🎯Today's Global Economy Pulse

Updated 20m agoWhat's happening: Supreme Court nullifies Trump-era tariffs, paving way for $130 billion in refunds

The Court ruled 6‑3 that the “Liberation Day” tariffs exceeded presidential authority under the International Emergency Economic Powers Act, overturning the measures. The decision opens a path for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries. Trade groups praised the ruling but warned the refund process could be complex.

News•Feb 13, 2026

Polish Disinflation Continues Despite Upside Surprise in January CPI

Poland’s January flash CPI showed headline inflation at 2.2% YoY, modestly above the 1.9% consensus but still under the NBP’s 2.5% ± 1‑point target. The decline was driven by a 7.1% drop in gasoline prices, while food prices held steady at 2.4% YoY and housing energy costs rose to 3.4% YoY, limiting the pace of disinflation. The new COICOP 2018 classification altered basket weights, contributing to a 0.6% month‑on‑month increase. Analysts expect the NBP to proceed with a 25‑basis‑point rate cut in March, potentially lowering the policy rate to 3.25% or lower.

By ING — THINK Economics

Social•Feb 13, 2026

AI Layoffs Risk Turning Companies Into Stranded Assets

Something worth remembering if you're trying to value the stock market right now: 👇 A corporation can only profit from human labor displacement once. If by engaging in that single cost saving to beef up your bottom line you inadvertently destroy...

By Izabella Kaminska

News•Feb 13, 2026

Australia Should Have CBAM on some Commodities: Review

Australia’s latest carbon leakage review recommends a carbon border adjustment mechanism (CBAM), beginning with cement and clinker imports and potentially expanding to hydrogen, steel, ammonia and related products. The review, led by ANU professor Frank Jotzo, evaluated 75 trade‑exposed commodities...

By Argus Media – News

Podcast•Feb 13, 2026•7 min

AI Phobia

The episode examines the rapid shift from AI euphoria to AI paranoia among investors, sparked by a controversial startup demo that triggered selloffs in sectors like insurance, logistics, and even impacted Apple. It also highlights the impact of recent January...

By Reuters Morning Bid

News•Feb 13, 2026

BNP Election Win Could Reshape Bangladesh's Energy Mix

The Bangladesh Nationalist Party secured a decisive parliamentary majority, clearing the path for a sweeping overhaul of the nation’s energy strategy. Its manifesto pledges to lift renewable power to 20% of the mix by 2030, a dramatic rise from today’s...

By Argus Media – News

News•Feb 13, 2026

Travel Takes the Lead

Visa’s latest Spending Momentum Index shows travel as the fastest‑growing consumer category in Asia‑Pacific, expanding about 2.5 times faster than overall spend in 2025. Cross‑border card use surged as tourists adopted digital wallets, while affluent consumers generated roughly three‑quarters of...

By TTG Asia

Blog•Feb 13, 2026

Chinese Loan Data Out After Market - Lighter than Expected

The episode reviews China’s latest loan data released after market close, noting new yuan loans of CNY 4.71 trillion in January—significantly below the CNY 4.8 trillion forecast and far under expectations of around CNY 5 trillion. While total social financing surged to CNY...

By Asian Market Sense

News•Feb 13, 2026

Rupee Closes Nearly Flat, Modest Depreciation Bias Lingers

India’s rupee ended Friday essentially unchanged, closing at 90.6350 per dollar, a slight dip from the prior session. The currency faced pressure from weak domestic equities, elevated interbank dollar demand, and maturing non‑deliverable forward contracts, while the Reserve Bank of...

By The Economic Times – Markets

Social•Feb 13, 2026

Singapore's Car Taxes Outpace Fiji's Entire GDP

Singapore is one of the world's biggest oil-trading hubs. It also LOVES to tax cars. https://www.bloomberg.com/news/articles/2026-02-13/singapore-s-car-tax-revenue-now-so-high-it-exceeds-fiji-s-gdp

By Akshat Rathi

Social•Feb 13, 2026

Russia's Dollar Return Threatens Metals Rally

🚨 THIS COULD BE A GAME CHANGER FOR METALS AND RISK ASSETS Big news emerged yesterday: Russia is seriously considering returning to dollar-based settlements as part of a broader economic partnership with President Trump. For the past 3–4 years, Russia has been...

