Social•Feb 14, 2026

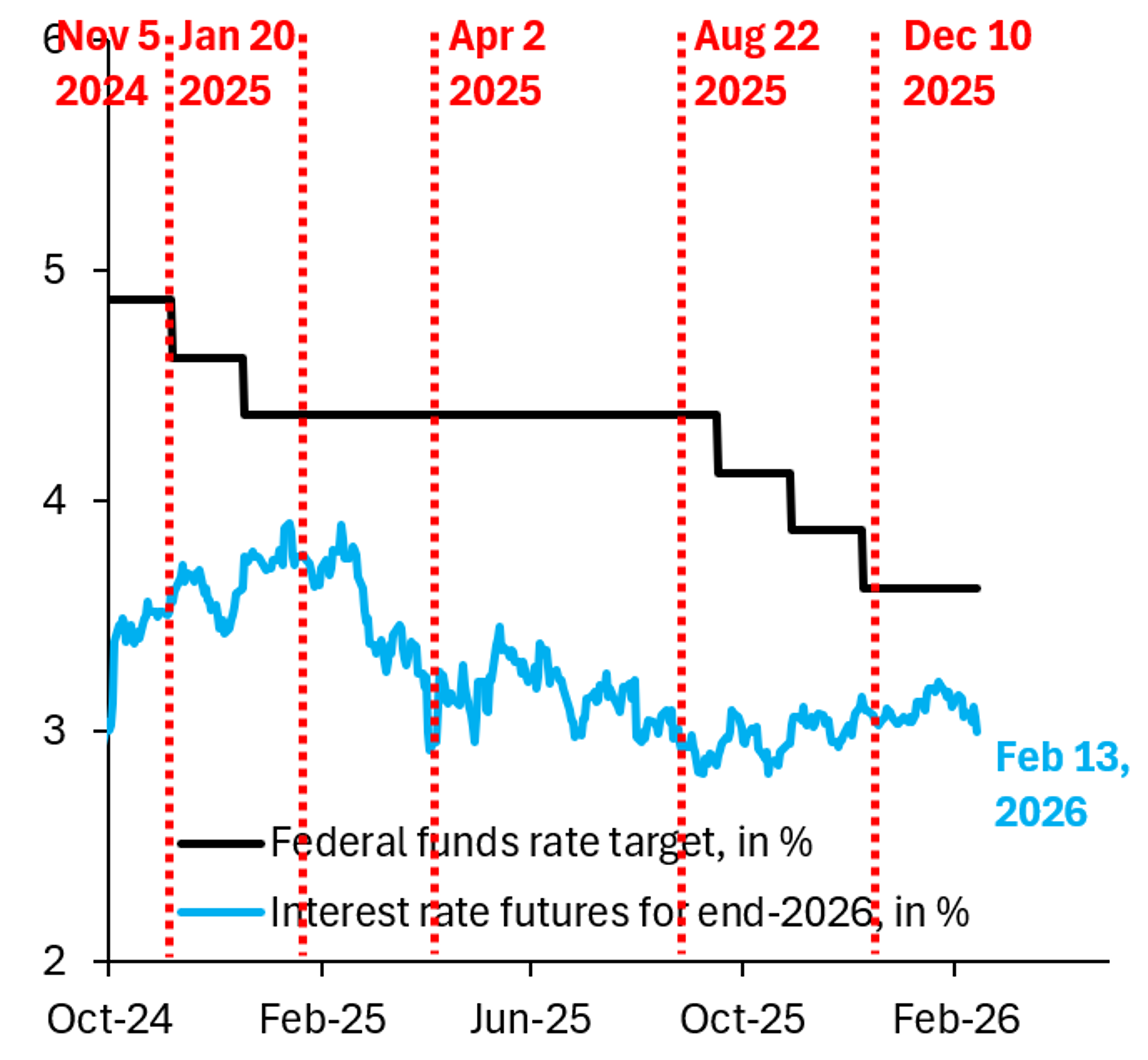

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See https://t.co/swDpfZ1KEh https://t.co/q8Gy6QGMg5

By Marc Chandler

Social•Feb 14, 2026

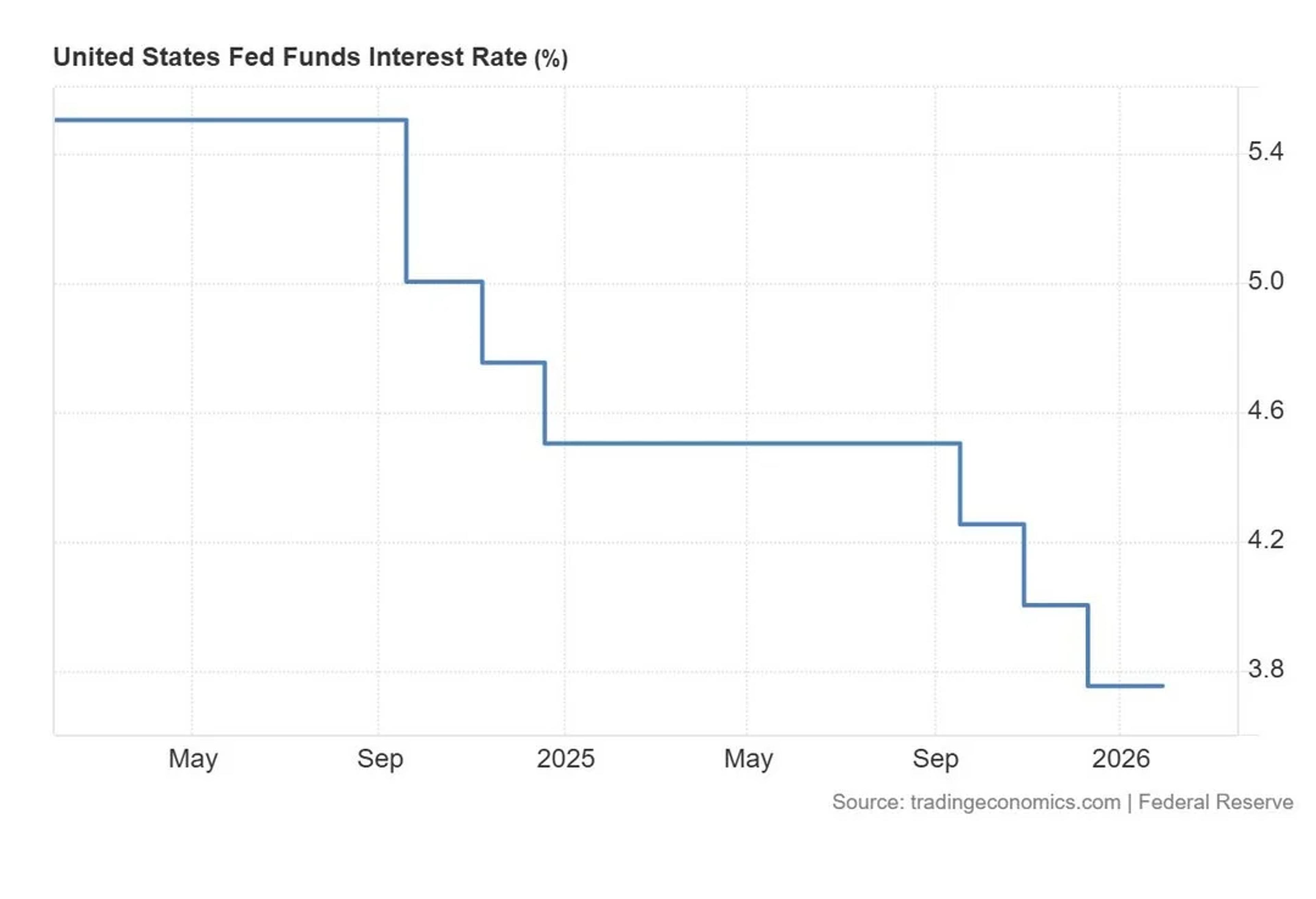

Warsh Fed Expected to Slash Rates 100bps, Dollar Falls

My forecast is for the Warsh Fed to cut policy rates by 100 bps in the 4 meetings after he takes over (June, July, September, October) ahead of midterms. Markets are moving in this direction, but still price only 63...

