🎯Today's Global Economy Pulse

Updated 23m agoWhat's happening: U.S. Supreme Court overturns Trump tariffs, paving way for $130B in refunds

The Supreme Court ruled 6‑3 that the Trump administration’s “Liberation Day” tariffs were unlawful, restoring congressional authority over trade barriers. The decision opens the door for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries.

Also developing:

Blog•Feb 11, 2026

How Federal Reserve’s Decentralised Structure Produced New Ideas on Banking Policy

Recent research by Michael Bordo and Edward Prescott shows that the Federal Reserve’s decentralized structure generated fresh banking‑policy ideas in the 1950s and 1960s. In response to industry consolidation and legal reforms, the Board and regional Reserve Banks hired industrial‑organization economists and recent PhDs, importing the SCP paradigm into regulatory analysis. Boston and Chicago Reserve Banks pioneered dissertation‑support programs, specialized data collection, and the Bank Structure Conference, which became the primary forum for academic work on bank structure, risk, and stability. The authors argue this decentralized knowledge‑production gave the Fed a distinct policy advantage.

By Mostly Economics

Social•Feb 11, 2026

Markets Await Jobs Data to Gauge Fed Cut Prospects

Will stock markets find enough to like in US jobs data? It’s all about Fed interest rate cut expectations. #Jobs #NFP #StockMarket #Dollar #Fed #Macro #Trading https://t.co/UBCpyuHxhZ

By Ilya Spivak

Blog•Feb 10, 2026

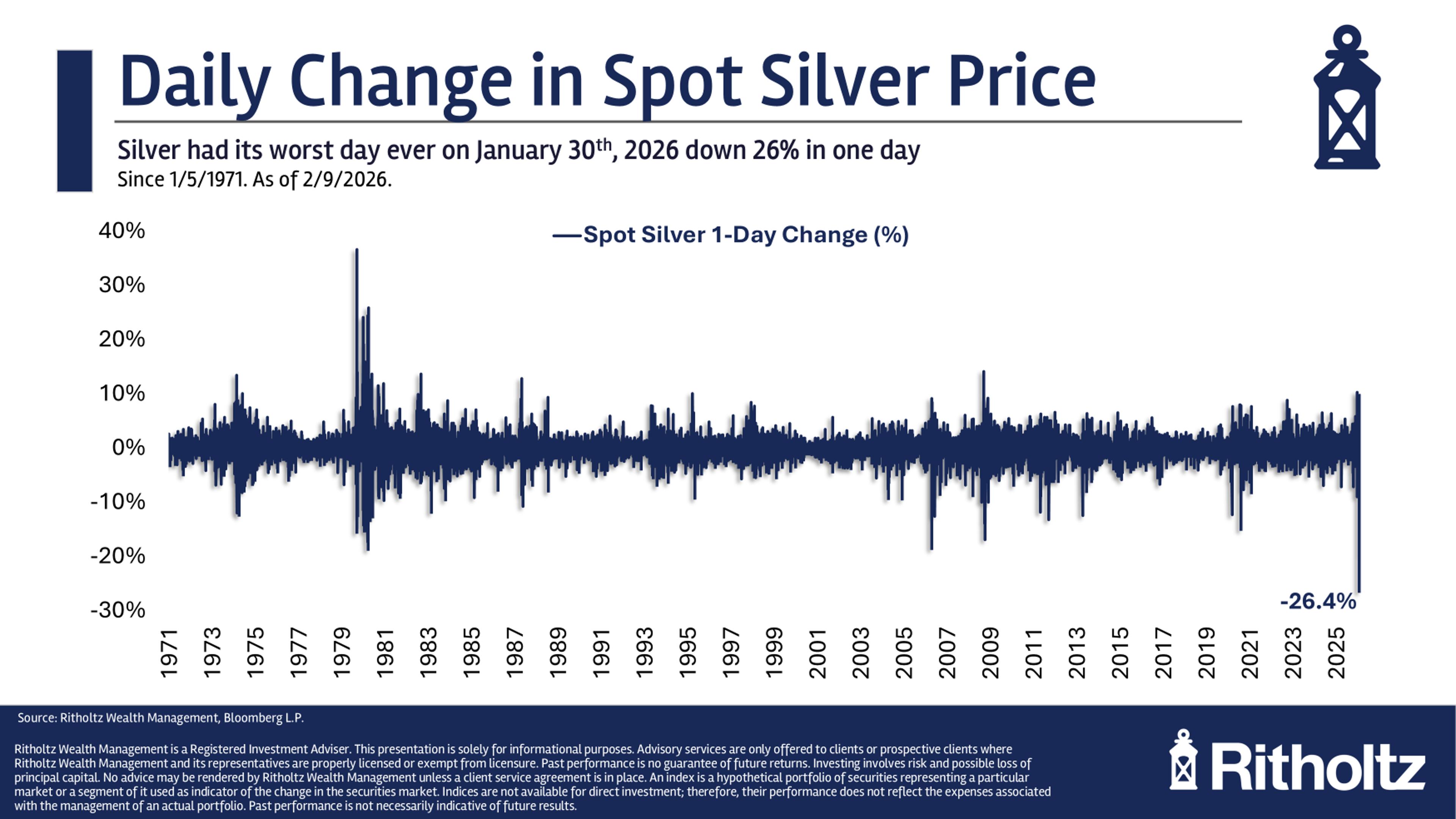

Chinese Traders Amplified Gold Volatility

The episode examines how Chinese traders, long recognized for aggressive speculation, sparked a dramatic swing in gold prices—from a surge to $5,600 in late January to a plunge to $4,423 within days. The host recounts a December report predicting this...