By That Martini Guy

News•Feb 13, 2026

Wieslander Published in Euractiv

In a Euractiv op‑ed, Anna Wieslander and Rachel Ellehuus of RUSI argue Europe must build a NATO led by Europeans. They warn waiting for a new U.S. administration would waste critical time. The authors propose an action‑oriented process focusing on...

By Atlantic Council – All Content

Social•Feb 13, 2026

Cathie Wood: Bitcoin Hedges Both Inflation and AI‑driven Deflation

🚨 UPDATE Cathie Wood just said that Bitcoin is a hedge against both inflation and the deflation that could come from the productivity shock of AI! https://t.co/LBcroO4Hst

By That Martini Guy

Social•Feb 13, 2026

ECB Staff Push for Tighter Oversight and Regulation

ECB staff comes up with the revolutionary idea of adding even more oversight and regulation

By Brent Johnson

News•Feb 13, 2026

We’re Trimming Our 2026 Romania Growth Forecast After a Bumpy End to 2025

Romania’s economy entered recession in early 2024 and posted a 1.9% quarterly contraction in Q4 2025, the steepest drop since 2012. Revised data also turned Q1 2025 growth negative, prompting analysts to slash the 2026 GDP outlook from 1.4% to 0.6%. The...

By ING — THINK Economics

Social•Feb 13, 2026

Three Consecutive CPI Misses Signal Rate‑Cut Surge

Last CPI missed expectations 3 months in a row. If it happens again today, rate cut bets explode and the dollar dumps. I'm trading it LIVE at 8AM ET. Don't watch from the sidelines 👇 https://t.co/gAw05zLlQ8

