Social•Feb 18, 2026

S&P Adds $500B, Gold Climbs; PCE Inflation Watch

WHAT A DAY, the S&P 500 has gained around $500 BILLION in market cap, up 0.8%. The index is now up 0.3% YTD 📈 Gold is also trading higher, back above $5,000/oz, as global tensions start to escalate 😳 Mark your calendars for Friday, the PCE report is out. It’s the Federal Reserve’s preferred inflation gauge 👀

By Peter Tuchman (Einstein of Wall Street)

Social•Feb 18, 2026

History’s Empire Cycle Reveals Today’s Global Power Shift

Empires rise. Empires peak. Empires fall. Medieval thinkers understood the structural forces behind power, decline, and transition. Those same cycles are shaping the world today. Understand the pattern. Know what comes next. Read more at davidmurrin.co.uk #Geopolitics #EmpireCycles #History #Strategy #GlobalPower

By David Murrin

Social•Feb 18, 2026

Geopolitical Tension Drives Gold Surge—Position Now

Gold is on the move🔥 As tensions in the Middle East rise and Iran escalates, markets are reacting and gold is back in focus When uncertainty rises, gold shines ✨ Big moves could be ahead. The question is… are you positioned? Trade Gold with...

By Kathy Lien

Social•Feb 18, 2026

Gold Rallies 13% as Tech Stocks Stumble

While the Magnificent Seven tech stocks have SUFFERED in 2026, GOLD IS UP over 13%. It's time to turn away from SILLY VALLEY. BUY GOLD, WEAR DIAMONDS. https://t.co/PZTIJFhPOp

By Steve Hanke

Social•Feb 18, 2026

Sector Rotation Timing Yields Asset‑rich Returns

The Great Rotation: From Growth to Asset Rich Value My job is timing sector rotation & picking the best stocks long/short within it. That & sizing up macro event risk & market structure support. That's how I could time the...

By Samantha LaDuc

Social•Feb 18, 2026

Markets Mirror Trump’s Shifting Policy Narratives

You just have to respect markets and the games they play Trump first term: Public is all about long Energy, short Solar.... Solar stocks go on an epic run Trump 2nd term: Tariffs going to crush International economies.... International stocks just thrashing...

By Joe Kunkle

Social•Feb 18, 2026

De-Dollarization Undermines US Military Financing Power

De-Dollarization Threatens US Military Power The dollar’s role in global trade is shrinking. As it loses value, I see us losing influence and even military strength, because our military depends on financing powered by the dollar. The markets are already showing...

By Peter Schiff

Social•Feb 18, 2026

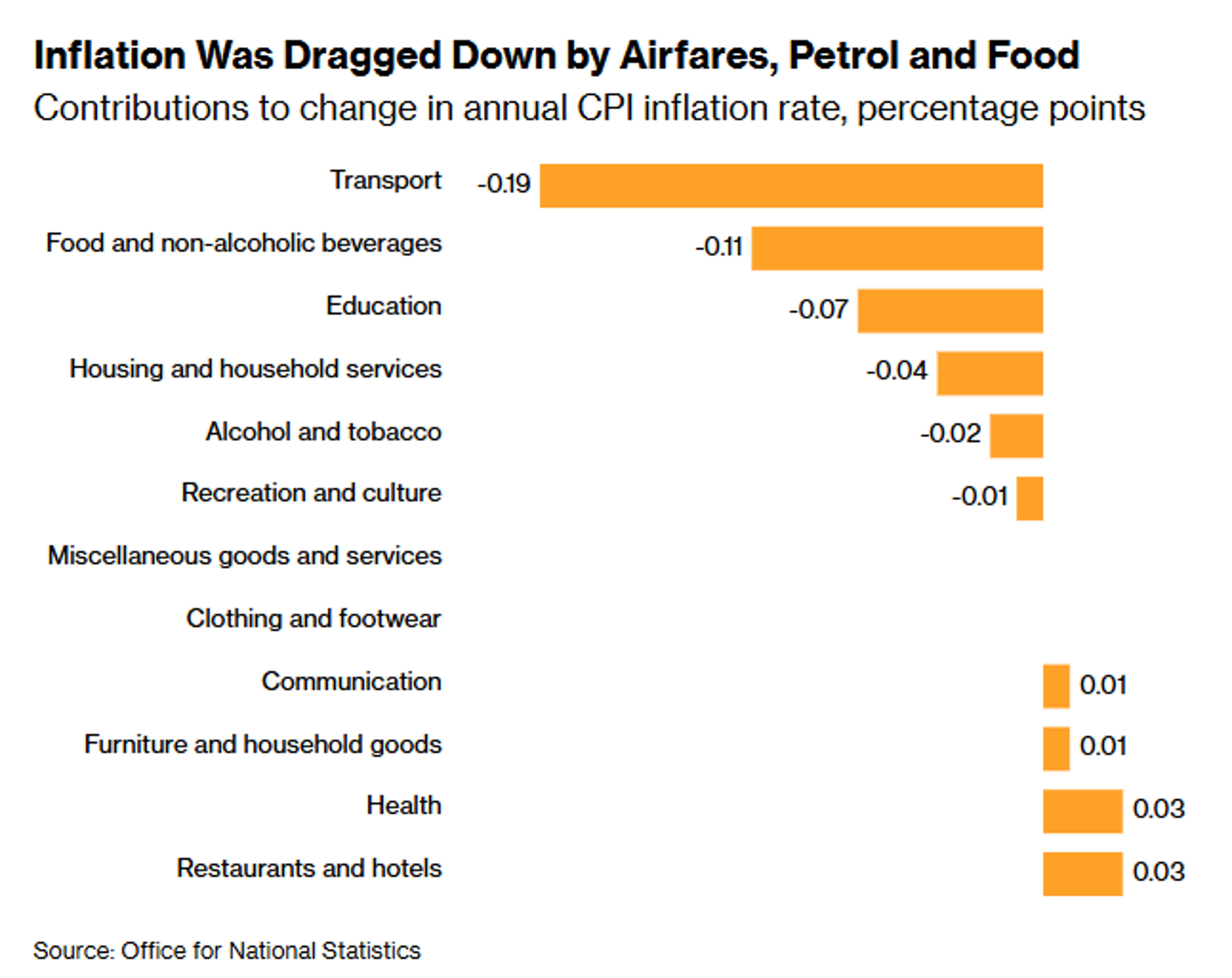

UK Inflation Hits 2025 Low, Strengthening BoE Rate‑Cut Case

UK inflation slowed to its weakest level since March 2025, bolstering the case for an interest rate cut when the Bank of England meets next month https://t.co/yJqzpiJ61p via @irinaanghel12 @PhilAldrick https://t.co/a5Mov7Jkhv

By Zöe Schneeweiss

Social•Feb 18, 2026

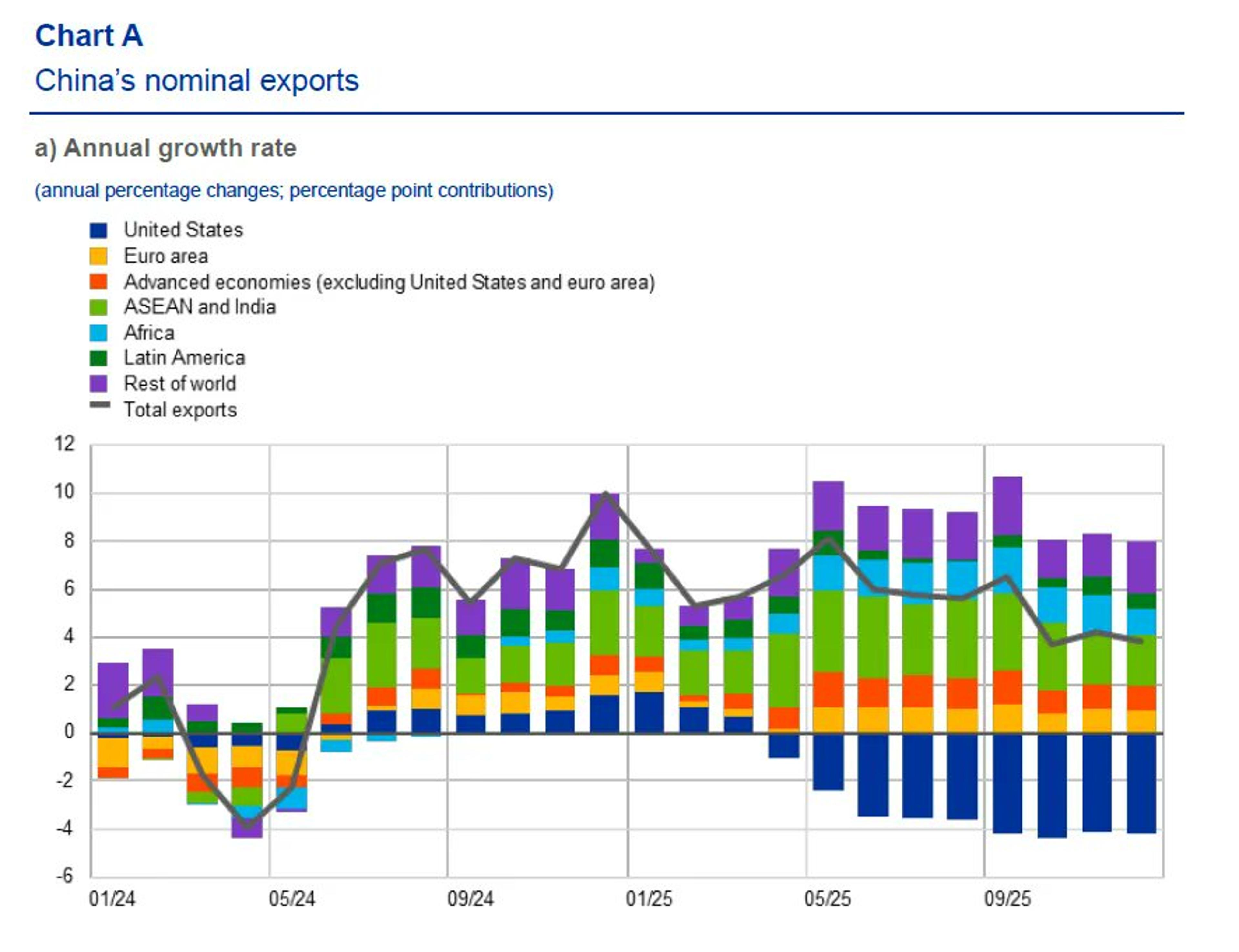

ECB Study Finds Tariffs Sparked Minor China Trade Diversion

Tariffs caused just a small China trade diversion, ECB study shows https://t.co/2xTwmZXdG6 via @weberalexander https://t.co/NfggkusEyQ

