🎯Today's Bonds Pulse

Updated 3h agoWhat's happening: ESMA Extends Transparency Deferrals for Sovereign Bond Trades

The European Securities and Markets Authority and most EU national competent authorities have published a list of supplementary deferrals that extend the MiFIR transparency regime for sovereign bonds. The new rule permits omission of volume publication for medium‑size trades on liquid Group 1 bonds until the end of the trading day.

News•Feb 13, 2026

India Bond Traders Seek Buybacks as Yields Climb Despite Switch

Indian bond traders are pressing the government for buybacks as 10‑year yields climb despite a recent debt‑switch operation. The benchmark 10‑year yield rose to 6.6878%, up about five basis points after the Treasury swapped ₹755 billion of FY27 bonds for longer‑term notes. Weak investor demand and a heavy supply of new issuance have kept yields elevated, limiting the impact of the central bank’s record purchases. Market participants forecast the 10‑year yield could reach 6.80% by March if supply pressures persist.

By The Economic Times – Markets

Social•Feb 13, 2026

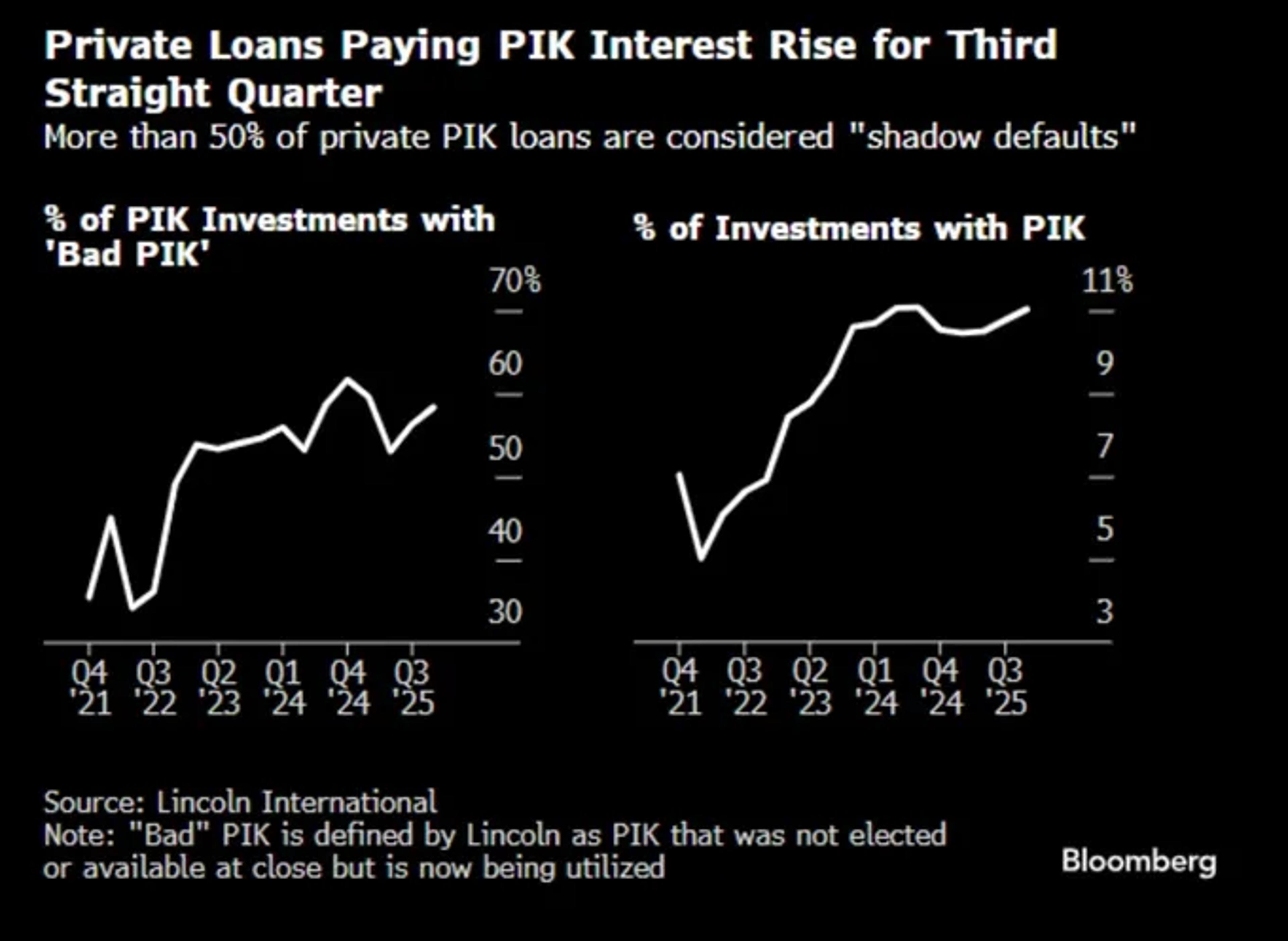

Most Private Credit PIK Is Bad Yet Labeled Performing

58% of PIK in private credit is "bad PIK" per Lincoln. Borrower stops paying cash. Lender accepts more debt instead. Everyone marks it at par. This is called "performing."

By JunkBondInvestor

Social•Feb 13, 2026

Inflation Still Stubborn: CPI 2.8%, Core 3.2%

FWIW, since the first "clean" CPI in November (post shutdown), headline CPI inflation is 2.8% annualized and core is 3.2% annualized. Neither suggests much stepdown yet in underlying inflation.

By Greg Ip

News•Feb 13, 2026

US Dollar Credit Supply: Primary Market Shows Strong Start to 2026

US dollar primary market began 2026 with robust corporate issuance, totaling $56 bn in January, driven largely by technology, media and telecom (TMT) firms contributing $24 bn. Banks led the financial sector, printing $134 bn of senior non‑preferred bonds, a $20 bn year‑to‑date increase...

By ING — THINK Economics

Social•Feb 13, 2026

Soft US Inflation Sparks Dollar Slide, Yield Drop, Gold Rise

📉 Softer US Inflation - Markets React 🔻 Softer US inflation numbers 🔻 USD tumbling 🔻 10-year yield falling ⬆️ Gold rising ⬆️ Stocks rallying 📊 CPI Breakdown: • MoM: 0.2% actual vs 0.3% forecast • YoY: 2.5% actual vs 2.5% forecast (2.7% previous)

By Kathy Lien

Social•Feb 13, 2026

January Spike: Core CPI Gains Outpace Typical Inflation

JANUARY EFFECT, or “Why this inflation report matters more than others” Since the start of 2022, core CPI has risen 0.45% month-on-month in January, versus an average of 0.33% for all months.

