Social•Feb 13, 2026

China Backs Struggling Cuba Amid Looming US Showdown

As Cuba teeters on the brink of economic disaster, China promises continued support. It looks like a SHOWDOWN between the US & China might be in the cards. https://t.co/rb7Qf0CdN2

By Steve Hanke

Social•Feb 13, 2026

Prometheus Macro Impresses; Aahan Delivers Real Quant Success

This is extremely impressive. Congrats to @prometheusmacro and the clients who are using its models If you are looking for Quant Macro That Actually Works, Aahan is your guy

By Jack Farley

Social•Feb 13, 2026

AI’s Growth Hinges on How Hard New Ideas Become to Discover

How much economic growth will get from AI? This is massively speculative. However, in a new piece today @ngoldschlag and myself make the case we can learn something about this from an academic economics debate about whether "ideas are getting...

By Adam Ozimek

Social•Feb 13, 2026

Labor Holds, Inflation Cools, Yen Soars Amid Crosscurrents

Resilient labor. Cooling inflation. Duration rallying. Yen surging. 130K jobs. CPI at 2.4%. 10Y yields sliding. Dollar down on the week. This isn’t a clean cycle — it’s macro crosscurrents. Full breakdown: https://t.co/vNAZw80IbE

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Assume BRICS' USD‑bypass Plans Are Real; Doubt USD Stability

Remember, every utterance from BRICS & Global South regarding potential new system to bypass USD is to be treated as if already operational & making material difference. And every piece of evidence that USD system isnt going anywhere is to be...

By Brent Johnson

Social•Feb 13, 2026

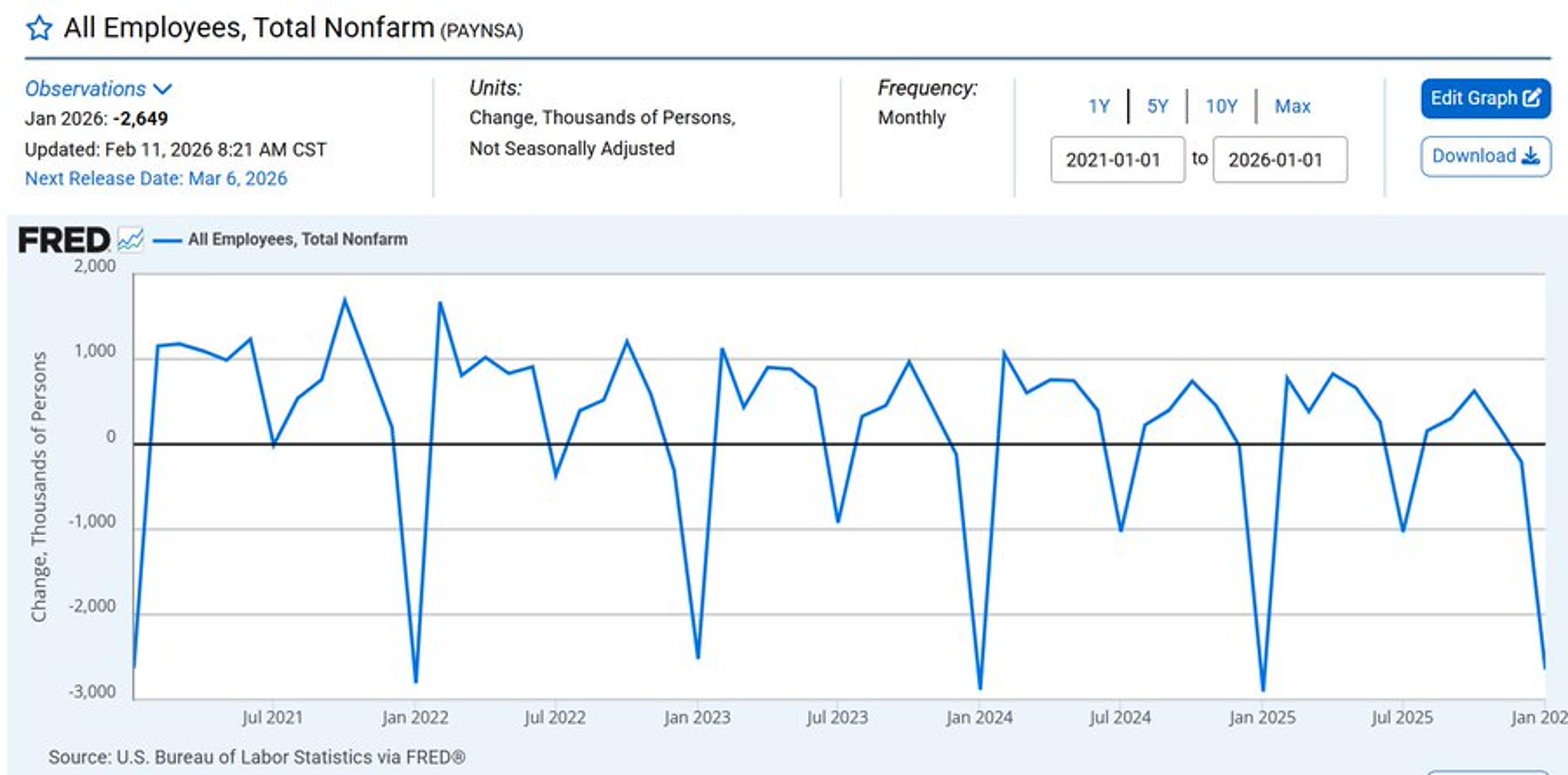

Last Year's Job Growth Fell Below a Single Biden Month

“.. we had less job growth all of last year than we had in an average month during the Biden administration.”

By Carl Quintanilla

Social•Feb 13, 2026

Americans Foot ~90% of Trump Tariff Costs

The New York Fed announced that US businesses and consumers paid NEARLY 90% of the cost of Donald Trump’s tariffs last year. TARIFFS = A SALES TAX ON AMERICANS. https://t.co/xEEfGxreUm

By Steve Hanke

Social•Feb 13, 2026

Bitcoin Beats Gold, Outperforms by 5% in Hours

Gold is "no longer actual gold," Bloomberg ETF analyst Eric Balchunas says. "Bitcoin outperformed gold by 5% in the first three hours of trading on Friday, Feb 13th" 😂

