🎯Today's Global Economy Pulse

Updated 2h agoWhat's happening: US growth stalls to 1.4% annualized in Q4 2025 amid fiscal gridlock

The U.S. economy expanded at a 1.4% annualized rate in the fourth quarter of 2025, roughly half of analysts' expectations and the slowest pace since early 2024. The deceleration follows a 4.4% surge in the prior quarter and coincides with heightened legislative gridlock over fiscal policy and the debt ceiling.

News•Feb 16, 2026

Why Chevron Is Betting Big on Venezuela’s Heavy Crude

Chevron is aggressively expanding its Venezuelan heavy‑crude production to feed its complex Gulf Coast refineries, which are optimized for dense, sulfur‑rich oil. Global supplies of such crude have tightened as Mexican exports fall, Russian barrels are sanctioned, and Canadian logistics strain. Chevron’s long‑standing Treasury‑licensed presence in Venezuela gives it a low‑cost upstream source that it can refine internally, capturing value across the supply chain. This vertical integration is boosting the company’s margins and its stock has risen over 20% YTD.

By OilPrice.com – Main

News•Feb 16, 2026

Niger Stockpiled 1,000t of Yellowcake at Military Base: FT

Niger's military government moved roughly 1,000 tonnes of uranium concentrate, known as yellowcake, to Air Base 101 near Niamey after seizing the Orano‑run mine. The stockpile remains unsold, with potential buyers from Russia, China, the United States and the UAE...

By MINING.com – Gold

News•Feb 16, 2026

Letters to the Editor Dated February 16, 2026

The Hindu BusinessLine letters highlight three regulatory concerns. First, they argue that the credit‑deposit ratio alone cannot gauge bank health and call for abolishing the Cash Reserve Ratio to improve deposit mobilisation amid RBI’s new risk‑based insurance premiums. Second, they...

By The Hindu Business Line – All

News•Feb 16, 2026

Keir Starmer Urges Faster Defence Spending Push Amid Russia Threat

UK Prime Minister Keir Starmer urged a faster acceleration of defence spending, citing the growing Russian threat. Britain currently spends 2.3% of GDP on defence, above NATO’s 2% guideline, and plans to reach 2.5% by 2027 and 3% by the...

By BusinessLIVE (South Africa) – RSS hub

News•Feb 16, 2026

Exporters Upbeat on Growth This Year

The Philippine Exporters Confederation (Philexport) is confident that export growth will accelerate this year, buoyed by the active Philippines‑South Korea free‑trade agreement and several pending deals. Preliminary data show 2025 merchandise exports reached $84.41 billion, a 15.2% increase over 2024 and...

By Philstar – Business

News•Feb 16, 2026

The Quiet Architect of Trump’s Global Trade War

Jamieson Greer, a low‑key lawyer turned U.S. Trade Representative, has become the chief architect of President Trump’s renewed global trade war. Since his appointment in early 2025, Greer has designed aggressive tariff structures and led negotiations with major trading partners,...

By The New York Times – Business

News•Feb 16, 2026

US Manufacturing Pipeline Grows, Firms Plan $1B in New Factories

A wave of new manufacturing projects across the United States is driving roughly $1 billion in capital spending, spanning heavy equipment, advanced electronics, automation and industrial components. Companies such as John Deere, Rockwell Automation, and Applied Optoelectronics are breaking ground on...

By FreightWaves

News•Feb 16, 2026

Munich Security Conference. What Was Said About Russia?

The Munich Security Conference highlighted growing diplomatic leverage for Russia, with EU foreign policy chief Kaja Kallas warning that Moscow may gain more at the negotiating table than on the battlefield. U.S. Senator Marco Rubio expressed uncertainty about Russia’s willingness...

By Defence24 (Poland)

Social•Feb 16, 2026

US Growth Decouples From Jobs, Entering Uncharted Territory

Via the Financial Times: My thoughts on why US "jobless growth" may have entered uncharted territory. The decoupling of US growth from employment looks more persistent—and consequential—than the three previous episodes we've seen over the last 40 years: https://www.ft.com/content/298a38bb-4cc1-44f3-bd62-6aff25d58b94 #economy #jobs #employment #unemployment #growth...

By Mohamed El‑Erian

News•Feb 16, 2026

Republicans and Democrats Unite to Condemn Trump’s Attacks on Allies

At the Munich Security Conference, both Republicans and Democrats openly condemned President Donald Trump’s tariff agenda, unpredictable foreign‑policy moves, and his claim over Greenland. High‑profile figures such as Hillary Clinton, Governor Gavin Newsom, Senator Elissa Slotkin and Rep. Alexandria Ocasio‑Cortez...

By The Guardian – UK Defence

News•Feb 16, 2026

Startup Nation: What It Really Takes to Build a Resilient Innovation Hub

Governments are seeking ways to build startup ecosystems that can grow even during geopolitical shocks, supply‑chain disruptions, and economic volatility. The article argues that resilience—not branding or isolated reforms—is the key, using Silicon Valley’s ability to compress, recalibrate, and accelerate...

By Startups Magazine

News•Feb 16, 2026

Japan's Economy Barely Grows in Oct-Dec Quarter as Exports Slow

Japan’s economy grew a modest 0.2 percent annualised in the October‑December quarter, just enough to avoid a technical recession after a 0.7 percent contraction in the prior quarter. Private consumption rose 0.4 percent, but a 1.1 percent drop in exports dragged overall growth. The...

By Japan Today – Business

News•Feb 16, 2026

What Keeps Singapore’s Retail Growth Resilient?

Singapore’s retail sector has quietly outperformed expectations, delivering a 12.3% inflation‑adjusted sales increase over the past decade while the population grew 10.4%. Excluding automotive sales, non‑auto retail rose 11.8% since 2019, translating to a healthy 0.7% annual per‑capita gain. Mall...

By Inside Retail Australia

Social•Feb 16, 2026

Institutional Cash at Historic Low Triggers Global Sell Signal

🚨Global equities 'SELL SIGNAL' was triggered for the 7th month STRAIGHT: Institutional investors' cash as a share of assets fell to 3.2% in January, the lowest EVER. Cash allocations at or below 4% indicate a SELL SIGNAL for world stocks.👇 https://globalmarketsinvestor.beehiiv.com/p/us-stocks-ended-the-week-mixed-after-a-powerful-rebound-on-friday-weekly-market-recap-trading-week-0

By Global Markets Investor (newsletter author)

Social•Feb 16, 2026

Warsh May Threaten Fed Stability Despite Doubtful Capability

Good piece. Warsh would be a fundamental break from the Bernanke, Yellen, and Powell Feds if he carried out his views. Do I think he’s capable of pulling that off? Not really. Do I think he might try to and...

By Claudia Sahm

Blog•Feb 15, 2026

Unpacking the Latest Finance News From China: Key Trends and Market Insights

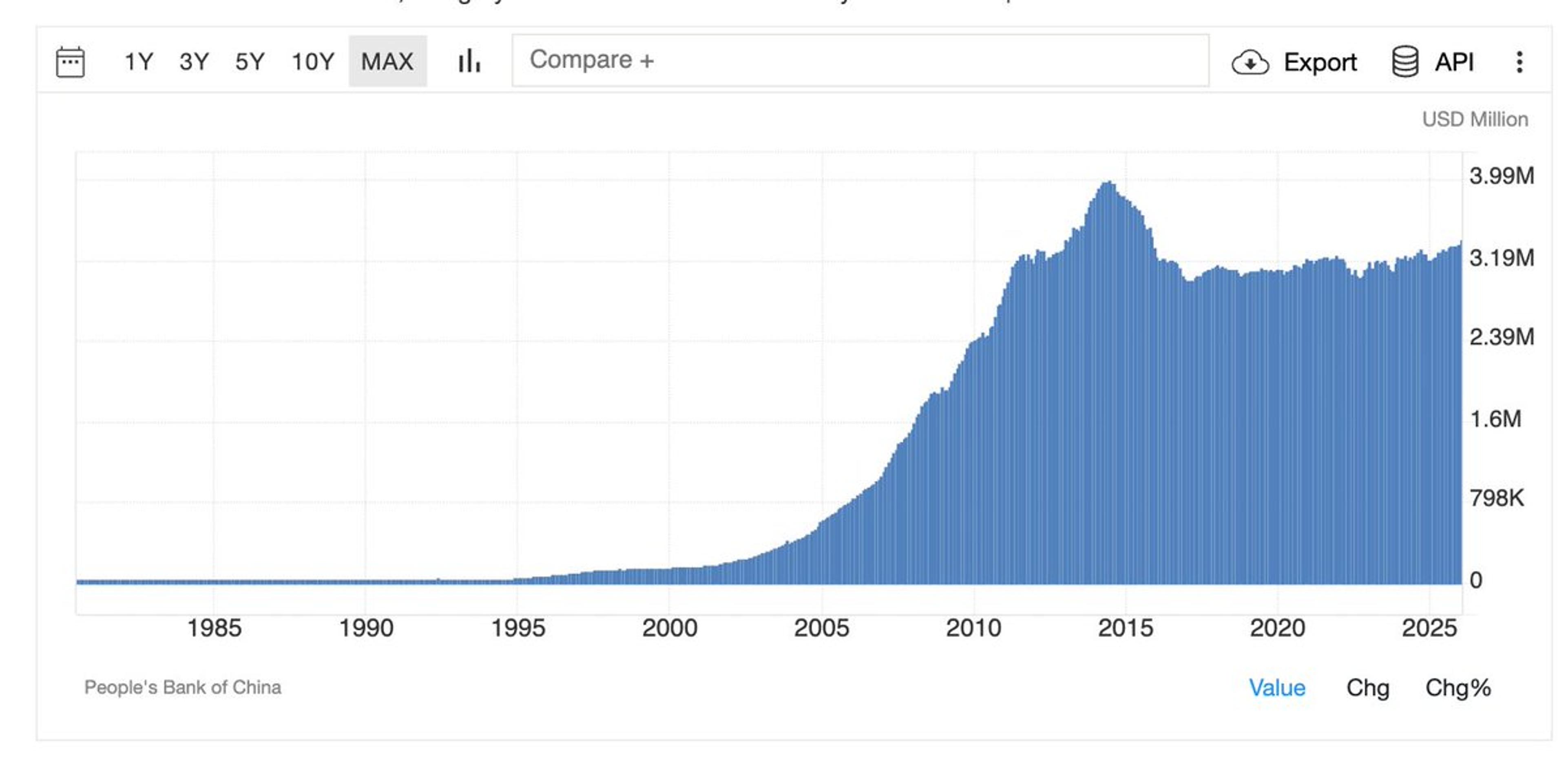

China’s latest five‑year plan emphasizes a shift from property‑driven growth to technology, targeting near‑5 % GDP expansion in 2026 and projecting tech to account for 18.3 % of output by 2026. The renminbi has appreciated past the 7.0 per dollar mark, indicating reduced central‑bank...

