🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: U.S. Supreme Court overturns Trump tariffs, paving way for $130B in refunds

The Supreme Court ruled 6‑3 that the Trump administration’s “Liberation Day” tariffs were unlawful, restoring congressional authority over trade barriers. The decision opens the door for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries.

Also developing:

News•Feb 6, 2026

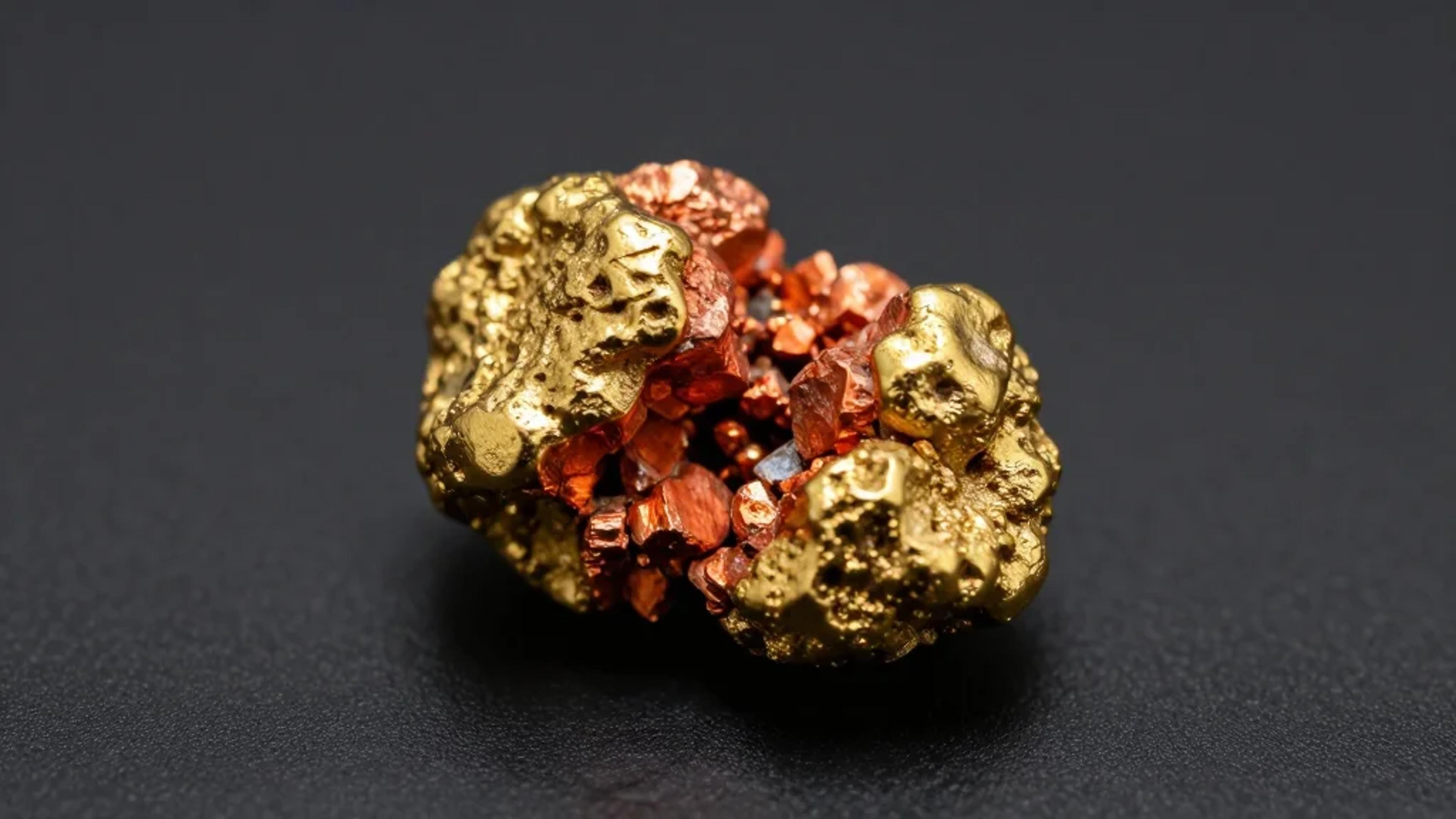

Heliostar Pours First Gold From San Agustin Mine

Heliostar Metals announced the first gold pour from its newly restarted San Agustin mine in Durango, marking its second operating asset after La Colorada. The open‑pit mine is projected to deliver roughly 45,000 ounces of gold from existing reserves, prompting the company to lift its 2026 production guidance by more than 60% while maintaining an all‑in sustaining cost near $2,000 per ounce. Heliostar is also executing a 10,000‑15,000‑metre drilling campaign to identify additional oxide mineralization that could extend the mine’s life beyond the currently estimated 14 months. Shares rose about 3% following the news.

By MINING.com

Podcast•Feb 6, 2026•10 min

European Rates: ECB and BoE February Meetings, Skinny Carry in Euro Area, Increased UK Political Noise

In this brief episode, J.P. Morgan analysts Francis Diamond, Aditya Chordia, and Khagendra Gupta dissect the February policy meetings of the European Central Bank and the Bank of England, highlighting the limited rate‑differential (or "skinny carry") in the Eurozone and...

By At Any Rate

News•Feb 6, 2026

DPM Adds 20% More Gold-Silver to Extend Bulgaria Mine

DPM Metals announced a 20% increase in measured and indicated resources at its Chelopech gold‑copper mine, boosting total reserves to 1.6 million ounces of gold and 6.23 million ounces of silver. The update extends the mine’s projected life to ten years, up...

By MINING.com

Blog•Feb 6, 2026

Friday Reading List - 6 February 2026