By Eric Balchunas

Social•Feb 13, 2026

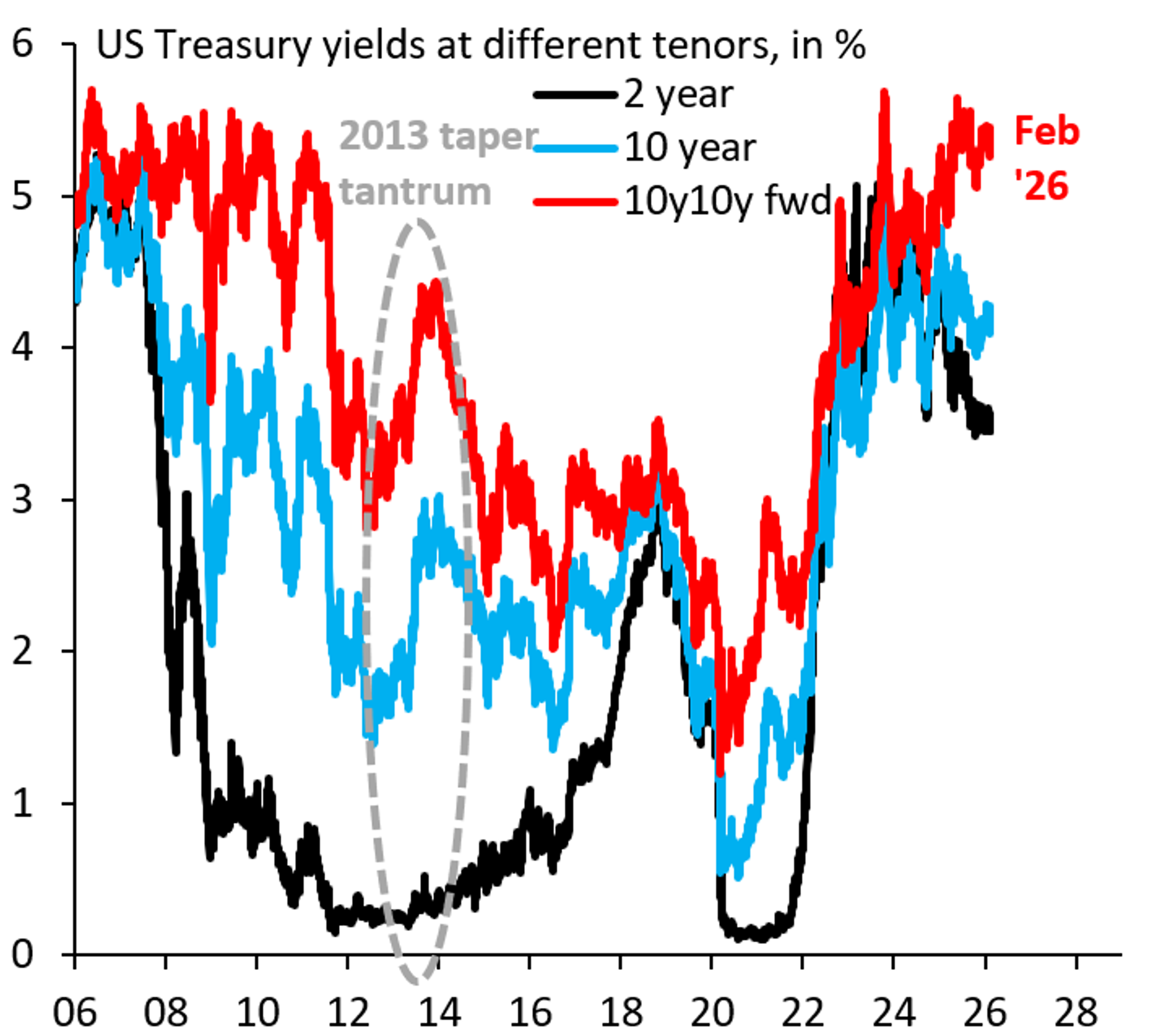

AI-Driven Low Rates Boost Term Premium Compression, Hedge Long Bonds

A very positive setup for duration and UST term premium compression if rates are to stay low for a longer timeframe because of AI disruption. It will take time to play out but long end is well priced and...

By Ed Bradford

Social•Feb 13, 2026

Market Prices Accelerating Fed Rate Cuts Through 2026

Notably, market-implied FOMC cuts through 2026 have been increasing. Through February, Fed Fund futures have priced in another -14bps of cuts for the year - and now the most dovish outlook after CPI since Dec 3rd: https://t.co/NZF2YksrWV

By John Kicklighter

Social•Feb 13, 2026

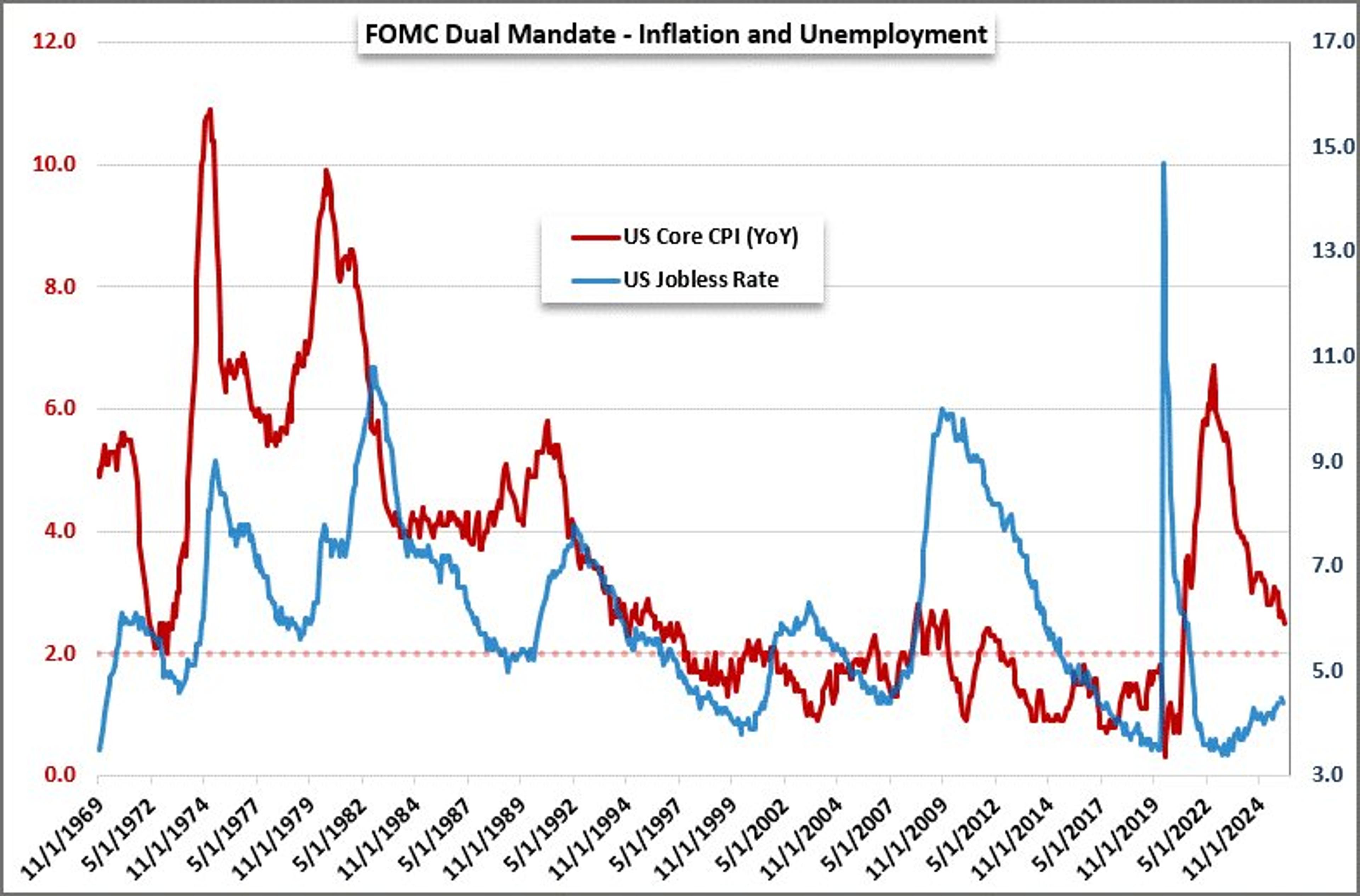

CPI Cools to 2.4%, Fed Eyes Jobs as Unemployment Falls

US #CPI inflation figures came in line with expectations of a pace cooling. Headline dropped from 2.7% to 2.4% while core eased 2.6% to 2.5%. This does shift priority towards employment in the Fed's dual mandate but the jobless rate...

By John Kicklighter

Social•Feb 13, 2026

AI‑driven Spending Masked Recession; Recovery Now Emerging

With this week's jobs revisions, my framework of a main street recession happening last spring that was papered over by large AI capex and top percentile income earners spending like mad makes more sense. And now IMO we're coming out the...

