🎯Today's Global Economy Pulse

Updated 24m agoWhat's happening: Supreme Court nullifies Trump-era tariffs, paving way for $130 billion in refunds

The Court ruled 6‑3 that the “Liberation Day” tariffs exceeded presidential authority under the International Emergency Economic Powers Act, overturning the measures. The decision opens a path for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries. Trade groups praised the ruling but warned the refund process could be complex.

News•Feb 13, 2026

The Panama Canal and The U.S. Grains & BioProducts Council Sign MoU

The Panama Canal and the U.S. Grains & BioProducts Council (USGBC) signed a Memorandum of Understanding to boost the flow of U.S. agricultural exports through the canal. The agreement focuses on improving efficiency, reliability and sustainability of grain shipments, with joint market analysis and data‑sharing initiatives. Grain traffic already accounts for roughly 25.1 million metric tons in FY 2025, underscoring the canal’s role as a critical conduit for U.S. ag‑trade. The partnership reinforces a century‑long U.S.–Panama commercial relationship and positions the canal as a strategic asset for future food‑security logistics.

By The Maritime Executive

News•Feb 13, 2026

The Industry Blind Spot that Lets Crew Suffering Escalate

Shipping consultant Frank Coles warns that seafarers face systemic abuse hidden by the industry’s self‑regulation. Crew members endure long contracts, limited shore leave, and mental‑health strain while owners chase cheap labor across weak‑law jurisdictions. Regulatory bodies draft safety rules but...

By Splash 247

News•Feb 13, 2026

CNOOC Targets 40% Offshore Wind Capacity Ramp up in 2026

China National Offshore Oil Corporation (CNOOC) announced a 40% increase in offshore wind capacity for 2026, targeting 3.5 GW of installed power. The expansion, executed with turbine maker Ming Yang Smart Energy, will roll out advanced turbines across southern provinces. Falling costs...

By Splash 247

News•Feb 13, 2026

Malaysia’s Population Growth Slows to 0.6% in Q4 2025

Malaysia’s fourth‑quarter 2025 demographic report shows population growth decelerating to 0.6%, reaching 34.3 million. Live births fell 5.4% while the elderly share rose to 8.0%, indicating an ageing trend. Labour demand grew 1.8% to 9.21 million jobs, the strongest since Q1 2024, with...

By Human Resources Online (Asia)

News•Feb 13, 2026

Appointment to the Monetary Policy Board

The Reserve Bank of Australia announced that Professor Bruce Preston has been appointed to the Monetary Policy Board, effective immediately. Preston brings a distinguished academic record and extensive experience in public‑policy economics. Governor Michele Bullock also thanked outgoing board member...

By Reserve Bank of Australia — Media Releases

Social•Feb 13, 2026

Trump’s Iran Remarks, Not IEA, Drive Oil Slump

A bit of a stretch, attributing crude’s slump on Thursday to the #IEA report. If the market thought a 4 million b/d glut would cushion any supply disruption/shock, including the one posed by current US-Iran tensions, Brent would not have been...

By Vandana Hari

Social•Feb 13, 2026

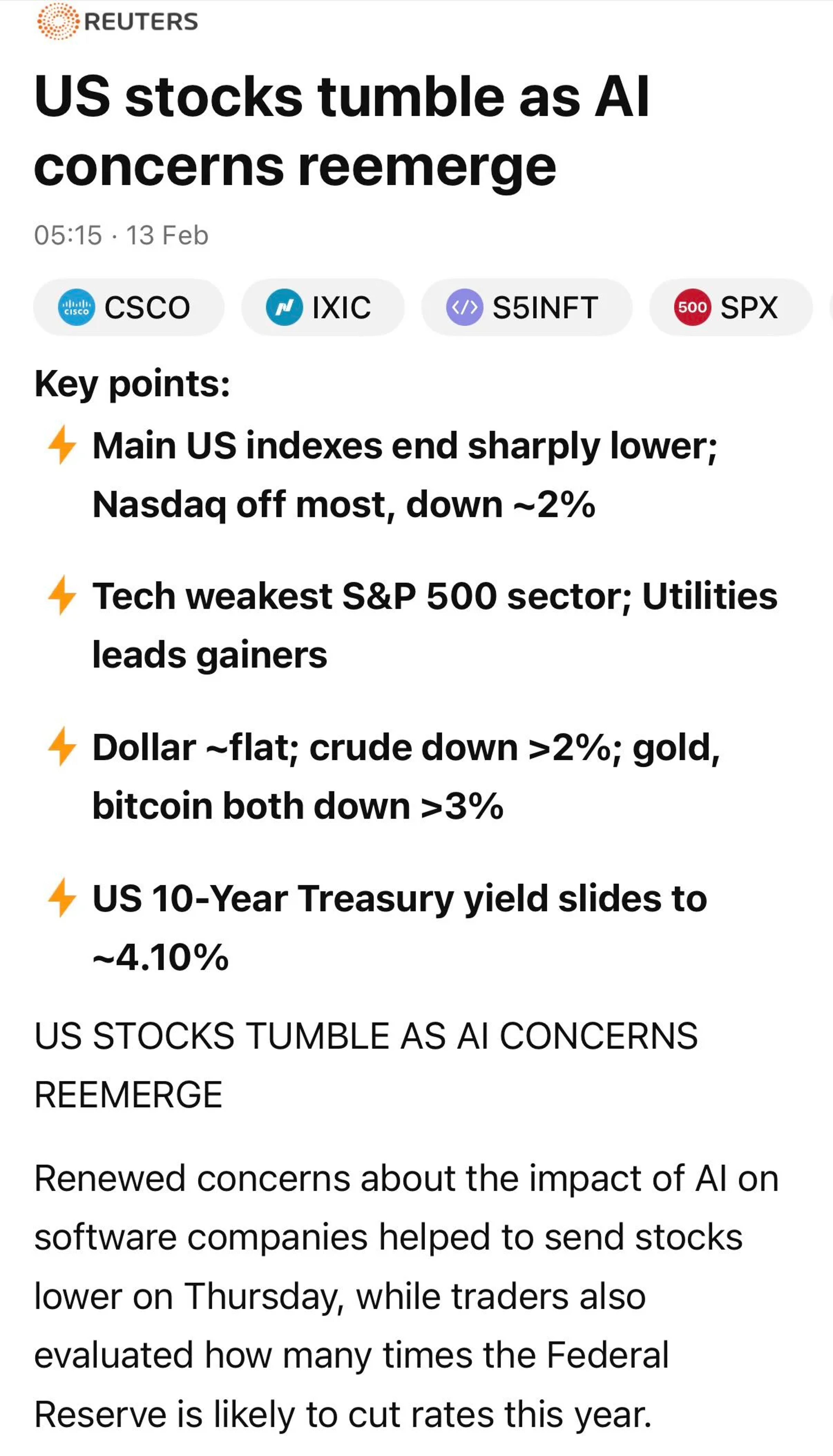

US AI Sell‑off Drags Japan, Korea From Record Highs

Tech, AI-related selling in US having early impact on Japan -1.6% and S Korea -0.7% stock markets. Both coming off record highs. Spore was also at record high yesterday. Some negative headlines.

