From Vision to Ambition: Evolving ESG Strategies in GCC Banking

•February 9, 2026

0

Companies Mentioned

Why It Matters

The move signals that GCC financial institutions are turning ESG into a strategic performance lever, unlocking capital for climate solutions while addressing social challenges, which will reshape regional investment flows and risk management.

Key Takeaways

- •Mashreq achieved end‑to‑end ESG assurance under AA1000AS.

- •GCC banks target DH 1 trillion sustainable finance by 2030.

- •ESG KPIs now embedded in Mashreq’s MBO framework.

- •Lack of regional ESG taxonomy hampers S and G integration.

- •Collaboration, not competition, drives GCC banking sustainability.

Pulse Analysis

Regulatory momentum in the Gulf is redefining how banks approach sustainability. The UAE’s Federal Decree Law No. 11 of 2024 and Saudi Green Initiatives have created a legal scaffolding that pushes institutions beyond carbon reporting toward comprehensive ESG integration. This shift is not merely compliance; it reflects a broader regional consensus that finance must underpin the transition to a low‑carbon, socially inclusive economy, especially as the GCC grapples with water scarcity and youth unemployment.

Mashreq Bank exemplifies the new operational model. By obtaining AA1000AS end‑to‑end assurance for its Global Integrated ESG report, the bank demonstrates a commitment to data transparency that few regional peers match. Its governance framework spans four tiers, linking ESG metrics directly to the Group CEO’s quarterly reviews and embedding Sustainable Performance Indicators into the management‑by‑objectives system. This rigorous approach supports the UAE Banks Federation’s DH 1 trillion sustainable‑finance pledge, with Mashreq’s Dh110 billion contribution targeting health, education, energy efficiency and industrial transition projects aligned with the UN SDGs.

Despite progress, the GCC faces structural challenges. A fragmented ESG taxonomy limits comparability of social and governance metrics, while data silos impede holistic risk assessment. Industry leaders advocate a "PPP 2.0" model that blends concessional finance, tax incentives and regulatory reform to scale impact. Collaborative initiatives, such as the Climate Ambition Accelerator and Mashreq’s Climb2Change program, illustrate a growing belief that shared standards and joint financing are essential to bridge the $4 trillion annual funding gap and meet the region’s ambitious climate and development goals.

From Vision to Ambition: Evolving ESG Strategies in GCC banking

As environmental, social and governance (ESG) pressures intensify globally, banks in the Gulf Cooperation Council (GCC) region are re-evaluating how they integrate sustainability into core strategy. The past five years have witnessed a flurry of ESG-linked announcements across the region – from national net-zero commitments to green finance targets. But moving from ambition to execution presents a real challenge.

We’re no longer in a world where ESG reporting is just about ticking boxes. If we want to deliver real change, it must become embedded into the corporate DNA – and that requires leadership, governance and painstaking internal transformation.”

Faisal AlShammari, Head of ESG at Mashreq

Mashreq is among the first banks in the UAE to undergo assurance and the only bank in the region to undergo end-to-end assurance (as per AA1000AS) of its Global Integrated ESG & Sustainability report as per GRI standards, covering not just GHG emissions data but all sustainability metrics. Its report covers the bank’s entire global operations – including ATMs and overseas branches. “Most banks focus only on carbon assurance,” says AlShammari. “We took it further because credibility depends on transparency and traceability. That journey wasn’t easy, but it was necessary.”

A shifting landscape

While ESG investing has faced political backlash in some Western markets, the momentum in the GCC remains broadly positive. Governments have introduced a raft of regulations and strategies – from the UAE’s Federal Decree Law No. 11 of 2024 on the reduction of climate change effects, to the Saudi and Middle East Green Initiatives – designed to institutionalise climate action.