By Zöe Schneeweiss

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss

Social•Feb 18, 2026

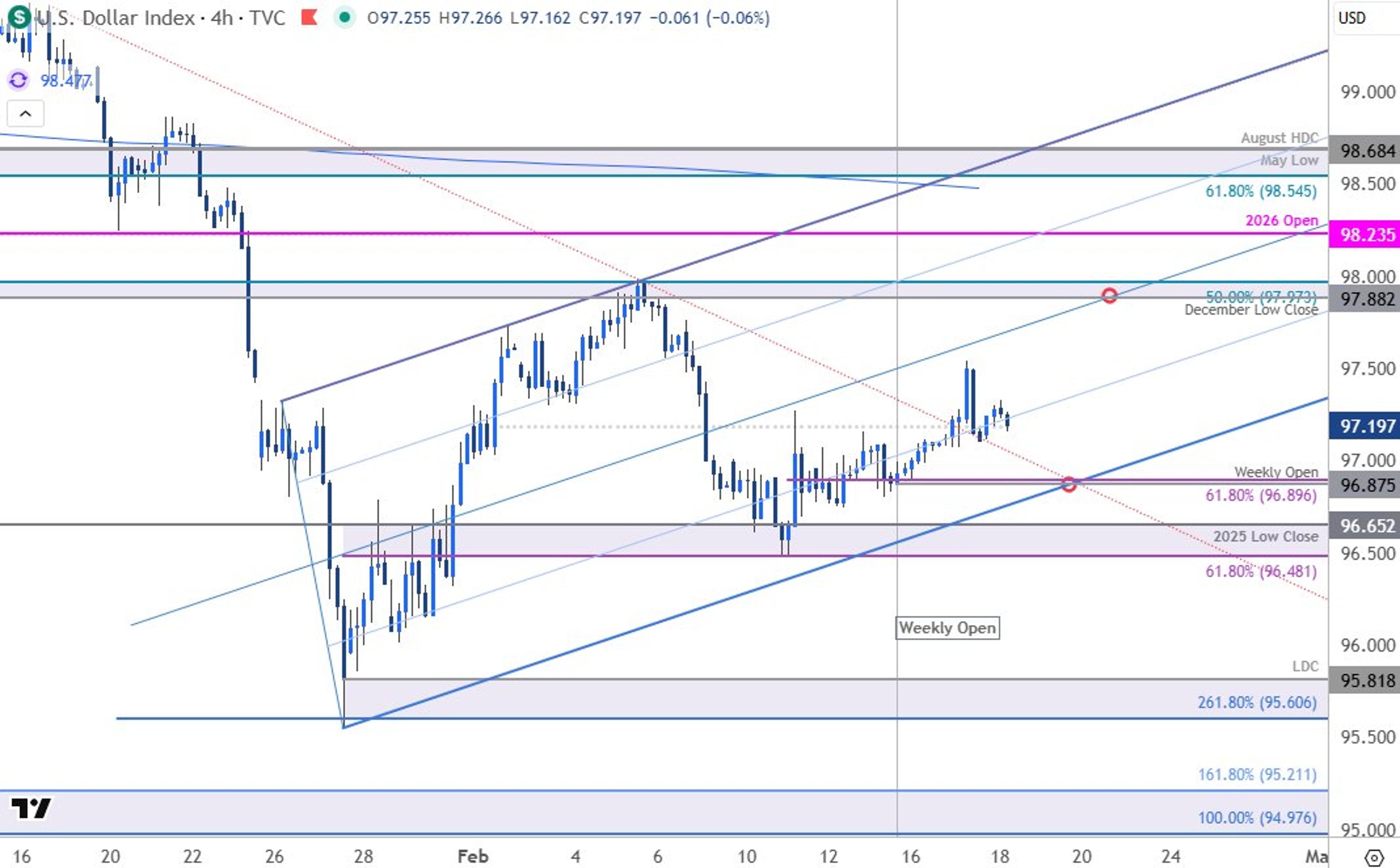

USD Coils Near Key Levels, Breakout Imminent

US Dollar Short-term Outlook: USD Coils Between Key Levels – Breakout Looms https://t.co/CxUMkIN5mg $DXY Daily & 240min Charts https://t.co/ILpuVkkqnw

By Michael Boutros

Social•Feb 18, 2026

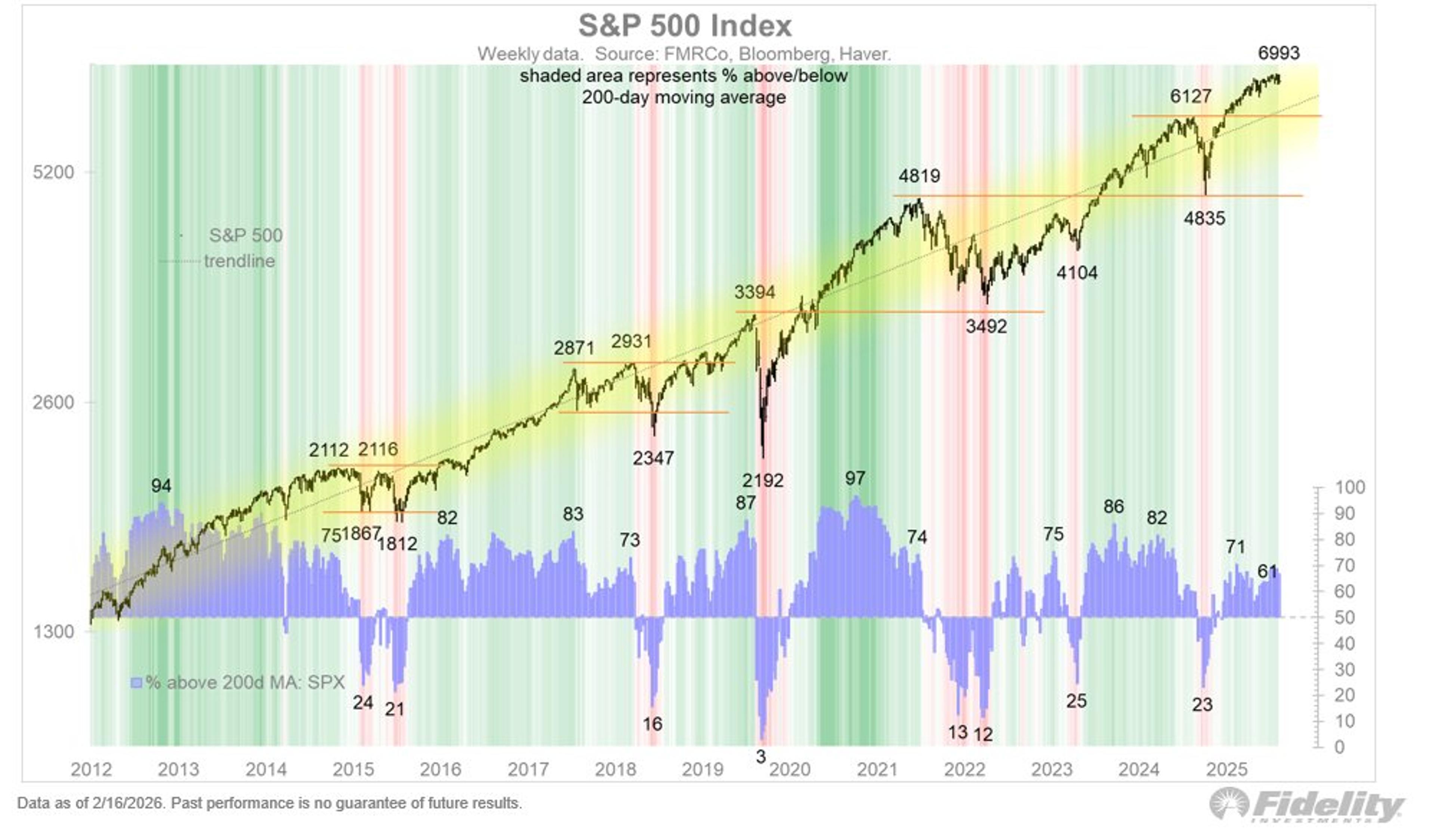

Equities Up, Trend Flattens Amid 4% Yield, Rotation

As for the markets, last week the Dow briefly reached the 50k milestone while the S&P 500 continued to hang out just below 7,000. The 10-year yield has been flirting with 4% again and the terminal rate for the Fed’s...

By Jurrien Timmer

Social•Feb 18, 2026

Russia's Pipeline Strike Sparks Absurd Diesel Bans

Russia: bombs Ukraine, damages an oil pipeline to Europe. The collaborator regimes in Hungary and Slovakia: banning diesel shipments to Ukraine because Russia damaged the pipeline. The level of inhuman grotesque borders on stupid comedy.