By Azharuddin | Azha Investing

Blog•Feb 13, 2026

2026-02-13: India-US Interim Trade Deal Sparks Opposition Protests and Political Criticism

The episode examines the India‑US interim trade agreement, which has moved from a tariff announcement to a flashpoint in India’s February 2026 budget session. Opposition parties are framing the pact as a “trap deal,” launching parliamentary attacks and street protests...

By Security Asia

Social•Feb 13, 2026

US Must Secure Mineral Sources, Not Just Funding

You can’t stockpile what you don’t control. The easy part is $12 billion from the Trump Adminstration. The hard part is finding the mines, processing & pricing. Washington needs to build alliances instead of burning them. https://t.co/JfhrJs5VnH #CriticalMinerals #Geopolitics #China #SupplyChains #EnergyTransition #Mining #USPolicy

By Art Berman Blog

Social•Feb 13, 2026

Shipping Decarbonizes Regardless of U.S. Policy Shifts

Shipping is decarbonizing with or without Washington. Capital has already committed: dual-fuel vessels dominate orderbooks, and investment decisions are being driven by EU rules, port levies, and future-proofing U.S. politics comes & goes https://t.co/LBSLcVd8Xn #Shipping #IMO #Decarbonization #EnergyTransition #ESG #Maritime #ClimatePolicy

By Art Berman Blog

News•Feb 12, 2026

Release: Market Participants Survey

On November 9 2026 the Bank of Canada published its quarterly Market Participants Survey, a systematic outreach to a broad cross‑section of financial‑market actors. The survey solicits expectations on key macro‑economic indicators such as inflation, growth, and exchange rates, as well as...

By Bank of Canada — RSS (site hub)

Social•Feb 13, 2026

Photo Op Won’t Revive Venezuela’s Oil Without Real Investment Conditions

You don’t revive Venezuela’s oil sector by touring dilapidated fields @SecretaryWright This is a pointless photo op Tell us about restoring conditions in which companies would risk capital to revive oil production. Otherwise, keep the photos on your phone #EnergyPolicy #Venezuela #OilMarkets #Geopolitics...

By Art Berman Blog

Social•Feb 13, 2026

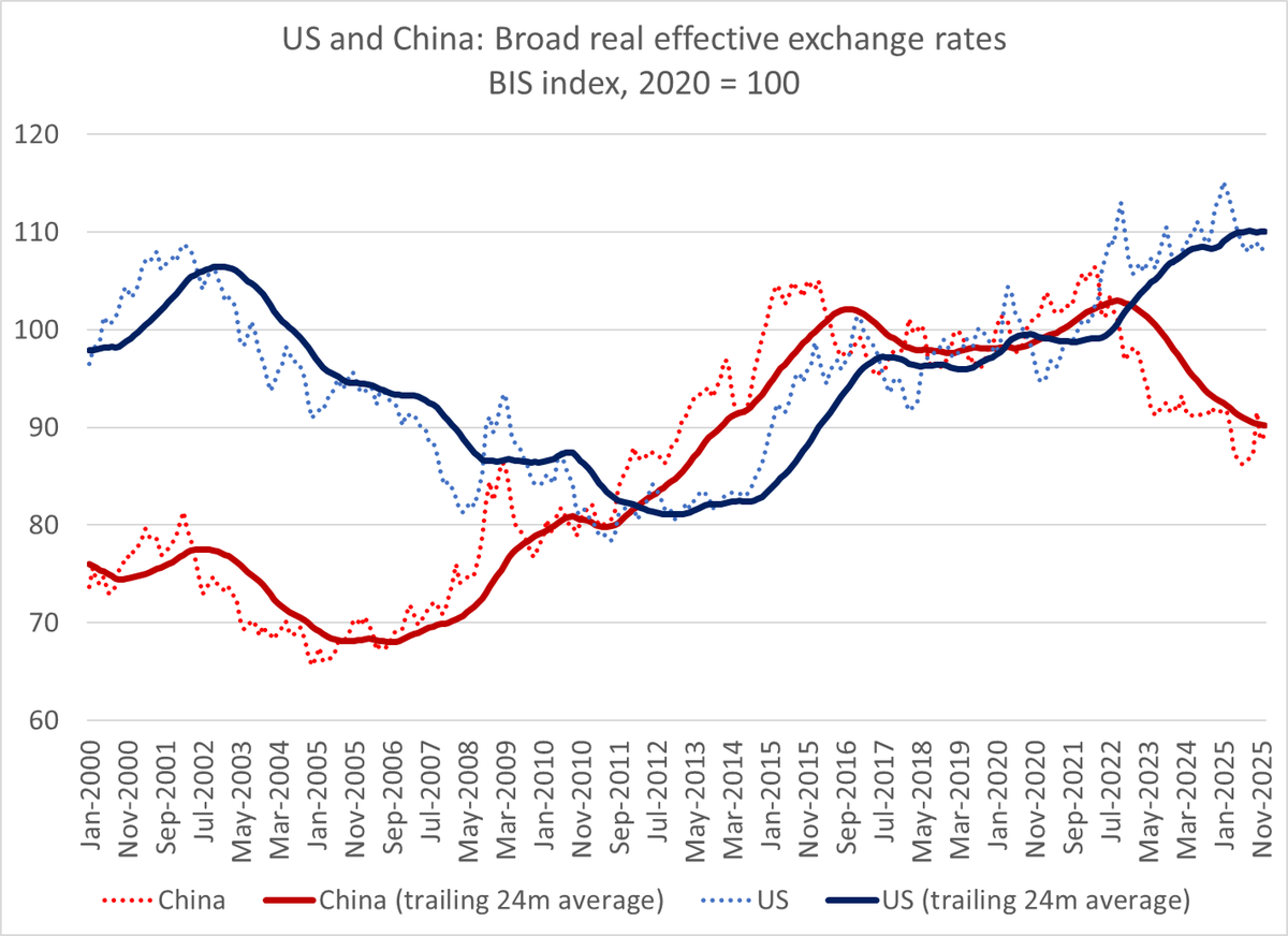

Inflation‑adjusted Dollar

A pet peeve. Talk about current dollar weakness. Numbers here are through December -- but in December the broad inflation adjusted dollar was stronger than in 01 or 02, the peak before 22-24 1/ https://t.co/c7KU9z1C6t

By Brad Setser

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada’s Governing Council released a detailed summary of its monetary‑policy deliberations for the decision announced two weeks ago. The Council kept the policy interest rate steady at 4.75%, citing modest progress toward its 2% inflation target. Officials...

