🎯Today's Bonds Pulse

Updated 1h agoWhat's happening: ESMA Extends Transparency Deferrals for Sovereign Bond Trades

The European Securities and Markets Authority and most EU national competent authorities have published a list of supplementary deferrals that extend the MiFIR transparency regime for sovereign bonds. The new rule permits omission of volume publication for medium‑size trades on liquid Group 1 bonds until the end of the trading day.

News•Feb 20, 2026

ESMA Publishes List of Supplementary Deferrals for Sovereign Bonds

The European Securities and Markets Authority (ESMA) and most EU national competent authorities have released a list of supplementary deferrals that extend the MiFIR transparency regime for sovereign bonds. The new rule permits the omission of volume publication for medium‑size trades on liquid Group 1 bonds until the end of the trading day. These supplementary deferrals become effective on 4 May 2026 and are adopted by all NCAs except the National Bank of Slovakia. The measure follows a rapid consultation process aimed at easing implementation for venues, firms and APAs.

By ESMA – Press

Social•Feb 20, 2026

Most Weekly BDC Discounts Are Mispriced—Learn Why

Everyone has a BDC take this week. Most of them are wrong. If you don't understand how they trade, what drives the discount, or why NAV isn't what you think it is, start here. https://www.junkbondinvestor.com/p/the-bdc-primer-part-1

By JunkBondInvestor

Social•Feb 20, 2026

Fed Minutes Reveal Mixed Inflation, AI Boosts Productivity

In this week's #OnInvesting, @LizAnnSonders and I talk about Fed minutes, mixed signals on inflation & unemployment, and weakness in the survey data. Liz Ann & @KevRGordon discuss the latest GDP report and the impact of tariffs, AI-driven investment and...

By Kathy Jones

News•Feb 20, 2026

WDI May Benefit From Shifting Interest Rate Policy

Western Asset Diversified Income Fund (WDI) trades at a 3.04% discount to NAV and offers a 12.41% yield, positioning it as a high‑yield income vehicle. The fund’s portfolio is heavily weighted toward high‑yield corporate bonds and a sizable floating‑rate component,...

By Seeking Alpha – ETFs & Funds

Social•Feb 20, 2026

IEEPA Threat Raises Tariff Ceiling, Shifts Negotiation Dynamics

While 15% is close to what many countries ended up negotiating with Trump, he invoked IEEPA to threaten much higher rates, providing powerful leverage. If 15% is an effective ceiling (outside 301/232 actions), that changes the bargaining dynamic.