By Robin Brooks

Social•Feb 14, 2026

Markets Discount Fed Cuts Amid Japan Election, Tariff Uncertainty

Week Ahead: SCOTUS Decision on Tariffs? 8 Fed Officials Speak as the Market Discounts almost 65 bp of Cuts this Year: Last week began with the LDP's stunning victory in Japan. However, rather than sell-off as the market expected, the...

By Marc Chandler

Social•Feb 14, 2026

Dollar Decouples: US Growth Rises as USD Falls

Great piece by @katie_martin_fx in the @FT on the correlation break happening for the Dollar. As Trump leans more and more on the Fed, positive data surprises like payrolls no longer lift USD. The US will boom this year. But...

By Robin Brooks

Social•Feb 14, 2026

Strengthening Critical Mineral Supply Chains Amid Geopolitical Fragmentation

Thanks @bmwfoundation for partnering w @ColumbiaUEnergy on such a substantive & productive session @MunSecConf on how to enhance critical mineral & energy supply chain security amid fragmenting geopolitics. Great insights from DOE’s @AlexFitzDC, @dan_brouillette & so many others. https://t.co/D1xRKHu7gO

By Jason Bordoff

Social•Feb 14, 2026

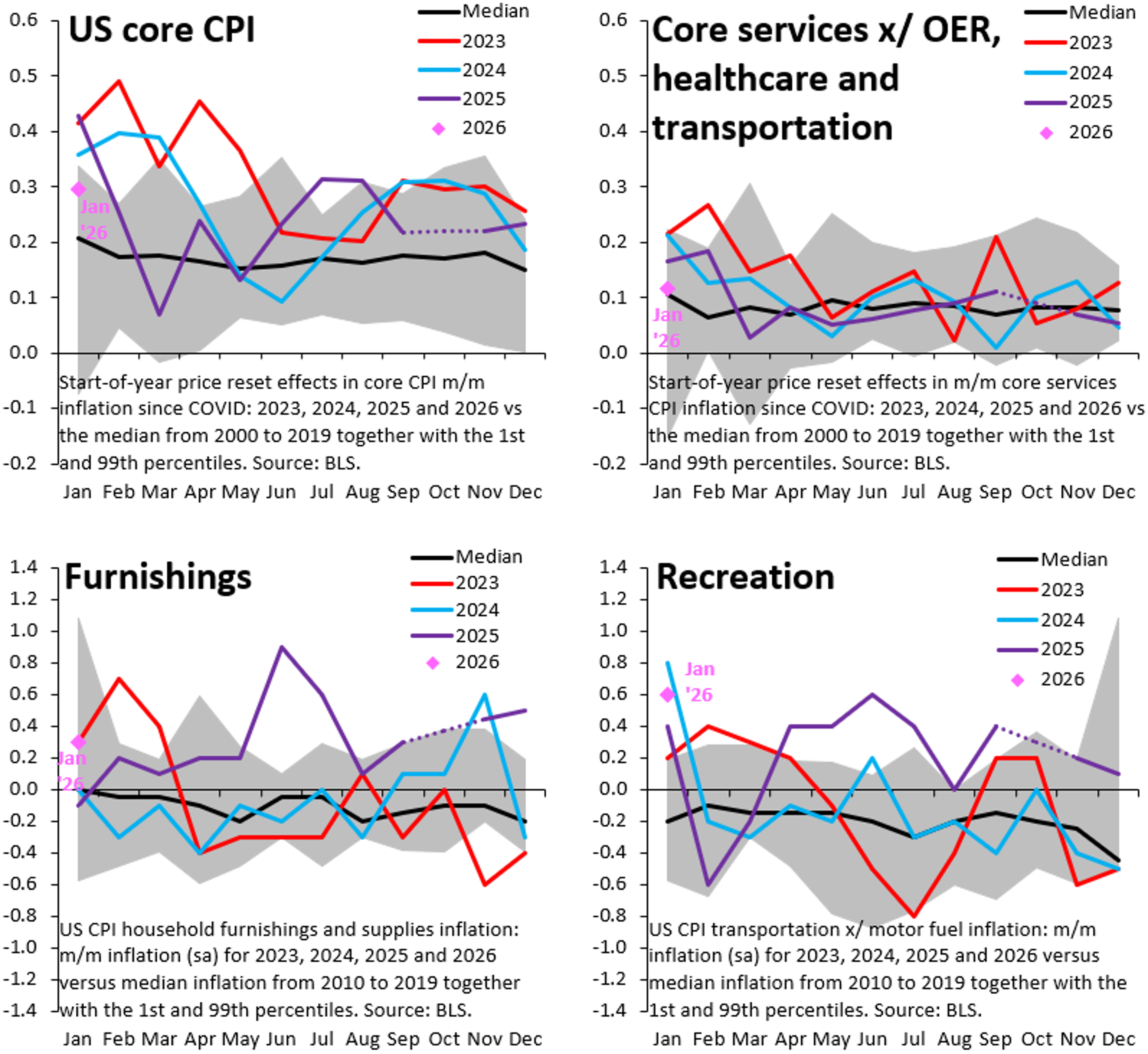

Anti‑Trump Bias Skews Dollar and Inflation Forecasts

A lot of economic commentary is inflected by anti-Trump sentiment. That's why so many forecast the Dollar would go into a death spiral last year (it didn't) & why there's so much focus on inflation overheating now (it isn't). Yesterday's...

By Robin Brooks

Social•Feb 14, 2026

Big Shocks Make Firms Change Prices Faster, Speeding Inflation

Recent inflation surge has subsided in most advanced economies, but effects may linger in unexpected ways. Inflation responds much more rapidly to large shocks than standard models predict, because firms adjust prices more frequently when shocks are large https://t.co/Lrr7d9eevX

By Linda Yueh

Social•Feb 14, 2026

Import‑Dependent Nations Face Greater Food Insecurity, Regardless of Wealth

Countries that rely on staple imports to feed their population tend to report higher levels of food insecurity. This holds even after controlling for income per capita, suggesting that exposure to international markets is independent of development level https://t.co/2tzjysif3u

By Linda Yueh

Social•Feb 14, 2026

Wars Trigger Persistent Democratic Decline in Specific Contexts

Data covering 115 conflicts & 145 countries over past 75 years show wars cause large & persistent declines in democratic institutions. Not inevitable. It appears only in specific settings –first-time conflicts, internal wars, conflicts that governments win https://t.co/Lq6ORZiquj

By Linda Yueh

Social•Feb 14, 2026

EU Trade Surplus Shrinks as Tariffs and China Pressure

1/5 Reuters: "The EU's trade surplus kept shrinking, data showed on Friday, as tariffs weighed on exports to the U.S. and rising Chinese imports crowded out domestic production, highlighting existential threats to the bloc's economic model." https://t.co/91sJO2nGjP

By Michael Pettis

Social•Feb 14, 2026

Provincial Revenues Forecast 2‑3% Growth, Lagging Economy

1/4 SCMP: "Major provinces are budgeting for 2 to 3 per cent growth this year in general public operating revenue, broadly in line with last year but below broader economic growth targets, Fitch Ratings said in a research note." https://t.co/HwyAPw042O

