🎯Today's Bonds Pulse

Updated 4m agoWhat's happening: ESMA extends MiFIR transparency deferrals for sovereign bonds

The European Securities and Markets Authority, together with most EU national competent authorities, published a list of supplementary deferrals that broaden the MiFIR transparency regime for sovereign bonds. The new rule allows omission of volume reporting for medium‑size trades on liquid Group 1 bonds until the end of the trading day. The deferrals take effect immediately, easing reporting burdens for market participants.

Also developing:

- •Western Asset Diversified Income Fund trades at discount, offers 12.4% yield

- •Virtus Newfleet Multi‑Sector Bond ETF beats Bloomberg Aggregate with 1.64% NAV return

- •Bank of Japan ends ultra‑easy stance, hikes rates, may trigger repatriation of savings

- •TIP Solar raises $179.7M in asset‑backed securities backed by solar leases

News•Feb 18, 2026

Japan Accounting Group Seeks to Ease Insurer Bond Loss Rule

The Japanese Institute of Certified Public Accountants (JICPA) has proposed treating life insurers' government‑bond holdings as held‑to‑maturity, removing the need for impairment accounting when certain criteria are met. Under current rules insurers must record a loss if market value falls 50% below book value, creating ¥13.2 trillion of unrealized losses across major firms. The proposal aims to ease earnings pressure, stabilize dividends and support insurers’ long‑term asset strategies. Shares of insurers rose sharply as investors priced in the potential regulatory relief.

By Accounting Today

Social•Feb 18, 2026

Global Growth Slows, Rates Sticky; Shorten Treasury Duration

Macro: global growth slows; rates remain sticky. Key factors: US CPI, China demand, energy. Risks: policy missteps, inflation shocks. Trade: shorten duration in US Treasuries. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 18, 2026

Fed Minutes Reveal Larger Faction Demanding Higher Cut Threshold

Minutes from the Fed's Jan. 27-28 meeting laid bare a lingering divide over where to set the bar for further rate cuts. In Fed speak, "some" is larger than "several" which means the group of "some" officials that includes those with...

By Nick Timiraos

News•Feb 18, 2026

The Big Four Recession Indicators: Industrial Production

Industrial production rose 0.7% in January, outpacing the 0.4% forecast, and posted a 2.3% year‑over‑year gain. Utilities output surged 2.1% month‑over‑month, while mining slipped 0.2% and manufacturing climbed 0.6%. The index’s current level is at or below the start‑of‑recession threshold...

By Advisor Perspectives — dshort (charts/econ & markets incl. rates)

Social•Feb 18, 2026

Hawks Push Back, Hint at Two‑Sided Policy Language

FOMC minutes suggest that the hawks pushed back. "Several would support two-sided language" about policy direction and "several" noted that if inflation remains high, rate hikes might be necessary.

By Kathy Jones

Social•Feb 18, 2026

FOMC Minutes Reveal Split Views: Cut, Hold, or Hike

Key paragraph of the FOMC minutes from January. (I am honestly a bit confused by the 'minutes math.') The main takeaway is that there is considerable disagreement. Cut, hold, and (even possibly) hike all got a nod. https://t.co/eV9ldjldl1 https://t.co/K53g1yqKJ8

By Claudia Sahm

News•Feb 18, 2026

ASR Nederland N.V. (ARNNY) Q4 2025 Earnings Call Transcript

ASR Nederland N.V. held its Q4 2025 earnings call on February 18, 2026, presenting full‑year results and outlining progress on its multi‑year strategy. CEO J.P.M. Baeten highlighted stronger underwriting performance and a rise in net profit, while CFO Ewout Hollegien detailed improvements in...

By Seeking Alpha — Site feed

Social•Feb 18, 2026

Lennar’s 13F Reveals 18.5M Opendoor

A note re: $OPEN and $Lennar --- if you back it out, Lennar held 18.5M shares of Opendoor at end of its Q3. The 13F likely indicates either they had some anti-dilution protections or participated in debt-for-equity swap, and that’s why...

By Luke Kawa

Social•Feb 18, 2026

FOMC Minutes Show Market‑Aligned Outlook, Fragile Jobs, Slowing Inflation

Few FOMC minutes takeaways: 1) Cmte basically in line with markets on major economic variables 2) Labor markets no longer outright weakening but remain fragile 3) Inflation decelerating as tariff passthru done, housing has downside (a misread on bad CPI method in Oct?) 1/...

By Guy LeBas

Blog•Feb 18, 2026

Heads Up: US Treasury to Release TIC Data Later Today

The US Treasury will publish its latest International Capital (TIC) data, showing foreign investors holding a record $9.36 trillion of Treasury securities. China’s holdings slipped to roughly $683 billion, the lowest level since 2008, while Japan remains the top holder with about...

By investingLive – Asia-Pacific News Wrap

Social•Feb 18, 2026

March 2Y Futures Expected Heavy Amid Nasty Roll

Great reminder futures rolls (H25 to M26) are upon us. Bottomline March 2y futs should be heavy. Roll is nasty at -4.5 which should add to the flattening pressure along with front-end auctions next week.

By Ed Bradford

News•Feb 18, 2026

FTSE 100 Live: Inflation Falls to Near Year-Low; BAE Leads Stock Rally

UK inflation eased to a near‑year low, with the CPI falling to 3% year‑on‑year in January 2026, down from 3.4% in December. The slowdown, driven by lower petrol, airfares and food prices, has revived expectations that the Bank of England...