By Felix Jauvin

Social•Feb 13, 2026

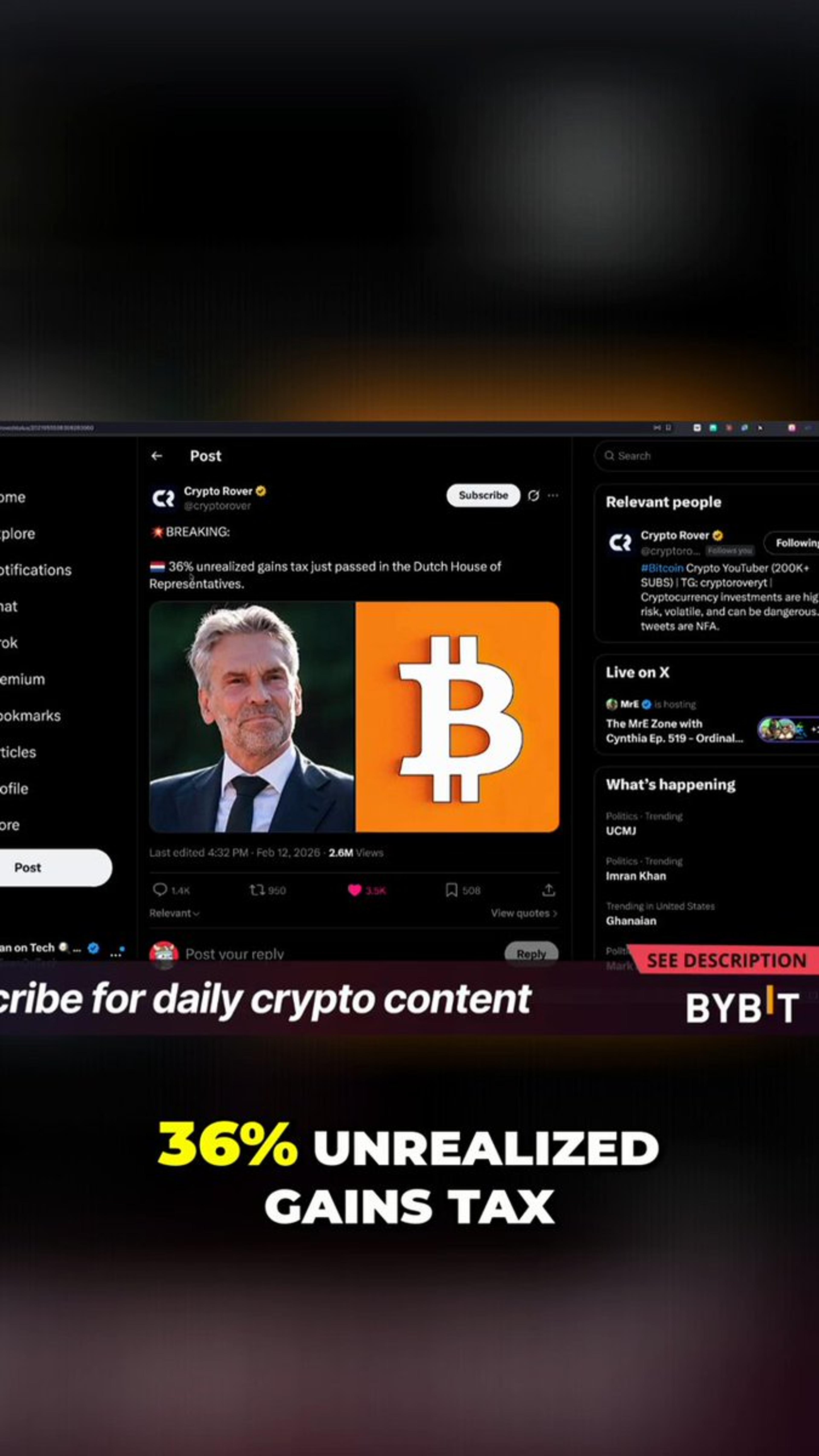

Netherlands' 36% Unrealized Gains Tax Slashes Decade‑Long Wealth Growth

A new 36% unrealized gains tax passed in the Netherlands. This means assets that have increased in value are now taxed, even if not sold. See the devastating impact on wealth growth over 10 years. #CryptoTax #Netherlands #IvanClips https://t.co/OMzGMofQhw

By Ivan on Tech

Social•Feb 13, 2026

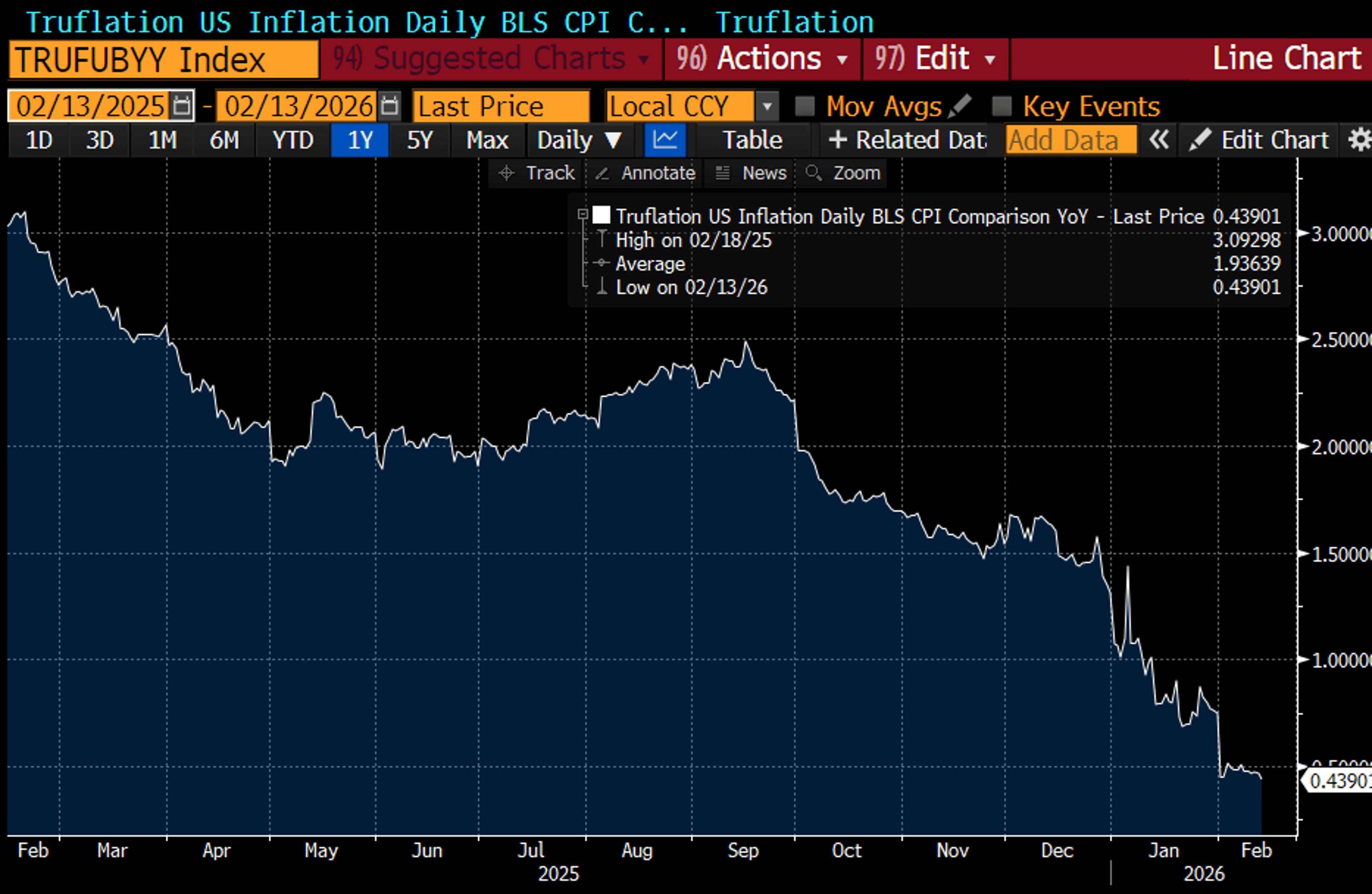

CPI Cool, but Data Gaps Mask True Inflation

The CPI data came in cooler than expected, which is always welcome. The headline is obscuring some of the underlying inflation due to the loss in data associated with the government shutdown. The overall index posted its coolest reading since...