By Greg Ip

Social•Feb 20, 2026

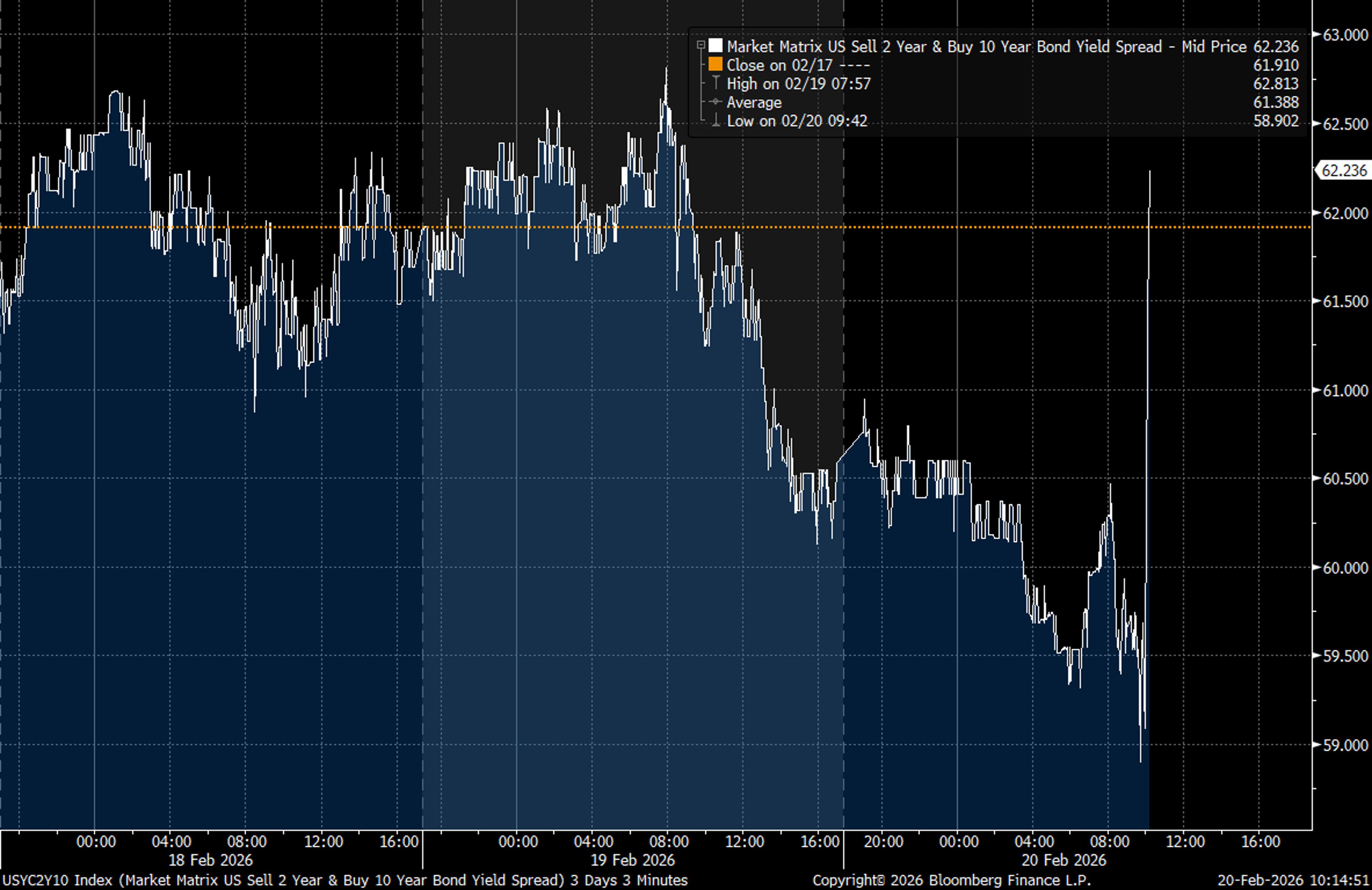

Yield Curve Ste

USTs for now reacting to the loss of tariff revenue, but it remains to be seen how this plays out. Curve steepening https://t.co/ZMjLP2vbxi

By Ed Bradford

News•Feb 20, 2026

Virtus Newfleet Multi-Sector Bond ETF Q4 2025 Commentary

The Virtus Newfleet Multi‑Sector Bond ETF posted a 1.64% NAV return in Q4 2025, beating the Bloomberg U.S. Aggregate Bond Index’s 1.10% gain. The fund’s deliberate underweight to U.S. Treasuries captured excess returns as spread‑rich sectors outperformed. Management continued to fine‑tune...

By Seeking Alpha – ETFs & Funds

News•Feb 20, 2026

RSBT ETF: It's A Directional Bet, Not A Diversification Vehicle

The Return Stacked Bonds & Managed Futures ETF (RSBT) posted a 12.25% year‑over‑year price gain after a tough 2022‑23 inflation cycle. The fund allocates capital between the AGG bond ETF and a suite of trend‑following managed‑futures strategies, positioning it as...

By Seeking Alpha – ETFs & Funds

News•Feb 20, 2026

Global Market | Japan’s Tightening Cycle Could Redraw the Map of Global Market Liquidity

The Bank of Japan has ended its ultra‑easy stance, pushing policy rates to the highest level in decades and pricing in another hike. Higher domestic yields are likely to trigger repatriation of Japanese savings, cutting the flow of low‑cost funding...

By The Economic Times (India) – RSS hub

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

The Close for Wednesday, Feb. 18, 2026

The Close segment recapped the day’s market outlook, highlighting upcoming earnings from RioCam and IA Financial, a slump in Canadian housing prices, Japan’s $36 bn investment in U.S. energy and minerals, Berkshire Hathaway’s portfolio shift, and General Motors’ $63 m Oshawa plant...

By BNN Bloomberg

Video•Feb 19, 2026

'New Canadian Government Has Really Taken the Opportunity to Focus on Areas We Can Control': Bai

The interview with John Bay, CIO of NEI Investments, centered on today’s market rally, a 3% oil price jump, and the broader impact of geopolitical tensions on North‑American equities. Bay linked the oil surge to stalled Russia‑Ukraine talks and heightened U.S.–Iran...