By City A.M. — Markets

News•Feb 18, 2026

Overseas Investors Tap Brakes on JGB Selling Post-Election

The Liberal Democratic Party’s landslide victory in Japan’s snap election has steadied the government‑bond market, halting a sharp rise in long‑term yields. Foreign institutional investors, who had been offloading JGBs, have paused sales and begun modest buying. Domestic investors are...

By Nikkei Asia – Economy

News•Feb 18, 2026

Stop Overpaying For PDI

The PIMCO Dynamic Income Fund (PDI) is trading at roughly a 12% premium to its net asset value, delivering a near‑14% yield and monthly distributions. While its strong distribution history appeals to income investors, the fund’s leverage and sensitivity to...

By Seeking Alpha – ETFs & Funds

News•Feb 17, 2026

US Treasuries Slip as Rally Loses Steam on Steady Labor Data

U.S. Treasury yields edged higher on Tuesday, halting a recent rally as steady private‑payroll data reinforced expectations of a still‑robust labor market. The benchmark 10‑year yield closed at 4.06%, while the two‑year rose to 3.43%, reflecting market pricing of two...

By Asset Securitization Report

News•Feb 17, 2026

PRESS RELEASE: BIGBEN ANNOUNCES IMPORTANT INFORMATION REGARDING THE PARTIAL REPAYMENT OF ITS BOND LOAN

Bigben Interactive announced that its banking pool unexpectedly refused to honor a drawdown notice for the partial refinancing of its senior bonds, leaving the company unable to execute the planned €43 million partial repayment on the February 19 maturity date. The...

By Euronext — News (RSS)

Social•Feb 17, 2026

TLT Seen as Lower High, Still Hating Treasuries

I think I might be the only person in the world who still hates US Treasuries here. $TLT is just another lower high imo until proven wrong.

By Quinn Thompson

News•Feb 17, 2026

Fitch Downgrades Missouri Hospital to ‘D’ Rating

Fitch downgraded John Fitzgibbon Memorial Hospital in Marshall, Missouri to a “D” rating from “C” and withdrew its issuer and bond ratings after the hospital defaulted on required debt payments. The default concerns principal and interest on 2010 bonds, and...

By Becker’s Hospital Review

Social•Feb 17, 2026

Fed Rarely Cuts Rates During >8% Nominal Growth

"The Federal Reserve has cut rates only a handful of times when nominal growth was greater than 8 per cent and most of those instances were in the 1970s." Richard Bernstein @RBAdvisors in the FT https://t.co/vzNnkKmGpY

