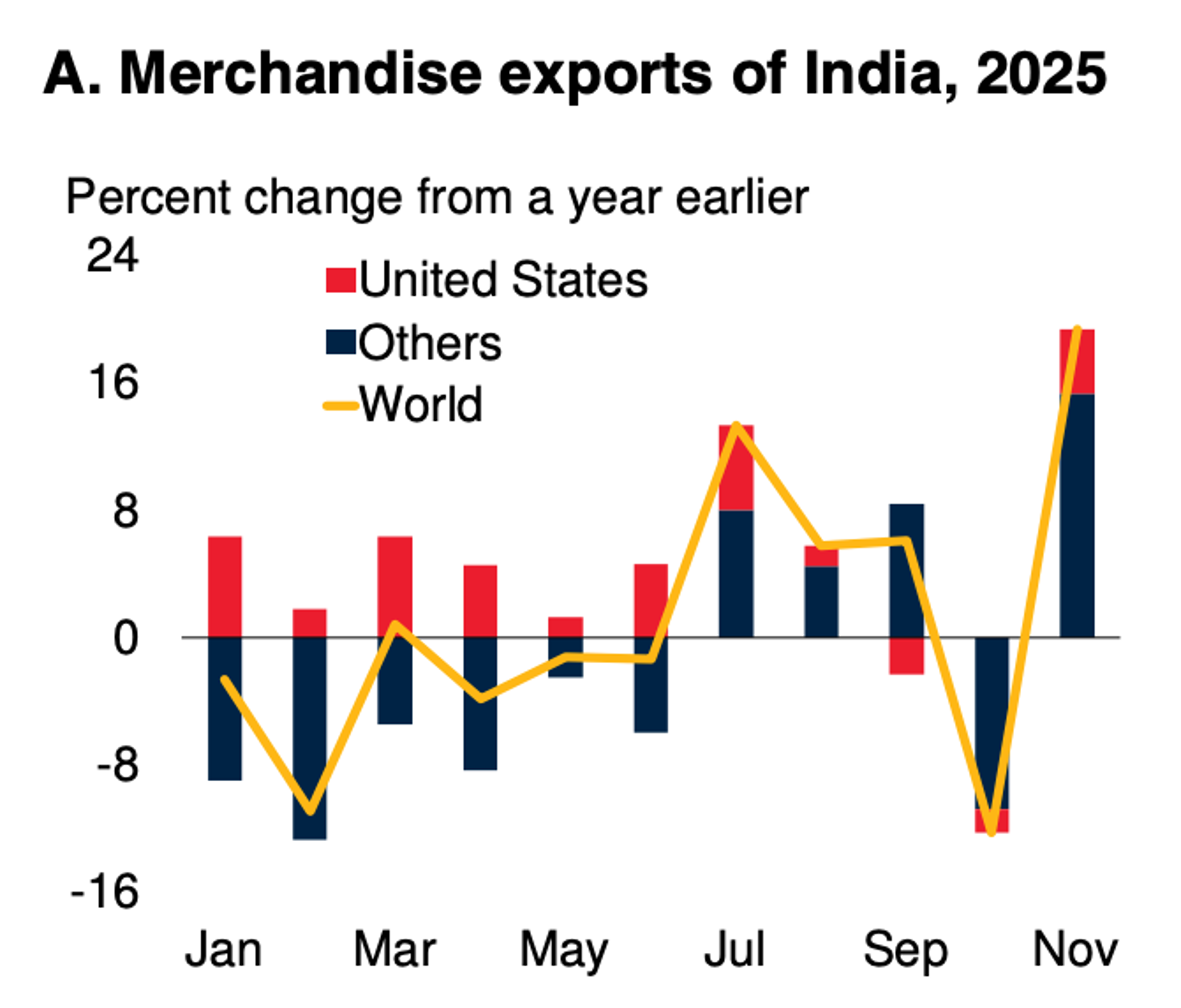

India's Exports Surge Despite Higher US Tariffs

From the World Bank’s Global Economic Prospects: Indian merchandise exports rose despite higher US tariffs. MODI’S ON A ROLL. https://t.co/yxKowcoHyv

