Social•Feb 17, 2026

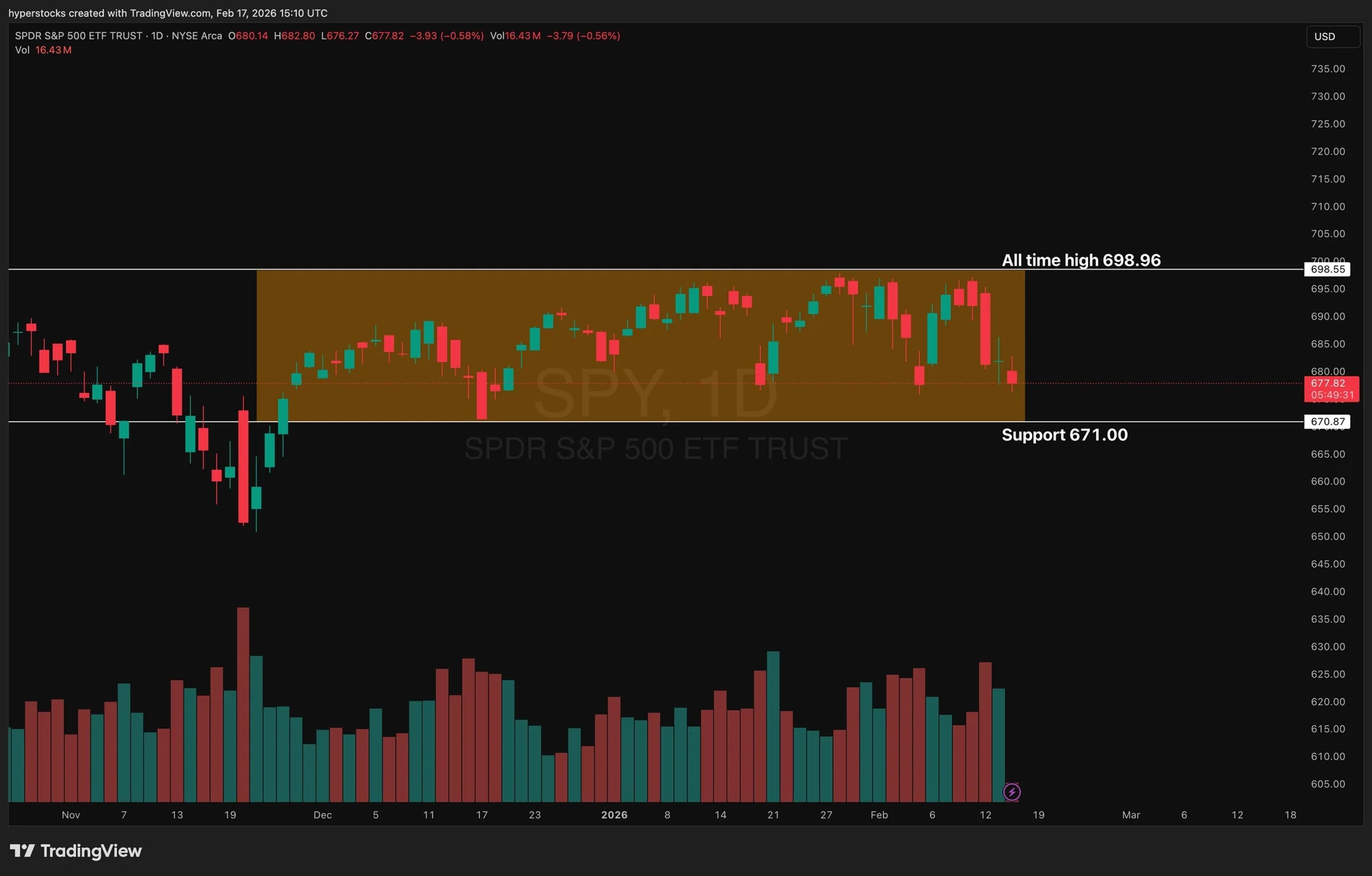

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks

Social•Feb 17, 2026

Chinese AI Firms Double, Hitting $35B—West Should Follow

china’s two ai model company minimax and zai have grown 2x in public markets in the last month they’re now $30-35b companies surely that should prompt western labs to go public already

By Nathan Benaich

Social•Feb 17, 2026

EURUSD Retreats to Fib Level as Longs Surge

$EURUSD has pulled back from its failed run on 1.20 a few weeks back - aligned to a 38.2% Fib of the 2008 to 2022 bear wave. Meanwhile, net speculative futures positioning has jumped this past week to its heaviest net-long...

By John Kicklighter

Social•Feb 17, 2026

Fed Rarely Cuts Rates During >8% Nominal Growth

"The Federal Reserve has cut rates only a handful of times when nominal growth was greater than 8 per cent and most of those instances were in the 1970s." Richard Bernstein @RBAdvisors in the FT https://t.co/vzNnkKmGpY

By Greg Ip

Social•Feb 17, 2026

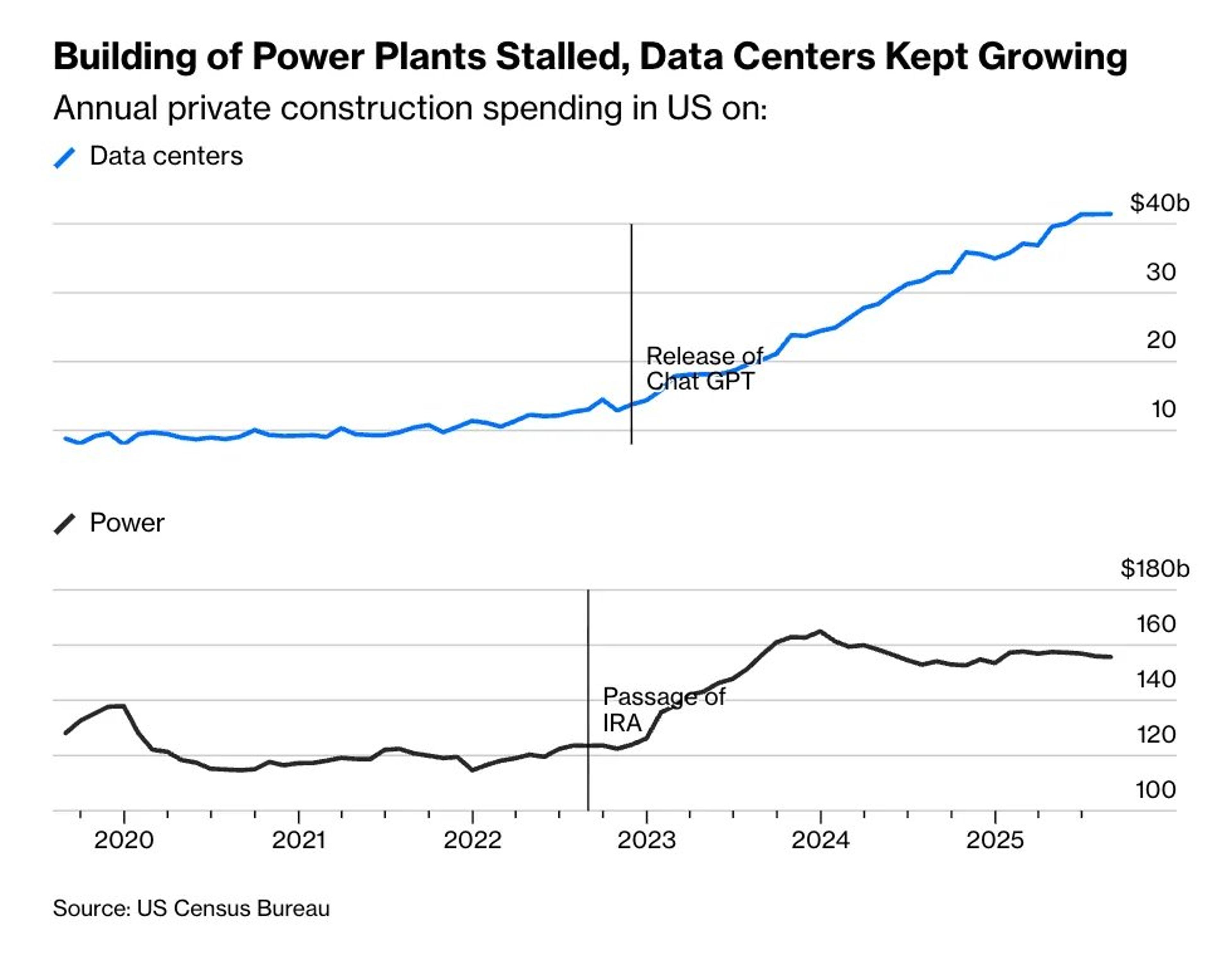

Trump's Shadow Stalls Power Investment, Creating AI Bottleneck

As the dark shadow of Trump fell over the US power sector & the highly effective IRA, investment in power generation plateaued in 2024. Well-time to create a power bottleneck for AI. More on this in the Chartbook Top Link...