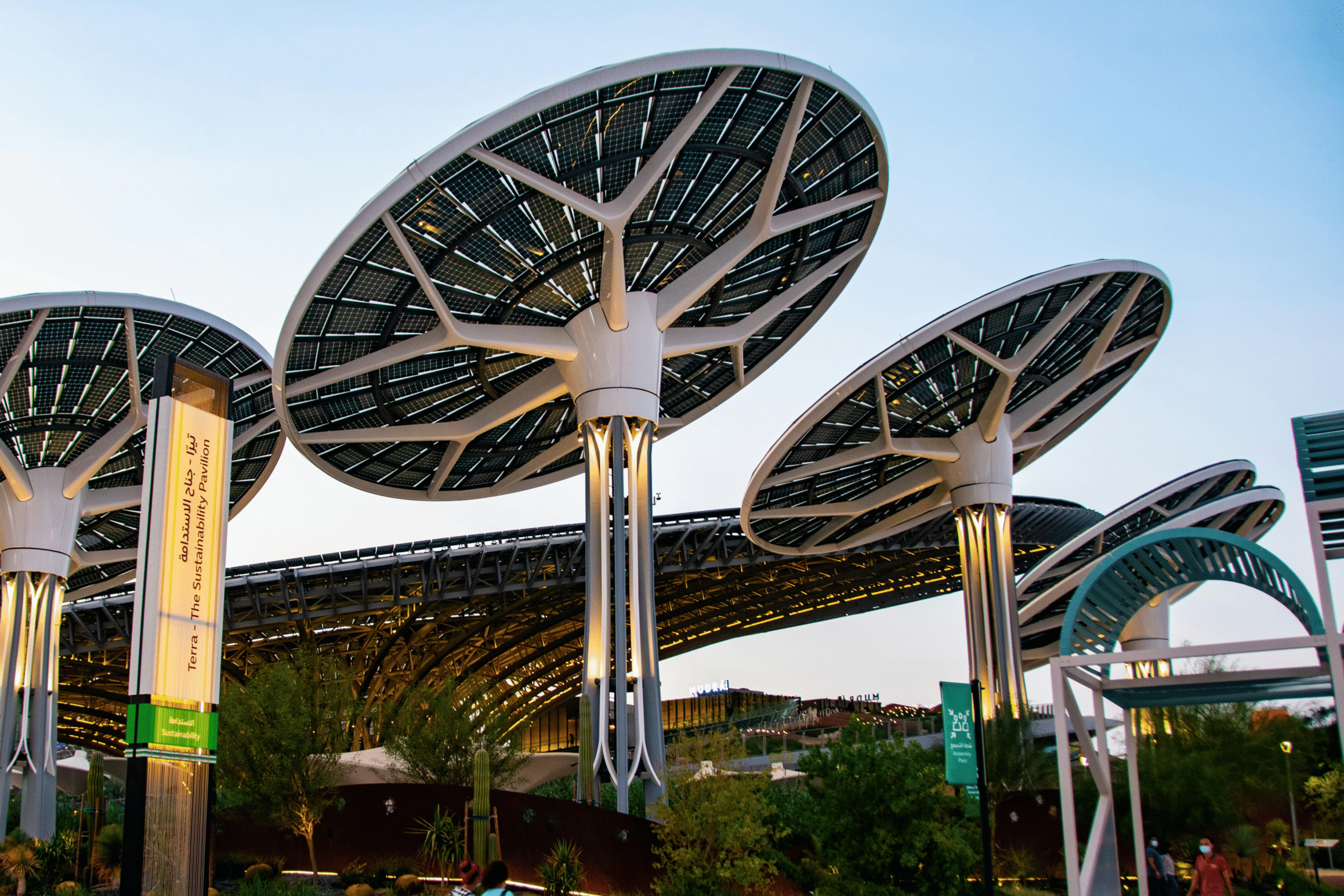

Banks, as capital allocators and policy enablers, have a central role to play in these efforts. At COP28 in 2023, the UAE Banks Federation (UBF) led an initiative where six national banks, including Mashreq, pledged that the Emirati financial sector would mobilise DH 1 trillion in sustainable finance by 2030. Yet questions remain over how these commitments are defined, measured and enforced.

According to AlShammari, the lack of a comprehensive ESG taxonomy – anchored in human centricity – across many jurisdictions hampers progress. “The ‘E’ often dominates the conversation,” he says. “But where is the ‘S’ and ‘G’? If we’re not simultaneously addressing poverty, financial inclusion, human centricity and governance, then we’re not really practising ESG – we’re practising selective reporting.”

More than green lending

The GCC banking sector is facing a dual imperative: support decarbonisation while safeguarding economic development in hydrocarbon-heavy economies. The inherent tension is not lost on industry leaders.

“Fossil fuels are polluting, yes – but they have also financed the very development that enables ESG transformation and achieving the UN SDGs,” says AlShammari. “To simply label them the enemy is to ignore both history and context.”

Mashreq’s Dh110 billion sustainable finance commitment by 2030 – which makes it one of the top contributors towards Dh1 trillion target – reflects this nuance. The bank is deploying capital across multiple sectors linked to the UN Sustainable Development Goals (UN SDGs) – from health and education to energy efficiency and industrial transition. Even the best-performing countries are falling short of their UN SDGs by nearly 50%, underscoring why financial enablement is critically important.

The annual funding gap stands at approximately $4 trillion – a scale that demands innovative solutions and collaborative action to close. But as AlShammari stresses, capital alone won’t deliver impact. “Sustainable finance isn’t just about loans. It’s about creating partnerships, syndications and risk-sharing mechanisms – and above all, aligning incentives.” Any sustainable-linked loan or SDG-aligned financing should ideally carry concessional IBOR and tax incentives, creating a strong impetus for adoption. This approach would mirror the benefits offered under national housing programmes, making sustainability-driven finance more accessible and impactful, he says.

The global transition to net zero faces a significant financing gap, with emerging markets alone needing an additional Dh350 trillion ($94.8 trillion) by 2050 – far exceeding current public commitments and requiring over Dh300 trillion ($83 trillion) from private investors. In the UAE, where the transition will require around Dh2.5 trillion ($671.1 billion), institutions like the Abu Dhabi Fund for Development, which surpassed Dh216 billion in financing and investments by the end of 2023, play a critical role in mobilising capital.