By Steve Hanke

Social•Feb 19, 2026

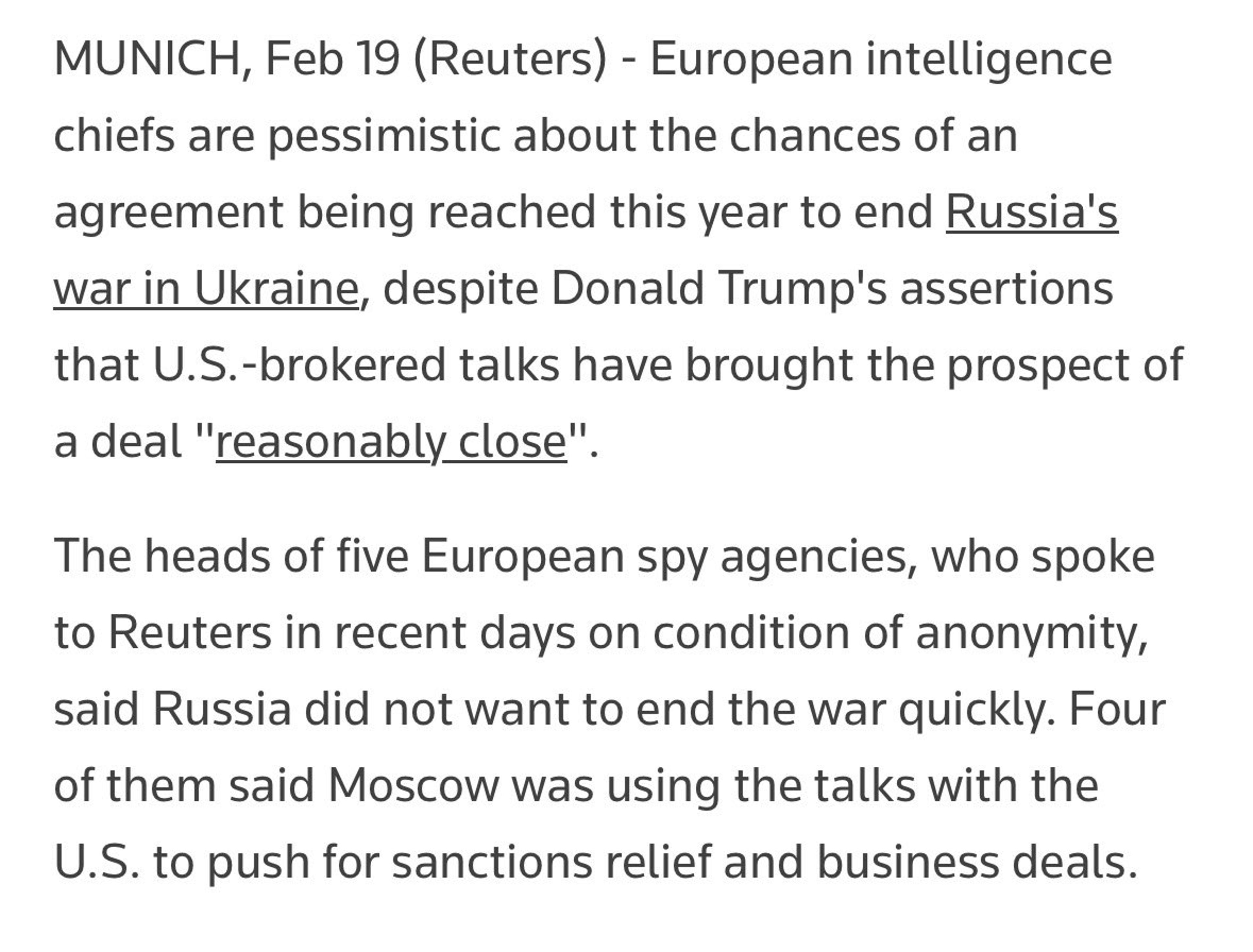

European Spies Say Russia Isn’t Seeking Peace, Talks Futile

“European intelligence chiefs are pessimistic about the chances of an agreement being reached this year to end Russia's war in Ukraine, despite Donald Trump's assertions that U.S.-brokered talks have brought the prospect of a deal ‘reasonably close’. The heads of five...

By Rob Lee

Social•Feb 19, 2026

Fuel Subsidy Masks Real Service Cost Surge

1.6% is a statistical illusion for the urban middle class While headline inflation is stable, the "unprotected" service sector is aggressive: Personal Care & Misc. → 6.6% Education → 3.2% Cause→Effect: Subsidized fuel (-0.7%) masks the reality of rising service labor costs. If you...

