🎯Today's Global Economy Pulse

Updated 24m agoWhat's happening: U.S. Supreme Court overturns Trump tariffs, paving way for $130B in refunds

The Supreme Court ruled 6‑3 that the Trump administration’s “Liberation Day” tariffs were unlawful, restoring congressional authority over trade barriers. The decision opens the door for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries.

Also developing:

News•Feb 11, 2026

What Rubio Gets Right (and Wrong) About the Western Hemisphere

Juan S. González argues that U.S. security hinges on a stable Western Hemisphere, echoing Roosevelt’s Monroe‑Doctrine insight. He praises Secretary of State Marco Rubio for recognizing the need for proactive engagement but criticizes Rubio’s reliance on coercion and short‑term pressure. The piece highlights infrastructure—ports, energy, telecom—as the new battleground where China and other rivals are gaining footholds. González calls for rapid, commercial‑pace financing, regulatory clarity, and risk‑sharing partnerships that respect democratic norms to build durable, supply‑chain‑resilient ties across Latin America and the Caribbean.

By Foreign Policy

Social•Feb 11, 2026

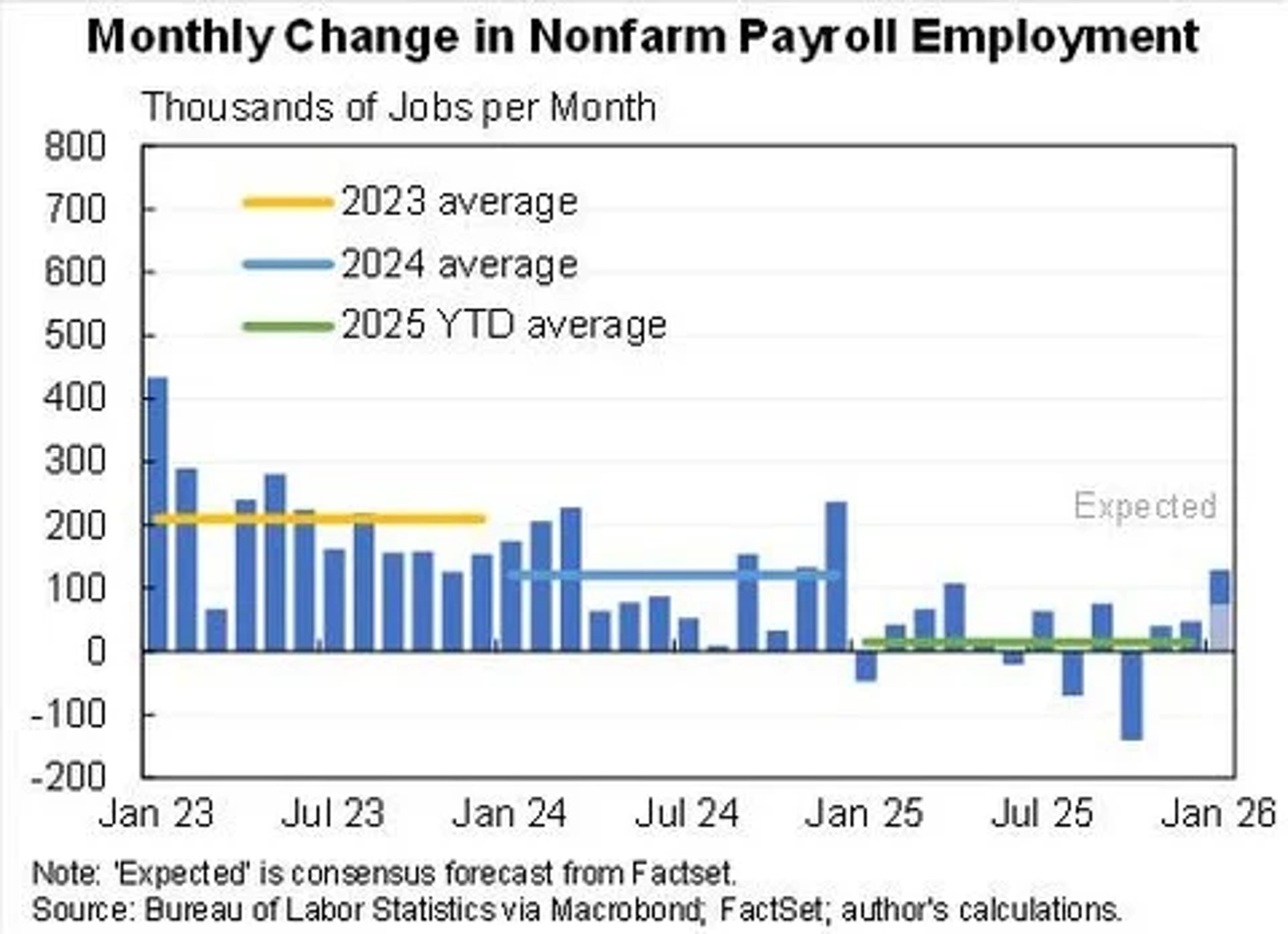

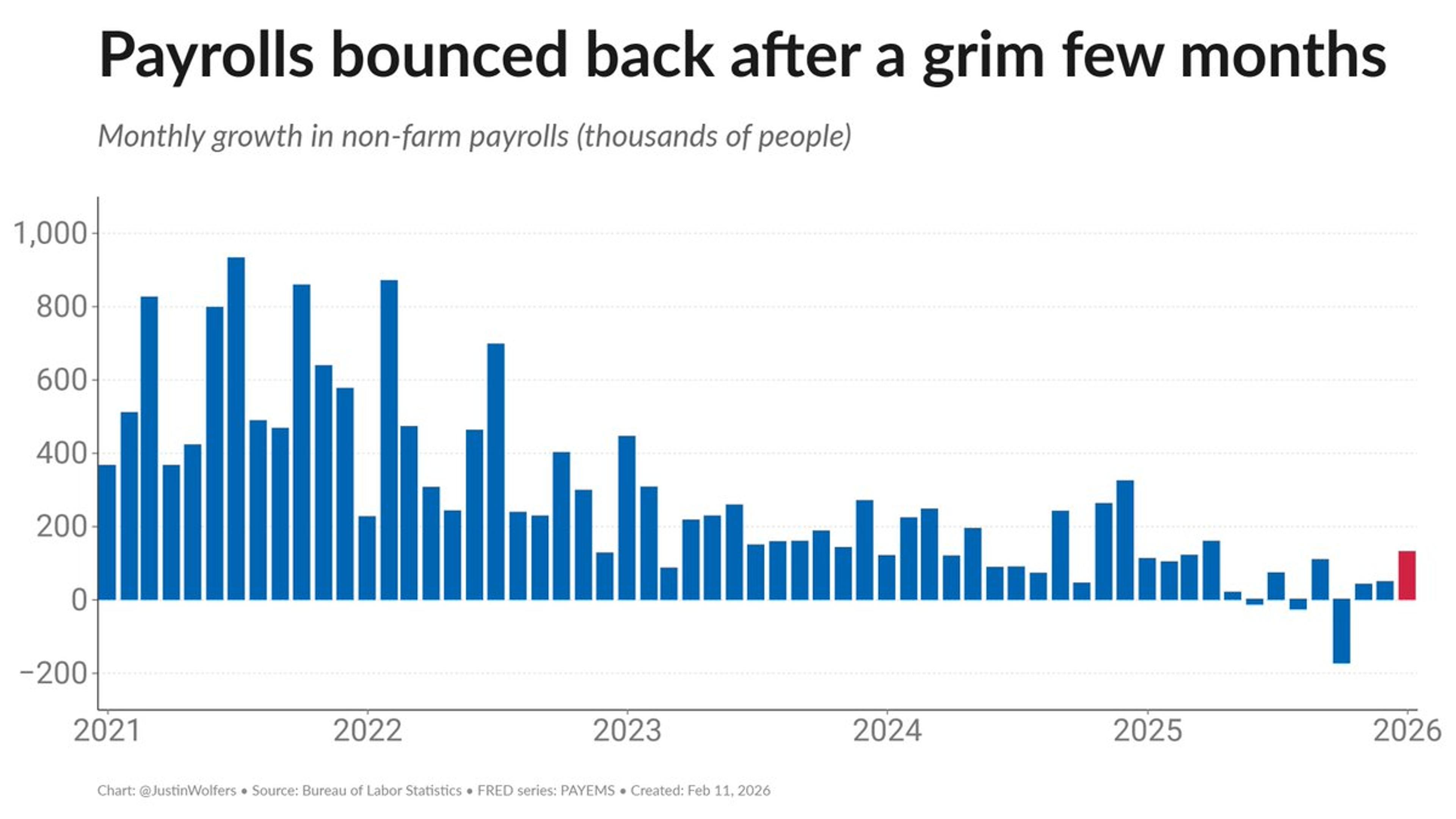

Labor Market Rebounds After Shutdown, Easing Temporary Layoffs

The labor market showed signs of healing late in 2025 and in January. Catch up following long government shutdown helps alleviate ranks of those suffering temporary layoffs and forced to accept part instead of full-time jobs. Some healthy churn returned...

By Diane Swonk

Social•Feb 11, 2026

2027 AI Race: Align or Lose Human Relevance

🚨 From Agent-1 to Superintelligence: The AI 2027 Scenario The AI 2027 Report outlines one of the most thought-provoking trajectories for artificial intelligence: a rapid evolution from simple assistants (Agent-1) to autonomous, adversarially misaligned systems (Agent-4) and ultimately to Agent-5 —...