By Boris Schlossberg

Social•Feb 13, 2026

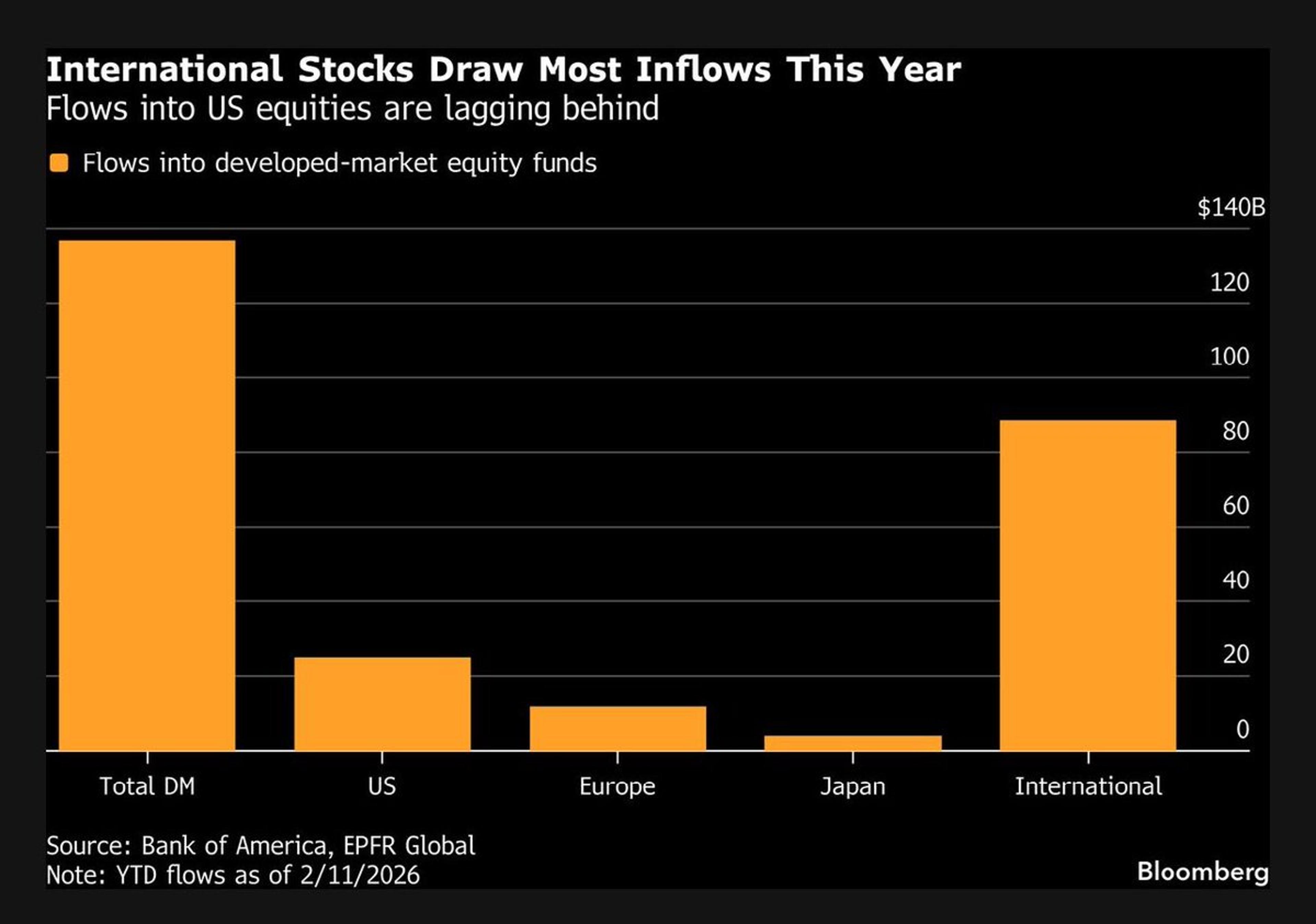

Global Fund Flows Outpace US, Shifting Investment Balance

US exceptionalism is turning into global rebalancing: BofA’s Michael Hartnett. Stock funds in Europe, Japan and other international developed markets have drawn $104 billion this year vs the $25 billion that’s flowed into US funds: BofA citing EPFR Global. https://t.co/ah9arXM6u9...

By Lisa Abramowicz

News•Feb 13, 2026

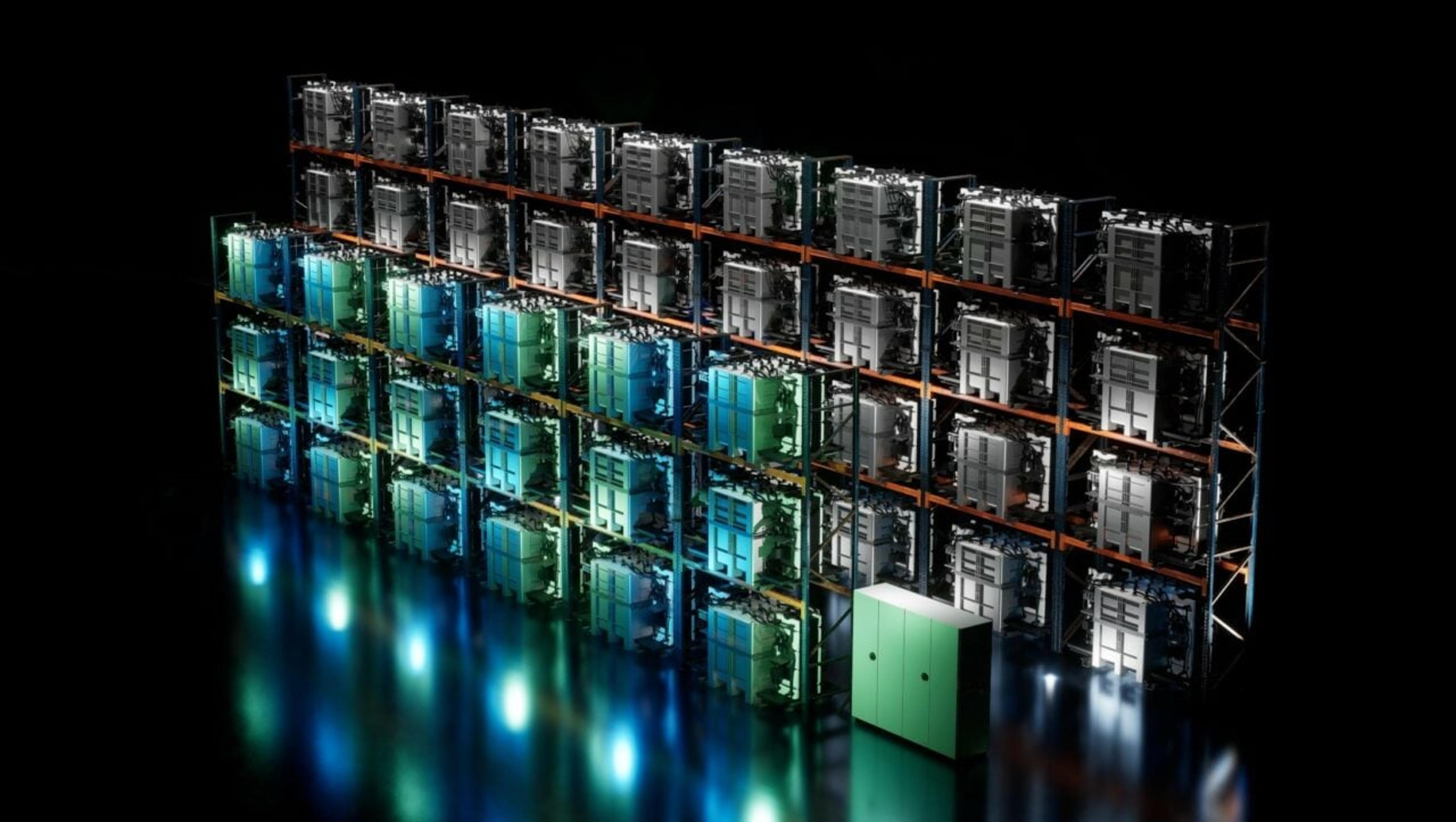

‘Beyond a Lithium-Only Future’: How US Trade Rules Could Accelerate BESS Diversification

US trade policy changes – FEOC restrictions and a 25% Section 301 tariff on Chinese‑origin battery energy storage systems (BESS) – took effect on 1 January, tightening cost and compliance pressures. While Chinese lithium‑ion BESS remain marginally cheaper on equipment‑only pricing, developers...