By Illia Ponomarenko

Social•Feb 18, 2026

Critical Minerals and Energy Drive Global Economic Competitiveness

Very good meeting with 🇺🇸 US Assistant Secretary of State for Economic, Energy & Business Affairs @CalebOrr__ We discussed developments in global energy markets, the importance of critical minerals for energy & economic security and energy’s role in boosting competitiveness https://t.co/Z4YDq3jEJG

By Fatih Birol

Social•Feb 18, 2026

Dollar Holds Firm Despite Weak Conviction and Recent Lows

US Dollar is Mostly Firmer, amid Weak Conviction: The US dollar was sold to new session lows against several currency pairs late in the North American afternoon yesterday, but there has been little follow-through today. The greenback is firmer against…...

By Marc Chandler

Social•Feb 18, 2026

Upcoming UST Auctions May Cool Rally, Create Opportunity

Busy UST auction schedule in the next eight days could finally slowdown the rally a bit and offer an opportunity. Brand new 20s ($16B) today, new 30y TIPS tomorrow ($9B), and regular size/schedule 2s, 5s and 7s next week.

By Ed Bradford

Social•Feb 18, 2026

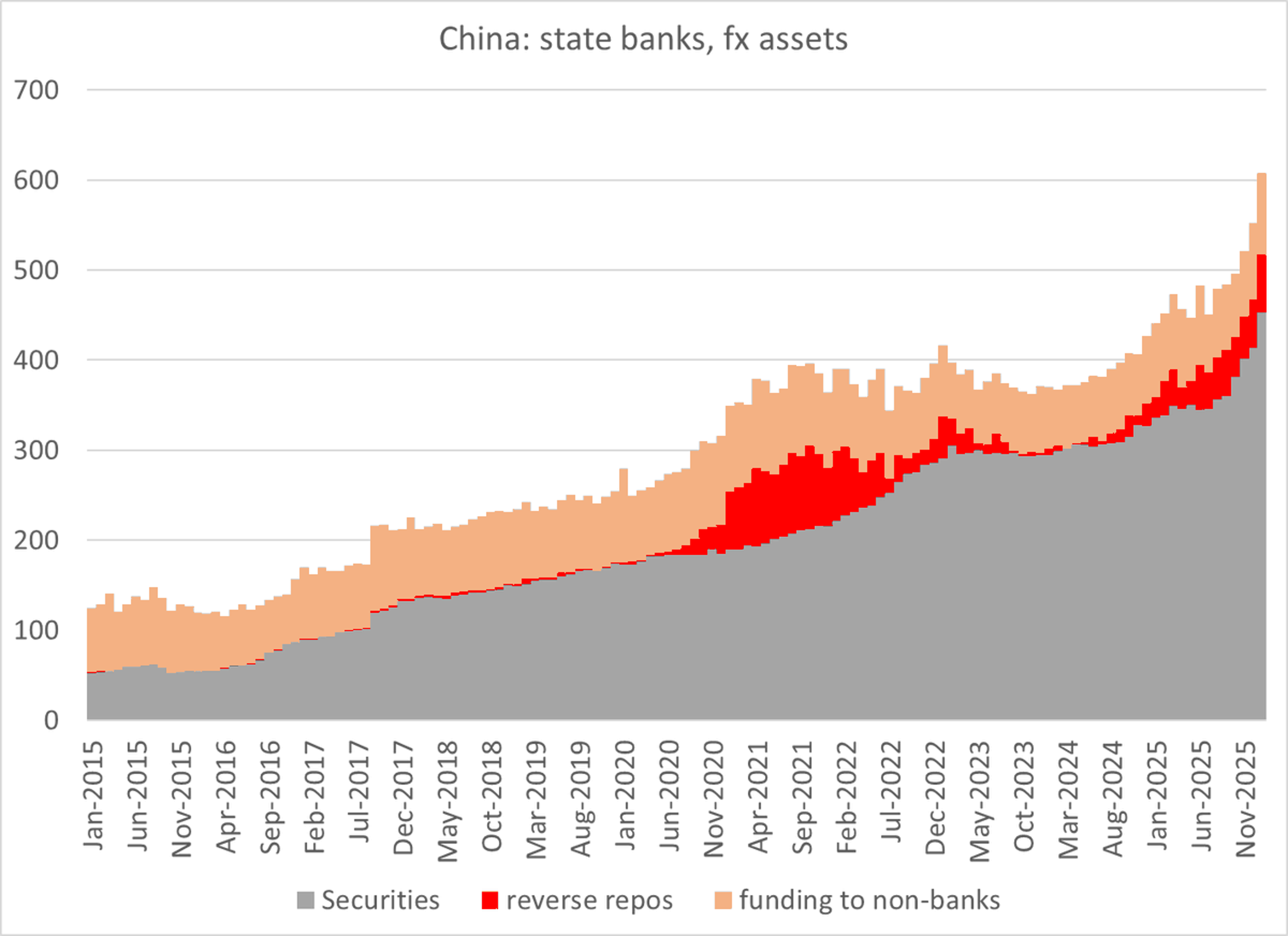

China Quietly Amasses Dollar Reserves Despite Official Narrative

Anyone who trusts official Chinese reserve data is a fool. The blind spot in the official narrative about China "dropping the dollar" is China's continued SHADOW dollar reserve accumulation, which looks like the below chart👇 The big January increase in state banks'...

By Izabella Kaminska

Social•Feb 18, 2026

2024 Forecast Missed: Iran Tensions Now Escalate

Some of my armchair geopolitical analysis from 2024 where I expected a cooling of tensions and no conflict with Iran. Circumstances are very different today.

By Quinn Thompson

Social•Feb 18, 2026

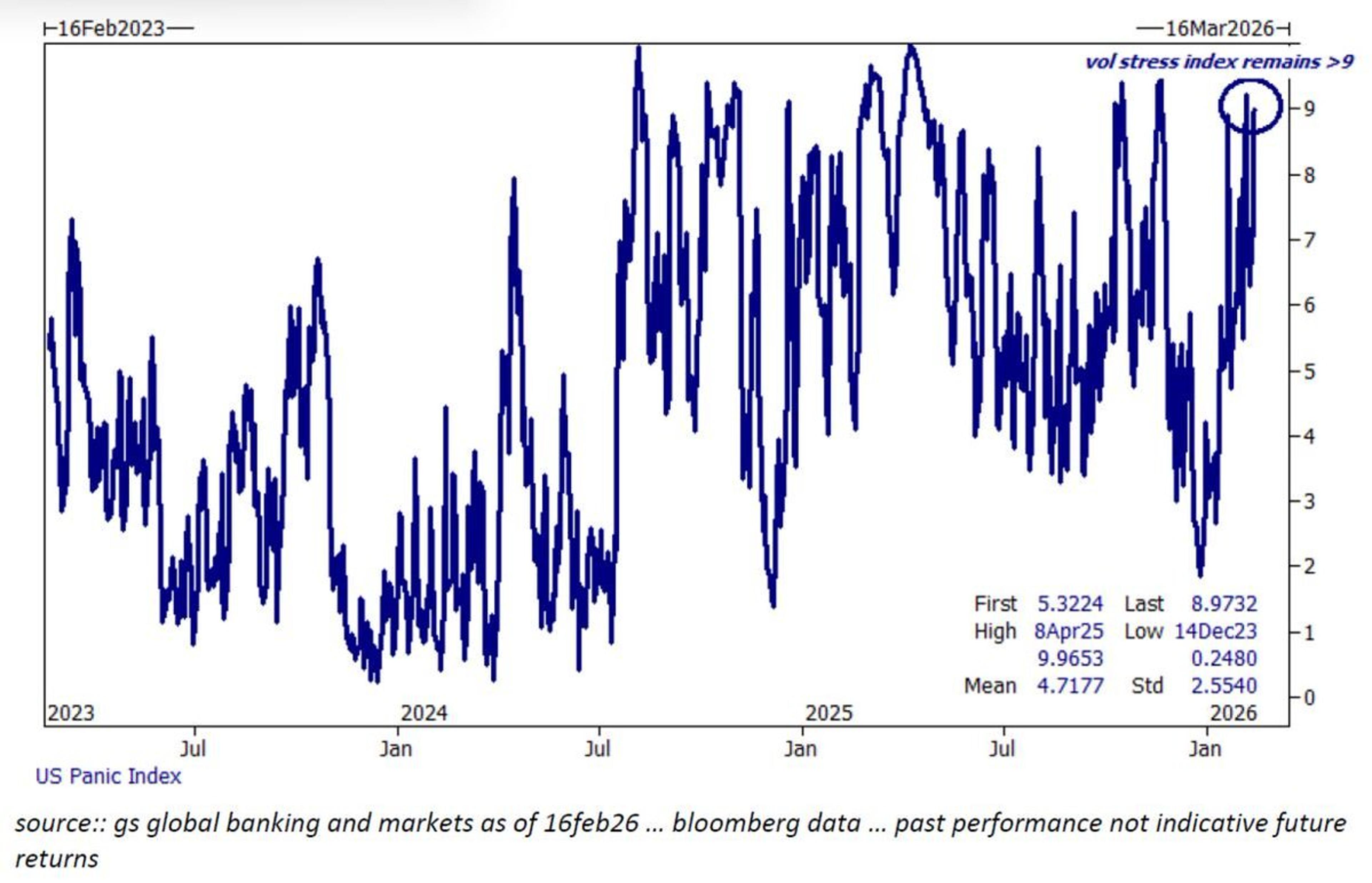

Equity Volatility Spike Defies Traditional Buying Signals

Good read on *market stress* from GS: “Our vol stress index closed the week registering 9 out of 10. Historically, readings of >9 have been buying opportunities, but this time ‘feels different’ as the increase in panic has not come with...

