Social•Feb 13, 2026

Singapore's Car Taxes Outpace Fiji's Entire GDP

Singapore is one of the world's biggest oil-trading hubs. It also LOVES to tax cars. https://www.bloomberg.com/news/articles/2026-02-13/singapore-s-car-tax-revenue-now-so-high-it-exceeds-fiji-s-gdp

By Akshat Rathi

Social•Feb 13, 2026

Russia's Dollar Return Threatens Metals Rally

🚨 THIS COULD BE A GAME CHANGER FOR METALS AND RISK ASSETS Big news emerged yesterday: Russia is seriously considering returning to dollar-based settlements as part of a broader economic partnership with President Trump. For the past 3–4 years, Russia has been...

By That Martini Guy

Social•Feb 13, 2026

US Firms and Consumers Shoulder Most 2025 Tariff Burden

1/5 The New York Fed finds that "U.S. firms and consumers continue to bear the bulk of the economic burden of the high tariffs imposed in 2025." https://t.co/X3Xz2tRn1j

By Michael Pettis

Social•Feb 13, 2026

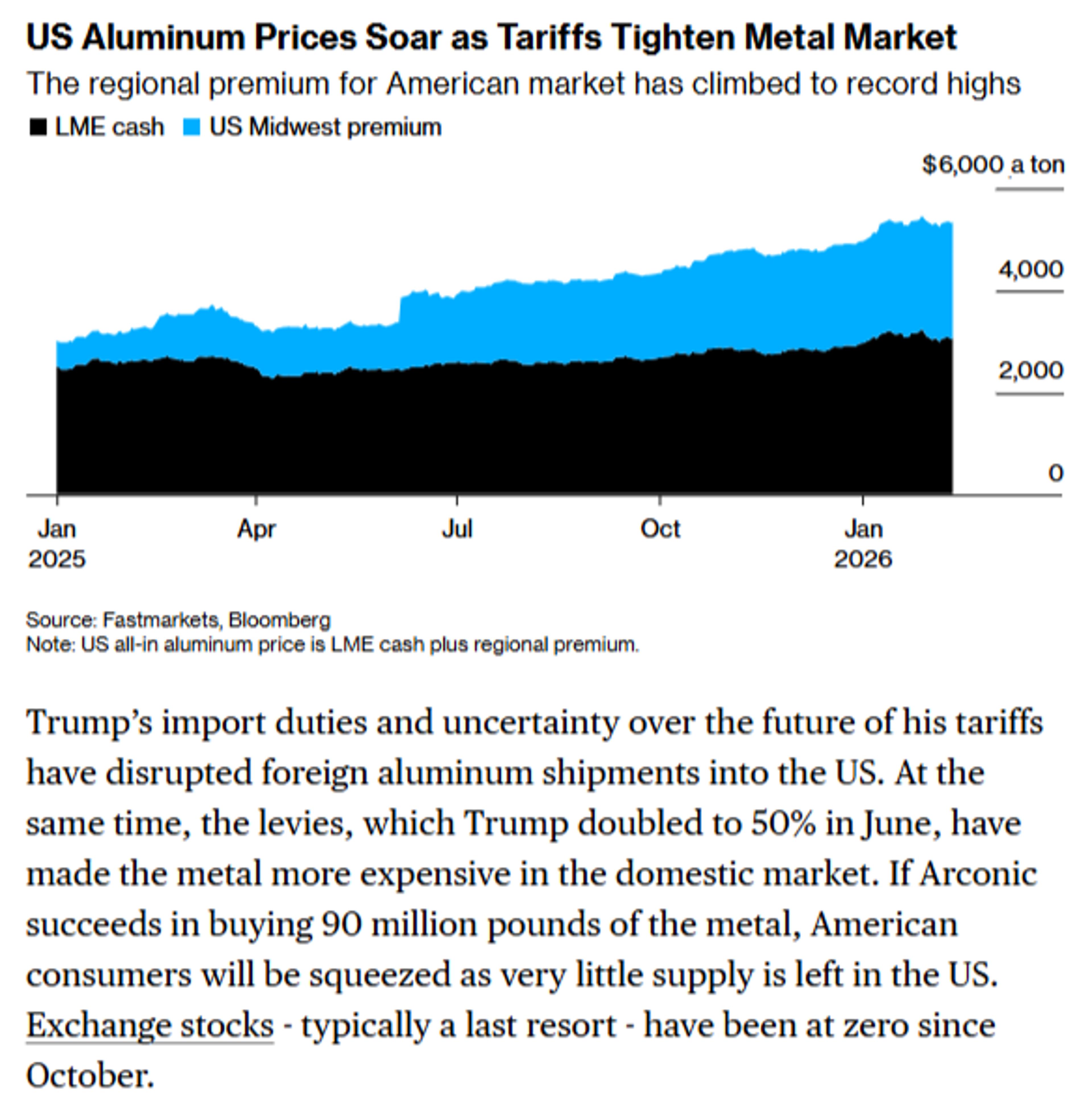

Trump Narrows Confusing Steel, Aluminum Tariffs Ahead of US‑EU Deal

The Trump administration is working to narrow its broad tariffs on steel and aluminum products that companies find difficult to calculate and the EU wants reined in as part of its pending trade deal with the US https://t.co/638iBN7IU0 via @jendeben...

By Zöe Schneeweiss

Social•Feb 13, 2026

Distinguish Inefficiency From Global Uncompetitiveness in EU Manufacturing

1/7 My latest piece was written for friends who are EU policymakers or advisors. In it I argue that there is a difference between an inefficient manufacturing sector and a globally uncompetitive manufacturing sector. We shouldn't conflate the two. https://t.co/qer7BAvgnc

By Michael Pettis

Social•Feb 13, 2026

Poland's Per‑capita GDP Eclipses Germany, Fueling Assertiveness

Poland’s GDP per capita OUTPACES Germany’s by a country mile. This growth gap is why Poland is flexing its muscles and pushing Germany around. https://t.co/78SQLlNP3o

By Steve Hanke

Social•Feb 13, 2026

ECB Still Assessing Full Effects of Euro Appreciation

ECB has yet to see full impact of euro appreciation, Kazaks says https://t.co/qqisWsfsJD via @aaroneglitis @Skolimowski https://t.co/TTDxRGmgMY

By Zöe Schneeweiss

Social•Feb 13, 2026

CBRT Hikes 2026 Inflation Outlook, Policy Stays Too Loose

#TurkeyWatch 🇹🇷: In the first Inflation Report of 2026, CBRT Gov. Fatih Karahan revised the end-2026 inflation forecast from 13–19% to 15–21%. Turkey's monetary policy remains TOO LOOSE. https://t.co/EC5mR04dt6

