Social•Feb 12, 2026

Excess Wealth vs Limited Cash Fuels Asset Bubbles

Wealth isn’t worth anything unless it can be converted into money to spend. And when there’s a lot of wealth relative to the amount of hard money available — like we’re seeing today — bubbles are created. @nikhilkamathcio https://t.co/iBiRkkv7Ok

By Ray Dalio

Social•Feb 12, 2026

Global Wealth Shift: US Cuts, Overseas Gains Ahead

A Massive Global Wealth Transfer Is Coming Americans will consume less, the rest of the world more. Capital is flowing overseas. This isn’t a crisis, it’s a wealth transfer — and there are winners if you know where to look. PeterSchiff #Economy...

By Peter Schiff

Social•Feb 12, 2026

Gold Lacks Earnings; Overvalued Compared to Commodities

I managed the largest gold fund in USA. Here's the truth: Stocks have "babies" (earnings). Gold has NO babies. 🍼 Gold's at historic extreme vs. oil/soybeans. You're crazy if you think gold's gonna outperform inflation - @BergMilton https://t.co/bNqmCOVYCt https://t.co/7NJ9NoBZCx

By Jack Farley

Social•Feb 12, 2026

Russia, China Shape Western Leaders' Strategic Decisions

This is not about rhetoric. This is about influence that changes outcomes. This piece explores how Russia and China have shaped the thinking and incentives of Western political leaders in ways that matter strategically. If you want to understand why Western policy sometimes...

By David Murrin

Social•Feb 12, 2026

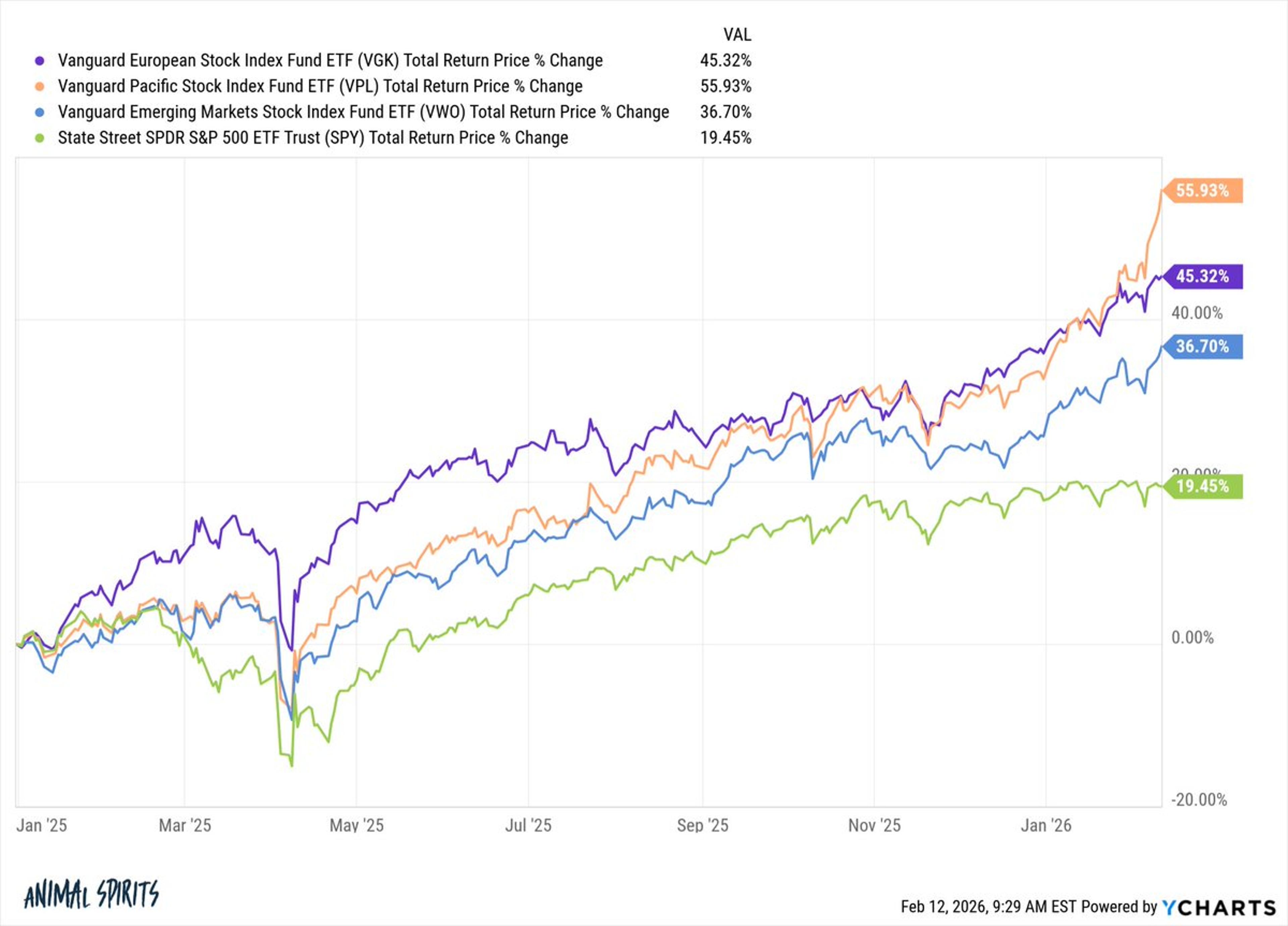

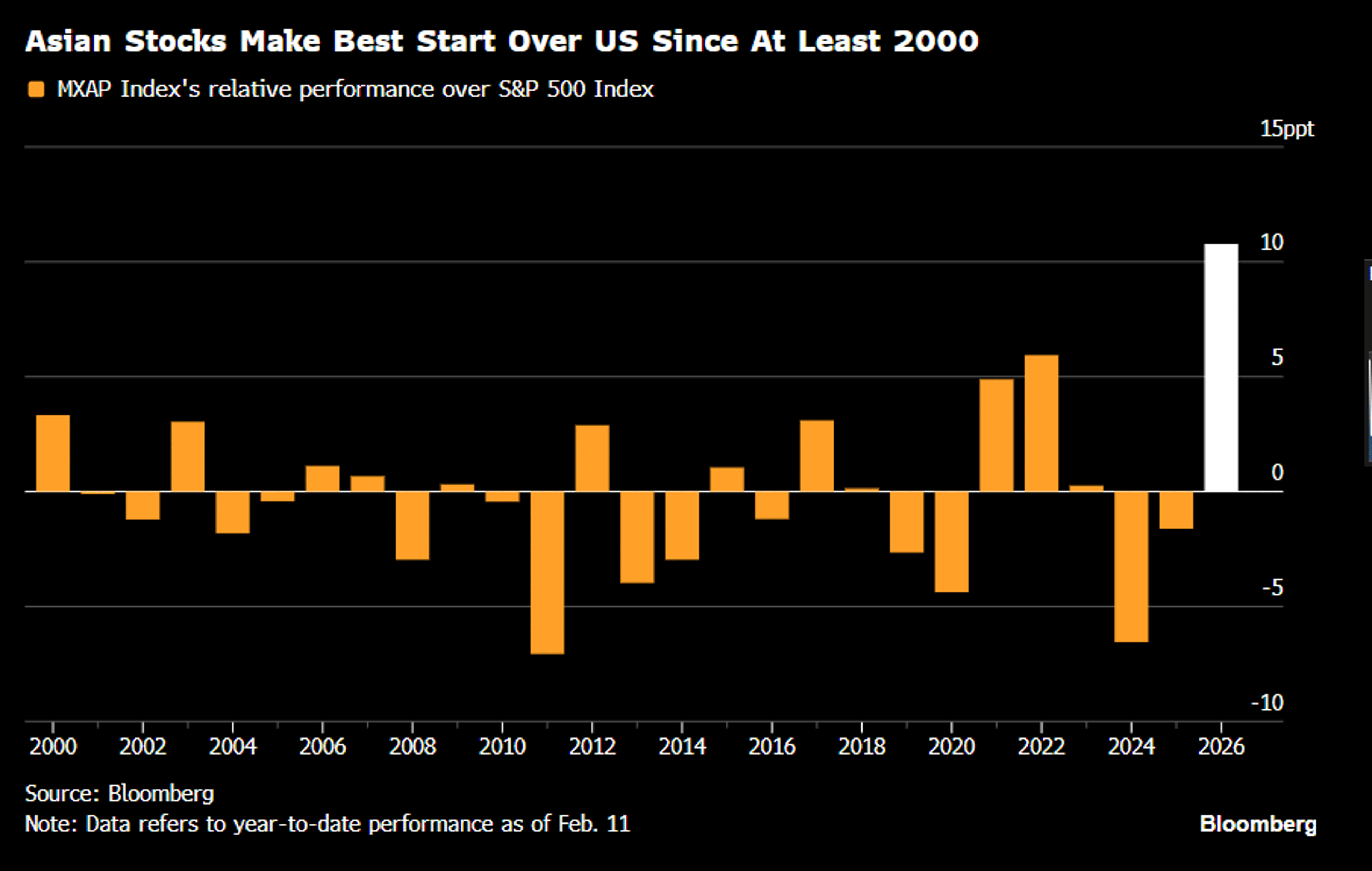

Global Equities Surge Far Beyond S&P 2025

Since the start of 2025: S&P 500 +19.5% European stocks +45.3% Emerging markets +50.8% Asian stocks +55.9% https://t.co/lrZrKKIC4x