By Diane Swonk

Social•Feb 13, 2026

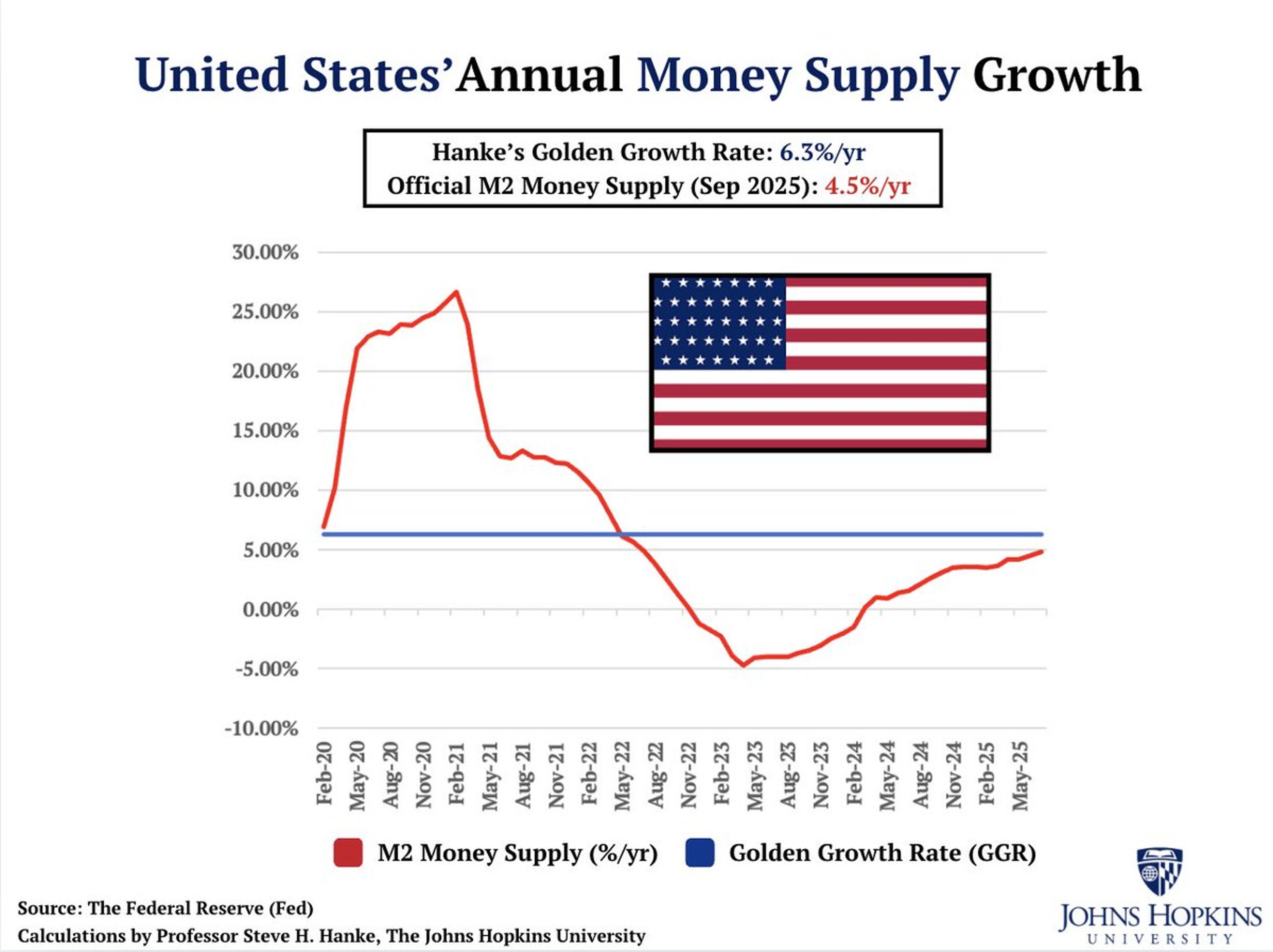

Inflation Stays Low as Money Supply Grows Below Golden Rate

US's CPI inflation rate comes in at 2.4%/yr in January. The US money supply (M2) has been growing BELOW Hanke's Golden Growth Rate of ~6.3%/yr, a rate consistent with hitting the Fed's 2%/yr inflation target, since April 2022. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 13, 2026

S&P Erases Almost All 2026 Gains Amid AI Hype

Forget Trump's AI HYPE. The S&P Index has now given up nearly all its 2026 gains. https://t.co/GAL0TbU7KG

By Steve Hanke

Social•Feb 13, 2026

Data Hints at First Post‑WWII US Soft Landing

After this week's employment & inflation data it is starting to look like the elusive soft landing may finally happen. Would be the first indisputable US post-WW II soft landing. We've had false hopes before dashed by the underlying economic dynamics &...

By Jason Furman

Social•Feb 13, 2026

Bloomberg's Russia Dollar Rumor Likely Misleading, Says Hanke

Yesterday, Bloomberg reported that Russia is considering a re-entry into the US dollar system. Bloomberg's report created quite a stir. RELAX, HANKE'S 95% RULE = 95% OF WHAT YOU READ IN THE PRESS IS EITHER WRONG OR IRRELEVANT. https://t.co/8E7OK7Zm1t

By Steve Hanke

Social•Feb 13, 2026

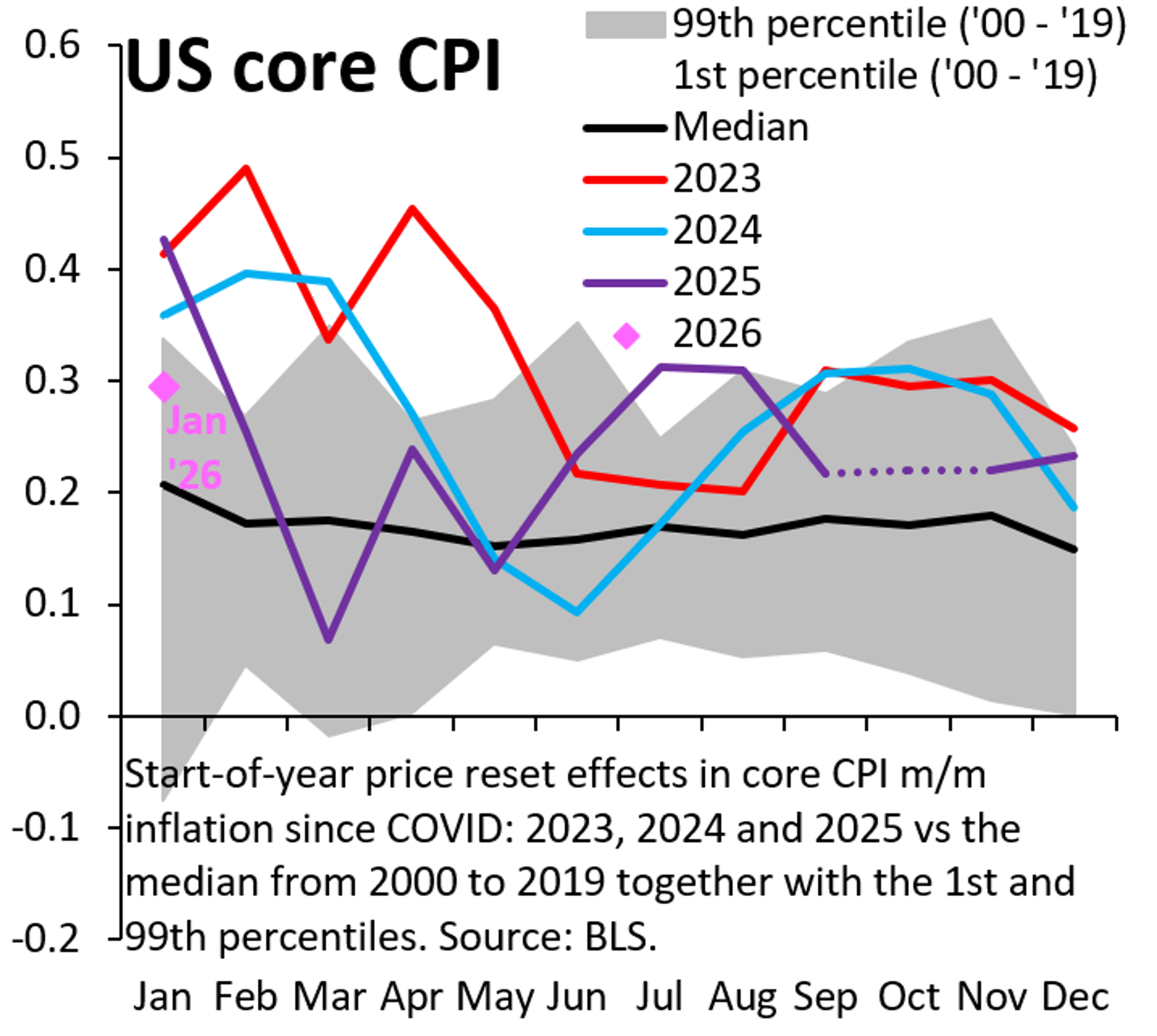

January 2026 Defies Post‑COVID Seasonal Inflation Surge

Ever since COVID, the start of the year has seen hot inflation prints, because residual seasonality pushed up inflation in the first quarter. That isn't the case in Jan. '26 and I think that holds a warning for those forecasting...