By Michael Pettis

Social•Feb 14, 2026

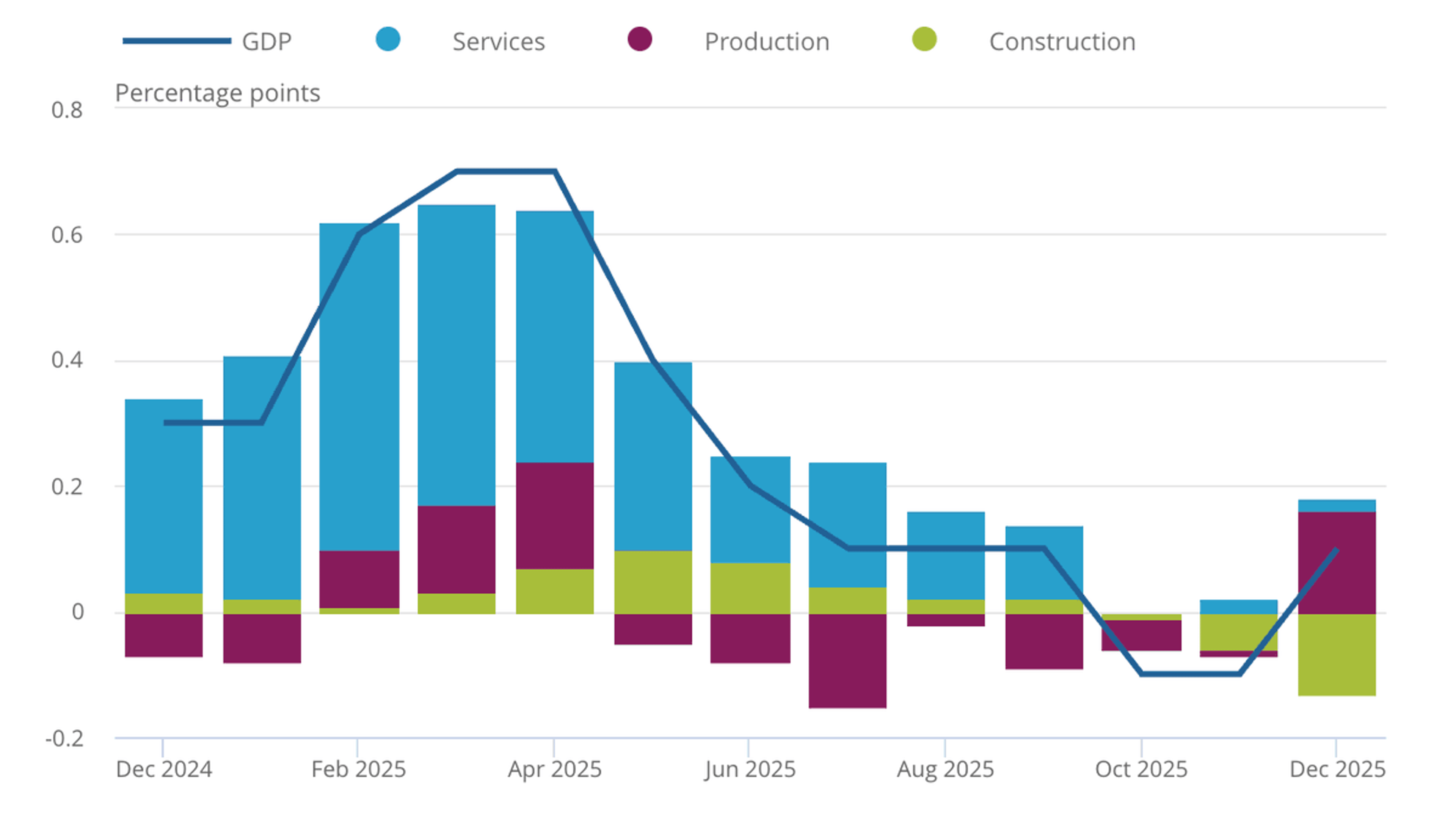

UK Growth Stalls at 0.1% Amid Rising Taxes

The U.K.'s GDP grew just 0.1% in Q4 2025 and an ANEMIC 1.3% for the entire year. Under RUSSOPHOBE Keir Starmer, taxes are up, productivity is flat, and consumers are feeling squeezed. https://t.co/WDyleJsH6n

By Steve Hanke

Social•Feb 14, 2026

China Cracks Down on Hidden Corporate IOU Market

1/3 Very interesting Caixin article on attempts by Chinese regulators to get their arms around "the opaque market for corporate IOUs that has allowed big-name companies to defer payments to suppliers on a massive scale." https://t.co/FIJywKAtIX

By Michael Pettis

Social•Feb 14, 2026

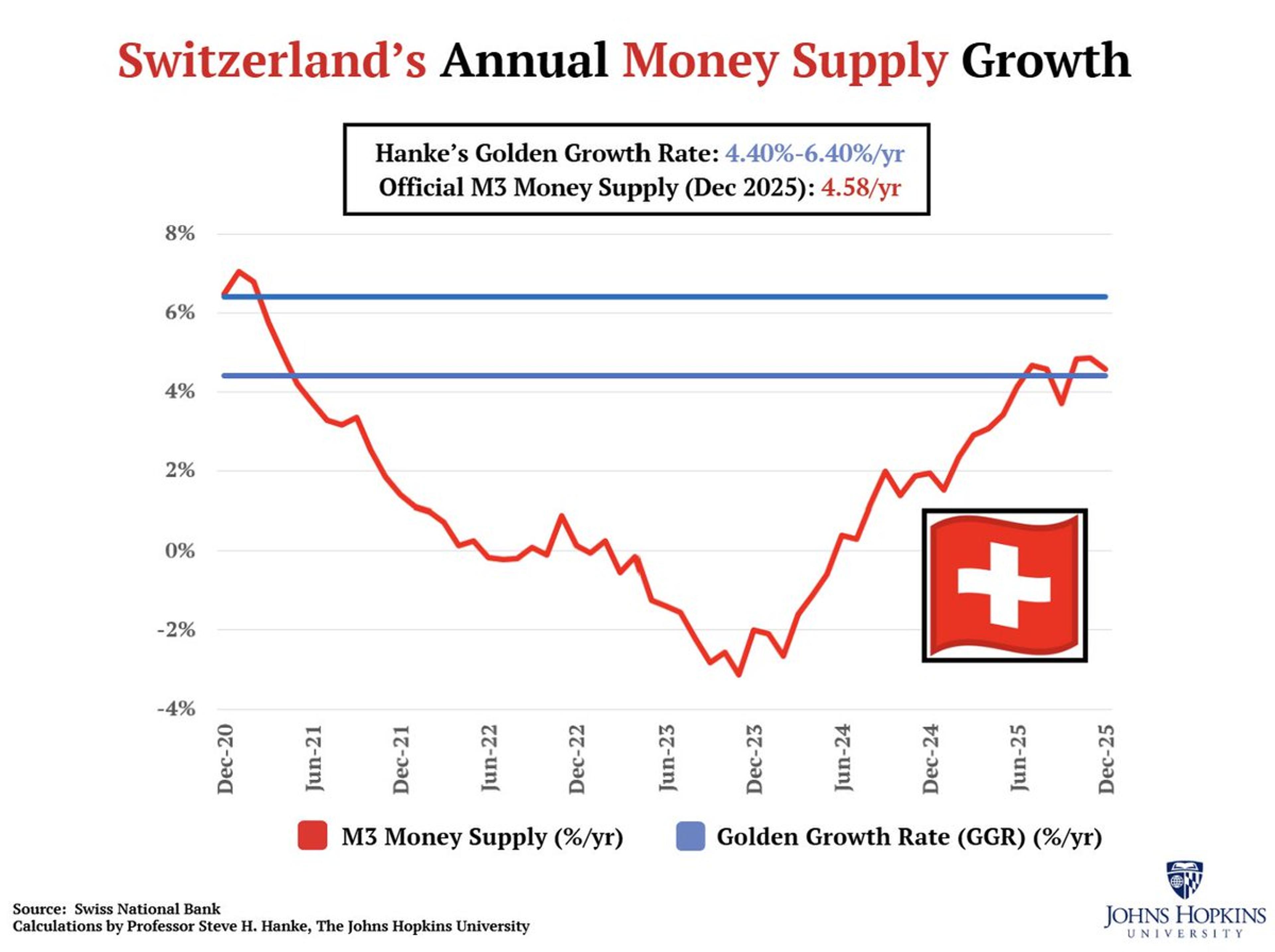

Swiss Inflation Near Zero as Money Growth Slows

Switzerland’s inflation rate is on the low end of its TARGET RANGE at 0.03%/yr. Switzerland’s money supply (M3) has been growing below Hanke's Golden Growth Rate of 4.40%-6.40%/yr since 2020 & is now only at 4.58%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