By Luke Kawa

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

Social•Feb 13, 2026

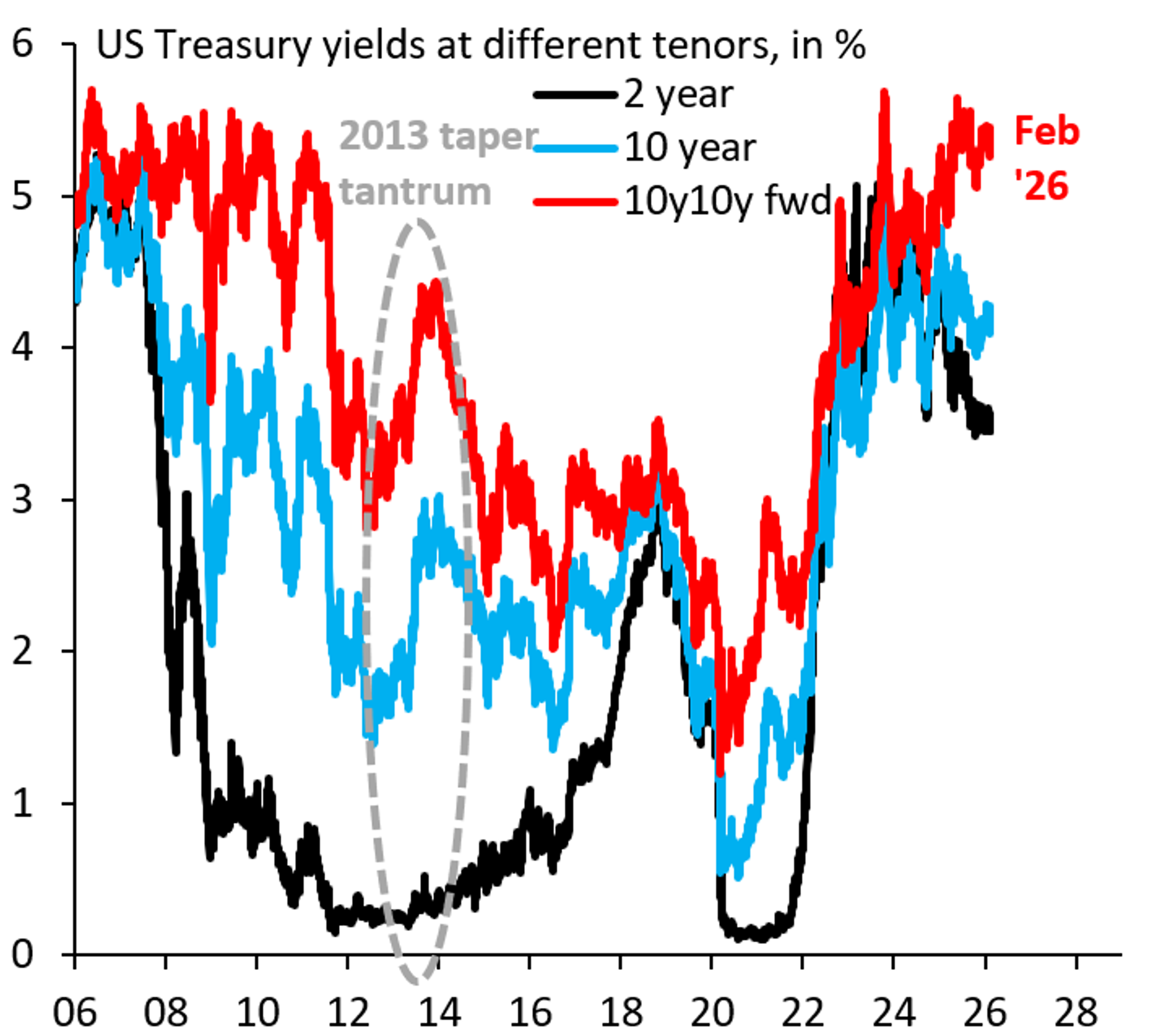

Trump Backs Off as Treasury Market Wobbles, Risk Premium Spikes

One constant in the Trump administration is that - when the Treasury market wobbles - it backs down. That happened on China in Apr. '25 and again on Greenland recently. 10y10y forward yield remains near its highs, even as 10y...

By Robin Brooks

Social•Feb 13, 2026

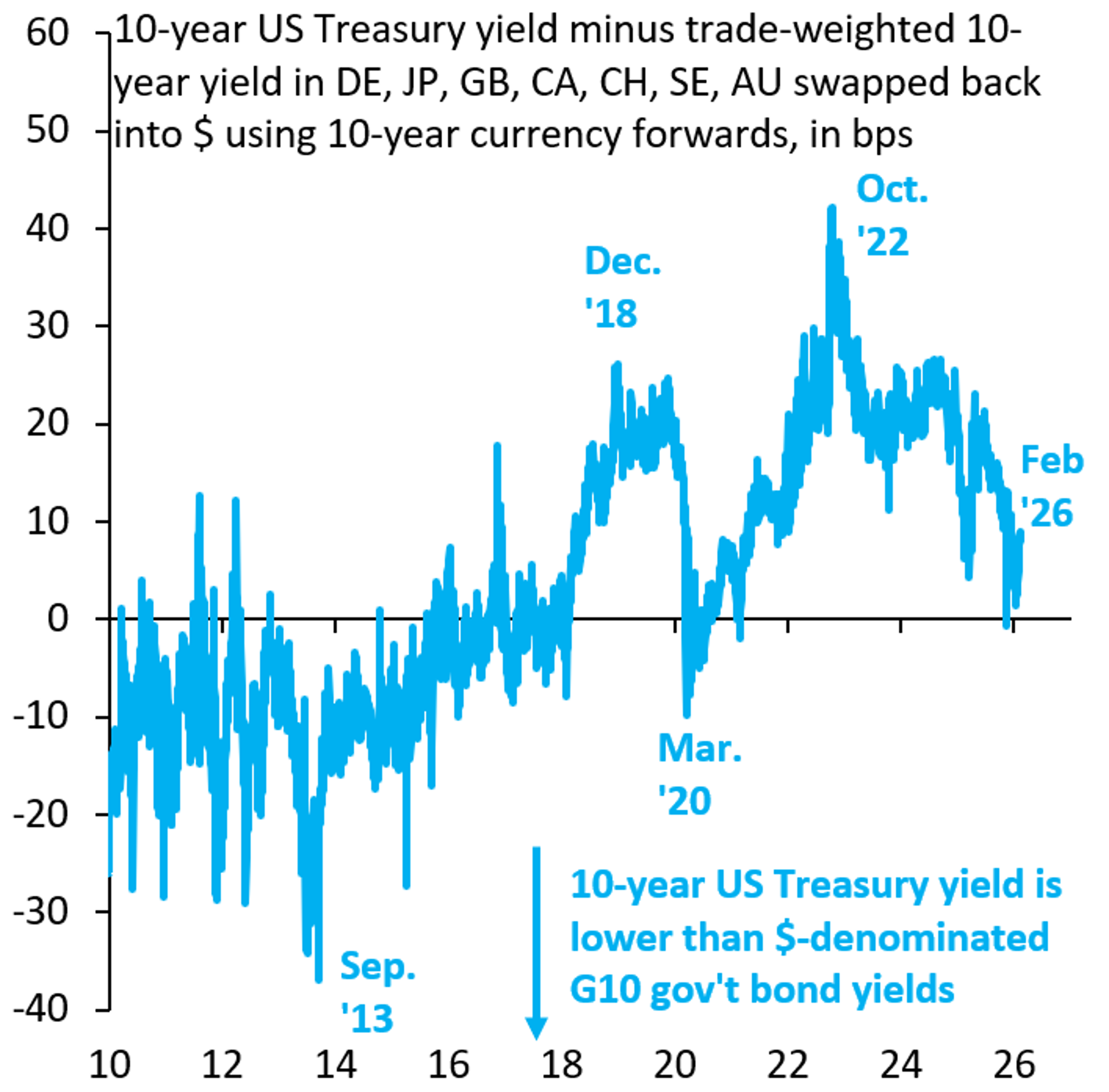

US Loses Cheap‑borrower Advantage, Now Pays Debt Premium

The US exorbitant privilege - the ability to issue debt more cheaply than others - ended about a decade ago. We're now issuing debt at a premium, the result of deficits and debt that are out of control. This change...

By Robin Brooks

News•Feb 12, 2026

Update on the Procurement for Digital Gilt Instrument (DIGIT) Pilot

The UK Treasury announced an update on the Digital Gilt Instrument (DIGIT) pilot, selecting HSBC’s Orion platform as the technology provider and Ashurst LLP for legal services. The competitive tender, launched in October 2025, aims to test distributed‑ledger technology for...

By HM Treasury – Atom feed

Social•Feb 13, 2026

CPI Insights on Friday the 13th: Inflation Talk

I will be on @YahooFinance at 8:30 am today to talk about the CPI. Friday the 13th and inflation. (My preview thread below.)

