🎯Today's Global Economy Pulse

Updated 1h agoWhat's happening: Supreme Court nullifies Trump-era tariffs, paving way for $130 billion in refunds

The Court ruled 6‑3 that the “Liberation Day” tariffs exceeded presidential authority under the International Emergency Economic Powers Act, overturning the measures. The decision opens a path for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries. Trade groups praised the ruling but warned the refund process could be complex.

News•Feb 12, 2026

The Power of Water to Transform Africa's Future

Access to safe water remains a critical bottleneck in Sub‑Saharan Africa, with roughly one‑third of the population—and nearly half in rural areas—still lacking basic services. The African Union’s 2026 Year of Assuring Sustainable Water Availability and Safe Sanitation Systems, backed by a new World Bank Water Strategy, aims to close this gap through long‑term, partnership‑driven investments. A $1.6 billion regional program will reach over 30 million people in Eastern and Southern Africa by 2032, while similar initiatives target 20 million in Western and Central Africa. Success stories such as Ethiopia’s One Water program and Senegal’s private‑financed desalination project illustrate how coordinated financing and strong institutions can scale impact quickly.

By African Business

Social•Feb 12, 2026

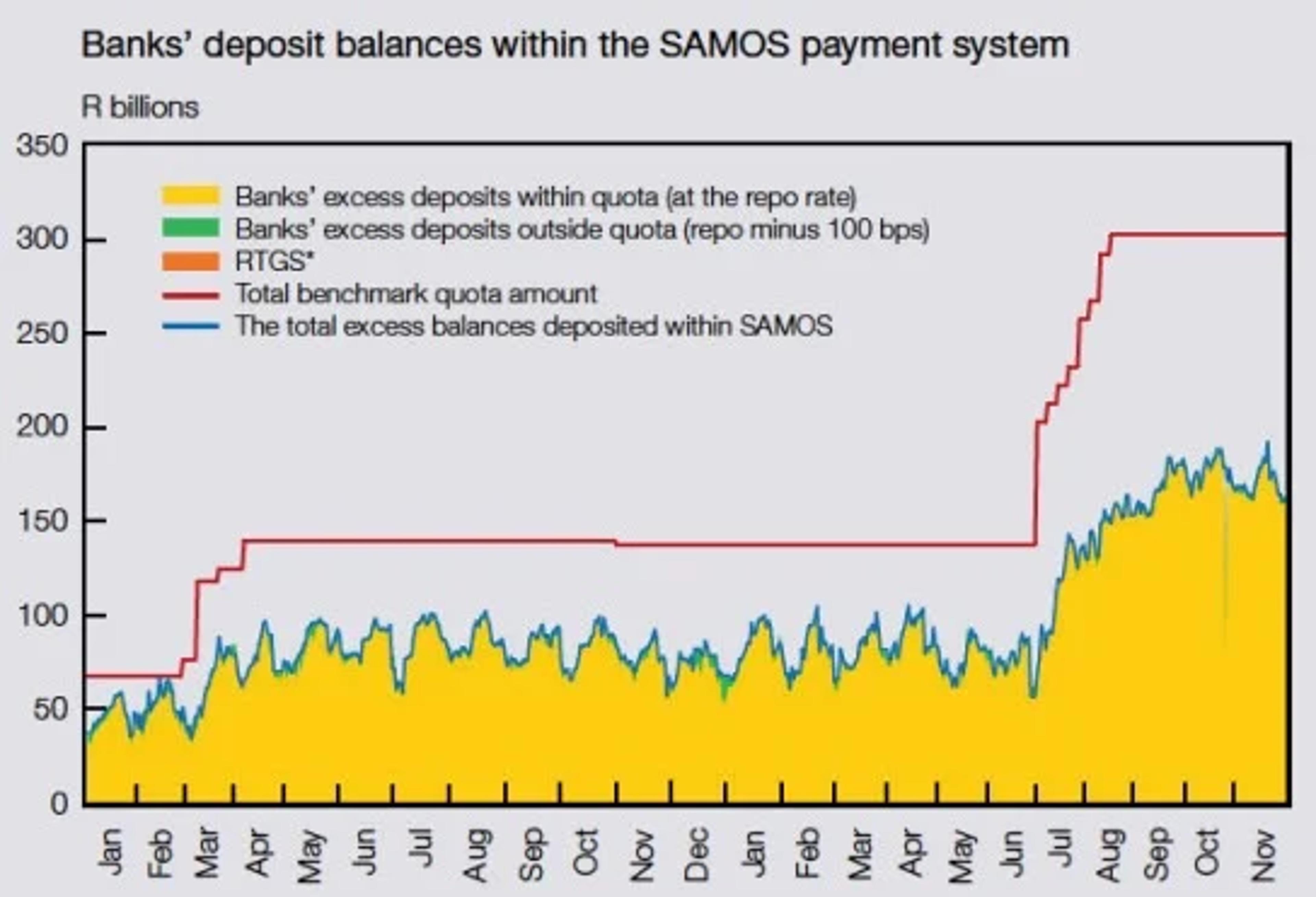

Treasury’s Cash Boost Saves Debt, Costs SARB

The state accessed funds held in the Gold and Foreign Exchange Contingency Reserve Account (GFECRA). When Treasury spent the funds, liquidity surged through the banking system, forcing the SARB to manage (“sterilize”) the excess cash, so short-term rates didn’t fall below...

By Talk Cents

News•Feb 12, 2026

China’s Wingtech Faces Setback as Dutch Court Keeps Nexperia CEO Suspended, Orders Probe

A Dutch court upheld the suspension of Nexperia’s former CEO Zhang Xuezheng and ordered a six‑month governance investigation, signaling a setback for Chinese parent Wingtech. The ruling keeps a court‑appointed temporary director in place and maintains share control by a...

By South China Morning Post – Global Economy

Social•Feb 12, 2026

BlockFills Freezes Withdrawals as Crypto Volatility Spikes

First, you lose in a matter of weeks 50%% to 99% - depending on which shitcoin you were duped to invest in - and then they don’t even allow you to withdraw the remaining crumbs of your investments. Standard operating...

By Nouriel Roubini

Podcast•Feb 12, 2026•36 min

A Geopolitical State of Emergency?

The episode examines escalating geopolitical risks to Europe’s energy security, focusing on rising US‑Iran tensions, Russia’s renewed attacks on Ukrainian energy assets, and shifting US interest in Greenland. Experts from Eurasia Group, Aurora Energy Research, and Montel analyze how these...

By Plugged In: the energy news podcast

Social•Feb 12, 2026

Europe’s LNG Hunger Redirects Chinese Shipments to Europe

LNG demand in Europe is so strong that it's taking a shipment *FROM CHINA* ⚠️ An LNG tanker reloaded a shipment at a Chinese terminal and is heading to Europe (China is the world’s largest LNG Buyer) Europe's LNG imports have surged...