By Bank of Canada — RSS (site hub)

Social•Feb 12, 2026

Call Centers Signal AI‑Driven Job Crisis Ahead

A good canary in the coal mine for AI-caused job loss will be call centers. We're currently projecting ~2.75M call center jobs in the US in 2026. In 2016 it was ~2.63M. The global call center market size has grown...

By François Chollet

Social•Feb 12, 2026

From Labor to Compute: Economy’s Next Quantum Leap

1900: Internal Combustion + Electricity = 5x GDP growth. 2026: AGI + Humanoid Robotics + Space-based Energy = 50x GDP growth. This is NOT a cycle; instead, we are in a phase change for the species. The transition from being...

By Peter H. Diamandis

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada released a detailed Summary of Deliberations outlining the Governing Council’s discussion of the monetary‑policy decision announced two weeks earlier. The document highlights the Council’s assessment of inflation trends, labour‑market tightness, and the domestic growth outlook. It...

By Bank of Canada — RSS (site hub)

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

Social•Feb 12, 2026

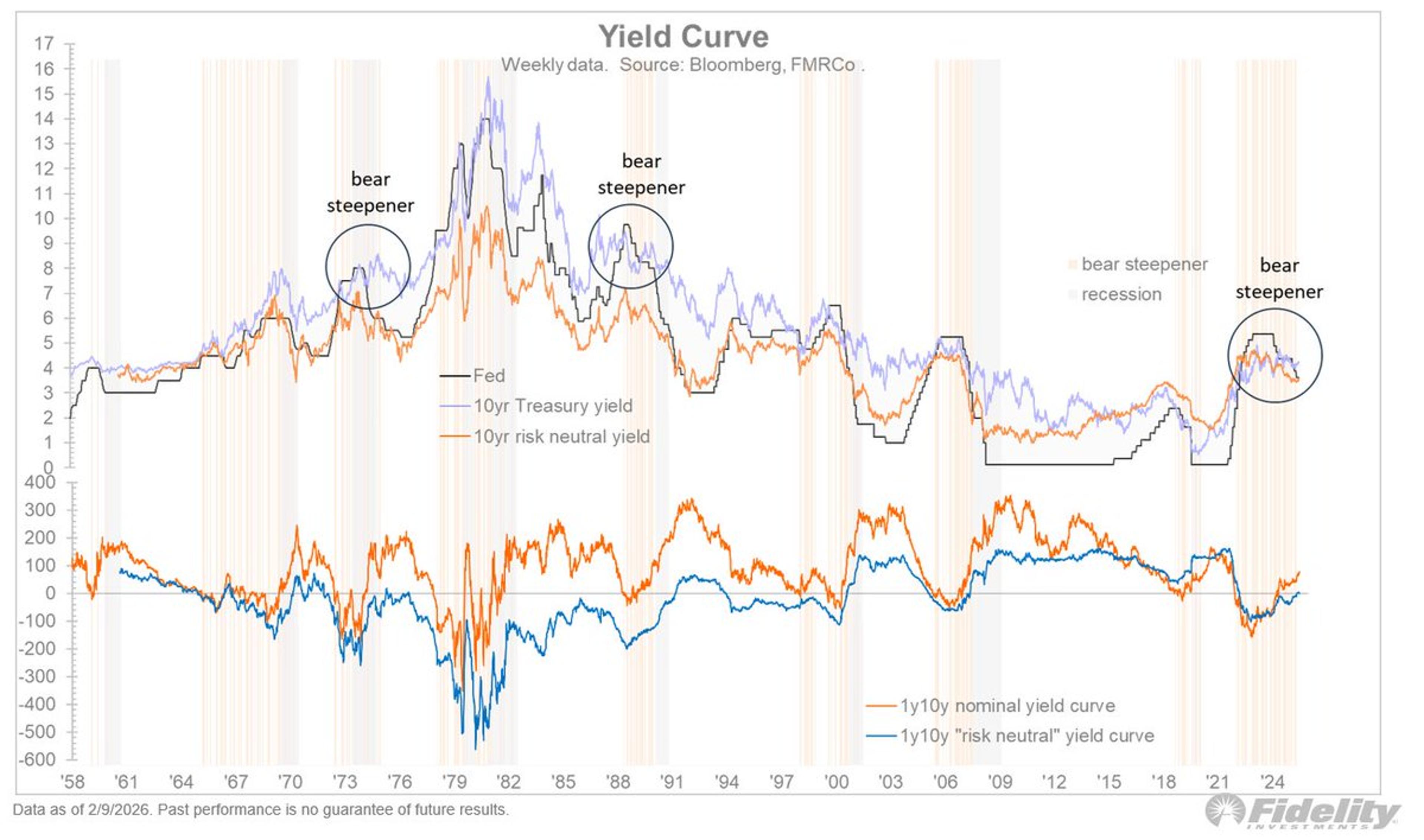

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

News•Feb 12, 2026

Interest Rate Announcement

On December 9, 2026 the Bank of Canada will release its next overnight rate target, one of eight scheduled policy announcements each year. The press release will outline the economic factors shaping the decision, including inflation trends, labour market conditions, and global...