By Steve Hanke

Social•Feb 13, 2026

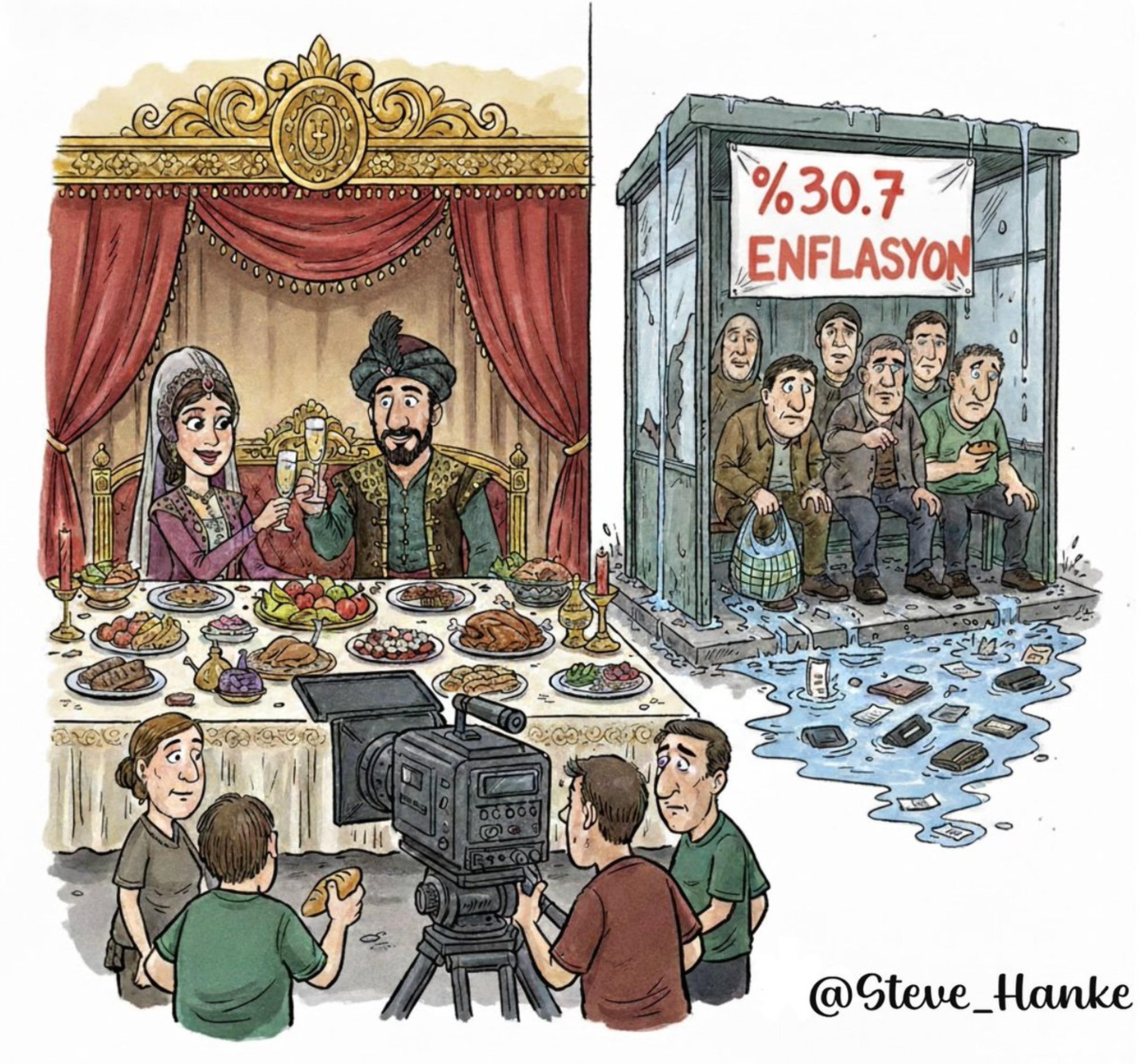

Turkey's 30% Inflation Threatens Global TV Drama Boom

#TurkeyWatch🇹🇷: In January, Turkey's official inflation was reported at 30.7%/yr. That's SIX TIMES HIGHER than the CBRT’s 5%/yr inflation target. Among other things, Turkey’s sky-high inflation is squeezing its famous TV dramas, which draw crowds of 1 billion+ worldwide. https://t.co/nr4JytEGeV

By Steve Hanke

Social•Feb 13, 2026

State Firms Snap up Foreclosed Homes, Easing Oversupply

1/2 Reuters: "Chinese state-owned companies are buying foreclosed property projects, in a sign that long-promised government efforts to reduce massive oversupply in the crisis-hit housing sector are finally getting traction, albeit at a slow pace." https://t.co/Nk0gtgJVgr

By Michael Pettis

Social•Feb 13, 2026

PE Firms Chase Japan’s Retail Wealth Amid Institutional Decline

Our story on PE giants like Blackstone, KKR, EQT's attempt to tap Japan's wealthy retail investors for funds as institutional money wanes. Most see Japan as the largest private wealth opportunity outside of the US, but the market comes with...

By Lisa Du

Social•Feb 13, 2026

China's Three-Year Deflation Signals Weak Money Supply

China is in the grip of a DEFLATION. In January, its Producer Price Index (PPI) was NEGATIVE at -1.42%/yr. If that's not bad enough, China's PPI has been negative for 3 STRAIGHT YEARS. DEFLATION = AN ANEMIC MONEY SUPPLY GROWTH STORY. https://t.co/HJkJ55fGfN

By Steve Hanke

Social•Feb 13, 2026

January Home Prices Slip Across All Chinese City Tiers

Xinhua: In four first-tier cities and 31 second-tier cities, the average month-on-month price declines in January were 0.3% for new homes and 0.5% for resold homes, while prices in 35 third-tier cities fell 0.4% for new homes and 0.6% for...

By Michael Pettis

Social•Feb 13, 2026

Higher CPI May Keep Fed From Cutting Rates, Threatening Stocks

Are stock markets in trouble if US CPI data points the Fed away from bolder interest rate cuts? #stockmarkets #CPI #Fed #DOLLAR #macro #trading https://t.co/2Ij9Tr0kWM

By Ilya Spivak

Social•Feb 13, 2026

Trump’s Iran Remarks, Not IEA, Drive Oil Slump

A bit of a stretch, attributing crude’s slump on Thursday to the #IEA report. If the market thought a 4 million b/d glut would cushion any supply disruption/shock, including the one posed by current US-Iran tensions, Brent would not have been...

By Vandana Hari

Social•Feb 13, 2026

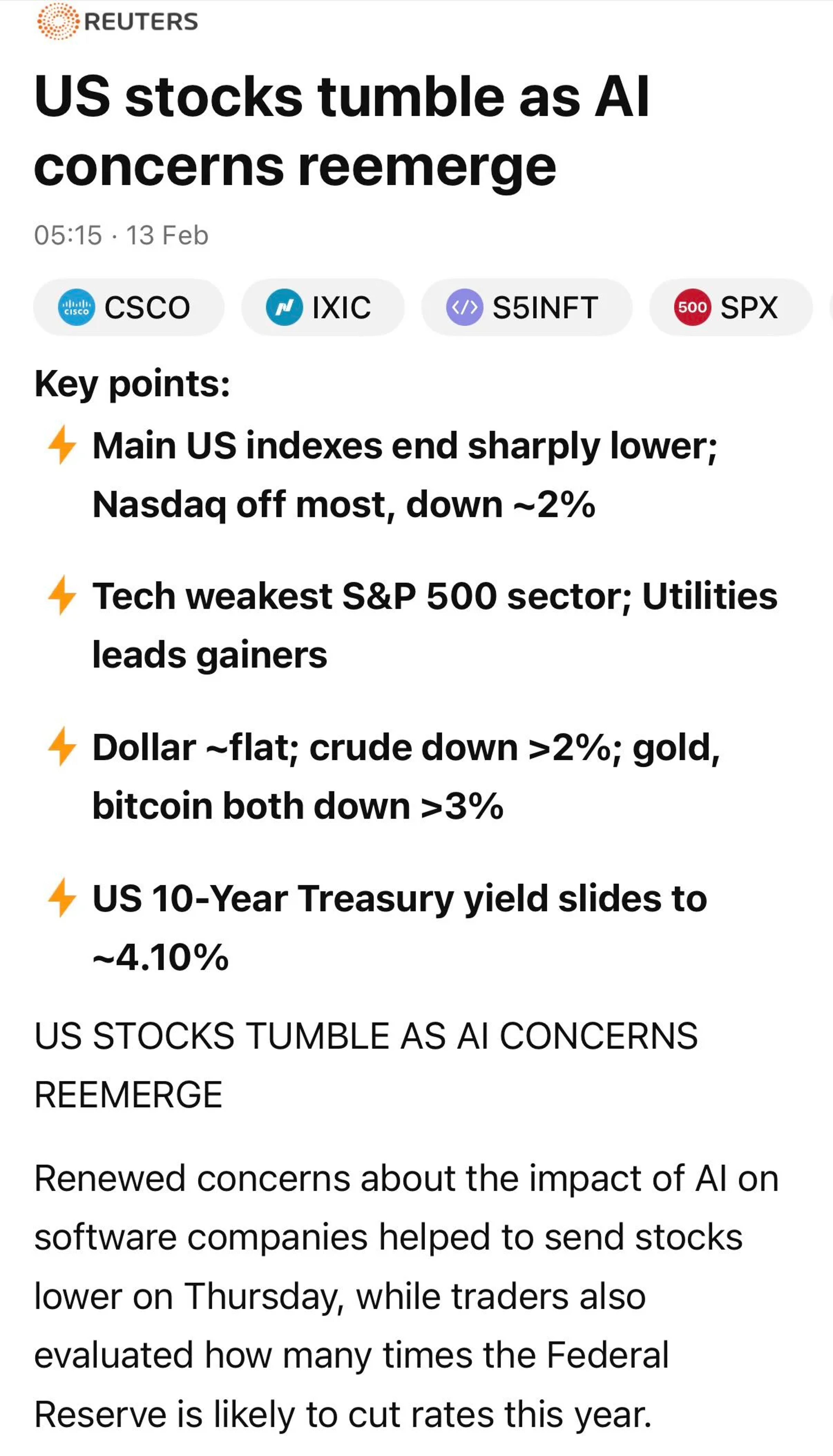

US AI Sell‑off Drags Japan, Korea From Record Highs

Tech, AI-related selling in US having early impact on Japan -1.6% and S Korea -0.7% stock markets. Both coming off record highs. Spore was also at record high yesterday. Some negative headlines.