By Stephen Stapczynski

Social•Feb 12, 2026

Dedollarisation Isn't Driving Yields Lower, Media Misleads

Is Dedollarisation driving bond yields lower or is social media pushing the wrong story? A deep dive into dollar strength, Fed policy, gold, and global trade dynamics. Full breakdown inside 👉️ : https://t.co/qdYNFtTIhV https://t.co/rMDnvdP14u

By Rohit Srivastava

News•Feb 12, 2026

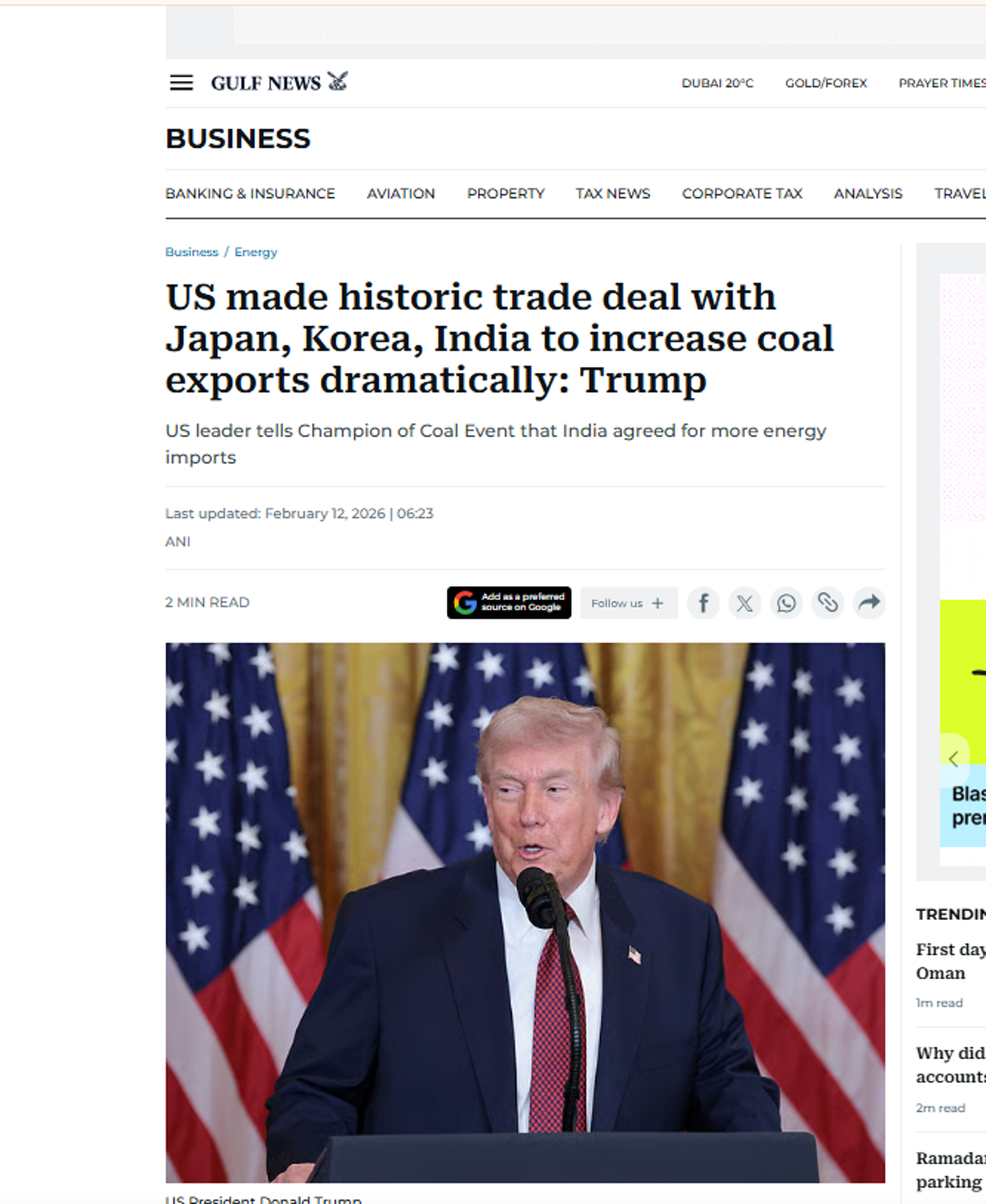

Trump Calls India-US Trade Deal ‘Historic’ as Tariff Cuts and Coal Exports Take Centre Stage

President Donald Trump called the newly concluded India‑US trade deal historic, highlighting its potential to expand American energy exports, especially coal. The interim agreement slashes U.S. duties on Indian goods to a uniform 18% across textiles, apparel, chemicals and more,...

By ET EnergyWorld (The Economic Times)

Social•Feb 12, 2026

Stablecoins Reveal New Gresham’s Law: Good Money, Bad Payments

Noelle is _always_ worth reading, but today is especially good Stablecoins and the new Gresham’s Law https://t.co/OPJ4BdgNVj "So, the US ended up with a system of good money, bad payments." https://t.co/B0xMfEdzHl

By Dave Birch

Social•Feb 12, 2026

Productivity Gains Are the Real Driver of Inflation

Posted this thread two years ago on the enigmatic relationship between inflation and productivity, and more relevant now than ever—

By Jeff Park

News•Feb 12, 2026

Fed Should ‘Aggressively’ Be Cutting Rates, Investor Says Amid Jobs Report Release

Anthony Pompliano, CEO of Professional Capital Management, argued on “Making Money” that the Federal Reserve should aggressively cut interest rates following the latest jobs report. He noted that the labor market remains solid but still offers room for monetary easing...

By Fox Business — Bonds (section)

Social•Feb 12, 2026

Trump’s Pipeline Push Could Cheapen Coal Rail Transport

🚂If President Trump is serious about increasing coal exports dramatically, and if he is serious about US energy dominance, he will build oil pipelines and prohibit rail transportation of oil. This will provide the US coal industry with the help...

By Anas Alhajji

Social•Feb 12, 2026

USDCNH and USDHKD Show Strong Inverse Correlation

The correlation between the USDCNH and USDHKD is the most intense and consistent inverted I've seen since the former (theoretically) 'floated'. What's going on there? https://t.co/KsfLfKWwTf

By John Kicklighter

News•Feb 11, 2026

U.S. Warns Peru Is ‘Losing Sovereignty’ Over Chinese-Owned Chancay Port

The U.S. State Department warned that Peru is losing sovereignty over the Chinese‑owned Chancay port after a local judge ruled the facility exempt from state regulator oversight. The $1.3 billion port, built by Cosco Shipping Ports and inaugurated by President Xi...

By gCaptain

Social•Feb 12, 2026

Venezuela's Oil Shifts: Implications for Canada Discussed in Calgary

I’ll be in Calgary in early March for a discussion hosted by the Canadian Heavy Oil Association about what recent developments in Venezuela mean for Canada’s oil industry. Join us! And drop me a line if you want to grab a...