By Ben Carlson

Social•Feb 12, 2026

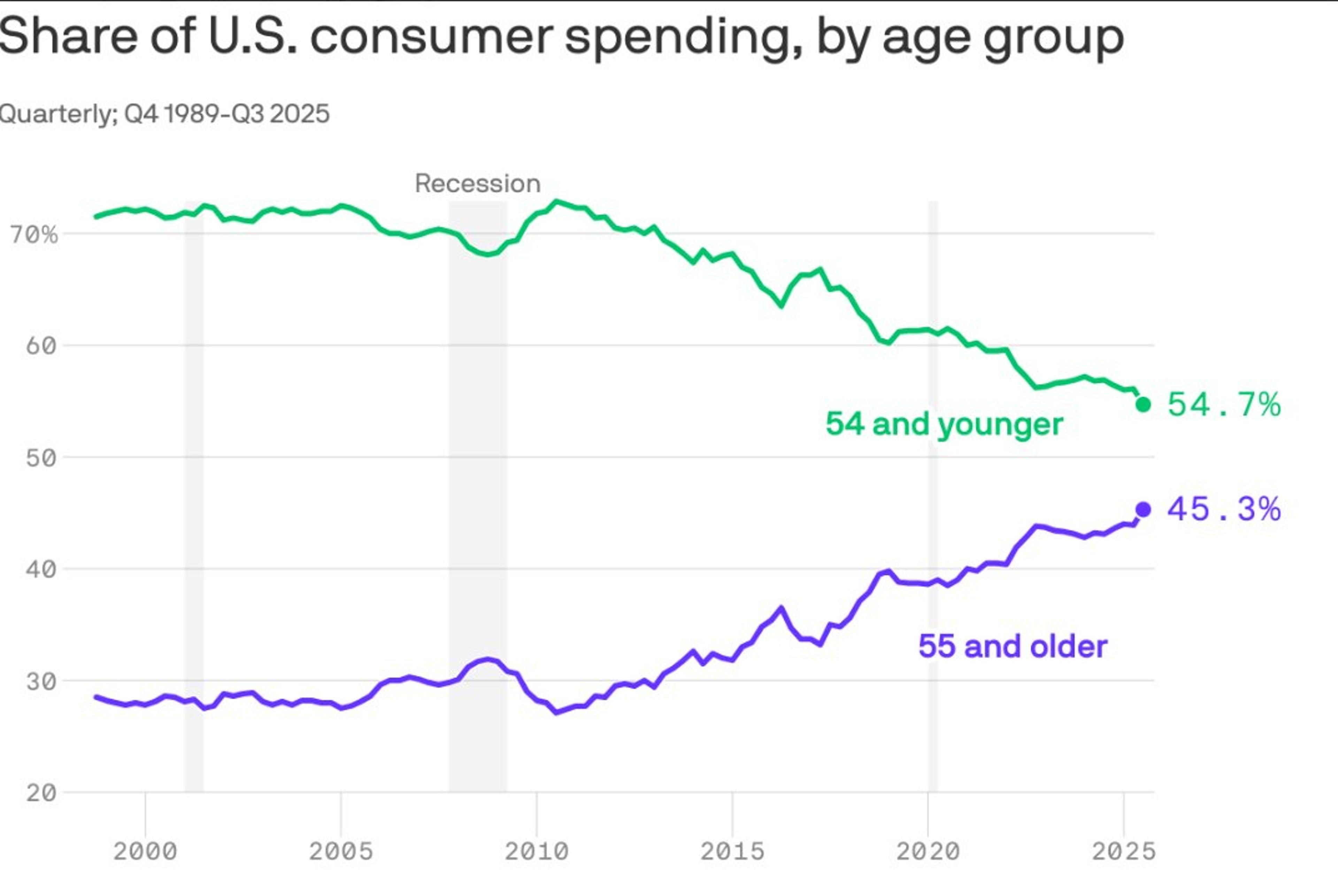

Older Americans Hold 70% Wealth, Drive Consumer Spending

The least productive part of our economy keeps getting wealthier...If you have a larger balance sheet you've relatively benefitted because of continuous gov't support, while labor has been shoved in a locker. Whatever happened to the party of labor?? hmm🧐🧐 "About 30%...

By Tyler Neville

Social•Feb 12, 2026

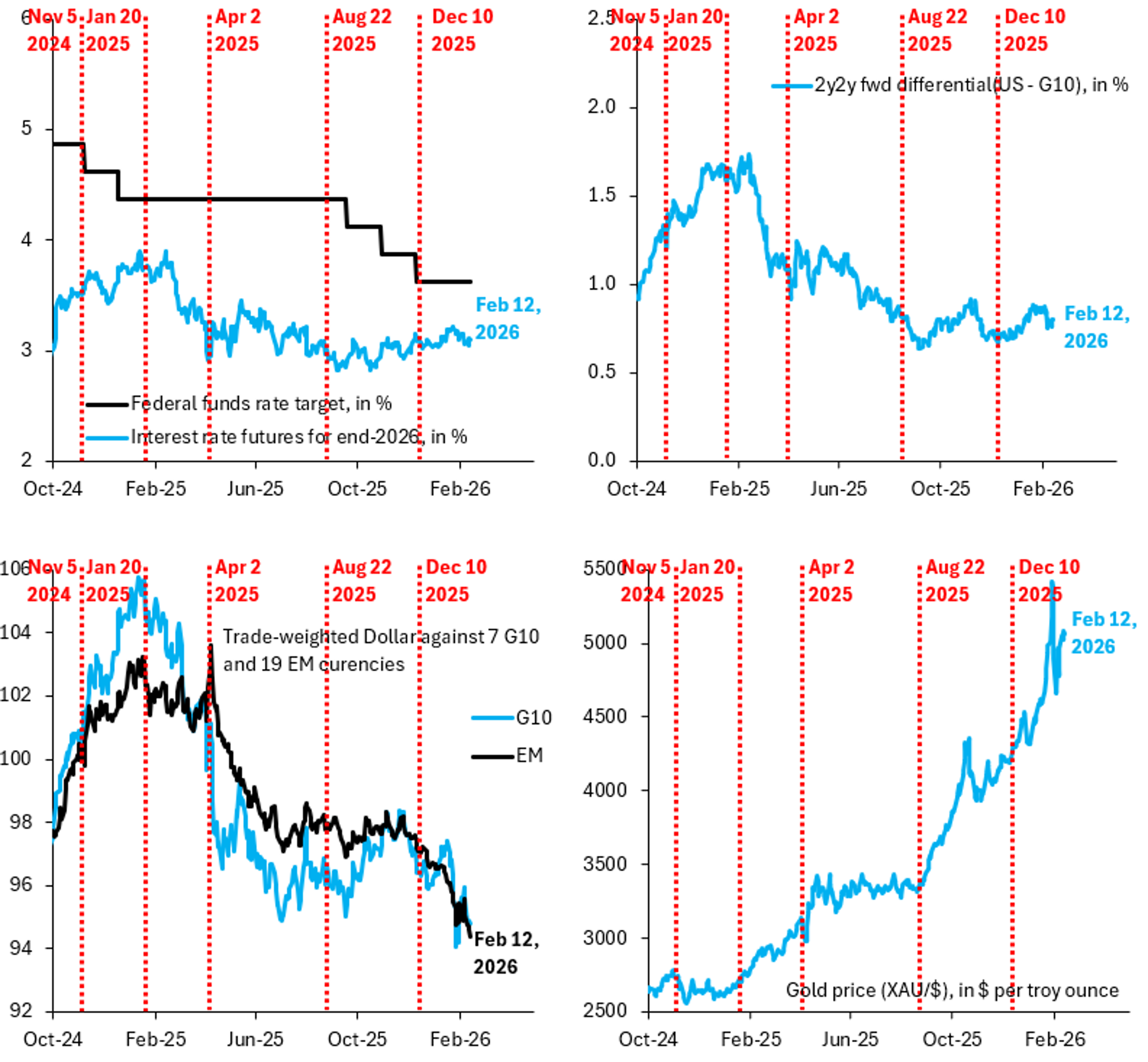

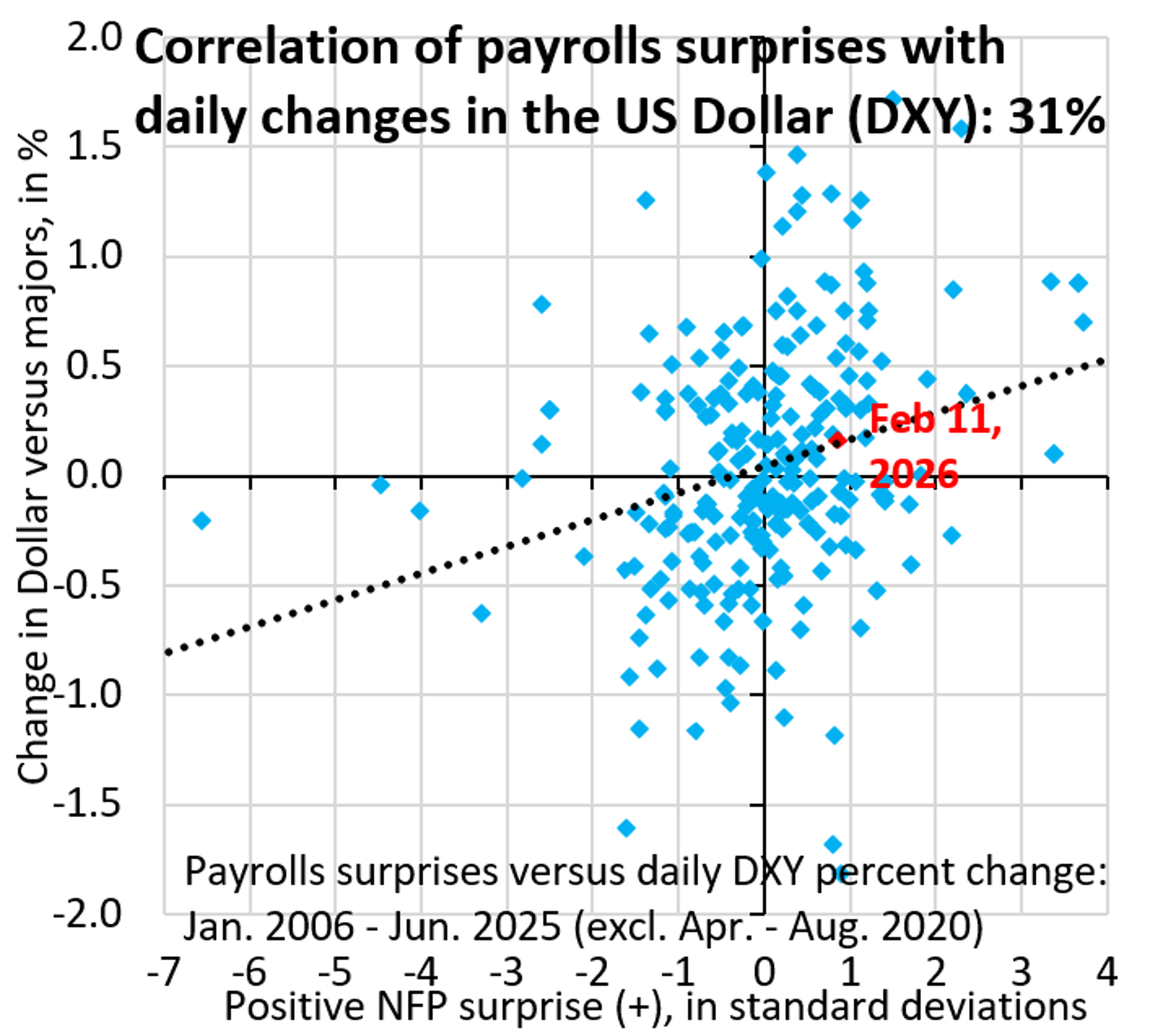

Dollar Regime Flip: Strong Data Now Weaken Currency

Something big is going on with the Dollar. In the past decade, strong data have pushed the Dollar up, but that isn't what happened yesterday. We're going back to the regime that prevailed before, whereby strong data push the Dollar...