By MacroCharts

Social•Feb 18, 2026

USD Rebounds but Short‑term Conviction Remains Weak

$USD recovered from the late sell-off in North America yesterday. It is trading firmer against most G10 currencies, but short-term participants seem to lack much conviction. Key US data and SCOTUS still lie ahead. See https://t.co/Ax3iZrTLT7 https://t.co/01M5ylxWt7

By Marc Chandler

Social•Feb 18, 2026

Markets Surge Higher After V‑Shape Recovery—Implications Ahead

The markets are extending higher after yesterday's V-shaped recovery - here's what it means 👇

By Kathy Lien

Social•Feb 18, 2026

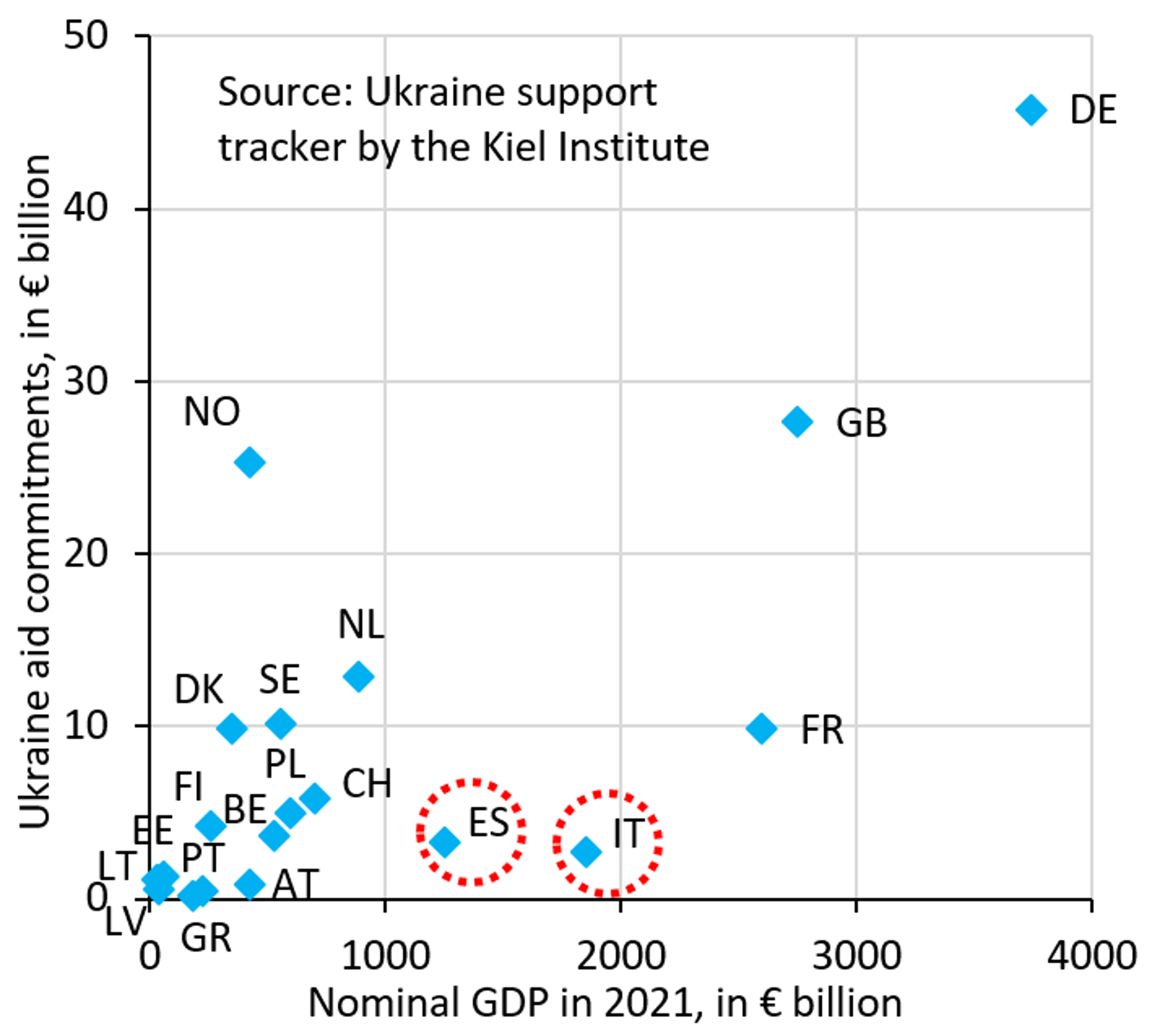

ECB Yield Caps Mask Fiscal Fragility, Exit Bond Markets

ECB yield caps give the illusion of fiscal sustainability, but it's just an illusion. A real shock like Russia's invasion of Ukraine shows high-debt countries have no money to help Ukraine. For the sake of Europe, the ECB needs to...

By Robin Brooks

Social•Feb 18, 2026

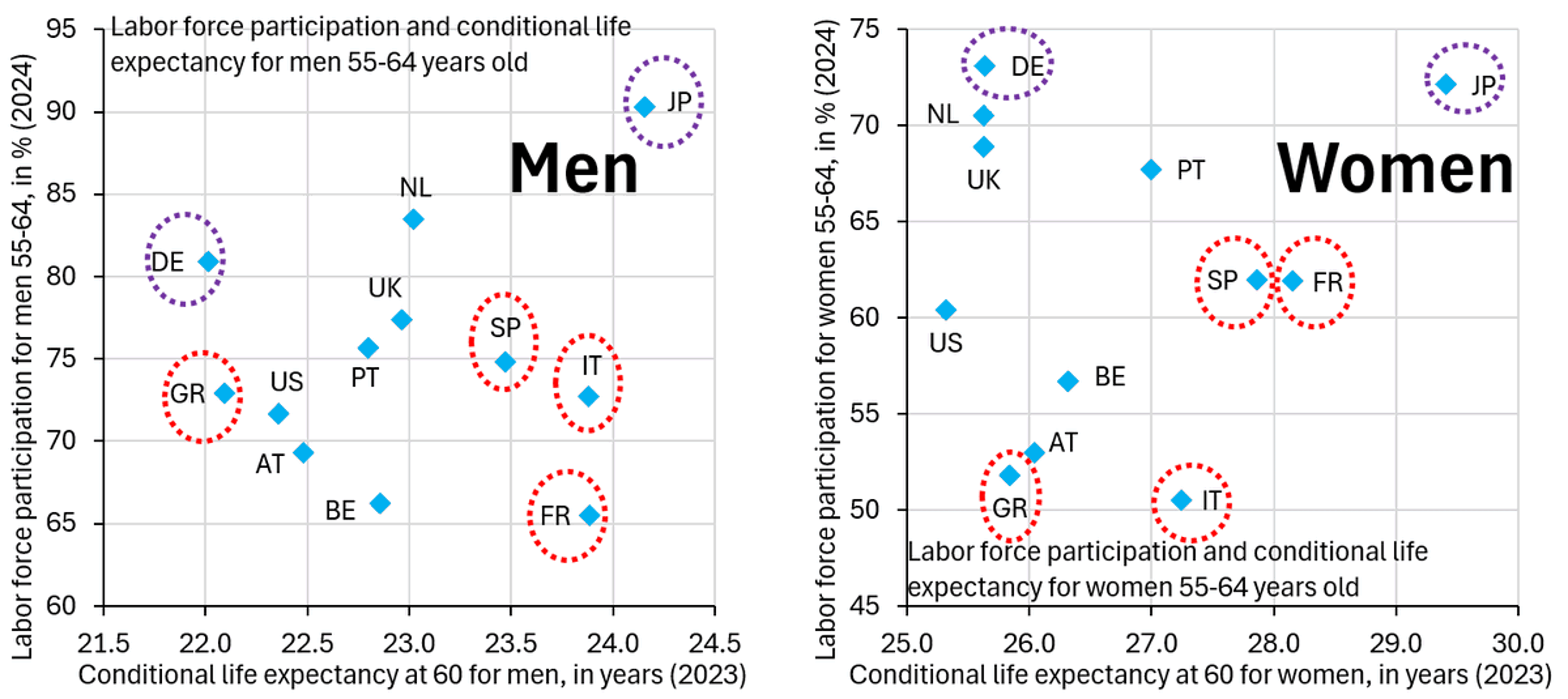

Aging Populations Strain Southern Europe; ECB Must Relinquish Yield Caps

Once you reach 60, your conditional life expectancy is another 20+ years. Problem in Southern Europe is that relatively few people work, so population aging becomes very expensive for the state. That only gets fixed if the ECB steps back...

By Robin Brooks

Social•Feb 18, 2026

US Energy Chief Declares Net‑Zero 2050 Impossible

Net-zero by 2050 has “zero point zero chance of happening,” says US Energy Secretary Chris Wright ahead of the biennial IEA ministerial meeting in Paris. (This ministerial meeting will mark a turning point in global energy policy making across industrialised...

