Which Latin American Leaders Will Be Forced From Power in 2026?

•February 10, 2026

0

Why It Matters

Understanding how prediction markets reflect political instability offers policymakers, investors, and analysts a novel, real‑time gauge of coup risk in a region historically prone to sudden power shifts. As these markets grow, they could become a critical component of geopolitical risk assessment, making the episode especially relevant for anyone tracking Latin American affairs or global stability.

Which Latin American leaders will be forced from power in 2026?

I’ve spent over two decades attempting to forecast various unscheduled changes in power in Latin America. There have always been data sources, including some academic coup prediction indexes that were helpful, but the emergence of widespread and heavily traded prediction markets in recent years has made this a much larger effort. Now, there are markets for many countries that serve as a potential measure and early warning system.

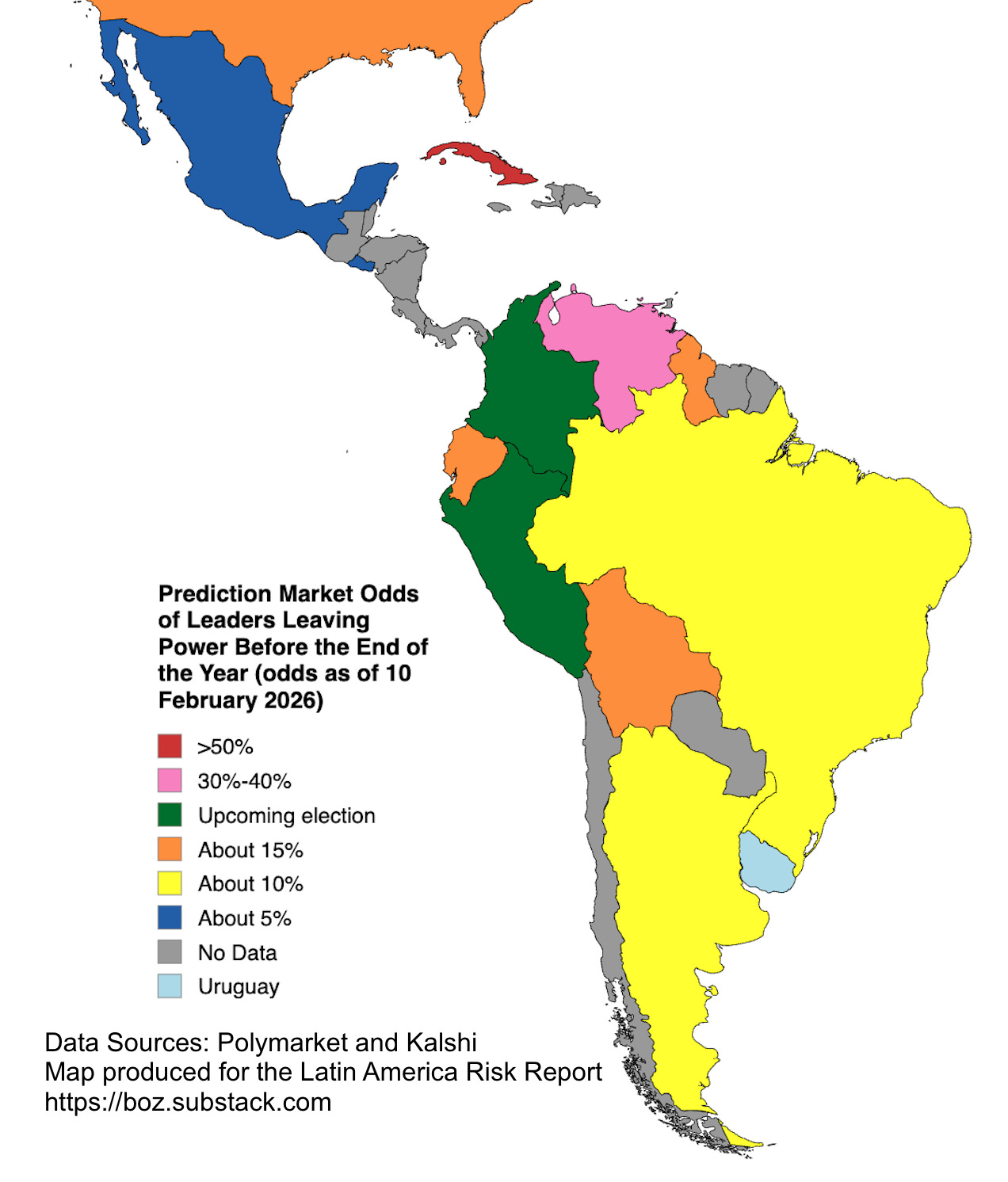

For today’s newsletter, I built a map of where the prediction market odds are on various leaders leaving office before the end of the year using data from both Kalshi and Polymarket.