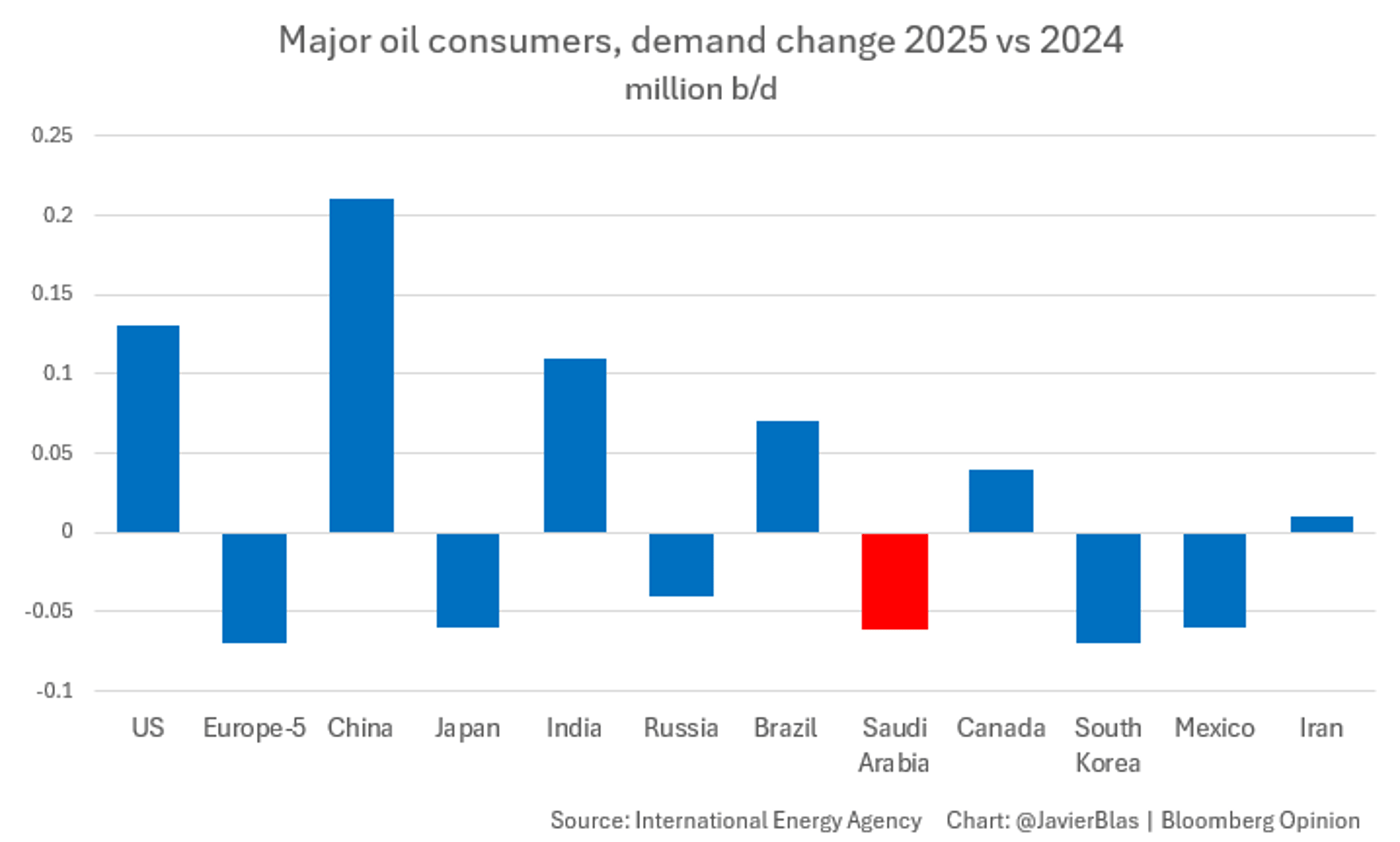

Saudi Arabia’s Oil Demand Plummets as Gas Powers Electricity

CHART OF THE DAY: Among the world's top oil consumers, a curious trend. The 2nd largest consumption drop last year ocurred in Saudi Arabia, where demand fell ~60,000 b/d (only South Korea saw a larger drop). The reason? Gas is...

By Javier Blas

Social•Feb 14, 2026

China's January Financing Jumps 2.4% Year‑over‑year, Beating Forecasts

1/5 According to Caixin, China’s aggregate financing grew slightly faster than expected in January, rising by RMB 7.22 trillion. This was 2.4% more than in January 2025 and 10.4% more than in January 2024. It is equal to 5.1% of annual...

By Michael Pettis

Social•Feb 14, 2026

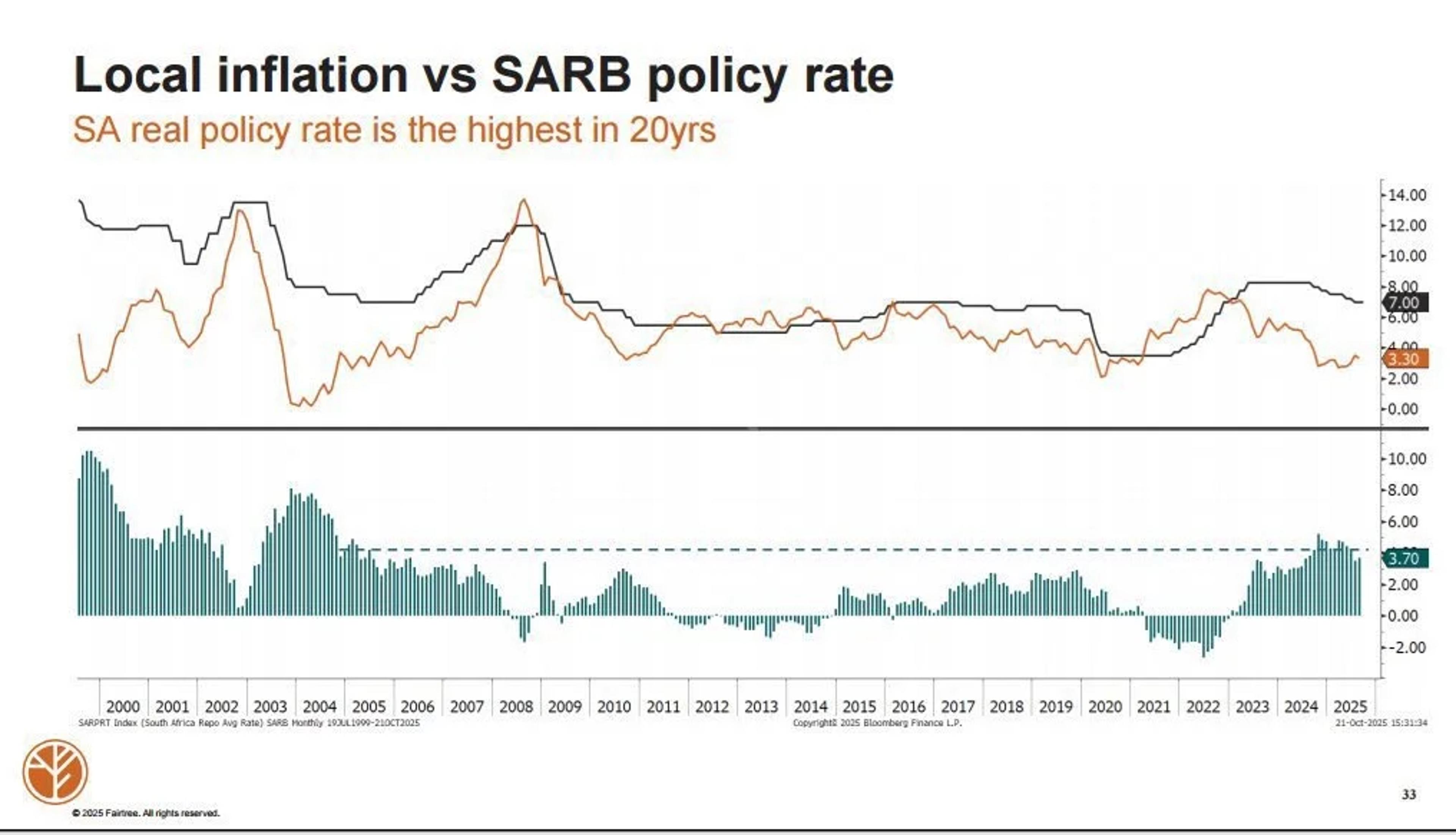

South Africa's Record Real Rates Prompt Slow, Steady Cuts

South African rates are restrictive. The real policy rate is the highest it’s been in 20 years, and they expect growth. They are suffocating the economy with high real rates. However, we can expect more rate cuts throughout the year,...

