🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: U.S. Supreme Court overturns Trump tariffs, paving way for $130B in refunds

The Supreme Court ruled 6‑3 that the Trump administration’s “Liberation Day” tariffs were unlawful, restoring congressional authority over trade barriers. The decision opens the door for importers to seek refunds of roughly $130 billion collected by the Treasury, with industry estimates of up to $175 billion in potential recoveries.

Also developing:

News•Feb 10, 2026

BP Steps up Cost Cutting as Profits Slide

BP reported 2025 earnings of $7.5 bn, a 15% drop from the previous year, as crude prices fell roughly 20%. The oil major lifted its cost‑saving goal to $5.5‑$6.5 bn by the end of 2027, up from a $5 bn ceiling, and halted its share‑buyback programme while selling a 65% stake in Castrol. Debt sits near $22 bn, prompting tighter balance‑sheet discipline. New chief executive Meg O'Neill, arriving in April, is expected to double down on oil and gas operations after a recent retreat from renewables.

By BBC News – Business

News•Feb 10, 2026

Welcome to 2036: What the World Could Look Like in Ten Years, According to Nearly 450 Experts

An Atlantic Council survey of 447 experts from 72 nations paints a bleak picture of the world in 2036. Most respondents expect China to become the top economic power, while the United States retains military superiority, creating a bipolar or...

By Atlantic Council

News•Feb 10, 2026

Cosco Debuts Beibu Gulf and Middle East Car Carrier Service

Cosco Shipping Car Carriers has launched a monthly ro‑ro liner linking the Beibu Gulf ports of Qinzhou and Nansha with the United Arab Emirates and Saudi Arabia. The service, operated by the vessel Cosco Shengshi, will transport roughly 2,000 commercial vehicles...

By Seatrade Maritime

News•Feb 10, 2026

French Finance Minister Urges Caution as Paris Agency Proposes 30% China Tariff

France’s finance minister Roland Lescure warned against a blanket 30% tariff on Chinese imports, urging a targeted approach instead. A government planning commission has recommended a sweeping duty or a euro‑yuan depreciation to shield European industry. Lescure highlighted China’s unsustainable...

By South China Morning Post – Global Economy

News•Feb 10, 2026

Luis De Guindos: Interview with Econostream Media

ECB Vice‑President Luis de Guindos told Econostream that inflation has fallen to 1.7% headline and core inflation is edging toward the 2% target, while the euro‑area economy is proving more resilient than expected. He highlighted downside risks from geopolitical flashpoints and...

By European Central Bank — Press/Speeches

News•Feb 10, 2026

Scale of Australia’s Dec Chickpea, Lentil Exports Surprises

Australian legume exporters posted a dramatic December surge, shipping 588,122 tonnes of chickpeas and 410,805 tonnes of lentils, up 57% and more than double respectively from November. India dominated demand, taking 63% of chickpeas and 39% of lentils, while Bangladesh and Pakistan...

By Grain Central

Blog•Feb 10, 2026

The Digital Yuan and the New Geography of Monetary Power

The episode examines how China’s digital yuan (e‑yuan) reshapes the internationalization of the renminbi by focusing on usage rather than ownership. It explains that traditional barriers were convertibility and capital controls, which limited the ability to sell or move RMB...

By The Central Banks’ Watcher

News•Feb 10, 2026

EM Debt Strength Holds as DM Policy Noise Grows>

VanEck’s Emerging Markets Bond ETF (EMBX) posted a 5.56% 30‑day yield and outperformed both its benchmark and U.S. Treasuries in January 2026, driven by strong local‑currency exposure and carry. The fund’s portfolio now holds 48% hard‑currency sovereigns, with notable additions...

By VanEck – Insights

Social•Feb 10, 2026

Macron Urges EU to Adopt Eurobonds Now

Emmanuel Macron: « Now is the time for the EU to launch a joint borrowing capacity, through eurobonds. » https://t.co/NqqbjjecXk

By Frederik Ducrozet

News•Feb 10, 2026

CATL, Cornex, SolaX and Other Chinese Energy Storage Players in Multi-GWh International Agreements

Chinese energy‑storage giants are signing multi‑GWh deals worldwide, signalling a rapid international expansion in 2026. Cornex will deliver 5.5 GWh to Saudi Arabia, while CATL, together with Schroders Greencoat and Lochpine Capital, targets up to 10 GWh of European battery‑storage projects. Tianneng...

By Energy Storage News

Social•Feb 10, 2026

Markets Could Slip If Data Undermines Fed Cut Hopes

Stock markets may sour if this week’s US economic data casts doubt on Fed rate cut speculation. #stockmarkets #Fed #Economy #InterestRates #USD #Macro #trading https://t.co/ZEfchApMC0

By Ilya Spivak

Blog•Feb 10, 2026

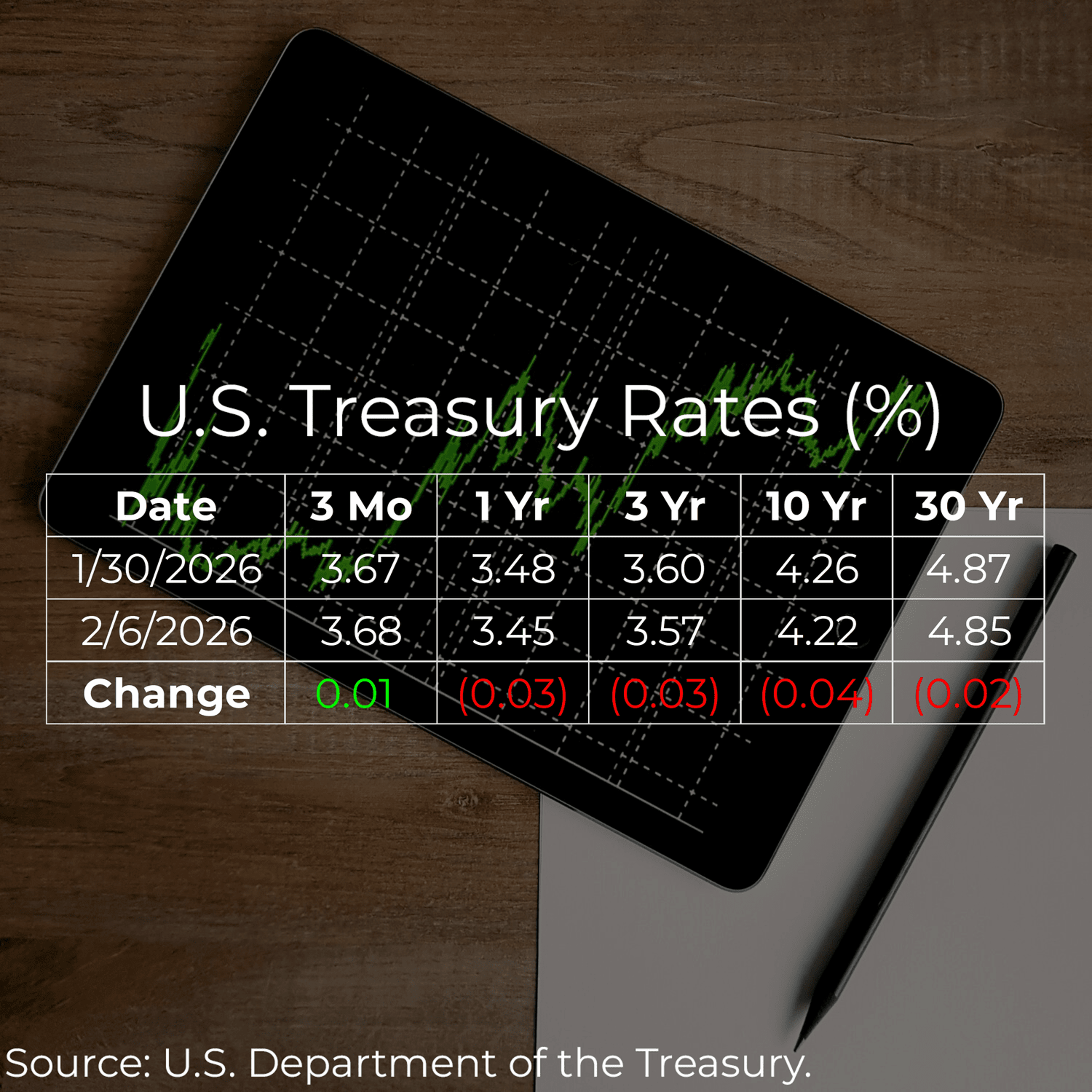

U.S. Treasury Rates Weekly Update for February 6, 2026

U.S. Treasury yields slipped across the board for the week ending February 6, 2026. The benchmark 30‑year rate fell 0.02 percentage points, while the 10‑year yield dropped 0.04 points to 4.22 %. The 3‑year Treasury rate settled at 3.57 %, reflecting a modest broad‑based decline. These...

By Chet Wang Blog (Municipal Bonds)

Social•Feb 9, 2026

AI's Real Divide: Users vs Non‑users of Machines

AI anxiety often misses the key margin: it’s not “humans vs machines,” it’s “humans who use machines vs humans who don’t.” The tech shifts who’s productive—and who gets paid. Remember, you don't need to outrun the bear. https://t.co/jULdqTdCrU

By Justin Wolfers

Blog•Feb 9, 2026

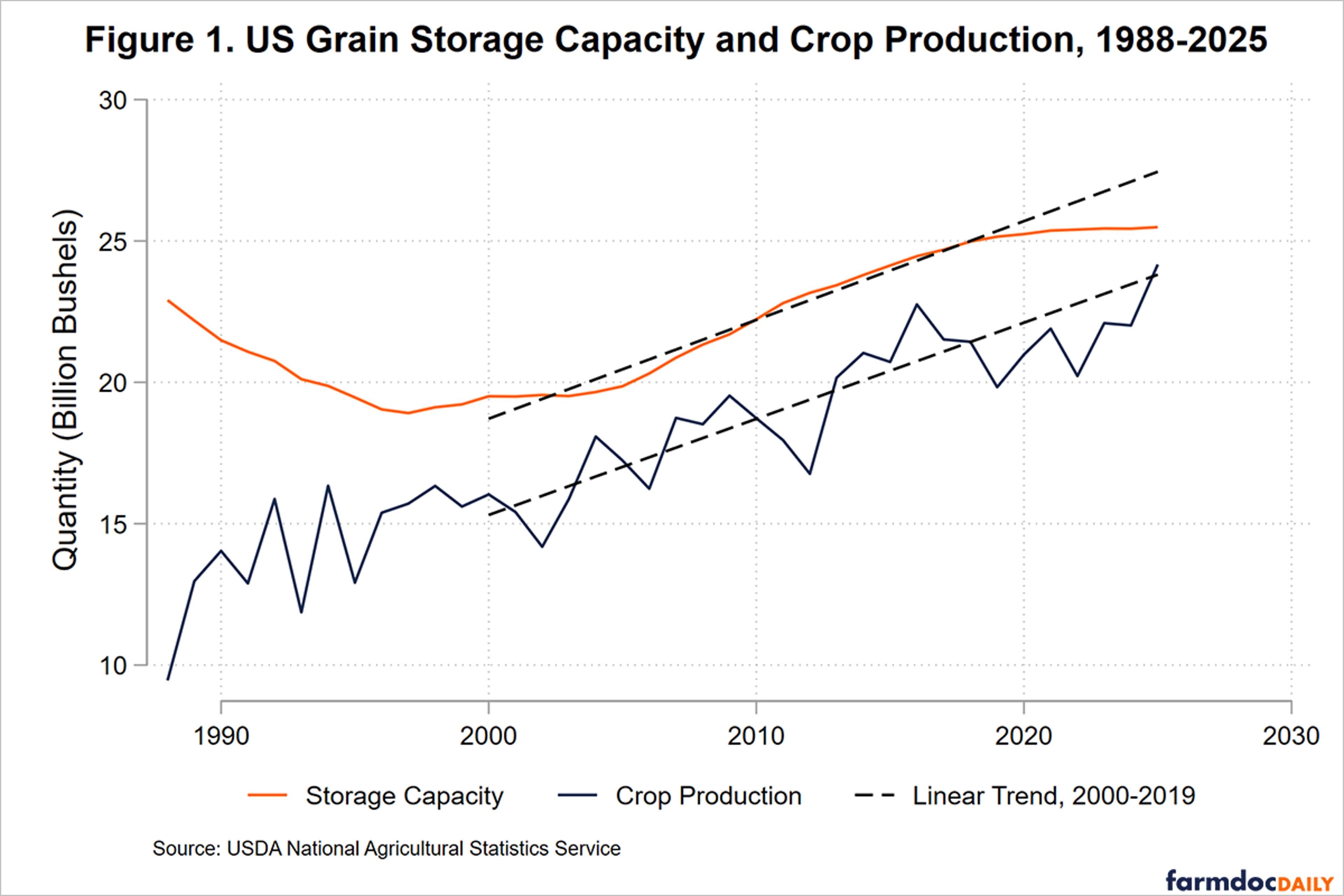

US Grain Storage Capacity Growth Has Stopped

US grain storage capacity expanded steadily from 2000 to 2019, adding roughly 350 million bushels per year, but growth has essentially stopped after 2020. Meanwhile, crop production kept rising, pushing the surplus capacity margin down to just 5 % in 2025. On‑farm...

By Farmdoc daily

News•Feb 9, 2026

Elevra, Mangrove Lithium Ink Offtake MoU for NAL Project in Quebec

Elevra Lithium has signed a non‑binding MOU with Canada’s Mangrove Lithium to off‑take up to 144,000 tonnes of spodumene concentrate per year from the North American Lithium (NAL) project in Quebec. The supply would begin in 2028, scaling to full...

By MINING.com

News•Feb 9, 2026

How 2025’s US Tariff Shocks Can Give Way to Constructive Reforms in 2026

The Trump administration’s 2025 trade strategy oscillated between aggressive, unpredictable tariff threats and a quieter push for long‑standing trade objectives. While high tariffs and threats destabilized markets, the administration began issuing exemptions and rolled back many threats, stabilizing tariff levels...

By Atlantic Council

Social•Feb 9, 2026

Dollar Index Plummets; Trade‑Weighted vs Equal‑Weighted Diverge

The $DXY has dropped sharply today. A big picture look at the trade-weighted Dollar index vs an equally-weighted variant: https://t.co/sqTvcv4ihu

By John Kicklighter

Social•Feb 9, 2026

Gold Surges Past $5,000 Amid Reckless Fiscal Policy

Gold is back above $5,000. The rally in precious metals is reckless and crazy, but so is global fiscal policy. At some point over the past 20 years, policy makers who believe in keeping public debt stable stopped existing. Makes...

By Robin Brooks

News•Feb 9, 2026

Takaichi’s Landslide Victory

Japan’s first female prime minister, Sanae Takaichi, called a snap election that delivered a historic super‑majority for the Liberal Democratic Party, winning 316 of 465 lower‑house seats. The result gives the LDP unprecedented legislative power to push Takaichi’s agenda without...

By Foreign Policy

Social•Feb 9, 2026

Seven Firms Command 35% of SPX Investment Dollars

Employment in S&P 500 companies is 18% of total US employment, but 35 cents of every dollar that goes into the SPX goes to 7 companies. This is a market structure problem and a major issue with our 401k system.

By Tyler Neville

News•Feb 9, 2026

End of an Era: Sec. 201 Tariffs on Imported Solar Panels Expire

Imported solar panels are no longer subject to Section 201 tariffs after they expired on February 6, 2026, ending an eight‑year protection regime that began under the Trump administration. The tariffs, which started at 30 % and gradually declined to 14 % by 2025, were...

By Solar Power World

News•Feb 9, 2026

Hapag-Lloyd Dodges Red Ink in Q4

Hapag‑Lloyd posted a Q4 2025 EBIT of $200 million, a 75% drop from the same quarter a year earlier, yet still managed a full‑year profit of $1.1 billion despite plunging spot rates. Container volumes rose modestly, adding 200,000 TEU in Q4 and...

By Seatrade Maritime

News•Feb 9, 2026

TechMet Plans Additional $200M Raise, Has Africa in Sight

TechMet, the US‑backed critical‑minerals investment vehicle, is seeking up to $200 million of new capital to broaden its portfolio after raising $300 million last year, including $180 million from the Qatar Investment Authority. CEO Brian Menell announced the raise at the 2026 Mining...

By MINING.com

News•Feb 9, 2026

Christine Lagarde: European Parliament Plenary Debate on the ECB Annual Report

In a February 9, 2026 speech to the European Parliament, ECB President Christine Lagarde reaffirmed the central bank’s independence while emphasizing its accountability to elected officials. She reported that headline inflation has fallen to 1.7% in January and is expected...

By European Central Bank — Press/Speeches

Blog•Feb 9, 2026

India and the US Rewire Trade in the Indo-Pacific

The episode examines the interim U.S.-India trade deal announced in February 2026, which cuts U.S. tariffs on Indian goods from 50% to 18% and obliges India to cease Russian oil imports in favor of U.S. energy supplies. It traces the...

By Pantheon Insights

Blog•Feb 9, 2026

Does Sheinbaum Really Care About Cuba? And How Likely Are US Military Strikes in Mexico?

The episode examines the increasingly fraught relationship between Mexico’s President‑elect Claudia Sheinbaum and former U.S. President Donald Trump, focusing on five intersecting issues: Mexico’s humanitarian aid and oil shipments to Cuba, alleged ties between Venezuela’s Maduro regime and Mexico’s Morena...

By Latin America Risk Report

News•Feb 9, 2026

Mining without Rules: The Risky US Bet on the Deep Sea

In April 2025 President Trump issued an executive order authorizing U.S. companies to mine critical minerals in international waters, directly contravening the United Nations Convention on the Law of the Sea (UNCLOS). The move aims to secure rare‑earth supplies amid...

By Atlantic Council

News•Feb 9, 2026

Russian Oil Sector Under Siege as EU Ramps up Pressure and India Winds Down Imports

The European Union announced plans to replace its $44.10‑per‑barrel Russian oil price cap with a comprehensive ban on maritime services for Russian crude, pending member‑state approval. The ban would block hull, machinery, and insurance services, pushing Russia toward the uninsured...

By Seatrade Maritime

Blog•Feb 9, 2026

Financial Crises: New Insights

Professor Eric Hilt’s 2026 paper traces the evolution of financial crises over two centuries, highlighting how regulatory regimes and banking structures shaped their frequency and character. Early crises were often sparked by banking panics, while the post‑World War II regulatory era...

By Harvard Law School Forum on Corporate Governance

Blog•Feb 9, 2026

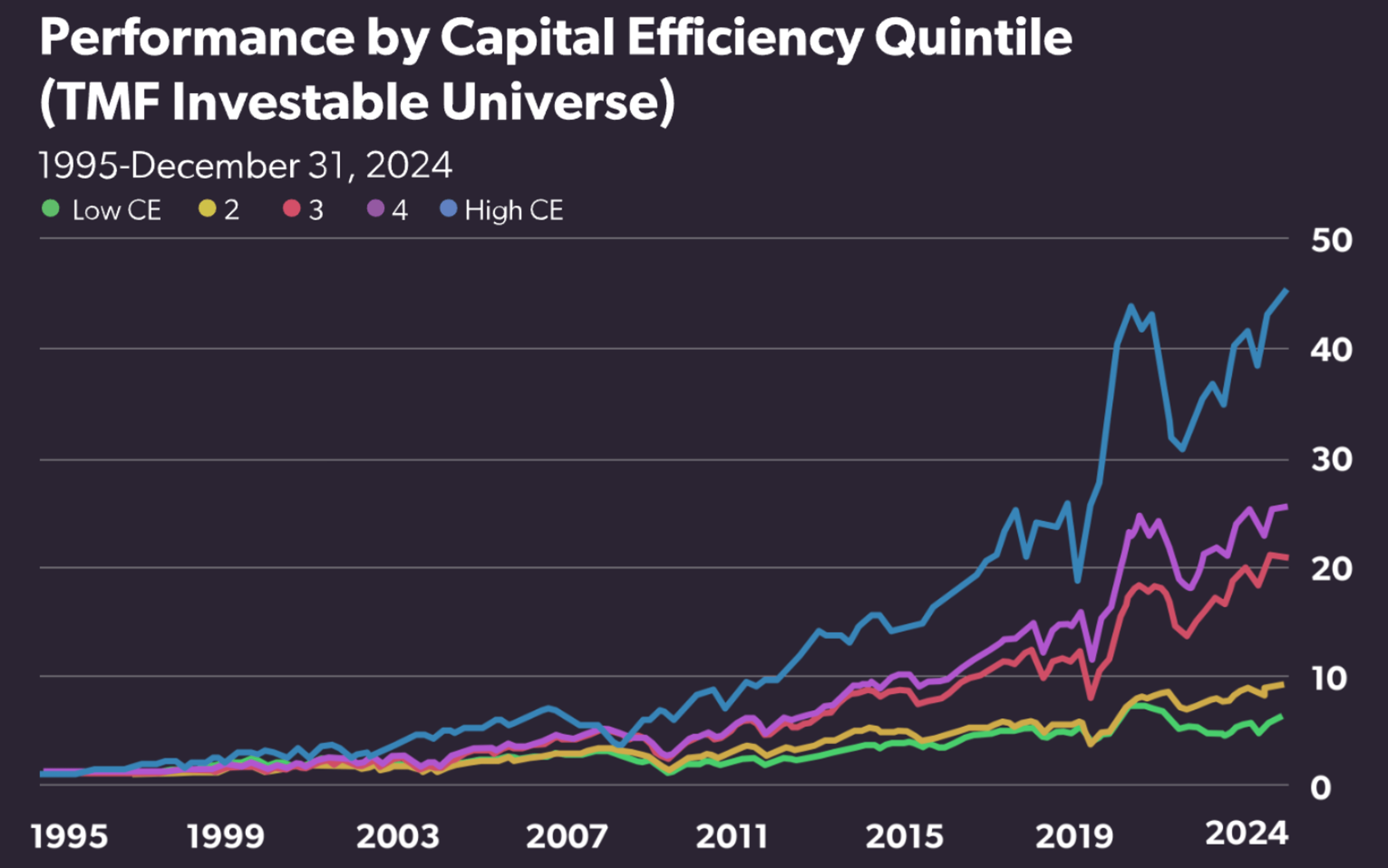

Talk Your Book: The Three A’s of the U.S. Economy

The latest "Talk Your Book" episode breaks down the three A’s shaping the U.S. economy—asset prices, artificial intelligence, and the affluent consumer. It highlights a widening market breadth and offers a framework for valuing the world’s largest firms. The discussion...

By A Wealth of Common Sense

News•Feb 9, 2026

US Backs Altona’s Mozambique Rare Earths Project

Altona Rare Earths announced that the U.S. Trade & Development Agency will support its Monte Muambe project in Mozambique, prompting a 76% surge in the company's London‑listed shares. The backing aims to map technical and financial routes for extracting rare‑earth...

By MINING.com

Blog•Feb 9, 2026

China Debt Ratio Exceeds 300 Percent of GDP Mark

The episode explains that China’s official macro debt ratio hit a record 302.3% of GDP in 2025, driven primarily by government borrowing while household and private company debt fell. It highlights the real‑estate crisis as the catalyst that halted household...

By China Business Spotlight

Blog•Feb 9, 2026

Deterrence Won’t Fail in the Taiwan Strait — It Will Be Bypassed

In this episode J. William DeMarco argues that recent Chinese military activities around Taiwan are less about rehearsing an invasion and more about a strategy of paralysis—using encirclement, law‑enforcement vessels, and limited rocket fire to create economic and political pressure...

By War on the Rocks

Blog•Feb 9, 2026

UFLPA Enforcement: When a “Red Light” Turns Yellow

The Uyghur Forced Labor Prevention Act, enacted in 2021, created a rebuttable presumption that Xinjiang‑origin goods are barred from the U.S. market. U.S. Customs data show a sharp drop in UFLPA‑related detentions, from roughly $1.58 billion in 2023 and $1.40 billion in...

By Corruption, Crime & Compliance

Blog•Feb 9, 2026

ASEAN Inc.: One Portfolio, Seven Markets — and a Clear Test of Southeast Asia’s Investment Story

The episode breaks down the ASEAN Inc. portfolio—a $1 million, equally weighted allocation across seven U.S.-listed ETFs covering Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, and a regional ASEAN‑40 fund—and shows it delivered a 21.3% annualized total return through February 2026, beating...

By The International Investor

News•Feb 9, 2026

Container Lines’ Red Sea Mixed Messages Confuse Shippers

Shippers are grappling with mixed signals from carriers about returning to the Suez Canal route. Maersk said peace in the Middle East is required, yet announced two services will resume via the Red Sea with military escort. CMA CGM has shifted...

By Seatrade Maritime

News•Feb 8, 2026

Which of the 132 Chinese EV Automakers Will Enter Canada?

Chinese electric‑vehicle makers are eyeing Canada as a strategic foothold into North America, with a government‑approved quota of 49,000 units annually – roughly 3.8% of the market. BYD is projected to dominate the allocation, taking about 30% of the quota,...

By CleanTechnica

Blog•Feb 8, 2026

Anutin’s Bhumjaithai Upsets the Odds: Surprise Thai Election Win Reshapes Southeast Asia’s Geopolitical Chessboard

The episode dissects Thailand’s surprise February 8, 2026 election, where Anutin Charnvirakul’s Bhumjaithai party captured nearly 200 seats, shifting the country’s foreign policy toward deeper engagement with China while prompting a tougher U.S. response. It highlights the immediate implications for...

By GeopoliticsUnplugged

Podcast•Feb 8, 2026•17 min

What to Expect From Bangladesh's Upcoming Elections

In this 17‑minute episode, RANE’s South Asia analyst Misha Iqbal breaks down the key actors and forces shaping Bangladesh’s upcoming election—the first since the 2024 pro‑democracy uprising that removed Sheikh Hasina from power. Iqbal outlines the political landscape, including emerging...

By RANE Podcast Series

News•Feb 7, 2026

TURKEY REPORTED RECORD TOURISM REVENUE IN 2025

Turkey recorded a historic tourism peak in 2025, welcoming roughly 63.9 million visitors and generating $65.2 billion in revenue. Visitor numbers rose 2.7% year‑over‑year, while tourism earnings climbed 6.8%, surpassing government targets. The market mix featured 52.8 million foreign tourists and 11.1 million Turkish...

By Tourism Review

News•Feb 7, 2026

Trump Turns to US Military Leaders for Diplomatic Efforts on Iran and Ukraine

President Donald Trump has turned to senior military officials to spearhead high‑stakes diplomatic talks on Iran’s nuclear program and the Russia‑Ukraine war. Admiral Brad Cooper, commander of U.S. Central Command, joined indirect Iran negotiations in Oman, while Army Secretary Dan...

By Military.com (Navy News)

Blog•Feb 7, 2026

Elliott Wave Analysis of EURUSD – February 9th, 2026

The latest Elliott Wave analysis notes that EUR/USD slipped during the first week of February 2026, testing the 1.1800 support zone. While the pair remains above this level, bullish sentiment persists, suggesting the wave count may still be in an...

By EWM Interactive – Forex

Blog•Feb 6, 2026

Oil Context Weekly (W6)

In this week’s Oil Context Weekly, the host reviews flat crude prices slipping below $68 a barrel after geopolitical chatter between the U.S. and Iran, while noting a modestly backwardated term structure with a "smiley‑faced" futures curve extending to 2027....

By Commodity Context

Blog•Feb 6, 2026

Friday Footnotes: What's Happening In China

In this episode, the host examines the current state of China's grain market, focusing on its ability to meet President Trump's promised soybean purchases of 8 million metric tons (294 million bushels) and the anticipated 25 million metric tons of new crop. The...

By Grains in Context

Podcast•Feb 6, 2026•0 min

#687: First Friday: The Retirement Rules That Changed While You Weren’t Looking

In this First Friday episode, host Paula Pant reviews the economic landscape of January 2026, highlighting a 2% S&P 500 pullback, a near‑10% Bitcoin drop, and a cooling labor market with job openings falling to 7.6 million. She discusses the surprise nomination of...

By Afford Anything

News•Feb 6, 2026

Saudi Graphite Plant Is ‘Wake-Up Call’ for Quebec, France: CEO

Northern Graphite has partnered with Saudi Arabia's Al Obeikan Group to build a $200 million battery‑grade graphite plant in Yanbu, slated for production in 2028. The venture will source concentrate from the revived Okanjande mine in Namibia and gives Northern a...

By MINING.com

Podcast•Feb 6, 2026•29 min

Global FX: RBA, JP Elections, Euro/APAC Rotation, Dovish BoE, US Data

The FX team discusses a variety of topics: the euro bloc/ APAC FX rotation, RBA hawkish pivot, scenarios around upcoming JP elections, the dovish BoE surprise and recent US data. This podcast was recorded on 06 February 2026. This communication is...

By At Any Rate

News•Feb 6, 2026

US Mineral Supply Chains Remain Exposed to China Chokehold: USGS Report

The U.S. Geological Survey’s 2026 mineral commodities summary shows the United States now imports 100% of 16 of the 90 non‑fuel minerals it tracks, up from 15 a year earlier, and relies on foreign sources for more than half of...

By MINING.com

News•Feb 6, 2026

Iran Can Still Normalize Its Economy—But the Path Will Be Painful and Slow

Iran’s inflation, hovering around 20% and spiking above 40% during sanctions, has become a structural feature of its macro‑economy. The country’s fragmented exchange‑rate system, fiscal deficits financed by the central bank, and dominant state‑linked enterprises perpetuate price pressures. Analysts argue...

By Atlantic Council

News•Feb 6, 2026

Heliostar Pours First Gold From San Agustin Mine

Heliostar Metals announced the first gold pour from its newly restarted San Agustin mine in Durango, marking its second operating asset after La Colorada. The open‑pit mine is projected to deliver roughly 45,000 ounces of gold from existing reserves, prompting...

By MINING.com