By Javier Blas

Social•Feb 18, 2026

Egypt's M3 Surge Drives Inflation Beyond Target

Egypt's inflation rate is 11.9%/yr. Egypt's money supply (M3) is growing at 22.7%, ABOVE Hanke's Golden Growth Rate range from 13.1%/yr-17.1%/yr, consistent with hitting its inflation target range of 5%/yr-9%/yr. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/V2EApGpMCY

By Steve Hanke

Social•Feb 18, 2026

China Delays Auto Sales Data, Signaling Weakening Market

The Economist: “Last month the China Association of Automobile Manufacturers, another state-backed trade group, appears to have deferred the publication of its weekly sales data—a sure sign of growing anxiety over weakening numbers.” https://t.co/feytAJBiP2

By Jonathan Cheng

Social•Feb 18, 2026

Shift to Equal‑weight, Financials, and Cyclical Assets

Wow, the goat is also rotating out of Megacap tech, long equal weight performance vs market cap, long financials for deregulation and curve steepening, and long real cyclical assets Feels good man

By Felix Jauvin

Social•Feb 18, 2026

Global Indices Inch Higher as India VIX Plunges

Global Market Update: Gift Nifty +50.50 (0.20%) 25,760.50 DowJones +32.26 (+0.07%) 49,533.19 Nasdaq +31.71 (+0.14%) 22,578.38 India Vix -0.6600 (-4.95%) 12.6700 S&P 500 +7.05 (+0.10%) 6,843.22

By stock_n_trade

Social•Feb 18, 2026

Markets May Slip as Fed Delays Rate Cuts

Will stock markets tip over amid worries about the Fed dragging its feet on rate cuts? FOMC meeting minutes are in focus. #stockmarkets #fed #fomc #dollar #macro #trading https://t.co/yYSQfOx27L

By Ilya Spivak

Social•Feb 17, 2026

Saudi Crude Shipments to China Hit Multi-Year High

Saudi Arabia’s projected March crude oil shipments to China are set to reach a multi-year high. When it comes to commodities, China is always the elephant in the room. Maybe this is a bullish sign? Stay tuned. https://t.co/d55SdnfvJv

By Steve Hanke

Social•Feb 17, 2026

Chinese Capital Sneaks Into Bitcoin via Offshore IBIT Vehicle

Something caught my eye in the latest 13F filings. The biggest new entrant into IBIT, from a brand new entity, is something called Laurore Ltd. No website. No press. No footprint. The only public information is that the filer's name is...

By Jeff Park

Social•Feb 17, 2026

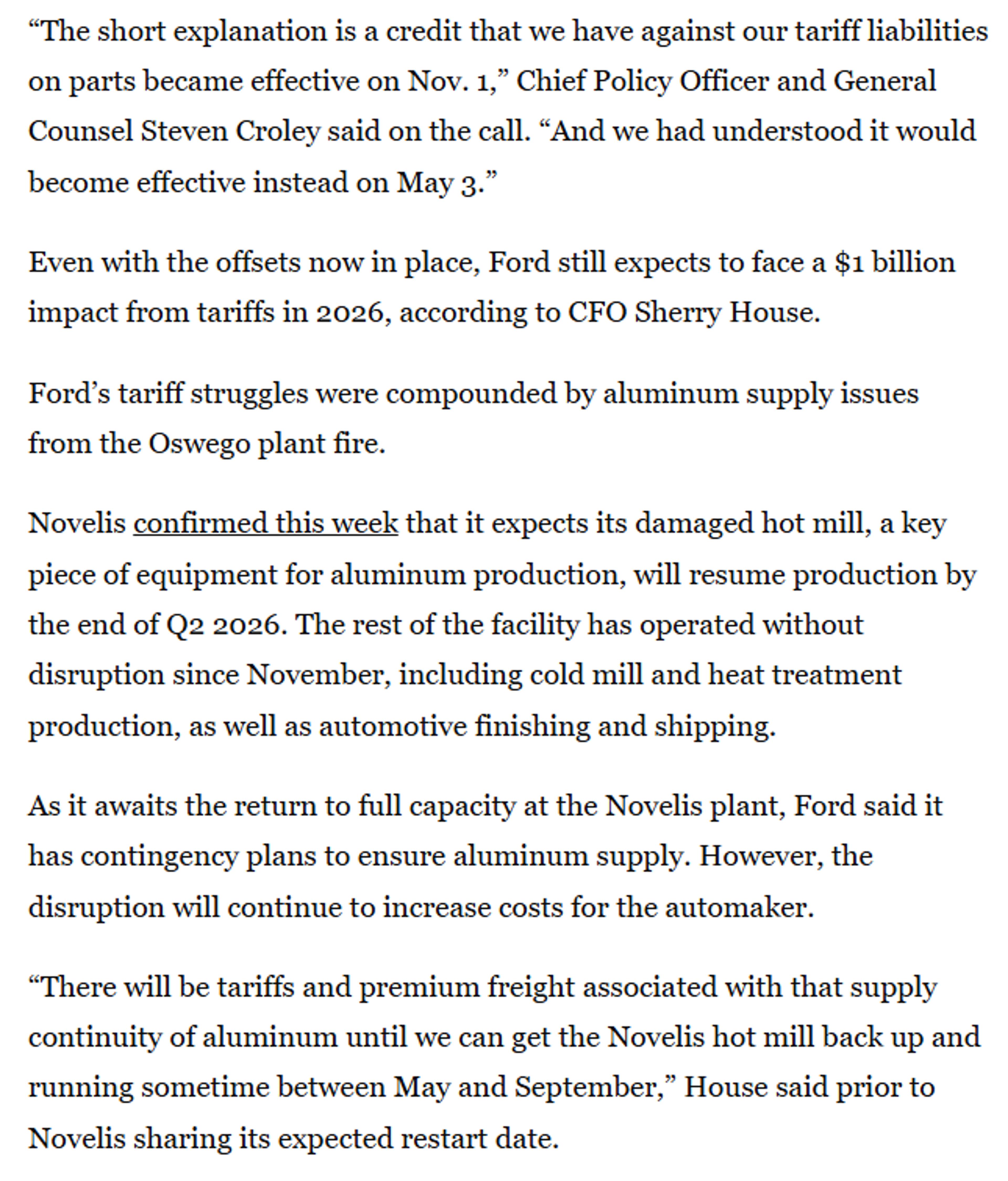

Ford Pays Millions in Tariffs After Supplier Fire

"Tariffs, supplier fire continue to batter Ford" https://t.co/3FKQwD9ycE That Ford is having to pay millions in aluminum tariffs simply bc its domestic supplier caught fire is one of the better/stupider examples of US tariff policy today: https://t.co/eOL1o1zgXf

By Scott Lincicome

Social•Feb 17, 2026

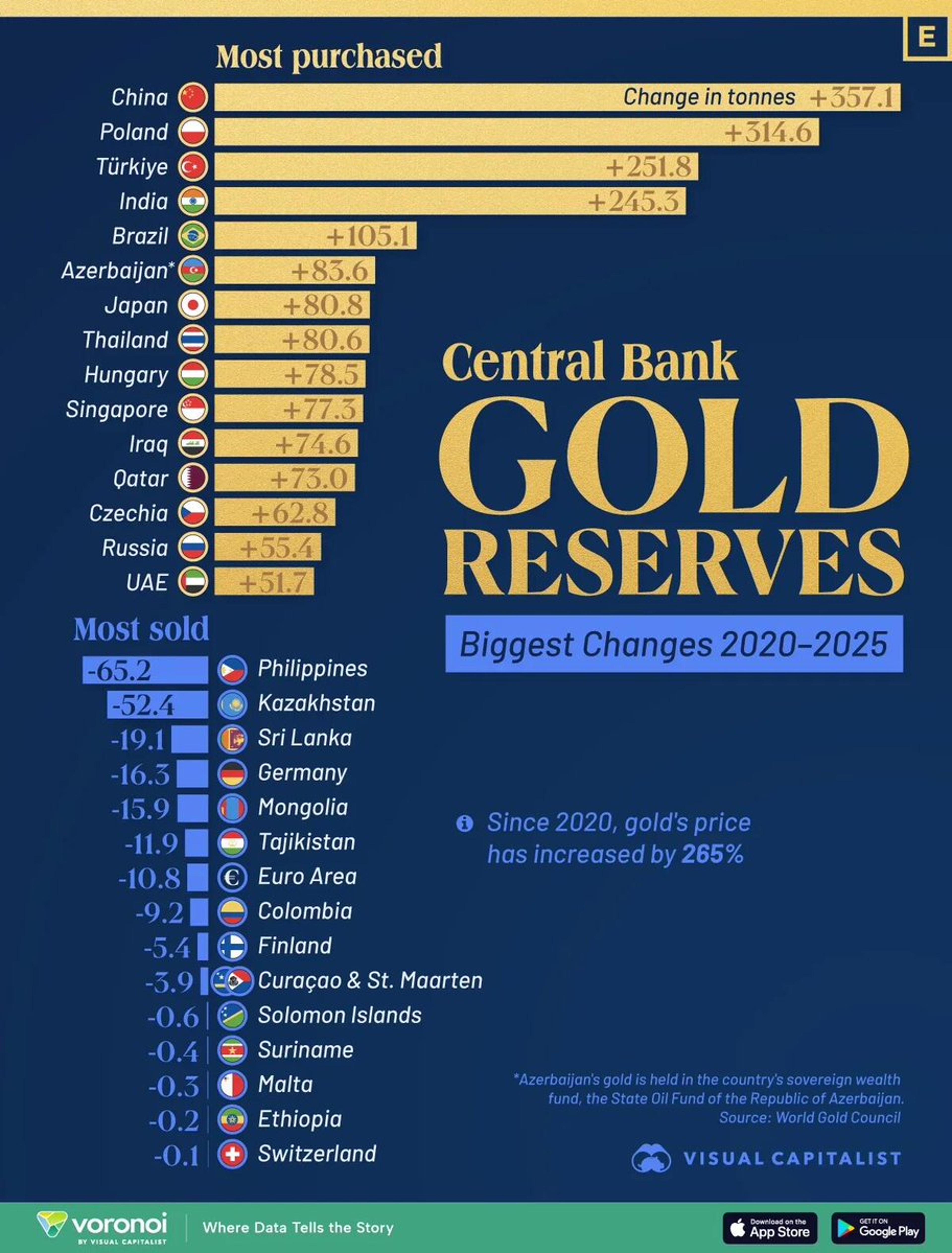

Central Banks Amass Record Gold, China Adds 357 Tonnes

Central banks around the world have spurred one of the largest gold-buying waves in history. The top 15 buyers added ~2,000 tonnes. China alone added over 357 tonnes since 2020. BUY GOLD, WEAR DIAMONDS. https://t.co/8Gm9M05oo3