By Talk Cents

Social•Feb 14, 2026

China's Railway Investment Climbs 5.5% in January

Xinhua: "China's railway sector completed 46.3 billion yuan (about 6.67 billion U.S. dollars) in fixed-asset investment in January, up 5.5 percent year on year." https://t.co/g109GF2REm

By Michael Pettis

Social•Feb 14, 2026

Politicized Asset Stewardship Spurs Lease Cancellations, REIT Shorts

Macro: politicized stewardship of public assets rising; Key: Interior canceled NLT lease; Risk: litigation & environmental hurdles delay projects; Trade: short park‑adjacent REITs. ⚖️ — Viktor Kopylov, PhD, CFA. More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

Malaysia Beats Forecast, Yet MSMEs Face Headwinds

Malaysia’s Economic Outlook & Risks Full-year performance exceeds government’s upper ceiling based on 4Q 2025 data Outperformance —► Hawkish BNM bias. Chatter of tougher operating conditions on the ground, especially for micro, small and medium enterprises (MSMEs) including F&B sector are leading many...

By David Chuah

Social•Feb 14, 2026

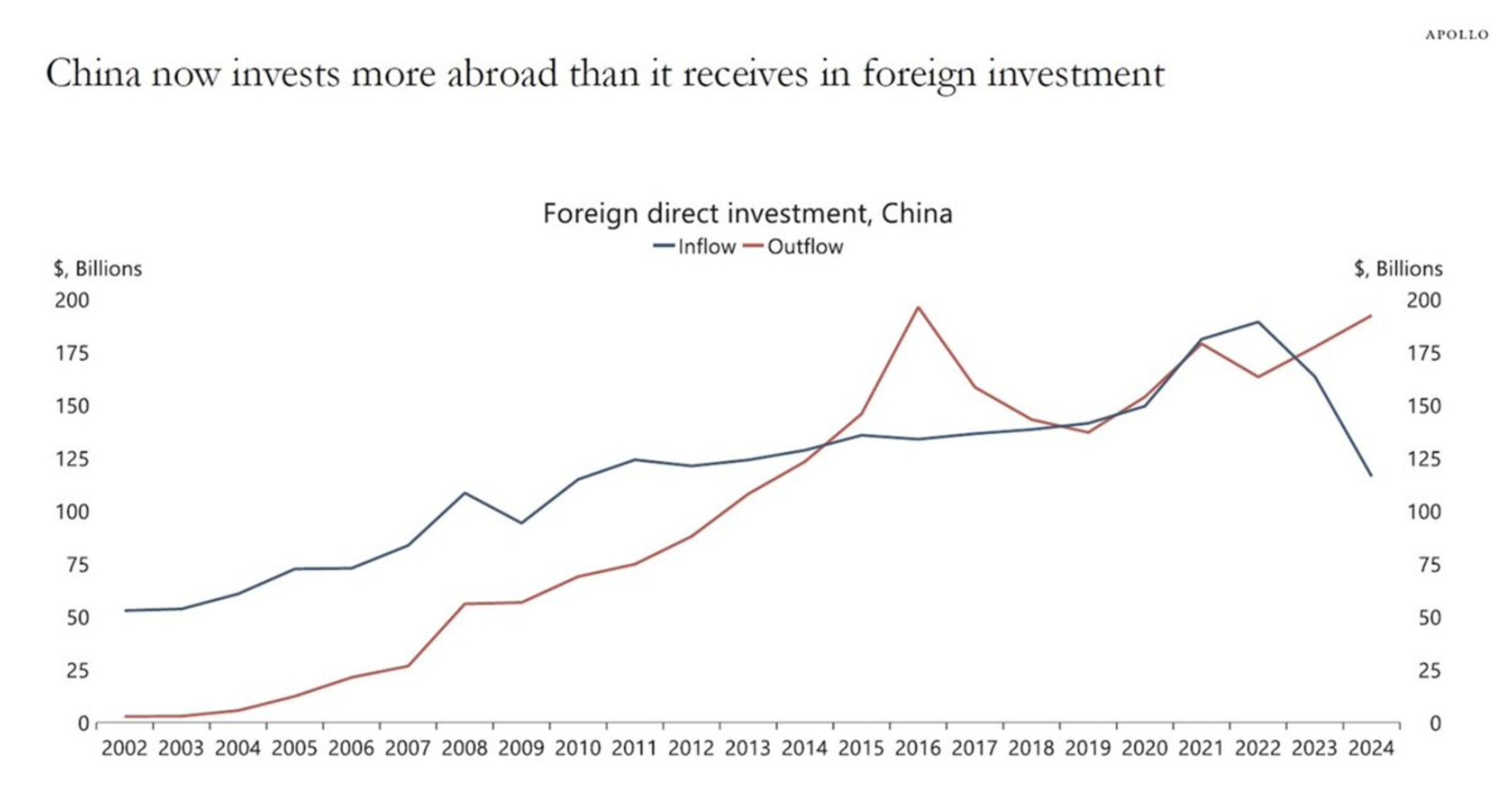

China’s Inbound FDI Collapses as Outbound Investment Soars

For years, the world invested in China. Since 2022, foreign direct investment inflows to China have PLUNGED, while China's foreign investment outflows have SURGED. https://t.co/TCWhEPF7bq

By Steve Hanke

Social•Feb 14, 2026

Disinflation Relief Meets Market Disruption Fear

CPI cools to 2.4%. Yields fall 18bps. S&P 500 posts its worst week since November. If inflation is easing… why aren’t stocks cheering? The market isn’t repricing rates. It’s repricing disruption. Disinflation Relief, Disruption Fear 👇 https://t.co/JM3yRs0tFM

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 14, 2026

China EV Sales Dip, Exports Surge 70% Abroad

China EV Sales Drop for First Time Since February 2024—Chinese exports of EVs and hybrids rise 70% in 2025 as automakers shift their focus overseas @ivy_jiahuihuang https://t.co/PdiFmEGPXg https://t.co/PdiFmEGPXg

By Jonathan Cheng

Social•Feb 14, 2026

China and US Slowdown Drag Global EV Sales

Global EV sales hampered by China, US slowdown in January "Global EV registrations, a proxy for sales, fell by 3% year-on-year to almost 1.2 million units in January, according to the data, which includes battery-electric and plug-in hybrid cars. They were down...

By Anas Alhajji

Social•Feb 14, 2026

Trump's Tariff Push Backfires, Approval Slips Sharply

Trump's tariff blitz BACKFIRES. Approval ratings are tanking. 52% of Americans say Trump’s economic policies have made things worse. Now the White House is scrambling to put a positive spin on the US economy. https://t.co/a1JUyOz6LJ

By Steve Hanke

Social•Feb 13, 2026

No Bullish Catalyst for Oil in 2026, Repeat Likely

🚦From a pure fundamentals perspective, there's simply no bullish driver in sight capable of pushing oil prices into the high $70s—or higher—in 2026. ⚽️Betting your capital on a major war with Iran or any similar geopolitical shock to spike prices isn't...

By Anas Alhajji

Social•Feb 13, 2026

Evolving Energy Security Toolkit Amid Fragmented Order, EU‑US Distrust

Energy security is high on the @MunSecConf agenda. I’ve been discussing how the toolkit to deliver it must evolve—amid a fragmenting global order, the need to accelerate the clean transition, and a far deeper level of European distrust toward the...