By David Chuah

Social•Feb 19, 2026

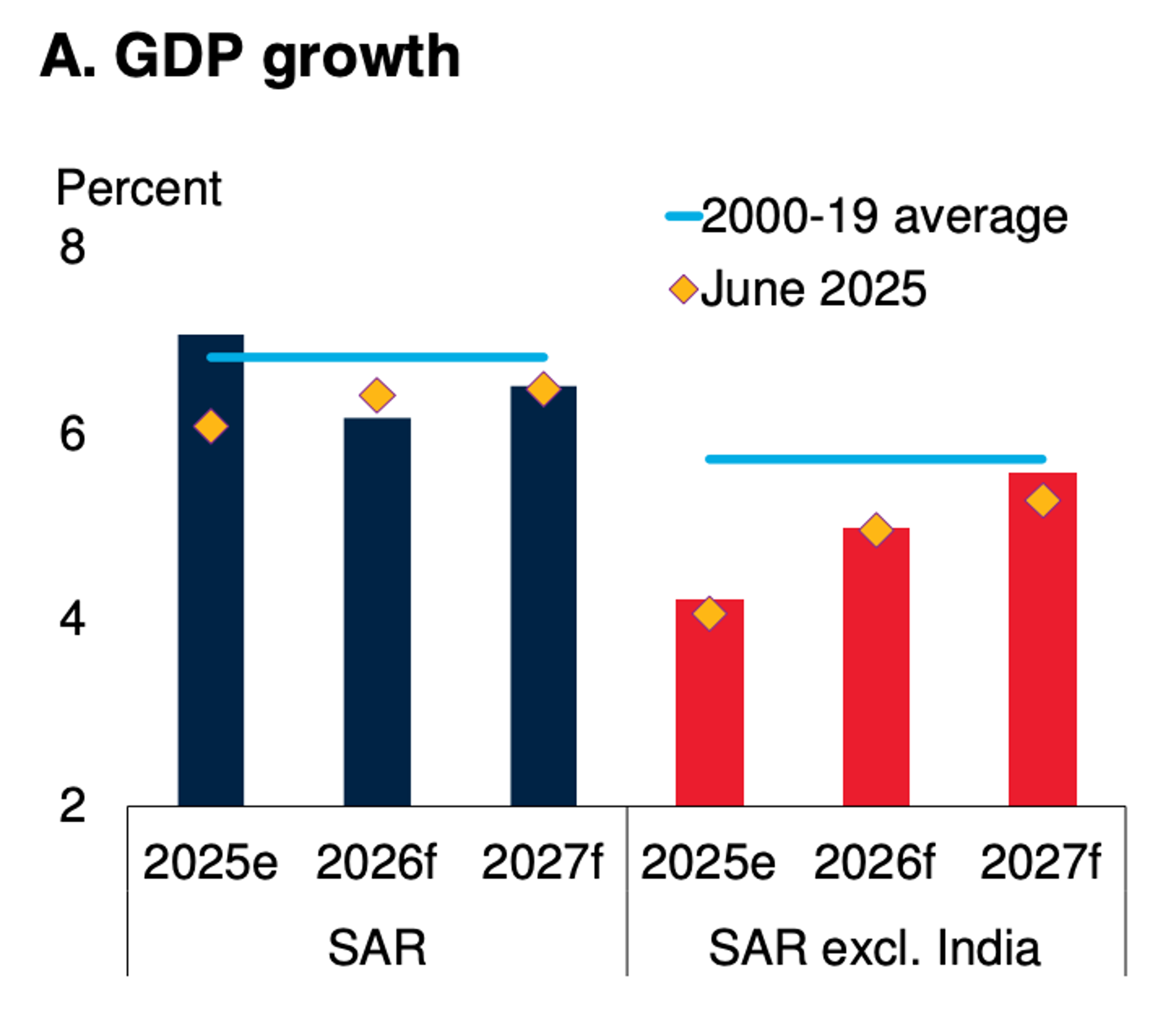

India's 6.5% Growth Beats China, Fastest Major Economy

As the World Bank notes, India is the fastest-growing major economy. India's growth rate of 6.5% is even outpacing China's. https://t.co/3S7a6Z6LbT

By Steve Hanke

Social•Feb 19, 2026

Nikkei Rises; Buy Nikkei ETF Amid FX Risks

Nikkei +0.71%; real estate, banks, textiles led; VIX-Nikkei 27.89. Leaders: Yokohama Rubber, Omron. Risks: FX (USD/JPY 155.11), commodity shocks. Trade: buy Nikkei ETF. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

India Drives South Asia's 6‑7% Growth; Rest Lags

According to the World Bank, South Asia growth stays near 6-7%. Strip out India, and the region slows sharply. India is the growth story. https://t.co/Q8e7g9b1j3

By Steve Hanke

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

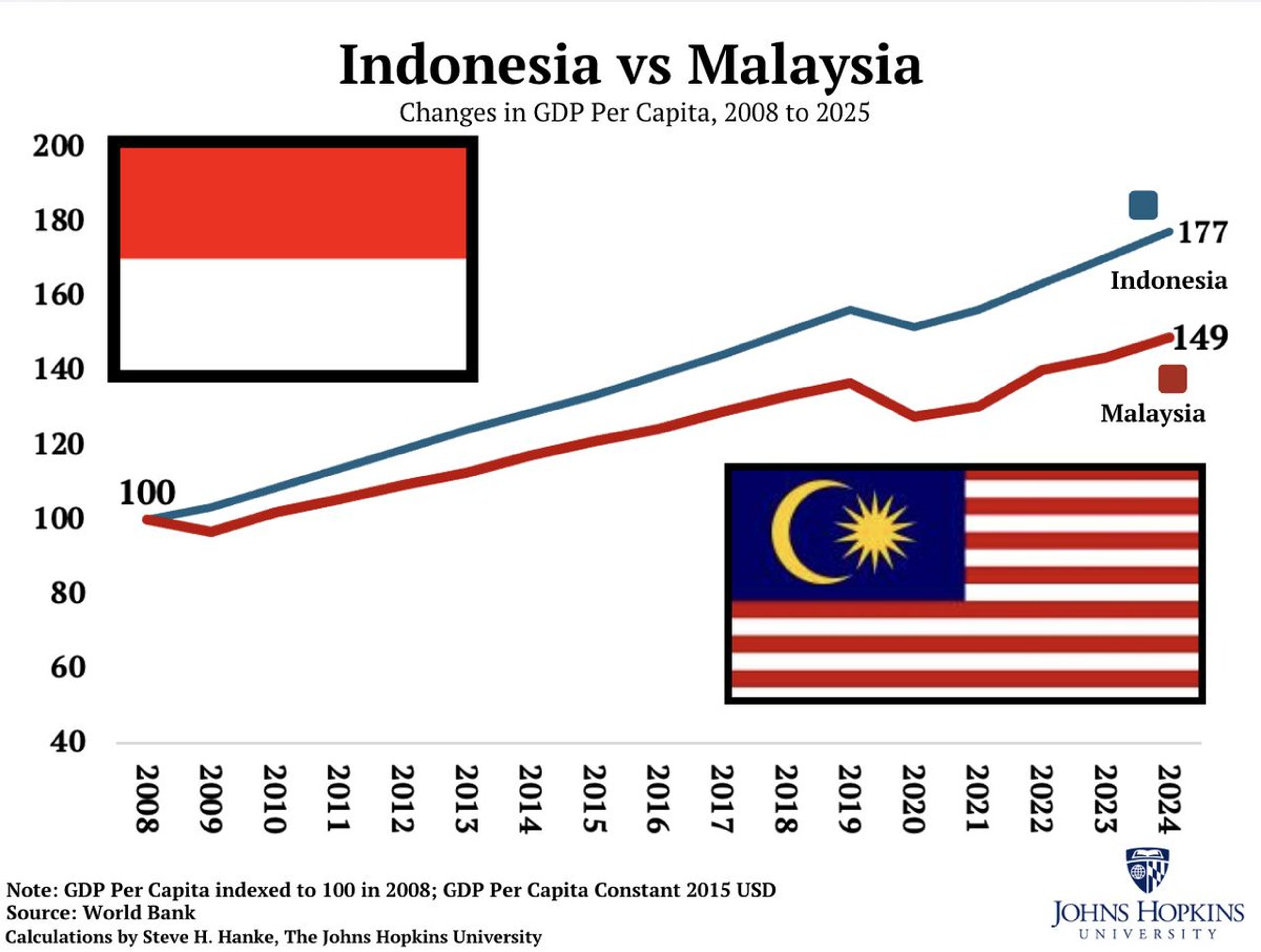

Indonesia Leads Malaysia in Palm Oil and Economic Growth

What do Indonesia and Malaysia have in common? They are the two biggest palm oil exporters in the world. Since 2008, Indonesia’s economy has outperformed Malaysia’s. https://t.co/mTUct95oZv

