🎯Today's Bonds Pulse

Updated 1h agoWhat's happening: ESMA extends MiFIR transparency deferrals for sovereign bonds

The European Securities and Markets Authority, together with most EU national competent authorities, published a list of supplementary deferrals that broaden the MiFIR transparency regime for sovereign bonds. The new rule allows omission of volume reporting for medium‑size trades on liquid Group 1 bonds until the end of the trading day. The deferrals take effect immediately, easing reporting burdens for market participants.

Also developing:

- •Western Asset Diversified Income Fund trades at discount, offers 12.4% yield

- •Virtus Newfleet Multi‑Sector Bond ETF beats Bloomberg Aggregate with 1.64% NAV return

- •Bank of Japan ends ultra‑easy stance, hikes rates, may trigger repatriation of savings

- •TIP Solar raises $179.7M in asset‑backed securities backed by solar leases

Blog•Feb 9, 2026

AM Resilience After Overnight Weakness

Overnight Treasury markets experienced a sharp, high‑volume move despite a relatively narrow price range. The volatility was triggered by news that Chinese regulators asked banks to limit their exposure to U.S. Treasuries. Domestic traders quickly digested the information, and by the 8:20 am ET open the market had steadied, showing resilience. The episode underscores how quickly the bond market can react to foreign policy cues while maintaining internal stability.

By Mortgage News Daily – MBS Live Commentary

Social•Feb 10, 2026

Earn 12‑18% Risk‑Free with Nigerian Treasury Bonds

TREASURY BILLS & GOVERNMENT BONDS Low-risk, government-backed securities. In Nigeria, buy FGN Savings Bonds or Treasury Bills through the CBN portal or apps like Chaka, Bamboo, or Cowrywise (minimum ₦10,000). Returns typically 12-18% annually. Other African countries offer similar products through their...

