Social•Feb 19, 2026

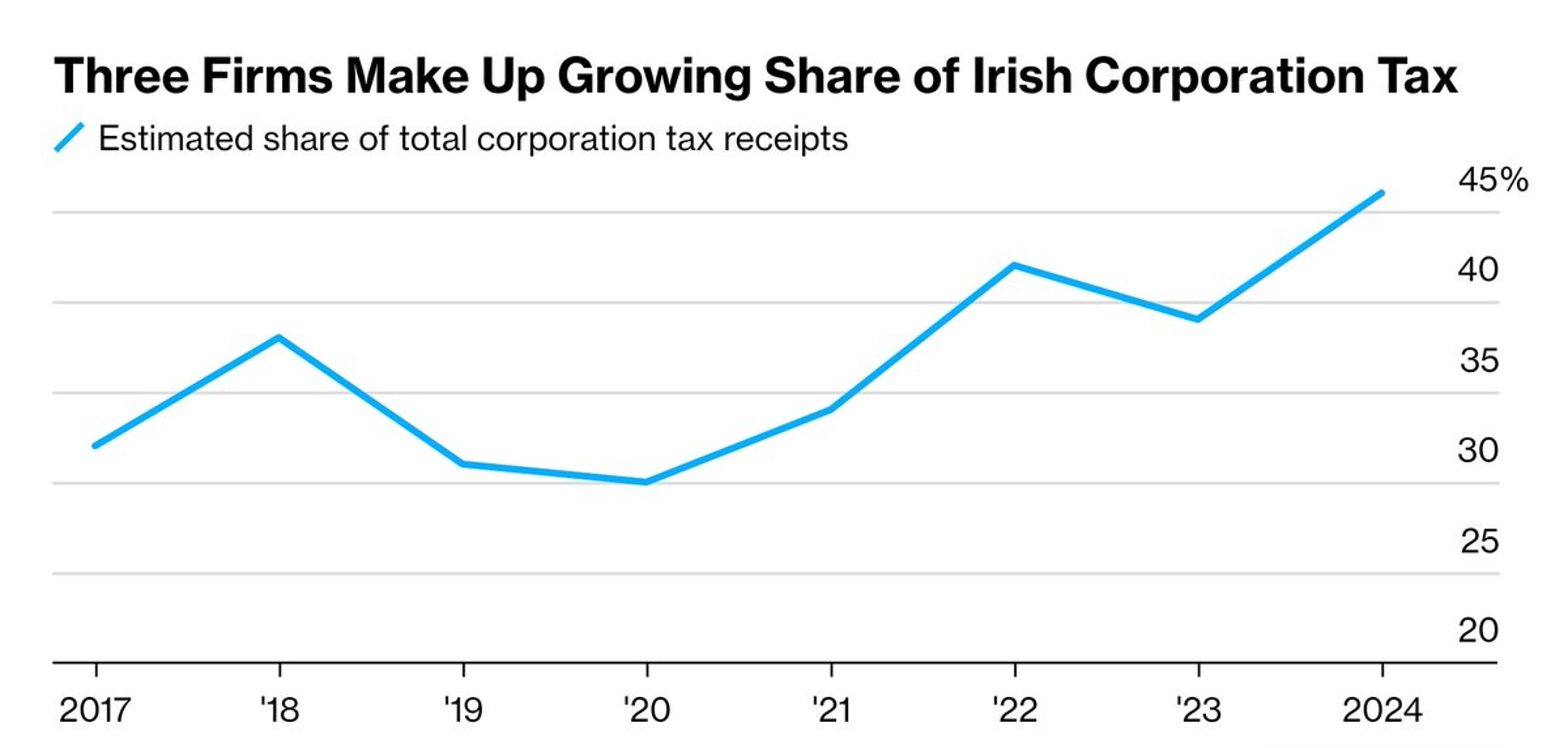

Three Multinationals Generate Half of Ireland's 2024 Tax Revenue

Ireland’s corporation tax receipts have become increasingly concentrated with just three multinational companies accounting for almost half of all of the revenue stream in 2024, watchdog warns https://t.co/of9w2dPPpV via @livfletcher_ https://t.co/iNNIyP8iwQ

By Zöe Schneeweiss

Social•Feb 19, 2026

Fuel Subsidy Masks Real Service Cost Surge

1.6% is a statistical illusion for the urban middle class While headline inflation is stable, the "unprotected" service sector is aggressive: Personal Care & Misc. → 6.6% Education → 3.2% Cause→Effect: Subsidized fuel (-0.7%) masks the reality of rising service labor costs. If you...

By David Chuah

Social•Feb 19, 2026

India's 6.5% Growth Beats China, Fastest Major Economy

As the World Bank notes, India is the fastest-growing major economy. India's growth rate of 6.5% is even outpacing China's. https://t.co/3S7a6Z6LbT

By Steve Hanke

Social•Feb 19, 2026

Nikkei Rises; Buy Nikkei ETF Amid FX Risks

Nikkei +0.71%; real estate, banks, textiles led; VIX-Nikkei 27.89. Leaders: Yokohama Rubber, Omron. Risks: FX (USD/JPY 155.11), commodity shocks. Trade: buy Nikkei ETF. — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 19, 2026

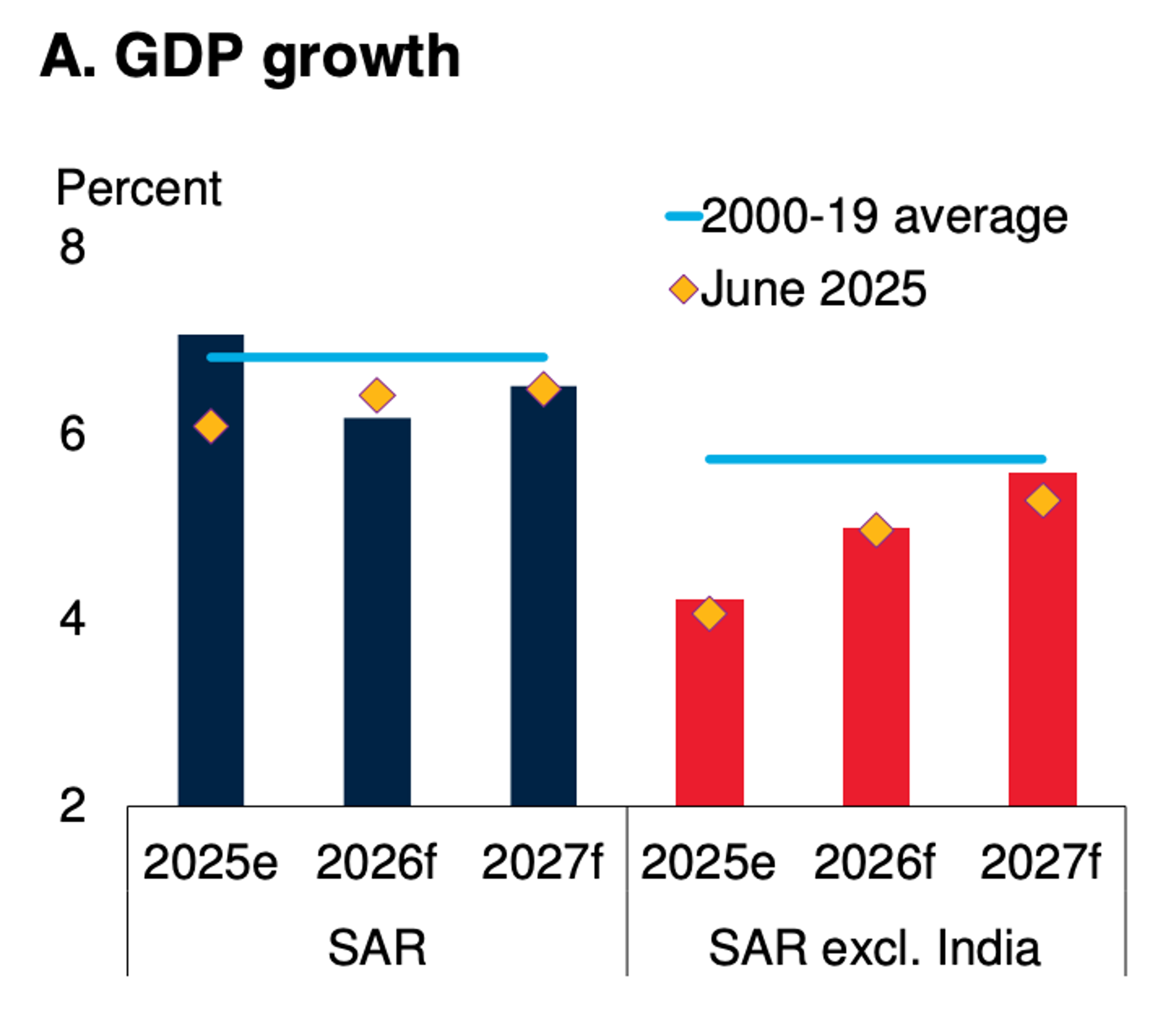

India Drives South Asia's 6‑7% Growth; Rest Lags

According to the World Bank, South Asia growth stays near 6-7%. Strip out India, and the region slows sharply. India is the growth story. https://t.co/Q8e7g9b1j3

