🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 10, 2026

Wrapped Helps Spotify Add Users Despite Artists' Criticism over Fees

Spotify reported a surge in paid subscribers, adding 9 million to reach 290 million in the last quarter of 2025, driving net profit to €1.17 bn and total revenue to $4.5 bn. The company’s annual Wrapped campaign engaged over 300 million users and generated 630 million social shares across 56 languages. CEO Gustav Söderström highlighted investments in AI‑enhanced audio, video podcasts, and audio e‑books as growth engines. Despite the financial upswing, the platform faces ongoing criticism from artists over royalty payouts, with recent boycotts from acts like Massive Attack.

By BBC News – Business

Social•Feb 10, 2026

Unemployment Rises to 4.5%, Signaling Market Underperformance

"So what does the job market data say to you?" "It says that we're underperforming right now... The thing that matters most to people's lives is the unemployment rate. Can you find work? And that was as low as...

By Justin Wolfers

News•Feb 10, 2026

Is a Dollar Vibe Shift Under Way?

The Atlantic Council’s GeoEconomics Center podcast explores whether a sustained dollar depreciation is emerging. Host Dan McDowell explains how a weaker greenback could reshape U.S. trade balances, investment flows, and national‑security calculations. The discussion highlights potential benefits for exporters alongside higher...

By Atlantic Council

News•Feb 10, 2026

Uranium Market Gathers Momentum in 2026: Sprott

Uranium spot prices surged above $100 per pound in January 2026, the first breach of that level in two years, signaling renewed market vigor. Sprott Asset Management, a major buyer, added 4 million lb to its fund this year, bringing total holdings...