By Steve Hanke

Social•Feb 17, 2026

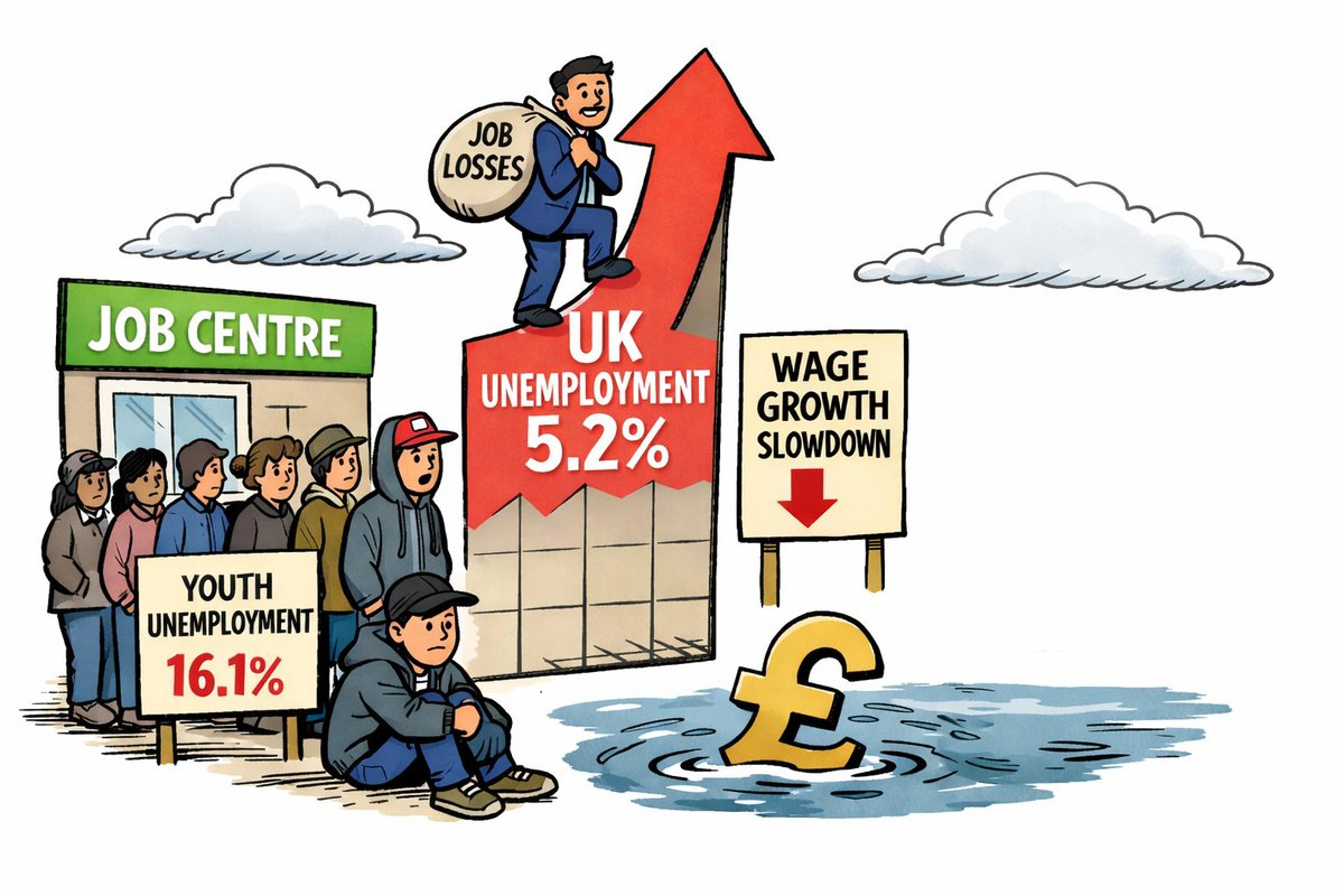

UK Unemployment Peaks Since COVID, Youth Jobless at 16%

#UKWatch🇬🇧: UK unemployment levels have reached their HIGHEST LEVEL since COVID. Youth unemployment ROSE TO 16.1%. RUSSOPHOBE STARMER’S GOVERNMENT IS FLOUNDERING. https://t.co/4jk4KQ1Q5I

By Steve Hanke

Social•Feb 17, 2026

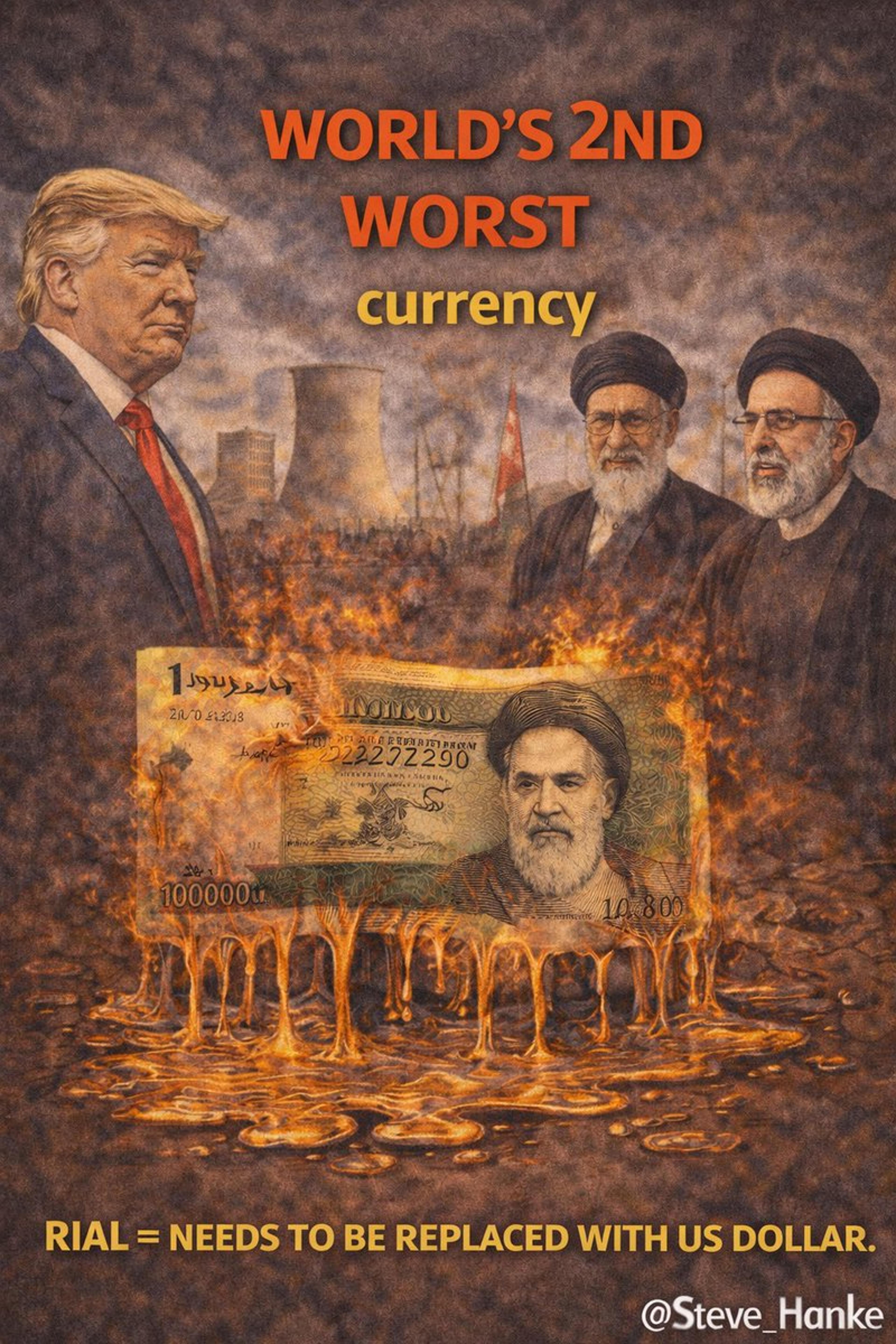

Iranian Rial Crashes as US‑Iran Nuclear Talks Begin

Today, US-Iran nuclear talks began in Geneva. As the talks start, the Iranian rial is in the tank. It has depreciated by over 43% against the dollar in the past year, making it THE SECOND WORST CURRENCY IN THE WORLD. https://t.co/PORIO6lGtc