By Azharuddin | Azha Investing

Social•Feb 13, 2026

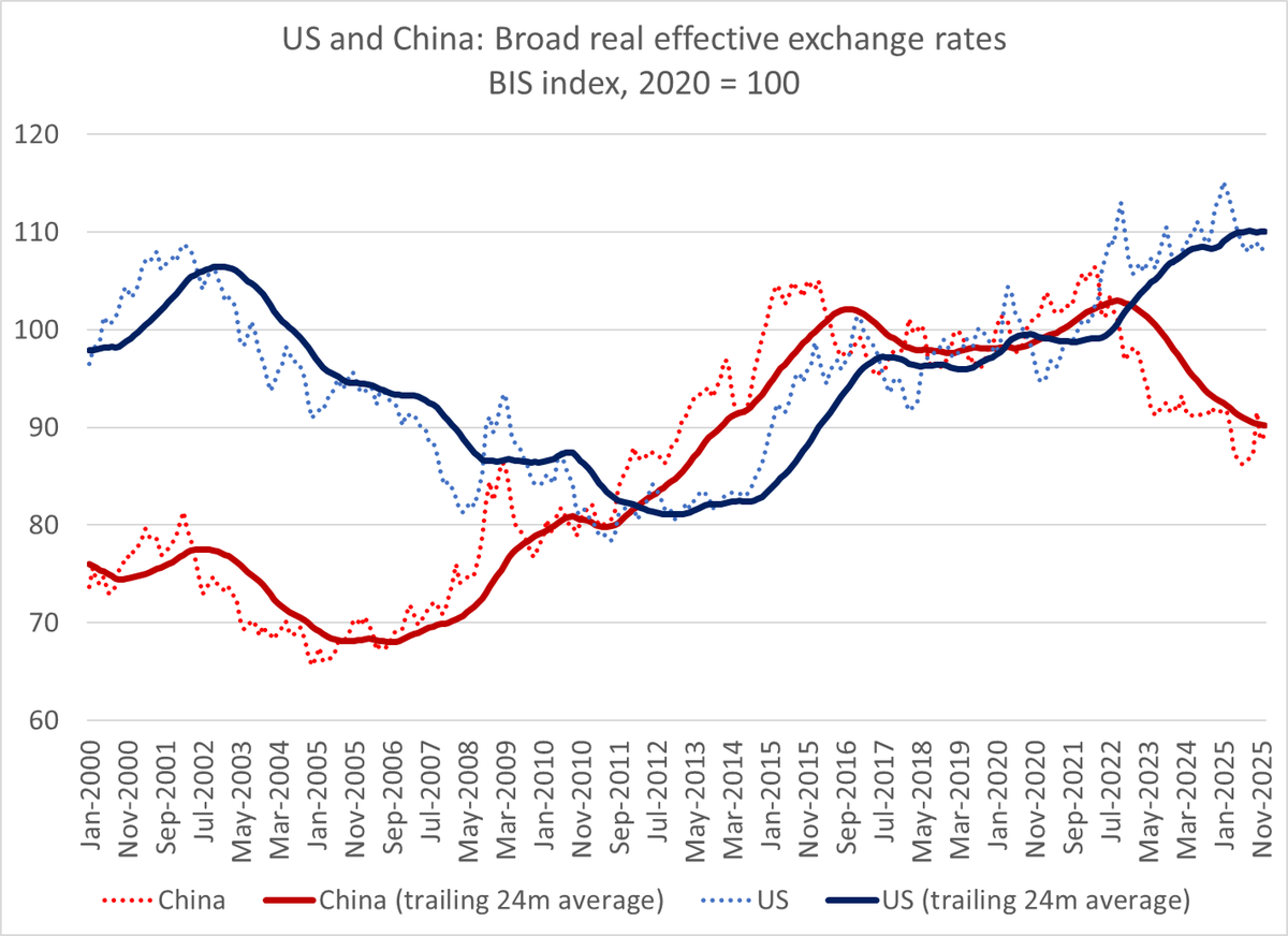

Inflation‑adjusted Dollar

A pet peeve. Talk about current dollar weakness. Numbers here are through December -- but in December the broad inflation adjusted dollar was stronger than in 01 or 02, the peak before 22-24 1/ https://t.co/c7KU9z1C6t

By Brad Setser

Social•Feb 12, 2026

CPI Near 5‑Year Low: Trade Nasdaq Move Live

🔴 TOMORROW: US CPI drops at 8:30 AM Core forecast at a near 5-year low. Hot print → Nasdaq dumps Cool print → Rate cuts back on the table Either way, there's a trade to be made. Join me LIVE at 8AM ET to...

By Boris Schlossberg

Social•Feb 12, 2026

Gold Surge Signals Capital Shift, Not Risk‑On Rally

Record gold prices + a weakening dollar don’t scream “risk-on.” They signal global capital reallocation and rising demand for insurance amid lingering policy uncertainty. Hedging behavior is increasing even as equities grind higher.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 12, 2026

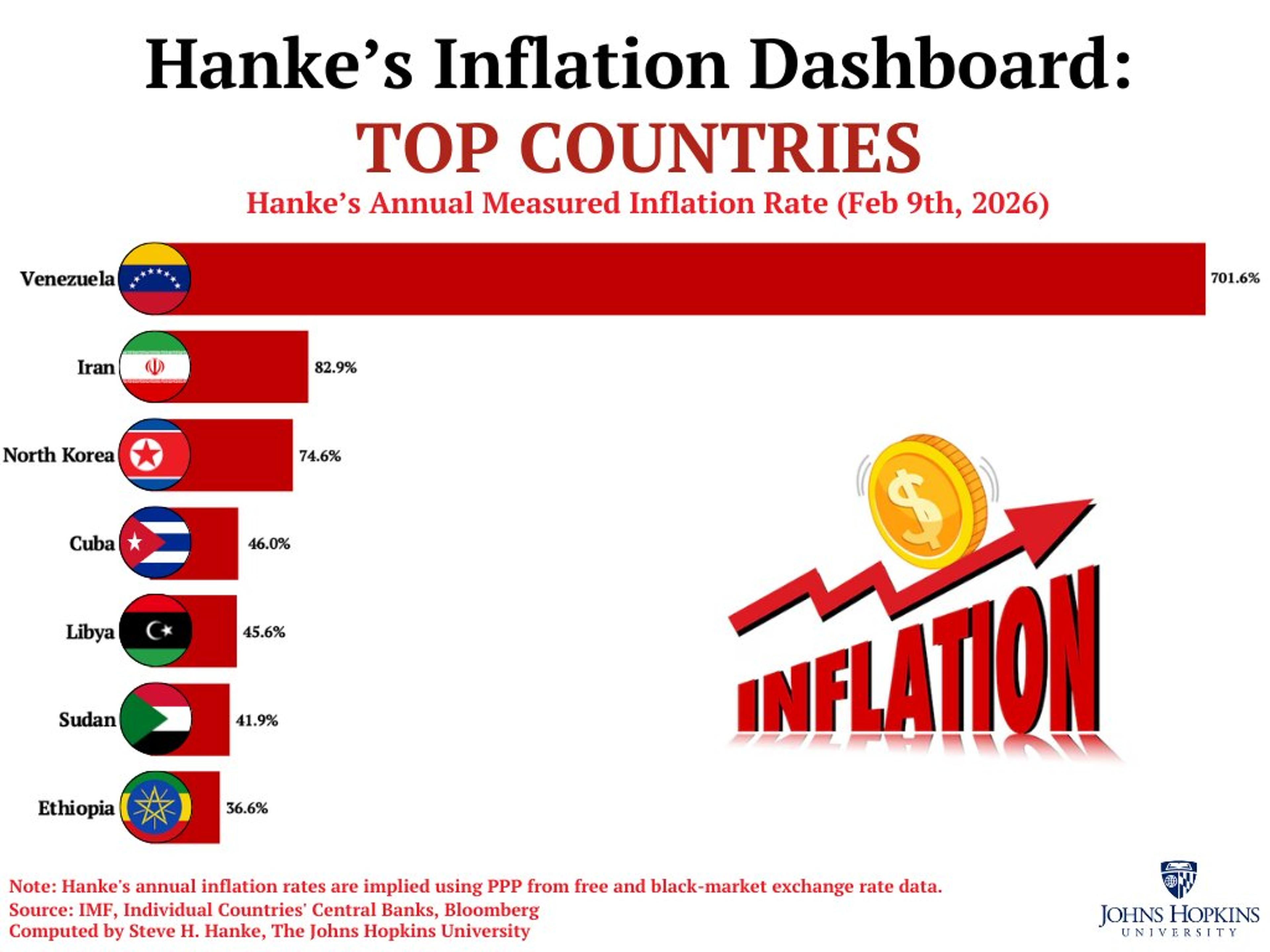

Cuba's Socialist Crisis Drives 46% Inflation, Fourth Globally

#CubaWatch🇨🇺: Cuba’s socialist disaster produces an inflation rate of 46%/yr. That makes Cuba the WORLD’S FOURTH-HIGHEST INFLATOR. I remain the only reliable source of inflationary measures in Cuba. https://t.co/tNgaFALVro