By Giuliano Liguori

News•Feb 11, 2026

Kroenig on NPR on Iran

Atlantic Council vice‑president and Scowcroft Center senior director Matthew Kroenig appeared on NPR on Feb. 11 to discuss the Trump administration’s ongoing negotiations with Iran. He outlined the limited progress of back‑channel talks aimed at reviving a nuclear agreement and highlighted...

By Atlantic Council

Social•Feb 11, 2026

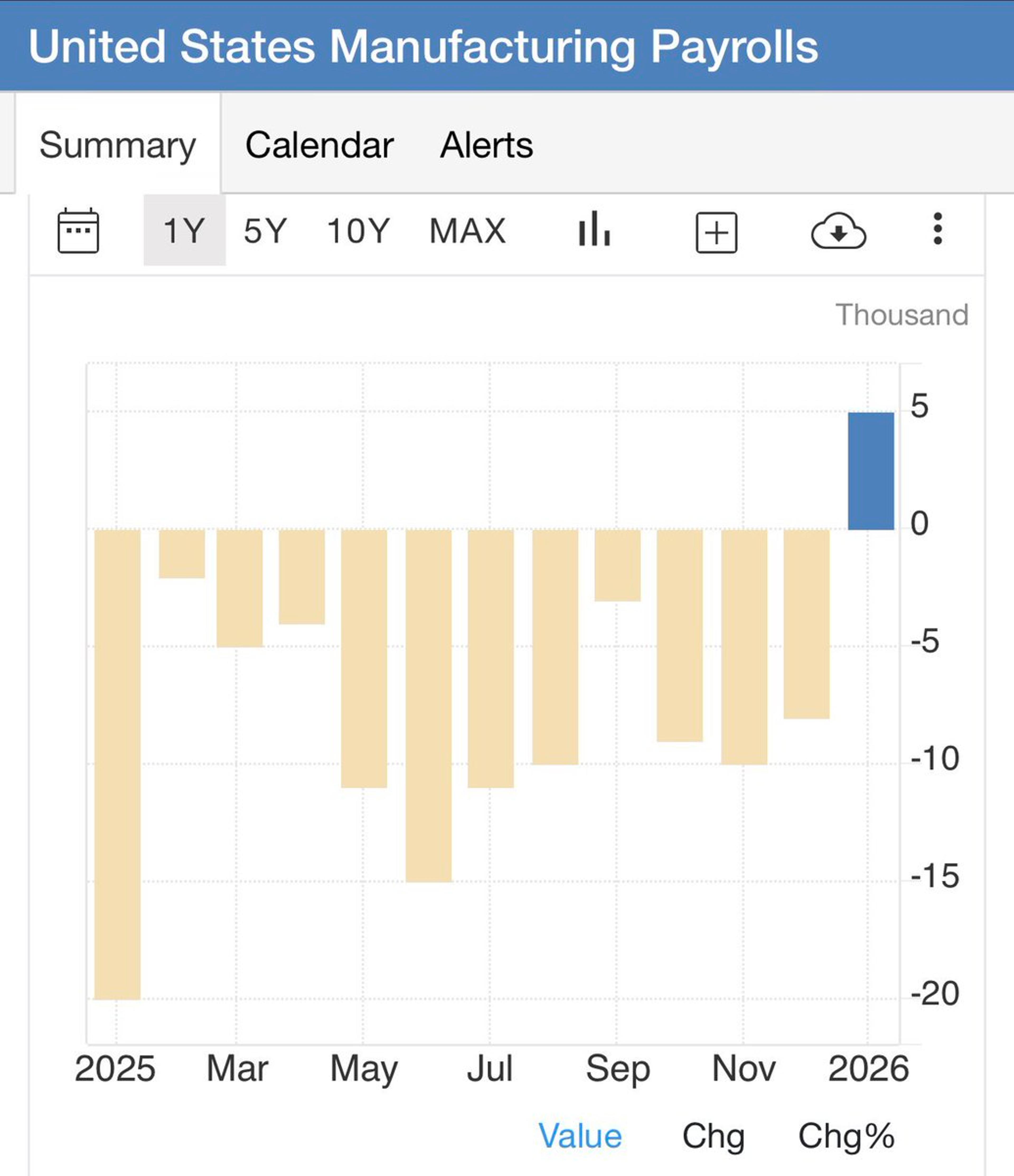

Jobs Surge, Unemployment Drops: GDP Gains Confirm Strength

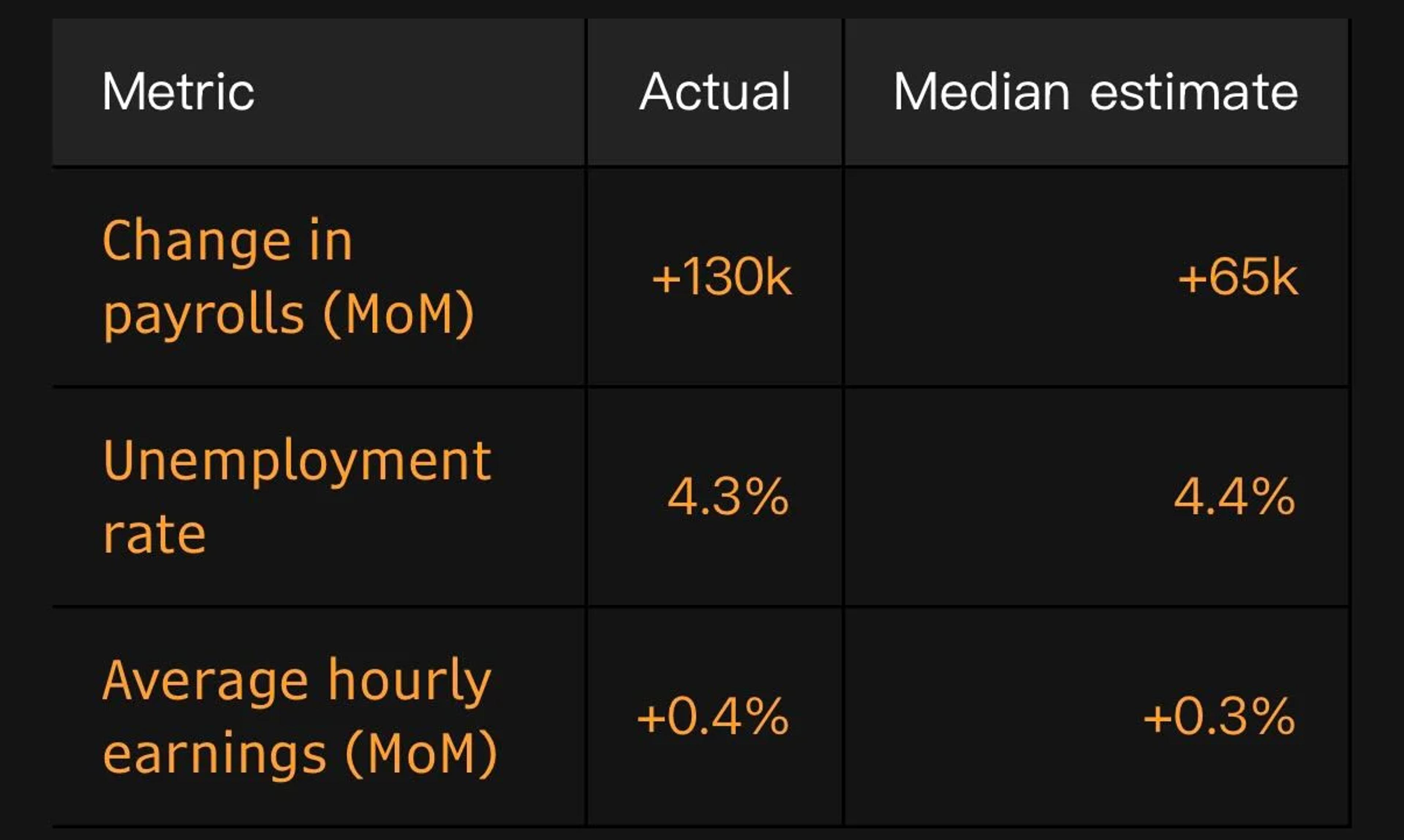

On the surface a strong jobs report (130K jobs & unemployment falls to 4.3%). And just about every detail makes that stronger: participation up, involuntary part-time down, hours up, wages up. The mystery of strong GDP and weak jobs is being resolved...

By Jason Furman

Social•Feb 11, 2026

Historical Cycles Link US Inequality, Deficits, and Global Populism

The changes in the US over the last decade — rising inequality, massive deficits, and a shifting global outlook — are not isolated events. They are all interconnected and part of a dynamic that has occurred many times before for...

By Ray Dalio

News•Feb 11, 2026

Turning Uncertainty Into Opportunity: Modernizing Retail Finance to Navigate Inflation, Interest Rates and Currency Volatility

Retail finance leaders are grappling with volatile interest rates, persistent inflation, and a weakening dollar, which together strain cash flow and margin stability. To survive, finance teams must shift from reactive bookkeeping to proactive portfolio‑management tactics, using scenario modeling and...