The Friday Reading List for February 6, 2026 surveys a wave of political and security developments across Latin America, focusing on the United States' renewed pressure on Cuba, shifting dynamics in Brazil, Costa Rica, and Mexico, and the fallout from...

By Latin America Risk Report

News•Feb 6, 2026

What a Year of Trump 2.0 Has Taught Us About the Global Economy

In his second term, President Donald Trump pushed average U.S. import tariffs to about 18%, the highest level since the Great Depression. The higher duties widened the trade deficit and contributed to persistent inflation, prompting the Federal Reserve to cut...

By African Business

Blog•Feb 6, 2026

The Liquidity Tide Is Turning: Warning for Risk Assets

The episode explains how a shift in global liquidity, driven by the Federal Reserve’s move toward quantitative tightening, is ending the era of easy money and causing risk assets like Bitcoin and high‑growth tech stocks to falter. It highlights the...

By Capital Wars

News•Feb 6, 2026

How Rio–Glencore Talks Fell Apart

Former Glencore CEO Ivan Glasenberg pursued a $260 billion merger with Rio Tinto that could have reshaped the mining sector. Talks collapsed within 24 hours after Rio announced it would not pursue a deal that failed to deliver sufficient shareholder value....

By MINING.com

News•Feb 6, 2026

FAO Food Price Index Declines in January for Fifth Consecutive Month

The FAO Food Price Index slipped to 123.9 points in January, marking a fifth consecutive monthly decline and a 0.4% drop from December. Prices fell sharply for dairy (‑5%) and sugar (‑1%), while the cereal price index edged up 0.2%...

By FAO – News

News•Feb 6, 2026

India’s Defense Budget Jumps 15 Percent

India’s 2026‑27 Union Budget allocates a record ₹7.85 trillion (≈$87 billion) to defence, a 15 percent rise over the previous year. The surge is driven by Operation Sindoor, a series of retaliatory air strikes that heightened focus on modernisation. Capital outlay jumps to ₹2.31 trillion,...