By Greg Ip

Social•Feb 17, 2026

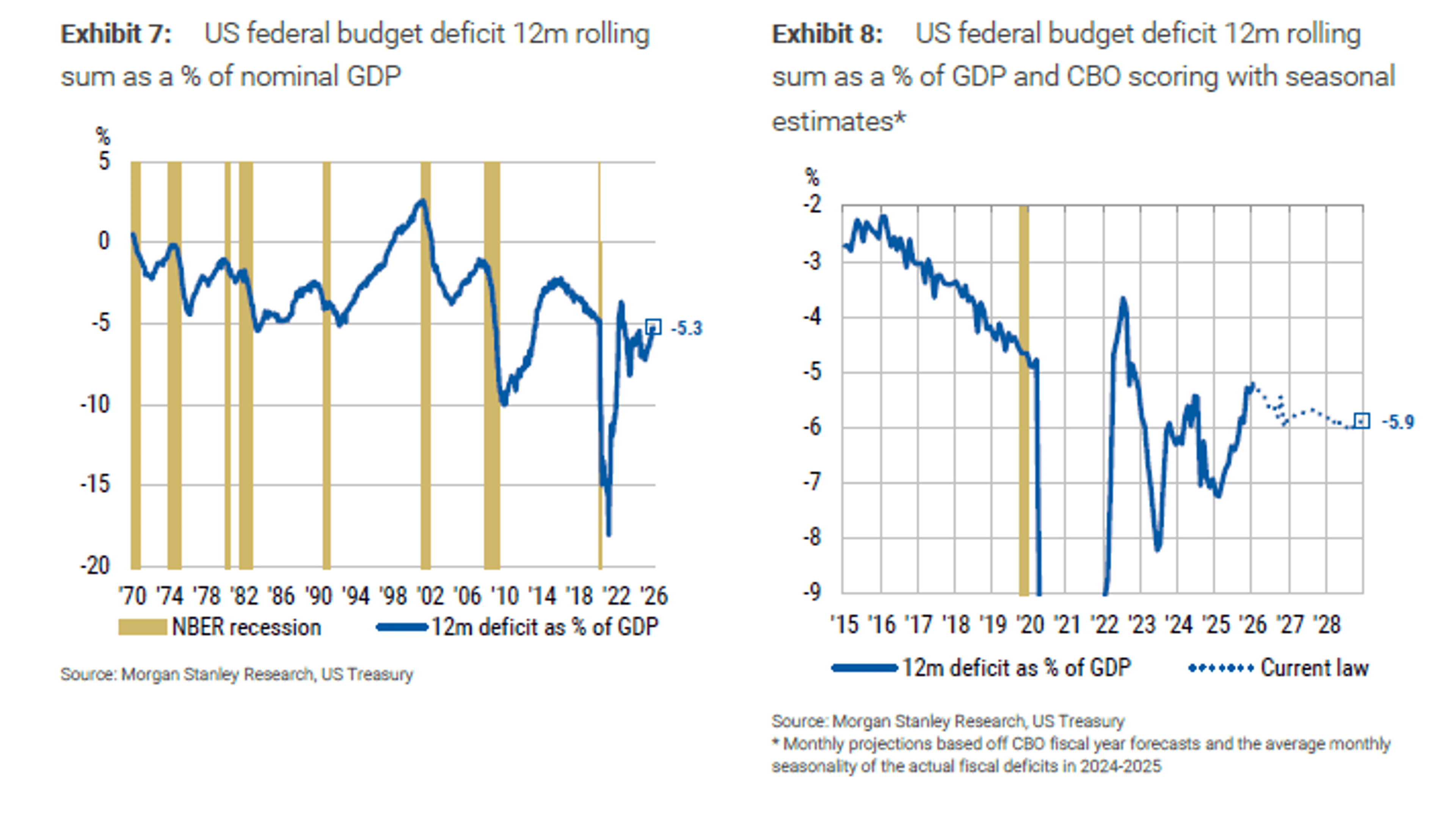

New Projections Quiet Bond Vigilantes, Ease Debt Fears

New US deficit and growth projections ""suggest a quiet period ahead for bond vigilantes and others who hand-wring over the unsustainable nature of the US debt and the inevitable market revolt – the Godot for which they have waited impatiently...

By Lisa Abramowicz

News•Feb 17, 2026

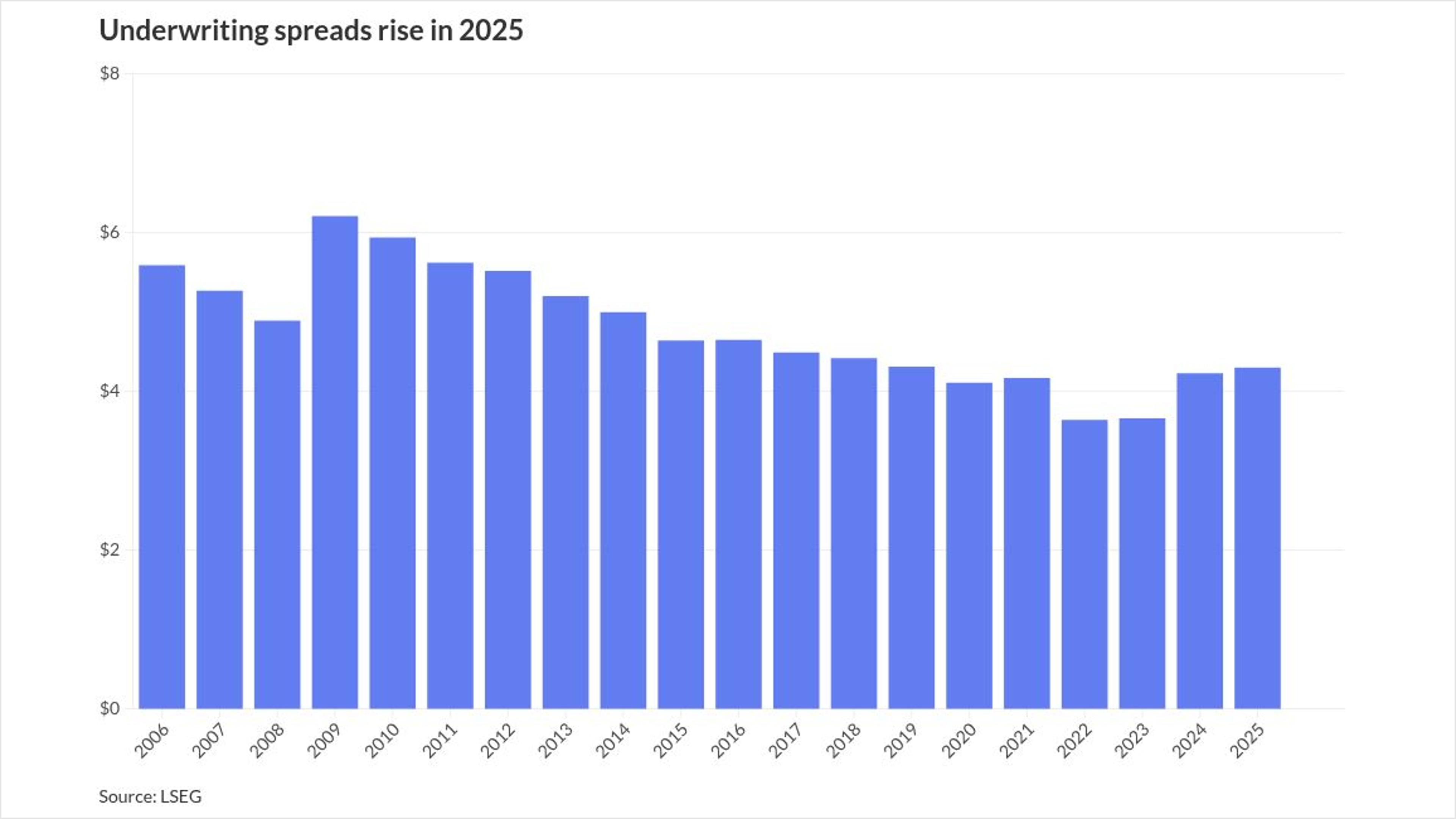

Underwriting Spreads Rise in 2025

Underwriting spreads for municipal bonds rose again in 2025, reaching an average of $4.30 per $1,000, up from $4.23 in 2024. Negotiated‑deal spreads increased to $4.64 while competitive‑deal spreads fell to $1.78. The uptick coincides with record issuance volumes—$586 billion in...