By Steve Hanke

Social•Feb 17, 2026

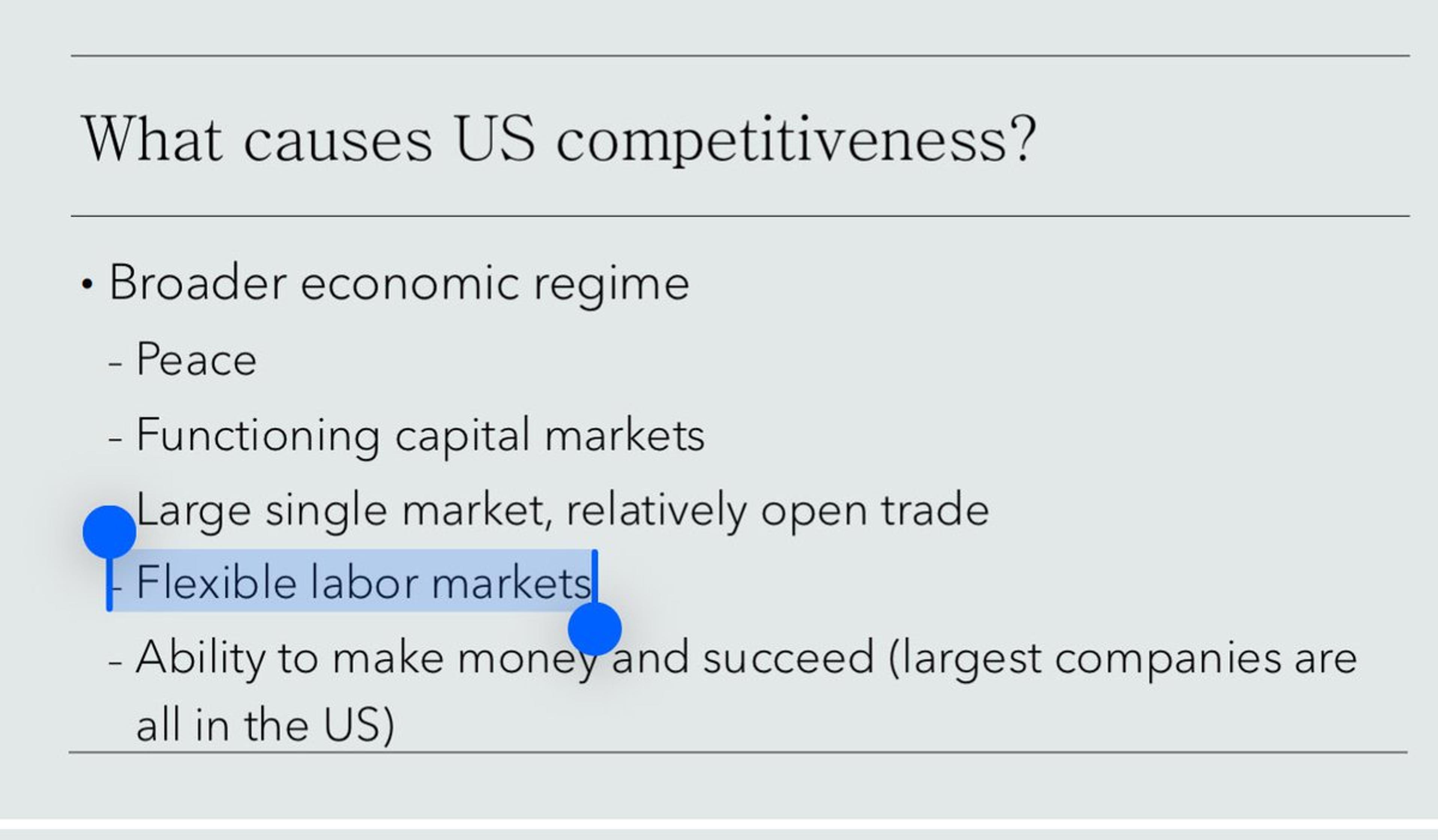

Labor Market Dynamism Drives Real Competitive Advantage

Labor market dynamism is the real differentiator. I make sure to stress it in my public talks https://t.co/jO6lNyPm8W

By Brian Albrecht

Social•Feb 17, 2026

Fed Says AI Boom Won’t Prompt Rate Cuts

Fed governor Michael Barr's latest speech contains 1) A short part on the current policy outlook. The key guidance: "Based on current conditions and the data in hand, it will likely be appropriate to hold rates steady for some time." 2) A...

By Nick Timiraos

Social•Feb 17, 2026

Sanctions Spawn Shadow Fleet, Aging Tankers Scrapped in India

US sanctions squeezed Russian and Venezuelan oil shipping out of mainstream markets. A shadow fleet emerged. Now aging dark fleet tankers are arriving at Indian scrapyards at a record pace. SANCTIONS = WORKAROUNDS = UNINTENDED CONSEQUENCES. https://t.co/GddyWzZwZd

By Steve Hanke

Social•Feb 17, 2026

Wheat Export Inspections Outpace USDA Target by 59M Bushels

Marketing year to date #wheat export inspections exceed the seasonal pace needed to hit USDA's target by 59 million bushels, versus 61 million the previous week. #oatt

By Arlan Suderman

Social•Feb 17, 2026

Iran Shuts Hormuz for Drills Amid US Nuclear Talks

"Iran says it temporarily closed the Strait of Hormuz as it held more indirect talks with the US." https://t.co/Ek0ckZEw6N Iran announced the temporary closure of the Strait of Hormuzon Tuesday for live fire drills in a rare show of force as its...

By John Spencer

Social•Feb 17, 2026

Third-Generation Auto Bailouts: How Long Until They're Considered?

How many years away are we from the third generation of auto bailouts being on the table?

By Adam Ozimek

Social•Feb 17, 2026

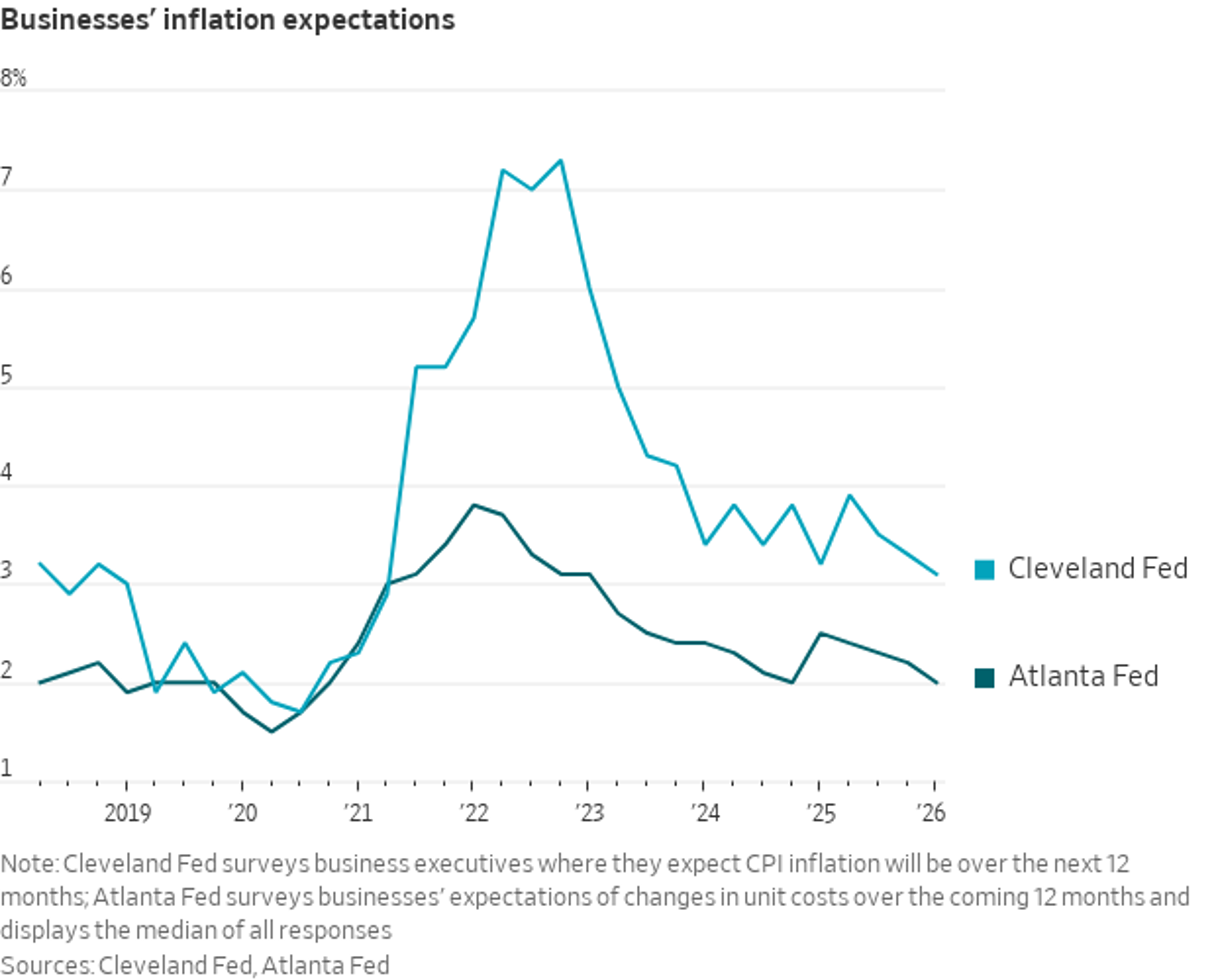

Business Inflation Expectations Return to Pre‑Pandemic Levels

Two different measures of business inflation expectations have essentially returned to pre-pandemic levels. The Atlanta Fed survey (dark line), which asks businesses how much they expect their own unit costs to change, is back at 2%—right where it was in 2019....

By Nick Timiraos

Social•Feb 17, 2026

TLT Seen as Lower High, Still Hating Treasuries

I think I might be the only person in the world who still hates US Treasuries here. $TLT is just another lower high imo until proven wrong.

By Quinn Thompson

Social•Feb 17, 2026

Chinese State Banks Boost FX Securities by $90B Monthly

Notable acceleration in the fx securities book of the Chinese state banks (And their reverse repo/ other funding of global financial institutions) in January -- consistent with the $90b monthly increase in the reported fx balance sheet https://t.co/PNDncW2w2s

By Brad Setser

Social•Feb 17, 2026

U.S. Corn Inspections Surpass Expectations, Soy Exports to China Strong

🇺🇸Last week's U.S. corn inspections easily beat all trade expectations (though they weren't a weekly record). FYI the previous week's corn volume was hiked significantly. Soy inspections were near the top end of estimates - 57% of the beans were...