By Total Retail

Social•Feb 11, 2026

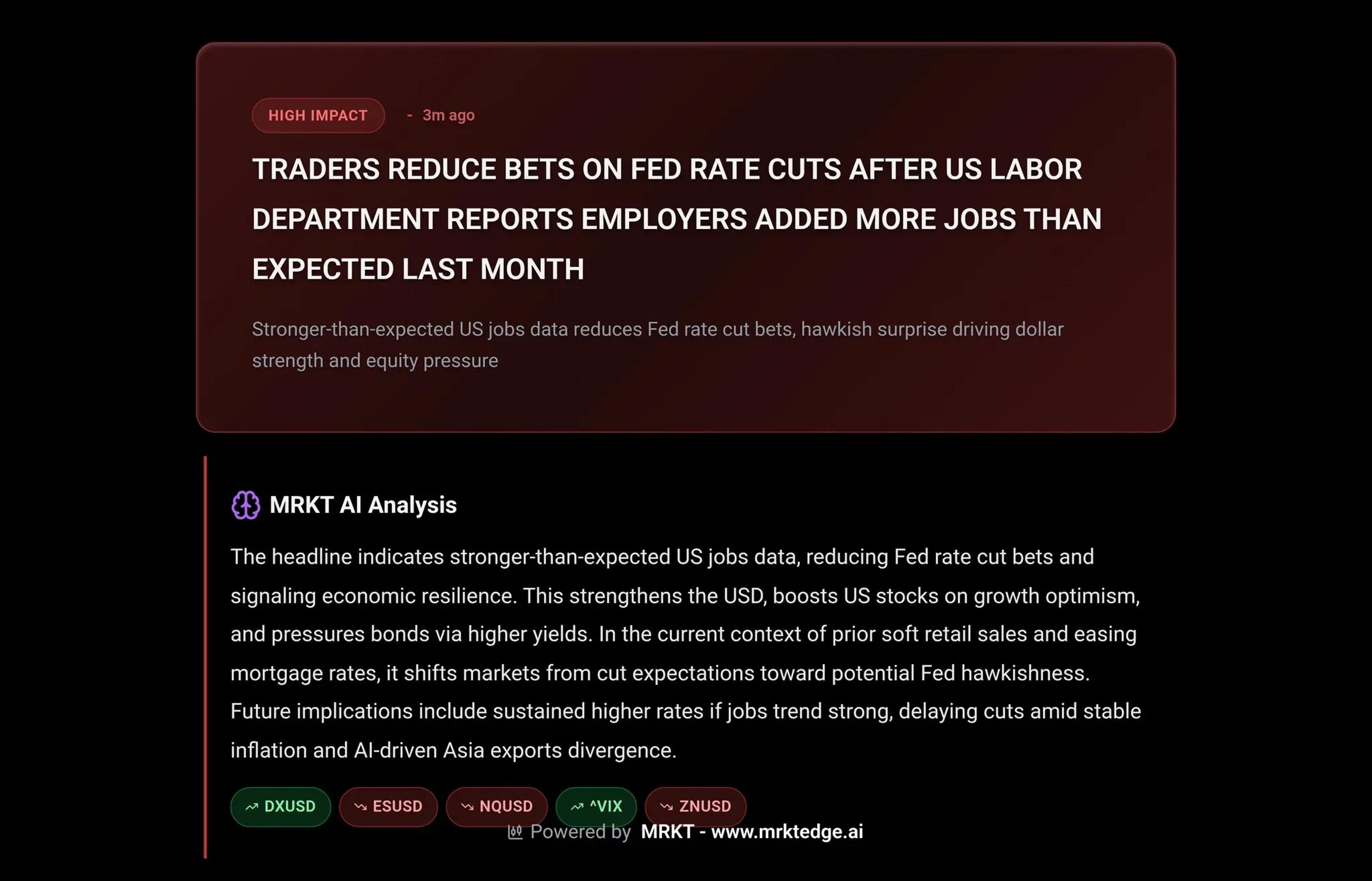

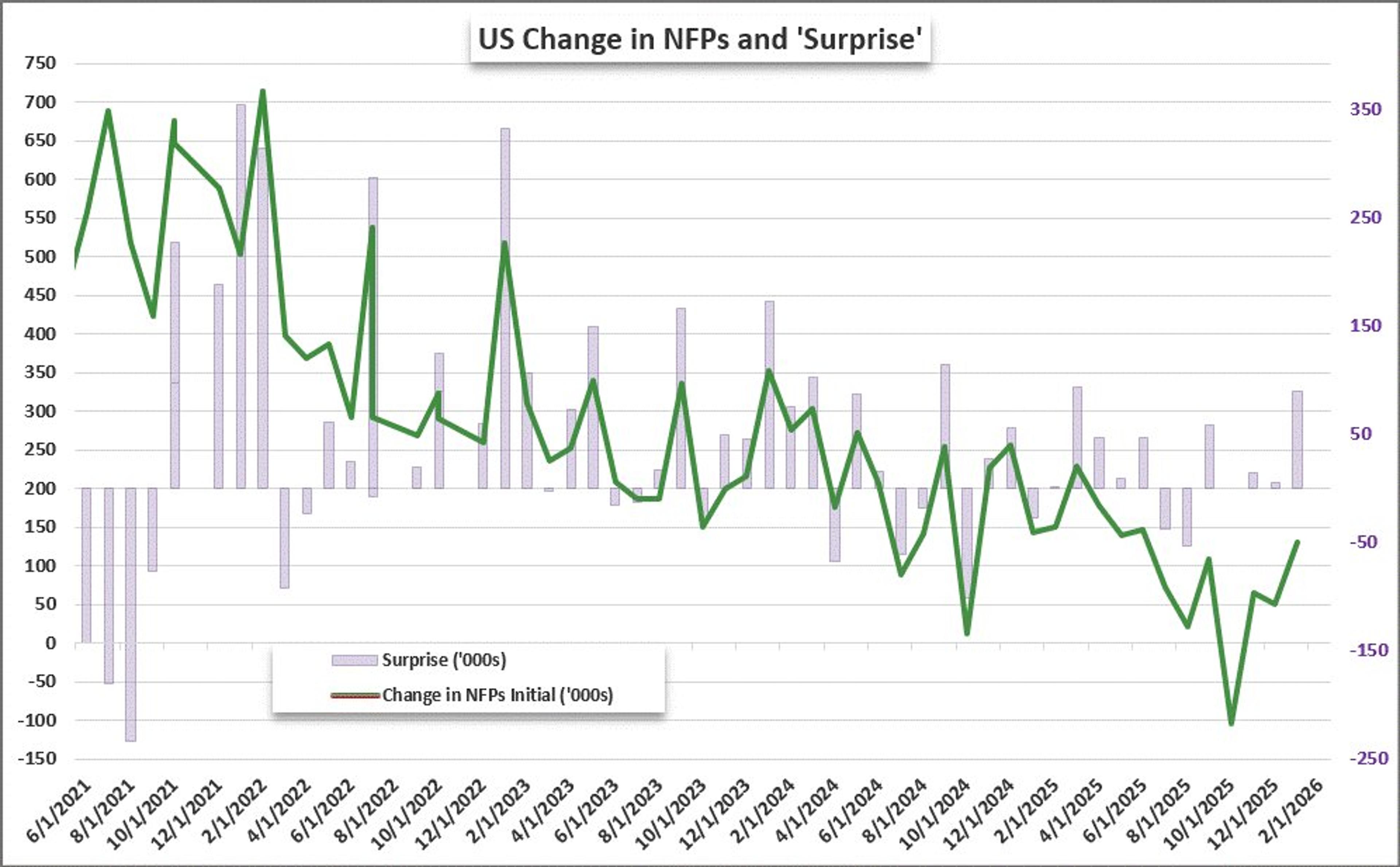

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

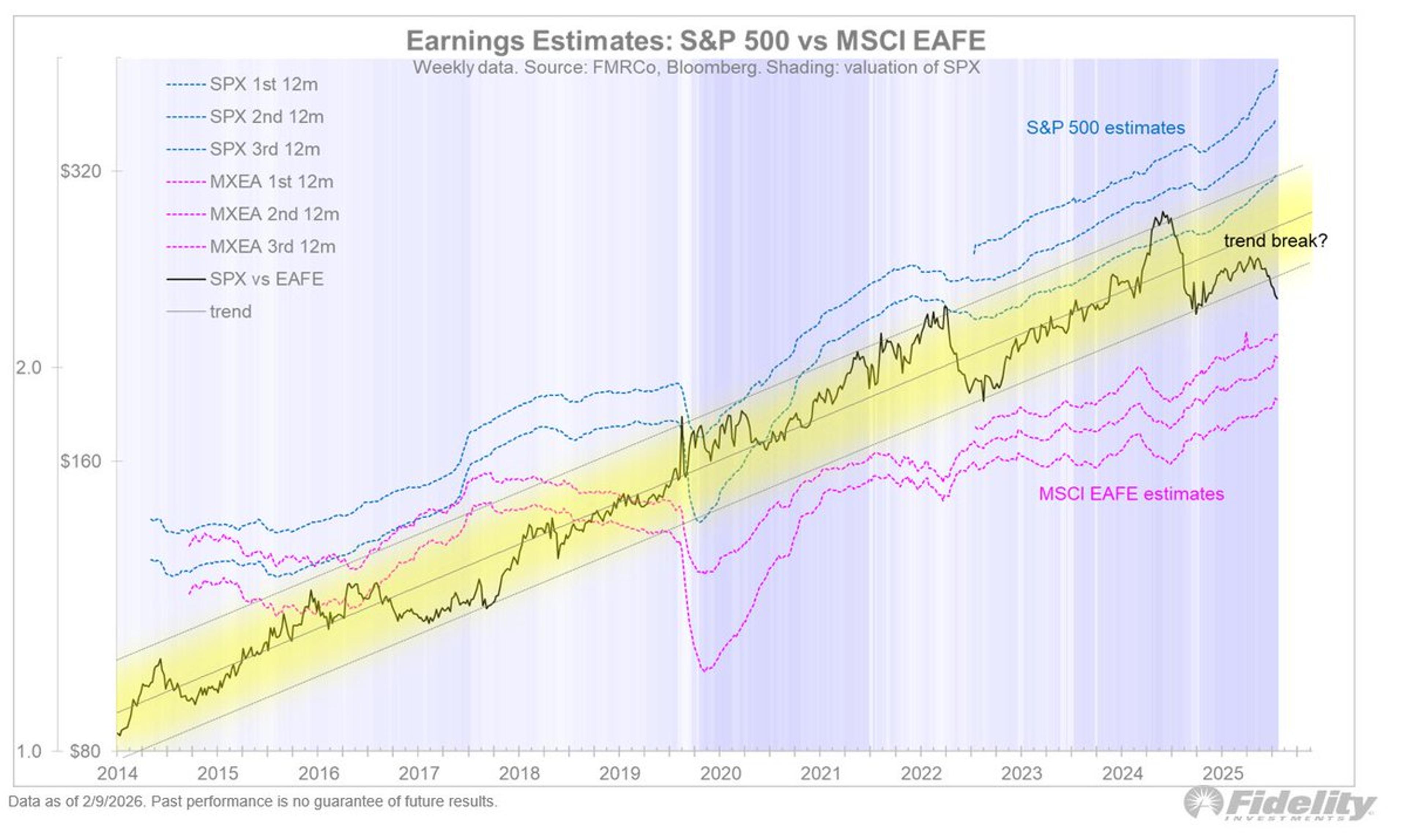

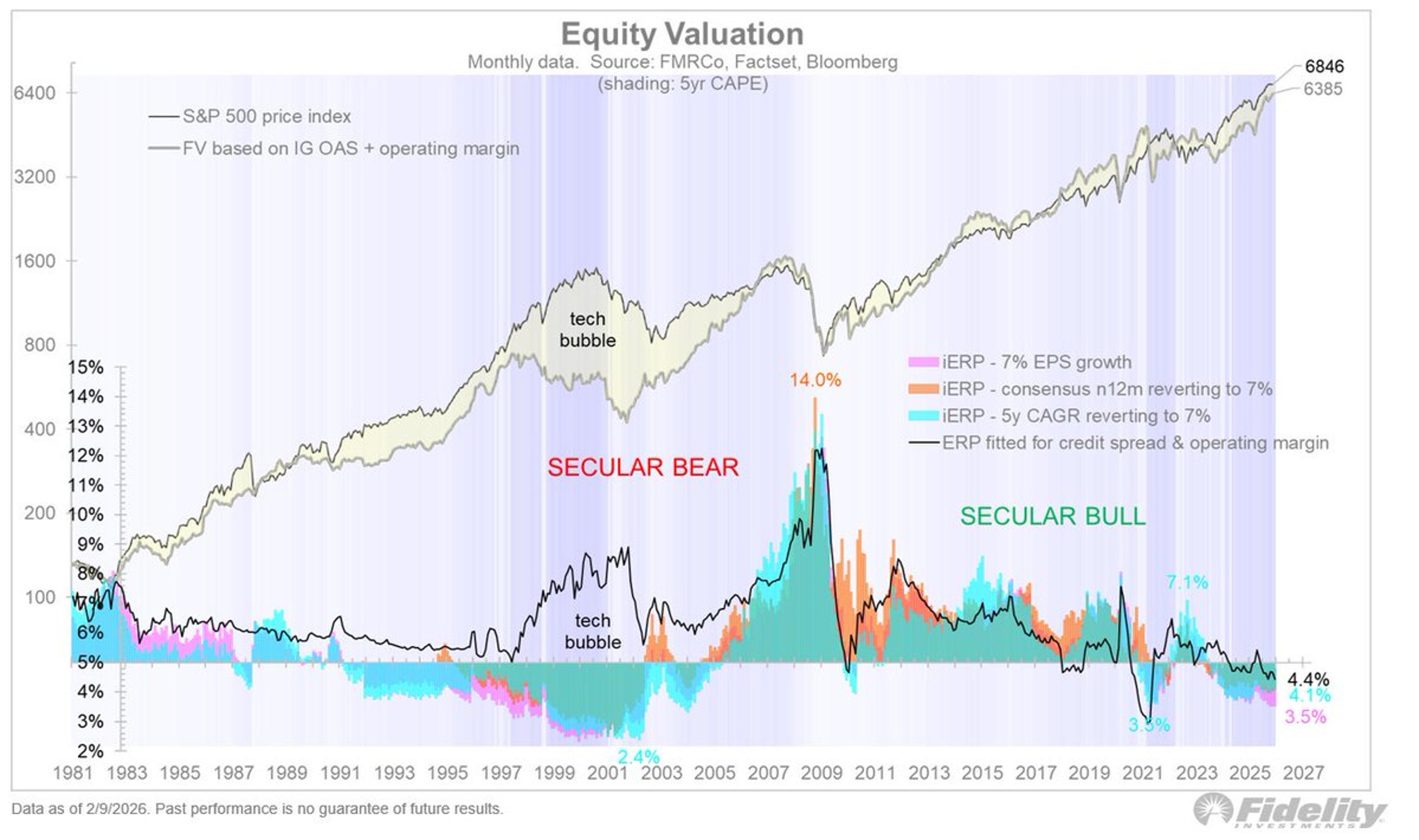

Global Earnings Boom Ends S&P’s EAFE Uptrend

The earnings boom has gone global, with estimates in both EAFE and EM showing good momentum. The blue squiggles show estimates for the S&P 500 and the pink ones are for the MSCI EAFE index. The days of significant divergences...