By Robin Brooks

Social•Feb 13, 2026

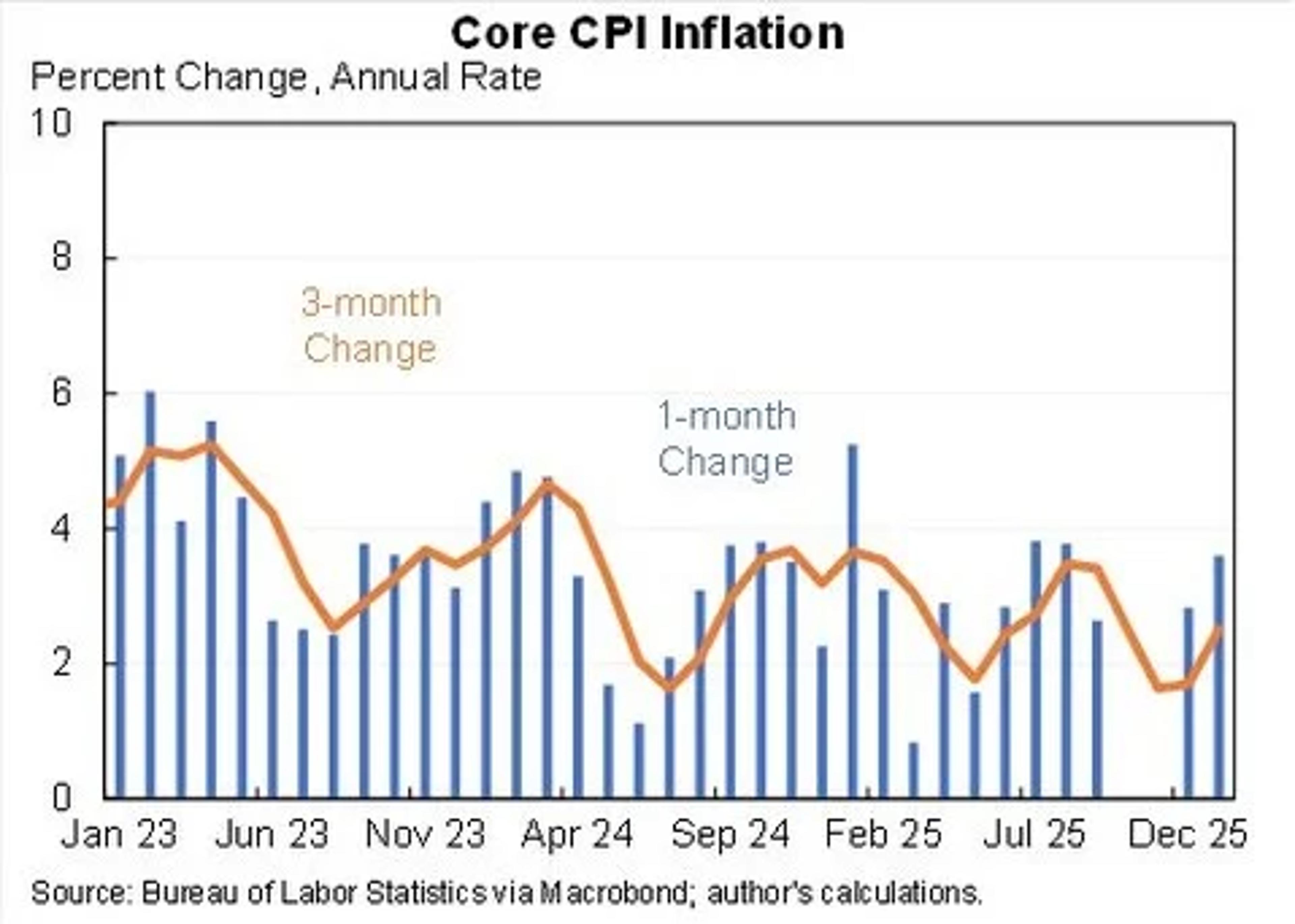

Core CPI Inflation Rose During the Month of January. But It Fell and Was Relatively Muted over Longer Periods of...

Core CPI inflation rose during the month of January. But it fell and was relatively muted over longer periods of time--although still some concern the numbers a bit lower due to shutdown-related quirks. Annual rates: 1 month: 3.3% 6 months: 2.5% 12 months: 2.5%

By Jason Furman

Social•Feb 13, 2026

Tariffs Drove Inflation; Rate Now Irrelevant, CPI Lagging

The scary part is tariffs HAVE increased inflation. The lagging and imputed portions of CPI are the only remaining sources of inflation. We may get a hit from oil some day, but inflation RATE is no longer the problem. And...