By Steve Hanke

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

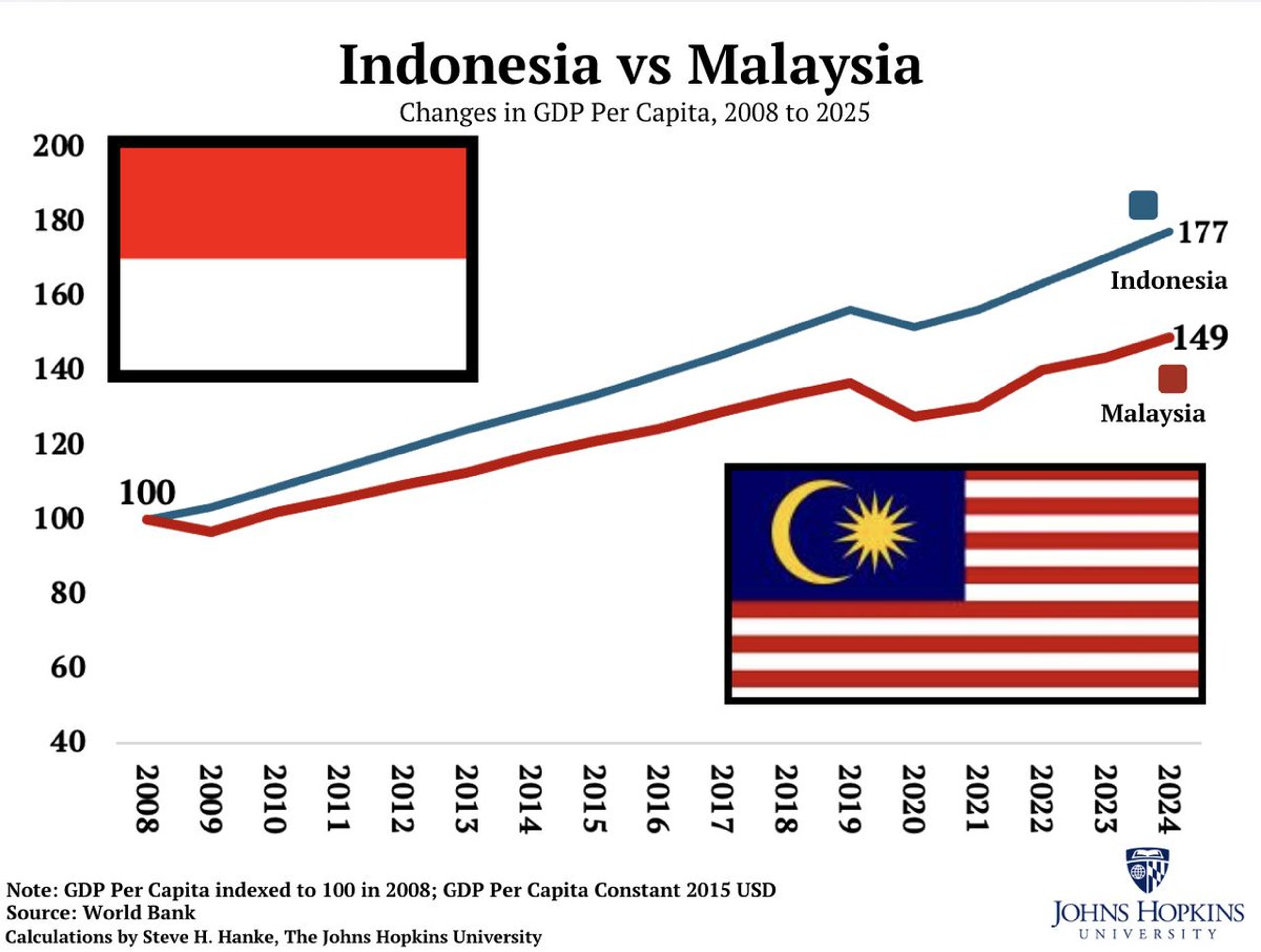

Indonesia Leads Malaysia in Palm Oil and Economic Growth

What do Indonesia and Malaysia have in common? They are the two biggest palm oil exporters in the world. Since 2008, Indonesia’s economy has outperformed Malaysia’s. https://t.co/mTUct95oZv

By Steve Hanke

Social•Feb 19, 2026

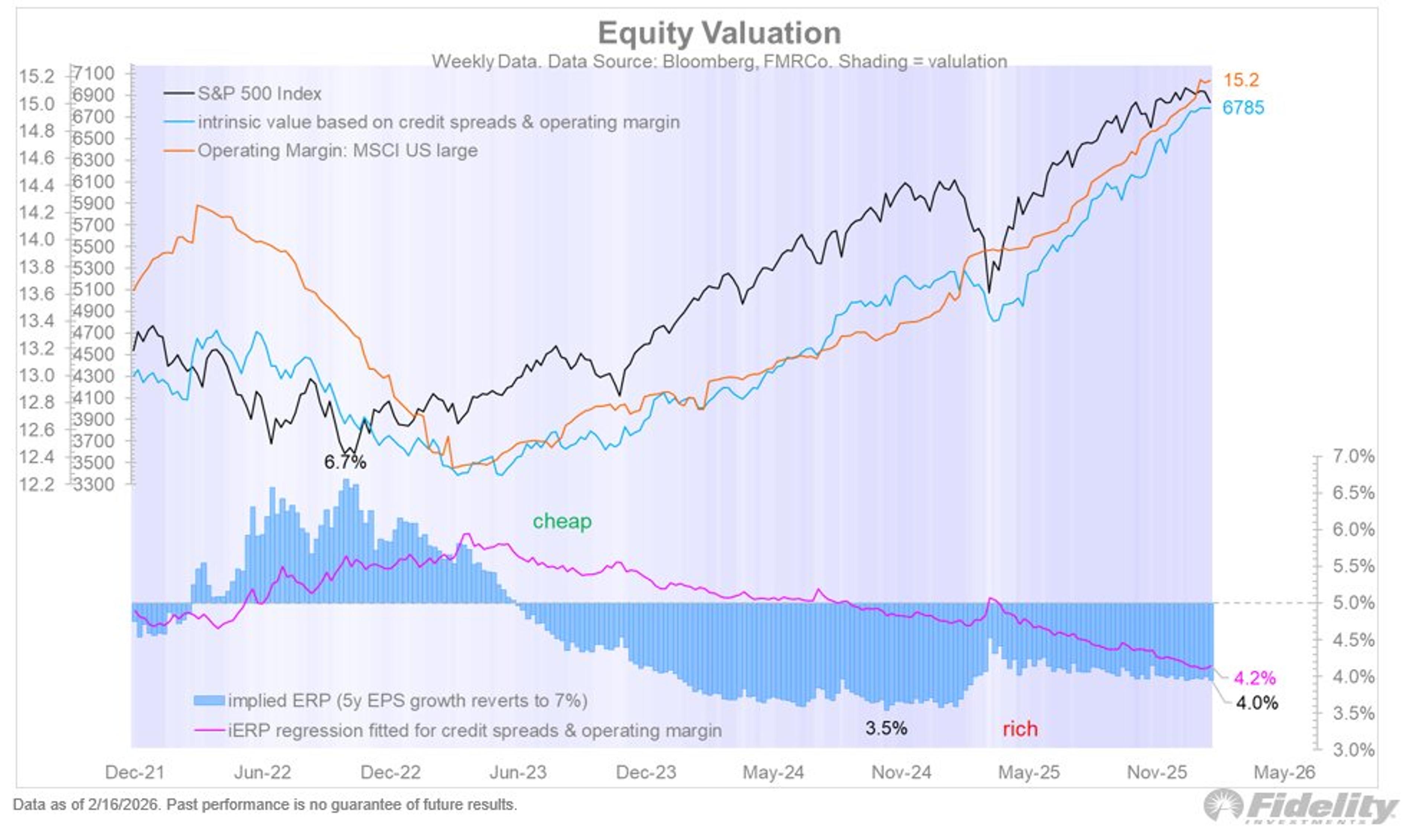

Rising Capex May Curb Buybacks, Pressure Valuations

With credit spreads low and profit margins seemingly on the rise, valuations seem OK at current levels. These two variables are important drivers for the equity risk premium, which is currently at 4.0% according to my version of the DCF...

By Jurrien Timmer

Social•Feb 19, 2026

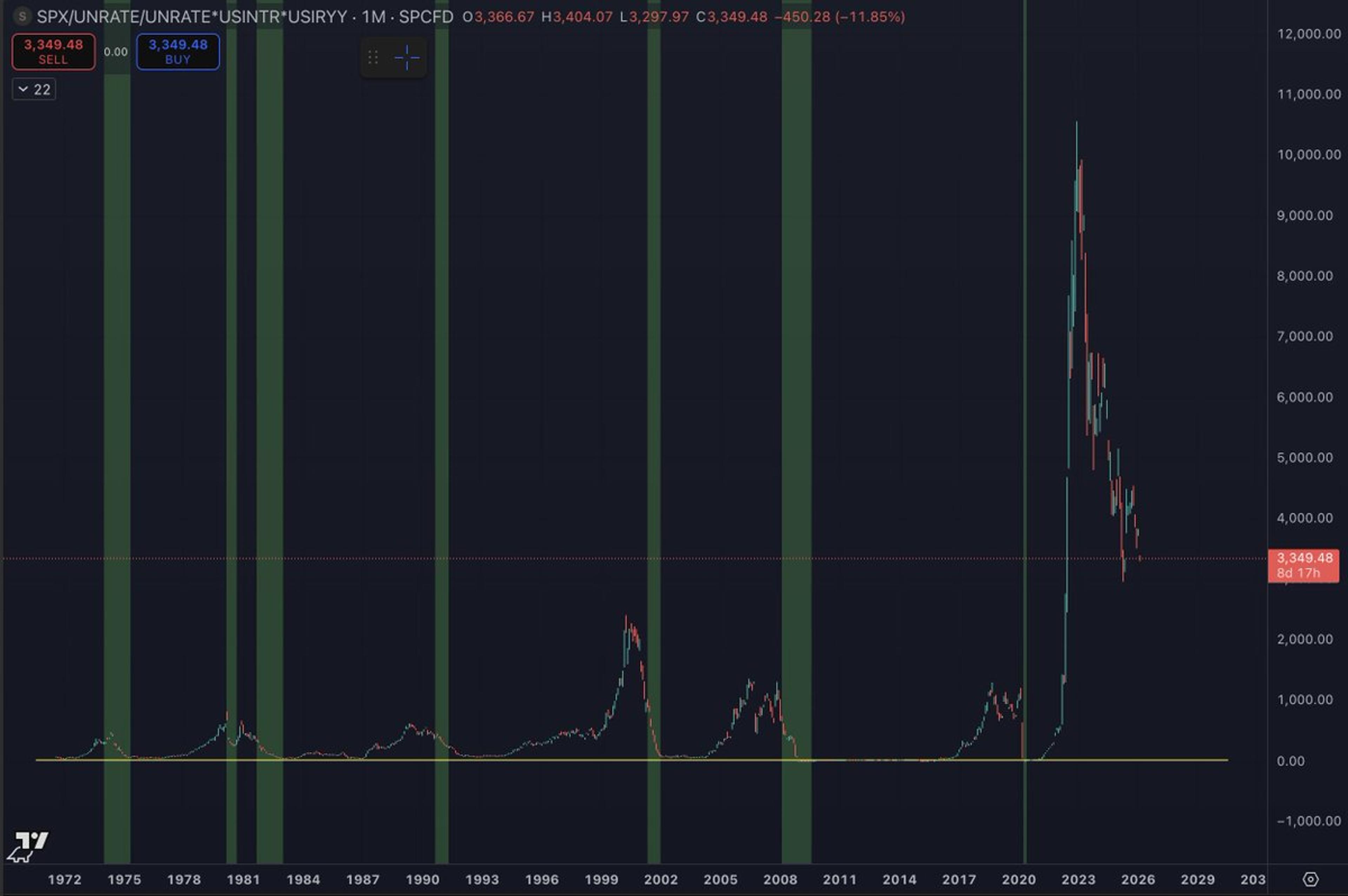

Euphoria Unwinds, Quality Assets Outshine Speculation

I have mentioned this chart a few times in the past, but it does really go to show just how extreme things got the last few years. The chart is SPX/(UNRATE^2)*USIRYY*USINTR Unravelling things after extreme euphoria is never an easy process. As things...