However, to meet climate and sustainable development goals, sustainable finance must be made more available, accessible, and affordable – particularly in developing countries. With clean tech investments needing to triple by 2030 and global energy transition spending averaging nearly $5 trillion per year, financial institutions must scale up efforts. Embedding human-centricity into sustainability is not only essential – it also represents a significant value creation opportunity.

To that end, he advocates for what he calls “PPP 2.0” – a reimagined public-private partnership model that combines concessional finance, blended capital and regulatory reform. “We need carrots, not just sticks,” he argues. “Penalties like carbon taxes have their place, but without affordability and incentives – such as tax waivers and tax rebates for ESG-related losses – we won’t get the scale or systemic change we need.”

From disclosure to strategic enforcement

In a region where regulatory expectations are rapidly evolving, internal capacity building is increasingly seen as a differentiator. At Mashreq, ESG KPIs (Sustainable Performance Indicators (SPIs)) are now embedded in the management-by-objectives (MBO) frameworks of all business group heads and reviewed quarterly by the group CEO.

“It’s coming from the top – and that’s when transformation really begins. For us at Mashreq, this transformation has been driven by strong leadership from our Group CEO Ahmed Abdelaal, whose support has been pivotal in making this initiative a reality. It’s not about one department trying to push an agenda anymore,” says AlShammari.

This approach reflects a broader trend among GCC banks: a shift from ESG as a reporting function to ESG as a strategic performance lever. To support this transition, Mashreq has established a robust four-tier governance structure designed to ensure accountability, alignment, and effective decision-making. At the top, Level 1 provides board-level oversight through the Board Risk, Compliance, and ESG Committee. Level 2 focuses on strategic direction and alignment, driven by the Group Risk Committee and the Sustainability Executive Committee. Level 3 features a dedicated ESG Committee, which ensures focused attention on implementation and integration efforts. Finally, Level 4 comprises functional and operational committees that are responsible for driving execution across various business units.

Still, challenges persist. Many ESG data systems remain fragmented, and disclosure practices vary widely in scope and depth. Independent ESG ratings remain inconsistent, and third-party frameworks often fail to account for regional priorities such as water scarcity or youth unemployment.

AlShammari believes the way forward lies in local context. “We can’t blindly copy what is labelled as ‘first-world’ ESG practices,” he says. “We need taxonomies and metrics that reflect the realities of our economies and the moral priorities of our societies. Should we prioritise melting ski resorts or dying farms? Water scarcity or low-carbon tourism? These are the real questions.”

Collaboration over competition

A notable shift in mindset is also underway in how banks approach ESG leadership. Rather than treating sustainability initiatives as a competitive differentiator to be shielded from peers, Mashreq is adopting a more collaborative stance.

In 2024, the bank in collaboration with UN Global Compact Network UAE hosted the 3rd Middle East Cohort of the Climate Ambition Accelerator. . “That’s unusual in our industry,” admits AlShammari. “But if we keep ESG strategies in silos, we all lose. Sectoral change needs sector-wide engagement.”

It’s also important to acknowledge the challenges that lie ahead – particularly around issues such as greenwashing, or and underdeveloped or inconsistently enforced regulations. Disclosure requirements for clients tapping sustainable and sustainability-linked finance are an area of focus. Clients are increasingly expected to provide assurance reports to validate the impact of financing.

As guided by the bank’s leadership, efforts are already underway to engage with counterparts – such as UBF equivalents in other countries – to foster a shared understanding and accelerate maturity across markets.

This collaborative spirit extends to clients as well. Under the umbrella of its “Climb2Change” initiative – which includes biodiversity-linked debit cards, mountain cleanups and net-zero advisory – Mashreq is embedding ESG into client engagement. In sectors such as aviation, logistics and agriculture, the bank is working with clients to understand emissions pathways, support disclosures and develop long-term transition plans.

“We’re not just handing out money,” says Al Shammari. “We’re walking the path with our clients. That’s where real impact happens.”

Looking ahead

The road ahead for ESG in GCC banking is both promising and complex. Climate vulnerabilities, resource dependencies and demographic pressures make the region uniquely exposed – and uniquely positioned – to pioneer sustainability solutions.

But as AlShammari warns, the stakes go beyond environmental compliance. “If we ignore the ‘S’ – if we don’t tackle poverty, exclusion and unemployment – we risk rising crime, social breakdown and a collapse in public trust. ESG isn’t a luxury. It’s a survival strategy.”

To realise the full potential of ESG, GCC banks must embrace transparency, invest in internal capabilities and collaborate across sectors and borders. The task is not merely to meet targets – but to rewire how banking defines long-term success.

The post From Vision to Ambition: Evolving ESG Strategies in GCC banking appeared first on Euromoney.

0

Comments

Want to join the conversation?

Loading comments...