News•Feb 20, 2026

All Global Experiences Useful for Vietnam S International Financial Hub

Vietnam aims to build an international financial centre by drawing on global precedents such as Dubai’s DIFC, China’s Shenzhen and Hangzhou, and Kazakhstan’s AIFC. Experts stress that independent, long‑term regulation, niche specialization in digital and green finance, and adaptive legal frameworks are critical success factors. The country must first cultivate a deep domestic financial ecosystem anchored in its manufacturing strength before attracting foreign participants. Concentrating liquidity in a single exchange and creating liveable urban hubs will further ensure resilience and sustainable growth.

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

Raised Ties Reaffirm Strategic Trust

Vietnam and the United Kingdom have upgraded their relationship to a comprehensive strategic partnership, the highest tier in Vietnam’s foreign‑policy framework. The deal follows Party General Secretary To Lam’s October visit to Britain and opens cooperation in politics, security, trade, education...

By Vietnam Investment Review (VIR)

News•Feb 20, 2026

India Sets ₹25,000 Crore Export Engine in Motion as Goyal Launches Plan

India’s Commerce Minister Piyush Goyal launched the ₹25,060‑crore Export Promotion Mission (EPM), a six‑year programme designed to boost outbound shipments and simplify export processes. The initiative consolidates multiple support schemes into a single, digitally driven framework aimed at micro, small...

By The Economic Times (India) – Economy

News•Feb 20, 2026

Five Things to Know to Start Your Day

Nigeria's federal government ordered ministries to defer 70% of the 2025 capital budget to 2026, limiting new projects to prioritize existing ones amid weak revenues. The Independent Corrupt Practices Commission raided former Kaduna governor Nasir El‑Rufai’s Abuja home as he remains...

By BusinessDay (Nigeria)

News•Feb 20, 2026

Strong Manufacturing Growth Lifts Flash PMI to Three-Month High of 59.3 in Feb

India’s flash Composite PMI rose to 59.3 in February, its strongest level in three months, driven by a surge in manufacturing activity. Total new orders grew at the fastest pace since November, pushing output to a four‑month high, while services...

By The Hindu BusinessLine – Economy

News•Feb 20, 2026

Africa Needs Patient Capital for the Long Term

Africa’s growth potential is hampered by a $350 billion SME financing gap and annual infrastructure needs of $130‑170 billion, far exceeding current investment. While the continent’s population tops 1.5 billion and GDP surpasses $3 trillion, capital flows remain fragmented and short‑term. The article argues...

By African Business

News•Feb 20, 2026

Google Bigger than India GDP? Sanjeev Bikhchandani Exposes the Flaw in that Viral Claim

A viral post claimed Google’s $4 trillion market capitalisation exceeds India’s GDP, prompting entrepreneur Sanjeev Bikhchandani to debunk the analogy. He explained that market cap is a stock measure reflecting investor expectations, while GDP is a flow metric tracking annual economic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Could Medical Care Help Cure China’s Services Trade Deficit?

China’s medical tourism is gaining traction as foreign patients praise rapid, affordable care in megacities like Shanghai and Beijing. While the absolute number of inbound patients remains modest, industry insiders see a growing pipeline driven by visa‑free entry, expanding international...

By South China Morning Post — Economy

News•Feb 20, 2026

Why Global Capital Is Looking at India Differently This Year

India’s economy is gaining traction through robust digital public infrastructure and maturing regulatory frameworks, positioning it as a distinct asset class for global investors. The latest Union Budget underscores this shift by offering a 20‑year tax holiday and a flat...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

US and Indonesia Agree to Cut Tariffs to 19% Under New Trade Deal

The United States and Indonesia have concluded a trade agreement that reduces U.S. tariffs on Indonesian goods to 19% from 32%. Indonesia will eliminate trade barriers on more than 99% of American exports across agriculture, healthcare, seafood, technology and automotive...