By Bank of Canada — RSS (site hub)

Social•Feb 12, 2026

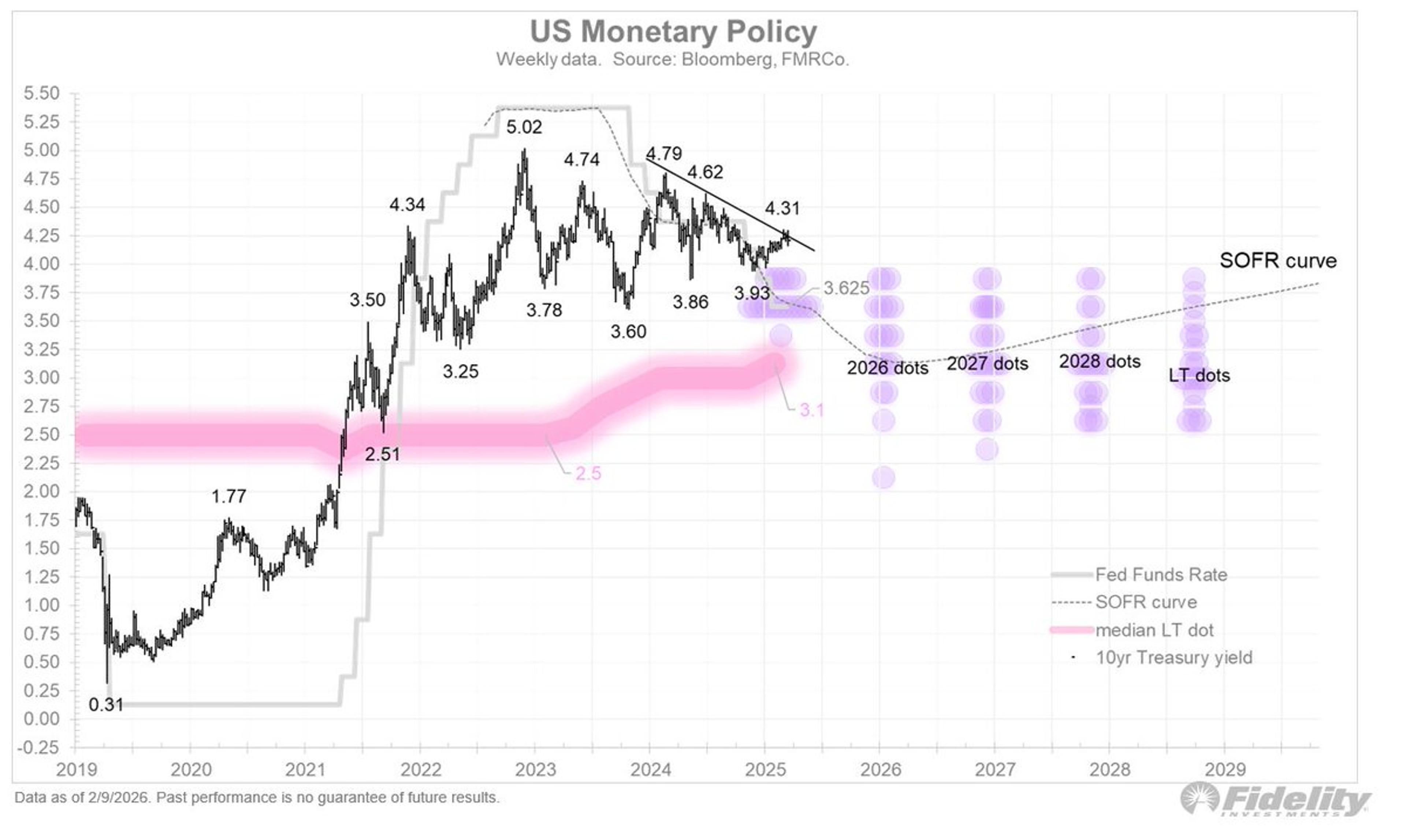

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

Social•Feb 12, 2026

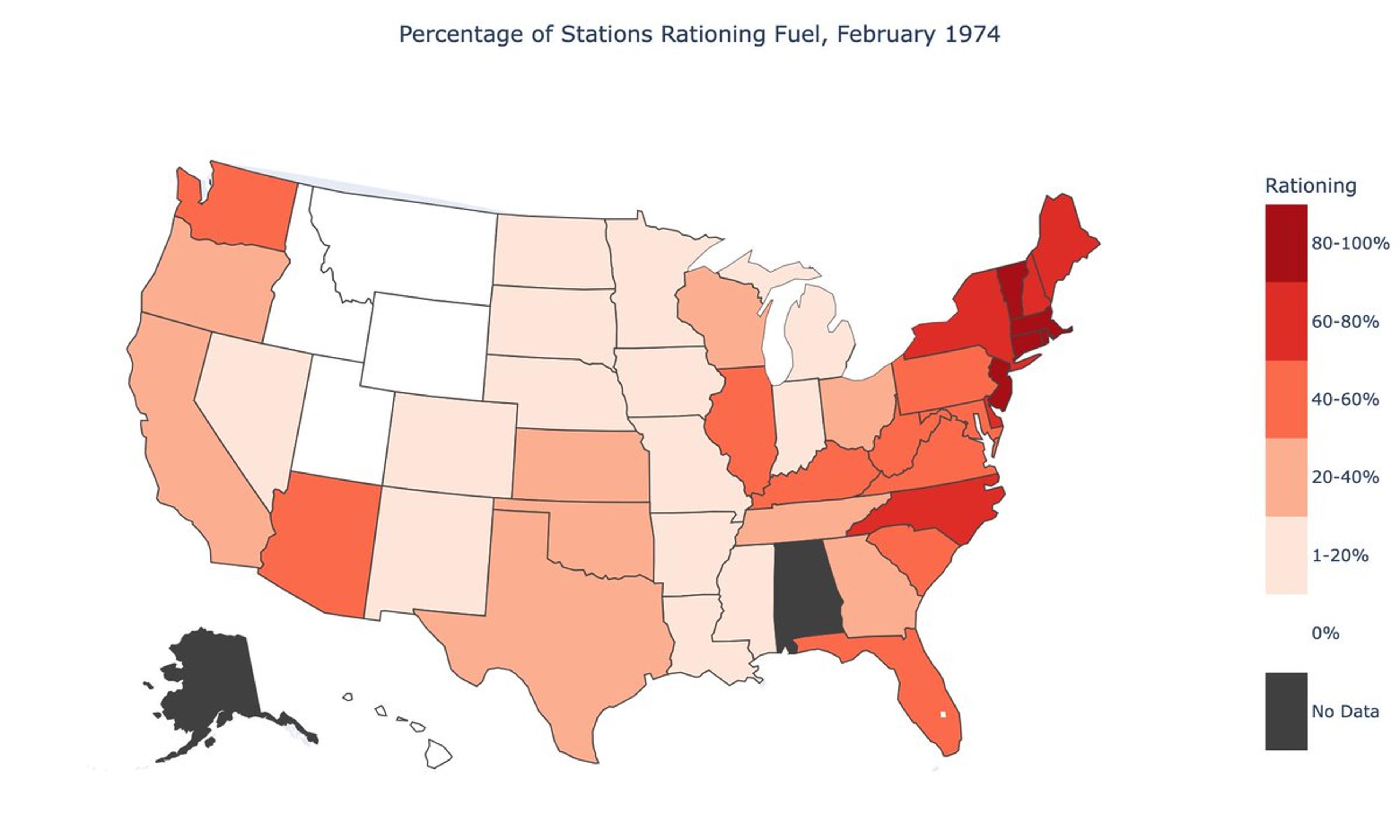

Price Controls Trigger Chaotic, Uneven Resource Allocation

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

News•Feb 12, 2026

Europe Debates Future Ties with US: Decouple or Double Down?

Europe is split on its future relationship with the United States under President Trump. Eastern European NATO members such as Romania and Lithuania argue for tighter security cooperation and participation in the critical‑minerals ministerial, citing Russian aggression. In contrast, France,...

By The Hill – Defense

News•Feb 12, 2026

Singapore Budget 2026: Key Highlights for HR Leaders, Employers, and Employees

Singapore’s 2026 Budget, delivered by Prime Minister Lawrence Wong, projects growth slowing to 2‑4% and introduces a suite of measures to keep the city‑state competitive. For employers, the budget raises the minimum qualifying salary for new Employment Passes to $6,000...

By Human Resources Online (Asia)

News•Feb 12, 2026

Piero Cipollone: Europe and Monetary Sovereignty