By Benjamin Cowen

Social•Feb 19, 2026

North Korea's Inflation Soars to 74.6%, World’s Third Highest

#NKWatch🇰🇵: Today, I measure North Korea’s inflation at 74.6%/yr — that’s the THIRD HIGHEST IN THE WORLD. Kim’s rockets fly, but inflation is what’s truly SKYROCKETING. https://t.co/EbYJ0oBnAW

By Steve Hanke

Social•Feb 19, 2026

Korea's Index Slides Below Historical Average After 150% Surge

It’s wild how Korea’s stock index is trading below its historical average following a nearly 150% price rally https://t.co/TyCTVuO5pW

By David Ingles

Social•Feb 19, 2026

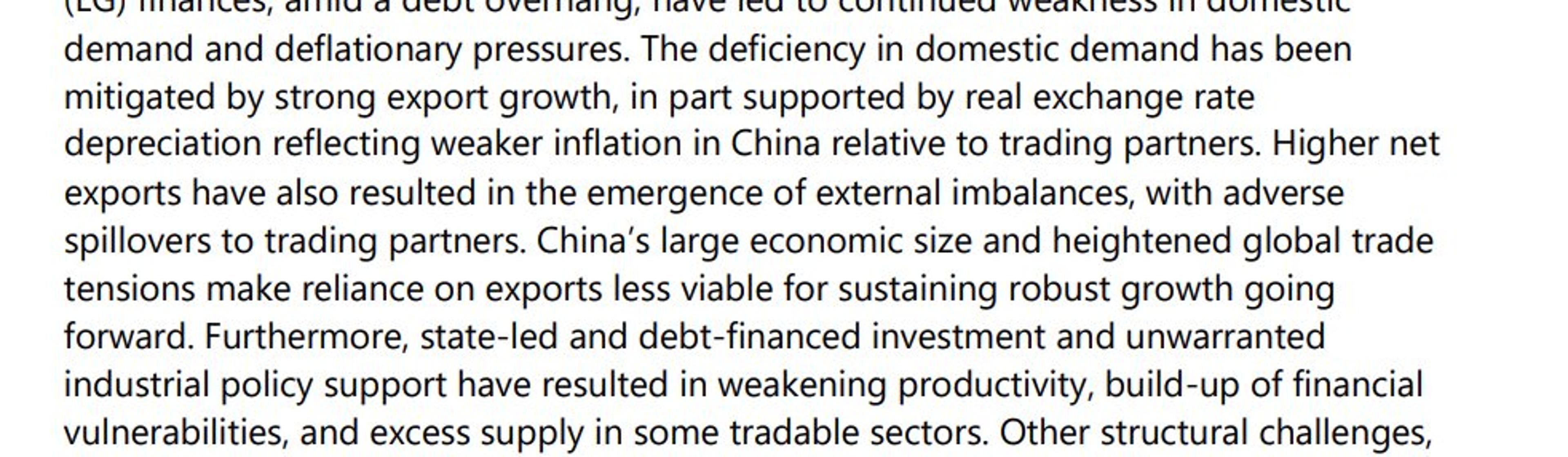

IMF: China's Export Growth Harms Its Trading Partners

The latest IMF analysis of China (The staff report/ Article IV) highlights that China's export driven growth has come at the expense of its trading partners. That is welcome, and very necessary message 1/many https://t.co/RTYAzRkFAv

By Brad Setser

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

Social•Feb 19, 2026

Blue Owl Stops Redemptions, Highlighting Exit Liquidity Risk

BLUE OWL PERMANENTLY HALTS REDEMPTIONS AT PRIVATE CREDIT FUND AIMED AT RETAIL INVESTORS — FT Being long scarcity might lead to illiquidity, but being long illiquidity doesn’t necessarily mean you’re long scarcity You’re long exit liquidity

By Jeff Park

Social•Feb 19, 2026

Korean Reforms Spark Value Ups, Awaiting IBKR Access

I initially thought the Korean reforms would be ineffective. But on the ground, I’m seeing many companies come up with highly positive value up plans. And valuations remain a fraction of those in Japan. Once IBKR opens access, the focus...

By Michael Fritzell

Social•Feb 19, 2026

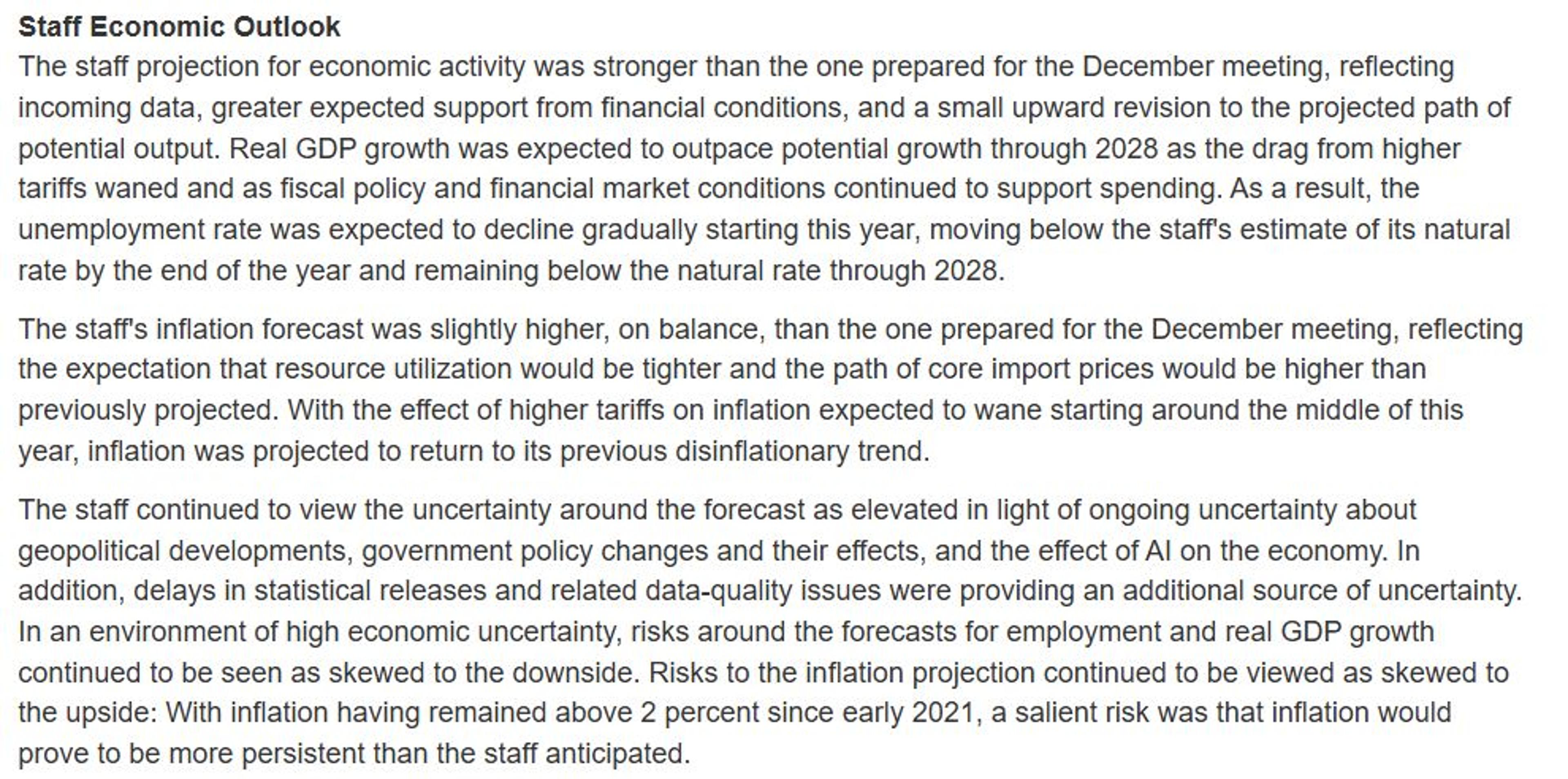

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Social•Feb 19, 2026

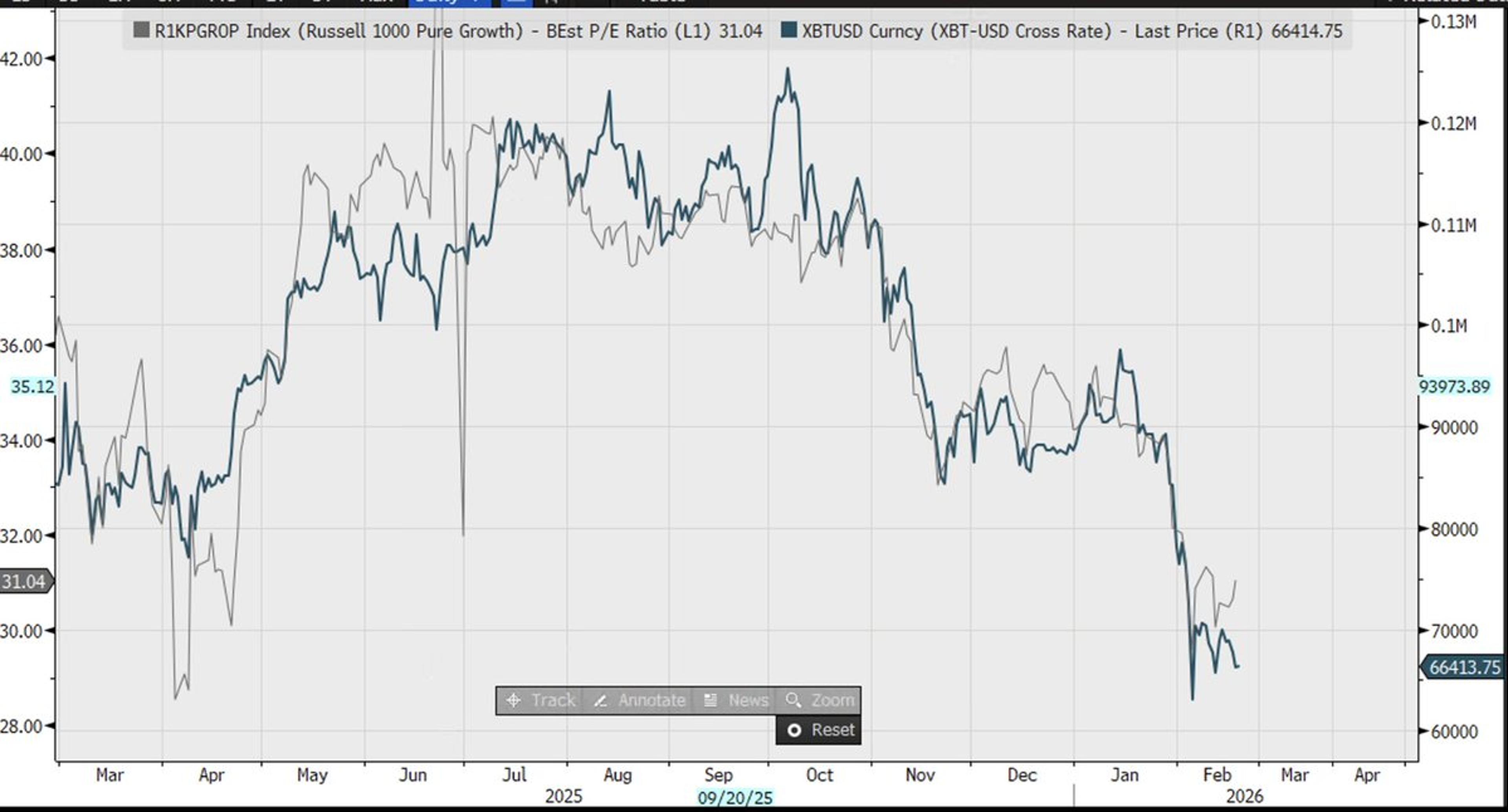

Long‑duration Assets Like Bitcoin, Growth Stocks Lose Favor

Bitcoin's drop has coincided with a decline in the Russell 1000's Pure Growth P/E. What do they have in common? Both are long-duration, and are being shunned during the underlying rotation into shorter-duration (cyclical) securities (think value, dividend payers, Energy...