By HedgeThink

Social•Feb 16, 2026

Bears Dominate Oil Market Narrative After Energy Week

COLUMN: In the oil market, the bears control the narrative — at least for now. (My summary after last week's International Energy Week, the oil trading industry's annual jamboree in London) @Opinion https://t.co/Y3OHEhD4k5

By Javier Blas

Social•Feb 16, 2026

Macro Risk Memo Extends Beyond Crypto After BTC Drop

In January, we outlined a late-cycle restrictive regime and leaned cautious on risk. Since then, BTC has declined materially and leadership has narrowed. The February Macro Risk Memo expands the framework beyond crypto into broader macro. Now live: https://t.co/QKQMRbbeKi https://t.co/b0h9q5CS5C

By Benjamin Cowen

News•Feb 15, 2026

Trump, Netanyahu Back Plan for US Pressure on Iran to Cut Oil Sales to China, Agree to Go ‘Full Force’...

President Donald Trump and Israeli Prime Minister Benjamin Netanyahu have agreed to intensify economic pressure on Iran by targeting its oil exports to China, which account for more than 80% of Tehran’s sales. The coordinated effort is intended to force...

By Mint (India) – Economy

Social•Feb 16, 2026

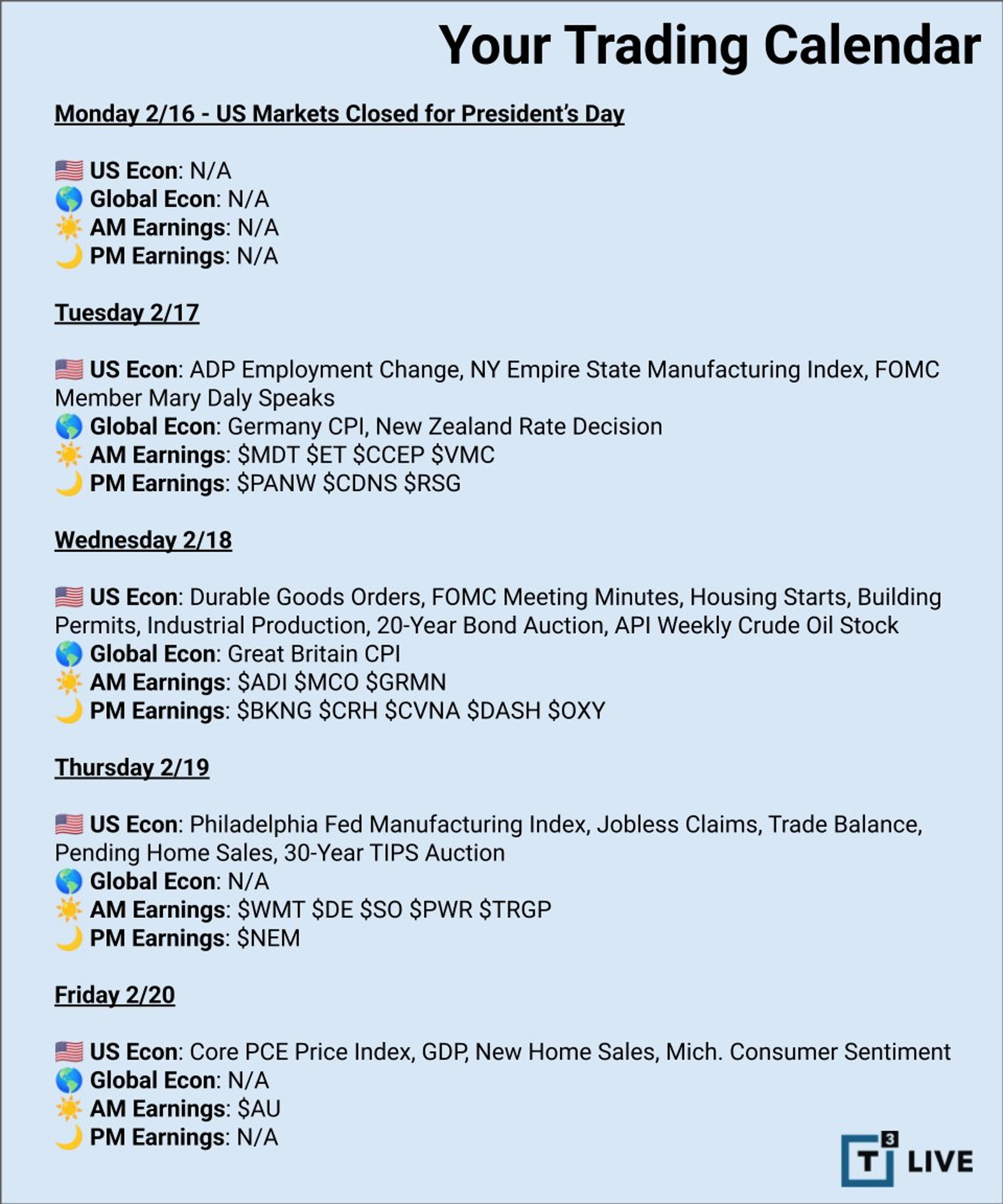

This Week's Macro Calendar Promises Major Market Volatility

🚨 KEY MACRO EVENTS TO WATCH THIS WEEK: Monday – U.S. markets closed for Presidents Day Wednesday – December Durable Goods Orders release and FOMC Meeting Minutes. Friday – December PCE Inflation data is released and 15% of S&P 500 companies are reporting...

By That Martini Guy

Social•Feb 16, 2026

Sheinbaum Halts Cuba Oil to Evade Trump Tariffs

Mexico's Sheinbaum is stopping oil flow to Cuba to dodge Trump’s tariff threat It risks backlash inside Morena’s pro-Cuba wing--her own party. https://t.co/A4rwOfLqHy #Mexico #Sheinbaum #Cuba #Morena #geopolitics #oil #sanctions #trade #tariffs #latam

By Art Berman Blog

News•Feb 14, 2026

China’s Ice and Snow Economy 2026: A 1 Trillion Yuan Winter Revolution

China’s ice and snow tourism sector surpassed 1 trillion yuan in 2025, a fourfold increase over the past decade. The industry is projected to reach 1.2 trillion yuan by 2027 and 1.5 trillion yuan by 2030, fueled by 360 million domestic winter trips generating...

By Travel And Tour World

Social•Feb 16, 2026

California's Gasoline Costs Rise From Bahamas Imports

California has to import US gasoline via Bahamas Refinery closures + no Gulf-to-CA pipelines + the Jones Act = a logistics tax https://t.co/3dGBI24oXI #gasoline #California #energy #refining #JonesAct #shipping #supplychain #oil #inflation #markets

By Art Berman Blog

Social•Feb 15, 2026

FOMC Minutes May Spark Q1 Market Shift

dailyanalysts 🚨 WEEK AHEAD ALERT: Feb 16-21 🚨 Three catalysts could define your portfolio's Q1. Markets closed Monday for Presidents' Day, but Tuesday through Friday is packed with market-moving data. S&P 500 is flat YTD. Nasdaq down 3%. Consumer confidence at DECADE LOWS. Here's...

By dailyanalysts

Social•Feb 15, 2026

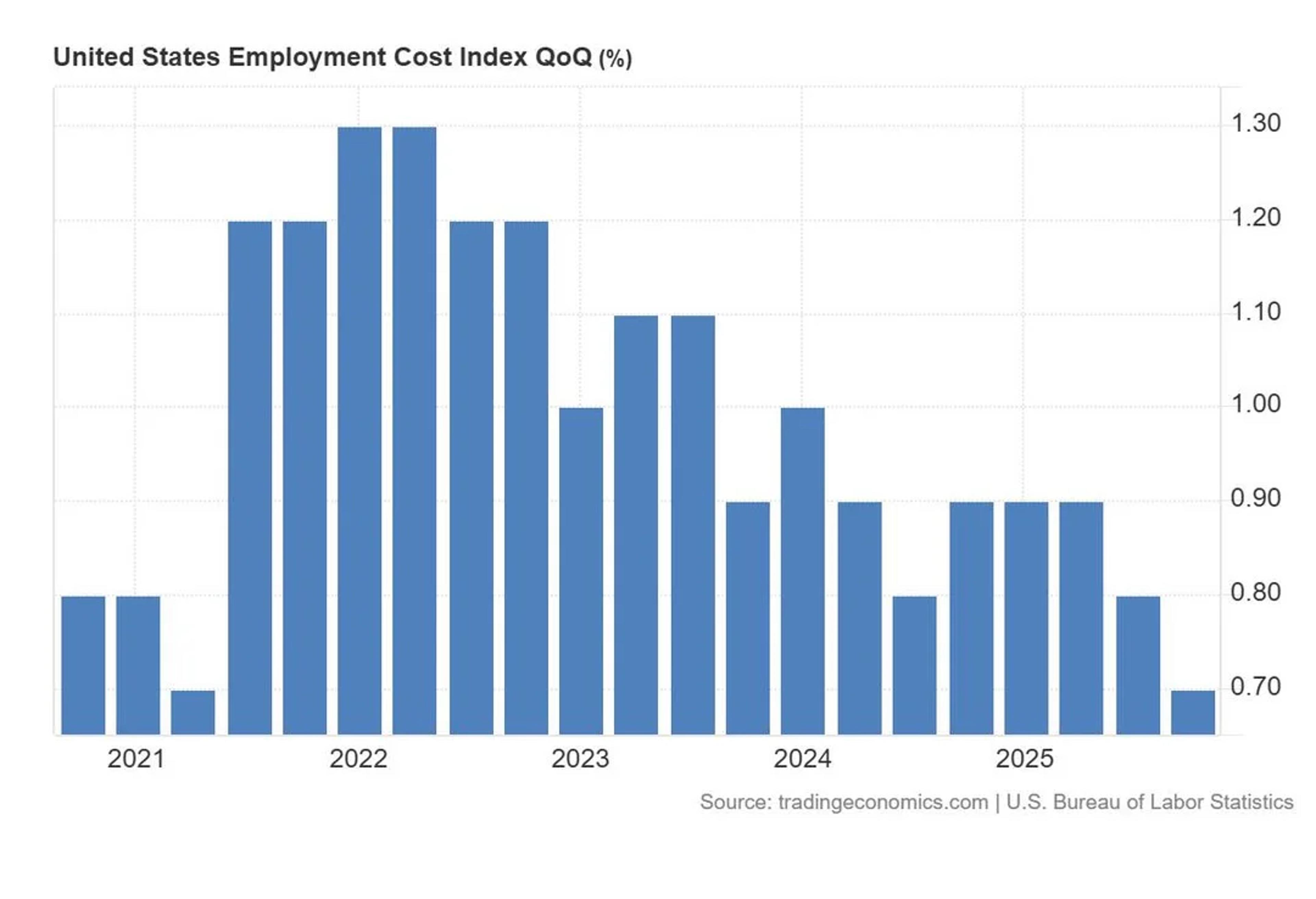

US Employment Costs Rise 0.7%, Lowest Since 2021

US employment costs rose 0.7% in the fourth quarter of 2025, just under forecasts of 0.8%, and the lowest level since Q2 2021.

