Social•Feb 16, 2026

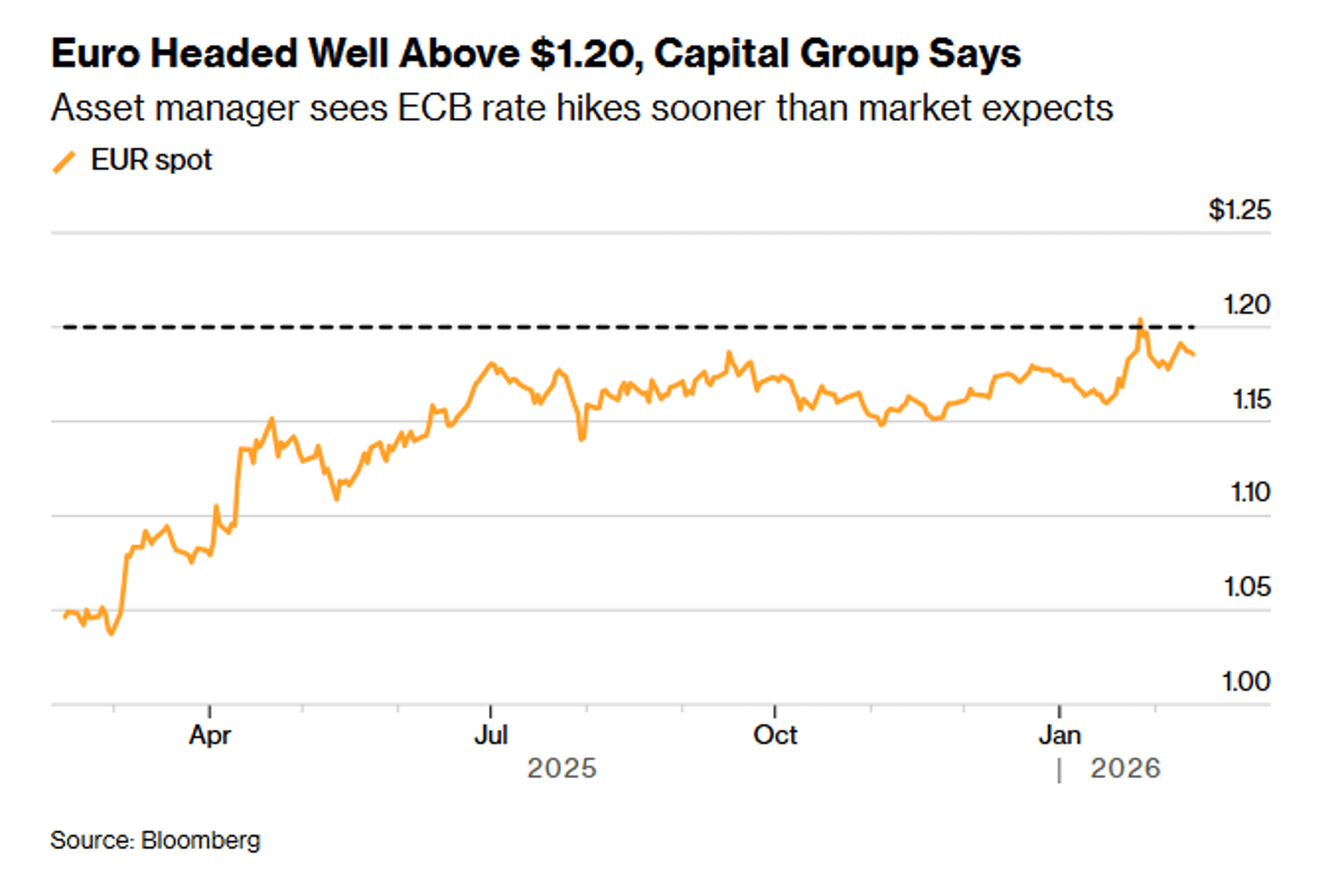

Euro's Neglect Highlights Geopolitical Weakness

We live in a beggar-thy-neighbor world. Everyone is trying to get their currencies down except for the Euro zone, another symptom of geopolitical weakness. While everyone else is managing their currencies down, the Euro is suffering from benign neglect... https://t.co/QpUo91Xcq2 https://t.co/7qByDtUMFN

By Robin Brooks

Social•Feb 16, 2026

Companies Resume Price Hikes After Tariff Surge

"The Break Is Over. Companies Are Jacking Up Prices Again." "Such new price increases follow last year’s wave of tariff-driven price hikes" https://t.co/onoN6WYPHy https://t.co/OjVUbYFXnM

By Scott Lincicome

Social•Feb 16, 2026

Dollar Gains Strength Over G10 Amid Low FX Turnover

In subdued foreign exchange turnover, the dollar enjoys a firmer bias against most G10 currencies amid on broadly consolidative tone. https://t.co/cyTShaySWO

By Marc Chandler

Social•Feb 16, 2026

US Growth Decouples From Jobs, Entering Uncharted Territory

Via the Financial Times: My thoughts on why US "jobless growth" may have entered uncharted territory. The decoupling of US growth from employment looks more persistent—and consequential—than the three previous episodes we've seen over the last 40 years: https://www.ft.com/content/298a38bb-4cc1-44f3-bd62-6aff25d58b94 #economy #jobs #employment #unemployment #growth...

By Mohamed El‑Erian

Social•Feb 16, 2026

Treasuries Prefer Higher Inflation Over Low Rates for Revenue

One of the under-reported stories in DM fiscal discourse is that for all the talk about how treasuries in the UK, US, France etc 'want' lower rates, they also want, and desperately, need high(er) inflation and the nominal tax revenue...

By Claus Vistesen

Social•Feb 16, 2026

FX Steadies as JPY Slips on Weak Data

US and China's mainland markets are closed today. The FX market is calmer and most G10 currencies are little changed. $JPY is the notable exception as disappointing data weighs on it. See https://t.co/cyTShaySWO https://t.co/ZB9uMP7xUC

By Marc Chandler

Social•Feb 16, 2026

Bears Dominate Oil Market Narrative After Energy Week

COLUMN: In the oil market, the bears control the narrative — at least for now. (My summary after last week's International Energy Week, the oil trading industry's annual jamboree in London) @Opinion https://t.co/Y3OHEhD4k5

By Javier Blas

Social•Feb 16, 2026

Macro Risk Memo Extends Beyond Crypto After BTC Drop

In January, we outlined a late-cycle restrictive regime and leaned cautious on risk. Since then, BTC has declined materially and leadership has narrowed. The February Macro Risk Memo expands the framework beyond crypto into broader macro. Now live: https://t.co/QKQMRbbeKi https://t.co/b0h9q5CS5C

By Benjamin Cowen

Social•Feb 16, 2026

This Week's Macro Calendar Promises Major Market Volatility

🚨 KEY MACRO EVENTS TO WATCH THIS WEEK: Monday – U.S. markets closed for Presidents Day Wednesday – December Durable Goods Orders release and FOMC Meeting Minutes. Friday – December PCE Inflation data is released and 15% of S&P 500 companies are reporting...

By That Martini Guy

Social•Feb 16, 2026

Institutional Cash at Historic Low Triggers Global Sell Signal

🚨Global equities 'SELL SIGNAL' was triggered for the 7th month STRAIGHT: Institutional investors' cash as a share of assets fell to 3.2% in January, the lowest EVER. Cash allocations at or below 4% indicate a SELL SIGNAL for world stocks.👇 https://globalmarketsinvestor.beehiiv.com/p/us-stocks-ended-the-week-mixed-after-a-powerful-rebound-on-friday-weekly-market-recap-trading-week-0

By Global Markets Investor (newsletter author)

Social•Feb 15, 2026

US‑China Gap Lies Beyond Financialization Share of GDP

Whatever the difference between the US and China may be and however you evaluate it, it isn’t in “financialization”, at least not as measured by the share of finance in GDP (h/t twitter account of devarbol for this graph). More...

By Adam Tooze

Social•Feb 15, 2026

FOMC Minutes May Spark Q1 Market Shift

dailyanalysts 🚨 WEEK AHEAD ALERT: Feb 16-21 🚨 Three catalysts could define your portfolio's Q1. Markets closed Monday for Presidents' Day, but Tuesday through Friday is packed with market-moving data. S&P 500 is flat YTD. Nasdaq down 3%. Consumer confidence at DECADE LOWS. Here's...

By dailyanalysts

Social•Feb 15, 2026

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

Cuba's Power Generation Falls Below Half Demand.

ENERGY CRISIS IN CUBA: Granma, the mouthpiece of the Cuban regime, says that electricity generation in the island is covering less than half the expected demand. The island is suffering the largest energy shortages since the collapse of the Soviet...

By Javier Blas

Social•Feb 15, 2026

Upcoming Week Packed with GDP, PCE, FOMC Insights

Get my newsletter Tuesday morning: https://t.co/dSU3TT2kZX Busy week coming with GDP, Core PCE, FOMC Minutes $PANW $ADI $WMT $DE https://t.co/7mNeUbi7R9