By Michael Kantro

Social•Feb 19, 2026

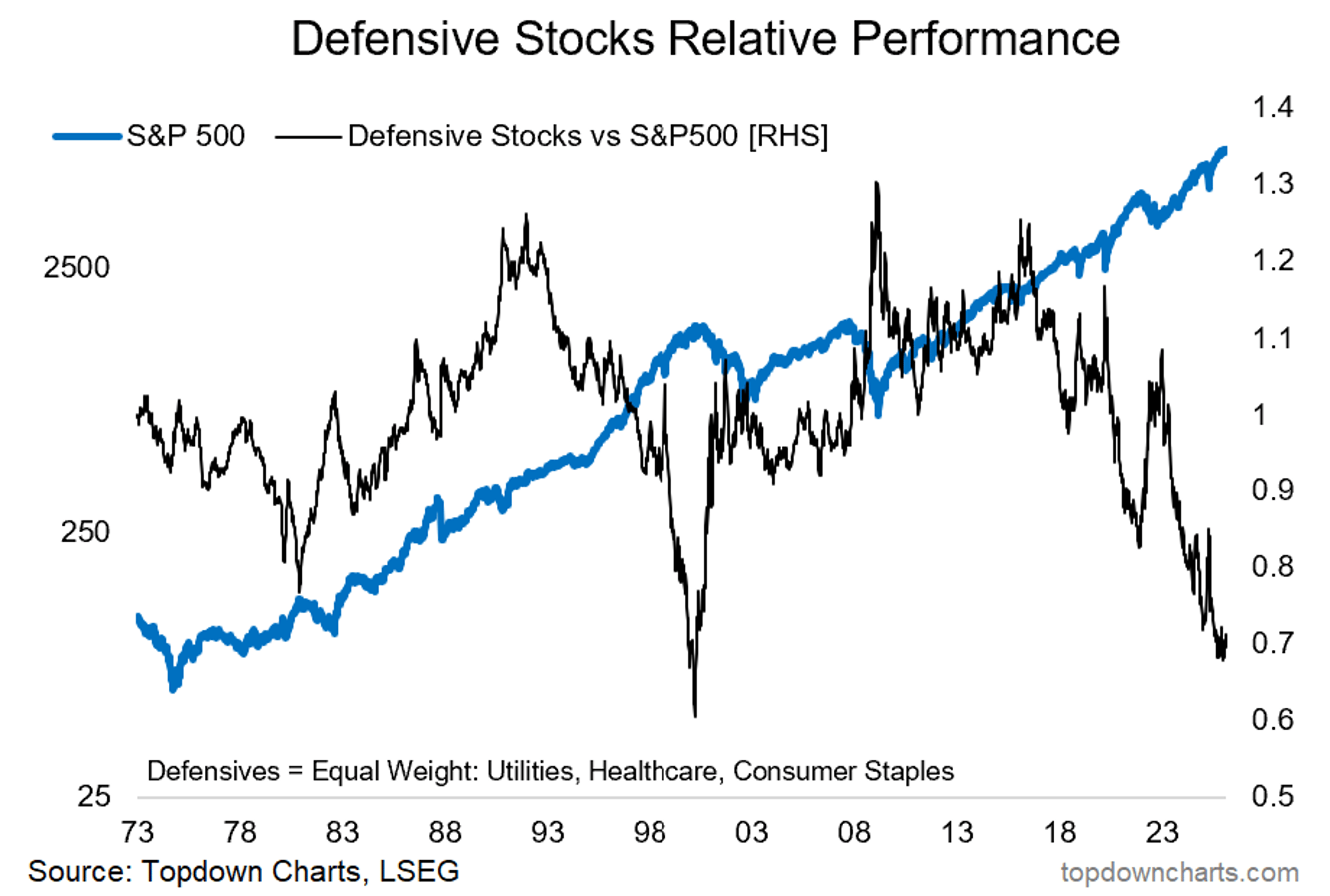

Defensives Hit Dot‑Com Lows, Poised for Rally

Chart of the Week - Defensives With tech in trouble (+a number of macro risks lurking on the horizon), defensives are starting to look interesting… Defensives (i.e. an equal-weighted basket of: Utilities, Healthcare, Consumer Staples) are turning up vs the S&P500 —after...

By Callum Thomas

Social•Feb 18, 2026

Packed 24‑Hour Macro Calendar: Japan, US, China Data

The global macro docket for the next 24 hours of trade pics up. Japan has machinery orders, mfg activity survey, a 1-year and 20-year JGB auction, Jan CPI. Walmart and Alibaba report earnings. US and Canada trade balance. PBOC rate setting. Start...

By John Kicklighter

Social•Feb 18, 2026

US Vaccine Policy Shift Boosts MRNA Stock Appeal

Macro: US vaccine-policy swing heightens regulatory risk; FDA will review Moderna’s flu shot. Key: public dispute, amended filing; decision by Aug 5. Risk: political oversight. Trade: Buy MRNA. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

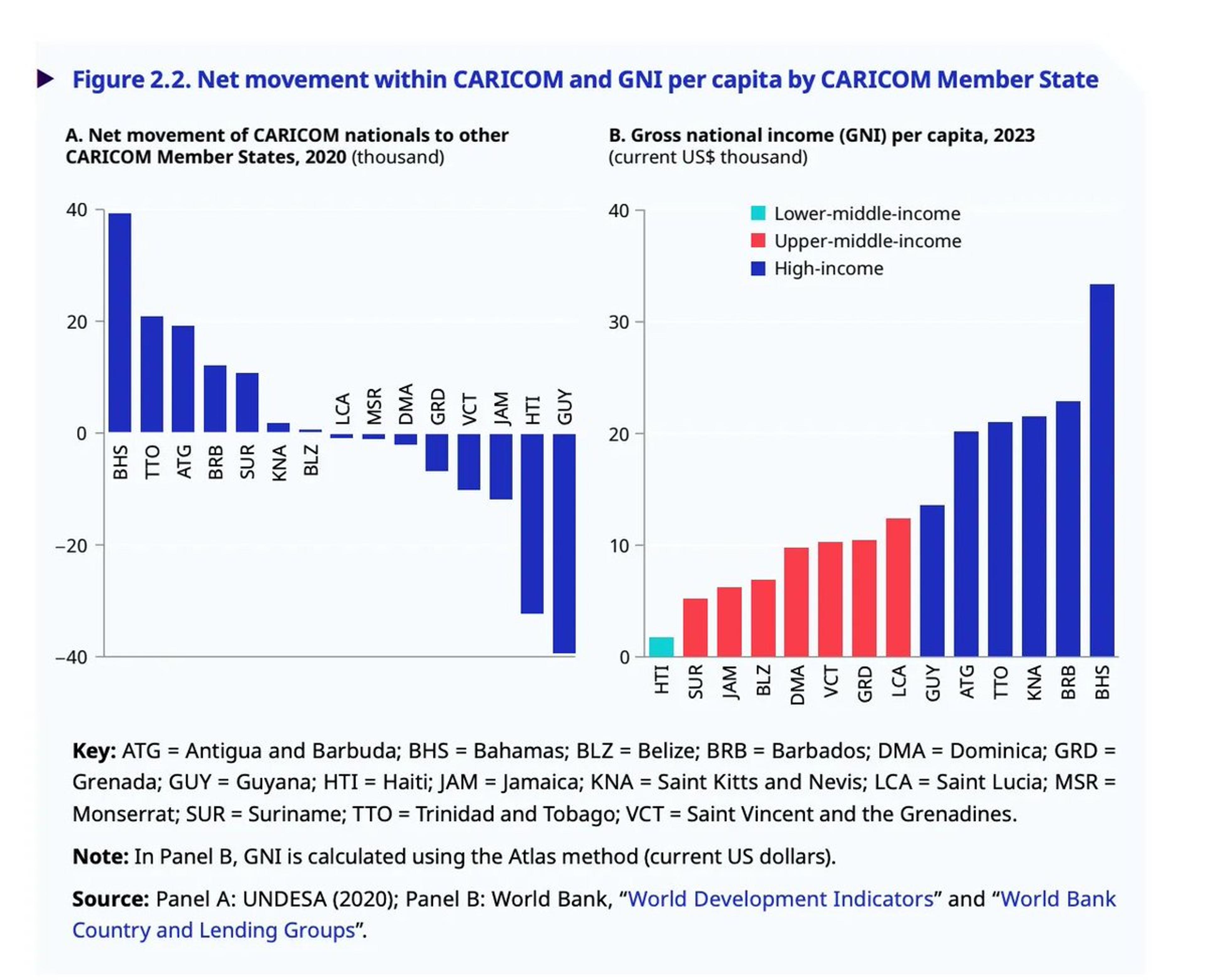

Income Gaps Fuel Migration Across CARICOM Nations

Stark differences in income drive migration within CARICOM (and these are official data). More at today's Chartbook Top Links: https://t.co/DaCnHTI3Wj

By Adam Tooze

Social•Feb 18, 2026

Tariffs Inflate Prices and Act Like Hidden Corporate Tax

A) Many studies have examined whether tariffs have been passed through to consumer prices, and they've found significant retail price increases B) Tariff burdens absorbed by US companies are an inefficient corporate tax, paid by Americans via lower wages or share...

By Scott Lincicome

Social•Feb 18, 2026

Debt-Based Money Ensures Perpetual Debt, Devalues Assets

Bc of the interest component & exponential function of a debt based monetary system, there is never enough money to pay off the debt. And bc debts are always paid (either by lender or borrower), if they didn’t debase the...