By Steve Hanke

Social•Feb 12, 2026

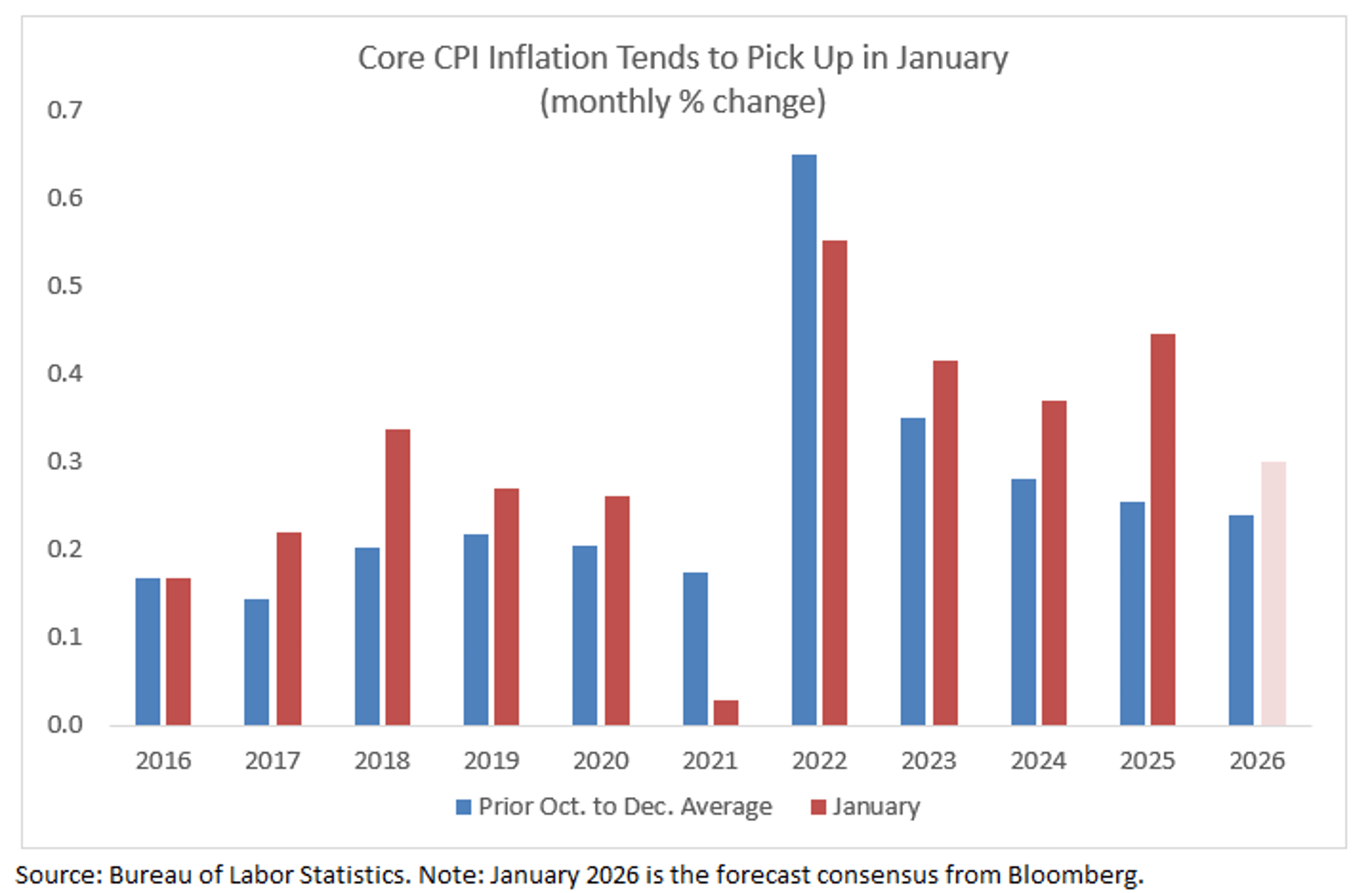

January CPI Likely Spikes Amid Data Gaps

Tomorrow is CPI for January. It's a month that has burned us repeatedly -- core CPI inflation (month-over-month) tends to pick up in January. Consensus forecast has a pickup *but* we do not have a clear sense of the...

By Claudia Sahm

Social•Feb 12, 2026

US Midwest Aluminum Premium Hits Record $1.03 per Pound

"Aluminum prices in the US have been rising faster than global prices for much of this past year because of tariffs. The so-called US Midwest premium...climbed to an all-time high of $1.03 a pound on Wednesday" https://t.co/lVUj91ooyh https://t.co/lIKmsxcJem

By Scott Lincicome

Social•Feb 12, 2026

Tariffs Won’t Drive Reindustrialization Without Consistent Policy

Its a warning shot to people who think tariffs are going to secure reindustrialization. Is it sustainable? Industrial policy can't be on and off and work.

By Adam Ozimek

Social•Feb 12, 2026

Call Centers Signal AI‑Driven Job Crisis Ahead

A good canary in the coal mine for AI-caused job loss will be call centers. We're currently projecting ~2.75M call center jobs in the US in 2026. In 2016 it was ~2.63M. The global call center market size has grown...

By François Chollet

Social•Feb 12, 2026

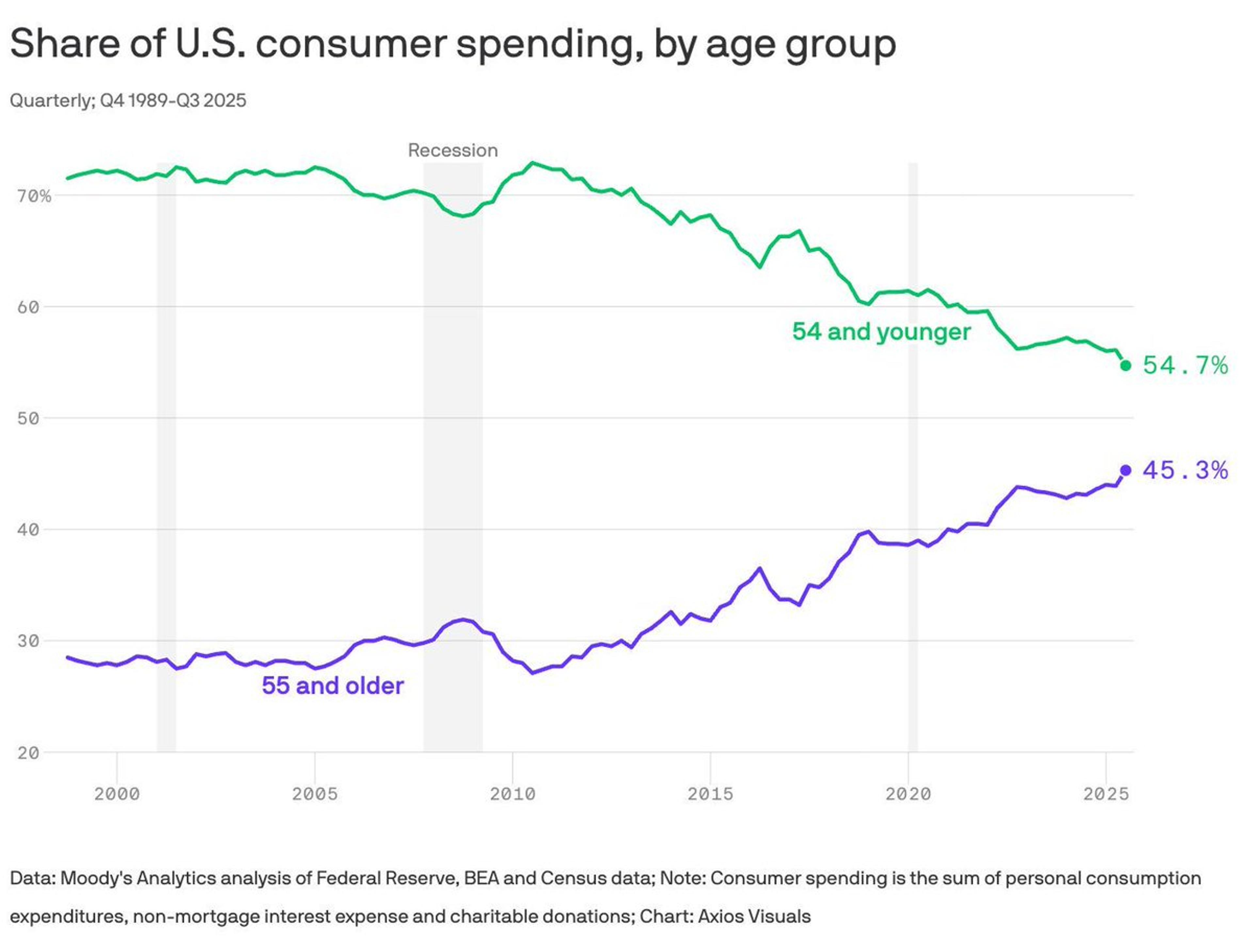

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Social•Feb 12, 2026

Trump’s Policies Projected to Add $1.4 Trillion Deficit

Congress’ fiscal watchdog, the CBO, has just indicated that Trump’s fiscal policies will add $1.4 tn to the US deficit over the next decade. US GOVERNMENT SPENDING IS OUT OF CONTROL. https://t.co/BZNx1n4jtt

By Steve Hanke

Social•Feb 12, 2026

Software Short‑squeeze Looms as Consumer Staples Pull Back

Whose ready for the short-squeeze in software over the next week because the 26 year-old analysts at the multi-platform funds convinced their PM's to go max short? Then we'll get the Consumer Staples pullback at the same time, when all the...

By Tyler Neville

Social•Feb 12, 2026

Tie US Aid to Venezuela Publishing Detailed

Secretary Wright, the only way to save Venezuela's oil industry—and I say this as an entirely disinterested party—is to tie any US support to reqs that the VZ oil ministry publicly publish regular, detailed oil industry statistics Simple bulk CSV file...