By Steve Hanke

Social•Feb 19, 2026

Rising Capex May Curb Buybacks, Pressure Valuations

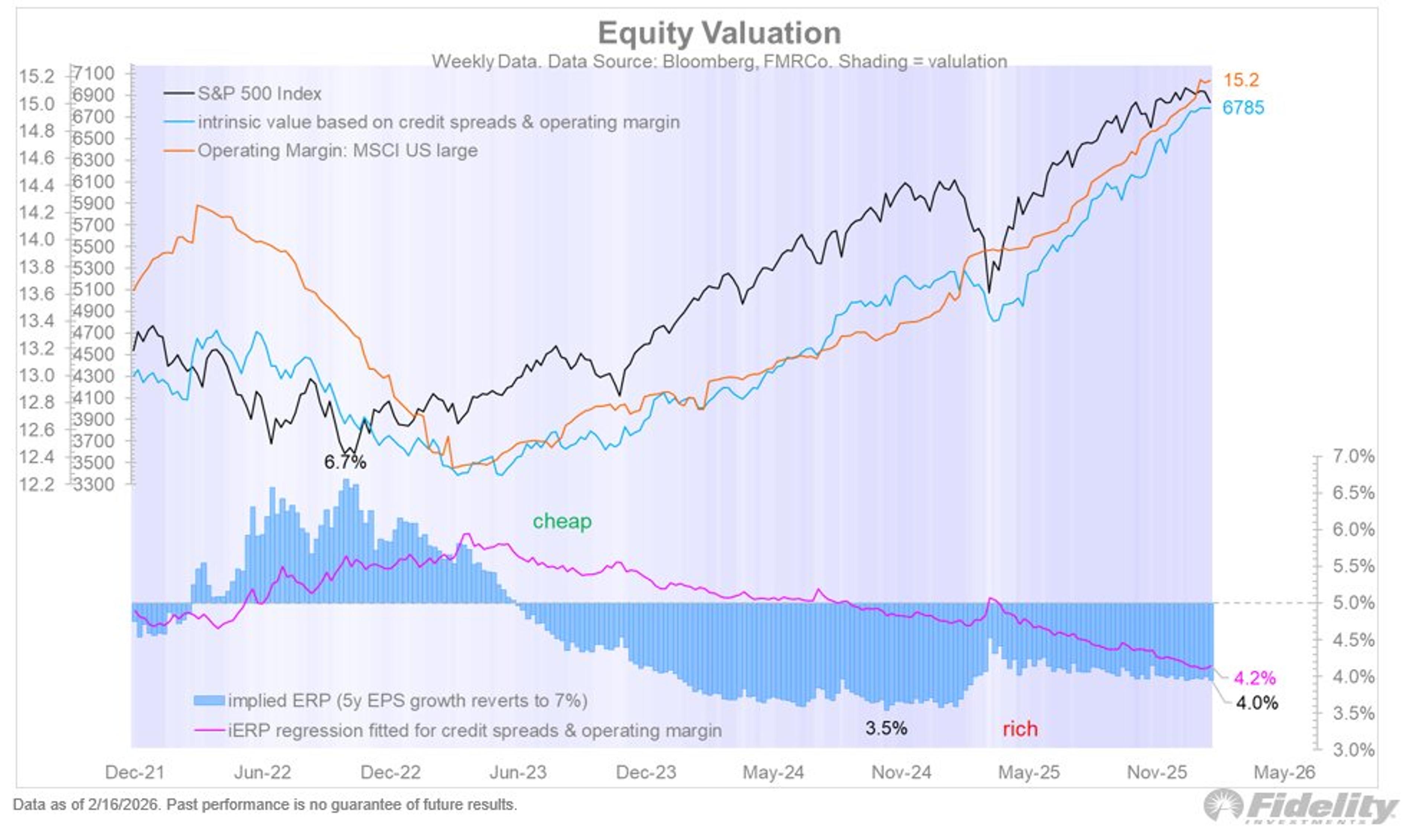

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

Social•Feb 19, 2026

North Korea's Inflation Soars to 74.6%, World’s Third Highest

#NKWatch🇰🇵: Today, I measure North Korea’s inflation at 74.6%/yr — that’s the THIRD HIGHEST IN THE WORLD. Kim’s rockets fly, but inflation is what’s truly SKYROCKETING. https://t.co/EbYJ0oBnAW

By Steve Hanke

Social•Feb 19, 2026

Korea's Index Slides Below Historical Average After 150% Surge

It’s wild how Korea’s stock index is trading below its historical average following a nearly 150% price rally https://t.co/TyCTVuO5pW