By Michael Green

Social•Feb 13, 2026

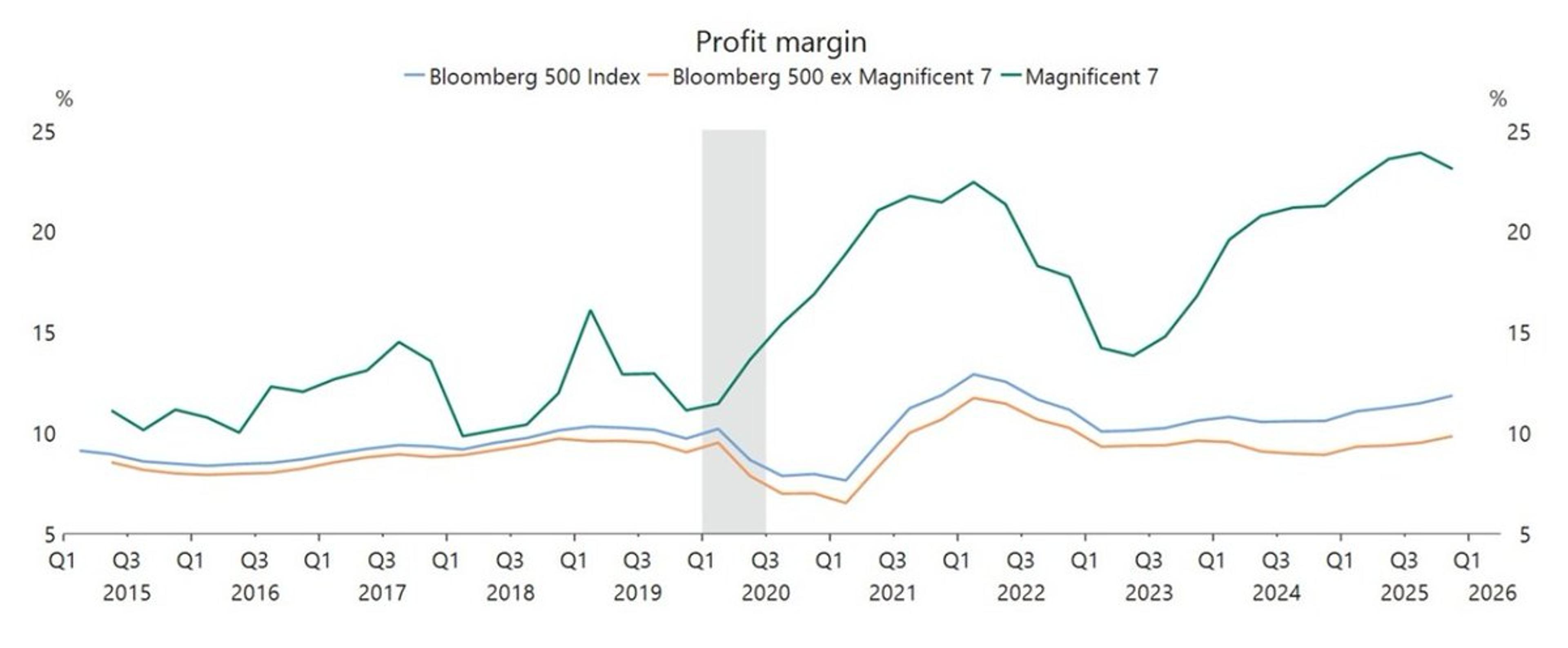

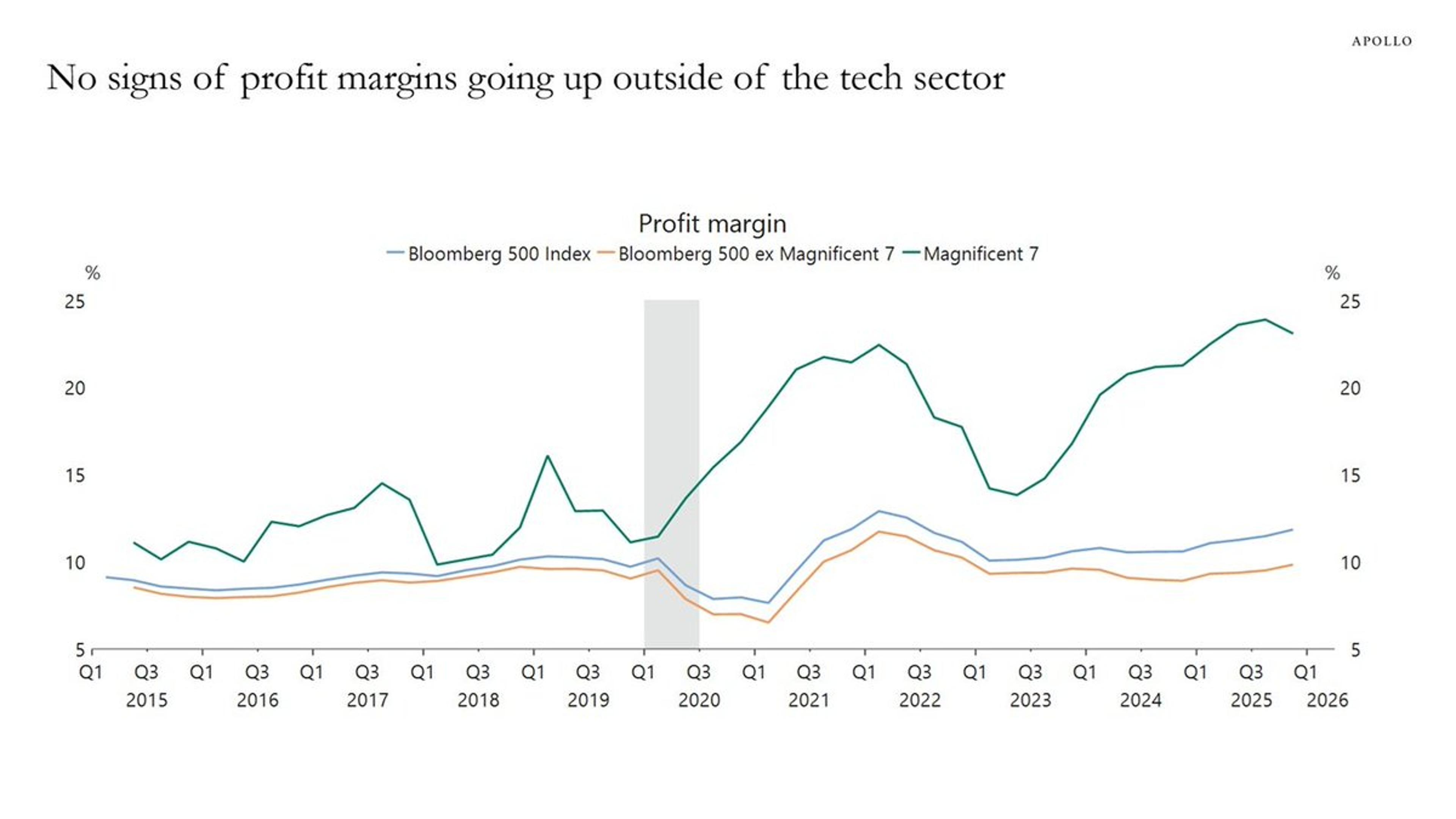

AI Hype Isn’t Boosting Profit Margins Across the Economy

If AI were living up to its hype, it would be benefiting the ENTIRE ECONOMY. IT ISN'T. Profit margins outside the tech sector would be growing. THEY'RE NOT. https://t.co/GXT1r783t0

By Steve Hanke

Social•Feb 13, 2026

Inflation Still Stubborn: CPI 2.8%, Core 3.2%

FWIW, since the first "clean" CPI in November (post shutdown), headline CPI inflation is 2.8% annualized and core is 3.2% annualized. Neither suggests much stepdown yet in underlying inflation.

By Greg Ip

Social•Feb 13, 2026

Inflation Misses Again; Labor Market Holds Real Power

🚨 Inflation just missed expectations. Again - Dollar dumping - Gold buying the dip - Stocks pumping on rate cut hopes ⚠️ But don't get comfortable - the labor market is the real story https://t.co/hpBwuiWtK4

By Kathy Lien

Social•Feb 13, 2026

Political Gridlock Stalls $22B US EV Investment

"Last year companies canceled $22 billion in planned investments in electric vehicle manufacturing, batteries or critical minerals in the United States...." Political sustainability limits industrial policy efficacy. https://t.co/RROrBFwACq

By Adam Ozimek

Social•Feb 13, 2026

No Evidence BLS Data Manipulation; Accusations Hinder Discourse

There is ZERO evidence that the Bureau of Labor Statistics is manipulating the data, not the CPI, not payrolls earlier this week. I am not being naive and people are watching carefully for signs of tampering. Such accusations now are harmful...

By Claudia Sahm

Social•Feb 13, 2026

AI Spending Lifts some Assets, Hurts Major Stock Valuations

The AI capex boom is absolutely stimulative to *certain* assets in the ecosystem and supply chain, but that won't be Mag7 stock prices from here. Revenue growth is slowing, input prices rising and you can connect the dots on what...

By Quinn Thompson

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen

Social•Feb 13, 2026

Soft US Inflation Sparks Dollar Slide, Yield Drop, Gold Rise

📉 Softer US Inflation - Markets React 🔻 Softer US inflation numbers 🔻 USD tumbling 🔻 10-year yield falling ⬆️ Gold rising ⬆️ Stocks rallying 📊 CPI Breakdown: • MoM: 0.2% actual vs 0.3% forecast • YoY: 2.5% actual vs 2.5% forecast (2.7% previous)

By Kathy Lien

Social•Feb 13, 2026

January Spike: Core CPI Gains Outpace Typical Inflation

JANUARY EFFECT, or “Why this inflation report matters more than others” Since the start of 2022, core CPI has risen 0.45% month-on-month in January, versus an average of 0.33% for all months.

By Luke Kawa

Social•Feb 13, 2026

Trump Backs Off as Treasury Market Wobbles, Risk Premium Spikes

One constant in the Trump administration is that - when the Treasury market wobbles - it backs down. That happened on China in Apr. '25 and again on Greenland recently. 10y10y forward yield remains near its highs, even as 10y...