By Scott Redler

Social•Feb 15, 2026

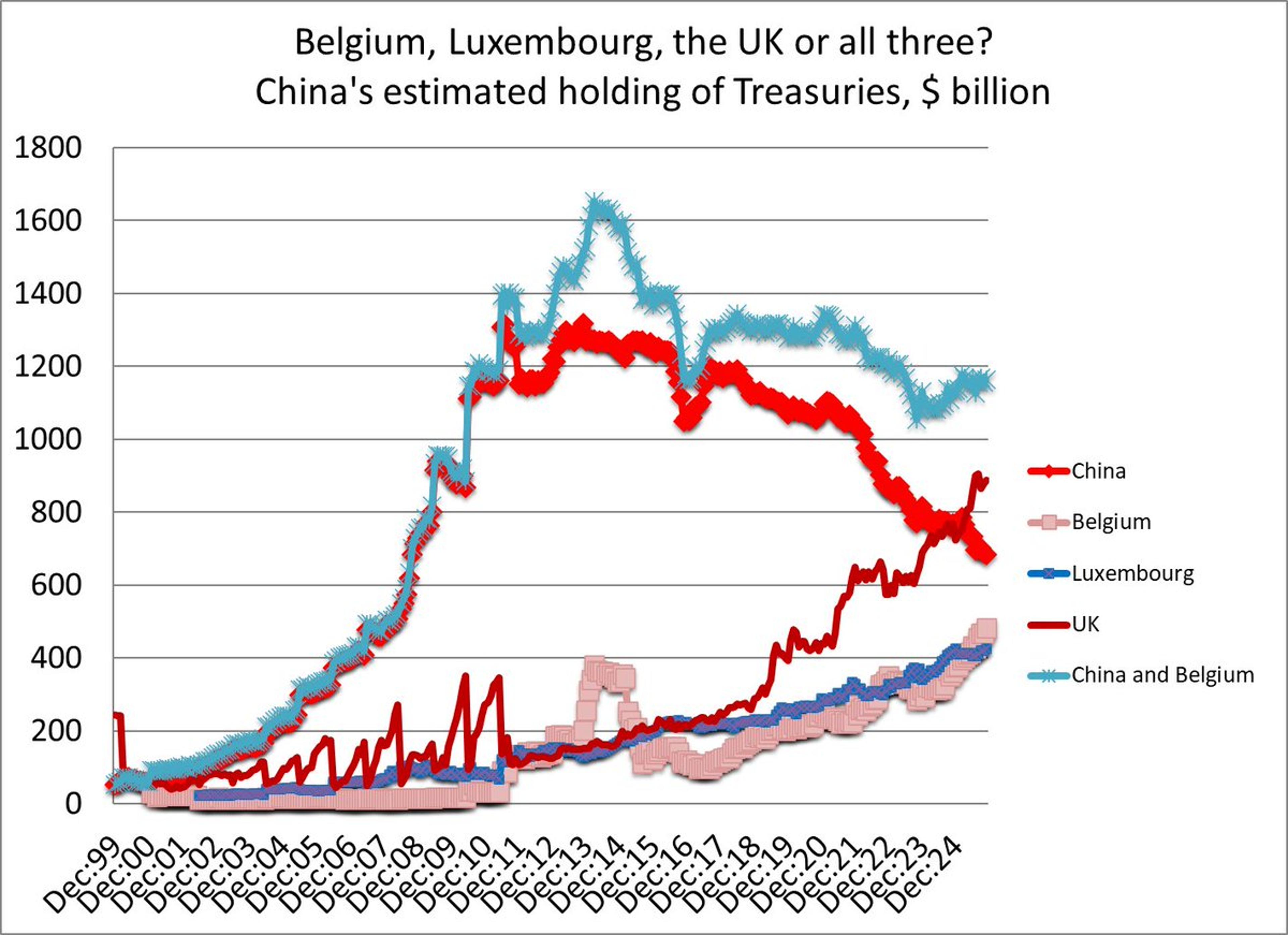

TIC Data Misses China’s Treasury Holdings Abroad

My periodic reminder that the US TIC data doesn't measure China's holdings of US Treasuries. It only measures China's holdings of Treasuries in US custodians. The real question is how many Treasuries Chinese entities hold in non US...

By Brad Setser

Social•Feb 15, 2026

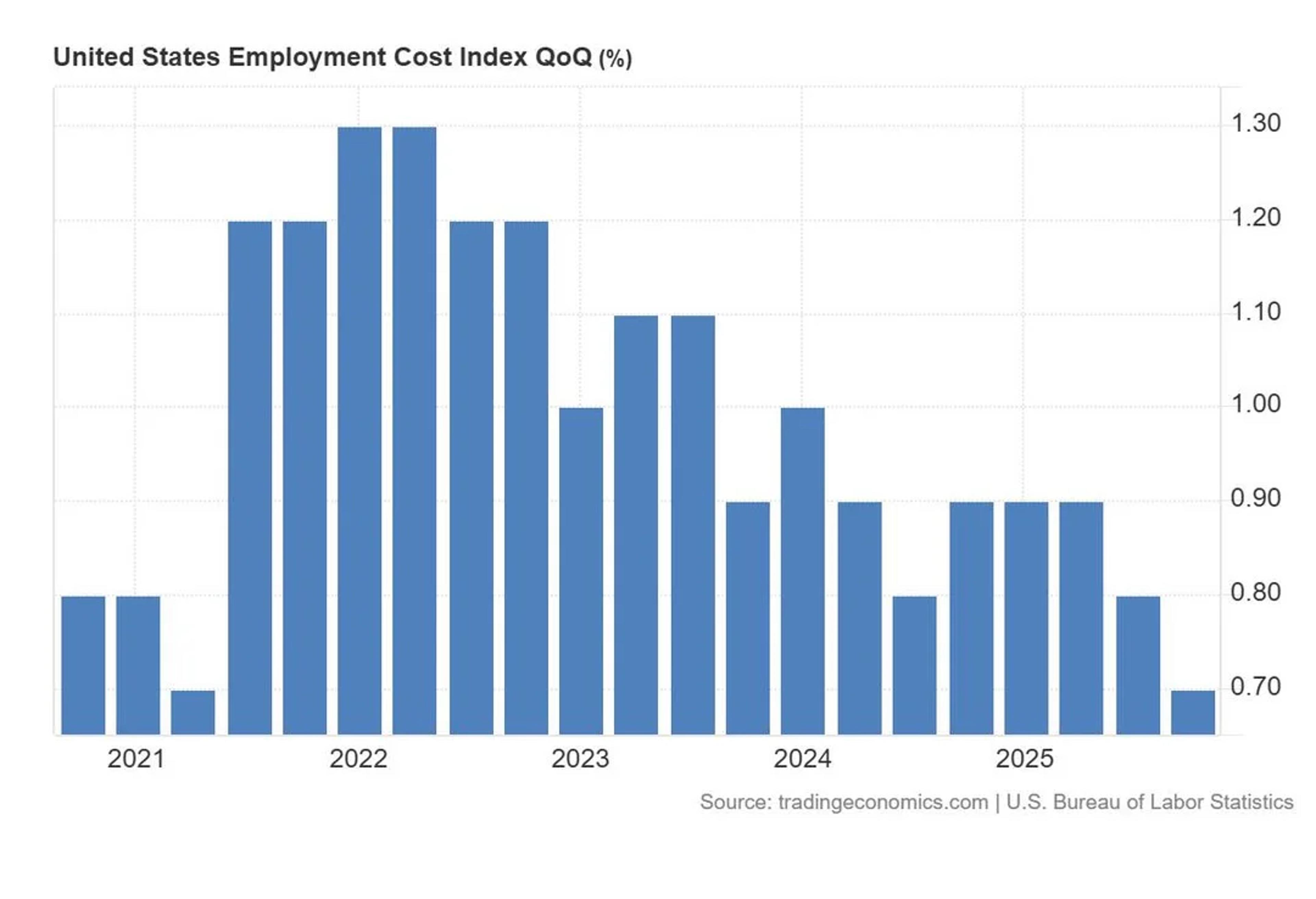

US Employment Costs Rise 0.7%, Lowest Since 2021

US employment costs rose 0.7% in the fourth quarter of 2025, just under forecasts of 0.8%, and the lowest level since Q2 2021.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 15, 2026

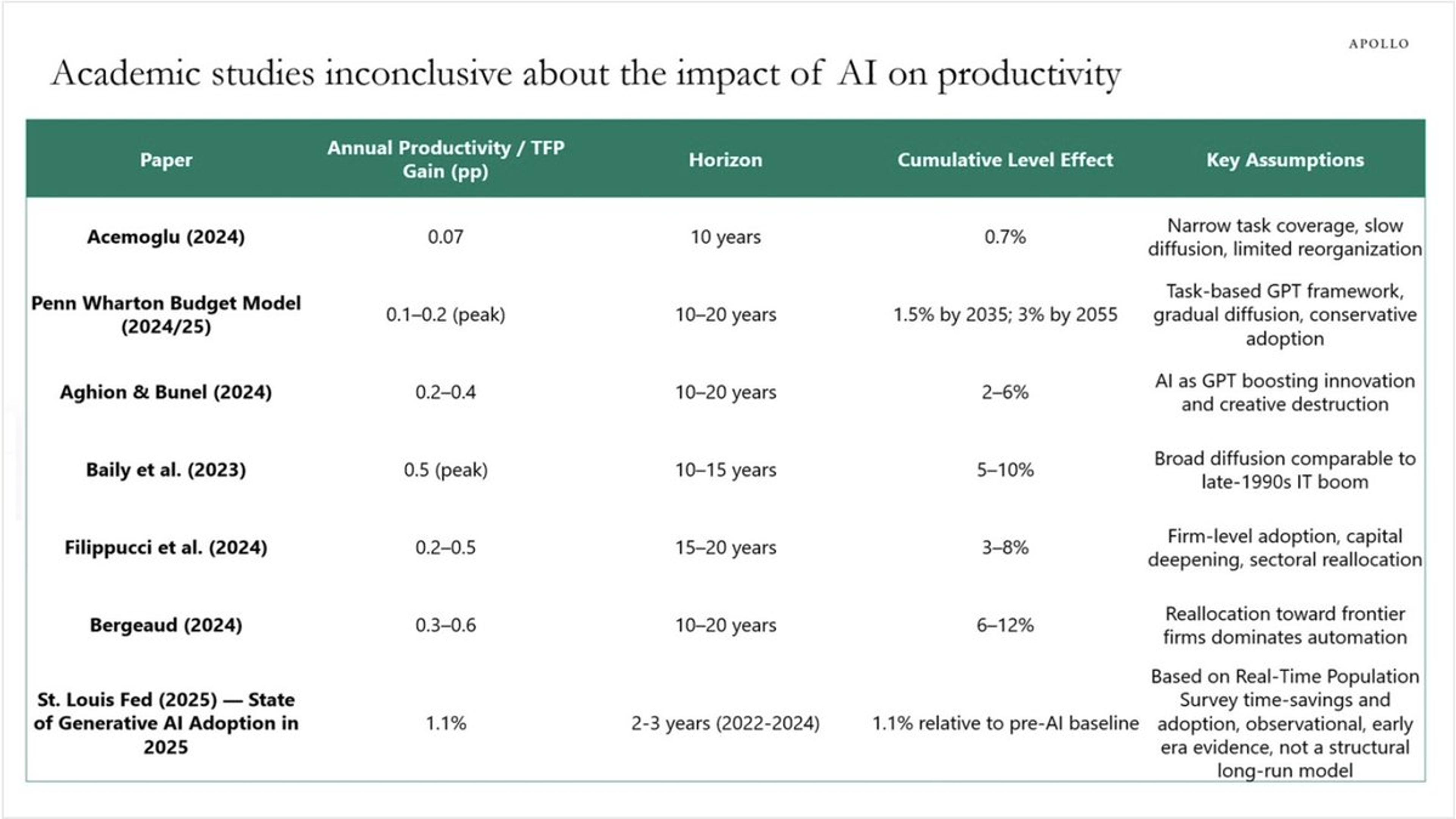

AI Hype Persists, yet Macro Data Shows No Productivity Boost

Three years after ChatGPT, AI is everywhere, except in macroeconomic data. If AI’s value is in productivity enhancement, it's still not showing up in the numbers. AI = LOTS OF HYPE. https://t.co/x96Abr0tD7

