Decagon AI Raises $250M at $4.5B Valuation to Scale AI Concierge Platform

Why It Matters

The capital injection enables Decagon to scale sophisticated conversational AI, allowing enterprises to deliver high‑touch, cost‑efficient customer service at volume. This shift could redefine CX economics across retail, finance and travel sectors.

Decagon AI raises $250M at $4.5B valuation to scale AI concierge platform

Artificial intelligence concierge for every customer company Decagon AI Inc., which offers an artificial intelligence “concierge” for customers, today revealed that it has raised $250 million in new late‑stage funding on a $4.5 billion valuation.

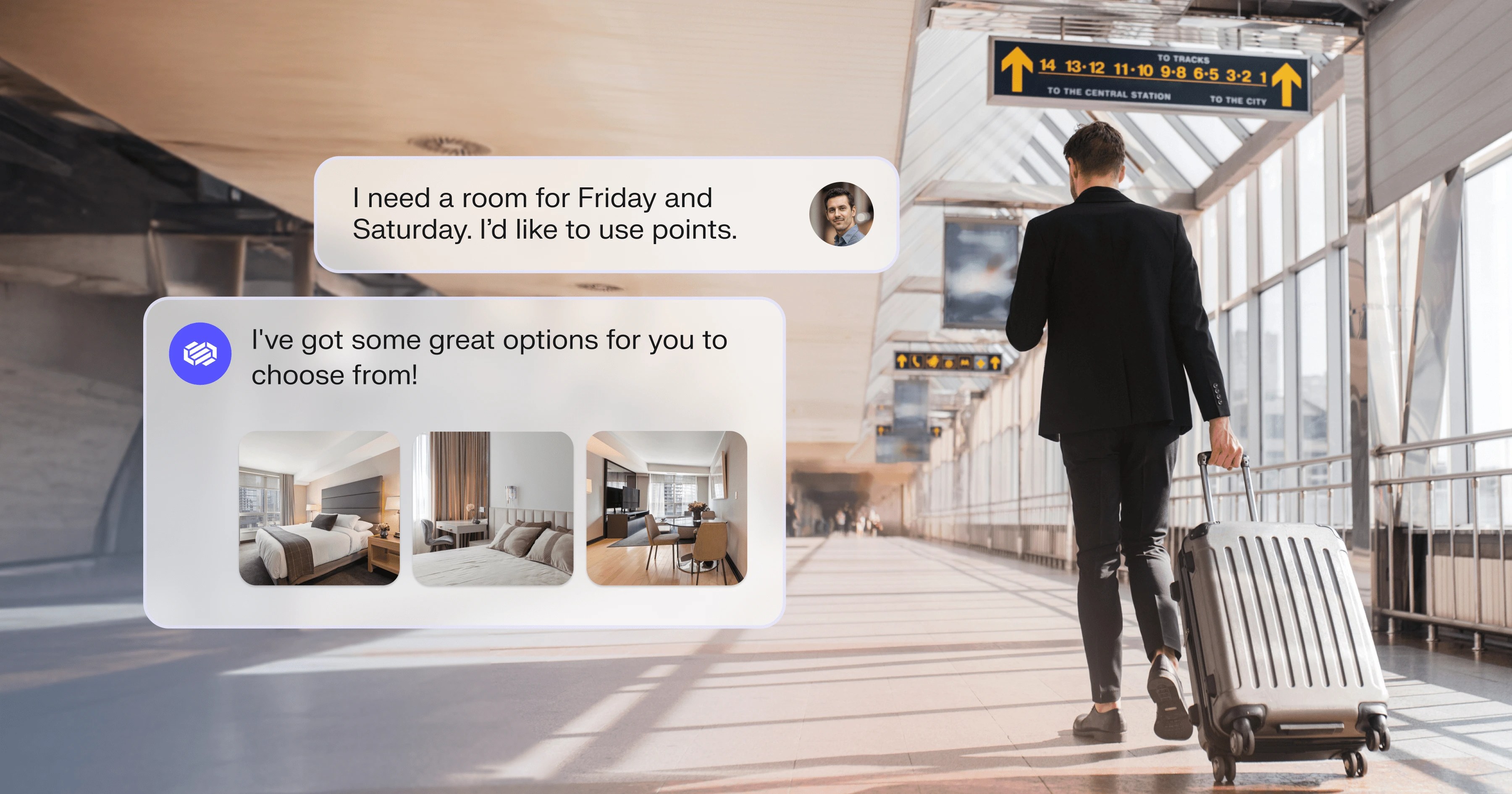

Founded in 2023, Decagon offers advanced conversational AI agents that are designed to transform how businesses interact with their customers at scale. The platform uses large language models and machine learning to power AI “concierge” agents that can understand natural language and respond in a way that feels fluid, contextual and human‑like, rather than offering simple scripted chats.

The new funding is intended to help it expand its conversational AI platform and accelerate growth as it scales up deployment of its AI concierge technology to more enterprises across industries. Decagon’s offering is powered by a unified AI agent engine that operates across multiple communication channels, such as chat, email and voice, to allow companies to deliver consistent support experiences regardless of how a customer chooses to reach out.

Differing from other solutions, the AI agents do more than answer basic FAQs by being able to navigate complex workflows, access backend systems like customer relationship management or billing and execute customer‑centric tasks such as processing refunds or managing subscriptions.

The platform allows both technical teams and non‑technical business users to configure and optimize AI agents without heavy engineering support. Decagon offers tools that help organizations customize how agents handle specific scenarios, define business logic and incorporate guardrails so interactions remain safe and reliable.

Decagon’s technology is also able to learn from interactions by gathering context from past conversations and feeding that data back into the system. The AI agents improve their performance over time to make future customer engagements smoother and more accurate. By making concierge experiences possible at both the individualized level and at global scale, Decagon says it is restoring alignment between businesses and customers.

“We believe every customer deserves concierge treatment,” explain Jesse Zhang and Ashwin Sreenivas, Decagon’s co‑founders. “And every business deserves the technology to make it possible.”

Across the platform, Decagon achieves average deflection rates exceeding 80%, which the company says demonstrates that scale and quality can work in harmony.

The technology is already being used to power AI concierge experiences for leading consumer and enterprise brands across daily life. Notable Decagon customers include Avis Budget Group Inc., The Hertz Corporation, Block Inc., Affirm Holdings Inc., Chime Financial Inc., Varo Bank N.A., Deutsche Telekom AG and Grubhub Holdings Inc.

The Series D funding round was led by Coatue Management and Index Ventures Management. Also participating were ChemistryVC, Definition Capital, Starwood Capital Group, Andreessen Horowitz, A* Capital, Accel Partners, Avra Capital, Bain Capital Ventures, Elad Gil, T.Capital (Deutsche Telekom Capital Partners), Forerunner Ventures and Ribbit Capital Management.

“Decagon is helping redefine how businesses engage with their customers,” said Lucas Swisher, general partner at Coatue Management. “As AI unlocks hyperscale commerce, Decagon is enabling concierge‑level interactions at scale. That’s why many trusted and innovative companies are choosing Decagon to modernize their customer experience.”

The new round takes the total raised by Decagon to approximately $481 million, according to data from Tracxn. Previous rounds raised by the company include $35 million in June 2024, $65 million in October 2024 and $131 million on a $1.5 billion valuation in June 2025.

Comments

Want to join the conversation?

Loading comments...