By Robin Brooks

Social•Feb 12, 2026

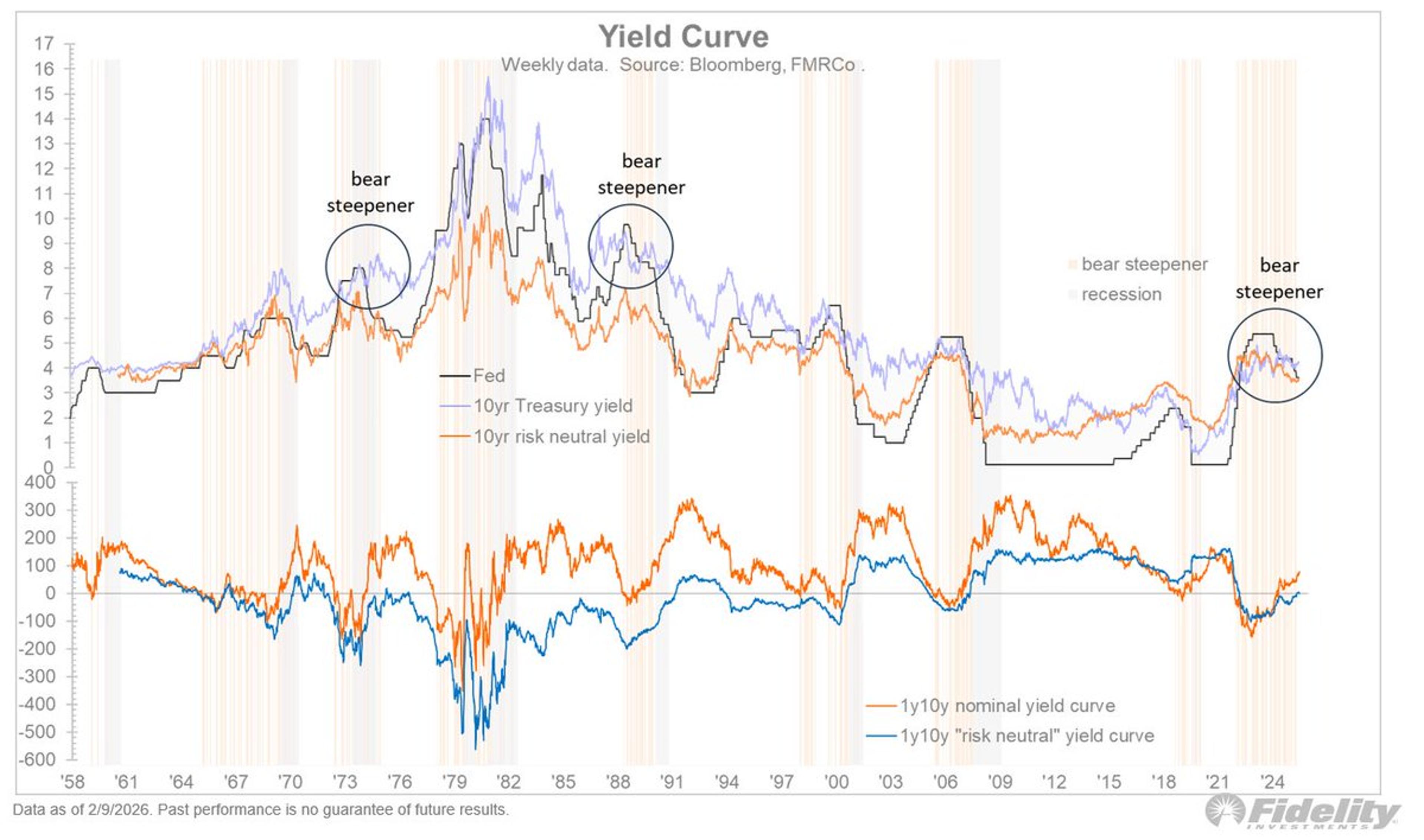

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

Social•Feb 12, 2026

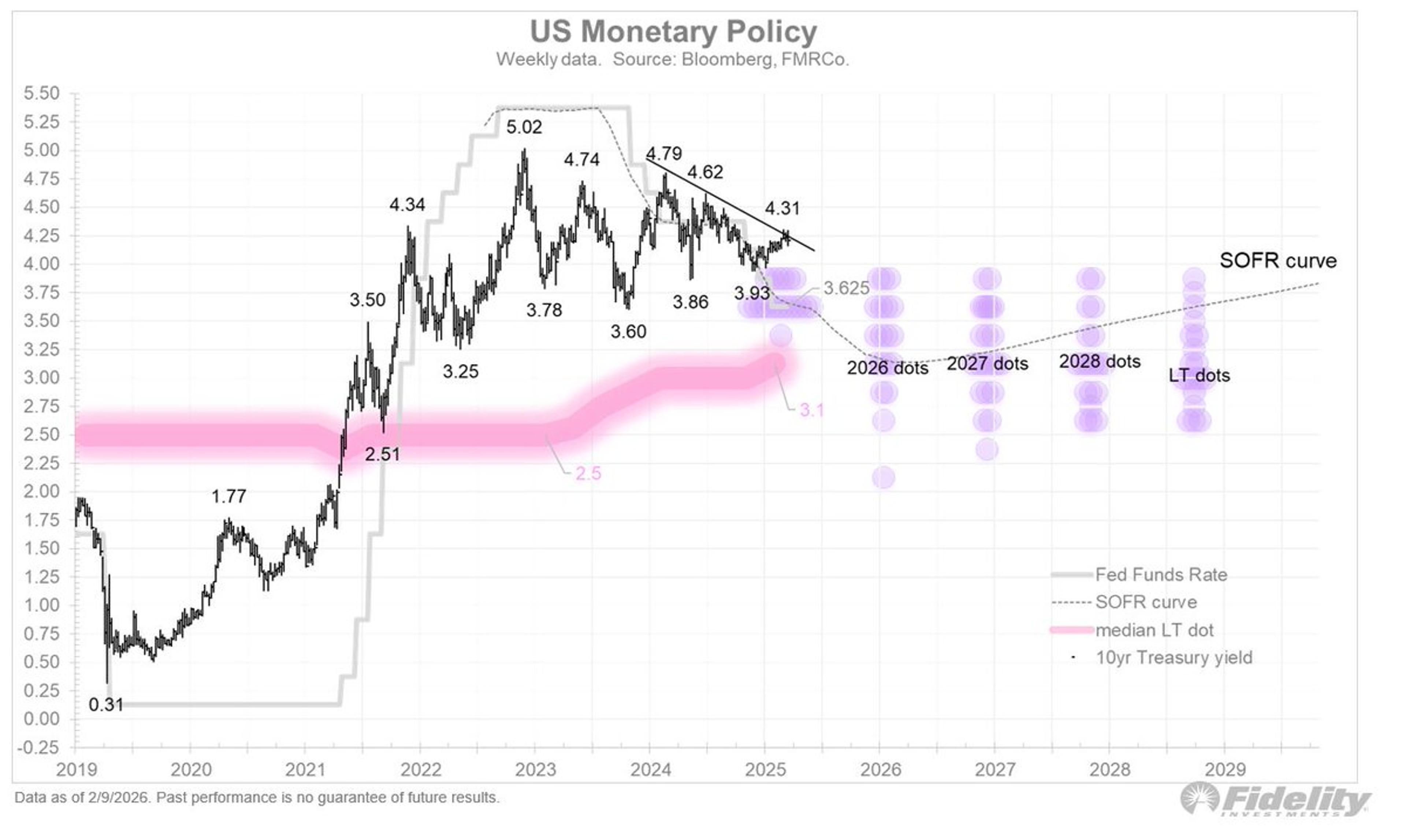

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 12, 2026

2025 Real GDP per Capita Rises, Energy Cuts Ease Inflation

Today's GDP figures show a much needed pickup in real GDP per capita - 2025 was the first year this measure grew for three years. In April, energy bill reductions from the 2025 Budget will come into effect, tackling inflation...

By Yuan Yang

Social•Feb 12, 2026

FX Market Consolidates After Strong January Jobs Data

Consolidation Featured after Yesterday's Big FX Moves: The general tone in the foreign exchange market is one of consolidation after yesterday’s stronger than expected January jobs data injected volatility into dollar trading. The news stream is light… https://t.co/TEyGQAuZOx https://t.co/b9kn9ngrdN

By Marc Chandler

Social•Feb 12, 2026

Price Controls Trigger Chaotic, Uneven Resource Allocation

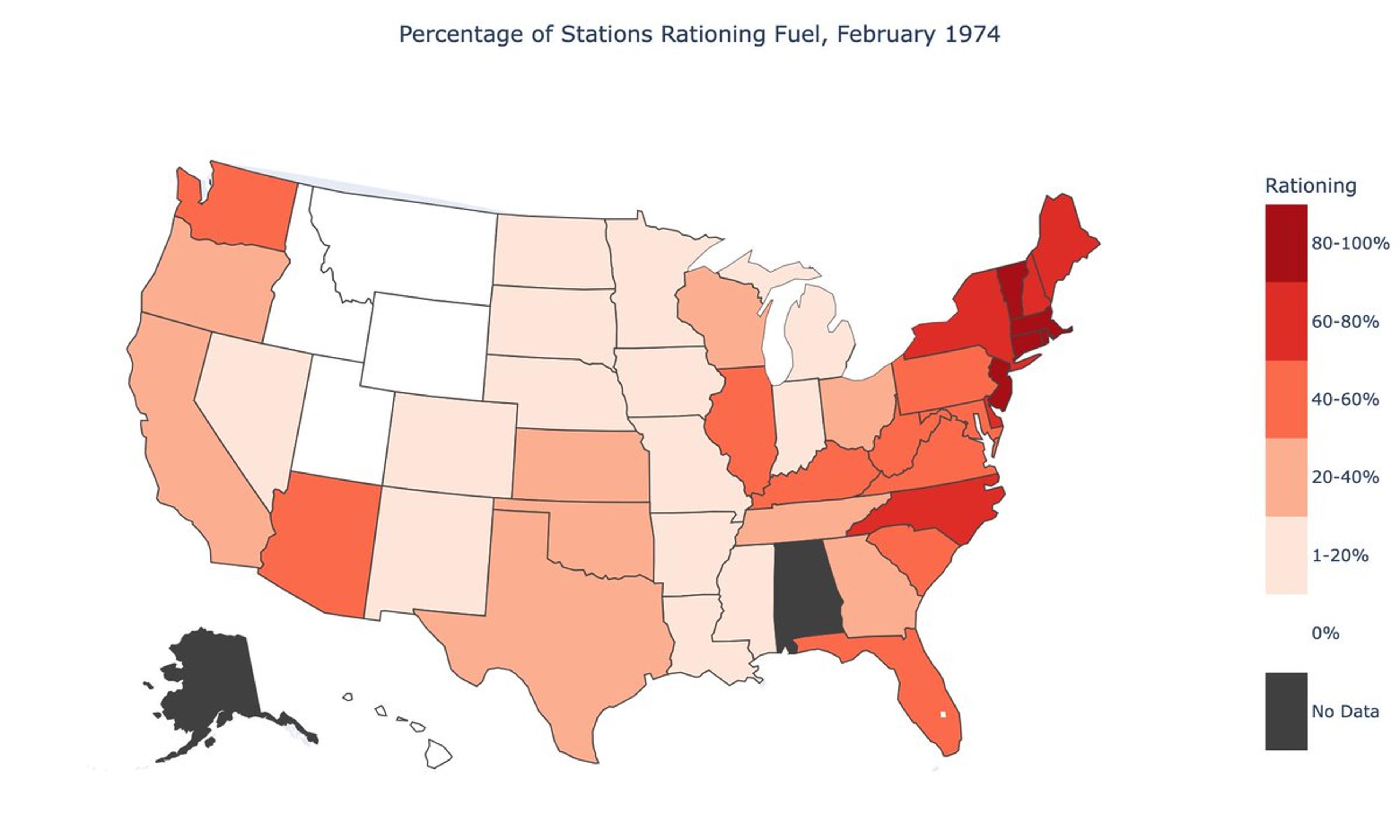

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

Social•Feb 12, 2026

EU Parliament Backs Digital Euro to Curb US Payment Dominance

Post-Trump assault on Greenland, the EU parliament delivers a big win for the digital euro as it wins 420-158 backing in EU Parliament straw poll The digital euro couldn't have better timing as the EU looks to the digital euro...

By Richard Turrin

Social•Feb 12, 2026

Makhlouf Predicts ECB Could Cut or Raise Rates

Makhlouf says next ECB move could be interest-rate cut or hike https://t.co/A8bEIJQ2pB via @livfletcher_ https://t.co/Wq9tyTki8q

By Zöe Schneeweiss

Social•Feb 12, 2026

Asian Stocks Outpace US, Shifting Money Abroad

Perhaps the trade this year isn't so much "sell America," but rather something like: "spend a lot more money everywhere else" - at least so far this year. For example, Asian stocks have made their best start over US equities...

By Lisa Abramowicz

Social•Feb 12, 2026

Dedollarisation Isn't Driving Yields Lower, Media Misleads

Is Dedollarisation driving bond yields lower or is social media pushing the wrong story? A deep dive into dollar strength, Fed policy, gold, and global trade dynamics. Full breakdown inside 👉️ : https://t.co/qdYNFtTIhV https://t.co/rMDnvdP14u

By Rohit Srivastava

Social•Feb 12, 2026

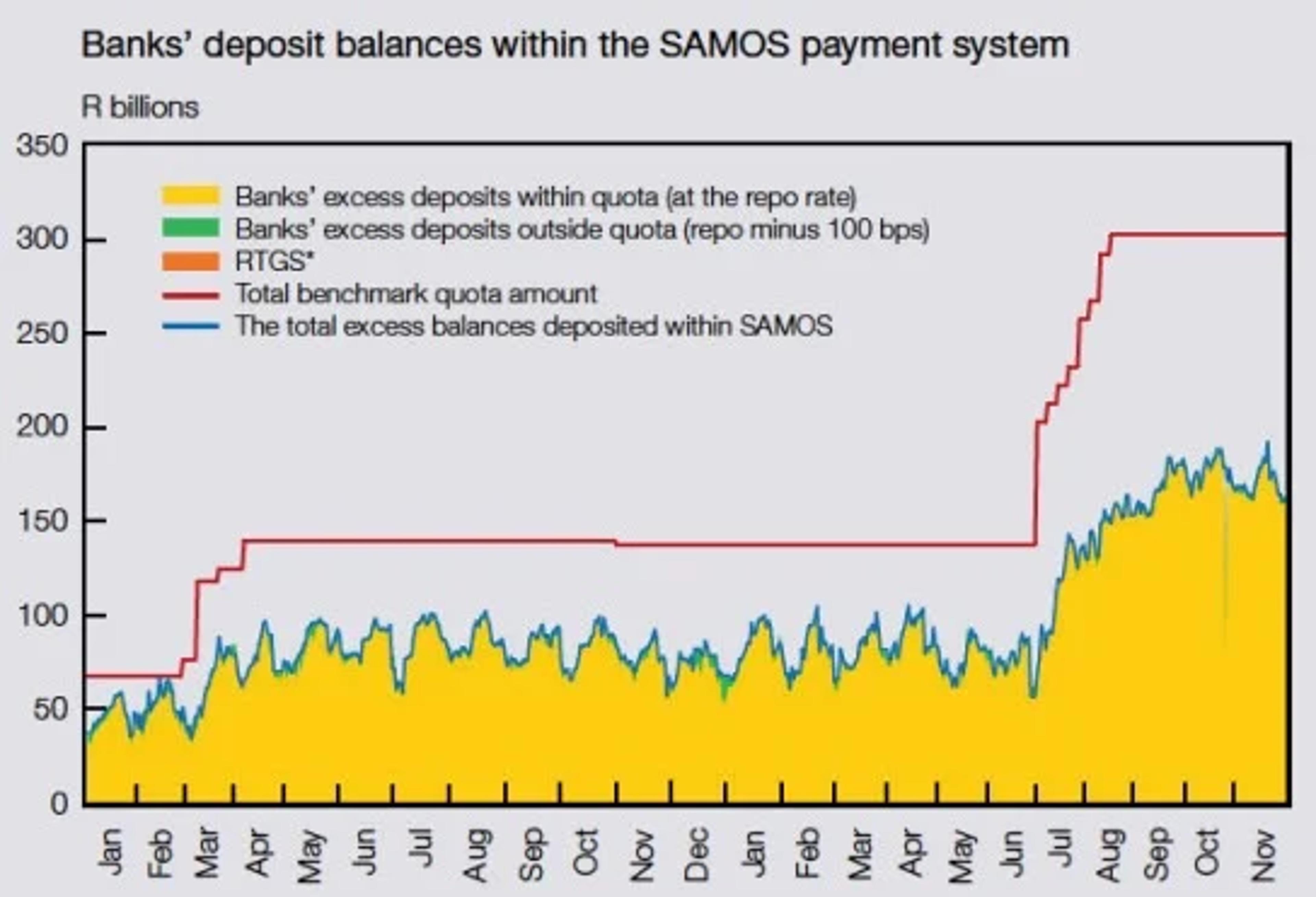

Treasury’s Cash Boost Saves Debt, Costs SARB

The state accessed funds held in the Gold and Foreign Exchange Contingency Reserve Account (GFECRA). When Treasury spent the funds, liquidity surged through the banking system, forcing the SARB to manage (“sterilize”) the excess cash, so short-term rates didn’t fall below...

By Talk Cents

Social•Feb 12, 2026

Stablecoins Reveal New Gresham’s Law: Good Money, Bad Payments

Noelle is _always_ worth reading, but today is especially good Stablecoins and the new Gresham’s Law https://t.co/OPJ4BdgNVj "So, the US ended up with a system of good money, bad payments." https://t.co/B0xMfEdzHl

By Dave Birch

Social•Feb 12, 2026

BlockFills Freezes Withdrawals as Crypto Volatility Spikes

First, you lose in a matter of weeks 50%% to 99% - depending on which shitcoin you were duped to invest in - and then they don’t even allow you to withdraw the remaining crumbs of your investments. Standard operating...

By Nouriel Roubini

Social•Feb 12, 2026

Europe’s LNG Hunger Redirects Chinese Shipments to Europe

LNG demand in Europe is so strong that it's taking a shipment *FROM CHINA* ⚠️ An LNG tanker reloaded a shipment at a Chinese terminal and is heading to Europe (China is the world’s largest LNG Buyer) Europe's LNG imports have surged...

By Stephen Stapczynski

Social•Feb 12, 2026

Productivity Gains Are the Real Driver of Inflation

Posted this thread two years ago on the enigmatic relationship between inflation and productivity, and more relevant now than ever—

By Jeff Park

Social•Feb 12, 2026

Trump’s Pipeline Push Could Cheapen Coal Rail Transport

🚂If President Trump is serious about increasing coal exports dramatically, and if he is serious about US energy dominance, he will build oil pipelines and prohibit rail transportation of oil. This will provide the US coal industry with the help...

By Anas Alhajji

Social•Feb 12, 2026

USDCNH and USDHKD Show Strong Inverse Correlation

The correlation between the USDCNH and USDHKD is the most intense and consistent inverted I've seen since the former (theoretically) 'floated'. What's going on there? https://t.co/KsfLfKWwTf

By John Kicklighter

Social•Feb 12, 2026

Venezuela's Oil Shifts: Implications for Canada Discussed in Calgary

I’ll be in Calgary in early March for a discussion hosted by the Canadian Heavy Oil Association about what recent developments in Venezuela mean for Canada’s oil industry. Join us! And drop me a line if you want to grab a...

By Rory Johnston

Social•Feb 11, 2026

Refineries Drowning in Silver Scrap, Bearish Outlook

Why @BergMilton is bearish silver: refineries are OVERWHELMED with silver scrap, EVEN MORE than in 2011 (prior speculative peak). Well sourced from "largest smelter in New York" Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi https://t.co/ng04tObLMG

By Jack Farley

Social•Feb 11, 2026

Argentine Peso Rallies, USDARS Breaks 100‑Day SMA Streak

In case you haven't been keeping tabs, the Argentine Peso has been gaining some traction recently. $USDARS has taken out some recent support and ended a 1,689 (trading) day streak above the 100-day SMA https://t.co/Vq0kH5UKHg

By John Kicklighter

Social•Feb 11, 2026

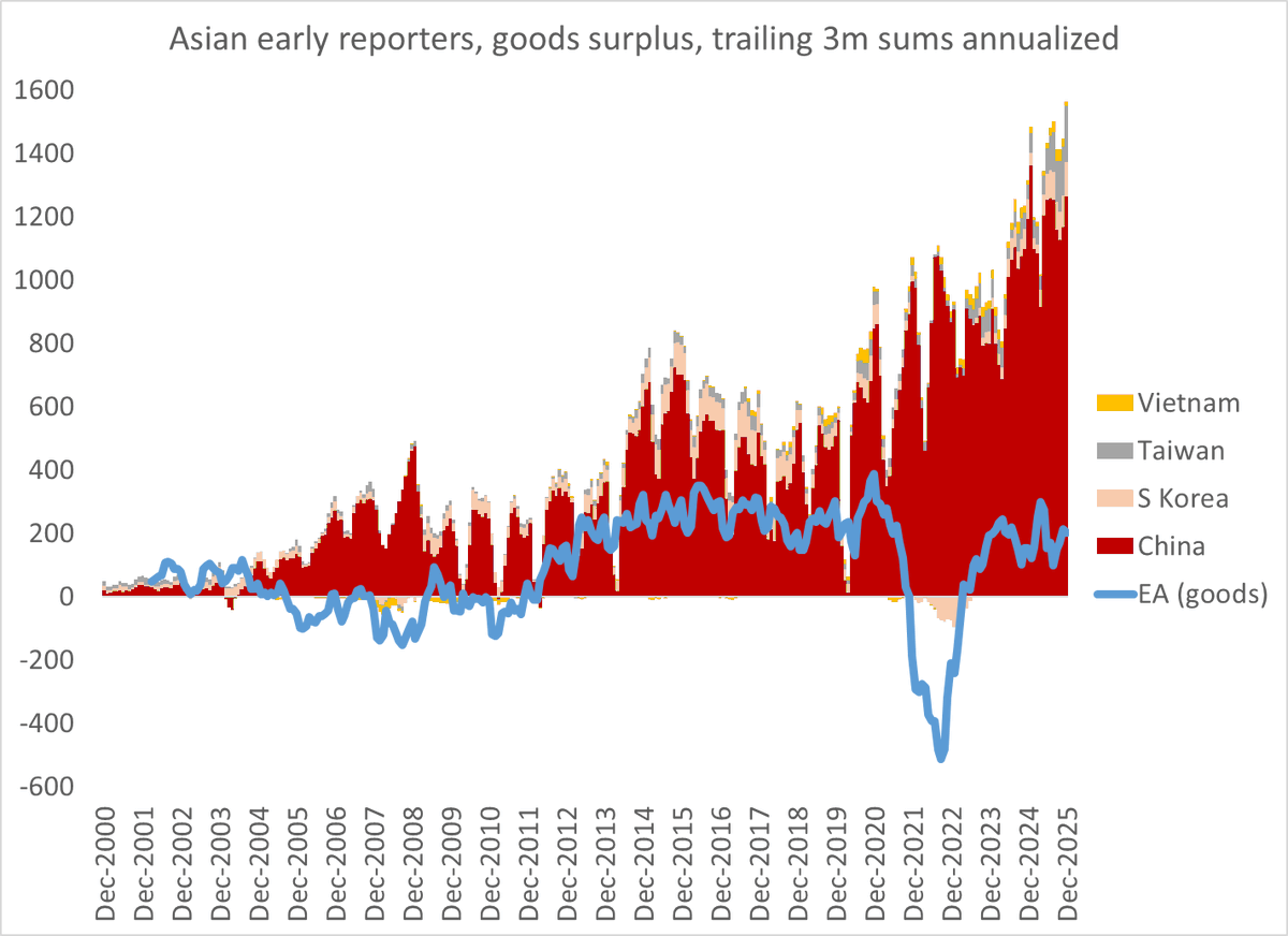

East Asia Dominates Global Goods Trade Surplus, Eclipsing Europe

Crazy how much of the global (goods) trade surplus is in East Asia now. Even with the "fake" Irish pharma surplus, the euro area is dwarfed 1/ https://t.co/eZjcgAlVqC