By Claudia Sahm

Social•Feb 12, 2026

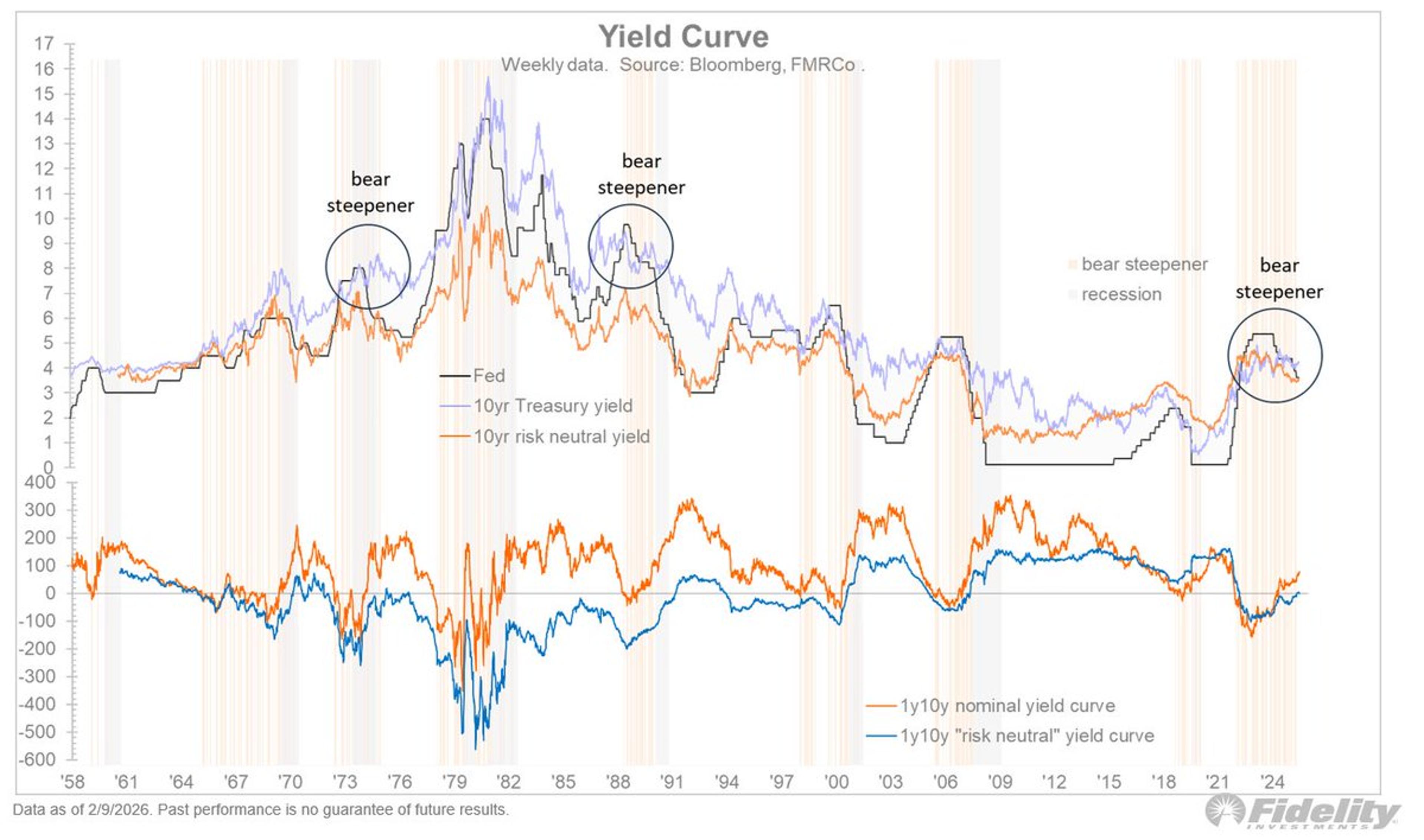

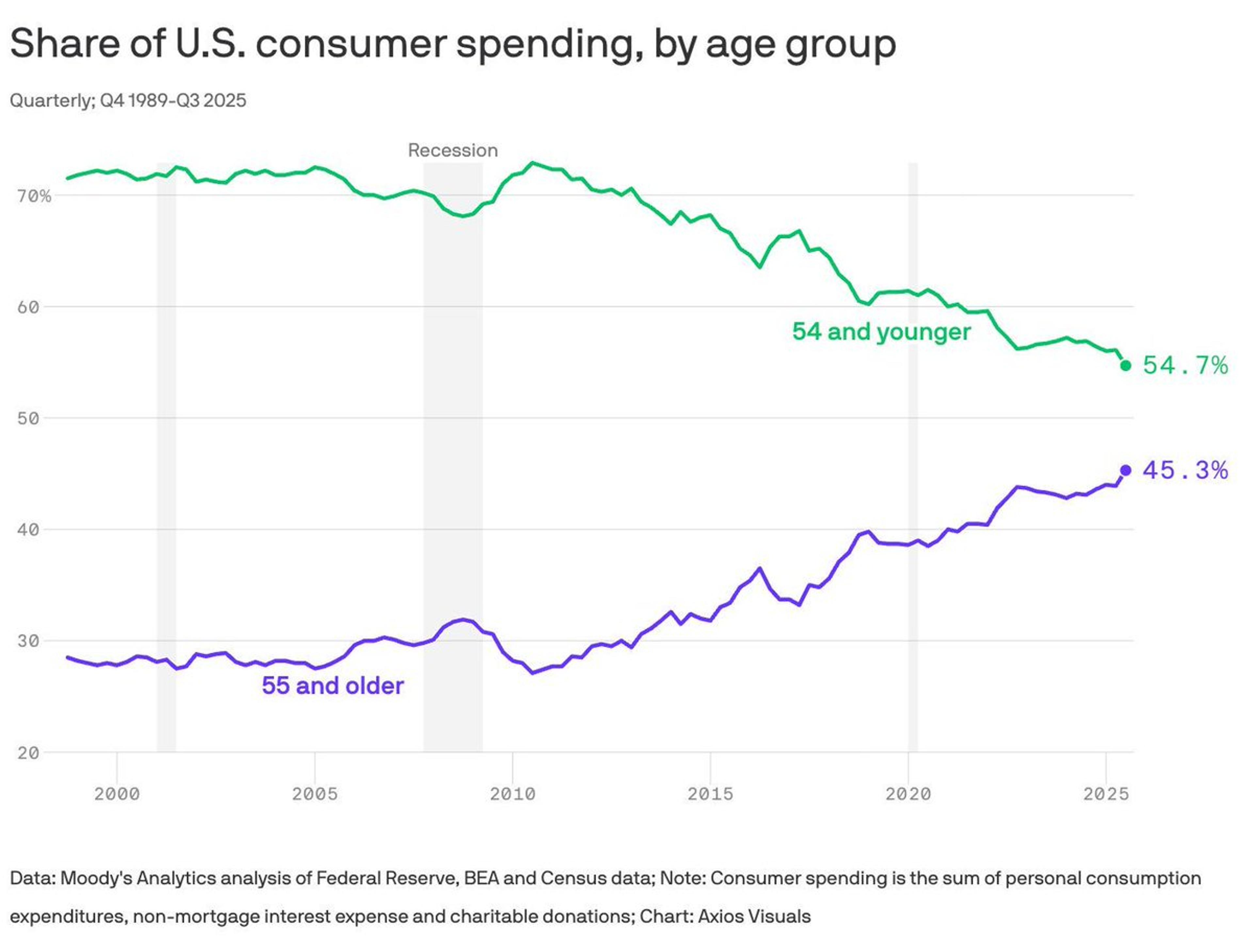

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

News•Feb 12, 2026

Fed Should ‘Aggressively’ Be Cutting Rates, Investor Says Amid Jobs Report Release

Anthony Pompliano, CEO of Professional Capital Management, argued on “Making Money” that the Federal Reserve should aggressively cut interest rates following the latest jobs report. He noted that the labor market remains solid but still offers room for monetary easing...