By Jason Bordoff

Social•Feb 13, 2026

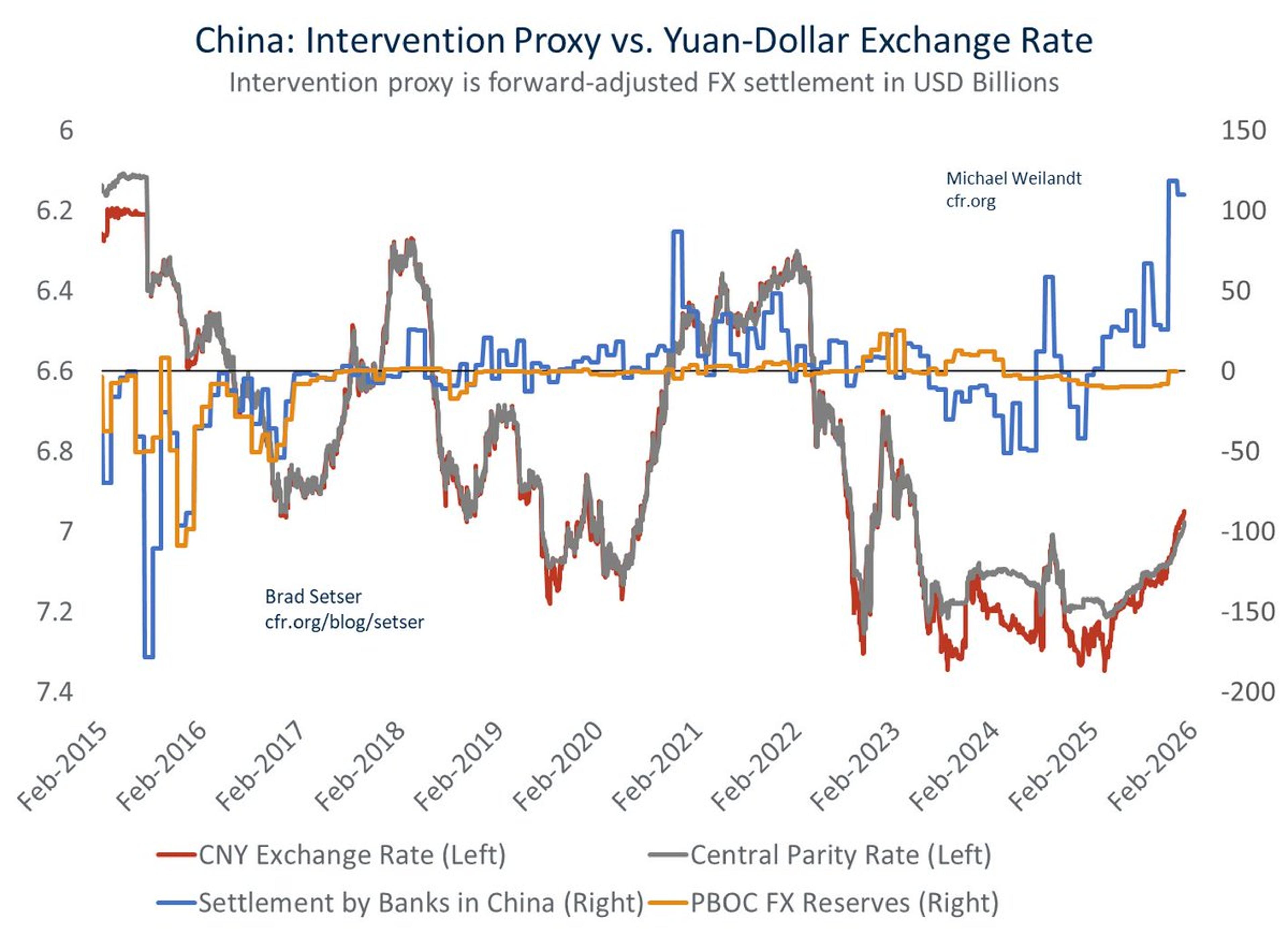

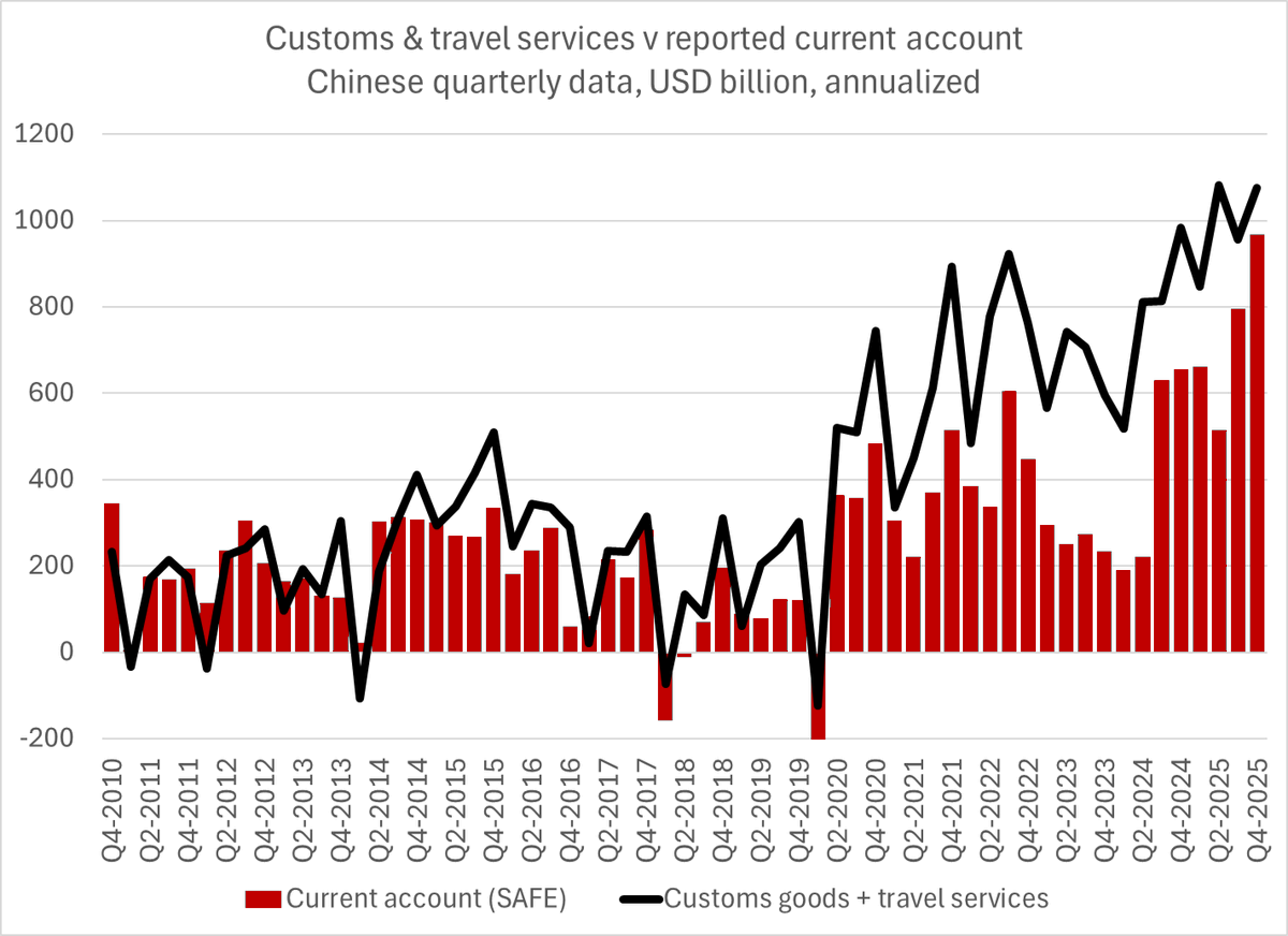

China’s $1.2 T Surplus Fuels Massive Market Interventions

One by product of China's exploding external surplus (goods surplus of $1.2 trillion, q4 current account surplus annualized is close to $1 trillion) is that it creates the raw material for some massive intervention numbers h/t @Mike_Weilandt for the chart https://t.co/PMvhatfgWh

By Brad Setser

Social•Feb 13, 2026

NYT Overlooks Money Growth, the Real Inflation Driver

The NYT credits cooling inflation to tariffs, housing, airfare, energy, & labor markets. But ignores money. Money growth has averaged 4%/yr over 2025 — far below the 6.3%/yr Golden Growth Rate, consistent with hitting the US's 2%/yr inflation target. https://t.co/tk42l7TVVZ

By Steve Hanke

Social•Feb 13, 2026

Ford Faces $900M Tariff Blow, Highlighting US Corporate Pain

Ford just disclosed an additional $900M tariff hit in its Q4 results. TARIFFS = BAD NEWS FOR AMERICAN CORPORATIONS. https://t.co/kau61WOizz

By Steve Hanke

Social•Feb 13, 2026

Services Inflation Sticks While Housing Disinflation Persists

Closing out the week with @GregDaco and @ElizRosner talking about inflation: "On the latest episode of The Inflation Brief from ECON-versations with NABE, hosts Greg Daco and Laura Rosner-Warburton are joined by special guest Claudia Sahm to break down the...

By Claudia Sahm

Social•Feb 13, 2026

Argentina's Survival Hinges on IMF Loans, Not Reserves

And net reserves are still negative -- Argentina survived 2025 thanks to a $14b loan from the IMF and a willingness on the part of the IMF and the US to ignored missed reserve targets. Indeed, Argentina got another $20b backstop...

