🎯Today's Global Economy Pulse

Updated 24m agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 11, 2026

Except Trump, Nobody Has Stated India's Refusal to Buy Russian Oil: FM Lavrov

Foreign Minister Sergei Lavrov told the Russian Duma that only U.S. President Donald Trump has claimed India will cease buying Russian oil, and no Indian official has made such a statement. Lavrov highlighted India’s new BRICS chairmanship and its focus on energy security, while noting the deepened strategic partnership forged during President Vladimir Putin’s December 2025 state visit. The United States, meanwhile, has imposed tariffs and sanctions aimed at curbing Russian oil sales to India and other strategic partners. India’s foreign secretary reiterated a policy of diversified crude sources to safeguard supply stability.

By ET EnergyWorld (The Economic Times)

News•Feb 11, 2026

Govt Urges Refiners to Prioritise US, Venezuelan Crude Amid Evolving Trade Ties: Report

India has urged its state‑owned refiners to give priority to crude from the United States and Venezuela as part of a broader effort to diversify supplies and reduce reliance on Russian oil. The government’s suggestion applies to spot‑market tenders for...

By ET EnergyWorld (The Economic Times)

News•Feb 11, 2026

Kremlin Says Russia Will Seek Clarification From US on Venezuela Oil Restrictions

The U.S. Treasury issued a general license for Venezuelan oil and gas exploration that explicitly excludes Russian and Chinese entities, tightening restrictions on Moscow’s energy interests. Kremlin spokesman Dmitry Peskov said Russia will seek clarification from Washington to protect its substantial...

By ET EnergyWorld (The Economic Times)

News•Feb 11, 2026

Nickel Price Jumps as Indonesia’s Top Mine Cuts Output

Indonesia ordered the world’s largest nickel mine, PT Weda Bay, to cut its ore quota from 42 million tonnes to 12 million tonnes for 2024, aiming to tighten global supply. The LME nickel price rose 2 percent to $17,835 a tonne, extending a rally of...

By MINING.com

Social•Feb 11, 2026

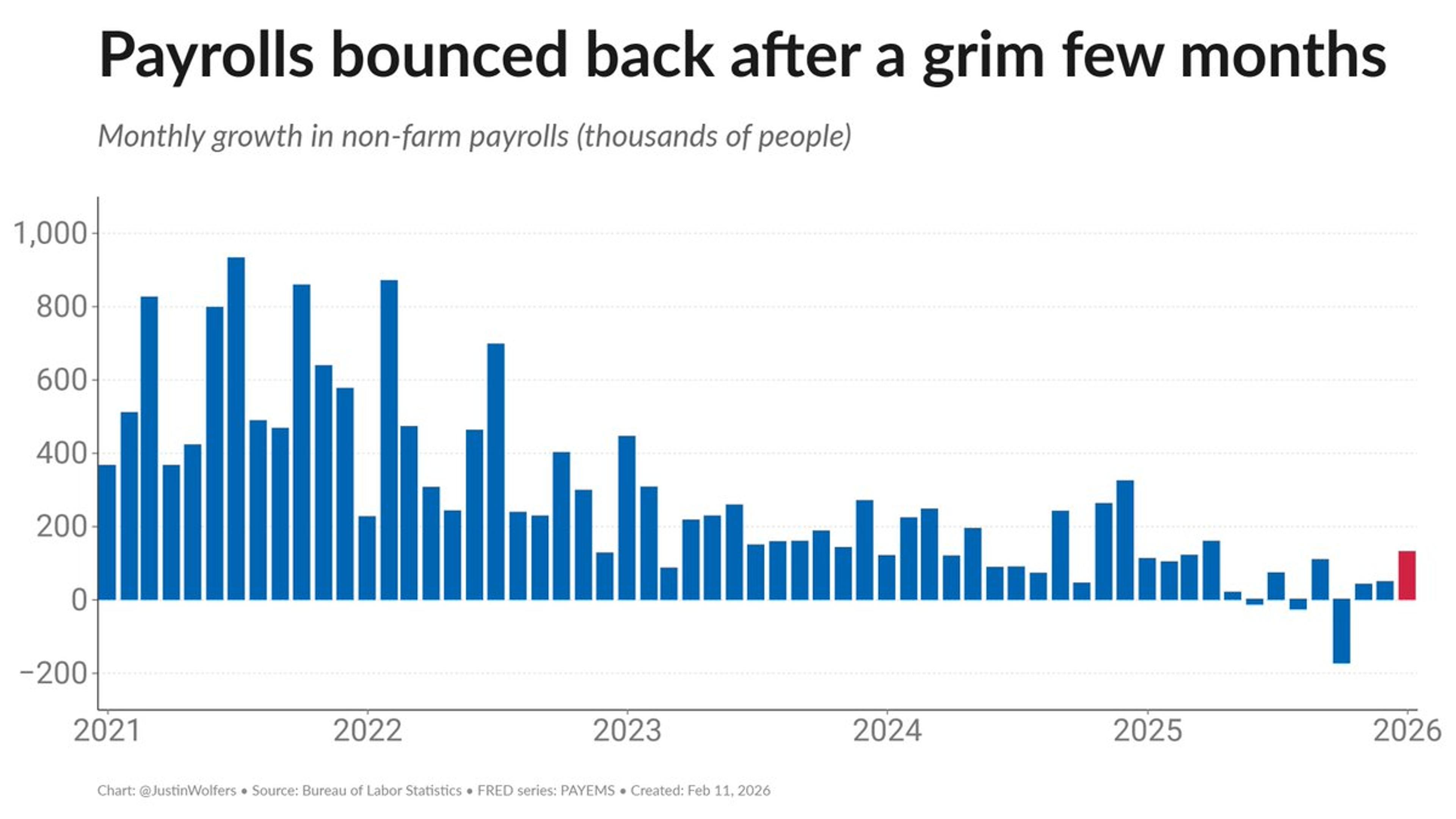

NEC Director Predicts Slightly Lower Jobs, NFP May Miss Forecast

https://t.co/k2T7oPbMh8 In an interview with CNBC on Monday (February 9, 2026), Kevin Hassett, the Director of the National Economic Council, advised markets to expect "slightly smaller job numbers" in the coming months. These remarks, have led many to speculate that the January...