By The Bubble Bubble Report

News•Feb 10, 2026

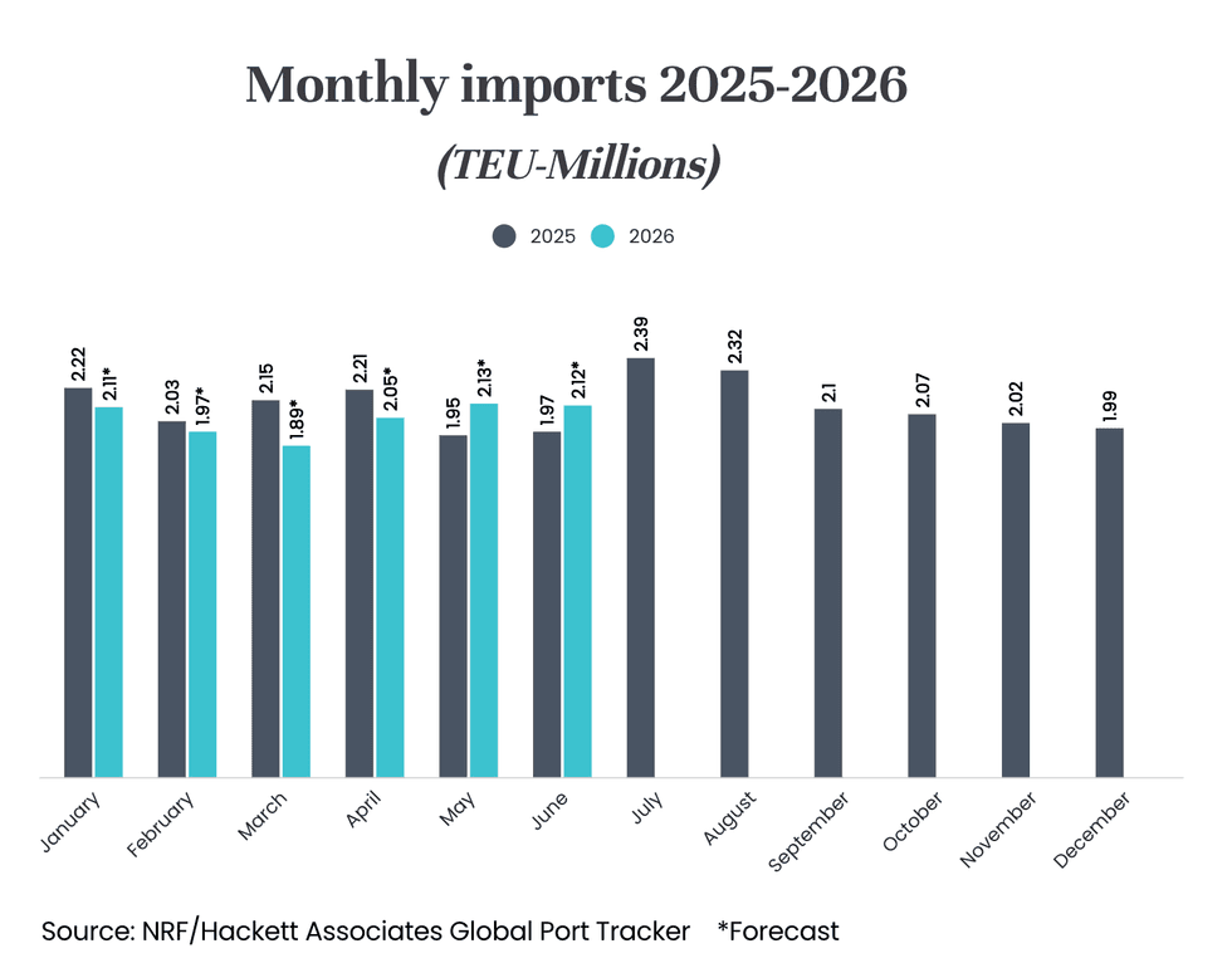

Forecast: Tariff Policies Will Weaken Container Imports in First Half of 2026

The NRF and Hackett Associates’ Global Port Tracker predicts U.S. container imports will fall in the first half of 2026, with a 2 percent year‑over‑year decline to 12.27 million TEUs. Full‑year volume is projected at 25.4 million TEUs, a 0.4 percent drop from 2024....

By Supply Chain Quarterly

Blog•Feb 10, 2026

Markets Are Now a Beauty Contest on Steroids

The article revisits Keynes’s beauty‑contest analogy, arguing that human psychology still drives markets, but the information age has accelerated opinion‑chasing. It uses the recent silver frenzy—spurred by geopolitical tension, AI‑related demand, and massive leverage—to illustrate how social media and bots...

By A Wealth of Common Sense

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-22113258881-f6461155210747d09aa8a6f5ea26c0cd.jpg)

News•Feb 10, 2026

Trump Expects An Economic Miracle From The New Fed Chair

President Donald Trump urged his Fed chair pick, Kevin Warsh, to deliver 15% annual GDP growth, a target rarely achieved outside wartime. The president’s demand follows criticism of current chair Jerome Powell and calls for aggressive rate cuts. Economists note...