By MINING.com

News•Feb 10, 2026

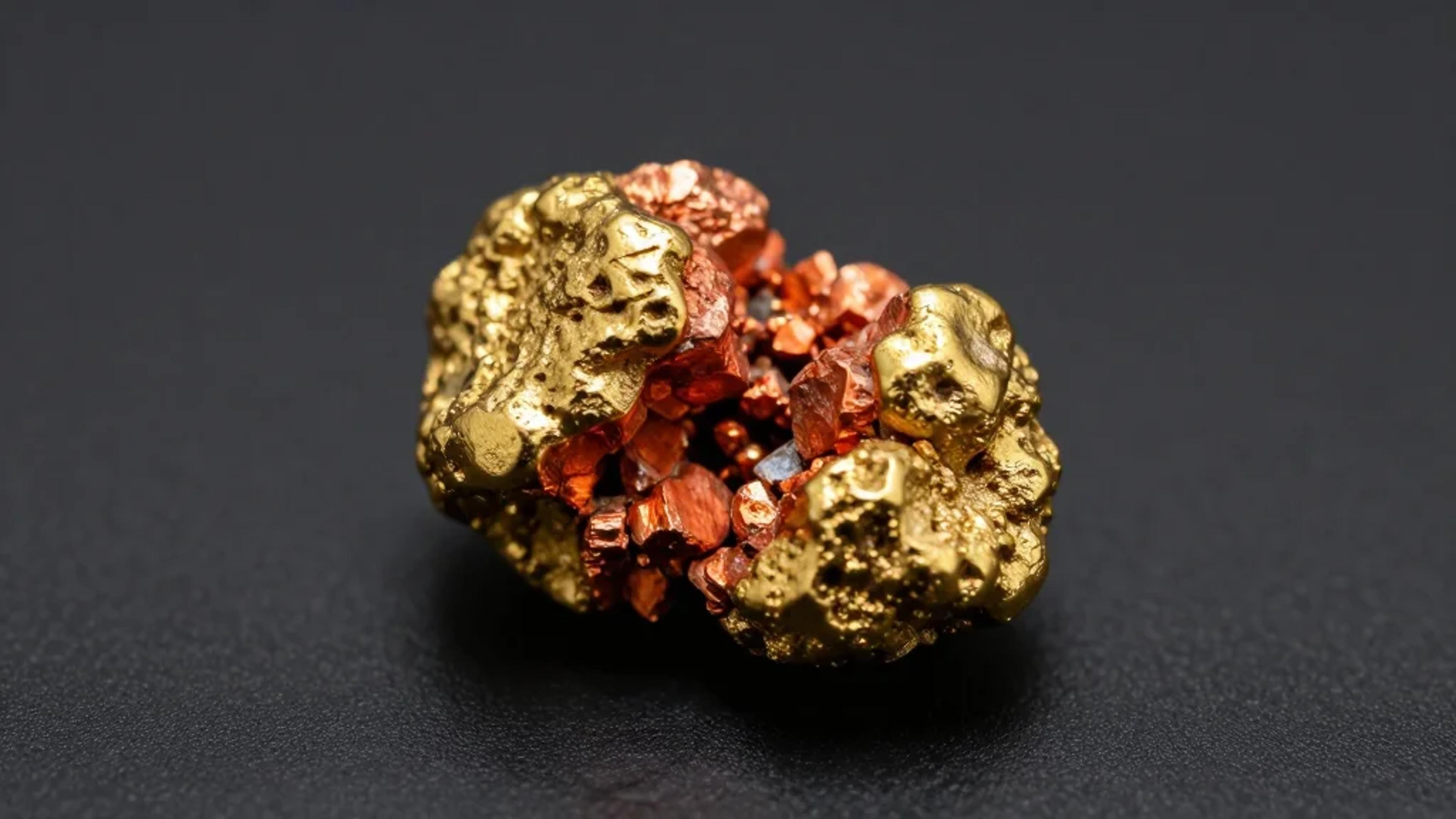

US Antimony, Americas Gold to Jointly Build Idaho Plant

United States Antimony and Americas Gold have formed a 51-49 joint venture to construct a hydrometallurgical processing plant in Idaho’s Silver Valley. The facility will treat antimony feed from Americas Gold’s Galena complex and could handle additional sources, aiming to...

By MINING.com

News•Feb 10, 2026

First Quantum Credit Outlook Improves on Cobre Panama Progress

S&P Global Ratings upgraded First Quantum Minerals' credit outlook to positive, citing tangible progress toward restarting the Cobre Panama copper mine. The agency now expects the mine to resume operations in the first half of 2026, with a production ramp‑up later...