By Rory Johnston

Social•Feb 12, 2026

Ford Repurposes Idle Plant for Batteries Amid Market Growth

Ford is going to try to make a go at batteries in its idled plant. I find it hard to be optimistic about that, but it's at least a growing market https://t.co/37Ns45bbLE

By Adam Ozimek

Social•Feb 12, 2026

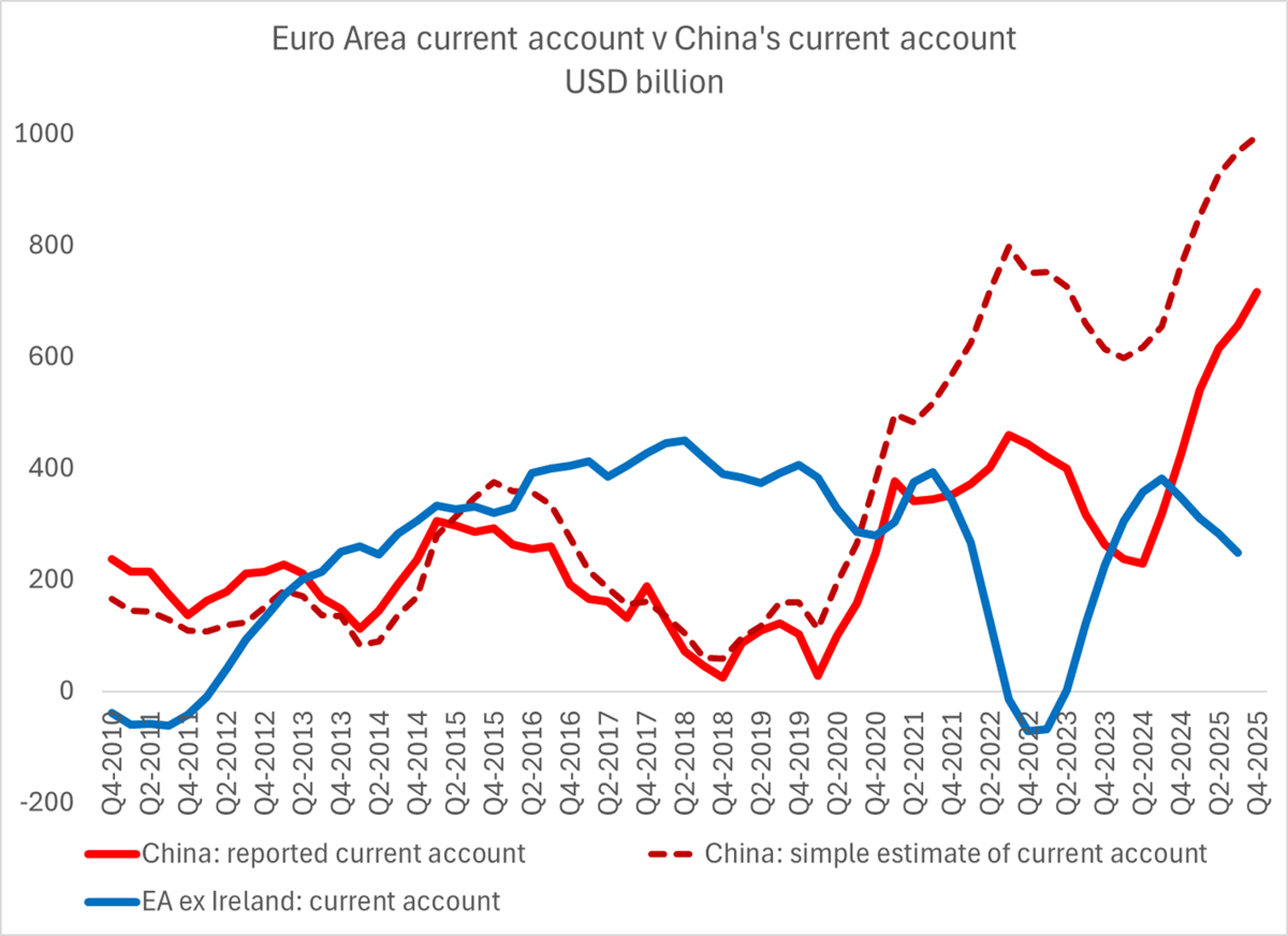

China’s Surplus Outpaces Europe, IMF View Outdated

The IMF's standard way of talking about global trade and payment imbalances tends to view Europe and China similarly -- but that is now out of date. China's reported surplus will top $700b in 2025, the euro area's surplus...

By Brad Setser

Social•Feb 12, 2026

Venezuela Leads This Week's Hyperinflation, Followed by Iran, North Korea

#HankeInflationDashboard: By my measurements, this week's top 5 inflators are: 🇻🇪Venezuela — 701.6%/yr 🇮🇷Iran — 82.9%/yr 🇰🇵North Korea — 74.6%/yr 🇨🇺Cuba — 46.0%/yr 🇱🇾Libya — 45.6%/yr https://t.co/ghPM730D4X

By Steve Hanke

Social•Feb 12, 2026

U.S. Interest Costs Set to Double by 2036

By 2036, the U.S. will spend $2.14 TRILLION a year on interest payments, versus just $1 trillion today. U.S. taxpayers are being taken to the cleaners. They’re paying for yesterday’s government largesse and receiving nothing for it. https://t.co/xMUu3S9H8I

By Steve Hanke

Social•Feb 12, 2026

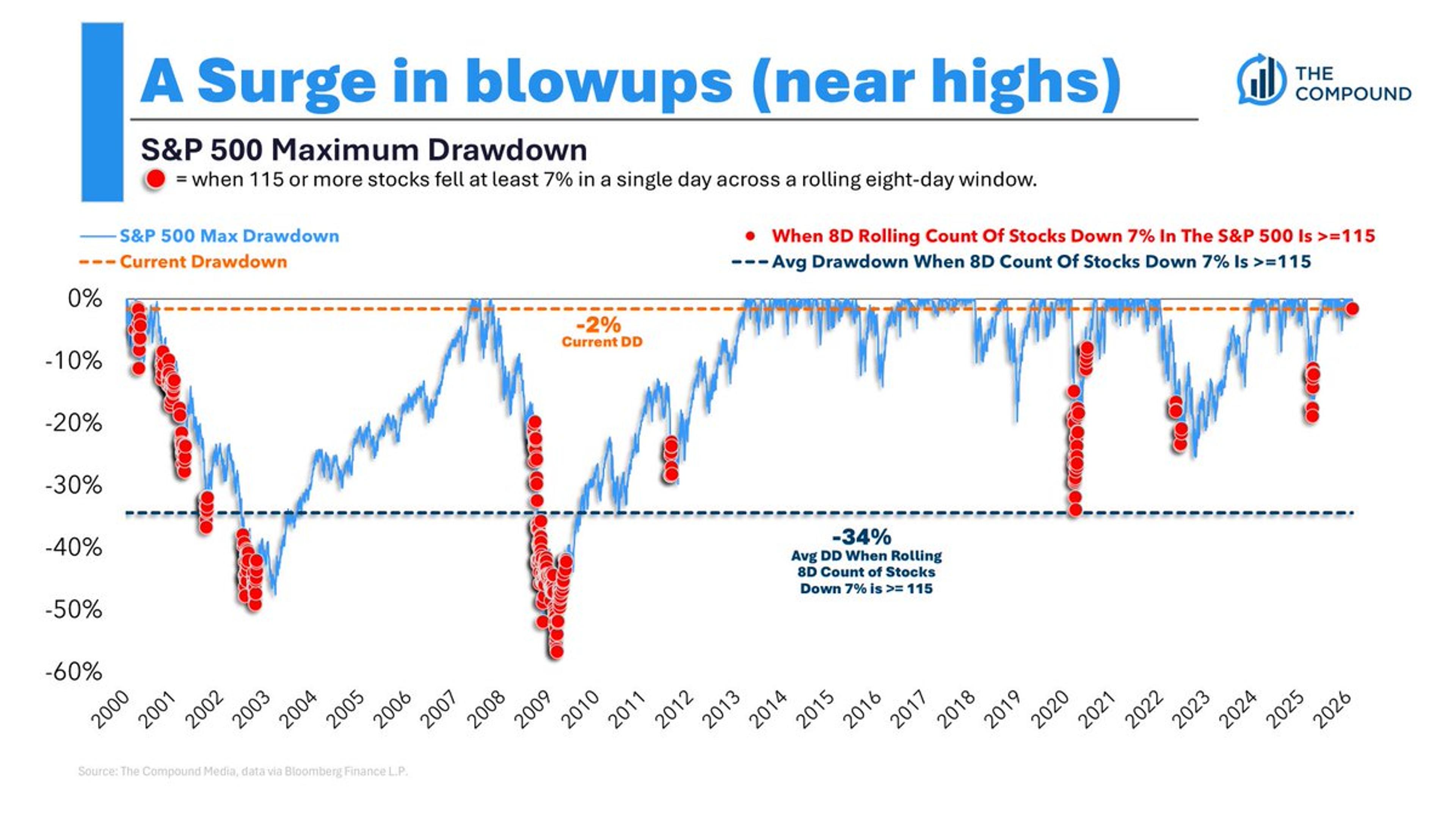

S&P500 Sees Unprecedented Daily 7% Drops, Echoing Dotcom Crash

Wild market. We haven't seen anything like this since the dotcom bubble burst. Over the last 8 sessions, 115 stocks in the S&P 500 have decline 7% or more in a single day. The average drawdown when that happens is...