By bne IntelliNews

News•Feb 20, 2026

US Market | Credit Concerns Mount: Blue Owl Shake-Up Weighs on US Financial Stocks

Blue Owl Capital announced the sale of $1.4 billion of assets across three credit funds and permanently halted redemptions in one fund to return capital and reduce leverage. The announcement triggered a broad sell‑off in listed alternative‑asset managers such as Apollo,...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

RSBT ETF: It's A Directional Bet, Not A Diversification Vehicle

The Return Stacked Bonds & Managed Futures ETF (RSBT) posted a 12.25% year‑over‑year price gain after a tough 2022‑23 inflation cycle. The fund allocates capital between the AGG bond ETF and a suite of trend‑following managed‑futures strategies, positioning it as...

By Seeking Alpha – ETFs & Funds

News•Feb 20, 2026

Rupee Declines 27 Paise to 90.95 Against US Dollar in Early Trade

The Indian rupee slipped to 90.95 per U.S. dollar in early Friday trade, down 27 paise from its previous close. The decline was driven by a firmer dollar, higher Brent crude at $71.77 a barrel, and escalating U.S.-Iran tensions. Domestic...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Pakistani PM Holds Talks with Rubio After Washington Summit

Pakistan’s Prime Minister Shehbaz Sharif met U.S. Secretary of State Marco Rubio in Washington on Feb 19, focusing on cooperation in critical minerals, energy, counter‑terrorism and potential American investment. The discussion also highlighted Pakistan’s backing of President Donald Trump’s Gaza peace plan...

By bne IntelliNews

News•Feb 20, 2026

Global Market | Japan’s Tightening Cycle Could Redraw the Map of Global Market Liquidity

The Bank of Japan has ended its ultra‑easy stance, pushing policy rates to the highest level in decades and pricing in another hike. Higher domestic yields are likely to trigger repatriation of Japanese savings, cutting the flow of low‑cost funding...

By The Economic Times (India) – RSS hub

News•Feb 20, 2026

Infra Sector Outlook Cautious as Weak Q3 Performance Leads to 4% YoY Contraction: Nuvama Research

India's infrastructure sector posted a 4% year‑on‑year revenue contraction in Q3 FY26, driven by eroding order books, payment delays, prolonged monsoons and construction bans. Average EBITDA margin slipped 40 basis points to 10.1%, while adjusted PAT margin fell to 5.2%....

By The Economic Times (India) – Economy

News•Feb 20, 2026

White House Maritime Action Plan Shows OMSA Leadership on Regulatory Reform

The White House released America’s Maritime Action Plan, a sweeping strategy to strengthen the U.S. maritime sector through regulatory reform, infrastructure investment, and workforce development. A central pillar targets the elimination of redundant, obsolete, or overly burdensome regulations, echoing Offshore...

By The Maritime Executive

News•Feb 20, 2026

Goldman: Gold to Grind Higher to $5,400/Oz by End-2026 on Strong Demand

Goldman Sachs projects gold prices to climb to $5,400 per ounce by the end of 2026, driven primarily by renewed central‑bank buying and modest private‑investor inflows linked to Federal Reserve rate cuts. The forecast assumes a conservative base case with...

