Xi’s Broken Heart: Why China’s Markets Are Bleeding Out

•February 11, 2026

0

Why It Matters

Understanding this market split is crucial for investors and policymakers because it signals that China’s financial system may no longer function as a reliable conduit for capital, raising risks for global portfolios. The episode’s timing is relevant as China’s leadership intensifies control ahead of key economic milestones, making the insights essential for anyone tracking the future of global finance and the stability of the world’s second‑largest economy.

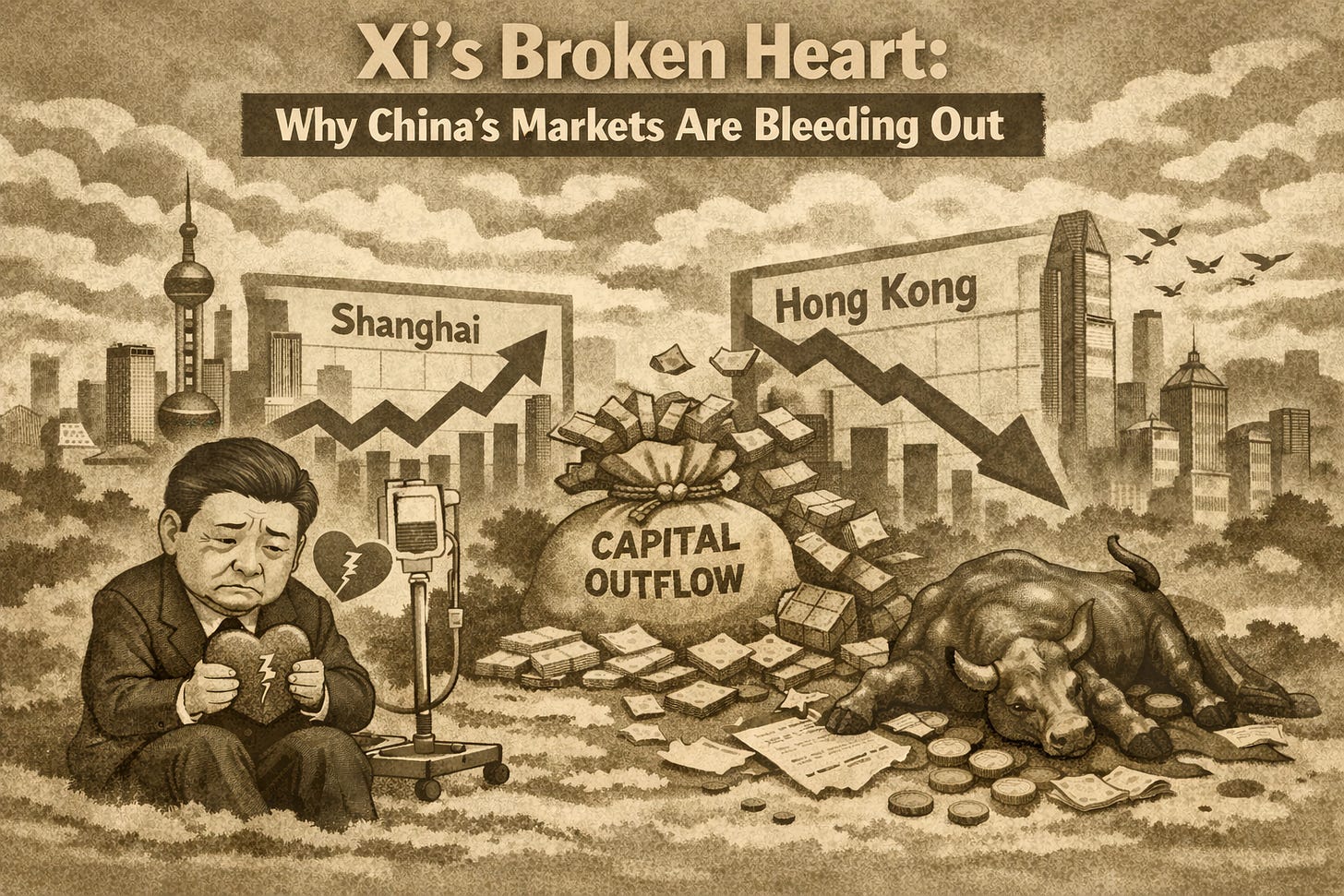

Xi’s Broken Heart: Why China’s Markets Are Bleeding Out

The stock markets in China reflect a structural mistrust of Xi Jinping. The official mainland indices remain stable, even though economic risks are increasing. At the same time, the offshore market in Hong Kong is losing value on a permanent basis. This divergence shows that capital no longer flows according to efficiency and innovation, but is directed according to political priorities. This systematic break reveals the limits of market liberalization and the strategic control of financial markets under Xi Jinping.

[

](https://substackcdn.com/image/fetch/$s_!-Mol!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F923b73b7-c93d-4e5a-a09e-3d4c38b807a0_1536x1024.png)

Generated by AI (DALE-E3)

The Dream of Becoming a Financial Superpower

In a speech delivered in January 2024 to senior officials, which has only now been made public, Xi Jinping emphasized that China must become a "financial superpower." Since taking office in 2012, he has repeatedly spoken about the importance of a strong financial market. His demand was most clearly expressed at the opening of the Belt and Road Forum for International Cooperation in 2017: "Finance is the lifeblood of the modern economy. Only when blood circulates smoothly can one grow." Aspiration and reality are a living contradiction in China. Nowhere is this more evident than in the financial markets. For over 20 years, the Chinese leadership has been talking about gradual opening up. And yet they are still almost as impenetrable as the Great Wall of China.

If finance is the lifeblood of modern economies, then stock exchanges are something like the heart of the economy. As the central hub of the economic cycle, the stock market pools the idle capital of savers and pumps it like vital oxygen into the productive organs of the real economy. Through this steady pulse and transparent pricing, it also acts as a filter that eliminates toxic risks, thereby maintaining the vital circulation of prosperity.

It is therefore worth taking a look at how these hearts of the Chinese economy have developed under Xi Jinping. What is particularly fascinating is the fact that the Chinese organism has, in a sense, two hearts that supply the same body with vital capital: the mainland Chinese stock exchanges in Shanghai and Shenzhen, and the financial center of Hong Kong. This anatomical peculiarity allows a direct comparison of how efficiently both centers fulfill their life-giving function.

China and Hong Kong: Two Stock Exchanges, Two Truths

The two graphs below illustrate how these two hearts have developed since Xi Jinping was elected General Secretary of the Communist Party of China in November 2012. The top graph shows the development of two normalized indices since that time.

What You Get Behind the Paywall

The complete deep dive into the 2012 to 2026 data including the proprietary Regime Divergence Index and the statistical evidence of China’s structural market break.

The Full Analysis Includes

-

The Divergence Data: A detailed look at why the gap between onshore and offshore markets is at a record high.

-

Statistical Proof: Why the current market behavior is not a coincidence but a calculated systemic shift.

-

The Stock Connect Leak: How international and domestic investors are using the opening of the markets to move capital out.

-

Economic Implications: Why the collapse of the stock market as a store of value is driving deflation in the broader Chinese economy.

-

Methodology Access: A link to the full documentation and calculations behind the findings.

Subscribe to Access

The financial heart of the world’s second largest economy is being replaced by a state regulated pump. If you want to understand the exact moment the system broke and what the proprietary data reveals about the future of global capital in China you should read the full report. Invest in this insight to avoid being caught on the wrong side of a rigged market.

0

Comments

Want to join the conversation?

Loading comments...