By Brad Setser

Social•Feb 13, 2026

Potential Crisis Looms as Fed‑White House Tensions Rise

How ironic would it be if there were a market crisis event in the next few months while Powell is still at the helm of the Fed, requiring extreme Fed and White House/Treasury cooperation while those relations are as strained...

By Quinn Thompson

Social•Feb 13, 2026

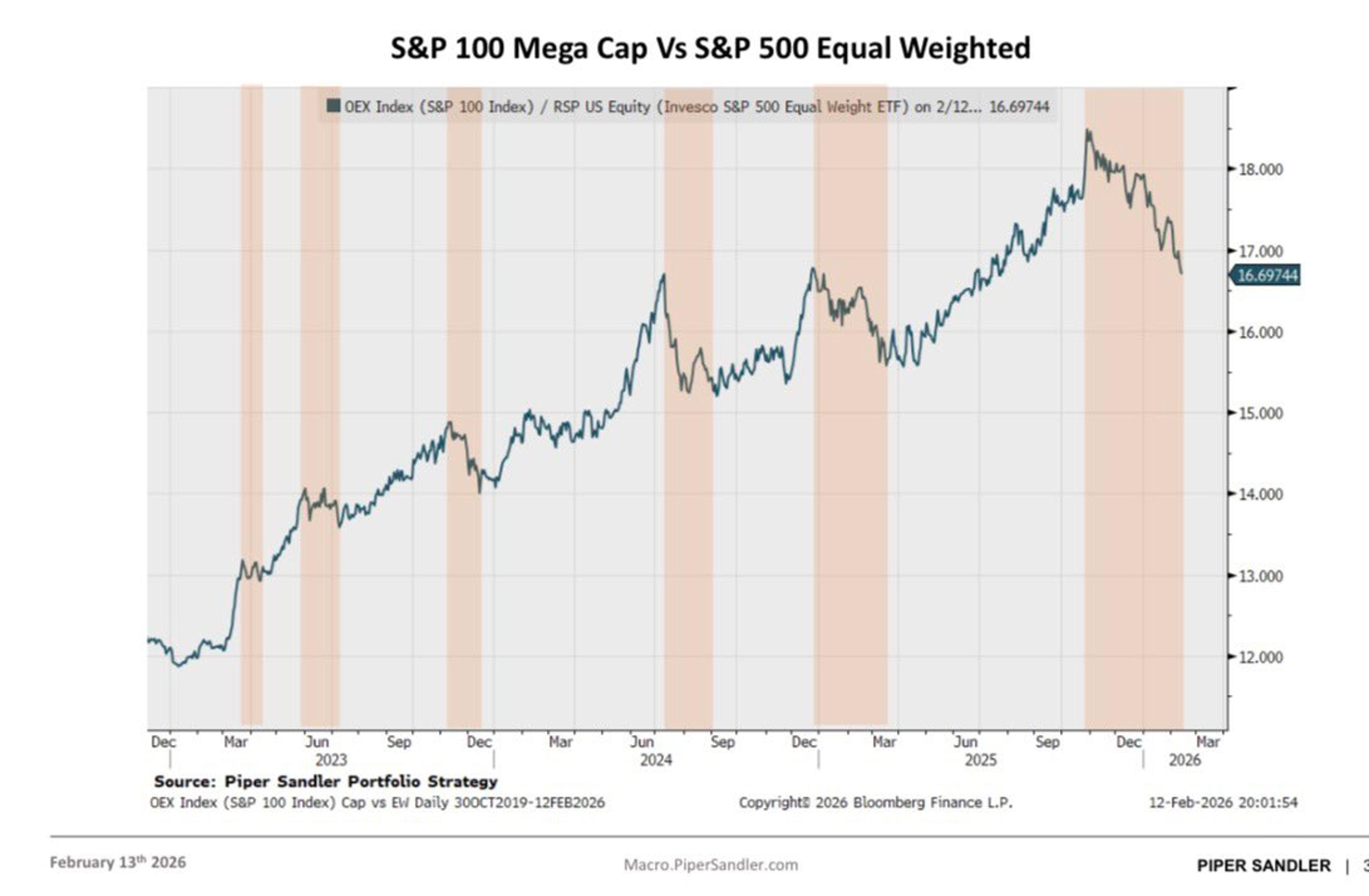

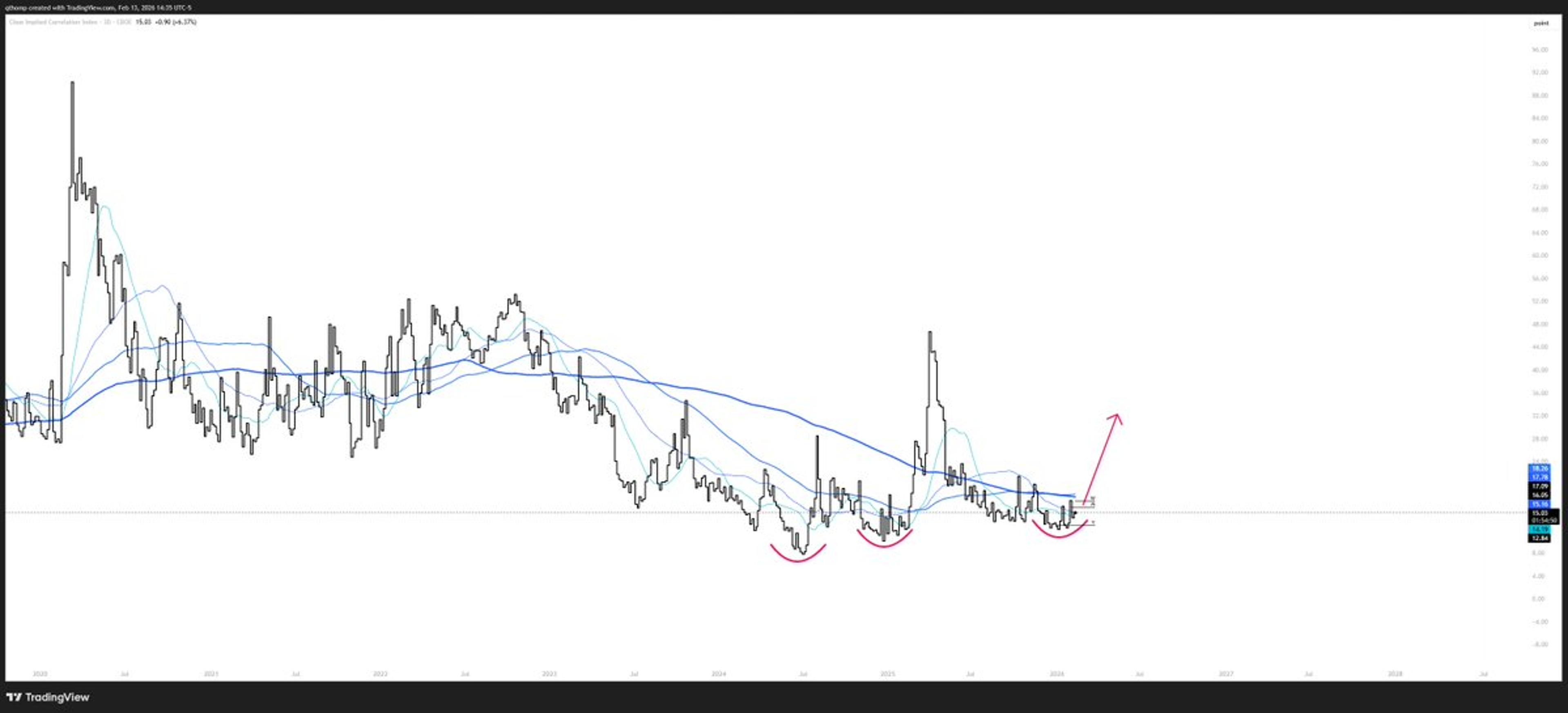

Broadening Value and Cyclical Rotation Driven by Fundamentals

We now have the longest and strongest breadth rotation in recent years. Notably, it’s the only rotation that has been propelled by broader macro and micro fundamentals rather than lower rates. We first recommended a broadening trade of value and...