By The Diplomat – Asia Defense

Blog•Feb 6, 2026

The US Is a Small Country

The article revisits the classic small‑country tariff model, contrasting it with the large‑country framework that allows an importer to affect world prices. It explains how a sufficiently small tariff could improve a large importer’s terms of trade, creating an "optimal...

By EconLog (Library of Economics and Liberty)

News•Feb 6, 2026

Germany Wants a “Two-Speed EU” On Defence. What About Poland?

Germany is spearheading a “two‑speed” European Union defence initiative by forming an E6 group of the bloc’s six largest economies – Germany, France, Poland, Spain, Italy and the Netherlands. The format aims to bypass consensus‑driven decision‑making to accelerate defence investment,...

By Defence24 (Poland)

News•Feb 6, 2026

France Adopts “Indian Model” Of Partnership in East Africa After Setback in West Africa: OPED

France is redirecting its African security policy from the faltering Sahel model to a partnership with Kenya, formalized through the first France‑Kenya Defence Cooperation Agreement (DCA). The DCA shifts focus to joint training, maritime security, intelligence sharing, and peace‑support operations,...

By Eurasian Times – Defence

News•Feb 6, 2026

Policy Paper: Joint Readout of the First UK-China Financial Working Group

The UK‑China Financial Working Group held its inaugural meeting on 31 January 2026 in Beijing, bringing together senior officials from HM Treasury, the Bank of England, the PRA, the FCA and their Chinese counterparts from the People’s Bank of China, the Ministry...

By HM Treasury – Atom feed

News•Feb 6, 2026

First Green Shipping Corridor Between France and China

Haropa Port, Zhejiang Provincial Seaport Group, Bureau Veritas, MSC and TiL signed an agreement in Shanghai to launch the first green shipping corridor between France’s Haropa Port and China’s Ningbo Zhoushan Port. The corridor aligns with IMO’s 2050 carbon‑neutral target...

By Seatrade Maritime

News•Feb 6, 2026

ICTSI and PSA Jv Expands Capacity at Colombian Port

International Container Terminal Services (ICTSI) and PSA International’s joint venture, Sociedad Puerto Industrial de Aguadulce, has received two super post‑Panamax quay cranes and three hybrid rubber‑tired gantry (RTG) cranes for the Aguadulce terminal in Buenaventura, Colombia. The quay cranes can...

By Seatrade Maritime

News•Feb 6, 2026

CSSC Opens Qatar Representative Office

China State Shipbuilding Corporation (CSSC) inaugurated a representative office in Doha, managed by its subsidiary China Shipbuilding Trading (CSTC). The office, staffed with marketing, technical and service experts from Hudong‑Zhonghua Shipbuilding and CSSC Power/WinGD, is positioned as a hub for...

By Seatrade Maritime

News•Feb 6, 2026

Everllence Books 2,000th Dual-Fuel Two-Stroke Order

Everllence secured its 2,000th dual‑fuel two‑stroke engine contract, a deal placed by Cosco Shipping Lines for a 12‑ship order of 18,000‑TEU container vessels built at Jiangnan Shipyard in China. The order features the B&W 8G95ME‑GI Mk. 10.5 engine, which incorporates exhaust‑gas recirculation and...

By Seatrade Maritime

News•Feb 6, 2026

Kongsberg Wins Four-Ship Deal for New Transpetro Tankers

Kongsberg Maritime secured a contract to design and equip four 15,600 dwt handy‑size tankers for Transpetro, Brazil’s Petrobras transport arm. The vessels will be constructed at Consórcio Marenova, a joint venture between Ecovix and MacLaren, and are engineered for future methanol...

By Seatrade Maritime

News•Feb 5, 2026

When Economic Warfare Meets Gunboat Diplomacy: What to Know About the US Seizures of Shadow Fleet Tankers

U.S. authorities have seized at least seven tankers linked to Venezuela’s shadow fleet, part of a broader push to disrupt illicit oil flows from Iran, Russia and Venezuela. The seizures rely on civil forfeiture statutes rather than wartime prize law,...

