Gold & Silver Rebound After Latest Selloff, While Warsh's 'Treasury Accord' Looms...

•February 18, 2026

0

Why It Matters

The rebound in gold and silver signals shifting risk sentiment, which can affect investors’ portfolio allocations. Warsh’s push for a Treasury‑Fed accord could alter how monetary policy interacts with fiscal actions, influencing bond yields and, consequently, precious‑metal prices. Understanding these dynamics helps listeners anticipate market moves and policy risks in a volatile economic environment.

Gold & Silver Rebound After Latest Selloff, While Warsh's 'Treasury Accord' Looms...

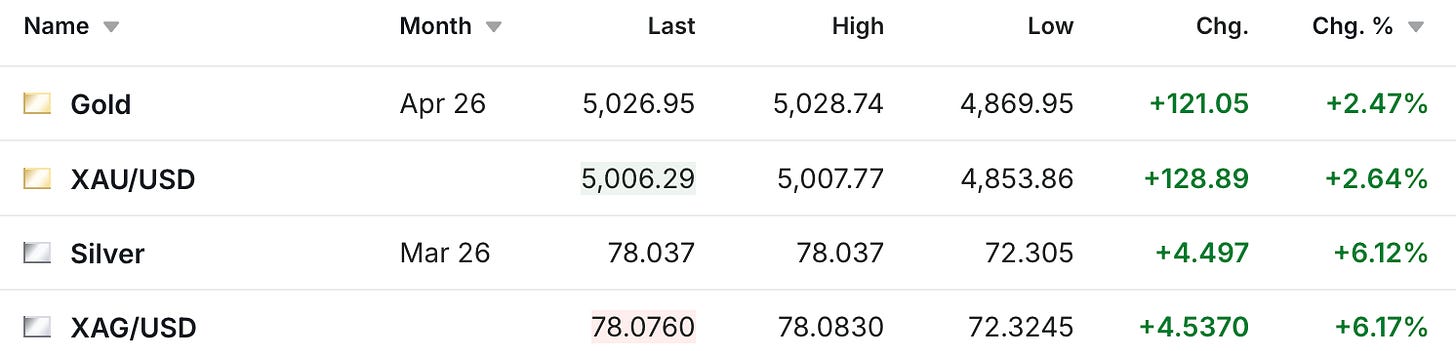

The gold and silver prices are rebounding after yesterday’s sell-off, with the gold futures up $121 to $5,026 while the silver futures are up $4.50 to $78.04.

[

](https://substackcdn.com/image/fetch/$s_!SGcV!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fcc793cfb-9051-468d-b374-b7fa4090252e_1492x360.png)

The Shanghai silver market is closed this week for the Chinese holiday, although it’s worth noting that silver is currently trading at $81.80 in India, while its last tick in China before the market there closed was $88.52.

In terms of events that you’ll want to keep an eye on over the next few months, that could conceivably be a big deal in the not all too distant future, it was fascinating to read this Bloomberg report about Trump’s Federal Reserve Chairman nominee Kevin Warsh, and the discussion about a ‘Treasury Accord.’

[

](https://www.bloomberg.com/news/articles/2026-02-08/warsh-call-for-fed-treasury-accord-stirs-debate-bond-market)

Kevin Warsh floated plenty of ideas for how he would run the Federal Reserve during his campaign for the job as chair. For Wall Street, few are as cryptic — or potentially consequential — as his call for a new accord with the Treasury Department.

Warsh has voiced support for overhauling the relationship between the two institutions with a new version of an agreement struck in 1951.

0

Comments

Want to join the conversation?

Loading comments...