By BNN Bloomberg

News•Feb 19, 2026

TIP Solar Raises $179.7 Million in ABS From Residential Solar, PPA Leases

TIP Solar, backed by GoodLeap’s residential solar leases and PPAs, has issued $179.7 million in asset‑backed securities. The ABS are collateralized by 7,812 leases held by Jaguar Solar Owner 2026‑1 and structured into A‑ and B‑tranches with anticipated repayments through March 2033 and...

By Asset Securitization Report

News•Feb 19, 2026

Ballard Spahr Public Finance Team Moves to Barnes & Thornburg

Barnes & Thornburg has hired the entire public finance and infrastructure team from Ballard Spahr, adding 35 attorneys—including 25 partners—to its Government Services and Finance Department. The acquisition more than doubles Barnes’ public finance bench to 56 lawyers and expands its...

By The Bond Buyer (municipal finance)

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

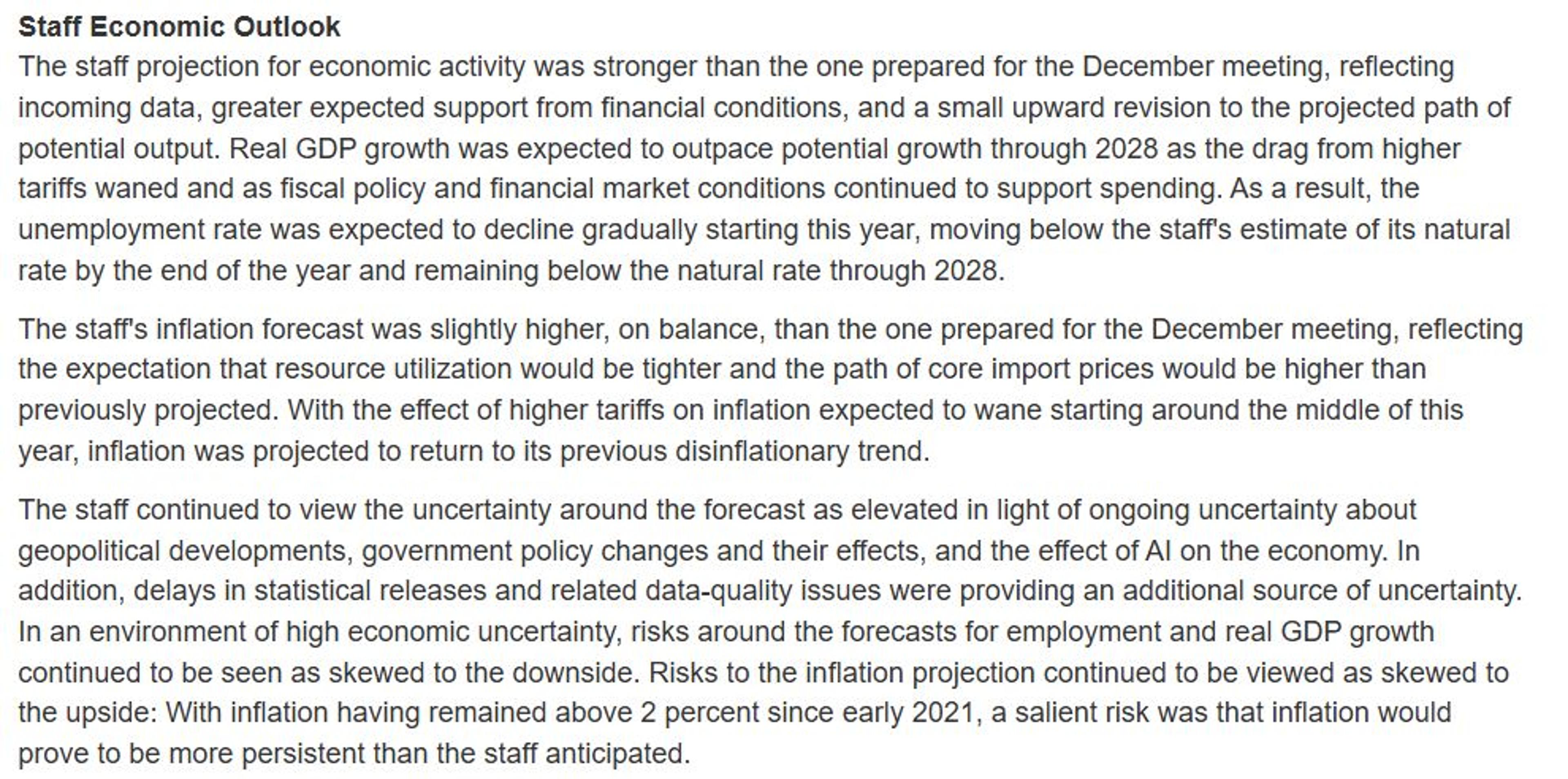

Fed Minutes Omit 2% Inflation Target Date, Signaling Uncertainty

One more note on the Fed minutes: Sometimes it's interesting what they don't say. Last year at every meeting until December, the staff forecast called for inflation to return to 2% by 2027. In December, the forecast pushed this back to...