By Jurrien Timmer

Blog•Feb 11, 2026

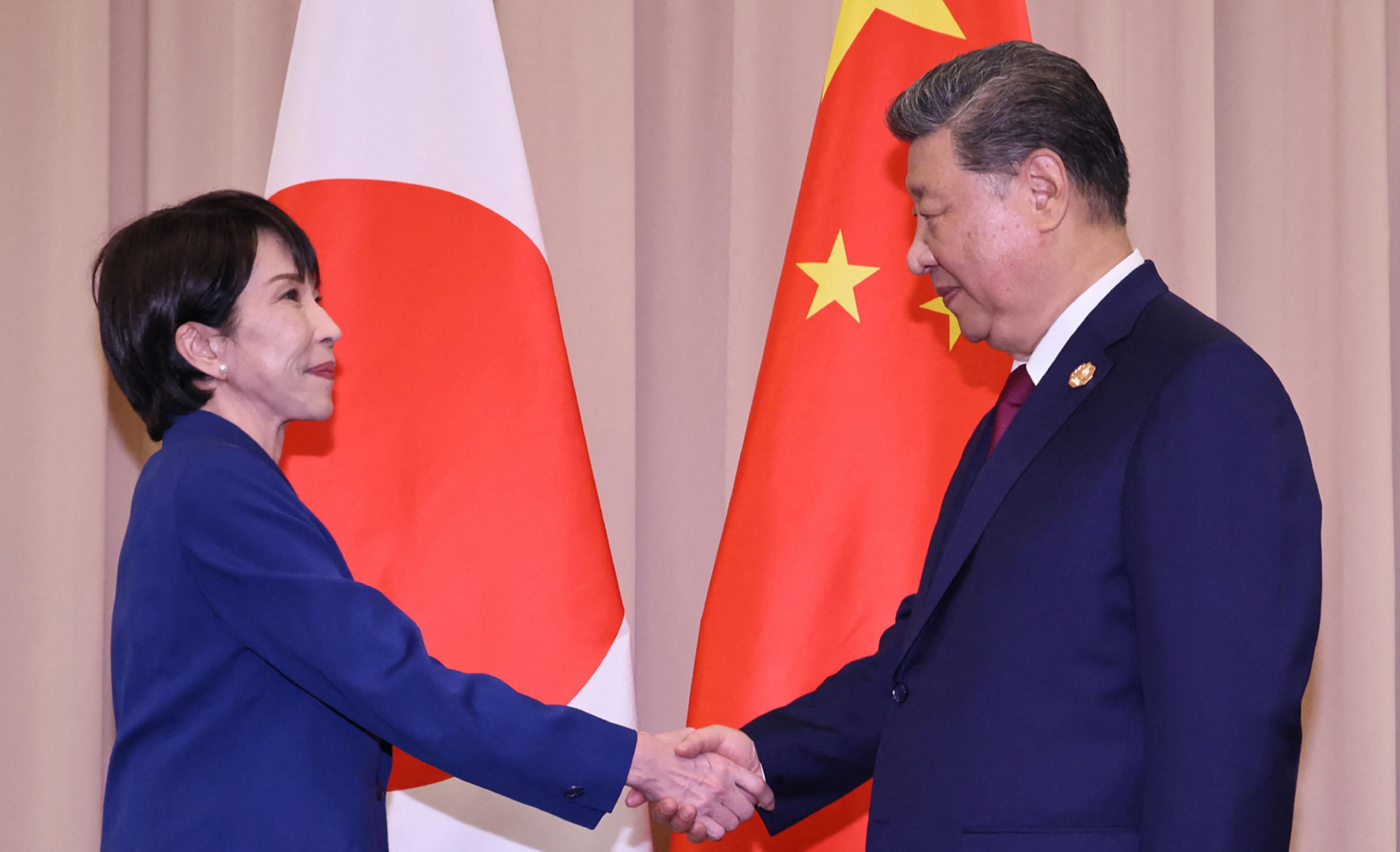

Asia’s Administrative Arms Race: How U.S.-China Strategic Competition Is Reshaping Economic Statecraft

China has invoked its Export Control Law to ban dual‑use exports to Japan and tighten rare‑earth licensing, signaling a new escalation in its diplomatic dispute with Tokyo. The move follows a broader trend of Beijing building offensive economic statecraft tools,...