In a February 2026 speech, ECB Executive Board member Piero Cipollone warned that Europe’s monetary sovereignty is threatened by growing dependencies on foreign payment systems and digital assets. He argued that control over the euro, both in cash and digital...

By European Central Bank — Press/Speeches

Social•Feb 12, 2026

BlockFills Freezes Withdrawals as Crypto Volatility Spikes

First, you lose in a matter of weeks 50%% to 99% - depending on which shitcoin you were duped to invest in - and then they don’t even allow you to withdraw the remaining crumbs of your investments. Standard operating...

By Nouriel Roubini

Social•Feb 12, 2026

Tight Credit Spreads, Fast‑Food Struggles, Tariff Burden Revealed

🆓 Thursday links: tight credit spreads, fast food woes, and who is paying the cost of tariffs. https://t.co/NOuKmm78S8 image: https://t.co/Lhs7cz5vWL https://t.co/nj3y6g7t8i

By Tadas Viskanta

News•Feb 12, 2026

Trump Calls India-US Trade Deal ‘Historic’ as Tariff Cuts and Coal Exports Take Centre Stage

President Donald Trump called the newly concluded India‑US trade deal historic, highlighting its potential to expand American energy exports, especially coal. The interim agreement slashes U.S. duties on Indian goods to a uniform 18% across textiles, apparel, chemicals and more,...

By ET EnergyWorld (The Economic Times)