By Steve Hanke

Social•Feb 15, 2026

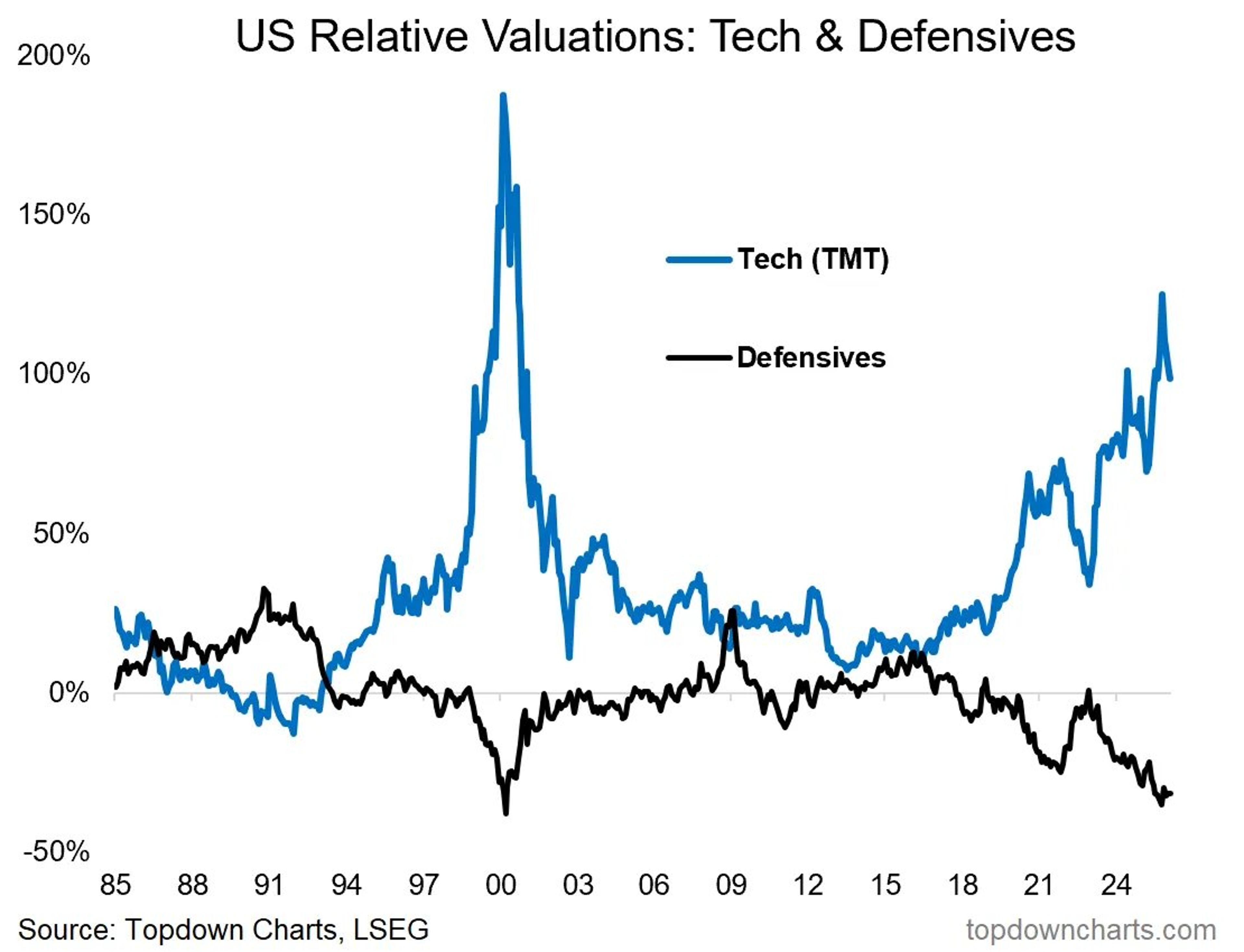

Tech Pressure Rises, Defensives Gain Amid Market Crossroads

Learnings and conclusions from this week’s charts: 1. Tech stocks (particularly software) remain under pressure. 2. Investor exposure to tech is at historically elevated levels. 3. Surging tech capex is coming at the cost of buybacks. 4. Private equity stocks are also coming under...

By Callum Thomas

Social•Feb 15, 2026

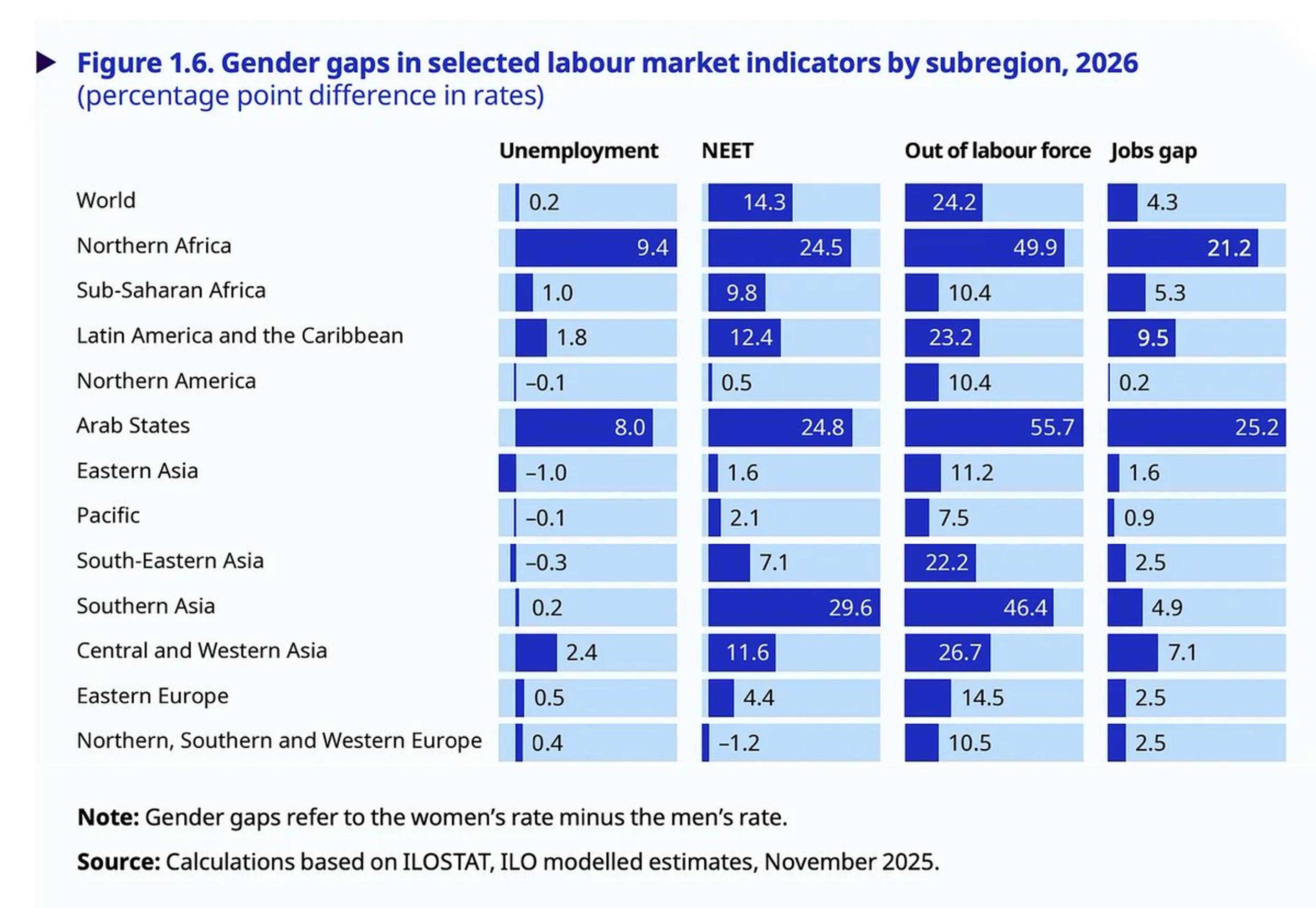

East Asia, Africa Match West; MENA, South Asia Lag

East Asia has labour-market gender gaps comparable to those in Europe and North America. Sub-Saharan Africa is also surprisingly similar (in the formal labour market). MENA and South Asia have massive gender segregation and LatAm and Carib are surprisingly in-between....

By Adam Tooze

Social•Feb 15, 2026

Stockpile Buffers Risk, Not Replaces Chinese Supply

A $12B rare earth stockpile is a step in the right direction, but buying from China on the open market isn’t independence; it’s a piggy bank with a very fragile supply chain. Until we build domestic processing, this is a...

By Peter Zeihan

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 15, 2026

Lagarde: Incentives, Not Taxes, Keep Capital in Europe

ECB President Christine Lagarde says creating incentives for investments in Europe is a better approach to prevent capital outflows to other regions than imposing taxes https://t.co/ULSkU54mw5 via @Rauwald @mcnienaber https://t.co/KxLtLZqWrp

By Zöe Schneeweiss

Social•Feb 15, 2026

ECB Rate Hike Expected to Strengthen Euro, Says Capital Group

The ECB will raise interest rates at least once this year, significantly boosting the euro against the dollar, according to Capital Group, the $3.3 trillion asset manager https://t.co/CFxgbQlz0Q via @Sujata_markets https://t.co/6EBSHD6SYI