By Michael Batnick

Social•Feb 12, 2026

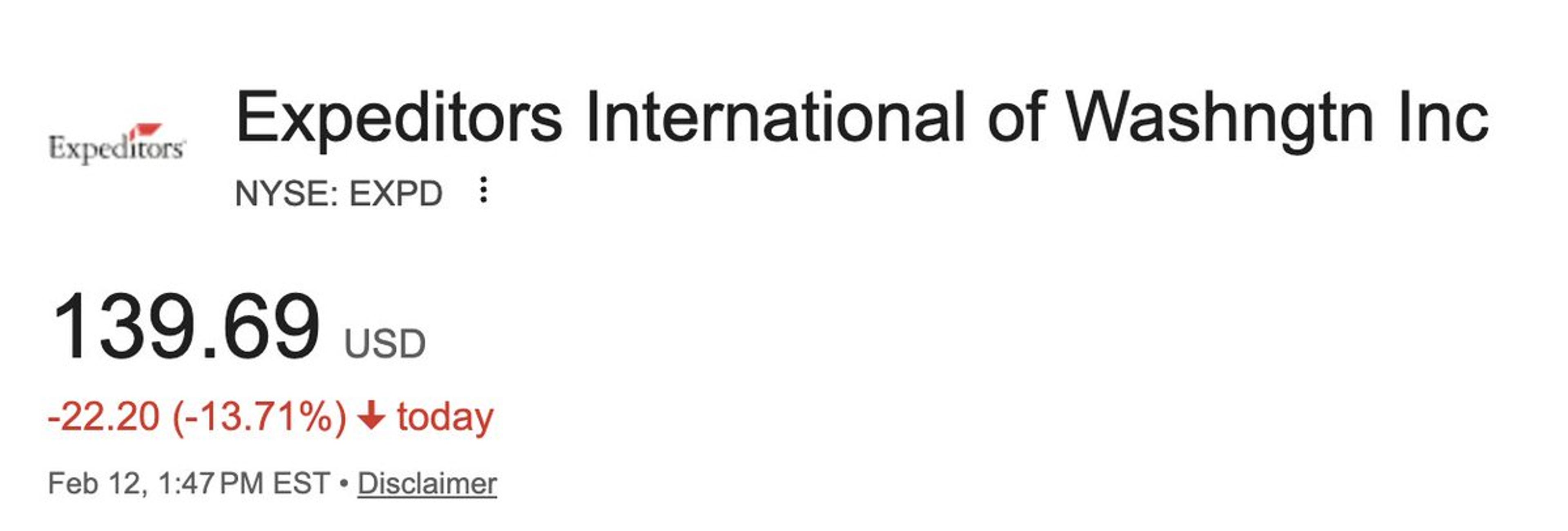

EXPD Faces Biggest Sell‑Off Since 1998 Crisis

Worst sell-off in this logistics/tech company since 1998 (LTCM & Russian Debt Crisis) $EXPD Bigger than Tariffs, March 2020, 2008. AI Fears https://t.co/pSckCN9oYm

By Jack Farley

Social•Feb 12, 2026

Biden's Trade Deficit Slightly Lower than Trump's, Not 78% Drop

So, for the record: The trade deficit in the first 11 months of the Trump administration was $839.5B. In the same period in 2024, the final Biden year, it was $806.6B. And if you think this year's performance is a...

By Ian Shepherdson

Social•Feb 12, 2026

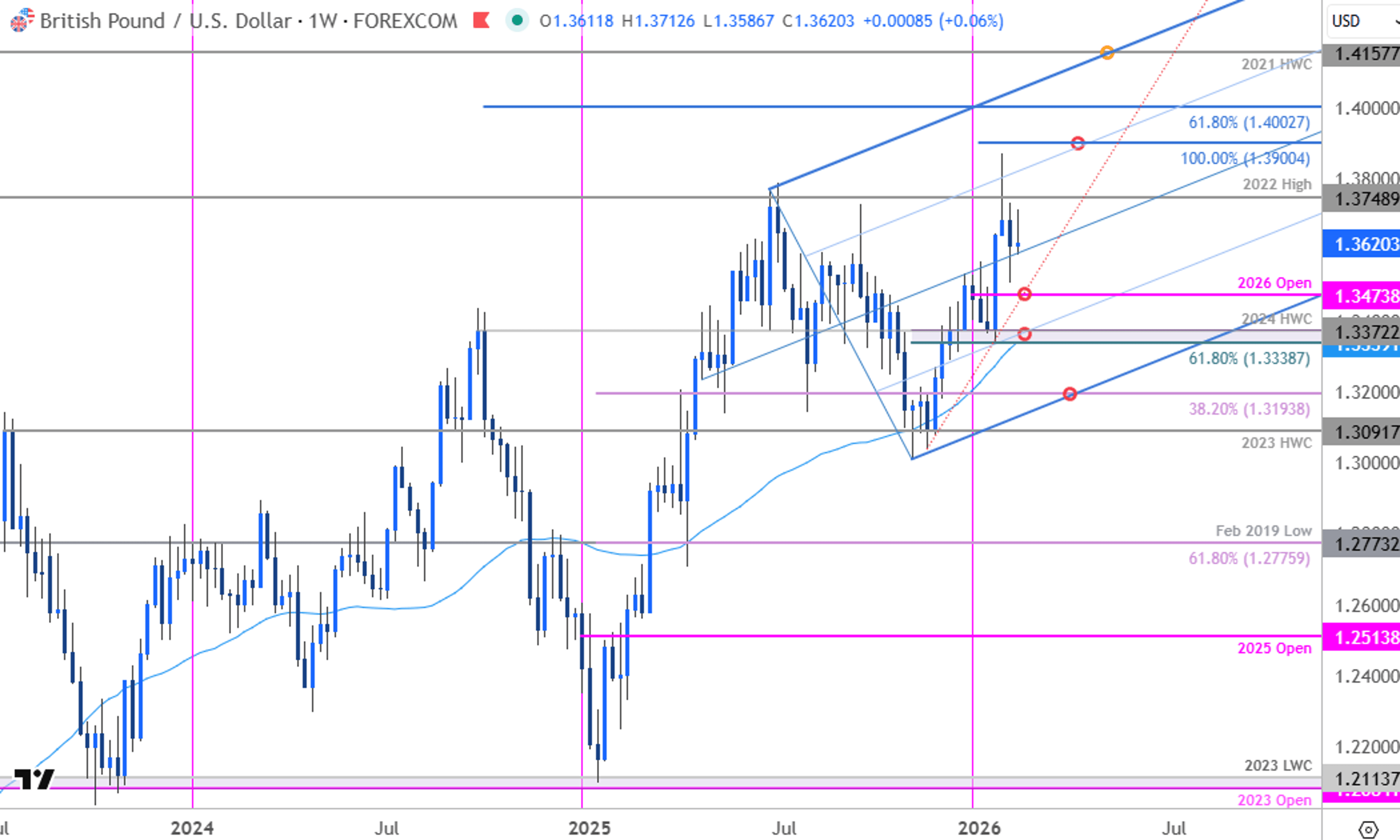

GBP/USD Poised for Breakout After Coiling Below Resistance

British Pound Forecast: GBP/USD Coils Below Resistance- Breakout to Set the Trend https://t.co/YCL1AwKRyY $GBPUSD Weekly Chart https://t.co/VuEneX3o2g