By Rory Johnston

Blog•Feb 11, 2026

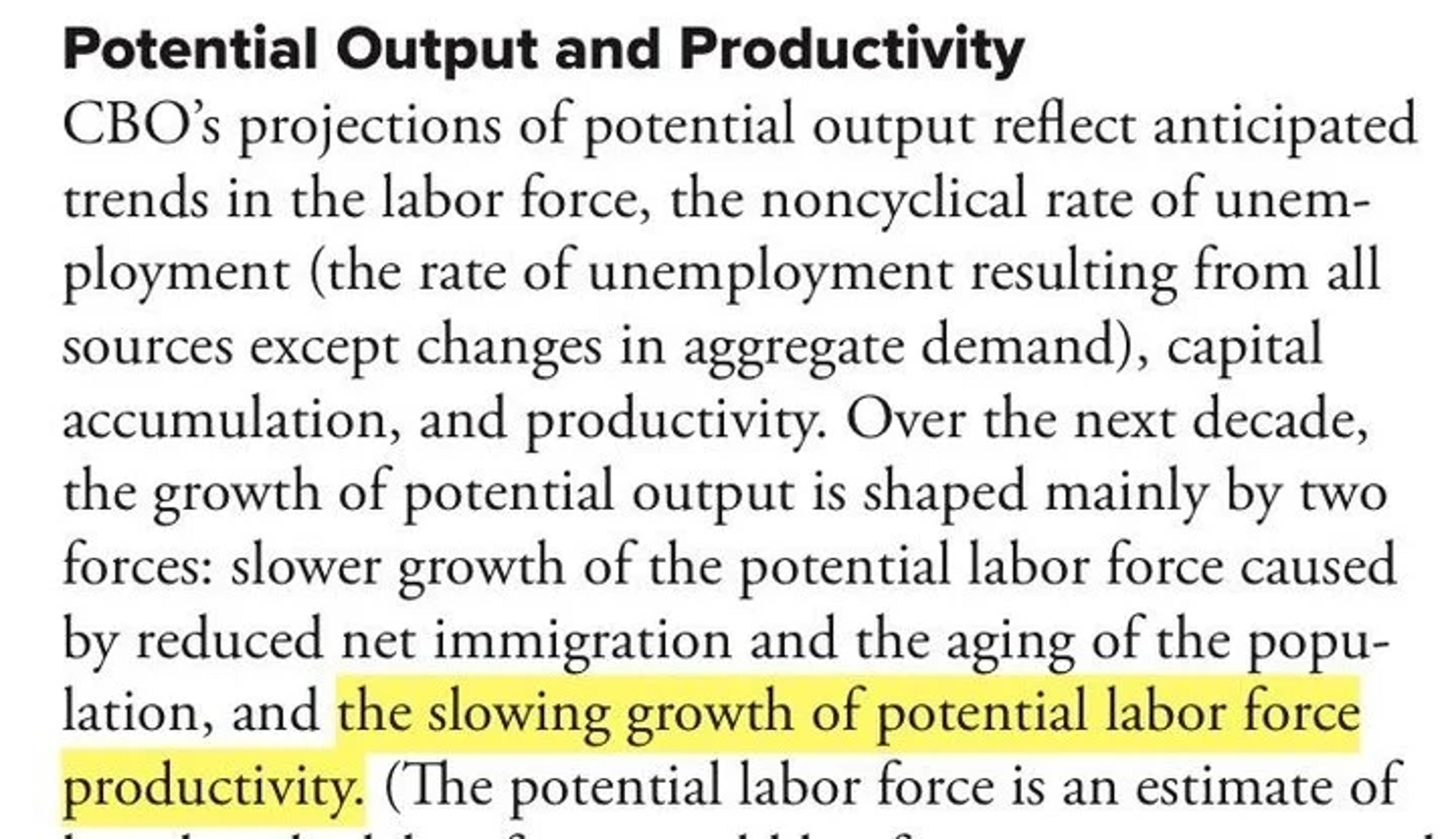

US Budget Deficits: Spitting Into the Wind

The CBO’s 2026‑2036 outlook shows U.S. federal deficits as a percent of GDP climbing to levels not seen since the 2007‑09 recession. While the primary deficit is modestly declining, net interest costs are soaring, already surpassing defense spending and projected...

By The Conversable Economist

News•Feb 11, 2026

Munis Mixed, UST Yields Rise Post-Jobs Report

Municipal bond prices were mixed on Wednesday as U.S. Treasury yields climbed following a stronger‑than‑expected jobs report, prompting market participants to reassess the timing of the Federal Reserve’s next rate cut. The two‑year muni‑UST spread slipped to 59% while longer‑dated...

By The Bond Buyer (municipal finance)

