Inventories Before and During the Storm: A Reliable Predictor of… Nothing

•January 29, 2026

0

Why It Matters

Understanding the composition of oil inventories is crucial for investors, policymakers, and analysts who rely on supply data to forecast prices. By revealing that a sizable portion of the reported build is tied up in the SPR, the episode clarifies why price pressures may not ease despite seemingly abundant supplies, making the discussion especially relevant amid ongoing debates about energy security and market stability.

Inventories Before and During the Storm: A Reliable Predictor of… Nothing

January 28, 2025

[

](https://substackcdn.com/image/fetch/$s_!BYqr!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fa18a8088-0857-4719-b754-b8531170ff31_624x405.png)

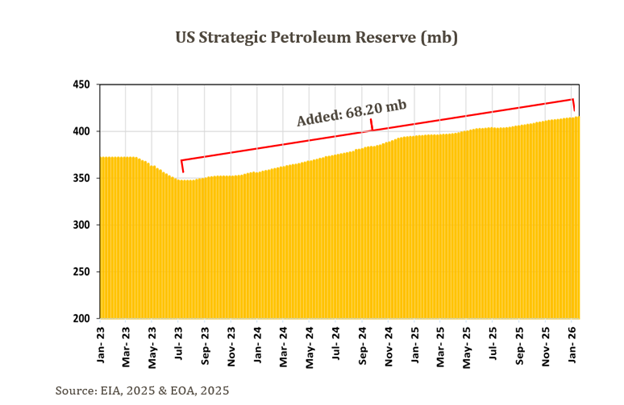

The amount of oil locked up in the U.S. Strategic Petroleum Reserve (SPR) since the start of 2025 has exceeded the growth in U.S. crude oil production over the same period.

This matters because it serves as key evidence challenging the narrative of a genuine global oil surplus. Much of the reported inventory build isn’t freely available commercial crude poised to flood the market and depress prices—it’s tied up in strategic government stockpiles, deliberately set aside for emergency use rather than active trading or immediate supply response.

IN DETAIL

0

Comments

Want to join the conversation?

Loading comments...