By Investopedia — Economics

News•Feb 10, 2026

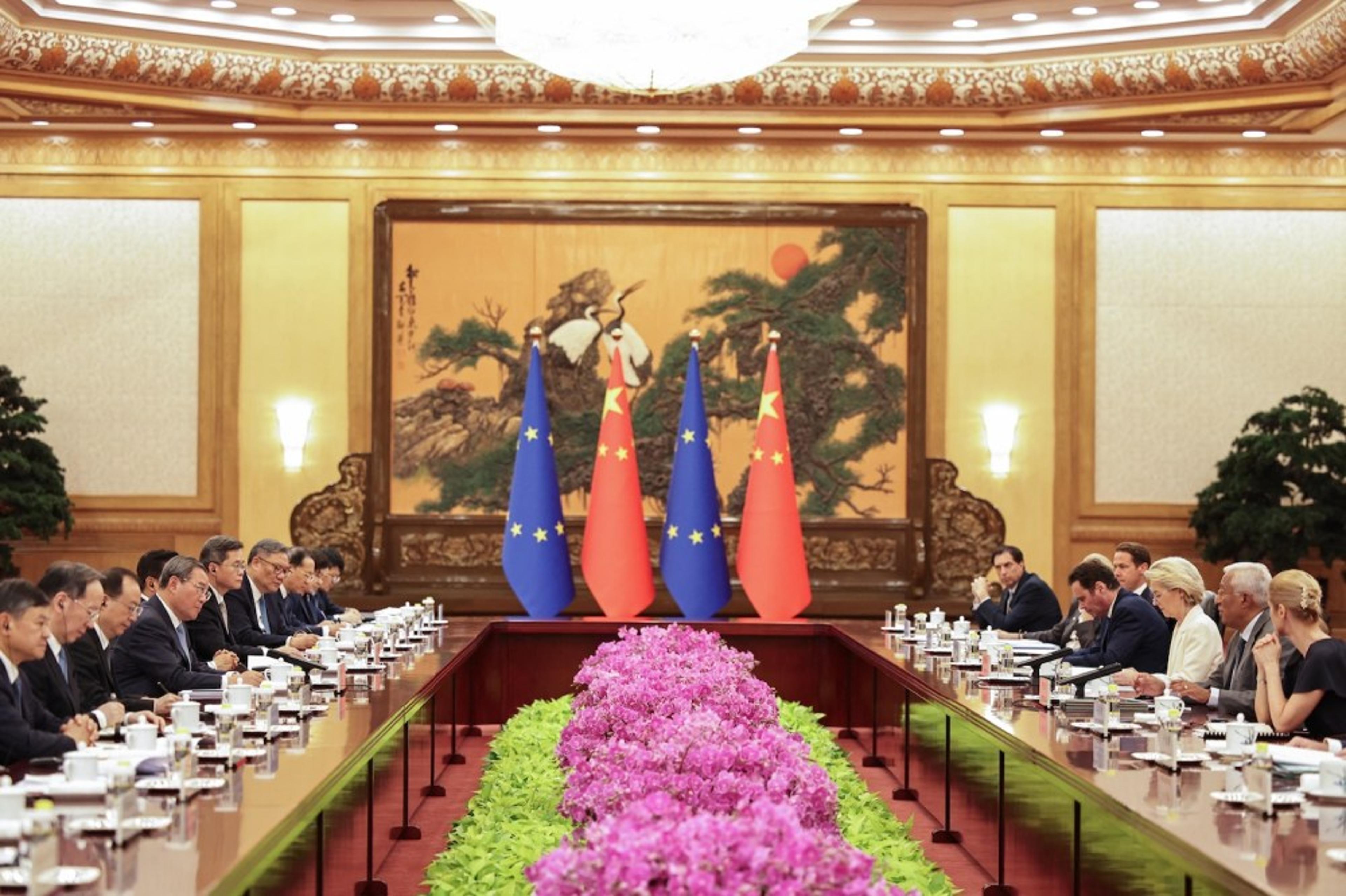

Beyond Blocs

The article argues that the world is moving beyond bloc politics toward issue‑based cooperation, with Europe seeking strategic autonomy while engaging China on a case‑by‑case basis. Recent high‑level visits to Beijing by European and other leaders underscore this shift. Trade...

By Foreign Policy

News•Feb 10, 2026

Wrapped Helps Spotify Add Users Despite Artists' Criticism over Fees

Spotify reported a surge in paid subscribers, adding 9 million to reach 290 million in the last quarter of 2025, driving net profit to €1.17 bn and total revenue to $4.5 bn. The company’s annual Wrapped campaign engaged over 300 million users and generated 630 million social...

By BBC News – Business

Social•Feb 10, 2026

Unemployment Rises to 4.5%, Signaling Market Underperformance

"So what does the job market data say to you?" "It says that we're underperforming right now... The thing that matters most to people's lives is the unemployment rate. Can you find work? And that was as low as...

By Justin Wolfers

News•Feb 10, 2026

Is a Dollar Vibe Shift Under Way?

The Atlantic Council’s GeoEconomics Center podcast explores whether a sustained dollar depreciation is emerging. Host Dan McDowell explains how a weaker greenback could reshape U.S. trade balances, investment flows, and national‑security calculations. The discussion highlights potential benefits for exporters alongside higher...

By Atlantic Council

News•Feb 10, 2026

Uranium Market Gathers Momentum in 2026: Sprott

Uranium spot prices surged above $100 per pound in January 2026, the first breach of that level in two years, signaling renewed market vigor. Sprott Asset Management, a major buyer, added 4 million lb to its fund this year, bringing total holdings...

By MINING.com

News•Feb 10, 2026

US Antimony, Americas Gold to Jointly Build Idaho Plant

United States Antimony and Americas Gold have formed a 51-49 joint venture to construct a hydrometallurgical processing plant in Idaho’s Silver Valley. The facility will treat antimony feed from Americas Gold’s Galena complex and could handle additional sources, aiming to...

By MINING.com

News•Feb 10, 2026

First Quantum Credit Outlook Improves on Cobre Panama Progress

S&P Global Ratings upgraded First Quantum Minerals' credit outlook to positive, citing tangible progress toward restarting the Cobre Panama copper mine. The agency now expects the mine to resume operations in the first half of 2026, with a production ramp‑up later...

By MINING.com

Social•Feb 10, 2026

Dollar Weakening as Diverging Policies Boost Global Assets

I keep playing through the potential outcomes over the coming months and I have a very difficult time painting a bull case for the dollar. I expect: 1. Monetary policy divergence widens (more dovish US vs RoW/Japan) 2. Capital flight risk as...

By Quinn Thompson

Blog•Feb 10, 2026

U.S. Secretary Of State: Brazil & China To 'Trade In Own Currencies & Get Around The Dollar'

U.S. Secretary of State Marco Rubio highlighted Brazil's new trade agreement with China that will use their own currencies instead of the U.S. dollar, signaling a shift toward a secondary, dollar‑independent global economy. He warned that as more nations transact...

By Arcadia Economics’ Gold & Silver Daily

Blog•Feb 10, 2026

Which Latin American Leaders Will Be Forced From Power in 2026?

In this episode the host examines prediction‑market odds for Latin American leaders being ousted before the end of 2026, using data from Kalshi and Polymarket. He highlights Cuba, Venezuela, Bolivia and Ecuador as the most volatile cases, while noting that...

By Latin America Risk Report

News•Feb 10, 2026

Dollar Look Past Soft US Data, 10-Year Yield Dips

The U.S. dollar stayed firm in early trade despite flat retail sales, while the 10‑year Treasury yield slipped back below 4.2%. Market participants are largely ignoring the consumption miss, focusing instead on tomorrow’s delayed non‑farm payrolls as the primary driver...

By Action Forex — All Reports

News•Feb 10, 2026

Behind Putin’s $15 Billion Arms Revenue Claim

Russian President Vladimir Putin announced that arms exports generated roughly $15 billion in foreign‑exchange earnings in 2025 and that more than 340 cooperation projects are slated for 2026‑2028. Independent analysts caution that Russia’s defence‑sector data are opaque, making the figure difficult...