By Zöe Schneeweiss

Social•Feb 15, 2026

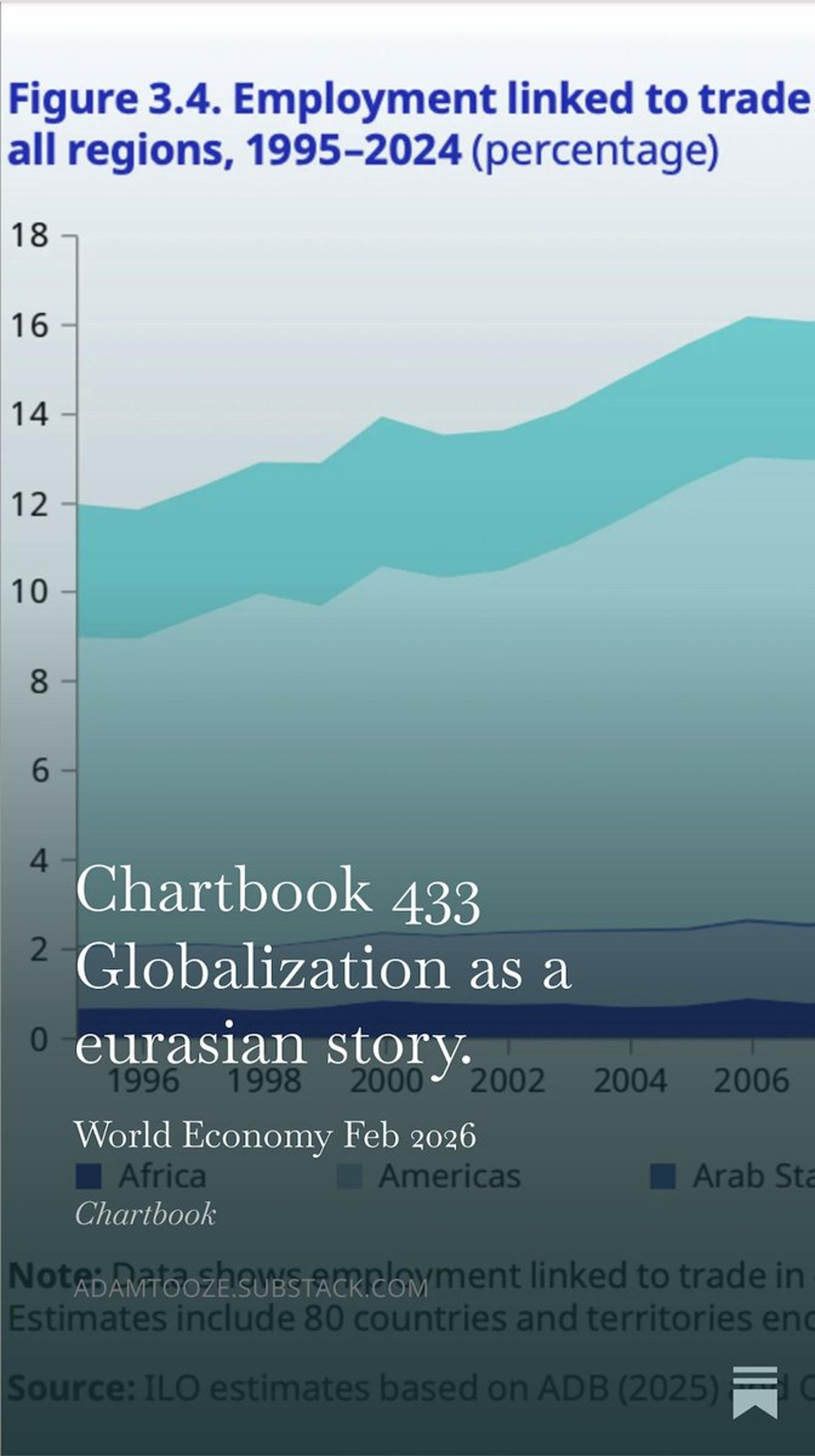

Eurasia Holds 81% of Trade‑Linked Jobs Globally

81 percent of employment worldwide that is linked to trade in goods and services is in Europe and Asia. Globalization is a eurasian story. Chartbook 433 just dropped. Check it out. https://t.co/jq1gYjLP4X https://t.co/I3iRrM8XEN

By Adam Tooze

Social•Feb 15, 2026

Consumption, Not Exports, Powers China's Growth

Why smart people say that exports “contribute” to China’s growth rather than “driving” it: almost all the time, growth in consumption is, in fact, a bigger contributor. More at today's Chartbook Top Links: https://t.co/NNNTMiyj6N

By Adam Tooze

Social•Feb 15, 2026

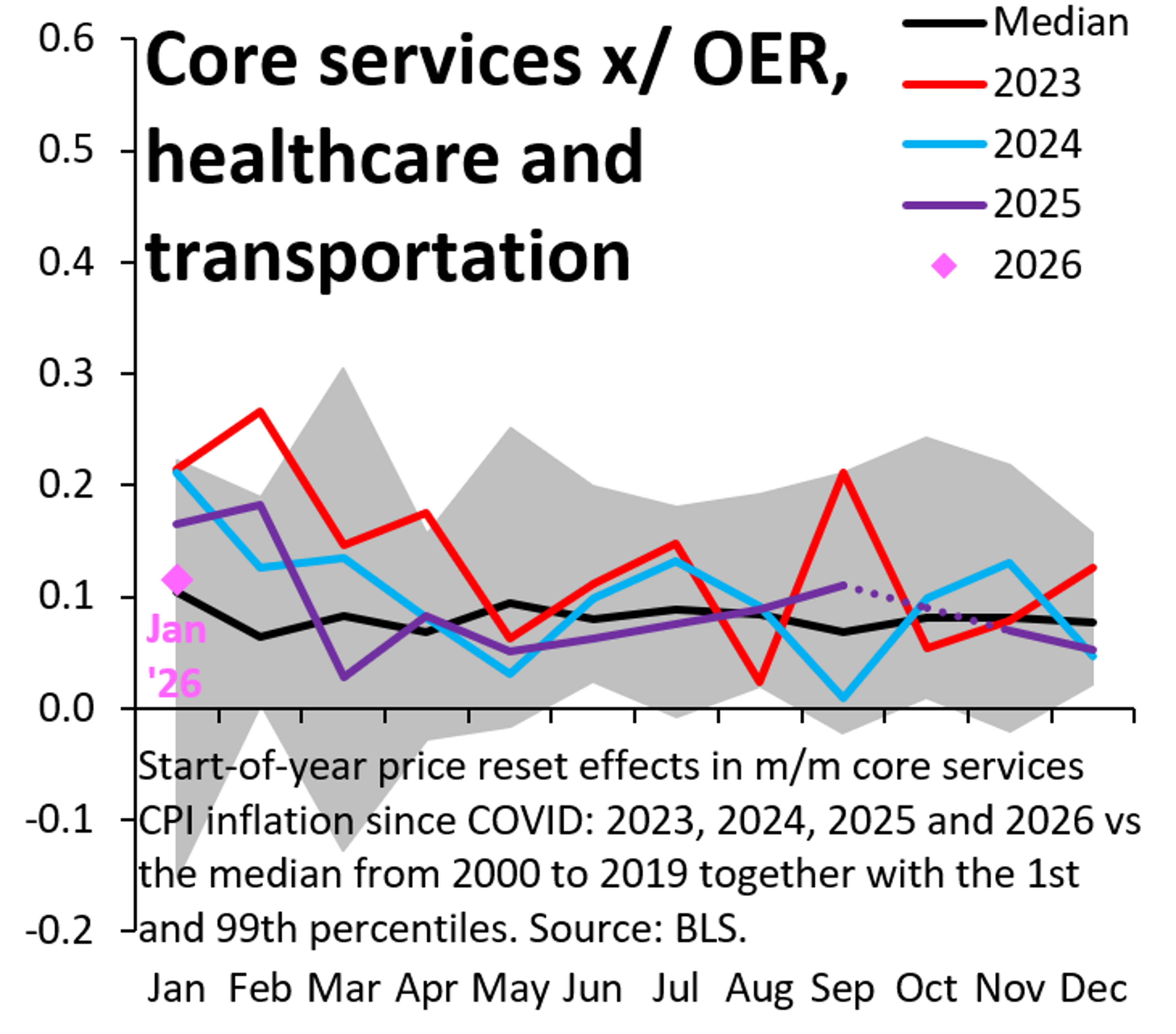

Core Services Inflation Stays Tame, No Overheating Signs

There's lots of commentary that US inflation will overheat, but there's no sign of that. My proxy for core services inflation was very well behaved in all of 2025 (purple) and the Jan. '26 data point (pink) was much more...

By Robin Brooks

Social•Feb 15, 2026

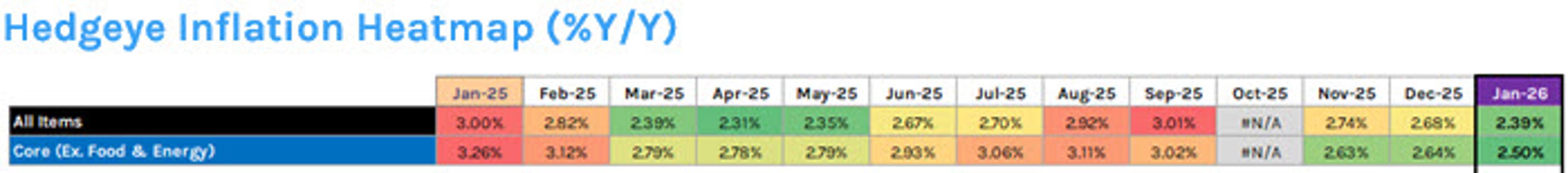

Hedgeye Nowcast Predicts Slowing Inflation, Yields Drop, Gold Rises

Hedgeye's Models vs. The Fed Reminder on the Hedgeye Nowcast for SLOWING US Inflation (which drove Bond Yields lower and Gold higher late this wk) Our monthly inflation nowcast is a weekly publication which augments our existing quarterly nowcast by offering a...

By Keith McCullough

Social•Feb 15, 2026

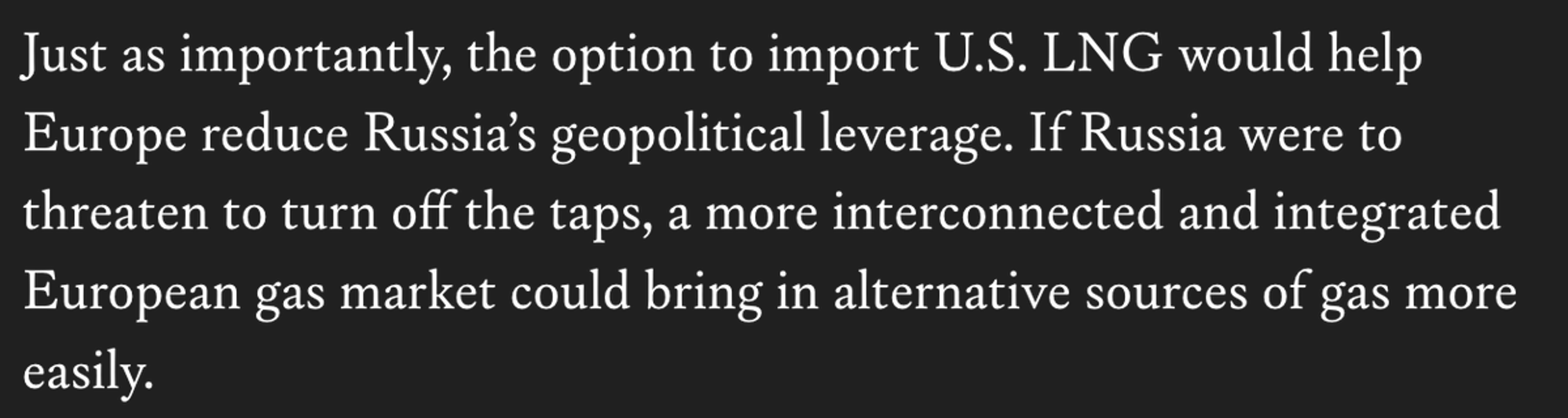

Europe Doubts US LNG Reliability Despite Past Optimism

A decade ago, I wrote an essay @ForeignAffairs about rise of US LNG w subhead "The benign energy superpower." https://t.co/P9r14hfb11 This week @MunSecConf, the Q I got most was whether Europe can trust US LNG to be reliable. And privately, senior...