By Michael Boutros

Social•Feb 12, 2026

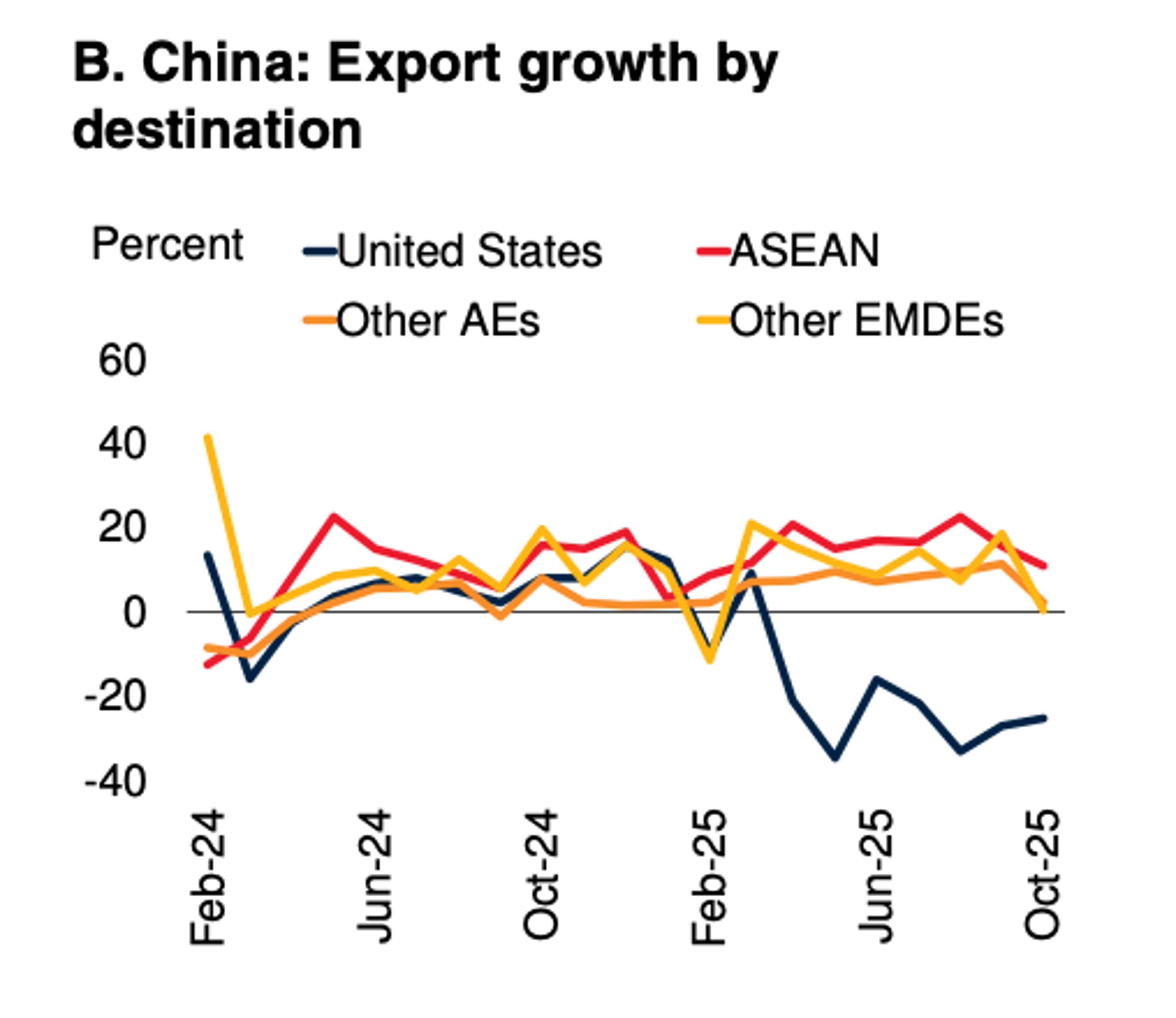

Trump Tariffs Backfire as China Shifts to New Markets

US tariffs were supposed to punish China. Instead, China pivoted away from the US and made friends and commerce with non-U.S. buyers. TRUMP’S TARIFFS = BACKFIRED. https://t.co/oibXA4xbmF

By Steve Hanke

Social•Feb 12, 2026

Silver Stalls Below 75; Inflation Data Could Spark Metal Rally

$SLV having big trouble getting above 75.00 again...which still won't be enough to restore confidence. Big inflation report ahead...precious metals may see a big reaction.

By Hyperstocks

Social•Feb 12, 2026

Bitcoin's Record Low vs Gold Signals Buying Opportunity

#Bitcoin is currently on the lowest valuation ever vs. Gold. Some people might say that this is the end of Bitcoin. Others might argue that the markets are actually going to turn around from here. If you look at the macroeconomic landscape and...

By Michaël van de Poppe

Social•Feb 12, 2026

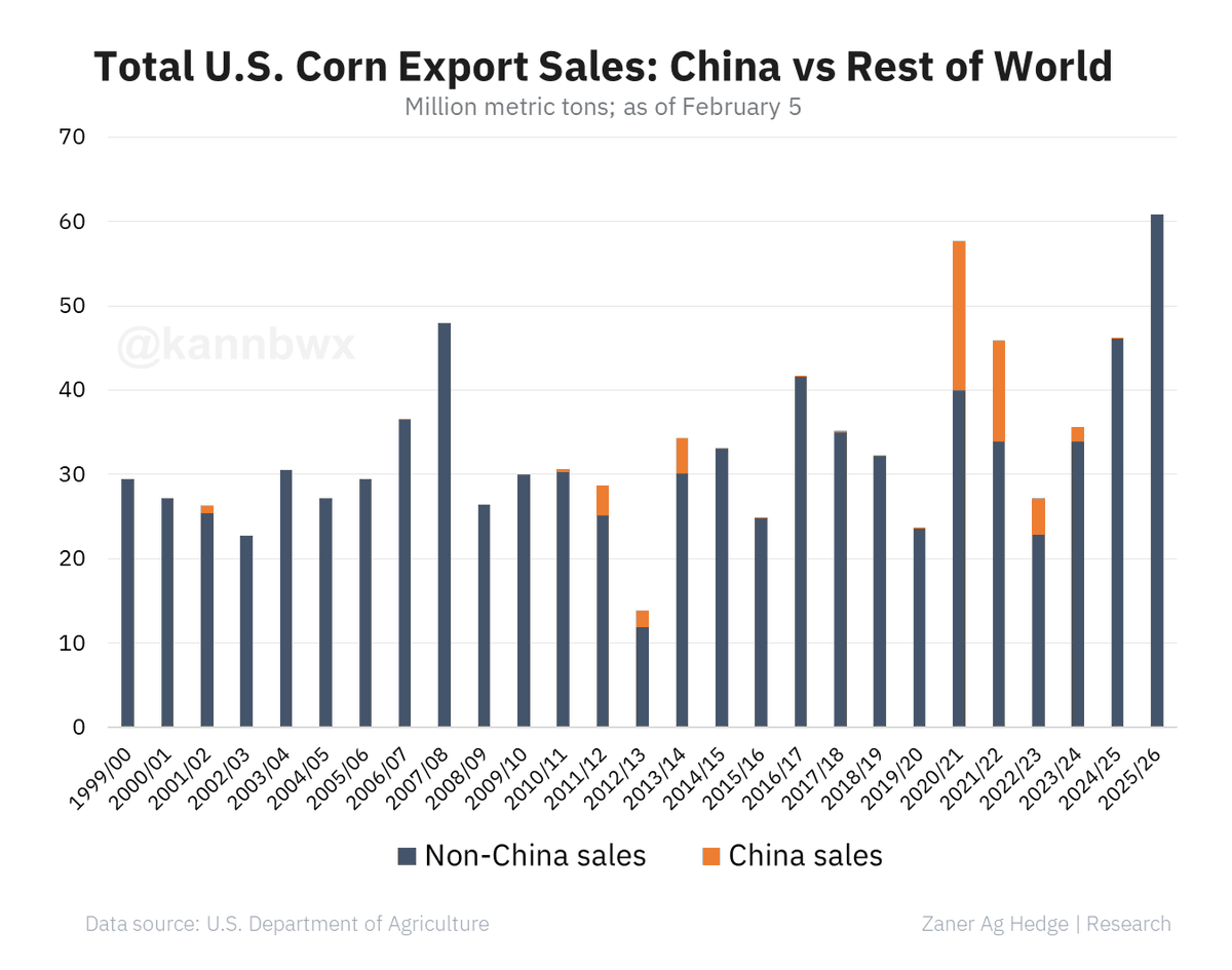

U.S. Corn Exports Surge 52% Beyond 2020 Levels

🌽U.S. corn export sales for 2025/26 are nearing 61 million metric tons (2.4 billion bushels). Early Feb sales in 2020/21 were similarly massive but heavily skewed by China. Non-China 2025/26 corn sales are 52% larger than at this point in 2020/21!

By Karen Braun

Social•Feb 12, 2026

Domestic Sales and Exports Aren't Comparable Economic Metrics

It is ignored because it is misleading to compare in country sales (generated by Chinese production for sale to Chinese buyers) to exports (goods produced in one country for sale in another). Firms and countries are different economic concepts

By Brad Setser

Social•Feb 12, 2026

Gold Dip After NFP Profit‑take, Still Bullish Long‑term

GOLD ( XAUUSD ) just dumped over a 1000 pips after yesterday's NFP , but what just happened ? 👇 Netanyanho signalled towards de-escalation in the middle east with a potential deal b/w Iran & US This optimistic headlines lead to a...

By tradeloq

Social•Feb 12, 2026

China Eases Capital Controls as Asset Buildup Accelerates

China usually liberalizes its financial account when the PBOC (now the state banks) are accumulating assets at too rapid a pace, and it wans the dollar risk to be taken by others ... 1/2

By Brad Setser

Social•Feb 12, 2026

From Labor to Compute: Economy’s Next Quantum Leap

1900: Internal Combustion + Electricity = 5x GDP growth. 2026: AGI + Humanoid Robotics + Space-based Energy = 50x GDP growth. This is NOT a cycle; instead, we are in a phase change for the species. The transition from being...

By Peter H. Diamandis

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

Social•Feb 12, 2026

East Asia Drives Surging Trade Surplus, Currencies Remain Cheap

Bingo And the global trade surplus (ex pharma) is now primarily in China, Taiwan and Korea ... Important qualification to the now standard argument the dollar has gotten weaker (which is true primarily if the clock starts at the end of 24,...