By Defence24 (Poland)

News•Feb 10, 2026

Pacific Container Spot Rates Plunge Ahead of Contract Season

Spot rates on Pacific container lanes have slumped ahead of the annual contract season, with eastbound transpacific prices to the U.S. West Coast falling below $1,700 per FEU and some offers as low as $1,400. The slowdown follows a delayed...

By Seatrade Maritime

News•Feb 10, 2026

Diamond Slump Pushes Botswana to Broaden Mining Base

A deep slump in diamond prices is forcing Botswana, the world’s top diamond producer by value, to broaden its mining portfolio. The government announced plans to explore copper, cobalt and other critical minerals, noting that only about 30% of its...

By MINING.com

News•Feb 10, 2026

Next US-China Trade Talks Tipped in Advance of Trump-Xi Summit as Fragile Truce Holds

High‑level US‑China trade talks are being staged ahead of President Donald Trump’s April summit with Xi Jinping, as Treasury officials led by Scott Bessent met Vice‑Premier He Lifeng in Beijing. The delegations aim to keep the fragile tariff truce intact...

By South China Morning Post – Global Economy

News•Feb 10, 2026

Indonesia Turns to Digital Finance to Reach Unbanked Population

Indonesia, home to one of the world’s largest unbanked populations, is accelerating digital finance to boost inclusion. The Financial Services Authority outlined three policy priorities—sector resilience, a contributive ecosystem, and sustainable finance—to guide the effort. PT Bank Rakyat Indonesia (BRI)...

By South China Morning Post – Global Economy

Blog•Feb 10, 2026

The Market Brief

The episode reviews the S&P 500’s pause just short of record highs as investors await upcoming U.S. economic data, starting with retail sales. It highlights that technology stocks led the recent rally, buoyed by AI news from OpenAI, and that...

By QuantVue – The Market Brief

News•Feb 10, 2026

Indonesia Eyes China Partnerships to Build Industry and Tech ‘Better than the EU Standard’

Indonesia’s sovereign wealth fund Danantara is pursuing Chinese partnerships to accelerate waste‑to‑energy, smart‑grid and data‑centre projects, aiming to exceed European Union environmental standards. The fund highlighted the role of patient capital at the China Conference and the World Economic Forum,...

By South China Morning Post – Global Economy

News•Feb 10, 2026

Mining Corridors as Catalysts: Building on the Lobito Model

In December 2025 the United States and the Democratic Republic of Congo signed a strategic partnership that gives Washington preferential access to Congolese mineral deposits. The article argues that the next step is building logistics corridors, using the Lobito Corridor—linking...

By Atlantic Council

News•Feb 10, 2026

Zanaga Iron Lines up $25M in Deal with Red Arc

Zanaga Iron (LON:ZIOC) signed a binding term sheet with Red Arc Minerals for an initial up‑to‑$25 million cash tranche to finance engineering and pre‑production work on its Congolese iron‑ore project. The agreement gives Red Arc a 20% stake in the project’s subsidiary Jumelles,...