By Fox Business — Bonds (section)

Social•Feb 12, 2026

Fed Treasury to Coordinate

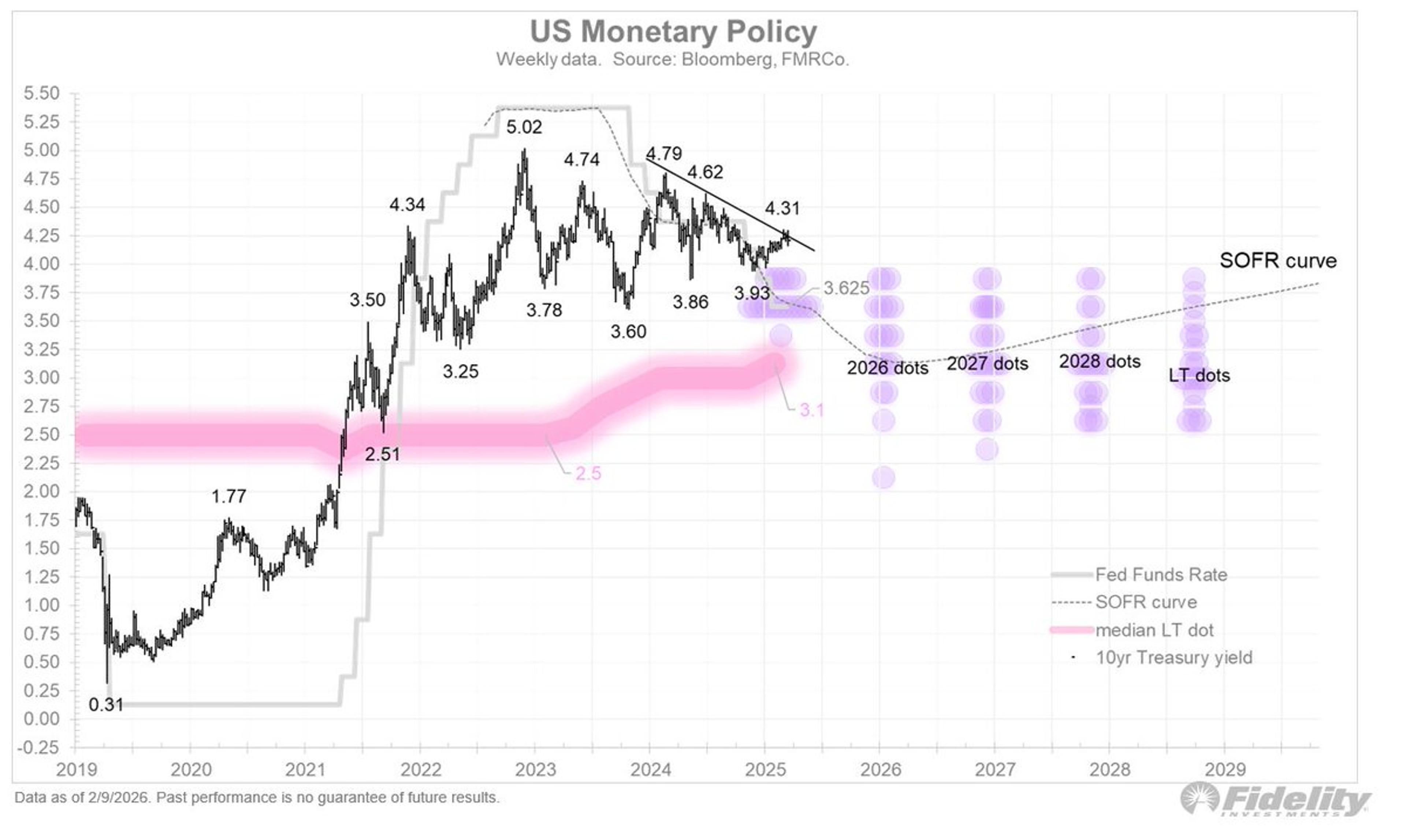

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

Podcast•Feb 11, 2026•38 min

Credit Crunch: Investor Survey 1Q - Fed, Earnings, Tech Supply

In this episode, Mahesh Bhimalingam of Bloomberg Intelligence and Ashwin Palta of BNY Investments discuss the Bloomberg Intelligence 1Q26 Investor Survey, highlighting the continued resilience of credit and high‑yield markets despite recent tariff shocks and rate volatility. They examine why...

By FICC Focus

News•Feb 11, 2026

Commonwealth Bank of Australia (CMWAY) Q2 2026 Earnings Call Transcript

Commonwealth Bank of Australia reported a solid second‑half 2025 performance, with cash net profit climbing 6% and earnings per share increasing $0.19. The bank highlighted disciplined growth across its core retail and business segments despite cost‑of‑living pressures and global uncertainty....

By Seeking Alpha — Site feed

News•Feb 11, 2026

MLPI: Supercharging MLPs For 15% Yields

NEOS MLP High Income ETF (MLPI) aims to deliver roughly 15% after‑tax yields by layering covered‑call premiums on a portfolio that mirrors the AMLP structure. The fund’s 100% return‑of‑capital distribution model defers taxes, boosting net income for investors. In addition...

By Seeking Alpha — Site feed

News•Feb 11, 2026

MPV: High-Quality Fund But Expensive At This Time

Barings Participation Investors (MPV) is a high‑quality, income‑focused closed‑end fund delivering a 7.8% yield and solid dividend coverage. The fund’s floating‑rate private‑credit portfolio positions it to profit from future interest‑rate cuts. However, shares currently trade at a 21% premium to...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Ladder Capital: No Harm In Positioning Itself Conservatively

Ladder Capital (LADR) continues to position itself as a low‑volatility, conservatively managed CRE REIT, with management holding over 10% of the equity. The Q4 2025 report showed a miss on dividend coverage, yet the portfolio remains anchored by more than...

By Seeking Alpha — Site feed

News•Feb 11, 2026

China Vanke Downsizes Serviced Apartment Business After Record Red Ink

China Vanke, a state‑backed developer, announced a record 82 billion yuan ($11.8 billion) loss for 2025. The loss prompted the company to shrink its serviced‑apartment business, scaling back operations in Shenzhen under the Port Apartment brand. The move is part of a...

By Nikkei Asia — Full feed

News•Feb 11, 2026

FTSE 100 Live: Heathrow Traffic Record; Homebuilders Call for Help

UK’s FTSE 100 slipped 0.3% after a string of negative corporate news. Energy giant BP announced a suspension of its share buyback programme and heightened cost‑cutting targets to fund oil production, while Standard Chartered saw its finance chief Diego De Giorgi...

By City A.M. — Markets

News•Feb 11, 2026

Voya Strategic Income Opportunities Fund Q4 2025 Commentary

Voya’s Strategic Income Opportunities Fund delivered outperformance in Q4 2025, surpassing its ICE BofA USD 3‑Month Deposit Index benchmark on a net asset value basis. The quarter was marked by heightened policy uncertainty due to a government shutdown, alongside market turbulence driven by a...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Thornburg Municipal Bond Funds Q4 2025 Commentary

U.S. fixed‑income markets ended 2025 on a positive note as Federal Reserve rate cuts and cooling inflation lifted bond prices. Thornburg's municipal bond funds posted mixed returns, with the AAA curve flattening and short‑term yields rising while longer maturities fell....

By Seeking Alpha — Site feed

News•Feb 11, 2026

Tradeweb Markets: Growth Outlook Remains Robust

Tradeweb Markets posted 12.5% year‑over‑year revenue growth in Q4 2025 and expanded its adjusted EBITDA margin to 53.2%, driven by strong volume gains in rates and derivatives. Early 2026 data shows double‑digit daily volume growth, supporting the firm’s high‑teens growth...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Country Garden Shares Edge up After Regulators Hold Back on Fines over Debt Disclosures

Country Garden shares rose about 1.8% after the Shanghai Stock Exchange issued a circulated criticism for delayed debt disclosures but stopped short of imposing fines. The regulator flagged failures across three reporting periods and recorded disciplinary action against the firm...