By ForexLive — Feed

News•Feb 20, 2026

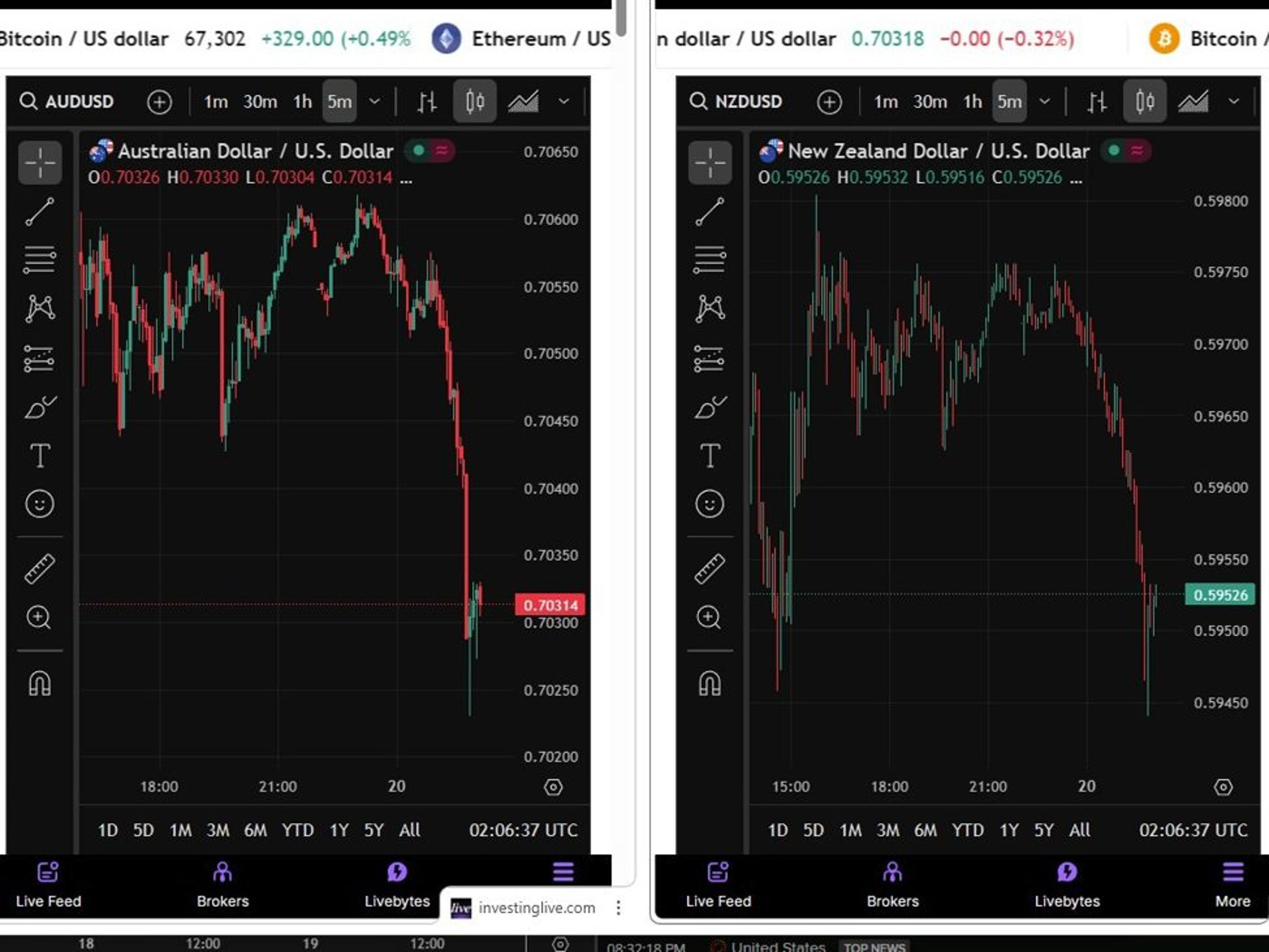

NZD, AUD Fall as RBNZ Says Inflation Returning to Target, No Preset Path

The New Zealand and Australian dollars slipped in Asian trade after the Reserve Bank of New Zealand signaled that inflation is already back within its 2% target band and is expected to stay there for the next year. Governor Adrian Breman emphasized that...

By ForexLive — Feed

News•Feb 20, 2026

US Removing Guardrails From Proposed Saudi Nuclear Deal, Document Says

President Trump has sent Congress a draft 123 Agreement to launch a civil nuclear partnership with Saudi Arabia that omits the long‑standing Additional Protocol and other non‑proliferation guardrails. The document allows Saudi Arabia to pursue uranium enrichment and spent‑fuel reprocessing,...