By Brad Setser

Social•Feb 11, 2026

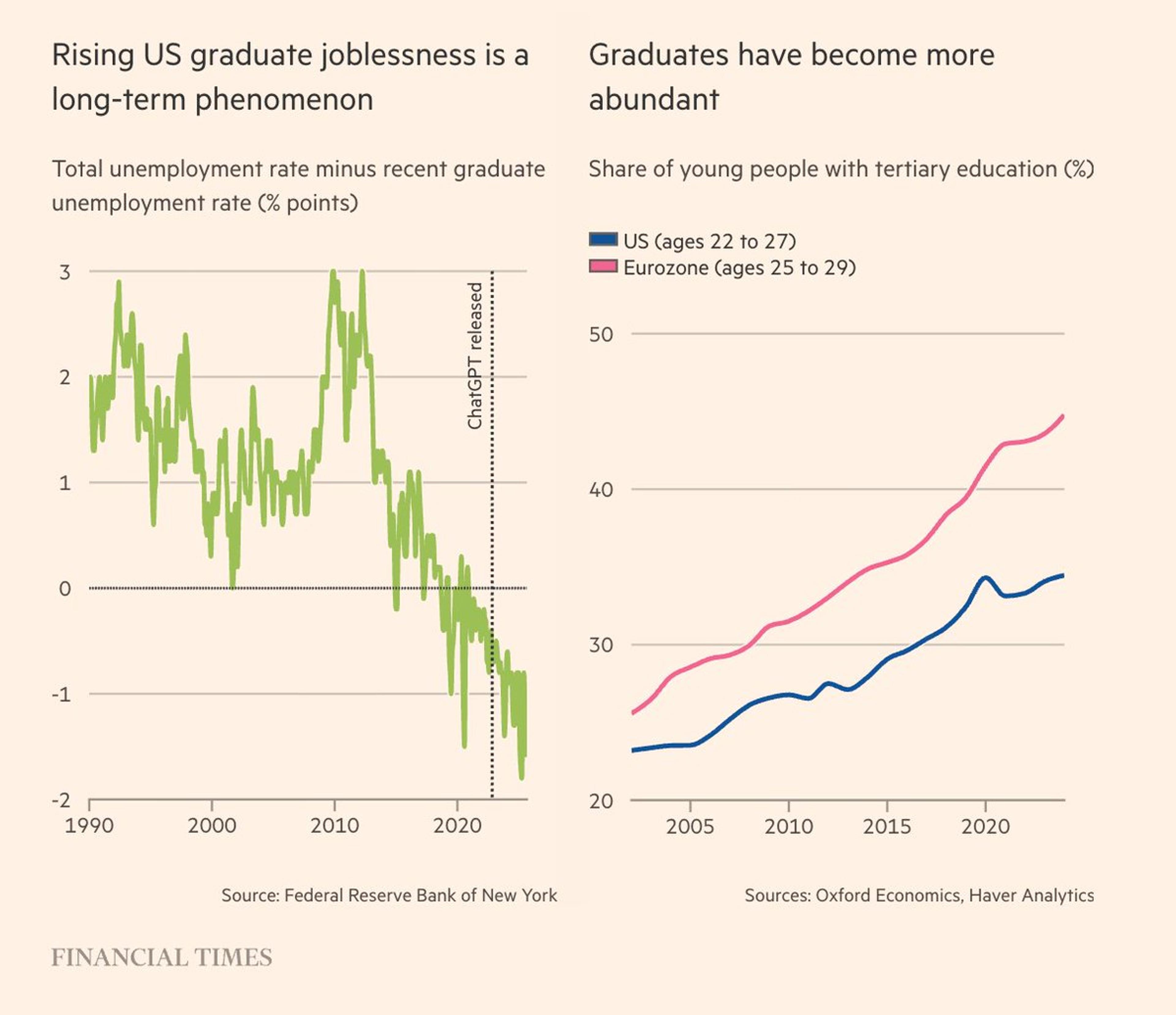

US Grads Face Higher Unemployment; Eurozone More Educated Workforce

Very striking data these a. on US graduate unemployment and b. higher share of tertiary education in Eurozone labor force than in the US. Explore these economic insights in today's Chartbook Top Links. https://t.co/xNeFQVgZKf

By Adam Tooze

Social•Feb 11, 2026

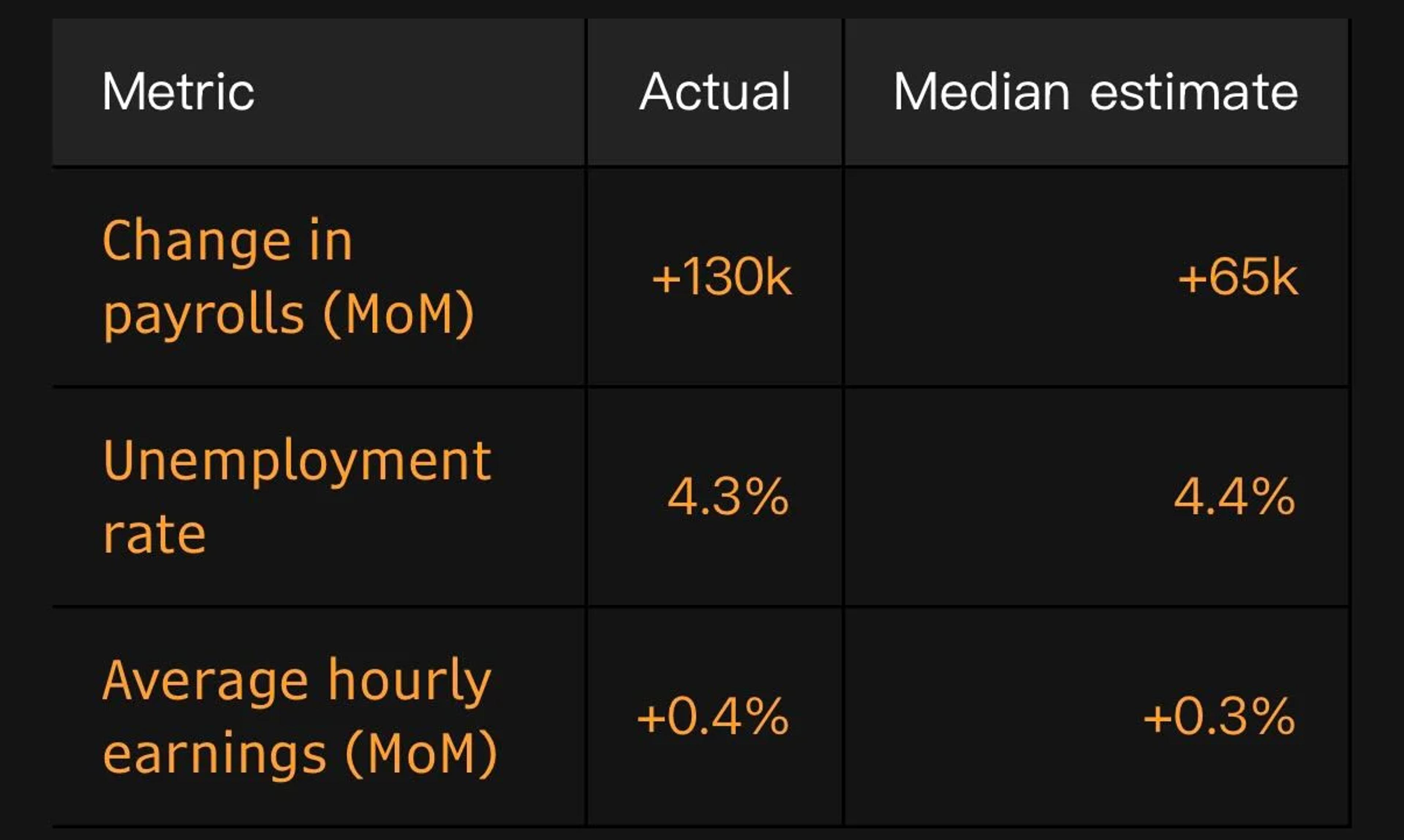

NFP Beat Trims Fed Rate Cut Expectations by 8‑12bps

In the wake of this morning's NFPs beat and downtick in the unemployment, Fed Funds futures have shaved off ~8bps worth of expected cuts through 2026 - was as much as 12bps. Someone is going to be surprised if this continues:...

By John Kicklighter

Social•Feb 11, 2026

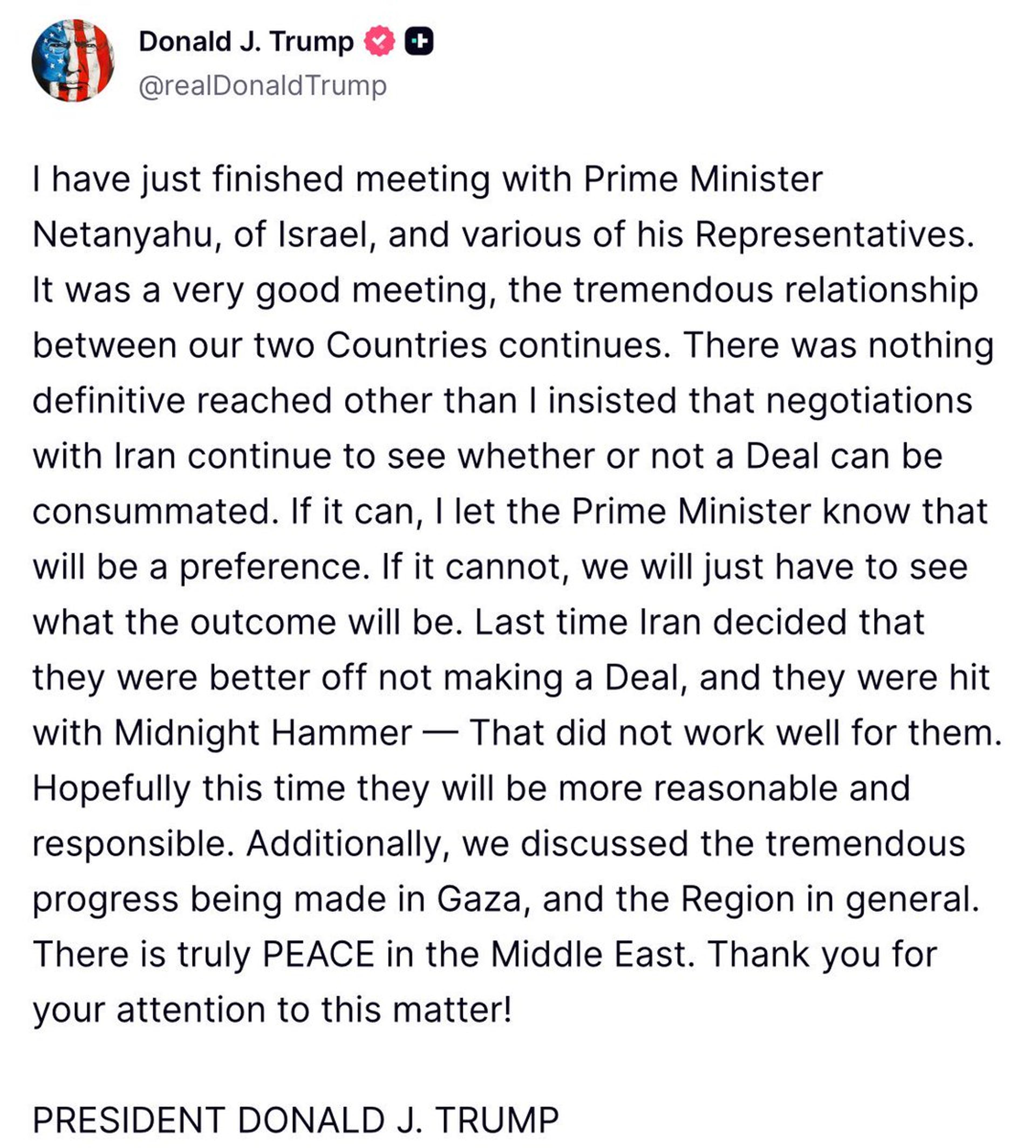

Trump Urges Netanyahu to Pursue Iran Nuclear Deal

OIL MARKET: President Trump says he told Israeli Primer Minister Netanyahu that his preference is to cut a deal with Iran. “I insisted that negotiations with Iran continue to see whether or not a deal can be consummated.” https://t.co/VhkfL7QBHF