By Adam Tooze

Social•Feb 17, 2026

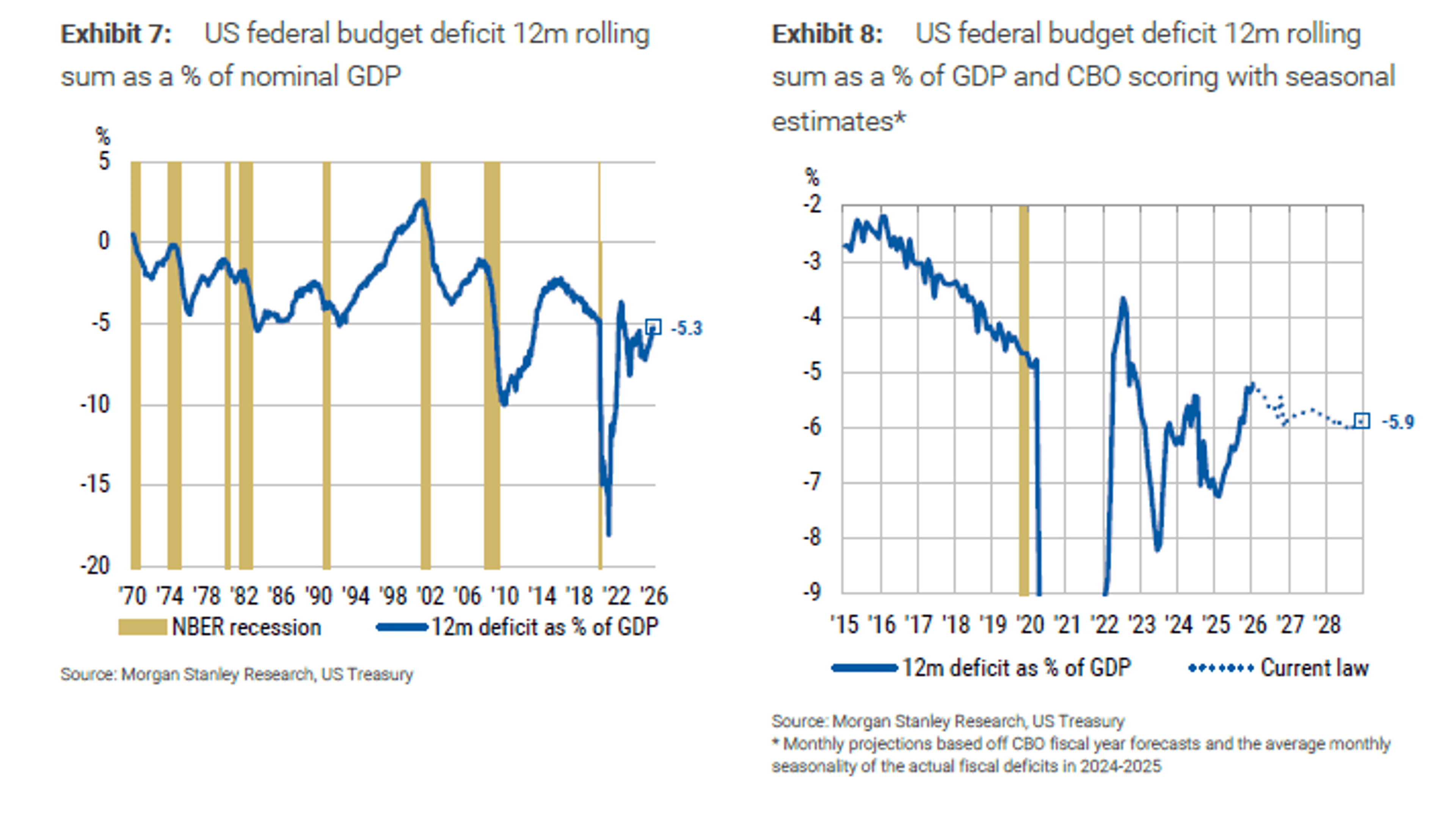

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

Social•Feb 17, 2026

Dalio Warns CBDCs Erase Privacy, Enable Political Control

As @RayDalio, founder of the world's LARGEST hedge fund told @TuckerCarlson on central bank digital currencies: "There will be no privacy... all transactions will be known... and if you're politically disfavored, you could be shut off." https://t.co/3H4Lcz4ysb

By Steve Hanke

Social•Feb 17, 2026

Critical Days Ahead: Watch Core Risk Signals

NEW POST: - RISKS. - Core signals to watch. - Volatility and Contagion. “The next few days will be absolutely critical to monitor…” 🔗Link in profile. https://t.co/qgBEZWrB8Z

By MacroCharts

Social•Feb 17, 2026

US‑Iran Oil Talks Conclude Second Round, Third Round Pending

OIL MARKET: The 2nd round of US-Iran talks has concluded, and Iranian media says there would be a 3rd round of negotiations in the “near future” after both sides consult with their respective governments.

By Javier Blas

Social•Feb 17, 2026

Rate Moves Aren’t Driven by Current Data, ADP Shows

Big mistake is assuming move in rates is about current economic data. Reaction to ADP a good example

By Ed Bradford

Social•Feb 17, 2026

Iran and Russia Clash over China Oil Supply Rivalry

The oil ministers of Iran and Russia met today. Contrary to popular belief, Moscow and Tehran are now bitter rivals in the oil market as the size of the black market for crude shrinks. Both compete to supply China. (My earlier @Opinion...

By Javier Blas

Social•Feb 17, 2026

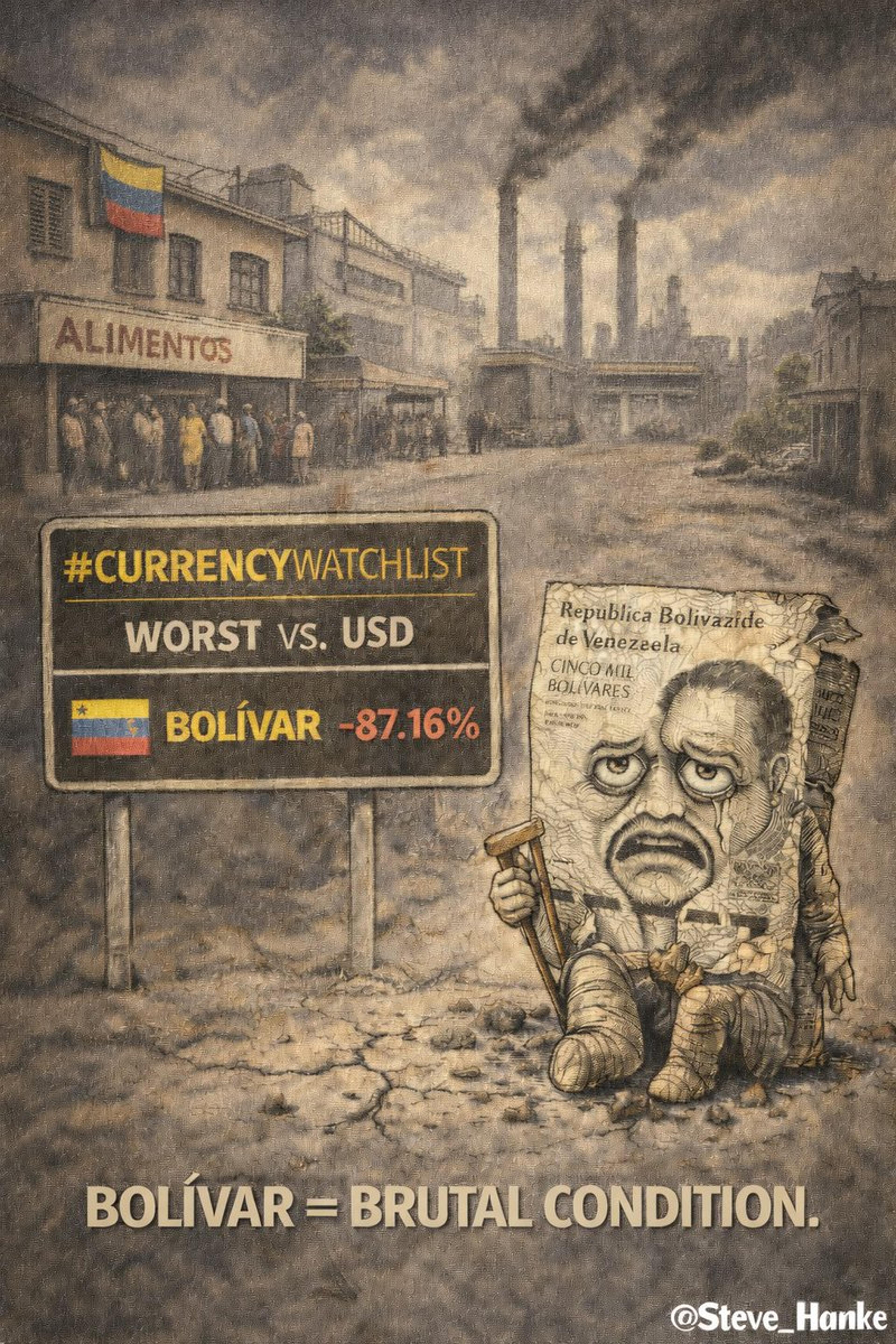

North Korean Won Plummets, Ranks Third Worst Globally

On this week's Hanke's #CurrencyWatchlist, the North Korean won ranks as the WORLD'S 3RD WORST currency. The won has depreciated by 41% against the USD over the past year. PLIGHT OF THE WON = ONE OF THE WORLD’S MOST UNREPORTED STORIES. https://t.co/7leiebPd5D