By The Prophetic Investor

Social•Feb 10, 2026

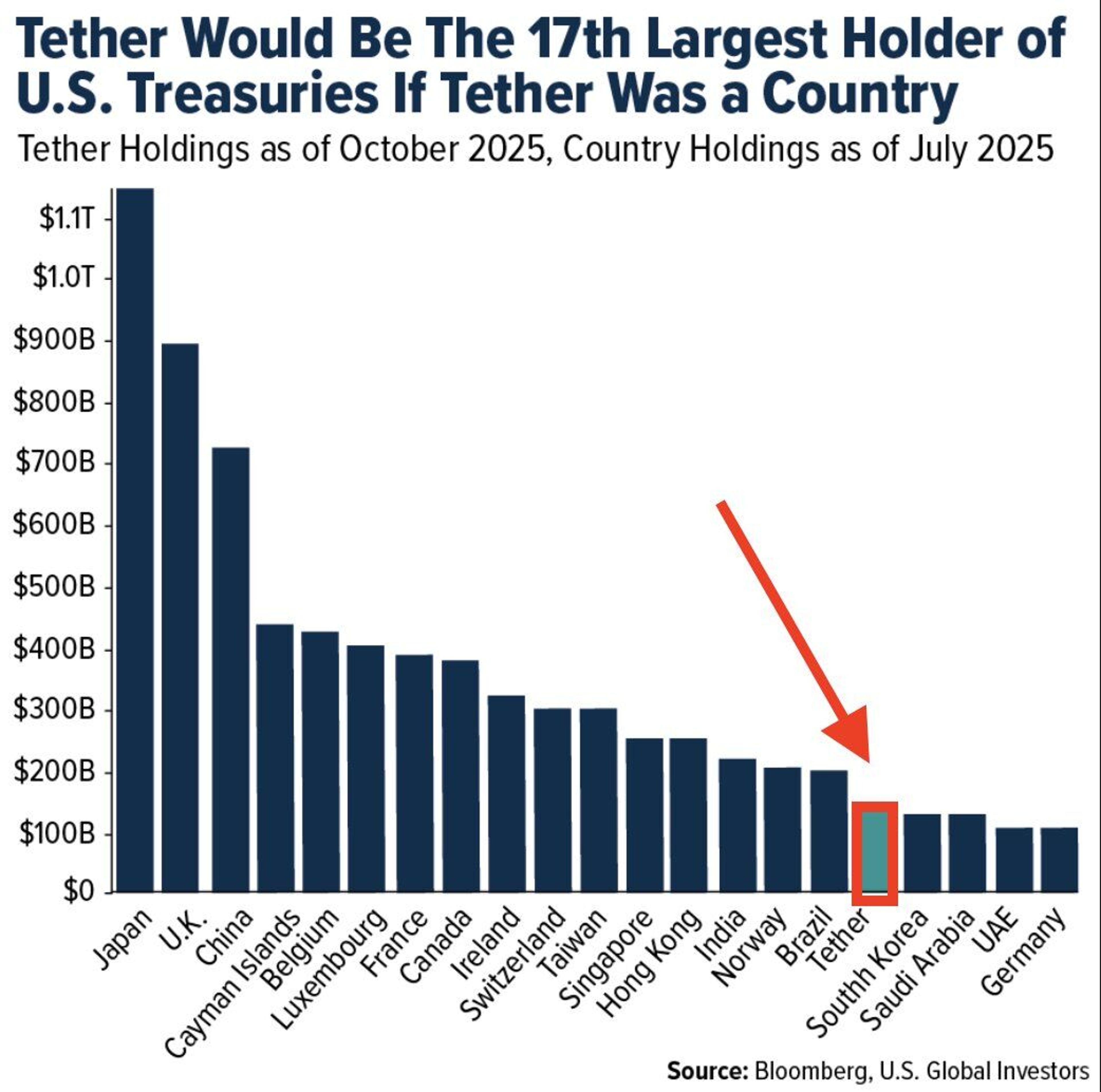

Tether Would Rank 17th in US Treasury Holdings

Who is the world's largest holder of US Treasuries? 🥇 Japan 🥈 United Kingdom 🥉 China But here's the wildest part - if Tether were a country, it would be the 17th largest holder of US Treasuries https://t.co/JoaE6JzFI9

By Kathy Lien

Blog•Feb 9, 2026

Private Credit Defaults

The episode dissects private‑credit defaults, arguing that most defaults are driven by borrower‑specific (idiosyncratic) factors rather than systemic risk, which the media often exaggerates for clicks. Data from the Cliffwater Direct Lending Index shows realized losses remain well below historic...

By Larry Swedroe on Substack

Social•Feb 10, 2026

Macron Urges EU to Adopt Eurobonds Now

Emmanuel Macron: « Now is the time for the EU to launch a joint borrowing capacity, through eurobonds. » https://t.co/NqqbjjecXk

By Frederik Ducrozet

Social•Feb 9, 2026

Alphabet Launches 100‑year GBP Bond, Eyes Currency Debasement

#Alphabet to issue 100-year GBPSterling bond after having issued 50-year $17.5 bn USD bond in November. Also plns to issue CHF bond. They're betting further currency debasement #forex

By Ashraf Laidi

News•Feb 9, 2026

IRRBB Management in Emerging Market and Developing Economies: The Role of Derivatives in Supporting Financial Stability and Economic Development

Interest rate risk in the banking book (IRRBB) is emerging as a top priority for banks and regulators across emerging market and developing economies (EMDEs). Monetary tightening and persistent macro‑volatility are making balance‑sheet exposures more fragile, exposing the limits of...

By ISDA — News & analysis feed

News•Feb 9, 2026

DClimate Launches Tyche to Bring On-Chain Transparency to Catastrophe Reinsurance

Decentralised climate platform dClimate has launched Tyche, a blockchain‑based marketplace that tokenises catastrophe reinsurance using ERC‑20 assets. The platform recorded $20 million of notional risk during last year’s hurricane season and relies on dClimate’s AI‑driven Aegis engine for real‑time pricing and...

By Artemis (ILS/cat bonds)

News•Feb 9, 2026

Downing Street Resignations Trigger Bond Market Jitters

UK bond markets reacted sharply on Monday after a series of high‑profile Downing Street resignations, with the 10‑year gilt yield climbing to 4.62% – a ten‑basis‑point surge that set a three‑month high. The departures, including communications chief Tim Allan and...

By City A.M. — Markets

Blog•Feb 9, 2026

Repriced Risk in a Rebuilt Regional Bank Subordinated Floater

The episode examines a regional bank that has rebuilt its balance sheet, achieving profitability, capital ratios above 12%, and improved liquidity after addressing over $12 billion of higher‑risk loans. It highlights that despite these fundamentals, the bank’s subordinated floating‑rate notes are...

By Fixed Income Beacon

Blog•Feb 9, 2026

Gradual End of Bank Dominance in India

India’s household financial portfolio is shifting away from traditional safe assets toward equities and managed funds. Between March 2021 and March 2025, bank deposits fell from roughly 47.5% to 43.5% of total financial assets, while mutual‑fund and pension holdings rose...

By Prof. Jayanth R. Varma’s Financial Markets Blog

Blog•Feb 6, 2026

Potential Signs of GSE Buying as MBS Outperform

MBS outperformed Treasuries on Feb 6, rising two ticks while 5‑ and 10‑year yields fell about six ticks. The move suggests possible GSE buying despite no official data. Consumer sentiment posted 57.3, beating forecasts, and inflation expectations eased to 3.5% for...

By Mortgage News Daily – MBS Live Commentary

Blog•Feb 6, 2026

Waiting on Next Week's Data

Friday's economic calendar was thin, with only the Consumer Sentiment report standing out. Treasury yields edged slightly higher but stayed near the 4.20% threshold, keeping bond markets largely unchanged. The previous day's disappointing labor figures have heightened market attention on...

By Mortgage News Daily – MBS Live Commentary

News•Feb 5, 2026

Bonds as Bargaining Chips: The $8 Trillion Selloff that Could Shake U.S. Markets

European investors hold roughly $8 trillion of U.S. Treasury debt, a quarter of the Treasury market, and recent geopolitical friction with the Trump administration has sparked talk of using those holdings as leverage. A Danish pension fund’s $100 million Treasury sell‑off highlighted...

By Quartz — Economy/Markets (site-wide feed)

Blog•Feb 5, 2026

Stronger Start Thanks to Employment Data

U.S. Treasury bonds edged higher in early trading on Thursday, with gains accelerating after 7 a.m. ET. The market reacted to two labor‑market releases: the Challenger job‑cut data at 7:30 a.m. and the more impactful weekly jobless claims at 8:30 a.m., the latter...

By Mortgage News Daily – MBS Live Commentary

News•Feb 4, 2026

Watchdog Warns on ‘Fire Sale Dynamics’ Risk in Repo Market

The Financial Stability Board warned that leveraged trades in the short‑term repo market could spark fire‑sale dynamics, pressuring sovereign bond prices. It highlighted a $16 trillion global repo market, with hedge‑fund borrowing near $3 trillion—about 25% of their assets—often conducted with zero...

By City A.M. — Markets

Blog•Feb 4, 2026

The BlackRock TCPC Story

The episode dissects BlackRock TCPC’s recent 19% NAV drop, revealing that the loss was driven by six concentrated positions heavily weighted in second‑lien loans and equity rather than first‑lien senior debt. The host contrasts this risky capital‑structure positioning and volatile...

By Larry Swedroe on Substack

Blog•Feb 4, 2026

Waiting on ISM Services as Early Data Fails to Inspire

ADP's employment numbers released at 8:15 a.m. ET came in softer than analysts expected, yet Treasury yields barely moved. Fifteen minutes later, the Treasury Department posted its quarterly financing estimates, which were in line with prior forecasts but warned that borrowing...

By Mortgage News Daily – MBS Live Commentary

Blog•Feb 3, 2026

The Hidden Cost Of Investment Income

The episode explores a new Longview Research Partners analysis that challenges the traditional view of bond interest and REIT dividends as portfolio positives, showing that forced investment income can erode over 1% of after‑tax wealth for high‑net‑worth investors. The hosts...