By The Bond Buyer (municipal finance)

Social•Feb 17, 2026

Rate Moves Aren’t Driven by Current Data, ADP Shows

Big mistake is assuming move in rates is about current economic data. Reaction to ADP a good example

By Ed Bradford

Social•Feb 17, 2026

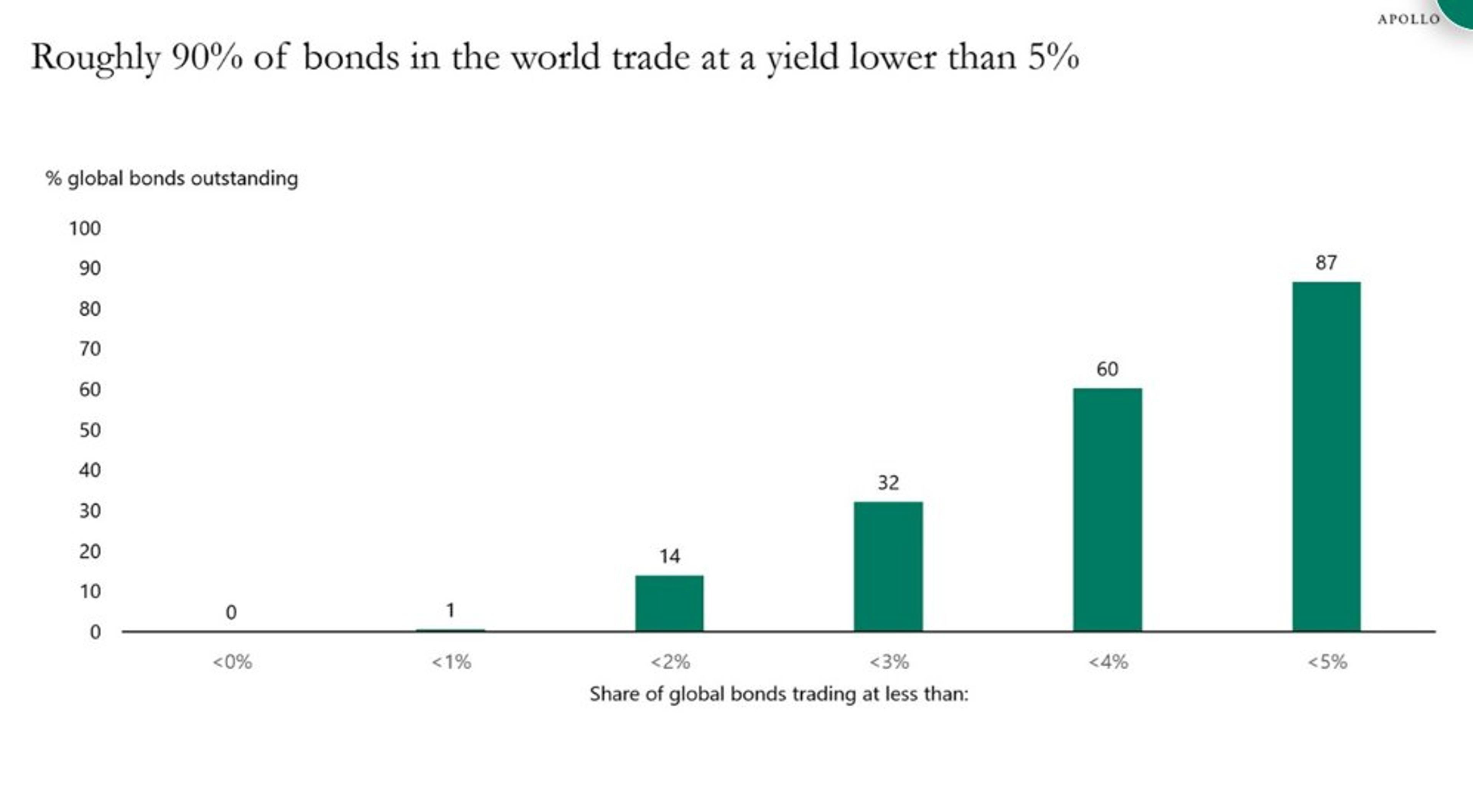

Global Bonds Yield Under 5%, Delivering ~2% Real Return

Almost 90% of global public bonds trade at a yield lower than 5%: Apollo's Torsten Slok. "With inflation at close to 3%, this means that investors in public fixed income only get a 2% real return each year." https://t.co/oCUWfCIGpn

By Lisa Abramowicz

Blog•Feb 17, 2026

Getting Paid to Wait for Deleveraging

The episode examines a REIT's high‑yield bond, which trades above 7% with a 340‑basis‑point spread despite solid market fundamentals and improving leasing. Management is actively selling $280‑300 million of assets, using proceeds to cut debt and potentially buy back bonds, positioning...