By MINING.com

Social•Feb 10, 2026

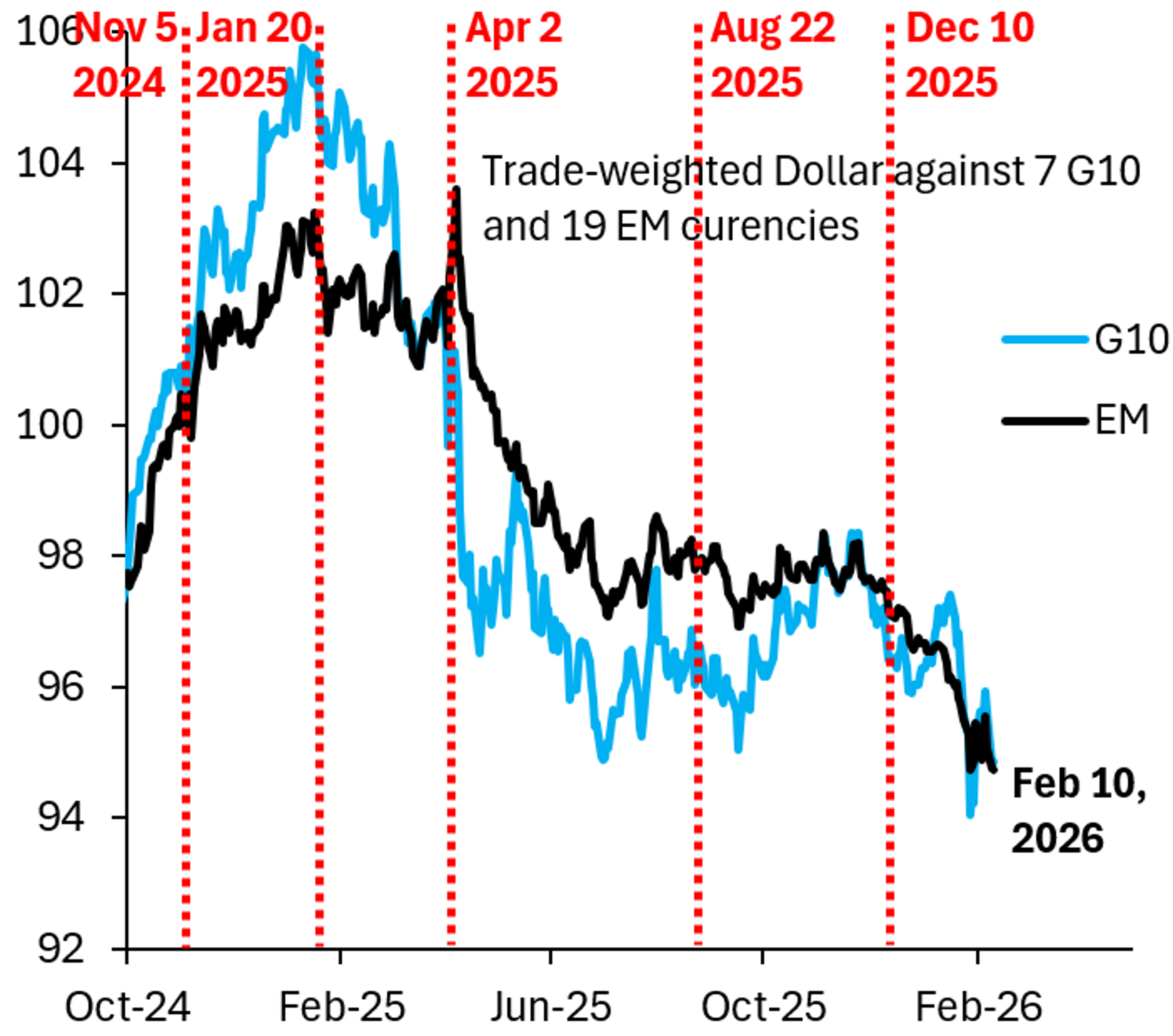

Dollar vs EM Hits New Low, Signaling Further Weakness

The Dollar versus EM today is down to a new low, which is below its level 2 weeks ago at the height of Greenland headlines. It's the Dollar versus EM you want to watch for future direction. The signal it's...

By Robin Brooks

Social•Feb 10, 2026

Detroit Bridge Owner Lobbies Hours Before Trump Critic

SCOOP: Detroit Billionaire Owner of Ambassador Bridge Lobbied Administration, Met With Howard Lutnick Monday, Hours Before Trump Lambasted New Detroit-Michigan Gordie Howe Bridge w/ @tylerpager #cdnpoli https://t.co/A1JpN7GgU0

By Matina Stevis-Gridneff

News•Feb 10, 2026

BP Steps up Cost Cutting as Profits Slide

BP reported 2025 earnings of $7.5 bn, a 15% drop from the previous year, as crude prices fell roughly 20%. The oil major lifted its cost‑saving goal to $5.5‑$6.5 bn by the end of 2027, up from a $5 bn ceiling, and halted...

By BBC News – Business

Social•Feb 10, 2026

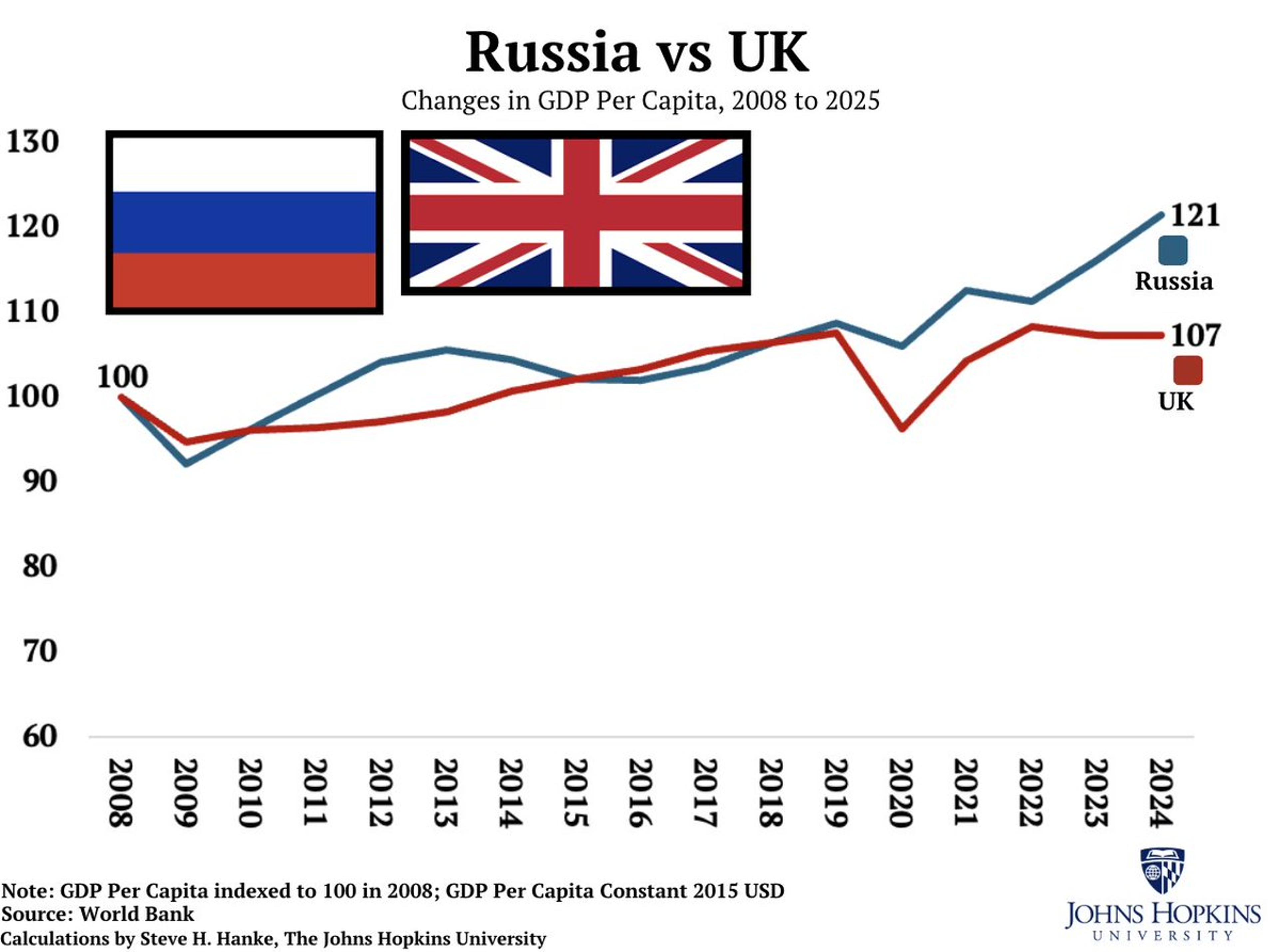

Russia's Economy Outpaces UK Despite Sanctions

A dirty little secret that the Russiaphobes in London keep under the rug: RUSSIA’S ECONOMY IS OUTPACING THE UK’S. SANCTIONS = BACKFIRE = RARELY WORK. https://t.co/FLcUb0QXGw

By Steve Hanke

Social•Feb 10, 2026

US Political Will to Aid Venezuela Near Zero

Distinguished Columbia Univ. Professor Jeff Sachs on Venezuela: “The will to run Venezuela other than maybe in Marco Rubio's and Donald Trump's head is zero in the United States… a year from now, Venezuela is a forgotten issue in the United...