Social•Feb 12, 2026

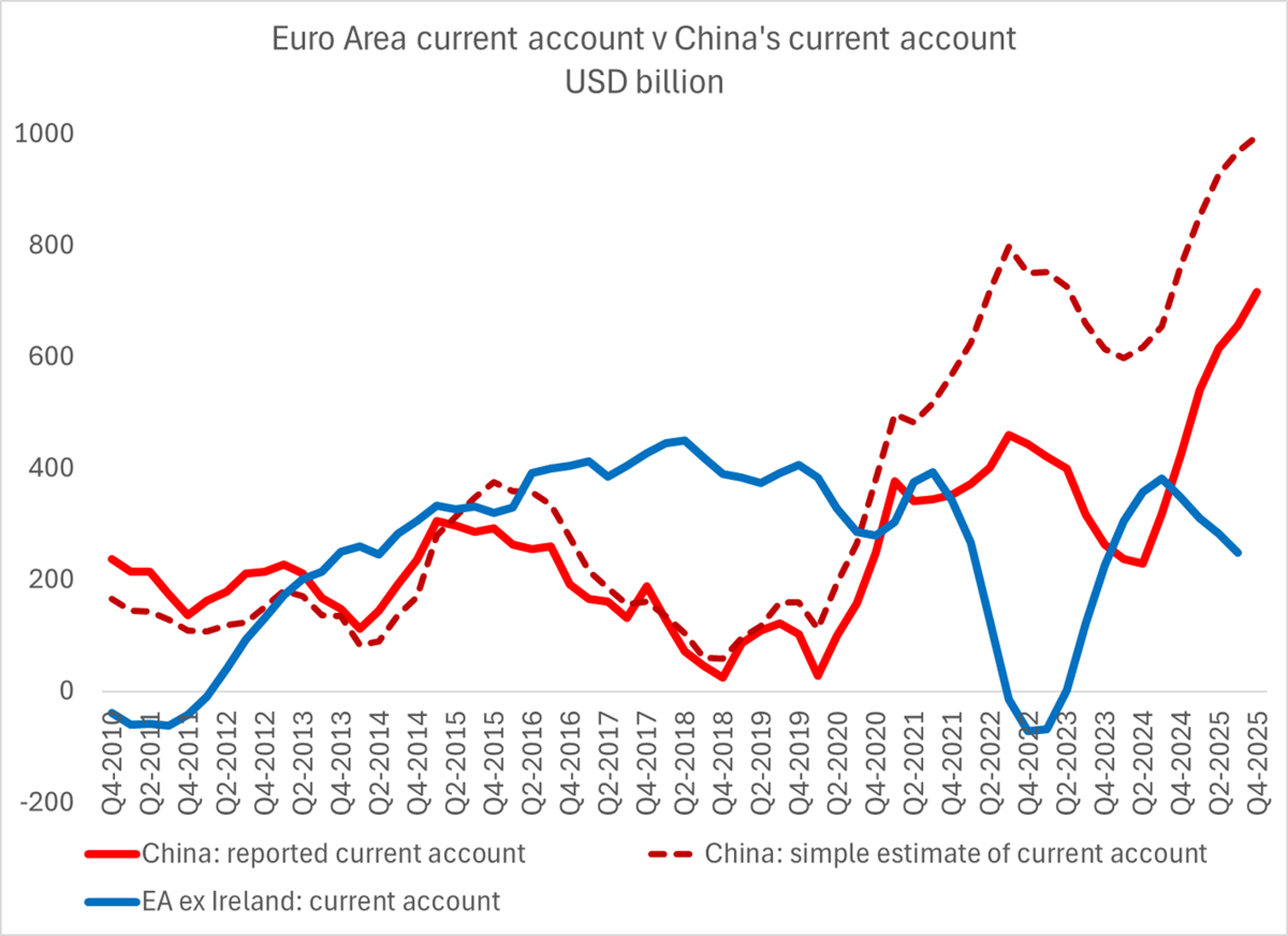

China’s Surplus Outpaces Europe, IMF View Outdated

The IMF's standard way of talking about global trade and payment imbalances tends to view Europe and China similarly -- but that is now out of date. China's reported surplus will top $700b in 2025, the euro area's surplus...

By Brad Setser

Social•Feb 12, 2026

Domestic Sales and Exports Aren't Comparable Economic Metrics

It is ignored because it is misleading to compare in country sales (generated by Chinese production for sale to Chinese buyers) to exports (goods produced in one country for sale in another). Firms and countries are different economic concepts

By Brad Setser

News•Feb 12, 2026

Fed Should ‘Aggressively’ Be Cutting Rates, Investor Says Amid Jobs Report Release

Anthony Pompliano, CEO of Professional Capital Management, argued on “Making Money” that the Federal Reserve should aggressively cut interest rates following the latest jobs report. He noted that the labor market remains solid but still offers room for monetary easing...

By Fox Business — Bonds (section)

Social•Feb 12, 2026

China Eases Capital Controls as Asset Buildup Accelerates

China usually liberalizes its financial account when the PBOC (now the state banks) are accumulating assets at too rapid a pace, and it wans the dollar risk to be taken by others ... 1/2

By Brad Setser

Social•Feb 12, 2026

East Asia Drives Surging Trade Surplus, Currencies Remain Cheap

Bingo And the global trade surplus (ex pharma) is now primarily in China, Taiwan and Korea ... Important qualification to the now standard argument the dollar has gotten weaker (which is true primarily if the clock starts at the end of 24,...

By Brad Setser

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2165717307-a843d8a1e1c94e9d98075343fa914292.jpg)

News•Feb 11, 2026

What To Expect From Friday's Report On Inflation

Economists expect the January Consumer Price Index to rise 2.5% year‑over‑year, a dip from December’s 2.7% and the lowest headline inflation since May 2021. Core CPI, which strips out food and energy, is also projected at 2.5%, matching the lowest...

By Investopedia — Economics

Social•Feb 12, 2026

Excess Wealth vs Limited Cash Fuels Asset Bubbles

Wealth isn’t worth anything unless it can be converted into money to spend. And when there’s a lot of wealth relative to the amount of hard money available — like we’re seeing today — bubbles are created. @nikhilkamathcio https://t.co/iBiRkkv7Ok

By Ray Dalio

Social•Feb 12, 2026

Productivity Gains Are the Real Driver of Inflation

Posted this thread two years ago on the enigmatic relationship between inflation and productivity, and more relevant now than ever—

By Jeff Park

News•Feb 11, 2026

Western Europe in a Multipolar World

The global order has moved from Cold‑War bipolarity to a multipolar system where the United States, Russia and a rising China dominate international affairs. Technological globalization and interdependence have intensified, reshaping how Western Europe engages with these powers. The article...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

The UK Chagos Deal Is an 'Act of Great Stupidity'

The United Kingdom has announced a plan to transfer sovereignty over the Chagos Islands to an unrelated African nation, sparking alarm among security analysts. The islands host Diego Garcia, a joint U.S.–U.K. military base that underpins American power projection across...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

Ex-Prince Andrew Suggested Uranium Investments to Epstein: BBC

A confidential UK briefing on high‑value minerals in Afghanistan’s Helmand province, highlighting uranium among other resources, was forwarded by former trade envoy Prince Andrew to Jeffrey Epstein in 2010. The document, prepared during Andrew’s official visit, outlined potential low‑cost extraction...

By MINING.com

News•Feb 11, 2026

Lloyds Banking Group to Close Another 95 Branches

Lloyds Banking Group announced it will shut 95 more branches – 53 Lloyds, 31 Halifax and 11 Bank of Scotland locations – between May 2024 and March 2027. The closures will leave the group with about 610 branches after the...

By BBC News – Business

News•Feb 11, 2026

Would You Pay £7.50 for a Pint of Guinness?

The Advocate Arms in Market Rasen is polling patrons on a possible £7.50 price for a pint of Guinness, up from its current £6. Diageo says the increase translates to roughly £0.04 per draught pint and stresses that retail pricing...

By BBC News – Business

Social•Feb 11, 2026

Labor Market Rebounds After Shutdown, Easing Temporary Layoffs

The labor market showed signs of healing late in 2025 and in January. Catch up following long government shutdown helps alleviate ranks of those suffering temporary layoffs and forced to accept part instead of full-time jobs. Some healthy churn returned...

By Diane Swonk

Social•Feb 11, 2026

2027 AI Race: Align or Lose Human Relevance

🚨 From Agent-1 to Superintelligence: The AI 2027 Scenario The AI 2027 Report outlines one of the most thought-provoking trajectories for artificial intelligence: a rapid evolution from simple assistants (Agent-1) to autonomous, adversarially misaligned systems (Agent-4) and ultimately to Agent-5 —...