By Fixed Income Beacon

Social•Feb 17, 2026

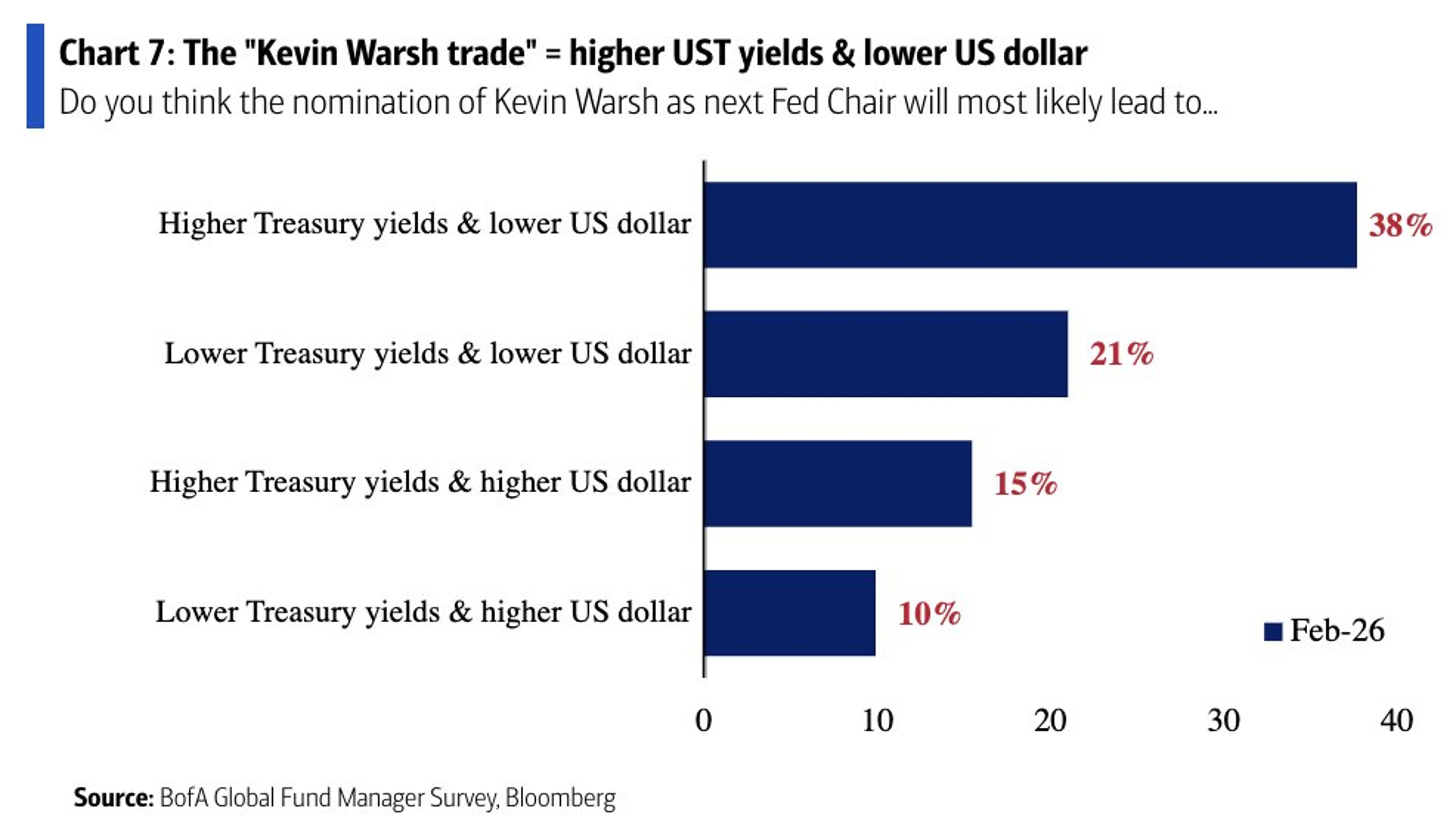

38% Expect Warsh Chair to Push Yields Higher, Dollar Lower

"38% of FMS investors believe that, all else equal, the nomination of Kevin Warsh as the next Fed Chair will likely lead to higher US Treasury yields and a lower US dollar." - BofA Global Fund Manager Survey https://t.co/5m0L3ZjRg1

By Sam Ro

Blog•Feb 17, 2026

Indian Banks: From Credit Provision to Liquidity Provision?

India’s corporate funding is increasingly sourced domestically as the yield gap with US Treasuries narrows to about 2.5%, eroding the cost advantage of foreign‑currency debt. Deepening private‑credit markets now finance even near‑investment‑grade borrowers, exemplified by a recent $3.4 billion rupee‑denominated deal....

By Prof. Jayanth R. Varma’s Financial Markets Blog

Social•Feb 16, 2026

Private Credit Bets on Software Amid AI Uncertainty

Five private credit firms just provided $1.4B for a software buyout of OneStream valued at $6.4B. Same week everyone’s asking whether AI will make these companies obsolete. The market is telling you software is at risk. The lenders are telling you...

By JunkBondInvestor

News•Feb 16, 2026

Fitch Ratings Assigns ‘a’ Rating to Lee County, Florida Airport Revenue Bonds Series 2026

Fitch Ratings assigned an ‘A’ rating to Lee County, Florida’s airport revenue bonds, Series 2026, and affirmed the rating on existing bonds with a stable outlook. The rating reflects a balanced carrier mix serving a leisure‑focused market and enplanements that...