By Boris Schlossberg

News•Feb 11, 2026

Moldova. EU – Yes; CIS – No; Unirea – Not This Time

Moldova announced its formal exit from the Commonwealth of Independent States, signaling a decisive break from a key Russian‑linked institution. At the same time, Chişinău is accelerating its integration with the European Union under President Maia Sandu’s pro‑Western agenda. Public...

By Defence24 (Poland)

News•Feb 11, 2026

What's Driving Northern Ireland's Falling Fuel Prices?

Petrol prices in Northern Ireland have fallen to 124.2 pence per litre, the lowest level in five years, while diesel holds steady at 131.9 pence. The decline follows a global oil oversupply and easing geopolitical tensions after the 2022 price spike triggered...

By BBC News – Business

Social•Feb 11, 2026

Jobs Report Day Shows Record Forecast Divergence

Good morning and welcome to Jobs Report Day in the US. The consensus forecasts are for a monthly employment gain of 65,000, an unemployment rate of 4.4%, and a 3.7% annual increase in average hourly earnings. As we head into this release,...

By Mohamed El‑Erian

Social•Feb 11, 2026

January Jobs Surge: Payrolls +130k, Unemployment at 4.3%

Payrolls rose a very healthy +130k in January, and unemployment fell a tick to 4.3 percent. Revisions subtracted -17k from the past two months, so not much there. This is the healthiest jobs report we've seen in a while. Keep your fingers...

By Justin Wolfers

News•Feb 11, 2026

An FTA No One Is Talking About Can Give India a Strategic Edge

The India‑Chile free trade negotiations are moving toward a Comprehensive Economic Partnership Agreement that explicitly includes critical minerals such as lithium, copper, and cobalt. Chile’s abundant reserves could supply India’s “Make in India” and clean‑energy ambitions, while recent moves by...

By ET EnergyWorld (The Economic Times)

Social•Feb 11, 2026

Trump's Blockade Halts Cuba's Jet Fuel Exports

#CubaWatch 🇨🇺: Thanks to Trump’s blockade, Cuba can no longer supply jet fuel to international airlines. Stay tuned. https://t.co/I5GxUM3wGq

By Steve Hanke

Social•Feb 11, 2026

Europe Trades Russian Gas for US LNG, Risks New Dependency

“I think Greenland was a wake-up call. There is more talk [in Brussels] about replacing one dependency with another.” This is what I told the Wall Street Journal about Europe’s increasing dependence on US LNG following the end of Russian...

By Jan Rosenow

News•Feb 11, 2026

HMM Stays in the Black in Q4

South Korean carrier HMM posted a Q4 2025 net profit of KRW 364 billion, a 59.9% plunge from the prior period, while revenues fell 14.2% to KRW 2.71 trillion. The full‑year results showed a 50.3% profit drop to KRW 1.88 trillion as container freight rates slumped 49%...