By Larry Swedroe on Substack

News•Feb 3, 2026

Bank of England Should Hold Interest Rates, City AM Shadow MPC Says

City AM’s Shadow Monetary Policy Committee, comprising nine independent economists, voted 7‑2 to keep the Bank of England’s base rate at 3.75%, citing persistent inflation and mixed business‑survey signals. Inflation for the year to December remains at 3.4%, above the...

By City A.M. — Markets

Blog•Feb 2, 2026

Scarce Reserves

Federal Reserve Governor Christopher Warsh is pushing to restart quantitative tightening, signaling a shift toward shrinking the central bank’s balance sheet. This move comes even as the Fed recently expanded its holdings to ease strains in the funding market. Warsh’s...

By Fed Guy

Podcast•Feb 2, 2026•15 min

Money and Me: When Gold Breaks, AI Bites Back, and Japan Shakes the World

In this episode, host Michelle Martin and guest Simon Ree, founder of Tao of Trading, dissect a volatile market landscape where gold and silver have sharply retreated after a steep rally, and Microsoft’s stock fell despite strong earnings, raising concerns...

By Your Money with Michelle Martin (MONEY FM 89.3)

Blog•Jan 28, 2026

Understanding Peer Momentum

The episode explores "peer momentum," the idea that a stock’s future returns can be better predicted by the recent performance of its connected firms—not just its own past returns. Research shows that using industry‑level peer momentum yields annualized return spreads...

By Larry Swedroe on Substack

News•Jan 27, 2026

The Changing Shape of Variation Margin Collateral

Variation margin (VM) collateral, long dominated by cash, is facing pressure from higher funding costs, stricter regulations, and market stress, prompting firms to explore non‑cash alternatives. A Risk.net survey of 114 collateral specialists shows 57% of sell‑side and 33% of...

By Risk.net — Fixed Income topic

News•Jan 27, 2026

Profit Warnings Citing Global Upheaval Hit ‘Record High’

EY’s latest analysis shows 240 UK‑listed firms issued profit warnings last year, the lowest total since 2021 but the highest proportion citing policy and geopolitical uncertainty. About 42 percent of those warnings named regulatory flip‑flops, tariffs and wage hikes as profit‑dragging...

By City A.M. — Markets

Blog•Jan 26, 2026

Modern Fed Chair

Asset‑management veteran Christopher Reider has surged to the front of the Federal Reserve chair race, positioning himself as the most suitable candidate for a fiscal‑dominant environment. Reider, a political outsider with no evident Trump connections, argues for lowering the policy...

By Fed Guy

Blog•Jan 26, 2026

Deleveraging Operator Offers Compelling Yield

The episode examines a high‑yield note offering over 8.5% that is backed by a company aggressively reducing its debt, positioning it for a potential rating upgrade within the next two years. It highlights how the current spread reflects genuine compensation...

By Fixed Income Beacon

News•Jan 26, 2026

Repo Clearing: Expanding Access, Boosting Resilience

Repo clearing is gaining traction as market liquidity tightens and regulators push for more transparency. LSEG’s RepoClear head Michel Semaan discussed how mandatory clearing and new haircut rules could enhance resilience while potentially shifting liquidity. Buy‑side firms, including hedge funds...

By Risk.net — Fixed Income topic

News•Jan 22, 2026

How Much Money Does the UK Government Borrow, and Does It Matter?

The UK’s public sector net borrowing fell 38% in December 2025, a £7.1 billion reduction from the previous month. Over the full financial year to March 2025 the government borrowed £152.6 billion, with an additional £140.4 billion borrowed between April and November 2025....

By BBC News — Business: Economy

Blog•Jan 22, 2026

High-Quality Real Estate Credit with More than Investment-Grade Spread

The episode examines a senior housing REIT whose current spread over the BBB index undervalues its credit quality, citing a strong net debt-to-adjusted EBITDA ratio, ample liquidity, and improving rent coverage. It argues that the market misreads the issuer as...

By Fixed Income Beacon

Blog•Jan 21, 2026

Stale Data Watch: Construction Spending for October — More “Green Shoots”?

Construction spending for October rose modestly, with total nominal spending up 0.5% and residential construction up 1.3%. After adjusting for a 0.2% decline in material prices, real overall spending increased 0.7% and residential spending 1.5%, pushing both series close to...

By The Bonddad Blog

Blog•Jan 20, 2026

How Your Brain’s “Break-Even” Bias Creates Mispricings

In this episode, Larry Swedroe discusses a new study by Jihoon Goh, Suk‑Joon Byun, and Donghoon Kim that uncovers how the “salience effect”—investors’ attraction to stocks with dramatic past moves—interacts with the “break‑even bias,” a tendency to take riskier bets...

By Larry Swedroe on Substack

Podcast•Jan 20, 2026•7 min

American Friction

The episode examines the fallout from escalating tariff disputes between the United States and Europe, which have prompted investors to sell U.S. assets and trigger a sell‑off in global markets. It highlights Japan’s bond market stress as yields climb to...

By Reuters Morning Bid

Blog•Jan 19, 2026

Practical Monetarism

The President is expected to announce his Fed Chairman pick this week, with former governor Kevin Warsh emerging as the leading contender. Warsh, a noted hawk, aligns his policy outlook with Treasury Secretary Bessent. He is best known for a...

By Fed Guy

Blog•Jan 17, 2026

Weekly Indicators for January 12 - 16 at Seeking Alpha

Seeking Alpha’s weekly indicators for Jan 12‑16 highlight a normalizing yield curve and mortgage rates at three‑year lows, which are reviving the housing market. At the same time, gasoline prices have slipped to their lowest level in almost five years, creating...

By The Bonddad Blog

Blog•Jan 16, 2026

Industrial Production Sets New Post-Pandemic High in December - but Mainly Due to Utilities

Industrial production reached a new post‑pandemic high in December, climbing 0.4% after revisions added another 0.2% to prior months. The modest 0.2% rise in manufacturing was dwarfed by a 2.6% jump in utility output, which also posted a 2.3% year‑over‑year...

By The Bonddad Blog

Blog•Jan 16, 2026

Subscriber Update on Block Inc. 2032s

The episode breaks down Block, Inc.'s latest credit outlook, highlighting a dramatic shift from a shaky to a durable balance sheet and a clear path to achieving the Rule of 40 by 2026. Q3 2025 results show 18% YoY gross...

By Fixed Income Beacon

Podcast•Jan 14, 2026•9 min

Thursday: Intervention Talk Props up Yen

In this brief episode of "5 in 5 with ANZ," host Bernard Hickey highlights how recent central bank interventions have bolstered the Japanese yen amid broader market volatility. He notes that while banking stress persists in the US and Europe,...

By 5 in 5 with ANZ

Blog•Jan 14, 2026

The Dollar Consolidates While Japan Steps Up Its Intervention Threats and Decision Day for the SCOTUS

The U.S. dollar is in a consolidating phase, hovering around JPY158.6 after a brief push toward JPY159.5, as Japanese authorities intensify verbal warnings of possible market intervention. In North America, traders await U.S. PPI, retail sales data and comments from...

By Marc to Market

Blog•Jan 14, 2026

Refinancing Into Deterioration

The episode dissects Molson Coors' looming $2.4 billion refinancing challenge amid a sharp operational downturn, highlighted by an 11.9% drop in pretax income, a $3.6 billion goodwill impairment, and rising net leverage to 2.28x. Volume shrinkage—especially in the economy and flavored‑alcohol segments—combined...

By Fixed Income Beacon

Blog•Jan 12, 2026

Sleeping Giants

The administration is signaling a willingness to enlist government‑sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac in its effort to push mortgage rates lower. After the 2008 crisis, the GSEs’ mortgage holdings shrank dramatically, but policymakers see an...

By Fed Guy