By Javier Blas

Social•Feb 11, 2026

EU Debt Issuance

If the EU were only able to issue its own debt, imagine the possibilities… Yeah, imagine if you gave EU bureaucrats the power to spend an astronomical amount in addition to its power to regulate https://t.co/KAqbSOG71R

By Axel Merk

Social•Feb 11, 2026

Yen Carry Trade Holds; USD Weakens, Markets Rise

Yen Carry Trade Is Not Unwinding Like You Think $USDJPY $FXY $QQQ $DXY Japan & China’s pressure on Treasury sales are weakening the USD, supporting equities + metals overall, without triggering a disruptive yen carry trade unwind. https://t.co/m6Mu3FpuRf

By Samantha LaDuc

Social•Feb 11, 2026

Big Tech Buys Trump Tariff Exemptions, Small Firms Suffer

Big Tech and their lobbyist have bought exemptions from Trump’s tariffs. Meanwhile, the small fries are getting FRIED. TRUMP’S TARIFFS = THE BIG GUYS CAN ALWAYS BUY AN EXEMPTION. https://t.co/zlVn4ornDl

By Steve Hanke

Social•Feb 11, 2026

New Jobs Report: What It Means for You

Latest jobs report just dropped. Let's spend a few minutes talking about what's really going on, what it means for you, and what to keep your eye on. https://t.co/ptv6DbFqKM

By Justin Wolfers

Social•Feb 11, 2026

Argentina's 32% Inflation Signals Milei Must Dollarize

Argentina’s January inflation came in at a RED HOT 32.4%/yr. Pres. Milei’s monetary model is not working. MILEI MUST DOLLARIZE NOW. https://t.co/MLSKqYfys7

By Steve Hanke

Social•Feb 11, 2026

USDJPY Plunges 2.5% in Three Days, Reversal Uncertain

$USDJPY is down over -2.5% over the past three days. One of the biggest drops in the past year and a half. Doesn't mean it has to stall and reverse though... https://t.co/LRjhnctyzL

By John Kicklighter

Social•Feb 11, 2026

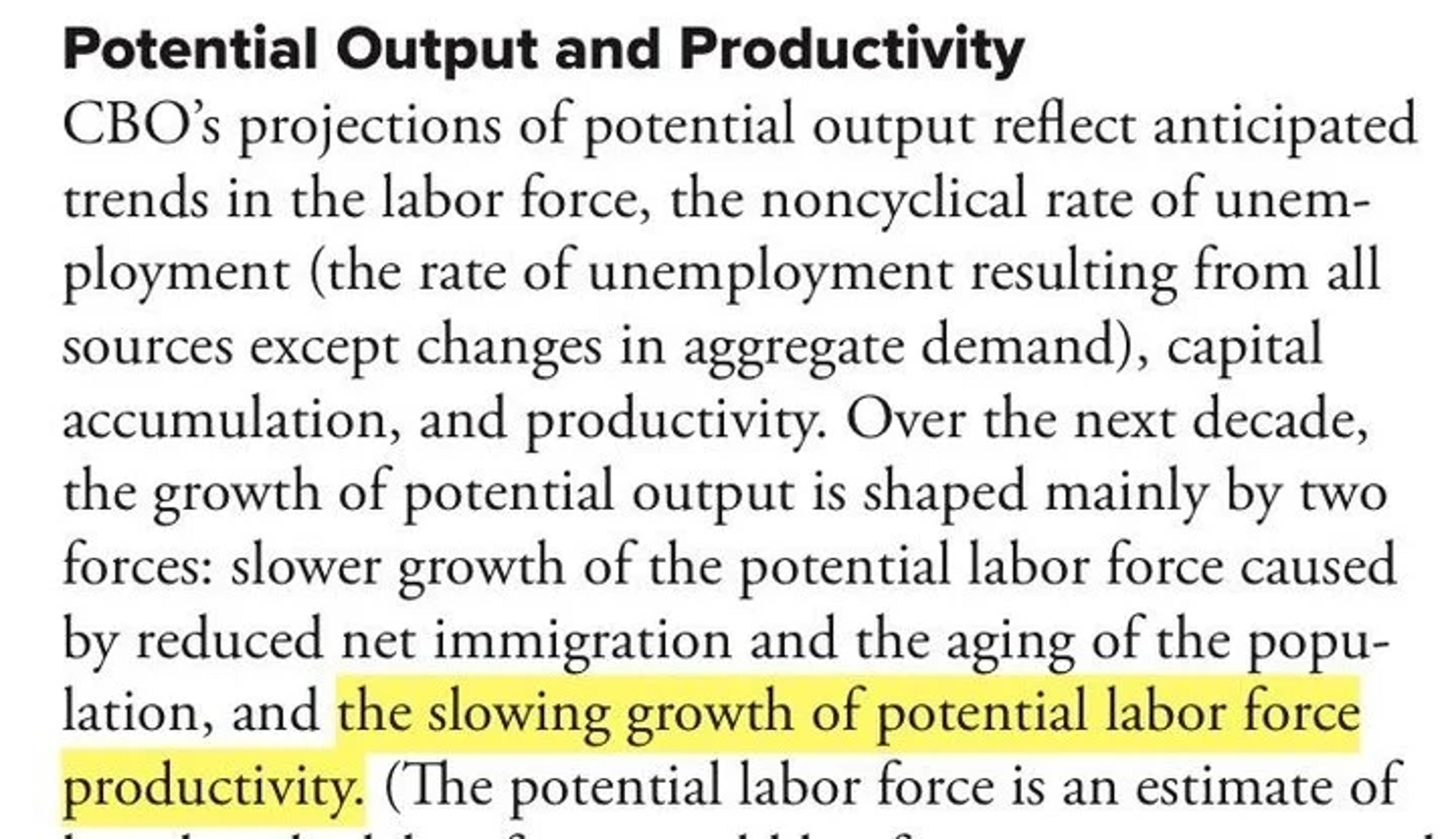

CBO Underestimates AI's Productivity Boost, Forecasts Too Low

CBO is mostly dismissive of the effects of AI on productivity growth (overly so IMHO). They expect *slowing* potential labor force productivity as the modest AI boost to TFP is swamped by the reduction in capital services. I would take the over...

By Jason Furman

Social•Feb 11, 2026

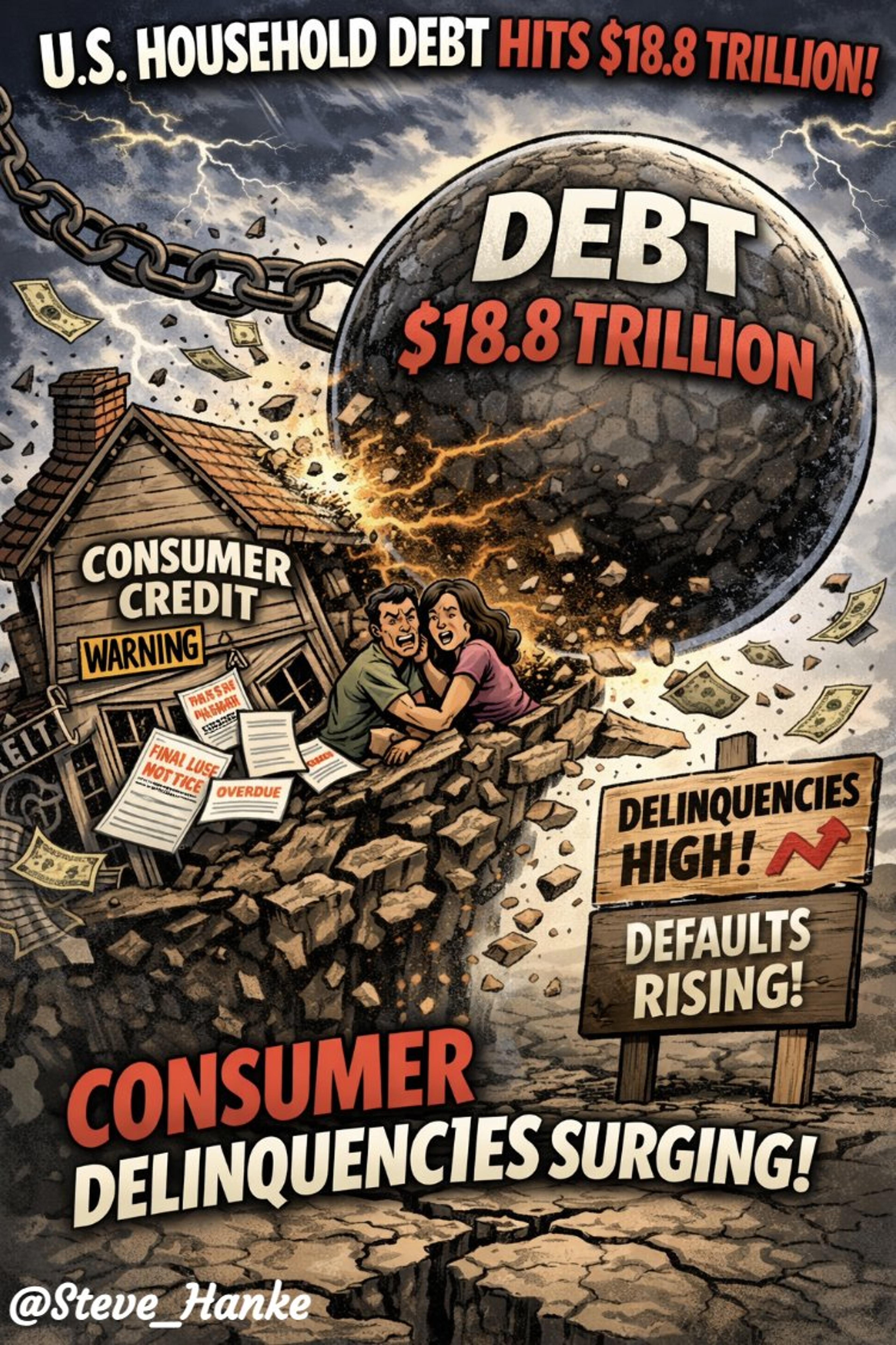

US Household Debt Peaks at $18.8T, Delinquencies Surge

US household debt just hit $18.8 TRILLION. Consumer delinquencies are at their HIGHEST LEVEL in nearly a DECADE. Not a good sign. https://t.co/PHcOGrhvOc