By Al-Monitor – All

News•Feb 20, 2026

Iran Tells UN Chief It Will Respond 'Decisively' If Subjected to Military Aggression

Iran warned the United Nations that any military aggression against it would be met with decisive force, stating that bases, facilities and assets of the perceived hostile force would be considered legitimate targets. The warning was delivered in a letter...

By Al-Monitor – All

News•Feb 20, 2026

USD Gains on Strong US Data Unlikely to Last; Policy Uncertainty, Political Risks to Cap

MUFG’s Derek Halpenny says the U.S. dollar’s recent rally, sparked by stronger‑than‑expected durable‑goods, housing and industrial production data and hawkish Fed minutes, is unlikely to be sustained. While the minutes hinted at a cautious stance on further rate cuts, Halpenny...

By ForexLive — Feed

News•Feb 20, 2026

Shares of Local Oil Explorers Surge on Supply Disruption Fears

Shares of Indian upstream explorers jumped as Brent crude breached $71 per barrel amid renewed US‑Iran tensions and temporary Strait of Hormuz closures. Oil India rose 5.2% and ONGC gained 3.6%, while downstream marketers HPCL and BPCL slipped nearly 5%...

By Economic Times — Markets

News•Feb 20, 2026

IMF Warns Venezuela’s Economy and Humanitarian Situation Is ‘Quite Fragile’

The IMF warned that Venezuela’s economy and humanitarian situation remain “quite fragile,” citing triple‑digit inflation, a sharply depreciating currency and public debt at roughly 180 percent of GDP. The country has seen massive emigration, with about 8 million people leaving since 2014,...

By Al Jazeera – All News (includes Economy)

News•Feb 20, 2026

Japan Inflation Slows to 1.5% in January, Core Measures Ease. What Will the BoJ Think?

Japan’s consumer price index slowed sharply in January, with headline inflation dropping to 1.5% year‑over‑year, the lowest level since March 2022 and below expectations. Core inflation excluding fresh food eased to 2.0% YoY, while the core‑core measure fell to 2.6%,...

By ForexLive — Feed

News•Feb 20, 2026

Civil War-Torn Sudan Sits On Unexplored Mineral Riches Worth Billions

Sudan, despite a civil war that began in 2023, is courting foreign investors to develop its largely untapped mineral portfolio that includes gold, copper, uranium and rare‑earth elements. Gold production set a new record of 70 tonnes in 2025, generating...

By OilPrice.com – Main

News•Feb 19, 2026

Trump’s Energy Dominance Clashes with Soaring Bills at Home

U.S. LNG exports are set to climb from 15 Bcf/d last year to 18.1 Bcf/d by 2027, driving record natural‑gas production. The surge in feed‑gas demand and AI‑powered data‑center growth is tightening domestic supply, pushing residential and wholesale electricity prices higher. While...

By OilPrice.com – Main

News•Feb 19, 2026

House E15 Council Eyes More US Biofuel Quota Waivers

The House Republican‑led E15 Rural Domestic Energy Council has revised its biofuel exemption plan, raising the annual cap from 450 million to 550 million Renewable Identification Number (RIN) credits. The proposal also authorizes year‑round sales of 15% ethanol gasoline (E15) and expands...

By Argus Media – News

News•Feb 19, 2026

Stocks Slide as Traders Assess Walmart Earnings, Potential Iran Conflict: Live Updates

U.S. stock futures were largely flat on Wednesday night after the major indexes posted gains, with the Dow down 0.09%, the S&P 500 down 0.09% and the Nasdaq down 0.1%. Investors focused on Walmart’s upcoming fourth‑quarter earnings, a widely watched...

By CNBC – Markets

News•Feb 19, 2026

Sixth Straight Week of Decline: Container Rates Fall as Pre-Lunar New Year Surge Fails to Materialize

Global container shipping rates slipped another 1% to $1,919 per 40‑foot container, marking a sixth consecutive weekly decline. The expected pre‑Lunar New Year cargo surge failed to materialise, leaving both carriers and shippers with excess capacity. Transpacific lanes saw spot...