By MINING.com

Social•Feb 10, 2026

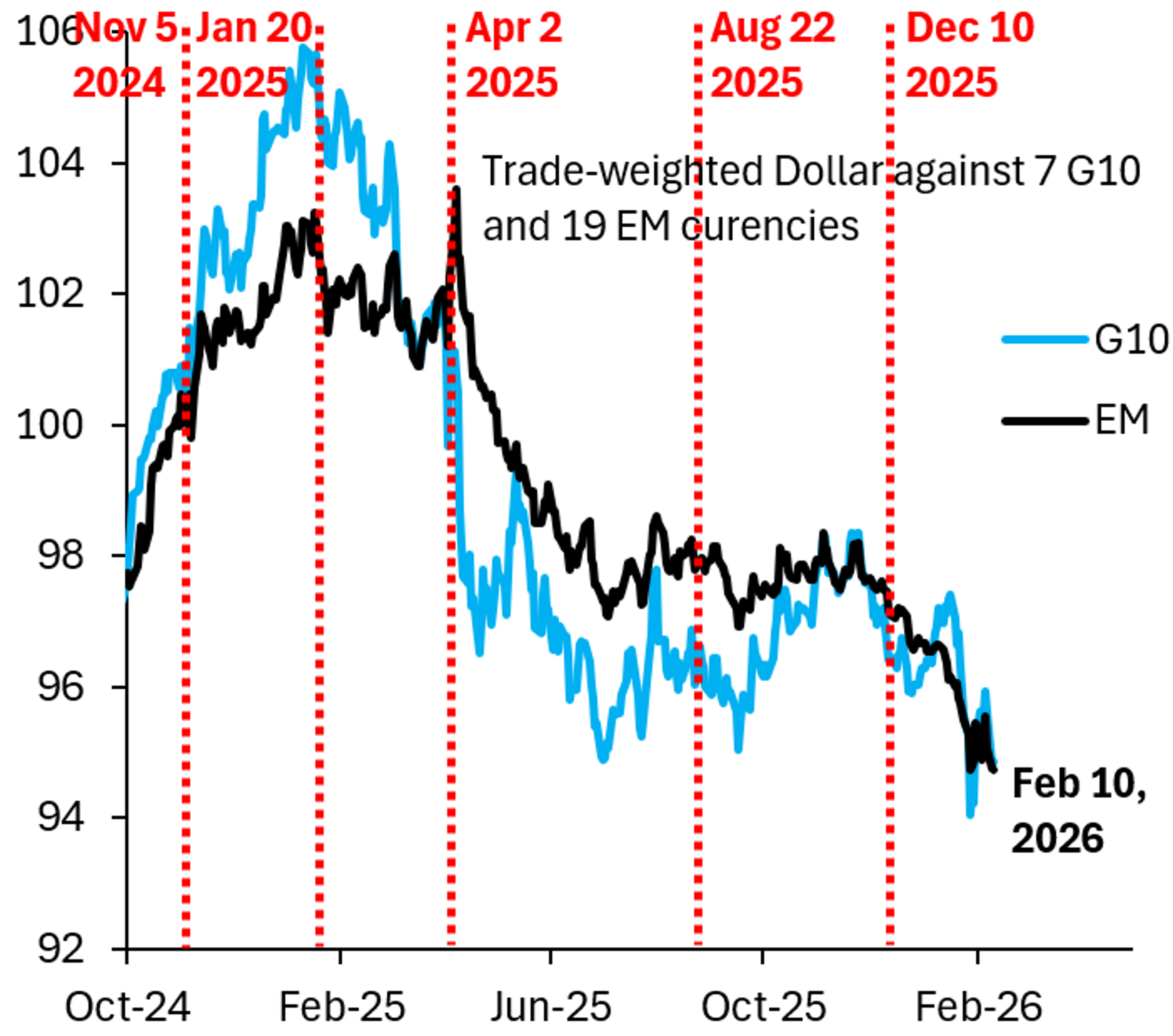

Dollar Weakening as Diverging Policies Boost Global Assets

I keep playing through the potential outcomes over the coming months and I have a very difficult time painting a bull case for the dollar. I expect: 1. Monetary policy divergence widens (more dovish US vs RoW/Japan) 2. Capital flight risk as...

By Quinn Thompson

News•Feb 10, 2026

Behind Putin’s $15 Billion Arms Revenue Claim

Russian President Vladimir Putin announced that arms exports generated roughly $15 billion in foreign‑exchange earnings in 2025 and that more than 340 cooperation projects are slated for 2026‑2028. Independent analysts caution that Russia’s defence‑sector data are opaque, making the figure difficult...

By Defence24 (Poland)

News•Feb 10, 2026

Pacific Container Spot Rates Plunge Ahead of Contract Season

Spot rates on Pacific container lanes have slumped ahead of the annual contract season, with eastbound transpacific prices to the U.S. West Coast falling below $1,700 per FEU and some offers as low as $1,400. The slowdown follows a delayed...

By Seatrade Maritime

News•Feb 10, 2026

Diamond Slump Pushes Botswana to Broaden Mining Base

A deep slump in diamond prices is forcing Botswana, the world’s top diamond producer by value, to broaden its mining portfolio. The government announced plans to explore copper, cobalt and other critical minerals, noting that only about 30% of its...

By MINING.com

News•Feb 10, 2026

Mining Corridors as Catalysts: Building on the Lobito Model

In December 2025 the United States and the Democratic Republic of Congo signed a strategic partnership that gives Washington preferential access to Congolese mineral deposits. The article argues that the next step is building logistics corridors, using the Lobito Corridor—linking...

By Atlantic Council

News•Feb 10, 2026

Zanaga Iron Lines up $25M in Deal with Red Arc

Zanaga Iron (LON:ZIOC) signed a binding term sheet with Red Arc Minerals for an initial up‑to‑$25 million cash tranche to finance engineering and pre‑production work on its Congolese iron‑ore project. The agreement gives Red Arc a 20% stake in the project’s subsidiary Jumelles,...

By MINING.com

Social•Feb 10, 2026

Dollar vs EM Hits New Low, Signaling Further Weakness

The Dollar versus EM today is down to a new low, which is below its level 2 weeks ago at the height of Greenland headlines. It's the Dollar versus EM you want to watch for future direction. The signal it's...