Blog•Feb 11, 2026

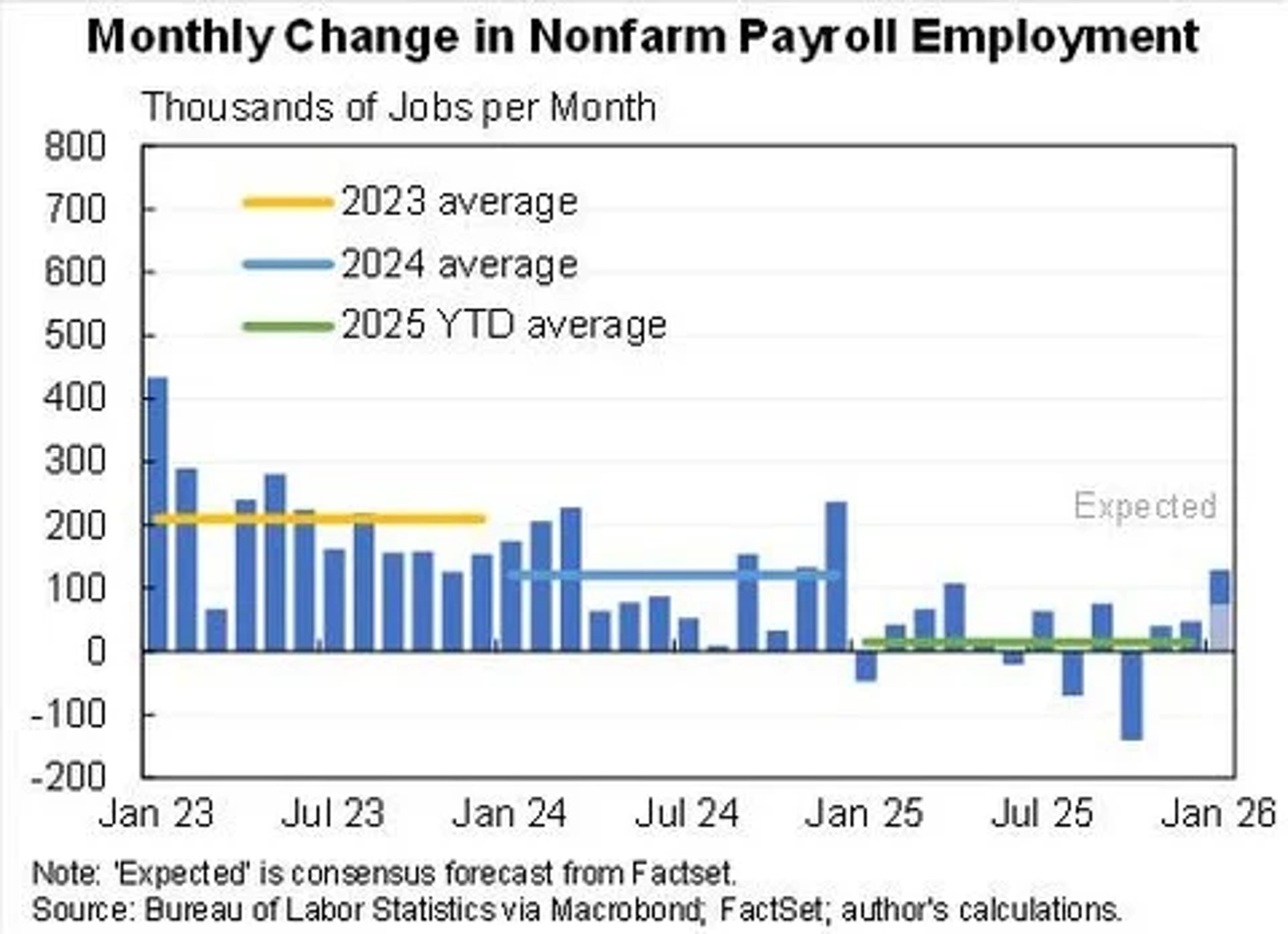

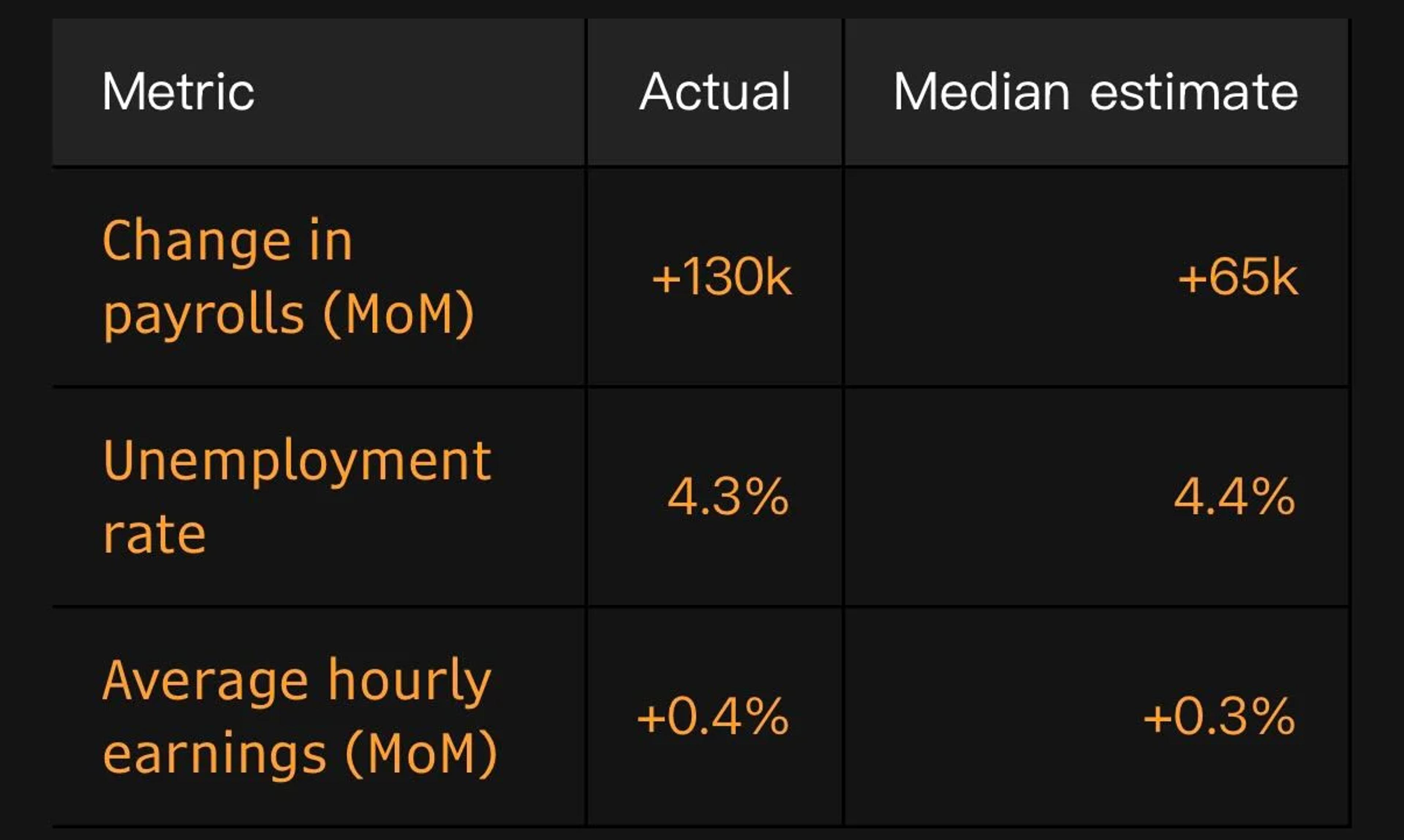

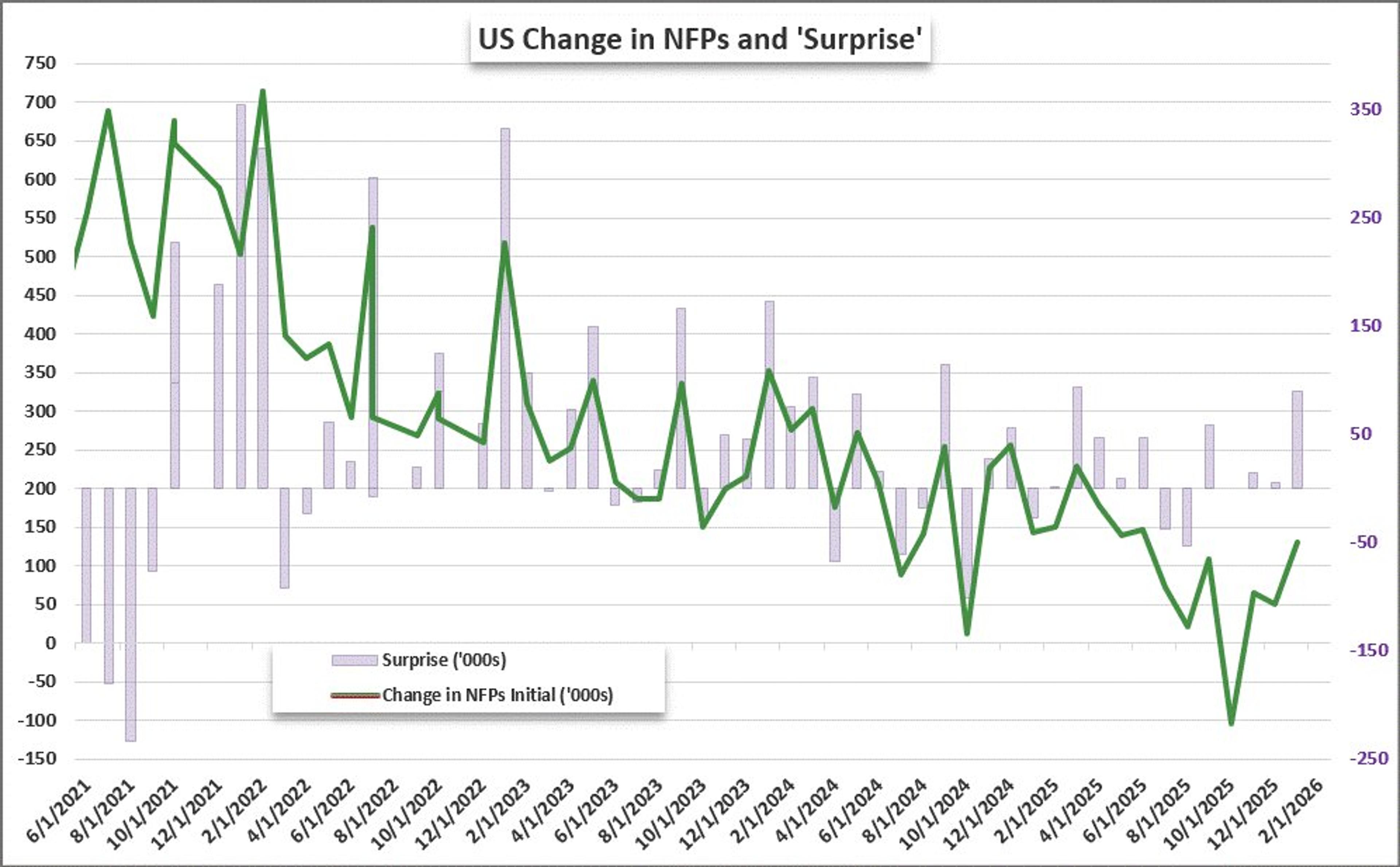

Stunning Resilience

The 10‑year Treasury yield slipped 8 basis points after a trio of surprisingly strong labor‑market releases, settling just below the 4.20% technical barrier. January’s payrolls added 130,000 jobs, far exceeding the 70,000 forecast, while the unemployment rate fell to 4.3%...

By Mortgage News Daily – MBS Live Commentary

News•Feb 11, 2026

Why the Largest U.S. Auto Dealer Isn't Interested in Chinese Cars — for Now

Lithia Motors, the largest U.S. auto dealer, said it will not bring Chinese‑made vehicles to its domestic showrooms for now. CEO Bryan DeBoer cited the high cost of establishing new franchise infrastructure and uncertain return‑on‑investment, not politics or logistics, as...

By CNBC – Economy

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2165717307-a843d8a1e1c94e9d98075343fa914292.jpg)

News•Feb 11, 2026

What To Expect From Friday's Report On Inflation

Economists expect the January Consumer Price Index to rise 2.5% year‑over‑year, a dip from December’s 2.7% and the lowest headline inflation since May 2021. Core CPI, which strips out food and energy, is also projected at 2.5%, matching the lowest...

By Investopedia — Economics

News•Feb 11, 2026

The UK Chagos Deal Is an 'Act of Great Stupidity'

The United Kingdom has announced a plan to transfer sovereignty over the Chagos Islands to an unrelated African nation, sparking alarm among security analysts. The islands host Diego Garcia, a joint U.S.–U.K. military base that underpins American power projection across...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

Western Europe in a Multipolar World

The global order has moved from Cold‑War bipolarity to a multipolar system where the United States, Russia and a rising China dominate international affairs. Technological globalization and interdependence have intensified, reshaping how Western Europe engages with these powers. The article...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

Lower Unemployment Rate Supports Longer Pause for Fed

January’s jobs report showed 130,000 new positions, nearly double expectations, and a unemployment rate drop to 4.3%, down from 4.5% in January. The stronger labor market has pushed back market expectations for the Federal Reserve’s next rate cut from June...

By The New York Times — Economy

News•Feb 11, 2026

Ex-Prince Andrew Suggested Uranium Investments to Epstein: BBC