By Nick Timiraos

Video•Feb 18, 2026

10-Year T-Note Futures Declined After Hawkish Fed Minutes. 2/18/26

The market focus on February 18 was the decline in 10‑year Treasury note futures after the Federal Reserve released its minutes. Futures slipped for a second straight session, retreating from a two‑and‑a‑half‑month high and trading around the 112.29 level. Two catalysts...

By CME Group

Social•Feb 19, 2026

Discussing 2026 Credit Outlook, Including Private Credit

I will be joining @CNBC's @michaelsantoli this afternoon at 430p ET for a discussion of the credit markets--including, yes, private credit. Snip from our Outlook 2026. https://t.co/u8NP4oAYoL https://t.co/umYLiLDzTY

By Guy LeBas

Social•Feb 19, 2026

TLT Call Skew at 90th Percentile, Expect Shakeout

Yep- Skew on TLT (calls expensive to outs) like 1 month out is in the 90th%tile. Gonna get shaken out before yields go lower. Let’s talk about this tomorrow on @ForwardGuidance

By Tyler Neville

Video•Feb 18, 2026

The One Number That May Explain This Market

The video centers on the 10‑year Treasury yield hovering near the 4% mark, which the presenter describes as the market’s thermostat for the coming trading week. He argues that this single number now dictates cross‑asset flows, influencing everything from tech...

By tastylive (tastytrade)

Video•Feb 16, 2026

💡 Loans vs Bonds Explained for IB Interviews

The video breaks down the fundamental differences between senior loans and bonds, a staple topic in investment‑banking interview prep. It highlights that senior loans are secured and usually carry floating rates tied to LIBOR or its successor, while bonds are unsecured,...

By Wall Street Oasis

Deals•Feb 13, 2026

SMFG Issues World's First Digital Inclusion Bonds, Raising $500M

Japan's Sumitomo Mitsui Financial Group (SMFG) has issued $500 million of bonds billed as the world's first 'digital inclusion' bonds. The proceeds will fund infrastructure projects to improve internet connectivity in emerging markets, aiming to bridge the global digital divide....

Nikkei Asia — Economy/Markets

Video•Feb 13, 2026

Nasdaq-100 and S&P 500 Futures Finished Lower for a Second Week. 2/13/26

The market focus this week centers on U.S. Treasury yields, which have slumped across the curve—from the 5‑year to the 30‑year—dragging the 10‑year rate to its lowest point since October 28, 2024. The yield plunge helped the dollar close its weakest week...

By CME Group

Video•Feb 12, 2026

Are Tighter Credit Spreads a Concern?

In a recent interview, JP Morgan Asset Management’s fixed‑income strategist Cheyenne Hussein addressed whether tighter credit spreads pose a risk to the U.S. bond market. The conversation was prompted by a strong jobs report and centered on how the data reshapes...

By BNN Bloomberg

Deals•Feb 11, 2026

RXO Issues $400M Senior Notes Amid Moody’s Downgrade

RXO announced on Feb. 11, 2026 the issuance of $400 million of unsecured senior notes due 2031, aimed at redeeming its 7.5% notes due 2027 and supporting general corporate purposes. The offering was oversubscribed, strengthening the company's balance sheet despite a...

FreightWaves

Video•Feb 10, 2026

Squawk Box Asia - 11-Feb-26

Squawk Box Asia’s Feb. 11 segment framed artificial intelligence as a transformative force across industries, offering a broad overview of its current capabilities and future potential. The program outlined AI’s applications, from operational efficiencies to new product development, and signaled...

By CNBC International Live

Video•Feb 5, 2026

President Lagarde Presents the Latest Monetary Policy Decisions – 5 February 2026

President Christine Lagarde’s February 5 press conference confirmed that the European Central Bank kept its three key policy rates on hold, emphasizing a data‑dependent stance as inflation eases toward the 2% medium‑term target. The meeting also marked Bulgaria’s accession to...

By European Central Bank