By Steve Hanke

Social•Feb 17, 2026

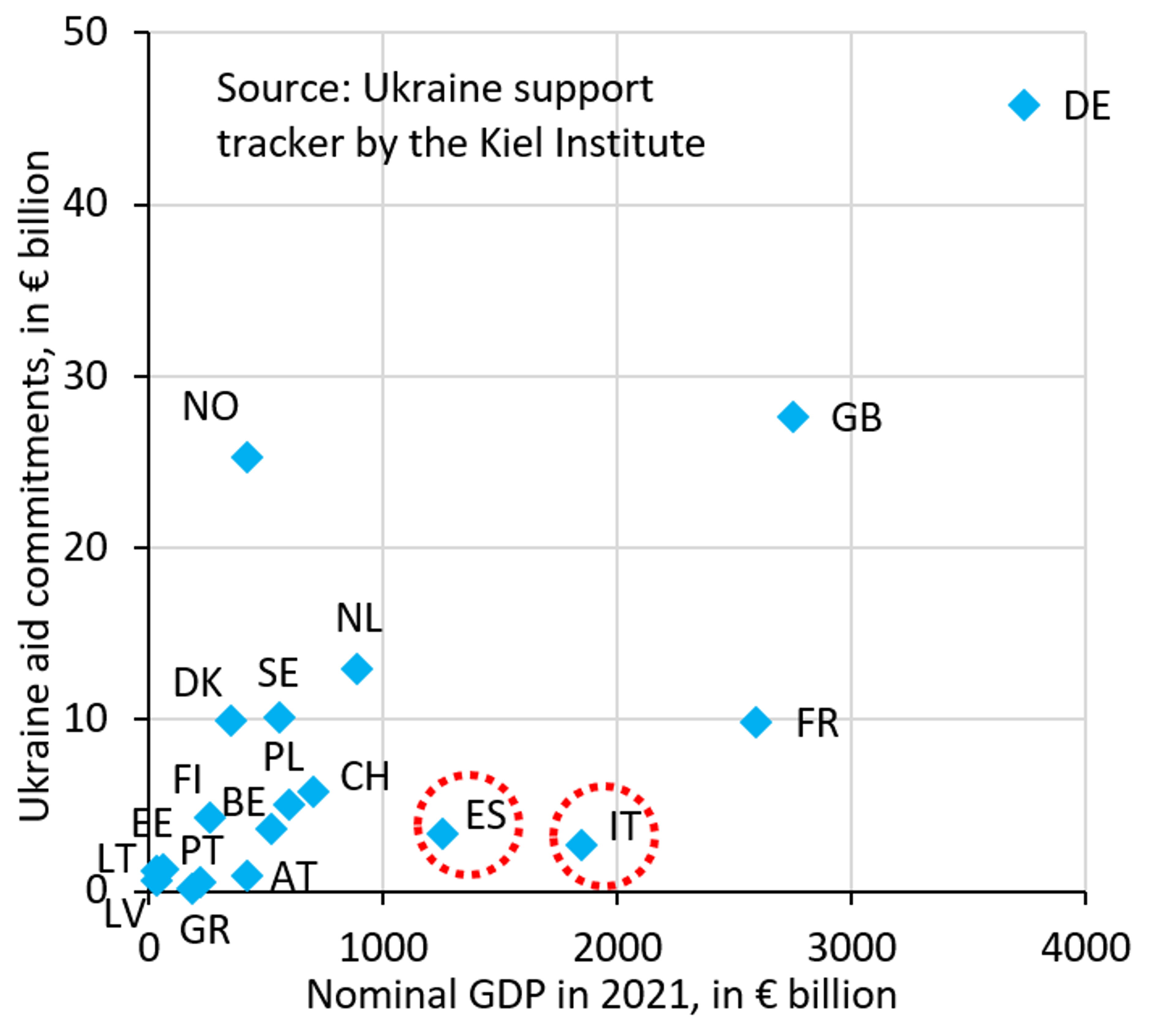

ECB Favors High-Debt Nations, Sidelining Low-Debt Germany

Low-debt countries like Germany are hopelessly outnumbered at the ECB. That's why ECB policy is inexorably drifting to help high-debt countries at the expense of low debt ones. So no surprise BuBa President Nagel supports Eurobonds. Going with the flow......

By Robin Brooks

Social•Feb 17, 2026

UK Unemployment Surge Drives Sterling Lower Amid Pay Stagnation

UK Unemployment Rises and Private Pay Increases Slow to Five-Year Lows, Pulling Sterling Lower: The US dollar is mixed against the G10 currencies. A healthy reception to Japan’s five-year bond auction helped extend the rally in JGBs, and despite the…...

By Marc Chandler

Social•Feb 17, 2026

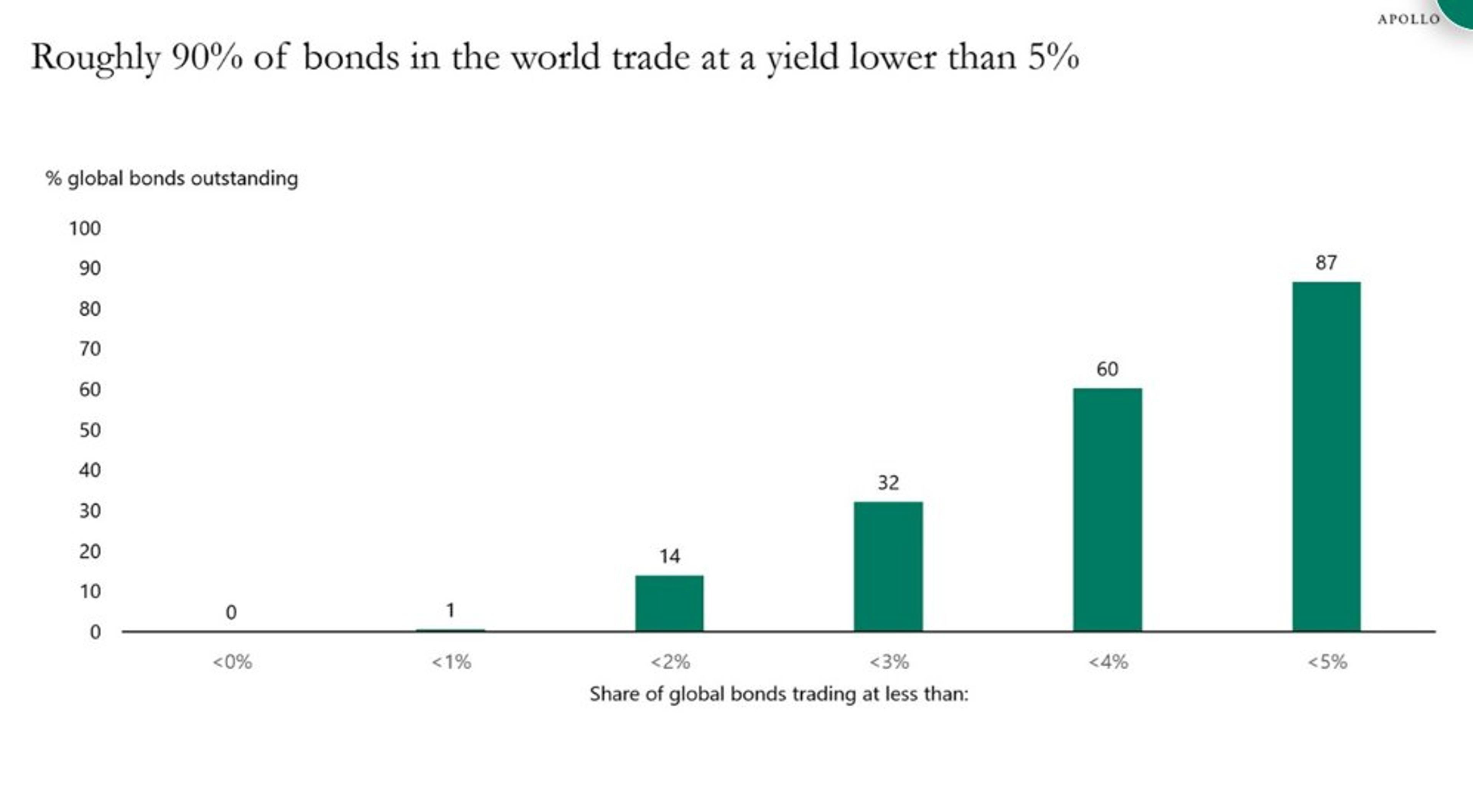

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Social•Feb 17, 2026

Global Fiat Fears Boost Gold and USD Stablecoins

Wrong. Vast majority of gold buyers have been non Americans that are more worried that their own fiat currencies will lose value than they are about the USD losing value. And while foreign CBs purchased around $100B of gold...

By Brent Johnson

Social•Feb 17, 2026

EU Resistance Threatens Effectiveness of New Russia Sanctions

EU countries’ resistance risks blunting latest Russia sanctions package https://t.co/ck1N8lGobr via @AlbertoNardelli @AfPalasciano @donatopmancini https://t.co/6LWNSkOoNN

By Zöe Schneeweiss

Social•Feb 17, 2026

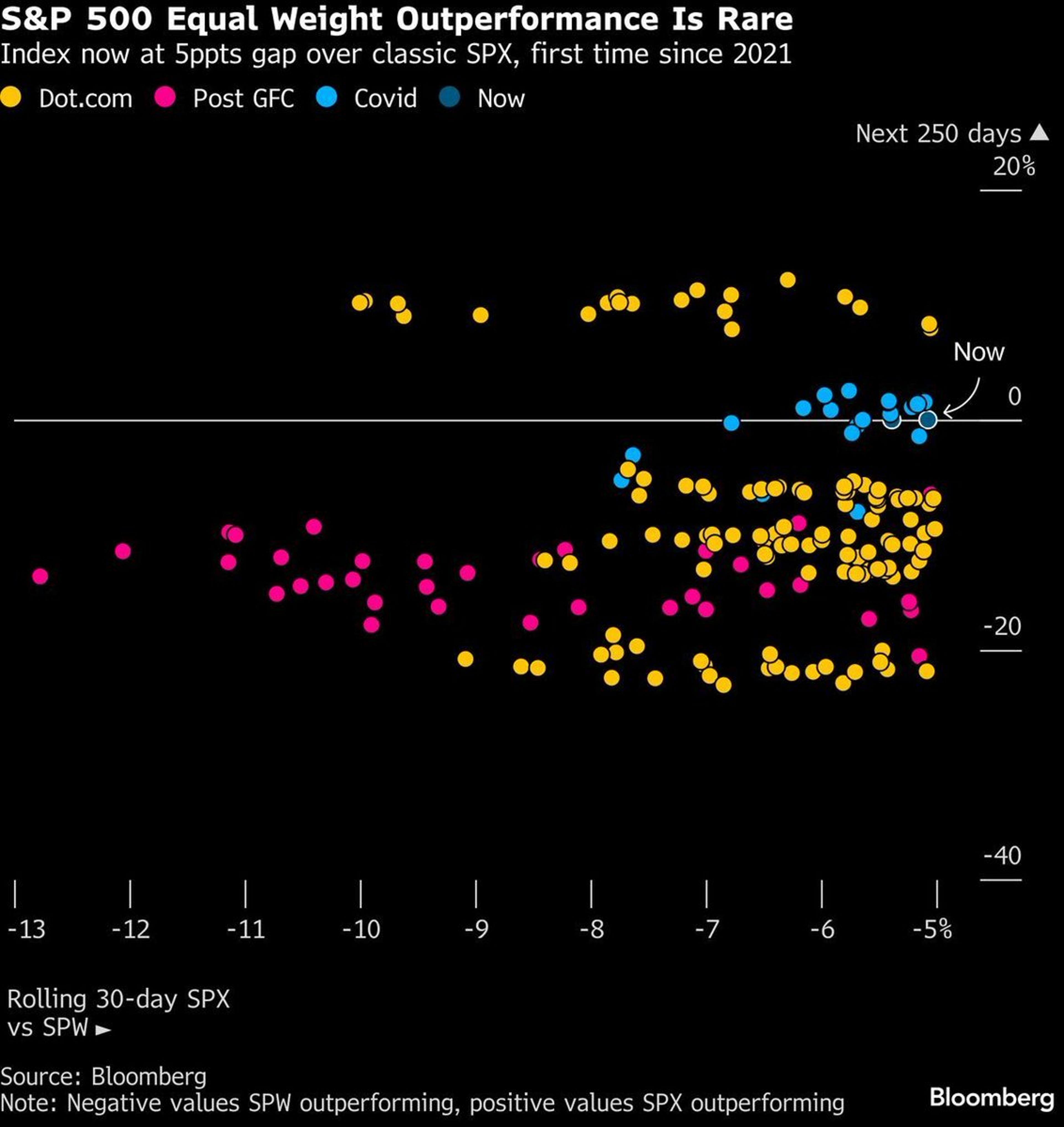

Equal‑Weight S&P Outperforms Only Amid Major Market Shifts

Fascinating study from Bloomberg: S&P Equal Weight outperformance was extremely rare historically: 1999-2002 Dotcom 2009 Post GFC 2020-2021 Covid “Those cases accompanied major shifts in the market.” “Equal-weight S&P managed to maintain some outperformance 250 days later.” “The big question: whether this is the start of an...