By Robin Brooks

Social•Feb 10, 2026

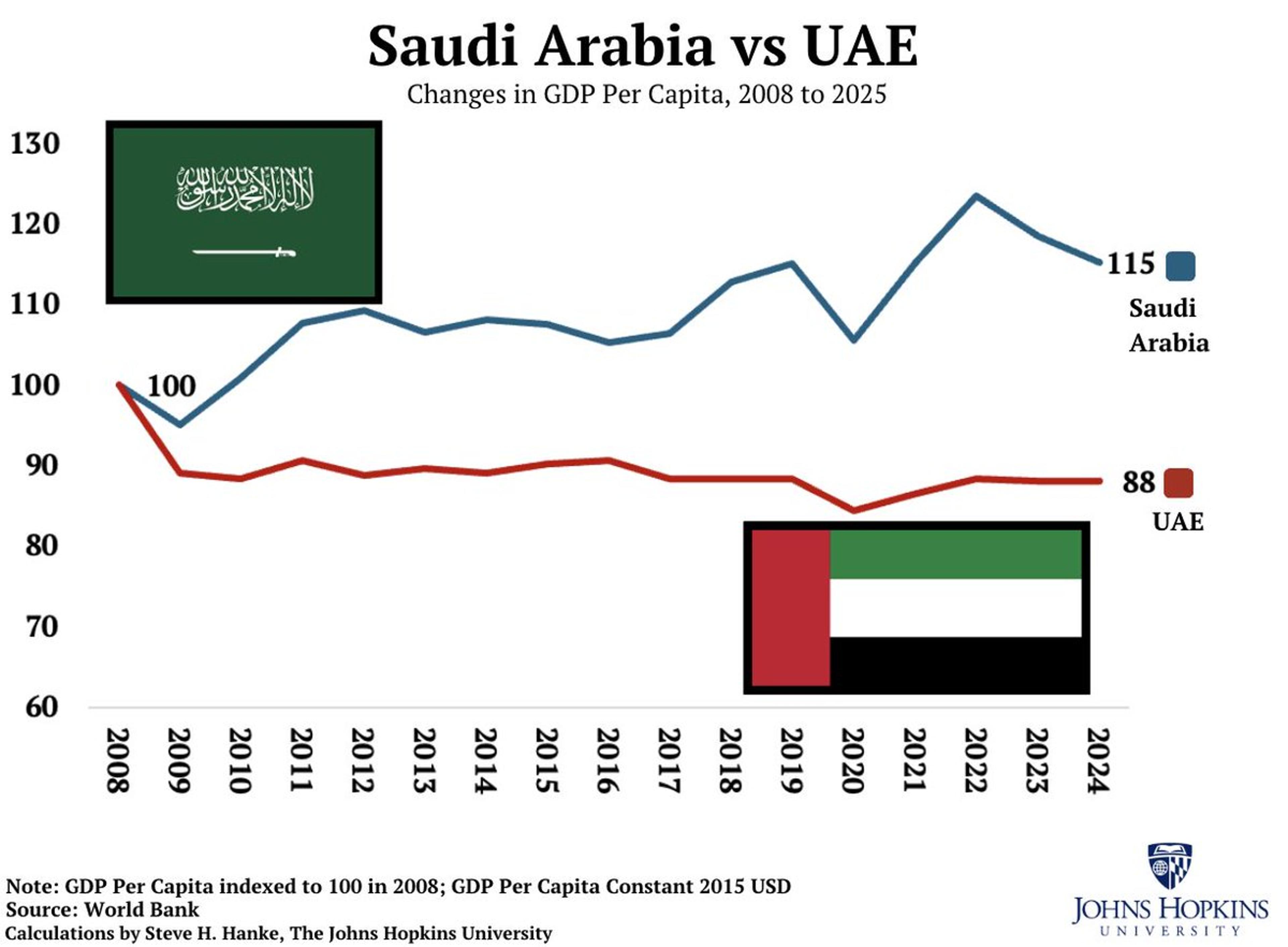

UAE’s GDP per Capita Fell, Saudi Arabia Modestly Rose

The headlines from the UAE always scream “Hot Growth.” But when compared to its arch-rival, Saudi Arabia, the UAE looks dreadful. Since 2008, the UAE’s GDP per capita shrank while the Kingdom’s grew modestly. https://t.co/aXuH6QU5nj

By Steve Hanke

News•Feb 10, 2026

BP Steps up Cost Cutting as Profits Slide

BP reported 2025 earnings of $7.5 bn, a 15% drop from the previous year, as crude prices fell roughly 20%. The oil major lifted its cost‑saving goal to $5.5‑$6.5 bn by the end of 2027, up from a $5 bn ceiling, and halted...