By South China Morning Post — Markets

News•Feb 11, 2026

Robinhood Markets, Inc. (HOOD) Q4 2025 Earnings Call Transcript

Robinhood held its Q4 2025 earnings call on February 10 2026, where CEO Vladimir Tenev and CFO Shiv Verma presented a solid financial rebound. Revenue rose 18% year‑over‑year to $1.2 billion and the net loss narrowed to $150 million, reflecting higher margin contributions from crypto...

By Seeking Alpha — Site feed

News•Feb 11, 2026

BNY Mellon Global Fixed Income Fund Q4 2025 Commentary

The BNY Mellon Global Fixed Income Fund posted a 0.67% return in Q4 2025, lagging its Bloomberg Global Aggregate USD‑Hedged benchmark by 11 basis points. Japanese government bonds surged, pushing the 10‑year yield 42 bp above the 2% threshold for the first...

By Seeking Alpha — Site feed

News•Feb 11, 2026

XOMA Royalty: Preferreds Still Offer Compelling Income Despite Call Risk

XOMA Royalty Corporation’s 8.375% cumulative preferred (XOMAO) trades at an attractive 8.3% yield, positioning it as a high‑income vehicle. The company added 24 royalty‑related assets in 2025, expanding its cash‑flow base from biotech milestones and licensing fees. Management highlights the...

By Seeking Alpha — Site feed

News•Feb 11, 2026

Bristow Group: Strong Long-Term Setup, Near-Term Execution Still Key

Bristow Group (VTOL) is positioned for medium‑term growth, capitalising on robust offshore energy demand in Brazil, Africa and the Caribbean. Recent debt refinancing and stronger free‑cash flow have shored up its balance sheet, enabling planned share buybacks and a 2026...

By Seeking Alpha — Site feed

News•Feb 10, 2026

Citadel and Cathie Wood Back Zero, a New Blockchain Designed for Traditional Finance

LayerZero, backed by Andreessen Horowitz and Sequoia, unveiled Zero—a new blockchain built for traditional finance. The network leverages zero‑knowledge proofs to claim 2 million transactions per second at sub‑cent costs, far outpacing Solana’s 100k TPS limit. Wall Street heavyweights including Citadel Securities,...

By Fortune — Finance

Social•Feb 10, 2026

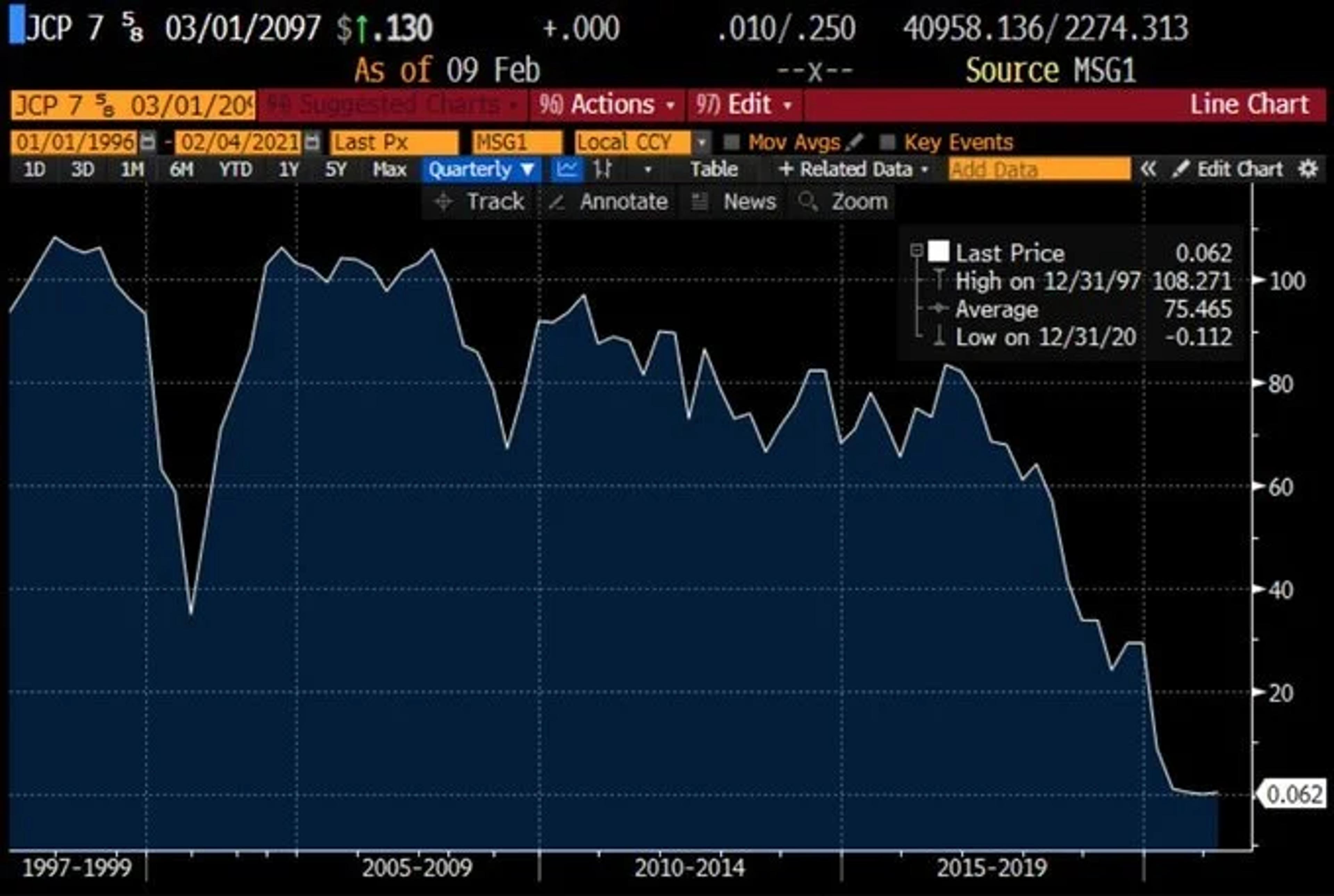

Google’s 100‑Year AI Bond: Ambitious or Foolhardy?

Google issuing a 100-year bond to fund AI capex. Remember JC Penney’s 100-year bond? Issued in 1997. Bankrupt in 2020. At least they got their basis back in coupons.

By JunkBondInvestor

News•Feb 10, 2026

China’s US Treasurys Exit Could Limit Japan’s Military Spending

China is directing state‑owned banks to cut U.S. Treasury holdings to roughly $750 billion by 2025, halving its 2010 peak. The reduction removes a major buyer from the market, shifting the financing burden toward Japan, the world’s largest foreign‑reserve holder. Japan’s...

By Asia Times – Defense

News•Feb 10, 2026

Oxbridge Re Unveils New Tokenized Reinsurance Sidecar Securities with 20% & 42% Return Targets

Oxbridge Re Holdings has launched two new tokenized reinsurance sidecar tranches, T20-2027 and T42-2027, targeting 20% and 42% annual returns. The securities are issued on the Solana blockchain, replacing the earlier Avalanche platform. Prior token offerings delivered strong performance, including...

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Arbol and Pollen Systems Partner on Parametric Product for Agricultural & Climate Challenges

Arbol and Pollen Systems, backed by Esri and Omniris, have launched a parametric insurance product that fuses AI‑driven risk models with real‑time satellite, drone and field data. The solution leverages Esri’s GIS platform to deliver location‑aware insights throughout the policy...