By Energy Storage News

Social•Feb 13, 2026

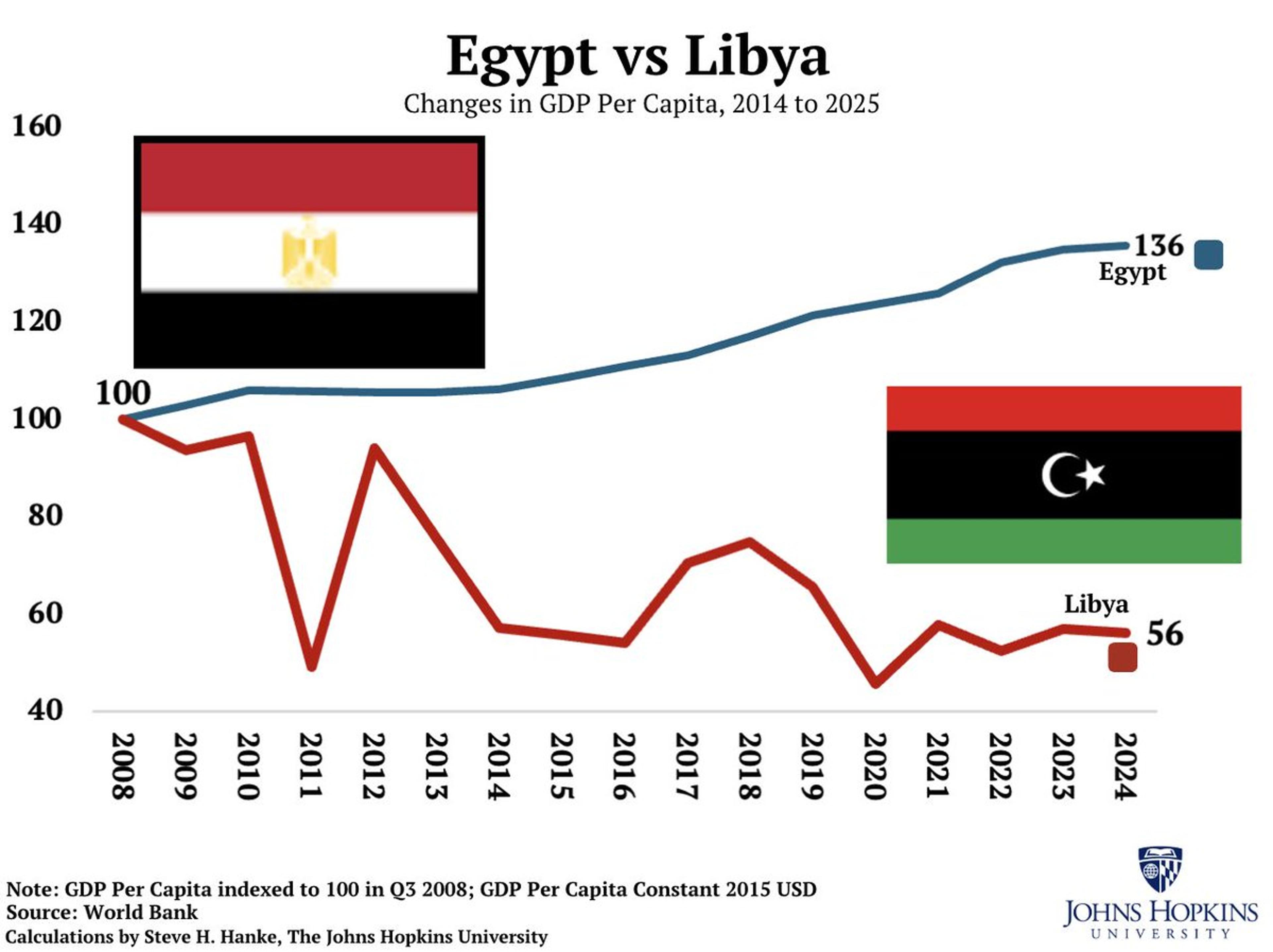

Libya's Economy Lags Egypt After 2011 US Intervention

#LibyaWatch🇱🇾: Libya’s economy is NOWHERE CLOSE to its neighbor Egypt. Thanks to the US-led regime change operation in 2011, Libya is IN THE TANK. https://t.co/mnlulHdvko

By Steve Hanke

News•Feb 13, 2026

Shanghai’s Tourism Comeback: 9.36 Million Visitors Return as Tokyo, Seoul Rivalry and US Geopolitics Reshape Asia Travel

Shanghai welcomed 9.36 million inbound visitors in 2025, a 39.6% year‑over‑year increase, marking a robust tourism rebound. Growth was driven by diversified source markets, notably South Korea, Russia and Southeast Asia, and by improved visa policies and airline connectivity that doubled...

By eTurboNews

News•Feb 13, 2026

ECB Publishes Consolidated Banking Data for End-September 2025

The European Central Bank released its consolidated banking data for end‑September 2025, covering 336 banking groups and 2,289 stand‑alone credit institutions across the EU‑27. Total assets rose 0.95 % to €33.44 trillion, while the non‑performing loan ratio edged up to 1.97 %. Return on...

By European Central Bank – Press

Social•Feb 13, 2026

US Firms and Consumers Shoulder Most 2025 Tariff Burden

1/5 The New York Fed finds that "U.S. firms and consumers continue to bear the bulk of the economic burden of the high tariffs imposed in 2025." https://t.co/X3Xz2tRn1j

By Michael Pettis

Blog•Feb 13, 2026

Emirates Is Being Thrown Out Of Algeria As Diplomatic Ties Between Algiers And Abu Dhabi Worsen

Algeria has begun the formal process of terminating its air services agreement with the United Arab Emirates, effectively expelling Emirates from the market. The move follows a deterioration in diplomatic ties, driven by accusations that the UAE fuels regional discord...

By Paddle Your Own Kanoo

Social•Feb 13, 2026

Trump Narrows Confusing Steel, Aluminum Tariffs Ahead of US‑EU Deal

The Trump administration is working to narrow its broad tariffs on steel and aluminum products that companies find difficult to calculate and the EU wants reined in as part of its pending trade deal with the US https://t.co/638iBN7IU0 via @jendeben...

By Zöe Schneeweiss

News•Feb 13, 2026

Cameroon Clamps Down on Shadow Fleet as Flag Purge Begins

Cameroon’s ship registry, now Africa’s third‑largest, surged 126% in the past year, largely due to Russian‑linked vessels adopting its flag. The fleet’s average age has risen to 32.7 years, prompting safety concerns after several high‑profile incidents. Under pressure from the EU...

By Splash 247

News•Feb 13, 2026

Poland’s Economy Expanded by 4%YoY in the Final Quarter of 2025

Poland’s economy posted a 4.0% year‑on‑year increase in the fourth quarter of 2025, outpacing the 3.8% growth recorded in Q3. Quarterly expansion accelerated to 1.0% from 0.9% in the prior period, driven primarily by a surge in private consumption that...

By ING — THINK Economics

Social•Feb 13, 2026

Distinguish Inefficiency From Global Uncompetitiveness in EU Manufacturing

1/7 My latest piece was written for friends who are EU policymakers or advisors. In it I argue that there is a difference between an inefficient manufacturing sector and a globally uncompetitive manufacturing sector. We shouldn't conflate the two. https://t.co/qer7BAvgnc

By Michael Pettis

Social•Feb 13, 2026

Poland's Per‑capita GDP Eclipses Germany, Fueling Assertiveness

Poland’s GDP per capita OUTPACES Germany’s by a country mile. This growth gap is why Poland is flexing its muscles and pushing Germany around. https://t.co/78SQLlNP3o

By Steve Hanke

News•Feb 13, 2026

Turkey’s Current Account Deficit Remains on a Widening Track

Turkey posted a December current‑account deficit of $7.3 bn, well above the $5.3 bn forecast, pushing the 12‑month rolling deficit to $25.2 bn (about 1.8 % of GDP). The gap widened mainly because the trade balance slipped to a $‑7.4 bn deficit and primary‑income balances...

By ING — THINK Economics

News•Feb 13, 2026

Splash Wrap: The Week in Shipping in 233 Words

The Pentagon intercepted a tanker suspected of moving Venezuelan oil, underscoring Washington’s aggressive stance on illicit exports. Vanuatu warned users about a fake registry website, while Cameroon suspended new shadow‑fleet registrations and began deregistering existing vessels. In the tech arena,...

By Splash 247

News•Feb 13, 2026

Both the Number of New Workforce and Jobs Stagnant in Korea, Reports Indicate

South Korea faces a looming labor shortage as its economically active population is projected to grow only 0.46% by 2034, creating a gap of roughly 1.22 million workers. Despite the demand for an additional 54,000 workers per year through 2029 and...

By The Korea Herald – RSS hub (includes Business)

News•Feb 13, 2026

Africa's GDP Race Tightens as Economic Interdependence Deepens

Africa’s five largest economies are now separated by razor‑thin margins, with South Africa’s $401.6 bn GDP barely outpacing Egypt’s $399.5 bn. Nigeria remains third at $334.3 bn but its ranking is highly sensitive to exchange‑rate swings. Algeria and Morocco round out the top...

By African Business

Social•Feb 13, 2026

ECB Still Assessing Full Effects of Euro Appreciation

ECB has yet to see full impact of euro appreciation, Kazaks says https://t.co/qqisWsfsJD via @aaroneglitis @Skolimowski https://t.co/TTDxRGmgMY

By Zöe Schneeweiss

News•Feb 13, 2026

Rates Spark: Dutch Pension Funds May Prepare Early for 2027 Transitions

Almost €1 trillion of Dutch pension assets are slated to transition by 2027, but early hedge rebalancing has already begun. Smaller funds moved interest‑rate hedges in December 2025, while larger players like PMT and PFZW are timing their flows for the first...

By ING — THINK Economics

News•Feb 13, 2026

China Merchants to Restart Wuhan Qingshan Shipyard

China Merchants Shipbuilding Industry Group announced the full restart of its long‑dormant Wuhan Qingshan shipyard in 2026, reviving a facility that ceased new‑building in 2018. The 113‑hectare river‑front yard, equipped with a 2,200‑metre wharf, will focus on small and medium‑sized...

By Splash 247

Social•Feb 13, 2026

CBRT Hikes 2026 Inflation Outlook, Policy Stays Too Loose

#TurkeyWatch 🇹🇷: In the first Inflation Report of 2026, CBRT Gov. Fatih Karahan revised the end-2026 inflation forecast from 13–19% to 15–21%. Turkey's monetary policy remains TOO LOOSE. https://t.co/EC5mR04dt6

By Steve Hanke

News•Feb 13, 2026

Reeves Urged to Reassure MPs over Public Finances Amid £6bn-a-Year Send Costs

Rachel Reeves faces mounting pressure to reassure MPs as the UK’s special educational needs and disabilities (SEND) programme costs rise to about £6 billion a year. The Office for Budget Responsibility warns that an £18 billion backlog could erode the fiscal surplus...

By The Guardian – Economics

News•Feb 13, 2026

Maran Dry Returns to Newbuilds with Capesize Order at Hengli

Maran Dry, the bulk carrier arm of Angelicoussis Shipping, has placed an order for four new capesize vessels at Hengli Heavy Industry’s Dalian yard, with options that could expand the deal to six ships. This marks the company’s first new‑build...

By Splash 247

Social•Feb 13, 2026

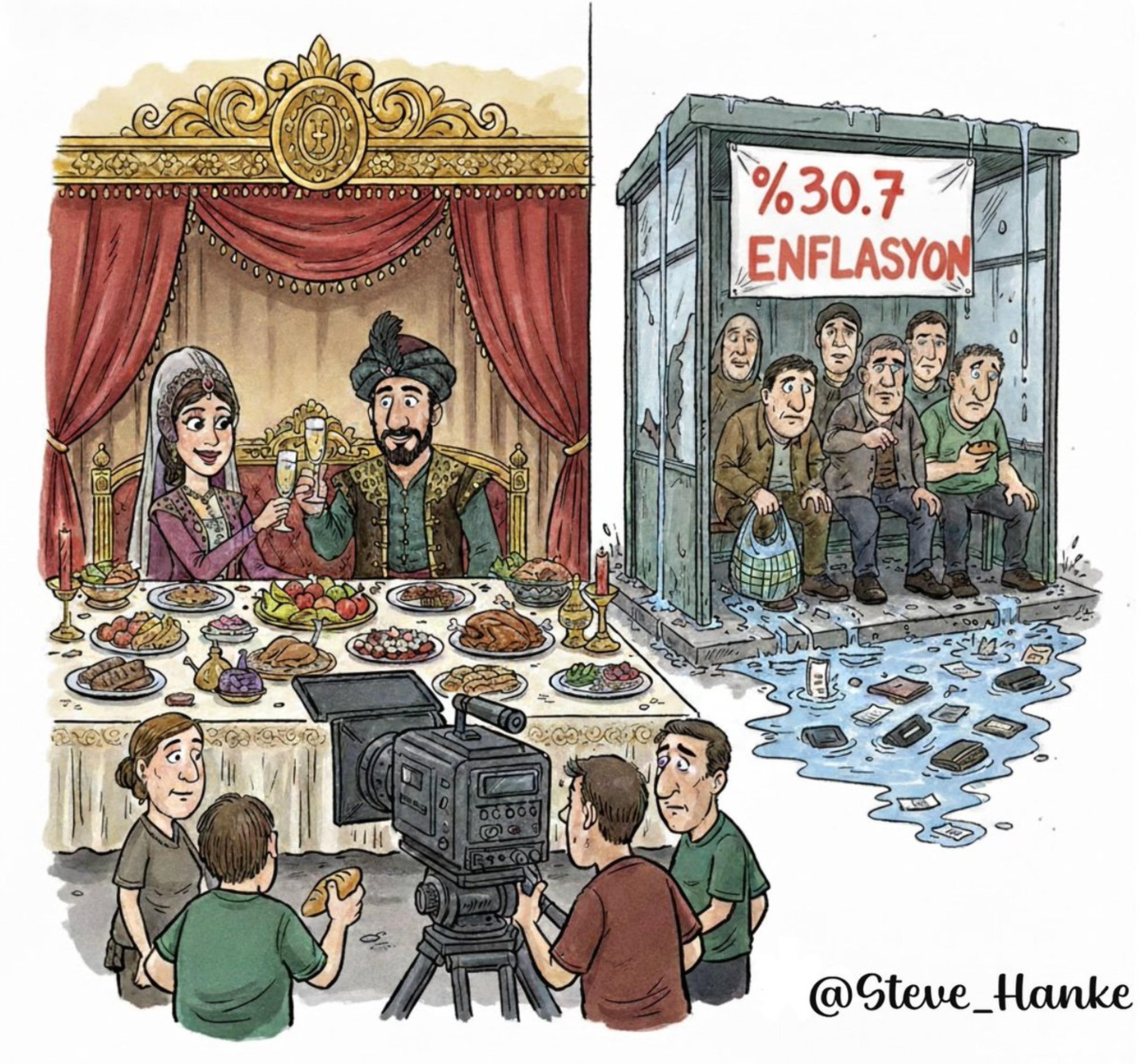

Turkey's 30% Inflation Threatens Global TV Drama Boom

#TurkeyWatch🇹🇷: In January, Turkey's official inflation was reported at 30.7%/yr. That's SIX TIMES HIGHER than the CBRT’s 5%/yr inflation target. Among other things, Turkey’s sky-high inflation is squeezing its famous TV dramas, which draw crowds of 1 billion+ worldwide. https://t.co/nr4JytEGeV

By Steve Hanke

News•Feb 13, 2026

Singaporeans to Get Nearly $400 in Vouchers, up to $316 in Cash as Cost-of-Living Support

Singapore's 2026 budget introduces a Cost‑of‑Living Special Payment, granting eligible adults up to S$400 cash and providing every household with S$500 in Community Development Council vouchers. The cash payout targets citizens earning up to S$100,000 and owning no more than...

By VNExpress – Companies (subset)

News•Feb 13, 2026

Asia Week Ahead: Key Growth Data From Japan

Japan is set to publish key macro data next week, including Q4 2025 GDP, export figures, and inflation. Analysts forecast a modest 0.3% quarter‑on‑quarter GDP rebound after a 0.6% contraction, driven by recovering construction and strong semiconductor exports. Inflation is expected...

By ING — THINK Economics

News•Feb 13, 2026

Oceanbird Lands First Commercial Order

Oceanbird, the Alfa Laval–Wallenius joint venture, announced its first commercial sale, delivering two Wing 560 wing sails for retrofit in Europe slated for early 2027. The order fills the initial production slots, shifting Oceanbird from prototype demonstrations to a commercial rollout. The...

By Splash 247

News•Feb 13, 2026

Singapore Mulls Keeping Carbon Tax at Low End of Target

Singapore’s finance minister said the city‑state may keep its carbon tax near the low end of the $50‑80 per tonne range slated for 2030, after noting a slowdown in global climate momentum. The current levy sits at S$45 (~$35.60) per tonne, already...

By Argus Media – News

Social•Feb 13, 2026

State Firms Snap up Foreclosed Homes, Easing Oversupply

1/2 Reuters: "Chinese state-owned companies are buying foreclosed property projects, in a sign that long-promised government efforts to reduce massive oversupply in the crisis-hit housing sector are finally getting traction, albeit at a slow pace." https://t.co/Nk0gtgJVgr

By Michael Pettis

Social•Feb 13, 2026

PE Firms Chase Japan’s Retail Wealth Amid Institutional Decline

Our story on PE giants like Blackstone, KKR, EQT's attempt to tap Japan's wealthy retail investors for funds as institutional money wanes. Most see Japan as the largest private wealth opportunity outside of the US, but the market comes with...

By Lisa Du

Podcast•Feb 13, 2026•0 min

Asia’s Bitumen Shift: Trade Flows, Freight, and Future Demand

The episode examines how shifting trade flows, tighter vessel availability, and rising freight costs are reshaping the global bitumen market in 2026, especially for Asian importers. It highlights a surge in Chinese bitumen exports that are undercutting traditional suppliers to...

By Metals Movers (Argus series within Argus Media feed)

Social•Feb 13, 2026

China's Three-Year Deflation Signals Weak Money Supply

China is in the grip of a DEFLATION. In January, its Producer Price Index (PPI) was NEGATIVE at -1.42%/yr. If that's not bad enough, China's PPI has been negative for 3 STRAIGHT YEARS. DEFLATION = AN ANEMIC MONEY SUPPLY GROWTH STORY. https://t.co/HJkJ55fGfN

By Steve Hanke

Social•Feb 13, 2026

January Home Prices Slip Across All Chinese City Tiers

Xinhua: In four first-tier cities and 31 second-tier cities, the average month-on-month price declines in January were 0.3% for new homes and 0.5% for resold homes, while prices in 35 third-tier cities fell 0.4% for new homes and 0.6% for...

By Michael Pettis

News•Feb 13, 2026

IMO Ramps Up Campaign to Close Flag State "Enforcement Gap"

The International Maritime Organization (IMO) has launched a two‑year campaign to narrow the enforcement gap that allows a shadow fleet of sanctions‑busting tankers to operate under weak flag‑state oversight. By leveraging its Member State Audit Scheme (IMSAS), the agency will...

By The Maritime Executive

Social•Feb 13, 2026

Higher CPI May Keep Fed From Cutting Rates, Threatening Stocks

Are stock markets in trouble if US CPI data points the Fed away from bolder interest rate cuts? #stockmarkets #CPI #Fed #DOLLAR #macro #trading https://t.co/2Ij9Tr0kWM

By Ilya Spivak

Podcast•Feb 13, 2026•30 min

Weekend Edition: From Dairy to Data: Can NZ Outgrow Australia’s Shadow?

In this episode, Phil and NAB’s Ray Attrill dissect the widening gap between New Zealand and Australia as AI‑driven investment costs strain US markets and commodity prices slide, while the Aussie dollar weakens below 71 cents. They explore how rising AI spending,...

By NAB Morning Call