By Robin Brooks

Social•Feb 13, 2026

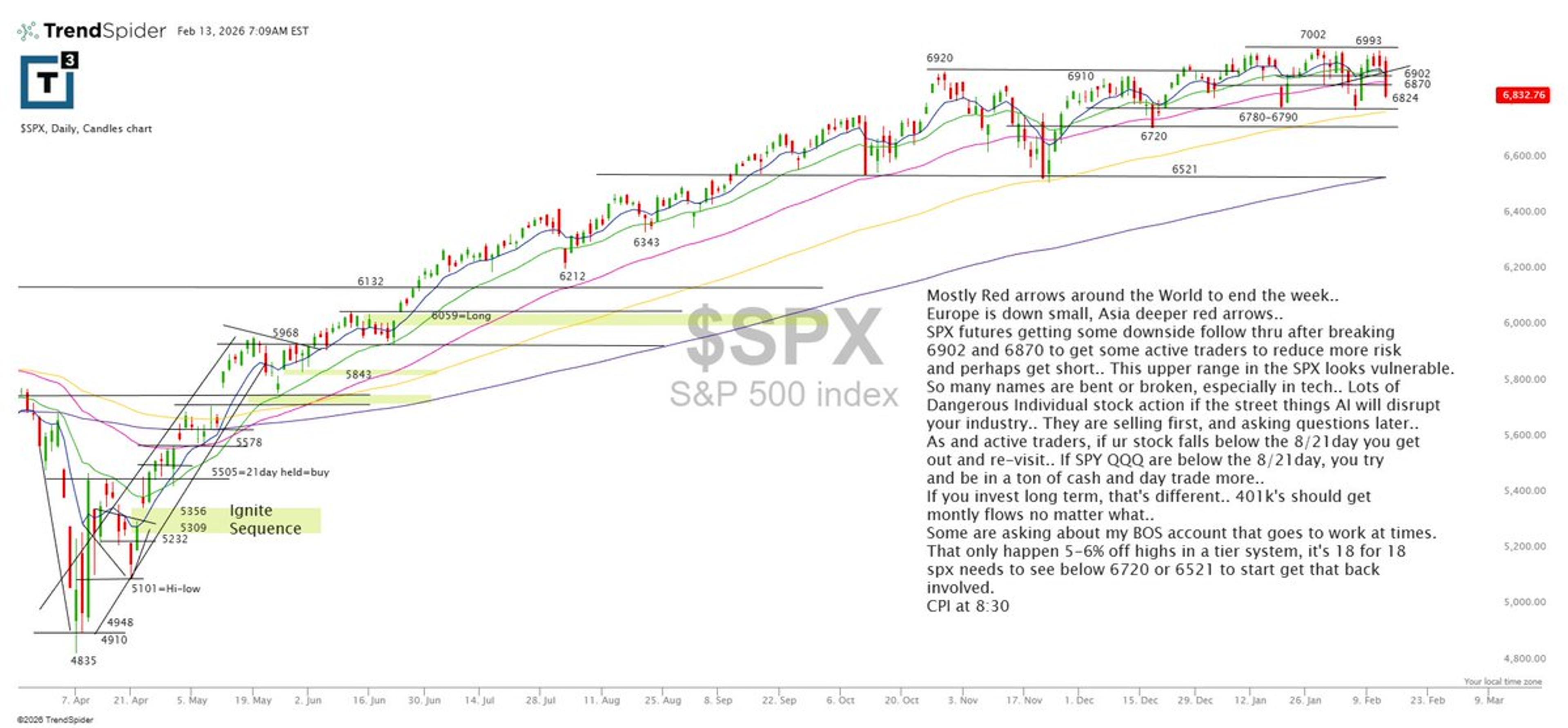

SPX Futures Slip, Risk‑Off Bias Ahead

$SPX futures slipping after losing 6902/6870 as traders cut risk and lean short. Upper range looks vulnerable, especially in tech with lots of names bent or broken. If SPY/QQQ lose the 8/21-day, expect more cash + day trading. CPI at...

By Scott Redler

Social•Feb 13, 2026

NATO Remains Vital Amid Transatlantic Trust Crisis

for all the criticism and hand wringing, nato continues to serve a useful role for all members and nobody is trying to leave it or replace it. there’s a crisis of trust in the transatlantic relationship. but not an existential...

By Ian Bremmer

Social•Feb 13, 2026

OPEC+ Faces March 1 Decision on Production Hikes

OIL MARKET: The core group of OPEC+ countries need to decide on March 1 whether to re-start production increases after the Jan-Mar pause. Some members in the group see scope for resuming the monthly hikes, although conversations haven't started yet....

By Javier Blas

Social•Feb 13, 2026

ETFs Rake $250B in 28 Days, EM Overtakes Gold

There's only been 28 trading days this year and ETFs have already pulled in about $250b. More than double any other start to a year. Up until 2020, $250b was what they averaged for a YEAR. That's $9b/day pace, or...

By Eric Balchunas

Social•Feb 13, 2026

Labor Market Stabilizing: Health Care Leads, Construction Rebounds

Yes, most of the jobs last month (and the previous 18 months) have come from health care/social assistance. But if things were so bad would there be 32k in construction? Or 5k added in manufacturing? The labor market isn't great by...

By Ryan Detrick

Social•Feb 13, 2026

US Loses Cheap‑borrower Advantage, Now Pays Debt Premium

The US exorbitant privilege - the ability to issue debt more cheaply than others - ended about a decade ago. We're now issuing debt at a premium, the result of deficits and debt that are out of control. This change...

By Robin Brooks

Social•Feb 13, 2026

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 13, 2026

Dollar Holds Steady Pre‑CPI as China Signals Treasury De‑risking

The Dollar is Firm Ahead of January CPI: The US dollar is firm against the G10 currencies ahead of the US January CPI. The week began with news that Chinese officials were encouraging de-risking from US Treasuries. Helped by stronger...

By Marc Chandler

Social•Feb 13, 2026

Trump Admin Eyes Tariff Cuts, Citing Price Hikes, Complexity

BOMBSHELL @FT scoop: Trump admin mulls cutting steel/aluminum tariffs bc these taxes 1) raise US prices; 2) are insanely complicated; 3) had other unintented consequences (incl lobbying). They're admitting, in other words, that gravity exists. Good. https://t.co/o4RkfMWxlF

By Scott Lincicome

Social•Feb 13, 2026

CPI Dip on Friday the 13th Sparks Inflation Uncertainty

CPI falling on Friday the 13th is the ultimate "Freaky Friday" energy. 👻 Is inflation actually cooling to 2.5%, or is the ghost of 2022 about to jump out of the data? I’m navigating the madness and trading the US CPI release...

By Boris Schlossberg

Social•Feb 13, 2026

USD Firms Ahead of CPI as Euro/GBP Options Expire

$USD enjoys a firmer tone ahead of the US CPI. Over 5 bln euro options at $1.1850 expire today. Session low so far is slightly below there. GBP530 mln options at $1.36 expire today. Session low so...

By Marc Chandler

Social•Feb 13, 2026

January Job Loss Smaller, Yields 130k Seasonal Gain

Great question. Drop in hiring happens every January. On a non-seasonally adjusted basis (left), we lost 2.6 million jobs in January 2026, but that was a smaller loss than a typical January ... so we got a good print seasonally adjusted...

By Claudia Sahm

Social•Feb 13, 2026

Trump’s $12 B Rare‑Earth Stockpile: Mere Band‑Aid

The Trump administration has announced a plan to create a $12 billion stockpile of rare earths. The goal is to create a buffer against any supply disruptions, but this is just a band-aid. Full Newsletter: https://t.co/daeIxnpldt #rareearths #trump #projectvault https://t.co/p6icljXtjO

By Peter Zeihan

Social•Feb 13, 2026

Cathie Wood: Bitcoin Hedges Both Inflation and AI‑driven Deflation

🚨 UPDATE Cathie Wood just said that Bitcoin is a hedge against both inflation and the deflation that could come from the productivity shock of AI! https://t.co/LBcroO4Hst

By That Martini Guy

Social•Feb 13, 2026

ECB Staff Push for Tighter Oversight and Regulation

ECB staff comes up with the revolutionary idea of adding even more oversight and regulation

By Brent Johnson

Social•Feb 13, 2026

AI Layoffs Risk Turning Companies Into Stranded Assets

Something worth remembering if you're trying to value the stock market right now: 👇 A corporation can only profit from human labor displacement once. If by engaging in that single cost saving to beef up your bottom line you inadvertently destroy...