By Steve Hanke

Social•Feb 11, 2026

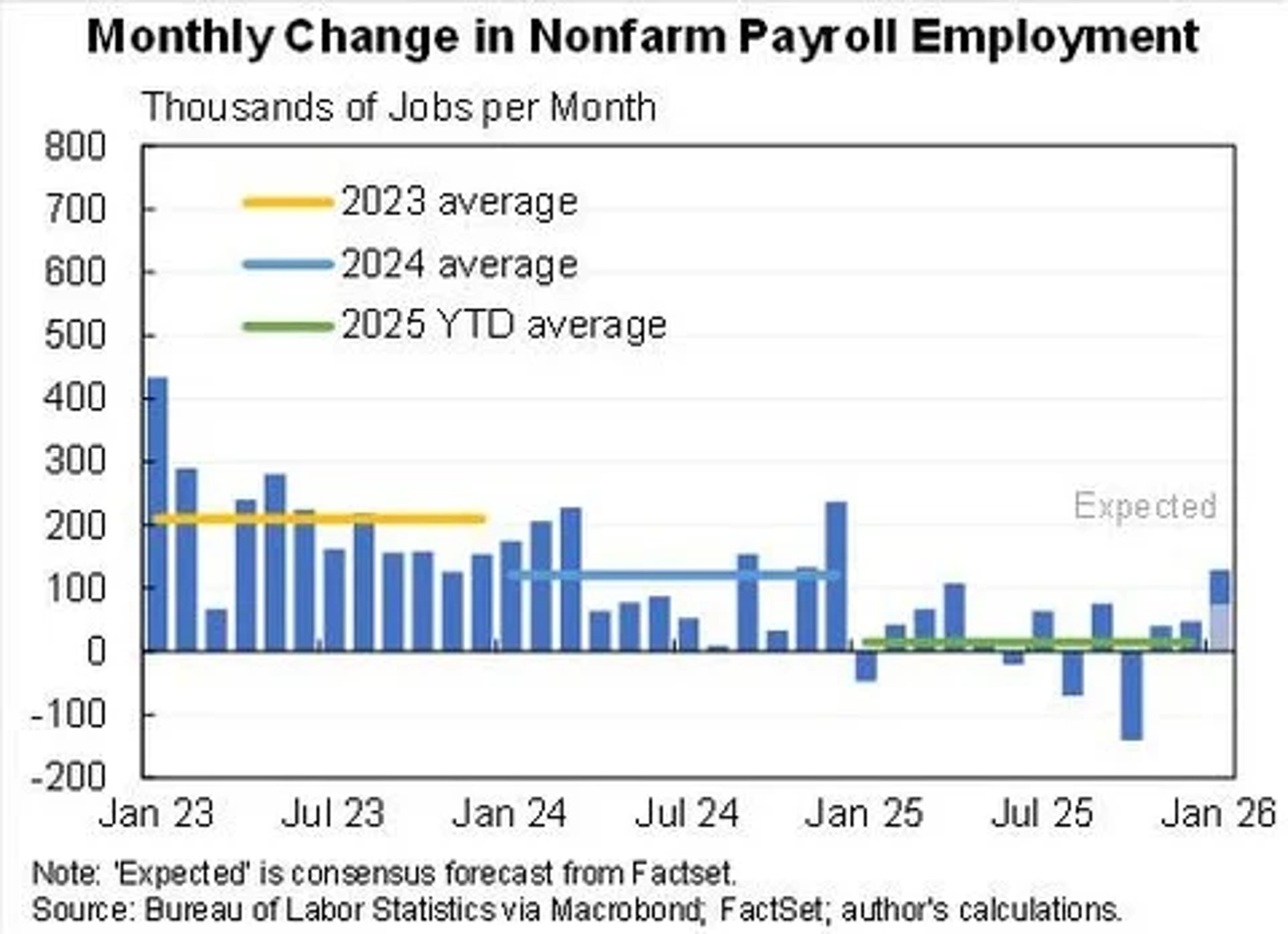

Labor Market Rebounds After Shutdown, Easing Temporary Layoffs

The labor market showed signs of healing late in 2025 and in January. Catch up following long government shutdown helps alleviate ranks of those suffering temporary layoffs and forced to accept part instead of full-time jobs. Some healthy churn returned...

By Diane Swonk

Social•Feb 11, 2026

2027 AI Race: Align or Lose Human Relevance

🚨 From Agent-1 to Superintelligence: The AI 2027 Scenario The AI 2027 Report outlines one of the most thought-provoking trajectories for artificial intelligence: a rapid evolution from simple assistants (Agent-1) to autonomous, adversarially misaligned systems (Agent-4) and ultimately to Agent-5 —...

By Giuliano Liguori

Social•Feb 11, 2026

Jobs Surge, Unemployment Drops: GDP Gains Confirm Strength

On the surface a strong jobs report (130K jobs & unemployment falls to 4.3%). And just about every detail makes that stronger: participation up, involuntary part-time down, hours up, wages up. The mystery of strong GDP and weak jobs is being resolved...

By Jason Furman

Social•Feb 11, 2026

Historical Cycles Link US Inequality, Deficits, and Global Populism

The changes in the US over the last decade — rising inequality, massive deficits, and a shifting global outlook — are not isolated events. They are all interconnected and part of a dynamic that has occurred many times before for...

By Ray Dalio

Social•Feb 11, 2026

Trump’s Trillion-Dollar Savings Claim Ignores Fixed-Rate Debt

Trump says lower rates would save "at least one trillion dollars per year." The federal government's entire annual net interest bill was $970 billion in fiscal 2025—and much of that is locked in at rates on previously issued debt that...