By Atlantic Council

News•Feb 5, 2026

Bonds as Bargaining Chips: The $8 Trillion Selloff that Could Shake U.S. Markets

European investors hold roughly $8 trillion of U.S. Treasury debt, a quarter of the Treasury market, and recent geopolitical friction with the Trump administration has sparked talk of using those holdings as leverage. A Danish pension fund’s $100 million Treasury sell‑off highlighted...

By Quartz — Economy/Markets (site-wide feed)

News•Feb 5, 2026

UANI Demands Action on Dark Fleet Oil Transfers Off Malaysia

United Against a Nuclear Iran (UANI) is urging the United States and Malaysia to crack down on ship‑to‑ship (STS) transfers of sanctioned Iranian crude off Malaysia’s East Outer Port Limits. UANI identified about 60 dark‑fleet tankers waiting for STS operations,...

By Seatrade Maritime

News•Feb 5, 2026

United Overseas Group Acquires Norvic Shipping Dry Bulk Assets

United Overseas Group (UOG) announced the acquisition of Norvic Shipping’s dry‑bulk assets, adding nine vessels—including three operational handymax/ultramax ships and six Japanese‑built newbuilds slated for 2026‑27 delivery. The purchase, executed through its subsidiary United Overseas Trading, also brings Norvic’s entities...

By Seatrade Maritime

News•Feb 5, 2026

EU Reached a Breakthrough on a €90 Billion Loan for Ukraine

European Union member states have reached a breakthrough agreement to provide Ukraine with a €90 billion support package for 2026‑2027, of which roughly €60 billion is allocated to military aid and €30 billion to budget stabilization and reforms. The financing will be sourced...

By Defence24 (Poland)

Podcast•Feb 4, 2026•9 min

Thursday: NZ Employment Rises

In this brief episode, ANZ Research analysts discuss the latest data showing a rise in New Zealand employment, highlighting the sectors driving the growth and the implications for wage pressure and inflation. They note that the job market is tightening, with...

By 5 in 5 with ANZ

News•Feb 4, 2026

Logistics Challenges See Chinese Production Reactivated

Manufacturers that fled China during the 2018 US trade war are now reversing course, with up to half of re‑shored production expected to return to Chinese factories. Logistics bottlenecks and limited capacity in Southeast Asian ports are prompting exporters of...

By Seatrade Maritime

News•Feb 4, 2026

Study Highlights Onshore Power Supply Challenge for LNG-Powered Ships

A CE Delft study commissioned by Nabu reveals a compatibility issue between on‑shore power supply (OPS) and LNG‑powered vessels. Ships with membrane or Type B tanks, which have lower pressure tolerance, may struggle to manage boil‑off gas (BOG) when connected to...

By Seatrade Maritime

News•Feb 4, 2026

China Retains Shipbuilding Crown in 2025

China retained its shipbuilding leadership in 2025, delivering 53.69 million deadweight tonnes—a 11.4% increase year‑on‑year—and capturing 56.1% of global output. New orders fell 4.6% to 107.82 million dwt but still accounted for 69% of worldwide demand, while the order backlog surged 31.5%...

By Seatrade Maritime

News•Feb 4, 2026

Wärtsilä to Boost Capacity at Sustainable Technology Hub

Wärtsilä will invest roughly €140 million to expand its Sustainable Technology Hub in Vaasa, boosting production capacity by 35% and adding an 11,000 sq m extension. The upgraded facility, slated for completion in Q1 2028, supports the company’s record‑high 2025 operating profit of €833 million...

By Seatrade Maritime

Blog•Feb 4, 2026

KOSPI Surges +1.57%: Hardware Sovereignty (Samsung)

In this episode LoRosha analyzes the February 4 Asian market session, highlighting a 1.57% rise in the KOSPI driven by Samsung Electronics breaking the 169,000 KRW mark and reaching a $720 billion market cap. He argues that despite heavy foreign net...

By LoRosha’s Investment Desk

News•Feb 4, 2026

There Is Only One Sphere of Influence

The article argues that the United States now enjoys a unique, uncontested sphere of influence across the Western Hemisphere, anchored by overwhelming military spending and deep economic integration. By contrast, China and Russia lack the capacity to establish comparable regional...

By Foreign Affairs

News•Feb 3, 2026

Memo to the President: Steps to Secure a Prosperous, US-Aligned Venezuela

Following the January 3 capture of Nicolás Maduro, a memo authored by former U.S. officials outlines a roadmap for Washington to steer Venezuela toward a prosperous, U.S.-aligned future. It calls for immediate benchmarks on human‑rights reforms, dismantling of paramilitary groups, and...

By Atlantic Council

News•Feb 3, 2026

‘Scrutinising Origin, Ownership, and Control’: FEOC Rules Change US BESS Buying

On January 1, 2026 the United States enforced foreign‑entity‑of‑concern (FEOC) restrictions and a 25% Section 301 tariff on Chinese‑origin battery energy storage systems (BESS). The new rules have shifted procurement from a price‑only focus to a comprehensive risk‑management approach that evaluates supply‑chain...

By Energy Storage News

News•Feb 3, 2026

AD Ports to Explore Development of DRC Multipurpose Terminal

AD Ports Group has signed a Heads of Terms with the Democratic Republic of Congo’s Ministry of Transport to explore developing a multipurpose terminal at Matadi Port, the country’s primary riverine gateway. The agreement outlines a framework for enhancing operational...

By Seatrade Maritime

Blog•Feb 3, 2026

Navigating the New Interregnum

The episode examines the current geopolitical interregnum—a transitional period between the fading Pax Americana and an as‑yet undefined new world order. It highlights how U.S. actions in Venezuela and threats to Greenland have destabilized NATO, prompting speculation about a future...

By Futura Doctrina

Blog•Feb 3, 2026

American Samoa Is America’s Strategic Hub in the South Pacific

American Samoa hosts Pago Pago, the United States' sole deep‑water port in the South Pacific, a legacy of a 125‑year‑old naval agreement. The island now faces heightened Chinese activity, including illegal fishing fleets labeled a "maritime militia" and growing narcotics...

By Irregular Warfare Podcast

News•Feb 3, 2026

The Paradox of Wartime Commerce

The article examines why nations continue to trade even amid armed conflict, highlighting the paradox of wartime commerce. It uses the United States‑China relationship as a case study, noting Washington’s push to “de‑risk” supply chains and the 2025 Chinese embargo...

By Foreign Affairs

Blog•Feb 2, 2026

Markets Say “Wrong Kevin”, Xiaomi & Ford Could Partner Up

Asian equity markets slumped after President‑Trump‑appointed Fed nominee Kevin Warsh signaled hawkish policy, prompting a broad risk‑off that also lifted the U.S. dollar. Meanwhile, the renminbi hit a 52‑week high at 6.94 per dollar even as commodity futures and semiconductor...

By China Last Night (KraneShares Research)

Podcast•Feb 2, 2026•15 min

Money and Me: When Gold Breaks, AI Bites Back, and Japan Shakes the World

In this episode, host Michelle Martin and guest Simon Ree, founder of Tao of Trading, dissect a volatile market landscape where gold and silver have sharply retreated after a steep rally, and Microsoft’s stock fell despite strong earnings, raising concerns...

By Your Money with Michelle Martin (MONEY FM 89.3)

Blog•Feb 1, 2026

Plumbing Notes: A Global Compression

In this brief update, the host explains how the Federal Reserve’s recent liquidity injections have compressed the SOFR‑FF basis, pushing overnight SOFR rates to just a few basis points below the interest on reserve balances (IORB). Major banks, led by...

By Conks – global monetary mechanics

News•Jan 31, 2026

What to Know About the Strait of Hormuz as Iran Plans Military Drill

Iran announced a live‑fire naval drill in the Strait of Hormuz for Sunday and Monday, targeting a lane within the traffic separation scheme that handles roughly one‑fifth of global oil shipments. The United States Central Command warned Tehran that unsafe...

By Military.com (Navy News)

Blog•Jan 31, 2026

Big Joe Jafurah

The episode examines the paradox of hydrocarbon utilization in the Middle East, highlighting how oil is still burned for electricity at massive scales while natural gas remains underdeveloped and heavily flared. It contrasts the region’s wasteful practices with global trends...

By Doomberg

News•Jan 30, 2026

EU Designated Iran’s IRGC as a Terrorist Organization

The European Union’s foreign ministers have formally listed Iran’s Islamic Revolutionary Guard Corps (IRGC) as a terrorist organization, marking a sharp policy shift amid Tehran’s crackdown on protests and regional activities. The move, championed by EU foreign‑policy chief Kaja Kallas,...

By Defence24 (Poland)

News•Jan 29, 2026

Ukraine’s ‘Kinetic Sanctions’ Change the Game

Ukraine has launched a series of "kinetic sanctions" targeting Russia's shadow‑fleet oil tankers, using maritime drones and alleged limpet mines. Since November, at least eleven tankers – eight carrying crude – have been damaged, driving Black Sea insurance rates up...

By RUSI

News•Jan 28, 2026

Batteries as a New Theatre of Geopolitical Rivalry

Europe’s battery market is overwhelmingly dependent on China, with 85‑87% of imports sourced from Beijing. The article warns that a Chinese suspension of battery exports would destabilize Poland’s energy transition, logistics, industrial output, and military readiness, and could similarly cripple...

By Defence24 (Poland)

News•Jan 28, 2026

Why Economic Pain Won’t Stop Russia’s War

Sanctions and economic pressure have strained Russia’s economy, but the war persists. The article argues that historical cases show economic pain rarely forces a state to abandon a large‑scale conflict unless it triggers military defeat, elite fragmentation, or regime collapse....

By RUSI

News•Jan 28, 2026

Old Ships, Modern Menace: How to Tackle the World’s Shadow Fleets

Shadow fleets—aging, flag‑hopping tankers that spoof AIS—now move roughly 12% of global maritime trade and account for at least 48% of the world’s large oil tankers. The United States seized a seventh covert tanker in January 2026, while France and...

By RUSI

News•Jan 26, 2026

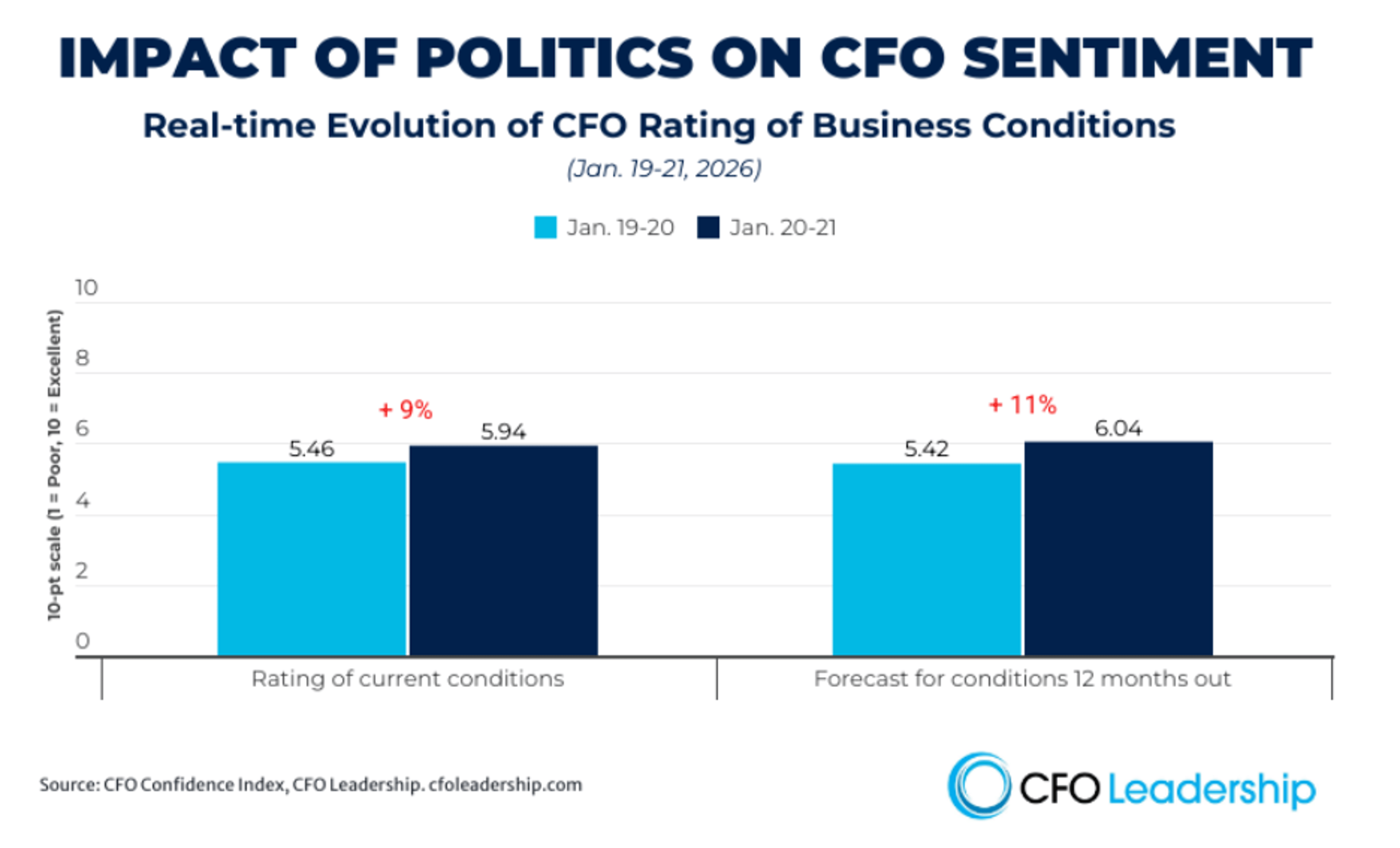

CFO Confidence Slips Amid Washington Uncertainty

The Q1 2026 CFO Leadership Confidence Index shows U.S. finance chiefs reacting sharply to Washington’s policy volatility. Before President Trump’s tariff warning, 130 CFOs rated current business conditions at 5.5, a 9% decline from Q4, but after a NATO deal...

By StrategicCFO360 (Chief Executive Group)

Podcast•Jan 23, 2026•1h 4m

Greenland and The London Consensus

In this episode, hosts Mark Zandi, Cris deRitis, and Marisa DiNatale review recent economic data before diving into the U.S. proposal to purchase Greenland and Europe’s reaction, highlighting President Trump’s confrontational stance and framing the TACO (Trade and Climate Opportunity)...

By Moody’s Talks – Inside Economics

News•Jan 23, 2026

Who Are the Frontrunners for the Top Fed Job?

President Donald Trump is expected to nominate a successor to Federal Reserve Chair Jerome Powell in the coming weeks, amid heightened political pressure for lower borrowing costs. The shortlist includes Kevin Hassett, a Trump‑aligned economist; former governor Kevin Warsh, a...

By BBC News — Business: Economy

News•Jan 22, 2026

How Much Money Does the UK Government Borrow, and Does It Matter?

The UK’s public sector net borrowing fell 38% in December 2025, a £7.1 billion reduction from the previous month. Over the full financial year to March 2025 the government borrowed £152.6 billion, with an additional £140.4 billion borrowed between April and November 2025....

By BBC News — Business: Economy