By Karen Braun

Social•Feb 17, 2026

Mistaking Short‑Term Labor Shortage for Full Employment Undermines Jobs

I disagree, but I don't think David is alone in this. To me, the biggest risk of confusing a temporary labor supply shortage that drives up inflation with full employment was that it would undermine actual full employment. We are...

By Adam Ozimek

Social•Feb 17, 2026

IEA Paris Meeting Tests Net‑Zero Shift Against US Oil Priorities

For energy policy making, a key week in Paris as @IEA energy officials gather Feb 18-19 for a biennial ministerial meeting. The IEA’s drift toward net-zero advocacy and overtures to China will be tested as US officials push to a return...

By Javier Blas

Social•Feb 17, 2026

Swiss Market Hits Record High as US Stocks Slide

Switzerland is hitting a new all-time high again today as U.S. stocks break down to new 6-month lows relative to European stocks. https://t.co/z6UH4K1Vfo

By J.C. Parets, CMT

Social•Feb 17, 2026

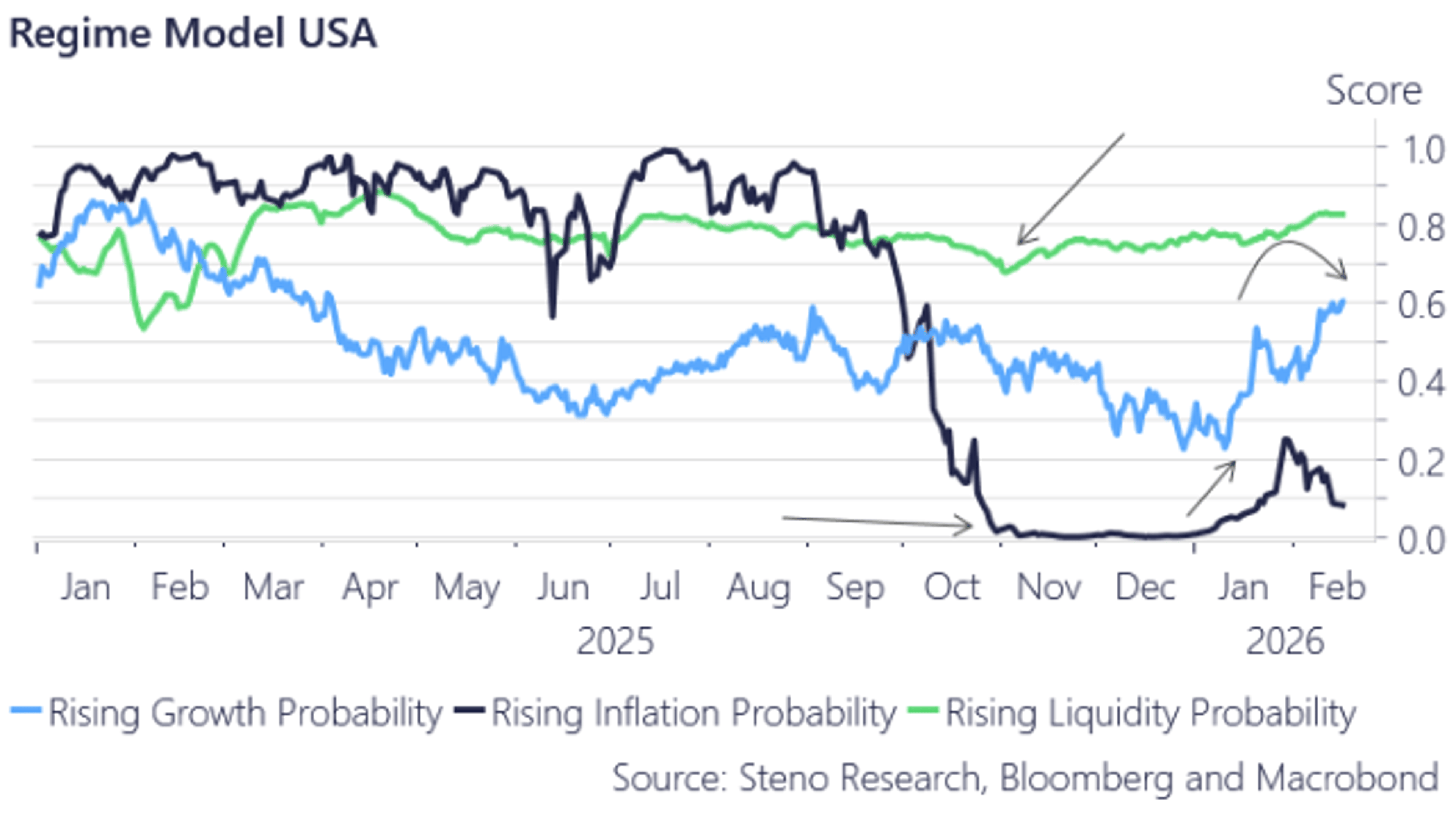

Nowcast IQ Predicts US Growth Despite Market Pessimism

A few of our weekly inputs have come in for US growth. We continue to rebound hard cyclically. EURUSD down, US assets (soon) up, and ISM PMI towards 60 by summer. Our Nowcast IQ is telling a VERY contrarian story to...

By Andreas Steno Larsen

Social•Feb 17, 2026

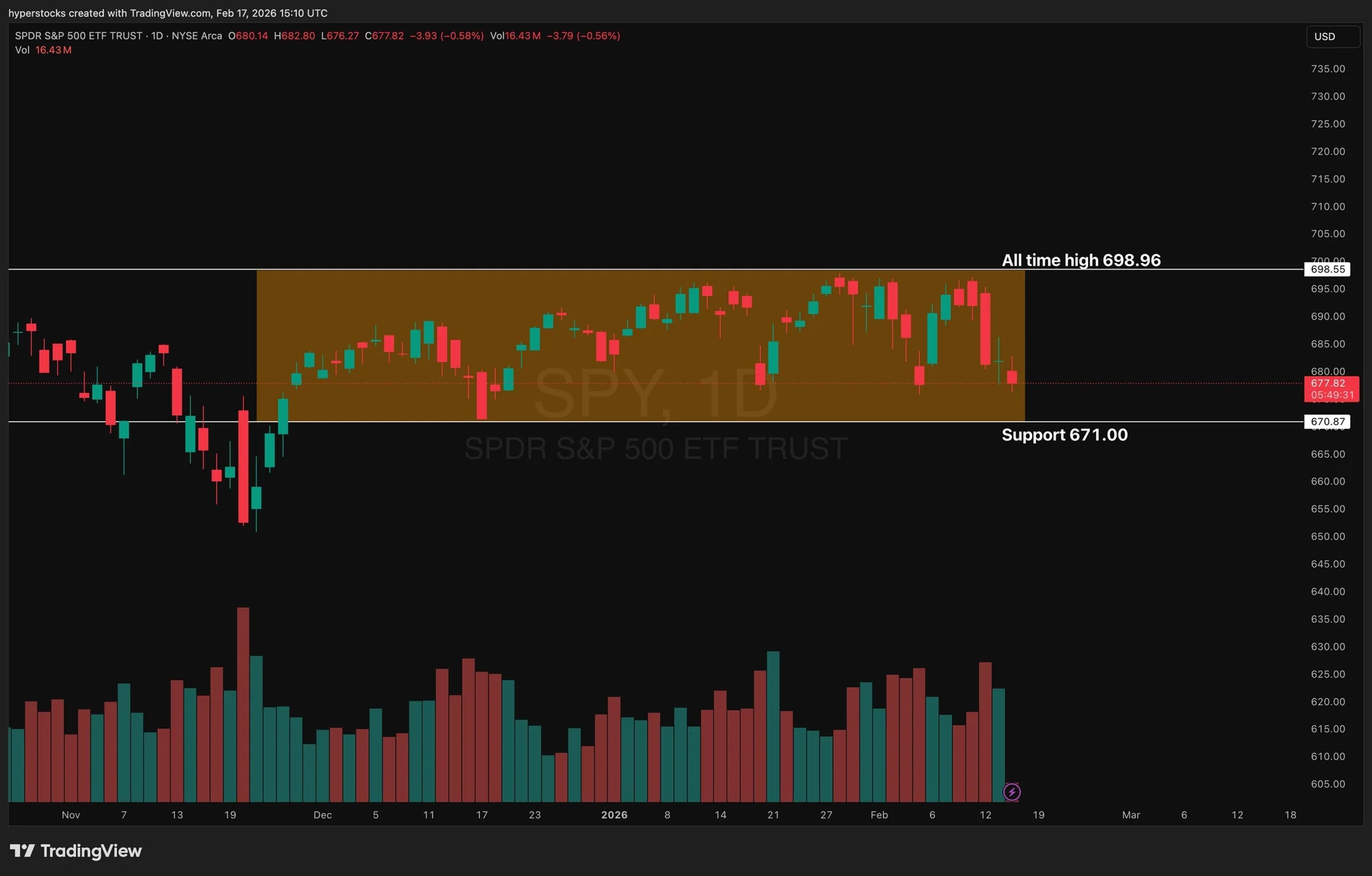

SPY Poised to Break November Range Amid Key Data

Is it finally the week $SPY breaks this range? Stuck here since November. Reports scheduled this week: - U.S. Trade Deficit Report (Thu) - GDP (Fri) - Inflation Report (Fri) - Consumer Sentiment (Fri)

By Hyperstocks