By David Ingles

Social•Feb 19, 2026

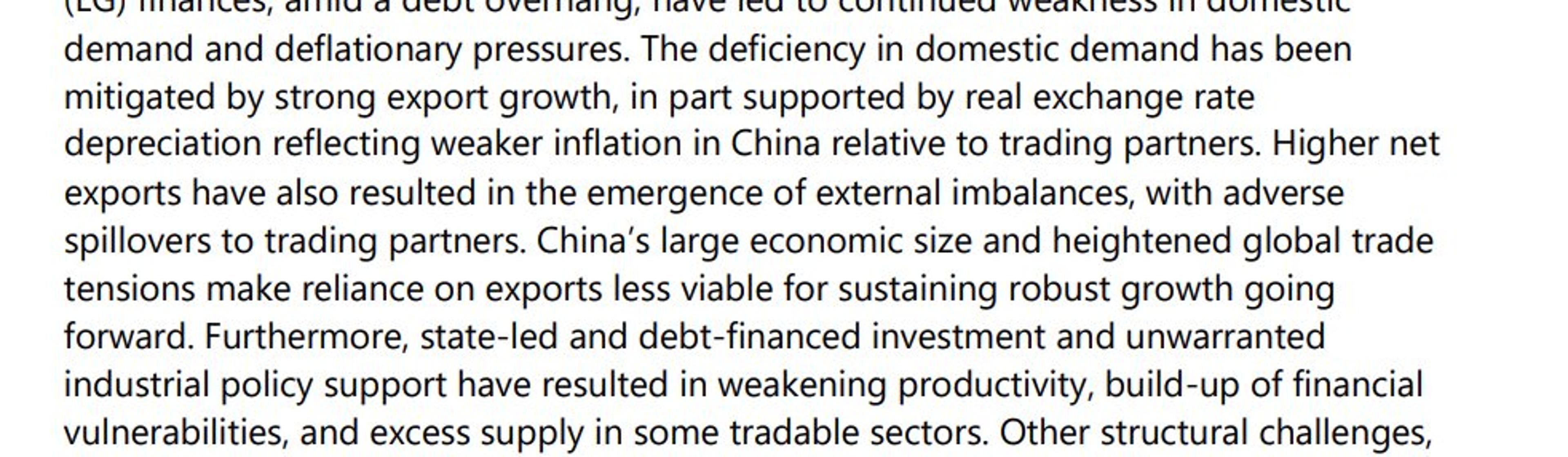

IMF: China's Export Growth Harms Its Trading Partners

The latest IMF analysis of China (The staff report/ Article IV) highlights that China's export driven growth has come at the expense of its trading partners. That is welcome, and very necessary message 1/many https://t.co/RTYAzRkFAv

By Brad Setser

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

Korean Reforms Spark Value Ups, Awaiting IBKR Access

I initially thought the Korean reforms would be ineffective. But on the ground, I’m seeing many companies come up with highly positive value up plans. And valuations remain a fraction of those in Japan. Once IBKR opens access, the focus...