By BBC News – Business

Social•Feb 10, 2026

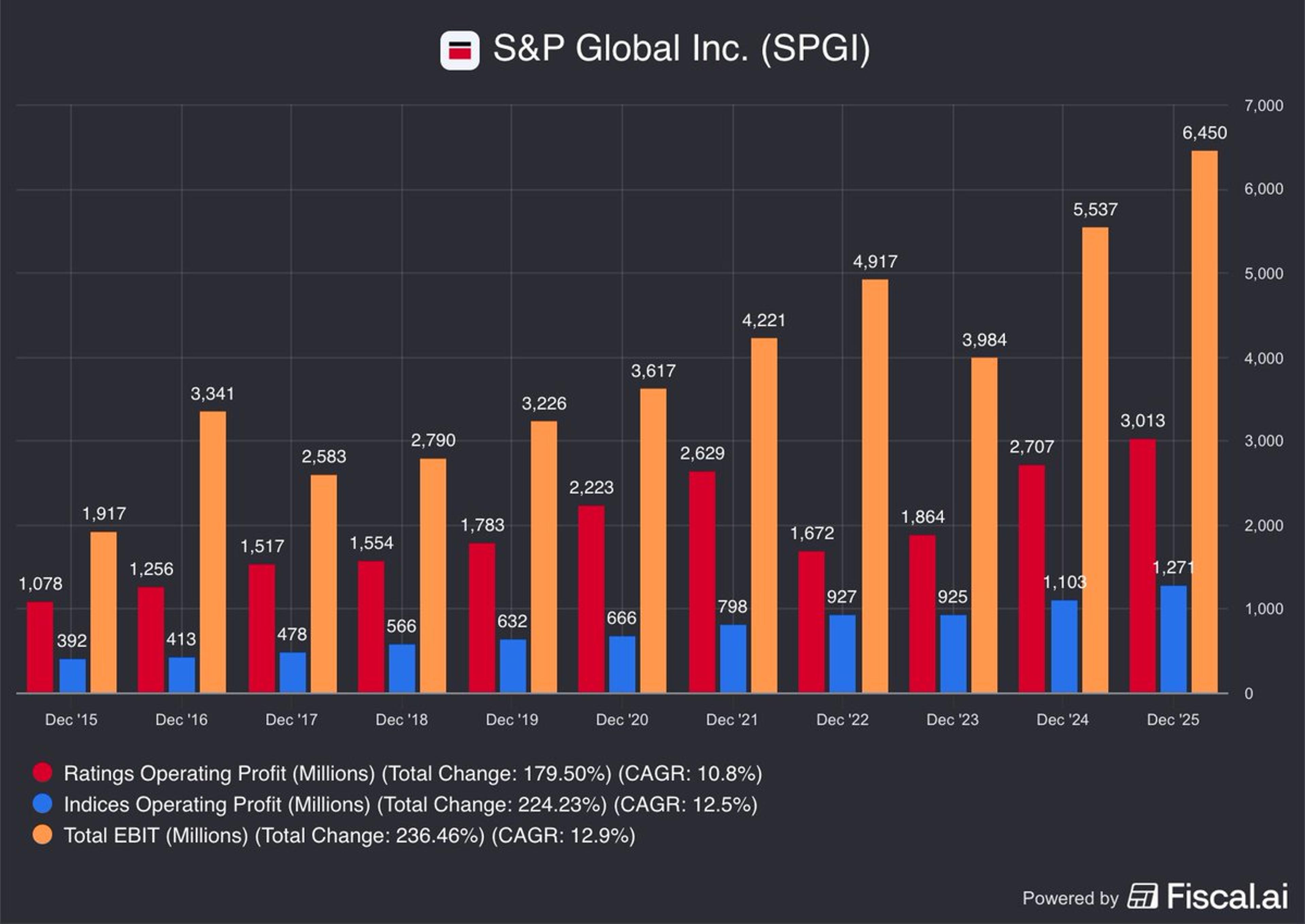

AI Threatens S&P's Analytics, Not Its Core Ratings

About 65% of $SPGI's (down >20% over past month) pre-tax earnings come from ratings & indices. The potential challenge that AI poses to S&P's analytics/consulting/intel business is something I get. But I don't understand AI's bear case for ratings & indices,...