By gCaptain

News•Feb 19, 2026

Philippine Central Bank Cuts Rates in Latest Bid to Support Growth

The Bangko Sentral ng Pilipinas (BSP) lowered its overnight repurchase rate by 25 basis points to 4.25%, marking the ninth cut since August 2024. Inflation remains modest at 2%, comfortably within the 2‑4% target band, while the peso rallied to...

By Nikkei Asia — Economy/Markets

News•Feb 19, 2026

Subprime Demand Drives US Loan Growth to New Heights

Subprime borrowers propelled U.S. unsecured loan balances to a record $276 bn, a 10% increase year‑over‑year, with 26.4 million consumers holding such loans. Credit‑card issuers expanded lending to lower‑income customers, pushing total balances 4% higher to $1.15 trillion, but responded by trimming initial...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Investors Unfazed by Uncertainties Around Tariffs in Med Tech

Investors remain steady in the med‑tech sector despite lingering tariff uncertainties, signaling confidence in long‑term growth. At the same time, research updates highlight the SCAN circuit as a core driver of Parkinson’s disease, TL1A overexpression in hidradenitis suppurativa, and an...

By BioWorld (Citeline) – Featured Feeds

News•Feb 19, 2026

World Briefs | Rwanda Hikes Lending Rate on Higher Inflation

Rwanda’s central bank raised its key lending rate by 50 basis points to 7.25% on Thursday, reacting to a jump in consumer price inflation to 8.9% year‑on‑year in January. The move aims to bring inflation back within the bank’s 2‑8%...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Russia Warns of Escalation as US-Iran Tensions Intensify

Russia warned of an unprecedented escalation around Iran as the United States completes a military buildup slated for mid‑March. A Russian corvette joined Iranian naval drills in the Gulf of Oman, underscoring Moscow’s support amid heightened US‑Iran tensions. Negotiations over...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

World Briefs | Nigeria’s Tinubu and Germany’s Merz Talk Security, Power Deal in Phone Call

Nigerian President Bola Tinubu and German Chancellor Friedrich Merz discussed reviving a stalled electricity transmission project with Siemens and the purchase of used German helicopters, highlighting deeper security and power cooperation. France’s audit office warned that the country must shift...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Pernod Ricard’s First-Half Sales Slip Limited by Improved Second Quarter

Pernod Ricard reported a first‑half sales decline across all five priority markets, with profits pressured by foreign‑exchange volatility and higher costs. The second quarter showed a modest rebound, helped by stronger demand in India and duty‑free channels. The group reaffirmed its...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 19, 2026

Bank Indonesia Keeps Rates Steady, as Rupiah Weakness Threatens to Delay Easing

Bank Indonesia left its policy rate unchanged at 4.75% as the rupiah continued to weaken amid fiscal‑sustainability concerns and volatile investor sentiment. Moody’s downgraded Indonesia’s credit outlook to negative, reflecting uncertainty over policy direction and transparency. Real‑rate differentials with the...

By ING — THINK Economics

News•Feb 19, 2026

Philippines’ Central Bank Delivers Expected Rate Cut Paired with Uncertain Guidance

The Bangko Sentral ng Pilipinas trimmed its policy rate by 25 basis points to 4.25%, matching market expectations. However, the central bank softened its forward guidance, dropping language that it was nearing the end of easing and emphasizing lingering confidence...

By ING — THINK Economics

News•Feb 19, 2026

Turkey Launches Ramadan Food Price Crackdown as Inflation Anger Intensifies

Turkey’s government has banned chicken exports and launched a nationwide crackdown on "exorbitant" food prices as Ramadan begins. Trade inspectors are sweeping markets for hoarding and misleading practices, with fines up to TL 1.8 million for violations. Food inflation is running at...