By Michael Fritzell

Social•Feb 19, 2026

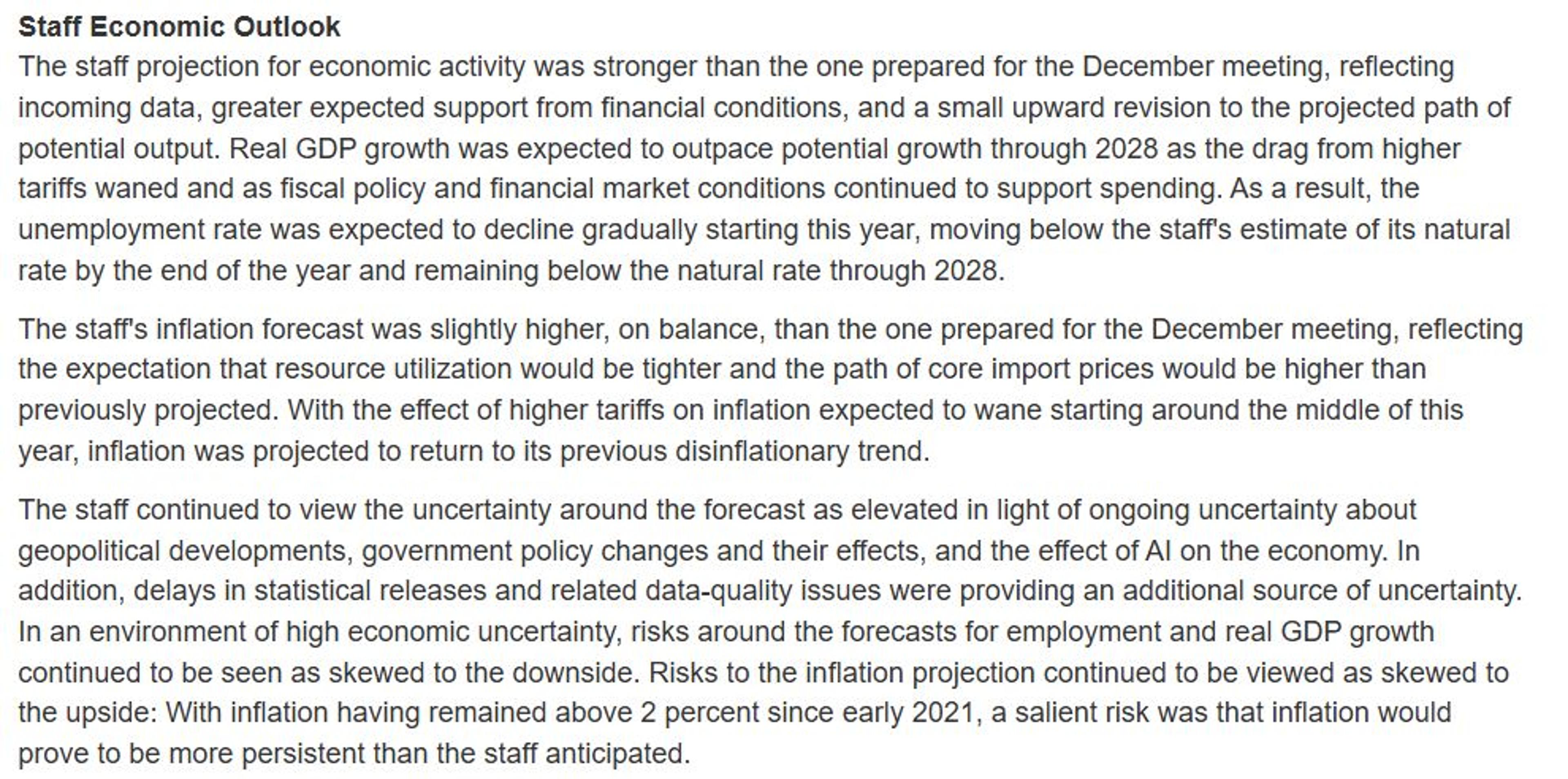

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 19, 2026

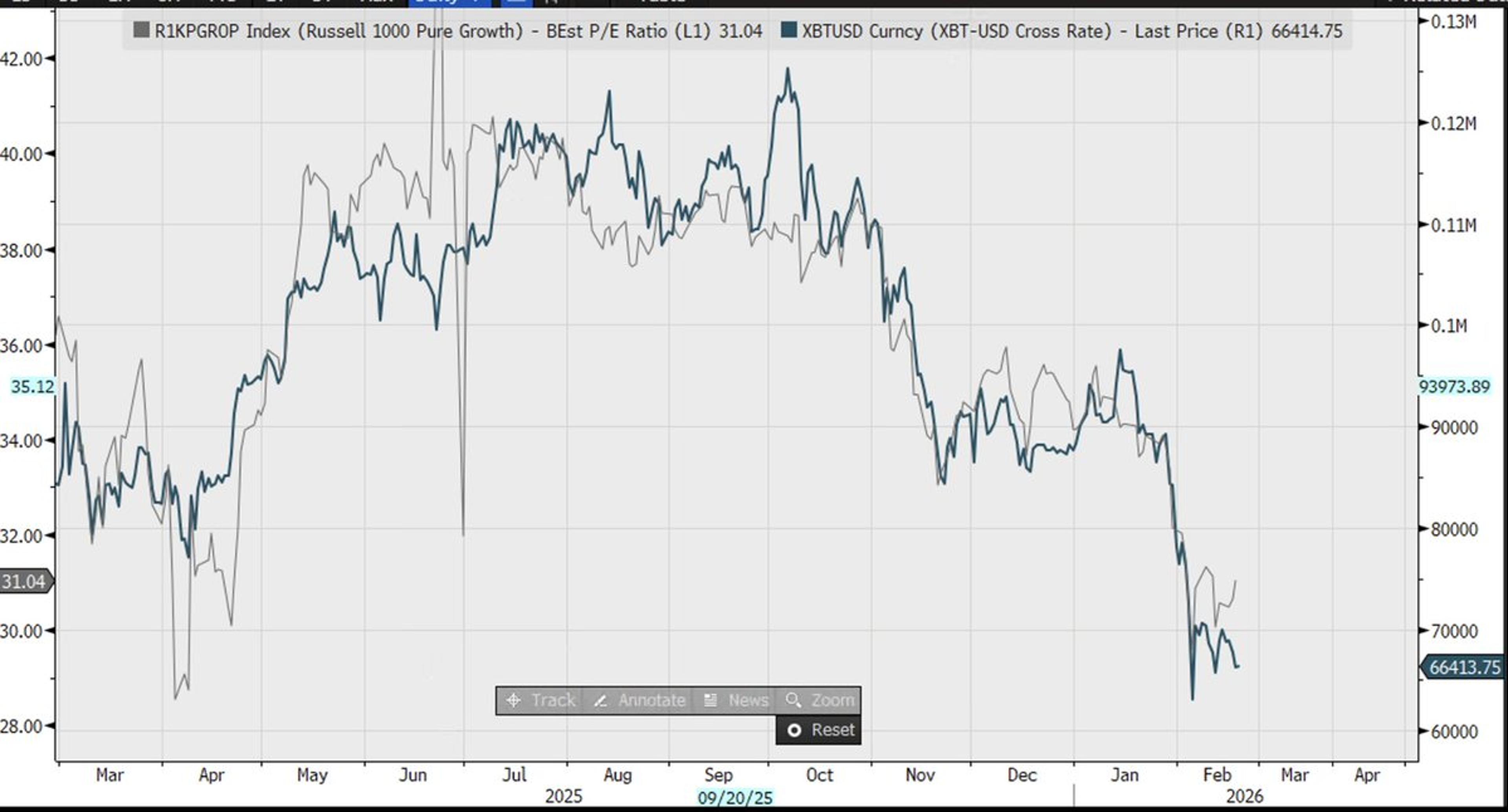

Long‑duration Assets Like Bitcoin, Growth Stocks Lose Favor

Bitcoin's drop has coincided with a decline in the Russell 1000's Pure Growth P/E. What do they have in common? Both are long-duration, and are being shunned during the underlying rotation into shorter-duration (cyclical) securities (think value, dividend payers, Energy...