By Jack Farley

Social•Feb 10, 2026

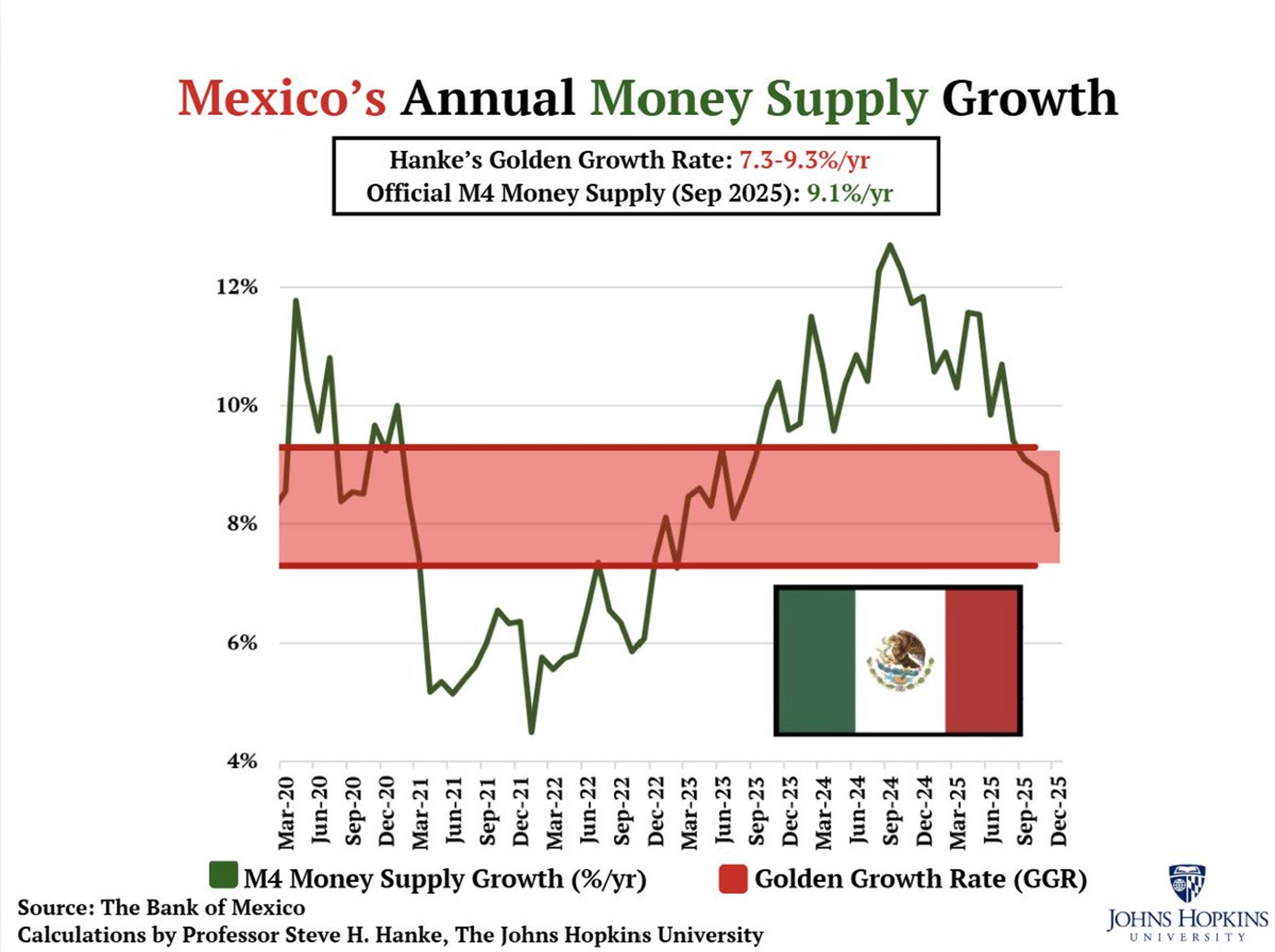

Mexico's Inflation On Target, Money Supply Within Golden Growth

Mexico’s inflation rate is ON TARGET at 3.65%/yr Mexico’s money supply (M4) is growing at 7.91%/yr, WITHIN Hanke's Golden Growth Rate of ~7.3%-9.3%/yr, a rate consistent with Mexico’s 2%-4%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/4w05Yr94Mz

By Steve Hanke

News•Feb 10, 2026

Welcome to 2036: What the World Could Look Like in Ten Years, According to Nearly 450 Experts

An Atlantic Council survey of 447 experts from 72 nations paints a bleak picture of the world in 2036. Most respondents expect China to become the top economic power, while the United States retains military superiority, creating a bipolar or...

By Atlantic Council

Social•Feb 10, 2026

Weak Retail, Slowing Wages Hint at Poor NFP

Bad retail sales, falling wage growth and now Hassett and Navarro comments implying bad NFP tomorrow...

By Quinn Thompson

Social•Feb 10, 2026

US Stocks Look Strong, Yet Lag Global Peers

"The US stock market, while it looks strong, is actually much weaker than almost any other industrialized country.... So while we're doing well… everyone else is doing even better." https://t.co/7KavXe5LXh

By Justin Wolfers

News•Feb 10, 2026

Cosco Debuts Beibu Gulf and Middle East Car Carrier Service

Cosco Shipping Car Carriers has launched a monthly ro‑ro liner linking the Beibu Gulf ports of Qinzhou and Nansha with the United Arab Emirates and Saudi Arabia. The service, operated by the vessel Cosco Shengshi, will transport roughly 2,000 commercial vehicles...