By Airport Improvement Magazine

Social•Feb 16, 2026

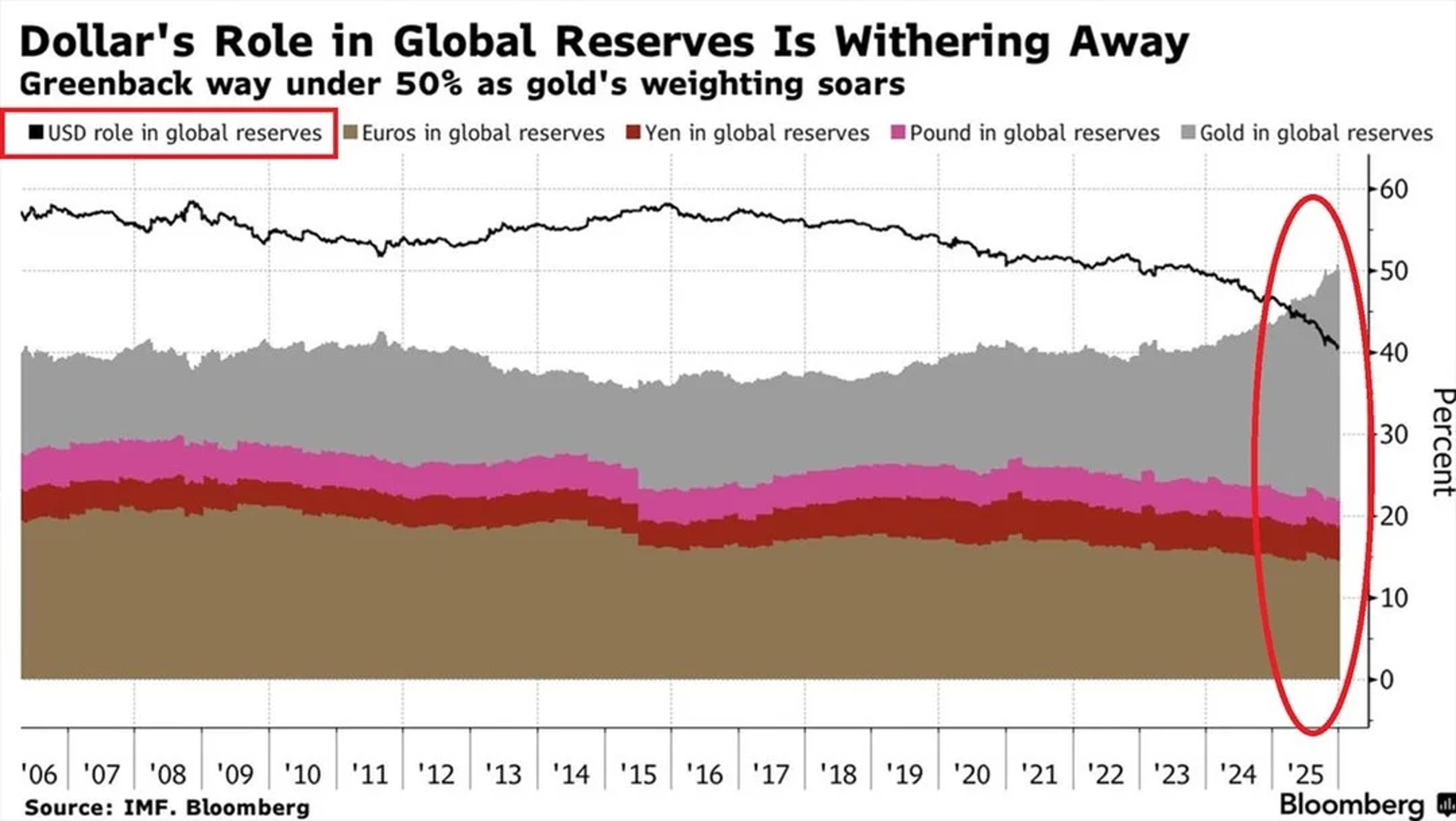

Gold Overtakes Major Currencies as Dollar Reserve Share Plummets

⚠️The US Dollar's role in global reserves is FALLING: USD share in global currency reserves dropped to ~40%, the lowest in at least 25 years. This is down from ~58% a decade ago. During the same period, gold’s share has risen from 16%...