By Jason Bordoff

Social•Feb 15, 2026

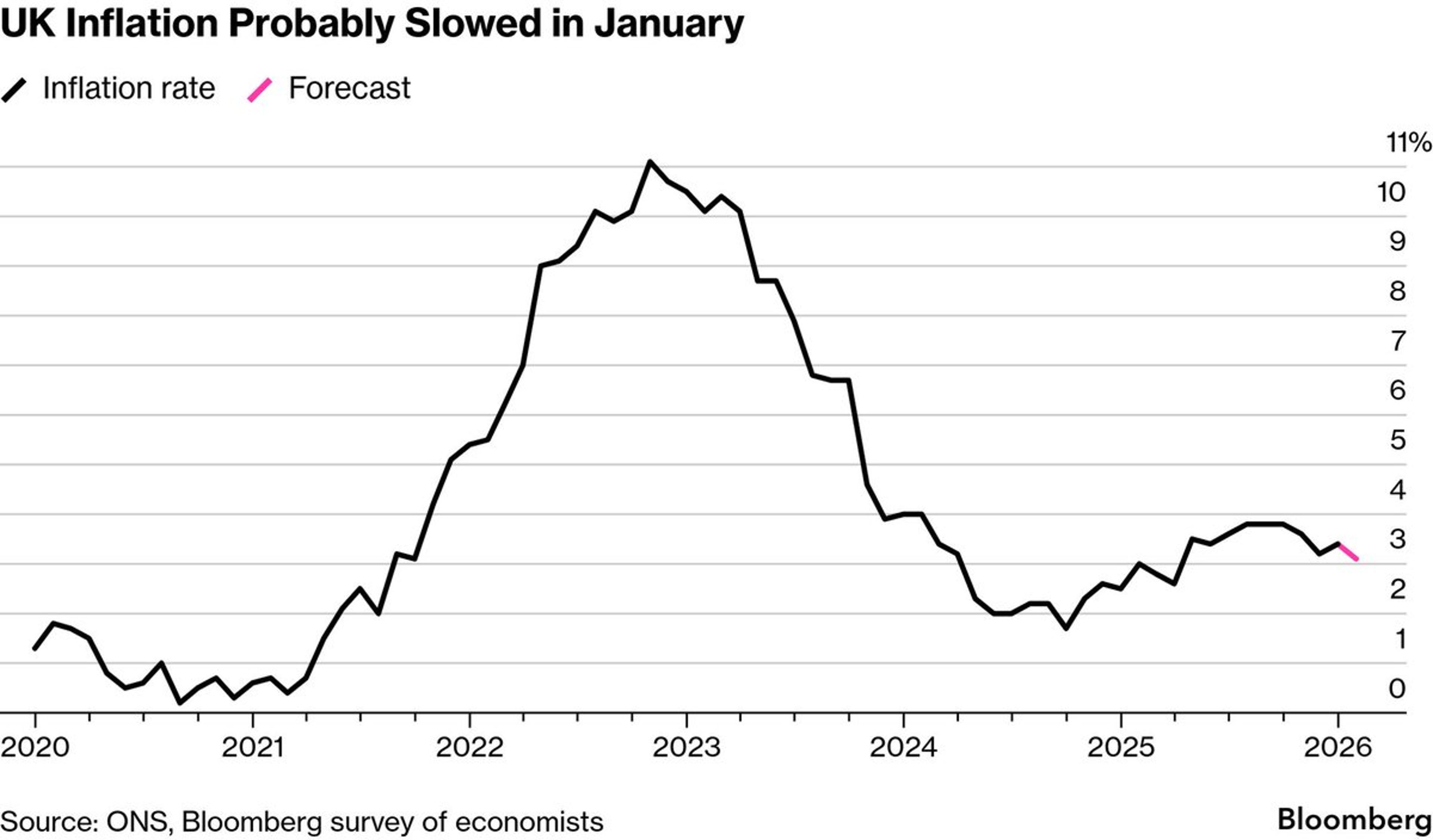

BOE Holds Rate Decision Pending Crucial UK Inflation Data

BOE on knife edge over interest rates awaits pivotal UK inflation data https://t.co/xROceOBQ9W via @PhilAldrick @CraigStirling https://t.co/H5s8yIIXBQ

By Zöe Schneeweiss

Social•Feb 14, 2026

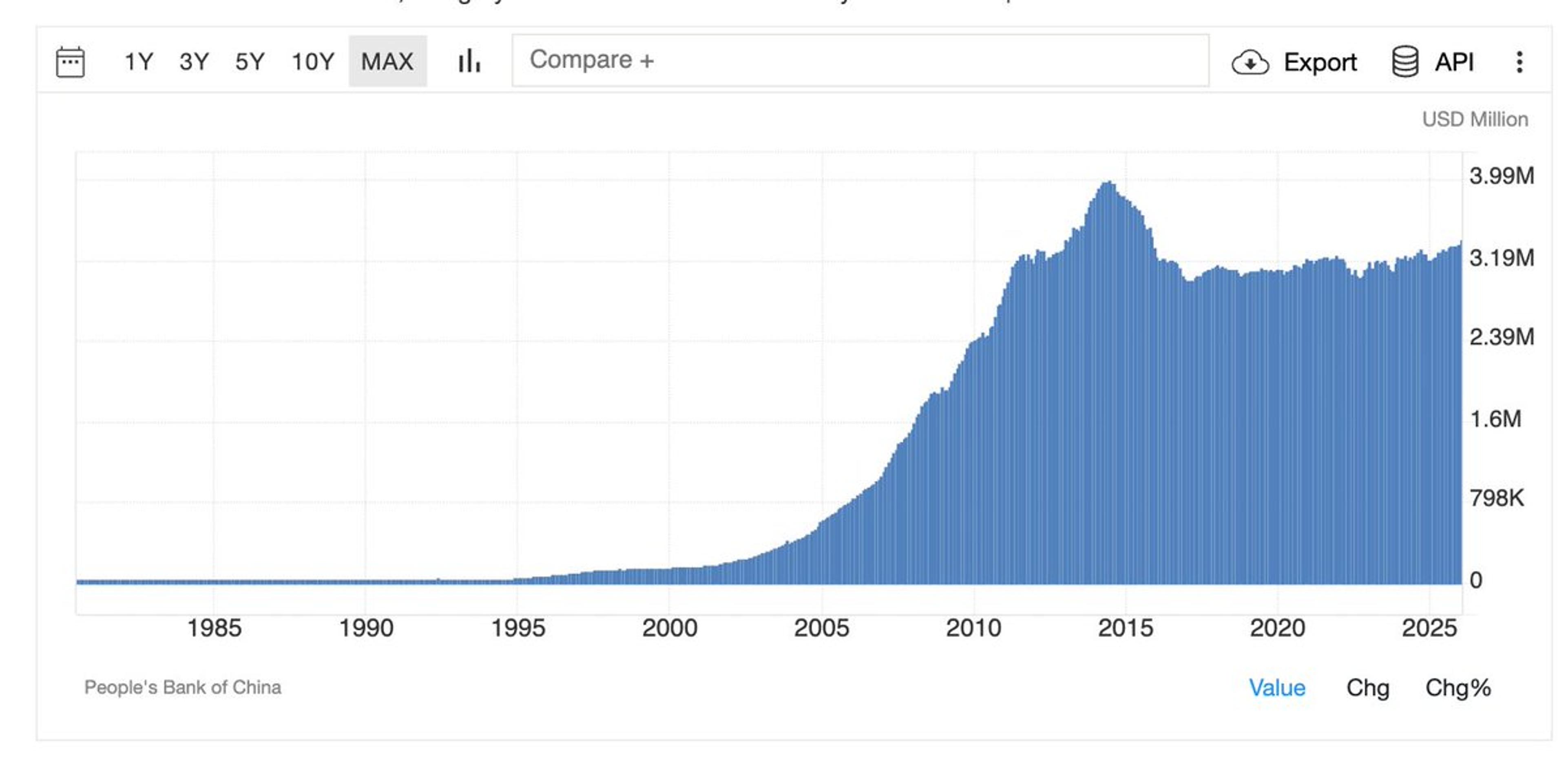

China's Foreign Exchange Reserves: Key Trends Unveiled

Deep dive into Chinese Foreign Exchange Reserves in today's version of the Chartbook Top Links. https://t.co/Yc09wNGpPK