By Brent Johnson

Social•Feb 18, 2026

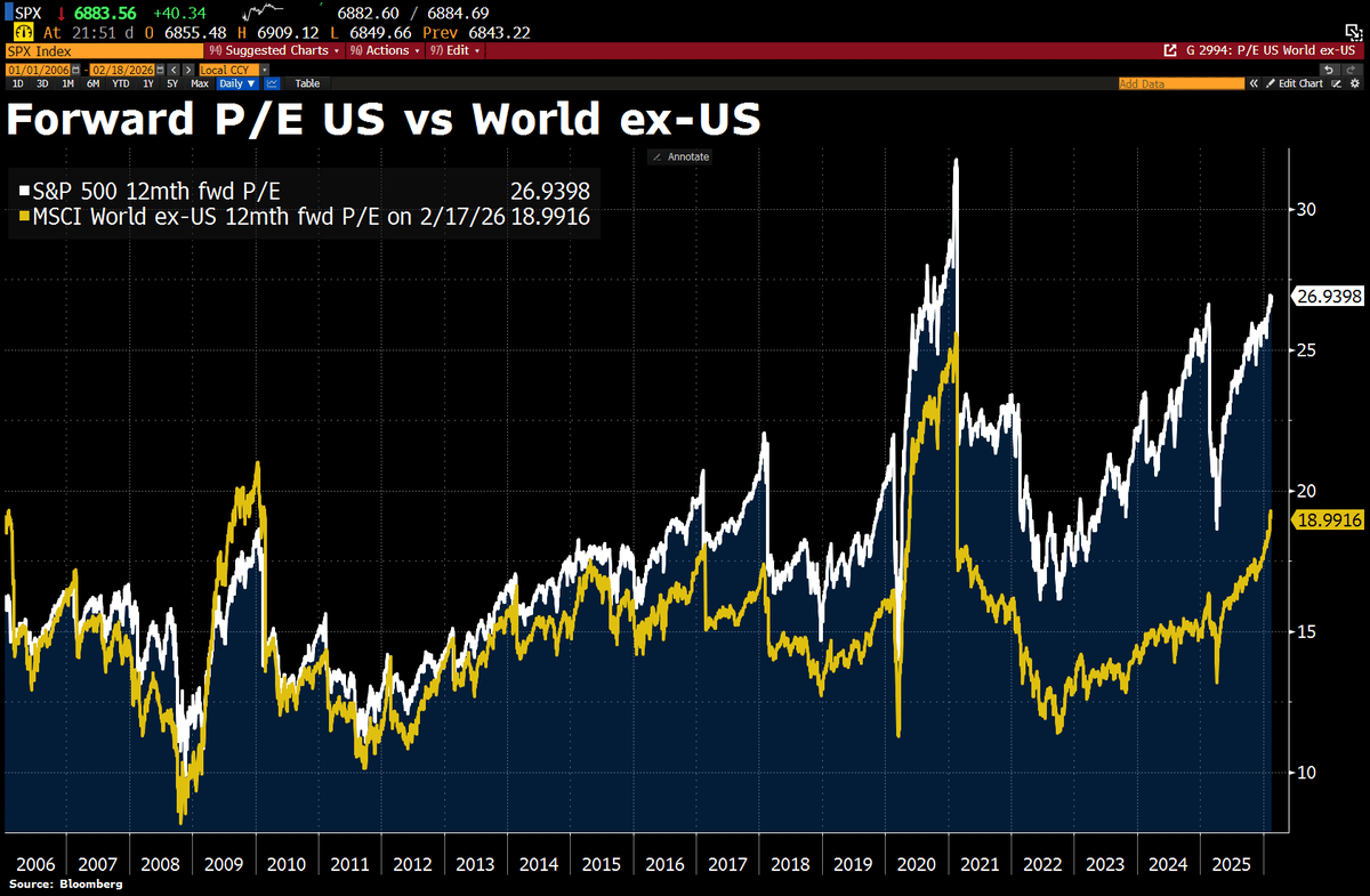

US Stock Premium at Risk as Tech Capex Rises

Although global markets have narrowed the gap with the US in recent weeks, US equities still trade at a roughly 40% valuation premium to the rest of the world. That premium could shrink further if big tech companies lose their...

By Holger Zschaepitz

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

Dalio Predicts US Will Print Money, Devalue Currency

Ray Dalio, founder of the world's LARGEST hedge fund, on the national debt: "When countries essentially go broke, what they do is... print money, devalue the currency, and create an artificially low interest rate...that is the way the [US] will do...

By Steve Hanke

Social•Feb 18, 2026

Lagarde’s Early Exit Fuels Concerns over ECB Politicization

The ECB should be apolitical. But now President Lagarde says she’s leaving early. According to people “familiar with her thinking,” this is so Macron can pick her successor before the French Presidential election in April 2027. Not very apolitical at...

By Robin Brooks

Social•Feb 18, 2026

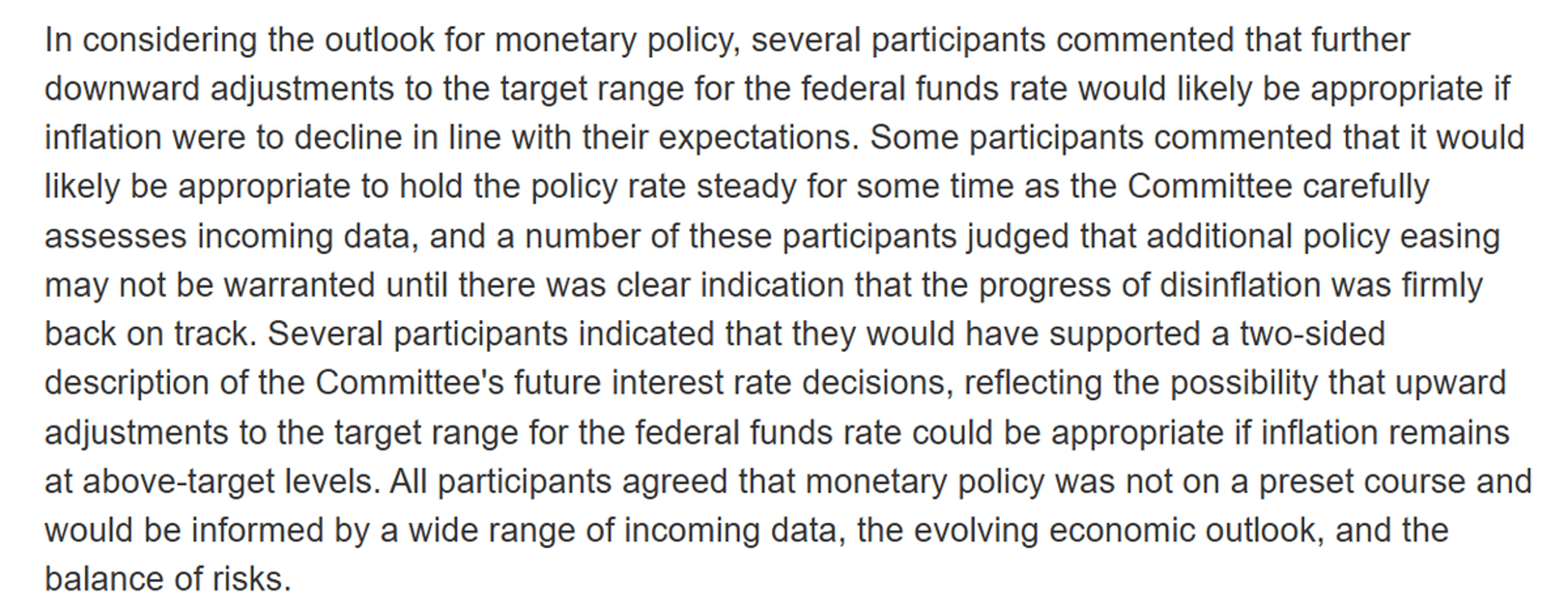

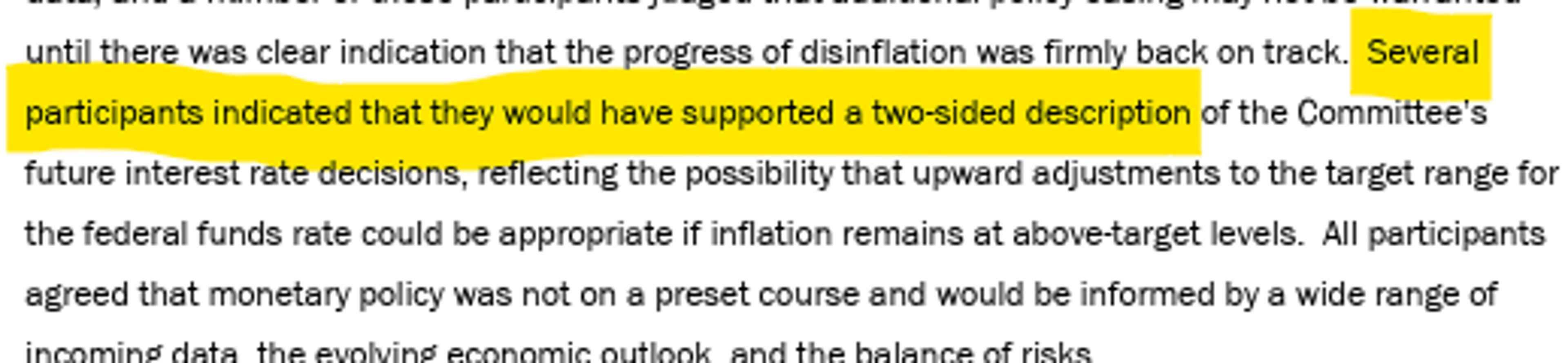

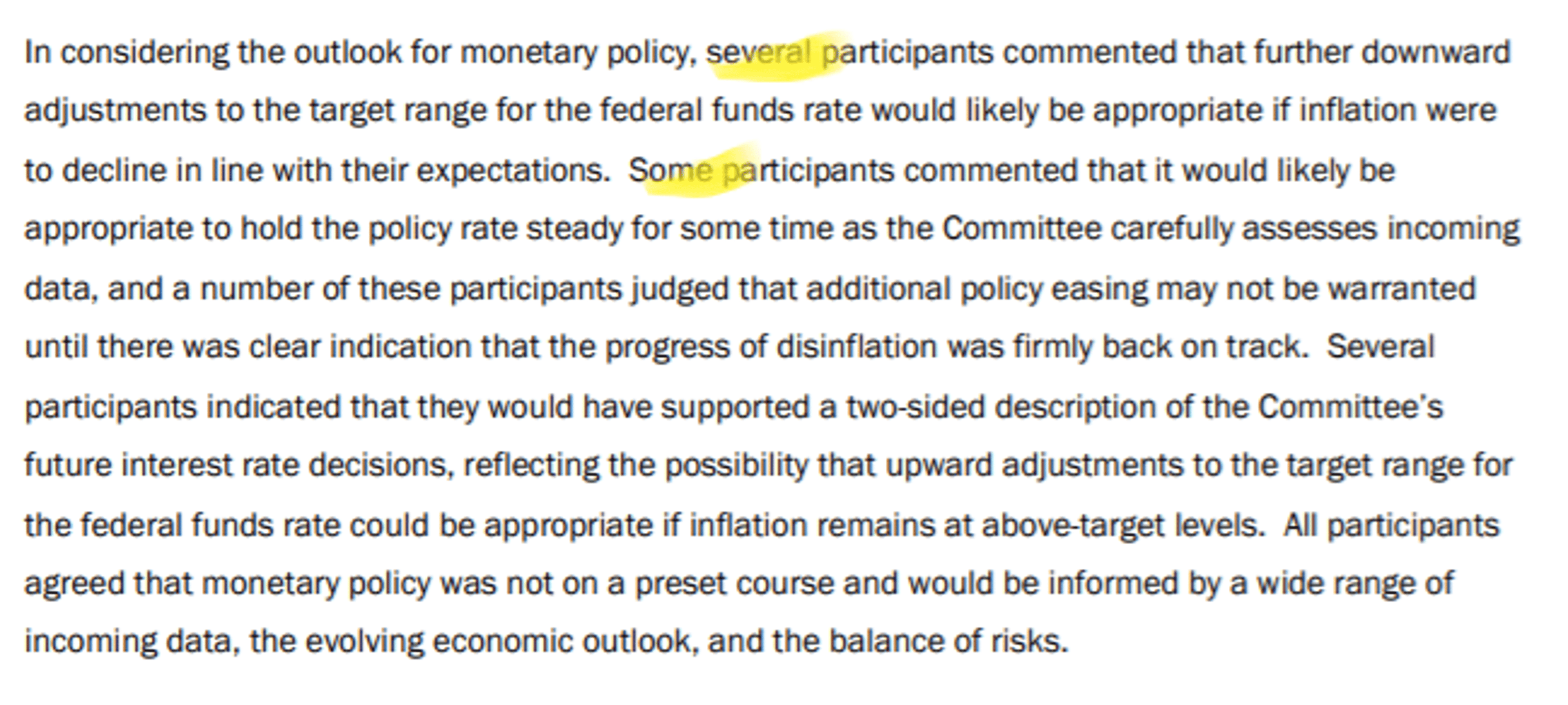

Hawks Push Back, Hint at Two‑Sided Policy Language

FOMC minutes suggest that the hawks pushed back. "Several would support two-sided language" about policy direction and "several" noted that if inflation remains high, rate hikes might be necessary.