[

](https://substackcdn.com/image/fetch/$s_!jjet!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5ec39000-0b9e-4ba3-8adc-4d916bc02c1a_1272x1492.png)

Notes on the map

Do some of these numbers seem wrong to you? I doubt anyone reading this thinks all of these numbers are correct. Prediction markets are still undeveloped on these sorts of questions. Low volume and a bias toward US and European users mean there are definitely inefficiencies in the markets. They are a useful data point for analysis, but the markets also have limitations.

The general narrative is correct that Cuba and Venezuela are the big questions of the year and are likely to be the most volatile markets. I also think the market is correct that Bolivia and Ecuador are two other countries to watch, even if I question whether 15% odds of either leader leaving power is the correct number.

Volume of trading matters. Some of these markets (Guyana) only have a few thousand dollars of liquidity, meaning they are likely quite inaccurate. Volume of trading increases as tensions rise, meaning volume is also a signal. For example, there is almost five million dollars of movement on the question of whether UK Prime Minister Starmer will be out soon. There was almost $56 million bet on Polymarket on the question about Maduro’s stability last year before that market resolved.

That low volume on some countries causes the odds of some presidential oustings to be overly high. Polymarket currently has Claudia Sheinbaum at 6% likely to leave office this year. No Mexican president has failed to finish their term since 1920. Meanwhile, Kalshi says there is a 5% chance that Gustavo Petro still remains in office at the end of the year. Even at 5%, that seems overweighted given the upcoming election and transition of power.

Additionally, some of these odds are too low/high because there is a monetary cost for trading at the extremes (99% or 1% odds). Few people want to lock up their money until the end of the year to make 1%. Kalshi has tried to fix this by offering 3% interest on money locked up on trades, to make it at least equal to putting it in a savings account, but it still is less worth it than using the money for more lucrative opportunities.

Brazil is listed around 10% instead of “election” because Brazil’s change of power does not happen until January 1, 2027. That likely reflects Lula’s age as well as the outside potential that he is impeached or resigns for political reasons. There are good arguments that 10% may be too high.

One difference between the two prediction markets is that Polymarket will resolve for any reason the leader leaves office while Kalshi has some complicated resolution rules if a leader dies while in office (because US law prohibits “assassination markets” where people can bet on someone dying, which creates negative incentives in the real world).

Insider trading is both a feature and a bug. Prior to Maduro’s removal, some traders made big money, suggesting they may have been tipped off about the US military operation. If you’re legitimately trading in the market, the threat of insider trading puts you at a disadvantage. If you are using the markets as an early warning system, the fact these insider trades exist could help you. For example, a sudden move on the odds related to Delcy Rodriguez might indicate a coup is in process. Or a sudden movement on Ecuador’s odds could suggest that Daniel Noboa plans to invoke the muerte cruzada clause that would force new elections.

One risk of that previous paragraph is that markets can also be manipulated, particularly if the trading is low volume. If some actor with bad intentions wanted to make Bolivian President Rodrigo Paz look less stable, perhaps to actually destabilize him or perhaps to manipulate Bolivia’s bond prices, a few thousand dollars of bets could change the betting market odds quickly. Artificially moving prediction market odds will become a new part of the dirty playbook for both elections and coups in the coming years.

I plan to write more on prediction markets and Latin American politics this year. Feedback is appreciated.

And please subscribe to support this newsletter and receive additional information. Tomorrow’s newsletter for paying subscribers will include comments about US policy in the hemisphere including Trump’s shifting plans for Venezuela and Cuba.

0

Comments

Want to join the conversation?

Loading comments...