Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

Social•Feb 18, 2026

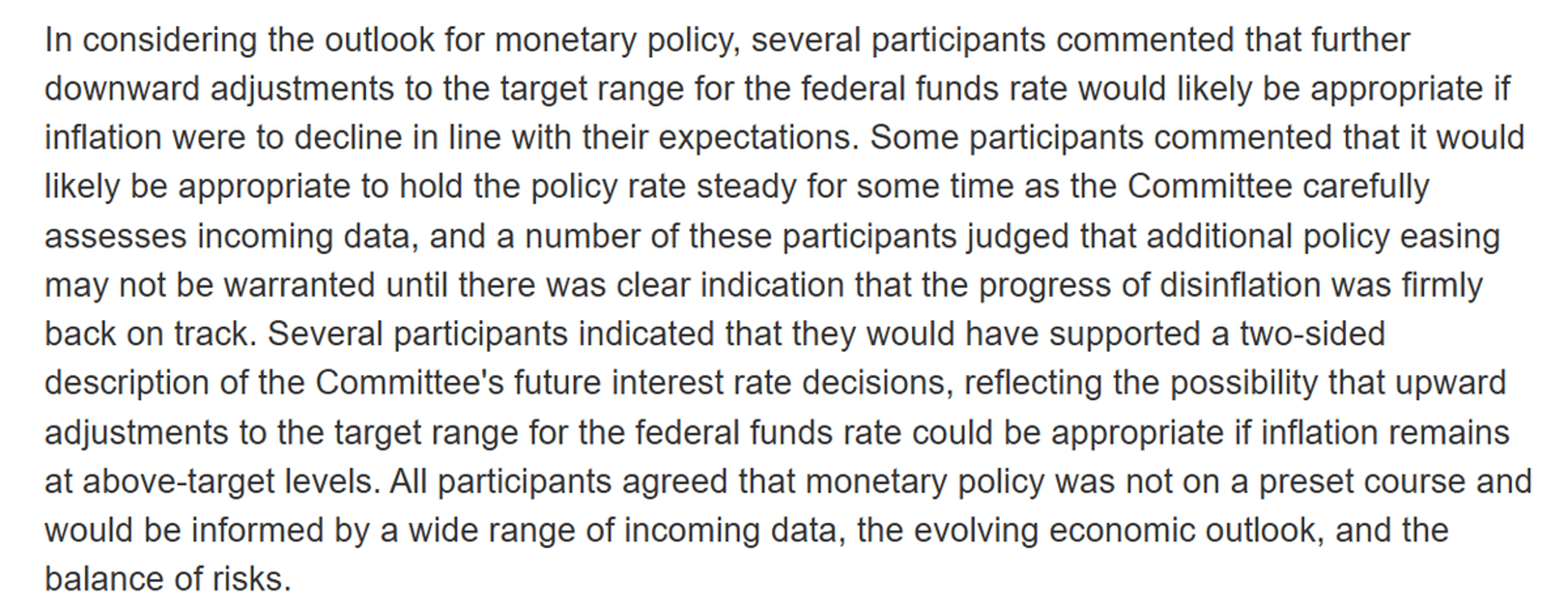

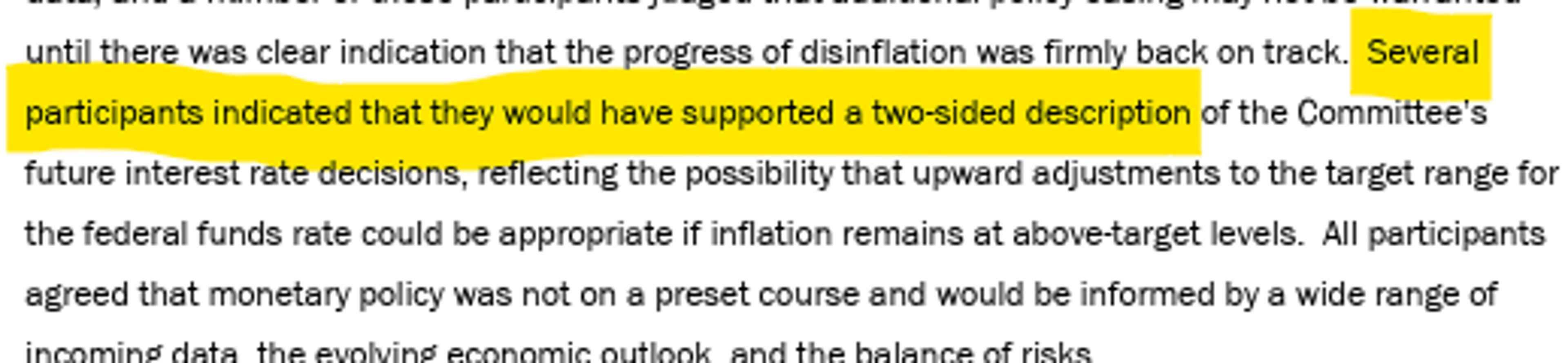

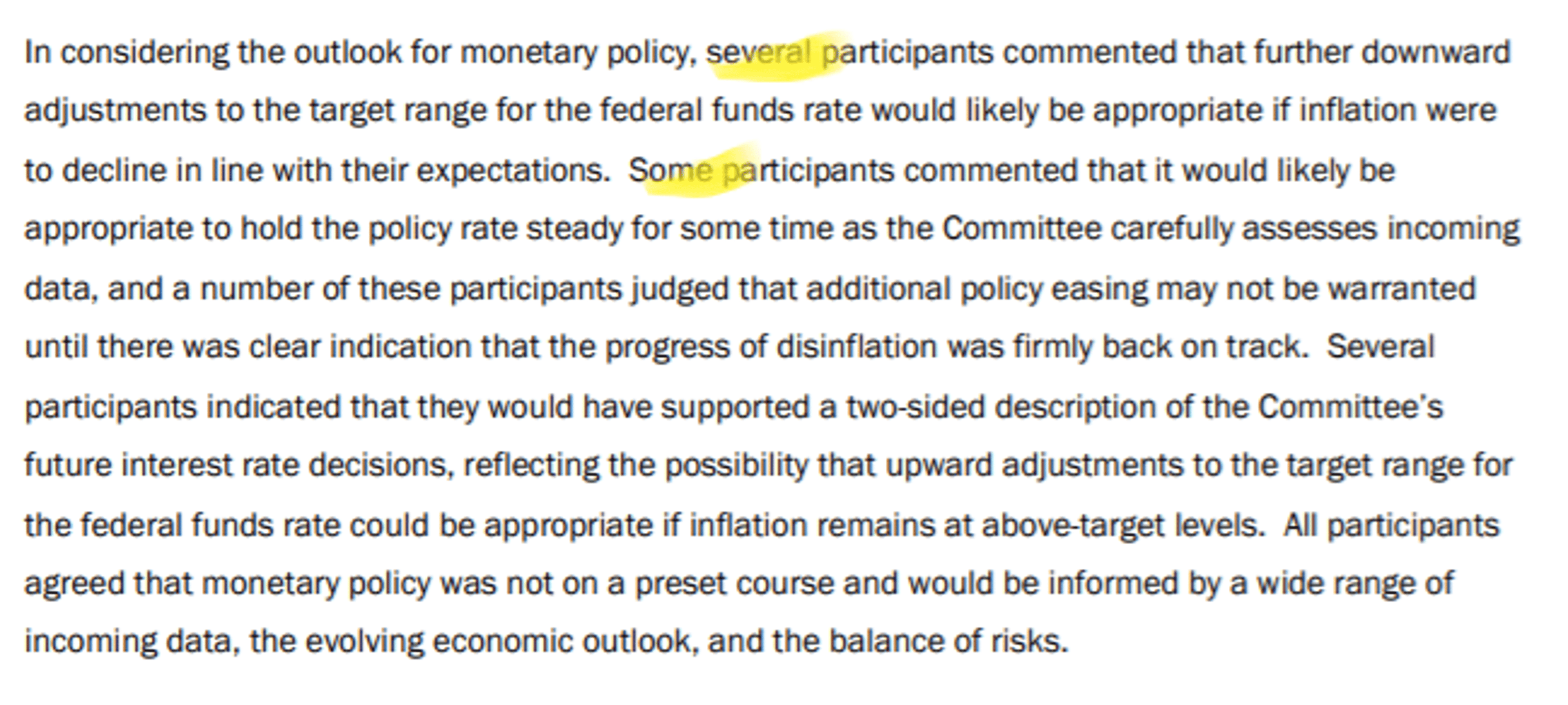

Hawks Push Back, Hint at Two‑Sided Policy Language

FOMC minutes suggest that the hawks pushed back. "Several would support two-sided language" about policy direction and "several" noted that if inflation remains high, rate hikes might be necessary.