By Seatrade Maritime

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler

Social•Feb 11, 2026

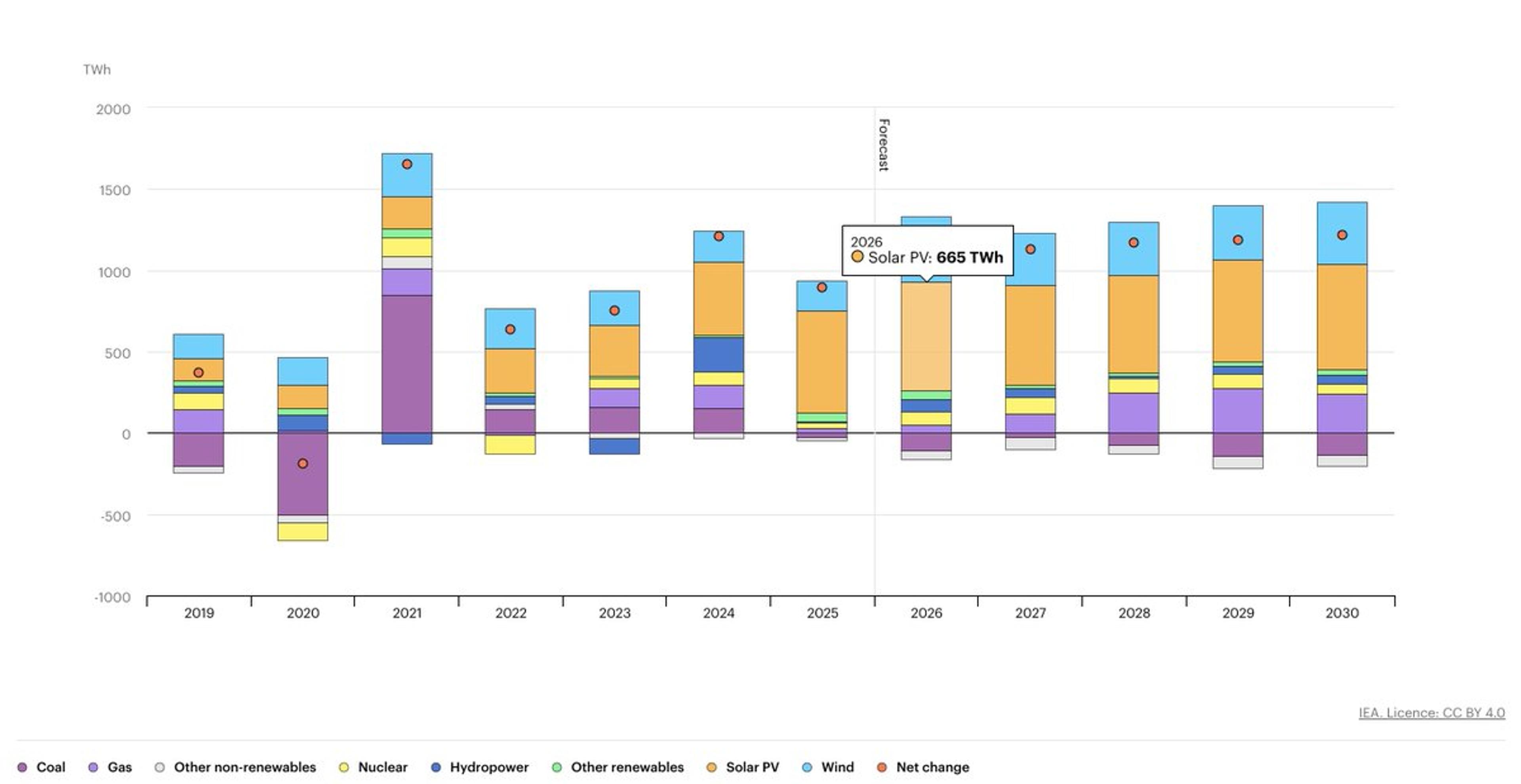

Emerging Economies Drive 80% of Electricity Growth

A new report shows that global electricity demand will increase at an average annual rate of 3.6% between 2026 and 2030. Emerging economies will account for nearly 80% of additional electricity consumption through 2030. More here: https://t.co/ZtTGSlWOMx https://t.co/dw82OPRKGw

By Damilola Ogunbiyi

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-22113258881-f6461155210747d09aa8a6f5ea26c0cd.jpg)

News•Feb 10, 2026

Trump Expects An Economic Miracle From The New Fed Chair

President Donald Trump urged his Fed chair pick, Kevin Warsh, to deliver 15% annual GDP growth, a target rarely achieved outside wartime. The president’s demand follows criticism of current chair Jerome Powell and calls for aggressive rate cuts. Economists note...

By Investopedia — Economics

Social•Feb 11, 2026

India Plans to Lift Bank FDI Cap, Boosting Lending

India’s government is considering raising the foreign direct investment (FDI) cap for banks from 20% to 49%. SMART MOVE. MORE FDI = MORE BANK CAPITAL = MORE LENDING CAPACITY https://t.co/agaPK9vbzO

By Steve Hanke

Social•Feb 11, 2026

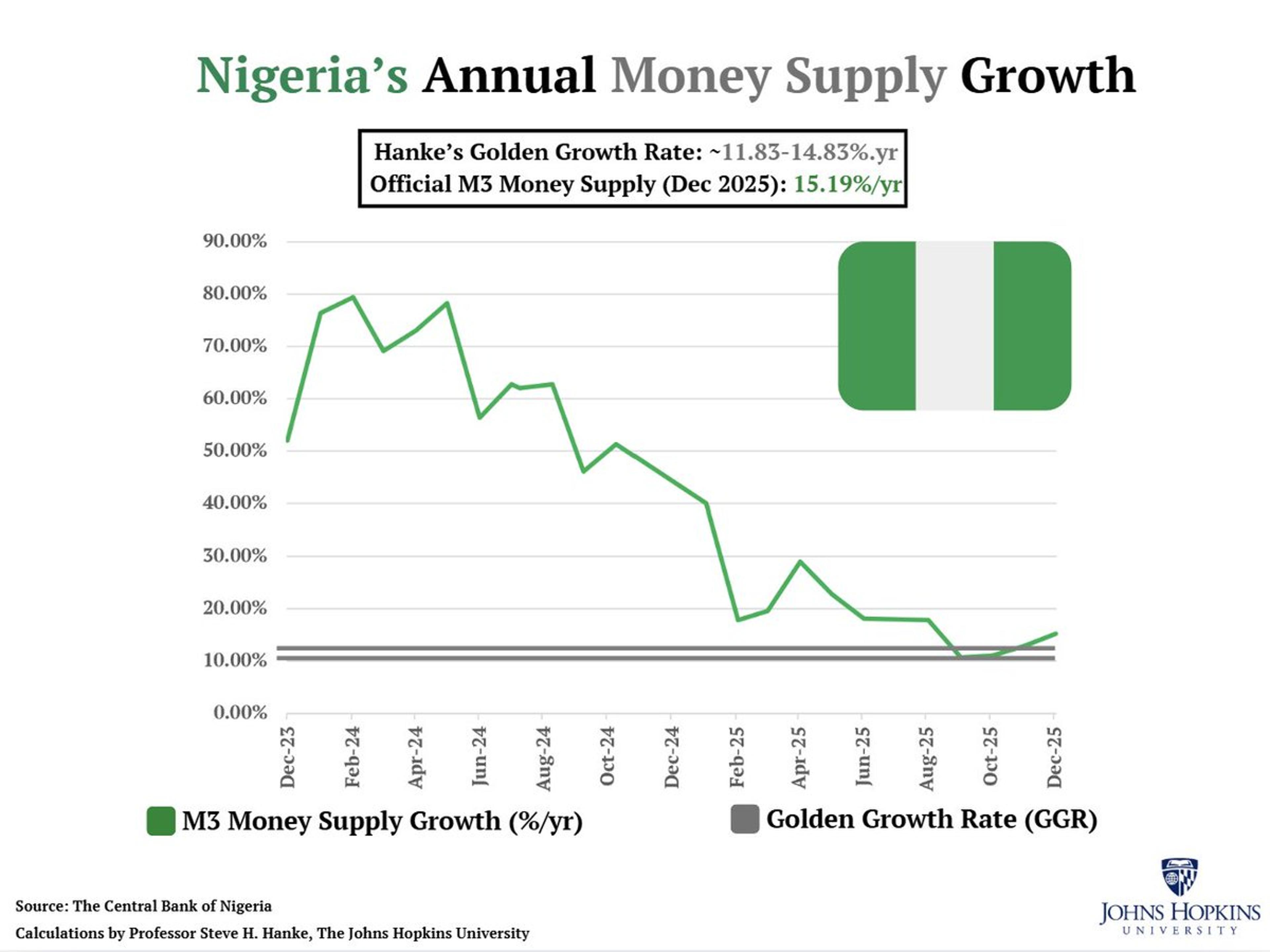

Nigeria's Inflation Surge Linked to Excess Money Supply

Nigeria’s inflation rate is DOUBLE NGA’s inflation target at 15.29%/yr. Nigeria’s money supply is growing at 15.19%/yr, ABOVE Hanke's Golden Growth Rate of ~11.83%-14.83%/yr, a rate consistent with Nigeria’s 6%-9%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/367h7H4ytf

By Steve Hanke

News•Feb 10, 2026

Beyond Blocs

The article argues that the world is moving beyond bloc politics toward issue‑based cooperation, with Europe seeking strategic autonomy while engaging China on a case‑by‑case basis. Recent high‑level visits to Beijing by European and other leaders underscore this shift. Trade...