By Just Security

Social•Feb 11, 2026

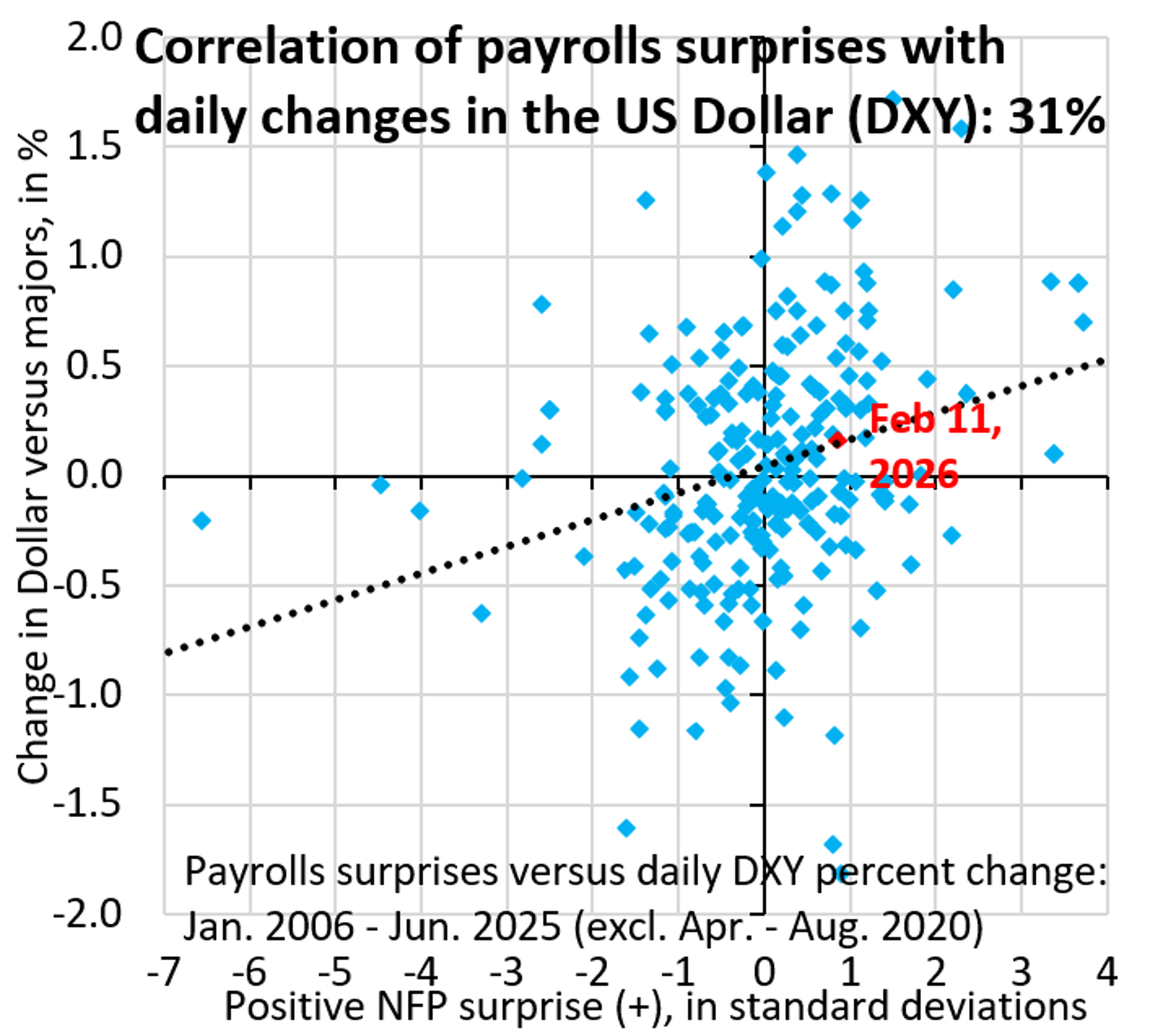

Strong Payrolls Fail to Boost Dollar, Correlation Shifts

Tepid response of the Dollar to a big upside surprise in payrolls. The whisper number for consensus was weak, so this was a solid beat, yet USD is barely able to rise. We're on our way to the correlation switch...

By Robin Brooks

Social•Feb 11, 2026

US Backs Coal Revival as Indonesia Slashes Output

Two major coal developments in the last 24 hours. 1. White House announcing purchases and support to revive the industry 2. Indonesia just ordered the world's largest nickel mine to sharply cut output. They are also looking to cut coal production by...

By Quinn Thompson

Podcast•Feb 11, 2026•38 min

Credit Crunch: Investor Survey 1Q - Fed, Earnings, Tech Supply

In this episode, Mahesh Bhimalingam of Bloomberg Intelligence and Ashwin Palta of BNY Investments discuss the Bloomberg Intelligence 1Q26 Investor Survey, highlighting the continued resilience of credit and high‑yield markets despite recent tariff shocks and rate volatility. They examine why...

By FICC Focus

News•Feb 11, 2026

Fear Grows That AI Is Permanently Eliminating Jobs

A growing chorus of workers, researchers, and public figures warn that artificial intelligence could permanently eliminate millions of jobs. MIT researchers estimate current AI systems can automate tasks performed by over 20 million American workers, roughly 12 % of the labor force,...

By Futurism AI

News•Feb 11, 2026

Oatly Loses Long-Running 'Milk' Battle with Dairy Lobby

Oatly has lost a UK Supreme Court ruling that bars the company from trademarking or using the phrase “post‑milk generation” in its marketing, after Dairy UK argued that the term “milk” should be reserved for animal‑derived products. The court affirmed earlier...

By BBC News – Business

Social•Feb 11, 2026

Strong Earnings, Modest Overvaluation—Boom, Not Bubble

This formidable earnings growth has allowed valuations to take a back seat for a change. While the 5-year CAPE ratio is up there at 32x, the n12m P/E multiple doesn’t seem too onerous at 22x, considering not only the earnings...

By Jurrien Timmer

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

News•Feb 11, 2026

Except Trump, Nobody Has Stated India's Refusal to Buy Russian Oil: FM Lavrov

Foreign Minister Sergei Lavrov told the Russian Duma that only U.S. President Donald Trump has claimed India will cease buying Russian oil, and no Indian official has made such a statement. Lavrov highlighted India’s new BRICS chairmanship and its focus...

By ET EnergyWorld (The Economic Times)

News•Feb 11, 2026

Govt Urges Refiners to Prioritise US, Venezuelan Crude Amid Evolving Trade Ties: Report

India has urged its state‑owned refiners to give priority to crude from the United States and Venezuela as part of a broader effort to diversify supplies and reduce reliance on Russian oil. The government’s suggestion applies to spot‑market tenders for...

By ET EnergyWorld (The Economic Times)

News•Feb 11, 2026

UK Retailers Hit by Double Whammy of Brexit Frictions and US Tariffs

New ONS data shows that 32.7% of UK retailers report rising export costs since Brexit, while US tariff changes further strain margins. Export volumes fell for 40.6% of retailers in December, and paperwork burdens rose for over a quarter of...

By InternetRetailing

News•Feb 11, 2026

Kremlin Says Russia Will Seek Clarification From US on Venezuela Oil Restrictions

The U.S. Treasury issued a general license for Venezuelan oil and gas exploration that explicitly excludes Russian and Chinese entities, tightening restrictions on Moscow’s energy interests. Kremlin spokesman Dmitry Peskov said Russia will seek clarification from Washington to protect its substantial...

By ET EnergyWorld (The Economic Times)

Blog•Feb 11, 2026

China Unveils New Year Measures as Consumption Data Dips

Chinese local governments announced a suite of stimulus measures ahead of the longest Lunar New Year break, extending the holiday to nine days. The central government allocated 2.05 billion yuan in vouchers, red‑envelopes and subsidies to directly benefit consumers. January's consumer...

By Asia Financial

News•Feb 11, 2026

Nickel Price Jumps as Indonesia’s Top Mine Cuts Output

Indonesia ordered the world’s largest nickel mine, PT Weda Bay, to cut its ore quota from 42 million tonnes to 12 million tonnes for 2024, aiming to tighten global supply. The LME nickel price rose 2 percent to $17,835 a tonne, extending a rally of...