By Kathy Jones

Social•Feb 18, 2026

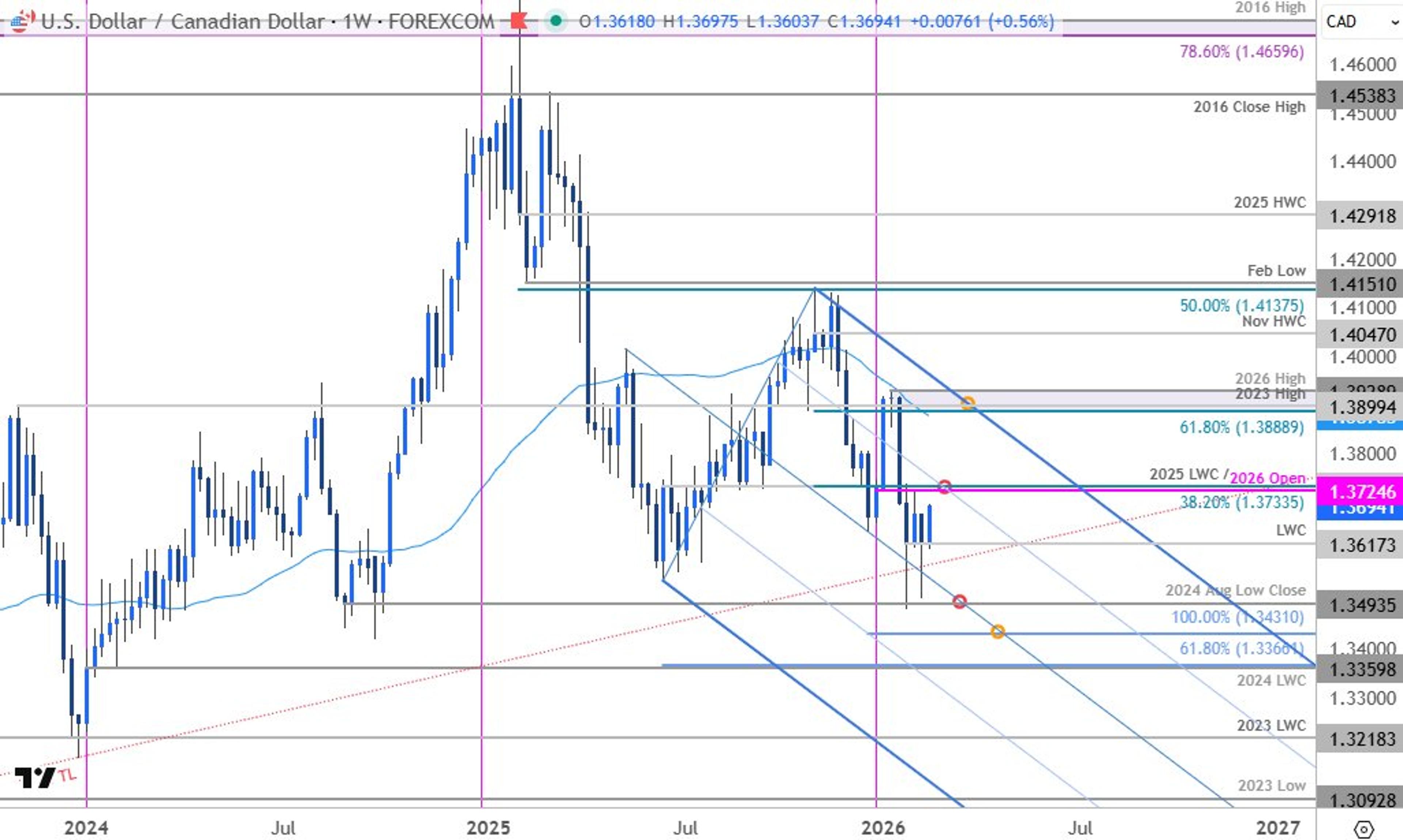

USD/CAD Nears Yearly High, Breakout Risk Rises

Canadian Dollar Forecast: USD/CAD Advances Toward Yearly Open – Breakout Risk Builds https://t.co/LswuuI4iVW $USDCAD Weekly Chart https://t.co/AfSOwTDtR3

By Michael Boutros

Social•Feb 18, 2026

Data Centers Drive Growth as Fed Shows Internal Split

Today’s burst of economic data showed an economy still powered by the boom in data centers with some broader increases in vehicle orders (Dec) and production (Jan). Housing starts popped in December and were revised higher for November. Good...

By Diane Swonk

Social•Feb 18, 2026

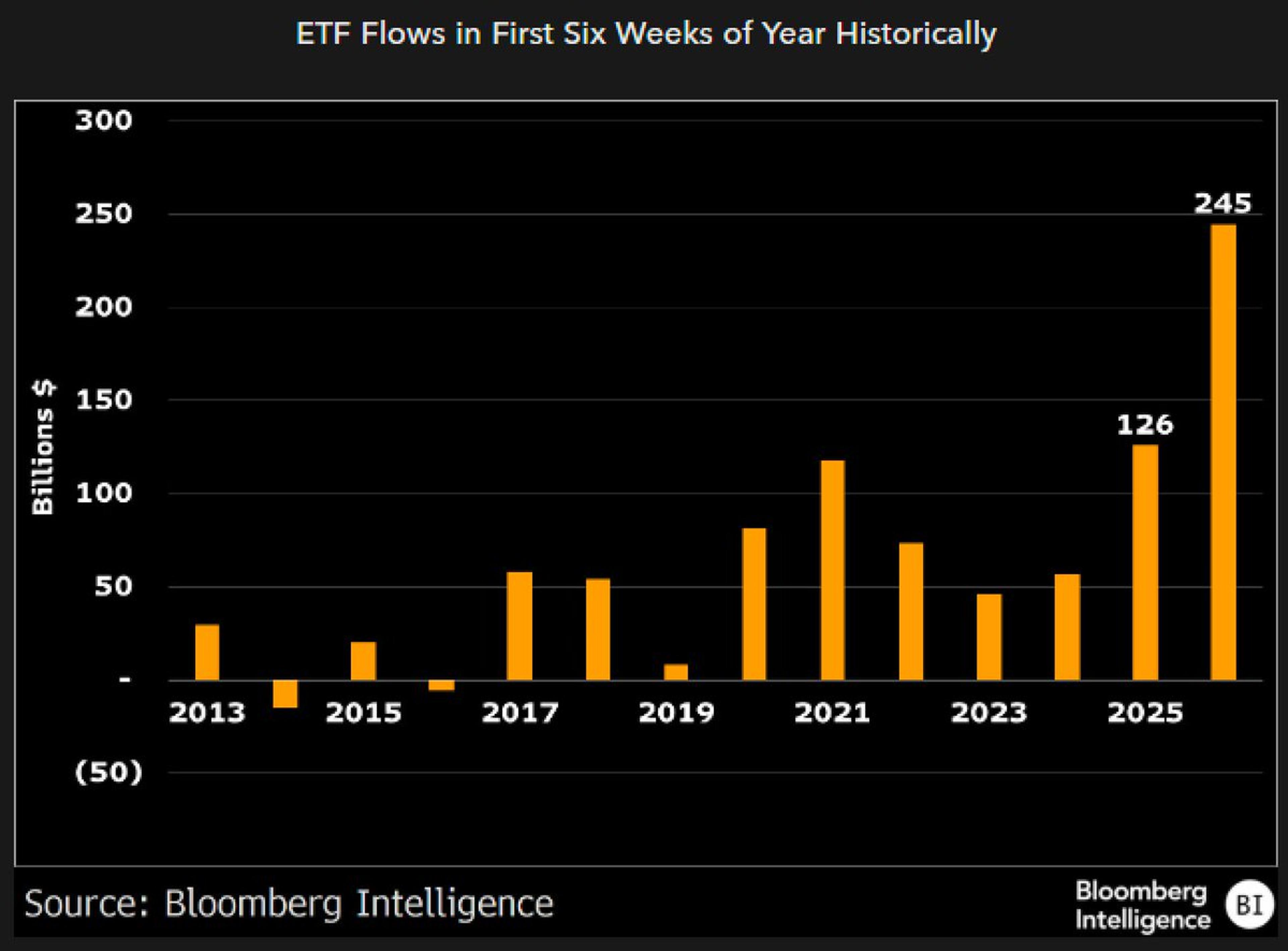

ETF Inflows Double Historic Pace in First Six Weeks

Here's ETF flows for the first six weeks of the year historically. This year is off to the best start almost by double. One reason is growing depth of cash vacuum cleaners. VOO, SPYM hoovering as always but there's already...

By Eric Balchunas

Social•Feb 18, 2026

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm

Social•Feb 18, 2026

FOMC Minutes Show Market‑Aligned Outlook, Fragile Jobs, Slowing Inflation

Few FOMC minutes takeaways: 1) Cmte basically in line with markets on major economic variables 2) Labor markets no longer outright weakening but remain fragile 3) Inflation decelerating as tariff passthru done, housing has downside (a misread on bad CPI method in Oct?) 1/...