By Foreign Policy

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

News•Feb 10, 2026

Wrapped Helps Spotify Add Users Despite Artists' Criticism over Fees

Spotify reported a surge in paid subscribers, adding 9 million to reach 290 million in the last quarter of 2025, driving net profit to €1.17 bn and total revenue to $4.5 bn. The company’s annual Wrapped campaign engaged over 300 million users and generated 630 million social...

By BBC News – Business

Social•Feb 10, 2026

Unemployment Rises to 4.5%, Signaling Market Underperformance

"So what does the job market data say to you?" "It says that we're underperforming right now... The thing that matters most to people's lives is the unemployment rate. Can you find work? And that was as low as...

By Justin Wolfers

News•Feb 10, 2026

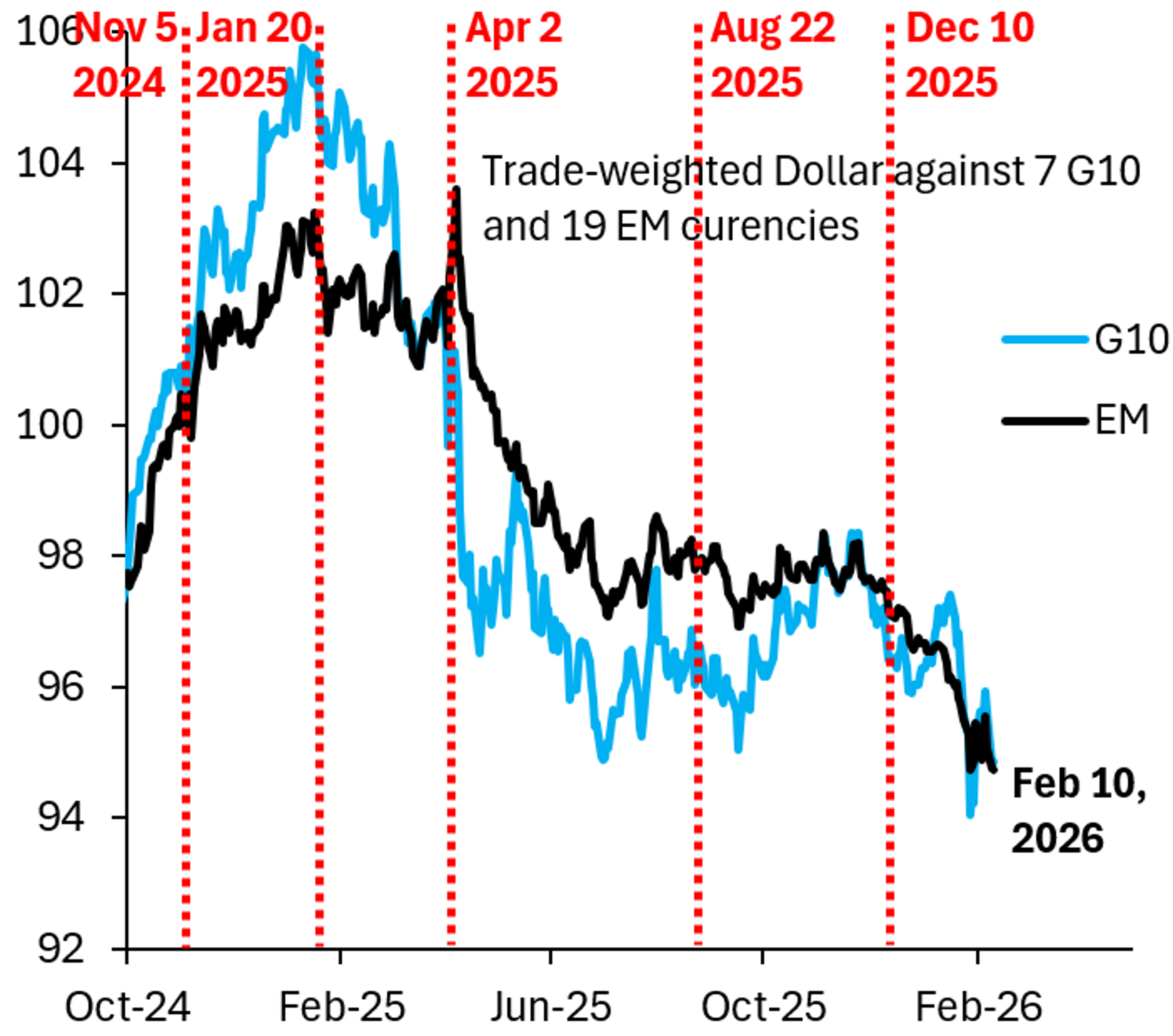

Is a Dollar Vibe Shift Under Way?

The Atlantic Council’s GeoEconomics Center podcast explores whether a sustained dollar depreciation is emerging. Host Dan McDowell explains how a weaker greenback could reshape U.S. trade balances, investment flows, and national‑security calculations. The discussion highlights potential benefits for exporters alongside higher...

By Atlantic Council

News•Feb 10, 2026

Uranium Market Gathers Momentum in 2026: Sprott

Uranium spot prices surged above $100 per pound in January 2026, the first breach of that level in two years, signaling renewed market vigor. Sprott Asset Management, a major buyer, added 4 million lb to its fund this year, bringing total holdings...