By Adam Tooze

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

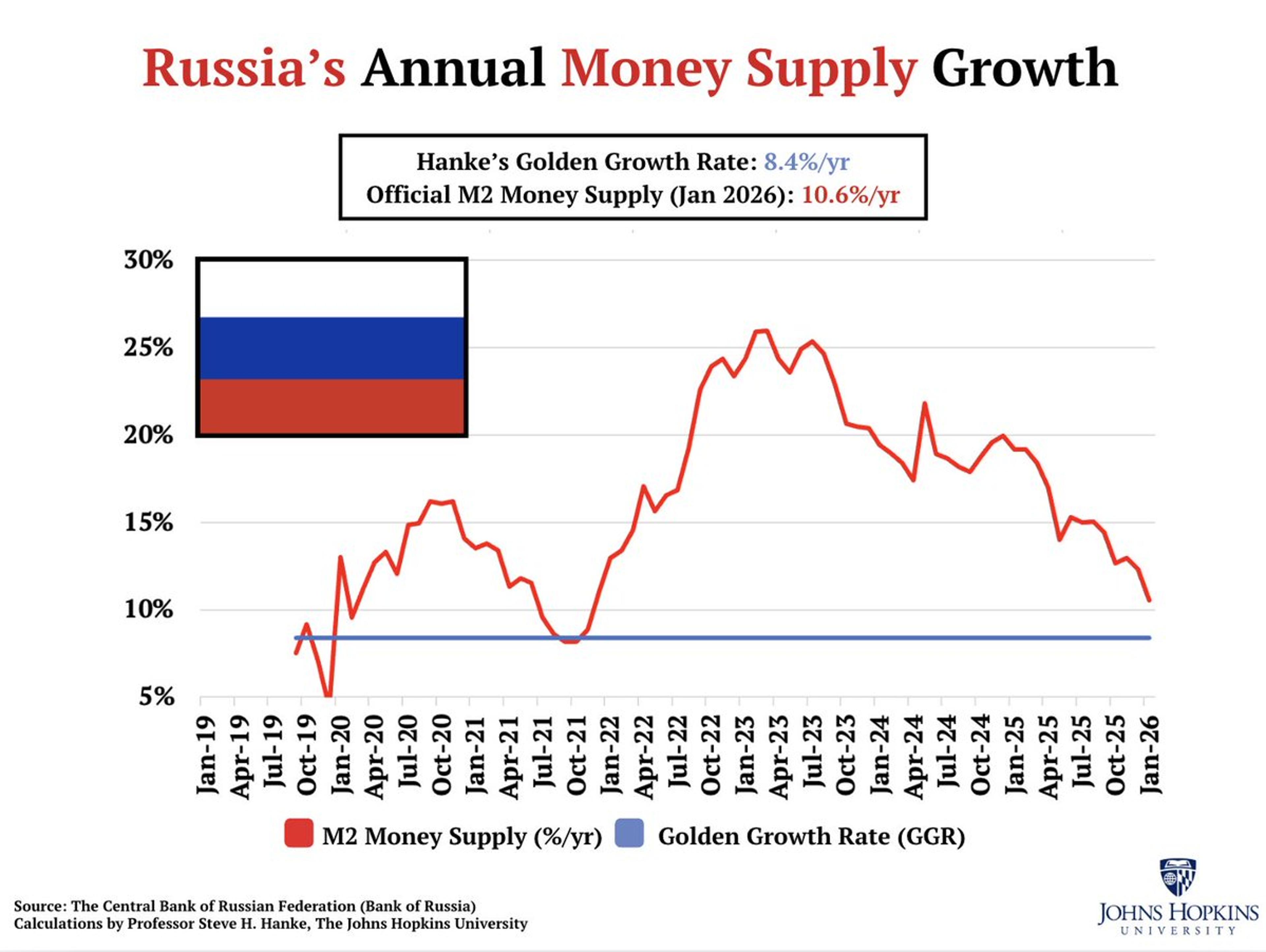

Russia's Inflation Spike Tied to Excess Money Supply

Russia’s inflation comes in at 6.0%/yr in January. That's ABOVE RU's 4%/yr target. RU's M2 money supply is growing at 10.6%/yr, ABOVE Hanke's Golden Growth Rate of 8.4%/yr, a rate consistent with hitting its inflation target of 4%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

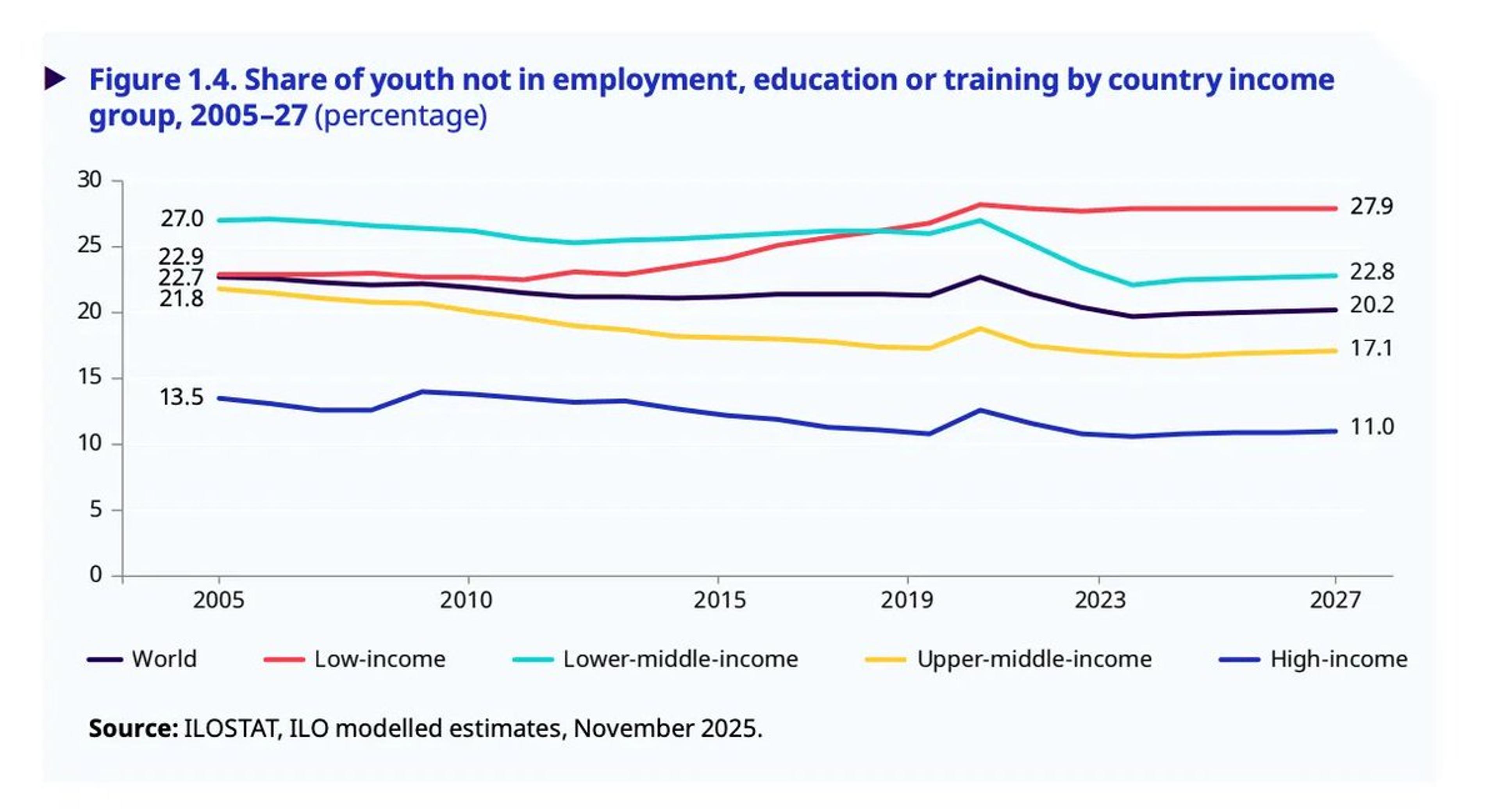

Poor Nations Double Youth Disengagement Compared to Rich Countries

How rich-country advantages compound. More than twice the share of young people in poor countries are not in employment, education or training. This and more insights in today's Chartbook Top Links. https://t.co/pokvStfn3w

By Adam Tooze

Social•Feb 14, 2026

US Ramps up Pressure, Threatens Chinese Oil Imports

Maximum Pressure 2: More max, more pressure, another round of threatening Chinese sanctioned oil imports. https://t.co/UNNBJOFLTx

By Rory Johnston

Social•Feb 14, 2026

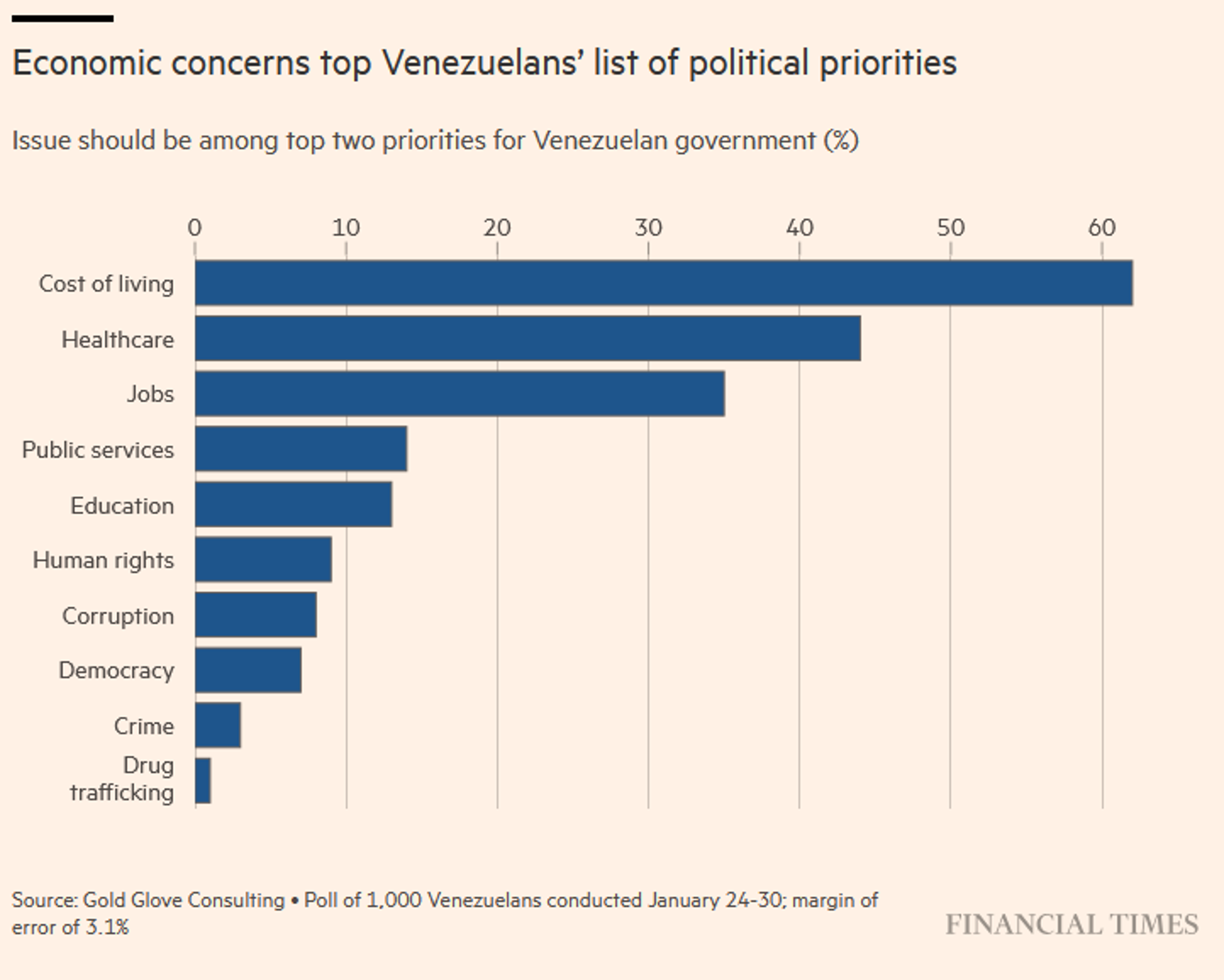

Venezuela Faces 651% Inflation, Cost of Living Crisis

The FT reports that the cost of living is Venezuelan's top concern. NO SURPISE. Today, I measure Venezuela’s inflation at a 651.5%/yr. Venezuela is the WORLD’S TOP INFLATOR. https://t.co/P4FBBSNdqk