By MacroCharts

Social•Feb 17, 2026

Weak UK Data, German Outlook Boost USD, Lift JPY

Disappointing UK jobs data and German ZEW expectations is helping the $USD extend its gains today. Robust reception to Japan's 5yr bond sales helped ignite JGB rally and lifted the $JPY. Softer US rates and heavier equities after US holiday....

By Marc Chandler

Social•Feb 17, 2026

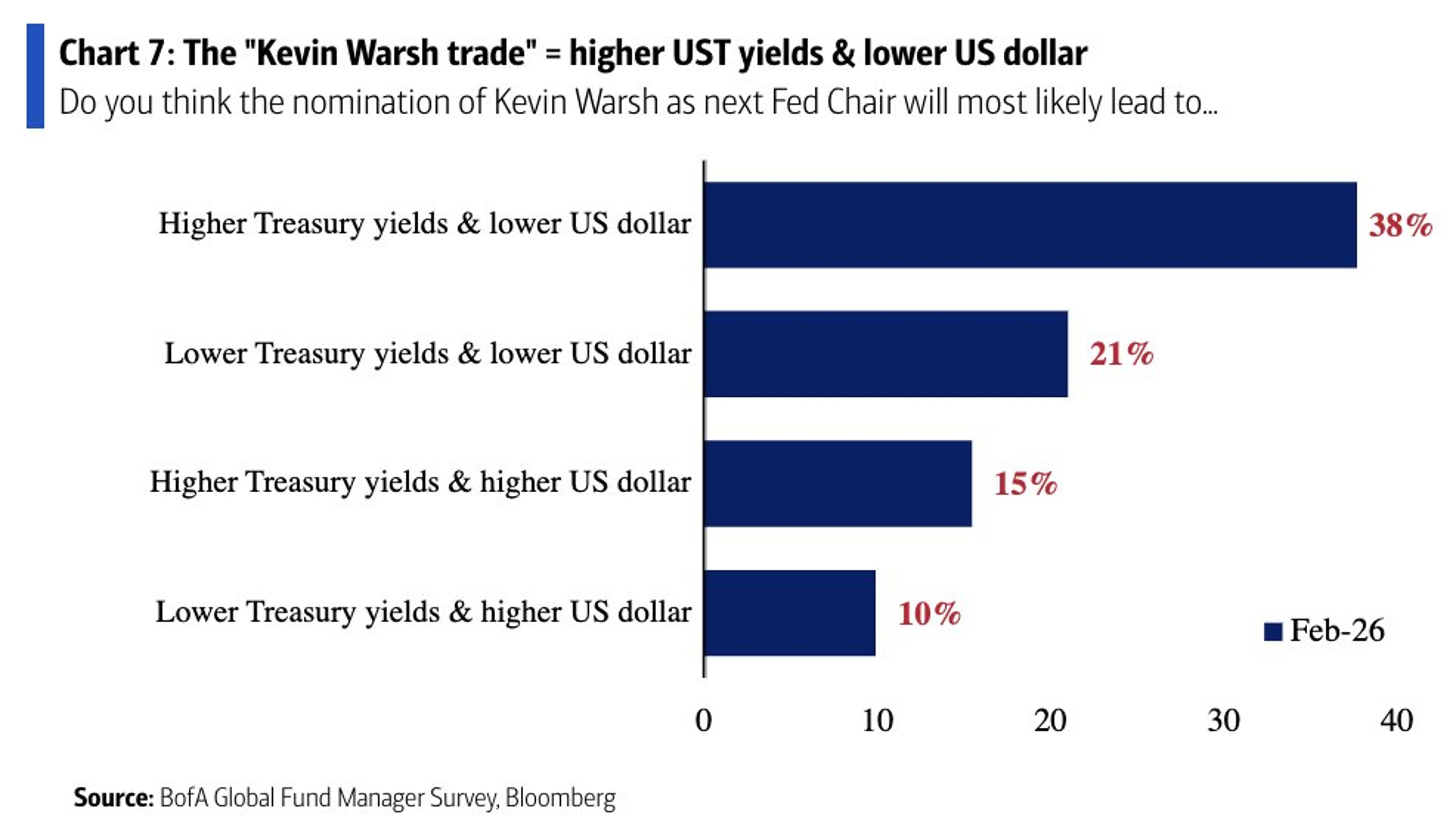

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

Social•Feb 17, 2026

Foreign Investment Steady, US Stocks Slightly Lagging

Balanced take from Bob. While the headline may be different than my "get out" thesis. The meat says the same. Flows suggest marginally weaker dollar and relative underperformance of U.S. stocks vs ROW. Don't panic out...

By Andy Constan

Social•Feb 17, 2026

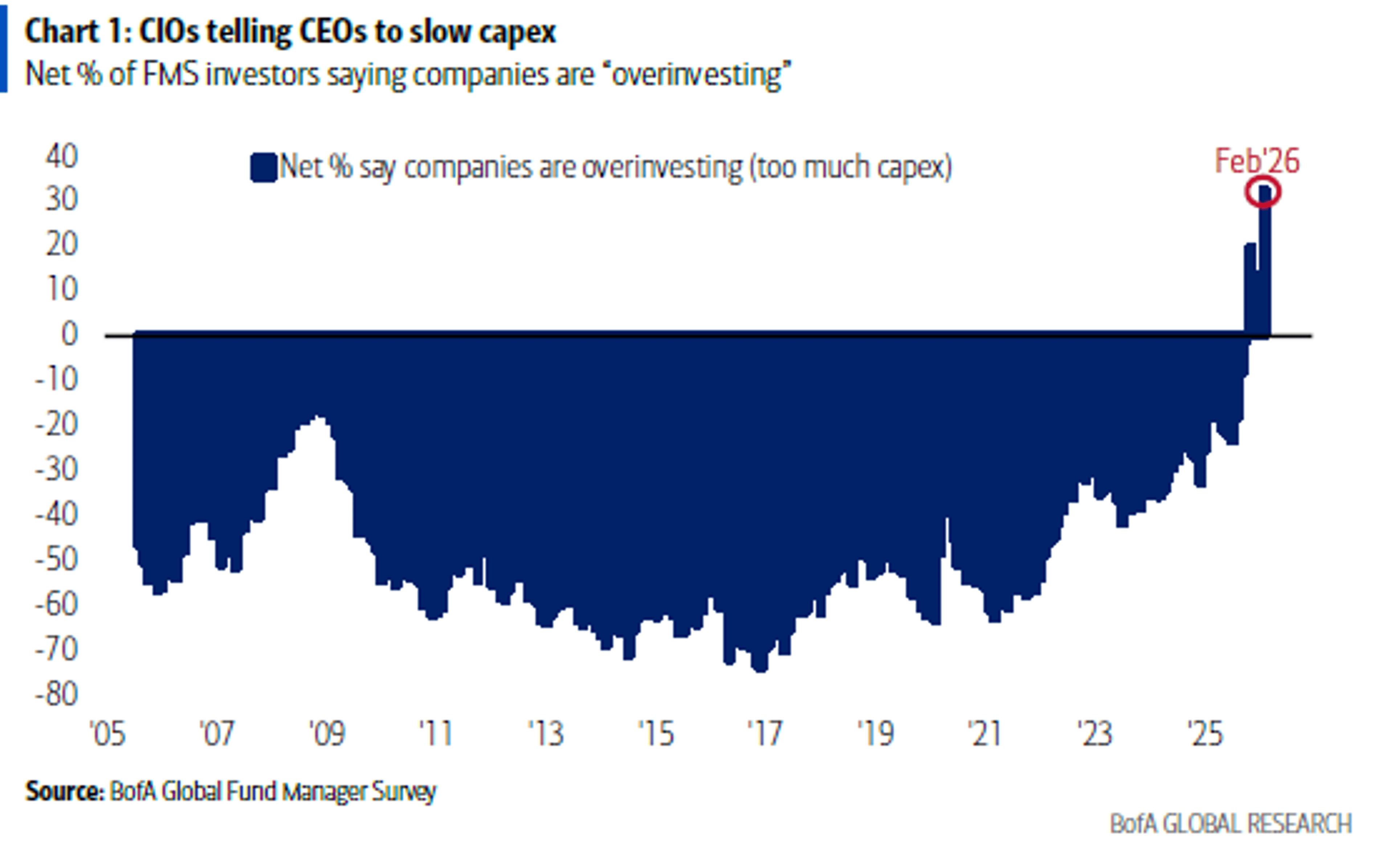

Investors Urge CEOs to Curb Spending Amid Bullish Optimism

Wall Street is full of worried bulls. On one hand, investors are telling CEOs they're overinvesting. On the other, investors are feeling the best about the overall backdrop since June 2021, with "no landing" expectations at a record high: February...

By Lisa Abramowicz

Social•Feb 17, 2026

Neoliberalism Crafts Rules to Shield Global Capitalism From Democracy

I just finished Quinn Slobodian's fascinating book on the parallel evolution of globalization and neoliberalism, with the former (according to the latter) requiring specific rules and institutions to "protect" global capitalism from democratic political pressures. While he focuses very heavily...