By Kathy Jones

Social•Feb 18, 2026

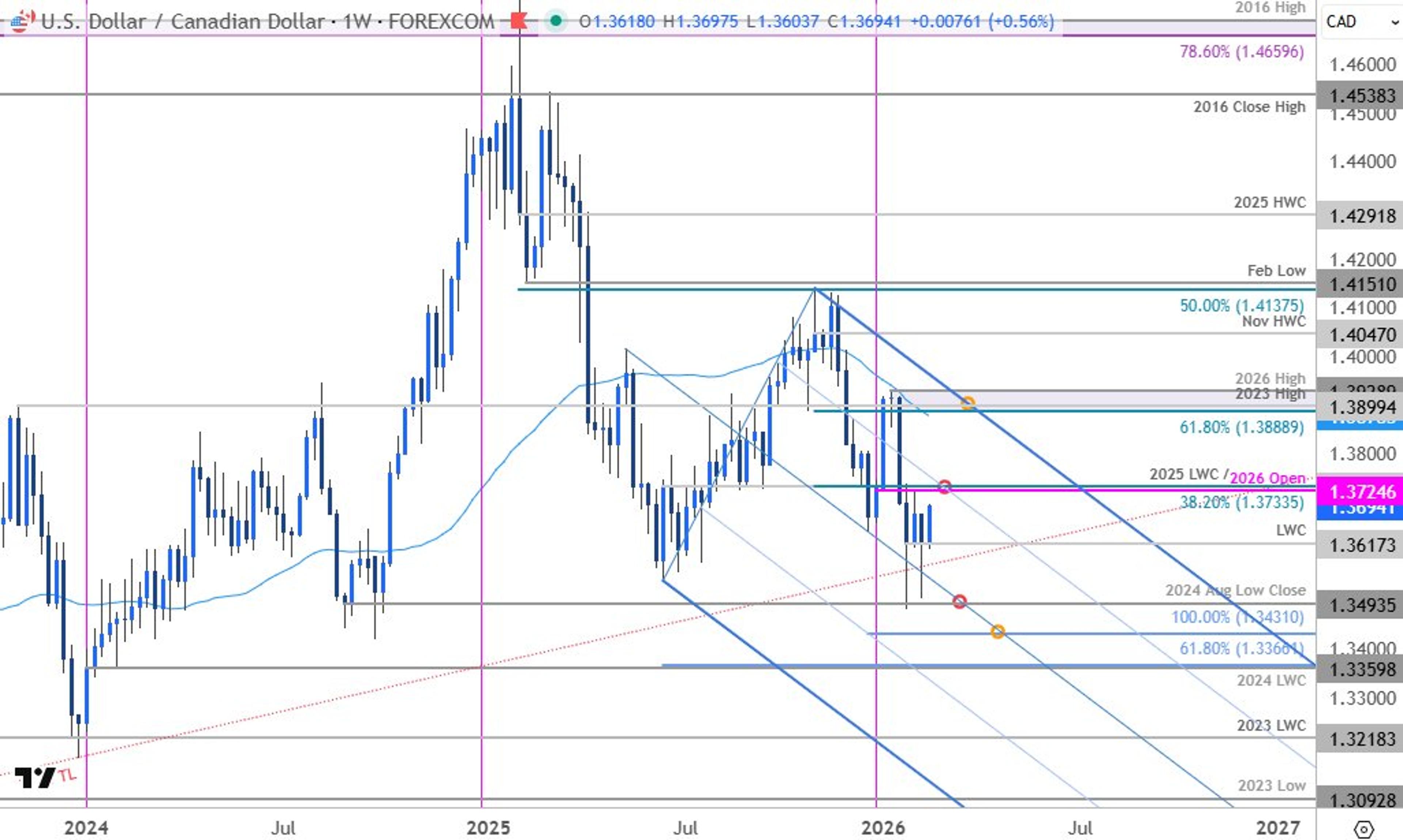

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

Data Centers Drive Growth as Fed Shows Internal Split

Today’s burst of economic data showed an economy still powered by the boom in data centers with some broader increases in vehicle orders (Dec) and production (Jan). Housing starts popped in December and were revised higher for November. Good...

By Diane Swonk

Social•Feb 18, 2026

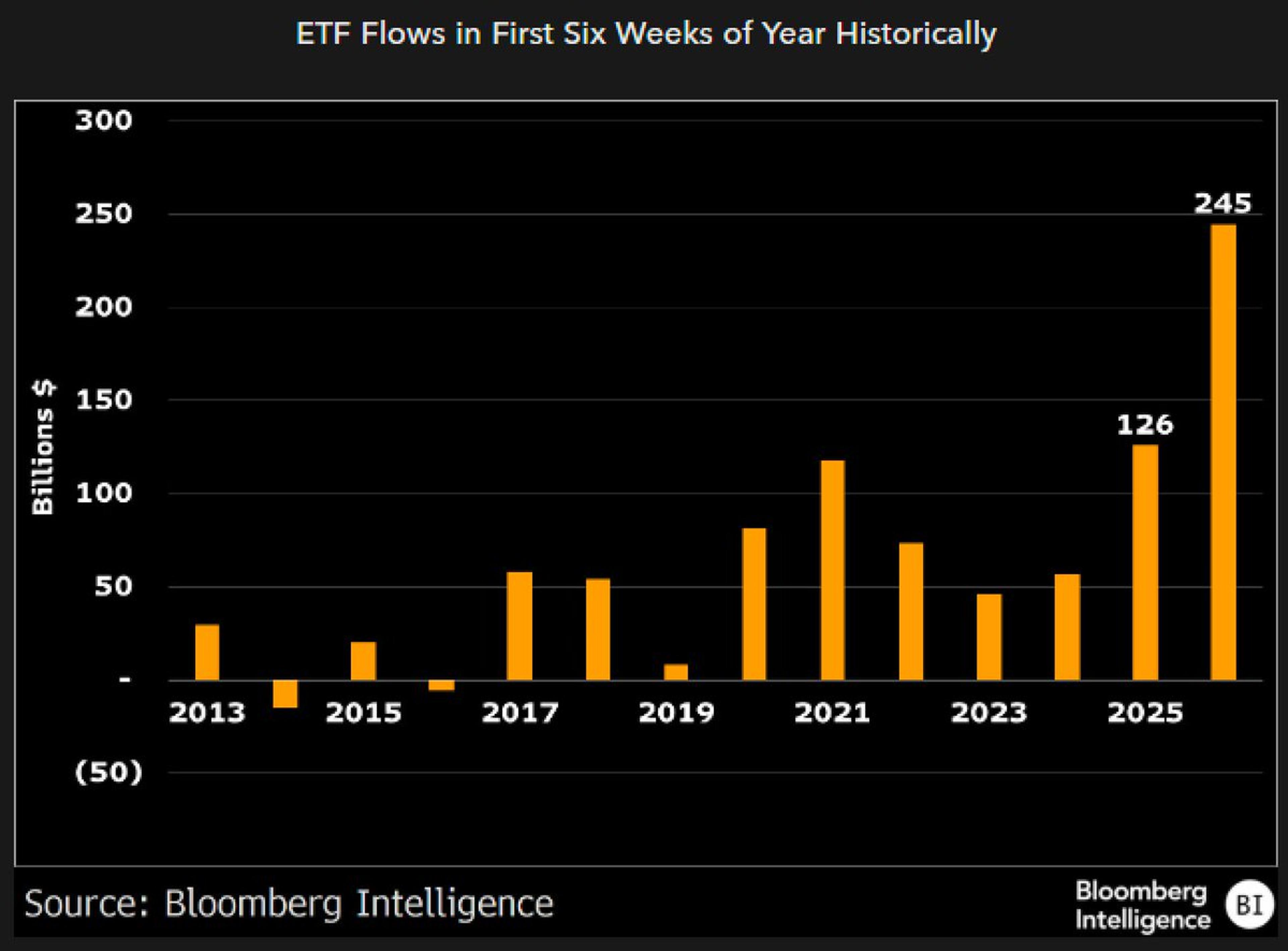

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm

Social•Feb 18, 2026

FOMC Minutes Show Market‑Aligned Outlook, Fragile Jobs, Slowing Inflation

Few FOMC minutes takeaways: 1) Cmte basically in line with markets on major economic variables 2) Labor markets no longer outright weakening but remain fragile 3) Inflation decelerating as tariff passthru done, housing has downside (a misread on bad CPI method in Oct?) 1/...