By Artemis (ILS/cat bonds)

Blog•Feb 10, 2026

Bonds Taking a Pre-NFP Lead-Off

Bond yields pulled back toward the 4.1‑4.2% band after weak retail‑sales data, reversing a brief flirtation with the 4.30% ceiling on the 10‑year Treasury. The market is now pricing in a softer labor outlook ahead of the February non‑farm payrolls...

By Mortgage News Daily – MBS Live Commentary

Social•Feb 10, 2026

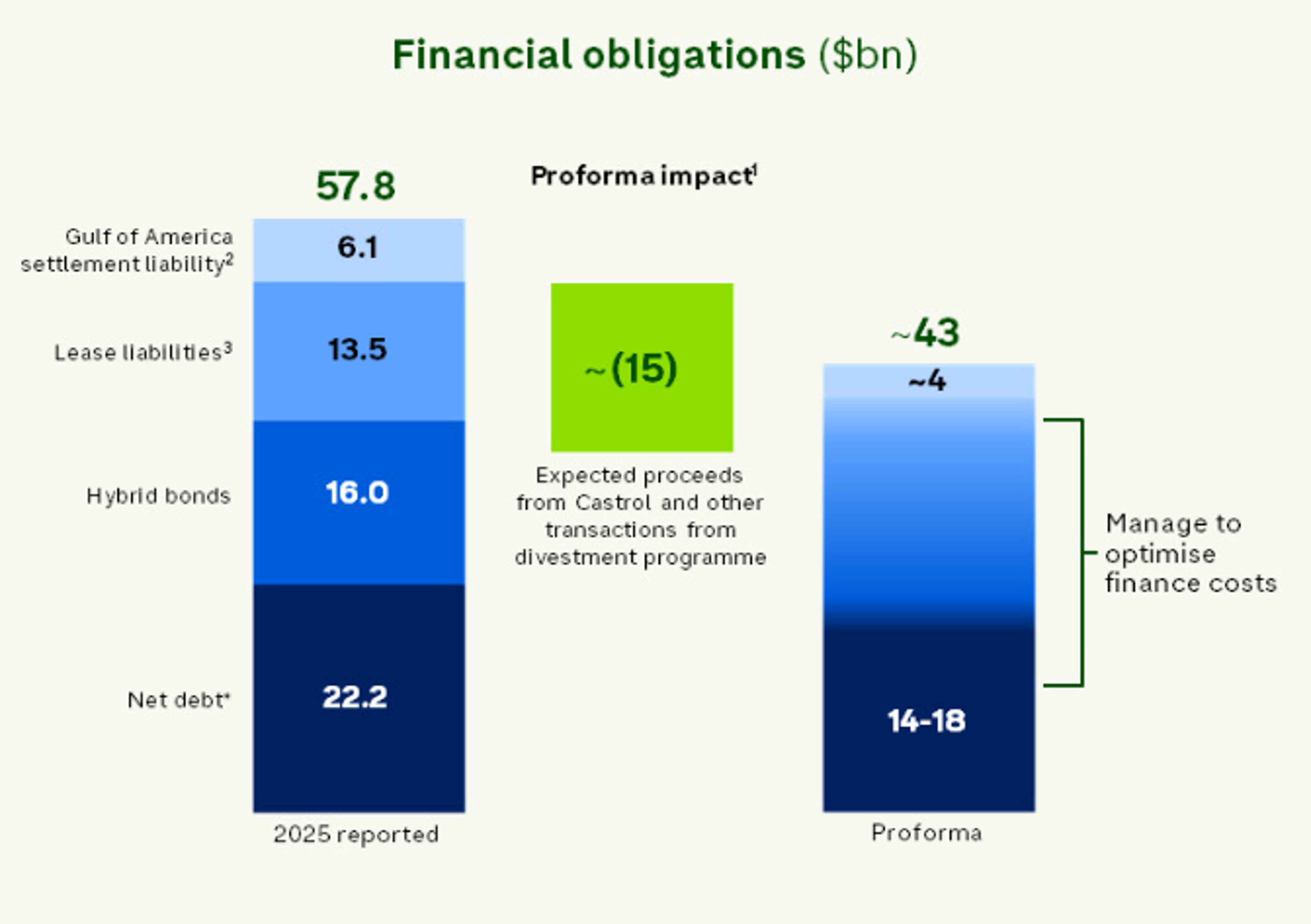

BP Finally Admits Debt Exceeds $50 Billion, Not $22 Billion

Regular readers know we at @Opinion had flagged BP had far more debt than the company's prefered metric (~$22 bn). Look at net debt + hybrids + leases + off-balance sheet items and it's >$50 bn. Now, BP acknowledges the issue...

By Javier Blas

News•Feb 10, 2026

Plymouth Rock Sponsoring Debut Catastrophe Bond, $100m Tremont Re 2026-1

Plymouth Rock, a northeastern U.S. insurer, has launched its first catastrophe bond, seeking $100 million of named‑storm reinsurance through the Tremont Re Ltd. Series 2026‑1 issuance. The Bermuda‑based issuer will sell a single Class A tranche with a three‑year term, an attachment point...

By Artemis (ILS/cat bonds)

News•Feb 10, 2026

Global Warming Expected to Drive Structural Growth in ILS Spreads: Solidum Partners

Solidum Partners says global warming will structurally expand ILS spreads. As natural disaster frequency and severity increase, traditional reinsurers face capital constraints under Solvency II, limiting their capacity. ILS instruments, being event‑specific and fully collateralized, can absorb tail risk, leading investors...

By Artemis (ILS/cat bonds)

Social•Feb 10, 2026

Earn 12‑18% Risk‑Free with Nigerian Treasury Bonds

TREASURY BILLS & GOVERNMENT BONDS Low-risk, government-backed securities. In Nigeria, buy FGN Savings Bonds or Treasury Bills through the CBN portal or apps like Chaka, Bamboo, or Cowrywise (minimum ₦10,000). Returns typically 12-18% annually. Other African countries offer similar products through their...

By The Prophetic Investor

Social•Feb 10, 2026

Software Selloff Hits BDCs, Creditors May Be at Risk

“Business Development Companies” have been hammered in the recent software selloff. Alphaville dug into the data of some of the biggest ones to find out if software creditors are in trouble. https://t.co/ybVLHwLoCi https://t.co/AMQPhflF5J