By Michael Pettis

Social•Feb 17, 2026

China’s $20T Paradox Defies Any Five‑year Plan

A short op on what’s going on under the hood in China’s $20 trn economic paradox with the 15th FYP due next month. No five-year plan will solve the paradox of China’s economy https://t.co/uCtAPYrW7A

By George Magnus

Social•Feb 17, 2026

Western Alliance Myths Unveiled: From Plato to MAGA

Reässessing the “West” from John Winthrop to Marco Rubio: **From Plato to NATO to MAGA: Marco Rubio’s Myths & the Real "Western Alliance”** 2026-02-16 Mo

By J. Bradford DeLong

Social•Feb 17, 2026

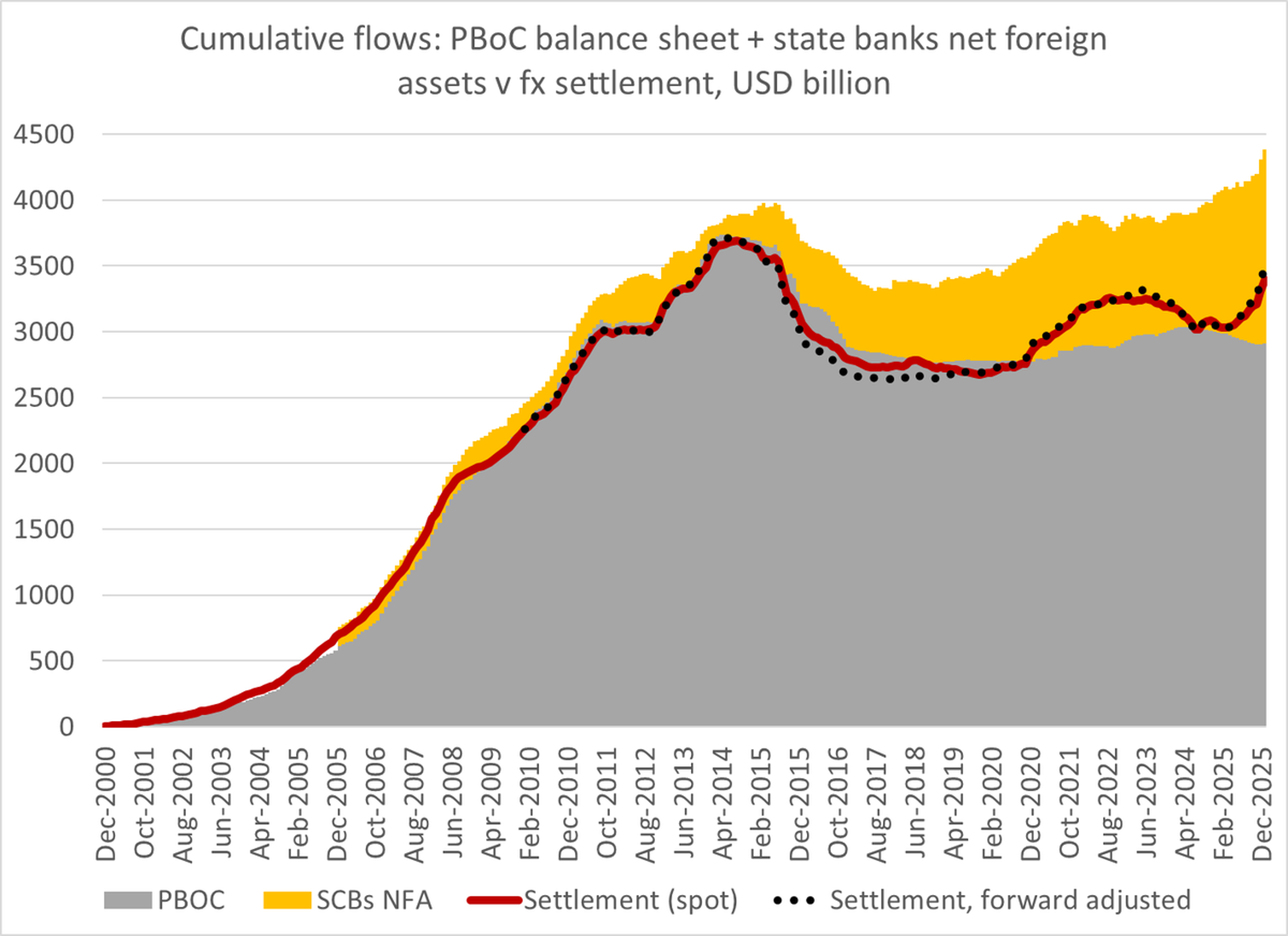

China Shifts Reserves to State Banks, Boosts Returns

Beijing really just outsourced its reserves to its state banks, and shifted out of US custodians High return on investment tho. Tons of folks swallow the fall in reported Treasury holdings hook, line and sinker https://t.co/MKw3EJlSuR

By Brad Setser

Social•Feb 17, 2026

2025 Year-End Bonuses Shrink, Uneven Amid Economic Slowdown

1/2 SCMP: "Long viewed by Chinese employees as a barometer of corporate prospects, industry momentum and even the broader economy, the year-end bonus packages for 2025 have become smaller, rarer and far more unevenly distributed, amid slowing... https://t.co/MFbnMtmZdY

By Michael Pettis

Social•Feb 17, 2026

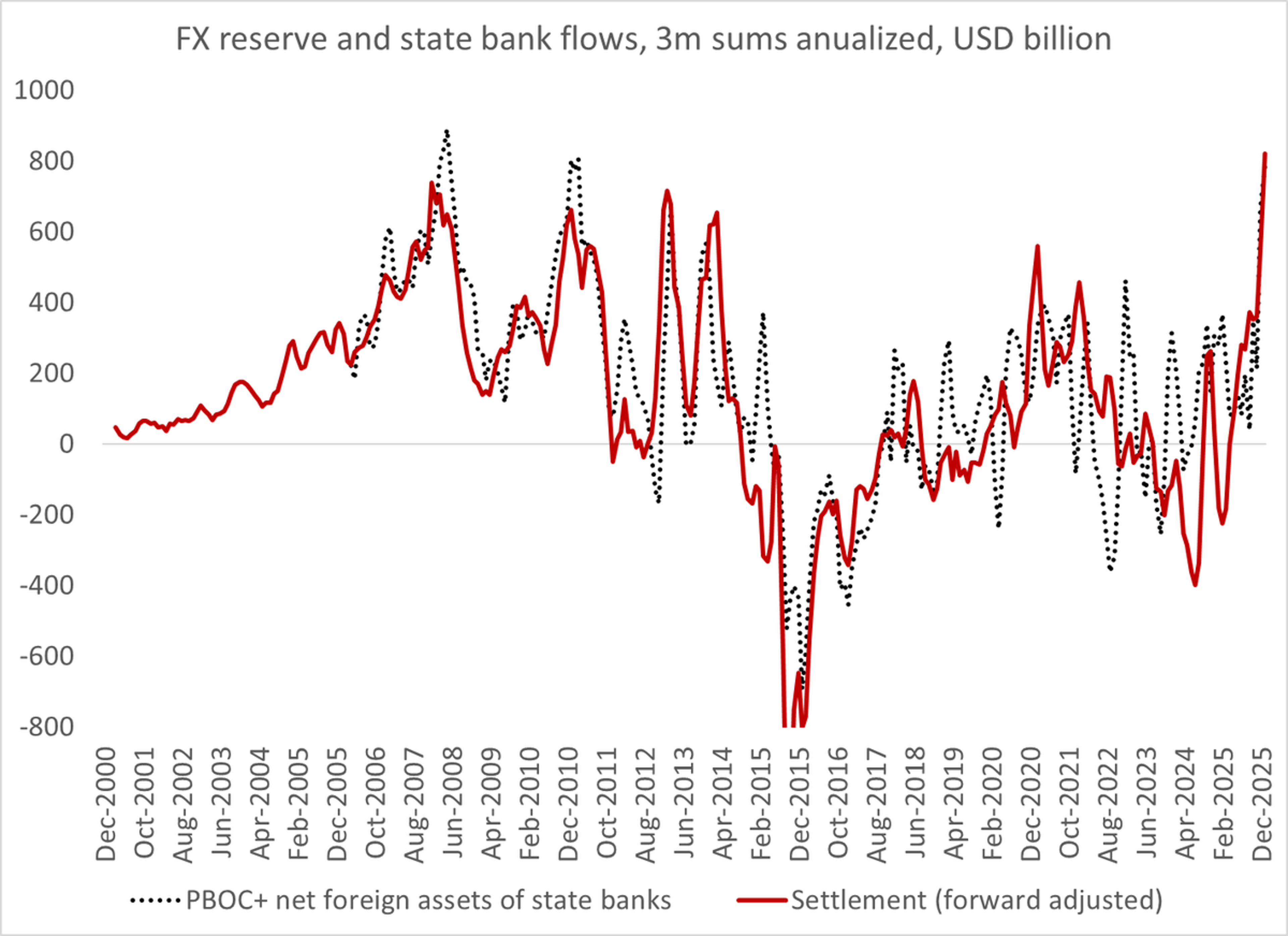

China's Hidden Bank Interventions Hit $800B Annual Record

The annualized measures of Chinese intervention over the last 3ms that capture backdoor intervention by the state banks are at all time highs in dollar terms -- over $200b a quarter/ over $800b annualized https://t.co/7vlh3tf4CX

By Brad Setser

Social•Feb 17, 2026

Falling Rates Could Quickly Revive Builder Margins

Sales are weak. Inventory is tight. Builder sentiment is soft. If rates fall, incentives drop — and margins can snap back fast. The setup in homebuilders isn’t getting enough attention. Read more: https://t.co/AJREG4myee

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 17, 2026

Iranian Rial Plummets, Becomes World's Second Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Iranian rial ranks as the WORLD'S 2ND WORST currency. The rial has depreciated by 44% against the USD over the past year. RIAL = THE GREAT DESTABILIZER. https://t.co/06OiclsaSq

By Steve Hanke

Social•Feb 17, 2026

2026 Macro Outlook: Resilient Momentum Amid Inflation Leaks

New episode 🎙️ Rob Haworth (U.S. Bank Asset Management) joins me to break down 2026 macro: resilient momentum, inflation + earnings “leaking” through the system, tariffs, geopolitics, Fed uncertainty, and what to watch if rates spike. https://t.co/OPTdLbcGgJ

By David Keller, CMT

Social•Feb 17, 2026

Europe Still Buys Russian LNG and Uranium, Despite Criticism

🧐This is nonsense hype from the Center for the Study of Democracy. Yet CNN did not bother to check the validity of their claims or ask other researchers. Here's why: 💥Many European countries, including France, buy LNG from Russia. 💥The US and...