A confidential UK briefing on high‑value minerals in Afghanistan’s Helmand province, highlighting uranium among other resources, was forwarded by former trade envoy Prince Andrew to Jeffrey Epstein in 2010. The document, prepared during Andrew’s official visit, outlined potential low‑cost extraction...

By MINING.com

News•Feb 11, 2026

From Kinshasa to Kansas: US Lays Out Its Plan to Reshape Cobalt Supply Chains

The United States unveiled Project Vault, a $12 billion critical‑mineral stockpile designed to underwrite domestic EV battery production and reduce reliance on China. Hours later, government‑backed Orion CMC signed an MoU with Glencore to acquire a 40% stake in the miner’s...

By Fastmarkets – Insights

News•Feb 11, 2026

Lloyds Banking Group to Close Another 95 Branches

Lloyds Banking Group announced it will shut 95 more branches – 53 Lloyds, 31 Halifax and 11 Bank of Scotland locations – between May 2024 and March 2027. The closures will leave the group with about 610 branches after the...

By BBC News – Business

News•Feb 11, 2026

Would You Pay £7.50 for a Pint of Guinness?

The Advocate Arms in Market Rasen is polling patrons on a possible £7.50 price for a pint of Guinness, up from its current £6. Diageo says the increase translates to roughly £0.04 per draught pint and stresses that retail pricing...

By BBC News – Business

News•Feb 11, 2026

Best Trade Finance Bank In North America: BNY

BNY was named the Best Trade Finance Bank in North America, reflecting its robust portfolio and eight global trade centers. The bank leverages high credit ratings, competitive pricing, and a suite of digital tools to streamline trade processing, risk mitigation,...

By Global Finance Magazine

Social•Feb 11, 2026

CBO Underestimates AI's Productivity Boost, Forecasts Too Low

CBO is mostly dismissive of the effects of AI on productivity growth (overly so IMHO). They expect *slowing* potential labor force productivity as the modest AI boost to TFP is swamped by the reduction in capital services. I would take the over...

By Jason Furman

Social•Feb 11, 2026

Labor Market Rebounds After Shutdown, Easing Temporary Layoffs

The labor market showed signs of healing late in 2025 and in January. Catch up following long government shutdown helps alleviate ranks of those suffering temporary layoffs and forced to accept part instead of full-time jobs. Some healthy churn returned...

By Diane Swonk

News•Feb 11, 2026

What Rubio Gets Right (and Wrong) About the Western Hemisphere

Juan S. González argues that U.S. security hinges on a stable Western Hemisphere, echoing Roosevelt’s Monroe‑Doctrine insight. He praises Secretary of State Marco Rubio for recognizing the need for proactive engagement but criticizes Rubio’s reliance on coercion and short‑term pressure....