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 15, 2026

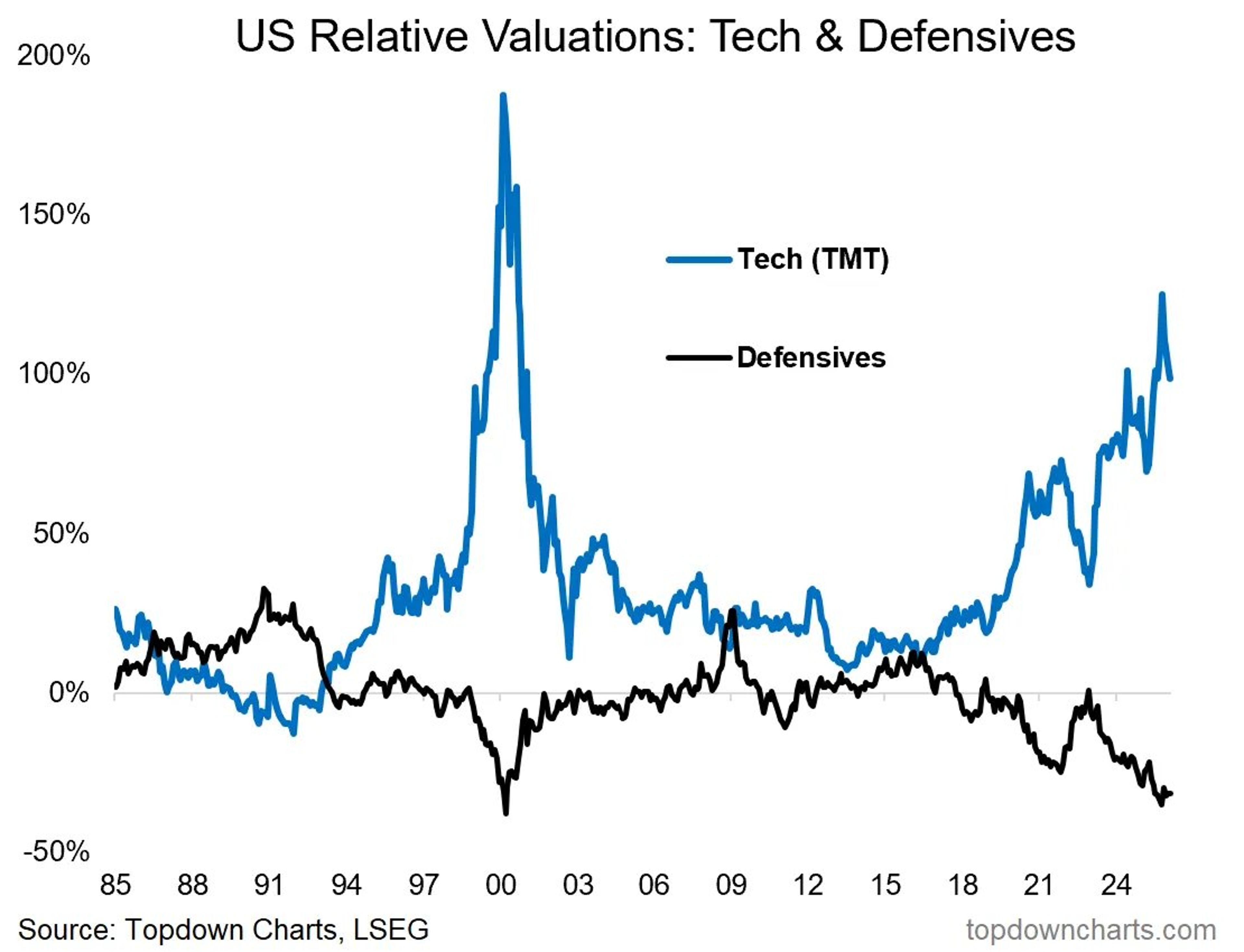

Tech Pressure Rises, Defensives Gain Amid Market Crossroads

Learnings and conclusions from this week’s charts: 1. Tech stocks (particularly software) remain under pressure. 2. Investor exposure to tech is at historically elevated levels. 3. Surging tech capex is coming at the cost of buybacks. 4. Private equity stocks are also coming under...

By Callum Thomas

Social•Feb 15, 2026

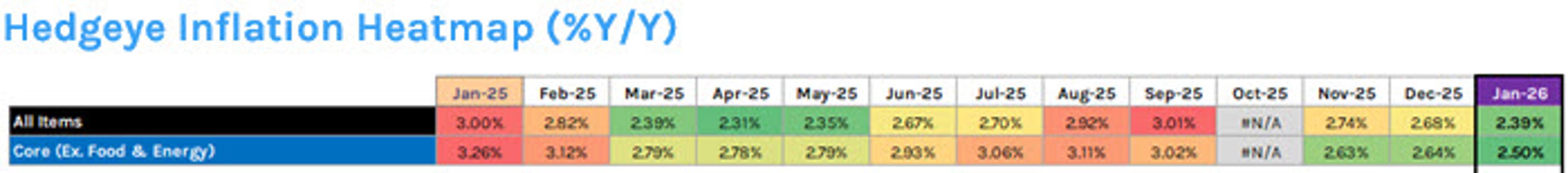

Hedgeye Nowcast Predicts Slowing Inflation, Yields Drop, Gold Rises

Hedgeye's Models vs. The Fed Reminder on the Hedgeye Nowcast for SLOWING US Inflation (which drove Bond Yields lower and Gold higher late this wk) Our monthly inflation nowcast is a weekly publication which augments our existing quarterly nowcast by offering a...

By Keith McCullough

Social•Feb 15, 2026

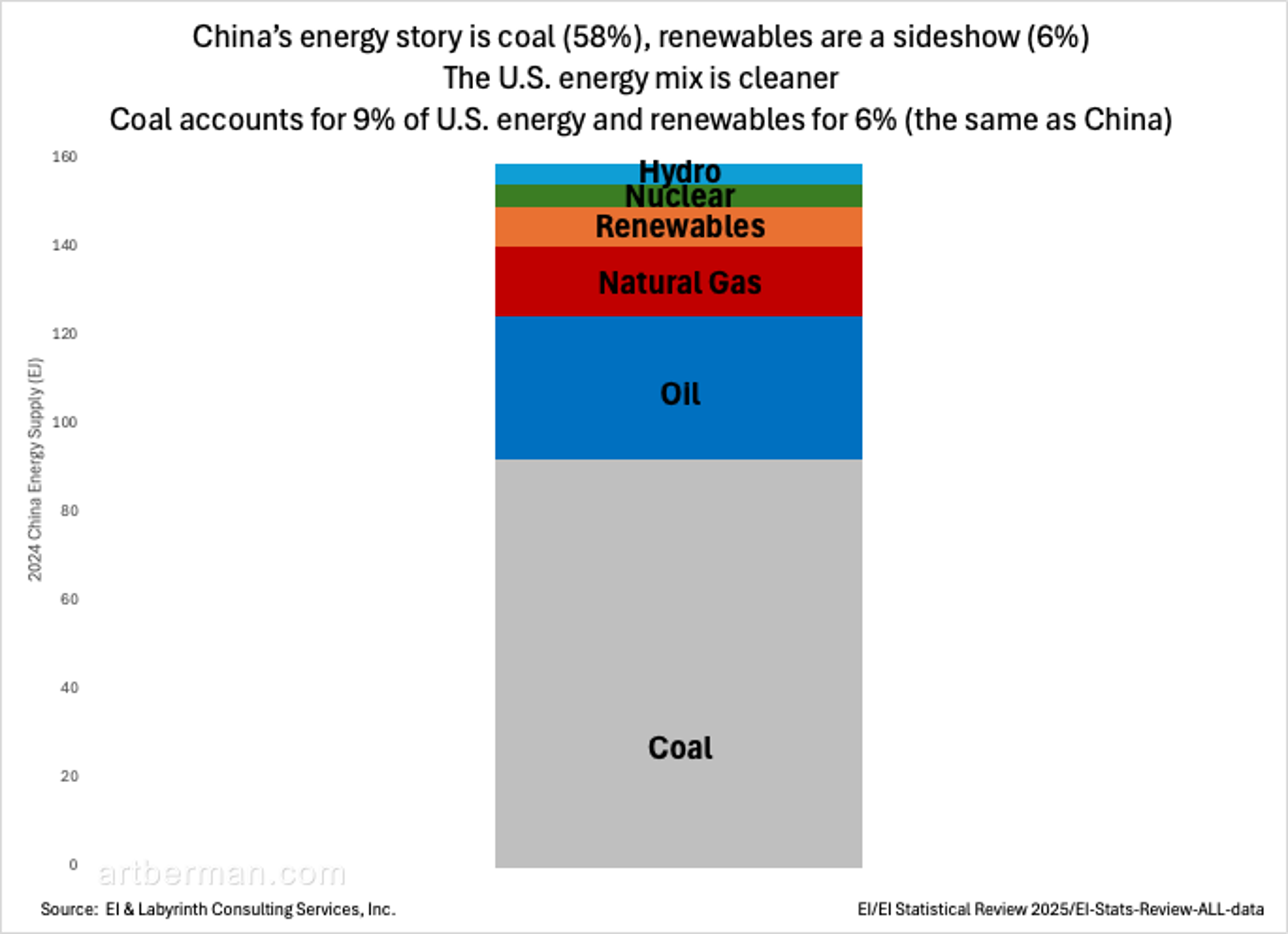

China’s Renewable Surge Fueled by Coal, Not Climate

Your green cheerleading misses the power politics @dominictsz China’s solar and wind boom is built on COAL, backed by COAL, and financed by COAL. It’s the world’s LARGEST CARBON EMITTER — and it’s not chasing climate virtue, it’s chasing energy...