By Robin Wigglesworth

Social•Feb 10, 2026

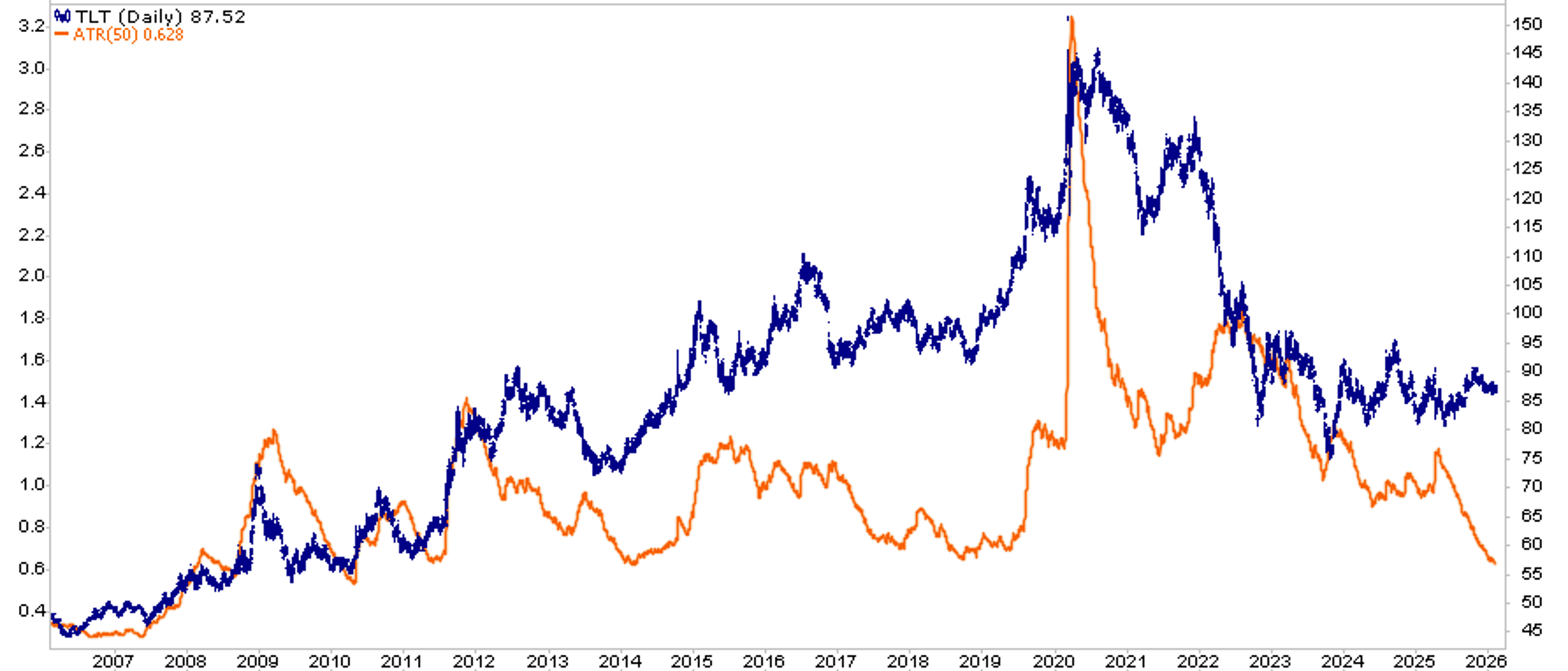

TLT's 15-Year Low ATR Signals Potential Breakout

$TLT : The Average True Range (orange) is now the lowest in over 15 years. Something has to give. Might the plummeting @truflation readings be a clue to which direction a breakout might occur? https://t.co/0pEENxYpXs

By Michael Lebowitz

Social•Feb 10, 2026

IG Spreads Widen Despite Equity Rally, Hinting Supply Worries

IG credit spreads wider +4bps from late-Jan yet HY wider by only +2bps. Last two days have seen +2.5% equity upside that statistically should mean IG spreads -2bps. May be nothing, may be worries about supply. A "balanced" IG...

By Guy LeBas

Social•Feb 10, 2026

Weak Data Fuels Bonds, 15% Growth Now Unrealistic

Soft retail sales, ECI flat for quarter and ADP jobs figures on the low end of expectations. Good data for the bond market, but that 15% GDP growth rate looks out of reach.

By Kathy Jones

Social•Feb 10, 2026

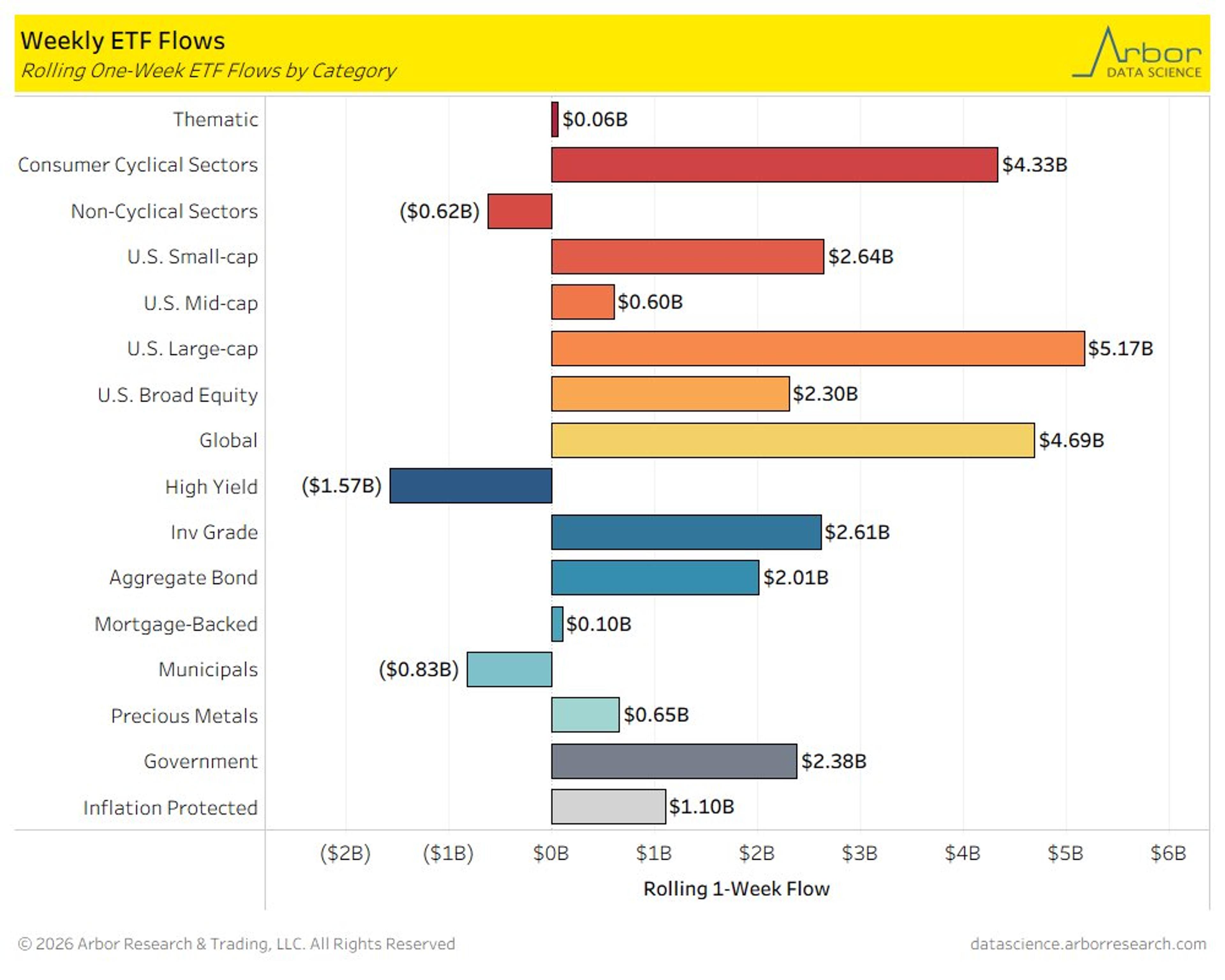

U.S. Large Caps Lead Inflows; High‑Yield Bonds Lose Ground

U.S. large caps dominated inflows last week, followed by global equities and consumer cyclicals ... high yield bonds saw most outflows, but broader fixed income universe was still positive @DataArbor https://t.co/l0soXmQF4S