By MINING.com

Social•Feb 11, 2026

NEC Director Predicts Slightly Lower Jobs, NFP May Miss Forecast

https://t.co/k2T7oPbMh8 In an interview with CNBC on Monday (February 9, 2026), Kevin Hassett, the Director of the National Economic Council, advised markets to expect "slightly smaller job numbers" in the coming months. These remarks, have led many to speculate that the January...

By Boris Schlossberg

News•Feb 11, 2026

Moldova. EU – Yes; CIS – No; Unirea – Not This Time

Moldova announced its formal exit from the Commonwealth of Independent States, signaling a decisive break from a key Russian‑linked institution. At the same time, Chişinău is accelerating its integration with the European Union under President Maia Sandu’s pro‑Western agenda. Public...

By Defence24 (Poland)

Podcast•Feb 11, 2026•7 min

Job Jitters

The episode examines the current economic turbulence on Main Street, highlighting widespread layoffs and soft retail sales, while contrasting this with TSMC's explosive growth in the tech sector. It also explores the impact of a new AI-driven tax‑management tool that...

By Reuters Morning Bid

News•Feb 11, 2026

What's Driving Northern Ireland's Falling Fuel Prices?

Petrol prices in Northern Ireland have fallen to 124.2 pence per litre, the lowest level in five years, while diesel holds steady at 131.9 pence. The decline follows a global oil oversupply and easing geopolitical tensions after the 2022 price spike triggered...

By BBC News – Business

Social•Feb 11, 2026

Jobs Report Day Shows Record Forecast Divergence

Good morning and welcome to Jobs Report Day in the US. The consensus forecasts are for a monthly employment gain of 65,000, an unemployment rate of 4.4%, and a 3.7% annual increase in average hourly earnings. As we head into this release,...

By Mohamed El‑Erian

Social•Feb 11, 2026

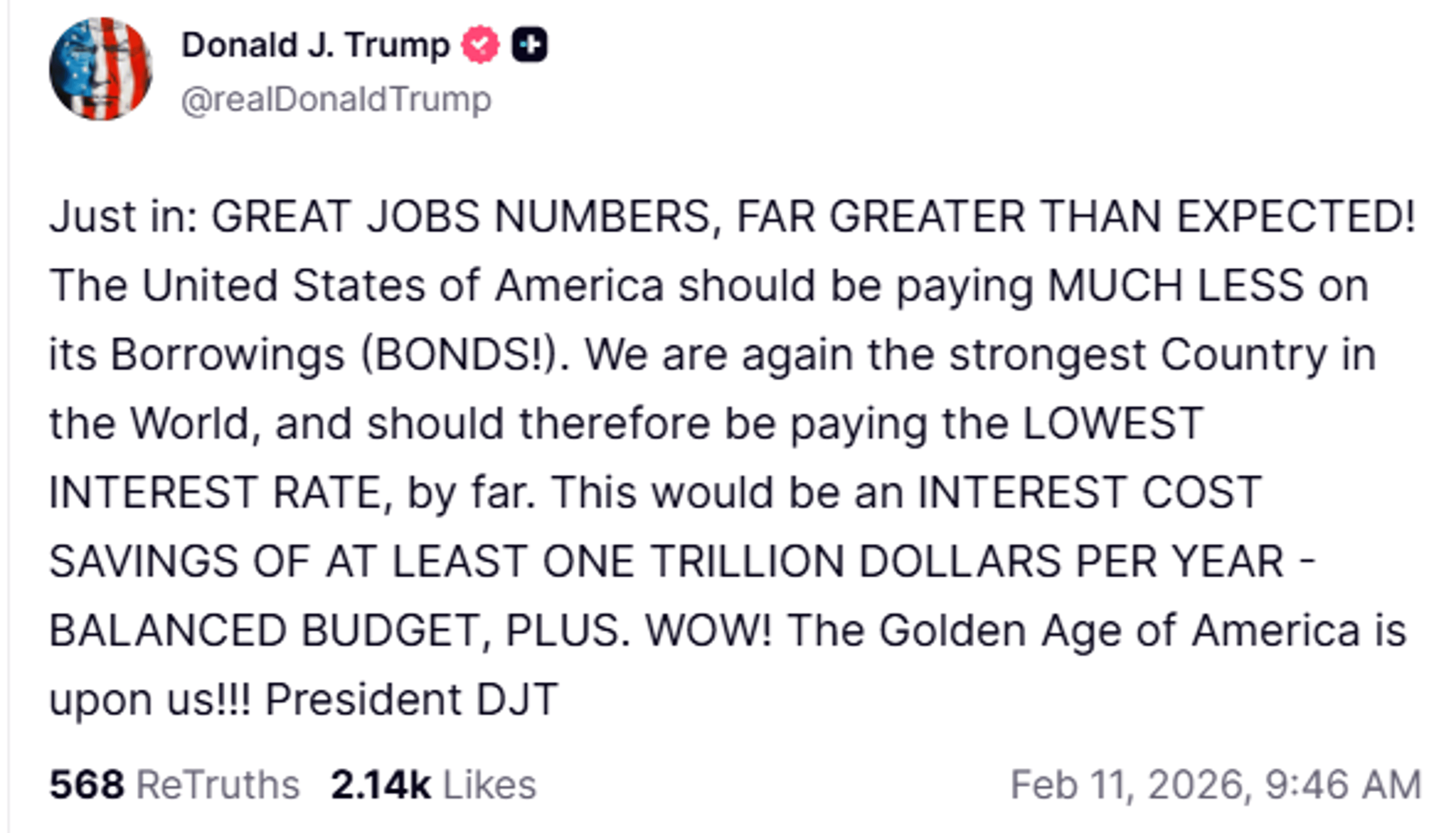

Trump’s Trillion-Dollar Savings Claim Ignores Fixed-Rate Debt

Trump says lower rates would save "at least one trillion dollars per year." The federal government's entire annual net interest bill was $970 billion in fiscal 2025—and much of that is locked in at rates on previously issued debt that...

By Nick Timiraos

Blog•Feb 11, 2026

Xi’s Broken Heart: Why China’s Markets Are Bleeding Out

The episode examines the growing divergence between China’s onshore stock markets and Hong Kong’s offshore market, arguing that this split reflects a deepening mistrust of Xi Jinping’s political control over finance. While mainland indices appear stable, the offshore market is...

By China Business Spotlight

Social•Feb 11, 2026

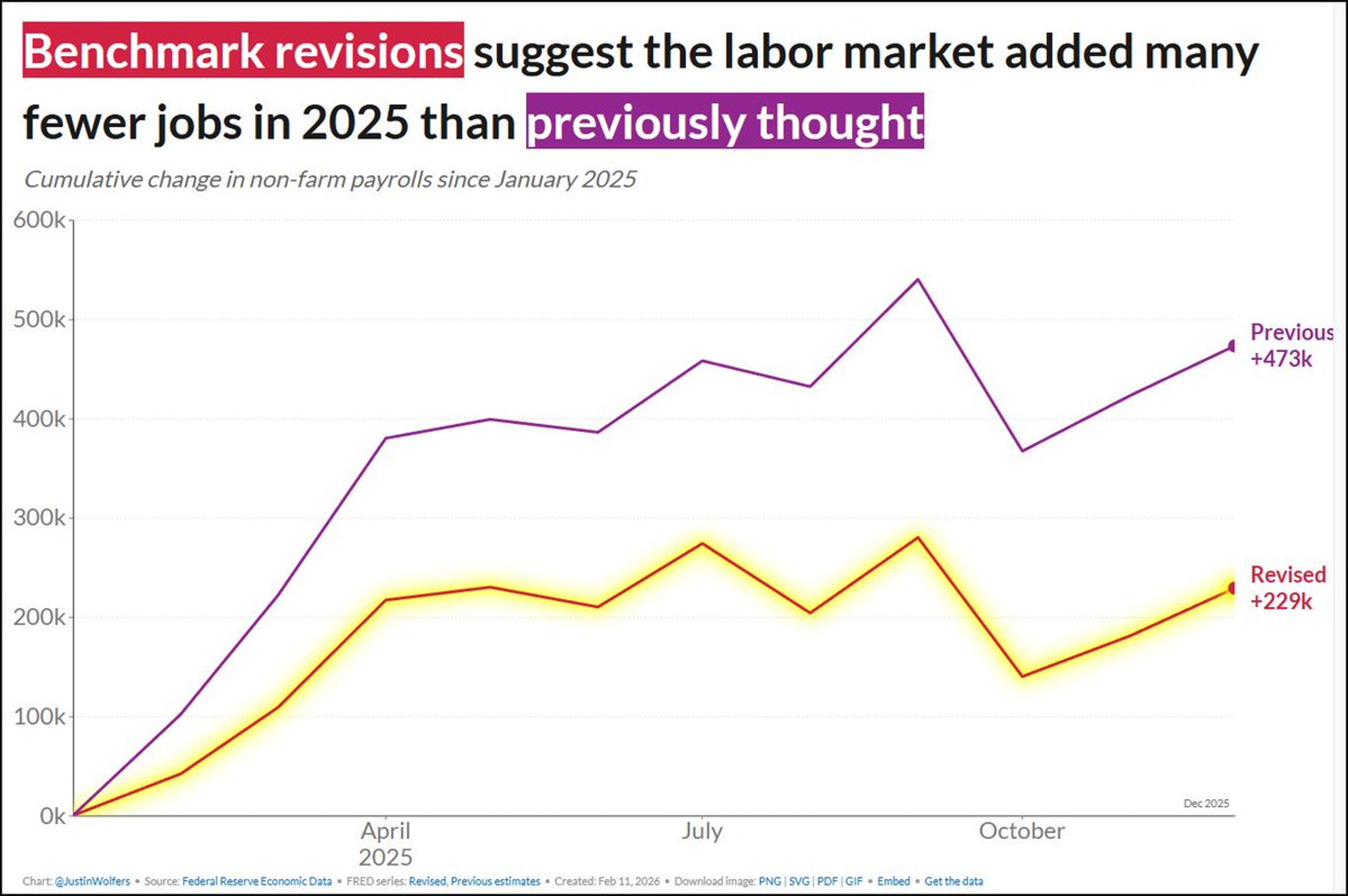

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter

Social•Feb 11, 2026

President's Attempt to Manipulate Job Data Failed

My menchies show a lotta distrust about the official jobs numbers right now. Lemme be clear: I don't believe there's *any* political meddling in these numbers. While the President has tried to mess with the BLS, he failed. I explain in...