By Guy LeBas

Social•Feb 18, 2026

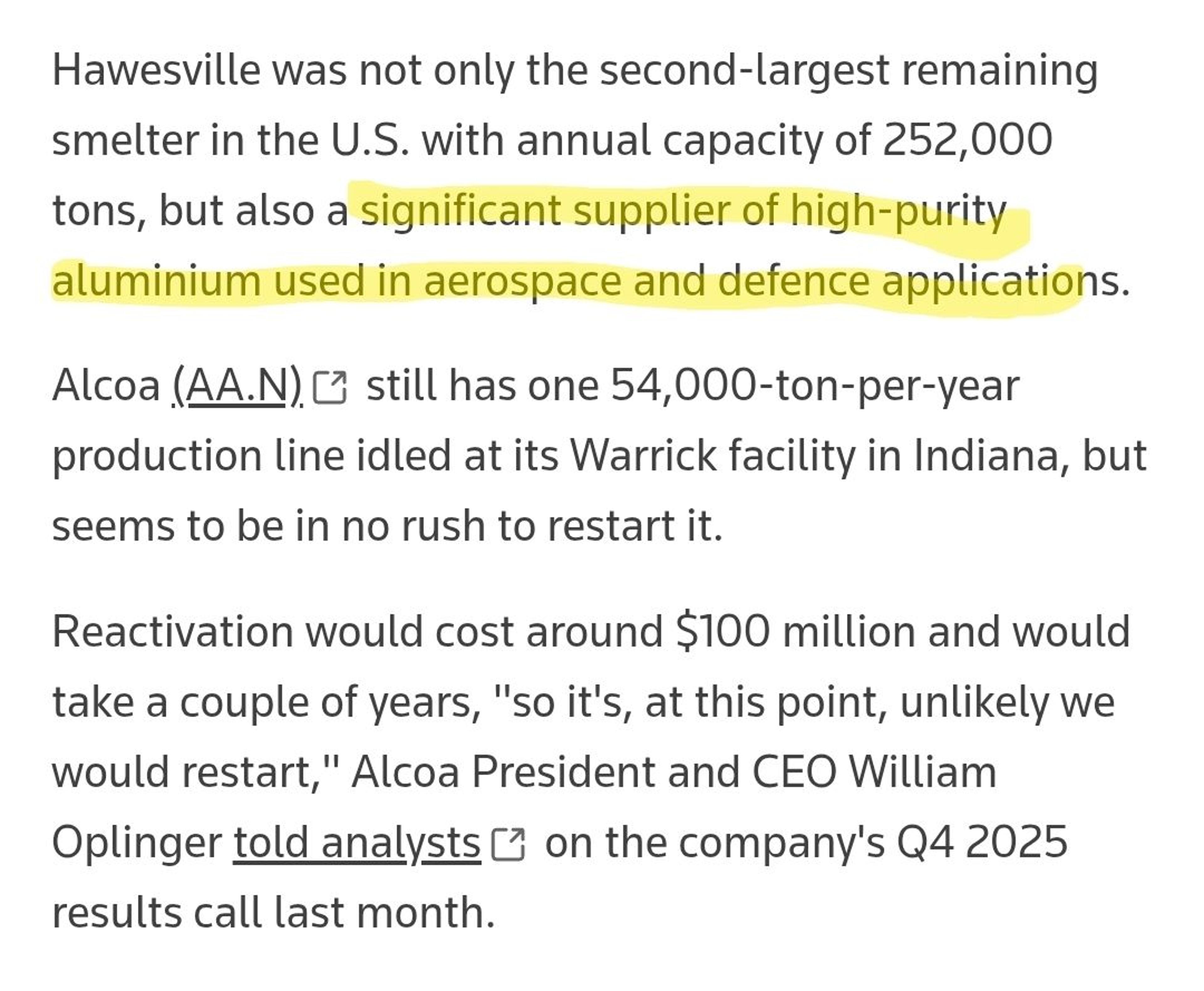

Tariffs Fail: US Down to Five Aluminum Smelters

"U.S. import tariffs haven't been enough to stop the United States losing another aluminium smelter, leaving the country with just five primary metal production plants." 😲 https://t.co/T5U4nxglb0 https://t.co/EOQY3OwzE6

By Scott Lincicome

Social•Feb 18, 2026

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

Social•Feb 18, 2026

World Order Collapses: Entering Stage 6 of Global Disorder

It’s official: The current world order has broken down. In my parlance, we are in the Stage 6 part of the Big Cycle in which there is great disorder arising from being in a period in which there are no rules,...

By Ray Dalio

Social•Feb 18, 2026

Mania Depression: Elites Stagnate, Borrowers Slip Further

FWIW - The sentiment data suggests its not a "boomcession" we're experiencing but a "maniapression." Those at the top can't put enough into the markets, while those at the bottom fall further and further behind on their loans.

By Peter Atwater

Social•Feb 18, 2026

NYC Deficit Sparks Mayor's Risky Corporate and Property Tax Plan

New York City faces a fiscal crisis –– a $5.4B budget deficit. Mayor Mamdani’s plan: tax the most profitable corporations or INCREASE PROPERTY TAXES FOR THE FIRST TIME IN DECADES. MAMDANI’S PLAN = A PLAN TO KILL NEW YORK’S ECONOMY. https://t.co/HKJXzJh4Cu

By Steve Hanke

Social•Feb 18, 2026

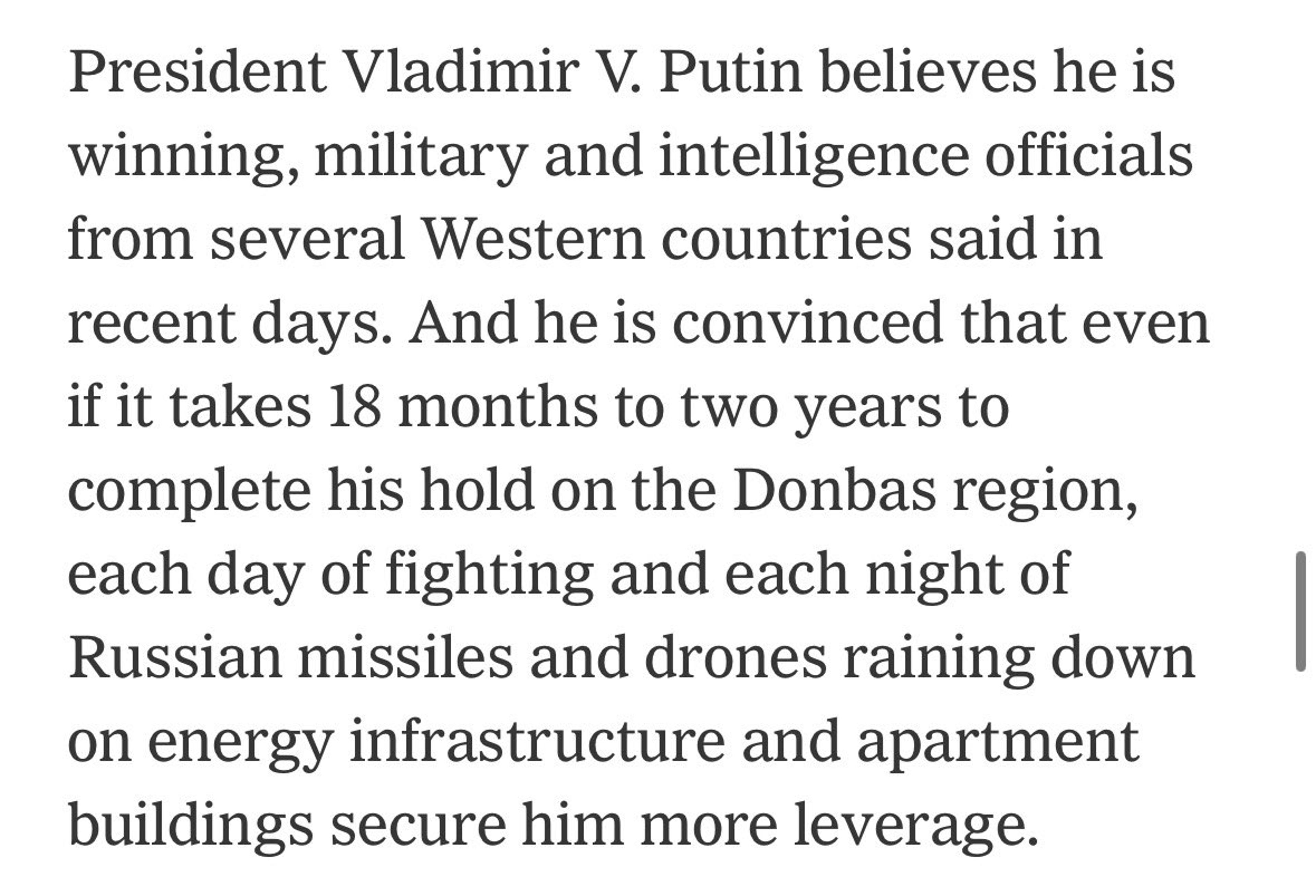

Putin Sees Prolonged War as Leverage, Feels Victorious

“President Vladimir V. Putin believes he is winning, military and intelligence officials from several Western countries said in recent days. And he is convinced that even if it takes 18 months to two years to complete his hold on the...

By Rob Lee

Social•Feb 18, 2026

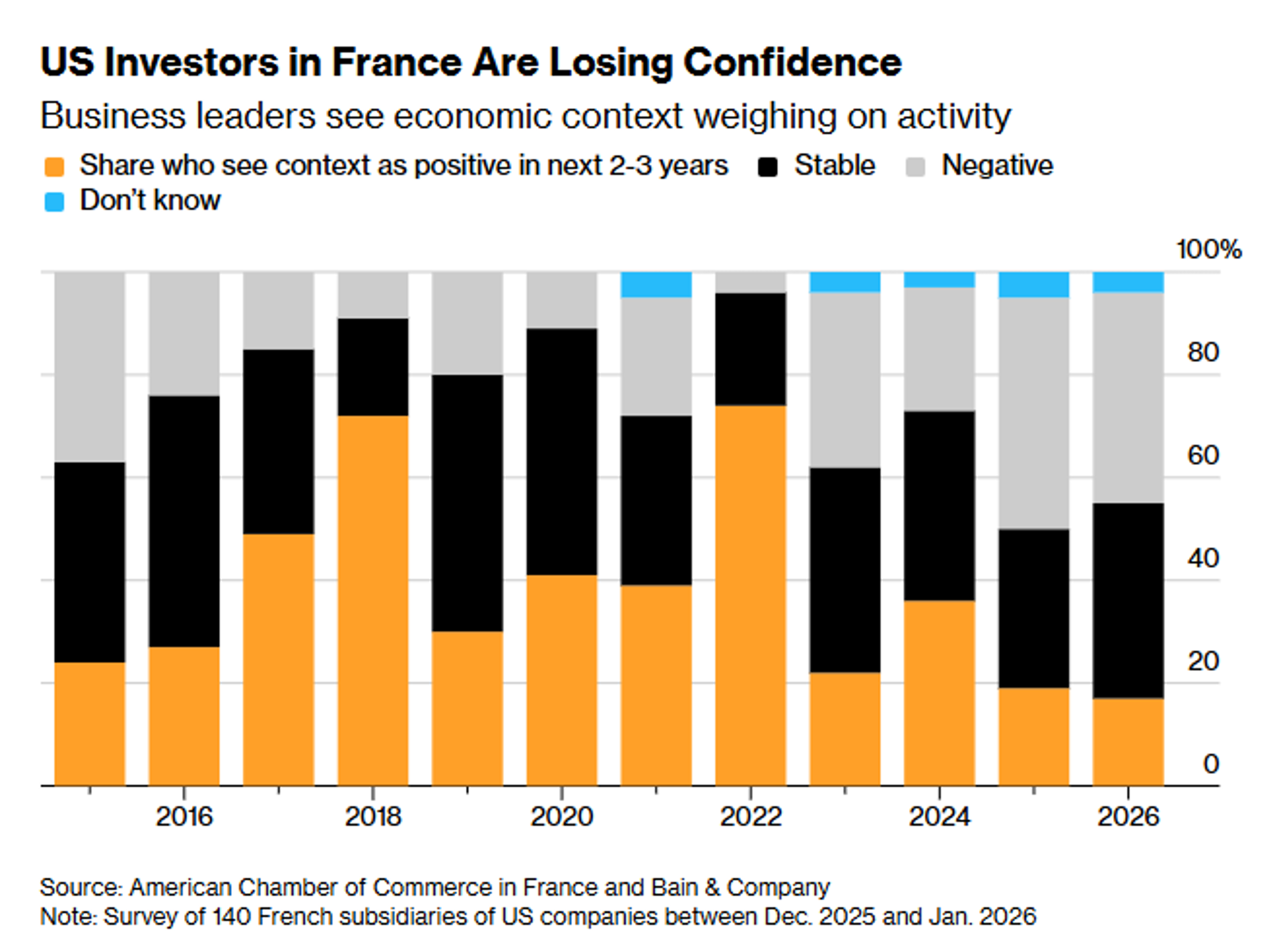

US Investors Turn Bearish on France as Macron Exits

US investors are gloomy on France as Macron era approaches its end https://t.co/a4q0NEuH3I via @WHorobin https://t.co/vhSuc9Ovr6