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

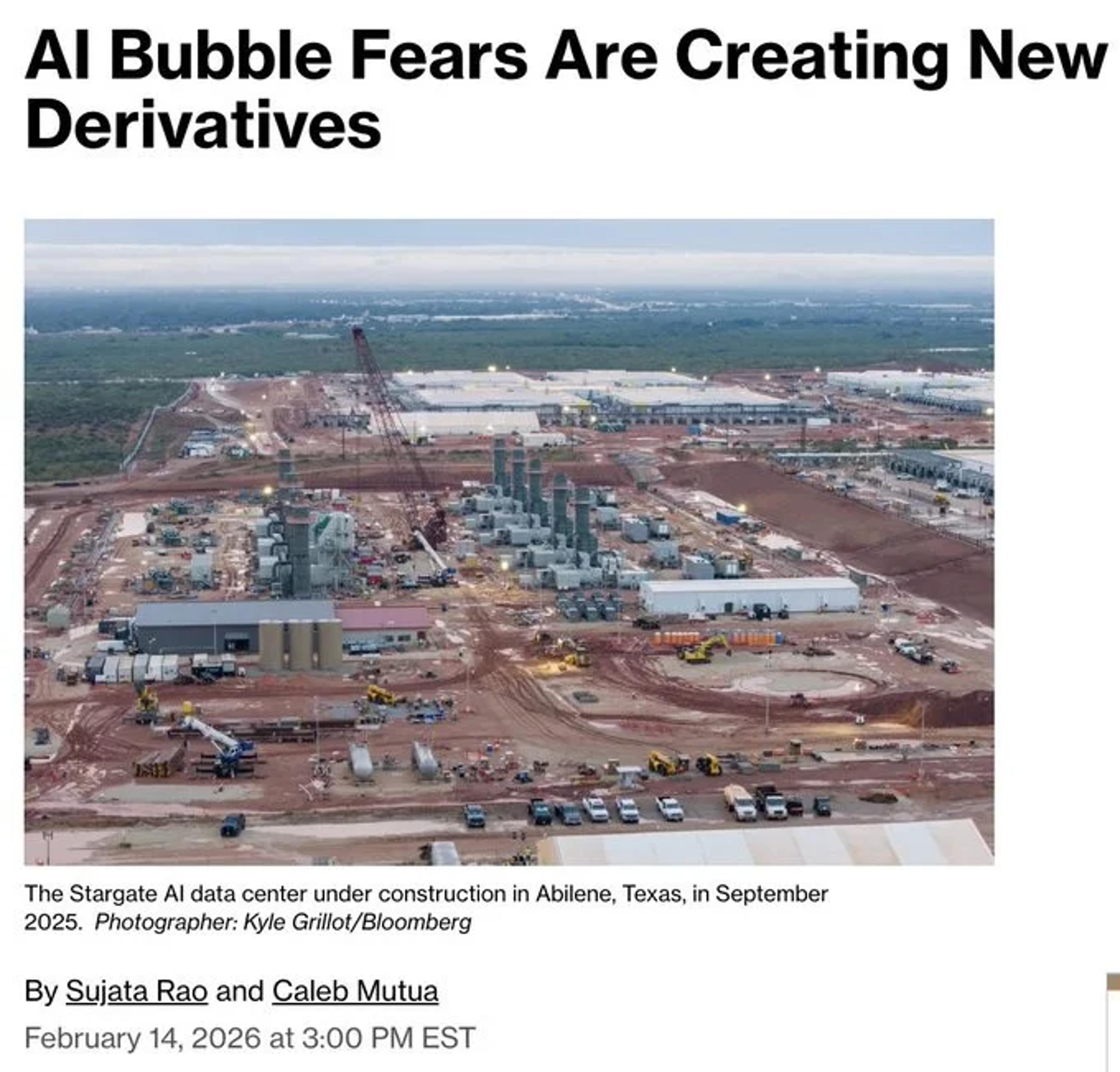

Alphabet and Meta CDS Explode From Zero to Top Traders

A year ago, CDS on Alphabet and Meta didn't exist. Now they're among the most actively traded single-name contracts in the US market Nobody creates a default insurance market for fun... $GOOG $META

By JunkBondInvestor

News•Feb 16, 2026

Cohu: Maintaining Bearish Stance Post Q4 Earnings Release

Cohu, Inc. posted a Q4 earnings miss despite a 34% surge in recurring bookings and over 12% revenue growth, keeping operating losses and margins under pressure. The company added $290 million of convertible debt, raising dilution concerns, while one‑time inventory charges...

By Seeking Alpha — Site feed

Social•Feb 16, 2026

AI Disruption Drives Widening Credit Spreads Ahead of Earnings

AI disruption is hitting IG credit spreads, not just stock prices. Concentrix: BBB-rated, 455,000 call center employees. Paid 130bps concession to refinance. Stock down 24% last week. Spreads doubled in February. Credit markets pricing obsolescence before it shows up in earnings.

By JunkBondInvestor

News•Feb 16, 2026

S&P Global: An Undervalued Dividend King For Long-Term Investors

S&P Global (SPGI) is a $133 billion market‑cap provider of credit ratings, benchmarks, analytics and workflow solutions. The company has raised its dividend for 53 consecutive years and trades at a 21.9× P/E, roughly 20% below its five‑year average, implying undervaluation....

By Seeking Alpha — Site feed

News•Feb 16, 2026

Tract’s Fleet Data Centers Seeks $3.8bn to Fuel Nevada Build-Out

Fleet Data Centers, the development arm of Tract, announced a $3.8 billion senior secured note issuance to fund a 230 MW data center campus in Reno, Nevada. The facility, built on a 252‑acre site, is 100 percent leased to an unnamed investment‑grade tenant...