By Financial Times – Commodities

News•Feb 19, 2026

GrainCorp Confident of Global Grain Market Rebalance

GrainCorp CEO Robert Spurway told shareholders that global wheat oversupply of 18 million tonnes is driving low prices and tighter margins for grain handlers. Growers are holding back grain, reducing market availability, but the company expects inventories to rebalance eventually, though...

By Grain Central

News•Feb 18, 2026

Isabel Schnabel: Fiscal Challenges Amid Geopolitical Uncertainty and Ageing Societies

Isabel Schnabel highlighted the euro area’s mounting fiscal pressures, noting that low debt levels often coincide with weak public investment. She examined Germany’s new defence and infrastructure package, showing it can lift GDP but also raise debt ratios under different...

By European Central Bank — Press/Speeches

News•Feb 18, 2026

Dow Jones Industrial Average Gains 200 Points as Fed Minutes Loom and Nvidia Rallies on Meta Deal

The Dow Jones Industrial Average rose about 300 points, or 0.65%, as investors returned to equities ahead of the Federal Reserve’s January minutes. Nvidia surged over 2% after Meta announced an expanded AI‑chip partnership worth tens of billions, reinforcing Nvidia’s...

By FXStreet — News

News•Feb 18, 2026

J.B. Hunt ‘a Little Bit More Positive’

J.B. Hunt’s CFO said demand is slightly stronger than early‑January expectations as truck capacity tightens, reflected in rising tender rejections and spot rates. Regulatory pressures on the driver pool and recent winter storms have limited supply, creating a modest but...

By FreightWaves

News•Feb 18, 2026

US Stocks: Trump Adviser Hassett Suggests New York Fed Researchers Be Punished for Tariffs Argument

Kevin Hassett, former Trump economic adviser, blasted a New York Fed research paper that argued tariffs mainly hurt American consumers, calling it "shoddy scholarship" and the worst paper in Fed history. He urged that the authors be disciplined for their...

By The Economic Times – Markets

News•Feb 18, 2026

Five US Policy Shifts Could Reshape Financial Markets

The Trump administration is advancing five domestic policy initiatives that touch credit, housing, monetary policy, corporate governance, and digital‑asset regulation. Proposed credit reforms would tighten loan underwriting, while housing changes could modify the mortgage interest deduction. Monetary officials hint at...

By Project Syndicate — Economics

News•Feb 18, 2026

Mining Stocks Dominate TSXV’s Top Performers List

Metals and mining dominated the TSX Venture Exchange’s 2025 top‑performer list, with 48 of the 51 entries coming from the sector. Junior miners posted an average share‑price gain of 443% and a combined market capitalisation of $19.9 billion. Record liquidity supported...

By MINING.com

News•Feb 18, 2026

The Big Four Recession Indicators: Industrial Production

Industrial production rose 0.7% in January, outpacing the 0.4% forecast, and posted a 2.3% year‑over‑year gain. Utilities output surged 2.1% month‑over‑month, while mining slipped 0.2% and manufacturing climbed 0.6%. The index’s current level is at or below the start‑of‑recession threshold...

By Advisor Perspectives — dshort (charts/econ & markets incl. rates)

News•Feb 18, 2026

The 'Ex-America' Trade Is Off to a Roaring Start in 2026

Global equities have surged ahead of the U.S. market in 2026, with the MSCI EAFE up roughly 8% and the MSCI ACWI ex‑U.S. gaining about 8.5% year‑to‑date, while the S&P 500 is down 0.5%. Goldman Sachs notes this is the widest...