By Anas Alhajji

Social•Feb 16, 2026

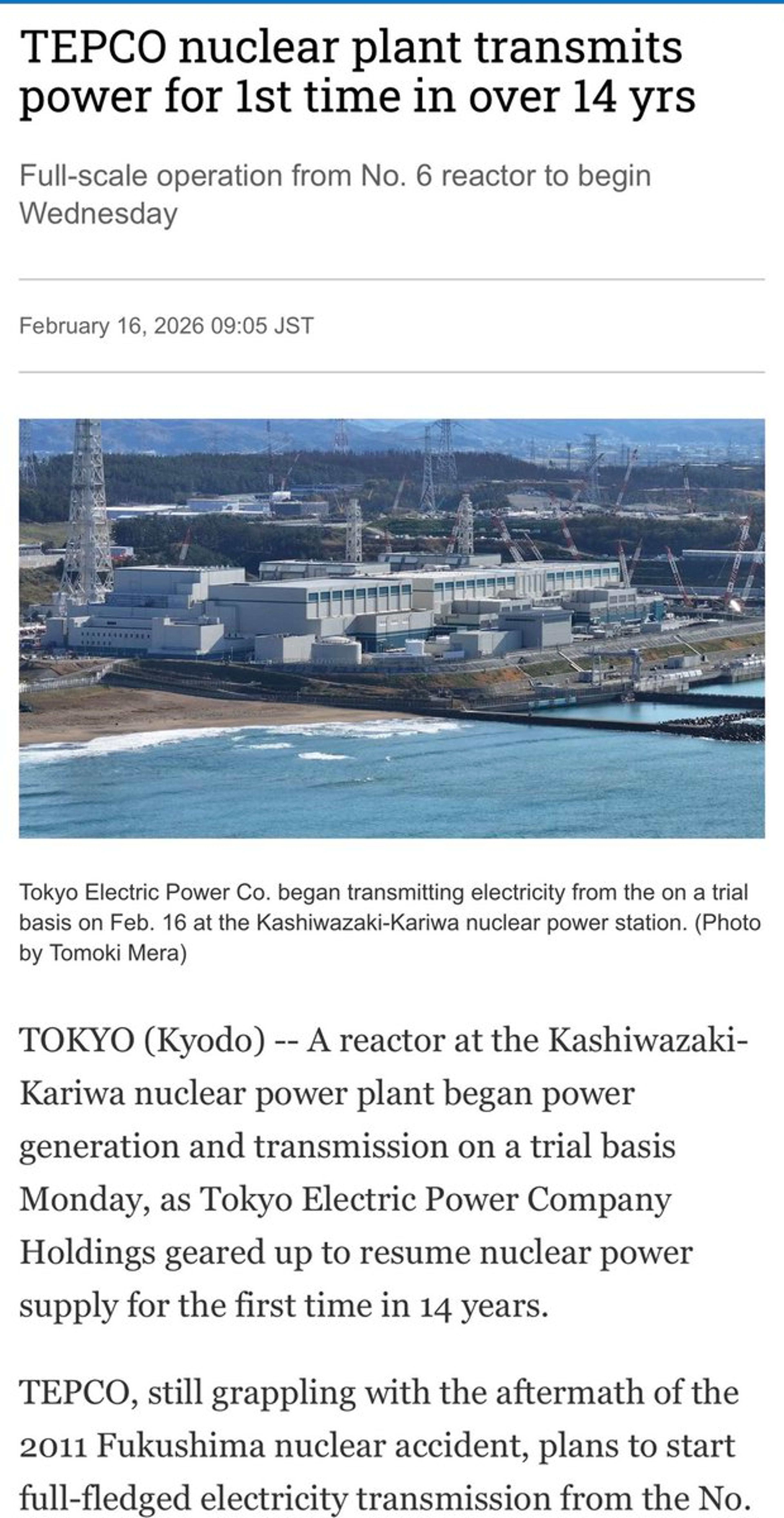

Japan’s Nuclear Restarts Cut Costs, Boost Yen, Tame Inflation

Japan’s nuclear reactors continue to come back online. This is a major positive for consumers, businesses, and the environment, as it increases the supply of cheap energy, and reduces reliance on expensive imported fossil fuels. This dynamic should also support the...

By Jamie Halse

Social•Feb 16, 2026

Dalio's Stage 6: 5 Stocks for the New World Order

Ray Dalio says the world order has broken down. His “Stage 6” post went viral on X. What does that mean for markets? I mapped his framework to 5 stocks positioned for trade wars, tech controls, rearmament, energy shocks & gold. Here’s the playbook: https://t.co/FrP3YuOJA9

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 16, 2026

Lower Inflation Narrative Clashes with Digital Asset Community

"Seeing lower inflation is a narrative violation for many people in the digital asset space." @ramahluwalia https://t.co/mCyinRw3Uv

By Laura Shin

Social•Feb 16, 2026

2025 Profitability Snapshot: Sector Returns & Excess Gains

In my sixth data update, I look at business profitability in 2025, across sectors, industries and regions, scaled to revenues (profit margins) and to invested capital (accounting returns). I use the latter to compute and compare excess returns. https://t.co/L3PDmph4VA

By Aswath Damodaran

Social•Feb 16, 2026

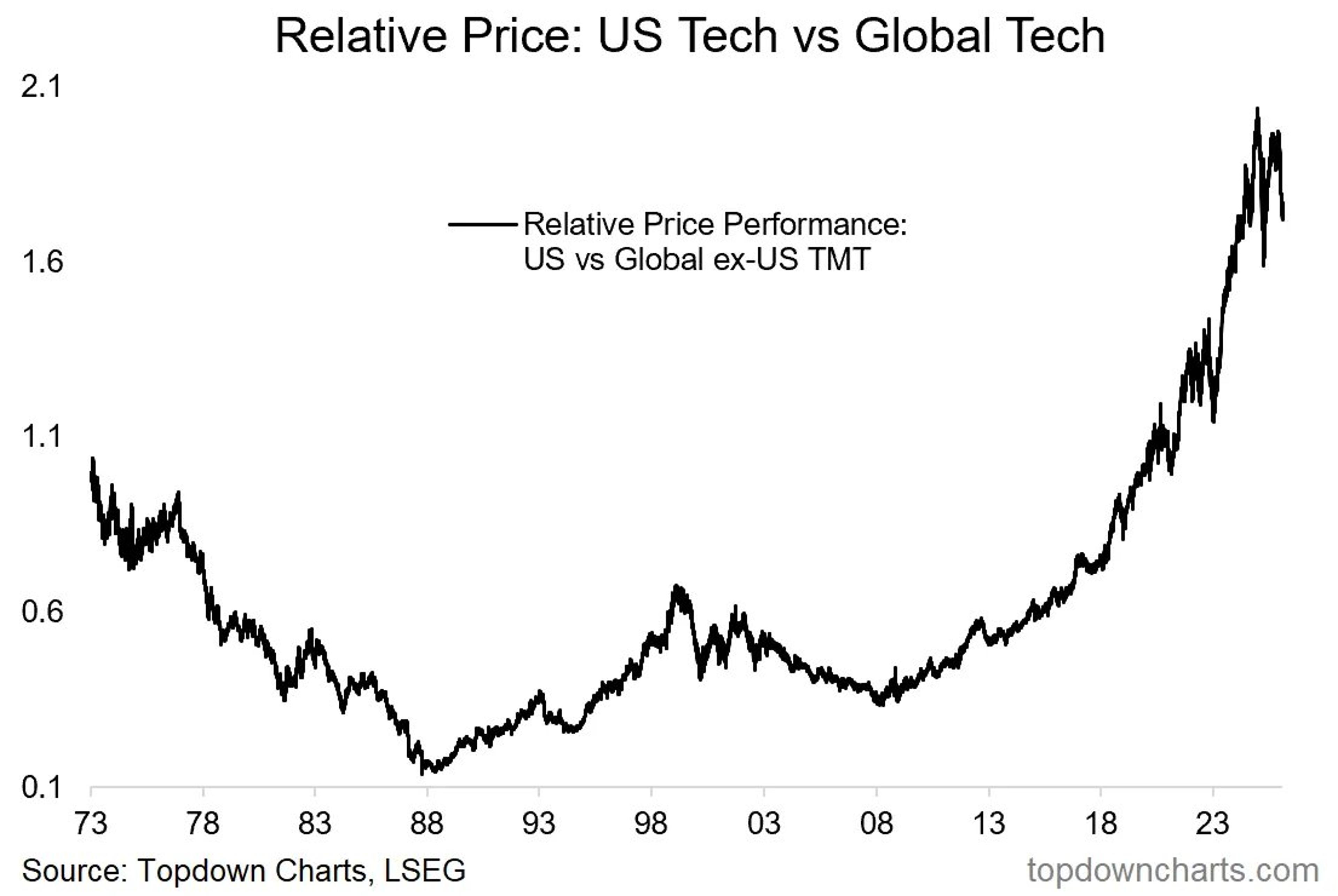

US Tech Dominance Fades as Global Rotation Shifts

This chart captures the 2 most important themes in the Stockmarket right now. 1. Global vs US rotation 2. Top in tech stocks For the past 17-years US Tech stocks have dominated global markets, but that is starting to change... https://t.co/6DhUXusR6C

By Callum Thomas

Social•Feb 16, 2026

Investors Shift From S&P 500 to Alternatives, Gains Accelerate

Rotation away from S&P500 (flat on the year) into other assets like foreign stocks, US value, etc up 10-15% seems to be accelerating...

By Meb Faber

Social•Feb 16, 2026

Venezuelan Bolivar Plummets 87%, Becomes World’s Worst Currency

On this week's Hanke's #CurrencyWatchlist, the Venezuelan bolivar ranks as the WORLD'S WORST currency. The bolivar has depreciated by over 87% against the USD in the past year. IT’S TIME TO DUMP THE BOLIVAR AND REPLACE IT WITH THE US DOLLAR. https://t.co/dHtPzNew81

By Steve Hanke

Social•Feb 16, 2026

Trump's Presidency Keeps Oil Prices Higher, OPEC+ Cuts Production

The best—only?—argument that Trump is bearish for oil prices is that OPEC+ wouldn't have hiked crude production as aggressively last year in a world in which Harris was sitting in the White House.