By Giuliano Liguori

Social•Feb 11, 2026

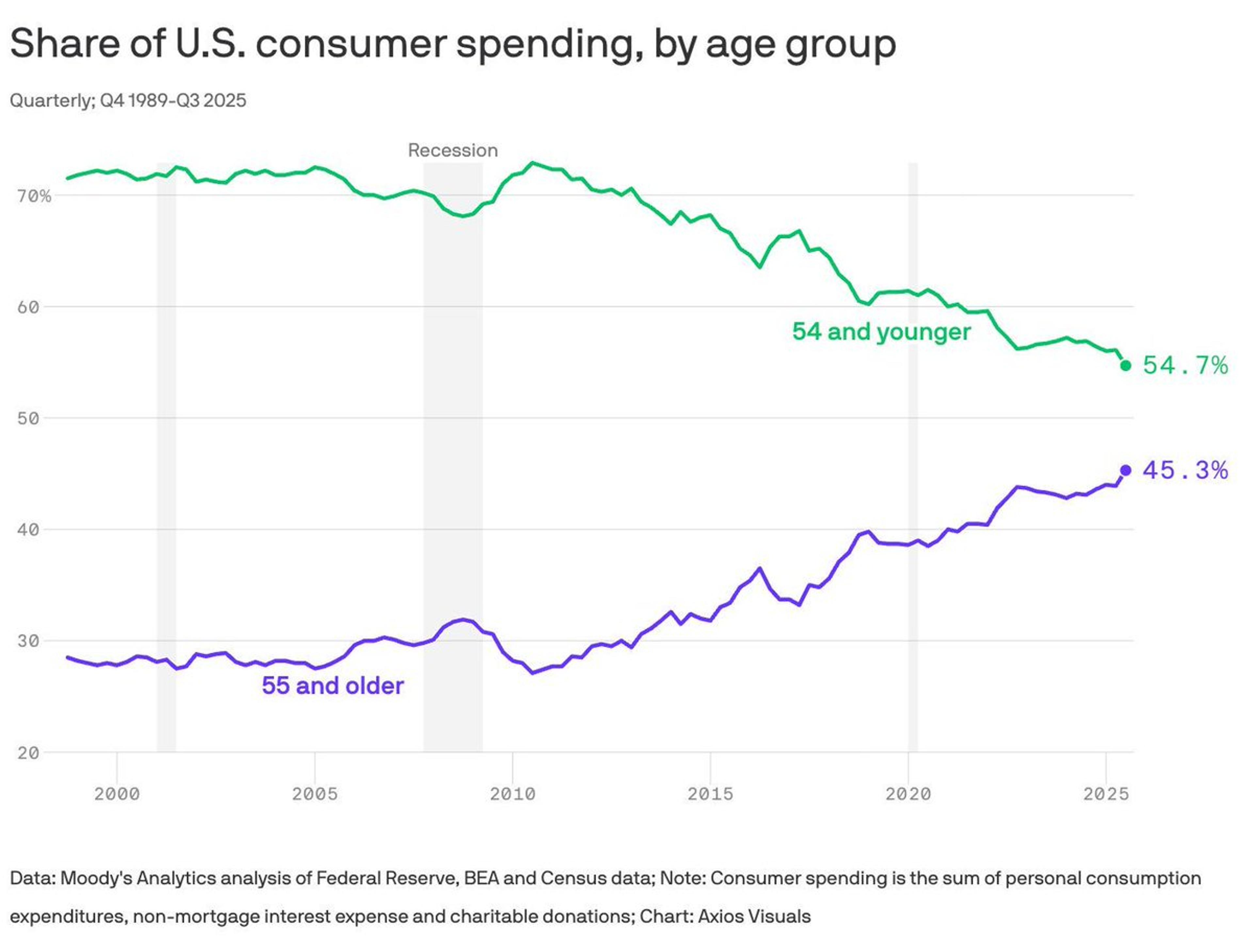

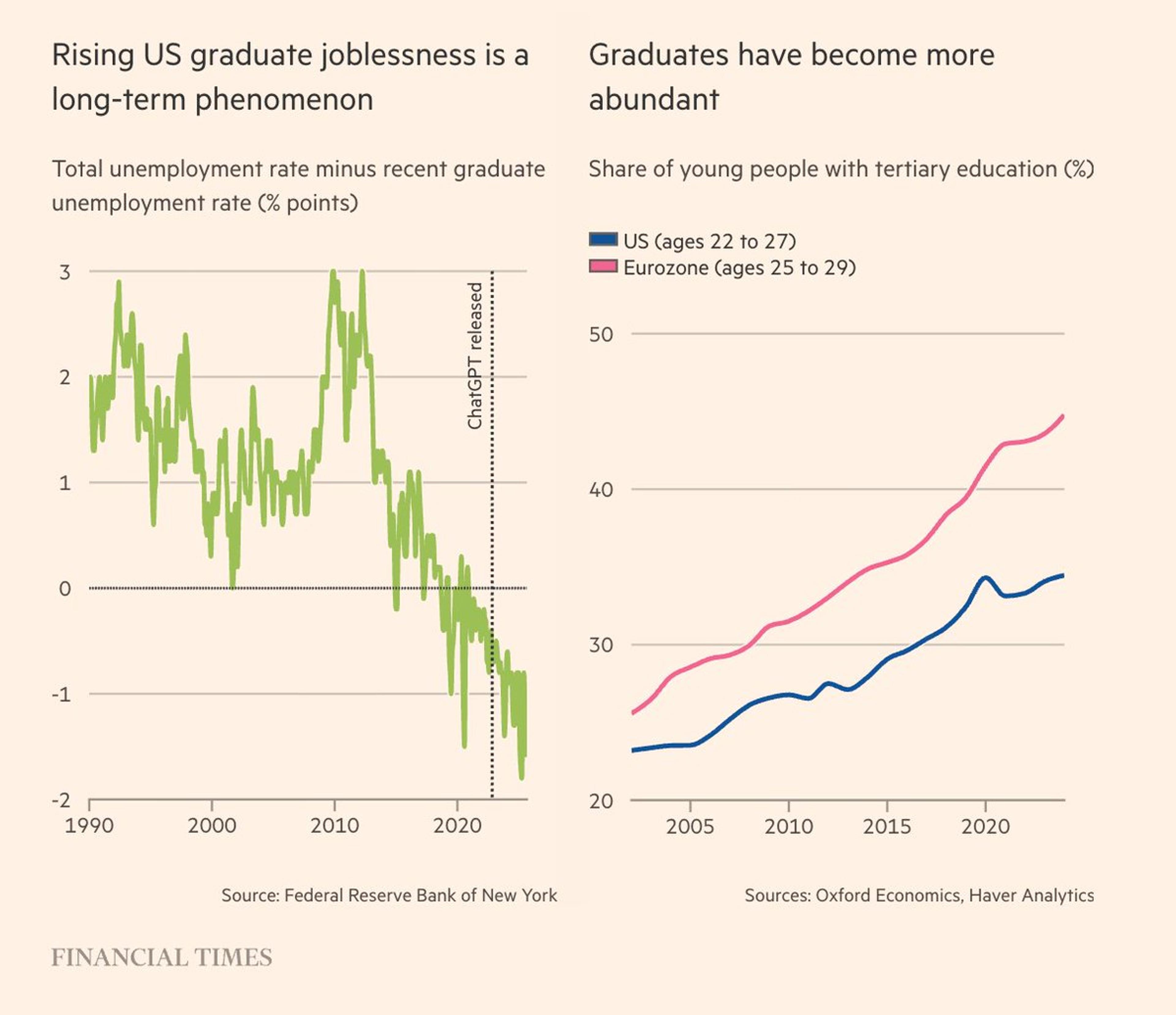

US Grads Face Higher Unemployment; Eurozone More Educated Workforce

Very striking data these a. on US graduate unemployment and b. higher share of tertiary education in Eurozone labor force than in the US. Explore these economic insights in today's Chartbook Top Links. https://t.co/xNeFQVgZKf