By Quartz — Economy/Markets (site-wide feed)

News•Feb 18, 2026

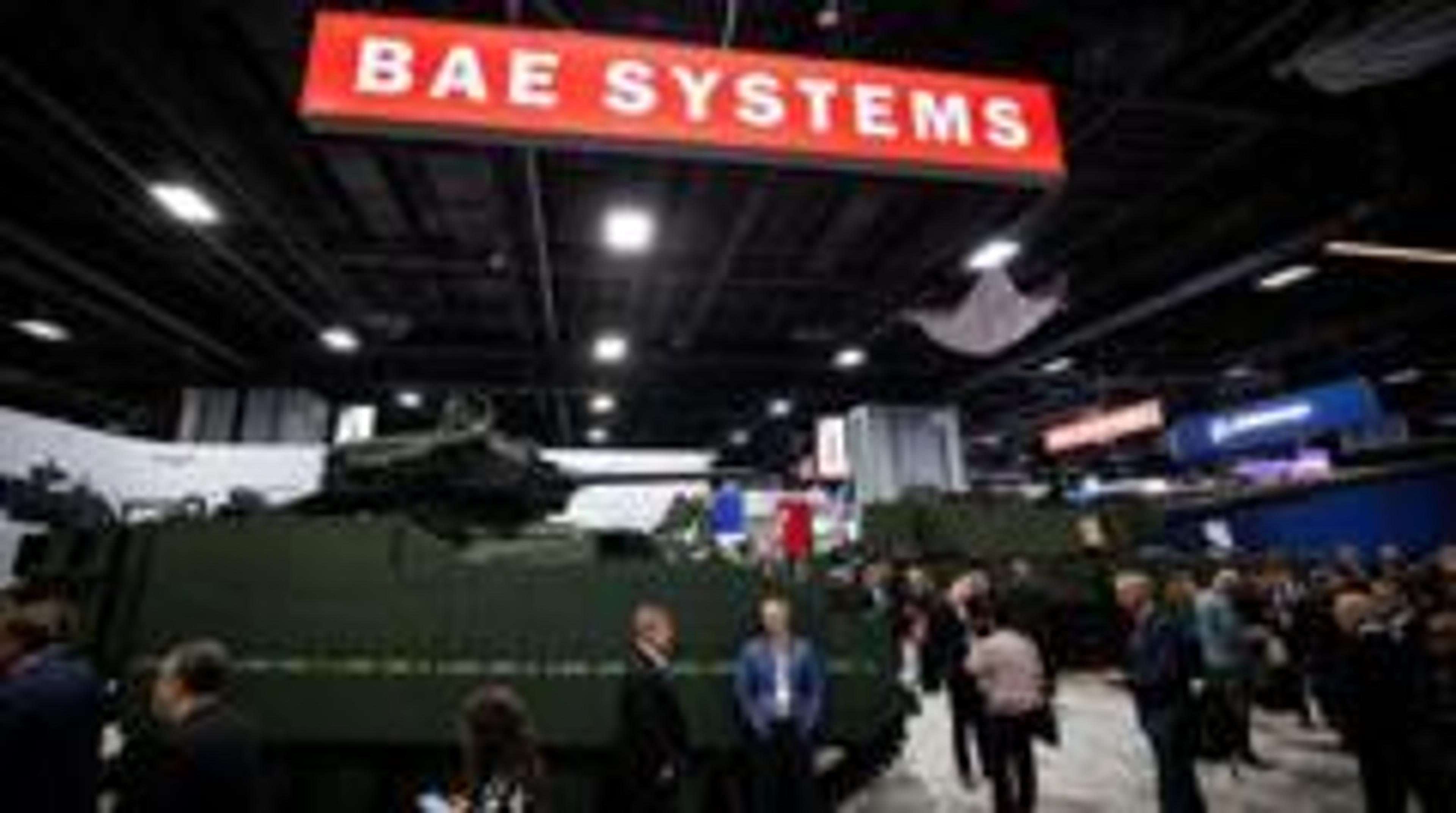

Defence Giant BAE Hails Record Sales as Workers Remain on Strike

BAE Systems announced record 2025 results, with sales rising 10% to £30.7 billion and pre‑tax profit climbing to £2.6 billion. The company highlighted a historic order backlog as global defence budgets surge amid geopolitical tension. Meanwhile, Unite union members at the Lancashire...

By BBC News – Business