By Rory Johnston

Social•Feb 16, 2026

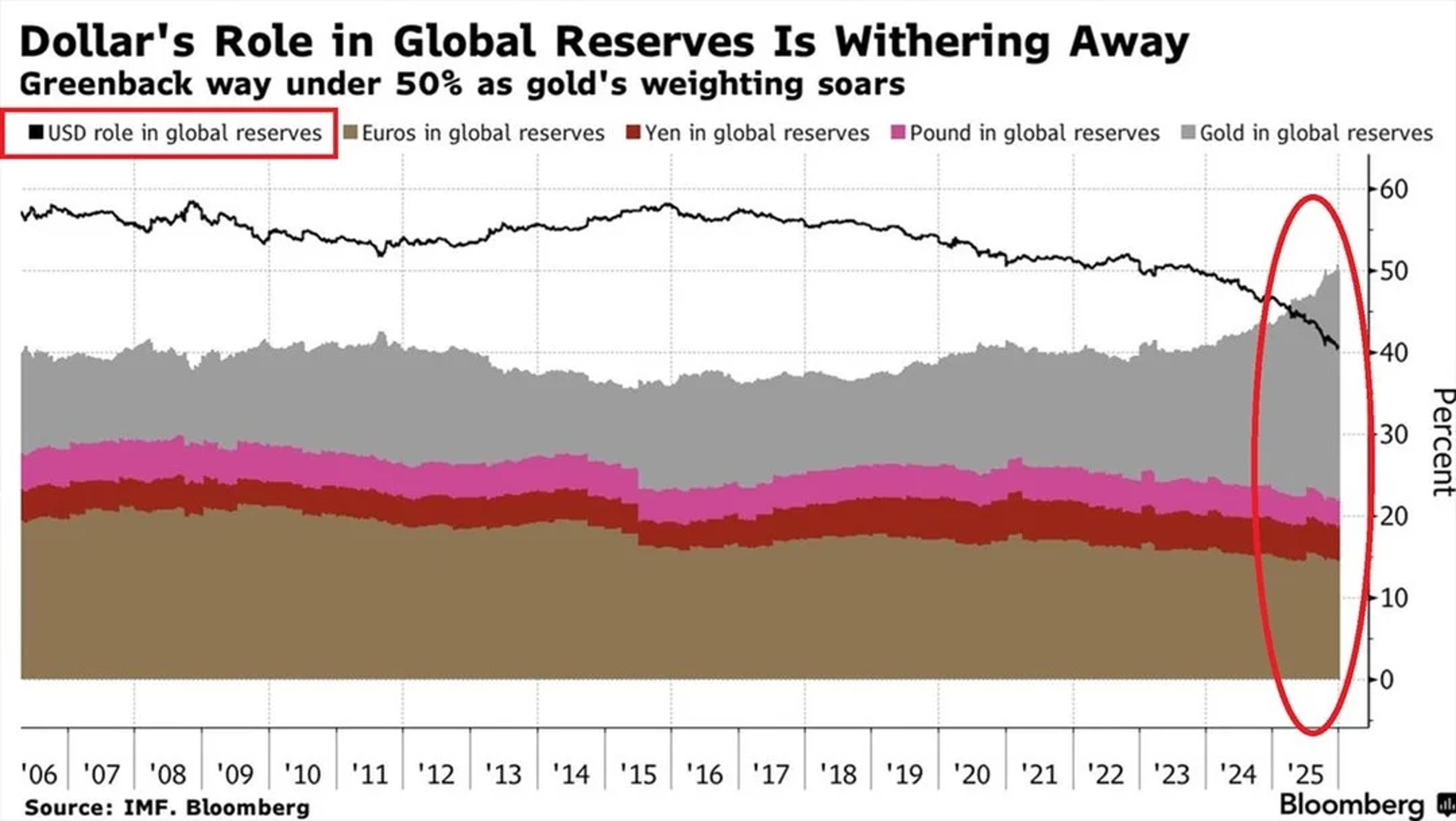

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

Eurogroup Sets 2026 Priorities, Boosts Euro’s Global Role

Back in Brussels today for the #Eurogroup meeting, where we discussed: 🔹 euro area policy priorities for 2026 🔹 the international role of the euro https://t.co/FAa7OvZiMt

By Christine Lagarde

Social•Feb 16, 2026

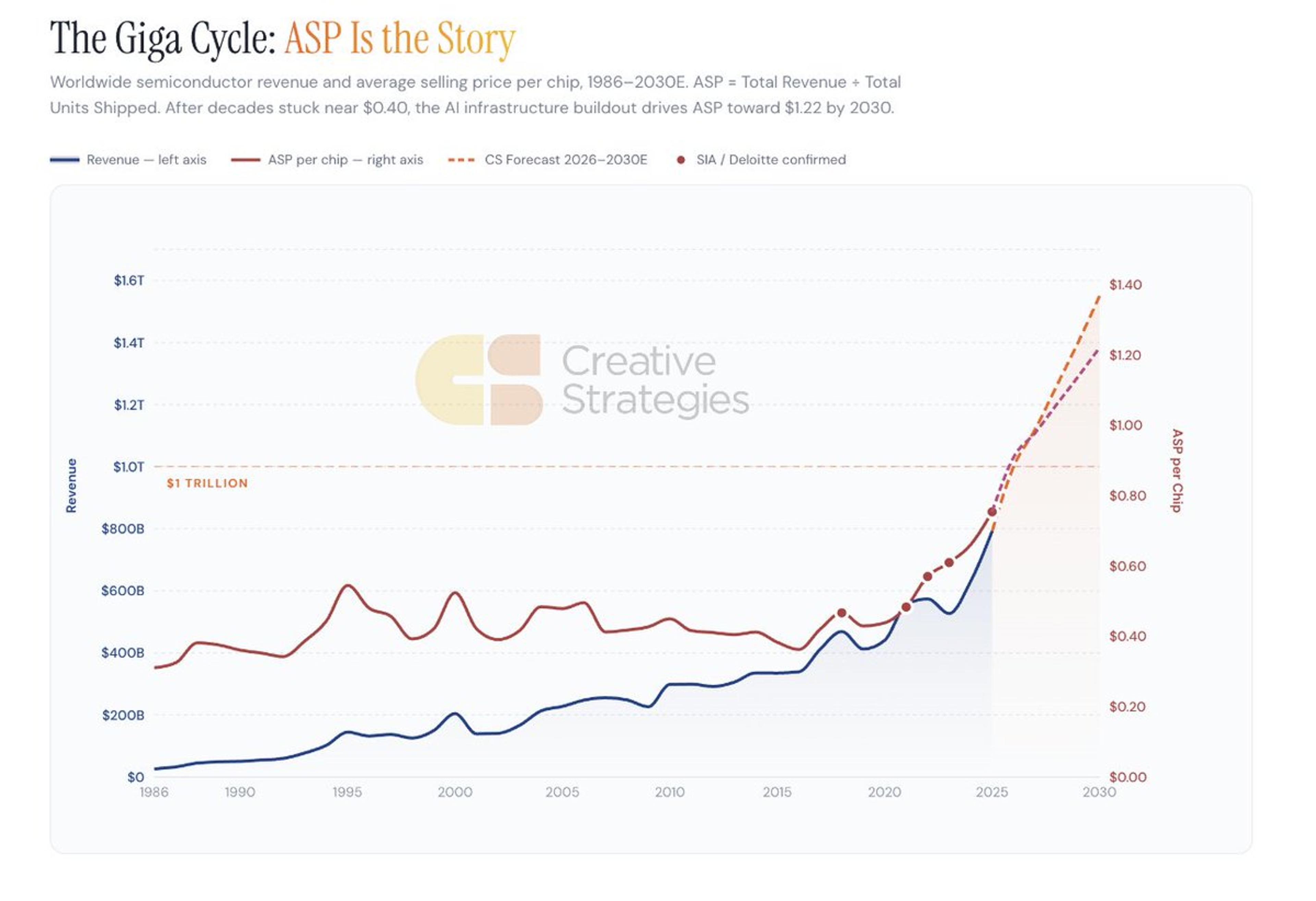

Semiconductors Shift From Volume to ASP‑Driven Value

Modeled a range of scenarios, but showing mid-bull to make a key point. For the first time in semiconductor industry history, value creation is primarily an ASP story not a volume story. https://t.co/IoHFb65Gmq

By Ben Bajarin

Social•Feb 16, 2026

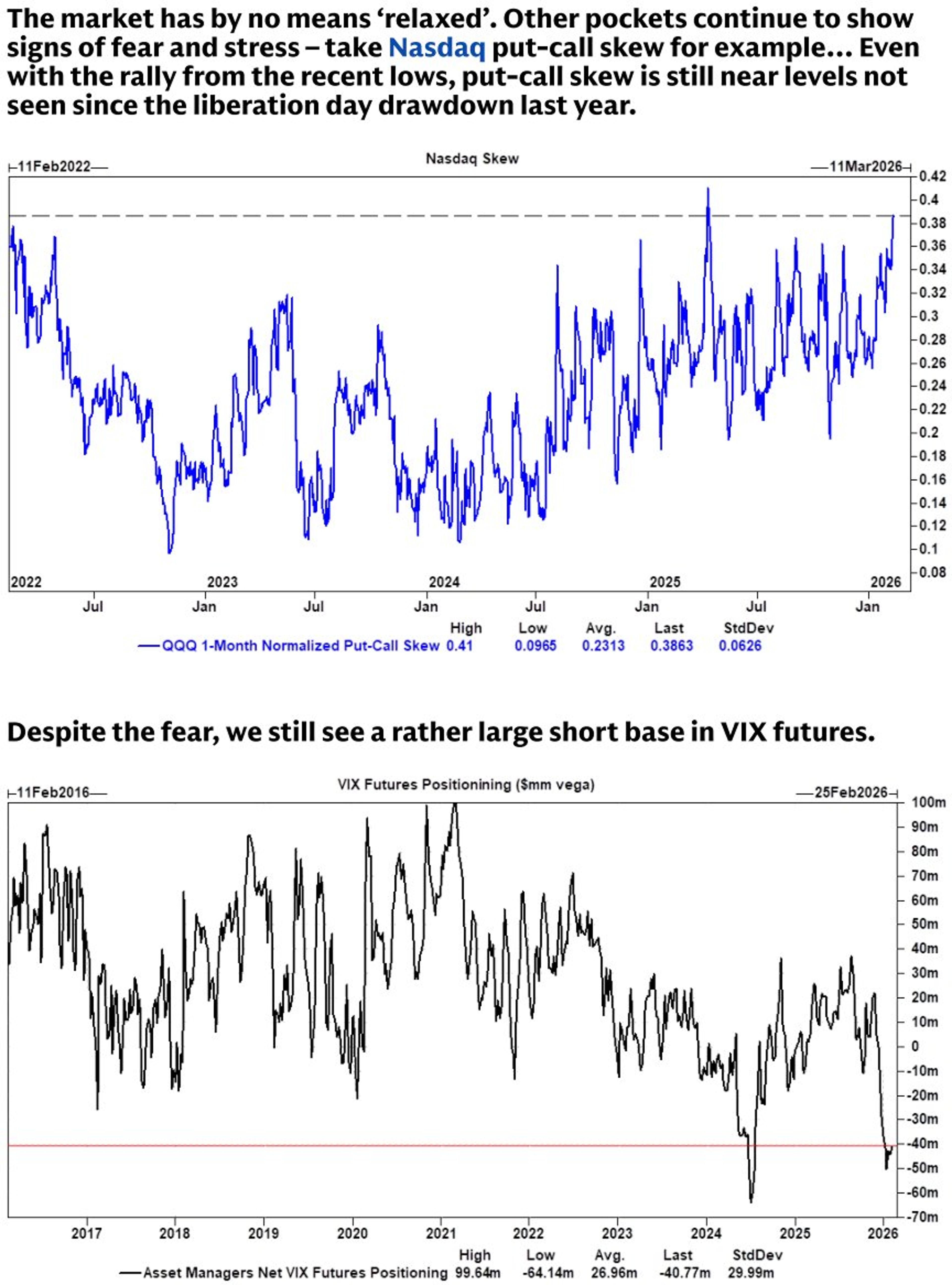

Investors Buy Protection Despite Record VIX Short Positions

Does anyone have a good explanation for why equity skew shows investors are paying up for downside protection but also VIX futures are at near record shorts? Those seem to be contradictory. https://t.co/IWYZ9IHTYl