By Foreign Policy

Social•Feb 11, 2026

2027 AI Race: Align or Lose Human Relevance

🚨 From Agent-1 to Superintelligence: The AI 2027 Scenario The AI 2027 Report outlines one of the most thought-provoking trajectories for artificial intelligence: a rapid evolution from simple assistants (Agent-1) to autonomous, adversarially misaligned systems (Agent-4) and ultimately to Agent-5 —...

By Giuliano Liguori

Social•Feb 11, 2026

Jobs Surge, Unemployment Drops: GDP Gains Confirm Strength

On the surface a strong jobs report (130K jobs & unemployment falls to 4.3%). And just about every detail makes that stronger: participation up, involuntary part-time down, hours up, wages up. The mystery of strong GDP and weak jobs is being resolved...

By Jason Furman

News•Feb 11, 2026

Kroenig on NPR on Iran

Atlantic Council vice‑president and Scowcroft Center senior director Matthew Kroenig appeared on NPR on Feb. 11 to discuss the Trump administration’s ongoing negotiations with Iran. He outlined the limited progress of back‑channel talks aimed at reviving a nuclear agreement and highlighted...

By Atlantic Council

Social•Feb 11, 2026

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

Social•Feb 11, 2026

Refineries Drowning in Silver Scrap, Bearish Outlook

Why @BergMilton is bearish silver: refineries are OVERWHELMED with silver scrap, EVEN MORE than in 2011 (prior speculative peak). Well sourced from "largest smelter in New York" Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi https://t.co/ng04tObLMG

By Jack Farley

Social•Feb 11, 2026

Argentine Peso Rallies, USDARS Breaks 100‑Day SMA Streak

In case you haven't been keeping tabs, the Argentine Peso has been gaining some traction recently. $USDARS has taken out some recent support and ended a 1,689 (trading) day streak above the 100-day SMA https://t.co/Vq0kH5UKHg

By John Kicklighter

Social•Feb 11, 2026

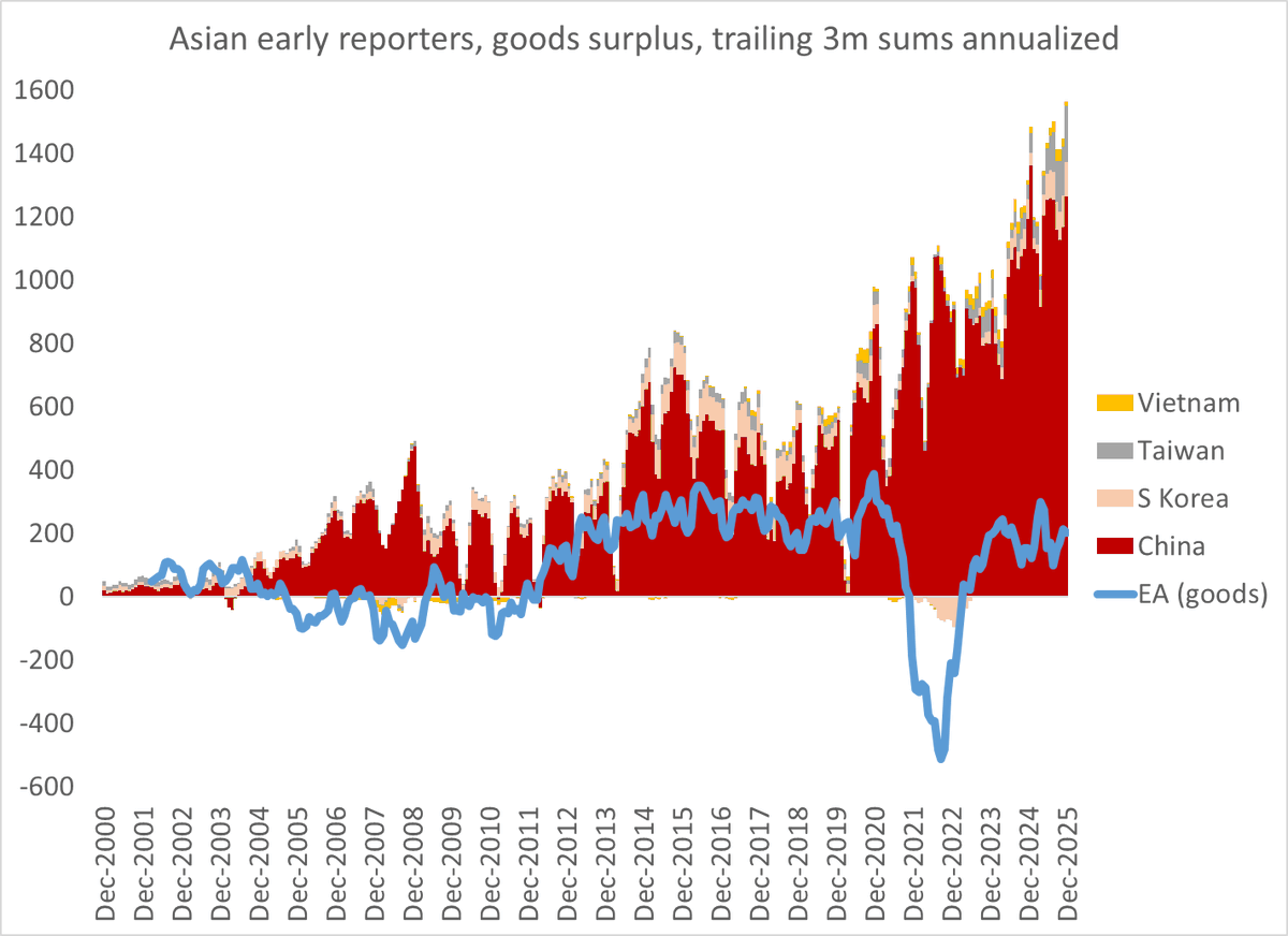

East Asia Dominates Global Goods Trade Surplus, Eclipsing Europe

Crazy how much of the global (goods) trade surplus is in East Asia now. Even with the "fake" Irish pharma surplus, the euro area is dwarfed 1/ https://t.co/eZjcgAlVqC