By MINING.com

News•Feb 10, 2026

US Antimony, Americas Gold to Jointly Build Idaho Plant

United States Antimony and Americas Gold have formed a 51-49 joint venture to construct a hydrometallurgical processing plant in Idaho’s Silver Valley. The facility will treat antimony feed from Americas Gold’s Galena complex and could handle additional sources, aiming to...

By MINING.com

News•Feb 10, 2026

First Quantum Credit Outlook Improves on Cobre Panama Progress

S&P Global Ratings upgraded First Quantum Minerals' credit outlook to positive, citing tangible progress toward restarting the Cobre Panama copper mine. The agency now expects the mine to resume operations in the first half of 2026, with a production ramp‑up later...

By MINING.com

Social•Feb 10, 2026

Dollar Weakening as Diverging Policies Boost Global Assets

I keep playing through the potential outcomes over the coming months and I have a very difficult time painting a bull case for the dollar. I expect: 1. Monetary policy divergence widens (more dovish US vs RoW/Japan) 2. Capital flight risk as...

By Quinn Thompson

News•Feb 10, 2026

Behind Putin’s $15 Billion Arms Revenue Claim

Russian President Vladimir Putin announced that arms exports generated roughly $15 billion in foreign‑exchange earnings in 2025 and that more than 340 cooperation projects are slated for 2026‑2028. Independent analysts caution that Russia’s defence‑sector data are opaque, making the figure difficult...

By Defence24 (Poland)

News•Feb 10, 2026

Pacific Container Spot Rates Plunge Ahead of Contract Season

Spot rates on Pacific container lanes have slumped ahead of the annual contract season, with eastbound transpacific prices to the U.S. West Coast falling below $1,700 per FEU and some offers as low as $1,400. The slowdown follows a delayed...

By Seatrade Maritime

News•Feb 10, 2026

Diamond Slump Pushes Botswana to Broaden Mining Base

A deep slump in diamond prices is forcing Botswana, the world’s top diamond producer by value, to broaden its mining portfolio. The government announced plans to explore copper, cobalt and other critical minerals, noting that only about 30% of its...

By MINING.com

News•Feb 10, 2026

Mining Corridors as Catalysts: Building on the Lobito Model

In December 2025 the United States and the Democratic Republic of Congo signed a strategic partnership that gives Washington preferential access to Congolese mineral deposits. The article argues that the next step is building logistics corridors, using the Lobito Corridor—linking...

By Atlantic Council

News•Feb 10, 2026

Zanaga Iron Lines up $25M in Deal with Red Arc

Zanaga Iron (LON:ZIOC) signed a binding term sheet with Red Arc Minerals for an initial up‑to‑$25 million cash tranche to finance engineering and pre‑production work on its Congolese iron‑ore project. The agreement gives Red Arc a 20% stake in the project’s subsidiary Jumelles,...

By MINING.com

Social•Feb 10, 2026

Dollar vs EM Hits New Low, Signaling Further Weakness

The Dollar versus EM today is down to a new low, which is below its level 2 weeks ago at the height of Greenland headlines. It's the Dollar versus EM you want to watch for future direction. The signal it's...

By Robin Brooks

Social•Feb 10, 2026

Detroit Bridge Owner Lobbies Hours Before Trump Critic

SCOOP: Detroit Billionaire Owner of Ambassador Bridge Lobbied Administration, Met With Howard Lutnick Monday, Hours Before Trump Lambasted New Detroit-Michigan Gordie Howe Bridge w/ @tylerpager #cdnpoli https://t.co/A1JpN7GgU0

By Matina Stevis-Gridneff

News•Feb 10, 2026

BP Steps up Cost Cutting as Profits Slide

BP reported 2025 earnings of $7.5 bn, a 15% drop from the previous year, as crude prices fell roughly 20%. The oil major lifted its cost‑saving goal to $5.5‑$6.5 bn by the end of 2027, up from a $5 bn ceiling, and halted...