By Steve Hanke

Social•Feb 14, 2026

USD Poised to Rise if Congress Regains Tariff Control

Wouldn’t that be something: $NVDA earnings 25th with SCOTUS decision on tariffs anytime after 20th… #IEEPA USD bullish in the short term if they hand back tariff control to Congress 🎰 $VIX

By Samantha LaDuc

Social•Feb 14, 2026

Cognitive Warfare Already Undermining Western Alliances and Institutions

Cognitive warfare isn’t coming—it’s here. Some Western political leaders are being used to weaken alliances, disrupt decision-making, and fragment institutions. Swipe to see the key predictions, and visit davidmurrin.co.uk for the full analysis. #Geopolitics #NationalSecurity #Russia #China #Strategy

By David Murrin

Social•Feb 14, 2026

Iran's Inflation Hits 81.5%, World's Second Highest

#IranWatch🇮🇷: Today, I measure Iran’s inflation at a PUNISHING 81.5%/yr. That's the world's SECOND HIGHEST INFLATION RATE. I remain the only reliable source of inflationary measures in Iran. https://t.co/HcSee4i4O2

By Steve Hanke

Social•Feb 14, 2026

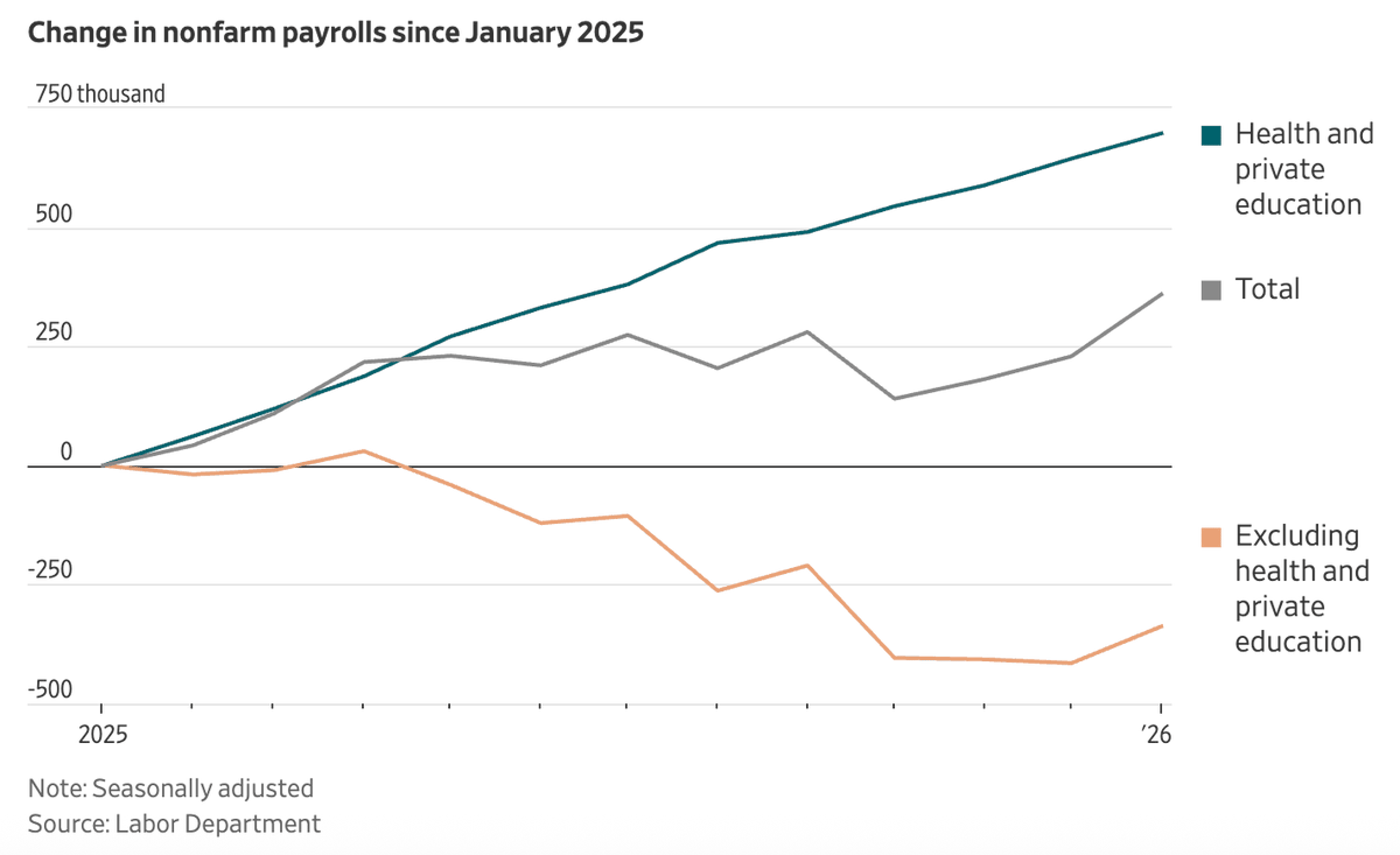

US Job Market Cooler than Washington’s Hype

Don't let first appearances fool you. The US job market is NOT as hot as the Spinmeisters in Washington DC crack it up to be. https://t.co/lKCBOl0rdi

By Steve Hanke

Social•Feb 14, 2026

Buy Manappuram on Pullbacks Amid RBI

Macro: PE flows target Indian NBFCs. RBI cleared Bain's up to 41.7% in Manappuram; ₹43.85bn injected. Risk: regulatory scrutiny. Trading insight: buy Manappuram on pullbacks. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

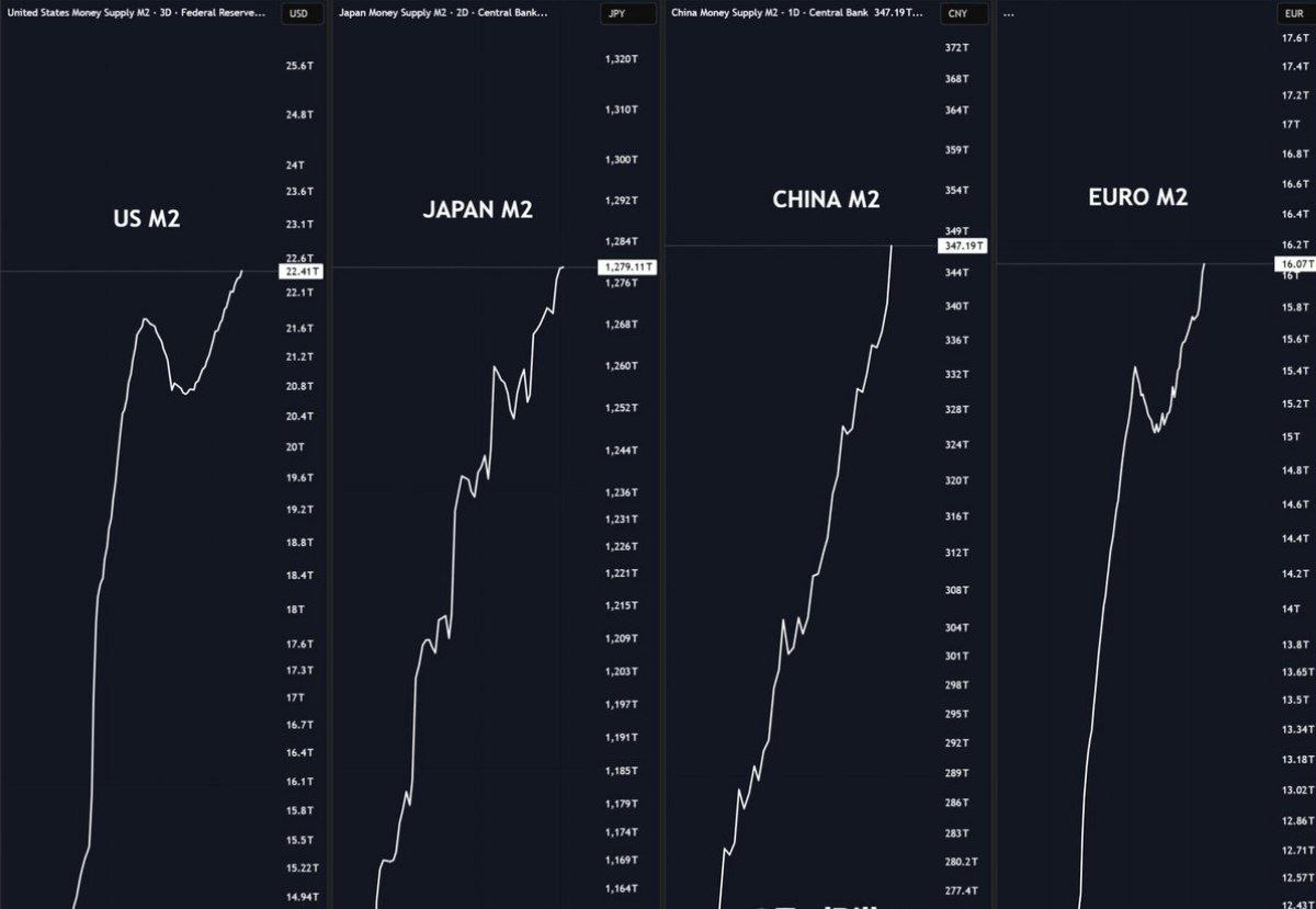

Global Money Supply Peaks, Crypto Braces for QT

US M2 is at ATH. Japan M2 is at ATH. EU M2 is at ATH. China M2 is at ATH. And the crypto market is acting like every major central bank is about to start QT. https://t.co/3tGwlu87Yb