By Art Berman Blog

Social•Feb 15, 2026

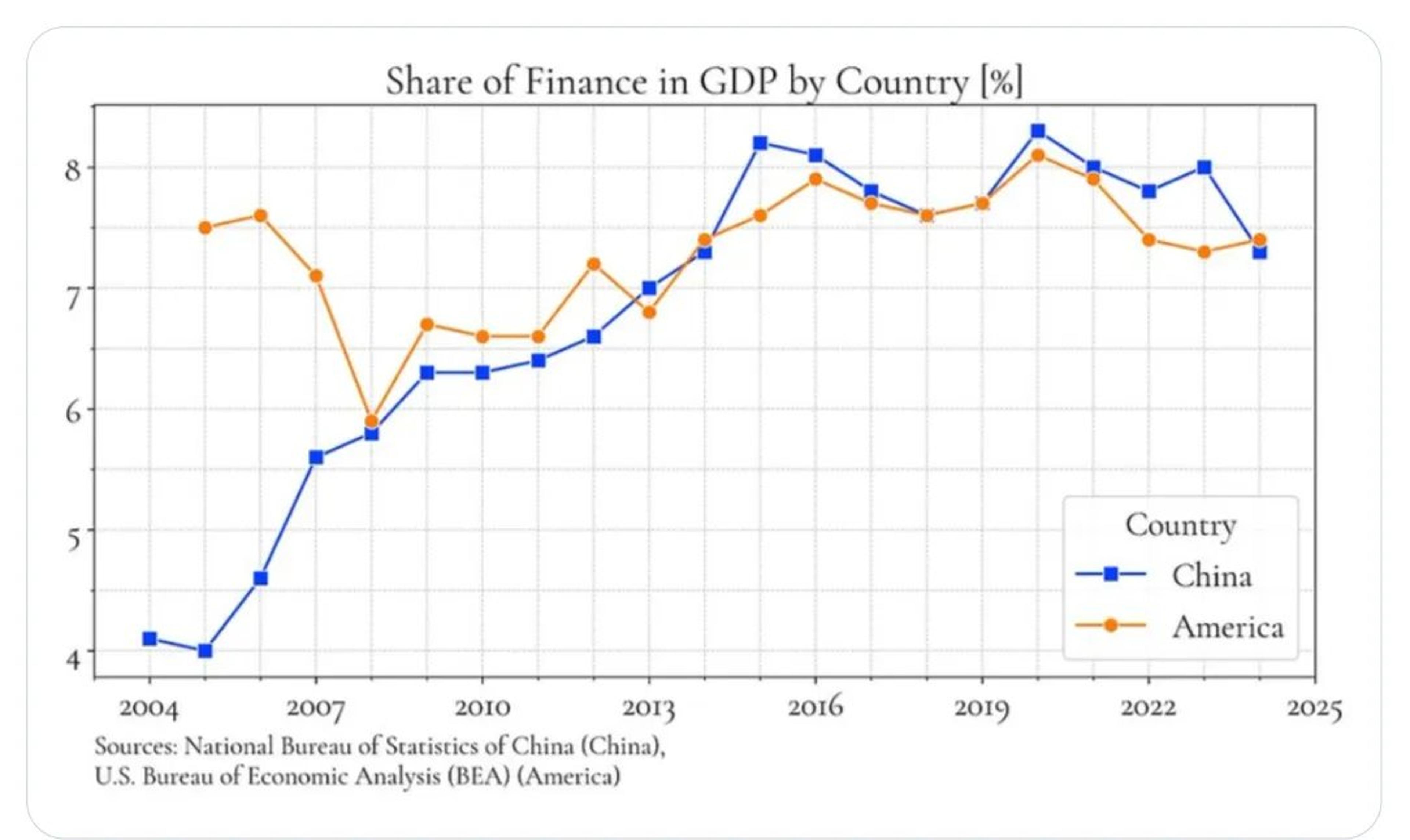

US‑China Gap Lies Beyond Financialization Share of GDP

Whatever the difference between the US and China may be and however you evaluate it, it isn’t in “financialization”, at least not as measured by the share of finance in GDP (h/t twitter account of devarbol for this graph). More...

By Adam Tooze

Social•Feb 15, 2026

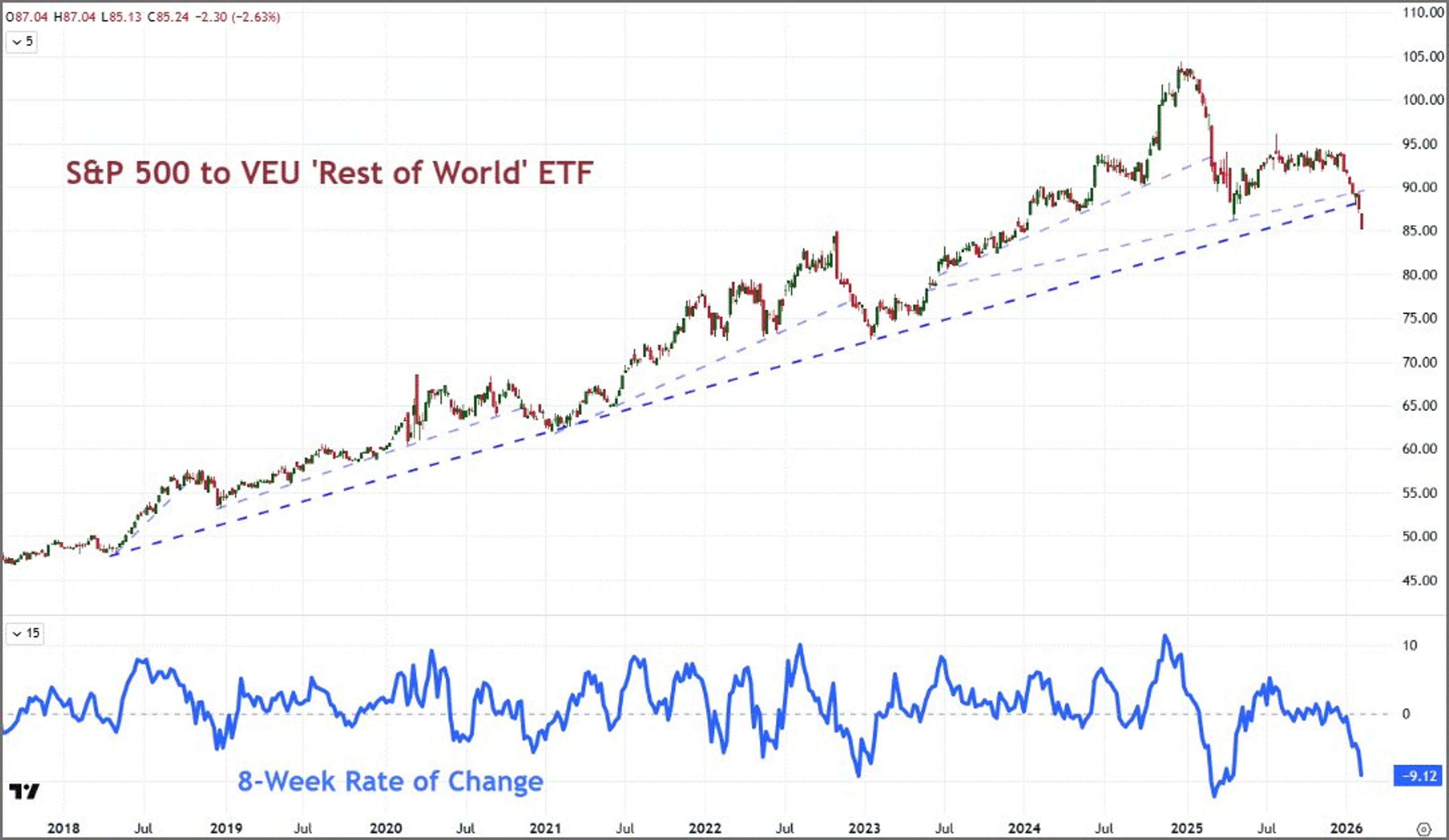

Volatility Rises, Liquidity Dips, US Premium Deflates

What's on tap for the week ahead? An increased frequency of volatility meets a holiday liquidity gap, while a run of event risk weighs in on the steadily deflating US premium. https://t.co/17IH2lFIn0 https://t.co/AlKhX25xxn

By John Kicklighter

Social•Feb 15, 2026

Cuba's Power Generation Falls Below Half Demand.

ENERGY CRISIS IN CUBA: Granma, the mouthpiece of the Cuban regime, says that electricity generation in the island is covering less than half the expected demand. The island is suffering the largest energy shortages since the collapse of the Soviet...

By Javier Blas

Social•Feb 15, 2026

Upcoming Week Packed with GDP, PCE, FOMC Insights

Get my newsletter Tuesday morning: https://t.co/dSU3TT2kZX Busy week coming with GDP, Core PCE, FOMC Minutes $PANW $ADI $WMT $DE https://t.co/7mNeUbi7R9

By Scott Redler

Social•Feb 15, 2026

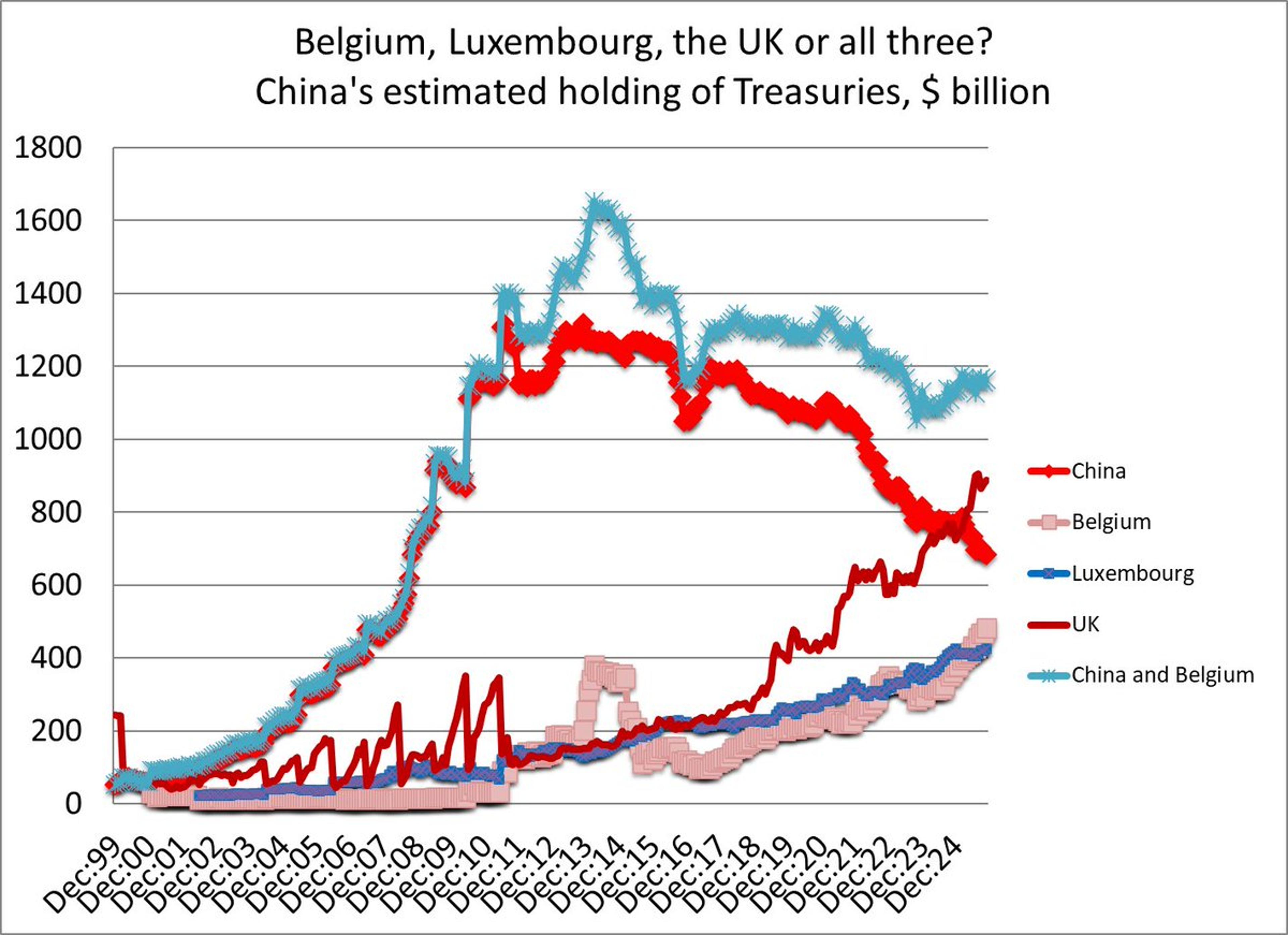

TIC Data Misses China’s Treasury Holdings Abroad

My periodic reminder that the US TIC data doesn't measure China's holdings of US Treasuries. It only measures China's holdings of Treasuries in US custodians. The real question is how many Treasuries Chinese entities hold in non US...

By Brad Setser

Social•Feb 15, 2026

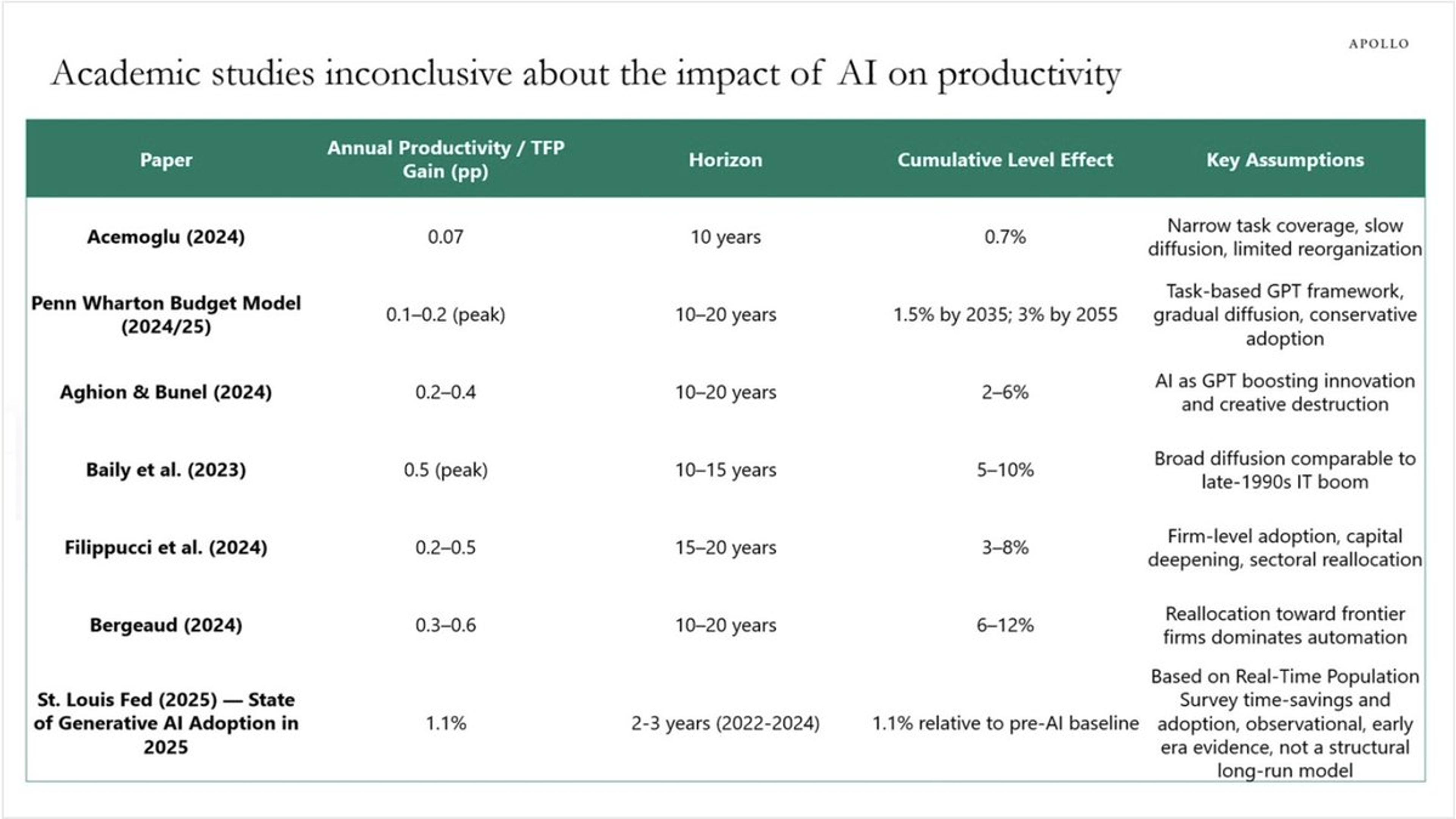

AI Hype Persists, yet Macro Data Shows No Productivity Boost

Three years after ChatGPT, AI is everywhere, except in macroeconomic data. If AI’s value is in productivity enhancement, it's still not showing up in the numbers. AI = LOTS OF HYPE. https://t.co/x96Abr0tD7

By Steve Hanke

Social•Feb 15, 2026

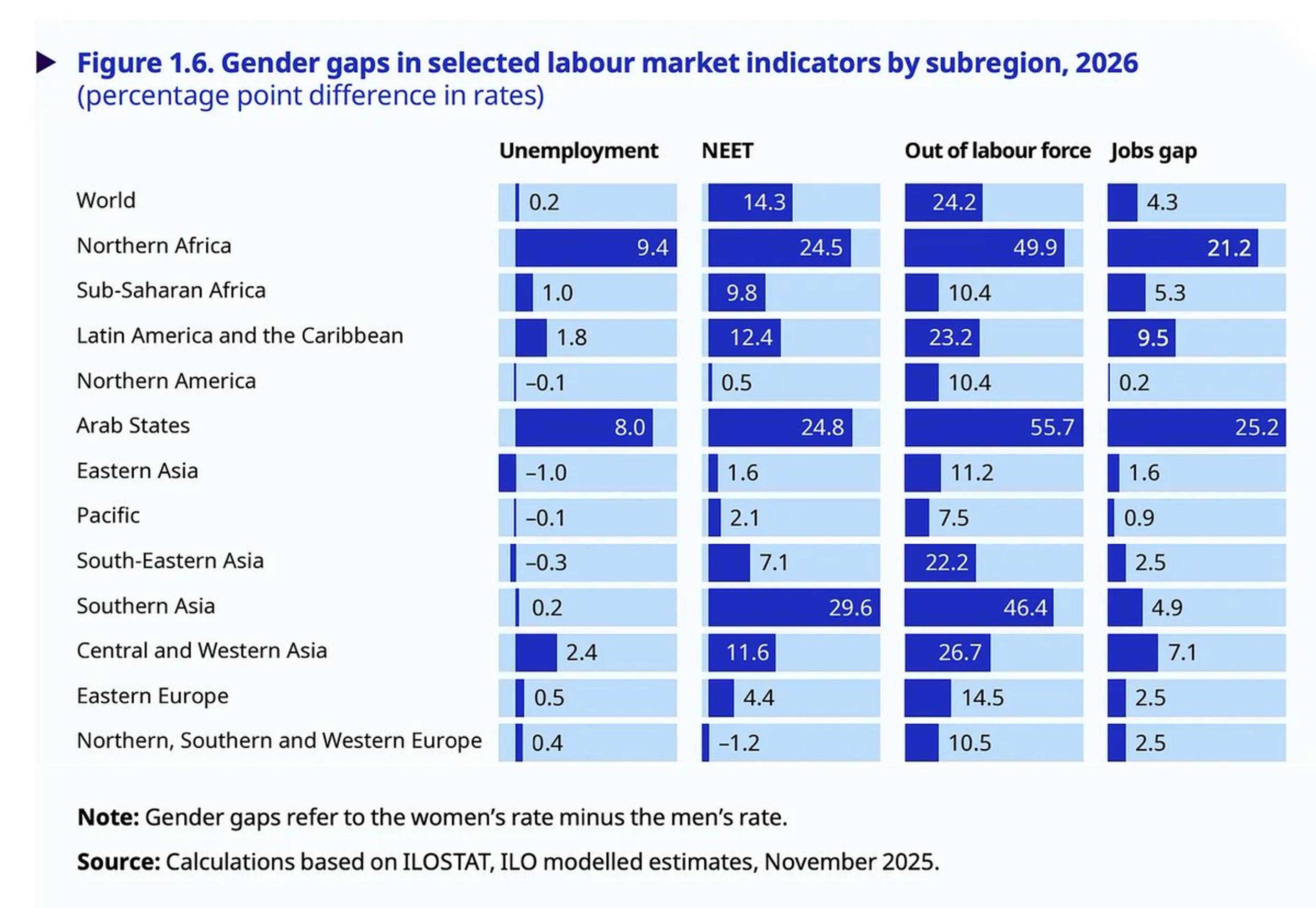

East Asia, Africa Match West; MENA, South Asia Lag

East Asia has labour-market gender gaps comparable to those in Europe and North America. Sub-Saharan Africa is also surprisingly similar (in the formal labour market). MENA and South Asia have massive gender segregation and LatAm and Carib are surprisingly in-between....

By Adam Tooze

Social•Feb 15, 2026

Stockpile Buffers Risk, Not Replaces Chinese Supply

A $12B rare earth stockpile is a step in the right direction, but buying from China on the open market isn’t independence; it’s a piggy bank with a very fragile supply chain. Until we build domestic processing, this is a...

By Peter Zeihan

Social•Feb 15, 2026

U.S. Economy Near Soft Landing Amid Multiple Risks

This isn’t a victory lap, and it isn’t a doom story. The U.S. economy is closer to a soft landing than it’s been in some time, and there are real risks that could undo it from multiple directions. I try...

By Nick Timiraos

Social•Feb 15, 2026

Lagarde: Incentives, Not Taxes, Keep Capital in Europe

ECB President Christine Lagarde says creating incentives for investments in Europe is a better approach to prevent capital outflows to other regions than imposing taxes https://t.co/ULSkU54mw5 via @Rauwald @mcnienaber https://t.co/KxLtLZqWrp

By Zöe Schneeweiss

Social•Feb 15, 2026

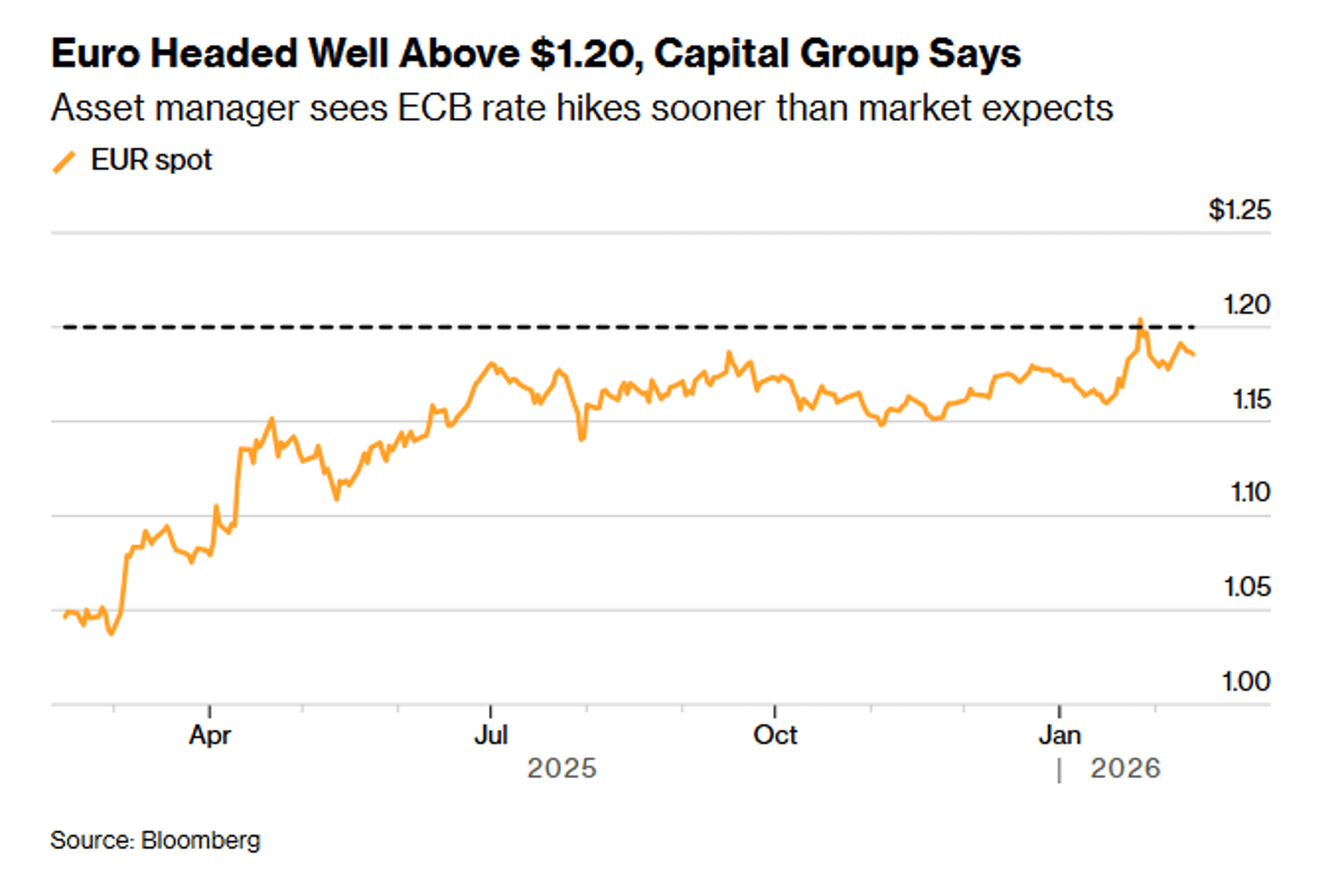

ECB Rate Hike Expected to Strengthen Euro, Says Capital Group

The ECB will raise interest rates at least once this year, significantly boosting the euro against the dollar, according to Capital Group, the $3.3 trillion asset manager https://t.co/CFxgbQlz0Q via @Sujata_markets https://t.co/6EBSHD6SYI

By Zöe Schneeweiss

Social•Feb 15, 2026

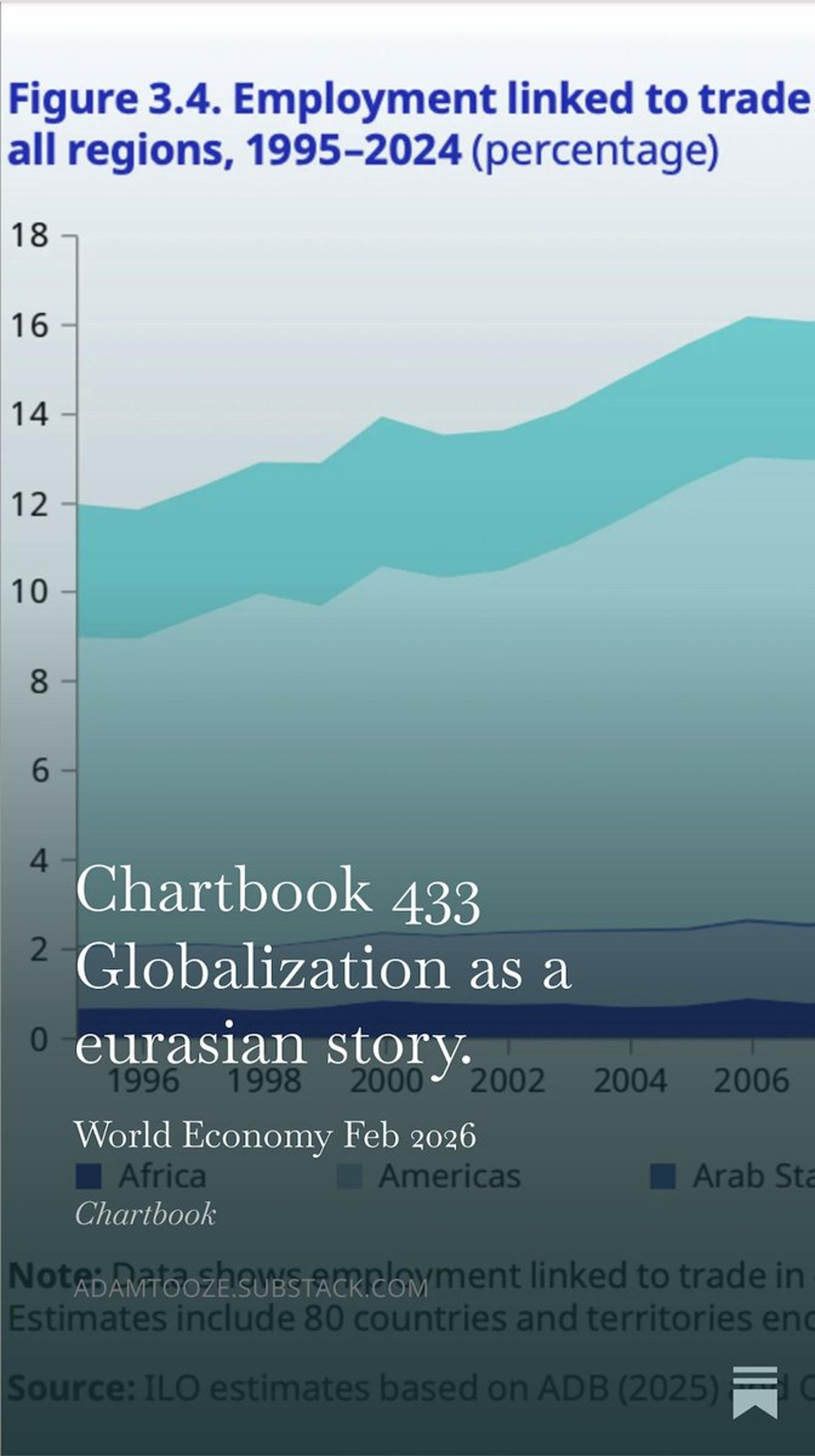

Eurasia Holds 81% of Trade‑Linked Jobs Globally

81 percent of employment worldwide that is linked to trade in goods and services is in Europe and Asia. Globalization is a eurasian story. Chartbook 433 just dropped. Check it out. https://t.co/jq1gYjLP4X https://t.co/I3iRrM8XEN

By Adam Tooze

Social•Feb 15, 2026

Consumption, Not Exports, Powers China's Growth

Why smart people say that exports “contribute” to China’s growth rather than “driving” it: almost all the time, growth in consumption is, in fact, a bigger contributor. More at today's Chartbook Top Links: https://t.co/NNNTMiyj6N

By Adam Tooze

Social•Feb 15, 2026

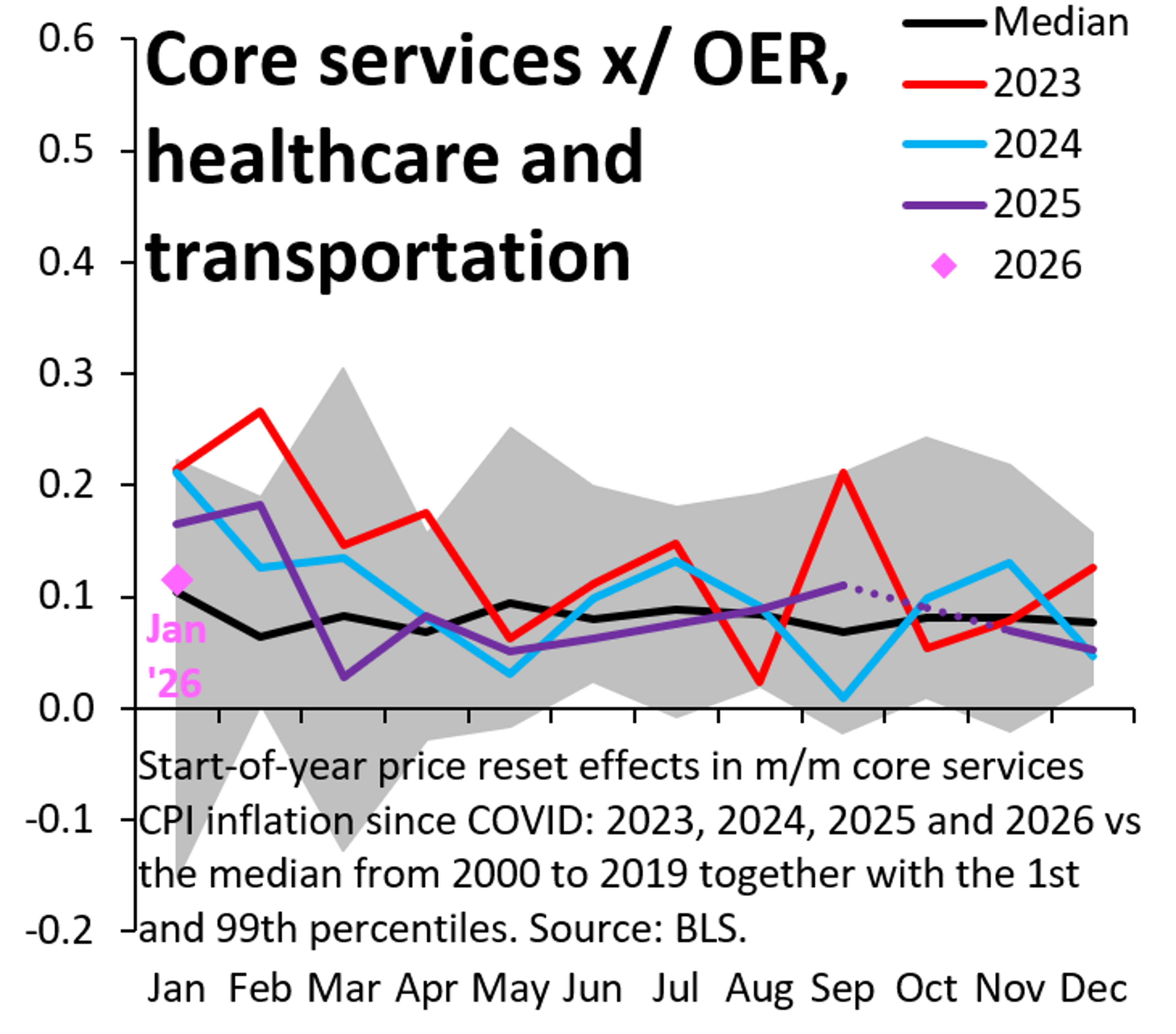

Core Services Inflation Stays Tame, No Overheating Signs

There's lots of commentary that US inflation will overheat, but there's no sign of that. My proxy for core services inflation was very well behaved in all of 2025 (purple) and the Jan. '26 data point (pink) was much more...

By Robin Brooks

Social•Feb 15, 2026

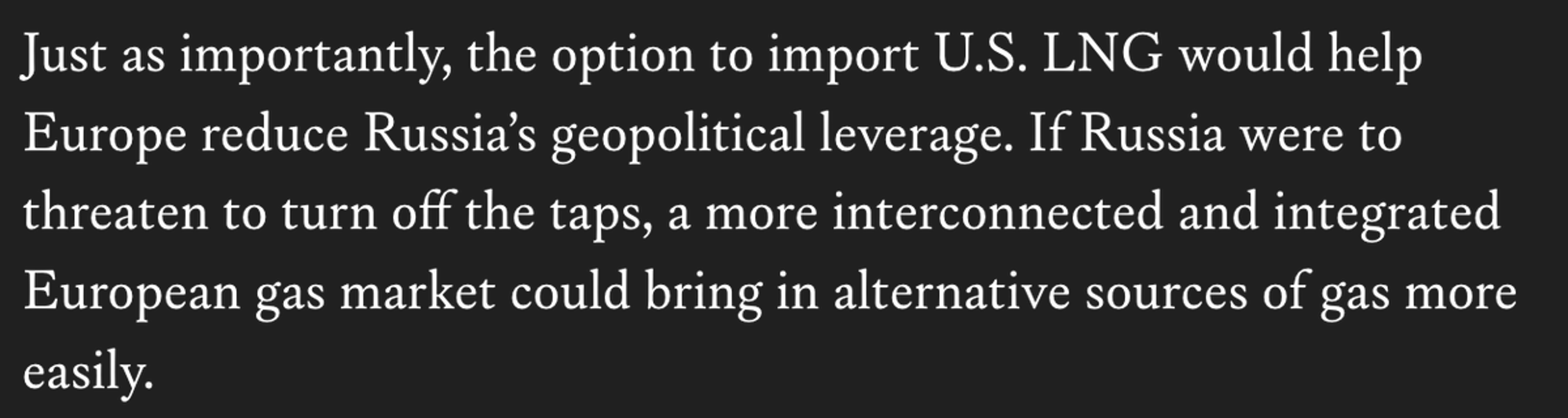

Europe Doubts US LNG Reliability Despite Past Optimism

A decade ago, I wrote an essay @ForeignAffairs about rise of US LNG w subhead "The benign energy superpower." https://t.co/P9r14hfb11 This week @MunSecConf, the Q I got most was whether Europe can trust US LNG to be reliable. And privately, senior...

By Jason Bordoff

Social•Feb 15, 2026

Speculators Turn to Oil for Stability Amid Market Turmoil

Speculative money is leaning back into oil as traders look for stability in a volatile world writes @Ole_S_Hansen Oil is becoming the preferred risk exposure in an otherwise uncertain macro landscape. Relative calm in crude contrasts with violent reversals in precious...

By Art Berman Blog

Social•Feb 15, 2026

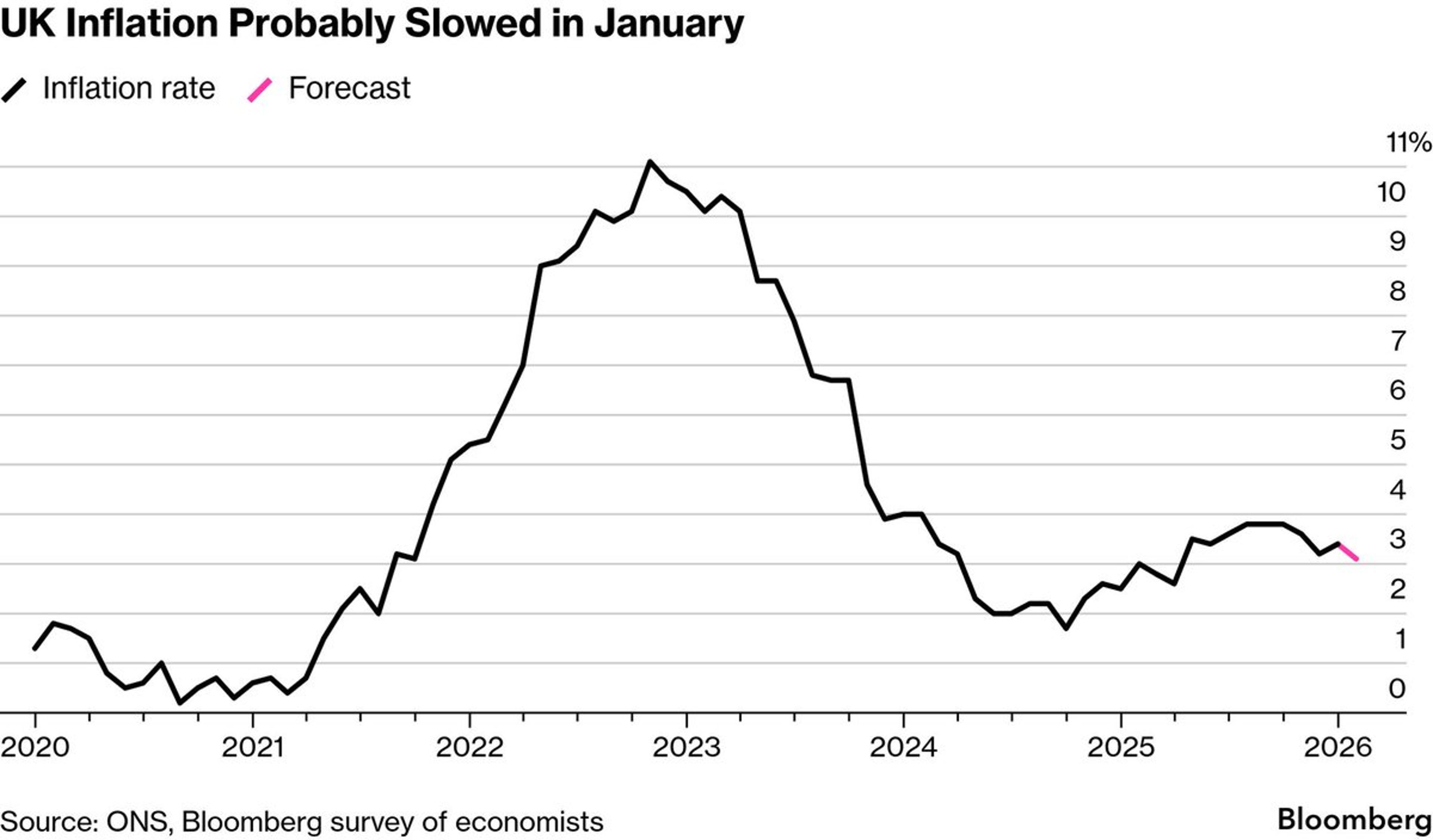

BOE Holds Rate Decision Pending Crucial UK Inflation Data

BOE on knife edge over interest rates awaits pivotal UK inflation data https://t.co/xROceOBQ9W via @PhilAldrick @CraigStirling https://t.co/H5s8yIIXBQ

By Zöe Schneeweiss

Social•Feb 14, 2026

RUB Strengthens as Oil Stabilizes, Gold Surges

Macro: MOEX flat as oil steadies and gold spikes; RUB strengthens (USD/RUB 76.65). Key drivers: commodity moves, stable RVI (24.9). Risks: commodity volatility, sanctions. Trade: buy selective energy exporters on RUB resilience. — Viktor Kopylov, PhD, CFA More insights: t.me/si14Kopylov

By Viktor Kopylov, PhD, CFA

Social•Feb 14, 2026

China's Foreign Exchange Reserves: Key Trends Unveiled

Deep dive into Chinese Foreign Exchange Reserves in today's version of the Chartbook Top Links. https://t.co/Yc09wNGpPK

By Adam Tooze

Social•Feb 14, 2026

Buffett’s Japanese Bond Move: Short Yen, Long Equities

The best macro trade of the past 5 years was Warren buffet’s Japanese bond issuance imo. Got him short the currency, short rates all while he was long the equities (trading houses).

By Citrini7 (pseudonymous)

Social•Feb 14, 2026

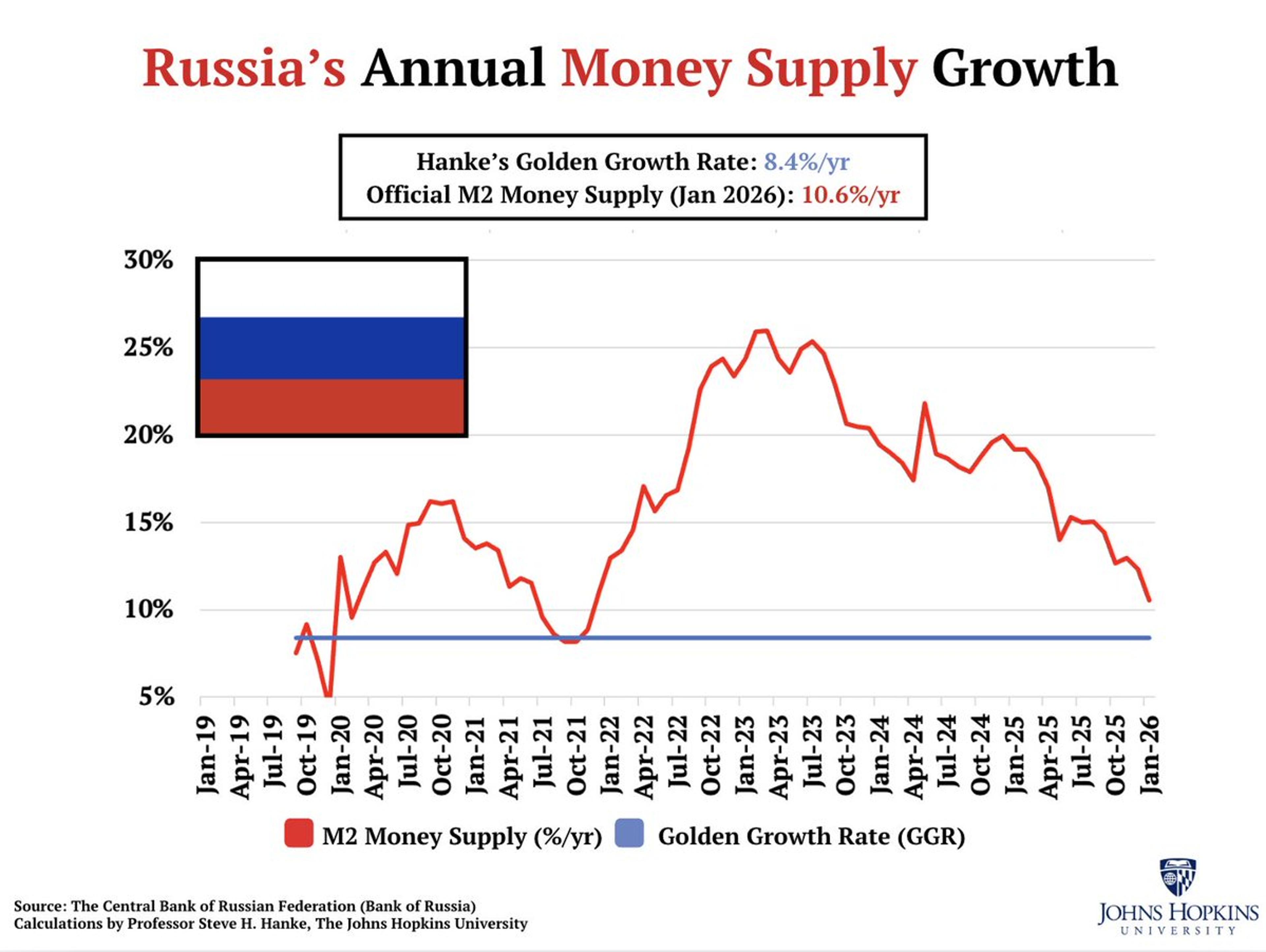

Russia's Inflation Spike Tied to Excess Money Supply

Russia’s inflation comes in at 6.0%/yr in January. That's ABOVE RU's 4%/yr target. RU's M2 money supply is growing at 10.6%/yr, ABOVE Hanke's Golden Growth Rate of 8.4%/yr, a rate consistent with hitting its inflation target of 4%/yr. THE INFLATION STORY =...

By Steve Hanke

Social•Feb 14, 2026

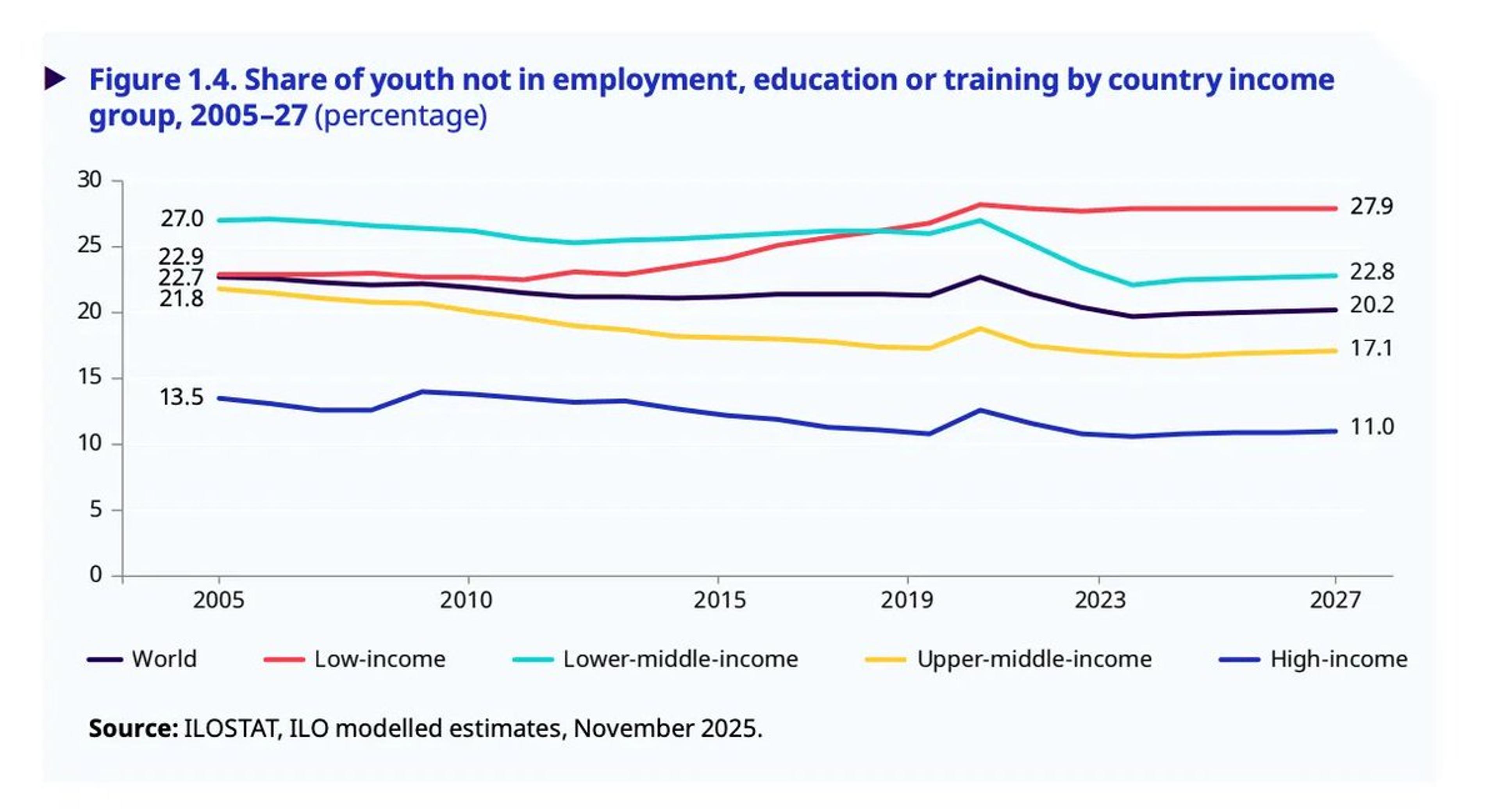

Poor Nations Double Youth Disengagement Compared to Rich Countries

How rich-country advantages compound. More than twice the share of young people in poor countries are not in employment, education or training. This and more insights in today's Chartbook Top Links. https://t.co/pokvStfn3w

By Adam Tooze