By Nick Timiraos

Social•Feb 11, 2026

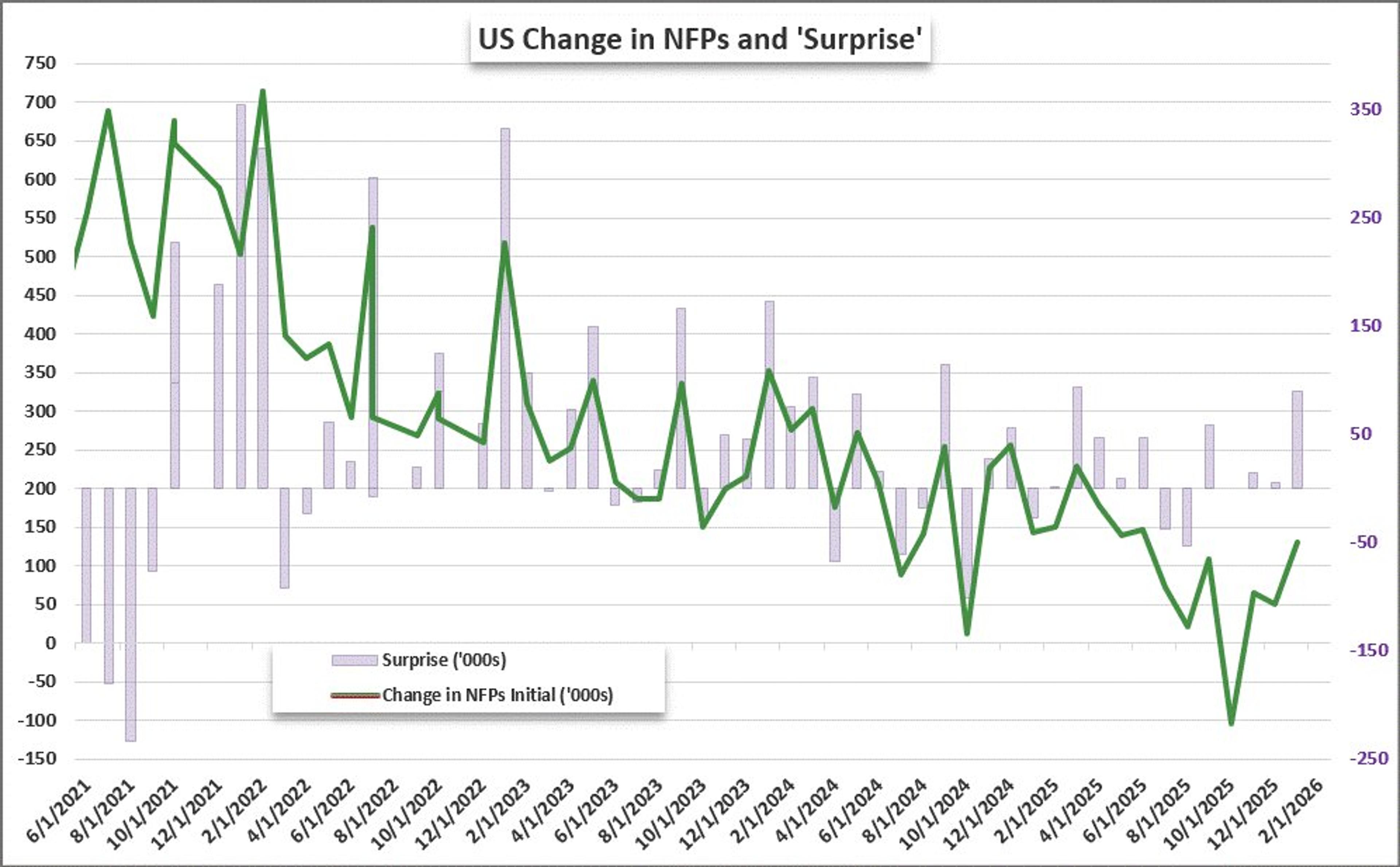

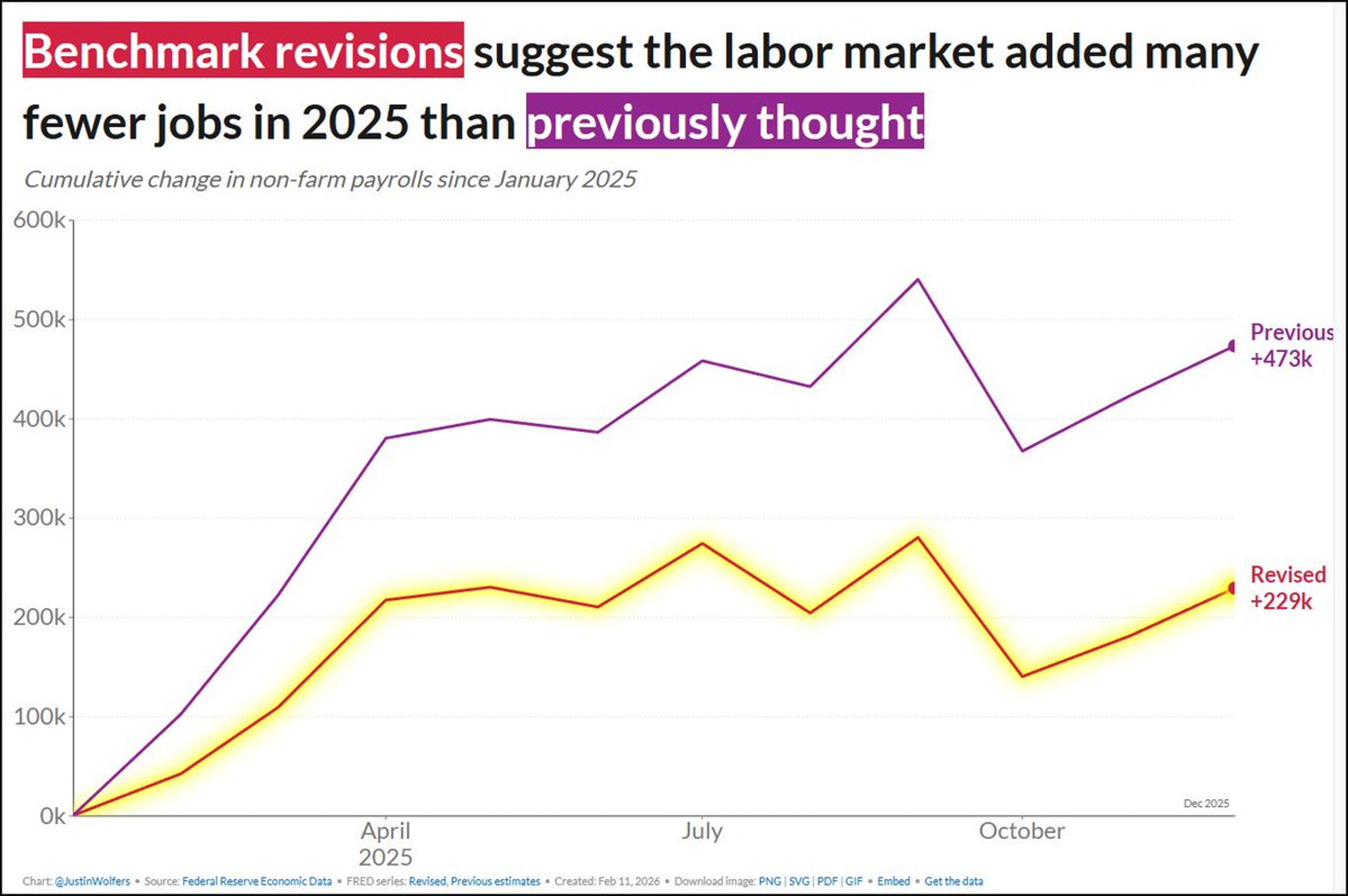

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter

Social•Feb 11, 2026

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

President's Attempt to Manipulate Job Data Failed

My menchies show a lotta distrust about the official jobs numbers right now. Lemme be clear: I don't believe there's *any* political meddling in these numbers. While the President has tried to mess with the BLS, he failed. I explain in...

By Justin Wolfers

Social•Feb 11, 2026

2025 Job Growth Halved by New BLS Revision

Every year the BLS does a benchmark revision which incorporates new and more detailed information. This year's revision suggests that 2025 was a far worse year than earlier estimates suggested, and total job growth was less than half that suggested...

By Justin Wolfers

Social•Feb 11, 2026

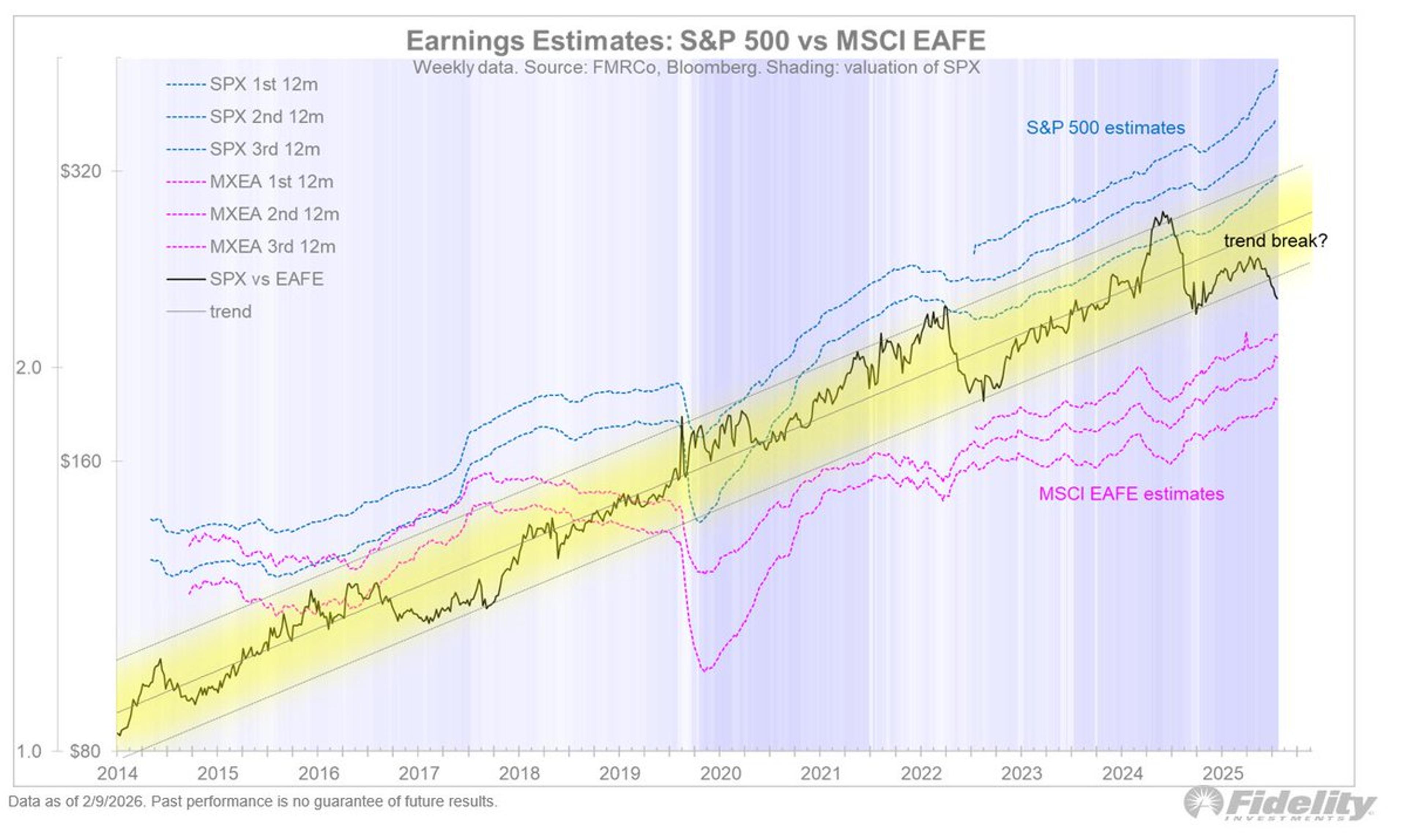

Global Earnings Boom Ends S&P’s EAFE Uptrend

The earnings boom has gone global, with estimates in both EAFE and EM showing good momentum. The blue squiggles show estimates for the S&P 500 and the pink ones are for the MSCI EAFE index. The days of significant divergences...

By Jurrien Timmer

Social•Feb 11, 2026

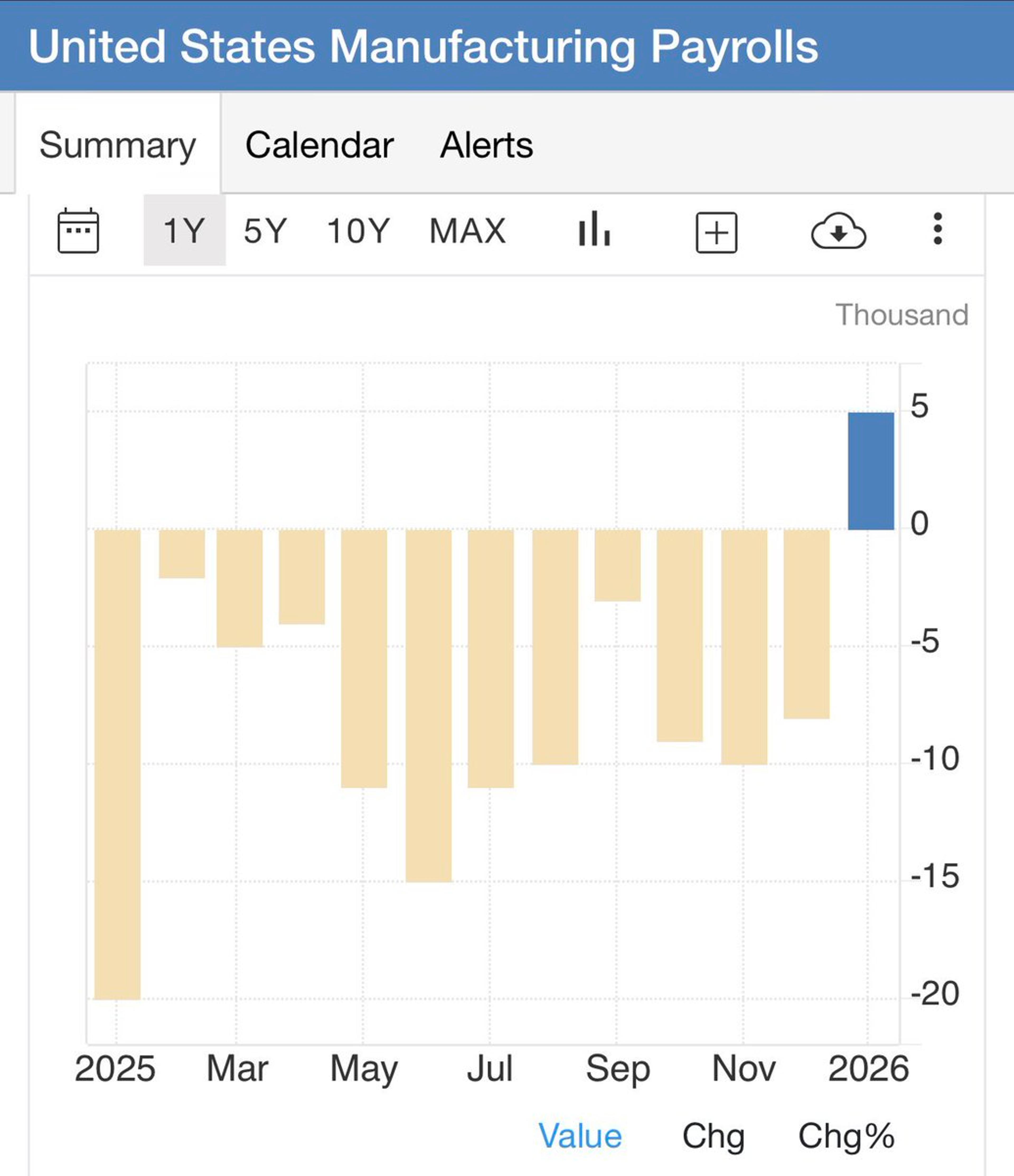

Manufacturing Payrolls Rise, Private Jobs Surge, Unemployment Falls

First positive manufacturing payrolls in a very long time, private payrolls surging, UR down. The economy is re-accelerating https://t.co/sbUBFBA4SA

By Felix Jauvin

Social•Feb 11, 2026

Strong Payrolls Fail to Boost Dollar, Correlation Shifts

Tepid response of the Dollar to a big upside surprise in payrolls. The whisper number for consensus was weak, so this was a solid beat, yet USD is barely able to rise. We're on our way to the correlation switch...

By Robin Brooks