By Michael Kantro

Social•Feb 13, 2026

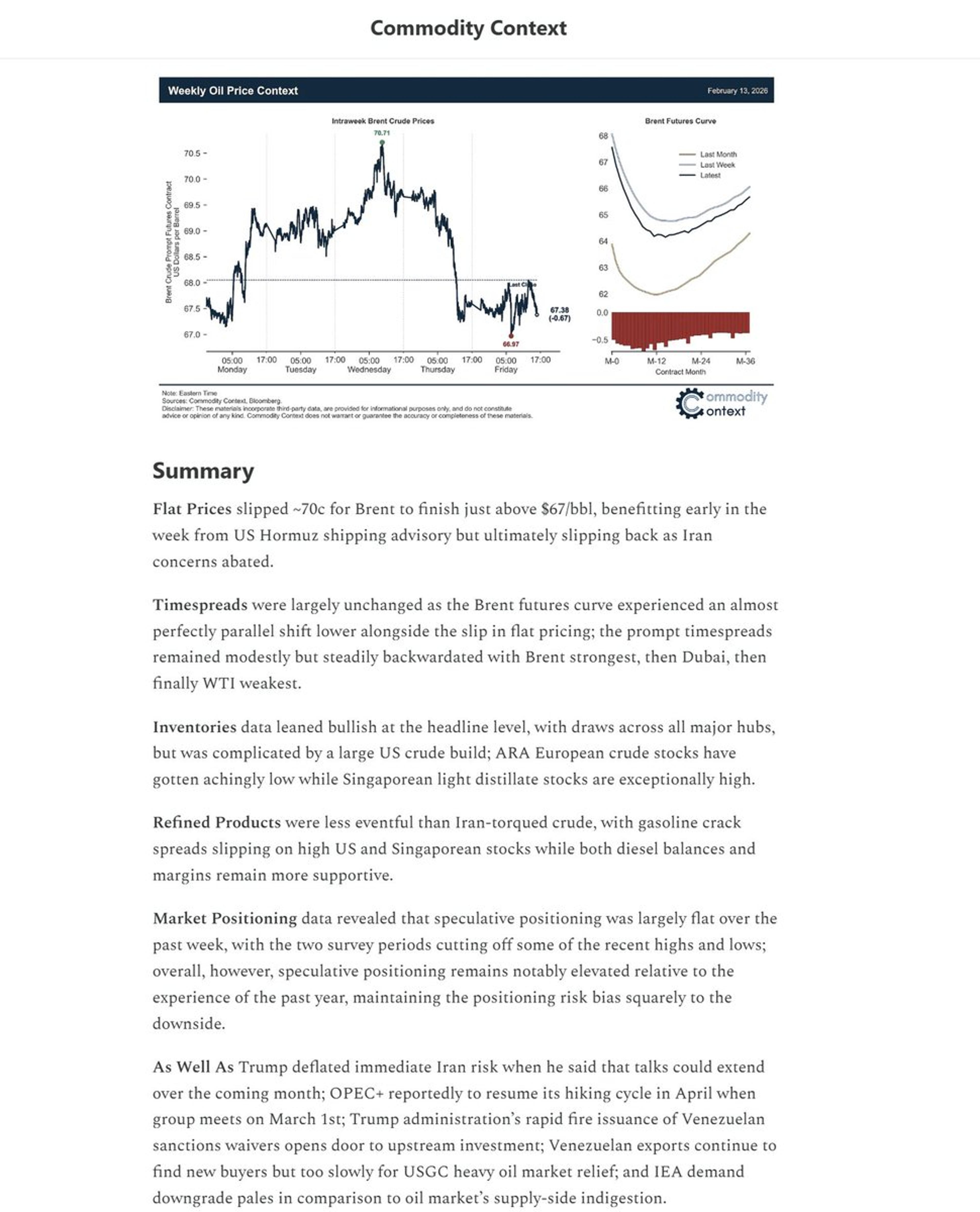

Crude Swings on Hormuz Alert, US‑Iran Talks, Venezuela Relief

🛢️ OIL CONTEXT WEEKLY 🛢️ 📈📉Crude prices rise on Hormuz advisory before falling back on the prospect of longer US-Iran talks, with headlines dotted with a flurry of US sanctions relief on Venezuela’s oil sector. Summary below, link to full report in...

By Rory Johnston

Social•Feb 13, 2026

Trump Tariffs Add $1,300 Hidden Tax per Household

According to a new report by the Tax Foundation, Trump’s latest tariffs amount to a $1,300 hidden tax per household. US TARIFFS = A SALES TAX ON AMERICANS. https://t.co/w3pnoqPIdP

By Steve Hanke

Social•Feb 13, 2026

BOE's Pill: Rates Slightly Too Low, Should Stay

BOE’s Pill says interest rates are ‘a little too low’ and should be held https://t.co/wMBsLKECUz via @irinaanghel12 https://t.co/axOKBgzYCV

By Zöe Schneeweiss

Social•Feb 13, 2026

China's Massive Surplus Threatens IMF Balance

China's reported current account surplus for q4 was $242b (close to $1 trillion annualized), and the 2025 surplus was $735b -- well over 3.5% of China's GDP. This has big implications for the IMF, for Secretary Bessent and and the world...

By Brad Setser

Social•Feb 13, 2026

Germany Mulls Debt Brake Exemption for Raw Materials Fund

Germany weighs debt brake exemption to boost raw materials fund https://t.co/lsvcwd09Y5 via @mcnienaber @ocrook https://t.co/wmKMMM7Dgu

By Zöe Schneeweiss

Social•Feb 13, 2026

Rabois Predicts Trump May Block China's Nvidia Chip Access

Here's @rabois saying he thinks the Trump administration may ultimately reverse course on letting China get access to Nvidia's best chips https://t.co/XImO09oRyf

By Eric Newcomer

Social•Feb 13, 2026

S&P 500 Mirrors US M2‑to‑GDP Ratio Trends

There's a general and logical correlation between money supply and capital markets. But what about money supply relative to GDP? Here's $SPX overlaid with the ratio of US M2 / real GDP: https://t.co/UA5X14bWEk

By John Kicklighter

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

Social•Feb 13, 2026

Key Differences Between OFAC's New GL

This is actually the best way to describe the difference between GL 49 and GL 50 (the two Venezuela-related General Licenses issued by OFAC today)

By Rory Johnston

Social•Feb 13, 2026

US Should Avoid Iran Strike During Ramadan, Preserve Allies

This is the last weekend before Ramadan (2/17 - 3/26) and it happens to be a 3 day US holiday. Not that someone with Trump's risk appetite couldn't strike Iran during the holiest month of the Islamic calendar, it certainly...

By Quinn Thompson

Social•Feb 13, 2026

Regulation Entrenches Incumbents, Stifling Innovation and Growth

Why is the mkt so centralized? Well, only megacorps survive the red tape & regulatory fees. “Regulation favors the incumbent” Most scaled companies extract value instead of innovate. They use short-vol strategies that extract from the middle class instead of grow...

By Tyler Neville

Social•Feb 13, 2026

Defensive Sectors Exhausted, Market Poised for Broad Correction

While sectors like staples (XLP), energy (XLE), materials (XLB) and industrials (XLI) have all provided a safe haven in recent weeks as large cap tech has sucked wind, most of these are all now reaching exhaustion. This means that from...

By Quinn Thompson

Social•Feb 13, 2026

CPI Slowdown Fuels Falling Yields, Bullish Duration, Utilities, Gold

Post Hedgeye's Nowcast nailing another decel in CPI Growth decelerates → yields fall → correlations re-assert That’s the whole #Quad3 playbook ✔️ Duration bullish ✔️ Utilities work ✔️ Gold works ❌ Financials don’t

By Keith McCullough

Social•Feb 13, 2026

Danny Moses Show Returns: Economy, AI, Markets Forecast

The Danny Moses Show returns tonight @scrippsnews at 7PM sponsored by @Kalshi. Great to have @pboockvar join me & we talk about the global & U.S. economy, A.I. stocks/bonds, commodities, the consumer, #FED, Private Credit & make some @Kalshi predictions... https://t.co/vQGLUQMHUc...

By Danny Moses

Social•Feb 13, 2026

Markets Trade Transition as Central Banks Hold Steady

Pauses aren’t pivots. Central banks are holding steady, but easing remains conditional. Inflation is cooler, labor is softer, yet not weak enough to confirm a recession. Markets are trading the transition, not the destination.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Explore 100+ Years of Industry Economic Geography Data

If you are interested in over 100 years of economic history and data on these geographic trends for this industry, I have some here for you: https://t.co/kayw0VoAML

By Adam Ozimek