By Brad Setser

Social•Feb 11, 2026

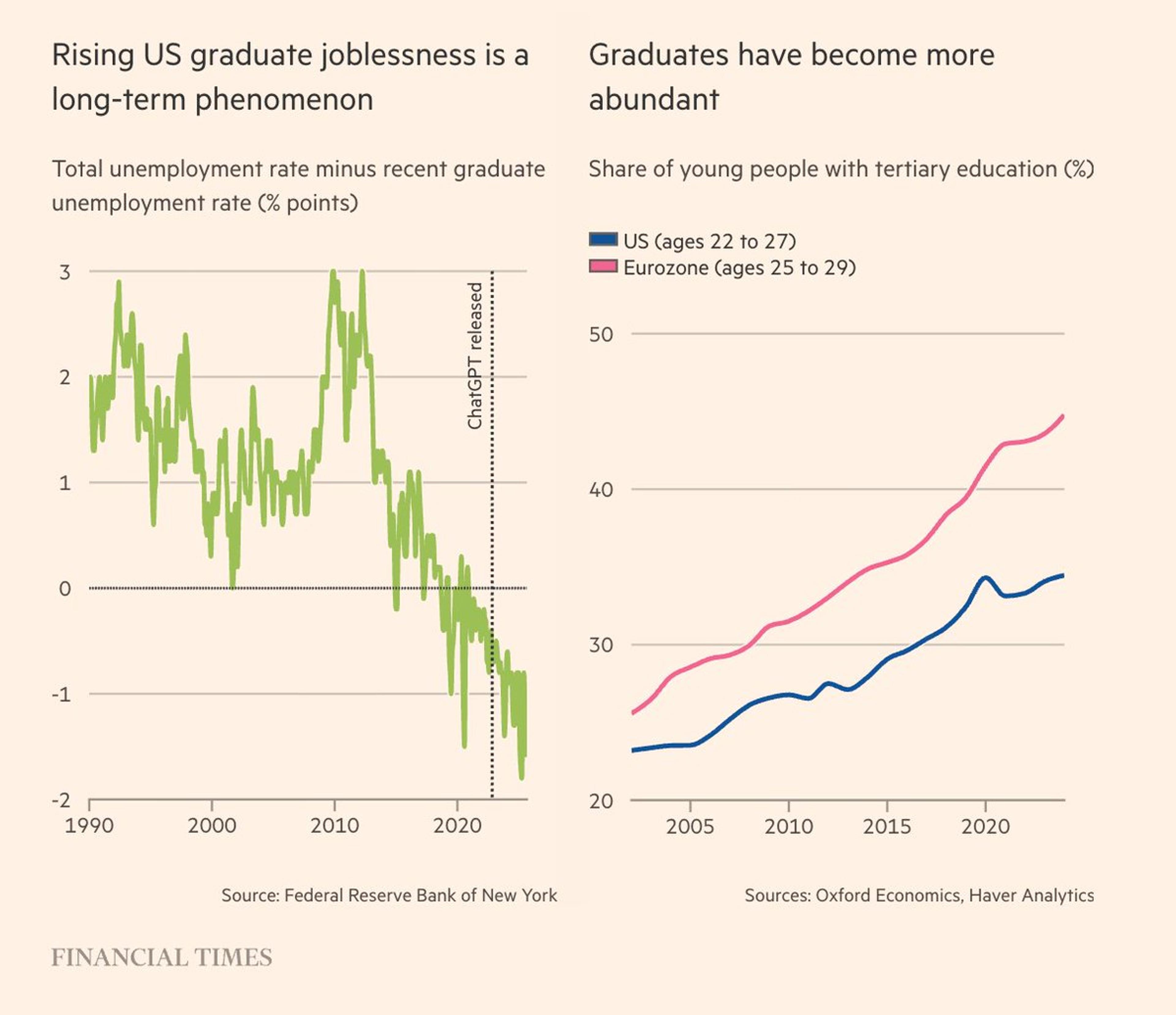

US Grads Face Higher Unemployment; Eurozone More Educated Workforce

Very striking data these a. on US graduate unemployment and b. higher share of tertiary education in Eurozone labor force than in the US. Explore these economic insights in today's Chartbook Top Links. https://t.co/xNeFQVgZKf

By Adam Tooze

Social•Feb 11, 2026

NFP Beat Trims Fed Rate Cut Expectations by 8‑12bps

In the wake of this morning's NFPs beat and downtick in the unemployment, Fed Funds futures have shaved off ~8bps worth of expected cuts through 2026 - was as much as 12bps. Someone is going to be surprised if this continues:...

By John Kicklighter

Social•Feb 11, 2026

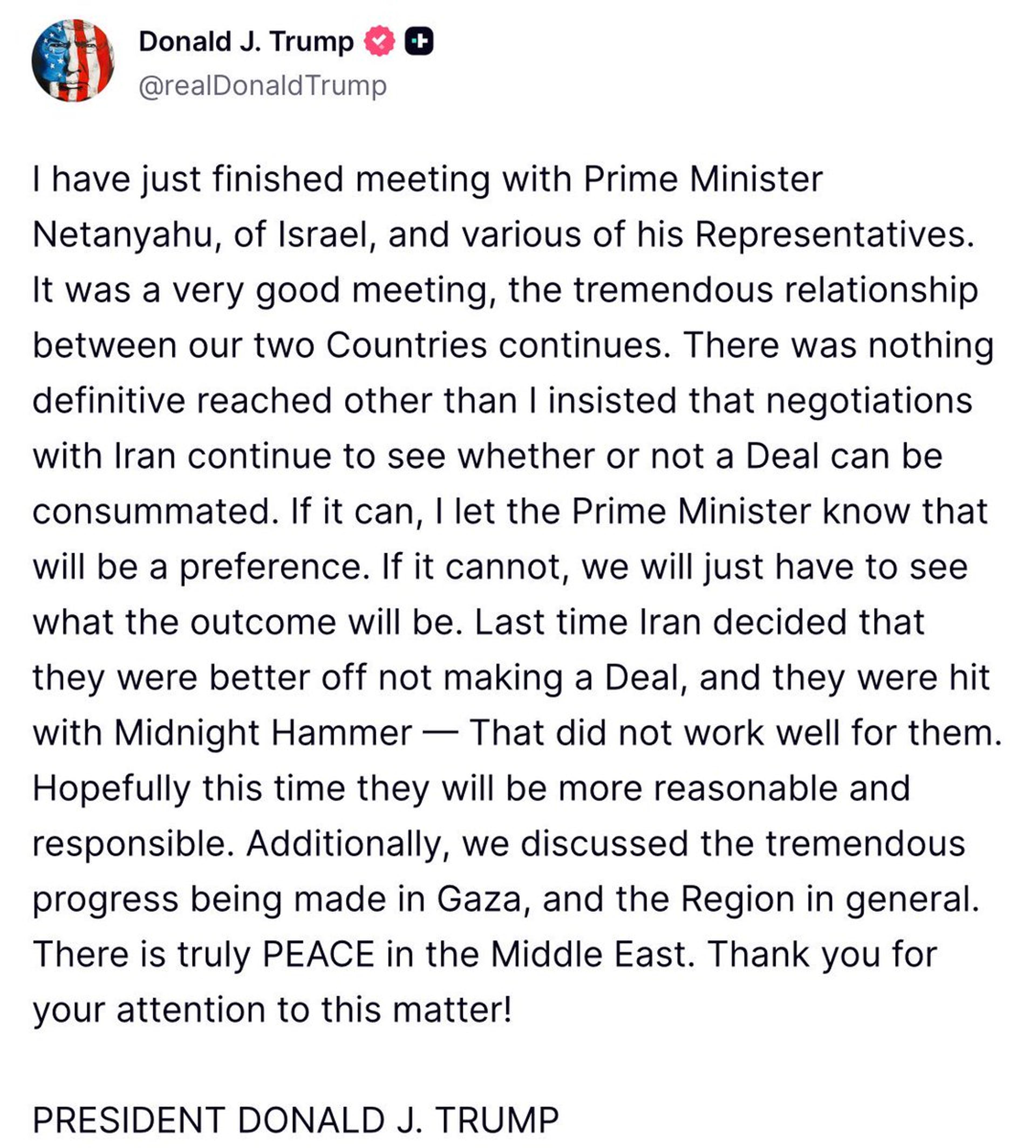

Trump Urges Netanyahu to Pursue Iran Nuclear Deal

OIL MARKET: President Trump says he told Israeli Primer Minister Netanyahu that his preference is to cut a deal with Iran. “I insisted that negotiations with Iran continue to see whether or not a deal can be consummated.” https://t.co/VhkfL7QBHF