By Seatrade Maritime

Social•Feb 10, 2026

Dollar Stabilizes, Still Strong vs G10; Yen Diverges

Greenback Consolidates after Yesterday's Shellacking: After yesterday’s sharp losses, the US dollar is mostly consolidating with a firmer bias against the G10 currencies. The yen is the exception. The unexpected post-election gains have been extended… https://t.co/s4awtQJ5o7 https://t.co/Xlf89Ydd1E

By Marc Chandler

Social•Feb 10, 2026

AI Cheapens Services, Cutting Vendor Profits, Boosting Productivity

That little market freakout is a real mechanism: if AI makes it cheap to do what a vendor used to sell you, the vendor’s future profits fall—even as the rest of us get more productive. https://t.co/HE7npk5km7

By Justin Wolfers

News•Feb 10, 2026

CATL, Cornex, SolaX and Other Chinese Energy Storage Players in Multi-GWh International Agreements

Chinese energy‑storage giants are signing multi‑GWh deals worldwide, signalling a rapid international expansion in 2026. Cornex will deliver 5.5 GWh to Saudi Arabia, while CATL, together with Schroders Greencoat and Lochpine Capital, targets up to 10 GWh of European battery‑storage projects. Tianneng...

By Energy Storage News

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler

News•Feb 9, 2026

Elevra, Mangrove Lithium Ink Offtake MoU for NAL Project in Quebec

Elevra Lithium has signed a non‑binding MOU with Canada’s Mangrove Lithium to off‑take up to 144,000 tonnes of spodumene concentrate per year from the North American Lithium (NAL) project in Quebec. The supply would begin in 2028, scaling to full...

By MINING.com

Social•Feb 10, 2026

Macron Urges EU to Adopt Eurobonds Now

Emmanuel Macron: « Now is the time for the EU to launch a joint borrowing capacity, through eurobonds. » https://t.co/NqqbjjecXk

By Frederik Ducrozet

Social•Feb 10, 2026

Markets Could Slip If Data Undermines Fed Cut Hopes

Stock markets may sour if this week’s US economic data casts doubt on Fed rate cut speculation. #stockmarkets #Fed #Economy #InterestRates #USD #Macro #trading https://t.co/ZEfchApMC0

By Ilya Spivak

News•Feb 9, 2026

How 2025’s US Tariff Shocks Can Give Way to Constructive Reforms in 2026

The Trump administration’s 2025 trade strategy oscillated between aggressive, unpredictable tariff threats and a quieter push for long‑standing trade objectives. While high tariffs and threats destabilized markets, the administration began issuing exemptions and rolled back many threats, stabilizing tariff levels...

By Atlantic Council

Social•Feb 9, 2026

AI's Real Divide: Users vs Non‑users of Machines

AI anxiety often misses the key margin: it’s not “humans vs machines,” it’s “humans who use machines vs humans who don’t.” The tech shifts who’s productive—and who gets paid. Remember, you don't need to outrun the bear. https://t.co/jULdqTdCrU

By Justin Wolfers

Social•Feb 9, 2026

Dollar Index Plummets; Trade‑Weighted vs Equal‑Weighted Diverge

The $DXY has dropped sharply today. A big picture look at the trade-weighted Dollar index vs an equally-weighted variant: https://t.co/sqTvcv4ihu

By John Kicklighter

News•Feb 9, 2026

Takaichi’s Landslide Victory

Japan’s first female prime minister, Sanae Takaichi, called a snap election that delivered a historic super‑majority for the Liberal Democratic Party, winning 316 of 465 lower‑house seats. The result gives the LDP unprecedented legislative power to push Takaichi’s agenda without...

By Foreign Policy

Social•Feb 9, 2026

Gold Surges Past $5,000 Amid Reckless Fiscal Policy

Gold is back above $5,000. The rally in precious metals is reckless and crazy, but so is global fiscal policy. At some point over the past 20 years, policy makers who believe in keeping public debt stable stopped existing. Makes...

By Robin Brooks

Social•Feb 9, 2026

Seven Firms Command 35% of SPX Investment Dollars

Employment in S&P 500 companies is 18% of total US employment, but 35 cents of every dollar that goes into the SPX goes to 7 companies. This is a market structure problem and a major issue with our 401k system.

By Tyler Neville

News•Feb 9, 2026

End of an Era: Sec. 201 Tariffs on Imported Solar Panels Expire

Imported solar panels are no longer subject to Section 201 tariffs after they expired on February 6, 2026, ending an eight‑year protection regime that began under the Trump administration. The tariffs, which started at 30 % and gradually declined to 14 % by 2025, were...

By Solar Power World

News•Feb 9, 2026

Hapag-Lloyd Dodges Red Ink in Q4

Hapag‑Lloyd posted a Q4 2025 EBIT of $200 million, a 75% drop from the same quarter a year earlier, yet still managed a full‑year profit of $1.1 billion despite plunging spot rates. Container volumes rose modestly, adding 200,000 TEU in Q4 and...

By Seatrade Maritime

News•Feb 9, 2026

TechMet Plans Additional $200M Raise, Has Africa in Sight

TechMet, the US‑backed critical‑minerals investment vehicle, is seeking up to $200 million of new capital to broaden its portfolio after raising $300 million last year, including $180 million from the Qatar Investment Authority. CEO Brian Menell announced the raise at the 2026 Mining...