By Quinn Thompson

Social•Feb 16, 2026

Warsh May Threaten Fed Stability Despite Doubtful Capability

Good piece. Warsh would be a fundamental break from the Bernanke, Yellen, and Powell Feds if he carried out his views. Do I think he’s capable of pulling that off? Not really. Do I think he might try to and...

By Claudia Sahm

Social•Feb 16, 2026

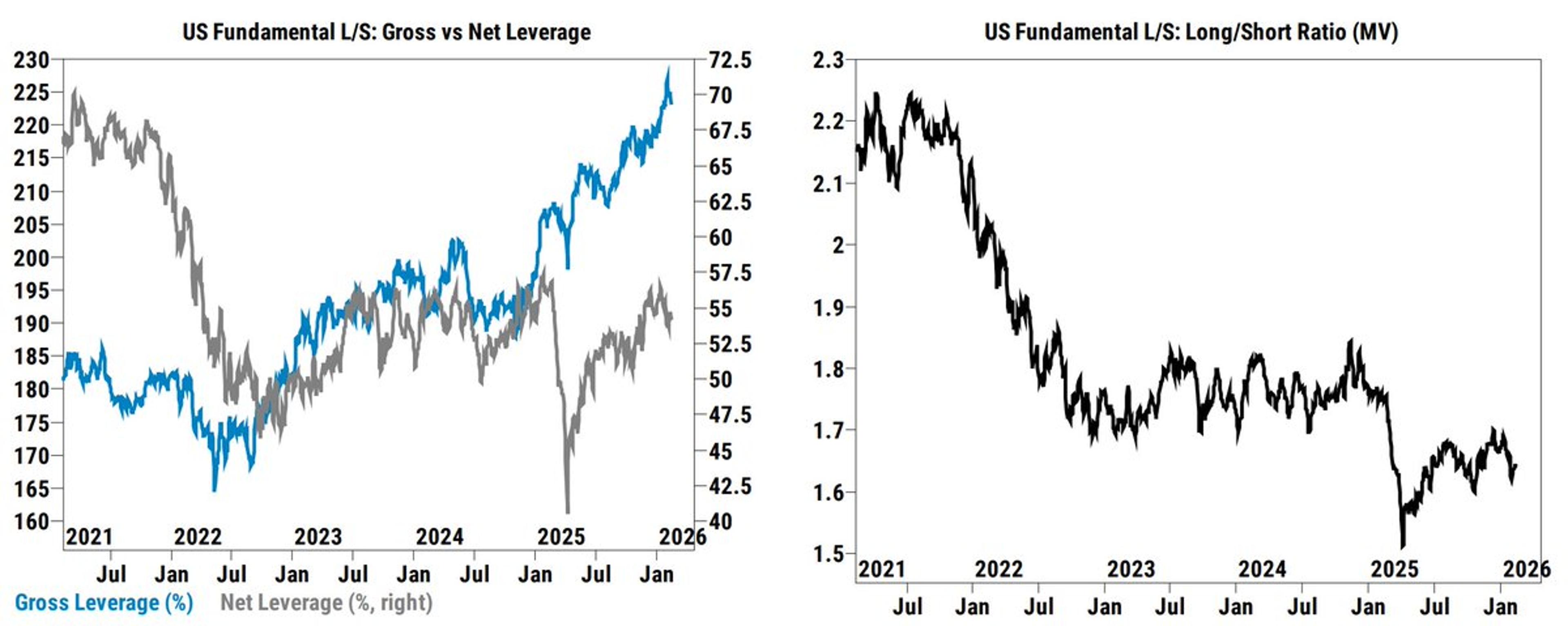

Seeking Causes Behind Hedge Funds' Rising Leverage Beyond

Are there any other explanations for the multi-year vertical ascent in hedge fund gross leverage aside from a reduction in front end interest rates / funding costs? https://t.co/WkIt1xAlmd

By Quinn Thompson

Social•Feb 16, 2026

China's Surplus Doesn't Directly Boost US Treasury Holdings

Two things are simultaneously true -- a) China's surplus doesn't automatically flow into its fx reserves and then into Treasuries and Agencies b) China's large ongoing surplus (+ the increase in fx assets of the state banks) cautions against using the...

By Brad Setser

Social•Feb 16, 2026

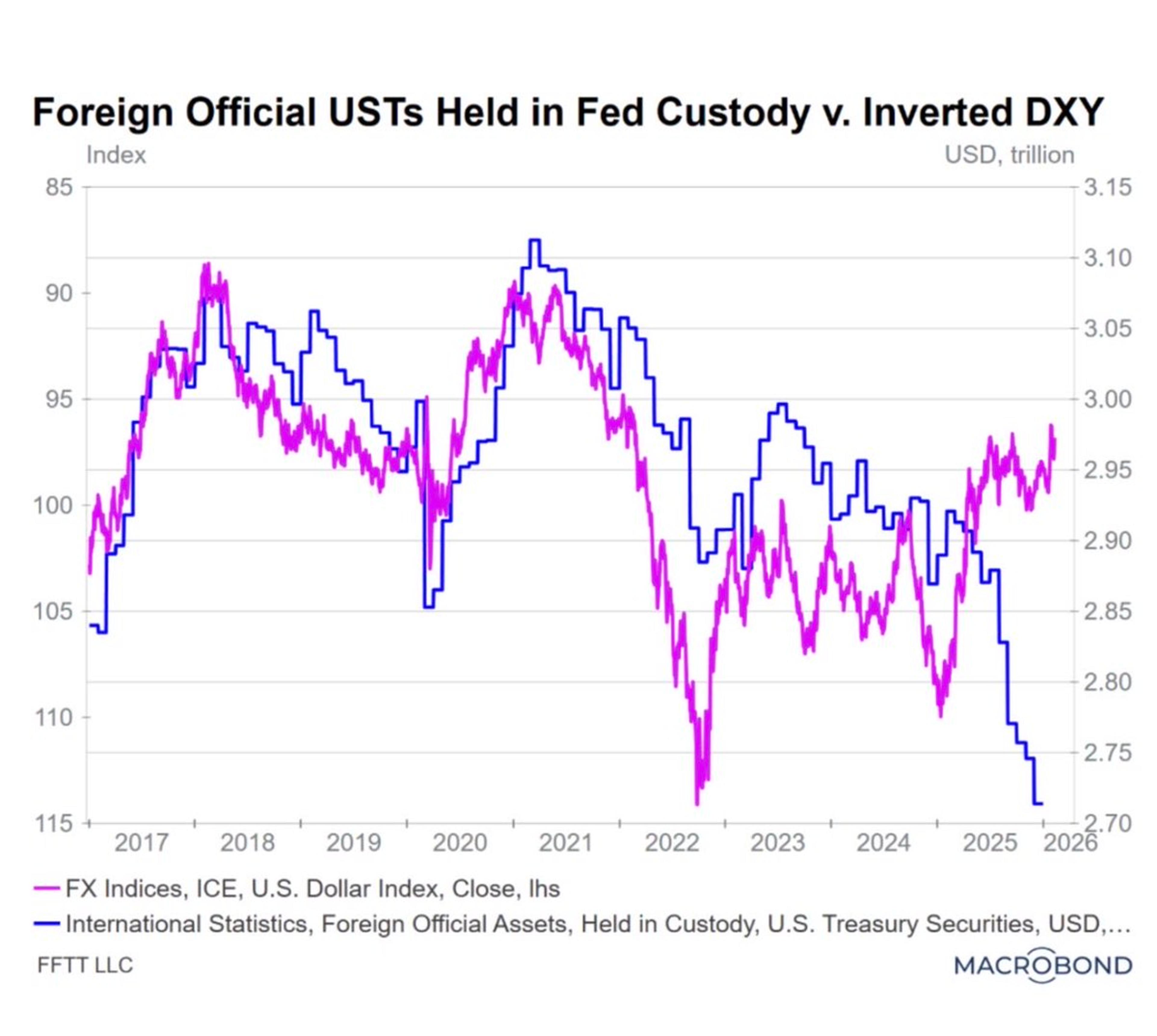

Foreign Central Banks Sell USTs Even as Dollar Weakens

One of a number of potentially important macro divergences that occurred in 2H25 is shown below. For the prior 10+ years, foreign Central Banks sold USTs when the USD rose and bought USTs when the USD fell. In 2H25, foreign CB’s sold...

By Luke Gromen

Social•Feb 16, 2026

IEA and OPEC Clash on Oil Outlook, Shaping 2024 Strategy

Why @IEA and @OPECSecretariat are split on what comes next for oil - and what it means for strategy this year https://t.co/FUAD5TlcG4 @TheNationalNews

By Robin Mills

Social•Feb 16, 2026

Trading Week Signals Fed Cut Outlook for 2026

New trading week = big clues for rates 👀 Futures up, gold down, dollar strong… what is the market betting on for Fed cuts in 2026? Fed speakers, FOMC minutes, global data & a surprise risk event ahead Watch the video before you...

By Kathy Lien