By BBC News – Business

Social•Feb 10, 2026

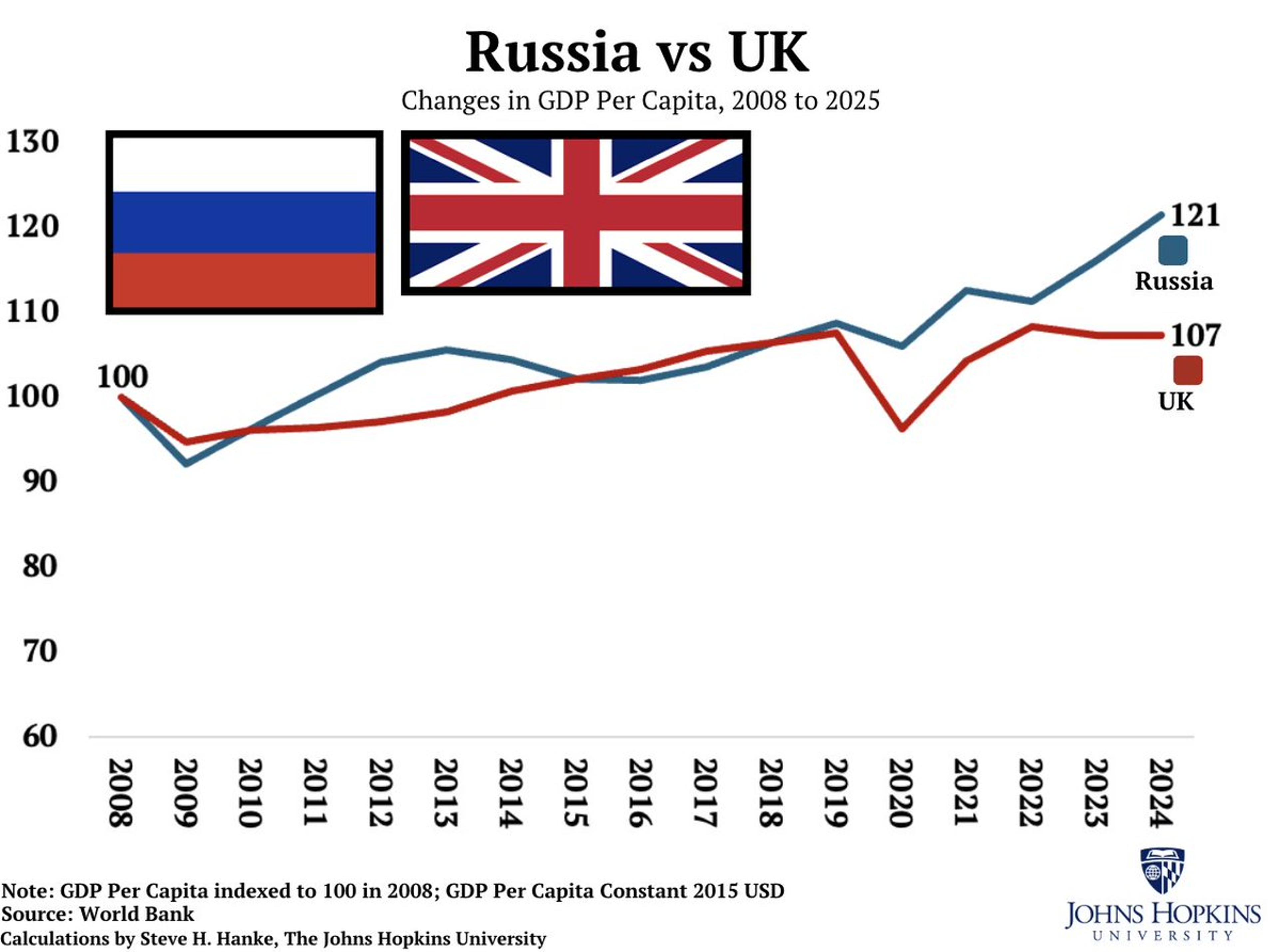

Russia's Economy Outpaces UK Despite Sanctions

A dirty little secret that the Russiaphobes in London keep under the rug: RUSSIA’S ECONOMY IS OUTPACING THE UK’S. SANCTIONS = BACKFIRE = RARELY WORK. https://t.co/FLcUb0QXGw

By Steve Hanke

Social•Feb 10, 2026

US Political Will to Aid Venezuela Near Zero

Distinguished Columbia Univ. Professor Jeff Sachs on Venezuela: “The will to run Venezuela other than maybe in Marco Rubio's and Donald Trump's head is zero in the United States… a year from now, Venezuela is a forgotten issue in the United...

By Steve Hanke

News•Feb 10, 2026

Welcome to 2036: What the World Could Look Like in Ten Years, According to Nearly 450 Experts

An Atlantic Council survey of 447 experts from 72 nations paints a bleak picture of the world in 2036. Most respondents expect China to become the top economic power, while the United States retains military superiority, creating a bipolar or...

By Atlantic Council

Social•Feb 10, 2026

Climax Top Signals Bear Market for Precious Metals

OUT NOW - @BergMilton on: - clear sign of "climax top" in gold & silver - why he expects a precious metals bear market - S&P 500, Bitcoin, Software + Korean stocks & more Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi 1/3 https://t.co/U3F0Pxojhy

By Jack Farley

Social•Feb 10, 2026

New BLS Commissioner Signals Positive Economic Outlook Amid Trump

I'm trying something new: Video essays exploring recent economic developments. There's... a lot to talk about these days. Here's the first one: Thoughts on Trump, the BLS, and the new BLS Commissioner. Spoiler: This is a good news story. https://t.co/M4NltoNXJR

By Justin Wolfers

Social•Feb 10, 2026

U.S. Stocks Under Pressure as SPX/VEU Hits Near Two‑Year Low

The 'sell America' trade pressure seems to be picking up again. The SPX-VEU (rest of world equity ETF) ratio is the lowest since April 22nd. A little further and it is a two year low. Adding the DXY Dollar Index in for...