By Data Center Dynamics

Social•Feb 15, 2026

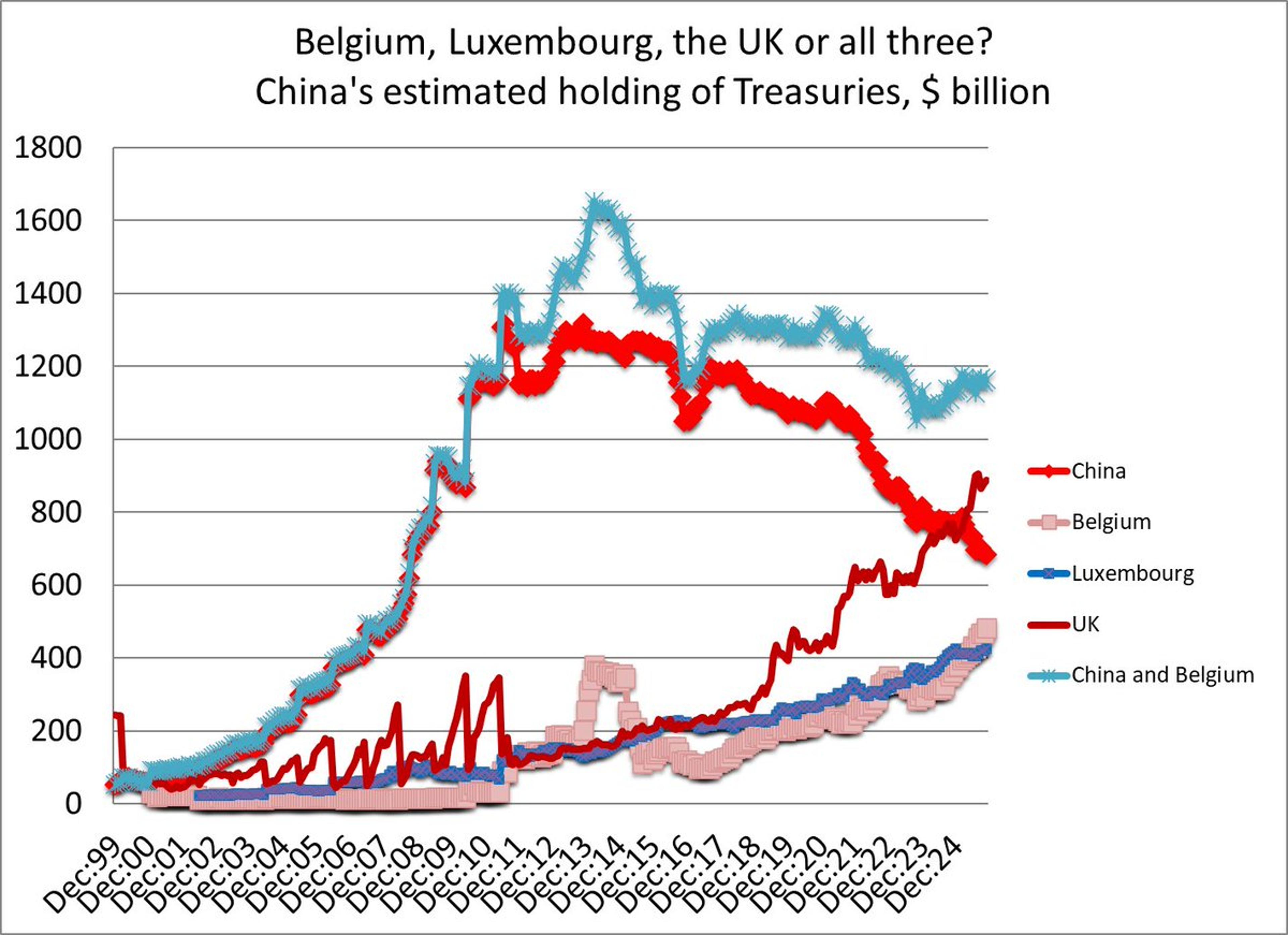

TIC Data Misses China’s Treasury Holdings Abroad

My periodic reminder that the US TIC data doesn't measure China's holdings of US Treasuries. It only measures China's holdings of Treasuries in US custodians. The real question is how many Treasuries Chinese entities hold in non US...

By Brad Setser

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

News•Feb 14, 2026

A U.S. ‘Debt Spiral’ Could Start Soon as the Interest Rate on Government Borrowing Is Poised to Exceed Economic Growth,...

The CBO projects publicly held U.S. debt will surpass 106% of GDP by 2030 and reach 120% by 2036. Average Treasury interest rates are expected to climb to 3.9% by the end of the forecast, outpacing nominal GDP growth that...

By Fortune – All Content

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

News•Feb 14, 2026

VGMS: This New Low-Cost Active Bond ETF Is Growing

Vanguard launched the Multi‑Sector Income Bond ETF (VGMS) in June 2025, offering a 5.19% SEC yield and a low 0.30% expense ratio. Over the past eight months the actively managed fund outperformed the benchmark AGG by 93 basis points, delivering...

By Seeking Alpha – ETFs & Funds

Social•Feb 14, 2026

Markets Price 2.5 Fed Cuts as Curve Flattens

After jobs and CPI, mkt has ~2.5 Fed rate cuts discounted this year. 2-10 yr curve flattened back-to-back weeks for first time since Oct. 10 yr yield 3-month low. Be prepared for next week. See...

By Marc Chandler

Social•Feb 14, 2026

Pemex's Bond Return Shows State Risk, Not Confidence

Pemex is back in the bond market after six years — and demand was strong. This doesn't signal confidence in Pemex. Buyers are really underwriting the Mexican state. https://t.co/YRGXmzi4aW #Pemex #Mexico #OilMarkets #EnergySecurity #SovereignRisk #DebtMarkets #EmergingMarkets

By Art Berman Blog

News•Feb 13, 2026

Figures on Automotive Securitization Tapes: Definitions Report - February 2026

The Fixed‑Asset Securitization Tracker (FAST) released its February 2026 Definitions report, detailing the data fields used in automotive securitization tapes. The document supplies precise definitions, code tables, and cross‑references to related transaction disclosures. By standardizing terminology, the report aims to simplify...

By DBRS Morningstar – Research/News

Social•Feb 14, 2026

Yield Drop Signals Benign CPI, Boosts Gold Prices

The 2-year Treasury yield (blue) fell sharply at 8:30 am today, a sign markets think today's CPI was benign and so the Fed cuts more. Bloomberg's XAU/$ gold price (white) rose around the same time, which is consistent with that...

By Robin Brooks

Social•Feb 13, 2026

Services Inflation Sticks While Housing Disinflation Persists

Closing out the week with @GregDaco and @ElizRosner talking about inflation: "On the latest episode of The Inflation Brief from ECON-versations with NABE, hosts Greg Daco and Laura Rosner-Warburton are joined by special guest Claudia Sahm to break down the...

By Claudia Sahm

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and...

By ForexLive — Feed

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

Social•Feb 13, 2026

BDC Quarterly Letters: Refusing Write‑Downs, Defying Pressure

Every BDC quarterly letter should just say “we are choosing not to mark this down and you can’t make us.”

By JunkBondInvestor

Podcast•Feb 13, 2026•7 min

European Rates: Scandinavian Rate Outlook – a Long Winter Hibernation

In this brief episode, J.P. Morgan analysts Francis Diamond and Frida Infante examine the current state and near‑term outlook for Swedish and Norwegian sovereign and corporate rate markets. They highlight that both countries are entering a prolonged period of low‑rate...

By At Any Rate

Social•Feb 13, 2026

Market Rally Likely False Amid Risk‑off Sentiment

I believe this is a false rally. Look at Utilities. That's defensive positioning. Same with long duration Treasuries. We remain in a risk-off condition for now.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

CPI Slowdown Fuels Falling Yields, Bullish Duration, Utilities, Gold

Post Hedgeye's Nowcast nailing another decel in CPI Growth decelerates → yields fall → correlations re-assert That’s the whole #Quad3 playbook ✔️ Duration bullish ✔️ Utilities work ✔️ Gold works ❌ Financials don’t

By Keith McCullough