By Justin Wolfers

News•Feb 11, 2026

An FTA No One Is Talking About Can Give India a Strategic Edge

The India‑Chile free trade negotiations are moving toward a Comprehensive Economic Partnership Agreement that explicitly includes critical minerals such as lithium, copper, and cobalt. Chile’s abundant reserves could supply India’s “Make in India” and clean‑energy ambitions, while recent moves by...

By ET EnergyWorld (The Economic Times)

Social•Feb 11, 2026

2025 Job Growth Halved by New BLS Revision

Every year the BLS does a benchmark revision which incorporates new and more detailed information. This year's revision suggests that 2025 was a far worse year than earlier estimates suggested, and total job growth was less than half that suggested...

By Justin Wolfers

Social•Feb 11, 2026

Manufacturing Payrolls Rise, Private Jobs Surge, Unemployment Falls

First positive manufacturing payrolls in a very long time, private payrolls surging, UR down. The economy is re-accelerating https://t.co/sbUBFBA4SA

By Felix Jauvin

Blog•Feb 11, 2026

Pauses Without Peace: What Last Year’s Ceasefires Reveal About Global Conflict Management

In this episode Gopi Krishna Bhamidipati examines how the Trump administration’s diplomatic interventions in 2025‑2026 produced ceasefires across Gaza, the Israel‑Iran clash, India‑Pakistan tensions, the Thailand‑Cambodia border dispute, and Ukraine‑Russia, but stopped short of achieving lasting political settlements. The host...

By War on the Rocks

Social•Feb 11, 2026

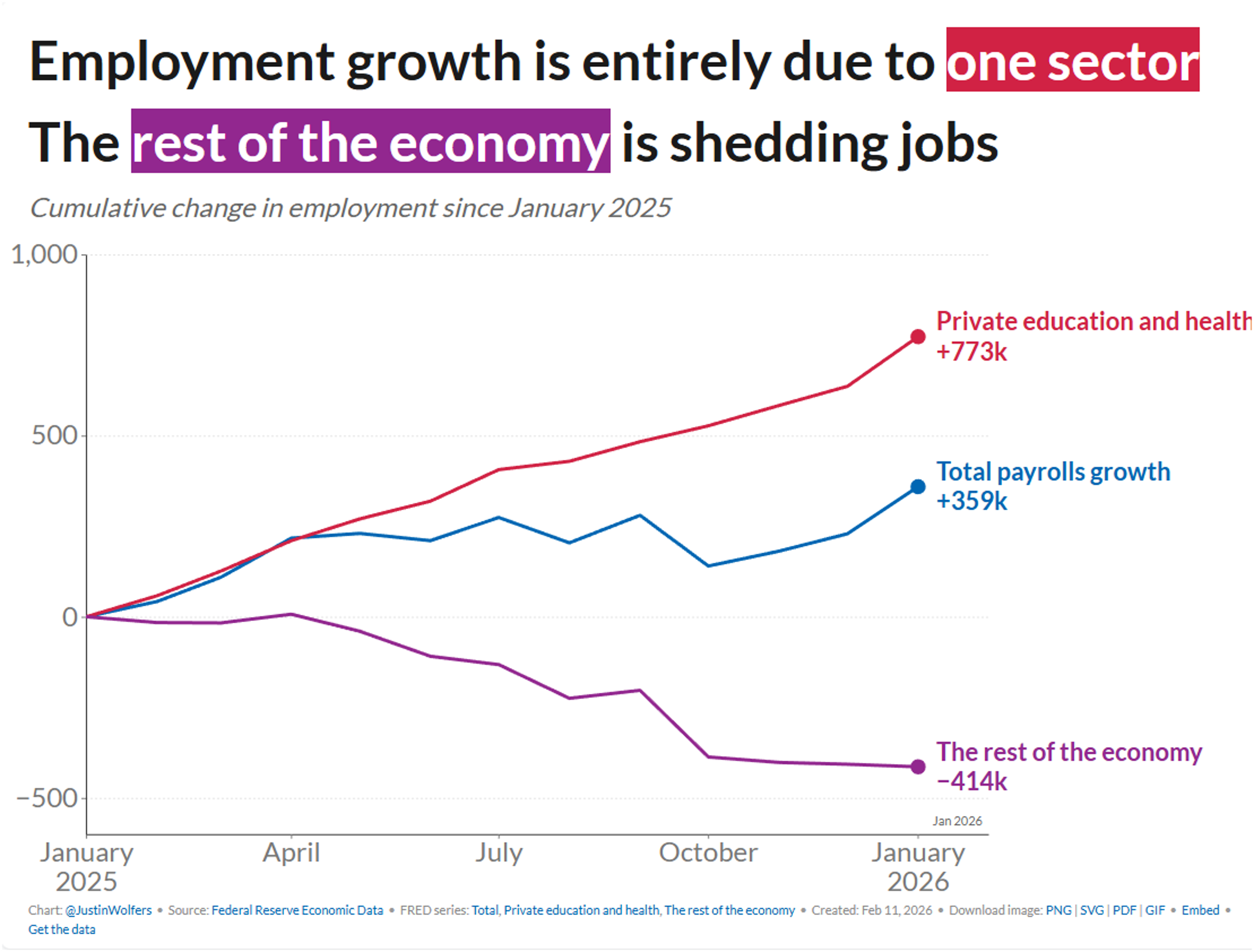

One Sector Drives All US Job Growth, Others Lose

The U.S. job market is very unbalanced right now. One sector more than accounts for all jobs growth over the past year. The rest of the economy is shedding jobs. https://t.co/EGsnQj04uA

By Justin Wolfers

Social•Feb 11, 2026

North Korea's Inflation Hits 74.6%, World’s Third Highest

#NKWatch🇰🇵: Today, I measure North Korea’s inflation at 74.6%/yr. This makes North Korea the WORLD'S THIRD-HIGHEST INFLATOR. SUPREME LEADER KIM JONG UN = KILLING NORTH KOREA'S ECONOMY. https://t.co/iTKJhtxWvr

By Steve Hanke

News•Feb 11, 2026

China Lets Yuan Rise to Strongest Level in Years as De-Dollarisation Trend Grows

China’s central bank set the yuan’s daily fixing at 6.9438 per dollar, the strongest level in 33 months, as the currency continued to appreciate. Offshore trading pushed the yuan to 6.909 per dollar, reflecting a broader rotation out of US...

By South China Morning Post – Global Economy

Social•Feb 11, 2026

Strong January Jobs, Lower Unemployment Boost USD Despite Cut Expectations

Jan jobs data better than expected and benchmark revision more or less in line. Unemployment rate ticks lower. $USD jump sold into quickly. Mkt still pricing in around two cuts this year.

By Marc Chandler

Social•Feb 11, 2026

January Jobs Surge: Payrolls +130k, Unemployment at 4.3%

Payrolls rose a very healthy +130k in January, and unemployment fell a tick to 4.3 percent. Revisions subtracted -17k from the past two months, so not much there. This is the healthiest jobs report we've seen in a while. Keep your fingers...

By Justin Wolfers

News•Feb 11, 2026

HMM Stays in the Black in Q4

South Korean carrier HMM posted a Q4 2025 net profit of KRW 364 billion, a 59.9% plunge from the prior period, while revenues fell 14.2% to KRW 2.71 trillion. The full‑year results showed a 50.3% profit drop to KRW 1.88 trillion as container freight rates slumped 49%...

By Seatrade Maritime

Social•Feb 11, 2026

BIS Chief Meets ECB to Discuss Current Economic Trends

Glad to welcome @BIS_org General Manager Pablo Hernández de Cos back to the @ecb today. We had a good discussion on the latest economic developments. https://t.co/NiOrDgbMRV

By Christine Lagarde

Social•Feb 11, 2026

Trump's Blockade Halts Cuba's Jet Fuel Exports

#CubaWatch 🇨🇺: Thanks to Trump’s blockade, Cuba can no longer supply jet fuel to international airlines. Stay tuned. https://t.co/I5GxUM3wGq

By Steve Hanke

News•Feb 11, 2026

Time Called on Happy Hour as French Wine and Spirit Sales Sour in Mainland China, US

French wine and spirit exporters recorded their steepest decline since the pandemic, with total sales falling 7.9% to €14.3 billion in 2025. Wine shipments slipped 4.1% while spirits plunged 17.4%, driven by a 23.8% collapse in cognac exports. The downturn reflects...