By John Kicklighter

Social•Feb 10, 2026

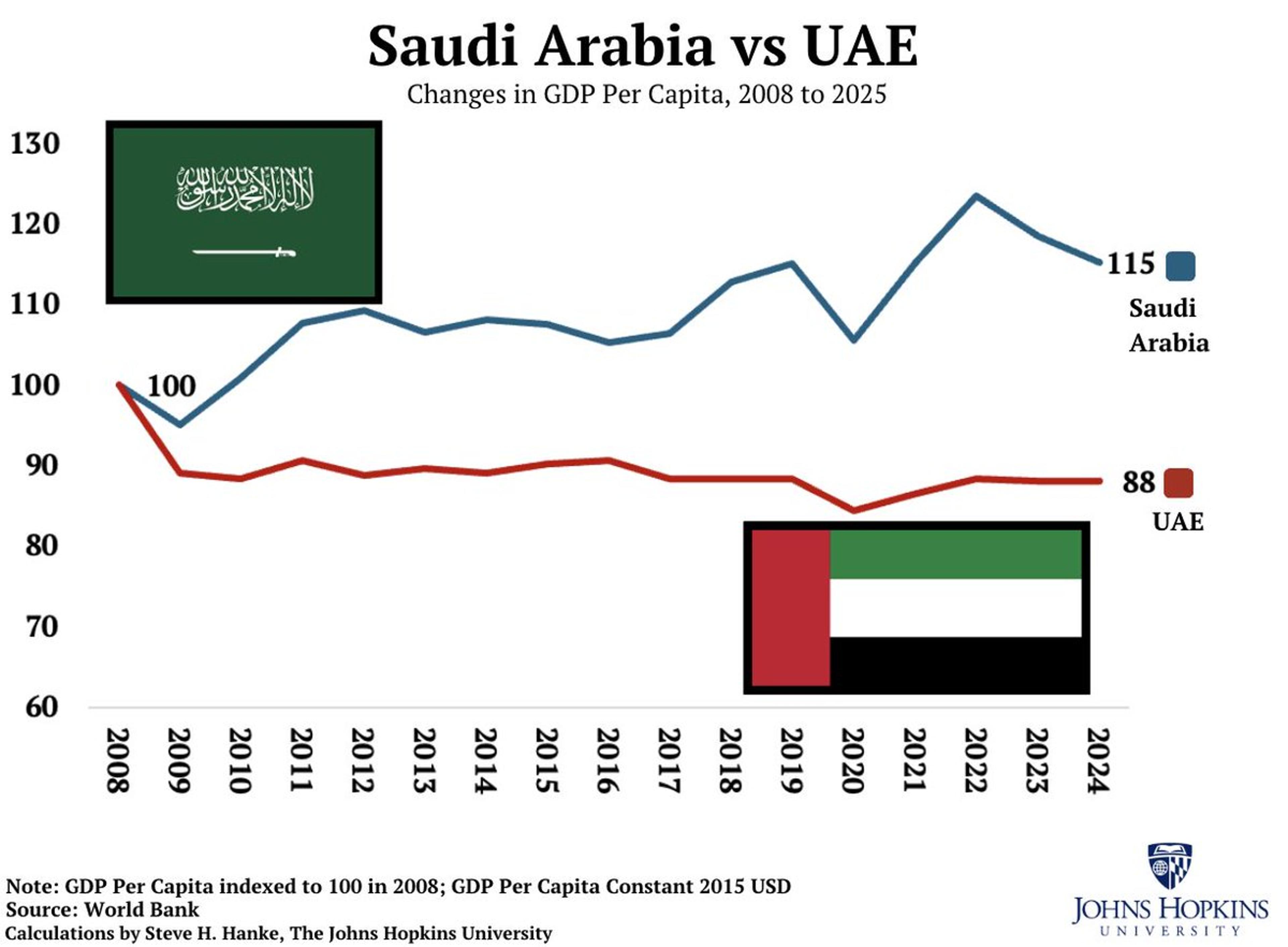

UAE’s GDP per Capita Fell, Saudi Arabia Modestly Rose

The headlines from the UAE always scream “Hot Growth.” But when compared to its arch-rival, Saudi Arabia, the UAE looks dreadful. Since 2008, the UAE’s GDP per capita shrank while the Kingdom’s grew modestly. https://t.co/aXuH6QU5nj

By Steve Hanke

Social•Feb 10, 2026

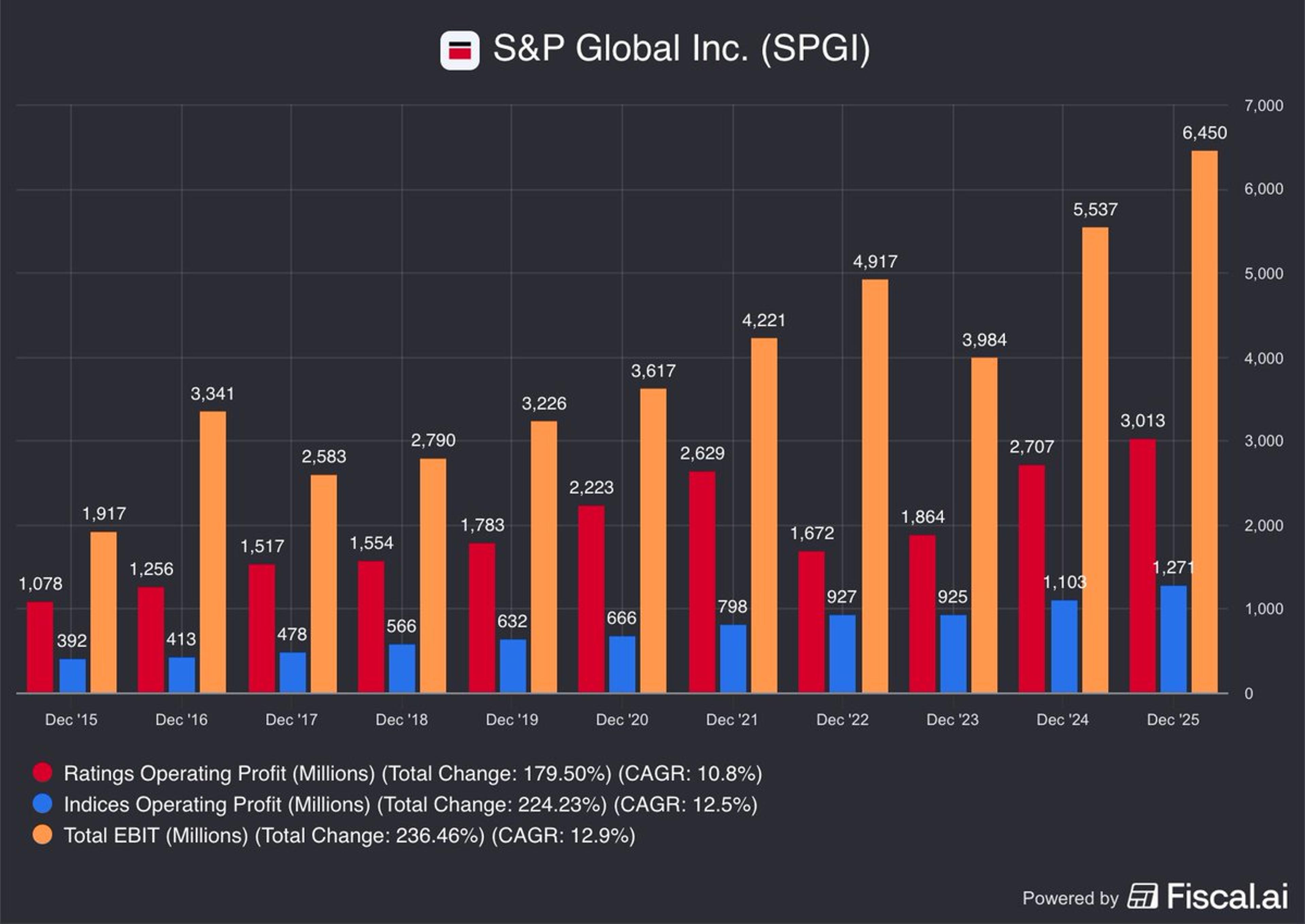

AI Threatens S&P's Analytics, Not Its Core Ratings

About 65% of $SPGI's (down >20% over past month) pre-tax earnings come from ratings & indices. The potential challenge that AI poses to S&P's analytics/consulting/intel business is something I get. But I don't understand AI's bear case for ratings & indices,...