By Izabella Kaminska

Social•Feb 13, 2026

Three Consecutive CPI Misses Signal Rate‑Cut Surge

Last CPI missed expectations 3 months in a row. If it happens again today, rate cut bets explode and the dollar dumps. I'm trading it LIVE at 8AM ET. Don't watch from the sidelines 👇 https://t.co/gAw05zLlQ8

By Boris Schlossberg

Social•Feb 13, 2026

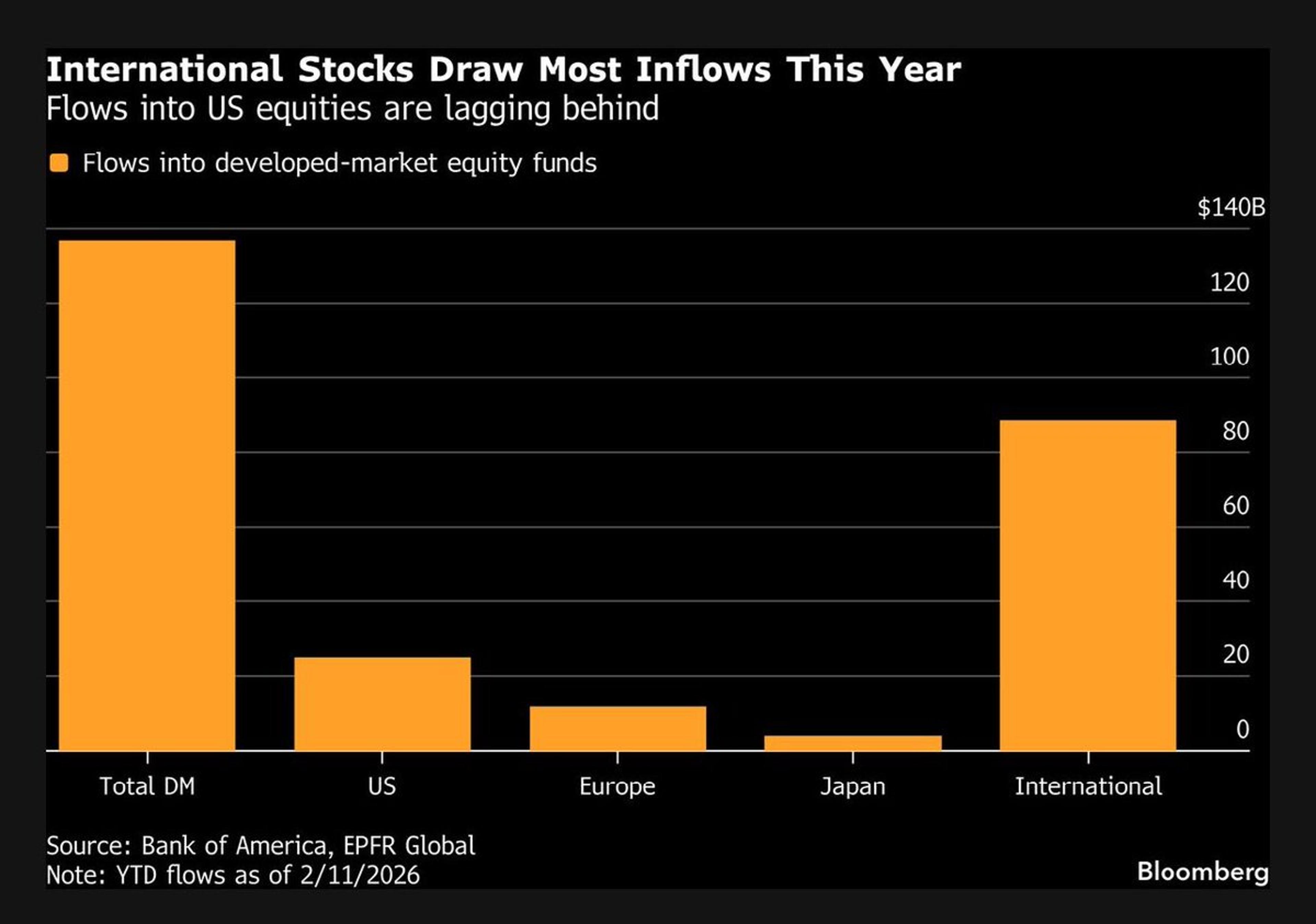

Global Fund Flows Outpace US, Shifting Investment Balance

US exceptionalism is turning into global rebalancing: BofA’s Michael Hartnett. Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that’s flowed into US funds: BofA citing EPFR Global. https://t.co/ah9arXM6u9...

By Lisa Abramowicz

Social•Feb 13, 2026

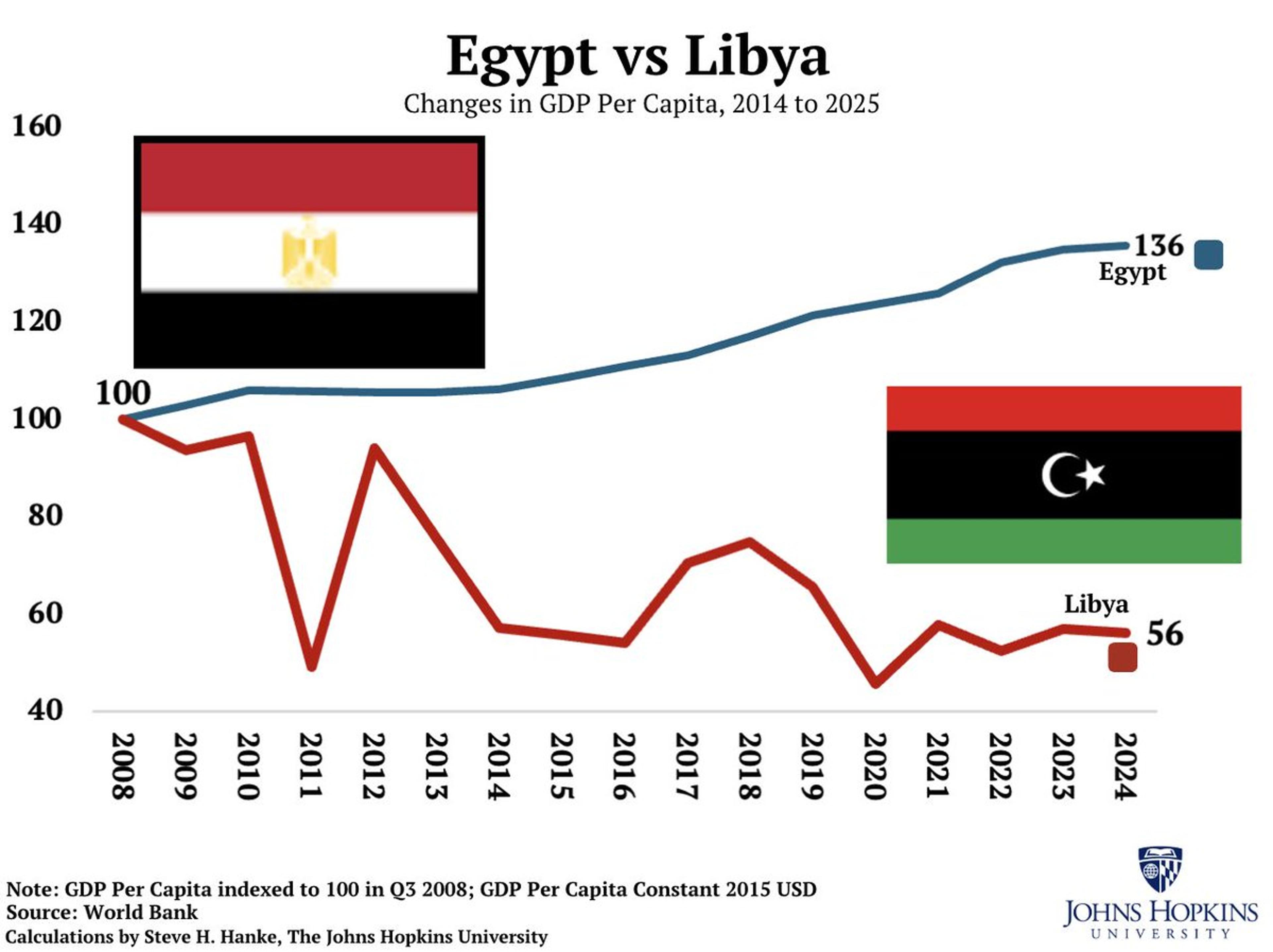

Libya's Economy Lags Egypt After 2011 US Intervention

#LibyaWatch🇱🇾: Libya’s economy is NOWHERE CLOSE to its neighbor Egypt. Thanks to the US-led regime change operation in 2011, Libya is IN THE TANK. https://t.co/mnlulHdvko

By Steve Hanke