By Liz Ann Sonders

Social•Feb 10, 2026

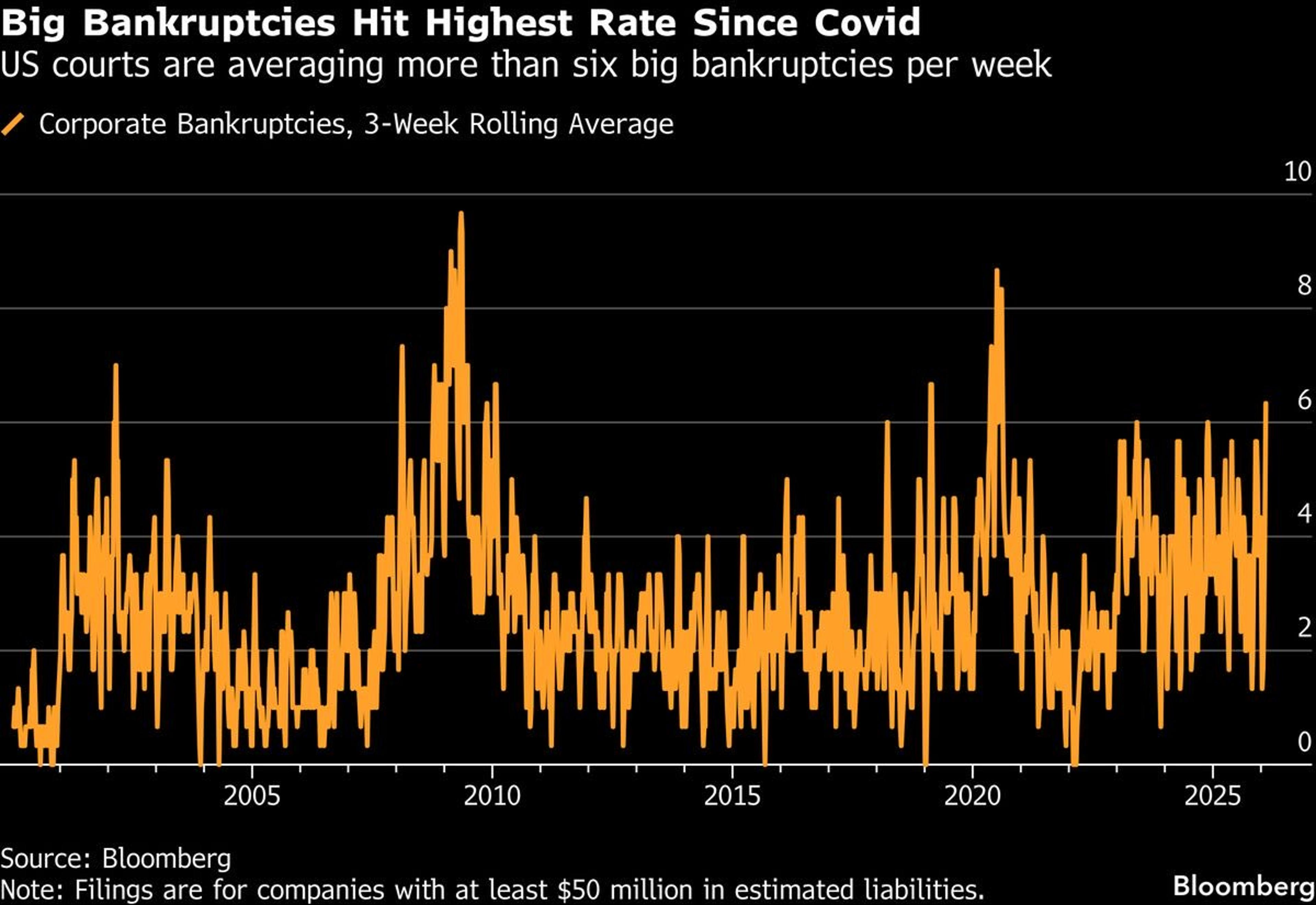

Record Wave of Large Bankruptcies Hits Weekly

How is this a healthy development? At least SIX big companies (liabilities >=$50M) have filed for bankruptcy EVERY WEEK during 3-wk period that began Jan 10, a level matched a handful of times since the turn of the century…last week alone...

By Daniëlle DiMartino Booth

Social•Feb 10, 2026

Alphabet's Sterling Bond Hits Record £4.5bn Demand

#Alphabet sterling bond raises a record £4.5 bn, with £24 bn in bids. They may start borrowing on behalf of Bessent if it continues like this $GOOG

By Ashraf Laidi

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler

Social•Feb 10, 2026

Equities Edge up as Dollar Slips, Data Awaits

Tuesday: Equity futures slightly higher, dollar weaker and treasury yields nearly unchanged. Retail sales, Employment Cost Index and Import prices out today.

By Kathy Jones

Social•Feb 10, 2026

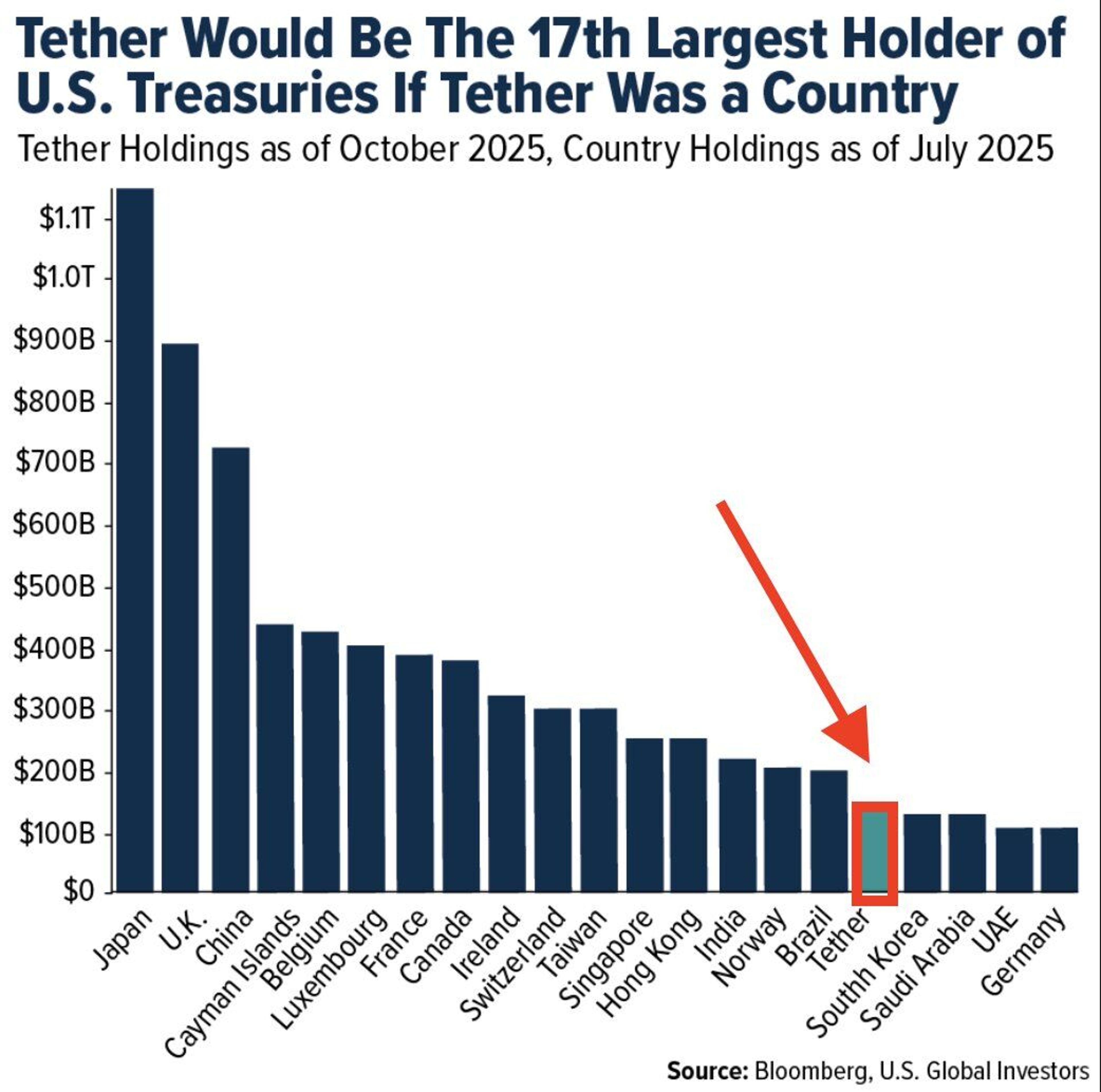

Tether Would Rank 17th in US Treasury Holdings

Who is the world's largest holder of US Treasuries? 🥇 Japan 🥈 United Kingdom 🥉 China But here's the wildest part - if Tether were a country, it would be the 17th largest holder of US Treasuries https://t.co/JoaE6JzFI9

By Kathy Lien