By Adam Tooze

Social•Feb 11, 2026

Big Tech Buys Trump Tariff Exemptions, Small Firms Suffer

Big Tech and their lobbyist have bought exemptions from Trump’s tariffs. Meanwhile, the small fries are getting FRIED. TRUMP’S TARIFFS = THE BIG GUYS CAN ALWAYS BUY AN EXEMPTION. https://t.co/zlVn4ornDl

By Steve Hanke

Social•Feb 11, 2026

New Jobs Report: What It Means for You

Latest jobs report just dropped. Let's spend a few minutes talking about what's really going on, what it means for you, and what to keep your eye on. https://t.co/ptv6DbFqKM

By Justin Wolfers

Social•Feb 11, 2026

Argentina's 32% Inflation Signals Milei Must Dollarize

Argentina’s January inflation came in at a RED HOT 32.4%/yr. Pres. Milei’s monetary model is not working. MILEI MUST DOLLARIZE NOW. https://t.co/MLSKqYfys7

By Steve Hanke

Social•Feb 11, 2026

USDJPY Plunges 2.5% in Three Days, Reversal Uncertain

$USDJPY is down over -2.5% over the past three days. One of the biggest drops in the past year and a half. Doesn't mean it has to stall and reverse though... https://t.co/LRjhnctyzL

By John Kicklighter

Social•Feb 11, 2026

US Household Debt Peaks at $18.8T, Delinquencies Surge

US household debt just hit $18.8 TRILLION. Consumer delinquencies are at their HIGHEST LEVEL in nearly a DECADE. Not a good sign. https://t.co/PHcOGrhvOc

By Steve Hanke

Social•Feb 11, 2026

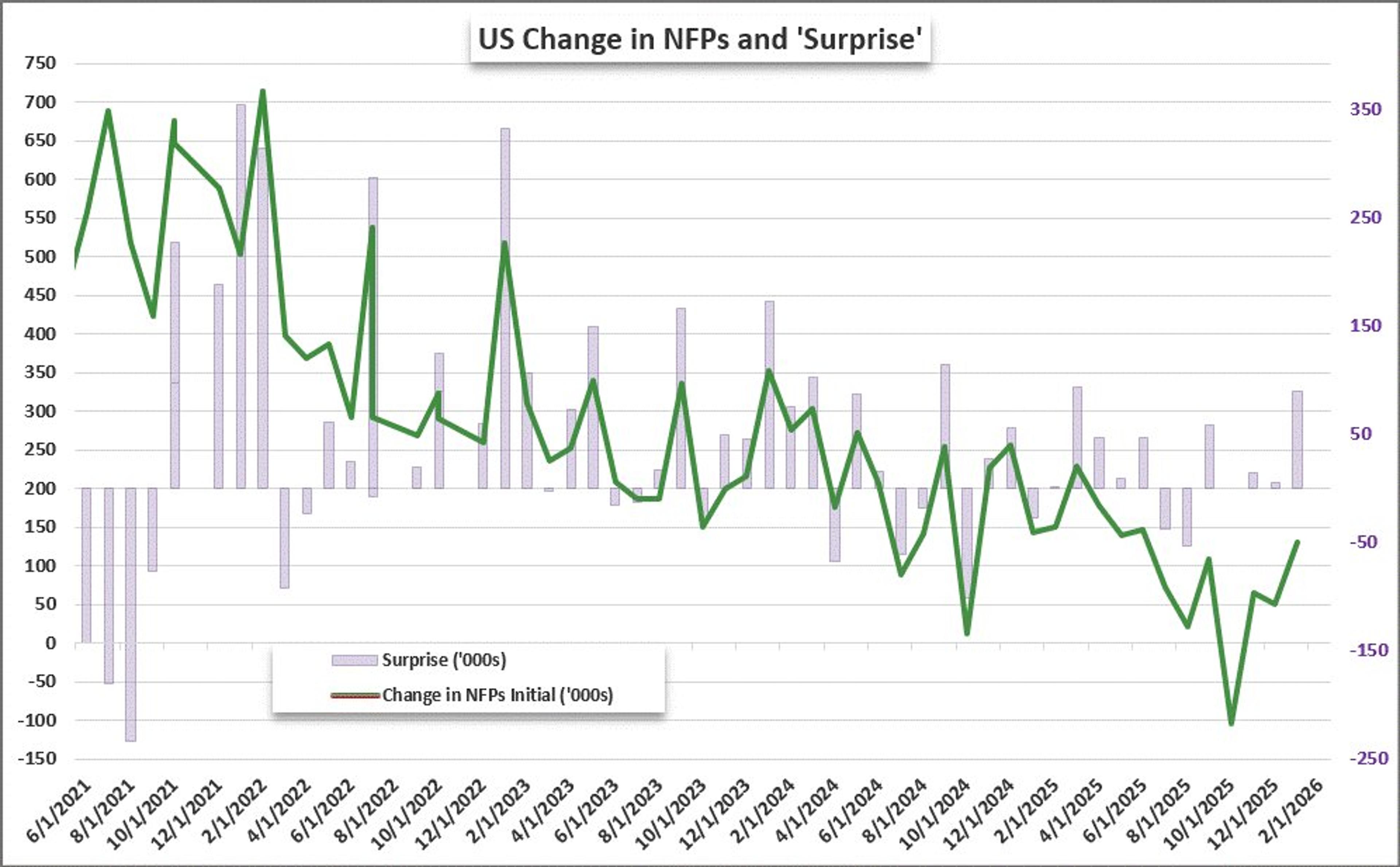

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter