🎯Today's Global Economy Pulse

Updated 1h agoWhat's happening: Supreme Court nullifies Trump-era tariffs, paving way for $130 billion in refunds

The Court ruled 6‑3 that the “Liberation Day” tariffs exceeded presidential authority under the International Emergency Economic Powers Act, overturning the measures. The decision opens a path for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries. Trade groups praised the ruling but warned the refund process could be complex.

News•Feb 12, 2026

IEA Lowers 2026 Oil Demand Forecast on Economic Uncertainty, Higher Prices

The International Energy Agency (IEA) lowered its 2026 global oil demand growth forecast to 850,000 barrels per day, down from a previous estimate amid heightened economic uncertainty and rising crude prices. Demand gains will come entirely from non‑OECD economies, with China contributing roughly 200,000 barrels per day, but growth is shifting toward petrochemical feedstocks, which now account for over half of the increase. Global oil supply contracted sharply in January, falling by 1.2 million barrels per day due to weather‑related shutdowns and sanctions, though production is expected to rebound in the latter half of the year. Inventories have swelled to record levels, providing a price floor despite the overall surplus.

By Oil & Gas Journal – General Interest

Social•Feb 12, 2026

Gold Dip After NFP Profit‑take, Still Bullish Long‑term

GOLD ( XAUUSD ) just dumped over a 1000 pips after yesterday's NFP , but what just happened ? 👇 Netanyanho signalled towards de-escalation in the middle east with a potential deal b/w Iran & US This optimistic headlines lead to a...

By tradeloq

Social•Feb 12, 2026

From Labor to Compute: Economy’s Next Quantum Leap

1900: Internal Combustion + Electricity = 5x GDP growth. 2026: AGI + Humanoid Robotics + Space-based Energy = 50x GDP growth. This is NOT a cycle; instead, we are in a phase change for the species. The transition from being...

By Peter H. Diamandis

News•Feb 12, 2026

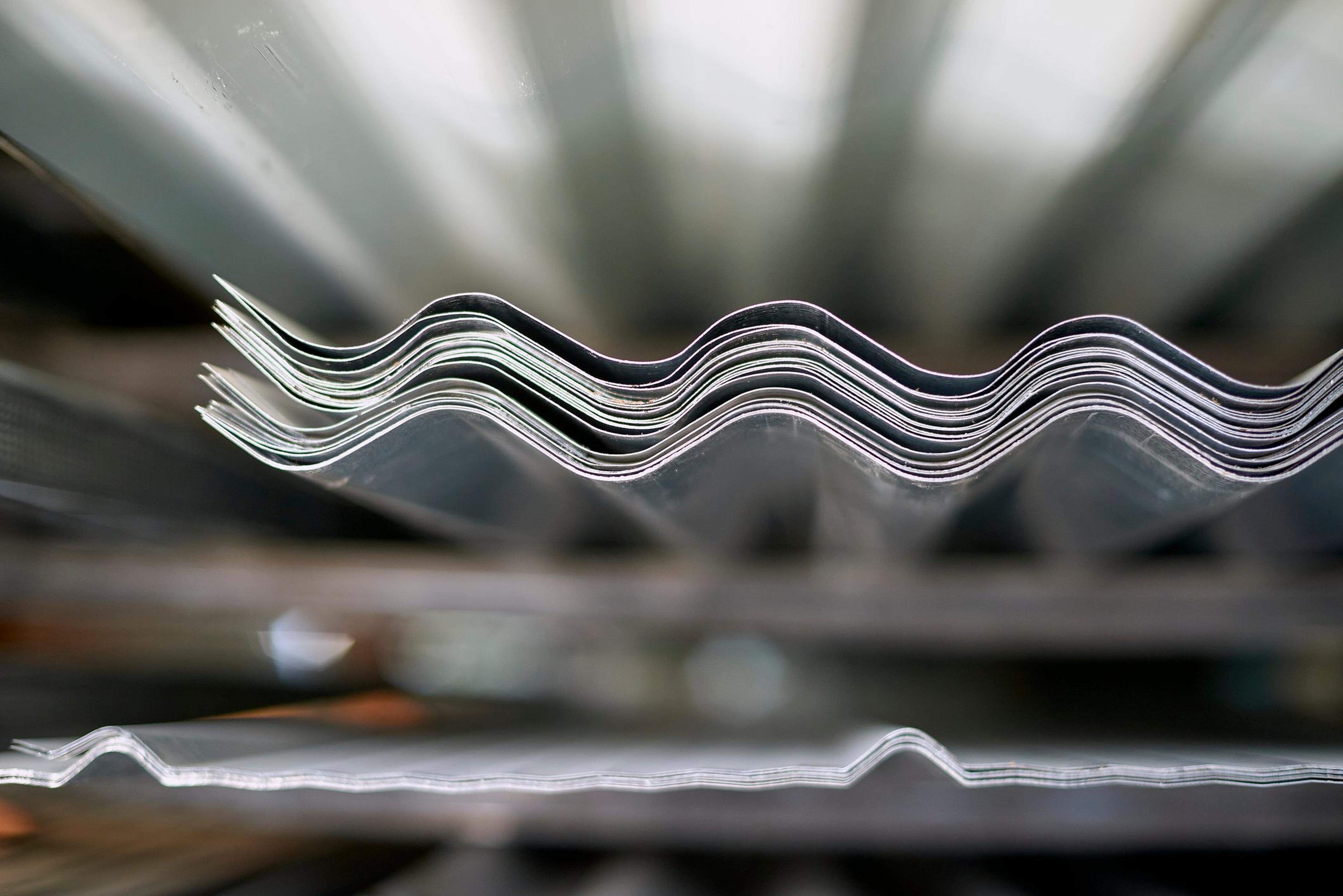

Chinese Zinc and Lead Smelters Rely on Byproducts in 2026

Chinese zinc and lead smelters are increasingly dependent on by‑product revenues as tight imported concentrate supplies compress primary treatment charge margins. Silver, sulfuric acid, copper and gold now provide critical income streams, offsetting low zinc and lead TCs projected for...

By Fastmarkets – Insights

Social•Feb 12, 2026

SOLS: Cheap US Uranium Conversion Monopoly Amid Global Shortage

Thread(1/2) 🧵 We put our SOLS long thesis above the paywall in our Atoms vs. Bits primer yesterday, so I’m also going to summarize for all you degenerates on X. The story is simple: the uranium trade has resulted in nearly every...

By Citrini7 (pseudonymous)

News•Feb 12, 2026

Will Bonds Outperform Stocks in 2026? Why the Timing Might Be Right To Double Down on Bonds.

Bond ETFs are poised to challenge equity returns in 2026 as central banks move from aggressive tightening to policy normalization. The Invesco Equal Weight 0‑30 Year Treasury ETF (GOVI) offers a diversified, lower‑volatility alternative to the long‑duration iShares 20+ Year...

By Yahoo Finance — Markets (site feed)

News•Feb 12, 2026

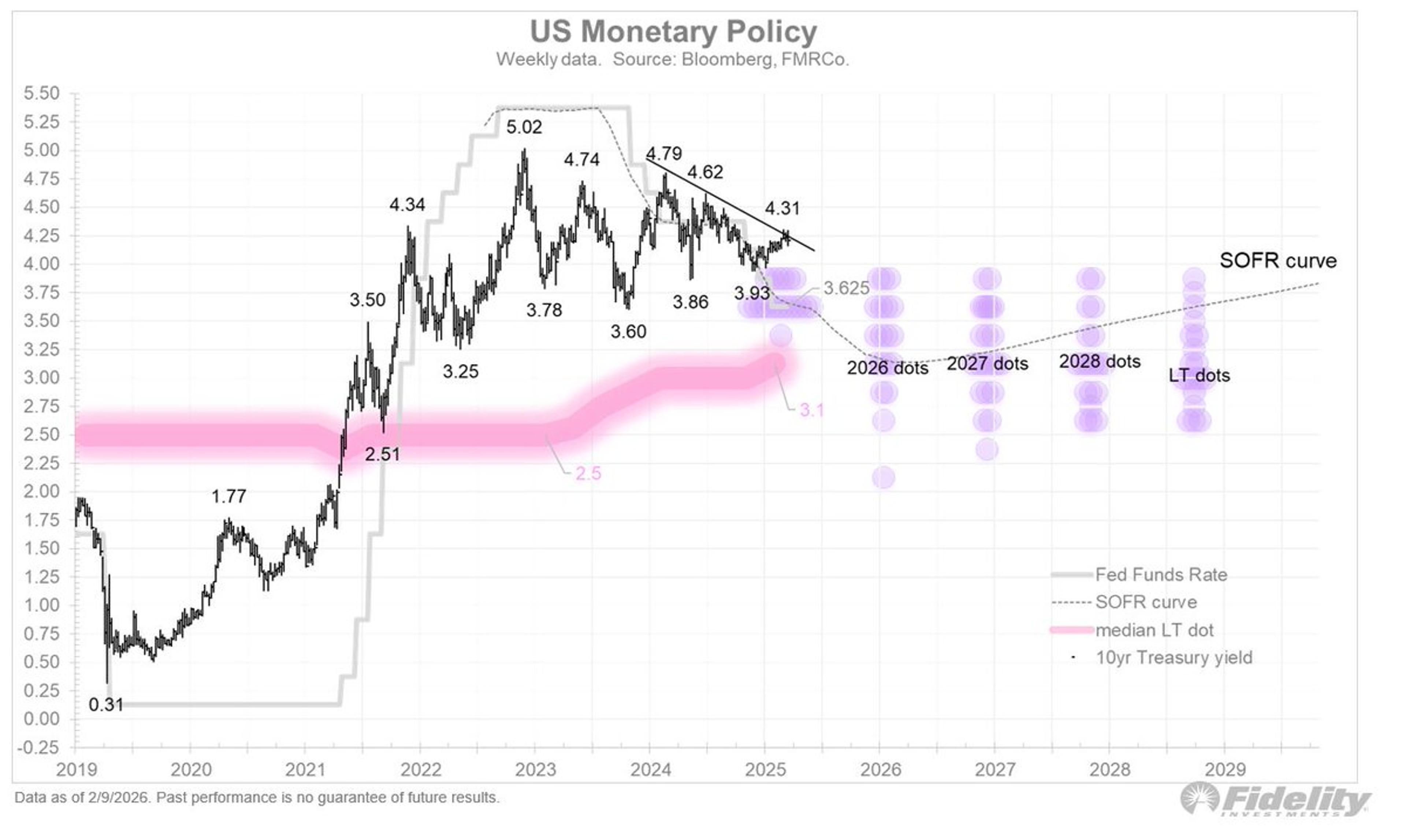

MacroVoices #519 Alex Gurevich: The Next Perfect Trade

Alex Gurevich joins Erik Townsend and Patrick Ceresna on MacroVoices to outline his outlook for fixed‑income markets and the broader macro environment. He argues that the Federal Reserve will keep a restrictive policy stance into 2026, keeping inflation pressures in...

By MacroVoices (podcast/site)

Social•Feb 12, 2026

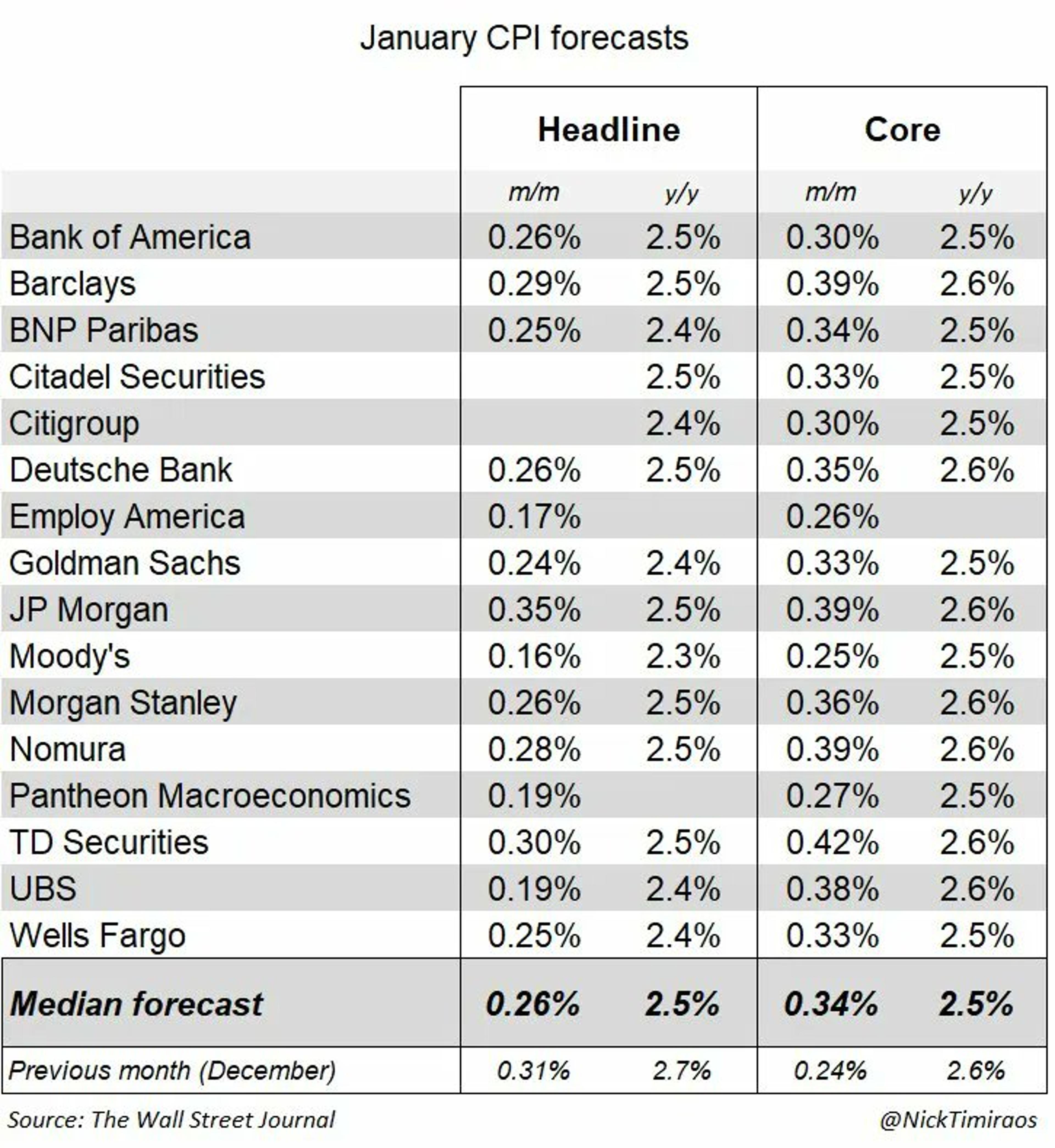

Headline Inflation Cools, Core CPI Accelerates in January

Wall Street expects a cooler month for headline inflation but a hotter month for core in January Headline CPI: 0.26% m/m, 2.5% y/y (down from 0.31% m/m and 2.7% y/y in December) Core CPI: 0.34% m/m, 2.5% y/y (core m/m accelerating from...

By Nick Timiraos

Social•Feb 12, 2026

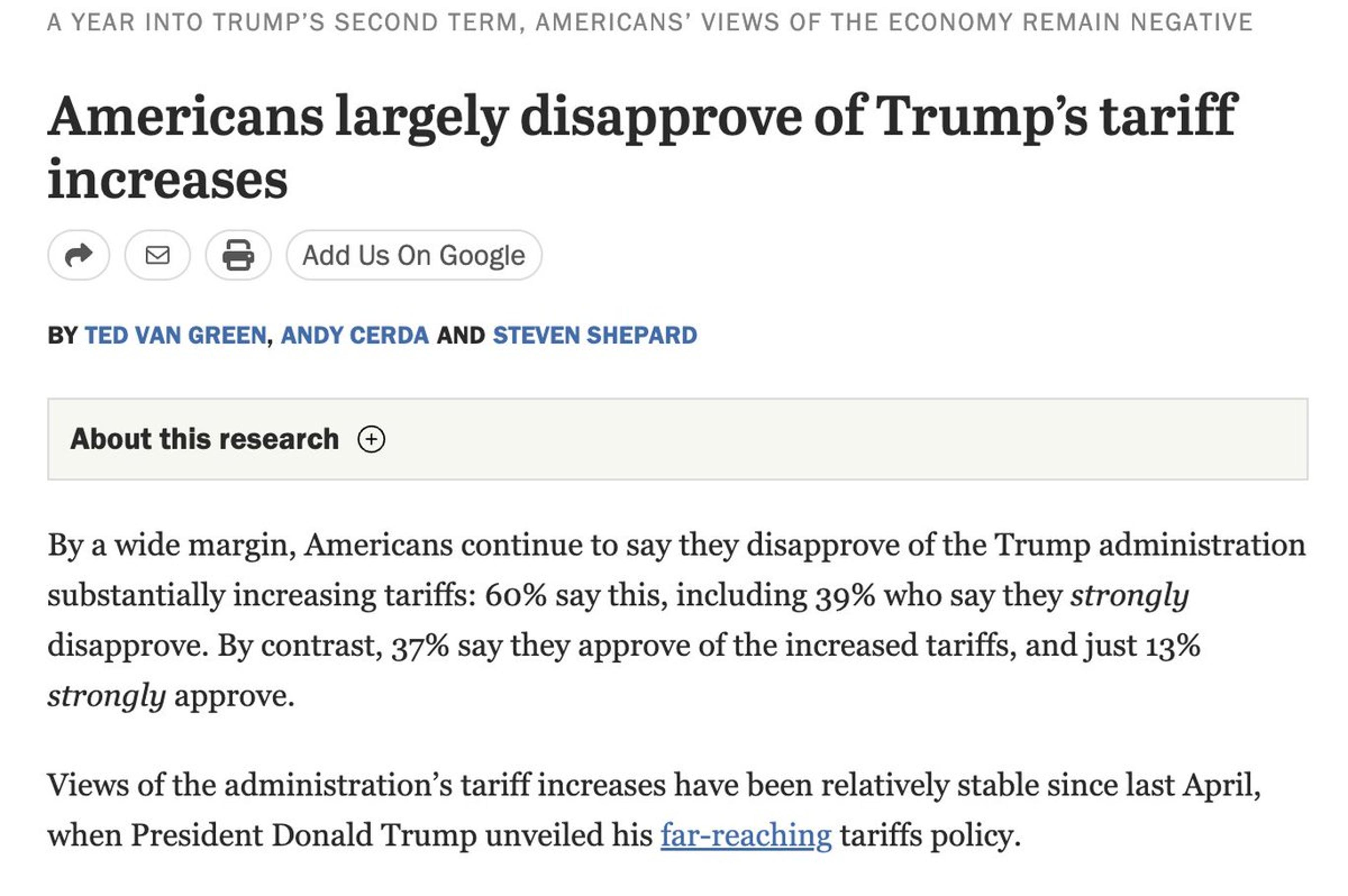

Tariffs Fail Without Consensus, Chaos Undermines Industrial Policy

The problem with "give tariffs time" as a plan is that they have been implemented in a way that won't stand up to courts, there is not a bipartisan consensus supporting them, and voters hate them now because they have...

By Adam Ozimek

News•Feb 12, 2026

Commerce Releases Final AD/CVD Amounts in Battery Anode Case

The U.S. Department of Commerce issued final antidumping (AD) and countervailing duty (CVD) rates for Chinese active anode material (AAM). AD margins remain at 93.5% for major exporters and 102.72% for others, while CVD rates settle around 66.86% for most...

By Solar Power World

News•Feb 12, 2026

Realtors Report a 'New Housing Crisis' As January Home Sales Tank More than 8%

The National Association of Realtors reported that existing‑home sales plunged 8.4% in January, the sharpest monthly decline since February 2022. Median prices rose to a record $396,800 for the month, up 0.9% year‑over‑year, while inventory remained 3.4% higher than a year...

By CNBC – Economy

News•Feb 12, 2026

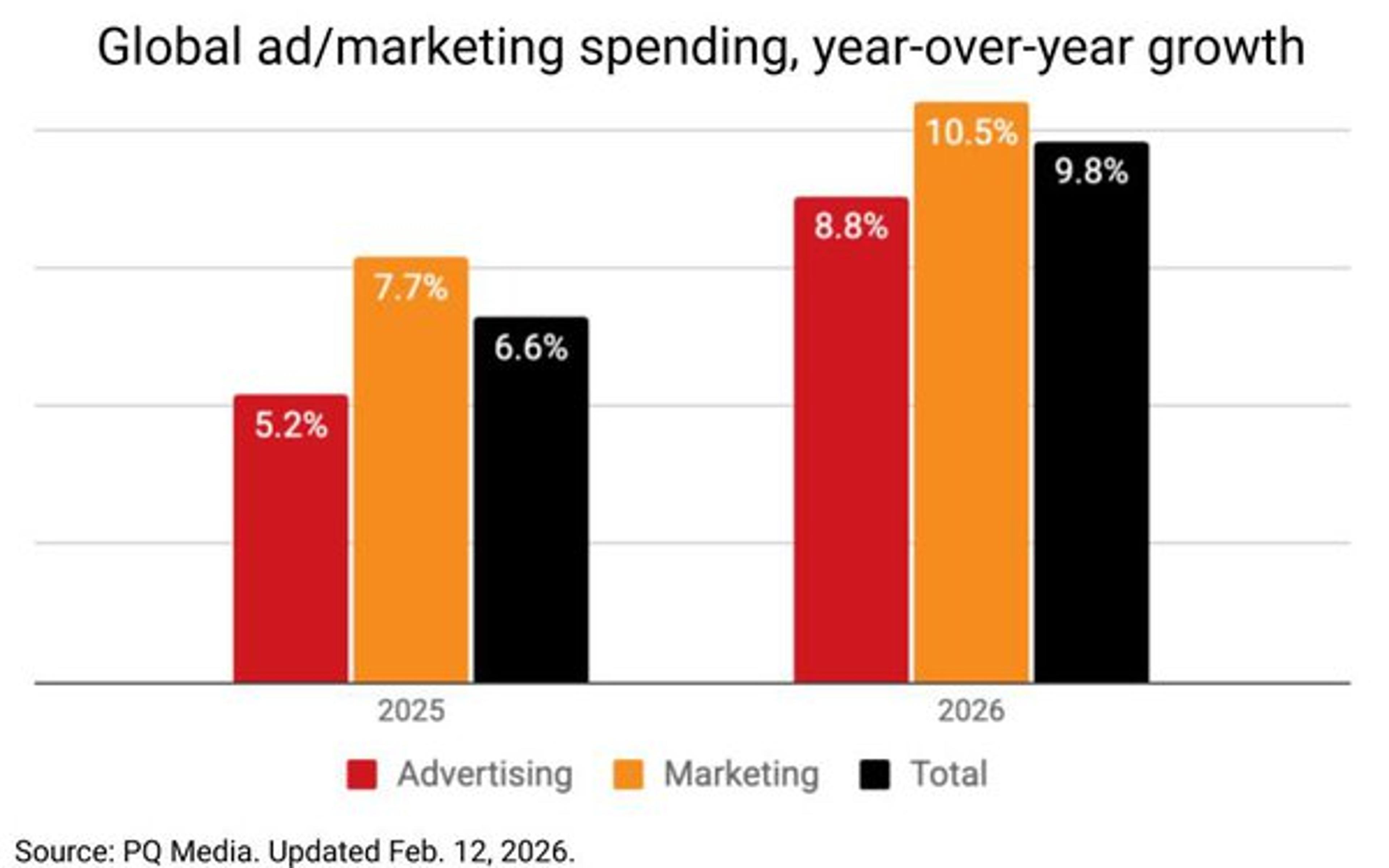

PQ: Global Ad Spend Will Climb 8.8%, Composite Rises Three-Tenths Of A Point

PQ Media’s 2026 Global Advertising & Marketing Spending Forecast projects worldwide ad spend to climb 8.8% and total marketing spend to rise 9.8% this year. The new data have been incorporated into MediaPost’s composite forecast, lifting the average industry growth...

By MediaPost

News•Feb 12, 2026

Declines in Health and Education in Poor Countries ‘Harming Earning Potential’

The World Bank reports that human capital—health, education and workplace learning—has declined in 86 of 129 low‑ and middle‑income countries between 2010 and 2025, threatening future earnings. Children born today could earn about 51 percent more over their lifetimes if their...

By The Guardian – Economics

Social•Feb 12, 2026

Global Wealth Shift: US Cuts, Overseas Gains Ahead

A Massive Global Wealth Transfer Is Coming Americans will consume less, the rest of the world more. Capital is flowing overseas. This isn’t a crisis, it’s a wealth transfer — and there are winners if you know where to look. PeterSchiff #Economy...

By Peter Schiff

Social•Feb 12, 2026

Russia, China Shape Western Leaders' Strategic Decisions

This is not about rhetoric. This is about influence that changes outcomes. This piece explores how Russia and China have shaped the thinking and incentives of Western political leaders in ways that matter strategically. If you want to understand why Western policy sometimes...

By David Murrin

Blog•Feb 12, 2026

Slower Data. Slower Morning

The bond market’s recent volatility, sparked by a strong jobs report, has calmed after this morning’s modest jobless‑claims data. Claims rose to 227,000, slightly above the 222,000 forecast but below the prior 232,000 level. With the CPI release looming, traders...

By Mortgage News Daily – MBS Live Commentary

Social•Feb 12, 2026

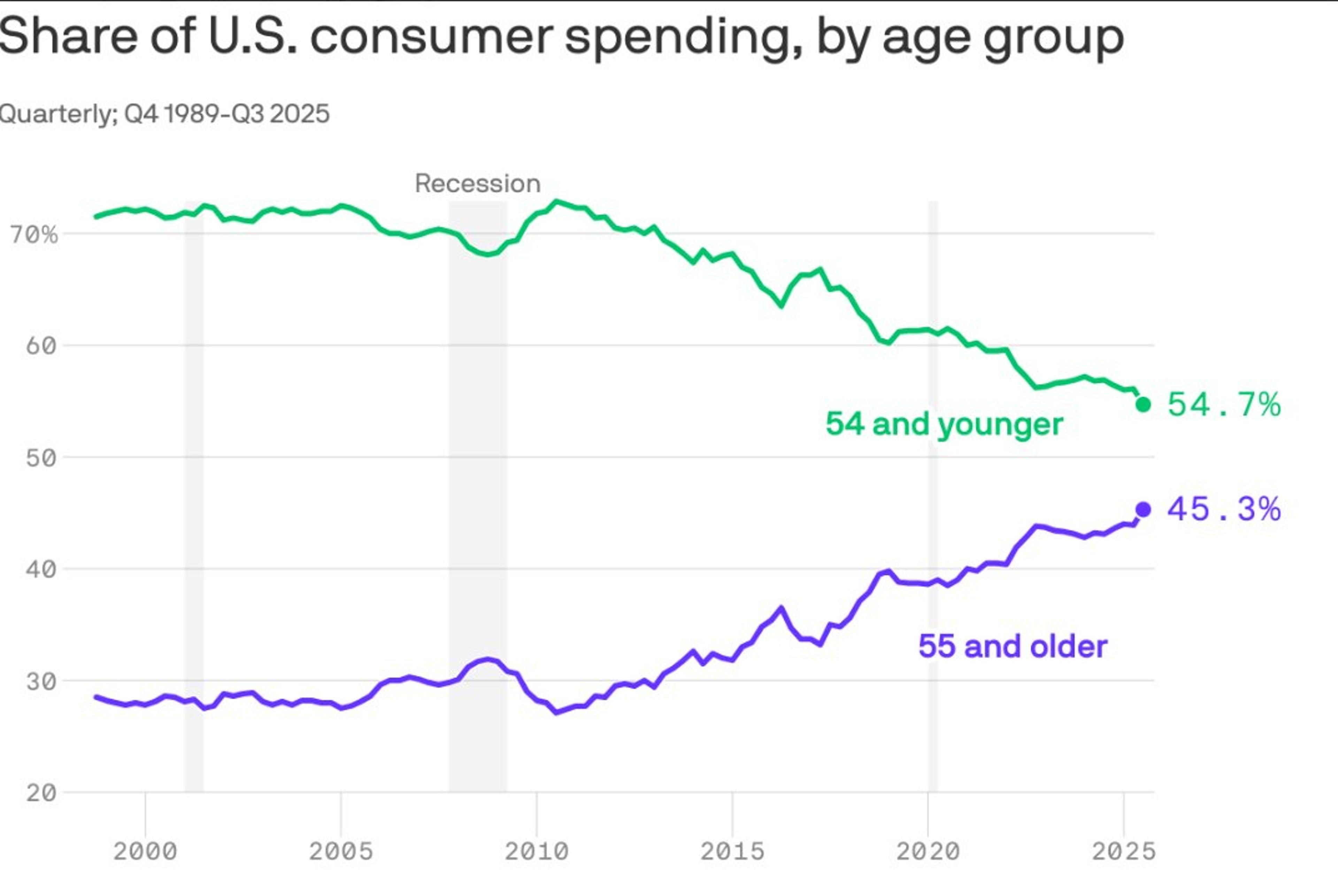

Older Americans Hold 70% Wealth, Drive Consumer Spending

The least productive part of our economy keeps getting wealthier...If you have a larger balance sheet you've relatively benefitted because of continuous gov't support, while labor has been shoved in a locker. Whatever happened to the party of labor?? hmm🧐🧐 "About 30%...

By Tyler Neville

Social•Feb 12, 2026

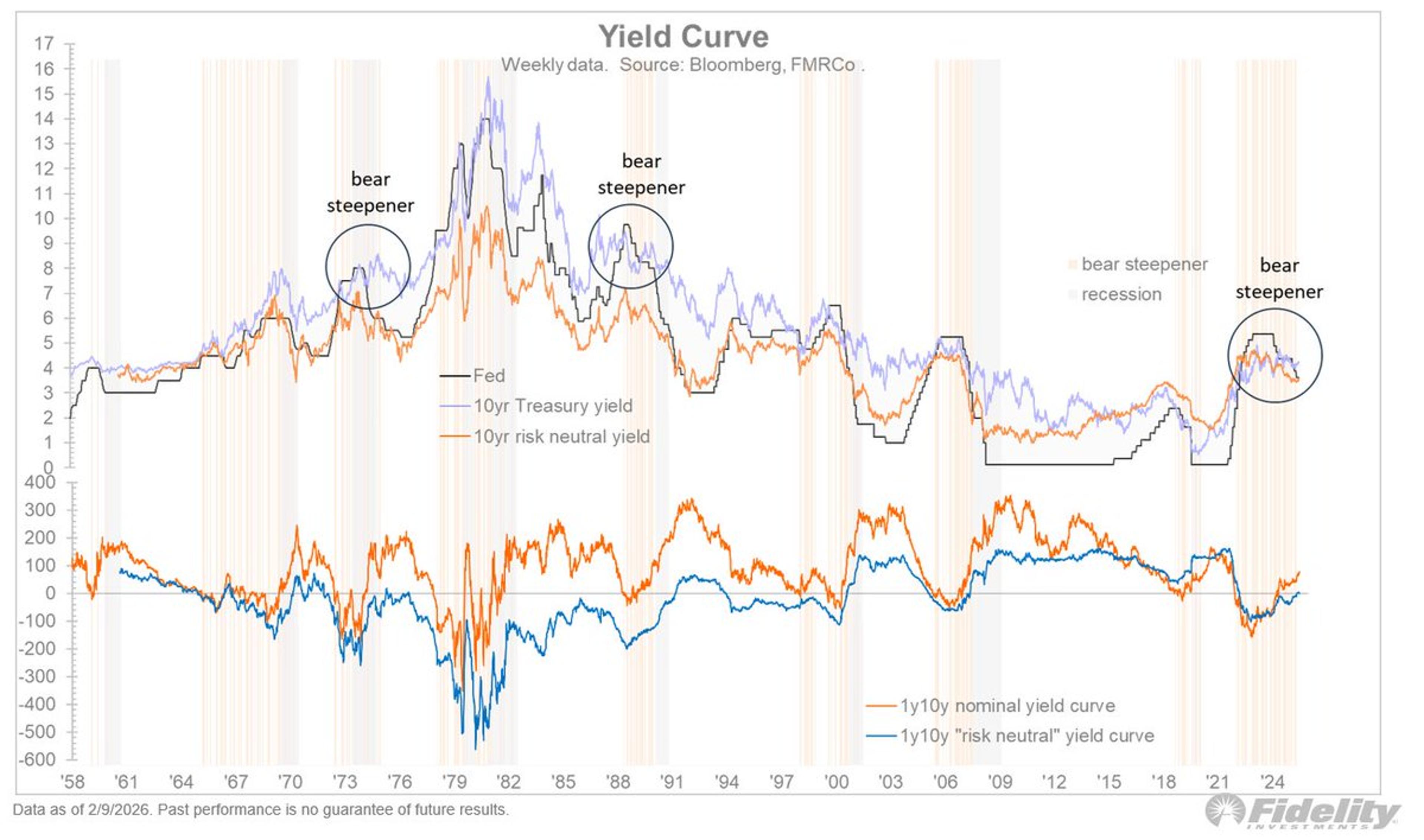

Steepening Yield Curve Could Shift QE Benefits to Main Street

How might the Fed/Treasury do that? One possibility is to cut short rates to steepen the yield curve, and deregulate the banks into buying the long end so that the Fed’s balance sheet can be “privatized.” If those QE assets...

By Jurrien Timmer

News•Feb 12, 2026

Ghana’s Unpaid Cocoa Farmers Are Forced to Go Hungry

Ghana’s cocoa regulator Cocobod owes farmers for tens of thousands of tons of beans as global cocoa prices have halved to about $4,000 per metric ton. The payment backlog forces smallholders like Joseph Dautey and Jacob Tetteh to skip meals,...

By BusinessLIVE (South Africa) – RSS hub

Social•Feb 12, 2026

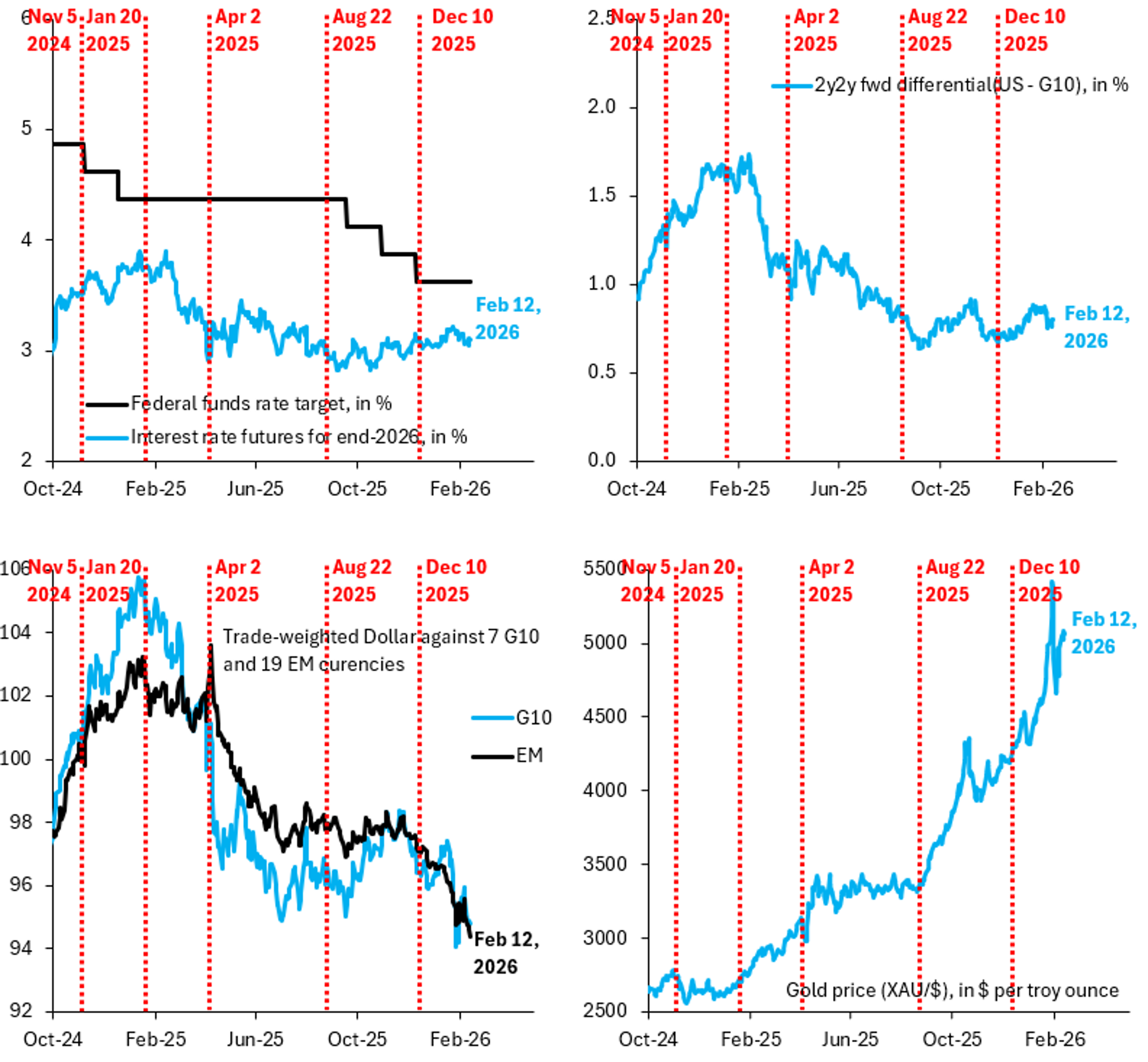

Fed Treasury to Coordinate

Things have been quiet on the rate side, with the 10-year yield trading at around 4 ¼ percent and expectations for a few more rate cuts (down to 3.1%) holding firm. We will likely soon have a lot more coordination between...

By Jurrien Timmer

News•Feb 12, 2026

EXCLUSIVE | Trump Pauses China Tech Curbs Ahead of Xi Summit

The Trump administration has temporarily shelved a suite of technology security measures targeting Chinese firms ahead of the April Trump‑Xi summit. The paused actions include a ban on China Telecom’s U.S. operations, restrictions on Chinese equipment in data centres, and...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 12, 2026

International Business Briefs | Ailing Thames Water Seeks Further £823m

Britain’s Thames Water announced that its creditors are reviewing an additional £823 million of funding, adding to the £1.43 billion already drawn from its super‑senior liquidity facility. In Nigeria, Dangote Petroleum’s refinery completed 72‑hour performance tests, confirming full‑capacity operation at 650,000 barrels...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 12, 2026

Release: Market Participants Survey

On November 9 2026 the Bank of Canada published its quarterly Market Participants Survey, a systematic outreach to a broad cross‑section of financial‑market actors. The survey solicits expectations on key macro‑economic indicators such as inflation, growth, and exchange rates, as well as...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada released a detailed Summary of Deliberations outlining the Governing Council’s discussion of the monetary‑policy decision announced two weeks earlier. The document highlights the Council’s assessment of inflation trends, labour‑market tightness, and the domestic growth outlook. It...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada’s Governing Council released a detailed summary of its monetary‑policy deliberations for the decision announced two weeks ago. The Council kept the policy interest rate steady at 4.75%, citing modest progress toward its 2% inflation target. Officials...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Interest Rate Announcement

On December 9, 2026 the Bank of Canada will release its next overnight rate target, one of eight scheduled policy announcements each year. The press release will outline the economic factors shaping the decision, including inflation trends, labour market conditions, and global...

By Bank of Canada — RSS (site hub)

Blog•Feb 12, 2026

Limited Risk Disclosure Updates Despite Political and Economic Volatility

Deloitte and USC’s Peter Arkley Institute released its fifth‑year analysis of S&P 500 risk‑factor disclosures, finding that average page counts rose to 14.3 and risk‑factor totals to 32. Despite SEC reforms aimed at trimming disclosures, 56% of firms added pages and 37%...

By Harvard Law School Forum on Corporate Governance

Social•Feb 12, 2026

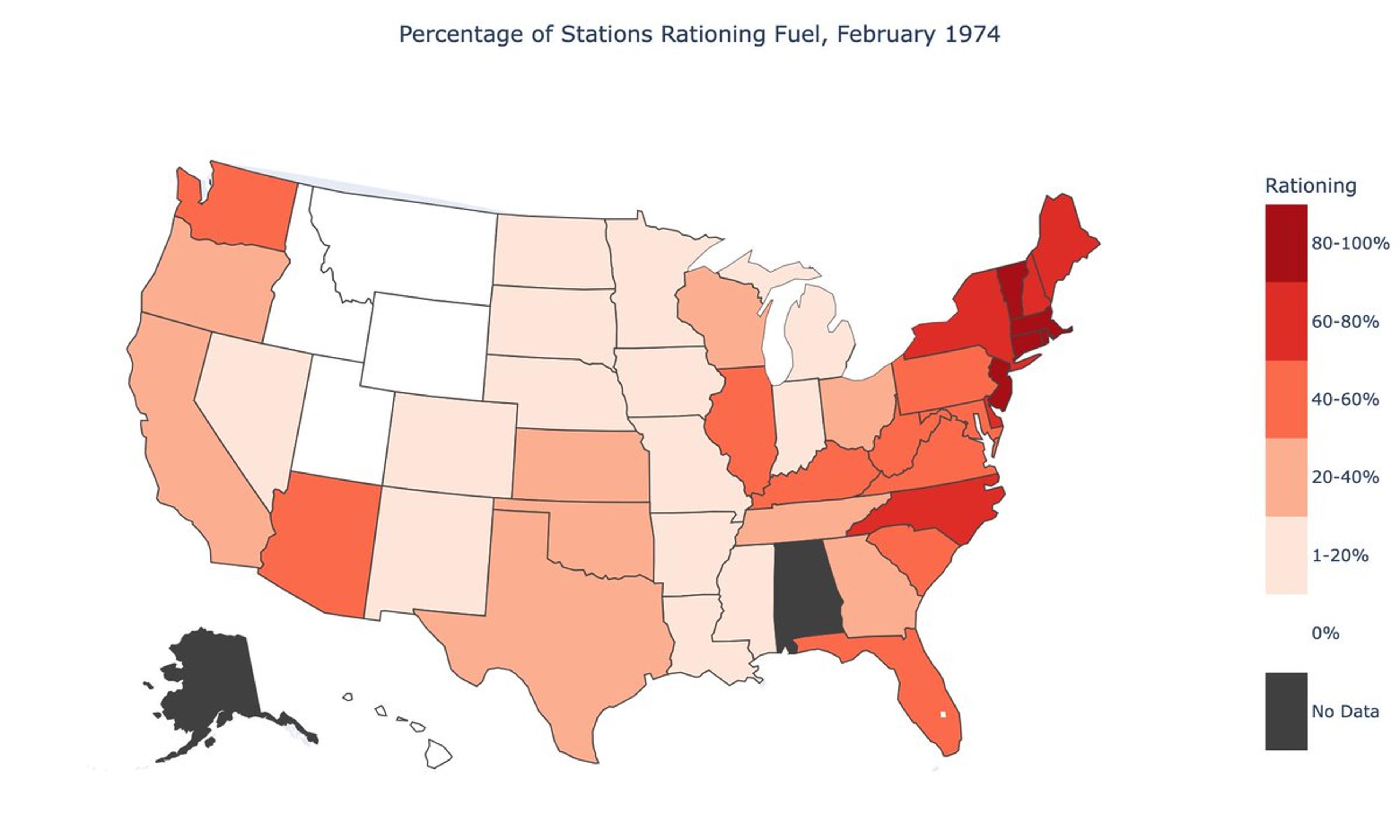

Price Controls Trigger Chaotic, Uneven Resource Allocation

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

Social•Feb 12, 2026

EU Parliament Backs Digital Euro to Curb US Payment Dominance

Post-Trump assault on Greenland, the EU parliament delivers a big win for the digital euro as it wins 420-158 backing in EU Parliament straw poll The digital euro couldn't have better timing as the EU looks to the digital euro...

By Richard Turrin

Blog•Feb 12, 2026

Finally, CPI Inflation Has a New Base Year

India's Statistics Ministry has finally updated the consumer price index (CPI) base year, moving it from 2012 to 2024 using the 2023‑24 Household Consumption Expenditure Survey. The revision expands the index from six to twelve COICOP‑aligned divisions and introduces All‑India...

By Mostly Economics

Social•Feb 12, 2026

China Eases Capital Controls as Asset Buildup Accelerates

China usually liberalizes its financial account when the PBOC (now the state banks) are accumulating assets at too rapid a pace, and it wans the dollar risk to be taken by others ... 1/2

By Brad Setser

Social•Feb 12, 2026

East Asia Drives Surging Trade Surplus, Currencies Remain Cheap

Bingo And the global trade surplus (ex pharma) is now primarily in China, Taiwan and Korea ... Important qualification to the now standard argument the dollar has gotten weaker (which is true primarily if the clock starts at the end of 24,...

By Brad Setser

Podcast•Feb 12, 2026•7 min

Rate Expectations

The episode dissects the impact of January's surprisingly strong jobs report, which undermined expectations of a weakening labor market and pushed anticipated Federal Reserve rate cuts further into the future. It also examines a new Congressional Budget Office outlook that...

By Reuters Morning Bid

Social•Feb 12, 2026

EURCHF Plummets to Record Lows, Yield Gaps Irrelevant

Another FX PSA: $EURCHF has extended its generational slide lower to fresh record lows. Yield differentials don't matter at all here apparently: https://t.co/cHMUxde914

By John Kicklighter

Social•Feb 12, 2026

US Energy Secretary Visits Venezuela's Orinoco Oil Belt

Well, I admit that if you have asked me three months ago, certainly I didn't have the following on my 2026 bingo card: "... US Secretary of Energy Chris Wright tours the Orinoco oil belt in Venezuela with the US-installed Venezuelan...

By Javier Blas

News•Feb 12, 2026

Europe Debates Future Ties with US: Decouple or Double Down?

Europe is split on its future relationship with the United States under President Trump. Eastern European NATO members such as Romania and Lithuania argue for tighter security cooperation and participation in the critical‑minerals ministerial, citing Russian aggression. In contrast, France,...

By The Hill – Defense

Social•Feb 12, 2026

Excess Wealth vs Limited Cash Fuels Asset Bubbles

Wealth isn’t worth anything unless it can be converted into money to spend. And when there’s a lot of wealth relative to the amount of hard money available — like we’re seeing today — bubbles are created. @nikhilkamathcio https://t.co/iBiRkkv7Ok

By Ray Dalio

Social•Feb 12, 2026

Gold Lacks Earnings; Overvalued Compared to Commodities

I managed the largest gold fund in USA. Here's the truth: Stocks have "babies" (earnings). Gold has NO babies. 🍼 Gold's at historic extreme vs. oil/soybeans. You're crazy if you think gold's gonna outperform inflation - @BergMilton https://t.co/bNqmCOVYCt https://t.co/7NJ9NoBZCx

By Jack Farley

News•Feb 12, 2026

Singapore Budget 2026: Key Highlights for HR Leaders, Employers, and Employees

Singapore’s 2026 Budget, delivered by Prime Minister Lawrence Wong, projects growth slowing to 2‑4% and introduces a suite of measures to keep the city‑state competitive. For employers, the budget raises the minimum qualifying salary for new Employment Passes to $6,000...

By Human Resources Online (Asia)

Social•Feb 12, 2026

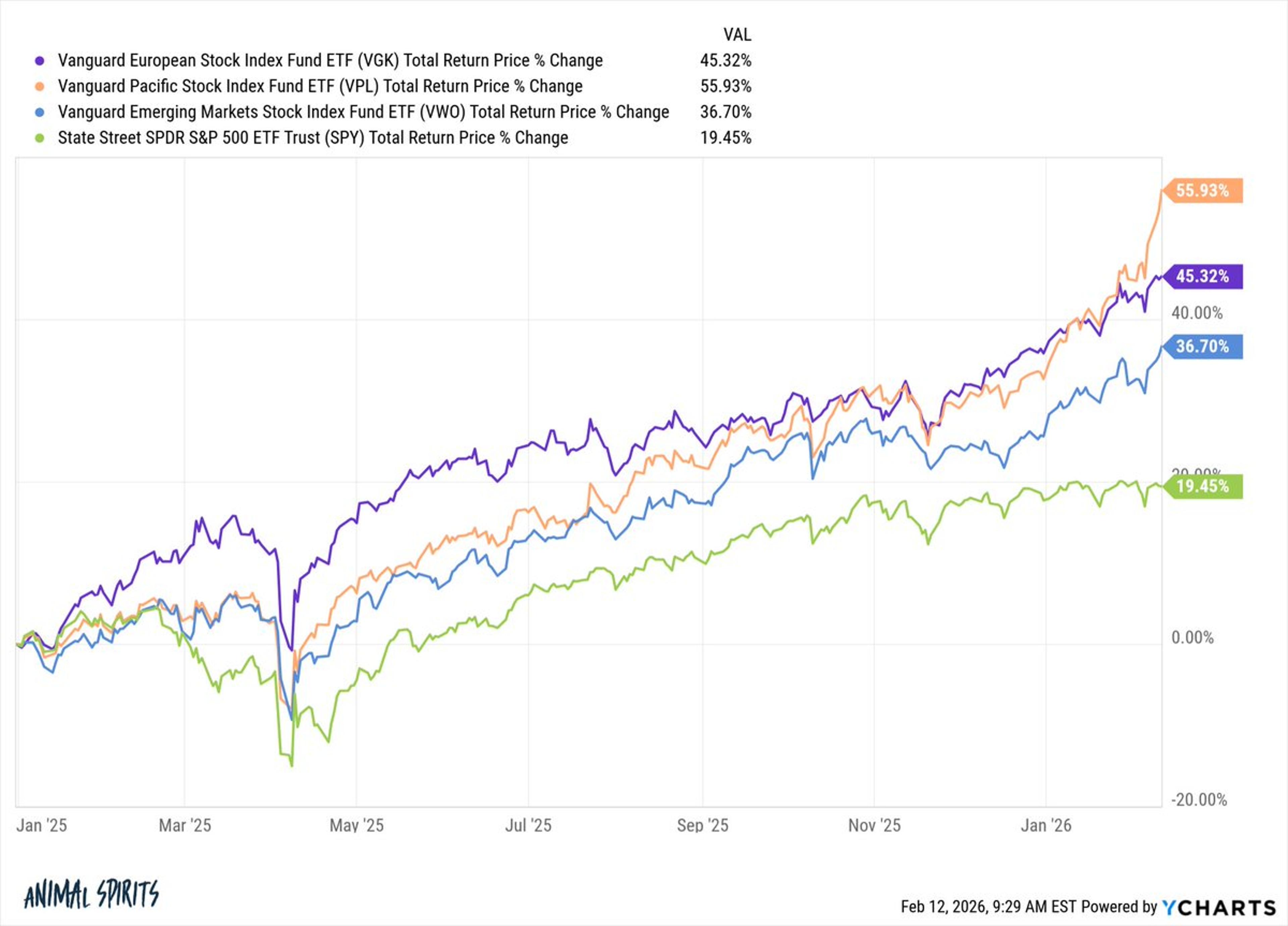

Global Equities Surge Far Beyond S&P 2025

Since the start of 2025: S&P 500 +19.5% European stocks +45.3% Emerging markets +50.8% Asian stocks +55.9% https://t.co/lrZrKKIC4x

By Ben Carlson

Social•Feb 12, 2026

Dollar Regime Flip: Strong Data Now Weaken Currency

Something big is going on with the Dollar. In the past decade, strong data have pushed the Dollar up, but that isn't what happened yesterday. We're going back to the regime that prevailed before, whereby strong data push the Dollar...