By Jack Farley

Social•Feb 10, 2026

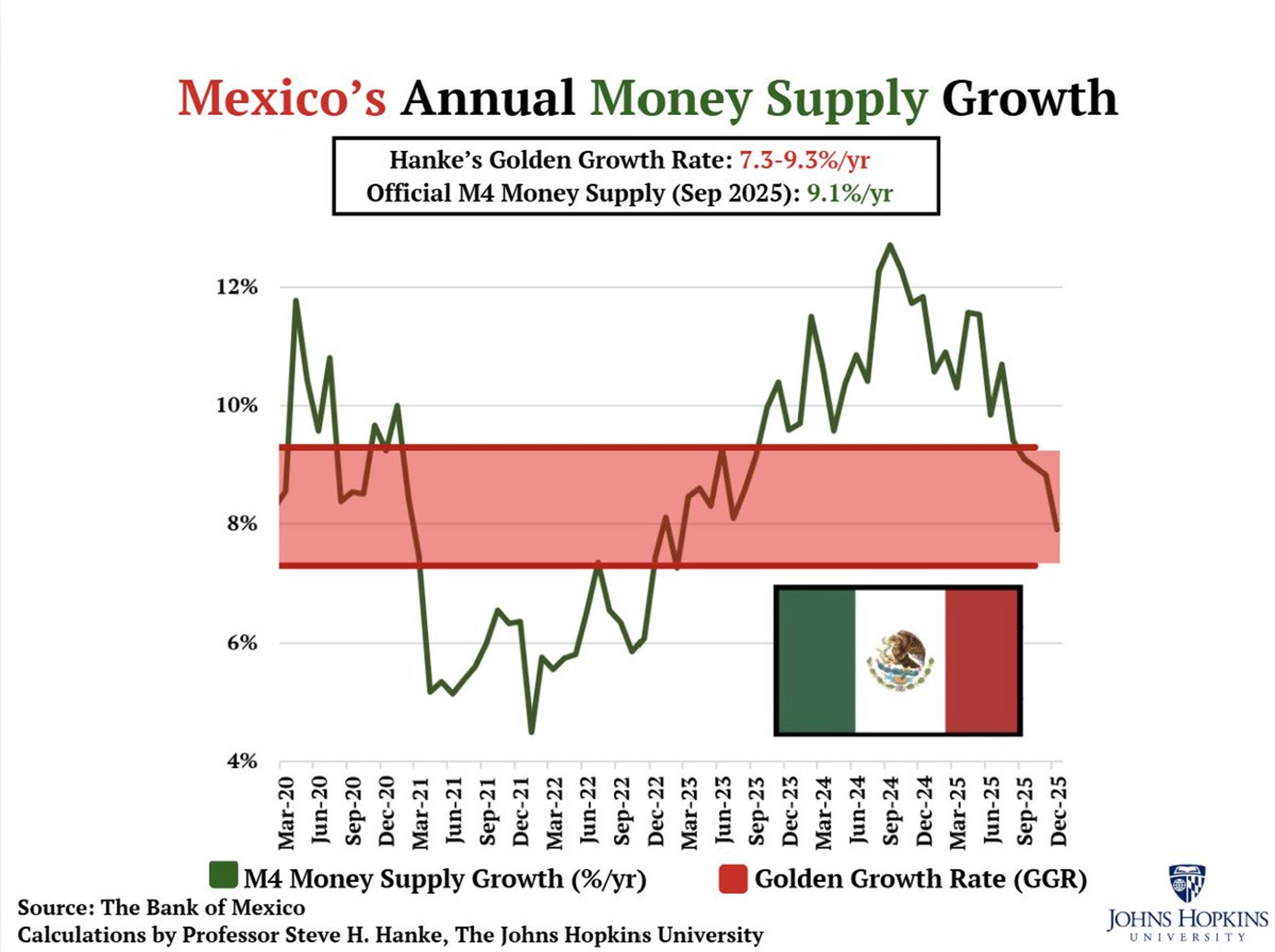

Mexico's Inflation On Target, Money Supply Within Golden Growth

Mexico’s inflation rate is ON TARGET at 3.65%/yr Mexico’s money supply (M4) is growing at 7.91%/yr, WITHIN Hanke's Golden Growth Rate of ~7.3%-9.3%/yr, a rate consistent with Mexico’s 2%-4%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/4w05Yr94Mz

By Steve Hanke

Social•Feb 10, 2026

Weak Retail, Slowing Wages Hint at Poor NFP

Bad retail sales, falling wage growth and now Hassett and Navarro comments implying bad NFP tomorrow...

By Quinn Thompson

Social•Feb 10, 2026

US Stocks Look Strong, Yet Lag Global Peers

"The US stock market, while it looks strong, is actually much weaker than almost any other industrialized country.... So while we're doing well… everyone else is doing even better." https://t.co/7KavXe5LXh

By Justin Wolfers

Social•Feb 10, 2026

Dollar Stabilizes, Still Strong vs G10; Yen Diverges

Greenback Consolidates after Yesterday's Shellacking: After yesterday’s sharp losses, the US dollar is mostly consolidating with a firmer bias against the G10 currencies. The yen is the exception. The unexpected post-election gains have been extended… https://t.co/s4awtQJ5o7 https://t.co/Xlf89Ydd1E

By Marc Chandler

Social•Feb 10, 2026

AI Cheapens Services, Cutting Vendor Profits, Boosting Productivity

That little market freakout is a real mechanism: if AI makes it cheap to do what a vendor used to sell you, the vendor’s future profits fall—even as the rest of us get more productive. https://t.co/HE7npk5km7

By Justin Wolfers

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler