Ground View: How Industry Leaders Are Shaping Pakistan’s Mining Future

•February 18, 2026

0

Why It Matters

Effective institutional reforms will determine whether Pakistan can translate its vast mineral endowment into reliable supply for the global energy transition, directly impacting investor risk and regional competitiveness.

Key Takeaways

- •Reko Diq copper‑gold project moves forward post‑arbitration

- •PMIF convenes investors, policymakers, and mining leaders in Islamabad

- •Institutional coordination, not resource size, drives project success

- •Federal‑provincial alignment critical for infrastructure and permits

- •Global copper demand hinges on Pakistan’s regulatory reforms

Pulse Analysis

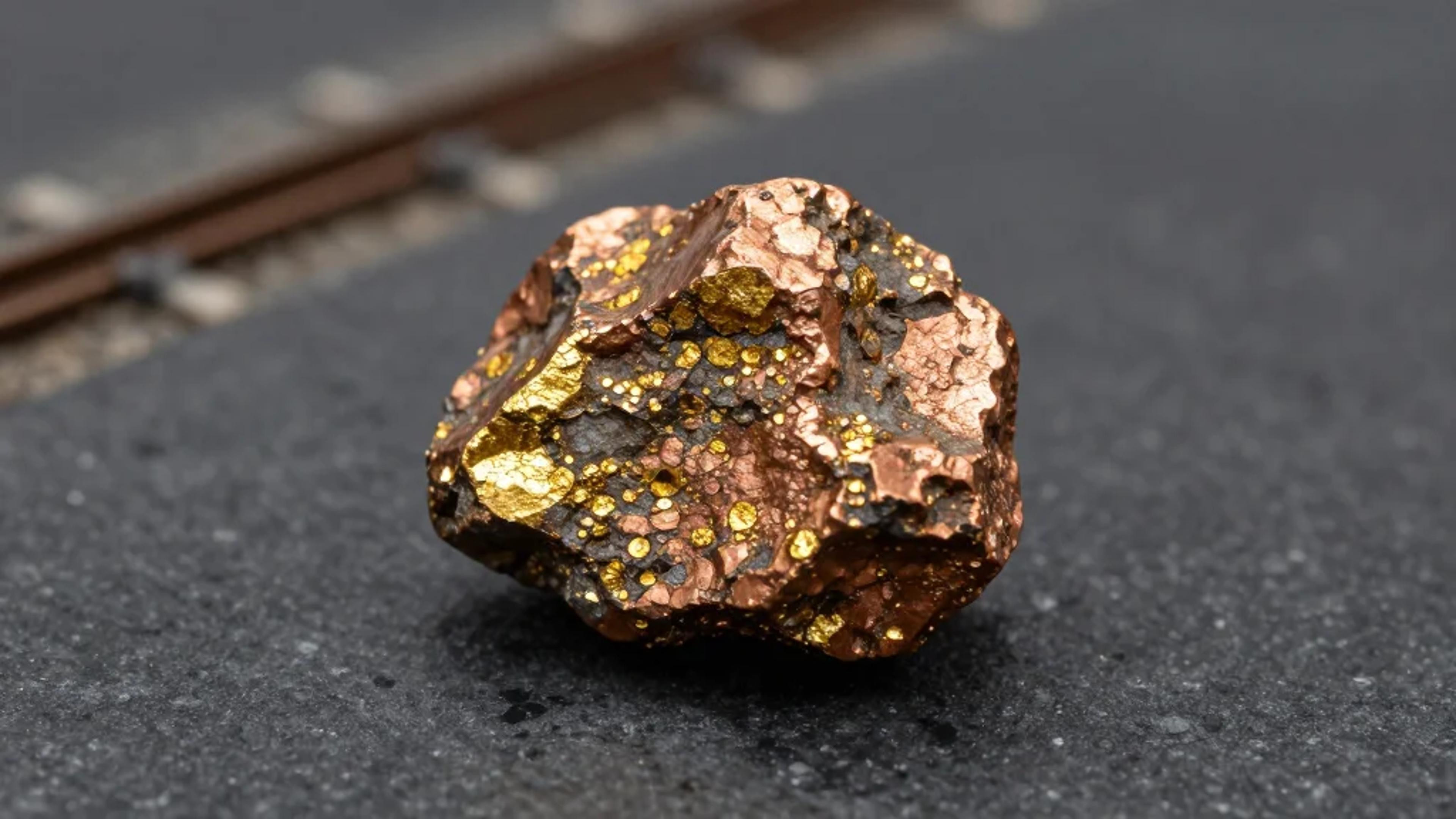

Pakistan’s mining sector sits at a crossroads where abundant copper‑gold deposits intersect with geopolitical ambition. The Reko Diq project, once stalled by legal battles, is now progressing, signaling renewed confidence from multinational miners. Coupled with the China‑Pakistan Economic Corridor’s infrastructure backbone, the country offers a compelling case for investors seeking exposure to critical minerals essential for renewable technologies. However, the true catalyst for growth lies beyond the ore body – it is the quality of governance that will unlock value.

Frontier markets often suffer from a “institutional middle” gap, where mid‑level regulators, engineers, and planners struggle to synchronize permits, logistics, and power supply. In Pakistan, fragmented authority between federal and provincial bodies can delay road construction, water allocation, and power connections, inflating project timelines and costs. The upcoming PMIF aims to showcase reforms, yet on‑the‑ground observations will reveal whether policy statements translate into streamlined processes. Effective coordination can reduce capital expenditures and improve the predictability that global financiers demand.

For the broader energy transition, reliable copper and other critical minerals are non‑negotiable. Pakistan’s ability to demonstrate consistent regulatory pathways and infrastructure readiness will position it as a viable alternative to traditional suppliers. Investors monitoring supply‑chain diversification will watch the outcomes of PMIF and subsequent field assessments closely, as any progress—or lack thereof—will reverberate through commodity markets and influence strategic sourcing decisions worldwide.

Ground View: How industry leaders are shaping Pakistan’s mining future

In April, industry leaders, investors and policymakers will gather in Islamabad for the Pakistan Mineral Investment Forum (PMIF). The focus will be on large-scale opportunity: world-class copper and gold deposits, critical minerals supply chains, and renewed foreign investment.

But conferences don’t determine whether mining projects succeed. Institutions do.

Pakistan is a useful case study. The country hosts major undeveloped assets, most notably Barrick’s Reko Diq copper-gold project, one of the largest of its kind globally. After years of legal dispute and international arbitration, the project is moving forward again. The geology has never been in question. The challenge has always been coordination, regulation and execution.

That challenge is not unique to Pakistan. Across frontier markets, mining outcomes are shaped less by resource size than by what happens inside ministries, permitting offices, provincial administrations and infrastructure planning departments. Projects stall when approvals do not align, when power and transport timelines slip, or when federal and provincial authorities move at different speeds.

This layer is referred to as the institutional middle. It includes mid-level regulators managing permits across jurisdictions, engineers solving logistics constraints, university departments training future geologists, and planners sequencing roads, water and power for remote projects. This is where mineral potential either turns into operating mines or remains in feasibility studies.

Why Pakistan, why now?

Pakistan sits at a strategic crossroads. It is central to China’s infrastructure footprint through the China-Pakistan Economic Corridor, while also drawing interest from Western governments seeking diversified critical mineral supply. Political leadership has made clear that mining is a national priority. The open question for investors is implementation capacity.

To examine that question more closely, I will spend more than 10 days in Pakistan ahead of and during PMIF. In addition to covering the forum itself, I will meet with federal and provincial mining officials, visit Balochistan where key projects are located, engage with universities preparing the next generation of sector professionals, and observe the regulatory and infrastructure coordination that rarely appears in investor presentations.

Telling the story that goes untold

My reporting approach, which I call Ground View, will be built on extended, on-the-ground observation rather than conference summaries. The objective is straightforward: understand how institutional processes function in practice, where bottlenecks exist, and how reform efforts are progressing.

Following a prior analysis I wrote on Balochistan’s role in global critical mineral competition, PMIF invited me to attend the forum as an industry analyst. I accepted on the condition that my reporting would extend beyond the two-day event. There are no advance approval rights over editorial content, no restrictions on critical analysis, and no compensation tied to published coverage.

For MINING.COM readers, the value of this series will not be in promotional narrative. It will be in clarity. Frontier-market mining carries the risk of being often undervalued because institutional realities are poorly understood. Investors see resource size and capex projections. They see political endorsements. They rarely see the administrative mechanics that determine timelines.

Ground View will focus on those mechanics.

If Pakistan can demonstrate that federal and provincial coordination is improving, that regulatory processes are becoming predictable, and that infrastructure planning aligns with project development, it will strengthen its case as a serious mining jurisdiction. If gaps remain, those are equally important to understand.

The global energy transition depends on new copper and critical mineral supply. The question is not whether deposits exist. It is whether institutions can deliver them.

This series begins on the ground in Pakistan.

** Erik Groves is a contributing analyst for MINING.COM and Corporate Strategy and In-House Counsel at Morgan Companies.*The views and opinions expressed in this column are those of the author and do not necessarily reflect the official position of MINING.COM or The Northern Miner Group.

0

Comments

Want to join the conversation?

Loading comments...