By Zöe Schneeweiss

Social•Feb 18, 2026

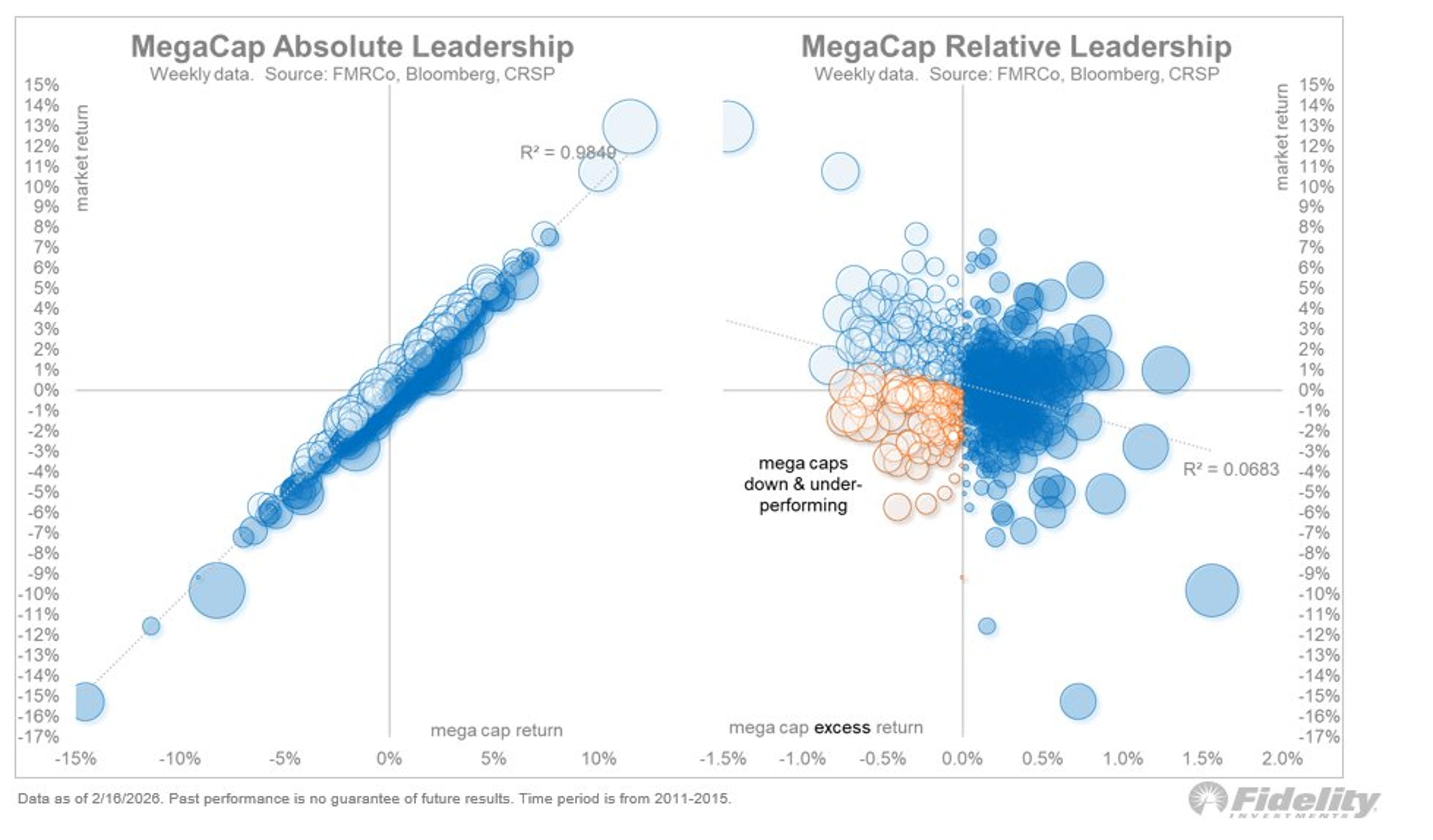

Mega‑Cap Weakness Could Drag Entire S&P Down

The reason this is important (even though it’s only a few stocks) is that the Mag 7 is so big that if they should fall they could well take the S&P 500 (cap-weighted) index with it. History shows (below) that...

By Jurrien Timmer

Social•Feb 18, 2026

Multiple Crises, Stalled Talks, White House Impatience Signal Change

two conflicts. two stalled negotiations. one impatient white house. the next few weeks could look very different from today. @gzeromedia

By Ian Bremmer

Social•Feb 18, 2026

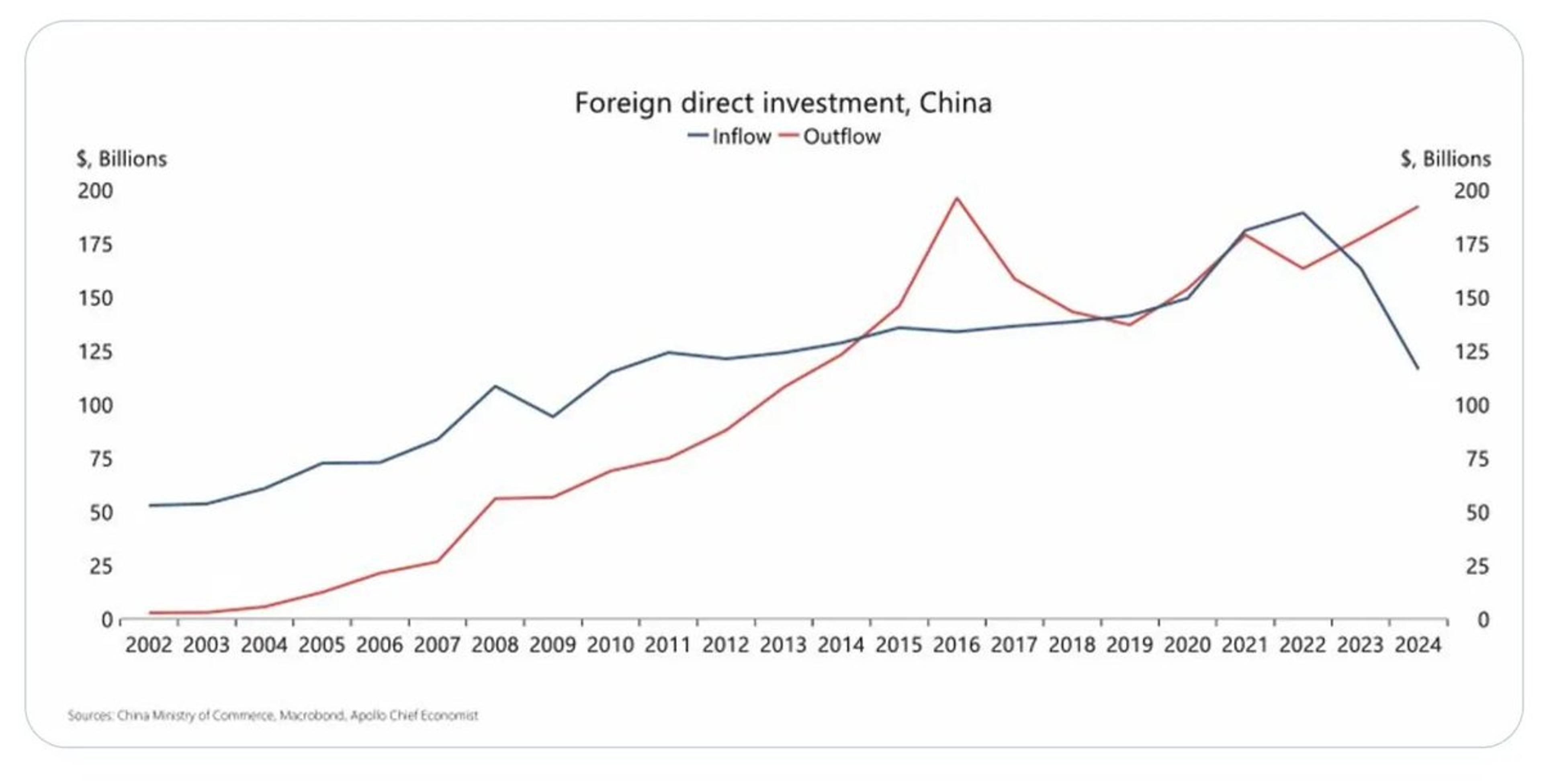

China’s Outward FDI Surpasses Inward, Gap Widens

Since the 2010s and BRI, Chinese FDI has matched or exceeded inward FDI, but now a really big gap is opening up. More at today's Chartbook Top Links: https://t.co/DcgBB3hzww

By Adam Tooze

Social•Feb 18, 2026

S&P Adds $500B, Gold Climbs; PCE Inflation Watch

WHAT A DAY, the S&P 500 has gained around $500 BILLION in market cap, up 0.8%. The index is now up 0.3% YTD 📈 Gold is also trading higher, back above $5,000/oz, as global tensions start to escalate 😳 Mark your calendars...

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 18, 2026

History’s Empire Cycle Reveals Today’s Global Power Shift

Empires rise. Empires peak. Empires fall. Medieval thinkers understood the structural forces behind power, decline, and transition. Those same cycles are shaping the world today. Understand the pattern. Know what comes next. Read more at davidmurrin.co.uk #Geopolitics #EmpireCycles #History #Strategy #GlobalPower

By David Murrin

Social•Feb 18, 2026

Geopolitical Tension Drives Gold Surge—Position Now

Gold is on the move🔥 As tensions in the Middle East rise and Iran escalates, markets are reacting and gold is back in focus When uncertainty rises, gold shines ✨ Big moves could be ahead. The question is… are you positioned? Trade Gold with...

By Kathy Lien

Social•Feb 18, 2026

Gold Rallies 13% as Tech Stocks Stumble

While the Magnificent Seven tech stocks have SUFFERED in 2026, GOLD IS UP over 13%. It's time to turn away from SILLY VALLEY. BUY GOLD, WEAR DIAMONDS. https://t.co/PZTIJFhPOp

By Steve Hanke

Social•Feb 18, 2026

Sector Rotation Timing Yields Asset‑rich Returns

The Great Rotation: From Growth to Asset Rich Value My job is timing sector rotation & picking the best stocks long/short within it. That & sizing up macro event risk & market structure support. That's how I could time the...

By Samantha LaDuc

Social•Feb 18, 2026

Markets Mirror Trump’s Shifting Policy Narratives

You just have to respect markets and the games they play Trump first term: Public is all about long Energy, short Solar.... Solar stocks go on an epic run Trump 2nd term: Tariffs going to crush International economies.... International stocks just thrashing...

By Joe Kunkle

Social•Feb 18, 2026

De-Dollarization Undermines US Military Financing Power

De-Dollarization Threatens US Military Power The dollar’s role in global trade is shrinking. As it loses value, I see us losing influence and even military strength, because our military depends on financing powered by the dollar. The markets are already showing...

By Peter Schiff