By Guy LeBas

Social•Feb 18, 2026

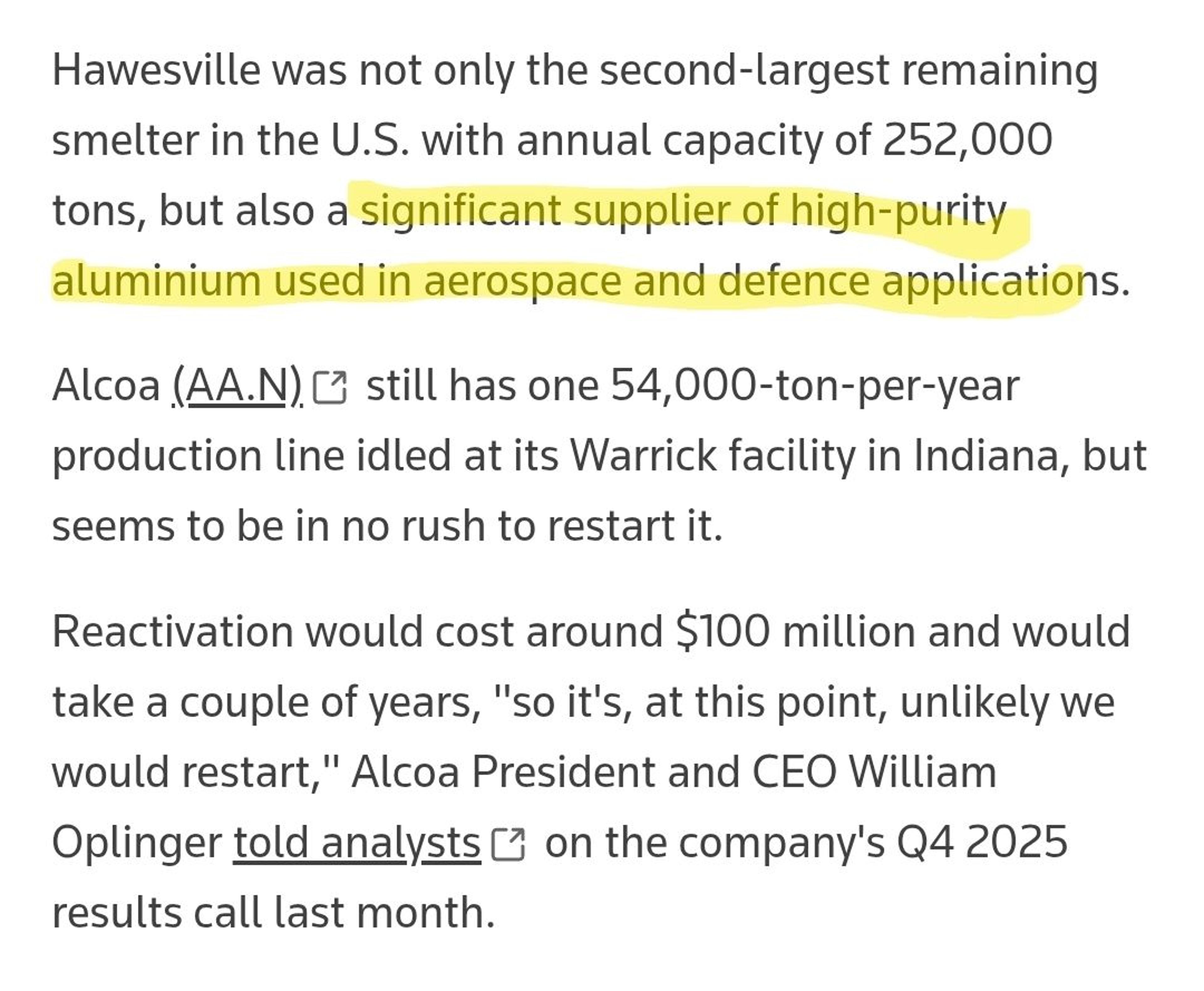

Tariffs Fail: US Down to Five Aluminum Smelters

"U.S. import tariffs haven't been enough to stop the United States losing another aluminium smelter, leaving the country with just five primary metal production plants." 😲 https://t.co/T5U4nxglb0 https://t.co/EOQY3OwzE6

By Scott Lincicome

Social•Feb 18, 2026

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

Social•Feb 18, 2026

Mania Depression: Elites Stagnate, Borrowers Slip Further

FWIW - The sentiment data suggests its not a "boomcession" we're experiencing but a "maniapression." Those at the top can't put enough into the markets, while those at the bottom fall further and further behind on their loans.

By Peter Atwater

Social•Feb 18, 2026

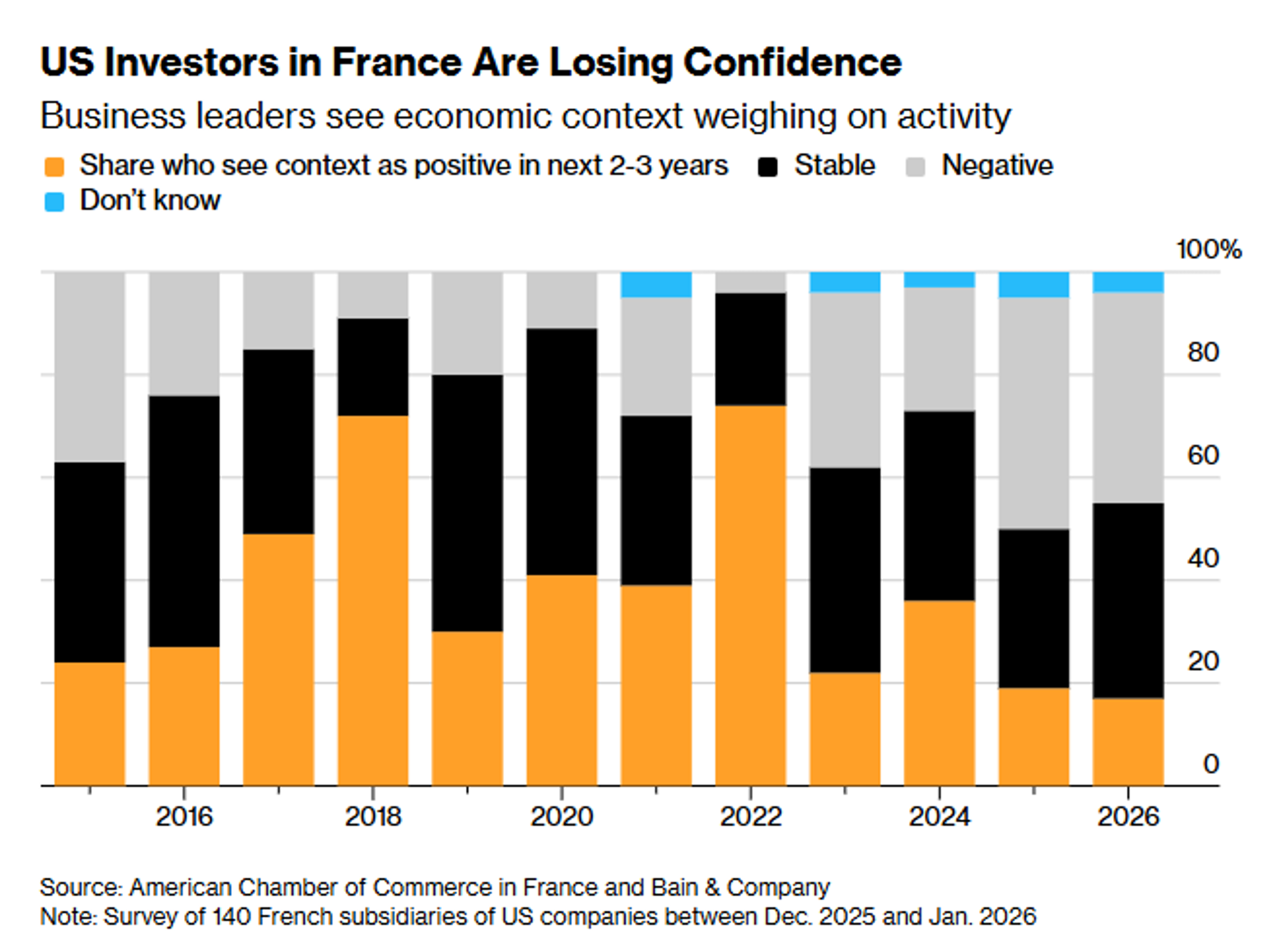

US Investors Turn Bearish on France as Macron Exits

US investors are gloomy on France as Macron era approaches its end https://t.co/a4q0NEuH3I via @WHorobin https://t.co/vhSuc9Ovr6

By Zöe Schneeweiss

Social•Feb 18, 2026

S&P Adds $500B, Gold Climbs; PCE Inflation Watch

WHAT A DAY, the S&P 500 has gained around $500 BILLION in market cap, up 0.8%. The index is now up 0.3% YTD 📈 Gold is also trading higher, back above $5,000/oz, as global tensions start to escalate 😳 Mark your calendars...

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 18, 2026

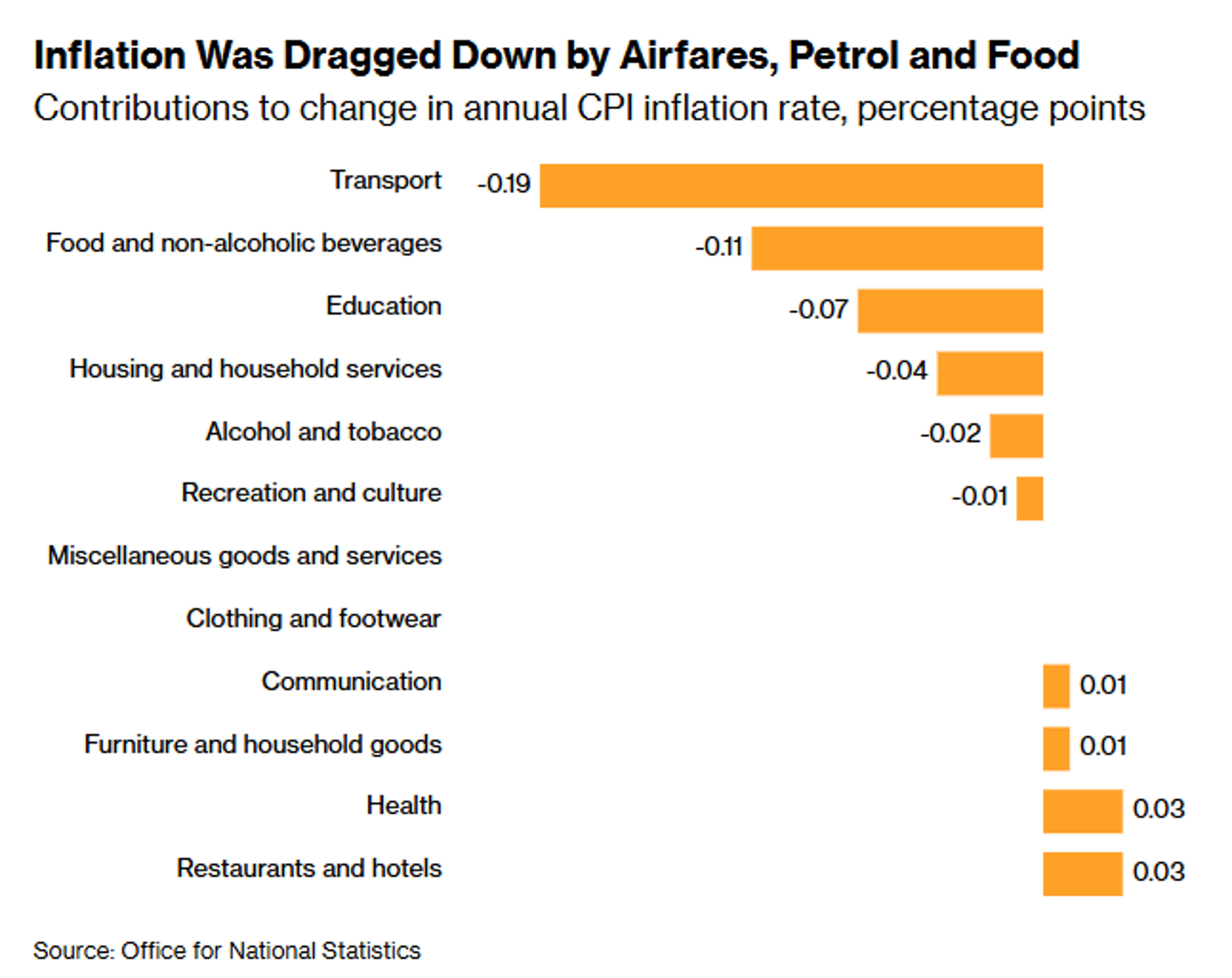

UK Inflation Hits 2025 Low, Strengthening BoE Rate‑Cut Case

UK inflation slowed to its weakest level since March 2025, bolstering the case for an interest rate cut when the Bank of England meets next month https://t.co/yJqzpiJ61p via @irinaanghel12 @PhilAldrick https://t.co/a5Mov7Jkhv