By Michael Kantro

Social•Feb 19, 2026

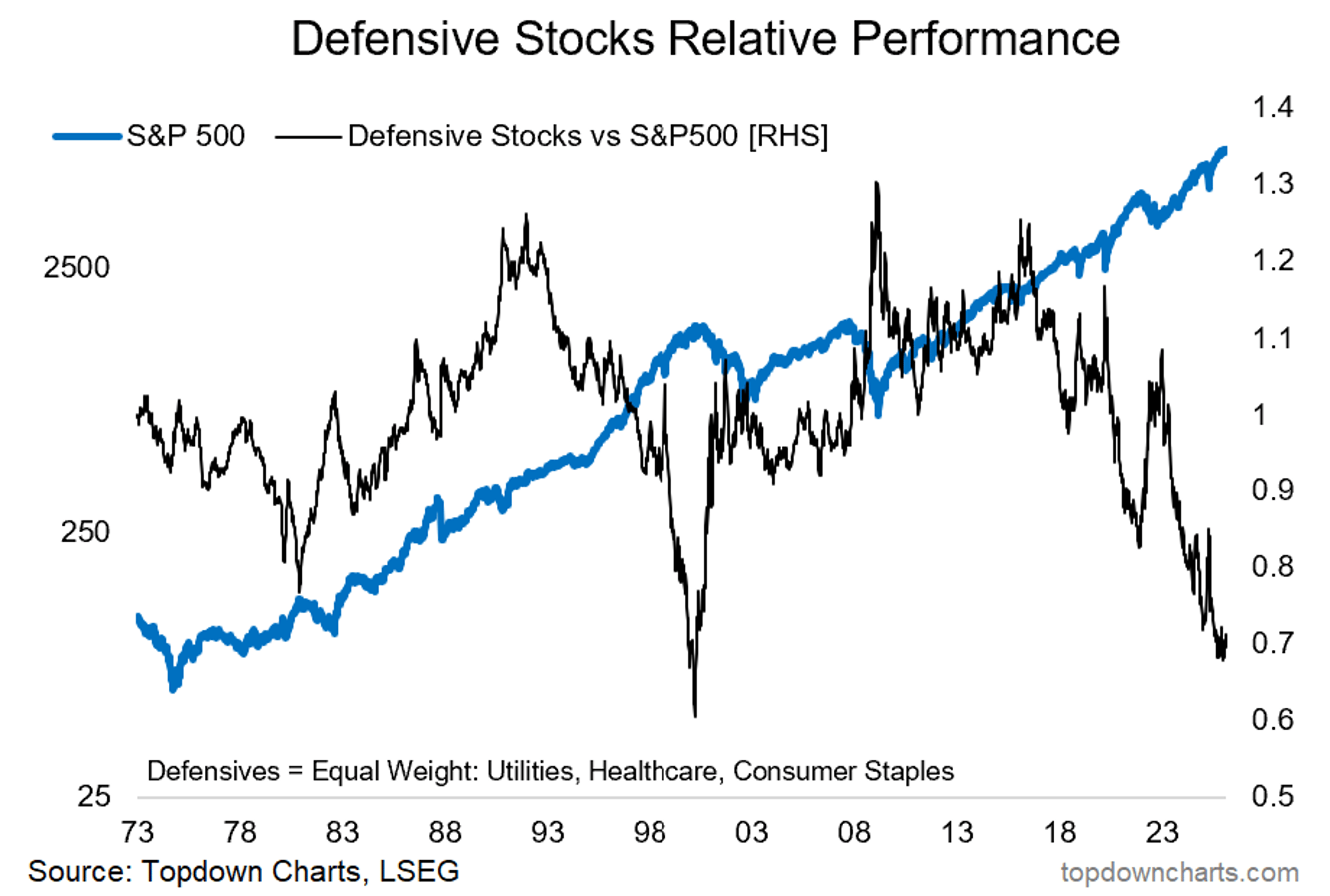

Defensives Hit Dot‑Com Lows, Poised for Rally

Chart of the Week - Defensives With tech in trouble (+a number of macro risks lurking on the horizon), defensives are starting to look interesting… Defensives (i.e. an equal-weighted basket of: Utilities, Healthcare, Consumer Staples) are turning up vs the S&P500 —after...

By Callum Thomas

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

Social•Feb 18, 2026

US Vaccine Policy Shift Boosts MRNA Stock Appeal

Macro: US vaccine-policy swing heightens regulatory risk; FDA will review Moderna’s flu shot. Key: public dispute, amended filing; decision by Aug 5. Risk: political oversight. Trade: Buy MRNA. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

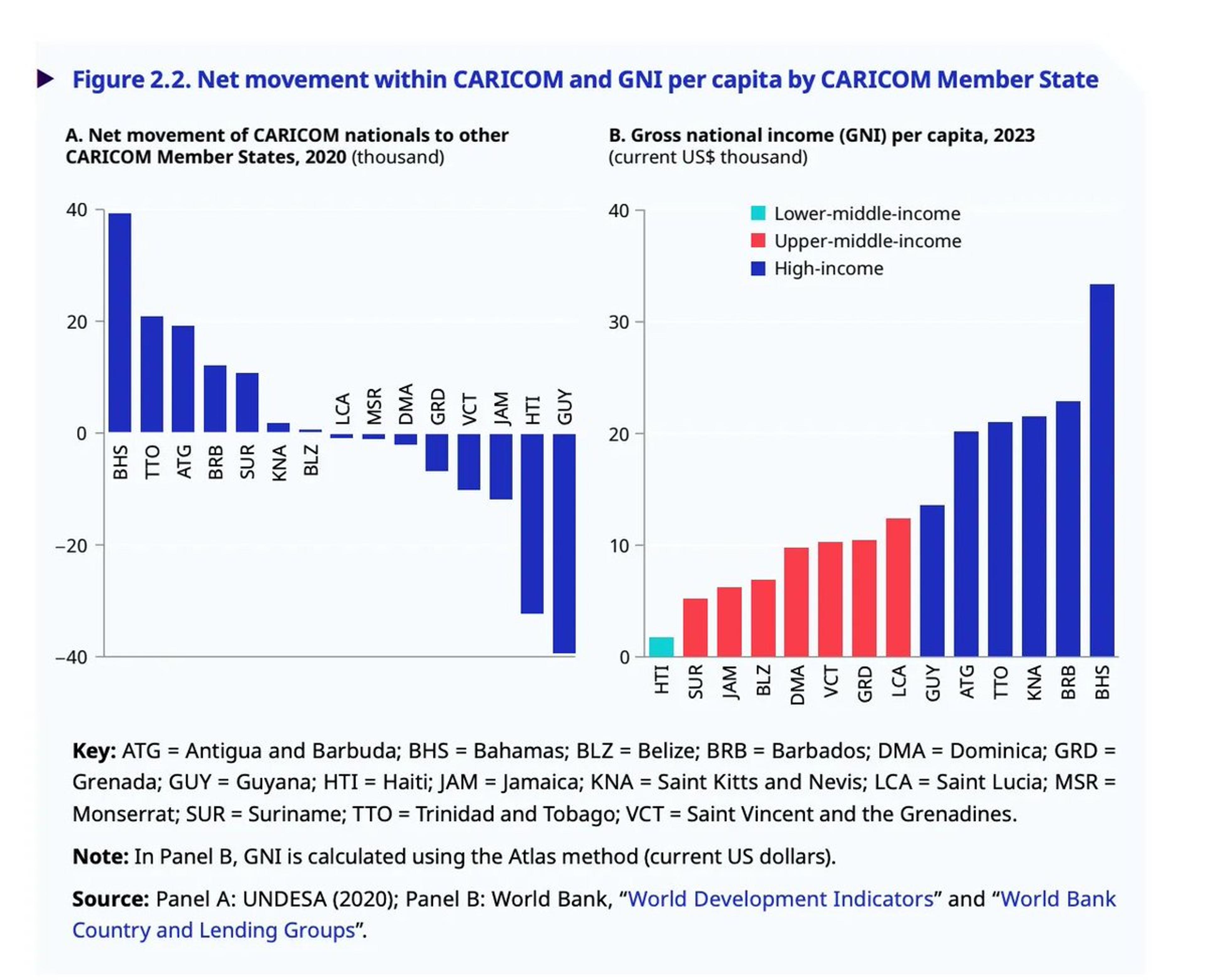

Income Gaps Fuel Migration Across CARICOM Nations

Stark differences in income drive migration within CARICOM (and these are official data). More at today's Chartbook Top Links: https://t.co/DaCnHTI3Wj

By Adam Tooze

Social•Feb 18, 2026

Tariffs Inflate Prices and Act Like Hidden Corporate Tax

A) Many studies have examined whether tariffs have been passed through to consumer prices, and they've found significant retail price increases B) Tariff burdens absorbed by US companies are an inefficient corporate tax, paid by Americans via lower wages or share...

By Scott Lincicome

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

Social•Feb 18, 2026

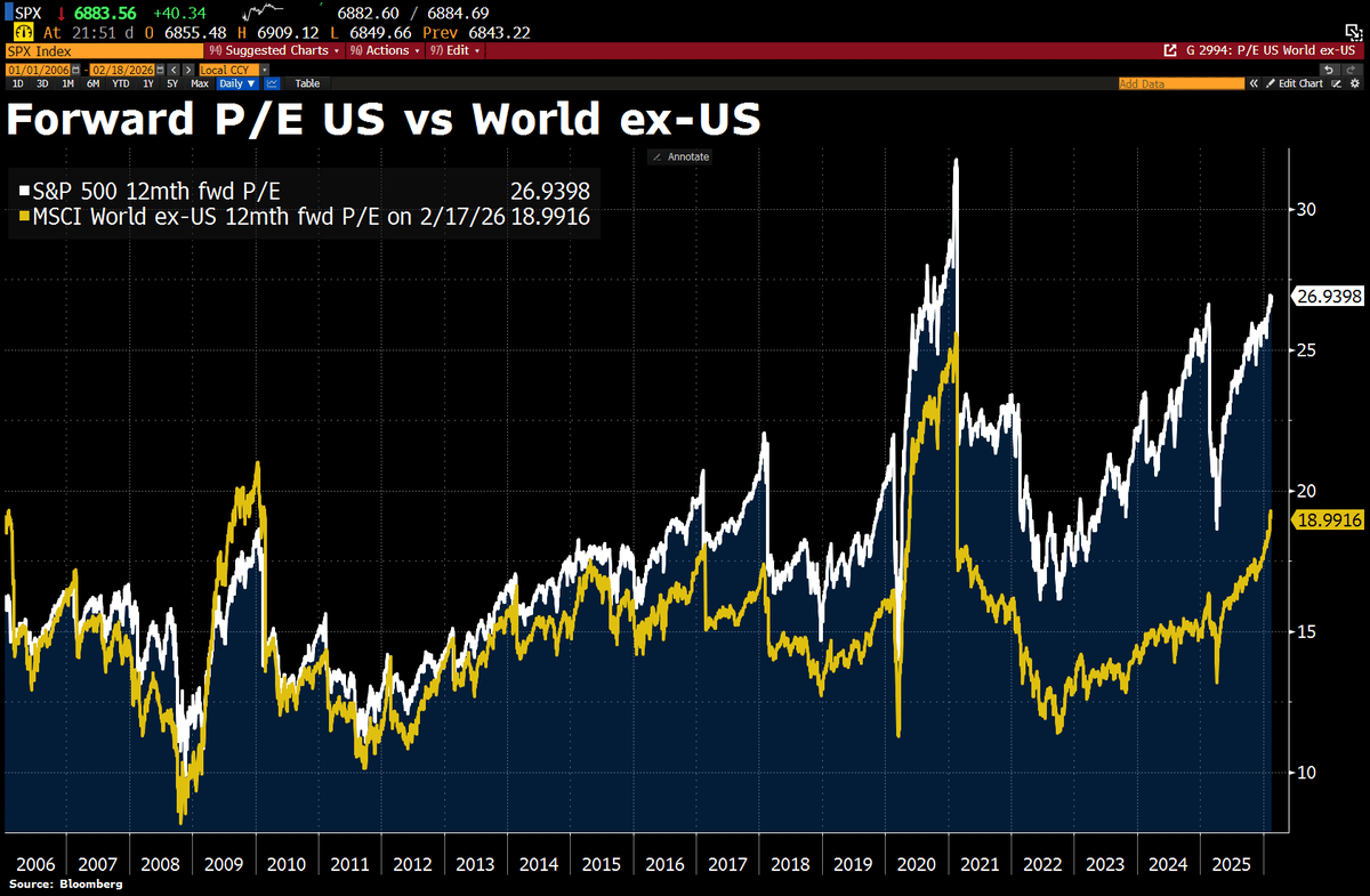

US Stock Premium at Risk as Tech Capex Rises

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world. That premium could shrink further if big tech companies lose their...

By Holger Zschaepitz