By Brad Setser

Social•Feb 12, 2026

EURCHF Plummets to Record Lows, Yield Gaps Irrelevant

Another FX PSA: $EURCHF has extended its generational slide lower to fresh record lows. Yield differentials don't matter at all here apparently: https://t.co/cHMUxde914

By John Kicklighter

Social•Feb 12, 2026

US Energy Secretary Visits Venezuela's Orinoco Oil Belt

Well, I admit that if you have asked me three months ago, certainly I didn't have the following on my 2026 bingo card: "... US Secretary of Energy Chris Wright tours the Orinoco oil belt in Venezuela with the US-installed Venezuelan...

By Javier Blas

Social•Feb 12, 2026

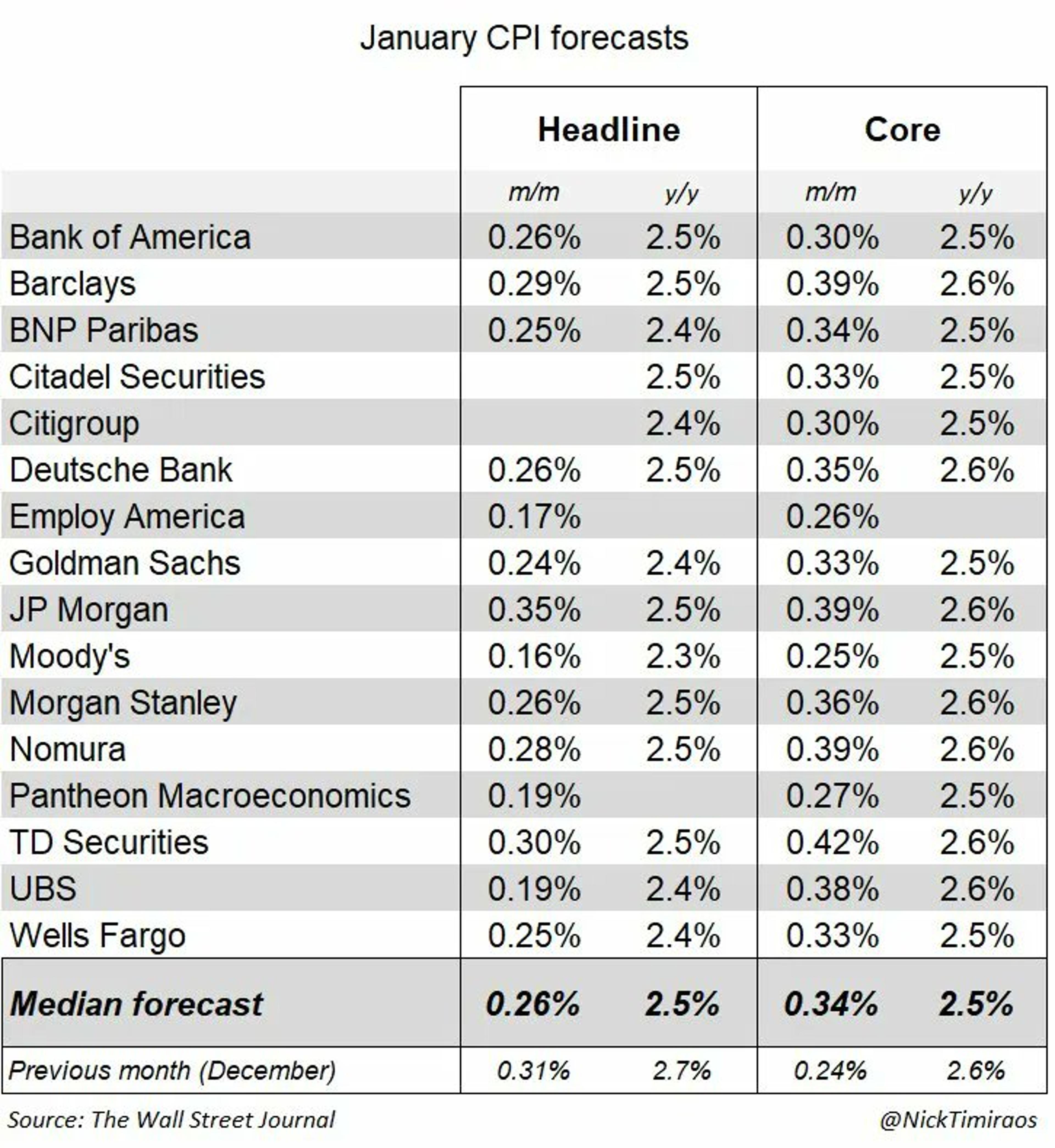

Headline Inflation Cools, Core CPI Accelerates in January

Wall Street expects a cooler month for headline inflation but a hotter month for core in January Headline CPI: 0.26% m/m, 2.5% y/y (down from 0.31% m/m and 2.7% y/y in December) Core CPI: 0.34% m/m, 2.5% y/y (core m/m accelerating from...

By Nick Timiraos

Social•Feb 12, 2026

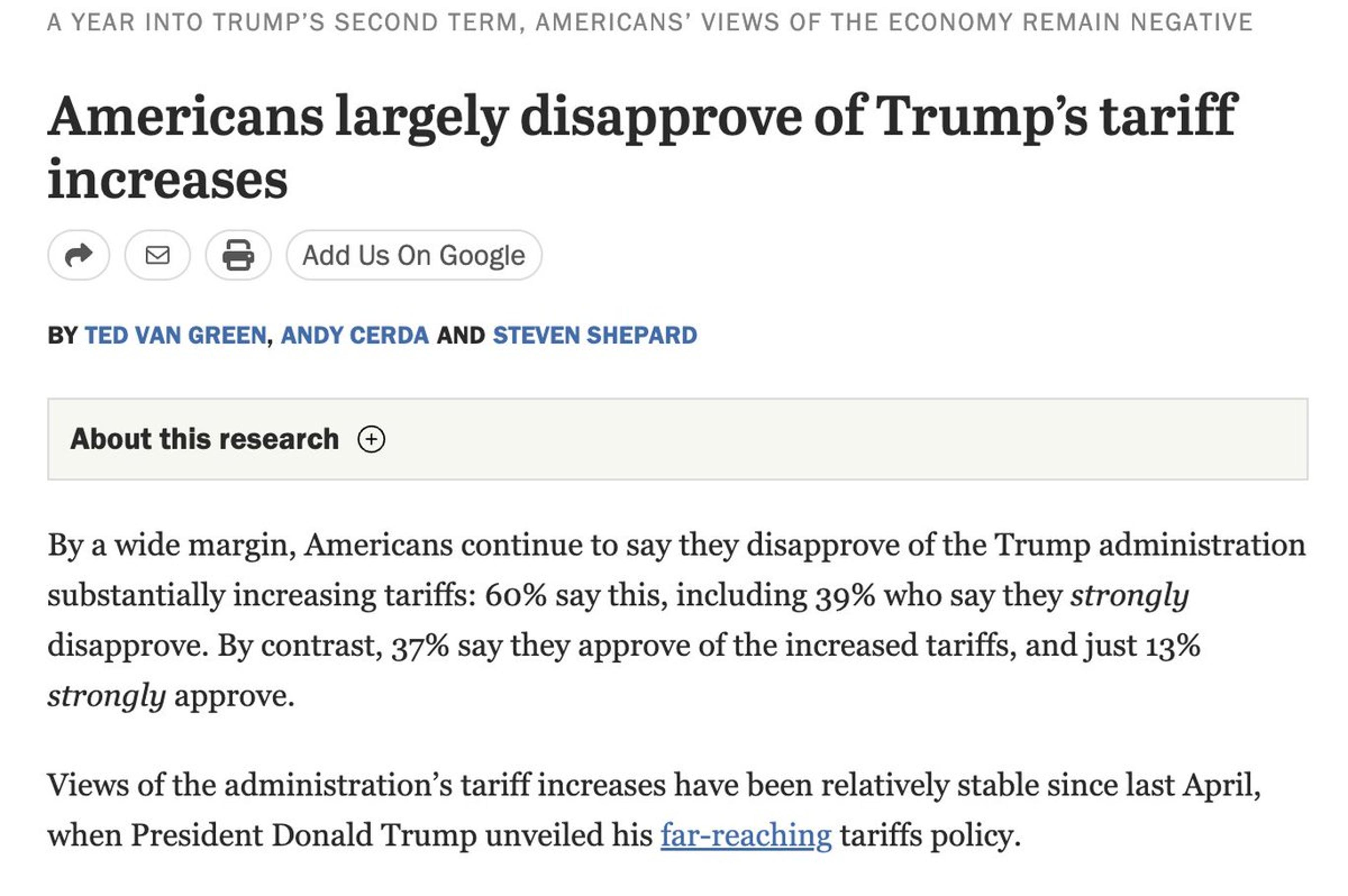

Tariffs Fail Without Consensus, Chaos Undermines Industrial Policy

The problem with "give tariffs time" as a plan is that they have been implemented in a way that won't stand up to courts, there is not a bipartisan consensus supporting them, and voters hate them now because they have...

By Adam Ozimek