By Zöe Schneeweiss

Social•Feb 18, 2026

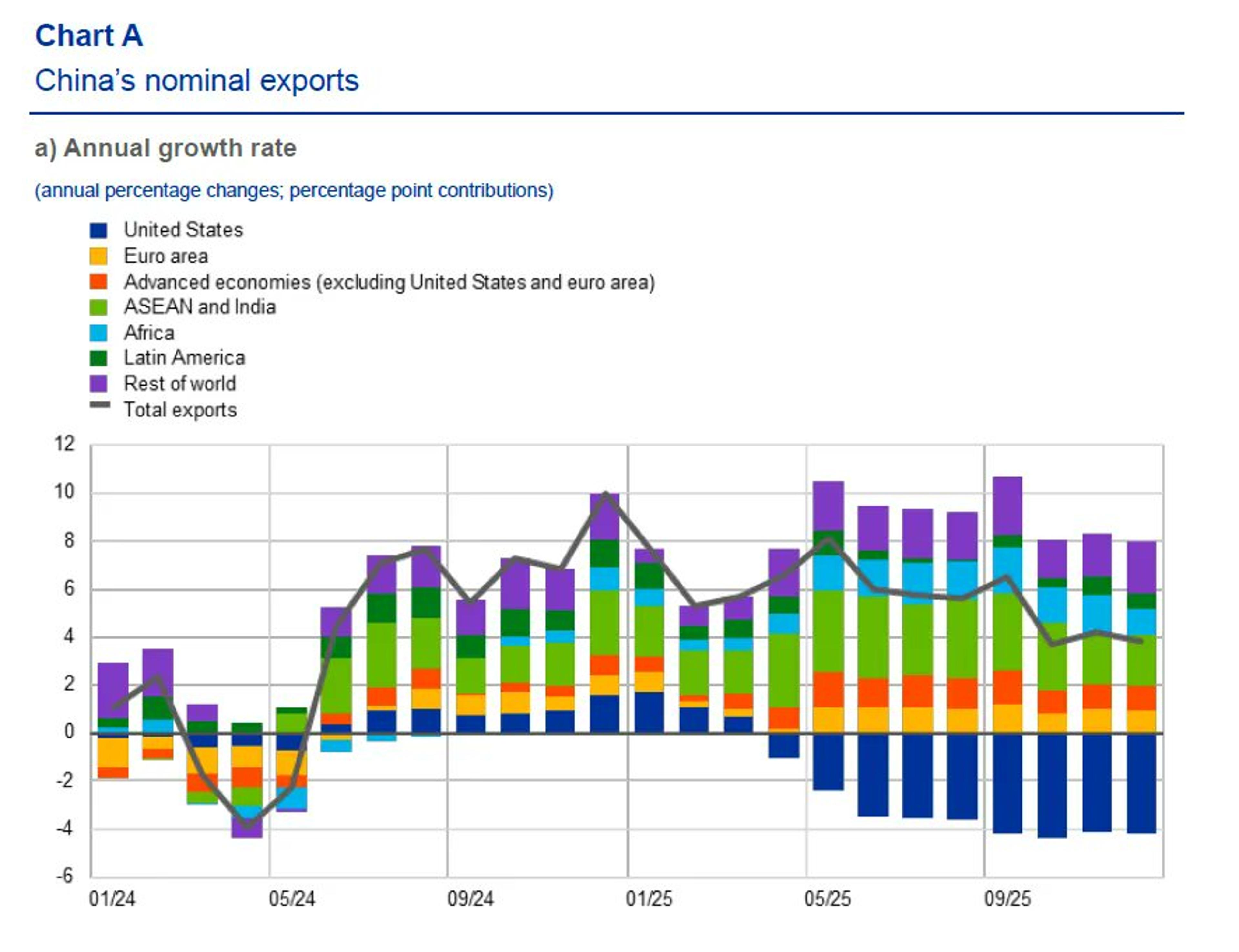

ECB Study Finds Tariffs Sparked Minor China Trade Diversion

Tariffs caused just a small China trade diversion, ECB study shows https://t.co/2xTwmZXdG6 via @weberalexander https://t.co/NfggkusEyQ

By Zöe Schneeweiss

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss

Social•Feb 18, 2026

China Delays Auto Sales Data, Signaling Weakening Market

The Economist: “Last month the China Association of Automobile Manufacturers, another state-backed trade group, appears to have deferred the publication of its weekly sales data—a sure sign of growing anxiety over weakening numbers.” https://t.co/feytAJBiP2

By Jonathan Cheng

Social•Feb 18, 2026

Shift to Equal‑weight, Financials, and Cyclical Assets

Wow, the goat is also rotating out of Megacap tech, long equal weight performance vs market cap, long financials for deregulation and curve steepening, and long real cyclical assets Feels good man

By Felix Jauvin

Social•Feb 18, 2026

Global Indices Inch Higher as India VIX Plunges

Global Market Update: Gift Nifty +50.50 (0.20%) 25,760.50 DowJones +32.26 (+0.07%) 49,533.19 Nasdaq +31.71 (+0.14%) 22,578.38 India Vix -0.6600 (-4.95%) 12.6700 S&P 500 +7.05 (+0.10%) 6,843.22

By stock_n_trade

Social•Feb 18, 2026

Markets May Slip as Fed Delays Rate Cuts

Will stock markets tip over amid worries about the Fed dragging its feet on rate cuts? FOMC meeting minutes are in focus. #stockmarkets #fed #fomc #dollar #macro #trading https://t.co/yYSQfOx27L

By Ilya Spivak

Social•Feb 17, 2026

UK Unemployment Peaks Since COVID, Youth Jobless at 16%

#UKWatch🇬🇧: UK unemployment levels have reached their HIGHEST LEVEL since COVID. Youth unemployment ROSE TO 16.1%. RUSSOPHOBE STARMER’S GOVERNMENT IS FLOUNDERING. https://t.co/4jk4KQ1Q5I

By Steve Hanke

Social•Feb 17, 2026

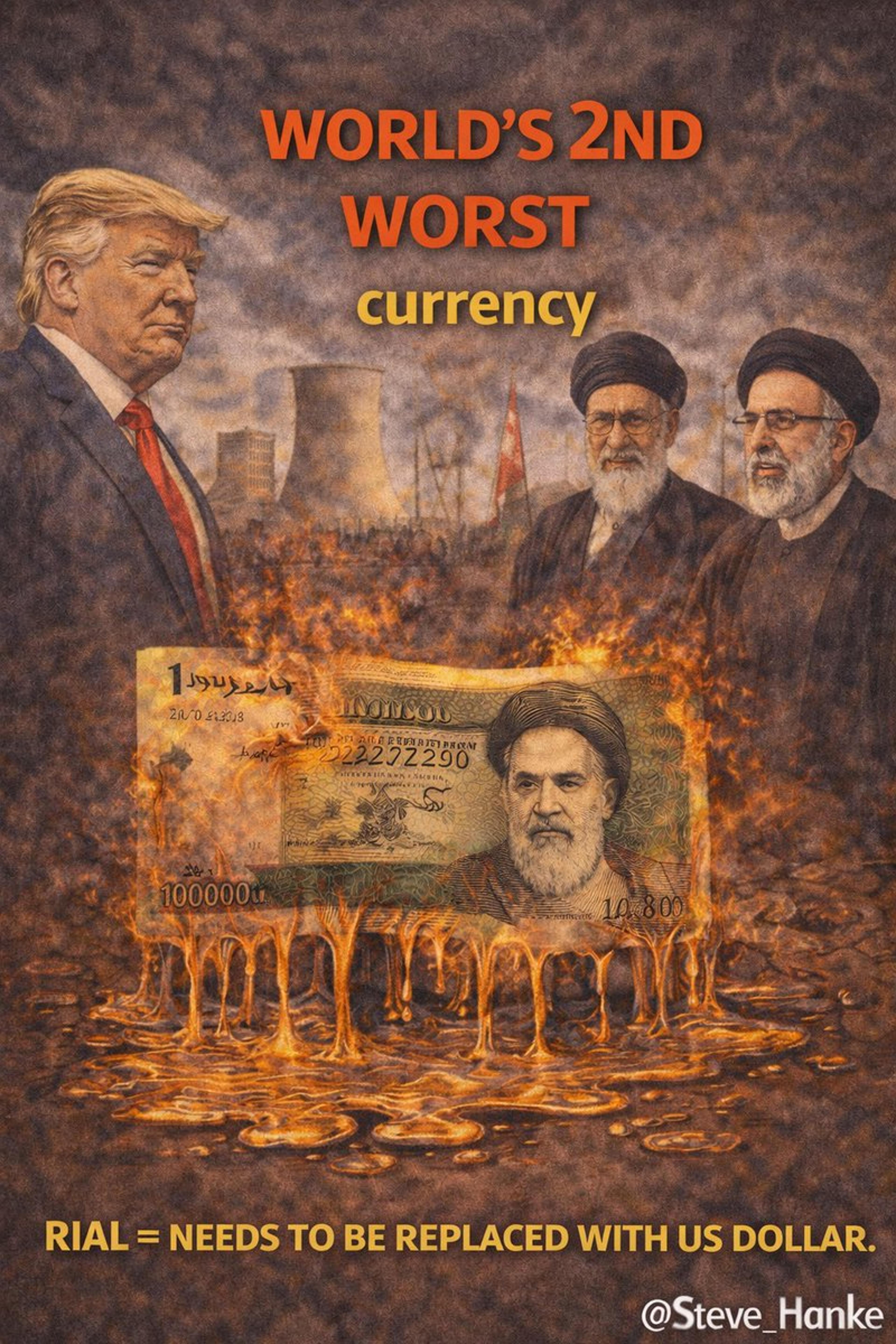

Iranian Rial Crashes as US‑Iran Nuclear Talks Begin

Today, US-Iran nuclear talks began in Geneva. As the talks start, the Iranian rial is in the tank. It has depreciated by over 43% against the dollar in the past year, making it THE SECOND WORST CURRENCY IN THE WORLD. https://t.co/PORIO6lGtc

By Steve Hanke

Social•Feb 17, 2026

Labor Market Dynamism Drives Real Competitive Advantage

Labor market dynamism is the real differentiator. I make sure to stress it in my public talks https://t.co/jO6lNyPm8W

By Brian Albrecht

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman

Social•Feb 17, 2026

Iran Shuts Hormuz for Drills Amid US Nuclear Talks

"Iran says it temporarily closed the Strait of Hormuz as it held more indirect talks with the US." https://t.co/Ek0ckZEw6N Iran announced the temporary closure of the Strait of Hormuzon Tuesday for live fire drills in a rare show of force as its...