By MINING.com

News•Feb 9, 2026

Mining without Rules: The Risky US Bet on the Deep Sea

In April 2025 President Trump issued an executive order authorizing U.S. companies to mine critical minerals in international waters, directly contravening the United Nations Convention on the Law of the Sea (UNCLOS). The move aims to secure rare‑earth supplies amid...

By Atlantic Council

News•Feb 9, 2026

Russian Oil Sector Under Siege as EU Ramps up Pressure and India Winds Down Imports

The European Union announced plans to replace its $44.10‑per‑barrel Russian oil price cap with a comprehensive ban on maritime services for Russian crude, pending member‑state approval. The ban would block hull, machinery, and insurance services, pushing Russia toward the uninsured...

By Seatrade Maritime

News•Feb 9, 2026

US Backs Altona’s Mozambique Rare Earths Project

Altona Rare Earths announced that the U.S. Trade & Development Agency will support its Monte Muambe project in Mozambique, prompting a 76% surge in the company's London‑listed shares. The backing aims to map technical and financial routes for extracting rare‑earth...

By MINING.com

Blog•Feb 9, 2026

ASEAN Inc.: One Portfolio, Seven Markets — and a Clear Test of Southeast Asia’s Investment Story

The episode breaks down the ASEAN Inc. portfolio—a $1 million, equally weighted allocation across seven U.S.-listed ETFs covering Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, and a regional ASEAN‑40 fund—and shows it delivered a 21.3% annualized total return through February 2026, beating...

By The International Investor

News•Feb 9, 2026

Container Lines’ Red Sea Mixed Messages Confuse Shippers

Shippers are grappling with mixed signals from carriers about returning to the Suez Canal route. Maersk said peace in the Middle East is required, yet announced two services will resume via the Red Sea with military escort. CMA CGM has shifted...

By Seatrade Maritime

News•Feb 8, 2026

Which of the 132 Chinese EV Automakers Will Enter Canada?

Chinese electric‑vehicle makers are eyeing Canada as a strategic foothold into North America, with a government‑approved quota of 49,000 units annually – roughly 3.8% of the market. BYD is projected to dominate the allocation, taking about 30% of the quota,...

By CleanTechnica

News•Feb 7, 2026

Trump Turns to US Military Leaders for Diplomatic Efforts on Iran and Ukraine

President Donald Trump has turned to senior military officials to spearhead high‑stakes diplomatic talks on Iran’s nuclear program and the Russia‑Ukraine war. Admiral Brad Cooper, commander of U.S. Central Command, joined indirect Iran negotiations in Oman, while Army Secretary Dan...

By Military.com (Navy News)

News•Feb 6, 2026

Saudi Graphite Plant Is ‘Wake-Up Call’ for Quebec, France: CEO

Northern Graphite has partnered with Saudi Arabia's Al Obeikan Group to build a $200 million battery‑grade graphite plant in Yanbu, slated for production in 2028. The venture will source concentrate from the revived Okanjande mine in Namibia and gives Northern a...

By MINING.com

News•Feb 6, 2026

US Mineral Supply Chains Remain Exposed to China Chokehold: USGS Report

The U.S. Geological Survey’s 2026 mineral commodities summary shows the United States now imports 100% of 16 of the 90 non‑fuel minerals it tracks, up from 15 a year earlier, and relies on foreign sources for more than half of...

By MINING.com

News•Feb 6, 2026

Iran Can Still Normalize Its Economy—But the Path Will Be Painful and Slow

Iran’s inflation, hovering around 20% and spiking above 40% during sanctions, has become a structural feature of its macro‑economy. The country’s fragmented exchange‑rate system, fiscal deficits financed by the central bank, and dominant state‑linked enterprises perpetuate price pressures. Analysts argue...

By Atlantic Council

News•Feb 6, 2026

Heliostar Pours First Gold From San Agustin Mine

Heliostar Metals announced the first gold pour from its newly restarted San Agustin mine in Durango, marking its second operating asset after La Colorada. The open‑pit mine is projected to deliver roughly 45,000 ounces of gold from existing reserves, prompting...

By MINING.com

News•Feb 6, 2026

DPM Adds 20% More Gold-Silver to Extend Bulgaria Mine

DPM Metals announced a 20% increase in measured and indicated resources at its Chelopech gold‑copper mine, boosting total reserves to 1.6 million ounces of gold and 6.23 million ounces of silver. The update extends the mine’s projected life to ten years, up...

By MINING.com