By Crypto Jack

Social•Feb 14, 2026

EU Boosts Chinese Imports as Trump Tariffs Bite

During 2025, Chinese exports to the EU jumped by 6.3%. TRUMP'S TARIFFS = EU PIVOTS TOWARDS CHINA. https://t.co/tkz6F9xAsN

By Steve Hanke

Social•Feb 14, 2026

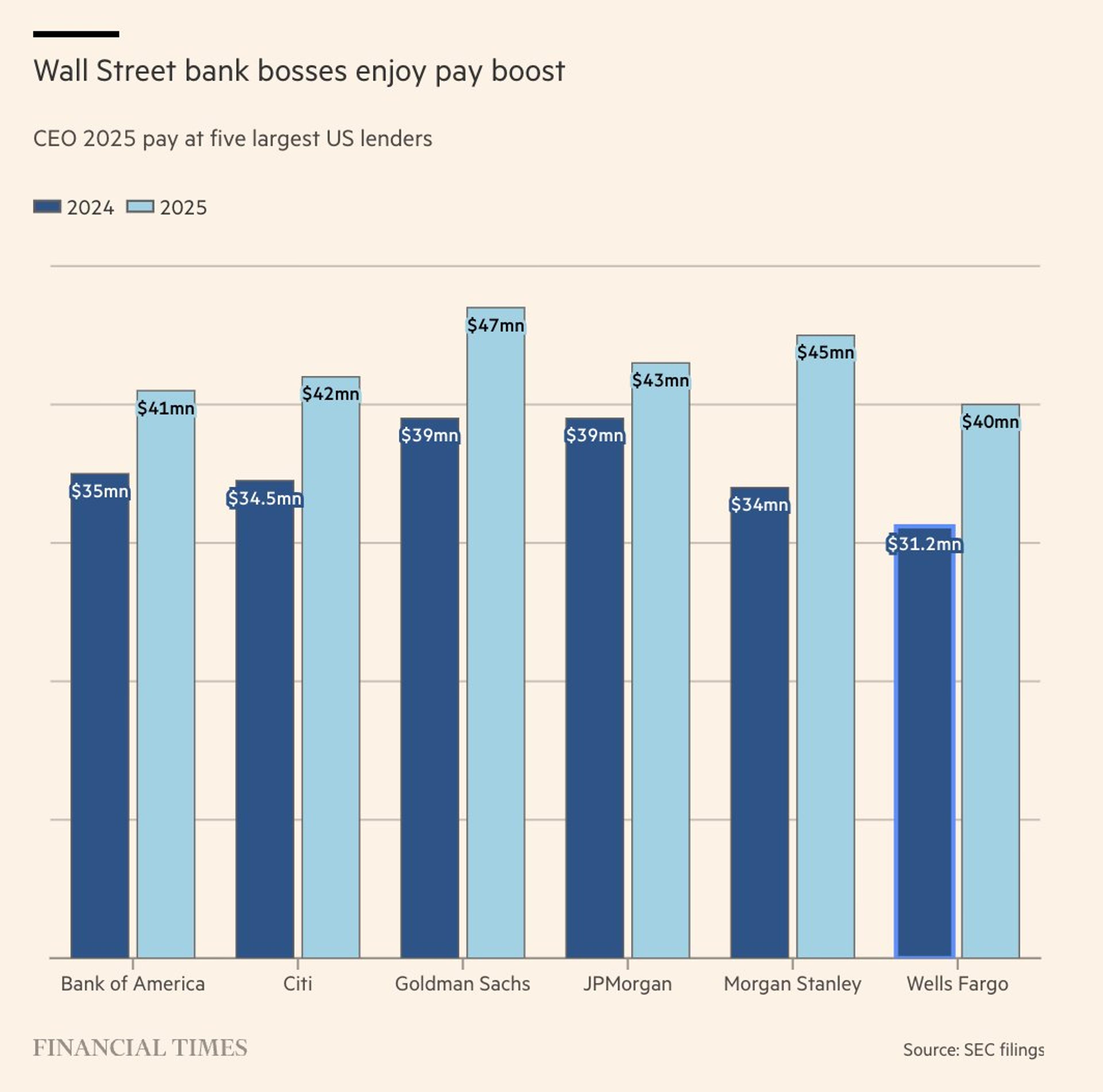

Bank CEOs Earn $41M, Dwarfed by Tech Wealth

"Six Wall Street bank chiefs bring in combined pay of $250mn in 2025" On the one hand this is shocking. On the other hand $41m each pa is a marker of quite how far banks have been eclipsed by private...

By Adam Tooze

Social•Feb 14, 2026

Venezuela Inflation Hits 651.5% Under U.S. Management

#VNZWatch🇻🇪: Under Uncle Sam's management, Venezuela's economy continues to CRUMBLE. Today, I measure Venezuela’s inflation at 651.5%/yr. I REMAIN THE ONLY SOURCE OF ACCURATE INFLATION MEASUREMENTS FOR VENEZUELA. https://t.co/MpUeEa9s1S

By Steve Hanke

Social•Feb 14, 2026

Nifty May Plunge to 19k Amid Global Macro Risks

The Nifty Can Crash to 19000 due to Global Macros - Prepare Now - Hindi ... https://t.co/gKdPPrx6C6 via @YouTube The video discussed the current market setup, IT sector view, which sectors are the weakest. Why we got here and where...

By Rohit Srivastava

Social•Feb 14, 2026

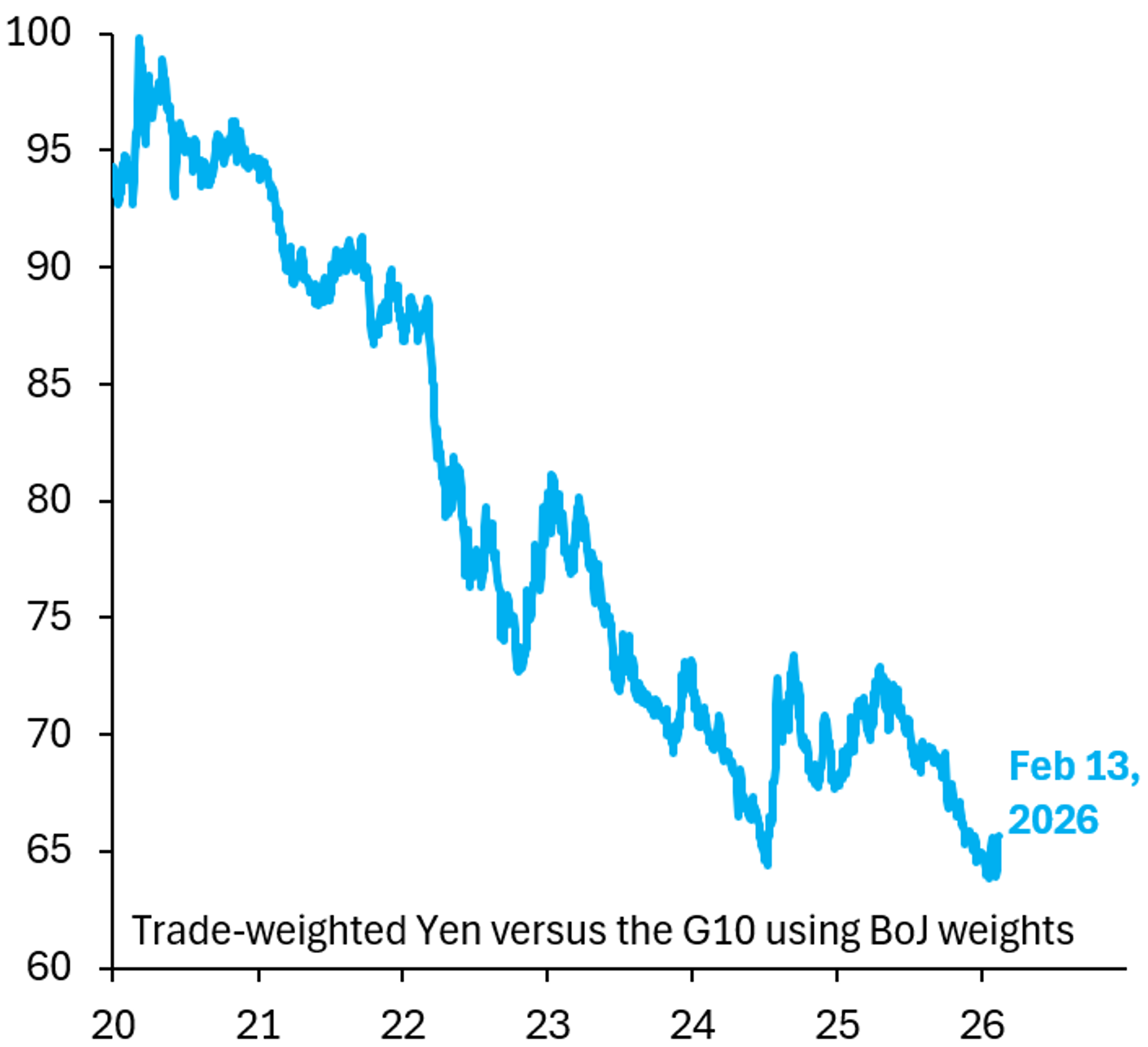

Yen Poised for New 2025 Lows Amid

The Yen will keep falling in trade weighted terms in 2025 and make new lows. Two reasons: (i) Japan remains in denial on the scale of its debt and what's needed to fix this; (ii) the Yen will be falling...

By Robin Brooks

Social•Feb 14, 2026

Global Data Week: FOMC Minutes to RBA Jobs

Buckle up! Its going to be a VERY Busy Data Week ahead👇 🇺🇸 US -FOMC Minutes -Q4 GDP -Empire State & Philly Fed 🇪🇺 EZ -IP -ZEW -PMIs 🇬🇧 UK -Jobs -Retail Sales -CPI -PMIs 🇯🇵 JP CPI & GDP 🇨🇦 CA -CPI -Retail Sales -Trade 🇳🇿 NZ -RBNZ -PSI -PPI 🇦🇺 AU -RBA MINUTES -JOBS -PMIS

By Kathy Lien

Social•Feb 14, 2026

Modi Leveraged Trump Tariff Threat to Advance Free Trade

My take on PM Modi's clever move to reduce India's punishing tariffs and non-tariff barriers: "Modi used the tariff threat from Trump as cover to push for free trade between India and other countries." MODI = SMARTER THAN YOU THINK. https://t.co/aTUbO8em04

By Steve Hanke