By John Spencer

Social•Feb 17, 2026

Third-Generation Auto Bailouts: How Long Until They're Considered?

How many years away are we from the third generation of auto bailouts being on the table?

By Adam Ozimek

Social•Feb 17, 2026

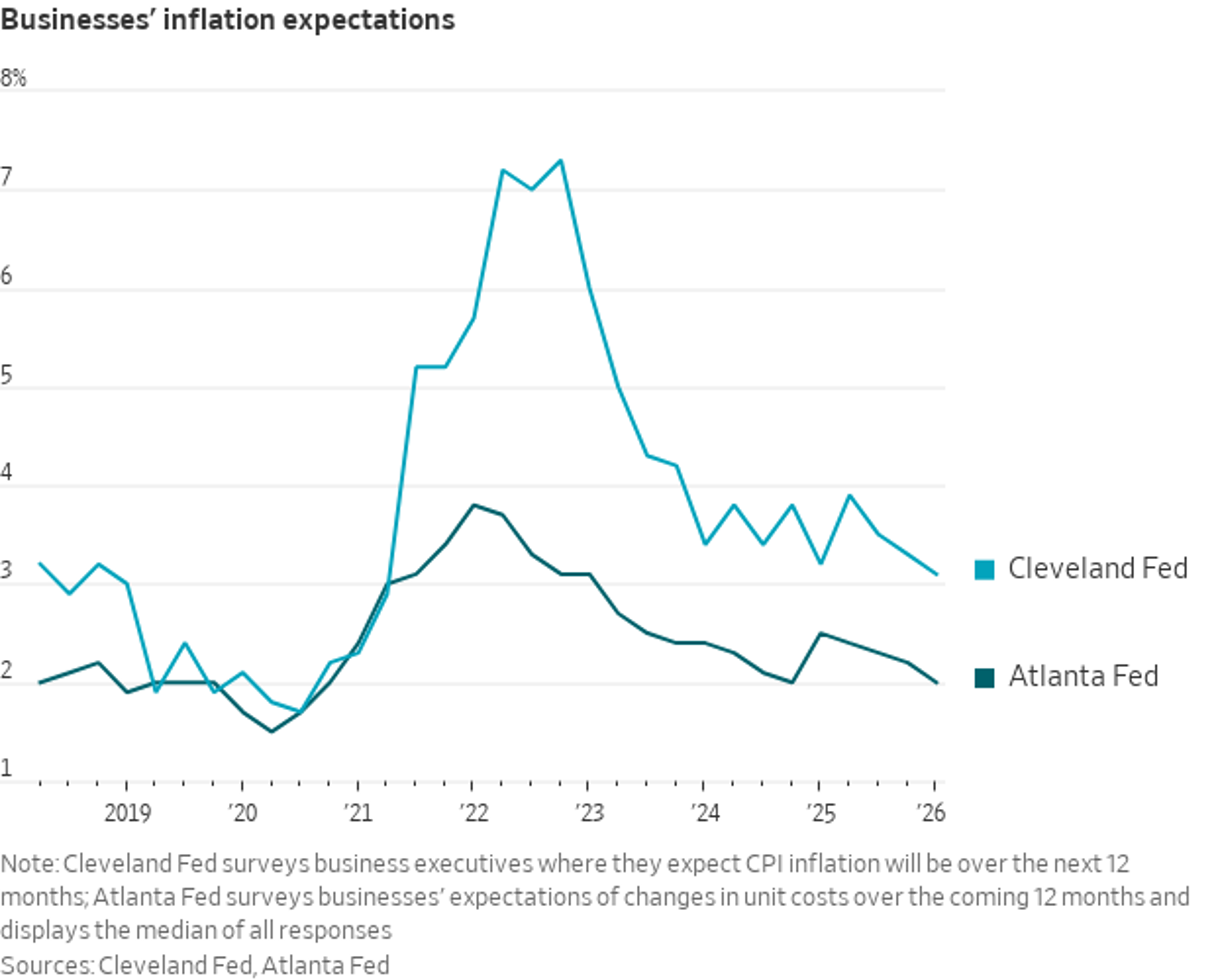

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

TLT Seen as Lower High, Still Hating Treasuries

I think I might be the only person in the world who still hates US Treasuries here. $TLT is just another lower high imo until proven wrong.

By Quinn Thompson

Social•Feb 17, 2026

U.S. Corn Inspections Surpass Expectations, Soy Exports to China Strong

🇺🇸Last week's U.S. corn inspections easily beat all trade expectations (though they weren't a weekly record). FYI the previous week's corn volume was hiked significantly. Soy inspections were near the top end of estimates - 57% of the beans were...

By Karen Braun

Social•Feb 17, 2026

Mistaking Short‑Term Labor Shortage for Full Employment Undermines Jobs

I disagree, but I don't think David is alone in this. To me, the biggest risk of confusing a temporary labor supply shortage that drives up inflation with full employment was that it would undermine actual full employment. We are...

By Adam Ozimek

Social•Feb 17, 2026

IEA Paris Meeting Tests Net‑Zero Shift Against US Oil Priorities

For energy policy making, a key week in Paris as @IEA energy officials gather Feb 18-19 for a biennial ministerial meeting. The IEA’s drift toward net-zero advocacy and overtures to China will be tested as US officials push to a return...

By Javier Blas

Social•Feb 17, 2026

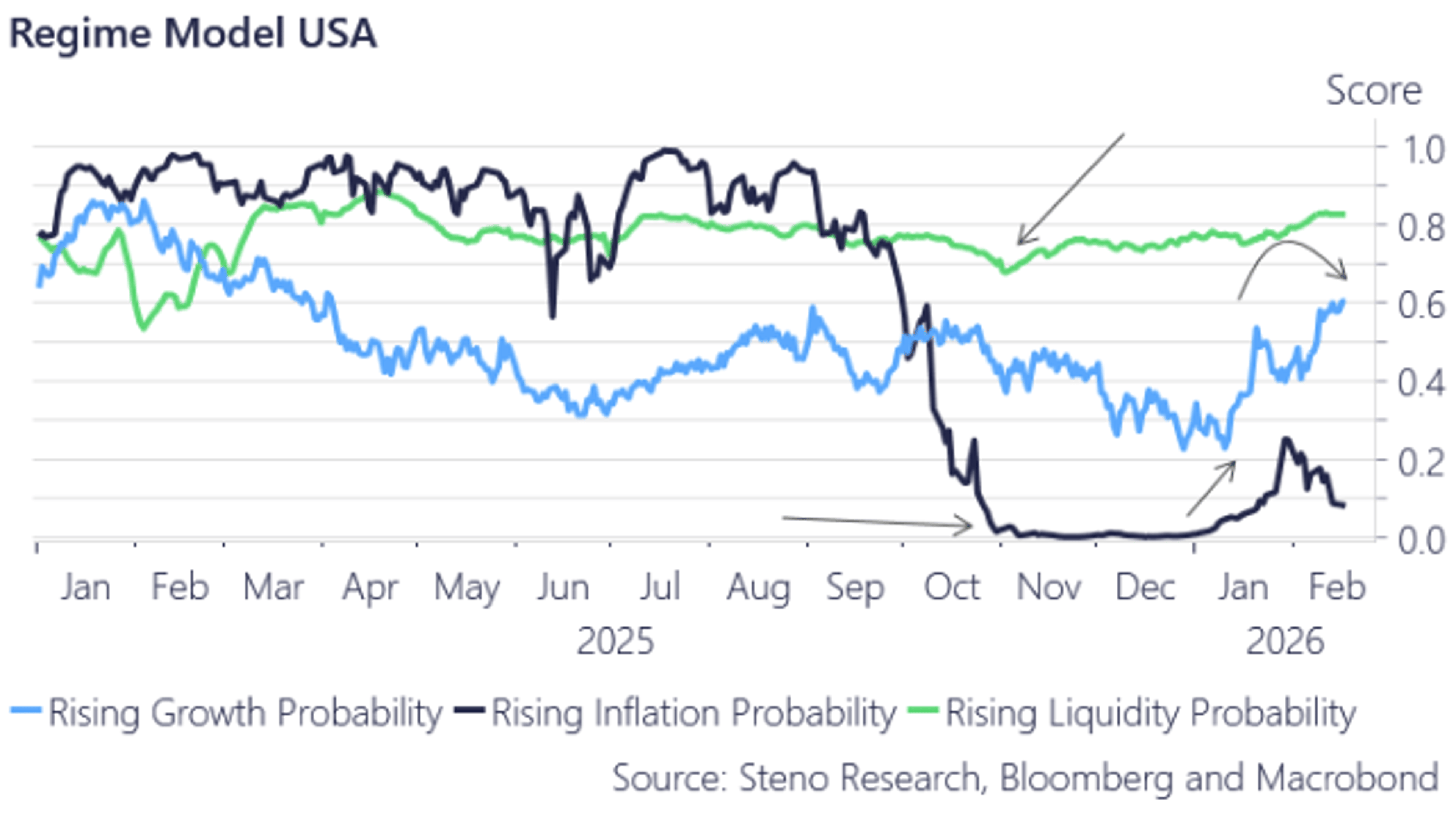

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

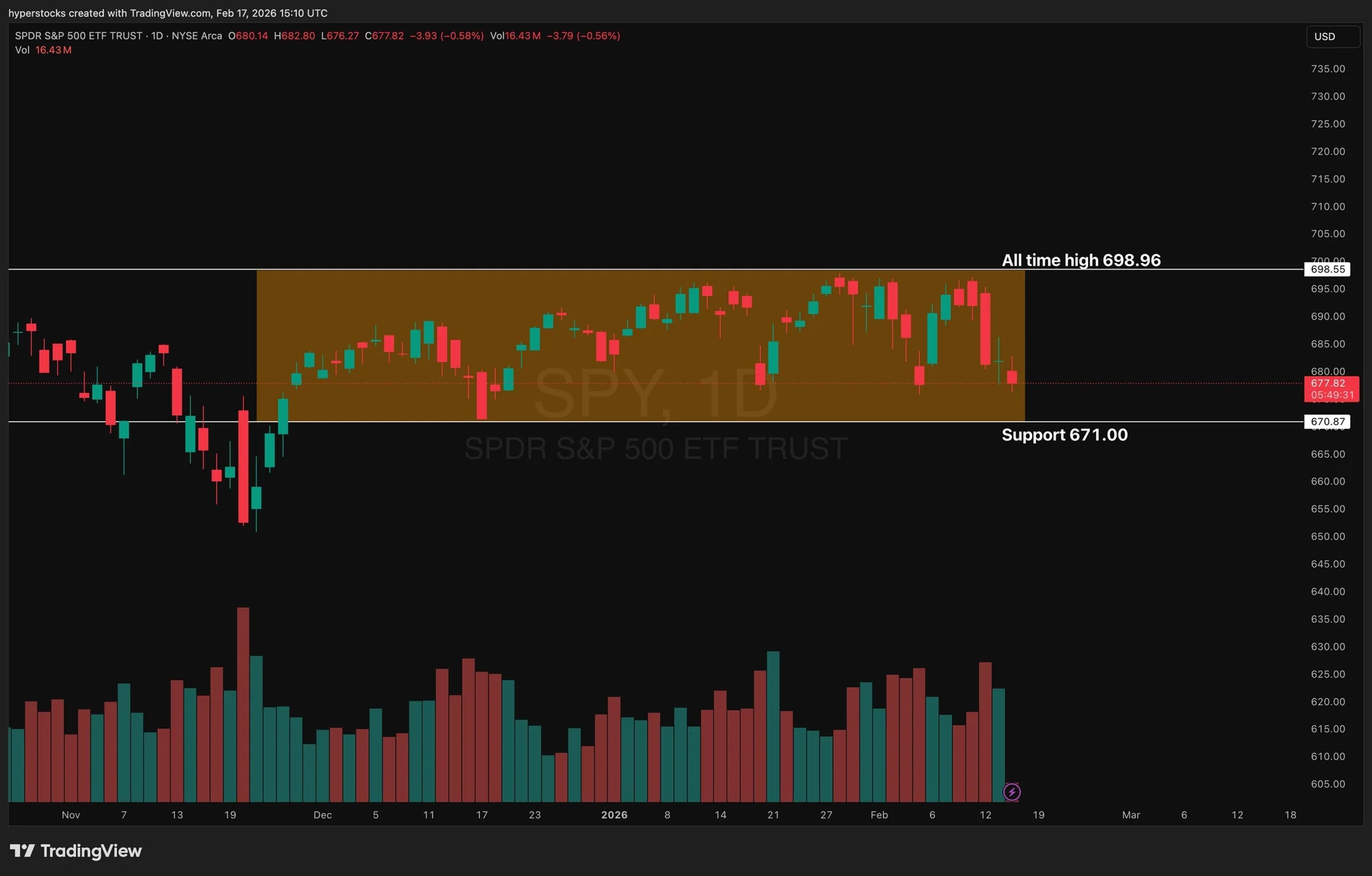

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks

Social•Feb 17, 2026

EURUSD Retreats to Fib Level as Longs Surge

$EURUSD has pulled back from its failed run on 1.20 a few weeks back - aligned to a 38.2% Fib of the 2008 to 2022 bear wave. Meanwhile, net speculative futures positioning has jumped this past week to its heaviest net-long...

By John Kicklighter

Social•Feb 17, 2026

Fed Rarely Cuts Rates During >8% Nominal Growth

"The Federal Reserve has cut rates only a handful of times when nominal growth was greater than 8 per cent and most of those instances were in the 1970s." Richard Bernstein @RBAdvisors in the FT https://t.co/vzNnkKmGpY

By Greg Ip

Social•Feb 17, 2026

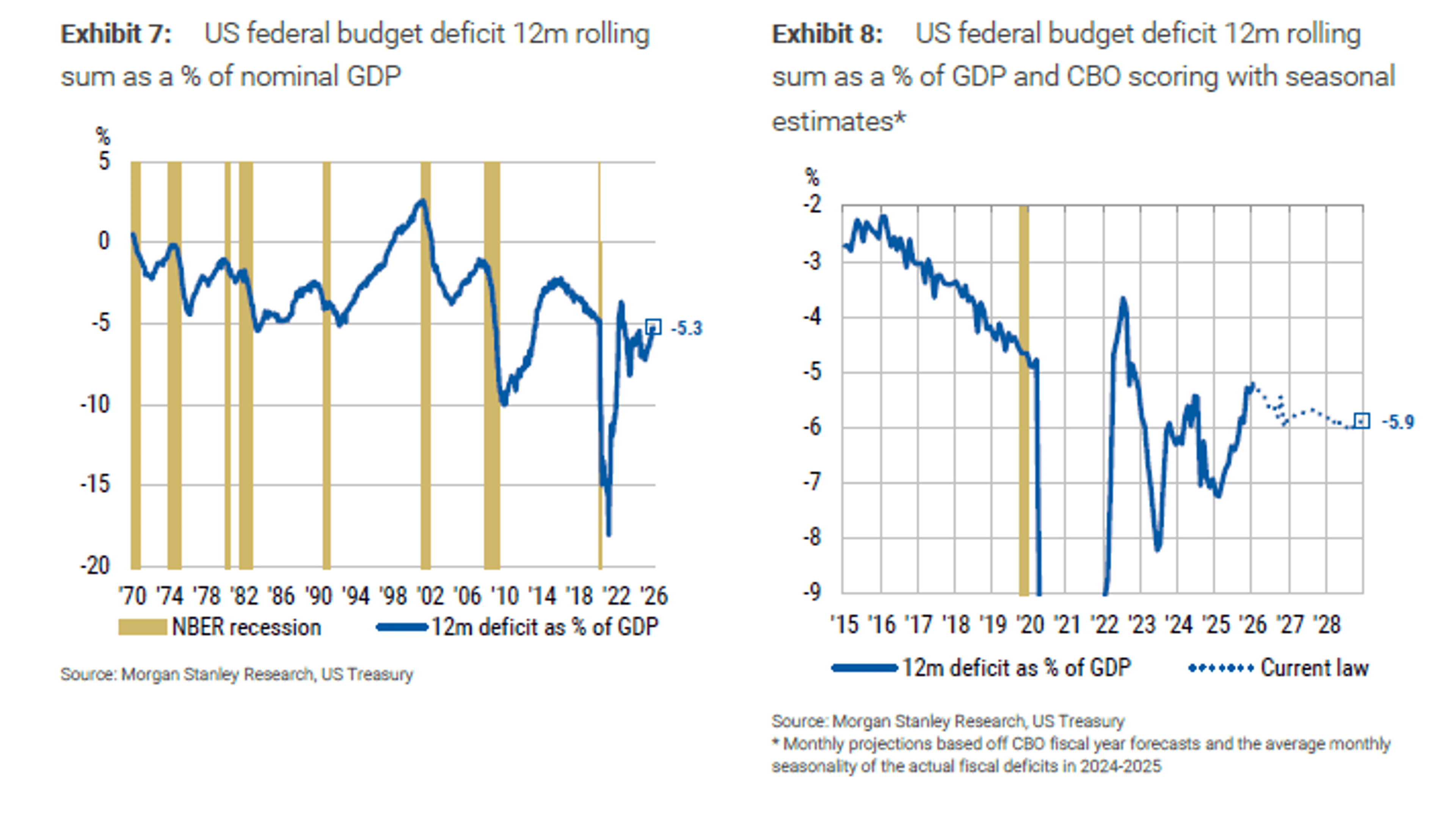

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

Social•Feb 17, 2026

Rate Moves Aren’t Driven by Current Data, ADP Shows

Big mistake is assuming move in rates is about current economic data. Reaction to ADP a good example

By Ed Bradford

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

Social•Feb 17, 2026

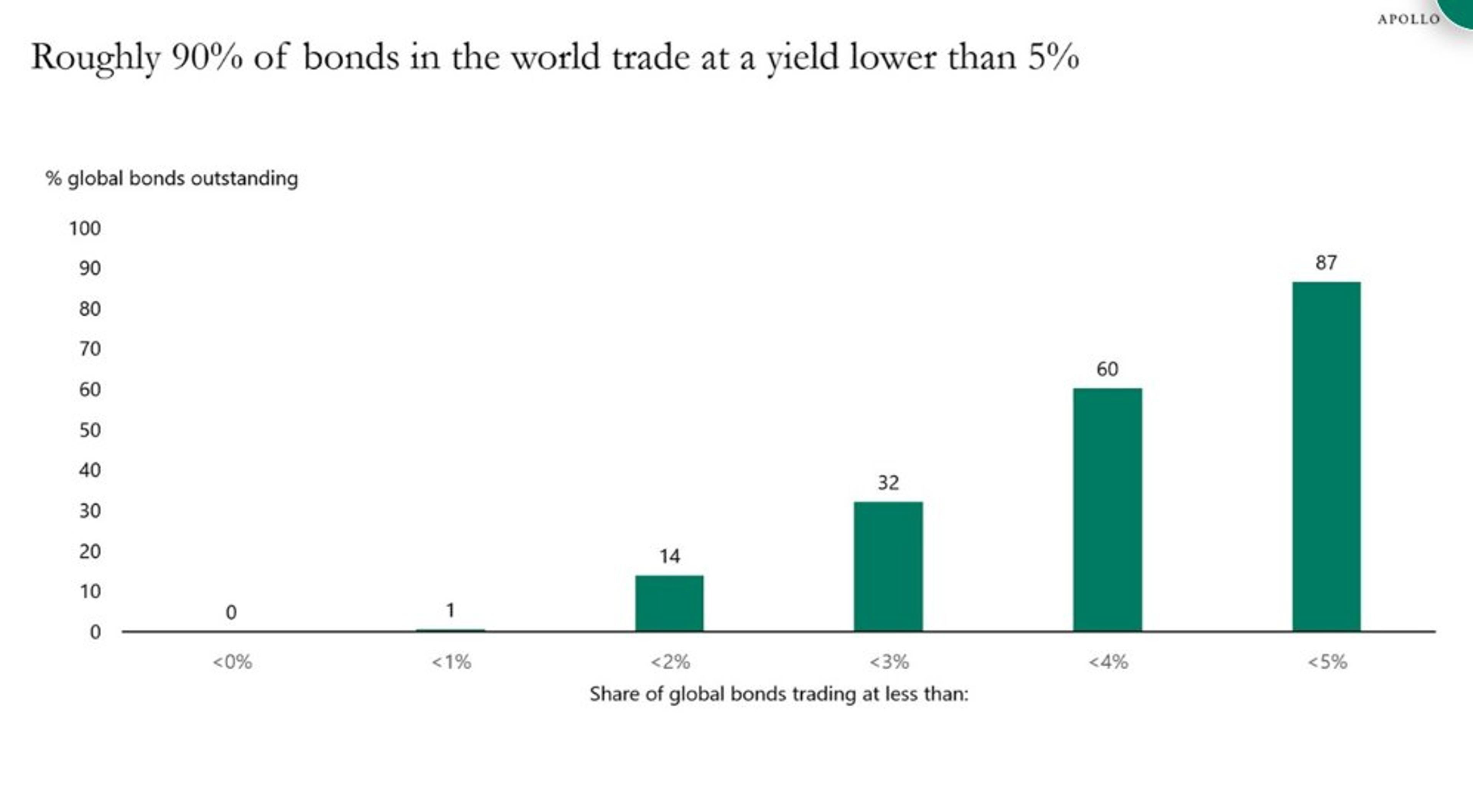

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

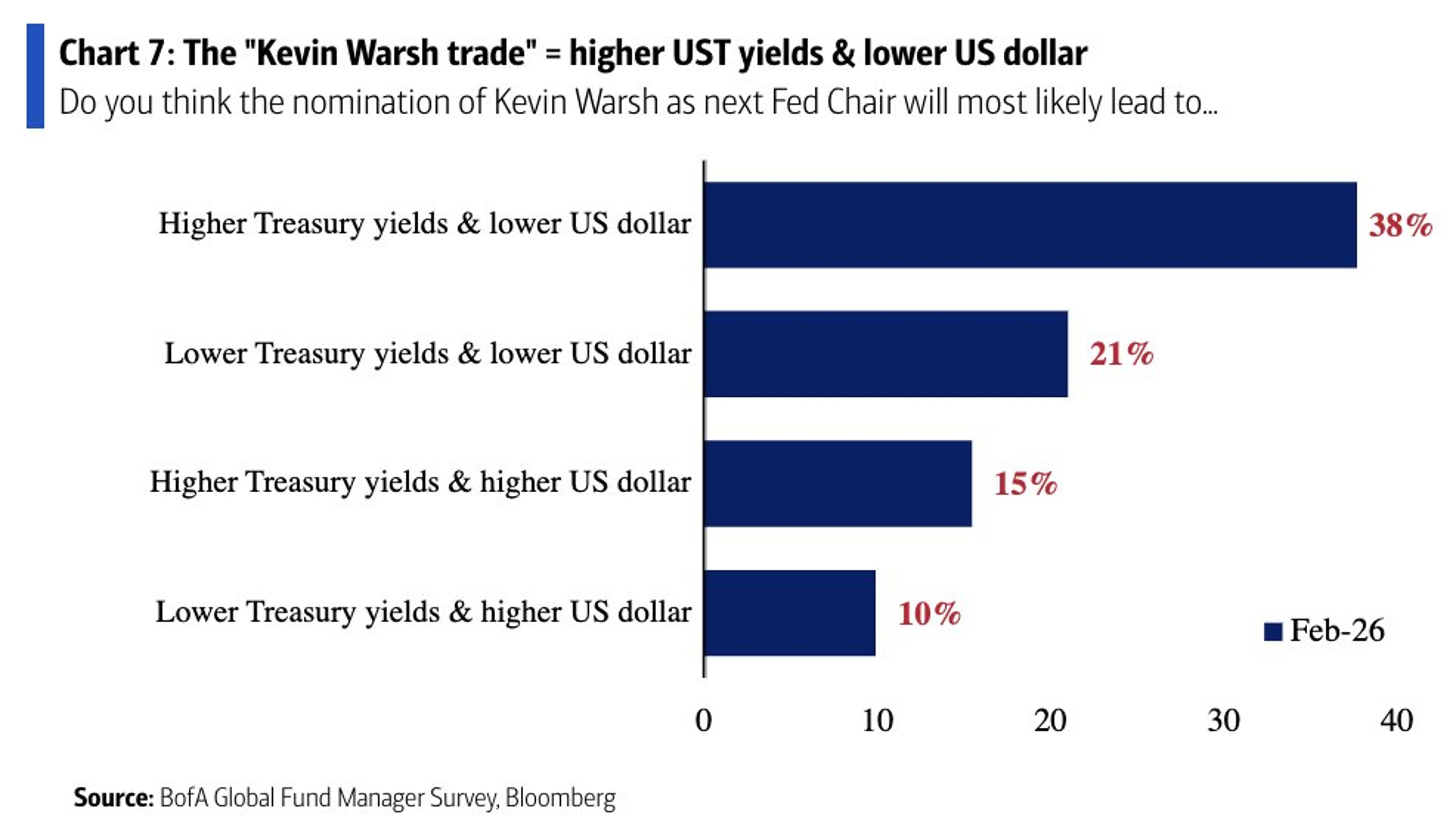

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

Social•Feb 17, 2026

Foreign Investment Steady, US Stocks Slightly Lagging

Balanced take from Bob. While the headline may be different than my "get out" thesis. The meat says the same. Flows suggest marginally weaker dollar and relative underperformance of U.S. stocks vs ROW. Don't panic out...