By South China Morning Post – Global Economy

Social•Feb 11, 2026

Europe Trades Russian Gas for US LNG, Risks New Dependency

“I think Greenland was a wake-up call. There is more talk [in Brussels] about replacing one dependency with another.” This is what I told the Wall Street Journal about Europe’s increasing dependence on US LNG following the end of Russian...

By Jan Rosenow

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler

Social•Feb 11, 2026

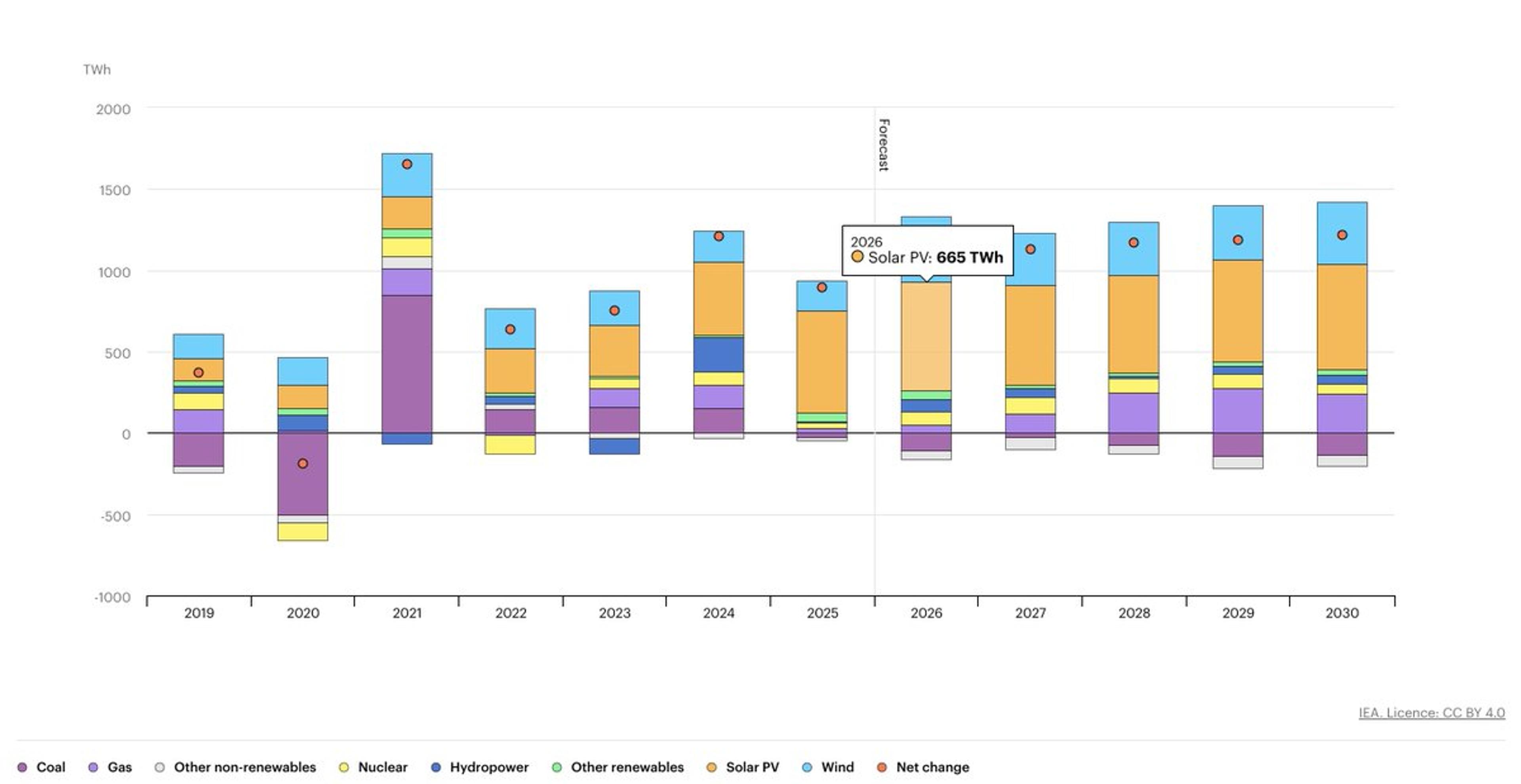

Emerging Economies Drive 80% of Electricity Growth

A new report shows that global electricity demand will increase at an average annual rate of 3.6% between 2026 and 2030. Emerging economies will account for nearly 80% of additional electricity consumption through 2030. More here: https://t.co/ZtTGSlWOMx https://t.co/dw82OPRKGw

By Damilola Ogunbiyi

Social•Feb 11, 2026

India Plans to Lift Bank FDI Cap, Boosting Lending

India’s government is considering raising the foreign direct investment (FDI) cap for banks from 20% to 49%. SMART MOVE. MORE FDI = MORE BANK CAPITAL = MORE LENDING CAPACITY https://t.co/agaPK9vbzO

By Steve Hanke

Social•Feb 11, 2026

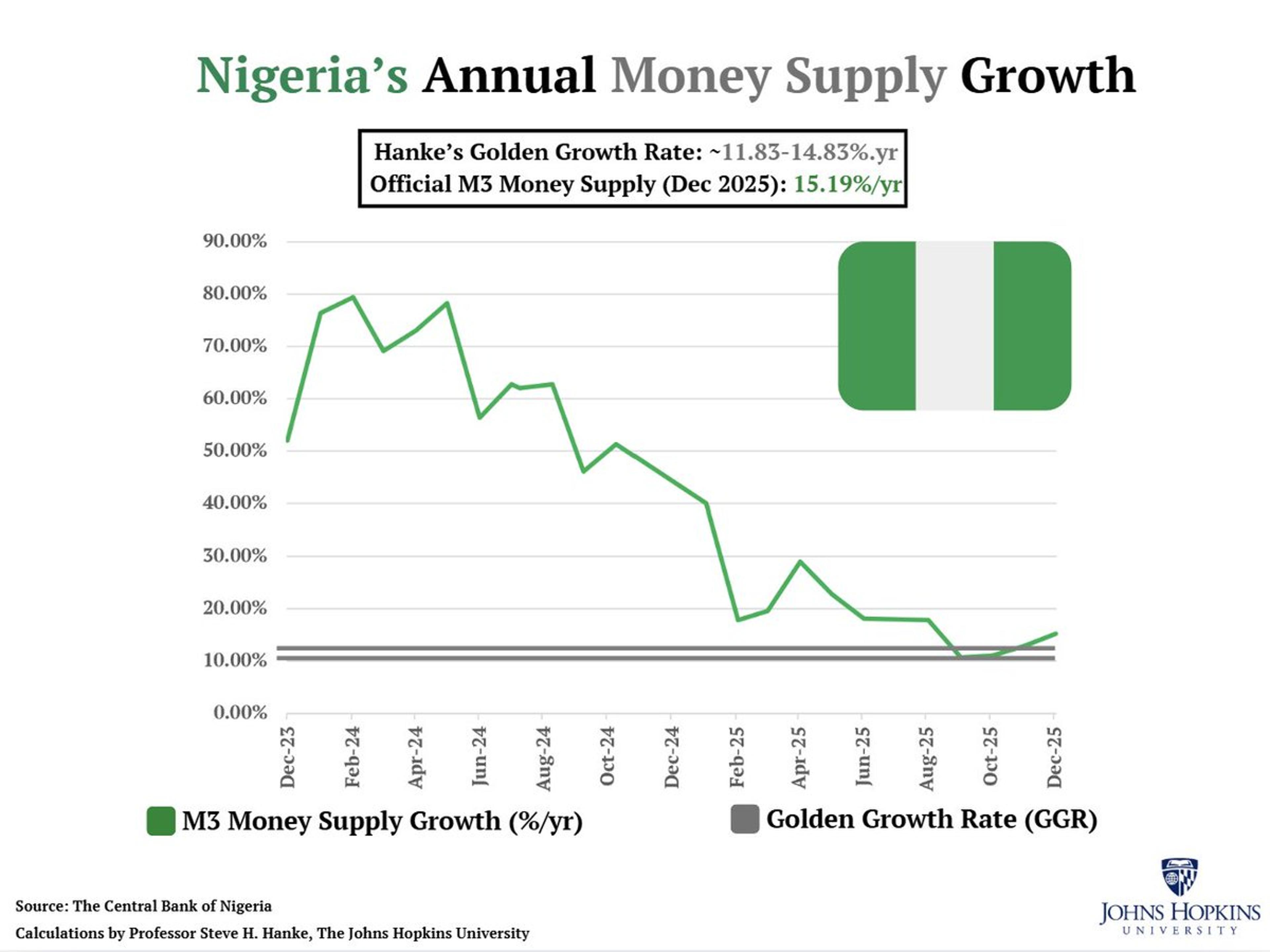

Nigeria's Inflation Surge Linked to Excess Money Supply

Nigeria’s inflation rate is DOUBLE NGA’s inflation target at 15.29%/yr. Nigeria’s money supply is growing at 15.19%/yr, ABOVE Hanke's Golden Growth Rate of ~11.83%-14.83%/yr, a rate consistent with Nigeria’s 6%-9%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/367h7H4ytf

By Steve Hanke