🎯Today's Global Economy Pulse

Updated 3h agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada’s Governing Council released a detailed summary of its monetary‑policy deliberations for the decision announced two weeks ago. The Council kept the policy interest rate steady at 4.75%, citing modest progress toward its 2% inflation target. Officials highlighted that inflation is projected to fall to 2.5% by mid‑2027, while labour market slack remains limited. The report also noted a stronger Canadian dollar and the need for cautious forward guidance pending new data.

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Publication: Summary of Deliberations

The Bank of Canada released a detailed Summary of Deliberations outlining the Governing Council’s discussion of the monetary‑policy decision announced two weeks earlier. The document highlights the Council’s assessment of inflation trends, labour‑market tightness, and the domestic growth outlook. It...

By Bank of Canada — RSS (site hub)

News•Feb 12, 2026

Interest Rate Announcement

On December 9, 2026 the Bank of Canada will release its next overnight rate target, one of eight scheduled policy announcements each year. The press release will outline the economic factors shaping the decision, including inflation trends, labour market conditions, and global...

By Bank of Canada — RSS (site hub)

Social•Feb 12, 2026

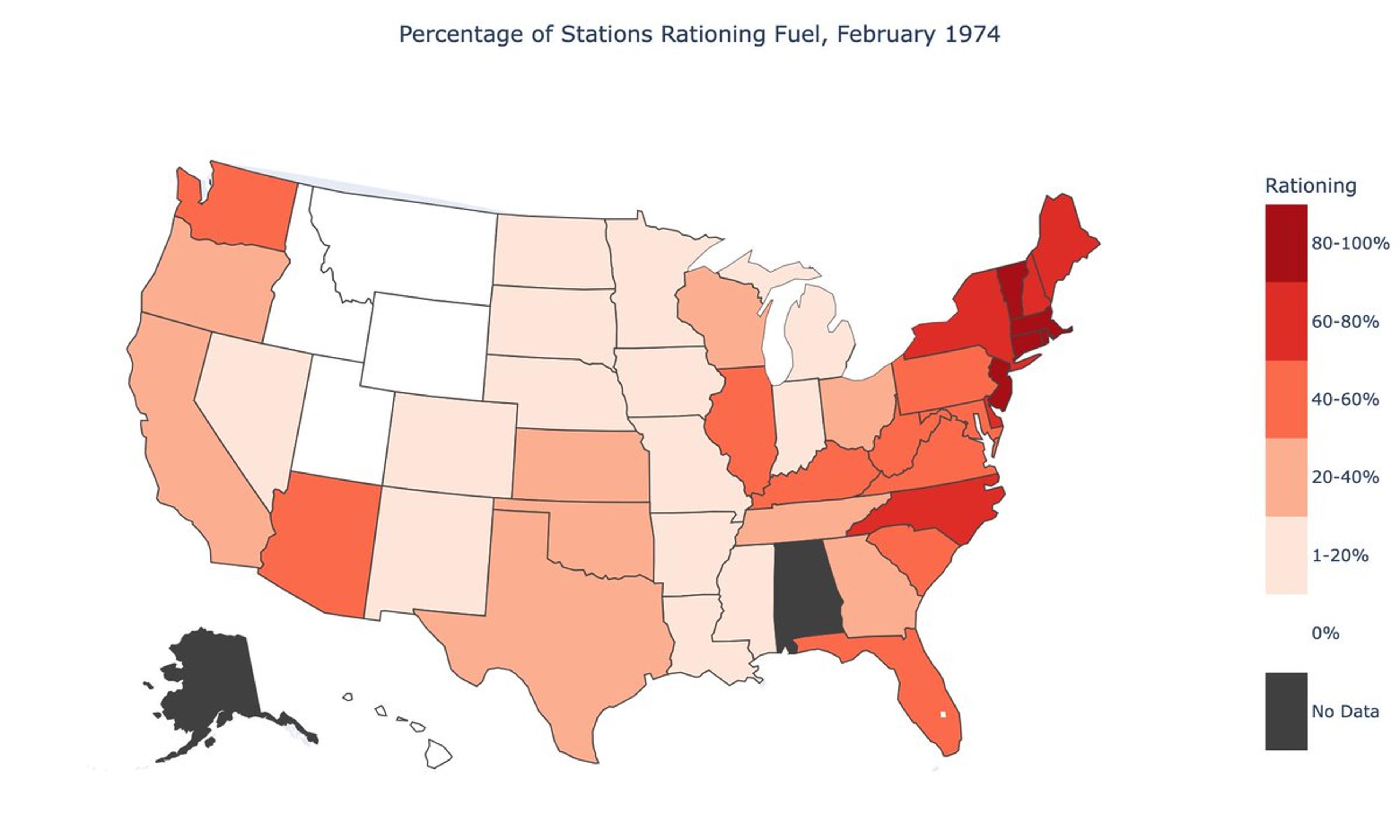

Price Controls Trigger Chaotic, Uneven Resource Allocation

I'm super excited for my new paper with @ATabarrok and Mark Whitmeyer: "Chaos and Misallocation under Price Controls" During the 1973-74 gasoline crisis, the U.S. had about a 9 percent national shortfall. But that was far from evenly spread out. Over...

By Brian Albrecht

News•Feb 12, 2026

Europe Debates Future Ties with US: Decouple or Double Down?

Europe is split on its future relationship with the United States under President Trump. Eastern European NATO members such as Romania and Lithuania argue for tighter security cooperation and participation in the critical‑minerals ministerial, citing Russian aggression. In contrast, France,...

By The Hill – Defense

News•Feb 12, 2026

Singapore Budget 2026: Key Highlights for HR Leaders, Employers, and Employees

Singapore’s 2026 Budget, delivered by Prime Minister Lawrence Wong, projects growth slowing to 2‑4% and introduces a suite of measures to keep the city‑state competitive. For employers, the budget raises the minimum qualifying salary for new Employment Passes to $6,000...

By Human Resources Online (Asia)

News•Feb 12, 2026

Piero Cipollone: Europe and Monetary Sovereignty

In a February 2026 speech, ECB Executive Board member Piero Cipollone warned that Europe’s monetary sovereignty is threatened by growing dependencies on foreign payment systems and digital assets. He argued that control over the euro, both in cash and digital...

By European Central Bank — Press/Speeches

Social•Feb 12, 2026

BlockFills Freezes Withdrawals as Crypto Volatility Spikes

First, you lose in a matter of weeks 50%% to 99% - depending on which shitcoin you were duped to invest in - and then they don’t even allow you to withdraw the remaining crumbs of your investments. Standard operating...

By Nouriel Roubini

Social•Feb 12, 2026

Productivity Gains Are the Real Driver of Inflation

Posted this thread two years ago on the enigmatic relationship between inflation and productivity, and more relevant now than ever—

By Jeff Park

News•Feb 12, 2026

Trump Calls India-US Trade Deal ‘Historic’ as Tariff Cuts and Coal Exports Take Centre Stage

President Donald Trump called the newly concluded India‑US trade deal historic, highlighting its potential to expand American energy exports, especially coal. The interim agreement slashes U.S. duties on Indian goods to a uniform 18% across textiles, apparel, chemicals and more,...

By ET EnergyWorld (The Economic Times)

News•Feb 12, 2026

Fed Should ‘Aggressively’ Be Cutting Rates, Investor Says Amid Jobs Report Release

Anthony Pompliano, CEO of Professional Capital Management, argued on “Making Money” that the Federal Reserve should aggressively cut interest rates following the latest jobs report. He noted that the labor market remains solid but still offers room for monetary easing...

By Fox Business — Bonds (section)

:max_bytes(150000):strip_icc():format(jpeg)/GettyImages-2165717307-a843d8a1e1c94e9d98075343fa914292.jpg)

News•Feb 11, 2026

What To Expect From Friday's Report On Inflation

Economists expect the January Consumer Price Index to rise 2.5% year‑over‑year, a dip from December’s 2.7% and the lowest headline inflation since May 2021. Core CPI, which strips out food and energy, is also projected at 2.5%, matching the lowest...

By Investopedia — Economics

News•Feb 11, 2026

The UK Chagos Deal Is an 'Act of Great Stupidity'

The United Kingdom has announced a plan to transfer sovereignty over the Chagos Islands to an unrelated African nation, sparking alarm among security analysts. The islands host Diego Garcia, a joint U.S.–U.K. military base that underpins American power projection across...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

Western Europe in a Multipolar World

The global order has moved from Cold‑War bipolarity to a multipolar system where the United States, Russia and a rising China dominate international affairs. Technological globalization and interdependence have intensified, reshaping how Western Europe engages with these powers. The article...

By RealClearWorld – Security/Defense (alt aggregation)

News•Feb 11, 2026

Ex-Prince Andrew Suggested Uranium Investments to Epstein: BBC

A confidential UK briefing on high‑value minerals in Afghanistan’s Helmand province, highlighting uranium among other resources, was forwarded by former trade envoy Prince Andrew to Jeffrey Epstein in 2010. The document, prepared during Andrew’s official visit, outlined potential low‑cost extraction...

By MINING.com

News•Feb 11, 2026

Lloyds Banking Group to Close Another 95 Branches

Lloyds Banking Group announced it will shut 95 more branches – 53 Lloyds, 31 Halifax and 11 Bank of Scotland locations – between May 2024 and March 2027. The closures will leave the group with about 610 branches after the...

By BBC News – Business

News•Feb 11, 2026

Would You Pay £7.50 for a Pint of Guinness?

The Advocate Arms in Market Rasen is polling patrons on a possible £7.50 price for a pint of Guinness, up from its current £6. Diageo says the increase translates to roughly £0.04 per draught pint and stresses that retail pricing...

By BBC News – Business

Social•Feb 11, 2026

Labor Market Rebounds After Shutdown, Easing Temporary Layoffs

The labor market showed signs of healing late in 2025 and in January. Catch up following long government shutdown helps alleviate ranks of those suffering temporary layoffs and forced to accept part instead of full-time jobs. Some healthy churn returned...

By Diane Swonk

Social•Feb 11, 2026

2027 AI Race: Align or Lose Human Relevance

🚨 From Agent-1 to Superintelligence: The AI 2027 Scenario The AI 2027 Report outlines one of the most thought-provoking trajectories for artificial intelligence: a rapid evolution from simple assistants (Agent-1) to autonomous, adversarially misaligned systems (Agent-4) and ultimately to Agent-5 —...

By Giuliano Liguori

News•Feb 11, 2026

What Rubio Gets Right (and Wrong) About the Western Hemisphere

Juan S. González argues that U.S. security hinges on a stable Western Hemisphere, echoing Roosevelt’s Monroe‑Doctrine insight. He praises Secretary of State Marco Rubio for recognizing the need for proactive engagement but criticizes Rubio’s reliance on coercion and short‑term pressure....

By Foreign Policy

Social•Feb 11, 2026

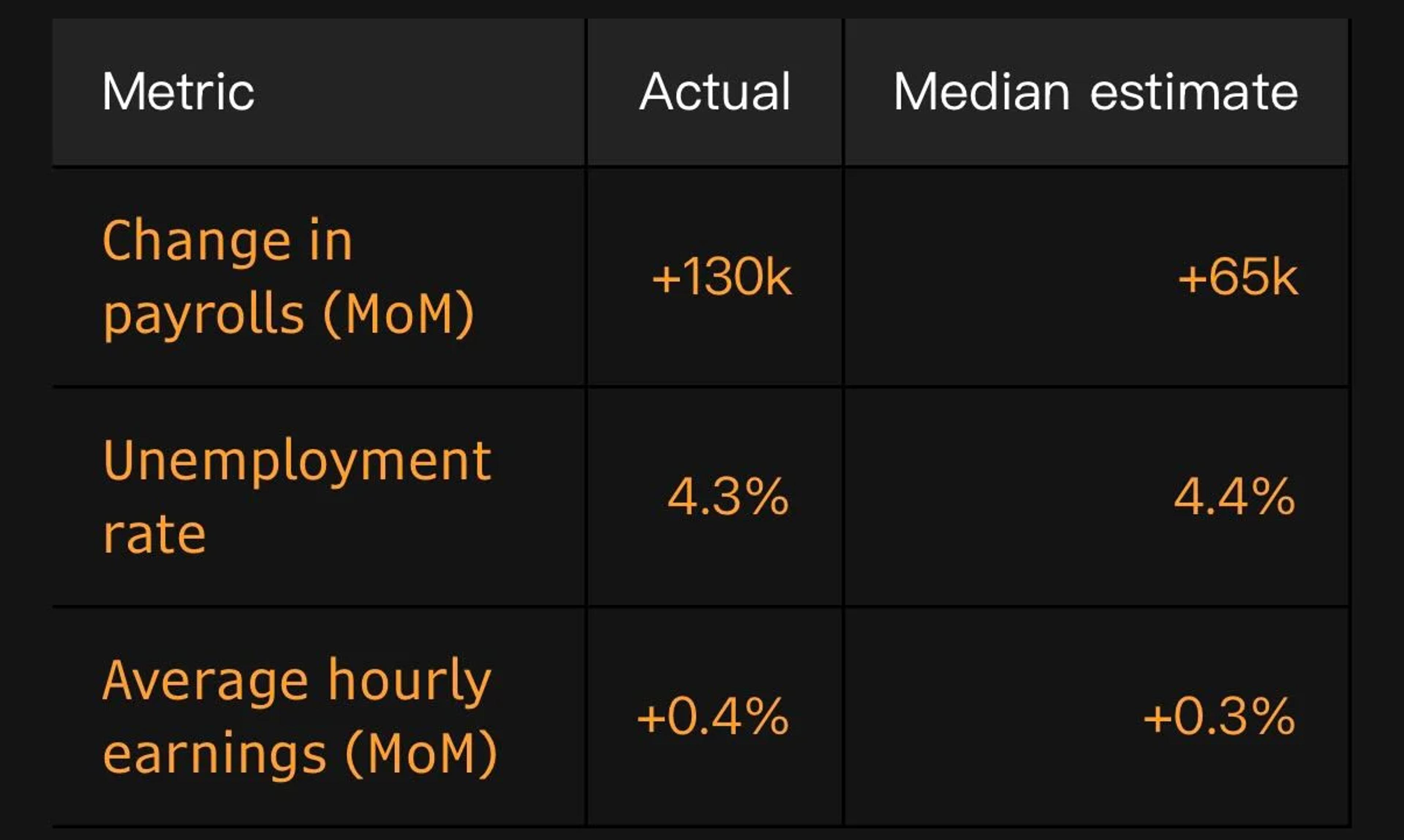

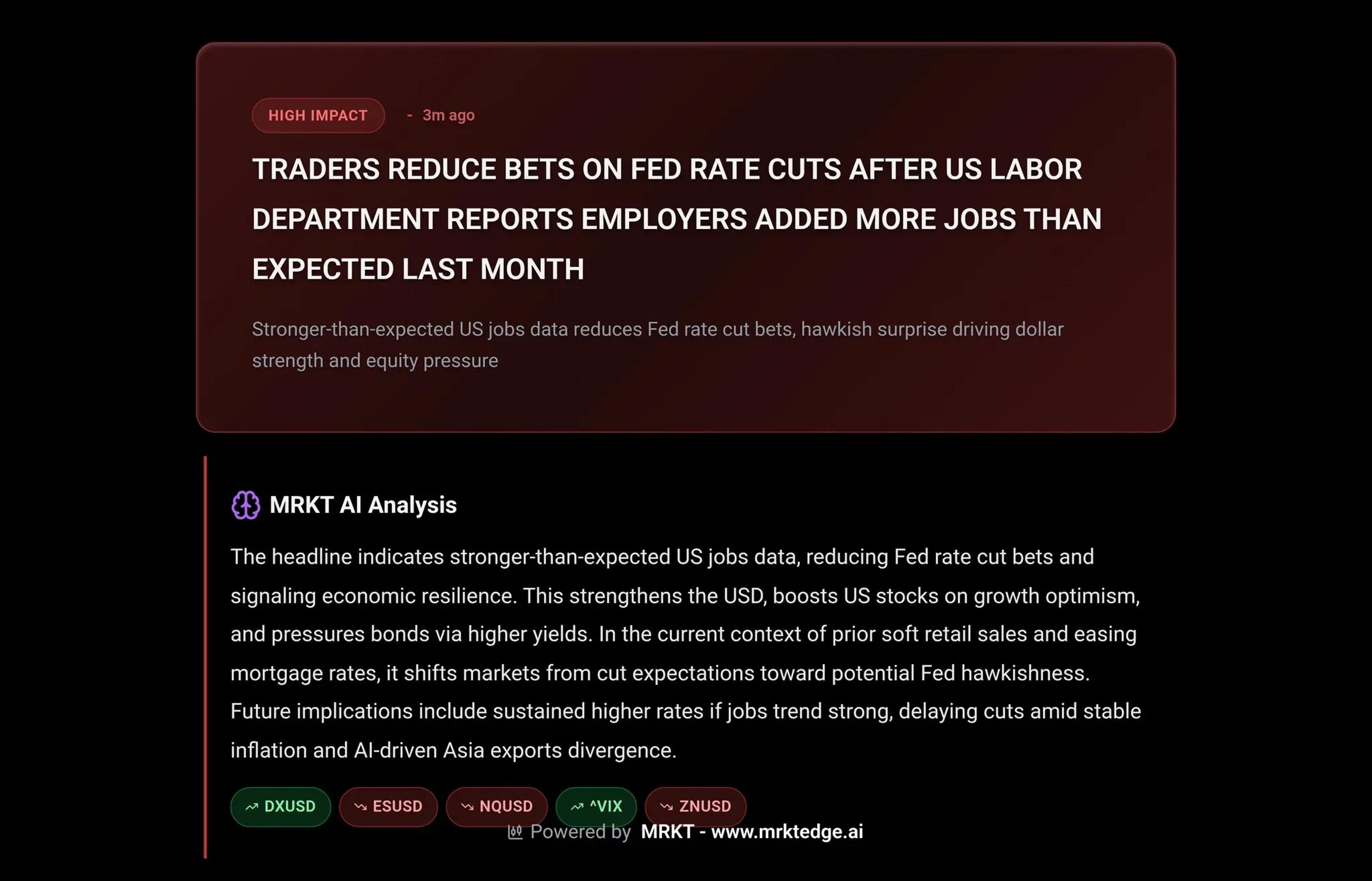

January Jobs Spark Rate‑cut Doubts Despite Solid Hires

Analytically, the January U.S. jobs report supports competing views. The market reaction, however, was clear: traders have sharply dialed back expectations for a June rate cut. The big beat on January job creation, paired with a dip in the unemployment rate...

By Mohamed El‑Erian

News•Feb 11, 2026

Kroenig on NPR on Iran

Atlantic Council vice‑president and Scowcroft Center senior director Matthew Kroenig appeared on NPR on Feb. 11 to discuss the Trump administration’s ongoing negotiations with Iran. He outlined the limited progress of back‑channel talks aimed at reviving a nuclear agreement and highlighted...

By Atlantic Council

Social•Feb 11, 2026

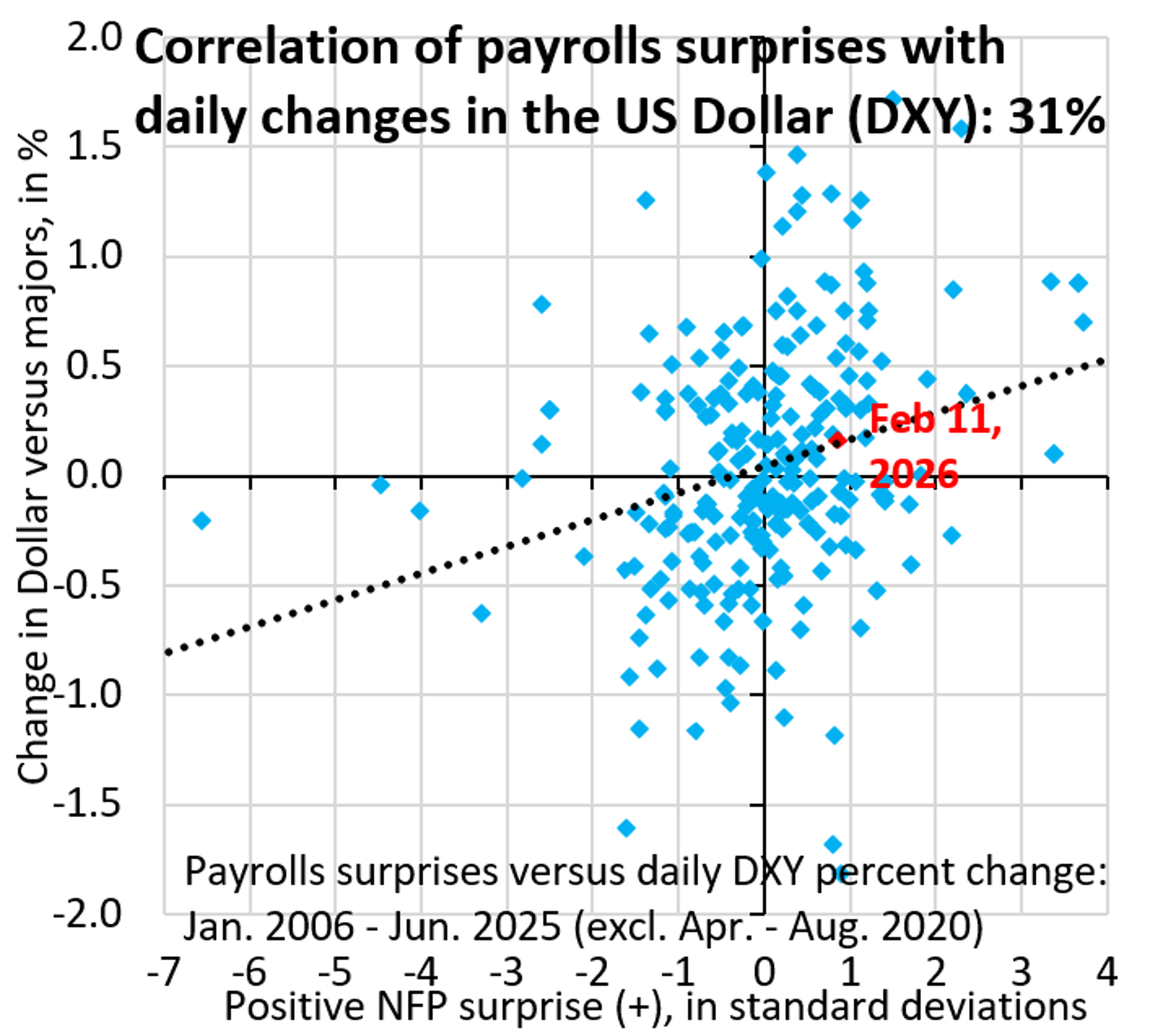

Strong Payrolls Fail to Boost Dollar, Correlation Shifts

Tepid response of the Dollar to a big upside surprise in payrolls. The whisper number for consensus was weak, so this was a solid beat, yet USD is barely able to rise. We're on our way to the correlation switch...

By Robin Brooks

Social•Feb 11, 2026

US Backs Coal Revival as Indonesia Slashes Output

Two major coal developments in the last 24 hours. 1. White House announcing purchases and support to revive the industry 2. Indonesia just ordered the world's largest nickel mine to sharply cut output. They are also looking to cut coal production by...

By Quinn Thompson

Blog•Feb 11, 2026

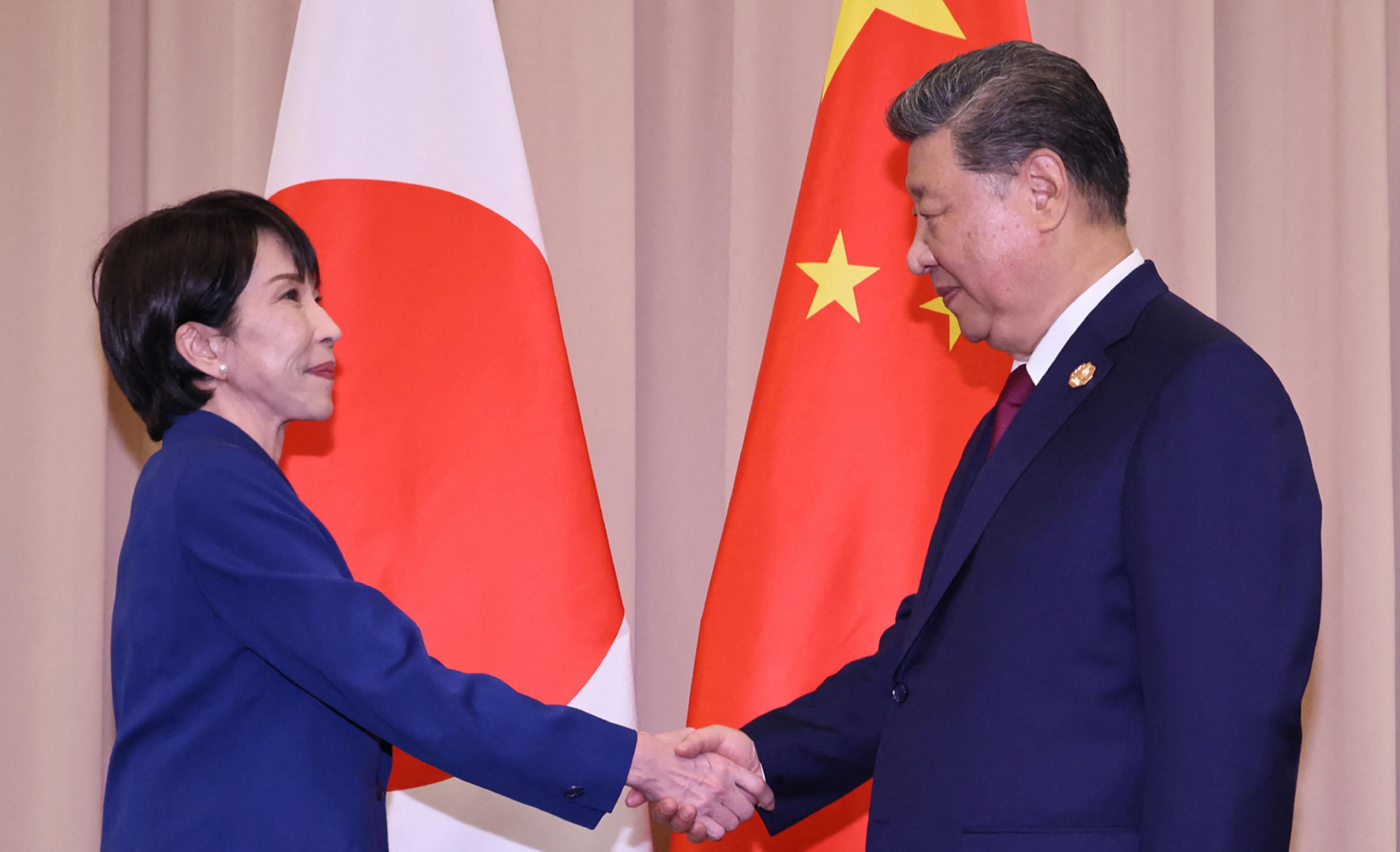

Asia’s Administrative Arms Race: How U.S.-China Strategic Competition Is Reshaping Economic Statecraft

China has invoked its Export Control Law to ban dual‑use exports to Japan and tighten rare‑earth licensing, signaling a new escalation in its diplomatic dispute with Tokyo. The move follows a broader trend of Beijing building offensive economic statecraft tools,...

By Just Security

Podcast•Feb 11, 2026•38 min

Credit Crunch: Investor Survey 1Q - Fed, Earnings, Tech Supply

In this episode, Mahesh Bhimalingam of Bloomberg Intelligence and Ashwin Palta of BNY Investments discuss the Bloomberg Intelligence 1Q26 Investor Survey, highlighting the continued resilience of credit and high‑yield markets despite recent tariff shocks and rate volatility. They examine why...

By FICC Focus

News•Feb 11, 2026

Fear Grows That AI Is Permanently Eliminating Jobs

A growing chorus of workers, researchers, and public figures warn that artificial intelligence could permanently eliminate millions of jobs. MIT researchers estimate current AI systems can automate tasks performed by over 20 million American workers, roughly 12 % of the labor force,...

By Futurism AI

News•Feb 11, 2026

Oatly Loses Long-Running 'Milk' Battle with Dairy Lobby

Oatly has lost a UK Supreme Court ruling that bars the company from trademarking or using the phrase “post‑milk generation” in its marketing, after Dairy UK argued that the term “milk” should be reserved for animal‑derived products. The court affirmed earlier...

By BBC News – Business

Social•Feb 11, 2026

Strong NFP Spurs Fed Pause, Dollar Gains, Market Pullback

NFP BREAKDOWN : Unemployment rate dropped to 4.3% while headline number crushed the expectations. In simple words , this was a much solid NFP all across the board. FED pause will continue. Profit taking in Gold , SPX , NASDAQ on reduced rate cut...

By tradeloq

Social•Feb 11, 2026

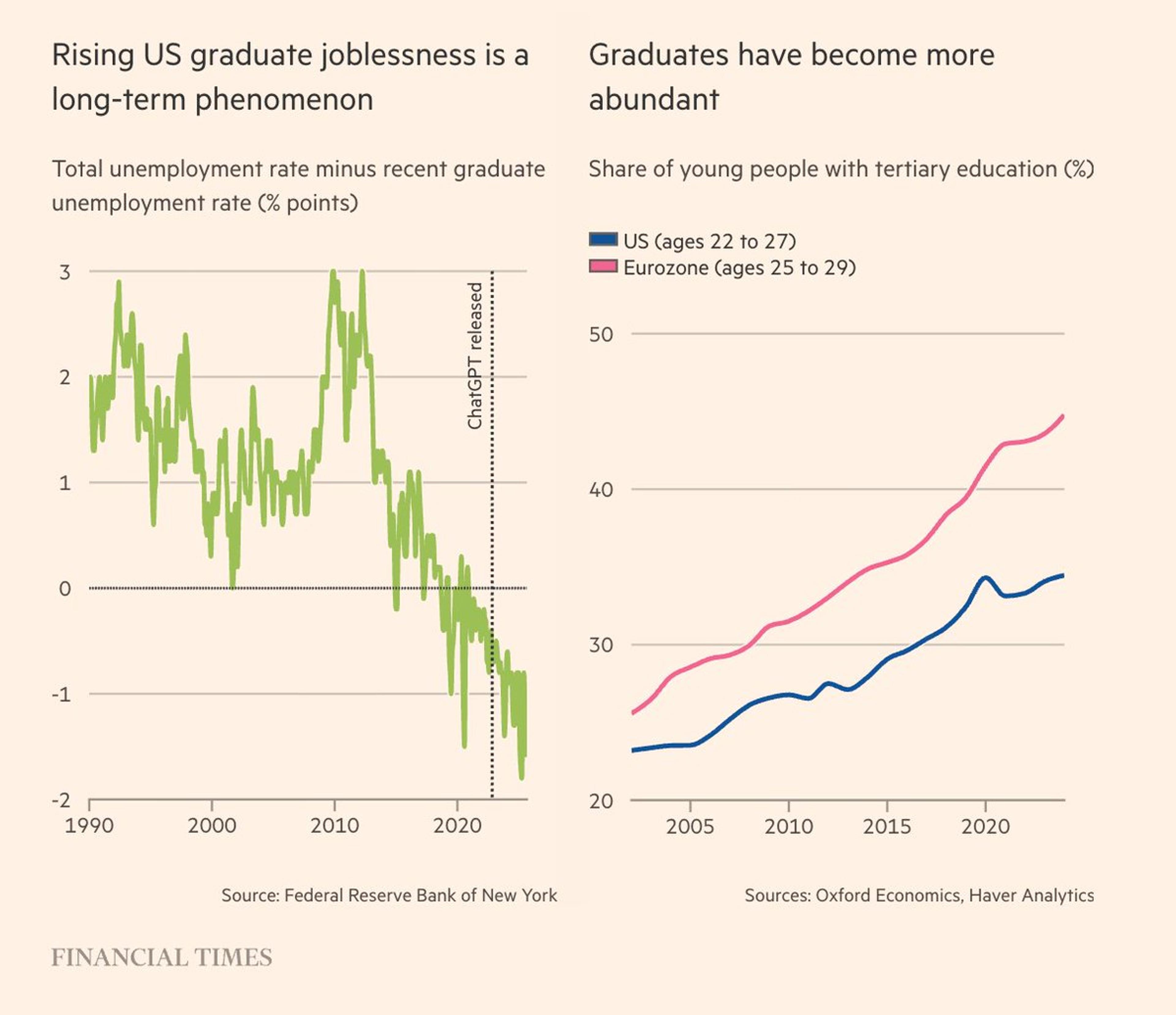

US Grads Face Higher Unemployment; Eurozone More Educated Workforce

Very striking data these a. on US graduate unemployment and b. higher share of tertiary education in Eurozone labor force than in the US. Explore these economic insights in today's Chartbook Top Links. https://t.co/xNeFQVgZKf

By Adam Tooze

News•Feb 11, 2026

Except Trump, Nobody Has Stated India's Refusal to Buy Russian Oil: FM Lavrov

Foreign Minister Sergei Lavrov told the Russian Duma that only U.S. President Donald Trump has claimed India will cease buying Russian oil, and no Indian official has made such a statement. Lavrov highlighted India’s new BRICS chairmanship and its focus...

By ET EnergyWorld (The Economic Times)

Social•Feb 11, 2026

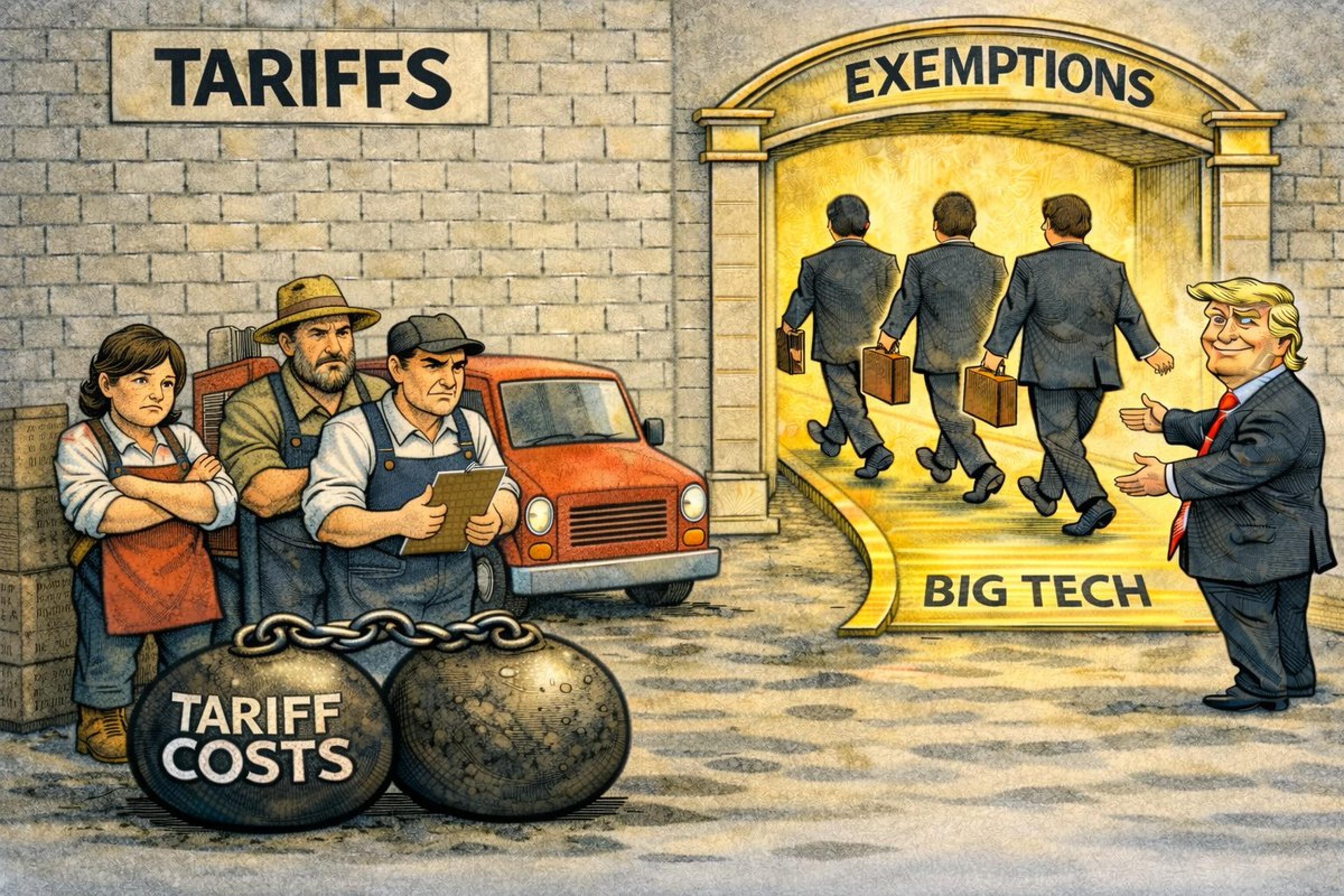

Big Tech Buys Trump Tariff Exemptions, Small Firms Suffer

Big Tech and their lobbyist have bought exemptions from Trump’s tariffs. Meanwhile, the small fries are getting FRIED. TRUMP’S TARIFFS = THE BIG GUYS CAN ALWAYS BUY AN EXEMPTION. https://t.co/zlVn4ornDl

By Steve Hanke

Social•Feb 11, 2026

New Jobs Report: What It Means for You

Latest jobs report just dropped. Let's spend a few minutes talking about what's really going on, what it means for you, and what to keep your eye on. https://t.co/ptv6DbFqKM

By Justin Wolfers

News•Feb 11, 2026

Govt Urges Refiners to Prioritise US, Venezuelan Crude Amid Evolving Trade Ties: Report

India has urged its state‑owned refiners to give priority to crude from the United States and Venezuela as part of a broader effort to diversify supplies and reduce reliance on Russian oil. The government’s suggestion applies to spot‑market tenders for...

By ET EnergyWorld (The Economic Times)

Social•Feb 11, 2026

Argentina's 32% Inflation Signals Milei Must Dollarize

Argentina’s January inflation came in at a RED HOT 32.4%/yr. Pres. Milei’s monetary model is not working. MILEI MUST DOLLARIZE NOW. https://t.co/MLSKqYfys7

By Steve Hanke

Social•Feb 11, 2026

USDJPY Plunges 2.5% in Three Days, Reversal Uncertain

$USDJPY is down over -2.5% over the past three days. One of the biggest drops in the past year and a half. Doesn't mean it has to stall and reverse though... https://t.co/LRjhnctyzL

By John Kicklighter

News•Feb 11, 2026

Kremlin Says Russia Will Seek Clarification From US on Venezuela Oil Restrictions

The U.S. Treasury issued a general license for Venezuelan oil and gas exploration that explicitly excludes Russian and Chinese entities, tightening restrictions on Moscow’s energy interests. Kremlin spokesman Dmitry Peskov said Russia will seek clarification from Washington to protect its substantial...

By ET EnergyWorld (The Economic Times)

Social•Feb 11, 2026

US Household Debt Peaks at $18.8T, Delinquencies Surge

US household debt just hit $18.8 TRILLION. Consumer delinquencies are at their HIGHEST LEVEL in nearly a DECADE. Not a good sign. https://t.co/PHcOGrhvOc

By Steve Hanke

Social•Feb 11, 2026

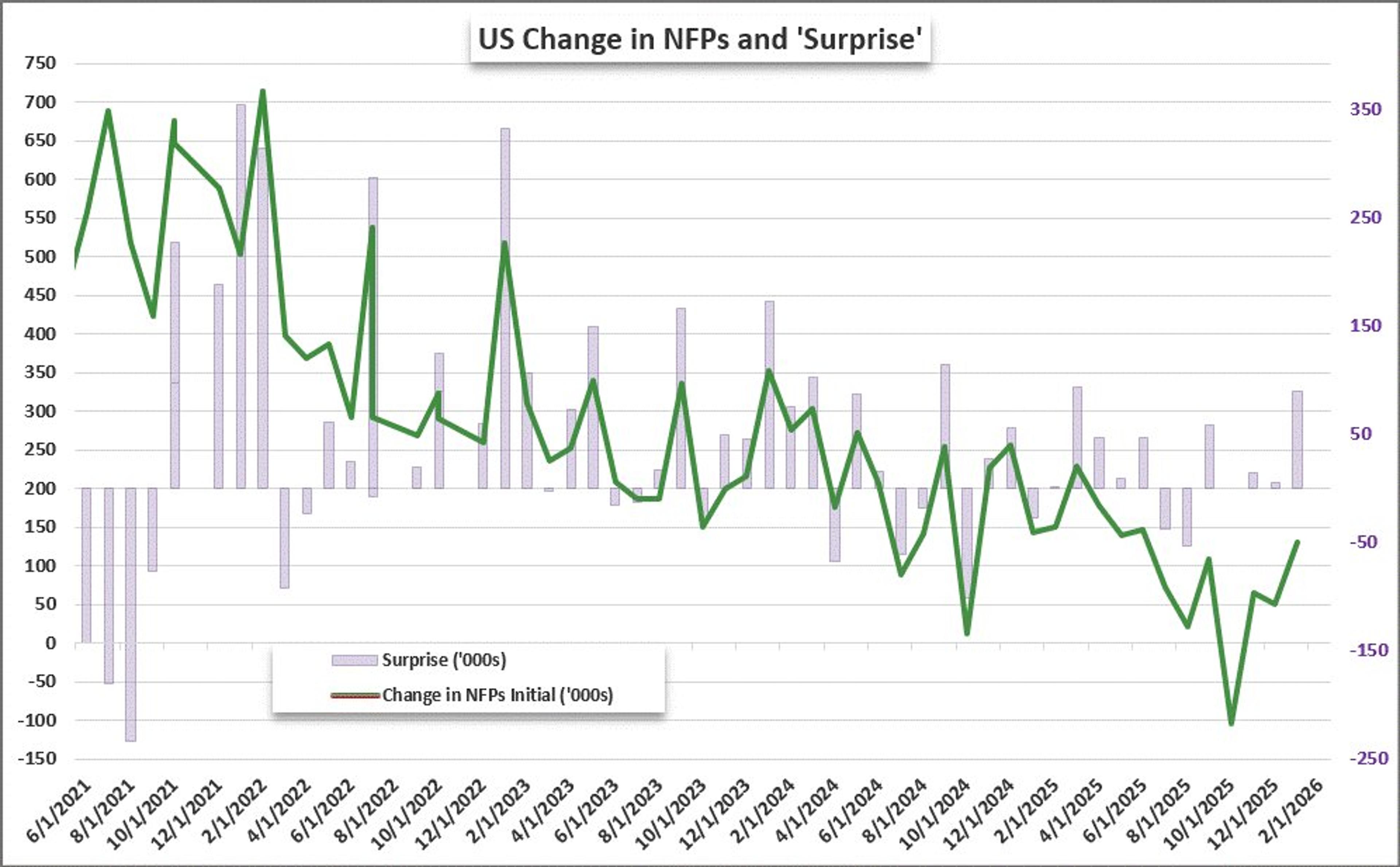

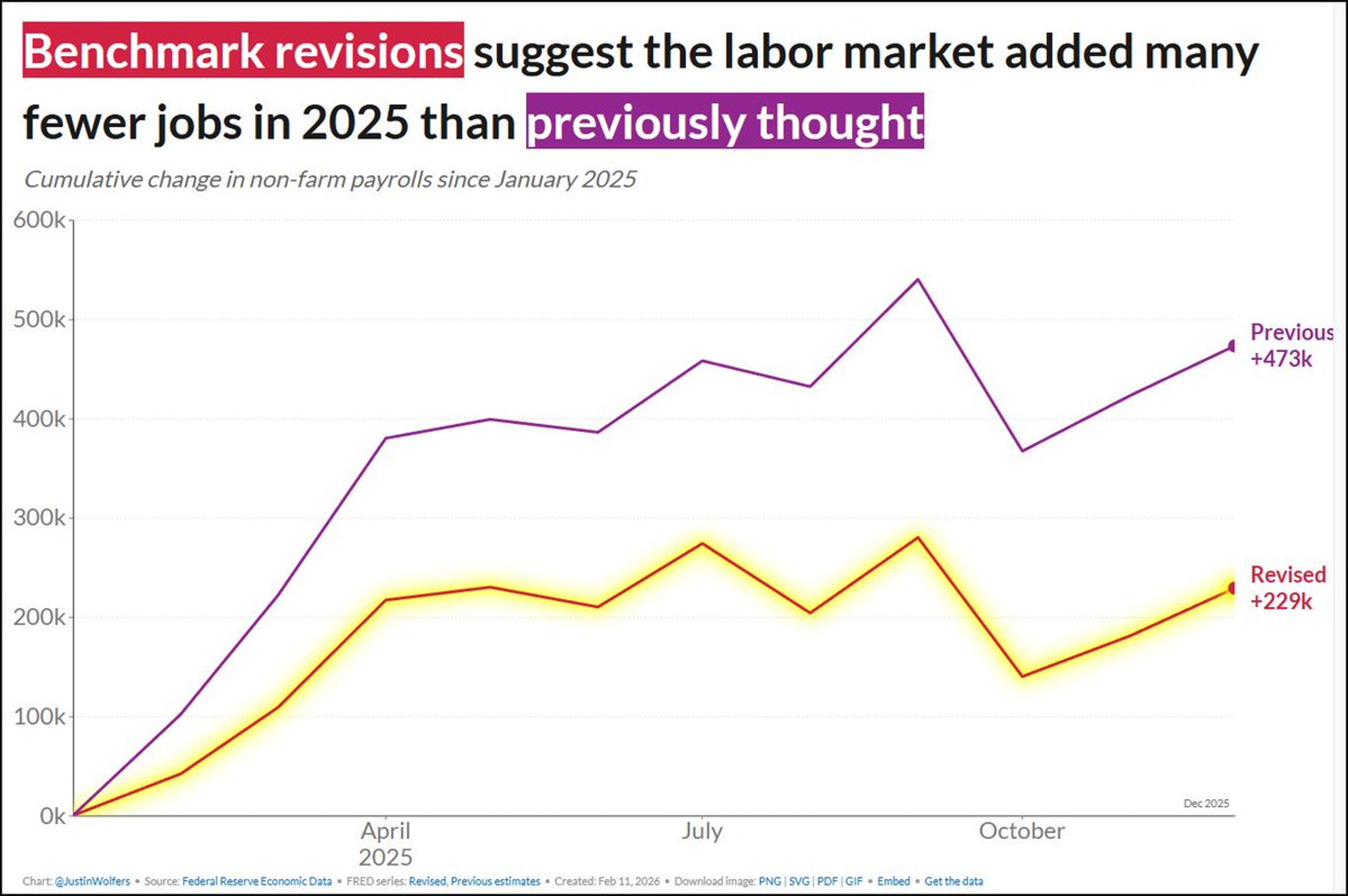

NFPs Surge Past Forecasts, yet 2025 Revisions Cut Million

#NFPs beat expectations by the most in 10 months - a 130K vs 40K expected. That said, revisions aggregated through 2025 have lowered the year's total by over 1 million https://t.co/p1pkqEWC57

By John Kicklighter

News•Feb 11, 2026

Nickel Price Jumps as Indonesia’s Top Mine Cuts Output

Indonesia ordered the world’s largest nickel mine, PT Weda Bay, to cut its ore quota from 42 million tonnes to 12 million tonnes for 2024, aiming to tighten global supply. The LME nickel price rose 2 percent to $17,835 a tonne, extending a rally of...

By MINING.com

Social•Feb 11, 2026

President's Attempt to Manipulate Job Data Failed

My menchies show a lotta distrust about the official jobs numbers right now. Lemme be clear: I don't believe there's *any* political meddling in these numbers. While the President has tried to mess with the BLS, he failed. I explain in...

By Justin Wolfers

Social•Feb 11, 2026

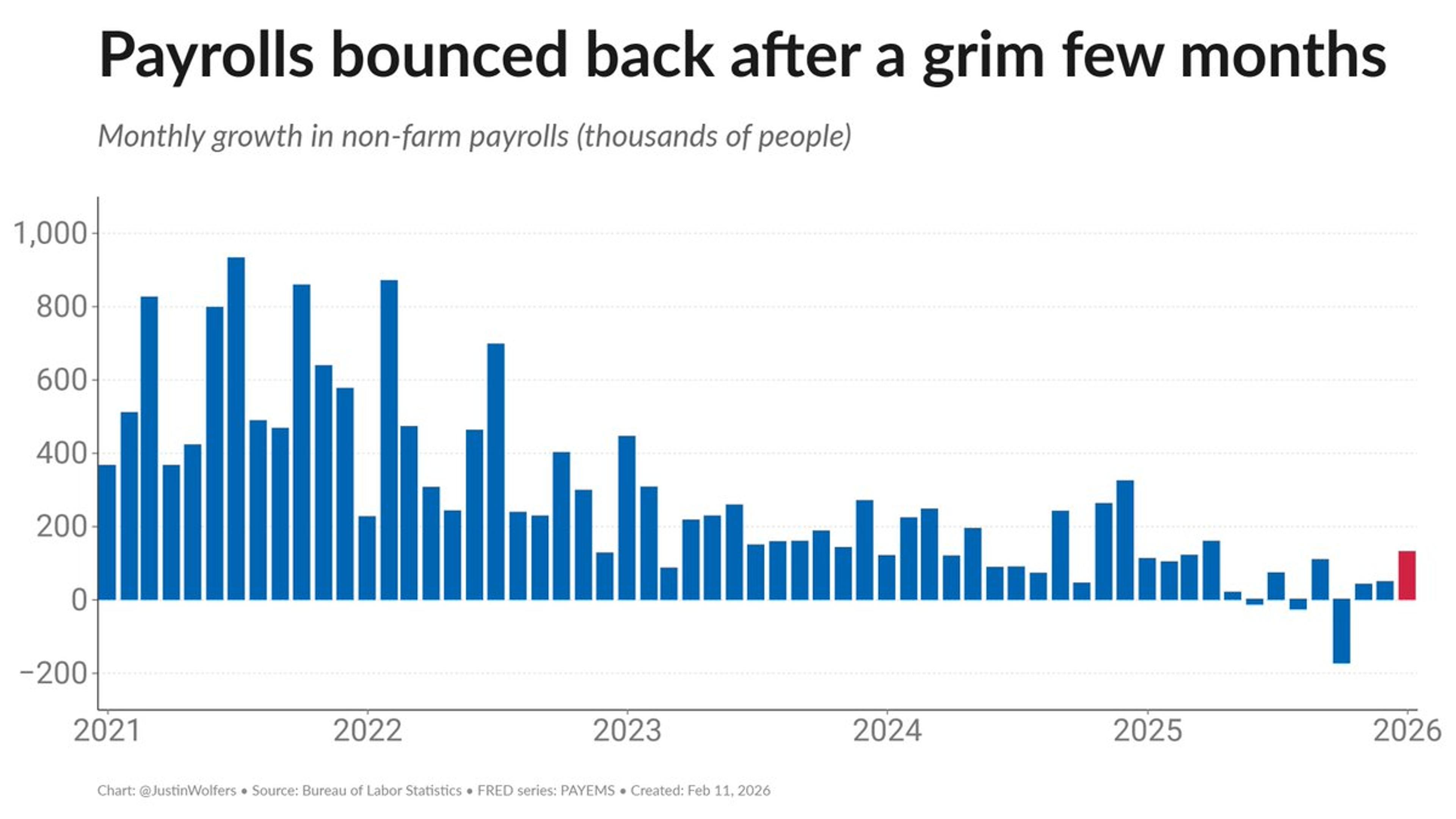

2025 Job Growth Halved by New BLS Revision

Every year the BLS does a benchmark revision which incorporates new and more detailed information. This year's revision suggests that 2025 was a far worse year than earlier estimates suggested, and total job growth was less than half that suggested...

By Justin Wolfers

Social•Feb 11, 2026

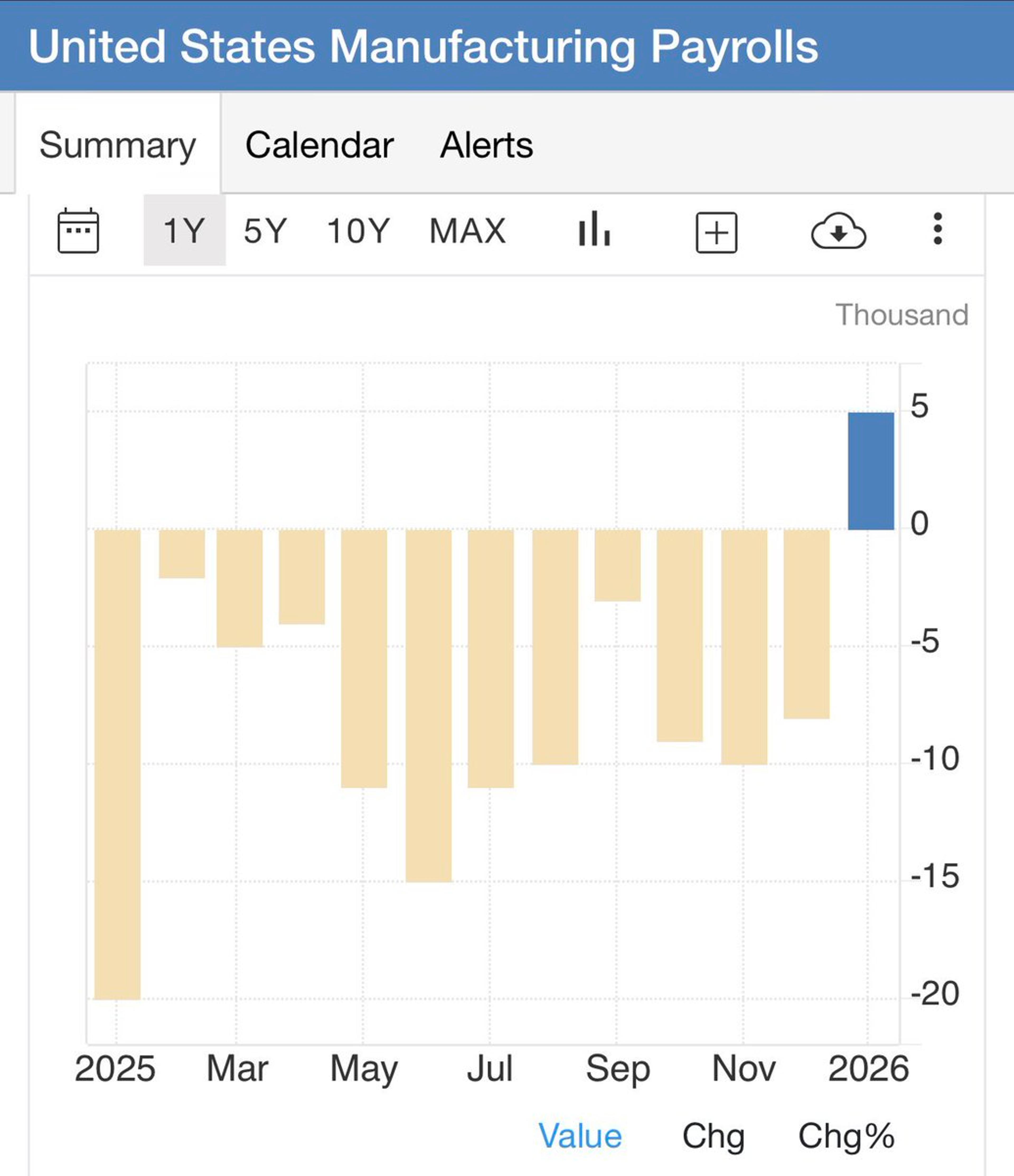

Manufacturing Payrolls Rise, Private Jobs Surge, Unemployment Falls

First positive manufacturing payrolls in a very long time, private payrolls surging, UR down. The economy is re-accelerating https://t.co/sbUBFBA4SA

By Felix Jauvin

Social•Feb 11, 2026

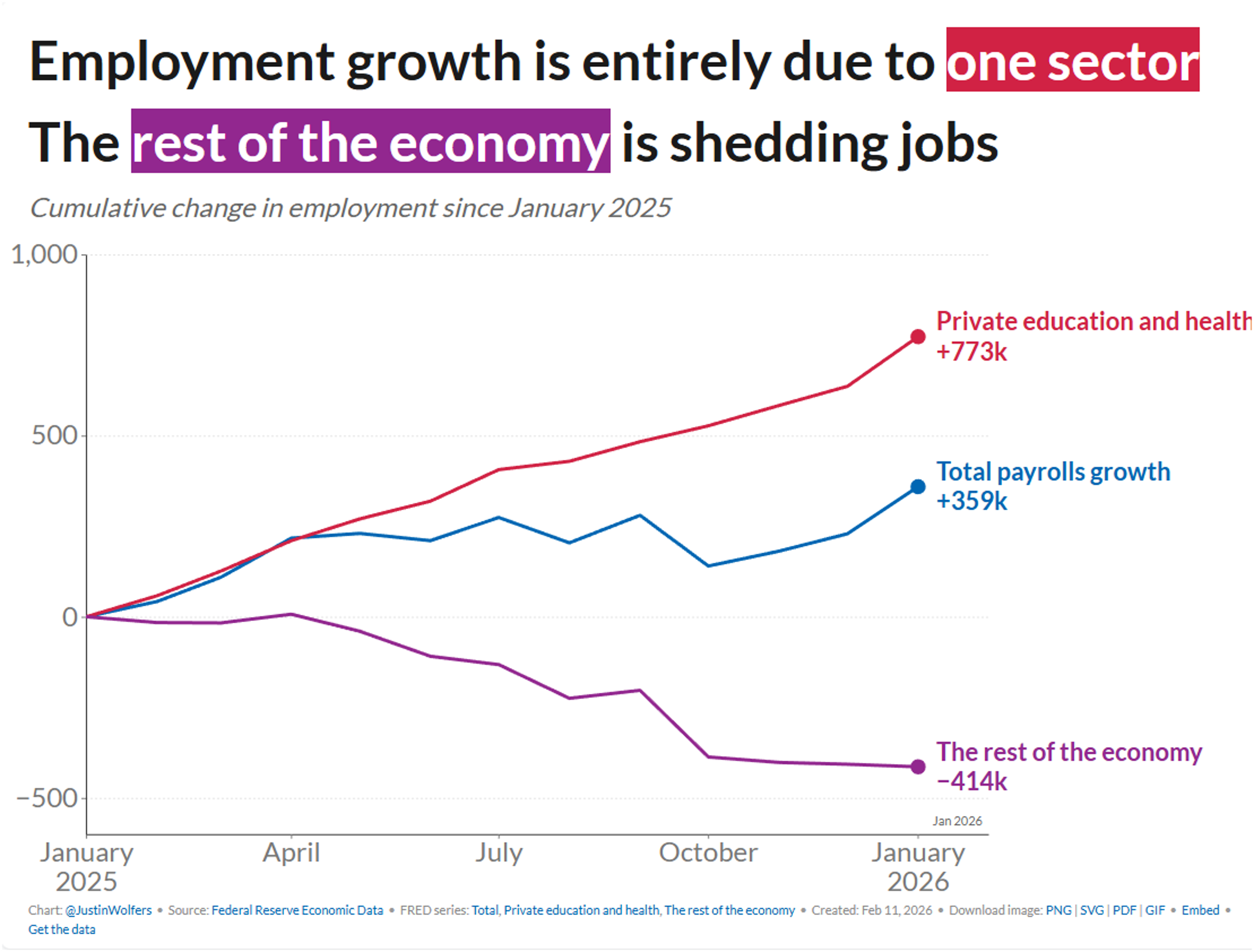

One Sector Drives All US Job Growth, Others Lose

The U.S. job market is very unbalanced right now. One sector more than accounts for all jobs growth over the past year. The rest of the economy is shedding jobs. https://t.co/EGsnQj04uA

By Justin Wolfers

Social•Feb 11, 2026

North Korea's Inflation Hits 74.6%, World’s Third Highest

#NKWatch🇰🇵: Today, I measure North Korea’s inflation at 74.6%/yr. This makes North Korea the WORLD'S THIRD-HIGHEST INFLATOR. SUPREME LEADER KIM JONG UN = KILLING NORTH KOREA'S ECONOMY. https://t.co/iTKJhtxWvr

By Steve Hanke

Social•Feb 11, 2026

Strong January Jobs, Lower Unemployment Boost USD Despite Cut Expectations

Jan jobs data better than expected and benchmark revision more or less in line. Unemployment rate ticks lower. $USD jump sold into quickly. Mkt still pricing in around two cuts this year.

By Marc Chandler

Social•Feb 11, 2026

January Jobs Surge: Payrolls +130k, Unemployment at 4.3%

Payrolls rose a very healthy +130k in January, and unemployment fell a tick to 4.3 percent. Revisions subtracted -17k from the past two months, so not much there. This is the healthiest jobs report we've seen in a while. Keep your fingers...

By Justin Wolfers

Social•Feb 11, 2026

Trump's Blockade Halts Cuba's Jet Fuel Exports

#CubaWatch 🇨🇺: Thanks to Trump’s blockade, Cuba can no longer supply jet fuel to international airlines. Stay tuned. https://t.co/I5GxUM3wGq

By Steve Hanke

Social•Feb 11, 2026

Europe Trades Russian Gas for US LNG, Risks New Dependency

“I think Greenland was a wake-up call. There is more talk [in Brussels] about replacing one dependency with another.” This is what I told the Wall Street Journal about Europe’s increasing dependence on US LNG following the end of Russian...

By Jan Rosenow

Social•Feb 11, 2026

USD Soft, JPY Squeeze Persists, Oil Spikes on Iran Tension

$USD is soft ahead of the delayed jobs report. Japanese markets were closed for a national holiday, but the dramatic short squeeze of $JPY continued. WTI is up ~2% as the US-Iran confrontation seems near a climax. ...

By Marc Chandler