By Javier Blas

Social•Feb 11, 2026

EU Debt Issuance

If the EU were only able to issue its own debt, imagine the possibilities… Yeah, imagine if you gave EU bureaucrats the power to spend an astronomical amount in addition to its power to regulate https://t.co/KAqbSOG71R

By Axel Merk

Social•Feb 11, 2026

Yen Carry Trade Holds; USD Weakens, Markets Rise

Yen Carry Trade Is Not Unwinding Like You Think $USDJPY $FXY $QQQ $DXY Japan & China’s pressure on Treasury sales are weakening the USD, supporting equities + metals overall, without triggering a disruptive yen carry trade unwind. https://t.co/m6Mu3FpuRf

By Samantha LaDuc

Social•Feb 11, 2026

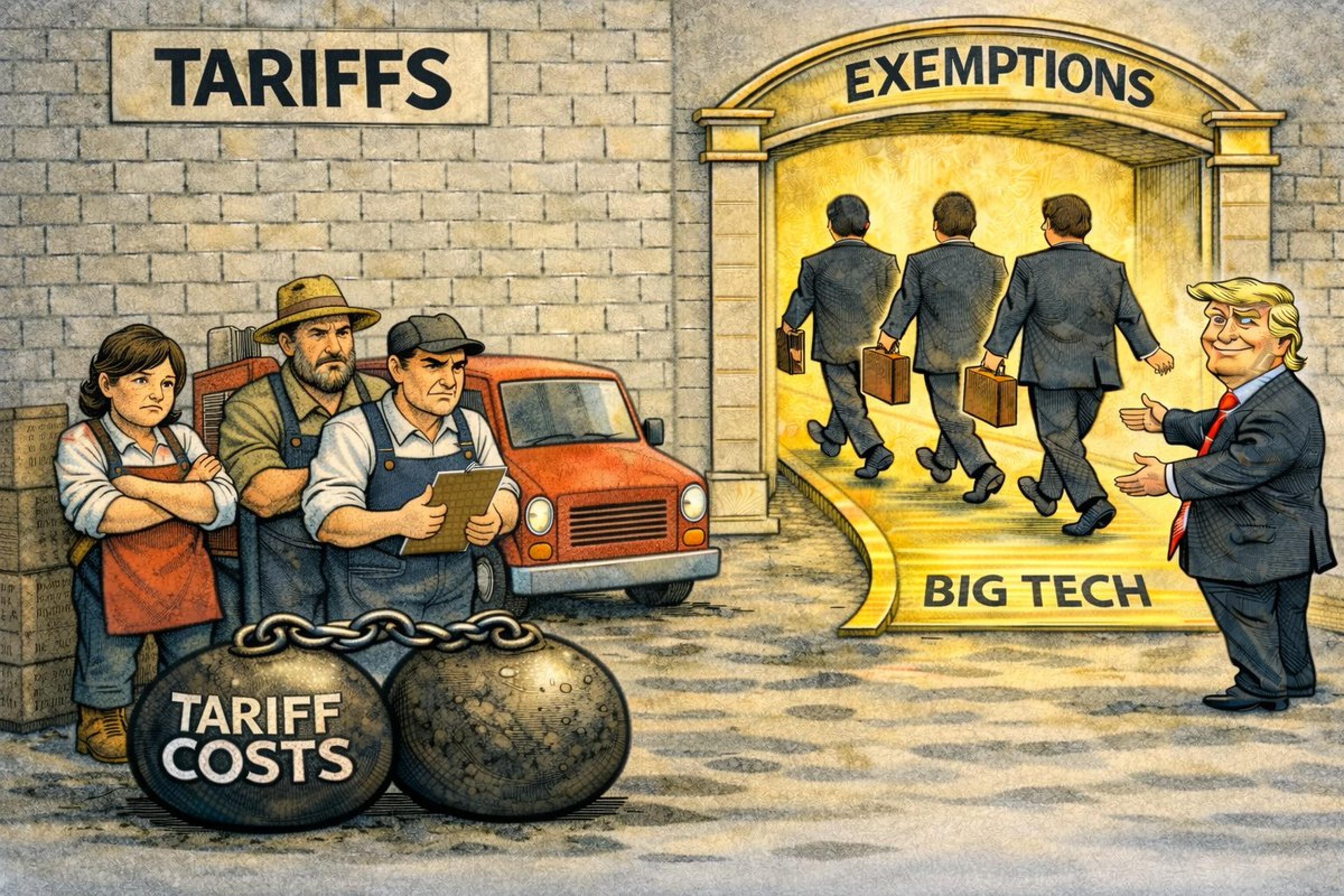

Big Tech Buys Trump Tariff Exemptions, Small Firms Suffer

Big Tech and their lobbyist have bought exemptions from Trump’s tariffs. Meanwhile, the small fries are getting FRIED. TRUMP’S TARIFFS = THE BIG GUYS CAN ALWAYS BUY AN EXEMPTION. https://t.co/zlVn4ornDl

By Steve Hanke

Social•Feb 11, 2026

New Jobs Report: What It Means for You

Latest jobs report just dropped. Let's spend a few minutes talking about what's really going on, what it means for you, and what to keep your eye on. https://t.co/ptv6DbFqKM

By Justin Wolfers

Social•Feb 11, 2026

Argentina's 32% Inflation Signals Milei Must Dollarize

Argentina’s January inflation came in at a RED HOT 32.4%/yr. Pres. Milei’s monetary model is not working. MILEI MUST DOLLARIZE NOW. https://t.co/MLSKqYfys7

By Steve Hanke

Social•Feb 11, 2026

USDJPY Plunges 2.5% in Three Days, Reversal Uncertain

$USDJPY is down over -2.5% over the past three days. One of the biggest drops in the past year and a half. Doesn't mean it has to stall and reverse though... https://t.co/LRjhnctyzL

By John Kicklighter

Social•Feb 11, 2026

US Household Debt Peaks at $18.8T, Delinquencies Surge

US household debt just hit $18.8 TRILLION. Consumer delinquencies are at their HIGHEST LEVEL in nearly a DECADE. Not a good sign. https://t.co/PHcOGrhvOc

By Steve Hanke

Social•Feb 11, 2026

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter

Social•Feb 11, 2026

President's Attempt to Manipulate Job Data Failed

My menchies show a lotta distrust about the official jobs numbers right now. Lemme be clear: I don't believe there's *any* political meddling in these numbers. While the President has tried to mess with the BLS, he failed. I explain in...

By Justin Wolfers