By Robin Brooks

News•Feb 12, 2026

Air Canada’s Airbus A350 Order Signals Geopolitical Shift Away From Boeing as Trump Policies Reshape Global Aviation

Air Canada announced a firm order for eight Airbus A350‑1000 wide‑body jets, citing the aircraft’s 9,000‑nautical‑mile range and 25% lower fuel burn as key efficiency drivers. The purchase enables new nonstop routes to Southeast Asia, India and Australia. It arrives...

By eTurboNews

Social•Feb 12, 2026

2025 Real GDP per Capita Rises, Energy Cuts Ease Inflation

Today's GDP figures show a much needed pickup in real GDP per capita - 2025 was the first year this measure grew for three years. In April, energy bill reductions from the 2025 Budget will come into effect, tackling inflation...

By Yuan Yang

Social•Feb 12, 2026

FX Market Consolidates After Strong January Jobs Data

Consolidation Featured after Yesterday's Big FX Moves: The general tone in the foreign exchange market is one of consolidation after yesterday’s stronger than expected January jobs data injected volatility into dollar trading. The news stream is light… https://t.co/TEyGQAuZOx https://t.co/b9kn9ngrdN

By Marc Chandler

News•Feb 12, 2026

Could a BRICS Currency Work?

The article probes the feasibility of a shared BRICS currency aimed at challenging the US dollar’s global dominance. While mainstream economists have long dismissed the concept, the bloc is actively seeking new settlement rails to lessen dollar dependence. Structural hurdles—including...

By Project Syndicate — Economics

Social•Feb 12, 2026

Makhlouf Predicts ECB Could Cut or Raise Rates

Makhlouf says next ECB move could be interest-rate cut or hike https://t.co/A8bEIJQ2pB via @livfletcher_ https://t.co/Wq9tyTki8q

By Zöe Schneeweiss

Social•Feb 12, 2026

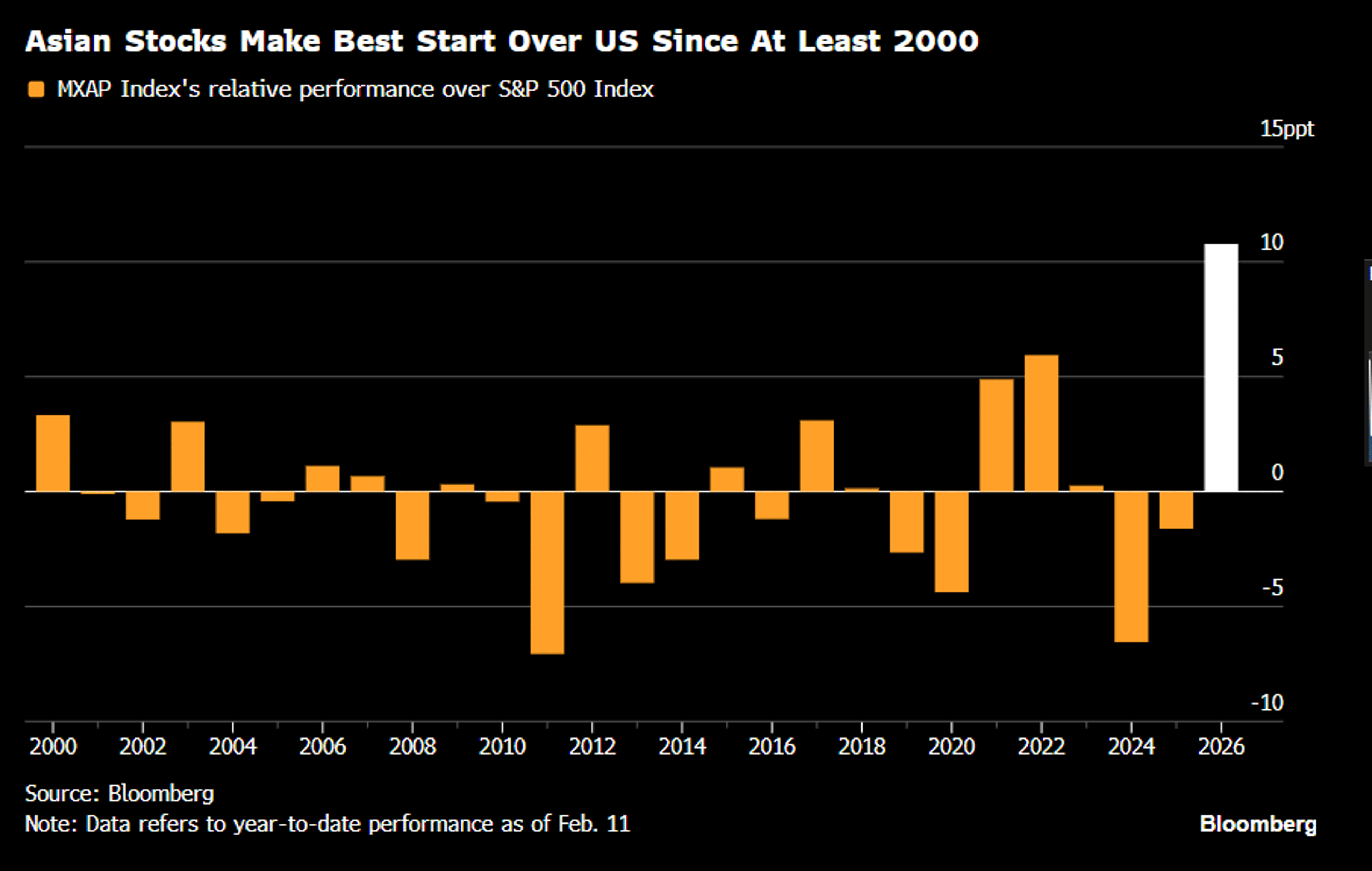

Asian Stocks Outpace US, Shifting Money Abroad

Perhaps the trade this year isn't so much "sell America," but rather something like: "spend a lot more money everywhere else" - at least so far this year. For example, Asian stocks have made their best start over US equities...

By Lisa Abramowicz

News•Feb 12, 2026

Piero Cipollone: Europe and Monetary Sovereignty

In a February 2026 speech, ECB Executive Board member Piero Cipollone warned that Europe’s monetary sovereignty is threatened by growing dependencies on foreign payment systems and digital assets. He argued that control over the euro, both in cash and digital...

By European Central Bank — Press/Speeches

Blog•Feb 12, 2026

Suffocating an Island: What the U.S. Blockade Is Doing to Cuba

The United States has intensified its embargo on Cuba, cutting oil shipments and tightening sanctions under President Trump and Senator Rubio. The fuel shortage has reduced electricity to three‑to‑six hours a day and halted public transport, forcing Cubans onto bicycles...

By Naked Capitalism

News•Feb 12, 2026

Economics Has Failed on the Climate Crisis. This Complexity Scientist Has a Mind-Blowing Plan to Fix That

Complexity scientist Doyne Farmer proposes a $100 million global economic simulator that models every firm individually, starting with the energy sector’s 30,000 companies and 160,000 assets. By replacing perfect‑rationality and equilibrium assumptions with simple, adaptive agents, the model promises forecasts that...

By The Guardian – Economics