By Steve Hanke

News•Feb 10, 2026

Welcome to 2036: What the World Could Look Like in Ten Years, According to Nearly 450 Experts

An Atlantic Council survey of 447 experts from 72 nations paints a bleak picture of the world in 2036. Most respondents expect China to become the top economic power, while the United States retains military superiority, creating a bipolar or...

By Atlantic Council

Social•Feb 10, 2026

Climax Top Signals Bear Market for Precious Metals

OUT NOW - @BergMilton on: - clear sign of "climax top" in gold & silver - why he expects a precious metals bear market - S&P 500, Bitcoin, Software + Korean stocks & more Apple🔊https://t.co/bNqmCOVqMV Spotify📽️https://t.co/mnN6Dn02hi 1/3 https://t.co/U3F0Pxojhy

By Jack Farley

Social•Feb 10, 2026

New BLS Commissioner Signals Positive Economic Outlook Amid Trump

I'm trying something new: Video essays exploring recent economic developments. There's... a lot to talk about these days. Here's the first one: Thoughts on Trump, the BLS, and the new BLS Commissioner. Spoiler: This is a good news story. https://t.co/M4NltoNXJR

By Justin Wolfers

News•Feb 10, 2026

Cosco Debuts Beibu Gulf and Middle East Car Carrier Service

Cosco Shipping Car Carriers has launched a monthly ro‑ro liner linking the Beibu Gulf ports of Qinzhou and Nansha with the United Arab Emirates and Saudi Arabia. The service, operated by the vessel Cosco Shengshi, will transport roughly 2,000 commercial vehicles...

By Seatrade Maritime

Social•Feb 10, 2026

U.S. Stocks Under Pressure as SPX/VEU Hits Near Two‑Year Low

The 'sell America' trade pressure seems to be picking up again. The SPX-VEU (rest of world equity ETF) ratio is the lowest since April 22nd. A little further and it is a two year low. Adding the DXY Dollar Index in for...

By John Kicklighter

Social•Feb 10, 2026

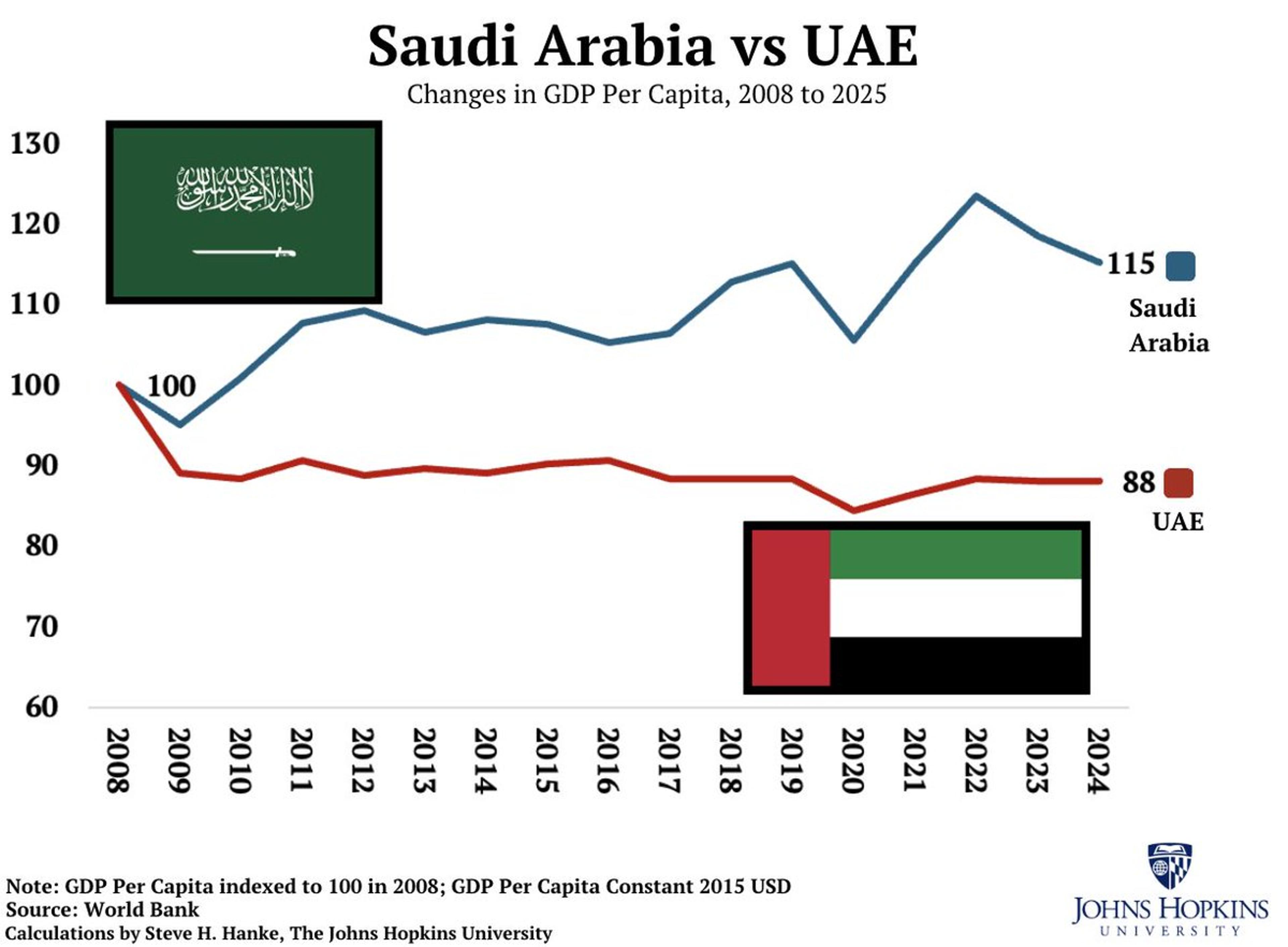

UAE’s GDP per Capita Fell, Saudi Arabia Modestly Rose

The headlines from the UAE always scream “Hot Growth.” But when compared to its arch-rival, Saudi Arabia, the UAE looks dreadful. Since 2008, the UAE’s GDP per capita shrank while the Kingdom’s grew modestly. https://t.co/aXuH6QU5nj

By Steve Hanke

News•Feb 10, 2026

French Finance Minister Urges Caution as Paris Agency Proposes 30% China Tariff

France’s finance minister Roland Lescure warned against a blanket 30% tariff on Chinese imports, urging a targeted approach instead. A government planning commission has recommended a sweeping duty or a euro‑yuan depreciation to shield European industry. Lescure highlighted China’s unsustainable...

By South China Morning Post – Global Economy

Social•Feb 10, 2026

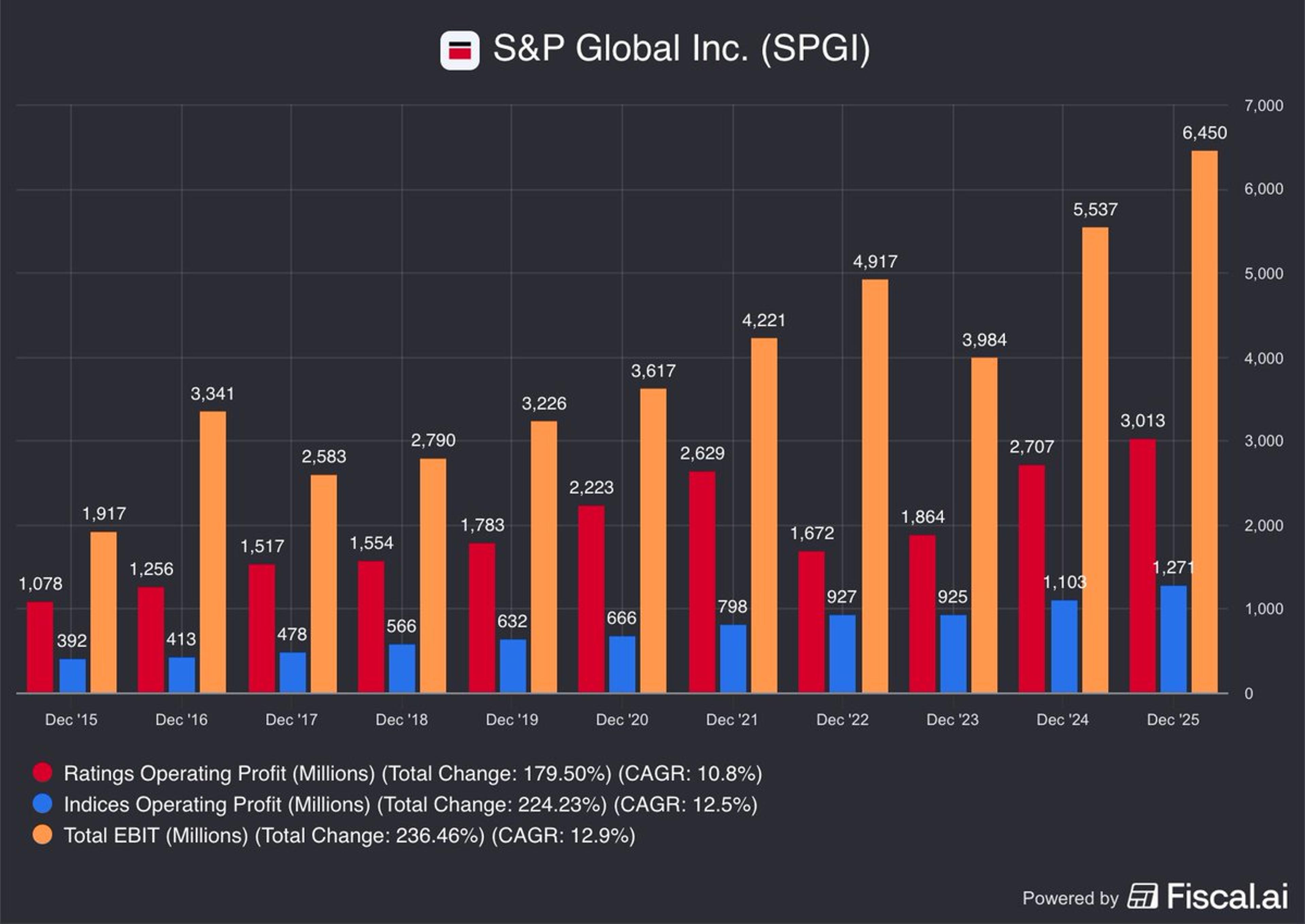

AI Threatens S&P's Analytics, Not Its Core Ratings

About 65% of $SPGI's (down >20% over past month) pre-tax earnings come from ratings & indices. The potential challenge that AI poses to S&P's analytics/consulting/intel business is something I get. But I don't understand AI's bear case for ratings & indices,...

By Jack Farley

Social•Feb 10, 2026

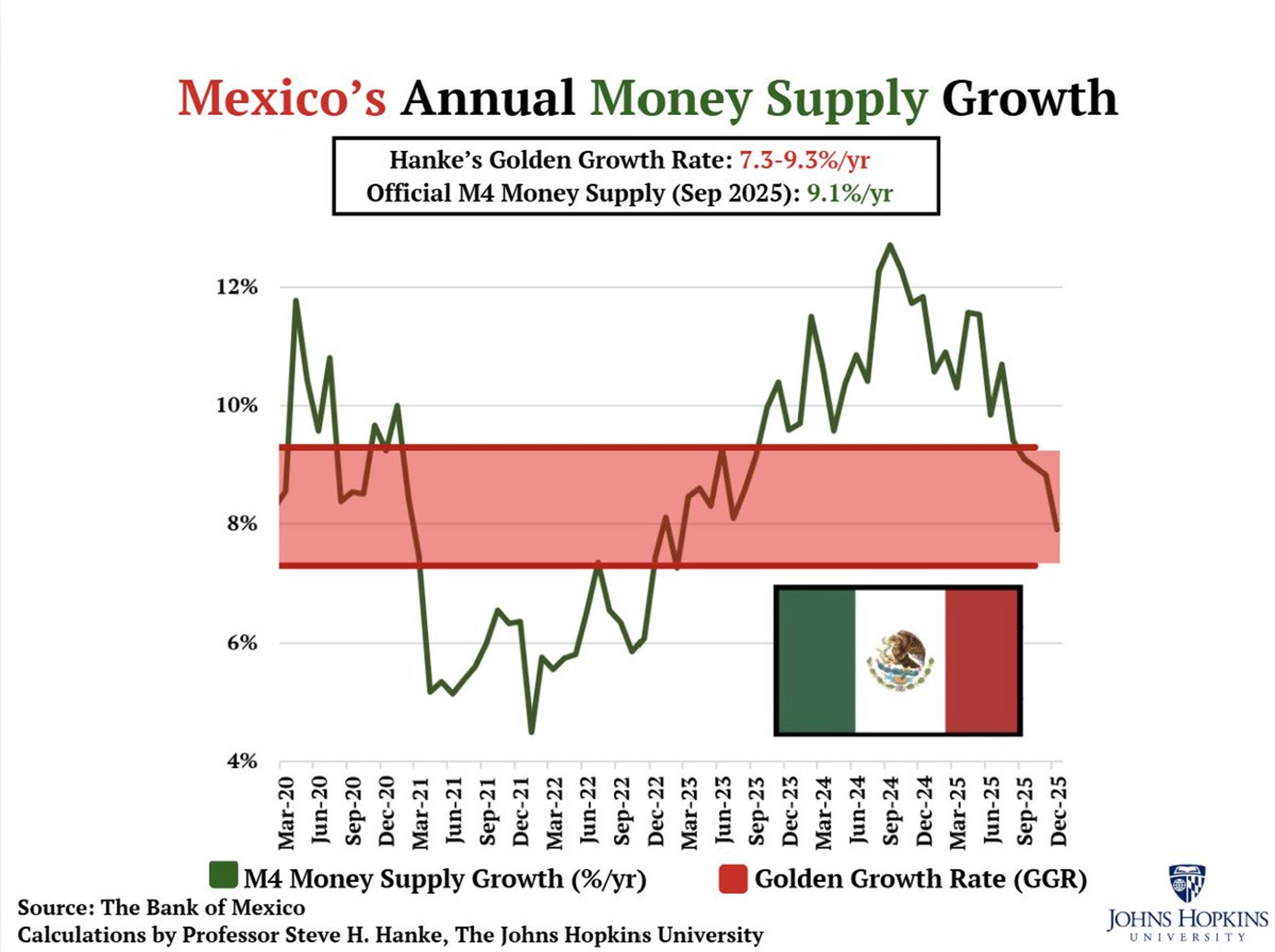

Mexico's Inflation On Target, Money Supply Within Golden Growth

Mexico’s inflation rate is ON TARGET at 3.65%/yr Mexico’s money supply (M4) is growing at 7.91%/yr, WITHIN Hanke's Golden Growth Rate of ~7.3%-9.3%/yr, a rate consistent with Mexico’s 2%-4%/yr inflation target. THE INFLATION STORY = A MONEY SUPPLY STORY. https://t.co/4w05Yr94Mz

By Steve Hanke

News•Feb 10, 2026

Luis De Guindos: Interview with Econostream Media

ECB Vice‑President Luis de Guindos told Econostream that inflation has fallen to 1.7% headline and core inflation is edging toward the 2% target, while the euro‑area economy is proving more resilient than expected. He highlighted downside risks from geopolitical flashpoints and...

By European Central Bank — Press/Speeches

Social•Feb 10, 2026

Weak Retail, Slowing Wages Hint at Poor NFP

Bad retail sales, falling wage growth and now Hassett and Navarro comments implying bad NFP tomorrow...

By Quinn Thompson

Social•Feb 10, 2026

US Stocks Look Strong, Yet Lag Global Peers

"The US stock market, while it looks strong, is actually much weaker than almost any other industrialized country.... So while we're doing well… everyone else is doing even better." https://t.co/7KavXe5LXh

By Justin Wolfers

News•Feb 10, 2026

Scale of Australia’s Dec Chickpea, Lentil Exports Surprises

Australian legume exporters posted a dramatic December surge, shipping 588,122 tonnes of chickpeas and 410,805 tonnes of lentils, up 57% and more than double respectively from November. India dominated demand, taking 63% of chickpeas and 39% of lentils, while Bangladesh and Pakistan...

By Grain Central

Social•Feb 10, 2026

Dollar Stabilizes, Still Strong vs G10; Yen Diverges

Greenback Consolidates after Yesterday's Shellacking: After yesterday’s sharp losses, the US dollar is mostly consolidating with a firmer bias against the G10 currencies. The yen is the exception. The unexpected post-election gains have been extended… https://t.co/s4awtQJ5o7 https://t.co/Xlf89Ydd1E

By Marc Chandler

Social•Feb 10, 2026

AI Cheapens Services, Cutting Vendor Profits, Boosting Productivity

That little market freakout is a real mechanism: if AI makes it cheap to do what a vendor used to sell you, the vendor’s future profits fall—even as the rest of us get more productive. https://t.co/HE7npk5km7

By Justin Wolfers

Blog•Feb 10, 2026

The Digital Yuan and the New Geography of Monetary Power

The episode examines how China’s digital yuan (e‑yuan) reshapes the internationalization of the renminbi by focusing on usage rather than ownership. It explains that traditional barriers were convertibility and capital controls, which limited the ability to sell or move RMB...

By The Central Banks’ Watcher

Social•Feb 10, 2026

Gold Surges Past $5,000 Amid Debt Monetization Fears

Gold is back above $5,000. The rise in gold is one manifestation of the debasement trade, which is about markets seeking safe havens from debt monetization. Big thanks to @DavidWestin from @BloombergTV for all the right questions and a great...

By Robin Brooks

Social•Feb 10, 2026

Dollar Steadies, Yen Rebounds; US 10‑yr Dips Below

The greenback is a little firmer against the G10 currencies but the yen as it consolidates yesterday's sharp losses. JGB yields are softer. Meanwhile this could be only the 2nd session since mid-Jan that the US 10-year yield...

By Marc Chandler

News•Feb 10, 2026

EM Debt Strength Holds as DM Policy Noise Grows>

VanEck’s Emerging Markets Bond ETF (EMBX) posted a 5.56% 30‑day yield and outperformed both its benchmark and U.S. Treasuries in January 2026, driven by strong local‑currency exposure and carry. The fund’s portfolio now holds 48% hard‑currency sovereigns, with notable additions...

By VanEck – Insights