By Andy Constan

Social•Feb 17, 2026

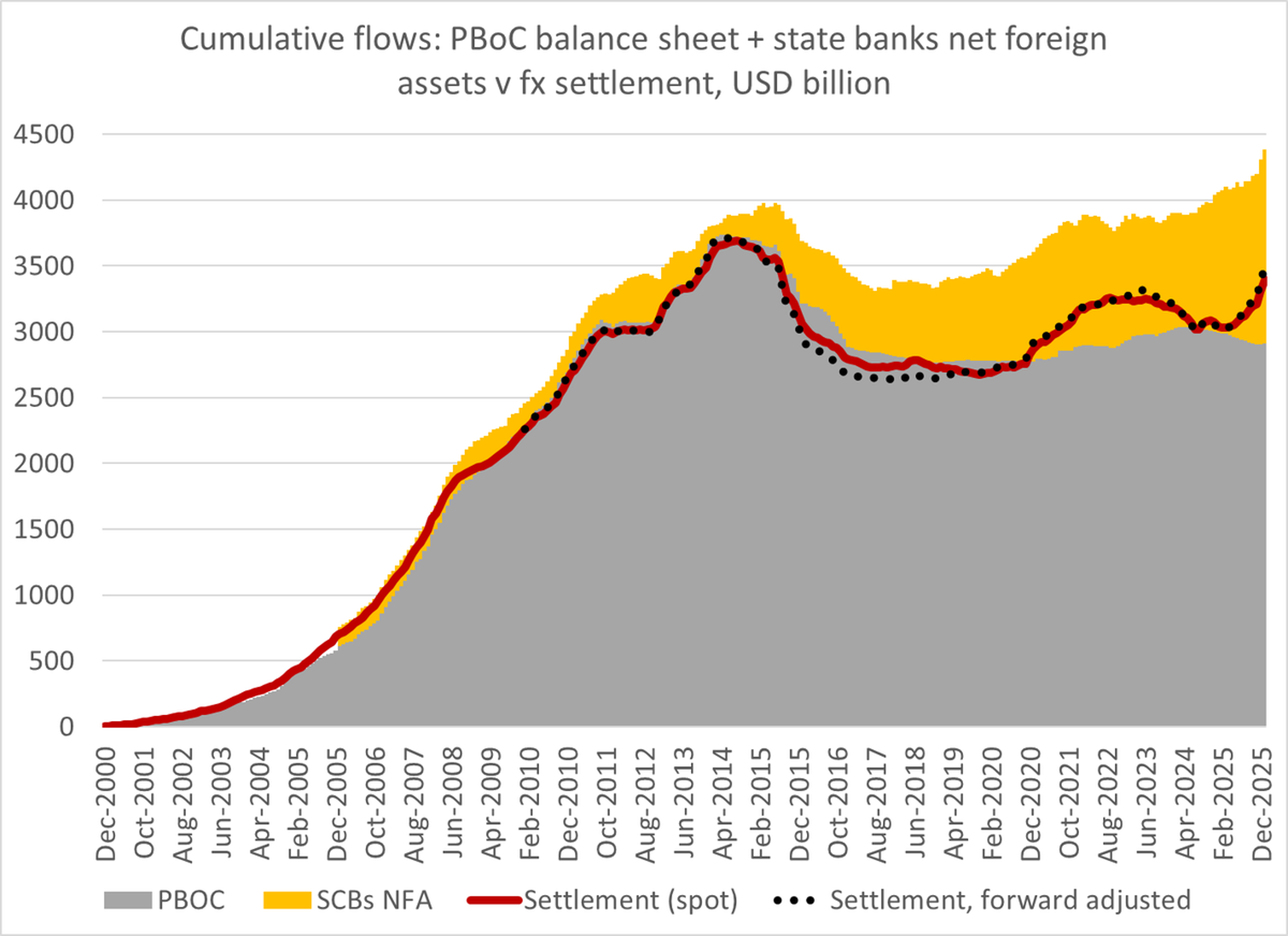

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

Social•Feb 17, 2026

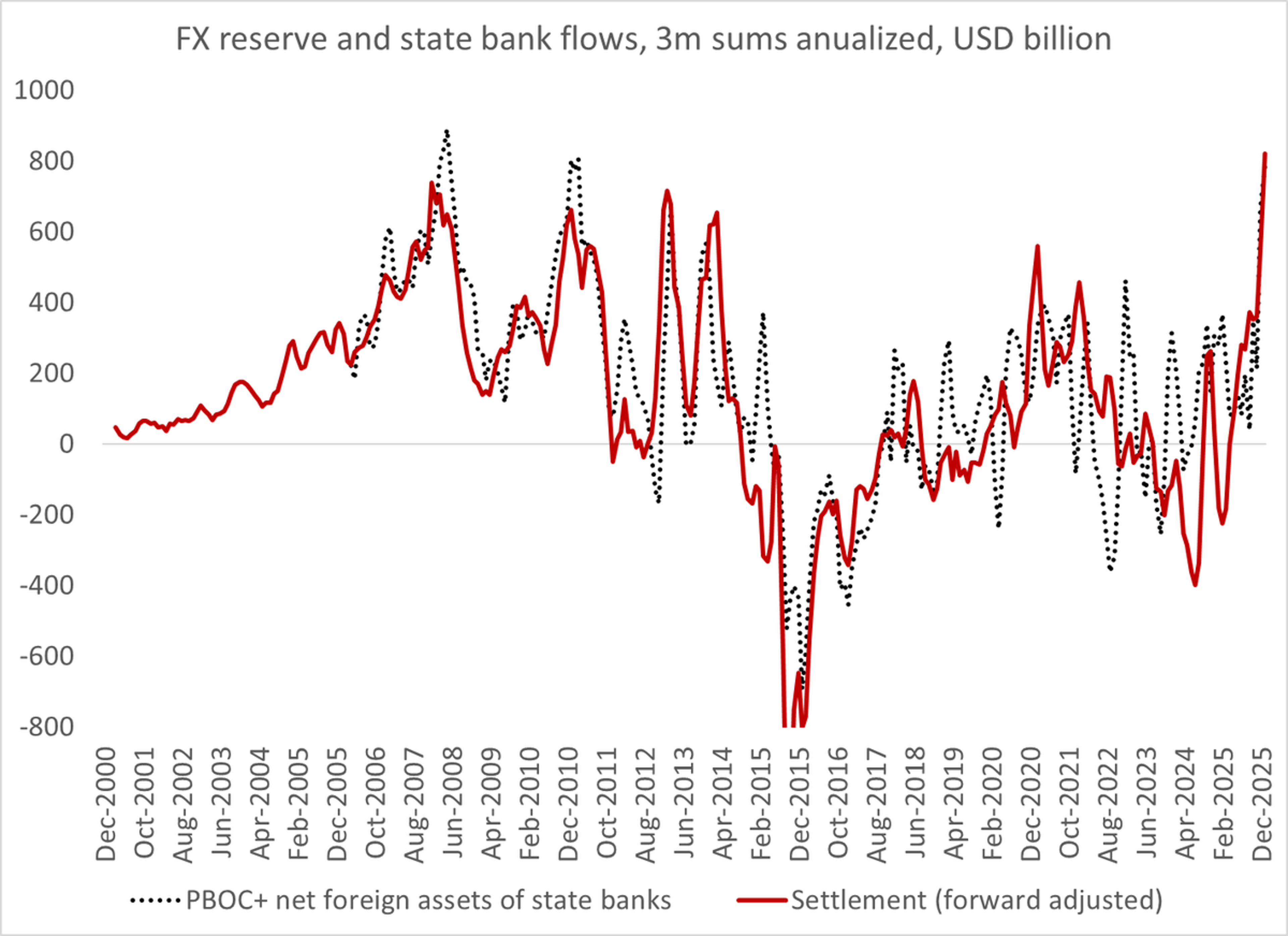

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

Social•Feb 17, 2026

Iranian Rial Plummets, Becomes World's Second Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Iranian rial ranks as the WORLD'S 2ND WORST currency. The rial has depreciated by 44% against the USD over the past year. RIAL = THE GREAT DESTABILIZER. https://t.co/06OiclsaSq

By Steve Hanke

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

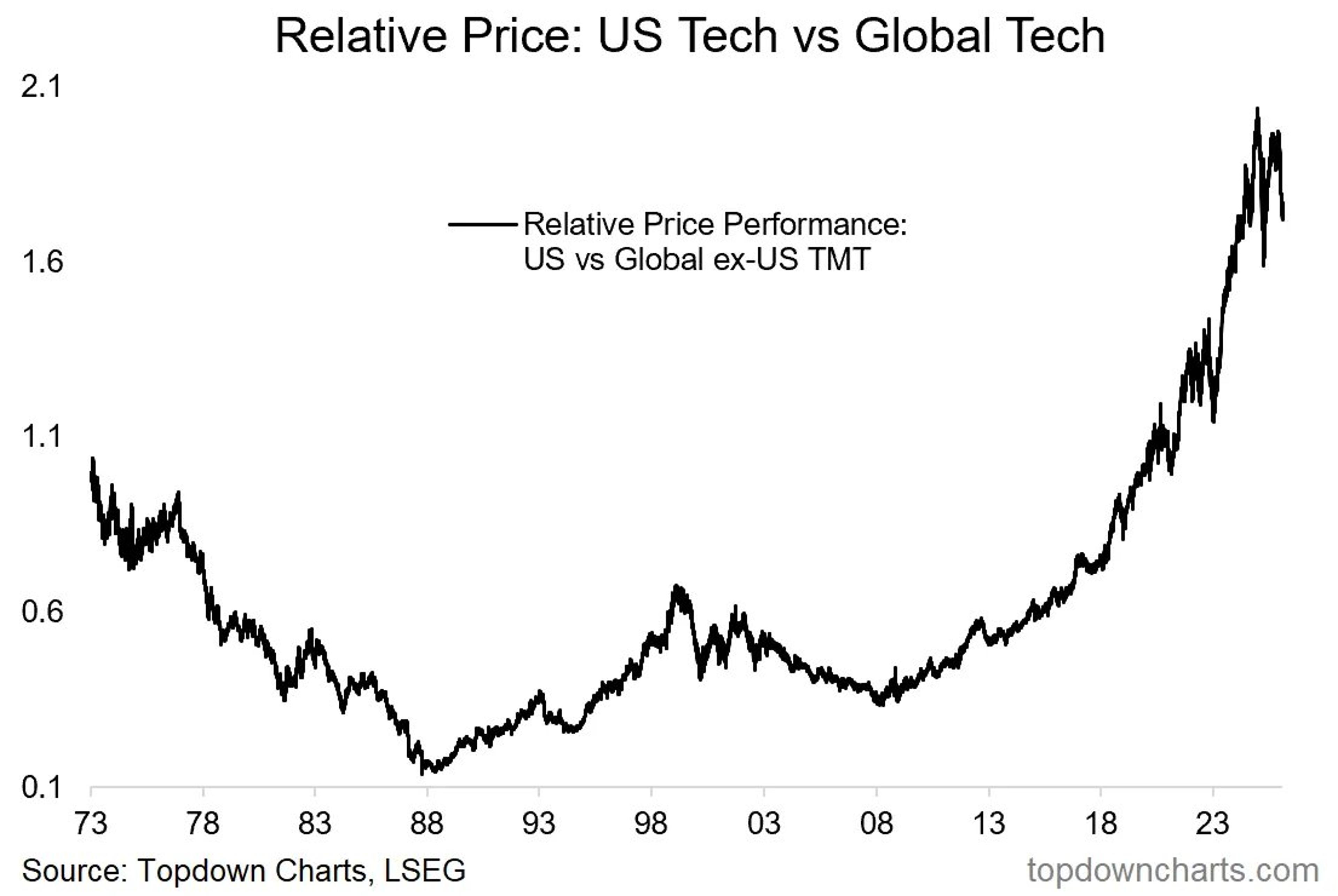

US Tech Dominance Fades as Global Rotation Shifts

This chart captures the 2 most important themes in the Stockmarket right now. 1. Global vs US rotation 2. Top in tech stocks For the past 17-years US Tech stocks have dominated global markets, but that is starting to change... https://t.co/6DhUXusR6C

By Callum Thomas

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber