🎯Today's Global Economy Pulse

Updated 24m agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 13, 2026

Fed's Goolsbee Sees Encouraging and Concerning Parts of the CPI Report

Chicago Fed President Austan Goolsbee highlighted a mixed CPI report, noting a modest 0.2% month‑over‑month rise in headline inflation and a steady 2.5% year‑over‑year rate. While core inflation matched expectations, services inflation remains elevated, keeping overall inflation around 3% and away from the Fed’s 2% target. Real weekly earnings turned positive at +0.5%, offering a rare boost to household income. Goolsbee warned that the path to 2% inflation is still uncertain, even as bond yields slipped and markets priced in potential policy easing.

By ForexLive — Feed

Social•Feb 13, 2026

Investors Choose Safe Bonds, Accepting Low Real Returns

One way to interpret recent price action in the bond market is that large pools of investment capital have made the determination that a 3.6%-4.1% guaranteed nominal return over the next 5-10 years is preferable to taking on the risk/reward...

By Quinn Thompson

News•Feb 13, 2026

Cameroon Suspends International Registry Citing Fraud

Cameroon’s Ministry of Transport announced a suspension of its international ship registry after uncovering multiple fraudulent registrations. The halt, effective immediately, follows pressure from the EU, IMO and U.S. authorities concerned about the flag’s role in the shadow fleet and...

By The Maritime Executive

Social•Feb 13, 2026

US Should Avoid Iran Strike During Ramadan, Preserve Allies

This is the last weekend before Ramadan (2/17 - 3/26) and it happens to be a 3 day US holiday. Not that someone with Trump's risk appetite couldn't strike Iran during the holiest month of the Islamic calendar, it certainly...

By Quinn Thompson

News•Feb 13, 2026

Trump Tells Troops 'Fear' Is Powerful Motivator in Difficult Iran Talks

President Donald Trump addressed troops at Fort Bragg, warning that fear may be necessary to compel Iran in stalled nuclear negotiations. He highlighted the recent deployment of a second U.S. aircraft carrier to the Middle East as a contingency if...

By Al-Monitor – All

News•Feb 13, 2026

British Gas Boss Warns UK Electricity Bills Will Soar by 2030

British Gas chief executive Chris O’Shea warned that UK electricity bills will exceed the 2022 peak by 2030 as the country scrambles to fund massive grid upgrades. He attributed the surge to years of under‑investment, with two‑thirds of future costs...

By OilPrice.com – Main

Social•Feb 13, 2026

Defensive Sectors Exhausted, Market Poised for Broad Correction

While sectors like staples (XLP), energy (XLE), materials (XLB) and industrials (XLI) have all provided a safe haven in recent weeks as large cap tech has sucked wind, most of these are all now reaching exhaustion. This means that from...

By Quinn Thompson

News•Feb 13, 2026

Tariffs, Supplier Fire Continue to Batter Ford

Ford Motor Co. reported a roughly $2 billion tariff hit in 2025, double the amount projected just months earlier, after a miscommunication about the effective date of auto‑part tariff offsets. A fire at Novelis’ Oswego aluminum plant added another $2 billion headwind,...

By Supply Chain Dive

News•Feb 13, 2026

Elon Musk’s X Is Accused of Selling Blue Checkmarks to Sanctioned Iranian Government Accounts

Elon Musk’s X platform has granted blue‑checkmark Premium subscriptions to more than two dozen Iranian government officials and state‑run media outlets that are subject to U.S. sanctions, according to a Tech Transparency Project report cited by Wired. The blue checkmark,...

By Inc. — Leadership

News•Feb 13, 2026

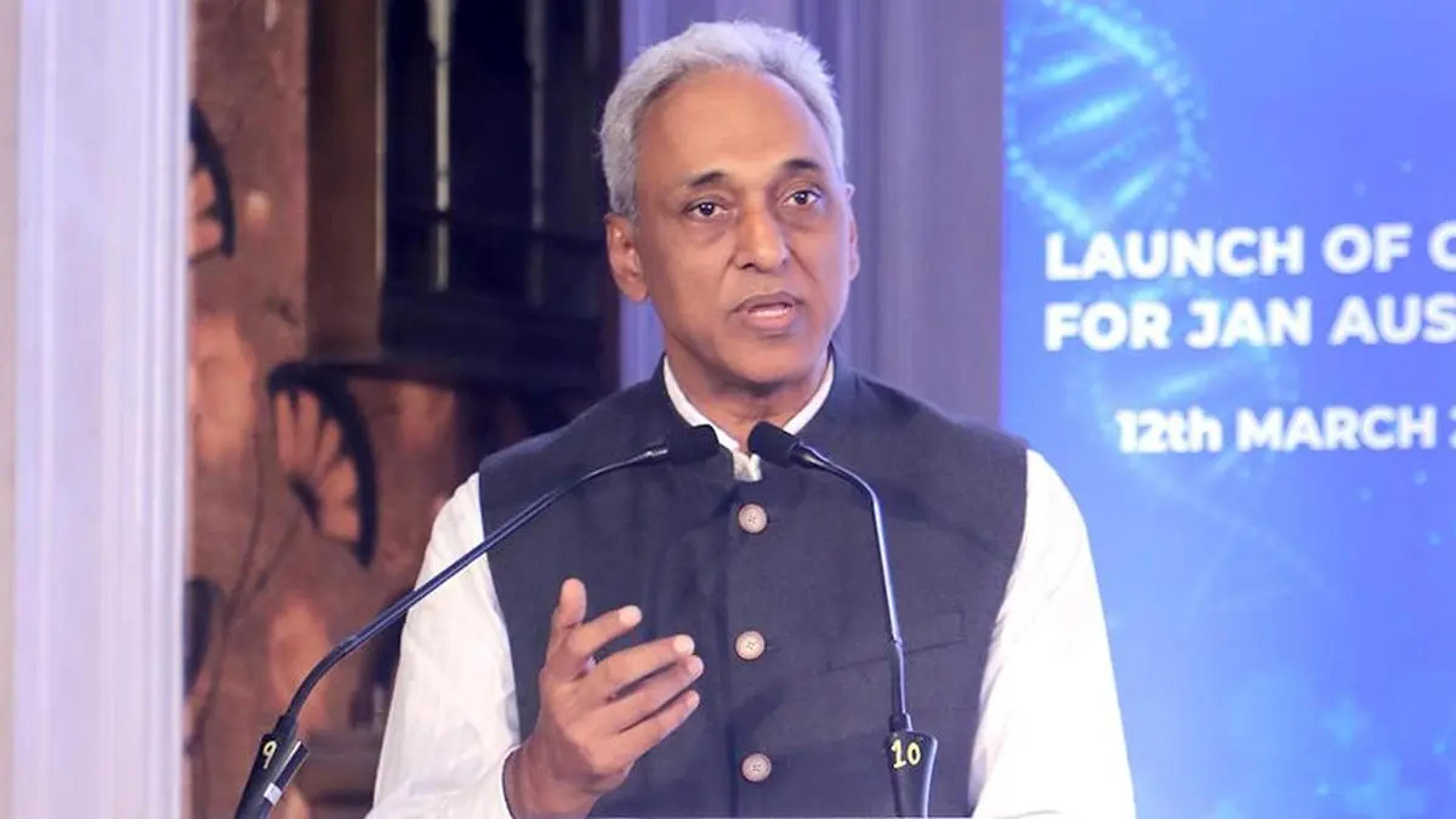

Trade Pacts Will Open New Markets & Won't Hurt Farmers, Assures Chirag Paswan

India’s decade‑long reform agenda, highlighted by UPI, GST and digital payment schemes, is now bearing fruit, according to Food Processing Minister Chirag Paswan. New free‑trade agreements, especially the pending pact with the United States, are expected to unlock fresh export...

By The Economic Times (India) – Economy

Podcast•Feb 13, 2026•12 min

US Aluminum Market Digests Tariff-Induced Volatility at Platts Symposium

The episode reviews how the U.S. aluminum market is coping with volatility caused by the 50% import tariff introduced in June, examining its impact on industry sentiment and pricing. Experts discuss the shifting demand landscape, noting the slowdown from removed...

By Commodities Focus

Podcast•Feb 13, 2026•24 min

Global FX: How Much Is Too Much?

In this episode, J.P. Morgan Global Research analysts Arindam Sandilya, James Nelligan, and Patrick Locke examine the current foreign‑exchange (FX) outlook, focusing on how recent US equity stress and the relative underperformance of US stocks are influencing currency markets. They...

By At Any Rate

News•Feb 13, 2026

Rubio Holds Joint Talks with Syria's FM and SDF Commander in Munich

U.S. Secretary of State Marco Rubio met Syrian Foreign Minister Asaad al‑Shibani and Kurdish‑led Syrian Democratic Forces commander Mazloum Kobane on the sidelines of the Munich Security Conference. The talks came two weeks after a Jan. 30 cease‑fire that promises to...

By Al-Monitor – All

Social•Feb 13, 2026

Markets Trade Transition as Central Banks Hold Steady

Pauses aren’t pivots. Central banks are holding steady, but easing remains conditional. Inflation is cooler, labor is softer, yet not weak enough to confirm a recession. Markets are trading the transition, not the destination.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 13, 2026

Key Differences Between OFAC's New GL

This is actually the best way to describe the difference between GL 49 and GL 50 (the two Venezuela-related General Licenses issued by OFAC today)

By Rory Johnston

News•Feb 13, 2026

Lithuania Could Break EU Ranks Over Critical Minerals Deal

Lithuania warned it may negotiate a stand‑alone critical minerals agreement with the United States if the European Union fails to deliver a bloc‑wide pact promptly. The move aims to secure rare‑earths, battery metals and other strategic inputs for its defense...

By OilPrice.com – Main

Social•Feb 13, 2026

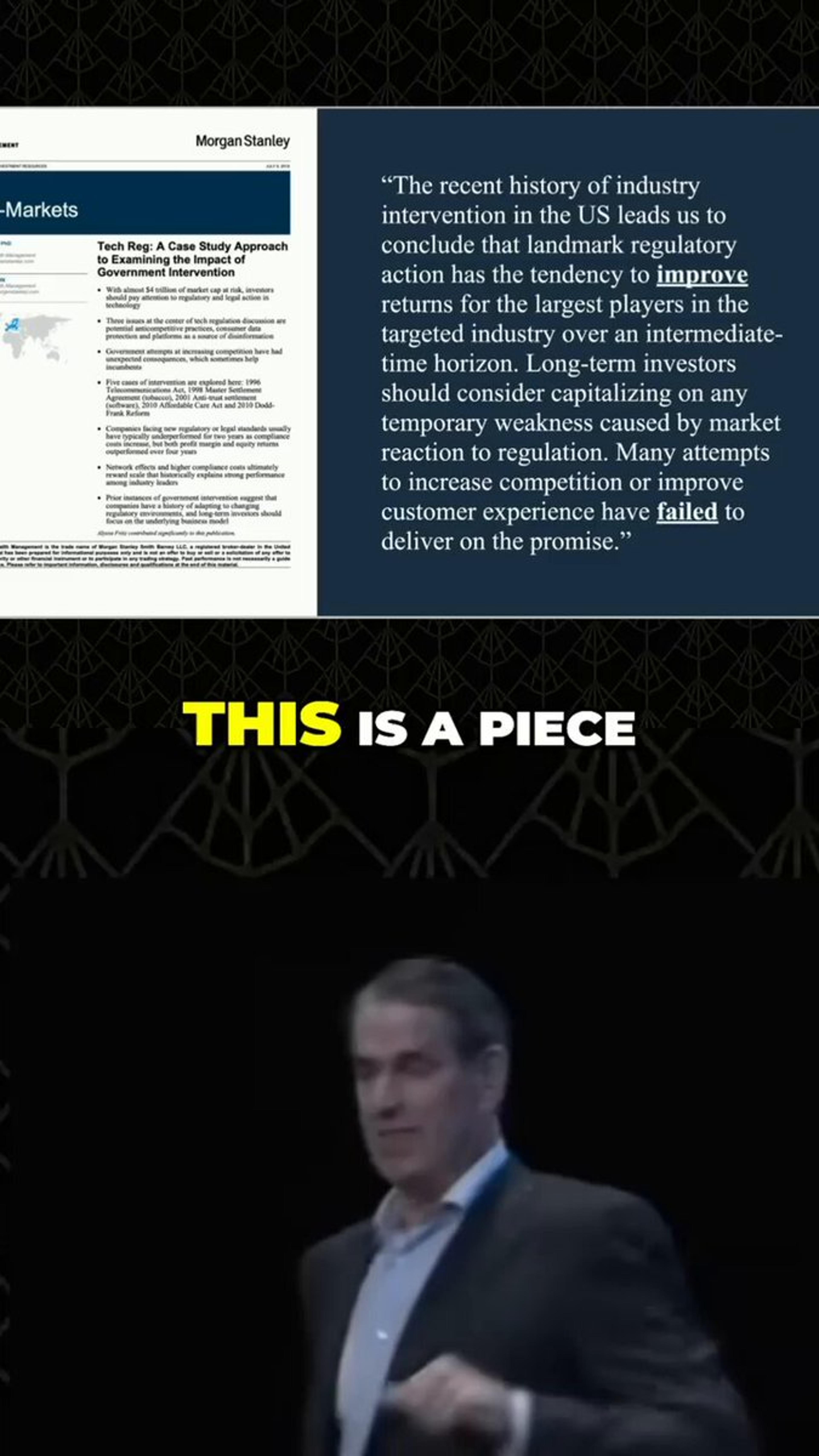

Regulation Entrenches Incumbents, Stifling Innovation and Growth

Why is the mkt so centralized? Well, only megacorps survive the red tape & regulatory fees. “Regulation favors the incumbent” Most scaled companies extract value instead of innovate. They use short-vol strategies that extract from the middle class instead of grow...

By Tyler Neville

Social•Feb 13, 2026

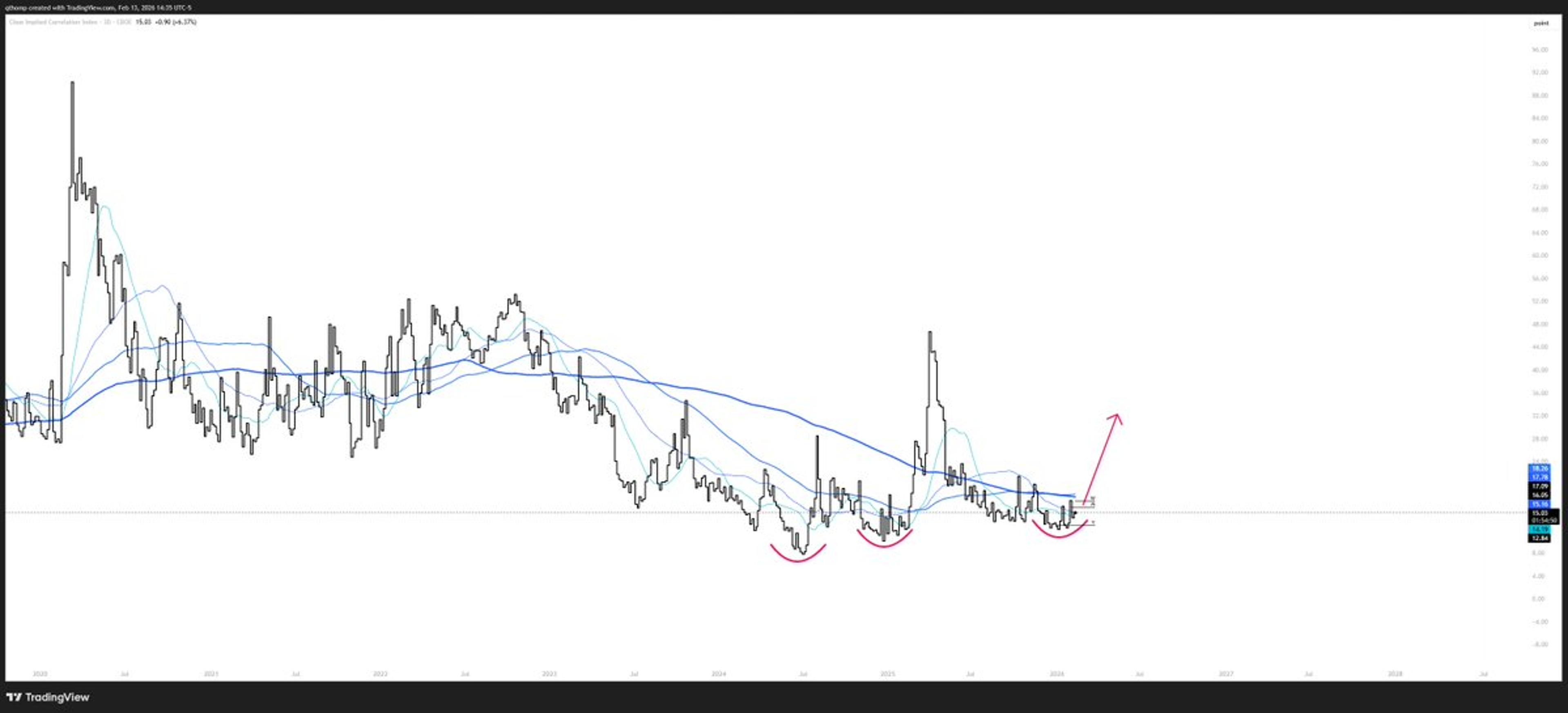

CPI Slowdown Fuels Falling Yields, Bullish Duration, Utilities, Gold

Post Hedgeye's Nowcast nailing another decel in CPI Growth decelerates → yields fall → correlations re-assert That’s the whole #Quad3 playbook ✔️ Duration bullish ✔️ Utilities work ✔️ Gold works ❌ Financials don’t

By Keith McCullough

News•Feb 13, 2026

Russia to Build 10 More Icebreakers and 46 Salvage Vessels to Develop NSR

Russia announced a second phase of Northern Sea Route development, planning to build ten additional nuclear icebreakers and 46 salvage vessels by 2035, supported by three new Arctic rescue‑fleet bases. The current fleet includes eight nuclear icebreakers, with the latest...

By The Maritime Executive

Social•Feb 13, 2026

Danny Moses Show Returns: Economy, AI, Markets Forecast

The Danny Moses Show returns tonight @scrippsnews at 7PM sponsored by @Kalshi. Great to have @pboockvar join me & we talk about the global & U.S. economy, A.I. stocks/bonds, commodities, the consumer, #FED, Private Credit & make some @Kalshi predictions... https://t.co/vQGLUQMHUc...

By Danny Moses

News•Feb 13, 2026

Health Cover to Be Bundled with Pension Schemes, Says PFRDA Chief

India’s PFRDA is piloting pension plans that bundle health insurance, allowing up to 30% of the retirement corpus to be earmarked for medical expenses. ICICI, Axis and Tata‑backed funds are testing the “Swasthya” product, which could leverage pooled investors to...

By The Hindu Business Line – All

Blog•Feb 13, 2026

Trade Tips From Washington DC

Ashraf Laidi notes recent Trump administration comments that imply a deliberately weaker US dollar ahead of today’s non‑farm payroll (NFP) release. He suggests the labor data could fall far short of the 68,000 consensus, echoing a pattern of "benign neglect"...

By Ashraf Laidi – Intraday Market Thoughts

News•Feb 13, 2026

U.S. Rig Count Holds Steady as Oil Drilling Slips and Gas Activity Climbs

The U.S. rig count held steady at 551 this week, with oil rigs slipping by three to 409 while gas rigs rose by three to 133. Crude output climbed to 13.713 million barrels per day, edging close to an all‑time high....

By OilPrice.com – Main

News•Feb 13, 2026

Carbon — In Focus: EU ETS in Political Crosshairs

Political scrutiny of the EU emissions trading system intensified in mid‑February, pushing the front‑year EU ETS contract down almost 6% on Feb 5 and a further 7% after German Chancellor Friedrich Merz’s comments. EU officials denied reports of extending free‑allowance allocations beyond...

By Argus Media – News

Social•Feb 13, 2026

Assume BRICS' USD‑bypass Plans Are Real; Doubt USD Stability

Remember, every utterance from BRICS & Global South regarding potential new system to bypass USD is to be treated as if already operational & making material difference. And every piece of evidence that USD system isnt going anywhere is to be...

By Brent Johnson

Blog•Feb 13, 2026

Labour MP Calls for NATO ‘Neighbourhood’ Model for Decisions

Labour MP Graeme Downie argues NATO’s consensus‑based decision‑making is too slow for modern crises. He proposes a “neighbourhood” model that empowers regional allies, especially those closest to a theatre, to act quickly. Downie cites the UK’s anti‑submarine capabilities in the...

By UK Defence Journal

News•Feb 13, 2026

Zelenskiy Meets Iranian Opposition Figure Pahlavi

Ukrainian President Volodymyr Zelenskiy met exiled Iranian opposition leader Reza Pahlavi on the sidelines of the Munich Security Conference. The two discussed the need to tighten sanctions on Iran and other authoritarian regimes, and jointly condemned the growing military cooperation between...

By Al-Monitor – All

News•Feb 13, 2026

One in Three French Car Manufacturing Jobs Was Lost in Dramatic 13-Year Decline

Employment in France’s automotive sector dropped from 425,500 in 2010 to 286,800 in 2023, a loss of nearly 139,000 jobs or 33 %. The decline was driven primarily by car manufacturers, which shed 46,000 positions, while parts suppliers lost 31.5 % of...

By Euronews – Business

Social•Feb 13, 2026

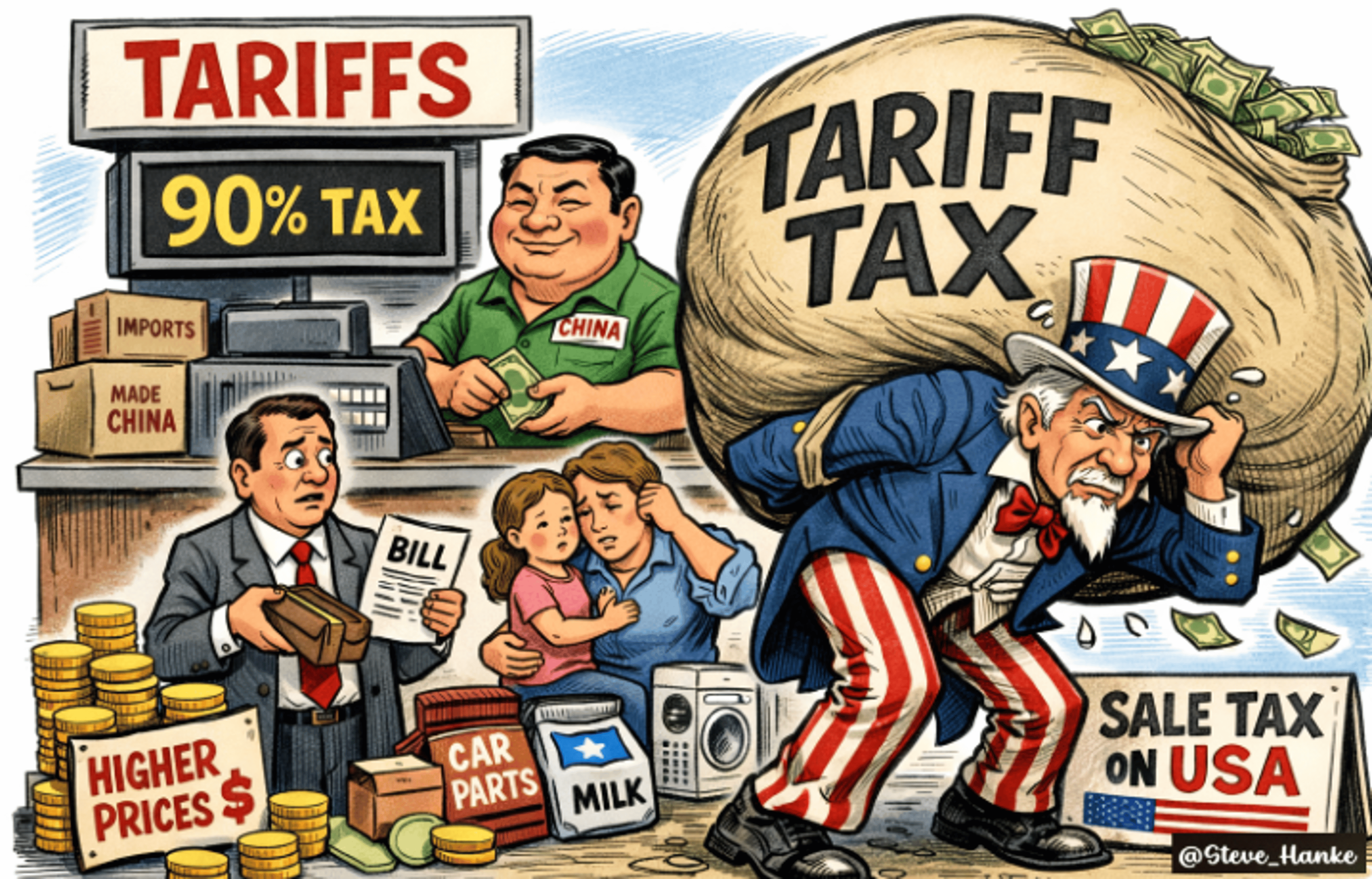

Americans Foot ~90% of Trump Tariff Costs

The New York Fed announced that US businesses and consumers paid NEARLY 90% of the cost of Donald Trump’s tariffs last year. TARIFFS = A SALES TAX ON AMERICANS. https://t.co/xEEfGxreUm

By Steve Hanke

Social•Feb 13, 2026

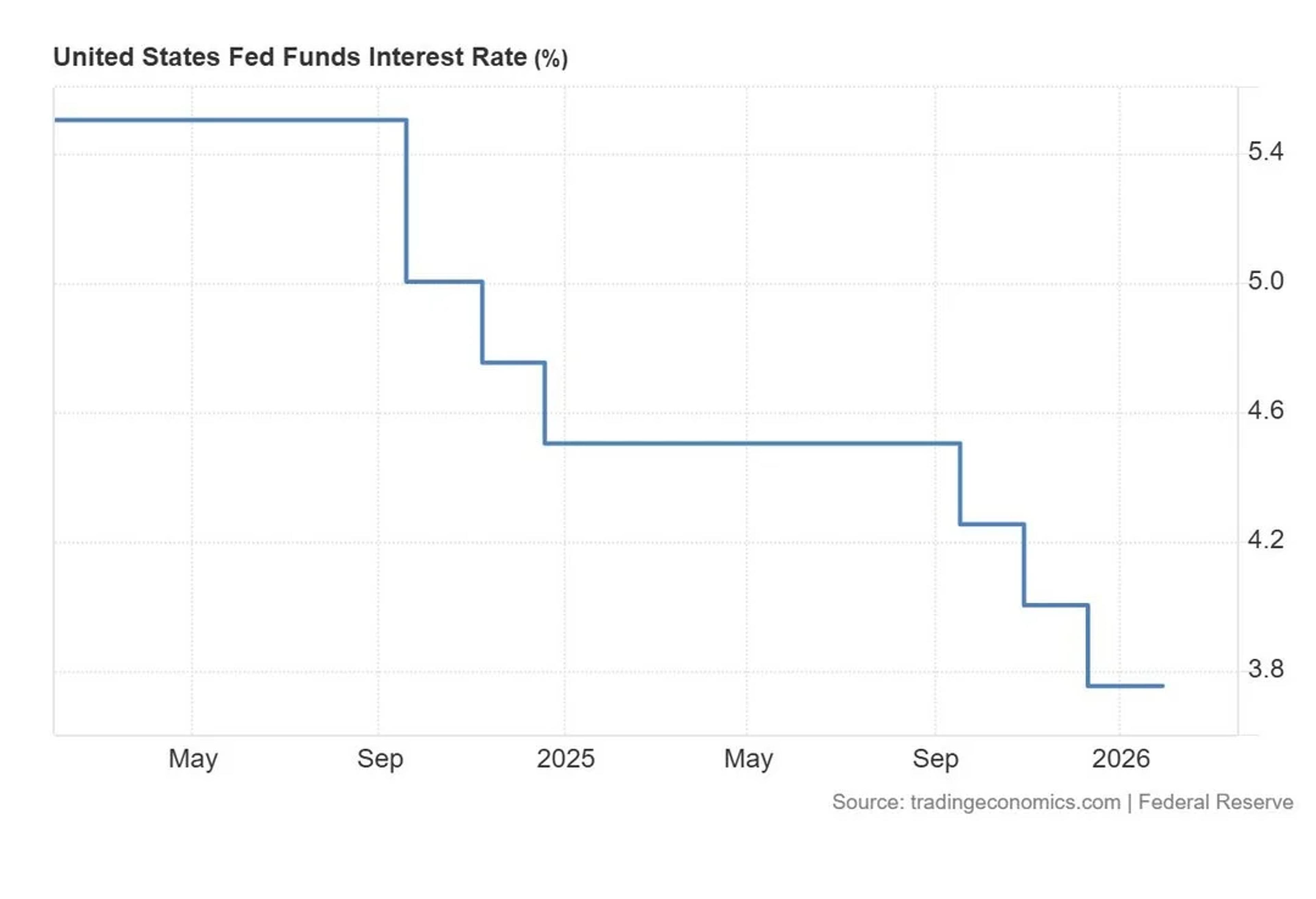

Market Prices Accelerating Fed Rate Cuts Through 2026

Notably, market-implied FOMC cuts through 2026 have been increasing. Through February, Fed Fund futures have priced in another -14bps of cuts for the year - and now the most dovish outlook after CPI since Dec 3rd: https://t.co/NZF2YksrWV

By John Kicklighter

News•Feb 13, 2026

TC Energy Tops Q4 Profit Estimate on Strong U.S. Natural Gas Demand

TC Energy reported fourth‑quarter earnings per share of US $0.72, beating the consensus estimate of $0.68, driven by record natural‑gas deliveries in both the United States and Canada. U.S. pipeline flows rose 9.5% YoY to 29.6 Bcf/d, while Canadian deliveries hit a...

By OilPrice.com – Main

Social•Feb 13, 2026

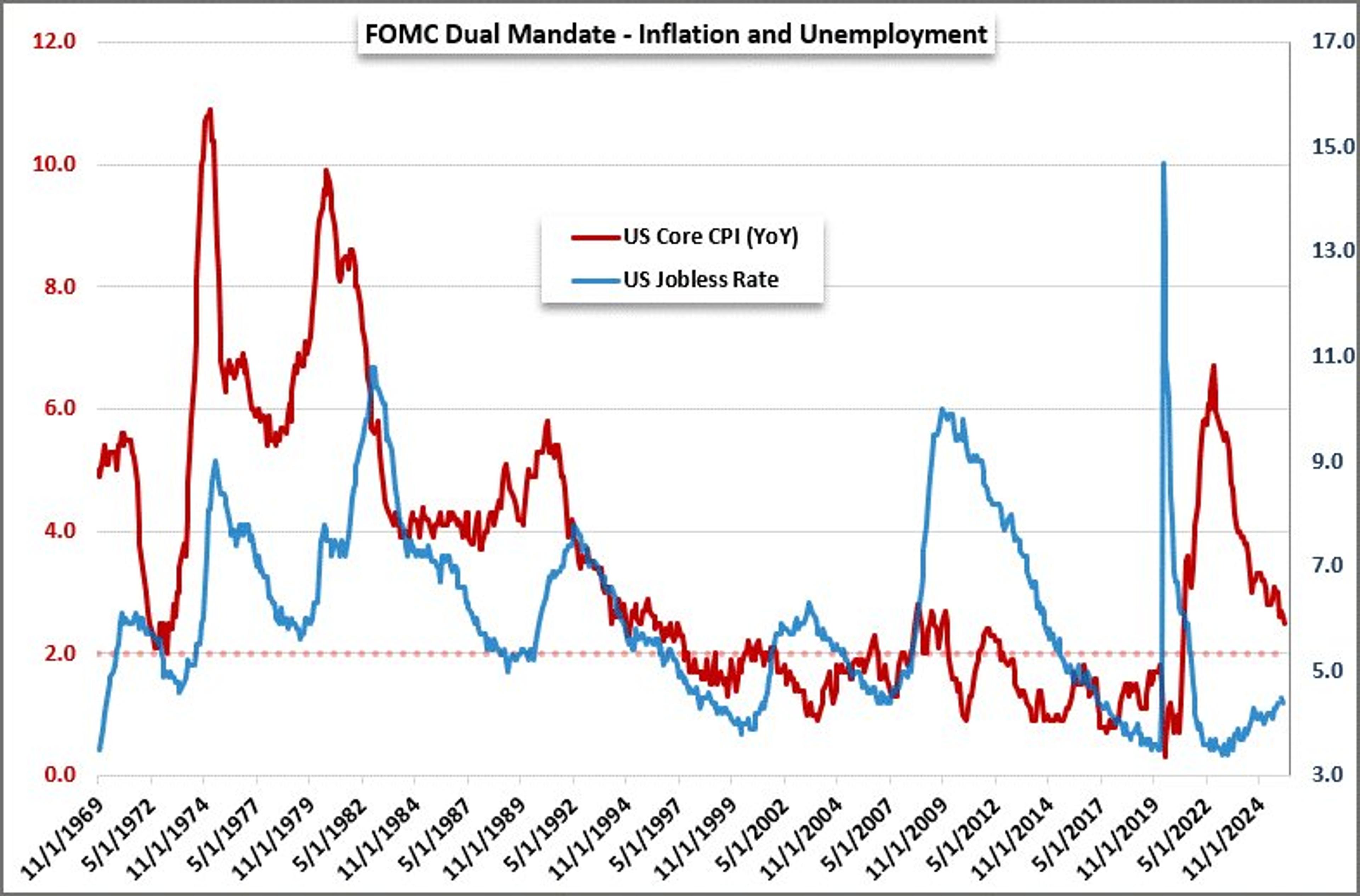

CPI Cools to 2.4%, Fed Eyes Jobs as Unemployment Falls

US #CPI inflation figures came in line with expectations of a pace cooling. Headline dropped from 2.7% to 2.4% while core eased 2.6% to 2.5%. This does shift priority towards employment in the Fed's dual mandate but the jobless rate...

By John Kicklighter

Social•Feb 13, 2026

AI‑driven Spending Masked Recession; Recovery Now Emerging

With this week's jobs revisions, my framework of a main street recession happening last spring that was papered over by large AI capex and top percentile income earners spending like mad makes more sense. And now IMO we're coming out the...

By Felix Jauvin

Podcast•Feb 13, 2026•7 min

European Rates: Scandinavian Rate Outlook – a Long Winter Hibernation

In this brief episode, J.P. Morgan analysts Francis Diamond and Frida Infante examine the current state and near‑term outlook for Swedish and Norwegian sovereign and corporate rate markets. They highlight that both countries are entering a prolonged period of low‑rate...

By At Any Rate

News•Feb 13, 2026

Pulse of the Street: Tech Rout, Muted Earnings Singe Indian Markets

Indian equities broke their recent rally as a broad technology sell‑off combined with mixed earnings commentary and profit‑taking pressured the benchmark indices. The IT sector led the decline, slipping sharply amid global chip‑maker weakness. Meanwhile, consumer‑focused stocks and a handful...

By Mint (LiveMint) – Markets

Social•Feb 13, 2026

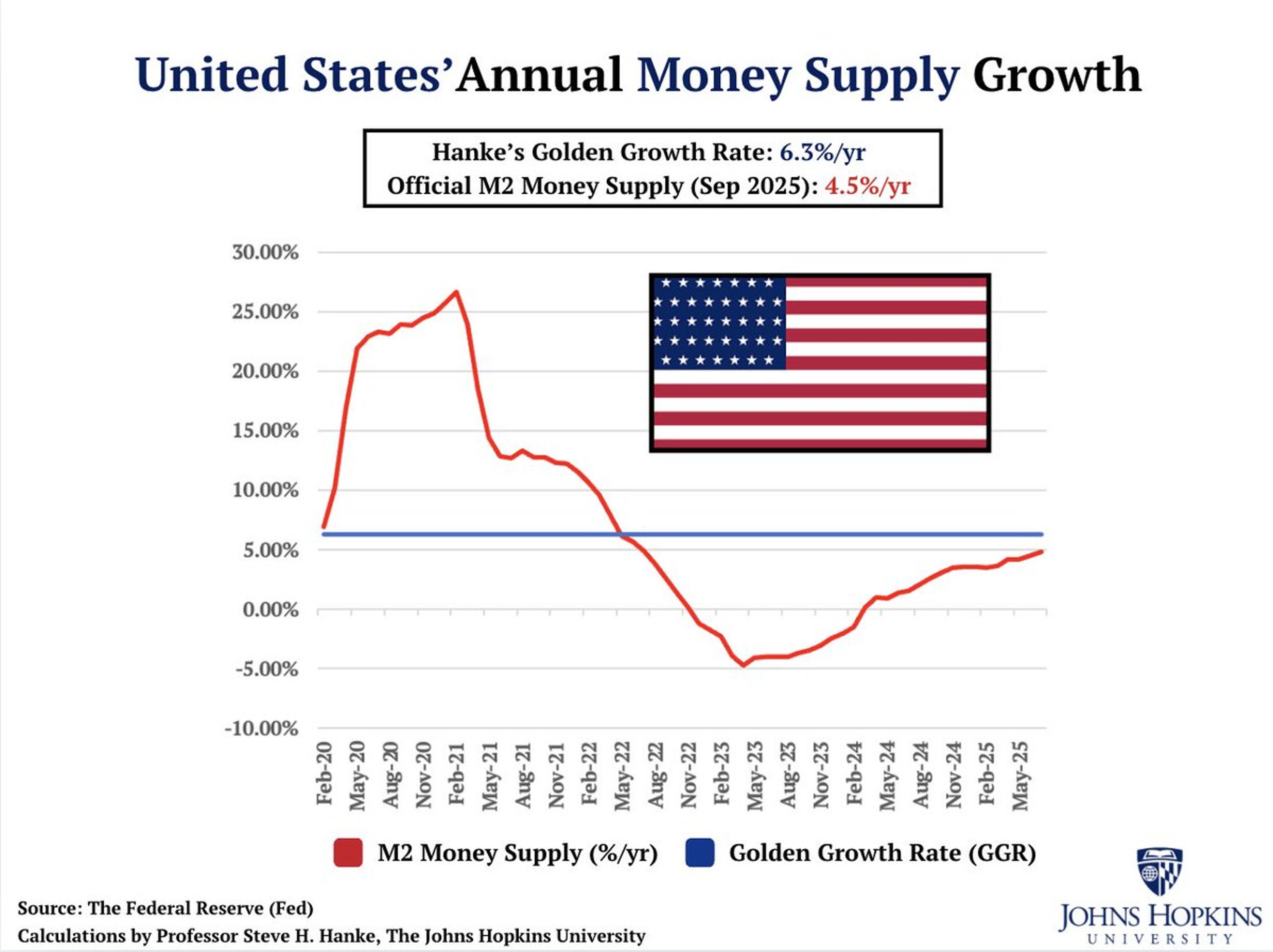

Inflation Stays Low as Money Supply Grows Below Golden Rate

US's CPI inflation rate comes in at 2.4%/yr in January. The US money supply (M2) has been growing BELOW Hanke's Golden Growth Rate of ~6.3%/yr, a rate consistent with hitting the Fed's 2%/yr inflation target, since April 2022. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 13, 2026

S&P Erases Almost All 2026 Gains Amid AI Hype

Forget Trump's AI HYPE. The S&P Index has now given up nearly all its 2026 gains. https://t.co/GAL0TbU7KG

By Steve Hanke

Blog•Feb 13, 2026

Bulgarian Central Bank Deputy Governor Appointed Prime Minister

President Iliana Iotova appointed suspended Bulgarian National Bank deputy governor Andrey Gurov as interim prime minister, invoking a constitutional rule that limits caretaker‑PM candidates to ten senior officials. Gurov’s selection follows an anti‑corruption finding that barred him from his central‑bank...

By Mostly Economics

Social•Feb 13, 2026

Bloomberg's Russia Dollar Rumor Likely Misleading, Says Hanke

Yesterday, Bloomberg reported that Russia is considering a re-entry into the US dollar system. Bloomberg's report created quite a stir. RELAX, HANKE'S 95% RULE = 95% OF WHAT YOU READ IN THE PRESS IS EITHER WRONG OR IRRELEVANT. https://t.co/8E7OK7Zm1t

By Steve Hanke

News•Feb 13, 2026

The Medical Device Industry: The Real Effects of Tariffs

The medical device sector is grappling with a wave of new and proposed tariffs that have lifted costs for metals, electronics, and finished components throughout global supply chains. Manufacturers must decide whether to absorb these higher expenses, pass them to...

By Medical Economics

Social•Feb 13, 2026

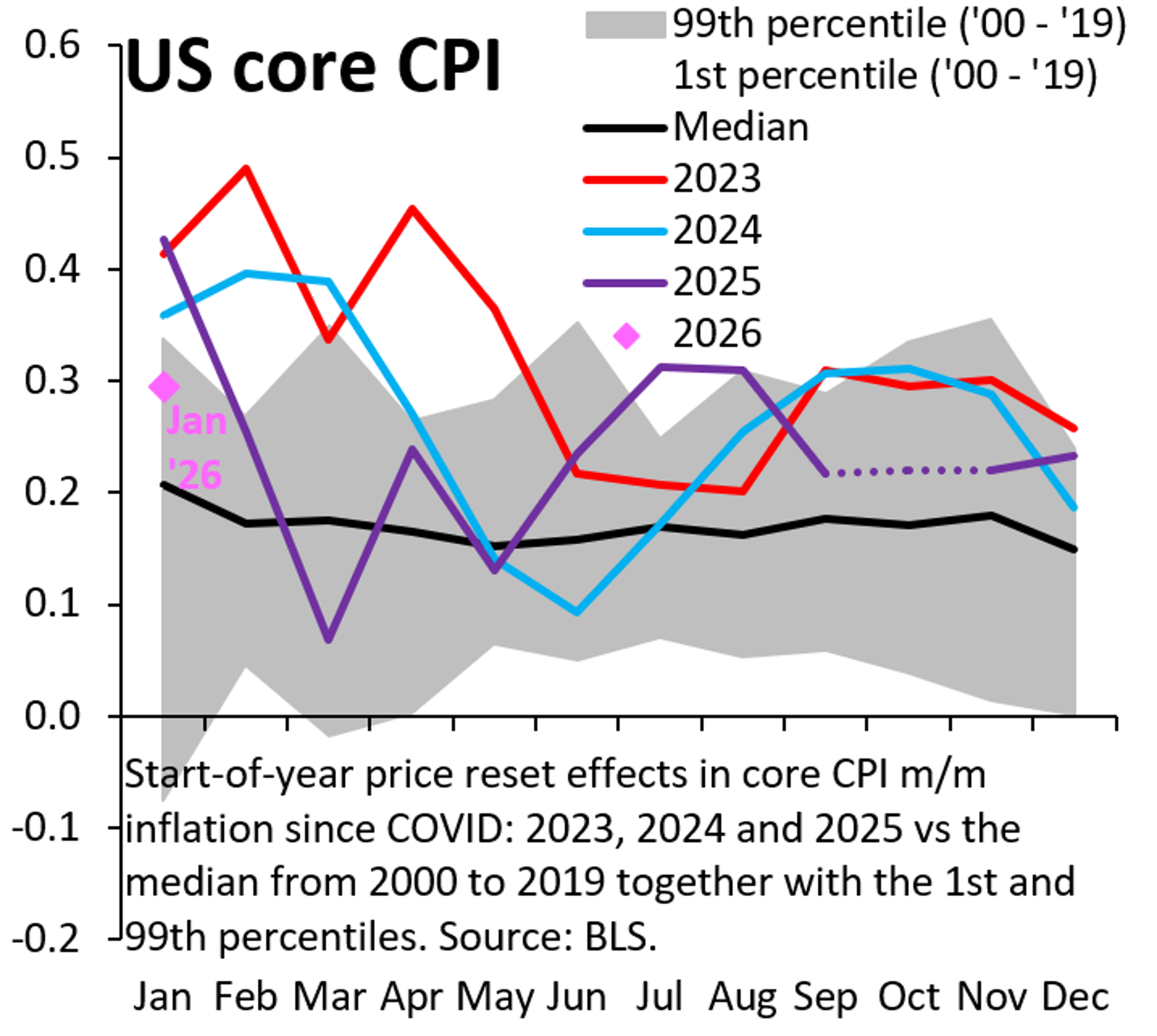

January 2026 Defies Post‑COVID Seasonal Inflation Surge

Ever since COVID, the start of the year has seen hot inflation prints, because residual seasonality pushed up inflation in the first quarter. That isn't the case in Jan. '26 and I think that holds a warning for those forecasting...

By Robin Brooks

News•Feb 13, 2026

THINK Ahead: Green Shoots or Just Weeds? What This Week’s Data Signals

Economists spot early signs of recovery in the US labor market, with private payrolls accelerating, yet underlying job quality remains thin. The Federal Reserve is expected to deliver two 25‑basis‑point cuts, likely in June and September, as inflation stays modest....

By ING — THINK Economics

Social•Feb 13, 2026

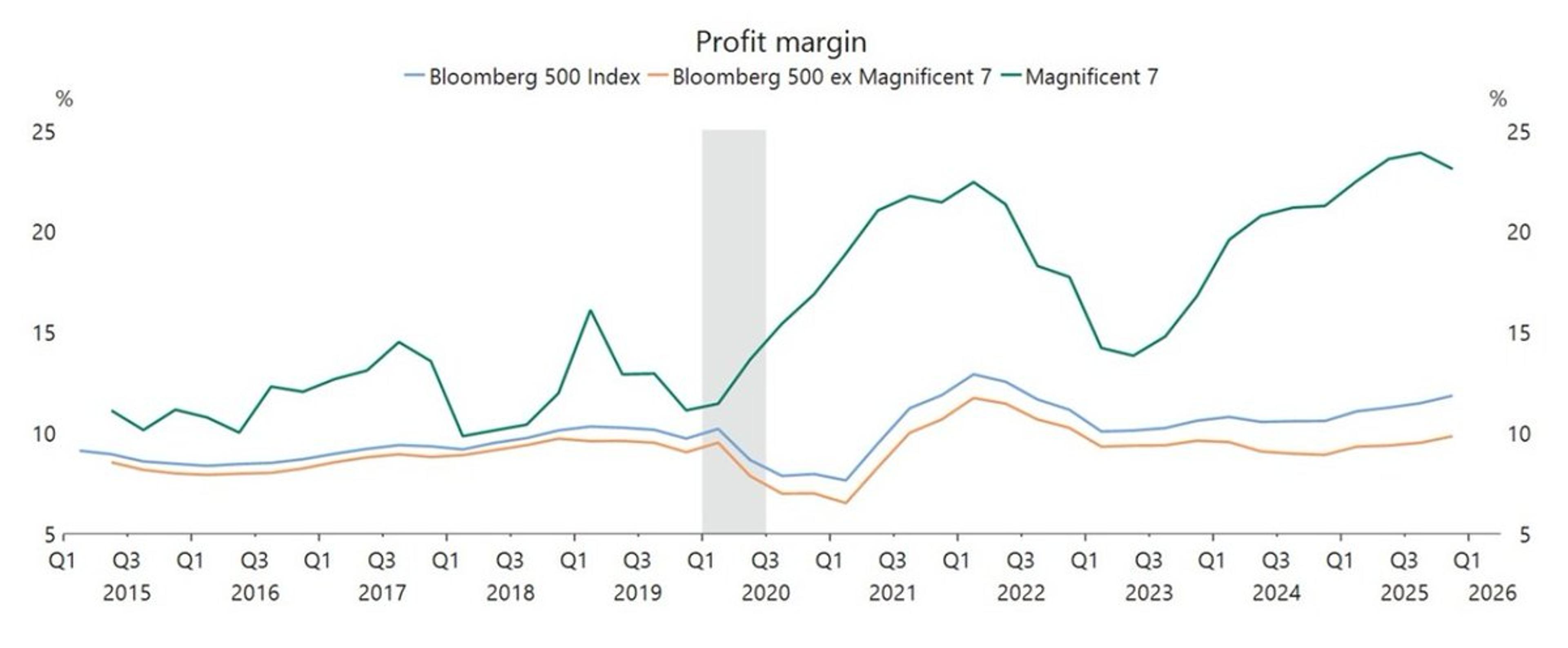

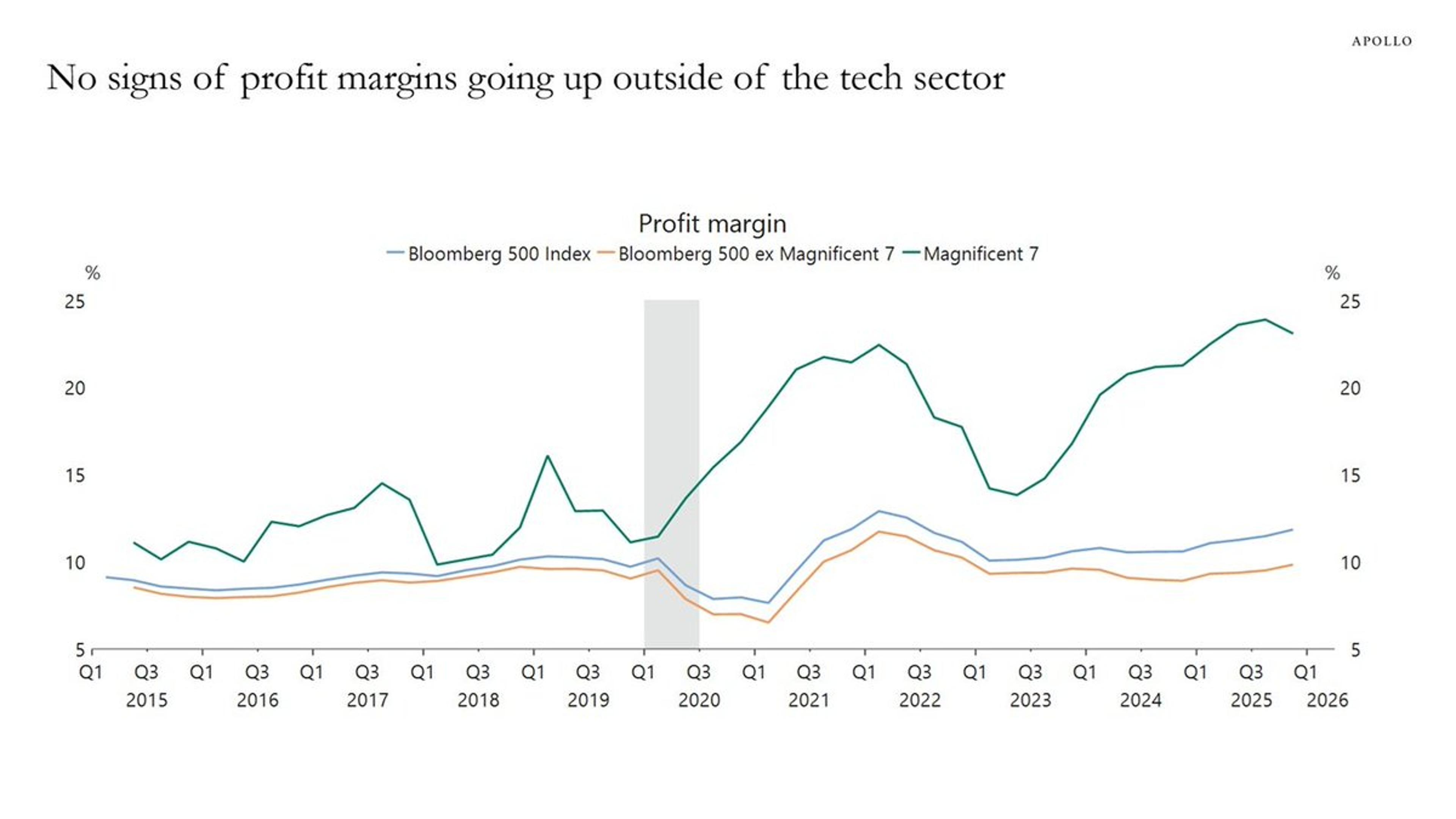

AI Hype Isn’t Boosting Profit Margins Across the Economy

If AI were living up to its hype, it would be benefiting the ENTIRE ECONOMY. IT ISN'T. Profit margins outside the tech sector would be growing. THEY'RE NOT. https://t.co/GXT1r783t0

By Steve Hanke

Social•Feb 13, 2026

Inflation Still Stubborn: CPI 2.8%, Core 3.2%

FWIW, since the first "clean" CPI in November (post shutdown), headline CPI inflation is 2.8% annualized and core is 3.2% annualized. Neither suggests much stepdown yet in underlying inflation.

By Greg Ip

News•Feb 13, 2026

US Inflation Details Offer Room for Deeper Fed Rate Cuts

U.S. consumer price inflation in January eased to 0.2% month‑on‑month, with core CPI matching expectations at 0.3% and both headline and core year‑on‑year rates falling to four‑year lows of 2.4% and 2.5%. Goods prices excluding food and energy were flat,...

By ING — THINK Economics

Social•Feb 13, 2026

Inflation Misses Again; Labor Market Holds Real Power

🚨 Inflation just missed expectations. Again - Dollar dumping - Gold buying the dip - Stocks pumping on rate cut hopes ⚠️ But don't get comfortable - the labor market is the real story https://t.co/hpBwuiWtK4

By Kathy Lien

Social•Feb 13, 2026

Political Gridlock Stalls $22B US EV Investment

"Last year companies canceled $22 billion in planned investments in electric vehicle manufacturing, batteries or critical minerals in the United States...." Political sustainability limits industrial policy efficacy. https://t.co/RROrBFwACq

By Adam Ozimek

Social•Feb 13, 2026

No Evidence BLS Data Manipulation; Accusations Hinder Discourse

There is ZERO evidence that the Bureau of Labor Statistics is manipulating the data, not the CPI, not payrolls earlier this week. I am not being naive and people are watching carefully for signs of tampering. Such accusations now are harmful...

By Claudia Sahm

Social•Feb 13, 2026

AI Spending Lifts some Assets, Hurts Major Stock Valuations

The AI capex boom is absolutely stimulative to *certain* assets in the ecosystem and supply chain, but that won't be Mag7 stock prices from here. Revenue growth is slowing, input prices rising and you can connect the dots on what...

By Quinn Thompson

Social•Feb 13, 2026

Banks' Inflation Forecasts Politicized, Yield Soft Surprises

Another SOFT inflation surrpise... It has become a bit of a theme, and we are increasingly convinced that inflation forecasting has become a "politicized arena" within banks, given how incredibly stubborn they have been in their wrong lean on this.

By Andreas Steno Larsen